Attached files

| file | filename |

|---|---|

| EX-99.4 - EX-99.4 - Kosmos Energy Ltd. | a2200598zex-99_4.htm |

| EX-99.8 - EX-99.8 - Kosmos Energy Ltd. | a2200598zex-99_8.htm |

| EX-99.6 - EX-99.6 - Kosmos Energy Ltd. | a2200598zex-99_6.htm |

| EX-99.3 - EX-99.3 - Kosmos Energy Ltd. | a2200598zex-99_3.htm |

| EX-23.2 - EX-23.2 - Kosmos Energy Ltd. | a2200598zex-23_2.htm |

| EX-99.5 - EX-99.5 - Kosmos Energy Ltd. | a2200598zex-99_5.htm |

| EX-99.7 - EX-99.7 - Kosmos Energy Ltd. | a2200598zex-99_7.htm |

| EX-23.1 - EX-23.1 - Kosmos Energy Ltd. | a2200598zex-23_1.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on January 13, 2011

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Kosmos Energy Ltd.

(Exact name of registrant as specified in its charter)

| Bermuda (State or other jurisdiction of Incorporation or organization) |

1311 (Primary Standard Industrial Classification Code Number) |

98-0686001 (I.R.S. Employer Identification Number) |

Clarendon House

2 Church Street

Hamilton HM 11, Bermuda

(441) 295-1422

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Brian F. Maxted, Chief Executive Officer

c/o Kosmos Energy Ltd.

8176 Park Lane, Suite 500

Dallas, TX 75231

(214) 445-9600

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies to: | ||

Richard D. Truesdell, Jr., Esq. Davis Polk & Wardwell LLP 450 Lexington Avenue New York, NY 10017 (212) 450-4000 |

David J. Beveridge, Esq. Shearman & Sterling LLP 599 Lexington Avenue New York, NY 10022 (212) 848-4000 |

|

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

|

||||

| Title of each Class of Security being registered |

Proposed Maximum Aggregate Offering Price(1) |

Amount of Registration Fee |

||

|---|---|---|---|---|

Common Shares, $0.01 par value per share(2) |

$500,000,000 | $58,050 | ||

|

||||

- (1)

- Estimated

solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended.

- (2)

- Includes common shares which may be issued on exercise of a 30-day option granted to the underwriters to cover over-allotments, if any.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JANUARY 13, 2011

Shares

Kosmos Energy Ltd.

Common Shares

This is an initial public offering of common shares of Kosmos Energy Ltd. Prior to this offering, there has been no public market for our common shares. The initial public offering price of the common shares is expected to be between $ and $ per share. We intend to apply to list our common shares on the New York Stock Exchange under the symbol "KOS."

The underwriters have an option to purchase a maximum of additional common shares from us to cover over-allotments of common shares. The underwriters can exercise this option at any time within 30 days from the date of this prospectus.

Investing in our common shares involves risks. See "Risk Factors" on page 19.

|

|||||||||

| |

Price to Public |

Underwriting Discounts and Commissions |

Proceeds to Us |

||||||

|---|---|---|---|---|---|---|---|---|---|

Per Common Share |

$ | $ | $ | ||||||

Total |

$ | $ | $ | ||||||

|

|||||||||

Delivery of the common shares will be made on or about , 2010.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Consent under the Exchange Control Act 1972 (and its related regulations) has been obtained from the Bermuda Monetary Authority for the issue and transfer of the common shares to persons resident and non-resident of Bermuda for exchange control purposes provided our common shares remain listed on an appointed stock exchange, which includes the New York Stock Exchange. This prospectus will be filed with the Registrar of Companies in Bermuda in accordance with Bermuda law. In granting such consent and in accepting this prospectus for filing, neither the Bermuda Monetary Authority nor the Registrar of Companies in Bermuda accepts any responsibility for our financial soundness or the correctness of any of the statements made or opinions expressed in this prospectus.

| Credit Suisse | Citi | |

Barclays Capital |

||

The date of this prospectus is , 2011.

We have not authorized anyone to provide any information other than that contained in this document or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information which others may give you. This document may only be used where it is legal to sell securities. The information in this document may only be accurate on the date of this document.

Dealer Prospectus Delivery Obligation

Until , 2011, all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealer's obligation to deliver a prospectus when acting as an underwriter and with respect to unsold allotments or subscriptions.

i

This summary highlights certain information appearing elsewhere in this prospectus. As this is a summary, it does not contain all of the information that you should consider in making an investment decision. You should read the entire prospectus carefully, including the information under "Risk Factors," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and the related notes included in this prospectus, before investing. Unless otherwise stated in this prospectus, references to "Kosmos," "we," "us" or "our company" refer to Kosmos Energy Holdings and its subsidiaries prior to the completion of our corporate reorganization, and Kosmos Energy Ltd. and its subsidiaries as of the completion of our corporate reorganization and thereafter. Although we believe that the estimates and projections included in this prospectus are based on reasonable assumptions, investors should be aware that these estimates and projections are subject to many risks and uncertainties as described in "Risk Factors" and "Cautionary Note Regarding Forward-Looking Statements." Unless we tell you otherwise, the information in this prospectus assumes that the underwriters will not exercise their over-allotment option. We have provided definitions for some of the industry terms used in this prospectus in the "Glossary of Selected Oil and Natural Gas Terms" beginning on page 159.

Overview

We are an independent oil and gas exploration and production company focused on under-explored regions in Africa. Our current asset portfolio includes world-class discoveries and partially de-risked exploration prospects offshore the Republic of Ghana, as well as exploration licenses with significant hydrocarbon potential onshore the Republic of Cameroon and offshore from the Kingdom of Morocco. This portfolio, assembled by our experienced management and technical teams, will provide investors with differentiated access to both high-impact exploration opportunities as well as defined, multi-year visibility in the reserve and production growth of our existing discoveries.

Following our formation in 2003, we acquired our current exploration licenses and established a new, major oil province in West Africa with the discovery of the Jubilee Field in 2007. This was the first of our five discoveries offshore Ghana; it was one of the largest oil discoveries worldwide in 2007 and the largest find offshore West Africa in the last decade. Oil production from the Jubilee Field offshore Ghana commenced on November 28, 2010, and we anticipate receiving our first oil revenues in early 2011. We expect gross oil production from the Jubilee Field to reach its design capacity of 120,000 barrels of oil per day ("bopd") in mid 2011.

Since our inception, over two thirds of our exploration and appraisal wells have encountered hydrocarbons in quantities that we believe will ultimately be commercially viable. These successes, all of which are offshore Ghana, include the Jubilee Field, Mahogany East (which includes the Mahogany Deep discovery) and three other discoveries in the appraisal and pre-development stage: Odum, Tweneboa and Enyenra (formerly known as Owo). To date we have identified 49 undrilled prospects within our existing license areas, including 20 prospects across three play types offshore Ghana, 10

1

prospects across three play types in Cameroon and 19 prospects across three play types offshore Morocco. The following table summarizes our existing licenses and their current development status.

License

|

Gross Acreage |

Location | Discovered Fields (Year of Discovery) |

Wells Drilled (Successful/ Total) |

Number of Additional Prospects Identified |

Kosmos Working Interest |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Ghana |

||||||||||||||||||

West Cape Three Points ("WCTP")(1) |

369,917 | Gulf of Guinea's | Jubilee (2007)(3) | 13/14 | 13 | 30.875 | %(4) | |||||||||||

|

Tano Basin | Odum (2008) | ||||||||||||||||

|

Mahogany East (2009) | |||||||||||||||||

Deepwater Tano ("DT") |

205,345 |

Gulf of Guinea's |

Jubilee (2007)(3) |

14/15 |

7 |

18.000 |

%(5) |

|||||||||||

|

Tano Basin | Tweneboa (2009) | ||||||||||||||||

|

Enyenra (2010) | |||||||||||||||||

Cameroon |

||||||||||||||||||

Kombe-N'sepe |

747,741 | Coastal strip of | — | 0/1 | 6 | 35.000 | %(6) | |||||||||||

|

Douala Basin | |||||||||||||||||

|

bordering the Gulf | |||||||||||||||||

|

of Guinea | |||||||||||||||||

Ndian River(1) |

434,163 |

(2) |

Coastal strip of |

— |

— |

4 |

100.000 |

%(7) |

||||||||||

|

Rio del Rey Basin | |||||||||||||||||

|

bordering the Gulf | |||||||||||||||||

|

of Guinea | |||||||||||||||||

Morocco |

||||||||||||||||||

Boujdour Offshore(1) |

10,869,654 | Northwest Africa's | — | — | 19 | 75.000 | %(8) | |||||||||||

|

Aaiun Basin | |||||||||||||||||

- (1)

- Kosmos

is the operator under these licenses.

- (2)

- This

acreage reflects the relinquishment of 30% of the current license area of the Ndian River Block upon the approval by Cameroon's Ministry of Industry,

Mines and Technological Development of the two year renewal of our exploration period for this block.

- (3)

- The

Jubilee Field straddles the boundary between the WCTP Block and the DT Block offshore Ghana. Consistent with the Ghanaian Petroleum Law, the WCTP and DT

Petroleum Agreements and as required by Ghana's Ministry of Energy, in order to optimize resource recovery in this field, we entered into the Unitization and Unit Operating Agreement (the "UUOA") on

July 13, 2009 with the Ghana National Petroleum Corporation ("GNPC") and the other block partners in each of these two blocks. The UUOA governs the interests in and development of the Jubilee

Field and created the Jubilee Unit from portions of the WCTP Block and the DT Block. Kosmos is the technical operator for development ("Technical Operator") and an affiliate of Tullow Oil plc

("Tullow") is the unit operator ("Unit Operator") of the Jubilee Unit. The Technical Operator plans and executes the development of the unit whereas the Unit Operator manages the

day-to-day production operations of the unit. Our unit participation interest in the Jubilee Unit is 23.4913% (subject to potential redetermination among the unit partners in

this field; see "Risk Factors—The unit partners' respective interests in the Jubilee Unit are subject to redetermination and our interests in such unit may decrease as a result" and

"Business—Material Agreements—Exploration Agreements—Ghana—Jubilee Field Unitization"). The other Jubilee Unit partners include: an affiliate of Tullow

with a 34.7047% unit participation interest, an affiliate of Anadarko Petroleum Corp. ("Anadarko") with a 23.4913% unit participation interest, GNPC with a 13.75% unit participation interest, Sabre

Oil and Gas Holdings Limited ("Sabre") with a 2.8127% unit participation interest and EO Group Limited ("EO Group") with a 1.75% unit participation interest. GNPC has exercised its option with respect

to the Jubilee Unit to acquire an additional paying interest of 3.75% in the unit. These interest percentages give effect to the exercise of that option.

- (4)

- The

other WCTP Block partners include: an affiliate of Anadarko with a 30.875% working interest, an affiliate of Tullow with a 22.896% working interest,

GNPC with a 10.0% carried working interest, EO Group with a 3.5% carried working interest and an affiliate of Sabre with a 1.854% working interest. GNPC will be carried through the exploration and

development phases and has an option to acquire an additional paying interest of 2.5% in a commercial discovery in the WCTP Block. These interest percentages do not give effect to the exercise of such

option.

- (5)

- The

other DT Block partners include: an affiliate of Tullow with a 49.95% working interest, an affiliate of Anadarko with an 18.0% working interest, GNPC

with a 10.0% carried working interest and an affiliate of Sabre with a 4.05% working interest. GNPC will be carried through the exploration and development phases and has an option to acquire an

additional paying interest of 5.0% in a commercial discovery in the DT Block. These interest percentages do not give effect to the exercise of such option.

- (6)

- The other Kombe-N'sepe Block partners include: Société Nationale des Hydrocarbures ("SNH"), the national oil company of Cameroon, with a 25.0% working interest and an affiliate of Perenco with a 40.0% working interest. Cameroon will back-in for a 60.0% revenue interest and a 50.0% carried paying interest in a commercial discovery on the Kombe-N'sepe Block, with Kosmos then holding a 35.0% interest in the remaining interests of the block partners, which would result in Kosmos holding a 14.0% net revenue interest and a 17.5% paying interest. In addition, Kosmos and its block partners are reimbursed for 100% of the carried costs paid out of 35.0% of the total gross production coming from Cameroon's entitlement. This interest percentage does not give effect to this back-in.

2

- (7)

- Cameroon

has an option to acquire an interest of up to 15.0% in a commercial discovery on the Ndian River Block. If Cameroon elects to acquire an interest,

they will be carried for their share of the exploration and appraisal costs. This interest percentage does not give effect to the exercise of such option.

- (8)

- The Office National des Hydrocarbures et des Mines, the national oil company of Morocco ("ONHYM"), is the only other Boujdour Offshore Block partner and has a 25% participating interest, which will be carried through the exploration phase.

As a result of our exploration and development success, we have an asset portfolio that is well-balanced between producing assets, near-term development projects, medium-term appraisal opportunities and exploration prospects with significant hydrocarbon potential. The Kosmos-led execution of the Jubilee Field Phase 1 Development Plan (the "Jubilee Phase 1 PoD") resulted in the commencement of oil production from the Jubilee Field on November 28, 2010, which we refer to as "first oil." This 42-month timeline from discovery to first oil is a record for a deepwater development at this water depth in West Africa. We believe the Jubilee Field, currently our main development project, will ultimately be developed in four distinct phases to maximize hydrocarbon recovery. We recently submitted a notice to Ghana's Ministry of Energy to declare our second discovery, Mahogany East, commercially viable. Also, we and our WCTP and DT Block partners are currently evaluating development plans for the Odum, Tweneboa and Enyenra discoveries. We expect these discoveries will provide a continuum of new developments coming on stream from our offshore Ghana assets over the near-to-mid term. These license areas contain prospects with significant hydrocarbon potential which we believe have been de-risked because of their proximity to our other Ghanaian discoveries, with which they share similar geologic characteristics.

We plan to drill two exploratory wells in Cameroon, one on our Kombe-N'sepe Block in early 2011 and the other on our Ndian River Block in early 2012. Our exploration prospects in both Cameroon and Morocco have geologic characteristics similar to those of our license areas in Ghana and we believe these prospects hold significant hydrocarbon potential. Going forward, we intend to use our expertise to selectively acquire additional licenses to maintain a high-quality exploration and new ventures portfolio to replace and grow reserves.

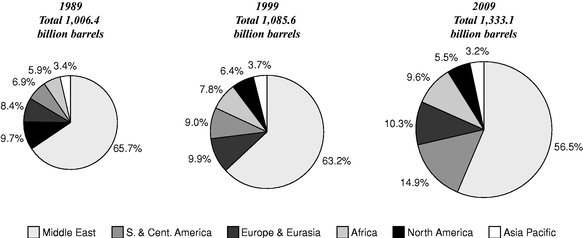

Our History

Kosmos was founded in 2003 when several members of our senior management team, backed by private equity firms Warburg Pincus and The Blackstone Group (together with their respective affiliates, our "Investors"), sought to replicate and build upon the success they had at Triton Energy Ltd. ("Triton") exploring for and developing oil and gas reserves in West Africa's Gulf of Guinea. Africa, the Gulf of Mexico and Brazil are widely recognized as possessing the world's greatest large-scale, deepwater oil resource potential. Among these regions, we believe West Africa possesses some of the world's most prolific and least developed petroleum systems, a highly competitive industry cost structure and supportive governments eager to develop their countries' natural resources.

In the last five years, Africa has entered a new phase in its petroleum history, with numerous large oil and natural gas discoveries made in formerly unexplored and undeveloped regions. The exploration of these regions has been historically constrained by industry assessments of political and technical risk. We intend to leverage our extensive experience in Africa, as well as the experience of our management team prior to forming Kosmos, to successfully manage these risks and profitably produce hydrocarbon resources in these regions.

We were led to West Africa by our exploration approach, which is deeply grounded in a fundamentals-oriented, geologically based process geared towards the identification of misunderstood, under-explored or overlooked basins, plays and fairways. This process begins with detailed geologic studies that methodically assess a particular region's subsurface in terms of attributes that lead to working petroleum systems. This includes basin-specific modeling to predict oil charge and fluid migration combined with detailed stratigraphic mapping and structural analysis to identify quality

3

reservoir fairways and attractive trapping geometries. This same approach was successfully employed by members of our management team while at Triton.

In compiling our asset portfolio, we considered exploration opportunities spanning the entire Atlantic margin of Africa, from Morocco to South Africa. Due to our management team's successful exploration history in the Gulf of Guinea in West Africa during their tenure at Triton, our focus was on acquiring exploration licenses in the same geographical area. We currently hold five licenses from Ghana, Cameroon and Morocco, and we are the operator under three of these licenses.

We established a new, major oil province in West Africa with the discovery of the Jubilee Field offshore Ghana in 2007. Subsequently, Kosmos participated in the discovery of four additional discoveries offshore Ghana. Kosmos' leadership of the Jubilee Unit partners enabled the Jubilee Field Phase 1 PoD to be approved by Ghana's Ministry of Energy in July 2009. The Jubilee Phase 1 PoD committed to delivering an approximately $3.3 billion project capable of producing 120,000 bopd. The Kosmos-led execution of the Jubilee Phase 1 PoD resulted in first oil on November 28, 2010. This 42-month timeline from discovery to first oil is a record for a deepwater development at this water depth in West Africa.

In 2009, Kosmos entered into a commercial agreement to sell our Ghanaian assets to Exxon Mobil Corporation ("ExxonMobil"). This sale was terminated in August 2010. From the date of the commercial agreement with ExxonMobil through December 31, 2010, we have spent approximately $630 million developing Jubilee Phase 1 and de-risking these assets, made the Enyenra discovery offshore Ghana and drilled six successful appraisal wells on our Mahogany East, Odum and Tweneboa discoveries.

Our Competitive Strengths

World-class asset portfolio situated along the Atlantic Coast Margin of West Africa

We targeted the Atlantic margin of Africa as a focus area for exploration following a multi-year assessment of numerous exploration opportunities across a broad region. Our assessment was driven by our interpretation of geological and seismic data and by our internationally experienced technical, operational and management teams.

We also make an in-depth evaluation of regional political risk, economic conditions and fiscal terms. Ghana, for example, enjoys relative political stability, overall sound economic management, a low crime rate, competitive wages and an educated, English-speaking workforce. The country also scores well among its peers on various measures of corruption, ranking 62nd out of 178 countries in Transparency International's 2010 Corruption Perceptions Index, vastly ahead of each of its peers according to a peer group selected by Standard & Poor's. Ghana is also the highest ranked among such peer group in the World Bank's Doing Business 2011 report, at fifth out of 46 sub-Sahara African countries included in such report.

Our asset portfolio consists of five discoveries including the Jubilee Field, which was one of the largest oil discoveries worldwide in 2007 and the largest find offshore West Africa in the last decade. Our other discoveries include Mahogany East, Odum, Tweneboa and Enyenra offshore Ghana, which have geologic characteristics similar to the Jubilee Field. In addition, we have identified 20 additional prospects offshore Ghana, 10 additional prospects in Cameroon and 19 additional prospects offshore Morocco. We expect to make new discoveries and to define additional prospects as our team continues to develop our current asset portfolio and identify and pursue new high-potential assets.

Well-defined production and growth plan

Our plan for developing the Jubilee Field provides highly visible, near-term cash generation and long-term growth opportunities. We estimate Jubilee Field Phase 1 daily gross production to reach the

4

120,000 bopd design capacity of the floating production, storage and offloading ("FPSO") facility used at the field, in mid 2011. Within the next few years, we intend to expand upon the Jubilee Field Phase 1 development with three additional phases that are designed to maintain production and cash flow from partially de-risked locations. A phased development program allows us to develop the full Jubilee Field on a faster timeline and allowed us to achieve first oil production at an earlier date than traditional development techniques. In addition to Jubilee, we are currently in the development planning stage for Mahogany East, the pre-development planning stage for the Odum discovery, and the appraisal stage for the Tweneboa and Enyenra discoveries. We believe these assets provide additional mid-term production and cash flow opportunities to supplement the phased Jubilee Field development.

Significant upside potential from exploratory assets

Since our inception we have focused on acquiring exploratory licenses in emerging petroleum basins in West Africa. This led to the assembly of a hydrocarbon asset portfolio of five licenses with significant upside potential and attractive fiscal terms. In Ghana, we believe our existing licenses offer substantial opportunities for significant growth in shareholder value as a result of numerous high value exploration prospects that are partially de-risked due to their similarity and proximity to our existing discoveries. For instance, we are currently drilling the Teak-1 exploration well north of the Jubilee Field. We plan to drill two exploratory wells in Cameroon, one on our Kombe-N'sepe Block in early 2011 and the other on our Ndian River Block in early 2012.

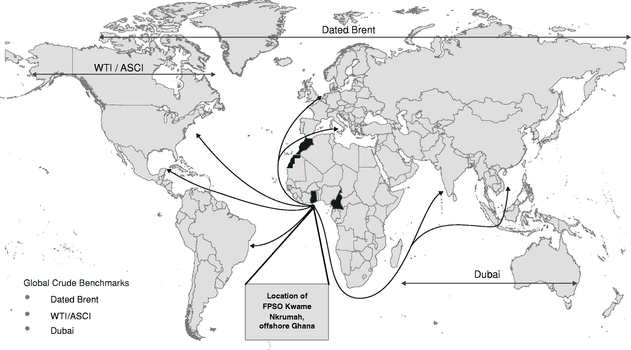

Oil-weighted asset portfolio in key strategic regions

Our portfolio of assets consists primarily of oil discoveries and prospects. Oil comprises approximately 94% of our proved reserves that are associated with the Jubilee Field Phase 1 development. Due to its high quality and strategic geographic location, we expect oil from the Jubilee Field will ultimately command a premium to Dated Brent, its reference commodity price. We expect our other Ghana discoveries and prospects, as well as our Cameroon and Morocco prospects, to maintain a primarily oil-weighted composition. We believe that global petroleum supply and demand fundamentals will continue to provide a strong market for our oil, and therefore we intend to continue targeting oil exploration and development opportunities. Furthermore, our geographic location in West Africa enables broad access to the major consuming markets of North America, Asia and Europe, providing marketing flexibility. The ability to supply oil to global markets with reasonable transportation costs reduces localized supply/demand risks often associated with various international oil markets.

New ventures group focused on expanding our high-quality asset portfolio

Our existing asset portfolio has already delivered large scale drill-bit success in Ghana and provided the opportunity for near- to mid-term reserve and production growth. While substantial exploration potential remains in our portfolio, we are also focused on renewing, replenishing and expanding our prospect inventory through a high-impact new venture acquisition program to replicate this success. We believe this will permit timely delivery of further oil and natural gas discoveries for continued long-term reserve and production growth. We aim to leverage our unique exploration approach to maintain our successful track record with these new ventures.

Seasoned and incentivized management and technical team with demonstrable track record of performance and value creation

We are led by an experienced management team with a track record of successful exploration and development and public shareholder value creation. Our management team's average experience in the energy industry is over 20 years. Members of the senior management team successfully worked together

5

both at and since their tenure at Triton, where they contributed to transforming Triton into one of the largest internationally focused independent oil and gas companies headquartered in the United States, prior to the sale of Triton to Hess Corporation ("Hess") for approximately $3.2 billion in 2001. Members of our management and senior technical team participated in discovering and developing multiple large scale upstream projects around the world, including the deepwater Ceiba Field, which was developed on budget and in record time offshore Equatorial Guinea, in West Africa in 2000. In the course of this work, the team acquired a track record for successful identification, acquisition and development of large offshore oil fields, and has been involved in discovering and developing over five billion barrels of oil equivalent ("Bboe"). We believe our unique experience, industry relationships, and technical expertise have been critical to our success and are core competitive strengths.

Furthermore, our management team has considerable experience in managing the political risks present when operating in developing countries, including working with the host governments to achieve mutually beneficial results, while at all times protecting the company's rights and asserting investors' interests.

Our management team currently owns and will continue to own a significant direct ownership interest in us immediately following the completion of this offering. We believe our management team's direct ownership interest as well as their ability to increase their holdings over time through our long-term incentive plan aligns management's interests with those of our shareholders. This long-term incentive plan will also help to attract and retain the talent to support our business strategy.

Strong financial position

Since inception we have been backed by our Investors, namely Warburg Pincus and The Blackstone Group, each supporting our initial growth with substantial equity investments. Each Investor will retain a significant interest in Kosmos following this offering. With the proceeds from this offering, our cash on hand and our commercial debt commitments, we believe we will possess the necessary financial strength to implement our business strategy through early 2013. As of September 30, 2010, we had approximately $292 million of total cash on hand, including $89 million of restricted cash, and $300 million of committed undrawn capacity under our commercial debt facilities. In addition, we have demonstrated the ability to raise capital, having secured commitments for approximately $1.1 billion of private equity funding and $1.25 billion of commercial debt commitments in the last seven years. Furthermore, we anticipate receiving our first oil revenues in early 2011 from the Jubilee Field, after which time a portion of these revenues will be used to fund future exploration and development activities.

6

Our Strategy

In the near-term, we are focused on maximizing production from the Jubilee Field Phase 1 development, as well as accelerating the development of our other discoveries. Longer term, we are focused on the successful acquisition, exploration, appraisal and development of existing and new opportunities in Africa, including identifying, capturing and testing additional high-potential prospects to grow reserves and production. By employing our competitive advantages, we seek to increase net asset value and deliver superior returns to our shareholders. To this end, our strategy includes the following components:

Grow proved reserves and production through accelerated exploration, appraisal and development

In the near-term, we plan to develop and produce our current discoveries offshore Ghana, including Jubilee and Mahogany East, and upon a declaration of commerciality and approval of a plan of development, Odum, Tweneboa and Enyenra. Additionally, we plan to drill-out our portfolio of exploration prospects offshore Ghana, which have been partially de-risked by our successful drilling program to date. If successful, these prospects will deliver proved reserve and production growth in the medium term. In the longer term, we plan to drill-out our existing prospect inventory on our other licenses in West Africa and to replicate our exploratory success through new ventures in other regions of the African continent.

Apply our technically-driven culture, which fosters innovation and creativity, to continue our successful exploration and development program

We differentiate ourselves from other E&P companies through our approach to exploration and development. Our senior-most geoscientists and development engineers are pivotal to the success of our business strategy. We have created an environment that enables them to focus their knowledge, skills and experience on finding and developing oil fields. Culturally, we have an open, team-oriented work environment that fosters both creative and contrarian thinking. This approach allows us to fully consider and understand risk and reward and to deliberately and collectively pursue strategies that maximize value. We used this philosophy and approach to unlock the Tano Basin offshore Ghana, a significant new petroleum system that the industry previously did not consider either prospective or commercially viable.

Focus on rapidly developing our discoveries to initial production

We focus on maximizing returns through phasing the appraisal and development of discoveries. There are numerous benefits to pursuing a phased development strategy to support our production growth plan. Importantly, a phased development strategy provides for first oil production earlier than what would otherwise be possible using traditional development techniques, which are disadvantaged by more time-consuming, costly and sequential appraisal and pre-development activities. This approach optimizes full-field development and maximizes net asset value by refining development plans based on experience gained in initial phases and by leveraging existing infrastructure as we implement subsequent phases of development. Other benefits include minimizing upfront capital costs, reducing execution risks through smaller initial infrastructure requirements, and enabling cash flow from the initial phase of production to fund a portion of capital costs for subsequent phases.

First oil from the Jubilee Field commenced on November 28, 2010 and we anticipate receiving our first oil revenues in early 2011. This development timeline from discovery to first oil is significantly less than the industry average of seven to ten years and is a record for a deepwater development at this water depth in West Africa. This condensed timeline reflects the lessons learned by members of our seasoned management while at Triton and during their time at other major deepwater operators. At Triton, the team took the 50,000 bopd Ceiba Field offshore Equatorial Guinea from discovery to first

7

oil in fourteen months. Additionally, members of our development team have led other larger scale deepwater developments, such as Neptune and Mensa in the U.S. Gulf of Mexico. These experiences drove the 42-month record timeline from discovery to first oil achieved by the significantly larger Jubilee Field Phase 1 development.

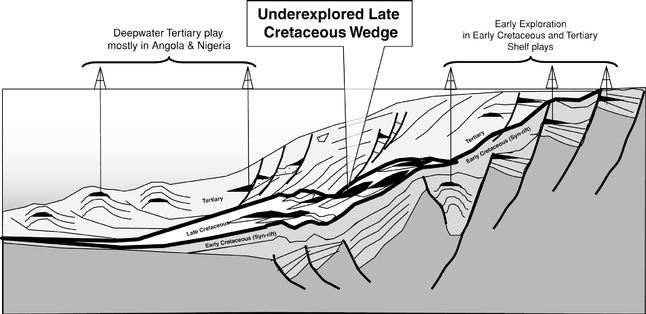

Identify, access and explore emerging exploratory regions and hydrocarbon plays

Our management and exploration team have demonstrated an ability to identify regions and hydrocarbon plays that will yield multiple large commercial discoveries. We will continue to utilize our systematic and proven geologically focused approach to emerging petroleum systems where source rocks and reservoirs have been established by previous drilling and where seismic data suggests hydocarbon accumulations are likely to exist, but where commercial discoveries have yet to be made. We believe this approach reduces the exploratory risk in poorly understood, under-explored or otherwise overlooked hydrocarbon basins that offer significant oil potential. This was the case with respect to the Late Cretaceous stratigraphy of West Africa, the niche in which we chose to build our asset portfolio between 2004 and 2006. Our licenses in Ghana, Cameroon and Morocco share similar geologic characteristics focused on untested structural-stratigraphic traps. This exploration focus has proved extremely successful, with the discovery of the Jubilee Field ushering in a new level of industry interest in Late Cretaceous petroleum systems across the African continent, including play types that had previously been largely ignored.

This approach and focus, coupled with a first-mover advantage, provide us a significant competitive advantage in identifying and accessing new strategic growth opportunities. We expect to continue to seek new opportunities where oil has not been discovered or produced in meaningful quantities by leveraging the skills of our experienced technical team. This includes our existing areas of interest as well as selectively expanding our reach into other locations in Africa or beyond that offer similar geologic characteristics.

Acquire additional exploration assets

We intend to utilize our experience and expertise and leverage our reputation and relationships to selectively acquire additional exploration licenses and maintain a high-quality portfolio of undrilled exploration prospects. We plan to farm-in to new venture opportunities as well as to undertake exploration in emerging basins, plays and fairways to enhance and optimize our position in Africa. In addition, we plan to expand our geographic footprint in a focused and systematic fashion. Consistent with this strategy, we also evaluate potential corporate acquisition opportunities as a source of new ventures to replenish and expand our asset portfolio.

Jubilee Phase 1 Reserve and Development Information

Jubilee Field Phase 1 is the first of our discoveries to have been determined to have proved reserves. As of June 30, 2010, Netherland, Sewell & Associates, Inc. ("NSAI"), our independent reserve engineers, evaluated the Jubilee Field Phase 1 development to hold gross proved reserves of 250 Mmboe. We currently hold a 23.4913% unit participation interest in this development (subject to any redetermination among the unit partners in this field. See "Risk Factors—The unit partners' respective interests in the Jubilee Unit are subject to redetermination and our interests in such unit may decrease as a result" and "Business—Material Agreements—Exploration Agreements—Ghana—Jubilee Field Unitization"). NSAI estimated our net proved reserves to be approximately 59 Mmboe as of June 30, 2010, consisting of approximately 94% oil. All of our proved reserves are currently located in the Jubilee Field Phase 1 development. Our other discoveries outside of the Jubilee Field Phase 1, including Mahogany East, Odum, Tweneboa, Enyenra and other Jubilee Field phases, do not yet have approved plans of development ("PoDs") and therefore cannot be classified as proved reserves.

8

The Jubilee Field Phase 1 development employs safe, industry standard deepwater equipment with conventional "off-the-shelf" technologies. We believe such technologies and development infrastructure meet industry safety standards and have been consistently used in deepwater oilfield development, with appropriate advancements in recent years. The Jubilee Field Phase 1 development was designed to provide suitable flexibility and expandability in order to minimize capital expenditures associated with subsequent phases of development. The FPSO facility used at the field was delivered and moored to the seabed in July 2010. Planning is underway for the development of additional reservoirs and subsequent phases of the Jubilee Field.

Once the drilling and completion activity associated with the Jubilee Field Phase 1 development is complete, the Eirik Raude, Atwood Hunter and Deepwater Millennium drilling rigs will test other high-potential identified prospects and appraise our other discoveries offshore Ghana. Additionally we will work with our block partners, GNPC and Ghana's Ministry of Energy to advance PoDs for approval for the staged and timely development of the Mahogany East, Odum, Tweneboa and Enyenra discoveries over the next three years.

Discovery Information

Information about our discoveries is summarized in the following table.

Discoveries

|

License | Kosmos Working Interest |

Block Operator(s) | Stage | Type | Expected Year of PoD Submission |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Ghana |

||||||||||||||||

Jubilee Field Phase 1(1)(2) |

WCTP/DT(3) | 23.4913% | (5) | Tullow/Kosmos(6) | Production | Deepwater | 2008 | (2) | ||||||||

Jubilee Field subsequent phases(2) |

WCTP/DT(3) | 23.4913% | (5) | Tullow/Kosmos(6) | Development | Deepwater | 2011 | |||||||||

Mahogany East |

WCTP(4) | 30.8750 | % | Kosmos | Development planning | Deepwater | 2011 | |||||||||

Odum |

WCTP(4) | 30.8750 | % | Kosmos | Development planning | Deepwater | 2011 | |||||||||

Tweneboa |

DT(4) | 18.0000 | % | Tullow | Appraisal | Deepwater | 2012 | (7) | ||||||||

Enyenra |

DT(4) | 18.0000 | % | Tullow | Appraisal | Deepwater | 2013 | |||||||||

- (1)

- For

information concerning our estimated proved reserves in the Jubilee Field as of June 30, 2010, see "Business—Our Reserves."

- (2)

- The

Jubilee Phase 1 PoD was submitted to Ghana's Ministry of Energy on December 18, 2008 and was formally approved on July 13, 2009.

The Jubilee Phase 1 PoD details the necessary wells and infrastructure to develop the UM3 and LM2 reservoirs. Oil production from the Jubilee Field offshore Ghana commenced on

November 28, 2010, and we anticipate receiving our first oil revenues in early 2011. We intend to submit or amend PoDs for other reservoirs within the unit for subsequent Jubilee Field phases

to Ghana's Ministry of Energy for approval in order to extend the production plateau of the Jubilee Field.

- (3)

- The

Jubilee Field straddles the boundary between the WCTP Block and the DT Block offshore Ghana. Consistent with the Ghanaian Petroleum Law, the WCTP and DT

Petroleum Agreements and as required by Ghana's Ministry of Energy, in order to optimize resource recovery in this field, we entered into the UUOA on July 13, 2009 with GNPC and the other block

partners of each of these two blocks. The UUOA governs the interests in and development of the Jubilee Field and created the Jubilee Unit from portions of the WCTP Block and the DT Block.

- (4)

- GNPC

has the option to acquire additional paying interests in a commercial discovery on the WCTP Block and the DT Block of 2.5% and 5.0%, respectively. In

order to acquire the additional paying interest, GNPC must notify the contractor of its intention to acquire such interest within sixty to ninety days of the contractor's notice to Ghana's Ministry of

Energy of a commercial discovery. These interest percentages do not give effect to the exercise of such options.

- (5)

- These

interest percentages are subject to redetermination of the working interests in the Jubilee Field pursuant to the terms of the UUOA. See "Risk

Factors—The unit partners' respective interests in the Jubilee Unit are subject to redetermination and our interests in such unit may decrease as a result" and

"Business—Material Agreements—Exploration Agreements—Ghana—Jubilee Field Unitization." GNPC has exercised its options, with respect to the Jubilee Unit,

to acquire an additional unitized paying interest of 3.75% in the Jubilee Field. The Jubilee Field interest percentages give effect to the exercise of such option.

- (6)

- Kosmos

is the Technical Operator and Tullow is the Unit Operator of the Jubilee Unit. See "Business—Material Agreements—Exploration

Agreements—Ghana—Jubilee Field Unitization."

- (7)

- Appraisal of the Tweneboa oil and gas condensate reservoirs is expected to continue through 2011. As outlined by the petroleum agreement covering the DT Block, a submission of a PoD would be required for an oil development by 2012, while the submission of a PoD related to a natural gas development would be required by 2013.

9

Ghana Well Information

Information about the wells we have drilled on our license areas in Ghana is summarized in the following table.

| |

Operator | Spud Date(1) | Total Depth (feet) |

Net Hydrocarbon Pay (feet) |

Status(2) | Comments | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Jubilee |

|||||||||||||||

J-09 (Mahogany-1) |

Kosmos | 05/30/07 | 12,553 | 321 | Completion Pending | Discovery well for Jubilee in WCTP Block. Drill stem tested at rates in excess of 20,500 bopd. Lower completion installed. | |||||||||

Hyedua-1 |

Tullow | 07/27/07 | 13,130 | 180 | Plugged Back | Downdip confirmation well in DT Block. | |||||||||

J-10 Water Injector ("WI") (Hyedua-1BP1) |

Tullow | 07/27/07 | 12,631 | 136 | Completion Pending | Whole core obtained. Injectivity test conducted at rates in excess of 20,000 bwpd. | |||||||||

J-16GI Gas Injectors ("GI") (Mahogany-2) |

Tullow | 03/06/08 | 11,296 | 164 | Completion Pending | Updip confirmation well for Jubilee reservoirs. Whole core obtained. Two Drill Stem Tests ("DSTs") conducted. | |||||||||

J-08 (Hyedua-2) |

Tullow | 10/09/08 | 12,018 | 180 | Producing | Drill stem tested at rates in excess of 16,500 bopd. Whole core obtained. | |||||||||

J-04 |

Tullow | 01/17/09 | 15,121 | 90 | Plugged Back | Tested the Southeastern edge of the Jubilee fairway. | |||||||||

J-04 Sidetrack ("ST") |

Tullow | 01/17/09 | 13,803 | 199 | Completion Pending | Observation well for interference testing. | |||||||||

J-01 |

Tullow | 03/18/09 | 12,411 | 140 | Producing | ||||||||||

J-02 |

Tullow | 03/25/09 | 13,829 | 186 | Producing | Observation well for interference testing. | |||||||||

J-11WI |

Tullow | 05/06/09 | 13,822 | 121 | Completion Pending | Down structure water injector—net reservoir 281 feet. | |||||||||

J-12WI |

Tullow | 05/11/09 | 14,081 | 188 | Injecting | Down structure water injector—net reservoir 319 feet. | |||||||||

J-15WI |

Tullow | 05/14/09 | 16,949 | 47 | Completion Pending | Only drilled through Upper Mahogany—down structure water injector-net reservoir 87 feet. | |||||||||

J-07 |

Tullow | 05/19/09 | 13,599 | 121 | Plugged Back | Whole core obtained. | |||||||||

J-07ST |

Tullow | 05/19/09 | 13,701 | 116 | Production Ready | ||||||||||

J-03 |

Tullow | 09/29/09 | 12,507 | 173 | Completion Pending | Lower completion installed. | |||||||||

J-05 |

Tullow | 07/08/09 | 13,753 | 193 | Completion Pending | Lower completion installed. | |||||||||

J-17 |

Tullow | 10/07/09 | 19,390 | 174 | Plugged Back | Only drilled through Upper Mahogany reservoirs. | |||||||||

J-17STGI |

Tullow | 10/07/09 | 19,574 | 197 | Completion Pending | ||||||||||

J-13WI |

Tullow | 10/10/09 | 13,058 | 143 | Completion Pending | Down structure water injector—net reservoir 348 feet. | |||||||||

J-14WI |

Tullow | 10/14/09 | 13,999 | 77 | Injecting | Down structure water injector—net reservoir 334 feet. | |||||||||

Mahogany East |

|||||||||||||||

Mahogany-3 |

Kosmos | 11/27/08 | 14,262 | 108 | Suspended | Discovery well for Mahogany Deep. | |||||||||

Mahogany-4 |

Kosmos | 08/28/09 | 12,074 | 141 | Suspended | Updip confirmation well for the Mahogany East reservoirs. | |||||||||

Mahogany Deep-2 |

Kosmos | 09/29/09 | 14,193 | 49 | Suspended | Drilled to delineate deep reservoirs—net reservoir of 384 feet. | |||||||||

Mahogany-5 |

Kosmos | 04/18/10 | 13,084 | 75 | Suspended | Eastern confirmation of Mahogany East reservoirs. | |||||||||

Odum |

|||||||||||||||

Odum-1 |

Kosmos | 01/18/08 | 11,109 | 72 | Suspended | Discovery well for Odum. | |||||||||

Odum-2 |

Kosmos | 11/12/09 | 8,222 | 66 | Suspended | Confirmation well for Odum. | |||||||||

10

| |

Operator | Spud Date(1) | Total Depth (feet) |

Net Hydrocarbon Pay (feet) |

Status(2) | Comments | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Tweneboa |

|||||||||||||||

Tweneboa-1 |

Tullow | 01/26/09 | 13,002 | 69 | Suspended | Discovery well for Tweneboa condensate pays. | |||||||||

Tweneboa-2 |

Tullow | 12/06/09 | 13,878 | 105 | Suspended | Confirmation well for Tweneboa. Discovery of Central Oil Channel below condensate pays. Whole core obtained. | |||||||||

Tweneboa-3 |

Tullow | 11/26/10 | 12,811 | 29 | Plugged back | Confirmation well for Tweneboa. | |||||||||

Tweneboa-3ST |

Tullow | 12/22/10 | 12,816 | 112 | Suspended | ||||||||||

Onyina |

|||||||||||||||

Onyina-1 |

Tullow | 09/25/10 | — | Abandoned | Dry hole. | ||||||||||

Enyenra (formerly known as Owo) |

|||||||||||||||

Owo-1 |

Tullow | 06/10/10 | 12,766 | 174 | Plugged Back | Discovery well for Enyenra. | |||||||||

Owo-1 ST1 |

Tullow | 07/28/10 | 13,117 | 115 | Suspended | Lateral confirmation well for Enyenra channels, and discovery wells for deeper condensate pays. Whole core obtained. | |||||||||

Dahoma |

|||||||||||||||

Dahoma-1 |

Kosmos | 02/04/10 | 14,403 | — | Abandoned | Dry hole. | |||||||||

- (1)

- In

connection with our side-track wells, "spud date" refers to the date we commenced drilling such well.

- (2)

- These terms have the following meanings:

| Abandoned | Exploration / appraisal well that was deemed to have no further utility. The well was permanently abandoned, per approved government procedures. | |

Completion Pending |

Production / Injection casing has been installed across the target interval as part of the normal drilling operations, and the well is scheduled / approved to have a completion installed to facilitate production / injection per the applicable PoD. |

|

Injection Ready |

Injection well has been drilled and completed. All well equipment is in place to commence injection. |

|

Plugged Back |

Well that has cement set across productive interval to facilitate production from sidetrack well. |

|

Production Ready |

Production well has been drilled and completed. All well equipment is in place to commence production. |

|

Suspended |

Exploration / appraisal well that has had production casing installed across the target interval. However, plans to utilize the well as part of a development have not yet been approved. |

11

Prospect Information

Information about our prospects is summarized in the following table.

Prospect

|

License | Kosmos Working Interest (%) |

Block Operator |

Type | Projected Spud Year(3) |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

Ghana(1) |

||||||||||||

Teak |

WCTP | 30.875 | Kosmos | Deepwater | 2010 | |||||||

Banda Campanian |

WCTP | 30.875 | Kosmos | Deepwater | 2011 | |||||||

Banda Cenomanian |

WCTP | 30.875 | Kosmos | Deepwater | 2011 | |||||||

Makore |

WCTP | 30.875 | Kosmos | Deepwater | 2011 | |||||||

Odum East |

WCTP | 30.875 | Kosmos | Deepwater | 2011 | |||||||

Sapele |

WCTP | 30.875 | Kosmos | Deepwater | 2012 | |||||||

Funtum |

WCTP | 30.875 | Kosmos | Deepwater | 2012 | |||||||

Assin |

WCTP | 30.875 | Kosmos | Deepwater | 2012 | |||||||

Okoro |

WCTP | 30.875 | Kosmos | Deepwater | Post 2012 | |||||||

Late Cretaceous WCTP Play (4 identified targets) |

WCTP | 30.875 | Kosmos | Deepwater | Post 2012 | |||||||

Tweneboa Deep |

DT | 18.000 | Tullow | Deepwater | 2012 | |||||||

Walnut |

DT | 18.000 | Tullow | Deepwater | 2012 | |||||||

DT Sapele |

DT | 18.000 | Tullow | Deepwater | 2012 | |||||||

Wassa |

DT | 18.000 | Tullow | Deepwater | Post 2012 | |||||||

Adinkra |

DT | 18.000 | Tullow | Deepwater | Post 2012 | |||||||

Oyoko |

DT | 18.000 | Tullow | Deepwater | Post 2012 | |||||||

Ananta |

DT | 18.000 | Tullow | Deepwater | Post 2012 | |||||||

Cameroon(2) |

||||||||||||

N'gata |

Kombe-N'sepe | 35.000 | Perenco | Onshore | 2011 | |||||||

N'donga |

Kombe-N'sepe | 35.000 | Perenco | Onshore | Post 2012 | |||||||

Disangue |

Kombe-N'sepe | 35.000 | Perenco | Onshore | Post 2012 | |||||||

Pongo Songo |

Kombe-N'sepe | 35.000 | Perenco | Onshore | Post 2012 | |||||||

Bonongo |

Kombe-N'sepe | 35.000 | Perenco | Onshore | Post 2012 | |||||||

Coco East |

Kombe-N'sepe | 35.000 | Perenco | Onshore | Post 2012 | |||||||

Liwenyi |

Ndian River | 100.000 | Kosmos | Onshore | 2012 | |||||||

Liwenyi South |

Ndian River | 100.000 | Kosmos | Onshore | Post 2012 | |||||||

Meme |

Ndian River | 100.000 | Kosmos | Onshore | Post 2012 | |||||||

Bamusso |

Ndian River | 100.000 | Kosmos | Onshore | Post 2012 | |||||||

Morocco(4) |

||||||||||||

Gargaa |

Boujdour Offshore | 75.000 | Kosmos | Deepwater | Post 2012 | |||||||

Argane |

Boujdour Offshore | 75.000 | Kosmos | Deepwater | Post 2012 | |||||||

Safsaf |

Boujdour Offshore | 75.000 | Kosmos | Deepwater | Post 2012 | |||||||

Aarar |

Boujdour Offshore | 75.000 | Kosmos | Deepwater | Post 2012 | |||||||

Zitoune |

Boujdour Offshore | 75.000 | Kosmos | Deepwater | Post 2012 | |||||||

Al Arz |

Boujdour Offshore | 75.000 | Kosmos | Deepwater | Post 2012 | |||||||

Felline |

Boujdour Offshore | 75.000 | Kosmos | Deepwater | Post 2012 | |||||||

Nakhil |

Boujdour Offshore | 75.000 | Kosmos | Deepwater | Post 2012 | |||||||

Barremian Tilted Fault Block Play (11 identified structures) |

Boujdour Offshore | 75.000 | Kosmos | Deepwater | Post 2012 | |||||||

- (1)

- GNPC

has the option to acquire additional paying interests in a commercial discovery on the WCTP Block and the DT Block of 2.5% and 5.0%, respectively. In

order to acquire the additional paying interests, GNPC must notify the contractor of its intention to do so within sixty to ninety days of the contractor's notice to Ghana's Ministry of Energy of a

commercial discovery. These interest percentages do not give effect to the exercise of such options.

- (2)

- Cameroon

will back-in for a 60.0% revenue interest and a 50.0% carried paying interest in a commercial discovery on the Kombe-N'sepe Block, with Kosmos then

holding a 35.0% interest in the remaining interests of the block partners. This would result in Kosmos holding a 14.0% net revenue interest and a 17.5% paying interest. Cameroon has an option to

acquire an interest of up to 15.0% in a commercial discovery on the Ndian River Block. These interest percentages do not give effect to the exercise of such options.

- (3)

- See

"Risk Factors—Our identified drilling locations are scheduled out over several years, making them susceptible to uncertainties that could

materially alter the occurrence or timing of their drilling" and "Risk Factors—Under the terms of our various license agreements, we are contractually obligated to drill wells and declare

any discoveries in order to retain exploration and production rights. In the competitive market for our license areas, failure to declare any discoveries and thereby establish development areas may

result in substantial license renewal costs or loss of our interests in the undeveloped parts of our license areas, which may include certain of our prospects."

- (4)

- We have not yet made a decision as to whether or not to continue into the drilling phase of the license. If we do, we anticipate the first well to drill within the Boujdour Offshore Block will be post 2012.

12

Recent Events

In January 2011, we announced that the "Tweneboa-3" appraisal well in the DT Block had successfully confirmed the Greater Tweneboa Area's (comprising the Tweneboa-1 and Tweneboa-2 oil and gas-condensate fields and the neighboring Enyenra light oil field (formerly known as the Owo Field)) resource base potential. The results of drilling, wireline logs and reservoir fluid samples show the Tweneboa-3 appraisal well encountered approximately 29 feet (9 meters) of gas-condensate pay before the well was sidetracked. The sidetrack encountered approximately 112 feet (34 meters) of net gas-condensate pay in high-quality stacked reservoir sandstones in two zones.

In January 2011, we announced that John R. Kemp III had been named Chairman and Brian F. Maxted, one of the founding partners of Kosmos, had been promoted from Chief Operating Officer to President and Chief Executive Officer and made a member of the Kosmos board of directors, following the retirement of James C. Musselman, Kosmos' former Chairman and Chief Executive Officer.

In September 2010, we announced that the Owo-1ST appraisal sidetrack well had successfully confirmed a significant column of high quality, light oil in the Enyenra Field, which lies wholly within the DT Block. The results of drilling, wireline logs and reservoir fluid samples show the Owo-1ST appraisal sidetrack well penetrated net oil pay of approximately 63 feet (19 meters) in two zones of high-quality stacked reservoir sandstones. In addition, the Owo-1ST encountered approximately 52 feet (16 meters) of natural gas condensate in two new pools not previously encountered.

In September 2010, we announced our second declaration of commerciality in Ghana with Mahogany East in the WCTP Block and are currently performing a Front End Engineering and Design ("FEED") study for final selection of the development concept to be included in a PoD submission. As operator of Mahogany East, we intend to submit a PoD for the field to Ghana's Ministry of Energy in 2011, with the potential to achieve first production from the development in early 2014.

In August 2010, we announced the execution of definitive documentation to increase our commercial debt facilities by $350 million, raising the total amount of our debt commitments to $1.25 billion. Along with the proceeds from this offering, these funds will support our share of the Jubilee Field Phase 1 development, appraisal of additional discoveries, and ongoing exploration activities.

In July 2010, Tullow announced that the "Owo-1" exploration well had successfully discovered hydrocarbons in the Enyenra Field in the DT Block. The results of drilling, wireline logs and reservoir fluid samples showed the Owo-1 exploration well encountered hydrocarbon-bearing net pay of approximately 174 feet (53 meters) in two zones of high-quality stacked reservoir sandstones.

In May 2010, we drilled the "Mahogany-5" appraisal well, the final appraisal well for Mahogany East. Such field lies wholly within the WCTP Block and has previously been appraised by the "Mahogany-3", "Mahogany-4" and "Mahogany Deep-2" wells.

In January 2010, we announced that the "Tweneboa-2" well in the DT Block had successfully appraised our Tweneboa discovery. The results of drilling, wireline logs and reservoir fluid samples confirmed the well has a gross hydrocarbon column of approximately 502 feet (153 meters) and penetrated combined net hydrocarbon-bearing pay of at least 105 feet (32 meters) in stacked sandstone reservoirs.

In December 2009, we announced that the "Odum-2" well in the WCTP Block had successfully appraised the "Odum-1" oil discovery with drilling, wireline logs and reservoirs fluid samples showed the well penetrated new hydrocarbon-bearing net pay of approximately 66 feet (20 meters) in high-quality stacked sandstone reservoirs over a gross interval of approximately 597 feet (182 meters).

13

Risks Associated with our Business

Please read the section entitled "Risk Factors" for a discussion of some of the factors you should carefully consider before deciding to invest in our common shares.

Corporate Information

We were incorporated pursuant to the laws of Bermuda as Kosmos Energy Ltd. in January 2011 to become a holding company for Kosmos Energy Holdings. Kosmos Energy Holdings was formed as an exempted company limited by guarantee on March 5, 2004 pursuant to the laws of the Cayman Islands. Pursuant to the terms of a corporate reorganization that will be completed simultaneously with, or prior to, the closing of this offering, all of the interests in Kosmos Energy Holdings will be exchanged for newly issued common shares of Kosmos Energy Ltd. and as a result Kosmos Energy Holdings will become wholly-owned by Kosmos Energy Ltd.

We maintain a registered office in Bermuda at Clarendon House, 2 Church Street, Hamilton HM11, Bermuda. Our registered offices are located at Clarendon House, 2 Church Street, Hamilton HM11, Bermuda. The telephone number of our registered offices is (441) 295-1422. Our U.S. subsidiary maintains its headquarters at 8176 Park Lane, Suite 500, Dallas, Texas 75231 and its telephone number is (214) 445-9600. Our web site is www.kosmosenergy.com. The information on our web site does not constitute part of this prospectus.

14

Issuer |

Kosmos Energy Ltd. | |

Common shares offered by us |

common shares |

|

Common shares to be issued and outstanding after this offering |

common shares |

|

Over-allotment option |

We have granted to the underwriters an option, exercisable upon notice to us, to purchase up to additional common shares at the offering price to cover over-allotments, if any, for a period of 30 days from the date of this prospectus. |

|

Use of Proceeds |

We intend to use the net proceeds from this offering and other resources available to us to fund our capital expenditures, and in particular our exploration and appraisal drilling program and development activities through early 2013 and associated operating expenses, and for general corporate purposes. See "Use of Proceeds" on page 51 of this prospectus for a more detailed description of our intended use of the proceeds from this offering. |

|

Listing |

We intend to apply to have our common shares listed on the New York Stock Exchange (the "NYSE") under the symbol "KOS." |

Except as otherwise indicated, all information in this prospectus assumes:

- •

- the completion, simultaneously with or prior to the closing of this offering, of our corporate reorganization pursuant to

which all of the interests of Kosmos Energy Holdings will be exchanged for common shares of Kosmos Energy Ltd. and as a result Kosmos Energy Holdings will become wholly-owned by Kosmos

Energy Ltd.;

- •

- an initial public offering price of $ per common share, the midpoint of the estimated public offering price

range set forth on the cover page of this prospectus. In the event that the initial public offering price in this offering is less than $ per common share, the aggregate number of

common shares issuable as a result of the conversion of the Series A Preferred Units of Kosmos Energy Holdings will be increased and the aggregate number of common shares issuable as a result

of the conversion of the Series B and Series C Preferred Units and the Common Units of Kosmos Energy Holdings will be decreased. The exact amount of any such adjustments, if any, will be

based on the actual per share initial public offering price. However, any such adjustments will not result in any change to the aggregate number of common shares issuable in exchange for preferred

units, nor any change in the aggregate number of common shares issued and outstanding after this offering (other than any increase or decrease resulting from the elimination of fractional shares); and

- •

- no exercise of the underwriters' over-allotment option to purchase additional shares.

15

SUMMARY HISTORICAL AND PRO FORMA FINANCIAL DATA

The summary historical financial data set forth below should be read in conjunction with the sections entitled "Corporate Reorganization", "Selected Historical and Pro Forma Financial Information" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" and with Kosmos Energy Holdings' financial statements and the notes to those financial statements included elsewhere in this prospectus. Kosmos Energy Holdings has been a development stage company. The consolidated statements of operations and cash flows for the years ended December 31, 2005, 2006, 2007, 2008 and 2009 and the consolidated balance sheets as of December 31, 2005, 2006, 2007, 2008 and 2009 were derived from Kosmos Energy Holdings' audited consolidated financial statements. We derived the consolidated statements of operations and cash flows for the nine months ended September 30, 2009 and 2010 and for the period April 23, 2003 (Inception) through September 30, 2010, and the consolidated balance sheets as of September 30, 2009 and 2010 from Kosmos Energy Holdings' unaudited consolidated financial data appearing elsewhere in this prospectus, which, in management's opinion, includes all adjustments necessary for the fair presentation of Kosmos Energy Holdings' financial condition as of such date and Kosmos Energy Holdings' results of operations for such periods. Results of operations for the nine months ended September 30, 2010 are not necessarily indicative of the results of operations that may be achieved for the entire year. The summary unaudited pro forma financial data set forth below is derived from Kosmos Energy Holdings' audited and unaudited consolidated financial statements appearing elsewhere in this prospectus and is based on assumptions and includes adjustments as explained in the notes to the tables.

16

Consolidated Statements of Operations Information:

| |

|

|

|

|

|

|

|

Period April 23, 2003 (Inception) through September 30 2010 |

|||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Year Ended December 31 | Nine Months Ended September 30 |

|||||||||||||||||||||||||

| |

2005 | 2006 | 2007 | 2008 | 2009 | 2009 | 2010 | ||||||||||||||||||||

| |

|

|

|

|

|

(Unaudited) |

(Unaudited) |

(Unaudited) |

|||||||||||||||||||

| |

(In thousands) |

||||||||||||||||||||||||||

Revenues and other income: |

|||||||||||||||||||||||||||

Oil and gas revenue |

$ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | |||||||||||

Interest income |

252 | 445 | 1,568 | 1,637 | 985 | 595 | 2,548 | 7,459 | |||||||||||||||||||

Other income |

1,822 | 3,100 | 2 | 5,956 | 9,210 | 7,578 | 3,793 | 25,383 | |||||||||||||||||||

Total revenues and other income |

2,074 | 3,545 | 1,570 | 7,593 | 10,195 | 8,173 | 6,341 | 32,842 | |||||||||||||||||||

Costs and expenses: |

|||||||||||||||||||||||||||

Exploration expenses, including dry holes |

6,718 | 9,083 | 39,950 | 15,373 | 22,127 | 17,191 | 52,764 | 146,088 | |||||||||||||||||||

General and administrative |

7,801 | 9,588 | 18,556 | 40,015 | 55,619 | 43,425 | 50,804 | 188,002 | |||||||||||||||||||

Depreciation and amortization |

340 | 401 | 477 | 719 | 1,911 | 1,369 | 1,655 | 5,737 | |||||||||||||||||||

Amortization—debt issue costs |

— | — | — | — | 2,492 | — | 20,555 | 23,047 | |||||||||||||||||||

Interest expense |

— | — | 8 | 1 | 6,774 | — | 45,645 | 52,452 | |||||||||||||||||||

Derivatives, net |

— | — | — | — | — | — | 15,310 | 15,310 | |||||||||||||||||||

Equity in losses of joint venture |

5,157 | 9,194 | 2,632 | — | — | — | — | 16,983 | |||||||||||||||||||

Other expenses, net |

7 | 7 | 17 | 21 | 46 | 39 | 20 | 875 | |||||||||||||||||||

Total costs and expenses |

20,023 | 28,273 | 61,640 | 56,129 | 88,969 | 62,024 | 186,753 | 448,494 | |||||||||||||||||||

Loss before income taxes |

(17,949 | ) | (24,728 | ) | (60,070 | ) | (48,536 | ) | (78,774 | ) | (53,851 | ) | (180,412 | ) | (415,652 | ) | |||||||||||

Income tax expense (benefit) |

— | — | 718 | 269 | 973 | 30 | (174 | ) | 1,786 | ||||||||||||||||||

Net loss |

$ | (17,949 | ) | $ | (24,728 | ) | $ | (60,788 | ) | $ | (48,805 | ) | $ | (79,747 | ) | $ | (53,881 | ) | $ | (180,238 | ) | $ | (417,438 | ) | |||

Pro forma net loss (unaudited)(1): |

|||||||||||||||||||||||||||

Pro forma basic and diluted net loss per common share |

$ | $ | |||||||||||||||||||||||||

Weighted average common shares outstanding used in pro forma basic and diluted net loss per common share |

$ | $ | |||||||||||||||||||||||||

- (1)

- Pursuant to the terms of a corporate reorganization that will be completed simultaneously with, or prior to, the closing of this offering, all of the interests in Kosmos Energy Holdings will be exchanged for newly issued common shares of Kosmos Energy Ltd. based on these interests' relative rights as set forth in Kosmos Energy Holdings' current operating agreement. The weighted average common shares outstanding have been calculated as if the owenership structure resulting from the corporate reorganization was in place since inception. Pro forma information does not give effect to this offering.

17

Consolidated Balance Sheets Information:

| |

As of December 31 | As of September 30 | Pro Forma as Adjusted as of September 30 2010(1) |

||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2005 | 2006 | 2007 | 2008 | 2009 | 2009 | 2010 | ||||||||||||||||||

| |

|

|

|

|

|

(Unaudited) |

(Unaudited) |

(Unaudited) |

|||||||||||||||||

| |

(In thousands) |

||||||||||||||||||||||||

Cash and cash equivalents |

$ | 14,349 | $ | 9,837 | $ | 39,263 | $ | 147,794 | $ | 139,505 | $ | 60,818 | $ | 202,846 | $ | ||||||||||

Total current assets |

16,346 | 10,334 | 65,960 | 205,708 | 256,728 | 176,536 | 491,638 | ||||||||||||||||||

Total property and equipment |

3,788 | 1,567 | 18,022 | 208,146 | 604,007 | 492,202 | 884,628 | ||||||||||||||||||

Total other assets |

727 | 3,704 | 3,393 | 1,611 | 161,322 | 22,650 | 175,622 | ||||||||||||||||||

Total assets |

20,861 | 15,605 | 87,375 | 415,465 | 1,022,057 | 691,388 | 1,551,888 | ||||||||||||||||||

Total current liabilities |

430 | 1,436 | 28,574 | 68,698 | 139,647 | 143,829 | 168,310 | ||||||||||||||||||

Total long-term liabilities |

1,312 | — | — | 444 | 287,022 | 1,902 | 967,211 | ||||||||||||||||||

Total convertible preferred units |

41,937 | 61,952 | 167,000 | 499,656 | 813,244 | 750,065 | 813,244 | ||||||||||||||||||

Total unit holdings |

(22,818 | ) | (47,783 | ) | (108,199 | ) | (153,333 | ) | (217,856 | ) | (204,408 | ) | (396,877 | ) | |||||||||||

Total liabilities, convertible preferred units and unit holdings |

20,861 | 15,605 | 87,375 | 415,465 | 1,022,057 | 691,388 | 1,551,888 | ||||||||||||||||||

- (1)

- Includes the effect of our corporate reorganization and the effect of this offering as described in "Corporate Reorganization," "Capitalization" and "Dilution."

Consolidated Statements of Cash Flows Information:

| |

|

|

|

|

|

|

|

Period April 23, 2003 (Inception) through September 30 2010 |

|||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Year Ended December 31 | Nine Months Ended September 30 | |||||||||||||||||||||||

| |

2005 | 2006 | 2007 | 2008 | 2009 | 2009 | 2010 | ||||||||||||||||||

| |

|

|

|

|

|

(Unaudited) |

(Unaudited) |

(Unaudited) |

|||||||||||||||||

| |

(In thousands) |

||||||||||||||||||||||||

Net cash provided by (used in): |

|||||||||||||||||||||||||

Operating activities |

$ | (13,978 | ) | $ | (9,617 | ) | $ | (17,386 | ) | $ | (65,671 | ) | $ | (27,591 | ) | $ | (6,506 | ) | $ | (133,180 | ) | $ | (272,389 | ) | |

Investing activities |

(3,980 | ) | (14,663 | ) | (58,161 | ) | (156,882 | ) | (500,393 | ) | (309,801 | ) | (451,164 | ) | (1,190,215 | ) | |||||||||

Financing activities |

30,895 | 19,768 | 104,973 | 331,084 | 519,695 | 229,331 | 647,685 | 1,665,450 | |||||||||||||||||

18

An investment in our common shares involves a high degree of risk. You should consider and read carefully all of the risks and uncertainties described below, together with all of the other information contained in this prospectus, including the consolidated financial statements and the related notes appearing at the end of this prospectus, before deciding to invest in our common shares. If any of the following risks actually occurs, our business, business prospects, financial condition, results of operations or cash flows could be materially adversely affected. In any such case, the trading price of our common shares could decline, and you could lose all or part of your investment. The risks below are not the only ones facing our company. Additional risks not currently known to us or that we currently deem immaterial may also adversely affect us. This prospectus also contains forward-looking statements, estimates and projections that involve risks and uncertainties. Our actual results could differ materially from those anticipated in the forward-looking statements as a result of specific factors, including the risks described below.

Risks Relating to Our Business

We have limited proved reserves and areas that we decide to drill may not yield oil and natural gas in commercial quantities or quality, or at all.