Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Sabra Health Care REIT, Inc. | d8k.htm |

J.P. MORGAN

HEALTHCARE CONFERENCE

January 10-13, 2011

Exhibit 99.1 |

FORWARD LOOKING

STATEMENTS 2

Statements made in this presentation that are not historical facts are

“forward-looking” statements (as defined in the Private Securities Litigation

Reform Act of 1995) that involve risks and uncertainties and are subject to change at any

time. These forward-looking statements may include, but are not limited to,

statements containing words such as “anticipate,” “believe,” “plan,” “estimate,” “expect,” “hope,” “intend,” “should,” “may” and similar

expressions. Forward-looking statements in this presentation also include all

statements regarding expected future financial position, results of operations, cash

flows, liquidity, financing plans, business strategy, the expected amounts and timing of dividends and distributions, projected

expenses and capital expenditures, competitive position, growth opportunities, potential

acquisitions and plans and objectives of management for future operations.

Factors that could cause actual results to differ materially from those projected in the forward-looking statements include our

dependence on Sun Healthcare Group, Inc., formerly known as SHG Services, Inc.

(“Sun”), until we are able to diversify our portfolio; our ability to

build the necessary infrastructure to operate as a separate publicly traded company; our

ability to qualify as a real estate investment trust (“REIT”) and to maintain

our REIT status once we qualify; changes in general economic conditions and volatility in financial and credit markets; our ability to pursue

and complete acquisitions and the costs and management attention required to do so; the

significant amount of our indebtedness; covenants in our debt agreements that may

restrict our ability to make acquisitions, incur additional indebtedness and refinance indebtedness on favorable terms;

increases in market interest rates; the impact of healthcare reform legislation on our

business; and competitive conditions in our industry. We caution that any forward-looking statements made in this presentation are not

guarantees of future performance. The forward-looking statements are based on

information currently available. We disclaim any obligation to update any such factors or to announce publicly the results of any revisions

to any of the forward-looking statements to reflect future events or developments.

|

NON-GAAP

FINANCIAL MEASURES 3

In this presentation, we refer to financial measures that are derived on the basis of

methodologies other than in accordance with generally accepted accounting principles

(“GAAP”). These non-GAAP financial measures are presented in this presentation on a pro forma basis and

include EBITDA, Adjusted EBITDA, FFO and Adjusted FFO. These non-GAAP financial

measures are reconciled to the corresponding pro forma GAAP financial measures in the

Appendices included at the end of this presentation. EBITDA is defined as net income before interest expense (net of interest income), income tax

expense and depreciation and amortization. Adjusted EBITDA is defined as EBITDA

adjusted to include estimated general and administrative expenses and to exclude the effect of estimated

stock-based compensation expense. FFO is calculated in accordance with The National

Association of Real Estate Investment Trusts’ (“NAREIT”) definition of

“funds from operations,” which is net income (computed in accordance with GAAP), excluding gains (or losses) from sales of

property, plus depreciation and amortization, and after adjustments for unconsolidated

partnerships and joint ventures. Adjusted FFO is FFO adjusted to include

estimated general and administrative expenses and to exclude the effect of estimated stock-based compensation expenses

and the amortization of financing fees.

This presentation includes information regarding Sun. Sun is subject to the reporting

requirements of the Securities and Exchange Commission (the “SEC”) and is

required to file with the SEC annual reports containing audited financial information and quarterly reports containing

unaudited financial information. The information related to Sun provided in this presentation

has been provided by Sun or derived from its public filings. We have not independently

verified this information. We have no reason to believe that such information is inaccurate in any

material

respect.

We

are

providing

this

data

for

informational

purposes

only.

Sun’s

filings

with

the

SEC

can

be

found

at

www.sec.gov.

|

4

Company Overview and

Investment Highlights |

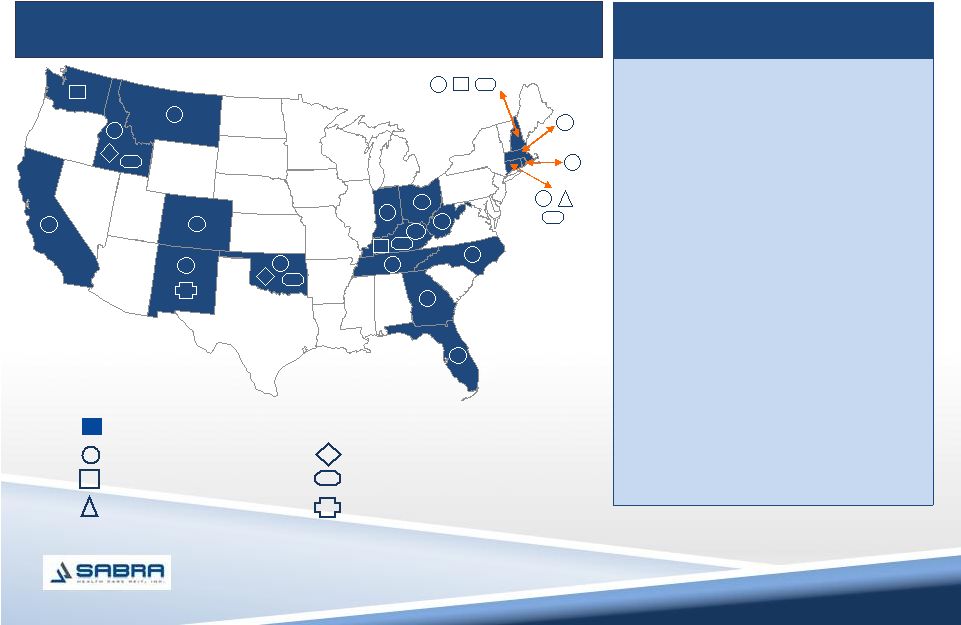

SABRA PROPERTY

PORTFOLIO 5

1

4

1

1

1

3

2

2

1

3

1

1

1

8

2

2

11

1

2

5

5

2

8

3

2

8

1

1

2

1

States with Facilities

Skilled Nursing (Total: 67)

Assisted Living (Total: 5)

Independent Living (Total: 1)

Mental Health (Total: 2)

Multi-Licensed Designation (Total: 10)

CCRC (Total: 1)

Geographically diversified portfolio of skilled nursing and senior

housing assets

Key Portfolio Metrics

Number of Facilities:

86

Property Type:

Skilled Nursing

SNF/AL/IL

AL

Mental Health

IL

CCRC

67 (78%)

10 (12%)

5 (6%)

2 (2%)

1 (1%)

1 (1%)

Beds:

Licensed

Available

9,603

9,266

States:

19

YTD 9/30/10 PF EBITDARM ($mm):

Margin (%):

$101.4M

19.0%

YTD 9/30/10 SNF Skilled Mix

(1)

:

Patient Days (%):

Revenue (%):

21.8%

39.3%

YTD 9/30/10 Occupancy (%):

88.2%

Facilities w/Specialty Units:

RRS Units

Solana Units

30

21

(1)

Skilled mix defined as Medicare and non-Medicaid managed care patient

days/revenues divided by the total patient days/revenues.

|

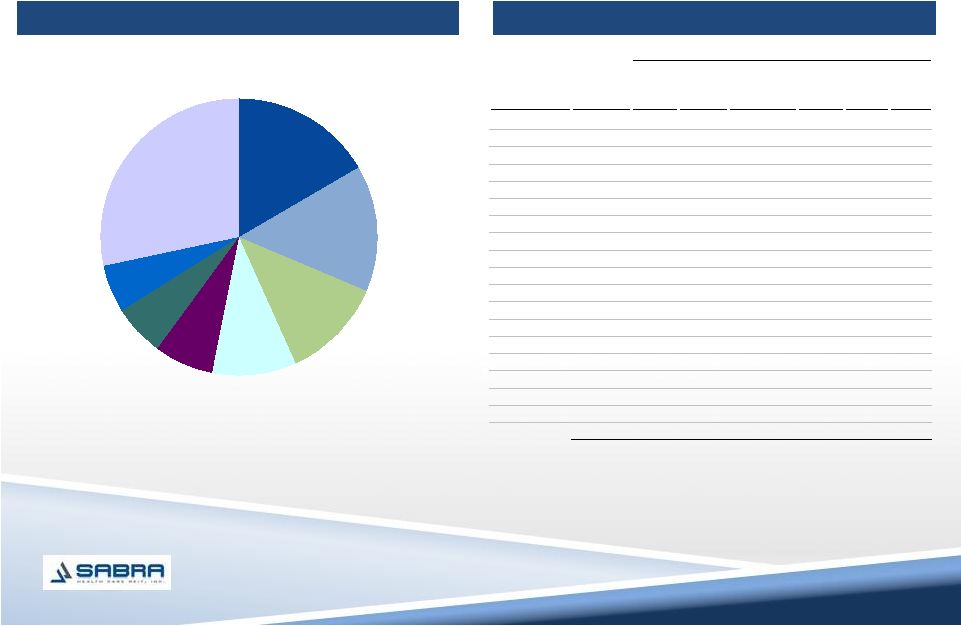

GEOGRAPHICALLY

DIVERSE PORTFOLIO 6

New

Hampshire

17%

Connecticut

15%

Kentucky

12%

Ohio

10%

Florida

7%

Oklahoma

6%

Montana

6%

Other States

27%

Beds / Units by State

86 Properties and 9,603 Beds in 19 States

(1)

“Licensed Beds”

refers to the number of beds for which a license has been issued, which may vary in some

instances from licensed beds available for use, which is used in the computation of

occupancy. Available beds for the 86 properties aggregated 9,266.

Number

of

Licensed

Beds

/

Units

(1)

State

Total

Number of

Centers

Skilled

Nursing

Assisted

Living

Independent

Living

Mental

Health

Total

% of

Total

New Hampshire

15

1,131

474

-

-

1,605

16.7%

Connecticut

10

1,327

23

49

-

1,399

14.6%

Kentucky

15

976

172

-

-

1,148

12.0%

Ohio

8

954

-

-

-

954

9.9%

Florida

5

660

-

-

-

660

6.9%

Oklahoma

5

441

71

12

60

584

6.1%

Montana

4

538

-

-

-

538

5.6%

New Mexico

3

190

120

60

-

370

3.9%

Colorado

2

362

-

-

-

362

3.8%

Georgia

2

310

-

-

-

310

3.2%

California

3

301

-

-

-

301

3.1%

Massachusetts

3

301

-

-

-

301

3.1%

Idaho

3

229

16

-

22

267

2.8%

Rhode Island

2

261

-

-

-

261

2.7%

West Virginia

2

185

-

-

-

185

1.9%

Tennessee

1

134

-

-

-

134

1.4%

North Carolina

1

100

-

-

-

100

1.0%

Indiana

1

88

-

-

-

88

0.9%

Washington

1

-

36

-

-

36

0.4%

Total

86

8,488

912

121

82

9,603

100% |

STRONG OPERATOR

PERFORMANCE 7

Strong occupancy and skilled mix trends in the underlying REIT portfolio

Bedford Hills in New Hampshire

Heartland Villa in Kentucky

Historical Portfolio Occupancy

Historical

Portfolio

SNF

Skilled

Mix

(1)

(1)

Skilled mix defined as Medicare and non-Medicaid managed care patient

days/revenues divided by the total patient days/revenues.

89.6%

91.4%

90.9%

90.0%

88.2%

0%

20%

40%

60%

80%

100%

2006

2007

2008

2009

YTD Q3 2010

18.0%

19.7%

21.5%

20.9%

20.8%

34.4%

35.9%

39.2%

39.4%

39.3%

0%

10%

20%

30%

40%

50%

2006

2007

2008

2009

YTD Q3 2010

Patient Days

Revenues |

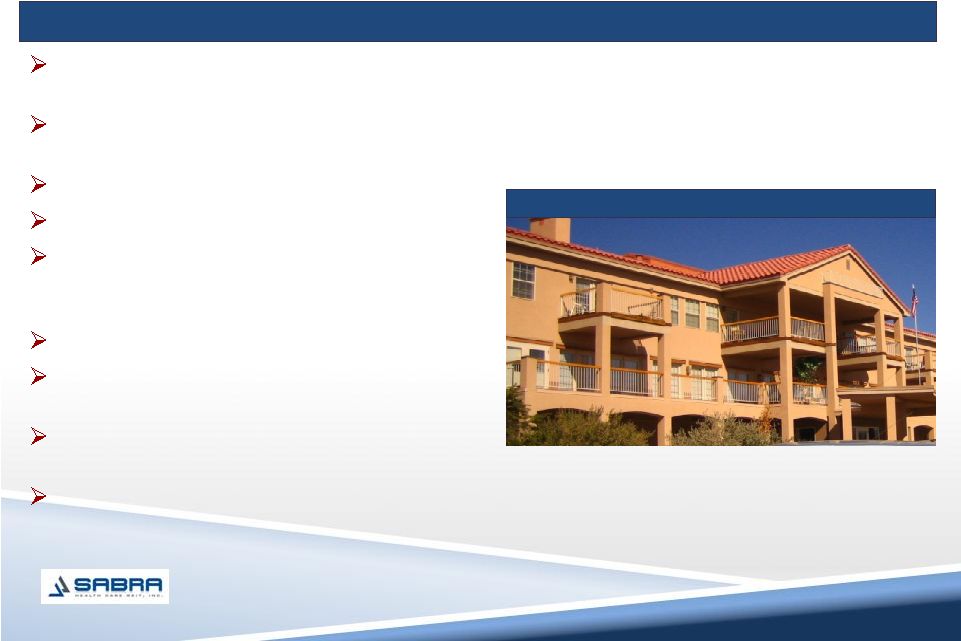

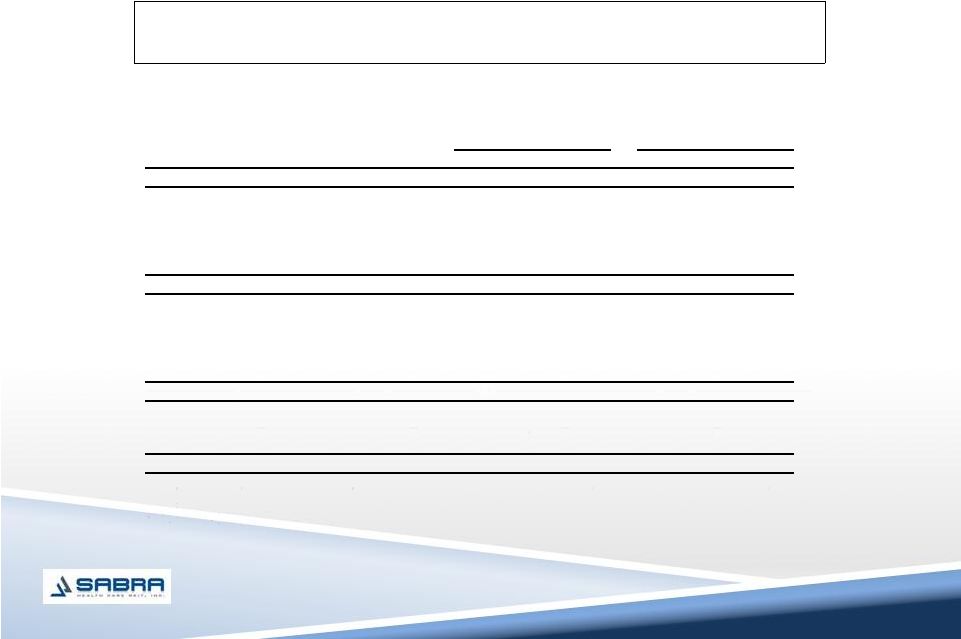

FAVORABLE

LONG-TERM LEASE STRUCTURE 8

Triple net master leases with staggered

maturities

10-15 year term, with 5 year renewal

options

Renewal options at time of renewal rates

Lesser of CPI or 2.5% escalators

2.1x EBITDARM lease coverage overall

and 1.6x EBITDAR lease coverage overall

and by master lease

No purchase options

Tenant responsible for insurance, taxes,

utilities, maintenance and repairs

Mandated minimum annual maintenance

and repairs expenditures

Master leases cross-defaulted

Strong structural protections to the REIT with operating flexibility to New Sun

Northrise

CCRC in New Mexico |

9

BUSINESS MODEL AND GROWTH OPPORTUNITIES

Focused on acquiring and leasing skilled nursing

and senior housing facilities to strong national,

regional, and local operators

Tenant responsible for property level expenses

such as labor, insurance, property taxes, and

capital expenditures

Tenants provide services to patients and are

reimbursed by Medicare, Medicaid and private

payors

Sabra

receives fixed rent payments from tenants,

with annual escalators of the lower of CPI or 2.5%

Flexible capital structure to support initiatives

Mix of bank, mortgage and unsecured term debt

Limited near-term maturities and amortization

Ample Liquidity

Sabra

Strategy & Business Model

Opportunistically pursue acquisitions and

diversification

Initial focus will be skilled nursing and senior

housing

Diversify by geography, asset class and tenant

within the healthcare sector

Develop new tenant relationships

Leverage management’s extensive network of

relationships

Capital source to underserved operators which

are not the focus of larger healthcare REITs

Strategic capital improvements

In the future, pursue strategic development

opportunities

Replace or renovate existing facilities

Design, develop and construct new facilities

Growth Opportunities |

10

EXPERIENCED MANAGEMENT TEAM

Dedicated leadership team with over 60 years of relevant experience

Strong and independent Board of Directors

Board

has

significant

leadership,

financial,

industry

and

public

company

experience

Four

of

the

five

Directors

are

“independent”

as

defined

under

applicable

NASDAQ

listing standards; Two of the independent Directors are on the Sun Board

Executive

Relevant

Experience

Profile

Rick Matros

Chairman

and Chief

Executive Officer

20+

Years

Former Sun Healthcare Chairman and CEO

Executive of healthcare companies for over 20 years

Harold Andrews, Jr.

Chief Financial Officer

20+

Years

Managing

Partner of Journey Health Properties, LLC and

Journey Lane 5, LLC

Former Chief Financial Officer of CareMeridian

Former Senior

Audit

Manager

for Arthur Andersen LLP

Talya

Nevo-Hacohen

Chief Investment Officer

20+

Years

Former Managing Director with Cerberus

Real Estate Capital

Management, LLC

Former SVP –

Capital Markets and Treasurer for HCP, Inc. from

2003 –

2006

Former VP –

Goldman Sachs

& Co. |

Industry

Overview 11 |

12

AGING POPULATION DRIVES DEMAND

65+ and 85+ population projected to increase 36% and 14%, respectively, by 2020

Number of SNF beds has steadily declined, creating favorable supply/demand

dynamics

Limits on new nursing home construction (CON states)

Healthcare

policy

favors

SNFs

–

payors

focused

on

driving

seniors

to

skilled

nursing facilities, the lowest cost setting of care

65+ Population Growth

85+ Population Growth

40.2

54.8

63.9

72.1

77.5

81.2

46.8

13.0%

14.5%

16.3%

18.3%

19.9%

20.0%

19.8%

0.0

30.0

60.0

90.0

2010

2015

2020

2025

2030

2035

2040

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

30.0%

CAGR = 2.4%

(population in millions)

5.8

6.6

7.2

8.7

11.5

14.2

6.3

2.3%

3.5%

2.9%

2.0%

1.9%

1.9%

1.8%

0.0

3.0

6.0

9.0

12.0

15.0

2010

2015

2020

2025

2030

2035

2040

0.0%

1.0%

2.0%

3.0%

4.0%

CAGR = 3.0%

(population in millions)

65+ Population

% of Total Population

85+ Population

% of Total Population

Source: U.S. Census Bureau

Source: U.S. Census Bureau |

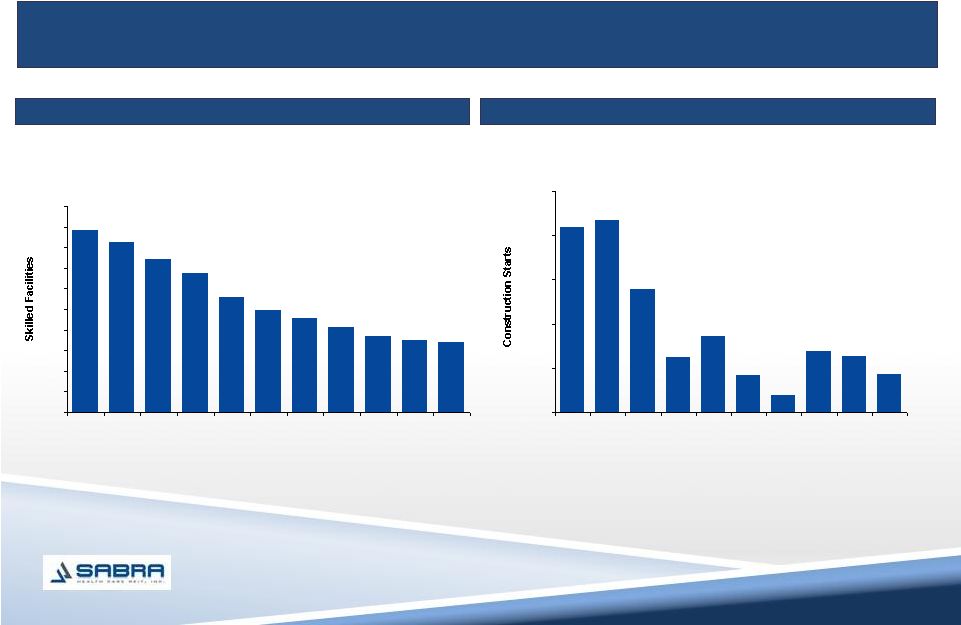

13

DECREASING BED SUPPLY

Sabra

will benefit from attractive supply / demand fundamentals within

the skilled nursing and senior housing sectors

Trend in Skilled Nursing Facilities

Senior Housing Construction Starts in Top 31 Metros (Units)

(figures in 000s)

Source: American Health Care Association (AHCA).

Source: Q1’10 NIC Map Data Construction Monitor for the top 31 metro

markets. 16.8

16.7

16.5

16.3

16.1

16.0

15.9

15.8

15.7

15.7

15.7

15.0

15.2

15.4

15.6

15.8

16.0

16.2

16.4

16.6

16.8

17.0

Jun-

00

Jun-

01

Jun-

02

Jun-

03

Jun-

04

Jun-

05

Jun-

06

Jun-

07

Jun-

08

Jun-

09

Jun-

10

4,184

4,335

2,773

1,245

1,716

842

374

1,385

1,257

870

0

1,000

2,000

3,000

4,000

5,000

4Q07

1Q08

2Q08

3Q08

4Q08

1Q09

2Q09

3Q09

4Q09

1Q10 |

14

SHIFT OF PATIENT CARE TO LOWER COST ALTERNATIVES

Sabra

will benefit from the increasing shift of patients toward SNF facilities

SNFs

deliver effective clinical

outcomes at lower costs

Increased Medicare funding for

treatment of high-acuity patients

Lower staffing requirements and

associated costs

60% rule driving high-acuity patients

from inpatient rehab facilities

Short stay outlier policy shifting

patients from LTACs

to SNFs

Shorter length of stays for SNFs

Skilled nursing facilities are a lower cost setting

Comparison of Per Case Rates

SNF

IRF

LTAC

Tracheotomy with Vent

$10,051

$26,051

$115,463

Respiratory with vent

7,897

26,051

74,689

Joint Replacement

6,165

17,135

67,104

Hip Fracture

10,618

18,487

44,633

Stroke

8,905

34,196

31,496

Average

$8,727

$24,384

$66,677

Source: MedPac. |

15

REIMBURSEMENT UPDATE

Medicare:

Implemented

new

Resource

Utilization

Group

(RUGs

IV)

system

effective

October

1,

2010

13 new RUG categories focused on medically complex

Elimination of lookback

period and change in concurrent therapy

Should provide opportunity for greater skilled mix and rate growth

|

Sun Healthcare

Overview 16 |

17

SUN OVERVIEW

Inpatient

SunBridge

(Skilled Nursing)

202 inpatient facilities

19,500 patients/residents

SolAmor

(Hospice)

Growing business operating in 8 states

SunDance

(Rehab)

476+ contracts / 344 non-affiliated

Contract services, rehab agency, management

services

CareerStaff

(Staffing)

Primarily hospital setting (also serve

SNFs, schools, prisons)

More than 50% of billings are for therapists (also

provide nursing / pharmacy services)

Medicaid

41%

Medicare

29%

Private pay /

other

30%

Net Revenue by Business

Net Revenue by Source

9/30/10 LTM Net Revenue = $1.9 billion

9/30/10 LTM Net Revenue = $1.9 billion

Inpatient

89%

SunDance

6%

CareerStaff

5% |

18

INPATIENT CENTERS

Sun operates 202 inpatient centers in 25 states

Number of Facilities Per State

States with Facilities

(1)Skilled mix defined as number of Medicare and non-Medicaid managed care

patient days divided by the total number of patient days.

Key Portfolio Metrics

Number of Centers

202

Property Type:

Skilled Nursing

SNF/AL/IL

AL

Mental Health

IL

CCRC

166 (82%)

15 (7%)

10 (5%)

8 (4%)

2 (1%)

1 (1%)

Beds:

Licensed

Available

23,189

22,407

States

25

YTD 9/30/10 Adjusted EBITDAR

Margin

$177,609

12.5%

YTD

9/30/10

SNF

Skilled

Mix

%

(1)

19.2%

YTD 9/30/10 Occupancy %

87.1%

Facilities w/Specialty Units:

RRS Units

Solana Units

67

46

5

15

5

11

1

1

9

1

9

8

9

7

9

9

8

20

2

17

7

3

1

10

2

18

15 |

19

FINANCIALLY SECURE PRIMARY TENANT

Attractive Business Profile and Premium Assets

23,189 licensed beds

87.1% occupancy; 19.2% SNF skilled mix as of Sept 30, 2010

Strong Operating Performance

$1.9 billion LTM 9/30/10 Pro Forma Revenue

$237.1 million LTM 9/30/10 Pro Forma Adjusted EBITDAR

Balance Sheet Strength

$78.4

million

in

pro

forma

net

debt

as

of

6/30/10

(1)

23% / 77% pro forma Debt-to-Equity ratio as of 6/30/10

Transparency and Visibility

Public entity

(1)

New Sun debt excludes $75 million under a new Deposit LC Facility held in a

restricted cash account to collateralize LCs. 202 inpatient facilities across 25 states; 476+

SunDance rehab contracts Sabra Management team has close

knowledge of Sun’s operations |

20

Financial Overview |

21

FINANCIAL SUMMARY

Sabra

Health Care REIT, Inc. –

Pro Forma

Income Statement Items

Balance Sheet Items

Annualized

9 Months

09/30/10

Revenue

$70.2

G & A

(2)

7.5

Adjusted EBITDA

(3)

65.1

FFO

(4)

40.1

AFFO

(5)

36.3

As of

09/30/10

Cash

$65.0

Real Estate, Net Book Value

486.2

Real Estate, Cap Rate

(6)

720.0

Total Debt

387.2

Liquidity

(7)

152.6

(1)

The annualized totals set forth in the table below were determined by taking the applicable

totals for the nine months ended September 30, 2010, and multiplying by one and one

third. (2)

Standalone general and administrative costs are projected to be between $6.6 million and $7.5

million in the first year after the restructuring. General and administrative costs are

not included on the pro forma income statement. (3)

Adjusted EBITDA deducts $5.1 million in estimated standalone cash G&A costs that are not

included on the pro forma income statement; excludes $2.4 million in stock-based

compensation. (4)

FFO defined as net income plus depreciation and amortization. Does not include estimated

standalone G&A costs. (5)

AFFO

adjusted

to

include

estimated

standalone

cash

G&A

costs

and

to

exclude

amortization

of

financing

fees.

(6)

Based on cap rate of 9.75% and $70.2 million annual revenue.

(7)

Liquidity includes $65.0 million in cash and $87.6 million in Revolver borrowing base

availability at close, 11/15/2010. (Dollars in millions)

(1) |

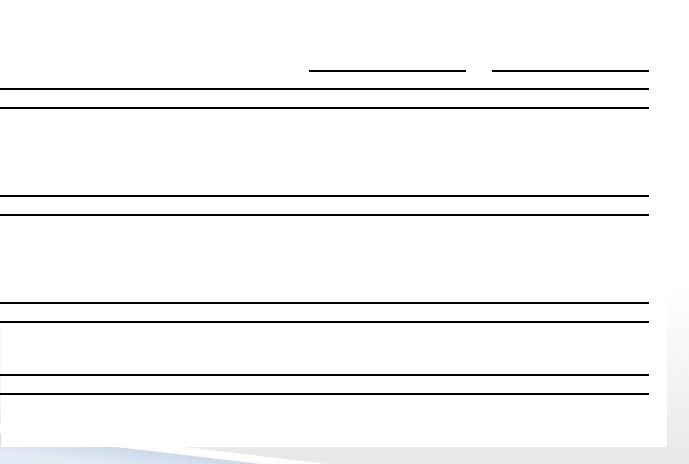

22

PRO FORMA RECONCILIATION SECTION

Sabra

Health Care REIT, Inc. Reconciliation to

Pro Forma FFO, AFFO and Adjusted EBITDA

(Dollars in millions)

Proforma

Proforma

For the Nine

For the Nine

Months Ended

Months Annualized

September 30, 2010

September 30, 2010

Revenue

52.7

$

70.2

$

Net income

12.2

16.2

Add: D&A

17.9

23.9

FFO

30.1

$

40.1

$

Less: Estimated G&A Expenses

(5.6)

(7.5)

Add: Estimated Non-Cash Compensation

1.8

2.4

Add: Amortization of Financing

Fees 1.0

1.3

Adjusted FFO

27.3

$

36.3

$

Add: Cash Interest

21.5

28.8

Adjusted EBITDA

48.8

$

65.1

$

Note: Pro forma Net income and FFO do not

include general and administrative expenses, which are projected to be between $6.6 million

and $7.5 million. |

23

PRO FORMA CAPITALIZATION

($ in millions)

Capitalization

As of September 30, 2010

Existing Sun

Cash and Cash Equivalents

$67.2

New Revolver ($100)

$0.0

Mortgage Notes Payable

162.2

Total Secured Debt

$162.2

New Senior Unsecured Notes

225.0

-

Total Debt

$387.2

Common Stockholders' Equity

123.7

Total Capitalization

$510.9

Other Financial Data

Adjusted EBITDA

(2)

$65.1

(3)

Net Cash Interest Expense

(4)

28.3

Summary Credit Statistics

Total Secured Debt / Adjusted EBITDA

2.49x

Total Debt / Adjusted EBITDA

5.95x

Net Debt / Adjusted EBITDA

4.92x

Adjusted EBITDA / Net Cash Interest Expense

2.30x

(1)

.

(1)

Reflects $156.7 million outstanding as of September 30, 2010 plus additional refinancings in

September – October 2010. (2)

Annualized based on EBITDA for the 9 months ended September 30, 2010.

(3)

Includes estimated cash standalone costs of $5.1 million (excludes $2.4 million of

non-cash compensation). (4)

Annualized based on pro forma debt balances. Excludes amortization of financing fees.

|

24

RESPONSIBLE FINANCIAL POLICY

Maintain a limited secured capital structure

Maintain conservative capitalization

Maintain significant liquidity

Structure initial acquisitions with triple-net leases

Initially pay dividends of 80% of adjusted funds from operations

(AFFO)

(1)

each quarterly period

(1)

FFO adjusted to eliminate the impact of non-cash compensation and to add back

the amortization of financing fees. |

25

INVESTMENT HIGHLIGHTS SUMMARY

Geographically

Diverse Portfolio

Attractive Industry

Fundamentals

Favorable Long-Term

Lease Structure

Strong Lease

Coverage

Strong Asset

Coverage

Financially Secure

Primary Tenant

Growth

Opportunities

Experienced

Management Team |