Attached files

| file | filename |

|---|---|

| 8-K - THE PANTRY, INC. FORM 8K - PANTRY INC | form8kicr.htm |

13th Annual ICR XChange Conference

Mark R. Bierley, SVP and CFO

January 12, 2011

Mark R. Bierley, SVP and CFO

January 12, 2011

Safe Harbor Statement

Some of the statements in this presentation constitute “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act

of 1995. All statements other than those of historical facts included herein,

including those related to the company’s financial outlook, goals, business

strategy, projected plans and objectives of management for future operations

and liquidity, are forward-looking statements. These forward-looking

statements are based on the company’s plans and expectations and involve a

number of risks and uncertainties that could cause actual results to vary

materially from the results and events anticipated or implied by such forward-

looking statements. Please refer to the company’s Annual Report on Form 10-

K and its other filings with the SEC for a discussion of significant risk factors

applicable to the company. In addition, the forward-looking statements

included in this presentation are based on the company’s estimates and plans

as of the date of this presentation. While the company may elect to update

these forward-looking statements at some point in the future, it specifically

disclaims any obligation to do so.

statements” within the meaning of the Private Securities Litigation Reform Act

of 1995. All statements other than those of historical facts included herein,

including those related to the company’s financial outlook, goals, business

strategy, projected plans and objectives of management for future operations

and liquidity, are forward-looking statements. These forward-looking

statements are based on the company’s plans and expectations and involve a

number of risks and uncertainties that could cause actual results to vary

materially from the results and events anticipated or implied by such forward-

looking statements. Please refer to the company’s Annual Report on Form 10-

K and its other filings with the SEC for a discussion of significant risk factors

applicable to the company. In addition, the forward-looking statements

included in this presentation are based on the company’s estimates and plans

as of the date of this presentation. While the company may elect to update

these forward-looking statements at some point in the future, it specifically

disclaims any obligation to do so.

2

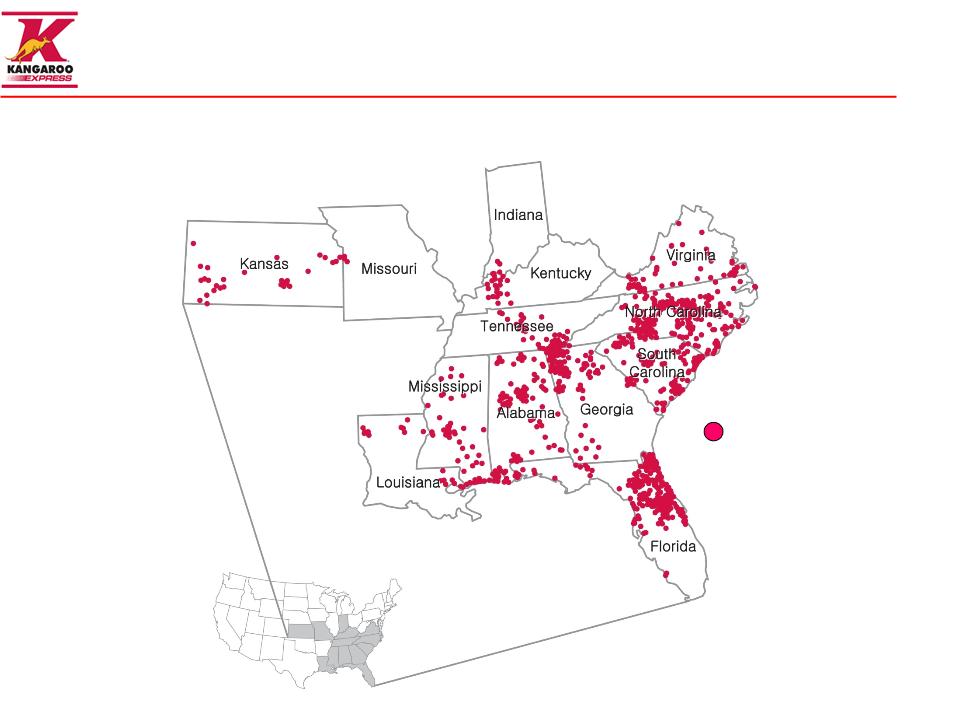

Leading convenience store retailer concentrated in the

southeastern United States

southeastern United States

3

_____________________

Note: Map is illustrative

1,667 Stores Located in Thirteen States as of January 11, 2011

Pantry Store Locations

Key Strategies

4

n Improve comp sales and merchandise gross margin with focus

on Coffee and Meals & Snacks

on Coffee and Meals & Snacks

n Invest in technology to drive effectiveness and efficiency

n 2% to 4% annual store growth target

n Accelerate EBITDA and cash flow growth

5

Why Meals & Snacks?

_____________________

(1) Represents fiscal year 2010 total merchandise gross margin for The Pantry

(2) Industry data is foodservice only for Calendar Year 2009 and Industry source is NACS SOI

1

2

Gross Margin Comparison

Focused on capturing the foodservice opportunity

6

_____________________

(1) Pantry Foodservice includes Fast Foodservice, Self-Service Fast Foods and Beverages and is for FY2010

(2) Industry Data is for Calendar Year 2009 and Industry source is NACS

Industry2

Pantry1

17%

9%

Foodservice Mix of Total Inside Sales

7

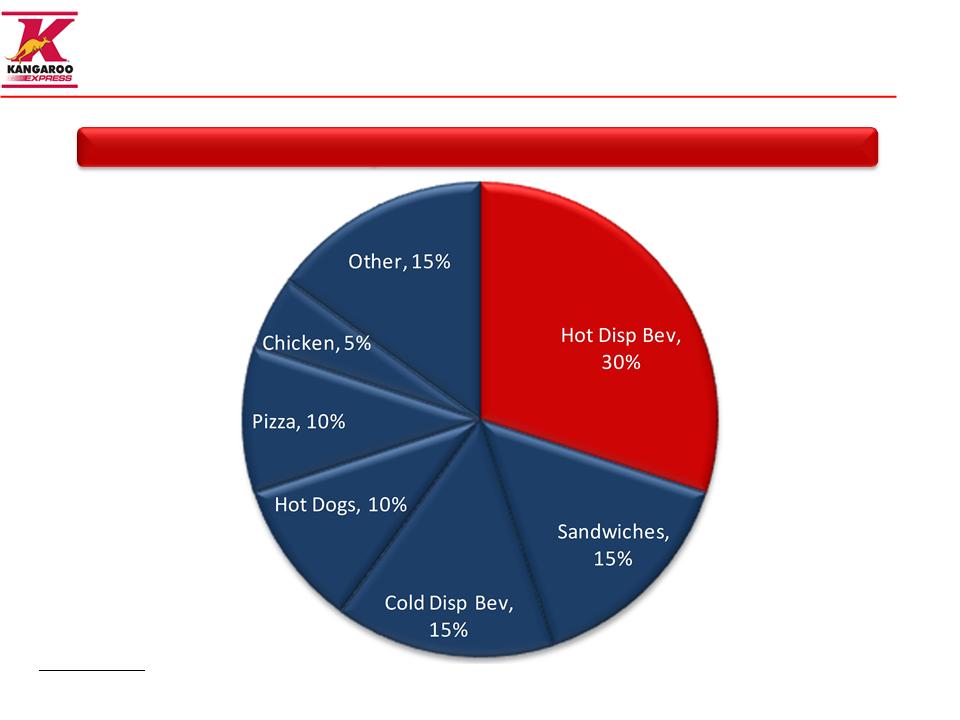

Why Coffee?

Industry Foodservice Sales Mix

Source: Convenience Store News 2009 Extended Foodservice Study. Figures based on annual 2008 average per store sales and rounded to nearest 5% interval

8

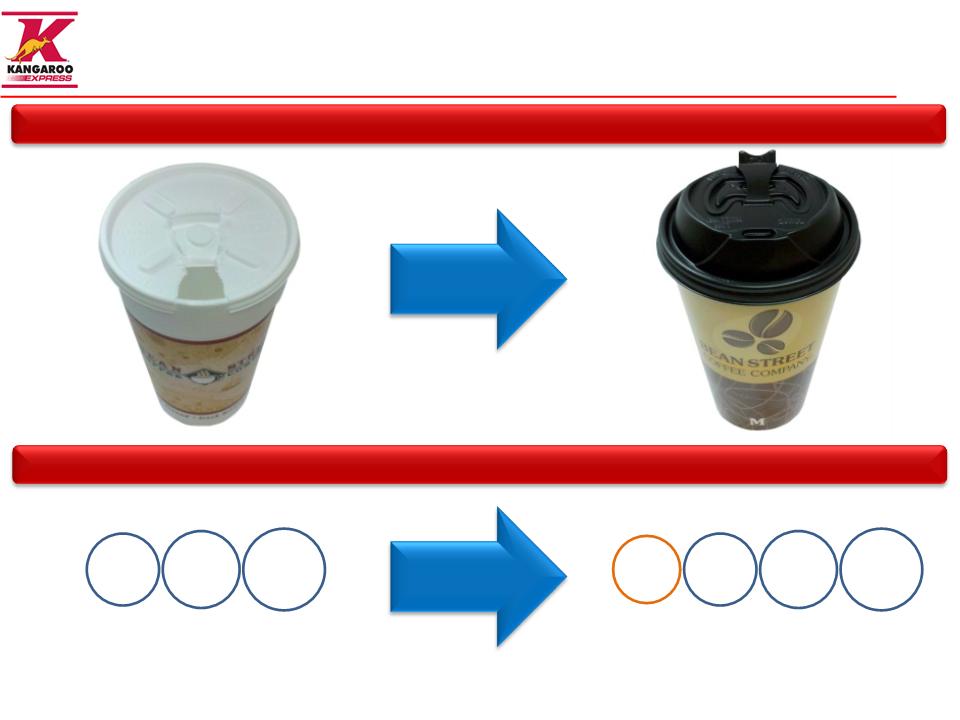

DISPENSING

PREPARATION

Bean Street Coffee Focus

9

16oz

20oz

24oz

12oz

16oz

20oz

24oz

CUPS

ASSORTMENT

Bean Street Coffee Focus

10

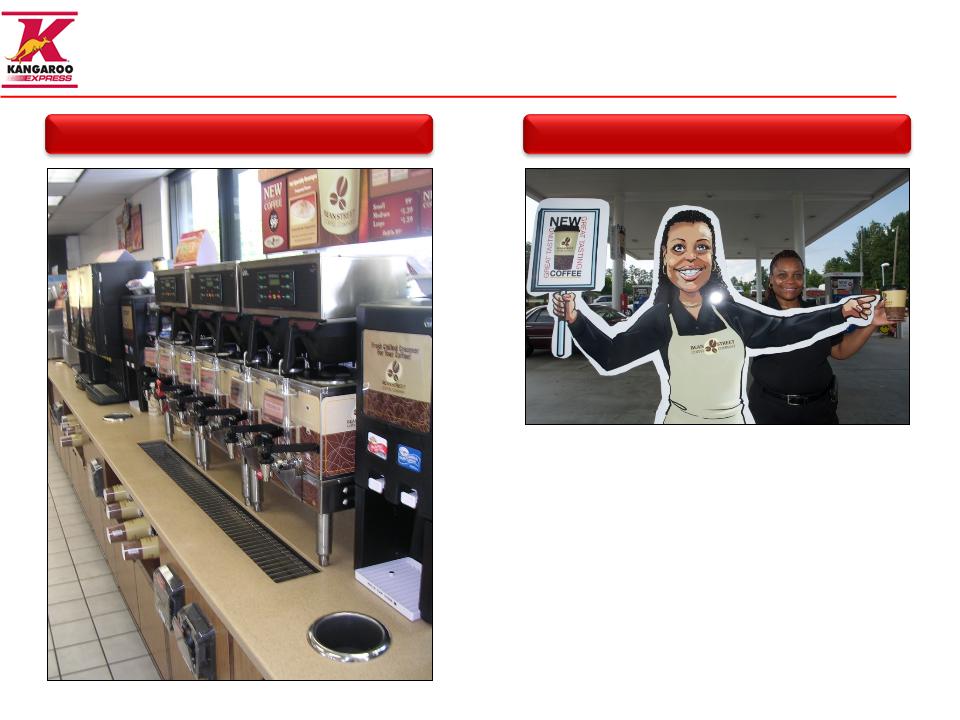

Bean Street Coffee Focus

Coffee

Hospitality Host

11

Getting the word out

Sampling

Strategic Partnerships

Digital Relationship Marketing

“Battle for Bean Street”

Radio

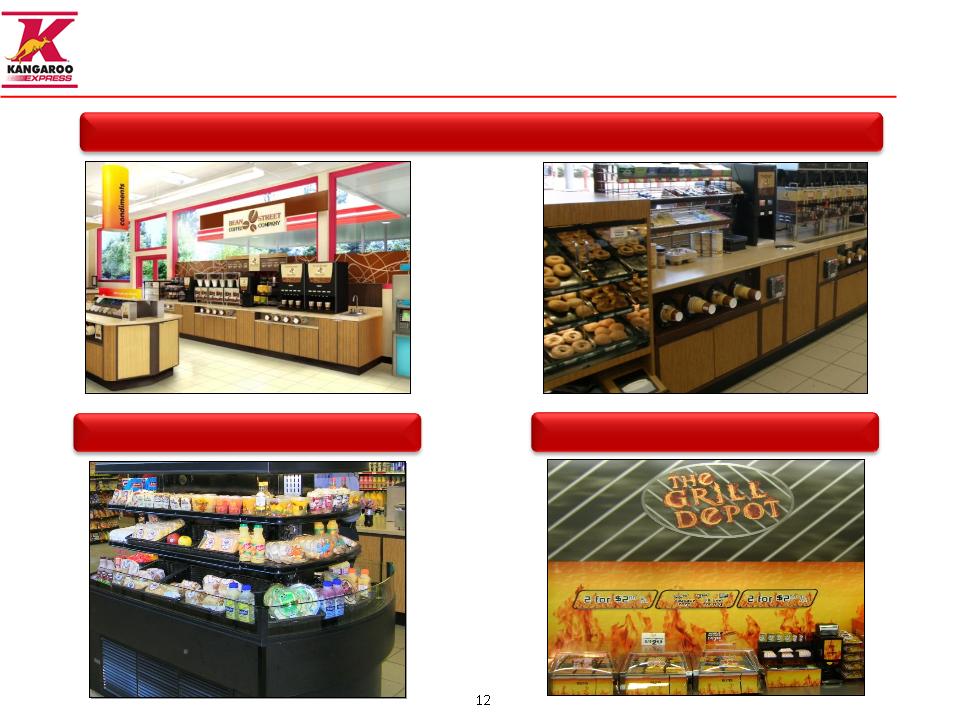

FRESH focus on breakfast, lunch, all day snacks

Lunch

Breakfast

Snacks

Fast, Friendly and Clean Platform

13

FRESH Program Highlights

14

n Estimated $30-45K average investment per store for Fresh elements

n Expect 20% cash on cash returns

n Coffee is King

n Breakfast, lunch and all day snack occasions

n Fast, Friendly and Clean foundation

n 130 stores completed by end of calendar 2010 (Raleigh and Charlotte)

n Expect 400 stores completed by end of calendar 2011

Financials

Focus

Roll-out

Systems investment to drive effectiveness and

efficiency

efficiency

15

n Site-level optimization

n 10 bps = $2 million

n Software fully installed across the chain as of January 11, 2011

n PCI Compliant

n Promotional flexibility

n Capturing transaction level detail

n Multi-phase initiative

- Phase 1: Task Management, launched in Q1 2011

- Phase 2: Labor Scheduling

- Phase 3: Time and Attendance

KSS Gas Pricing

Point of Sale

Workforce

Management

Management

High degree of fragmentation presents continued

consolidation opportunities

consolidation opportunities

16

79% of U.S. Convenience Stores are Single Stores or Small Chains

145,000 Total U.S. C-Stores

_____________________

Source: U.S. Convenience December 2009 Store Count (Gas and Non-Gas) from NACS/TDLinx

17

Low C-Store Channel Density1

Geographic Diversification2

= Pantry Site

= Presto Site

_____________________

(1) Stores per 10,000 residents from U.S. Census Bureau 2009 population estimates and

U.S. Convenience December 2009 Store Count (Gas and Non-Gas) from NACS/TDLinx

(2) Map is illustrative

_____________________

(1) Fiscal year 2010 included 53 weeks

(2) We are no longer including lease payments we make under our lease finance obligations as a reduction in our presentation of Adjusted EBITDA. See slides 27 and 28, which include a

reconciliation of Adjusted EBITDA to the most comparable U.S. GAAP financial measures.

reconciliation of Adjusted EBITDA to the most comparable U.S. GAAP financial measures.

History of consistent cash flows & Adjusted EBITDA

18

Adjusted EBITDA 2

Operating Cash Flow

1

1

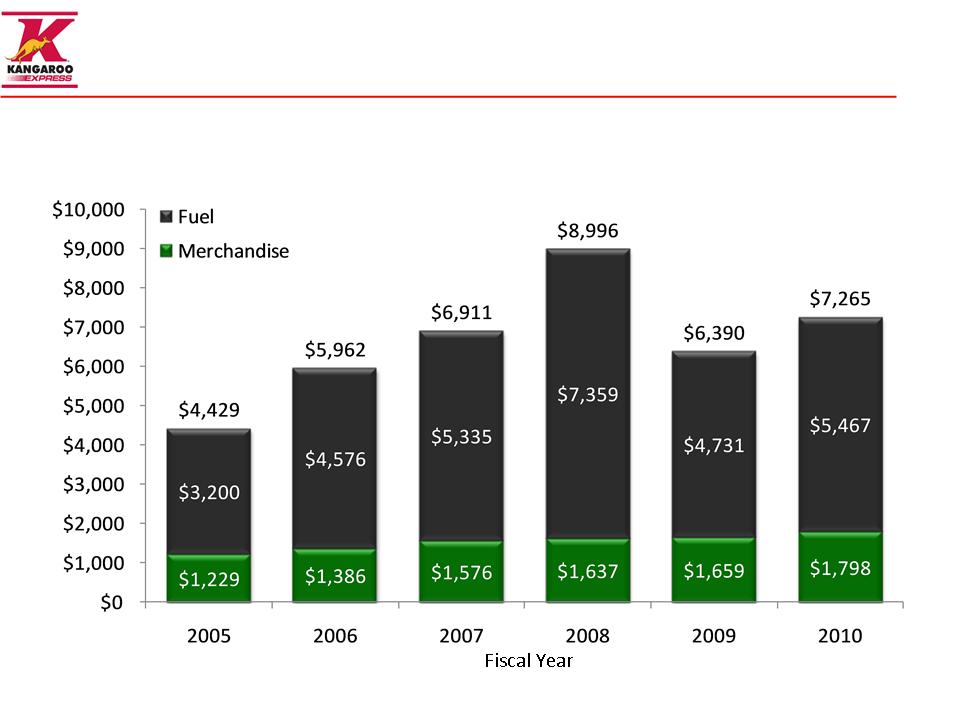

Fuel comprises the majority of revenue

19

Revenue Split: Merchandise vs. Fuel

($ in mm)

_____________________

(1) Fiscal year 2010 included 53 weeks

1

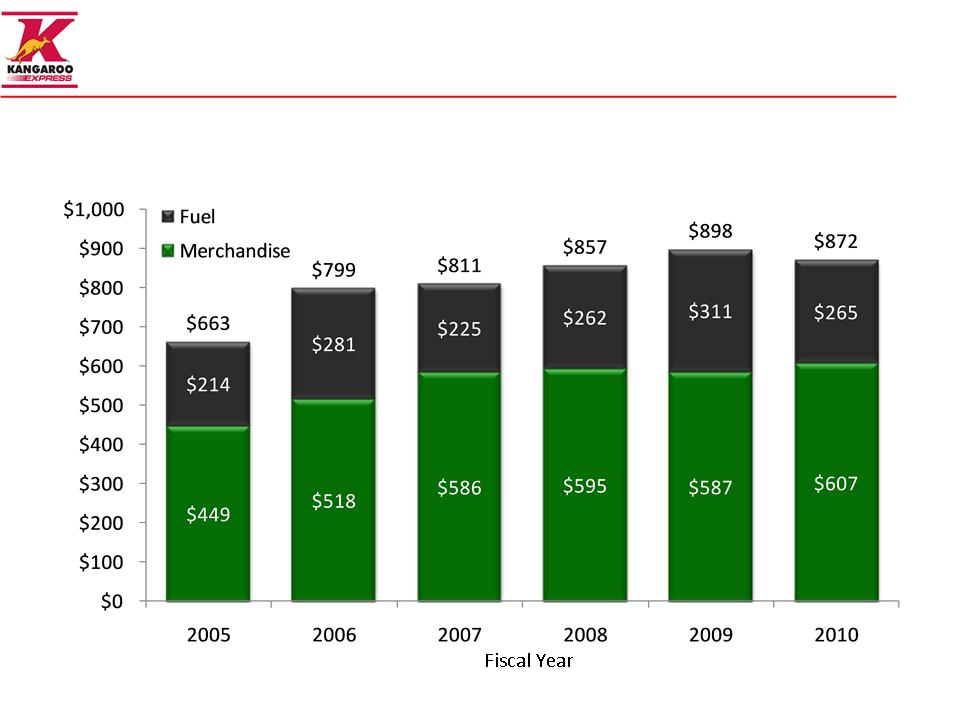

Gross profit is driven by merchandise

20

Gross Profit Split: Merchandise vs. Fuel

($ in mm)

_____________________

(1) Fiscal year 2010 is 53 weeks

1

Oil price changes drive volatility in quarterly retail

gasoline margins

gasoline margins

21

_____________________

Source: Energy Information Administration. Data represents daily average futures contract price per barrel of light sweet crude (contract 1) and CPG is net of credit card fees and repairs and

maintenance

maintenance

FY2006

FY2007

FY2008

FY2009

¢

¢

¢

¢

¢

¢

¢

FY2010

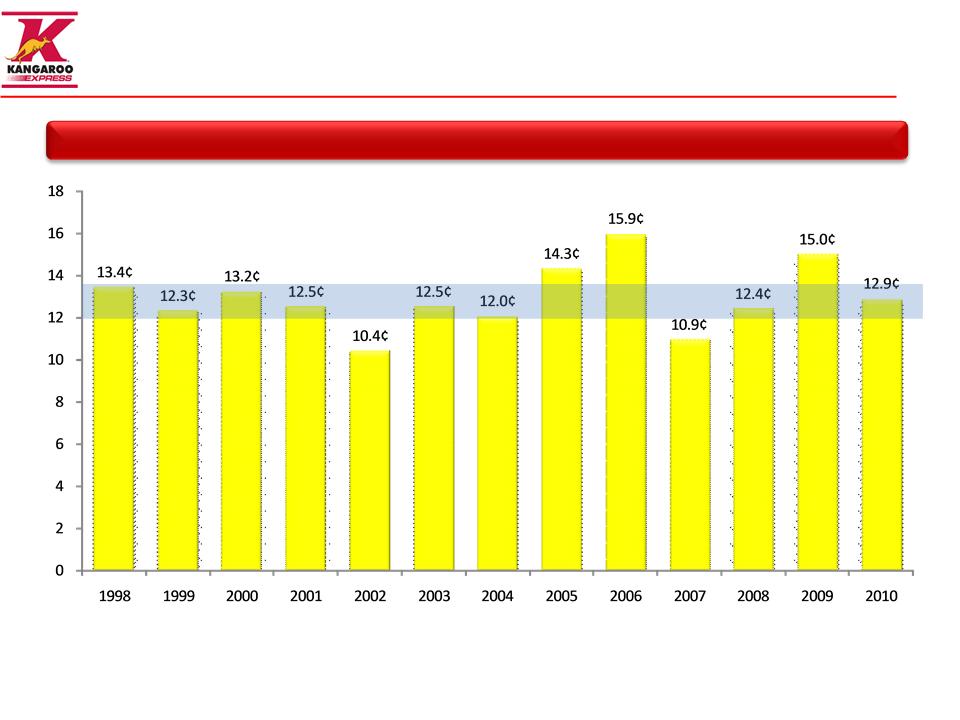

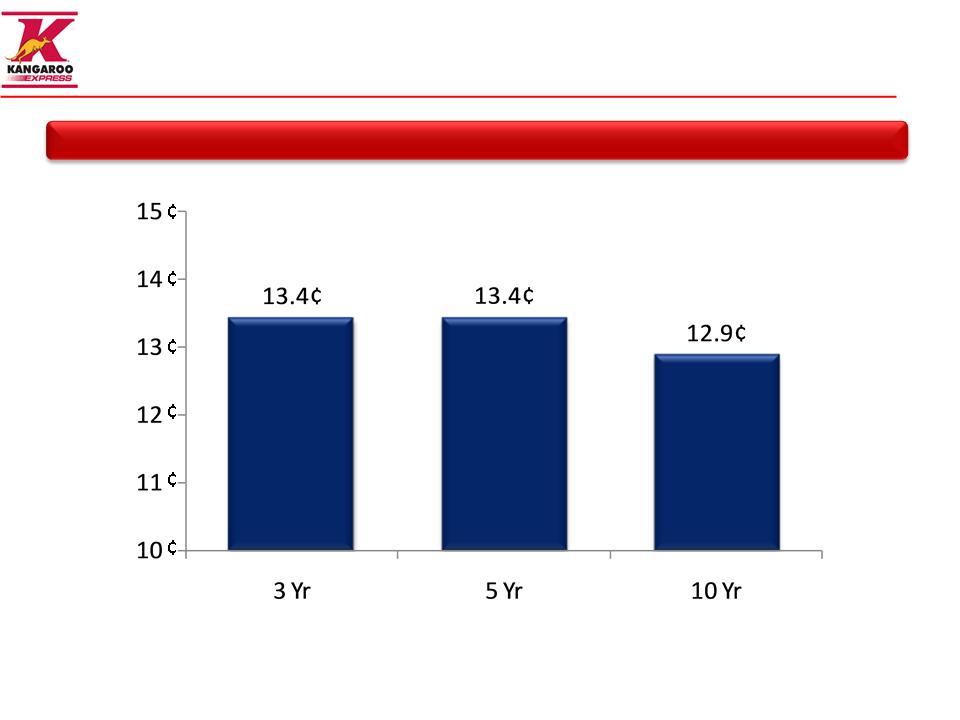

Annual CPG tends to remain relatively stable

22

Fiscal Year

_____________________

Note: Shaded area represents average historical CPG range and CPG is net of credit card fees and repairs and maintenance.

Annual Net CPG Margins Typically Range from 12.0¢ to 13.5¢

¢

¢

¢

¢

¢

¢

¢

¢

¢

¢

Historical averages reinforce the stability

23

Historical CPG Averages

_____________________

Note: Historical averages are non-weighted averages of each fiscal year. CPG is net of credit card fees and repairs and maintenance

Financial Flexibility

24

n Meaningful liquidity

} $201 million in cash-on-hand

} $225 million revolver - $0 drawn, approximately $106 million

available after LOCs

available after LOCs

n Long-term debt profile; earliest maturity is the convertible debt in

November 2012

November 2012

n Covenant-light bank facility

} 6.25x Adj. Net Debt / EBITDAR Leverage

} 2.25x Interest Coverage

_____________________

Note: Balance Sheet data as of September 30, 2010

Key Strategies

25

n Improve comp sales and merchandise gross margin with focus

on Coffee and Meals & Snacks

on Coffee and Meals & Snacks

n Invest in technology to drive effectiveness and efficiency

n 2% to 4% annual store growth target

n Accelerate EBITDA and cash flow growth

Appendix

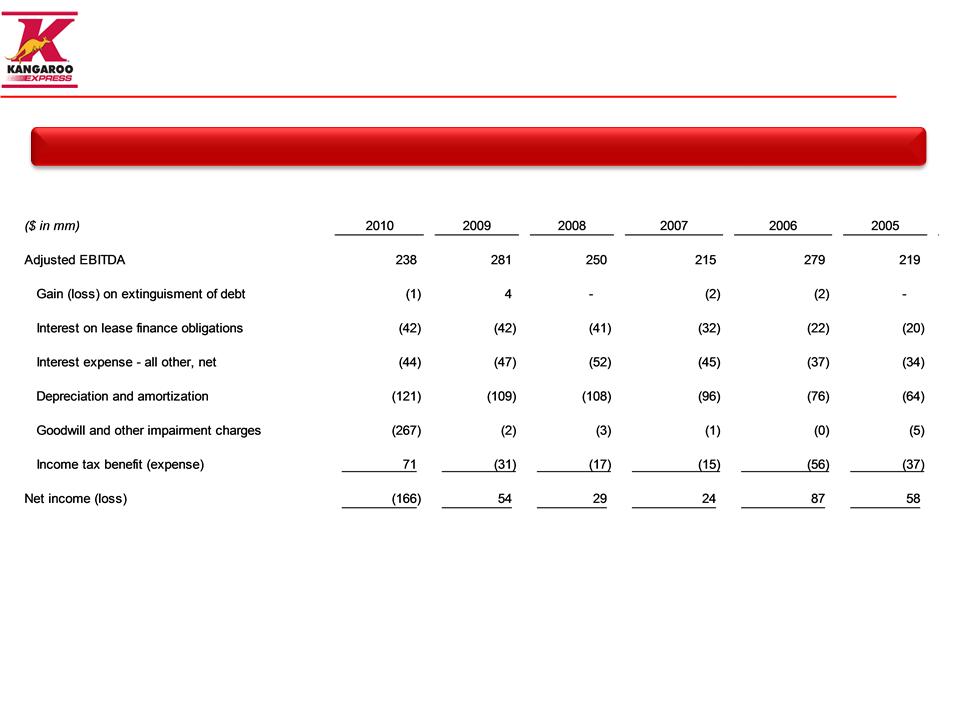

Reconciliation of Non-GAAP Measures

27

Adjusted EBITDA Reconciled to Net Income/(Loss)

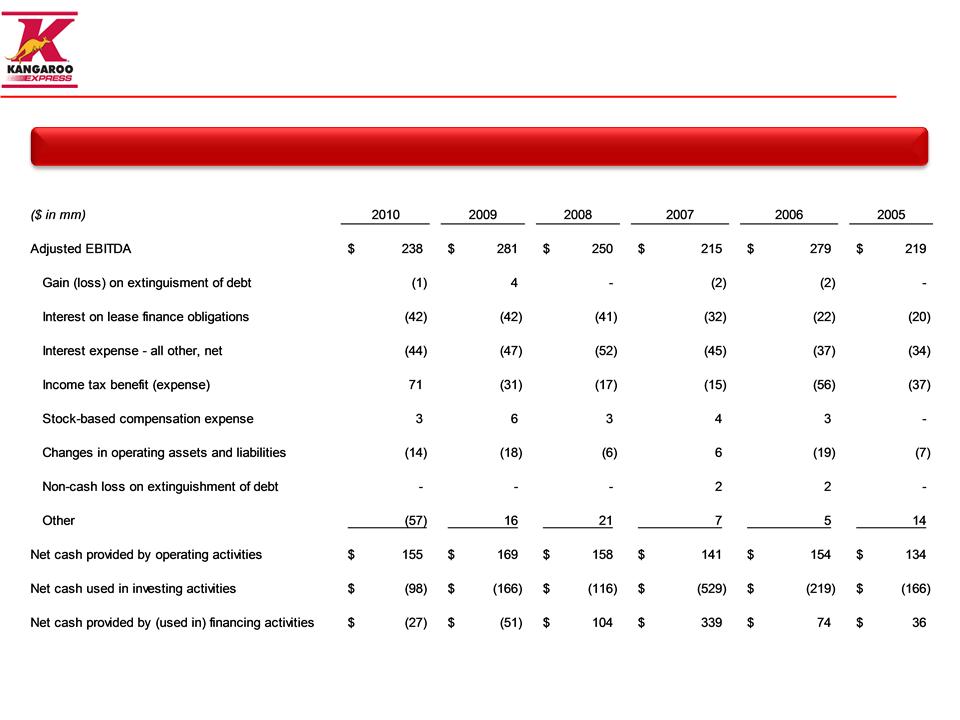

Reconciliation of Non-GAAP Measures

28

Adjusted EBITDA Reconciled to Cash Flows