Attached files

| file | filename |

|---|---|

| 8-K - EMCORE FORM 8-K - EMCORE CORP | s22-10021_8k.htm |

13th Annual Needham Growth Conference

Hong Hou, Chief Executive Officer

Mark Weinswig, Chief Financial Officer

January 12, 2011

EMCORE Corporation

2

“Safe Harbor” Statement

Statements in this presentation which are not historical facts, and the assumptions underlying such statements, constitute "forward-looking statements" and assumptions underlying "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 including, but not limited to statements regarding, (a) future product introductions and performance metrics, (b) 2010 and future financial performance, and (c) future development and growth in the Company’s markets. Actual results may differ materially form those projected in the forward-looking statements. Readers should carefully review the risk factors set forth in EMCORE's latest Annual Report on Form 10-K, and other reports filed with the SEC from time to time, for a list of factors that could cause our business prospects, financial condition, operating results and cash flows to be materially adversely affected.

3

3

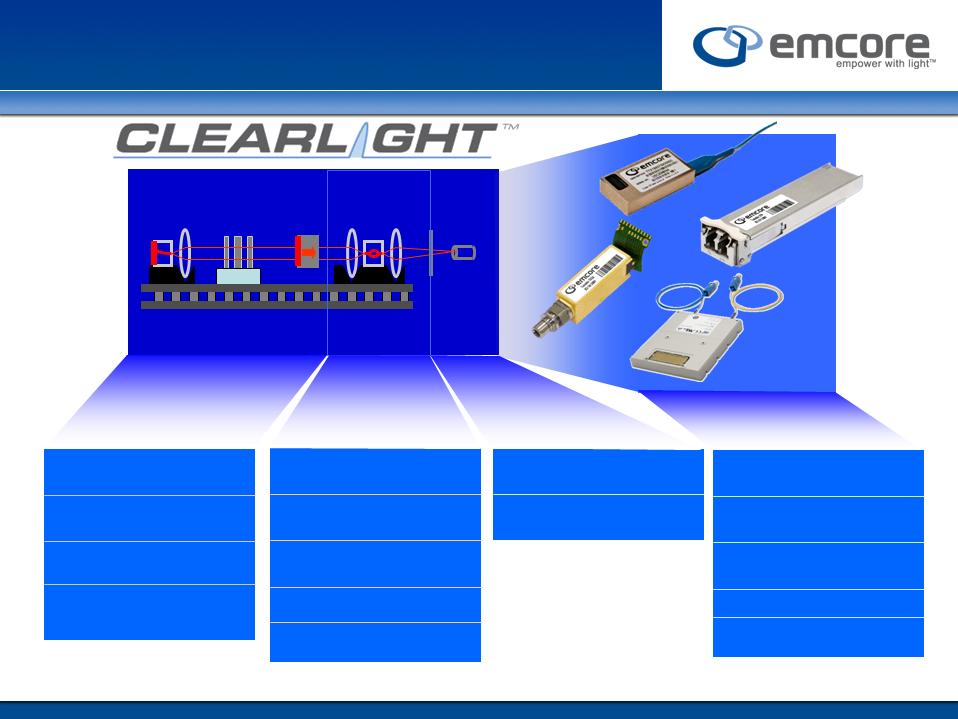

EMCORE’s Business Units

Global Communications and Power at the Speed of Light

Fiber Optic Components &

Systems for Broadband, 10G

Ethernet, Datacom & Telecom

Systems for Broadband, 10G

Ethernet, Datacom & Telecom

Space and Terrestrial

Solar Power Based on

Multi-Junction Solar Cells

Photovoltaics

Space Power

Space Solar Cells

Space Solar Panels

Concentrator

Solar Power

Solar Power

CPV Solar Cells

Solar Power Systems

Solar Power Systems

Fiber Optics

Broadband

Fiber Optics

Data & Telecom

10 Gb/s Optical TxRxs

Tunable TxRx, Transpdr

Active Optical Cables

VCSEL, PIN, DFB, APD

VCSEL, PIN, DFB, APD

CATV / FTTx

Satellite Com Tx/Rx

Fiber Optic Gyro

Video Transport

Video Transport

4

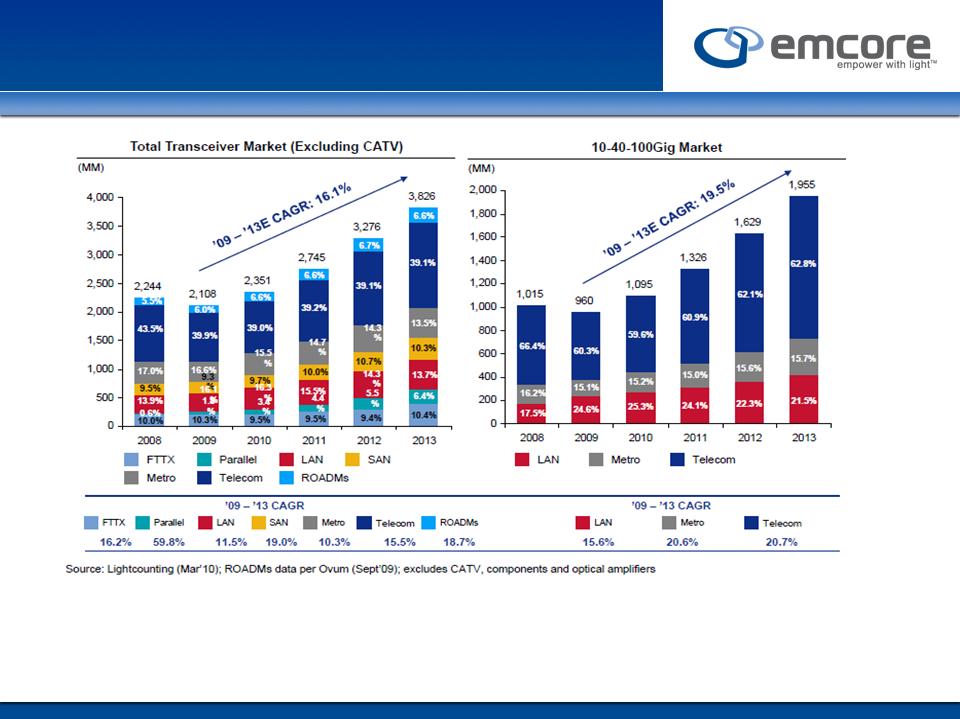

High Growth Projected for Fiber Optics

§ New Infonetics forecasts market for 10/40/100G transceivers to reach $2.14bn by 2014

§ Growth driven by higher use of optical interfaces, continuing transition to higher speed

and infrastructure upgrades occurring

and infrastructure upgrades occurring

5

LightCounting Mar 2010 and OVUM

Emcore Positioned Well in High Growth

Segments

Segments

§ Emcore has a great opportunity to grow - participating in high growth areas

§ Differentiated position in many of the markets above

§ Tunable XFP market forecast to grow at a 117% CAGR between 2009 and 2014

§ Emcore parallel products targeted in high speed QSFP, CXP and CFP module markets as

well as AOC market

well as AOC market

§ Emcore ITLAs advancing to dominate 40G/100G Coherent market for lasers

§ High performance Emcore QAM products leading market penetration

§ New product introduction and time-to-market key for growth strategy

6

6

Telecom / Datacom Fiber Optics

● 14 Gb/s VCSELs & PDs

● 10Gb/s DFB & PDs

● GPON TO Cans

● 1-14 Gb/s TOSA/ROSA

● 10Gb/s DFB & PDs

● GPON TO Cans

● 1-14 Gb/s TOSA/ROSA

● Tunable lasers, ITLAs &

m-ITLAs for 10, 40, & 100

Gb/s transponder apps

● Tunable XFP & transpndr

m-ITLAs for 10, 40, & 100

Gb/s transponder apps

● Tunable XFP & transpndr

Components

LAN / SAN

Parallel Optics

Telecom Transport

● Xenpak/X2 LX4, CX4, LR,

SR, ER TxRxs

● 1/2/4 Gb/s SFF/SFP TxRx

● SFP+ and XFP TxRxs

SR, ER TxRxs

● 1/2/4 Gb/s SFF/SFP TxRx

● SFP+ and XFP TxRxs

7

Modular Approach using TOSA based ECL Laser Architecture, enables flexibility, low cost and higher density

LD

MZM,

MPD

Tuner,

l Locker

End

Mirror,

Mirror,

Isolator

C or L band

High Power

16 dBm

High / Standard Frequency

Accuracy ( +/- 1.5 or 2.5 GHz

EOL)

Accuracy ( +/- 1.5 or 2.5 GHz

EOL)

Standard Power

13.5 dBm

100G, Planned R&D

Engaging with Partners

40G DQPSK

Planned R&D

10G NRZ (development)

Launch 2H 2010

No Modulator (CW)

Launch 2H 2010

PM Fiber pigtail or receptacle

LC TOSA receptacle

Tunable TOSA

Launch 2H 2010

Tunable XFP

Launch 2H 2010

300 PIN - TOSA

µITLA (37 x 15 x 8mm)

Launch 2H 2010

Other MSA / Subsystem Form

Factor

Factor

Laser Block

Modulator

Block

Fiber

Block

Integration Level

Tunable ECL Platform &Product Portfolio

8

Comprehensive Broadband Products

1550nm Transmitters,

Video Receivers,

PON Transceivers, EDFA’s

Video Receivers,

PON Transceivers, EDFA’s

RF Satellite Links

Tx/Rx/Delay Lines,

FOG’s, THz, Lithium

Niobate Devices

Tx/Rx/Delay Lines,

FOG’s, THz, Lithium

Niobate Devices

Video / Audio / Data

Fiber Links,

HDTV / 1080p Video, &

IP Video Encoding

Fiber Links,

HDTV / 1080p Video, &

IP Video Encoding

CATV Transmitters &

Receivers, Lasers,

Photodiodes

Receivers, Lasers,

Photodiodes

SPECIALTY

VIDEO

FTTx

CATV

9

§ Leading Provider of Broadband Components and Systems

§ Consolidated technology, IP, product portfolio & CATV customer base,

§ Full end-to-end product offering for hybrid-fiber-coaxial (HFC) network.

§ CATV Market Drivers

§ Upgrade of HFC network to 1GHz to offer more value-added premium services,

§ Buildout of new networks to businesses offering commercial services,

§ Strong overseas market demand in Eastern Europe, Russia, India, China, etc.

§ Penetration into High Growth Video Transport and IPTV Markets

§ Telecom product offering,

§ Intra-studio transmission,

§ Pre and post production video transport.

§ Technology Provider for both CATV & Telecom Companies

§ Transmitters, receivers and components enabling “triple play” services,

§ Technology build-out occurring with both CATV and Telecom customers.

Broadband Fiber Optics Business

10

Fiber Optics Growth Strategy

§ Grow Business through Disruptive New Products

§ Tunable XFP transceivers and tunable TOSAs

§ m-ITLA for 40 and 100 Gb/s Telecom transponders

§ CXP pluggable modules and active cables based on parallel optic engines

§ Expand Market Share of Current Product Portfolio

§ Nine product lines are being qualified by a leading OEM located in China

§ Increase penetration to international customer base

§ Grow Optical Components by Leveraging Our Fab Infrastructure and

Low-cost Manufacturing Base in China

Low-cost Manufacturing Base in China

§ PON components

§ SAN optical components for 14 Gb/s

11

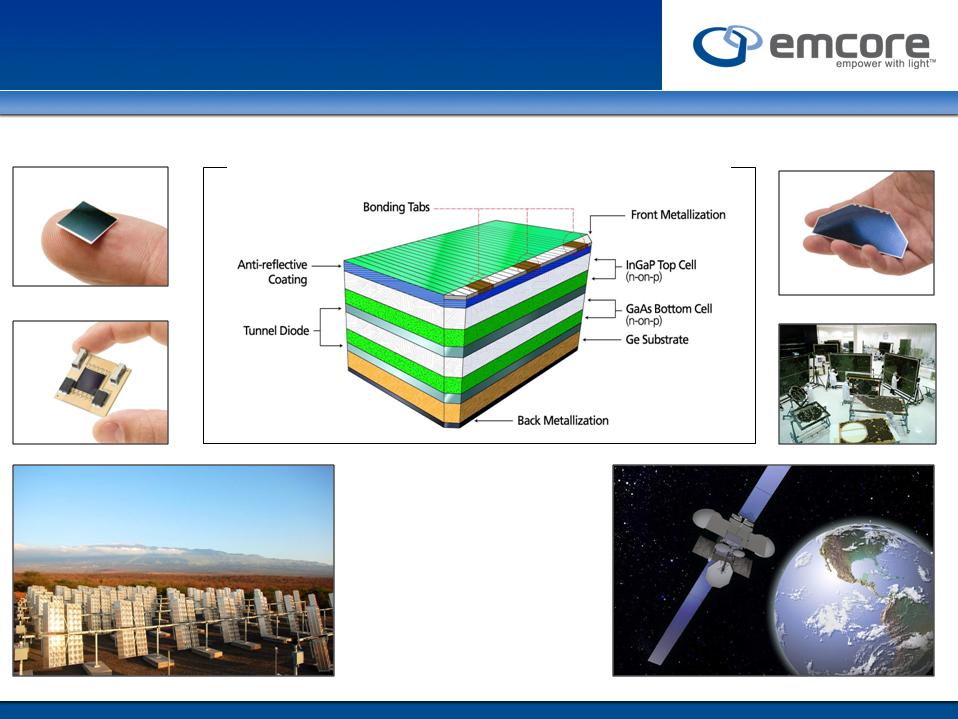

Solar Cell Technology & Applications

CORE TECHNOLOGY:

Multi-Junction Photovoltaic Solar Cell

Multi-Junction Photovoltaic Solar Cell

SPACE EFFICIENCY

29.5%

29.5%

39.0%

CPV EFFICIENCY

CPV EFFICIENCY

12

§ Current Status

§ State-of-the-art infrastructure and competitive cost - strong financial performance,

§ Strong position (with >50% market share) to serve the commercial satellite

markets with backlog to support 82 active programs currently,

markets with backlog to support 82 active programs currently,

§ Robust visibility: $74M in orders booked in 2010, with options for additional $34M,

§ Outstanding reliability track record (zero on-orbit failures through 76 missions).

§ Growth Strategy

§ Expand government business through establishment of Trusted Supplier program,

§ Provide more value-added products to customers (solar panels in lieu of PV cells),

§ Develop other applications enabled by high efficiency multi-junction solar cells.

§ Major Customers

Industry Leader within Space Market

13

§ CPV systems: dual-axis tracking of

CPV modules of high-efficiency multi-

junction solar cells (~40%) under a

1,000x concentration of DNI sunlight

CPV modules of high-efficiency multi-

junction solar cells (~40%) under a

1,000x concentration of DNI sunlight

§ Advantages:

§ Low CapEx requirement for production ramp up

§ Attractive LCOE in regions with high DNI

§ Advanced cell technology to further reduce cost

CPV Solar Cell Receiver

Solar Flux

(1x)

(1x)

Fresnel Lens

Solar Flux

(500-1000x)

(500-1000x)

Direct Normal Irradiance (DNI)

Concentrator Photovoltaics (CPV)

Maui, Hawaii - Gen3 CPV Installation

14

CPV Solar Cell Technology Roadmap

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2005

2006-2007

2011 P

33.0%

Concentrator

Triple Junction

(CTJ)

36.0%

2nd Generation

Concentrator

Triple

Junction

(CTJ2)

42.0%

Inverted

Meta-

Morphic

Morphic

(IMM)

39.0%

3rd Generation

Concentrator

Triple

Junction

(CTJ3)

45.0%

2nd

Generation

(IMM2)

2012 P

30.0%

32.5%

35.0%

37.5%

40.0%

42.5%

45.0%

2008-2010

Year

45.0% - 50.0%

3rd

Generation

(IMM3)

>2013 P

Year-End Average Cell Efficiency

47.5%

50.0%

15

EMCORE CPV Business Model

§ Direct P&L

§ EMCORE continues to sell CPV components and systems recognized as

revenue,

revenue,

§ Products will be manufactured at the China JV and priced at an internal

transfer cost,

transfer cost,

§ EMCORE will continue to develop lower-cost, higher performing CPV cells

and system products as future technology contribution to the JV.

and system products as future technology contribution to the JV.

§ P&L from the JV below the line

§ JV will manufacture and sell EMCORE-designed CPV components and

systems to EMCORE and other customers in China under a technology

license from EMCORE,

systems to EMCORE and other customers in China under a technology

license from EMCORE,

§ EMCORE will consolidate 40% of the JV profit/loss below the line.

16

§ Business scope

§ Manufacture EMCORE-designed CPV components and systems in high-volume to

supply EMCORE and its own business needs,

supply EMCORE and its own business needs,

§ Develop solar power business in China.

§ Ownership and management

§ EMCORE owns 40% and San’an Optoelectronics Co, Ltd owns 60%,

§ Initial registered capital: $30M

§ EMCORE’s Executive VP, Charlie Wang serves as General Manager of Suncore.

§ JV operation expected to be highly cost competitive

§ CapEx for CPV component and system manufacturing lines will be funded through a

cash grant ($75M) by Huainan City,

cash grant ($75M) by Huainan City,

§ JV receives a land grant of 263 acres from Huainan City,

§ Working capital will be provided in a form of loan from our JV partner, San’an,

§ Other incentives and subsidies will further reduce the cost of products,

§ EMCORE will contribute $12M (40% of the total registered capital) to the JV, of which

$8.5M was funded by San’an in a form of consulting fee to EMCORE.

$8.5M was funded by San’an in a form of consulting fee to EMCORE.

CPV Joint-Venture - Suncore Photovoltaics

17

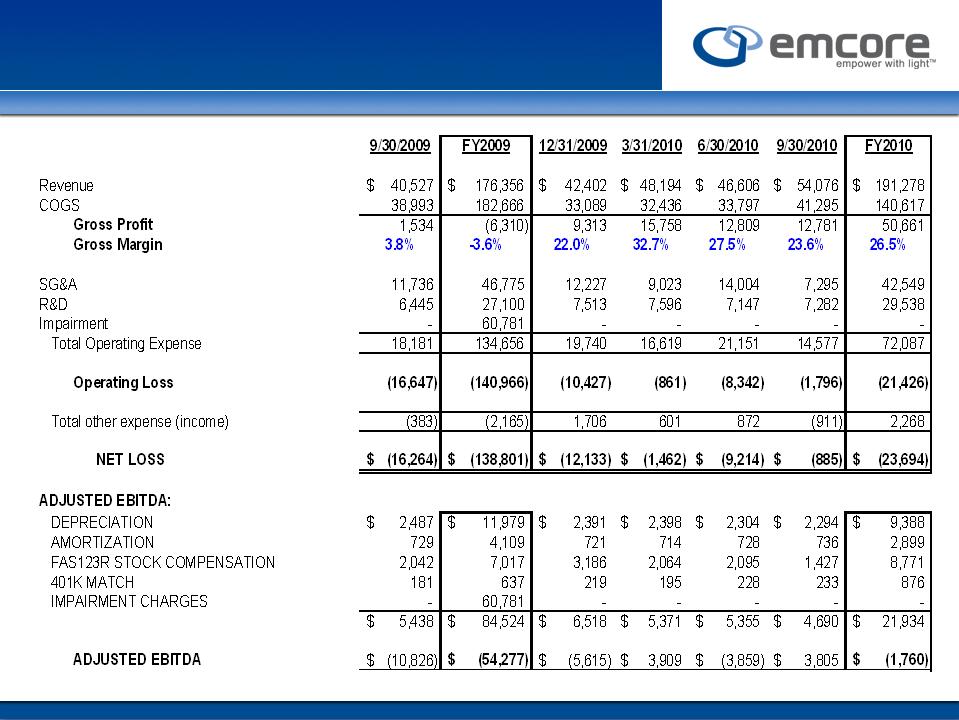

Financial Recap of FY2010

Significant Improvements include:

§ Strong revenue growth

§ Reduced net loss

§ Improved Adjusted EBITDA

18

Key Investment Considerations

§ Terrestrial CPV Solar

§ The only vertically integrated player

from “cell-through-system”

from “cell-through-system”

§ Space Solar

§ Market and technology leader

§ Robust visibility & growth

potential through government

programs

potential through government

programs

§ Broadband Fiber Optics

§ Market and technology leader

§ CATV infrastructure upgrade

continues within the HFC

network

continues within the HFC

network

§ Telecom/Datacom Fiber Optics

§ Tunable ECL laser for 40 &100 Gb/s

§ Tunable TOSA and XFP for 10 Gb/s

§ Parallel optic module & active cable

The Company Is Poised to Grow and Deliver Improved Profitability

Support

13th Annual Needham Growth Conference

Hong Hou, Chief Executive Officer

Mark Weinswig, Chief Financial Officer

January 12, 2011

EMCORE Corporation

20

Reconciliation of Adjusted EBITDA