Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CASCADE CORP | d8k.htm |

Cascade

Corporation Leading the world in quality

attachments for industrial vehicles

Exhibit 99.1 |

2

Products: Lift truck attachments for lift trucks and

construction vehicles

Headquarters: Fairview, Oregon

Employees: Approximately 1,700

Revenue (TTM): $380 million

Gross Profit (TTM): $112 million (29%)

Operating Profit (TTM): $38 million* (10%)

Net Income: $3 million*

Debt to Equity (as of 10/31/10): 0.23

Cascade Corporation (NYSE: CASC)

Headquarters in Fairview, Oregon

Note: Financial data is for trailing twelve months ended October 31,

2010. * (Excludes European restructuring costs) |

3

Global Locations

North America

–

Fairview, Oregon *

–

Springfield, Ohio *

–

Findlay, Ohio *

–

Warner Robins, Georgia *

–

Woodinville, Washington *

–

San Juan Capistrano, California *

–

Guelph, Canada *

–

Mississauga, Canada *

Europe

–

Ancenis, France

–

Almere, The Netherlands

–

Vaggeryd, Sweden

–

Vantaa, Finland

–

Hagen, Germany

–

Barcelona, Spain

–

Verona, Italy *

–

Brescia, Italy *

–

Manchester, England *

Asia Pacific

–

Inchon, Korea

–

Osaka, Japan

–

Brisbane, Australia *

–

Auckland, New Zealand

–

Johannesburg, South Africa

–

Mumbai, India

China

–

Hebei, China *

–

Xiamen, China *

*Manufacturing locations |

4

Products –

Specialized Material Handling Attachments

Paper Roll Clamps

Sliding Arm Clamps

Multiple Load Handlers |

5

Products –

Specialized Material Handling Attachments

Primary Channel of Distribution: Original Equipment Dealers (OED) Average Price Point: $8,000 - $12,000 Customer Concentration: Low – thousands with dealers and

customers purchasing low numbers of units each End Markets: Paper, Grocery, Consumer Dry Goods, Appliances,

Consumer Electronics, General Distribution and Warehousing Degree of Customer Modification: High – Ranges from 40 to 60% General Financial Characteristics: Higher Gross Margin; Higher

SG&A to Support

|

6

Products –

OEM (Original Equipment Manufacturer)

Forks

Sideshifters |

7

Primary Channel of Distribution: 75% to OEM’s for “first fit”

application

and ‘after market’

sales; 25% sold through OED’s for dealer installation

Average Price Point: $200 -

$600

Customer Concentration: High –

High

percentage of sales go to a few

dozen OEM’s

End Markets: Lift truck and light duty construction vehicle manufacturers

Degree of Customer Modification: Low -

Large number of product

variations offered as standard, but low degree of specific modification

General Financial Characteristics: Lower Gross Margin. Lower SG & A

support required

Products –

Original Equipment |

8

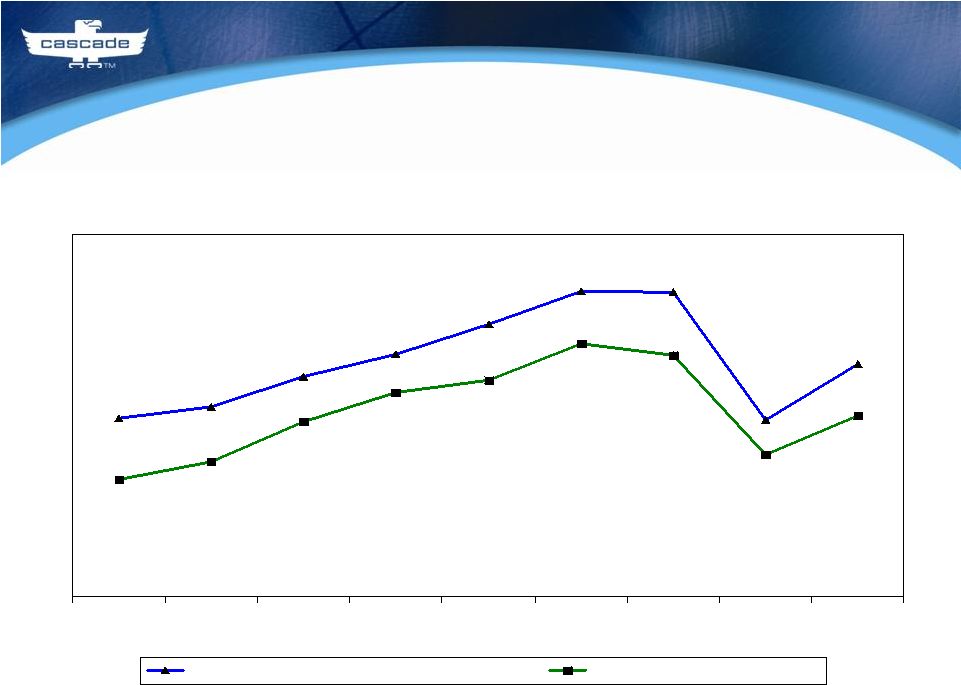

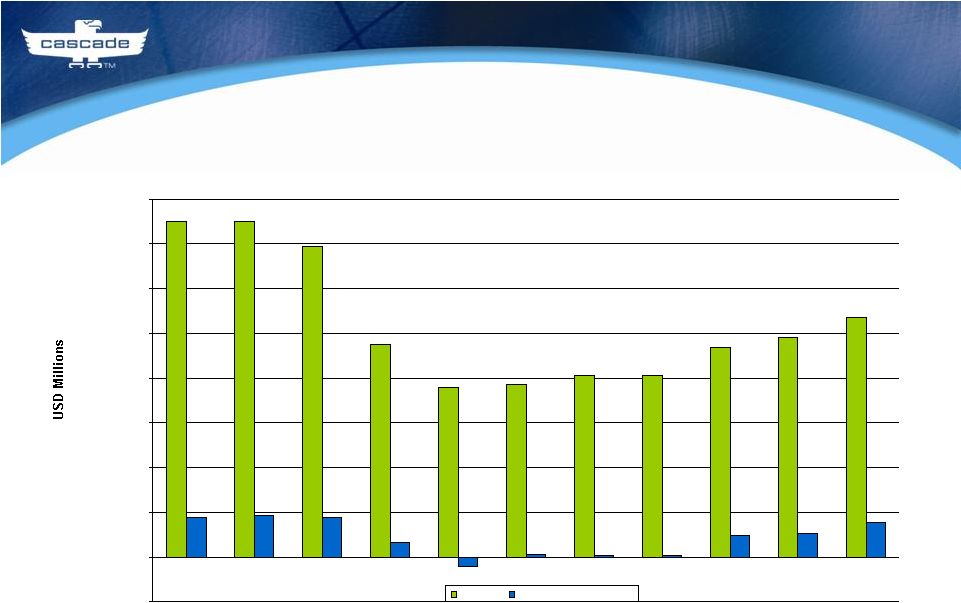

World Lift Truck Shipments & Cascade Revenue

513,000

391,000

602,000

675,000

673,000

487,000

535,000

395,000

420,000

$314,353

$400,000

$478,850

$558,073

$534,172

$385,719

$258,329

$297,756

$450,503

2003

2004

2005

2006

2007

2008

2009

2010

2011*

World Lift Truck Shipments (units)

Revenue ($thousands)

*Annualized based on nine months ended October 31, 2010.

|

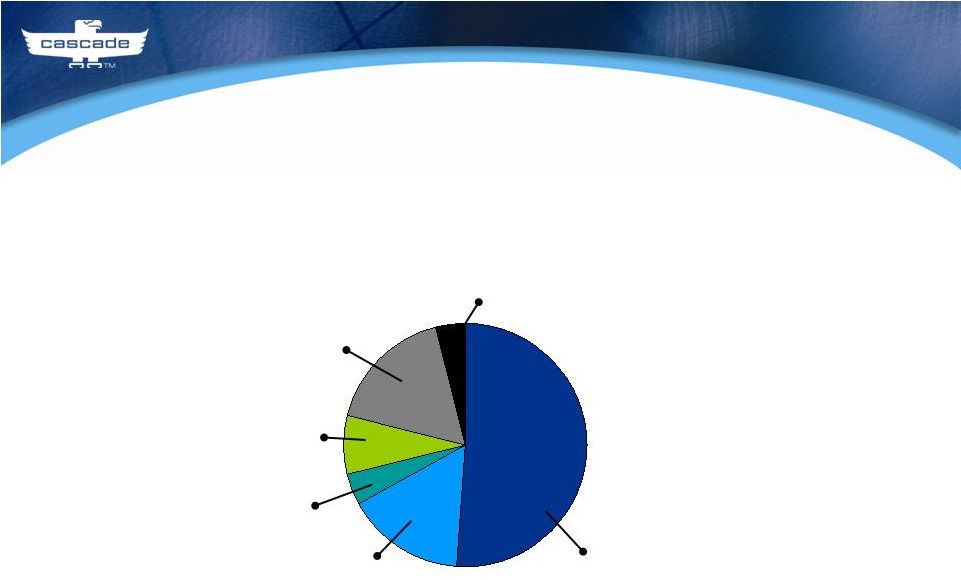

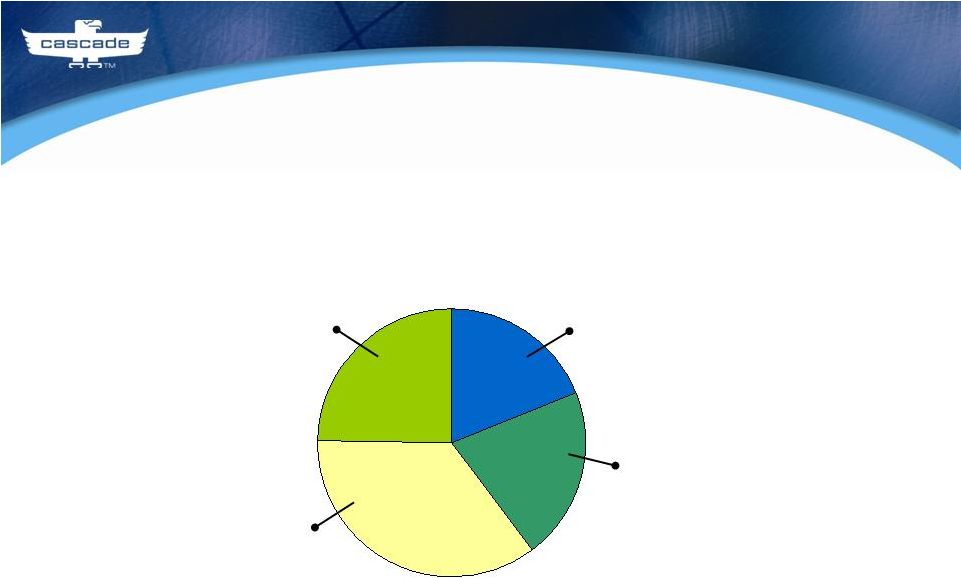

9

Lift Truck Products Market Share -

World

Cascade 50%

Other 18%

Vetter (Germany) 4%

MSI (UK) 4%

Bolzoni

/ Auramo

/ Meyer (Italy) 16%

Kaup

(Germany) 8% |

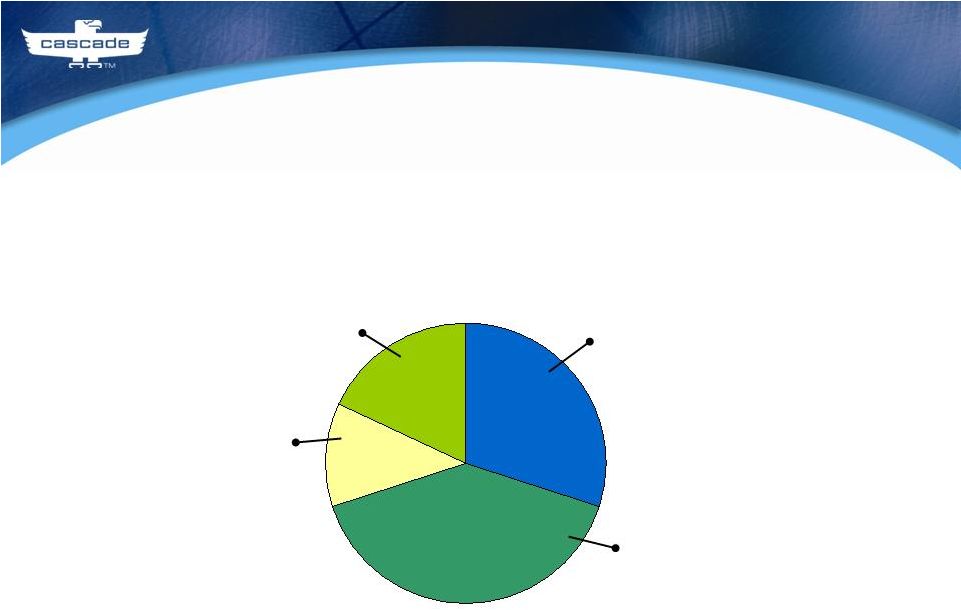

10

Lift Truck Market

China -

25%

Asia Pacific -

36%

North America -

19%

Europe -

21% |

11

Attachment/Fork Market

China -

18%

Asia Pacific -

12%

North America -

30%

Europe -

40% |

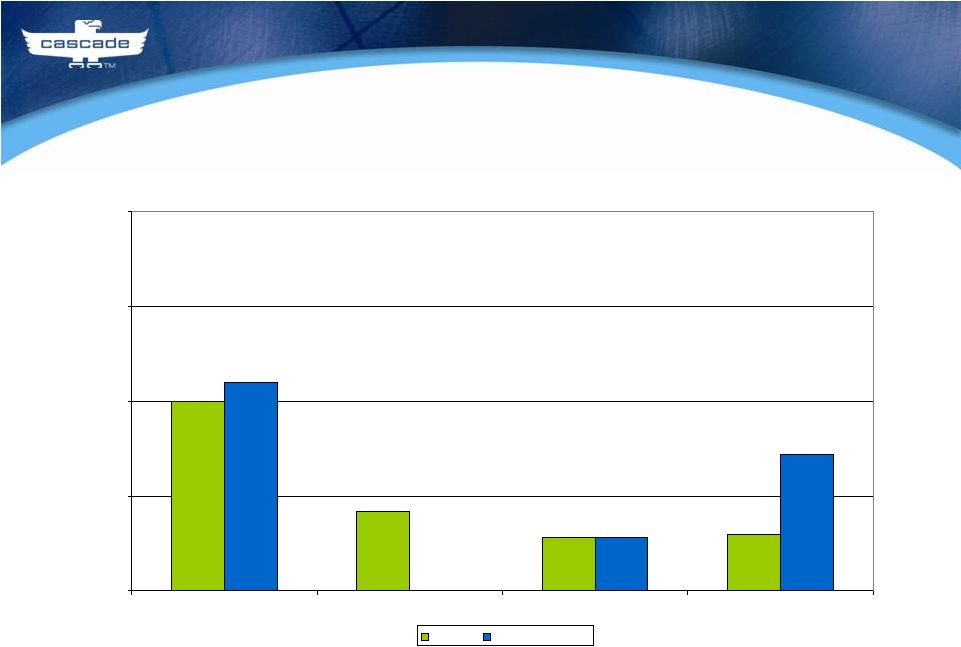

12

Revenue and Operating Income

50%

21%

14%

15%

55%

0%

14%

36%

0%

25%

50%

75%

100%

North America

Europe

Asia Pacific

China

Revenue

Operating Income |

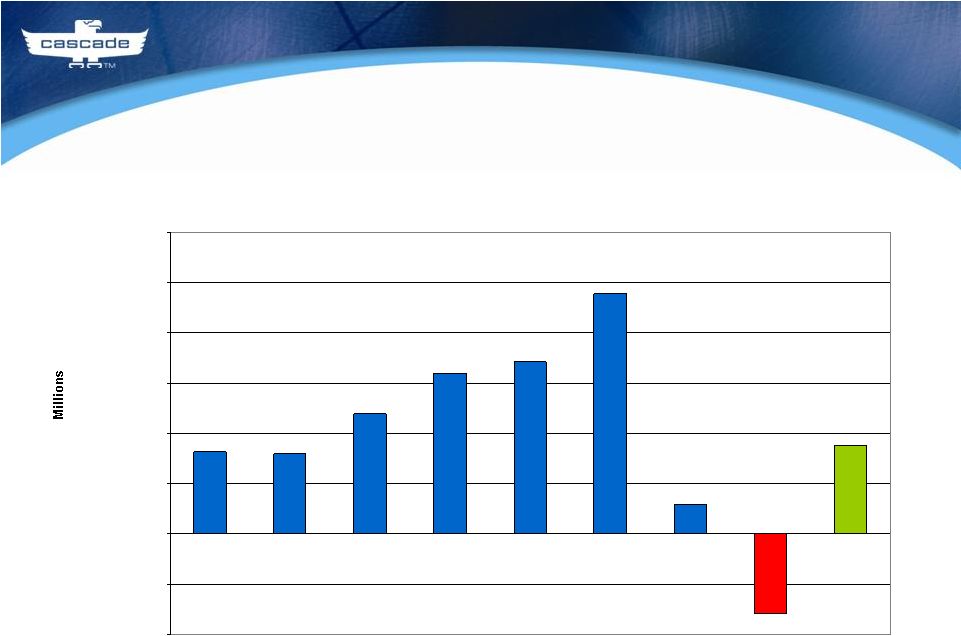

13

Cascade Operating Income (Loss)

2003

2004

2005

2006

2007

2008

2009

2011*

$35.3

$11.5

$95.6

$68.4

$63.9

$47.8

$32.0

$32.8

$(31.5)

$(40.0)

$(20.0)

$-

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

*Nine months ended October 31, 2010.

2010 |

14

Quarterly Results*

Q1

Q2 Q3 Q4

Q1

Q2 Q3 Q4

Q1

Q2 Q3

2009

2010

2011

*Excluding impairment charge and restructuring costs.

$139.0

$98.0

$107.0

($4.2)

$1.0

$0.6

$0.6

$94.0

$81.0

$81.0

$77.0

$76.0

$95.0

$150.0

$150.0

$9.5

$10.4

$15.4

$6.3

$17.8

$18.5

$17.7

-$20.0

$0.0

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

$140.0

$160.0

Net sales

Operating income (loss) |

15

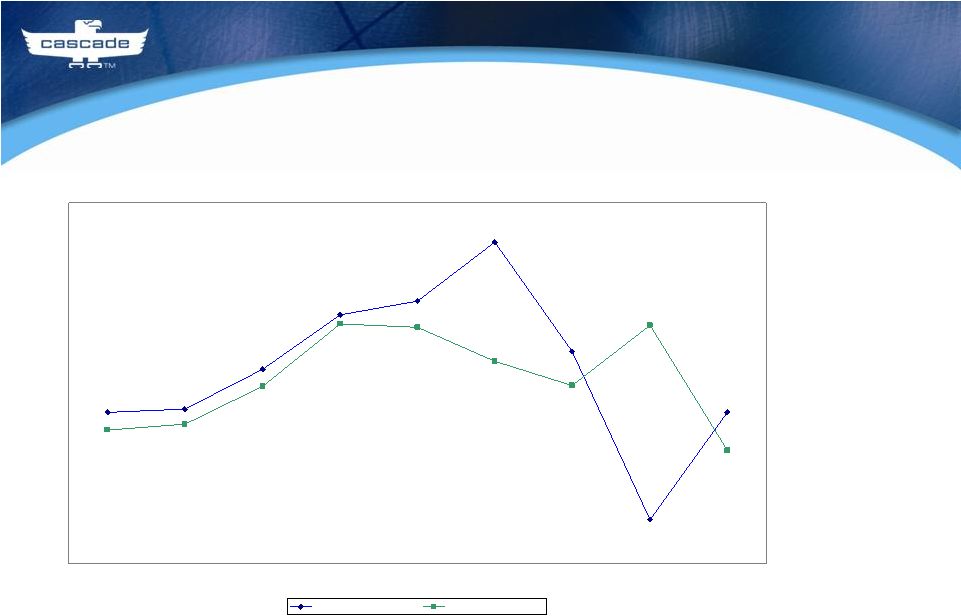

Cascade Net Income (Loss) & Free Cash Flow

(Free Cash Flow = Cash from Operations –

Maintenance CAPEX)

2009 net income excludes asset impairment charge ($31,576)

2010 net income excludes European restructuring charge ($29,519)

*2011 –

Nine months ended October 31, 2011

$32,843

$39,031

$18,506

$17,707

$28,490

$42,051

$45,481

$60,147

($9,130)

$17,682

$39,845

$14,838

$13,276

$24,227

$30,518

$24,377

$39,479

$8,280

2003

2004

2005

2006

2007

2008

2009

2010

2011*

Net Income (Loss) ($000)

Free Cash Flow ($000) |

16

Europe Revenue and Operating Income (Loss) by Quarter*

Q1

Q2 Q3 Q4

Q1

Q2 Q3 Q4

Q1 Q2 Q3

2009

2010

2011

*Net of restructuring costs.

29,538

17,218

17,013

-5,611

-174

-2,017

-5,611

-3,051

-4,684

-4,590

-1,826

-1,015

-586

16,477

14,434

12,810

14,907

16,060

21,488

30,985

32,115

1,212

-10,000

-5,000

0

5,000

10,000

15,000

20,000

25,000

30,000

35,000

Revenue

Operating income (loss), net |

17

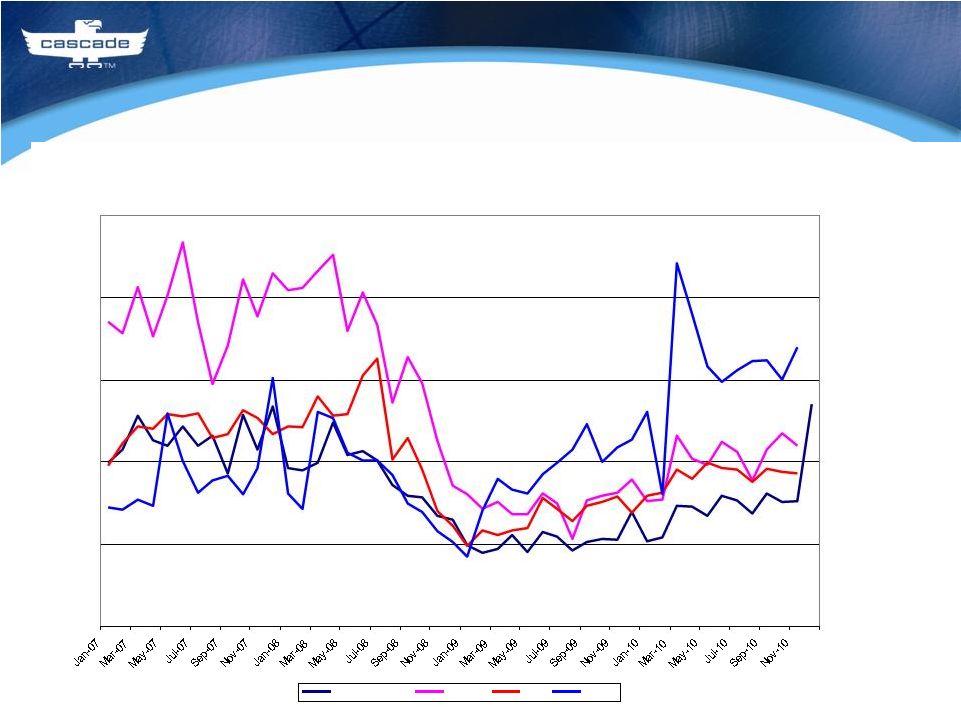

Global Lift Truck Order Trends

Data for Europe, Asia Pacific and China shown through

November 2010. Data for North America shown through December 2010.

North America

Europe

Asia

China |