Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - 3D SYSTEMS CORP | f8k_011111.htm |

Copyright 3D Systems Corporation All Rights Reserved

1

www.3dsystems.com

NASDAQ:TDSC

Presentation

January 2011

Copyright 3D Systems Corporation All Rights Reserved

2

2

Forward Looking Statements

Copyright 3D Systems Corporation All Rights Reserved

3

3D Content-To-Print Leader

Copyright 3D Systems Corporation All Rights Reserved

4

Marketplaces

Copyright 3D Systems Corporation All Rights Reserved

5

5

Profile And Presence

Copyright 3D Systems Corporation All Rights Reserved

6

Services

Materials

Systems &

Other

Other

Balanced Revenue Composition

First Nine Months 2010-Recurring Revenue Represented 69% of Total Revenue

Revenue Buckets

Geography

Copyright 3D Systems Corporation All Rights Reserved

7

Experienced Management Team

Copyright 3D Systems Corporation All Rights Reserved

8

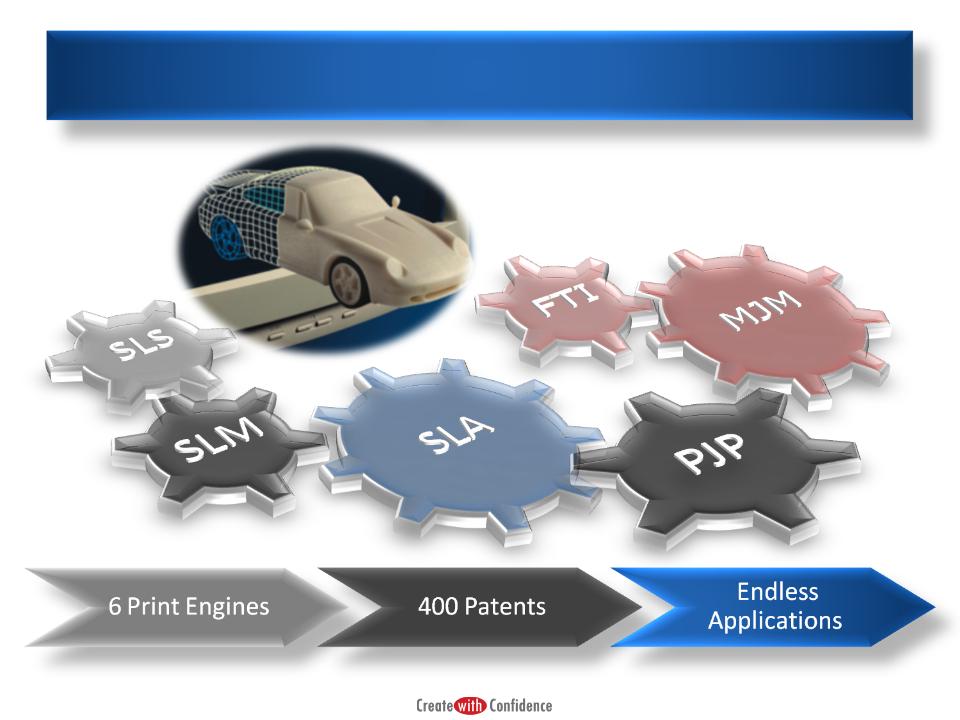

Technology Rich Portfolio

Copyright 3D Systems Corporation All Rights Reserved

9

9

Proprietary Performance Materials

Copyright 3D Systems Corporation All Rights Reserved

10

Diversified Customer Base

Copyright 3D Systems Corporation All Rights Reserved

11

Revenue Growth Drivers

Copyright 3D Systems Corporation All Rights Reserved

12

Growth Strategy

Copyright 3D Systems Corporation All Rights Reserved

13

Marketplace Opportunities

Source: 3D Systems

3D Aerospace

$400 Million

$600 Million

$1 Billion

$500 Million

$500 Million

Copyright 3D Systems Corporation All Rights Reserved

14

Multiple Revenue Sources

Print Services

Personal Printers

Production Printers

Recurring Materials & Services Revenues

3D Print Technology

Copyright 3D Systems Corporation All Rights Reserved

15

15

Print Services

Copyright 3D Systems Corporation All Rights Reserved

16

3Dproparts™ Breadth

Copyright 3D Systems Corporation All Rights Reserved

17

Design To Manufacturing Source

Copyright 3D Systems Corporation All Rights Reserved

18

Personal & Professional Printers

Copyright 3D Systems Corporation All Rights Reserved

19

Personal

Printers

Printers

• Desktop

• Office

• Small format

• Simple, easy to use

Professional

Printers

Printers

• Groupware

• Office, model shop

• Small and mid

format

format

• Material properties

Production

Printers

Printers

• Productionware

• Manufacturing

floor

floor

• Small to large

format

format

• Extreme

productivity

productivity

Printer Positioning

Copyright 3D Systems Corporation All Rights Reserved

20

Democratizing Access

Copyright 3D Systems Corporation All Rights Reserved

21

MCAD ARC & Jewelry Solutions

Copyright 3D Systems Corporation All Rights Reserved

22

22

22

Personal Printers

Copyright 3D Systems Corporation All Rights Reserved

23

Production Printers

Copyright 3D Systems Corporation All Rights Reserved

24

24

Healthcare Solutions

Copyright 3D Systems Corporation All Rights Reserved

25

25

25

Aerospace and Defense Solutions

Copyright 3D Systems Corporation All Rights Reserved

26

26

26

Automotive and Motorsports Solutions

Copyright 3D Systems Corporation All Rights Reserved

27

Shareholder Value

Maximize Free Cash

Flow Operations

Flow Operations

Integrate Targets,

Harvest Synergies

Harvest Synergies

Target & Close

Suitable Acquisition

Candidates

Suitable Acquisition

Candidates

10 Acquisitions in 14 Months

Copyright 3D Systems Corporation All Rights Reserved

28

Competitive Advantage

Copyright 3D Systems Corporation All Rights Reserved

Damon Gregoire Senior Vice President & CFO

Copyright 3D Systems Corporation All Rights Reserved

30

Nine Months 2010 Operating Results

Copyright 3D Systems Corporation All Rights Reserved

31

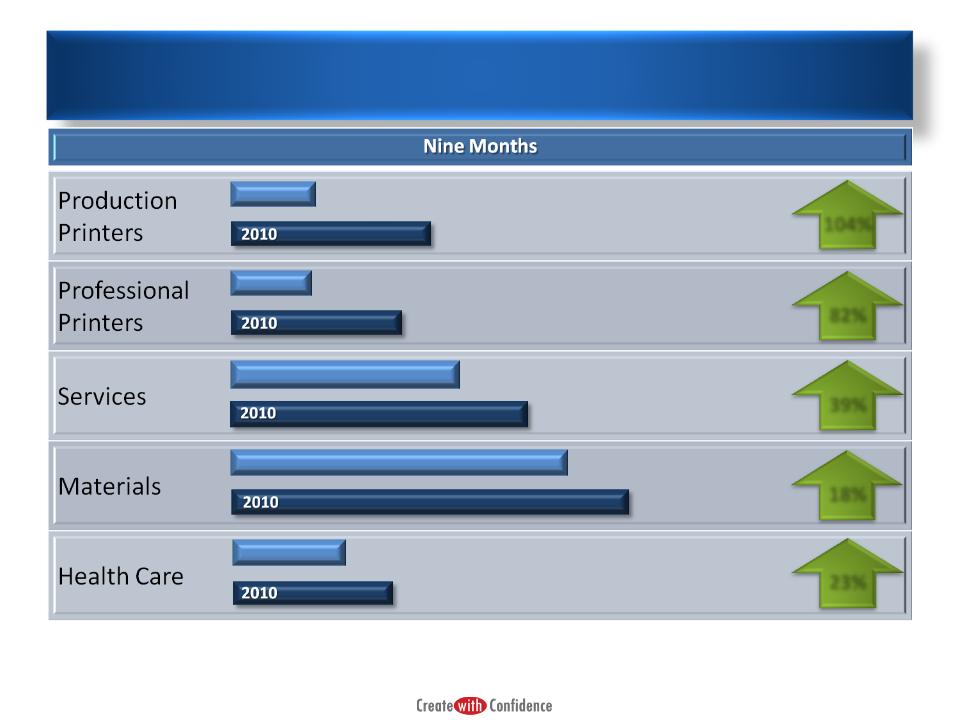

Across-The-Board Revenue Growth

2009

2009

2009

2009

2009

23%

104%

82%

39%

18%

$9.5

$19.2

$8.1

$14.7

$23.4

$32.5

$35.5

$41.8

$11.7

$14.5

($ in millions)

Copyright 3D Systems Corporation All Rights Reserved

32

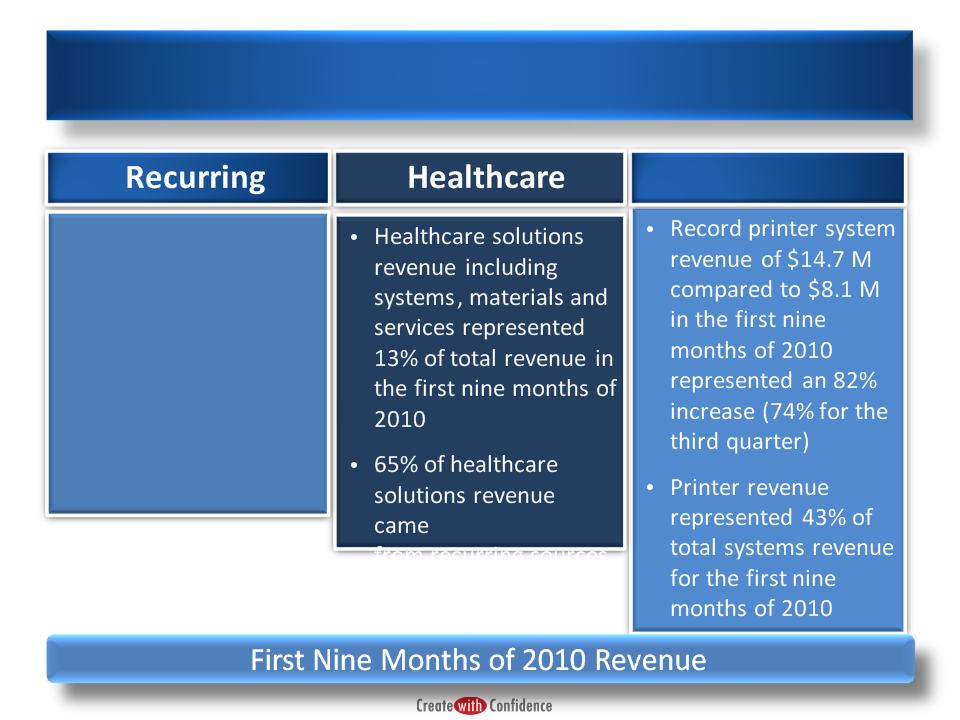

Revenue Quality and Mix

Printers

• Materials and services

made up 69% of total

revenue for the first

nine months of 2010

made up 69% of total

revenue for the first

nine months of 2010

• Recurring revenue

contributed 75% of

our gross profit margin

for the first nine

months of 2010

contributed 75% of

our gross profit margin

for the first nine

months of 2010

Copyright 3D Systems Corporation All Rights Reserved

33

Copyright 3D Systems Corporation All Rights Reserved

34

Gross Profit Margin Trend

Q3-10

45.4%

45.4%

Q1-10

45.3%

45.3%

Copyright 3D Systems Corporation All Rights Reserved

35

35

Available cash as of October 26, 2010 was $25.4 million after using $11.0

million for acquisition activities since September 30, 2010

million for acquisition activities since September 30, 2010

• Net income of $5.4 million included $2.4 million of non-cash expenses

• Cash position increased from the previous quarter to $33.8 million, after

funding our acquisitions of CEP, ProtoMetal and Express Pattern

funding our acquisitions of CEP, ProtoMetal and Express Pattern

• We continue to carry no debt on our balance sheet

• Inventory decreased $1.2 million from the second quarter of 2010

**Percents are rounded to the nearest whole number

Working Capital Management

Copyright 3D Systems Corporation All Rights Reserved

36

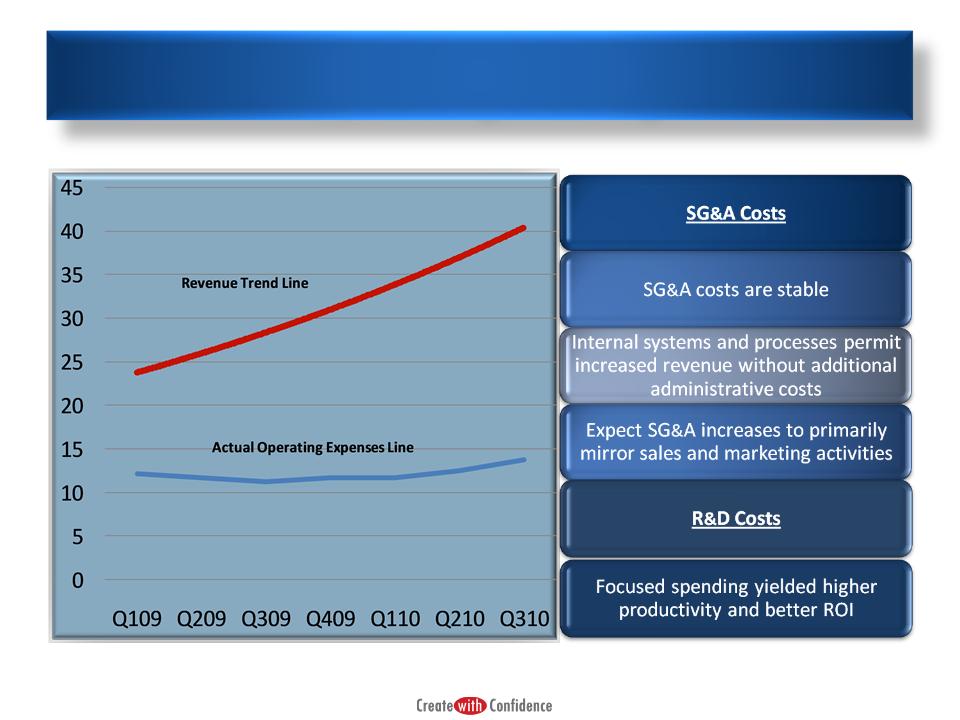

Operating Leverage

Copyright 3D Systems Corporation All Rights Reserved

37

Revenue and margin expansion, coupled with operating costs

containment and optimization resulted in an improved

bottom line and stronger balance sheet

containment and optimization resulted in an improved

bottom line and stronger balance sheet

Bottom Line

Copyright 3D Systems Corporation All Rights Reserved

38

Strong

balance sheet

coupled with

operating leverage

allows us to fund

our strategic initiatives

Balance Sheet Management

Copyright 3D Systems Corporation All Rights Reserved

39

39

Current and planned investments in all areas are evaluated as

part of our overall strategic plan

part of our overall strategic plan

R&D spending to enhance competitive advantage

Acquisitions must be accretive

Capital expenditures built around R&D and revenue generation,

not back office spending

ROI-based with an eye on the future

Investment Philosophy and Execution

Copyright 3D Systems Corporation All Rights Reserved

40

This target model is not intended to constitute financial guidance related to the company’s expected

performance. It is based upon management’s current expectations concerning future events and trends and is

necessarily subject to uncertainties.

performance. It is based upon management’s current expectations concerning future events and trends and is

necessarily subject to uncertainties.

|

|

Operating Model

|

|

Actual Results

|

||

|

|

|

Q3 2010

|

YTD 2010

|

||

|

Revenue

|

$150.0

|

$200.0

|

|

$41.5

|

$108.3

|

|

Gross Profit

|

48%

|

58%

|

|

45%

|

45%

|

|

SG&A

|

25%

|

23%

|

|

26%

|

28%

|

|

R&D

|

8%

|

7%

|

|

7%

|

7%

|

|

Operating Income

|

15%

|

28%

|

|

12%

|

10%

|

|

Net Income After Tax

|

10%

|

20%

|

|

13%

|

9%

|

|

Depreciation & Amortization

|

4%

|

4%

|

|

5%

|

5%

|

|

Capital Expenditures

|

2%

|

2%

|

|

1%

|

1%

|

|

Recurring Revenue

|

70%

|

80%

|

|

65%

|

69%

|

Progress Towards Long Term Operating Model

Copyright 3D Systems Corporation All Rights Reserved

41

Investor Composition

*As of 12/9/10

Copyright 3D Systems Corporation All Rights Reserved

42

Well Positioned For the Long Term

Copyright 3D Systems Corporation All Rights Reserved

43