Attached files

| file | filename |

|---|---|

| 8-K - ZOGENIX FORM 8-K - ZOGENIX, INC. | d8k.htm |

[ 1

] INVESTOR PRESENTATION

January 2011

NASDAQ: ZGNX

Exhibit 99.1 |

[

2 ]

Forward Looking Statements

Zogenix cautions you that statements included in this presentation that are not a

description of historical facts are forward-looking statements. Words such

as “believes,” “anticipates,” “plans,” “expects,” “indicates,” “will,” “intends,”

“potential,” “suggests,” “assuming,”

“designed” and similar expressions are intended to identify forward looking

statements. These statements are based on Zogenix’s current beliefs and

expectations. These forward-looking statements include statements

regarding: the ability to successfully commercialize Sumavel DosePro and its

continued sales growth; the ability to obtain additional marketing approvals for

Sumavel DosePro in the European Union; the timing of the release of Phase IV

data for Sumavel DosePro; the potential for, and timing of, an NDA submission

for ZX002 and IND submissions for Zogenix’s additional product candidates; the potential for ZX002 to be

the first approved oral, single-entity controlled release formulation of

hydrocodone; the completion of enrollment of one of the Phase 3

clinical trials for ZX002; the timing of results for the Phase 3 clinical trials for ZX002; the potential of

co-promotion discussions for ZX002; the expansion of Zogenix’s existing

sales team; the potential to broaden the application of the DosePro

technology; and the potential market penetration of Sumavel DosePro and ZX002. The

inclusion of forward-looking statements should not be regarded as a

representation by Zogenix that any of its plans will be achieved. Actual

results may differ from those set forth in this presentation due to the risk and uncertainties

inherent in Zogenix’s business, including, without limitation: the market

potential for migraine treatments, and Zogenix’s ability to compete

within that market; inadequate therapeutic efficacy or unexpected adverse side

effects relating to Sumavel DosePro that could delay or prevent commercialization, or

that could result in recalls or product liability claims; Zogenix’s

dependence on its collaboration with Astellas Pharma US, Inc. to promote Sumavel

DosePro; the ability of Zogenix to ensure adequate and continued supply of Sumavel

DosePro to successfully launch commercial sales or meet anticipated market

demand; the progress and timing of Zogenix’s clinical trials; the

potential that earlier clinical trials may not be predictive of future results; the

potential for ZX002 to receive regulatory approval on a timely basis or at

all; the potential for adverse safety findings relating to ZX002 to delay or prevent

regulatory approval or commercialization; the ability of Zogenix and its licensors to

obtain, maintain and successfully enforce adequate patent and other

intellectual property protection of its products and product candidates and the

ability to operate its business without infringing the intellectual property rights

of others; and other risks described in Zogenix’s filings with the

Securities and Exchange Commission. You are cautioned not to place undue reliance on

these forward-looking statements, which speak only as of the date hereof, and

Zogenix undertakes no obligation to revise or update this presentation to

reflect events or circumstances after the date hereof. All forward-looking

statements are qualified in their entirety by this cautionary statement. This caution

is made under the safe harbor provisions of Section 21E of the Private

Securities Litigation Reform Act of 1995. |

[

3 ]

Commercializing and Developing Products for Treatment of

Central Nervous System (CNS) Disorders and Pain

RAMPING SALES

1

Single Use, Needle-Free,

Commercial Product

$3.5B Market

Acute Migraines

and Cluster Headaches

$13B Market

Codeine and Morphine

Based Pain Products

MEDICINE

and

TECHNOLOGY

PHASE 3 DEVELOPMENT

ZX002

1

Oral Single-Entity, Controlled

Release Hydrocodone

st

st

Sources:

Wolters Kluwer Pharma Solutions, Source®

PHAST Institution/Retail (12 months ended June 30, 2010) |

[

4 ]

Established

Commercial

Infrastructure

•

Sophisticated Manufacturing and Sales Organization in

Place to Support Continued Growth

Positioned for Significant Value Creation

SUMAVEL

®

DosePro

™

:

Differentiated,

Marketed Product

•

Full Commercial Launch Underway, Marketing

Partnership with Astellas, Quarterly Prescription Growth

Phase 3 Ongoing:

ZX002 for

Chronic Pain

•

Potential To Be 1st Approved Oral, Single-Entity,

Controlled Release Formulation of Hydrocodone

DosePro™

Delivery

System:

Proprietary Technology

•

Validated, Innovative Needle-Free Delivery System

•

U.S. FDA approval, initial E.U. marketing authorizations

•

Broad Range of Potential Applications

Experienced

Management Team

•

History of Successful Manufacturing, Development and

Commercialization |

[

5 ]

1

st

Single Use, Needle-Free, Commercial Product Marketed

for Treating Acute Migraine and Cluster Headaches

RAMPING SALES

Launched

Mid-January 2010 |

[

6 ]

75%

of

Patients

Are Women

The

9th

Leading Cause

of Disability

in Women Globally

7th

Most Costly Disease

to US Employers

30 Million People in the U.S. Suffer Migraines**

Symptoms and Nature of Episodes Vary Widely

Disabling Headache Pain, 4-72 Hours in Duration

$25 B Annual Estimated Cost to Employers

63% Suffer

1 Attack per

Month

25% Have

1 Attack per Week

48% Upon Morning Wakening (between 4 -9 am)

29% Reported Vomiting as a Symptom of Migraine Attacks

Treatment Depends on Type of Episode

Migraine Frequency, Severity, Speed of Onset, and Previous

Response to Medication Determine Treatment

25% Have

2 Active Prescriptions

Oral Triptans

Often Prescribed as 1

st

Line Therapy

Sources:

NHF(2010),

World

Health

Organization

(2000),

Goetzel

et

all,

JOEM

(2004),

International

Headache

Society

(www.ihs-headache.org), Thomson

Medstat

(2006),

Lipton

et

al,

Neurology

(2002),

Fox

and

Davis,

Headache

(1998),

Lipton

et

al,

Neurology

(2001),

Boston

Healthcare

Associates,

Inc.

(2007) |

[

7 ]

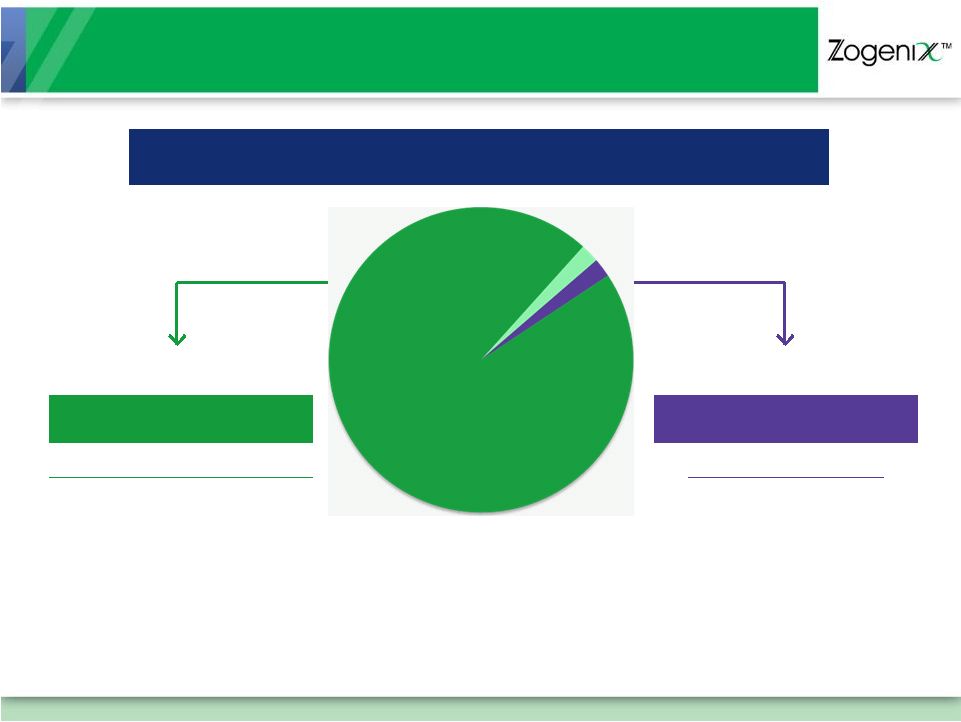

$3.5 Billion Migraine Market

TARGET AUDIENCE: DISSATISFIED ORAL USERS

2% Nasal

2% Injectable*

Oral and Nasal

128 Million Doses

CONVENIENCE

But…

Limited Efficacy for

Many Attacks

Injectable

3.2 Million Doses

EFFECTIVE

But…

50% of Patients Refuse

Needle-based Injection

Due to Anxiety, Fear,

and Complexity

96%

Tablets and

Melt Tablets

*Sumatriptan Is the Only Injectable Triptan

Sources: Palace Healthcare Group, Inc. (2006), Wolters Kluwer Pharma Solutions,

Source® PHAST Institution/Retail (12 months ended June 2010) |

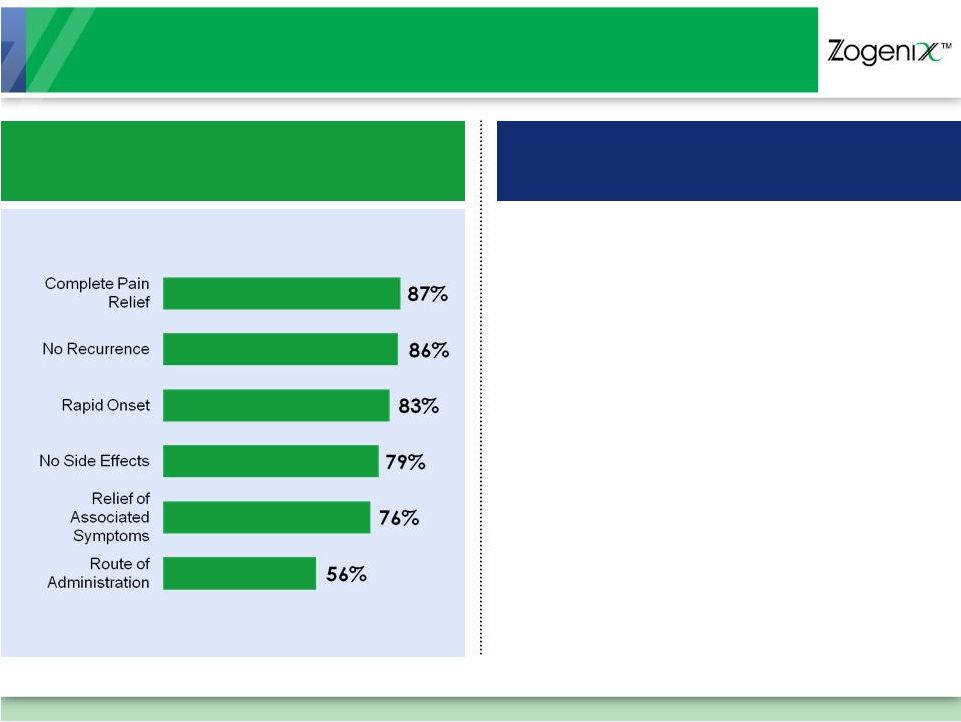

Significant Unmet Needs

Patients Want Fast,

Complete Pain Relief…

…

But Most Patients Are Dissatisfied

50%

Unsatisfied with Their Current Therapy

75%

Said Medication Didn’t

Work Fast Enough

Majority

Said Prescription Oral Medication

Not Useful for Every Migraine Attack

30%

Fail to Respond to Oral or Nasal Triptans

[ 8

]

Sources: Lipton et al, Headache (1999), NHF Survey of 500 Migraine Sufferers (June

2010), Gerson Lehrman Group (2006) |

SUMAVEL

DosePro: A Differentiated Migraine Therapy

COMPLETE

Pain Free

EFFECTIVE

Pain Relief

EASY TO USE

98%

of

Patients

Correctly

Used SUMAVEL DosePro

During Migraine Attacks

on Their First Try At Home

FAST

Pain Relief in as Little as

10 Minutes

for Some Patients

Sources: SUMAVEL DosePro

Prescribing Information

[ 9

] |

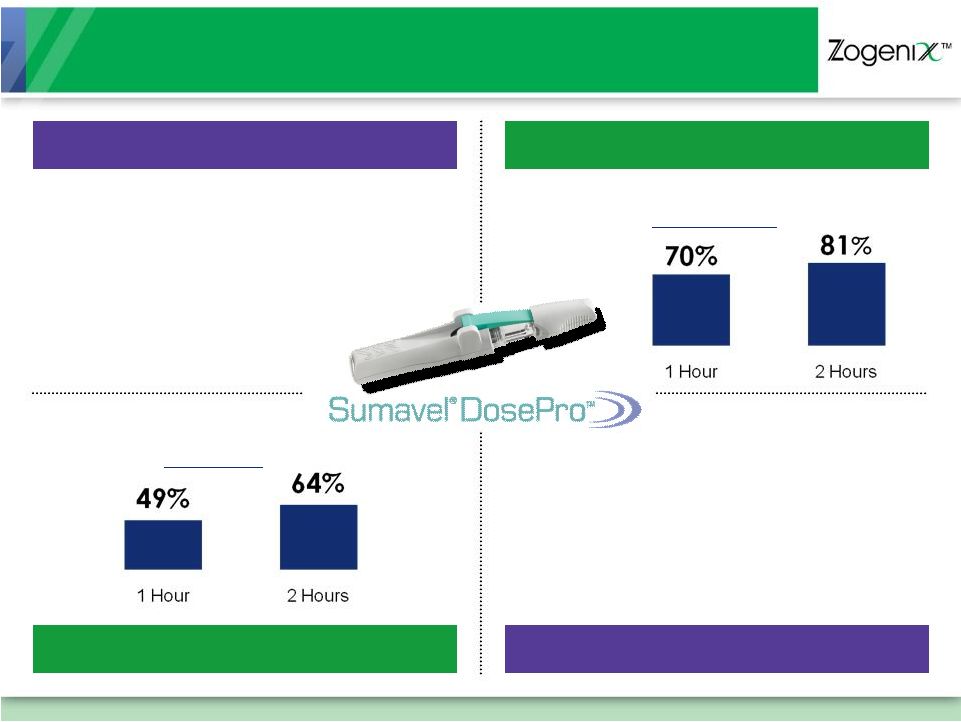

[

10 ]

Highly Effective Treatment for Migraine Pain

Fastest Time to Maximum Drug

Concentration in Blood (Hours)

Most Effective Patient

Pain Relief at 1 Hour

70%

38-43%

28%

20-30%

12 Minutes

1.6 -

2.5

Hours

1 Hour

1.5 Hours

ORAL

TABLETS

ORAL

MELT

ORAL TABLETS

ORAL MELT

Sources: Products’

Prescribing Information

(sumatriptan injection)

(sumatriptan

injection) |

[

11 ]

Rapid, Growing

Market Adoption Since January Launch

Weekly Prescriptions: Rolling 4-Week Average

(Through week ending October 22, 2010)

SUMAVEL DosePro

Prescriptions: Over 25,000 TRx

To Date

$1.9M

Net Sales

$4.2M

Net Sales

$5.7M

Net Sales

Refill Prescriptions

New Prescriptions

Total

Prescriptions

New

Prescriptions

Sources: Wolters

Kluwer

Pharma

Solutions (Source®

LaunchTrac, (w/e

January 15, 2010 –

w/e

October 22, 2010), Source®

PHAST Retail (Jan 2010 –

Sep 2010)

Refill

Prescriptions

at

31%

of

Total

(September)

Over 6,100 Prescribing Physicians |

[

12 ]

Market Experience To Date …

New Physicians

32%

of Prescribing Physicians Had Not

Written a Prescription for Needle-

Based

Sumatriptan

Injections

in

prior

12 months

We’re Changing the Way Migraines Are Treated

Sources:

Wolters

Kluwer

Pharma

Solutions

:

Source®

LaunchTrac

(w/e

January

15,

2010

–

w/e

July

30,

2010),

Source®

Lx

PTA

(Jan

2010

–

Aug

2010);

Infomedics, based on 1,071 patient respondents (through September 11, 2010)

Patients Switching

77%

of Patients Switching Dosage Forms

through August were from Oral

Triptans

Higher Patient Satisfaction

Average Patient Satisfaction Score

vs. 5.5 (9 point scale) for Prior

Migraine Medication;

Confirmed by Phase 4 Study Results

7.1

New Patients

34%

of Patients Were New to the

Triptan

Market since launch |

[

13 ]

SUMAVEL DosePro:

CONNECT 2010 Most Innovative Product (MIP) Winner

2010

Winner

in

Life

Sciences

–

Medical

Products

category

Recognizes emerging technologies and cutting-edge

products that drive San Diego’s innovation economy

DosePro

Technology…as easy as 1-2-3 |

[

14 ]

Successfully Executing with

Well-Established Sales and Marketing Organization

~ 80 Field Sales Reps, Most Have

Neurology and/or Migraine

Experience

Targeting Neurologists, Headache

Clinics and Specialists, Select PCPs

12+ Years Average Experience per

Sales Rep

~ 400 Field Sales Reps

Targeting PCPs, OB/GYNs, EM

Physicians and Urologists

Multi-Year Co-Marketing and

Co-Promotion Agreement

$20M Upfront and Milestone Payments

Pay-for-Performance Sales Results

Positioning

SUMAVEL

DosePro

as

a

First-Line

Alternative

for

Oral

Triptan

Non-Responders

and

Dissatisfied

Patients

Collaboration With Over

475 Sales Representatives |

[

15 ]

Comprehensive Marketing and Patient Support

Programs |

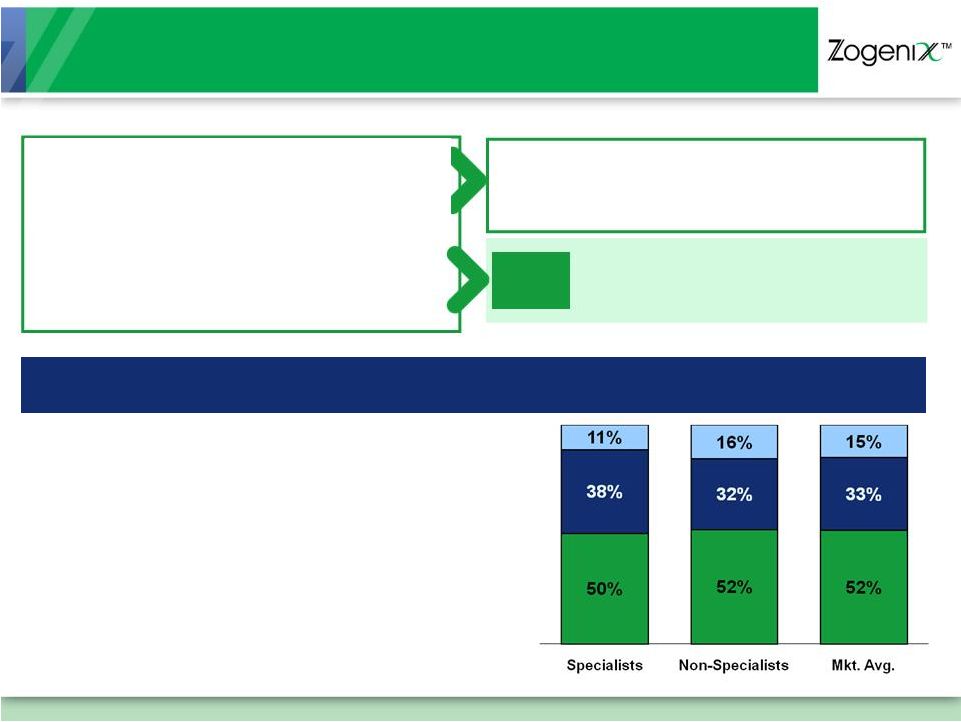

Broad

Reimbursement Coverage Source:

Wolters

Kluwer

Pharma

Solutions

Source®

Dynamic

Claims

(January

2010

–

November

2010)

of Reimbursement Claims

Submitted Are Approved

79%

Tier 3 Reimbursement Strategy

Meeting Expectations

Broad Coverage with the Largest

Commercial Healthcare Plans

Range of Physician and Patient

Reimbursement and

Support Programs ($15 Co-Pay)

Non-Retail Initiatives Underway

$87 WAC per Unit

$522 Sold in 6-Packs

$15 Cost to Patient

[ 16

] |

[

17 ]

High Quality Partnerships Support

Domestic and European Commercialization

Manufactured and Released Over 1,000,000

SUMAVEL DosePro

Units to Date

Manufacturing

Contract Manufacturers and Component Suppliers

Distribution and Marketing

Europe |

[

18 ]

ZX002

1

st

Oral, Single-Entity, Controlled Release Hydrocodone

for Treating Chronic Pain

PHASE 3 DEVELOPMENT |

ZX002:

Filling A Significant Treatment Gap for Chronic Pain Sources:

Wolters

Kluwer

Pharma

Solutions,

Source®

PHAST

Retail

(12

months

ended

June

30,

2010),

bioStrategies

Group

(2007)

NO

Controlled Release Hydrocodone

Single Entity Hydrocodone

$13 Billion Market (202M TRx)

Codeine and Morphine

Based Pain Products

Hydrocodone

Rx Share By Pain Type: ~50% for Chronic Pain

Acute

Chronic

–

Other

Chronic

Back/

OA

June 2009 FDA Joint Advisory

Committee Meeting

Highlighted public health problem of

liver injury related to use of

acetaminophen in OTC and Rx

products

$3.1 Billion Annual Sales (126M TRx)

Generic, Immediate Release

Hydrocodone

Combination Products

Oral ER Formulations Accepted at

Significant Premiums to Generics/IR

[ 19

] |

[

20 ]

ZX002: Phase 3 Clinical Development Program

Study 801

Study 802

Open Label Safety:

Enrollment Completed 4Q10

Initiated May 2010, ~55 Sites

~450 patients on therapy

Open Label Safety Study to Provide

Safety Database for 505(b)(2) NDA:

300 Subjects at 6 Months and 100

Subjects at 1 Year Exposure

Broad Spectrum of Chronic Pain

Pivotal Phase 3 Efficacy Trial:

Enrollment Completion 1Q11

Initiated March 2010, ~60 Sites

~340 patients to be randomized

Standard Opioid Trial Design with

12-Weeks Active Treatment Following

Dose Titration and Randomization

Chronic Lower Back Pain Patients

Top Line Data Expected 2H 2011

Intend to Submit NDA by Early 2012 |

ZX002

Single Entity Hydrocodone, Multiple Strengths (10-50 mg)

Uses Elan’s

Proprietary SODAS Delivery System to Enhance

Hydrocodone

Release Profile

Planning expansion of existing sales team to 250+

representatives to support ZX002 launch

ZX002: A Late Stage Product Candidate

with Numerous Benefits Over Existing Opioids

Effective12-Hour Pain Relief

Enables Dose

Optimization and

Switching from

Other Opioids

Improves

Adherence and

Patient

Convenience

Provides Consistent,

Around-the-Clock

Relief

Eliminates

Safety Risks

Associated with

Acetaminophen

[ 21

] |

DosePro: Proprietary Drug Delivery System

Validated by FDA Approval of SUMAVEL DosePro

10+ Years

Development

and Validation

US and Foreign IP

61 Issued Patents

31 Patent

Applications Pending

Proven Ability

to Deliver Biologics

and Highly

Viscous Formulations

[ 22

] |

DosePro: Broad Range of Potential Applications

Attractive Delivery Option for Additional Medications,

Including Biologics and Small Molecules

DosePro

Internal Development

Injectable

CNS Drug

Product Candidates

(2 Pre-Clinical)

Second Generation

Technology

(1mL device)

Technology Out Licensing

Enhance, Differentiate

or Extend Injectable

Product Lifecycles

Prototypes of Second Generation DosePro

[ 23

] |

[

24 ]

TRx

Market

1.26 Million TRx

$244 Million

48% of Episodes Upon Morning Wakening

(between 4 -9 am)

29% of Sufferers Reported Vomiting as a

Symptom of Migraine Attacks

30% of Patients Fail to Respond to Oral or

Nasal Triptans

Net Revenue/Dose: $70/Unit*

7 Units/TRx

Average TRx

Value: $490

12.1 Million TRx

per Year

1% Triptan

Share

ZX002

126M Hydrocodone

(~50% for Chronic Use)

76M Other ER and IR Opioids

Net Revenue/Day: $7.75**

Average TRx: 25 Days

Average TRx

Value: $194

202 Million TRx

per Year

1% Hydrocodone

Share

Large Commercial Opportunities

Patient/ Market

Segments

Prescription

Values

*Includes Co-Pay Assistance ** Based on current pricing of

branded ER opioids Sources:

Wolters

Kluwer

Pharma

Solutions

,

Source®

PHAST

Retail

(12

months

ended

June

30,

2010)

Illustrative

Market

Penetration

121,000 TRx

$59 Million |

Financial Summary

9 months ended September 30, 2010

P&L

$ Millions

Financial Highlights

$ Millions

Revenue

$

14.6

Operating Expense

$

66.2

Loss From Operations

$

51.6

Other (Income)/Loss

$ 19.9

Net Loss

$

71.5

Gross Invoiced Sales

$

16.4

Invested Capital

$ 164.0

Cash Balance

$

11.7

Debt Facility

$25M Term Loan

$10M Working Capital Line

•

Balance $2.7M

Cash Flow Used In

Operations

$ 58.5

[ 25

] |

2010

Achievements SUMAVEL DosePro

Full U.S. Commercial Launch by

Zogenix

with co-promote

partner Astellas

Enhanced Formulary Coverage

and Patient Support

Phase IV Study Completed

Consistent Monthly Rx Growth

Since Launch

1 Million Commercial Units

Produced

Initial EU Approvals by Desitin

Named a 2010 “Most Innovative

Product”

Winner by CONNECT

ZX002

Initiated Phase 3 Safety Study

(Study 802)

Initiated Phase 3 Efficacy Study

(Study 801)

Completed Enrollment in

Phase 3 Safety Study

Corporate

Appointed Ann D. Rhoads to

Serve as CFO

Established Term Loan and

Revolving Line of Credit

Completed Initial Public

Offering

[ 26

] |

[

27 ]

2011 Goals and Milestones

SUMAVEL DosePro

Continue US Sales Growth

Phase IV Data Publication

Additional EU Approvals

New Direct-to-Patient

Initiatives

ZX002

Pivotal Study 801 Efficacy Top–

Line Results

Open Label Study 802 Top-Line

Safety Results

Initiate Co-Promotion Discussions

Pre-NDA Meeting with FDA

Prepare to File NDA by early

2012

DosePro

Technology

File IND for Next Zogenix

CNS

Product

Seek First Licensee for Biologic

Building on Track Record of

Successful Execution |

[

28 ]

Experienced Management Team with a History

of Successful Development & Commercialization

*Co-Founders

Aradigm, Invacare

19

John Turanin*

VP/GM, Zogenix

Technologies

GlaxoSmithKline, Elan, Skin Medica, InterMune

30

Mark Thompson

VP, Sales & Managed Markets

Nektar, Connetics

24

Edward Smith, Ph.D., RAC

VP, Regulatory Affairs

Avera, Windamere

17

Bret Megargel*

VP, Corporate Dev

Elan, Allergan, Valient

12

Stephen Jenner

VP, Marketing

Elan, InterMune

19

Cynthia Robinson, Ph.D.

CDO

Premier, Sprout, DLJ, Bain & Co, Merrill Lynch

18

Ann Rhoads

CFO

Aradigm, Cardiff University

20

Stephen Farr, Ph.D.*

President & COO

GlaxoSmithKline, Elan, InterMune

23

Roger Hawley*

CEO

Years

Experience |

[

29 ]

Established

Commercial

Infrastructure

•

Sophisticated Manufacturing and Sales Organization in

Place to Support Continued Growth

Positioned for Significant Value Creation

SUMAVEL

®

DosePro

™

:

Differentiated,

Marketed Product

•

Full Commercial Launch Underway, Marketing

Partnership with Astellas, Quarterly Prescription Growth

Phase 3 Ongoing:

ZX002 for

Chronic Pain

•

Potential To Be 1st Approved Oral, Single-Entity,

Controlled Release Formulation of Hydrocodone

DosePro™

Delivery

System:

Proprietary Technology

•

Validated, Innovative Needle-Free Delivery System

•

U.S. FDA approval, initial E.U. marketing authorizations

•

Broad Range of Potential Applications

Experienced

Management Team

•

History of Successful Manufacturing, Development and

Commercialization |