Attached files

| file | filename |

|---|---|

| 8-K - UIL FORM 8-K DATED JANUARY 10, 2011 - UIL HOLDINGS CORP | uil_form8kdated01102011.htm |

1

Shields Transmission Seminar

Wellington Shields & Co.

Transmission Seminar

January 11, 2011

EXHIBIT 99.1

2

Shields Transmission Seminar

2

Important Note to Investors

Richard Peters

Associate Vice President, Transmission

Safe Harbor Provision

Certain statements contained herein, regarding matters that are not historical facts, are forward-looking statements (as defined in the

Private Securities Litigation Reform Act of 1995). These include statements regarding management’s intentions, plans, beliefs,

expectations or forecasts for the future. Such forward-looking statements are based on UIL Holdings’ expectations and involve risks and

uncertainties; consequently, actual results may differ materially from those expressed or implied in the statements. Such risks and

uncertainties include, but are not limited to, general economic conditions, legislative and regulatory changes, changes in demand for

electricity, gas and other products and services, unanticipated weather conditions, changes in accounting principles, policies or

guidelines, and other economic, competitive, governmental, and technological factors affecting the operations, markets, products and

services of UIL Holdings’ subsidiaries, The United Illuminating Company, The Southern Connecticut Gas Company, Connecticut

Natural Gas Corporation and The Berkshire Gas Company. Such risks and uncertainties with respect to UIL Holdings’ recent acquisition

of The Southern Connecticut Gas Company, Connecticut Natural Gas Corporation and The Berkshire Gas Company include, but are not

limited to, the possibility that the expected benefits will not be realized, or will not be realized within the expected time period. The

foregoing and other factors are discussed and should be reviewed in UIL Holdings’ most recent Annual Report on Form 10-K and other

subsequent periodic filings with the Securities and Exchange Commission. Forward-looking statements included herein speak only as of

the date hereof and UIL Holdings undertakes no obligation to revise or update such statements to reflect events or circumstances after the

date hereof or to reflect the occurrence of unanticipated events or circumstances.

Private Securities Litigation Reform Act of 1995). These include statements regarding management’s intentions, plans, beliefs,

expectations or forecasts for the future. Such forward-looking statements are based on UIL Holdings’ expectations and involve risks and

uncertainties; consequently, actual results may differ materially from those expressed or implied in the statements. Such risks and

uncertainties include, but are not limited to, general economic conditions, legislative and regulatory changes, changes in demand for

electricity, gas and other products and services, unanticipated weather conditions, changes in accounting principles, policies or

guidelines, and other economic, competitive, governmental, and technological factors affecting the operations, markets, products and

services of UIL Holdings’ subsidiaries, The United Illuminating Company, The Southern Connecticut Gas Company, Connecticut

Natural Gas Corporation and The Berkshire Gas Company. Such risks and uncertainties with respect to UIL Holdings’ recent acquisition

of The Southern Connecticut Gas Company, Connecticut Natural Gas Corporation and The Berkshire Gas Company include, but are not

limited to, the possibility that the expected benefits will not be realized, or will not be realized within the expected time period. The

foregoing and other factors are discussed and should be reviewed in UIL Holdings’ most recent Annual Report on Form 10-K and other

subsequent periodic filings with the Securities and Exchange Commission. Forward-looking statements included herein speak only as of

the date hereof and UIL Holdings undertakes no obligation to revise or update such statements to reflect events or circumstances after the

date hereof or to reflect the occurrence of unanticipated events or circumstances.

3

Shields Transmission Seminar

Today’s Topics

n UIL Corporate Structure, Service Areas

n UIL-Wide Projected CapEx

n Near-Term

n Ten-Year

n UIL-Wide Projected Rate Base

n Transmission Highlights

n Projected Capital Program

n Examples of Current Reliability Upgrades

n NEEWS Investment

n Region-Wide RPS Obligations

n Renewable-Enabling Transmission

4

Shields Transmission Seminar

4

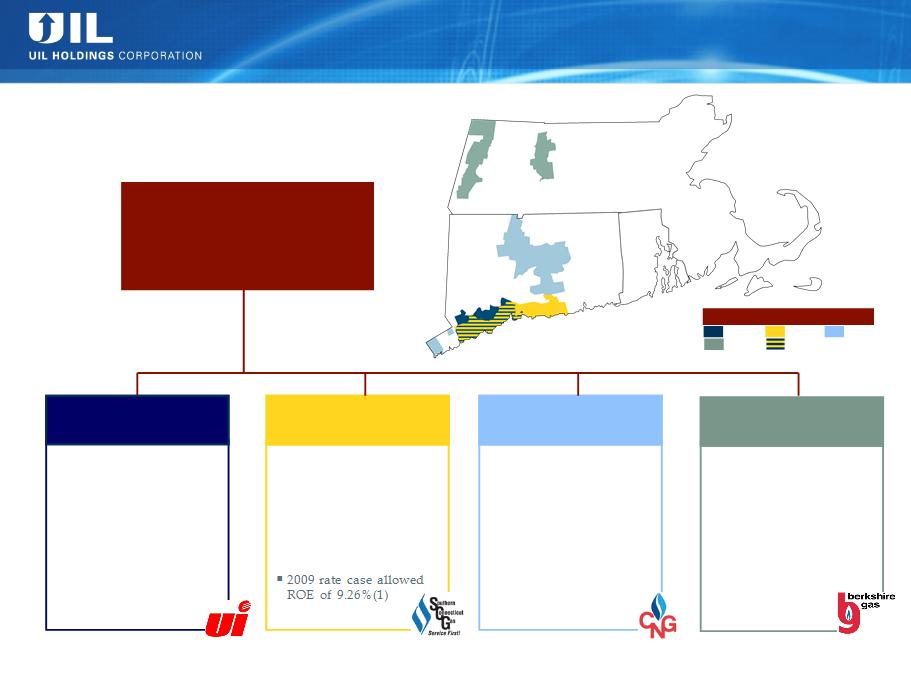

UIL - Corporate Structure, Service Areas

§ Service territory: 335 sq

miles

miles

§ ~324,000 customers

§ 1,066 employees

§ Allowed Distribution ROE

of 8.75%

of 8.75%

§ Allowed ’09 Transmission

ROE (composite) of 12.52%

ROE (composite) of 12.52%

§ 50% interest in GenConn

Energy LLC

Energy LLC

The United Illuminating

Company (UI)

Company (UI)

Note: (1) Includes 10 basis point penalty reduction. Previously authorized 10.0% in effect pending resolution of rate case appeals.

UIL Holdings

Corporation

Corporation

Service Area Key

SCG

CNG

UI

Berkshire

Overlapping Territory

§ Service territory: 716 sq

miles - Greater Hartford-

New Britain & Greenwich

miles - Greater Hartford-

New Britain & Greenwich

§ ~158,000 customers

§ 341 employees

§ 2,011 miles of mains with

~124,000 services

~124,000 services

§ 2009 rate case allowed

ROE of 9.31% (1)

ROE of 9.31% (1)

Connecticut Natural Gas

(CNG)

(CNG)

§ Service territory: 738 sq

miles in Western MA

including Pittsfield and

North Adams

miles in Western MA

including Pittsfield and

North Adams

§ ~35,000 customers

§ 127 employees

§ 738 miles of mains

§ Allowed ROE of 10.50%

Berkshire Gas Company

(Berkshire)

(Berkshire)

§ Service territory: 512 sq

miles from Westport, CT to

Old Saybrook, CT

miles from Westport, CT to

Old Saybrook, CT

§ ~173,000 customers

§ 324 employees

§ 2,269 miles of mains with

~131,000 services

~131,000 services

Southern Connecticut Gas

(SCG)

(SCG)

5

Shields Transmission Seminar

5

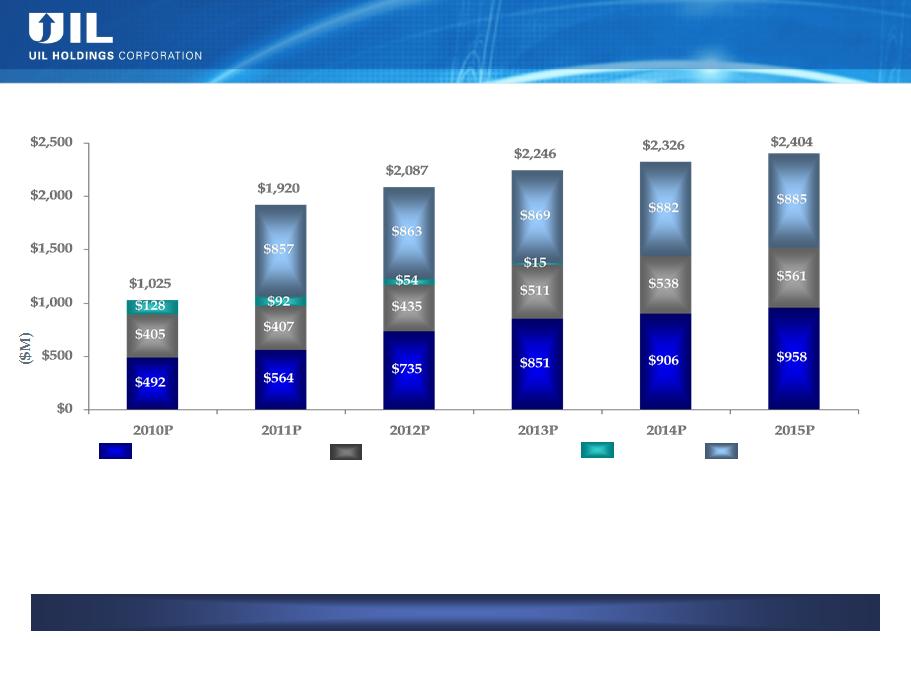

Total CapEx ($M)

2011P - 2015P

Electric Distribution

$695

Electric Transmission

314

Gas Distribution (1)

GenConn

316

63

UIL (Total)

$1,389

UIL Near-Term Regulated Capital Investment*

($M)

Identified projects with clear need.

Electric Distribution

GenConn

Electric Transmission

Gas Distribution

Notes: (1) Gas Distribution projected CapEx provided by Iberdrola, USA prior to closing on the acquisition. *Amounts may not add due to rounding.

20%

27%

53%

18%

16%

48%

24%

17%

59%

27%

20%

53%

25%

27%

48%

18%

23%

34%

43%

6

Shields Transmission Seminar

Notes: *Gas Distribution projected capex provided by Iberdrola, USA prior to closing on the acquisition. ** Equity investment - Devon plant now operating,

Middletown expected operation June 2011. Amounts may not add due to rounding.

Middletown expected operation June 2011. Amounts may not add due to rounding.

Identified projects with clear need and regulatory support.

($ in millions)

Base 10-yr CapEx by Business:

UIL-Wide Base 10-yr CapEx Forecast

7

Shields Transmission Seminar

7

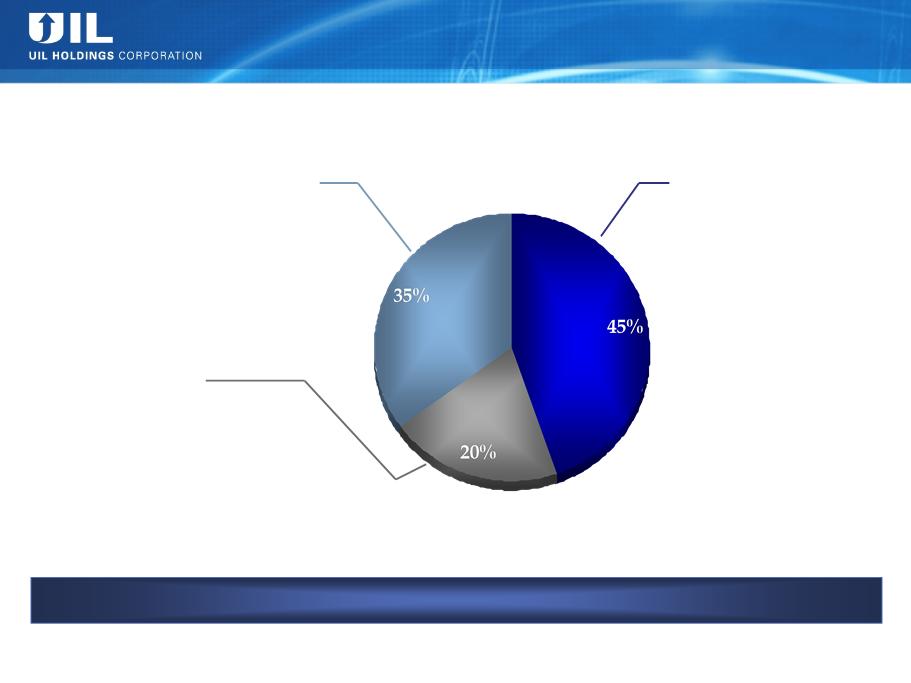

Near-Term Average Rate Base Profile

48%

40%

12%

29%

21%

5%

35%

3%

41%

Attractive rate base growth even with a declining CTA balance.

1%

23%

38%

38%

39%

45%

21%

38%

23%

37%

40%

23%

Notes: *Gas Distribution rate base projections provided by Iberdrola, USA prior to closing on the acquisition. Amounts may not add due to rounding.

Electric Distribution

CTA

Gas Distribution*

Electric Transmission

UI’s 50% Share ($M): 2010P 2011P 2012P 2013P 2014P 2015P

Avg. GenConn RB Equivalent: $ 51 $ 147 $ 185 $ 175 $ 166 $ 158

Avg. Gen Conn Equity “Rate Base” $ 25 $ 74 $ 92 $ 88 $ 83 $ 79

Rate Base (Excluding GenConn Equity Investments):

GenConn Equity Investments:

8

Shields Transmission Seminar

8

Base 10-Yr. Txm Capital Investment Program

2010P - 2019P: $593M

Aging Infrastructure

$265M

$265M

Capacity-Driven

$121M

Standards Compliance, Other

$207M

$207M

Notes: Amounts may not add due to rounding. *Expected in-service year (subject to change).

A well-balanced portfolio of high-probability projects.

Examples:

n Pequonnock 115 kV Substation Fault Duty

Mitigation (2015*)

Mitigation (2015*)

n Naugatuck Valley Reliability (2014*)

n Devon Tie Switching Station BPS Upgrades

(2011*)

(2011*)

Examples:

n New Broadway II 115/13.8 kV Substation

(placed in-service 2010)

(placed in-service 2010)

n New Union Avenue 115/26.4 kV Substation

(2012*)

(2012*)

n New Shelton 115/13.8 kV Substation (2016*)

Examples:

n Grand Avenue 115 kV

Switching Station Rebuild

(2012*)

Switching Station Rebuild

(2012*)

n East Shore 115 kV

Substation Upgrades (2011-

2013*)

Substation Upgrades (2011-

2013*)

9

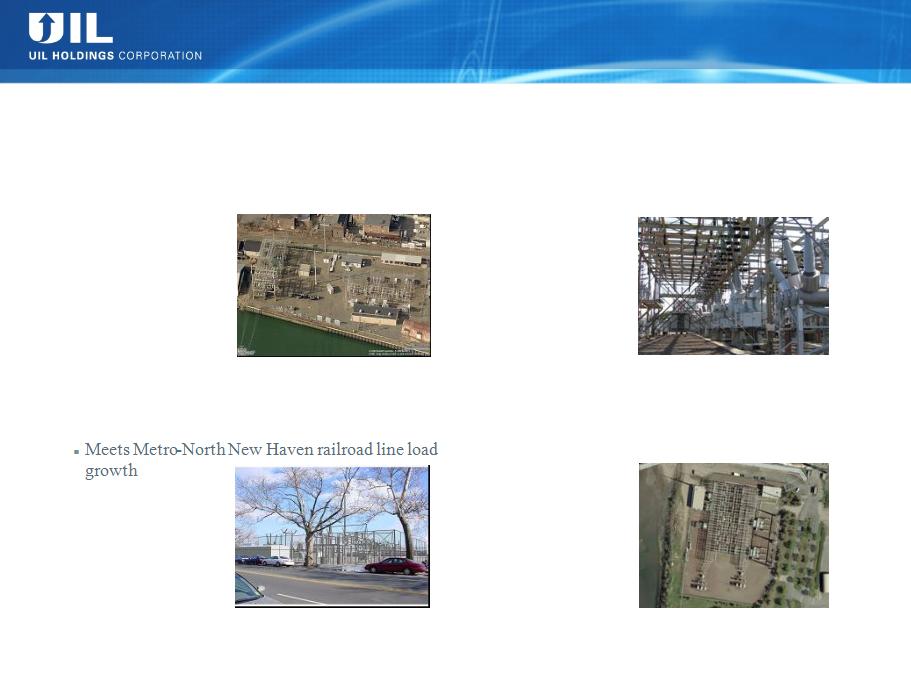

Shields Transmission Seminar

Grand Avenue 115 kV Switching

Station Rebuild

Station Rebuild

Pequonnock 115 kV Substation

Fault Duty Mitigation

Fault Duty Mitigation

New Union Avenue 115/ 26.4 kV

Substation

Substation

East Shore 115 kV Substation Upgrades

§ Addresses short circuit capability issues and

aged/obsolete infrastructure

aged/obsolete infrastructure

§ Under construction

§ Planned in-service

2012

2012

~ $60M*

§ Circuit breakers are nearing their capabilities to

safely interrupt high short circuit current

safely interrupt high short circuit current

§ Alternatives under

evaluation

evaluation

§ Planned in-service

2015

2015

~ $60M*

§ In engineering

§ Planned in-service

2012

2012

~ $15M*

§ Addresses infrastructure condition, maintenance

short circuit capability concerns

short circuit capability concerns

§ Phased upgrades,

in engineering and

construction

in engineering and

construction

§ Planned in-service

2011-2013

2011-2013

~ $25M*

Notes: *Dollars shown are rounded/approximate expected total project CapEx (generally including both spend to date and future expected spend); excluding AFUDC.

Examples of Current Transmission

Reliability Upgrades

Reliability Upgrades

10

Shields Transmission Seminar

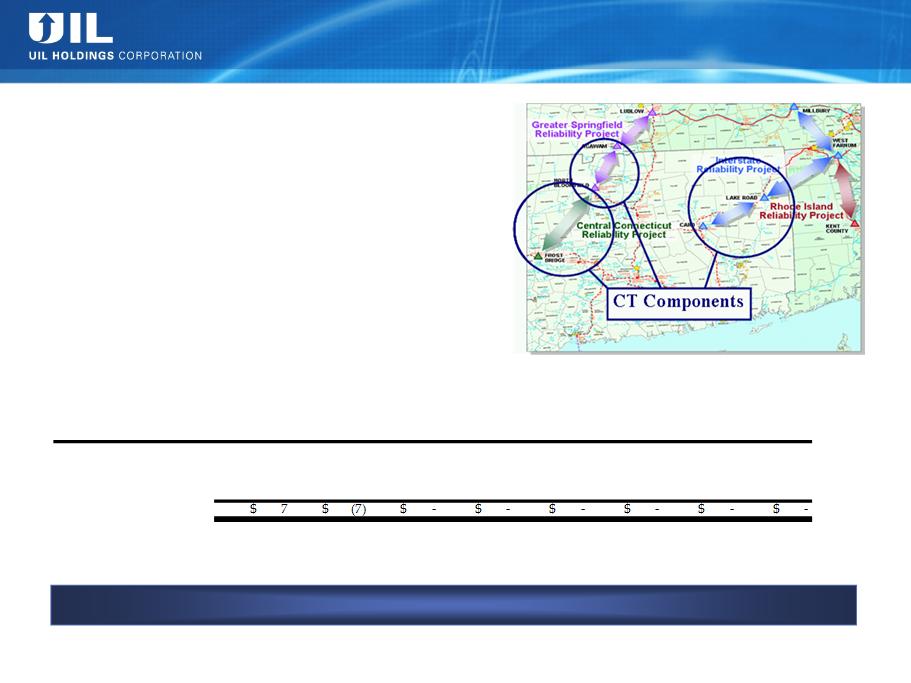

UI Transmission - NEEWS Investment

UI Participation in CL&P Project:

n UI’s portion of investment: greater of

$60M or 8.4% of CL&P’s costs for the

CT portions …

$60M or 8.4% of CL&P’s costs for the

CT portions …

n 8.4% currently estimated at

approximately $69M (increased from

original estimate of $60M).

approximately $69M (increased from

original estimate of $60M).

n First deposit made in December 2010.

UI’s anticipated investment increased from $60M to $69M.

Refreshed UI Investment Amounts and Timeline:

($ in millions)

Potential UI Investment*

2010P

2011P

2012P

2013P

2014P

2015P

2016P

Total

Current Projection

7

$

3

$

9

$

8

$

12

$

23

$

7

$

69

$

Previous Projection**

-

$

10

$

9

$

8

$

12

$

23

$

7

$

69

$

Difference

* Based on NU's latest projection of UI's Investment in CL&P's portion of the NEEWS Projects.

** Presented on 12/3/10

11

Shields Transmission Seminar

Notes: * RPS = Renewable Portfolio Standard. **From ISO-NE Presentation dated 5/15/09 - driven by 2008 data. ***From ISO-NE Presentation dated 5/25/10 -

“existing” includes RPS obligations through 2009. Total RPS Requirement excludes Vermont renewables, combined heat & power, and energy efficiency obligations.

“existing” includes RPS obligations through 2009. Total RPS Requirement excludes Vermont renewables, combined heat & power, and energy efficiency obligations.

Region-Wide

Compliance Gap

Compliance Gap

(v. “existing” renewable resources**)

forecasted/estimated at

~ 18,000GWh

Region-Wide RPS Obligation thru 2020:

See Appendix for summary of CT’s RPS Requirements

n Unlikely to be

satisfied by

renewables currently

in the ISO-NE queue.

satisfied by

renewables currently

in the ISO-NE queue.

n Will require

significant additional

transmission.

significant additional

transmission.

Satisfaction will likely require significant new transmission in the region.

Region-Wide RPS* Obligations

12

Shields Transmission Seminar

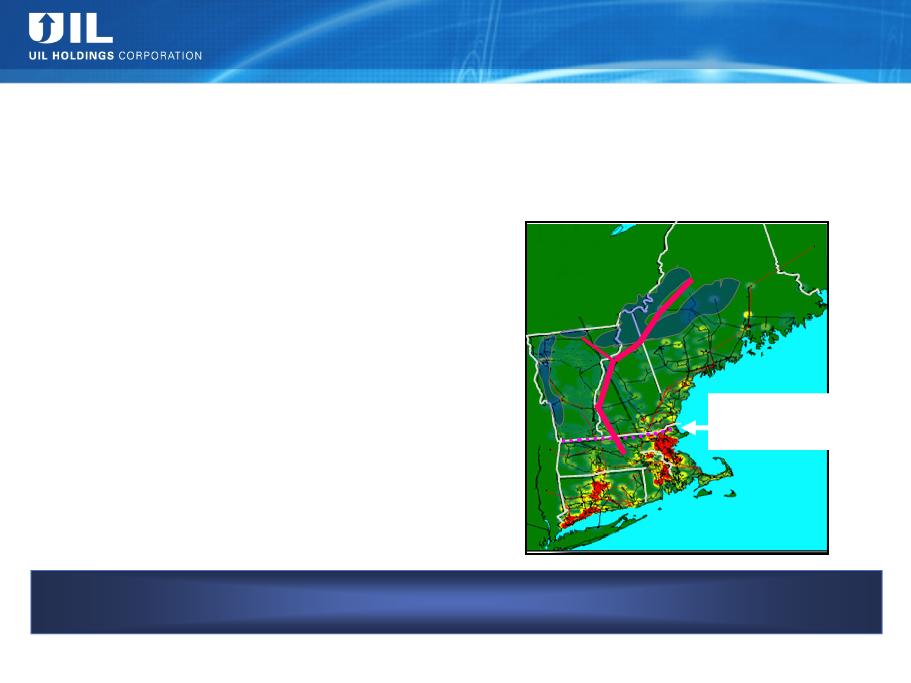

Renewable-Enabling Transmission

12

Collaborative effort: UI, NU, NSTAR, and NGrid …

to research / identify the most economical means of satisfying future RPS obligations

Significant Region-Wide Need:

n RPS requirement > 3x current

available renewables*.

available renewables*.

n CT requirement** is > UI’s entire load.

n Gap will be filled by renewables

remote from load.

remote from load.

N.E. Governors’ Blueprint:

n Significant transmission build-out

indicated.

indicated.

n Potential $7 to $10B range - could be

higher or lower to satisfy a 4,000 to

12,000 MW need.

higher or lower to satisfy a 4,000 to

12,000 MW need.

n Cost to New England likely much less

than Midwestern wind.

than Midwestern wind.

Potential Solutions Under Study

n Need will likely be satisfied by a portfolio

of projects.

of projects.

n One promising example is shown below.

Notes: *From ISO-NE Presentation dated 5/15/09 - driven by 2008 data. **Refer to Appendix for summary of CT RPS requirements.

Vast majority of

potential onshore

renewables (wind)

potential onshore

renewables (wind)

are in northern NE

North-South Interface:

80% of NE electric

load is below this line

load is below this line

13

Shields Transmission Seminar

Q&A

14

Shields Transmission Seminar

Appendices

15

Shields Transmission Seminar

|

|

||||||

|

|

|

› Connecticut Department of Public Utility Control (DPUC)

› Distribution currently operating under 2 year rate plan with full revenue decoupling pilot*

› Allowed ROE of 8.75%, based on a capital structure of 50.0% equity

|

||||

|

|

|

› Federal Energy Regulatory Commission (FERC)

› Transmission trued up on an annual basis to allowed composite ROE based on FERC approved formula rate

› 2010 composite ROE of approximately 12.4%-12.5%, based on a capital structure of 50.0% equity

|

||||

|

› DPUC Contracts for Differences with CL&P (subsidiary of Northeast Utilities) and cost sharing agreement (80% CL&P /

20% UI) › Allowed ROE has a lifetime floor of 9.75% based on a capital structure of 50.0% equity

|

||||||

|

|

|

› Connecticut Department of Public Utility Control (DPUC)

› 2009 Rate Case decision is under appeal and has been stayed pending determination of the appeal

› Currently operating under old rates with embedded overearnings credit - new rates per rate case virtually the same as old

rates currently in place › Allowed ROE of 9.26%*, based on a capital structure of 52.0% equity

|

||||

|

|

› Massachusetts Department of Public Utilities (DPU)

› 10 year constructive rate plan expiring 1/31/12

› Rates adjusted annually based on inflation and other factors

|

|||||

15

Regulatory Overview

Distribution

Transmission

Notes: (1)The revenue decoupling mechanism was allowed to continue until the Department issues its final ruling in 2011 on the evaluation of this adjustment mechanism. *Previously

authorized 10.0% in effect pending resolution of rate case appeals.

authorized 10.0% in effect pending resolution of rate case appeals.

› Connecticut Department of Public Utility Control (DPUC)

› 2009 Rate Case decision is under appeal and has been stayed pending determination of the appeal

› Currently operating under old rates with embedded overearnings credit - new rates per rate case virtually the same as old

rates currently in place

rates currently in place

› Allowed ROE of 9.31%*, based on a capital structure of 52.5% equity

16

Shields Transmission Seminar

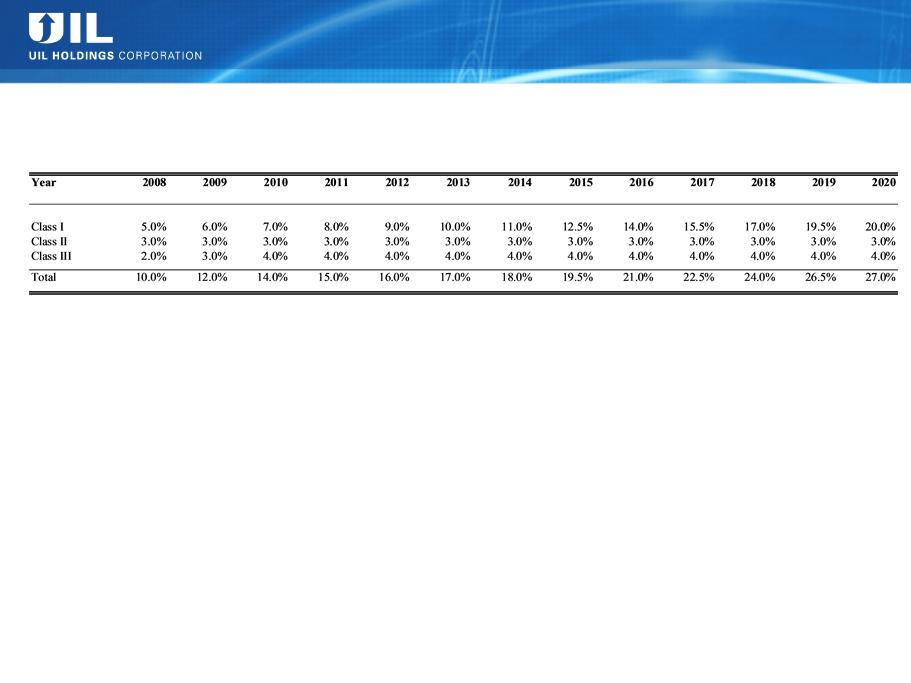

Connecticut RPS Requirements

(Percentage of Retail Load)

Class I resources include energy derived from solar, wind, fuel cell, methane gas from landfills, ocean thermal, wave,

tidal, run-of-river hydropower (<5MW, began operation after July 1, 2003), sustainable biomass (NOx emission <0.075

lbs/MMBtu of heat input)

tidal, run-of-river hydropower (<5MW, began operation after July 1, 2003), sustainable biomass (NOx emission <0.075

lbs/MMBtu of heat input)

Class II resources include other biomass (NOx emission <0.2 lbs/MMBtu of heat input, began operation before July 1,

1998), small run-of-river hydroelectric (<5MW, began operation before July 1, 2003) and municipal solid waste trash-to-

energy facilities.

1998), small run-of-river hydroelectric (<5MW, began operation before July 1, 2003) and municipal solid waste trash-to-

energy facilities.

Class III include customer-sited combined heat and power (with operating efficiency >50% of facilities installed after

January 1, 2006), waste heat recovery systems (installed on or after April 1, 2007), electricity savings from conservation

and load management programs (began on or after January 1, 2006)

January 1, 2006), waste heat recovery systems (installed on or after April 1, 2007), electricity savings from conservation

and load management programs (began on or after January 1, 2006)

CT RPS Requirements