Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - OMEGA PROTEIN CORP | d8k.htm |

Investor Presentation

Bret Scholtes

Executive Vice President and Chief Financial Officer

January 10, 2011

Exhibit 99.1 |

Forward Looking Statements

2

The information presented herein may contain predictions, estimates and other forward-looking

statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of

the Securities Exchange Act of 1934. Although the Company believes that its expectations

are based on reasonable assumptions, it can give no assurance that its goals will be achieved.

Important factors that could cause actual results to differ materially from those included in the

forward looking statements include: (1) the Company’s ability to meet its raw

material requirements through its annual menhaden harvest, which is subject to fluctuations due

to natural conditions over which the Company has no control, such as varying fish population, fish oil yields,

adverse weather conditions, oil spill impacts and disease; (2) the impact of worldwide supply and

demand relationships on prices for the Company’s products;

(4) fluctuations in the Company’s quarterly operating results due to the seasonality of the

Company’s business and its deferral of inventory sales based on worldwide prices for

competing products. These and other factors are described in further detail in Omega

Protein’s filings with the Securities and Exchange Commission, including its 2009 Annual Report on Form 10K under the

headings, “Management’s Discussion and Analysis of Financial Condition” and “Risk

Factors.” Omega Protein cautions you not to place undue reliance on these

forward-looking statements, which speak only as of the date of this presentation, and Omega

Protein undertakes no obligation to update this information. Omega Protein urges you to

carefully review and consider the disclosures made in this presentation and its filings with

the Securities and Exchange Commission that attempt to advise interested parties of the

risks and factors that may affect its business. Some of the information presented is derived from third-

party sources and, while the Company believes the data to be reliable, the Company has made no

independent investigation of these third-party sources or attempted to verify the veracity

of the third-party data in any way. (3)

Omega

Protein’s

expectations

regarding

demand

for

OmegaPure

®

proving

to

be

incorrect; and |

Omega

Protein

Corporation

(NYSE:OME)

3

•

Founded in 1913

•

Leading producer of omega-3 fish oil,

specialty fish meal, and other nutrition

ingredients

•

Serves the human, animal and plant

nutrition markets

•

Strategically positioned to capitalize on

long-term growth opportunities

•

Vertically integrated, highly efficient

operation

•

Investing in research and development

to expand market position

•

Blue chip customer base

•

Global distribution network

•

Strong balance sheet |

OME Historical Timeline

4

Hurricanes impact all 3

Gulf plants

Zapata owns ~58% of OME until Nov 2006

OME pays off

balance of bank loan

OME levers up to

purchase Zapata shares |

Omega Protein Business Model

Omega Protein Corporation

Human Nutrition

Ingredients

Animal Nutrition

Ingredients

Plant Nutrition

Ingredients

Nutraceuticals

Functional Foods

Aquaculture Feed

Pet Food

Livestock Feed

Organic

Fruits and Vegetables

5 |

Vertically Integrated Business

•

Harvest from a sustainable fishery

•

Over 1,000 employees

•

35 fishing vessels and 35 spotter planes

•

Four meal and oil processing plants and

dedicated fish oil refinery |

7

Human Nutrition

Nutraceutical Ingredients

Global Nutrition Industry

Source: Nutrition Business Journal; March 2010

•

Diverse product set of

nutritional ingredients

•

Supply the dietary supplement

and functional food markets

•

Support good health and well-

being (i.e. cardiovascular

health, cognitive function and

anti-aging) |

Omega-3 Ingredient Market

Source: Frost & Sullivan

8

End Use Applications of EPA and DHA Oils (Metric Tons)

Global Omega-3 Dietary Supplement Sales

•

The dietary supplement industry

is the largest market segment

for omega-3 ingredients.

•

The omega-3 supplement

industry has grown rapidly for

the past 15 years.

•

Globally, 49,671 metric tons and

$2.8 billion in sales

U.S. Omega-3 Dietary Supplement Sales

Supplements

49,671

Functional

Foods

19,090

Infant/Clinical

4,531

Animal

Feed

5,243

Pharma

1,970 |

•

Founded in 1984

•

Located in Irvine, California

•

Selling focus: health and well-being

•

Strong customer relationships in the

dietary supplements industry

•

Focused on high-value, higher margin

products

•

2010 sales ~ $12M

•

Provides established distribution network

for omega-3

9

Cyvex Acquisition

Background

Transaction Rationale

•

Increase presence in human nutrition

•

Access to the top supplement

retailers

•

Existing line of non-marine products

•

Combination fits with shifting

customer demand

•

B2B ingredient supplier |

10

Animal Nutrition

2009 End Usage of OME Fish Meal

2009 End Usage of OME Fish Oil

Market Segments

•

Aquaculture

•

Companion Animals

•

Swine

•

Dairy

•

Beef

•

Poultry/Layers

Feed Ingredients

•

Fish meal

High-quality protein source with superior

amino acid profile and omega-3

•

Fish oil

Contains 35% omega-3 fatty acids with a

balanced concentration of EPA and DHA

Higher Value

Lower Value |

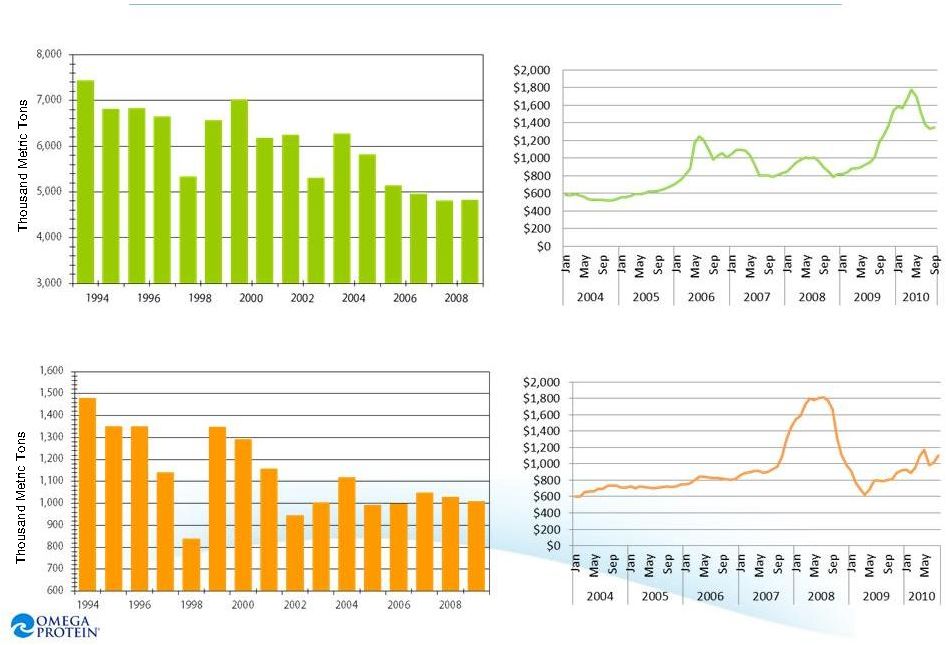

World Supply/Demand Imbalance

Global Fish Meal Production

Global Fish Oil Production

Source: IFFO, 2010

Average Fish Meal Prices (FOB from Peru )

Average Fish Oil Prices (FOB from Netherlands) |

12

Plant Nutrition

Nutritive Products

•

OmegaGrow

Organic fertilizer produces healthier, faster

growing plants

•

OmegaGrow

Plus

Provides the same benefits as OmegaGrow

®

but with 25% oil to enhance plant health and

fortification

•

Seacide

Currently in process of bio-pesticide registration

(market ~$594 million)

®

®

® |

Strong Customer Relationships

13 |

Research and Development

•

The OmegaPure Technology and Innovation Center (OPTIC)

for research and development of new and innovative ways to

formulate omega-3 fatty acids and protein.

•

Staff of scientists and food technologists:

•

Partner with food manufacturers to create successful

formulations

•

Oil refinery pilot plant

•

Certified by the American Oil Chemists Society for analysis of

marine oils and AOCS/GOED analysis for EPA and DHA.

Resources

•

Analytical Laboratory

•

Delivery Systems Laboratory

•

Professional Kitchen

•

Bakery

•

Dairy and Beverages Lab

•

Oil Refinery Pilot Plant

14 |

Research and Development Alliances

Source: OME internal analysis

15 |

Global Distribution Network

16 |

17

Growth Strategy

Focus on Nutritional

Products and Applications

Products

Expand

Nutritional

Product Line

Develop

higher margin

applications

Seek obligate

users to

maximize

margins

Stable Growth

Markets |

18

Key Initiatives in 2011

•

Continue to drive operational efficiency

•

Expand the number of obligate users

•

Develop higher margin applications

•

Develop or acquire additional product lines |

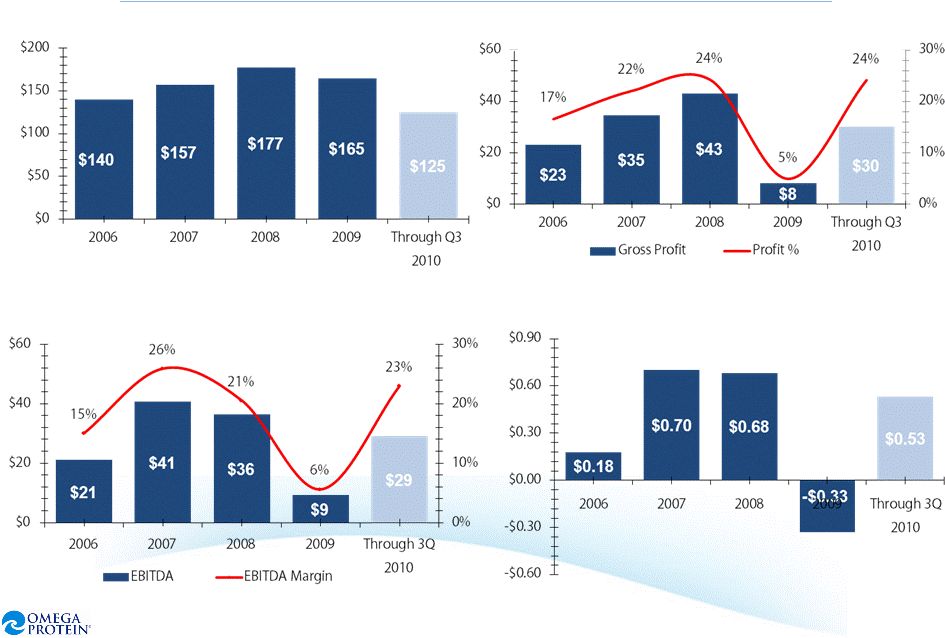

Financials

19 |

Financial Performance

Gross Margin 2006-2010 (Million U.S. Dollar)

Revenue 2006-2010 (Million U.S. Dollar)

20

EBITDA 2006-2010 (Million U.S. Dollar)

Diluted Earnings Per Share 2006-2010

(Million U.S. Dollar) |

Summary

•

Leading producer of omega-3 fish oil, specialty fishmeal, and other

nutrition ingredients

•

Broad product offering targeting multiple end-markets

•

Vertically integrated, highly efficient operation

•

Strategically positioned to capitalize on long-term growth

opportunities

•

Investing in research and development to expand market position

•

Blue chip customer base focused on human, animal and plant

nutrition

•

Global distribution network

•

Strong balance sheet

21 |