Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Duke Energy CORP | d8k.htm |

| EX-99.1 - JOINT PRESS RELEASE - Duke Energy CORP | dex991.htm |

CREATING

THE LEADING U.S. UTILITY January 10, 2011

Exhibit 99.2

OH

KY

NC

SC

FL |

Creating

the Leading U.S. Utility – January 10, 2011

Safe Harbor

2 |

Creating

the Leading U.S. Utility – January 10, 2011

Safe Harbor (cont’d)

ADDITIONAL INFORMATION AND WHERE TO FIND IT

This document does not constitute an offer to sell or the solicitation of an offer to

buy any securities, or a solicitation of any vote or approval, nor shall there

be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or

qualification

under

the

securities

laws

of

any

such

jurisdiction.

In

connection

with

the

proposed

merger

between

Duke

Energy

and

Progress

Energy, Duke Energy will file with the SEC a Registration Statement on Form S-4

that will include a joint proxy statement of Duke Energy and Progress Energy

that also constitutes a prospectus of Duke Energy. Duke Energy and Progress Energy will deliver the joint proxy

statement/prospectus to their respective shareholders. Duke Energy and Progress

Energy urge investors and shareholders to read the joint proxy

statement/prospectus regarding the proposed merger when it becomes available, as well as other documents filed with the

SEC, because they will contain important information.

You may obtain copies of all documents filed with the SEC regarding this transaction,

free of charge, at the SEC's

website (www.sec.gov). You may also obtain these documents, free of charge, from Duke

Energy’s website (www.duke-energy.com) under the heading

“Investors” and then under the heading “Financials/SEC

Filings.” You may also obtain these

documents,

free

of

charge,

from

Progress

Energy’s

website

(www.progress-energy.com)

under

the

tab

“Investors”

and

then

under

the

heading

“SEC Filings.”

PARTICIPANTS IN THE MERGER SOLICITATION

Duke Energy, Progress Energy, and their respective directors, executive officers and

certain other members of management and employees may be soliciting proxies from

Duke Energy and Progress Energy shareholders in favor of the merger and related matters. Information regarding

the persons who may, under the rules of the SEC, be deemed participants in the

solicitation of Duke Energy and Progress Energy shareholders in connection with

the proposed merger will be set forth in the joint proxy statement/prospectus when it is filed with the SEC. You can find

information about Duke Energy’s executive officers and directors in its definitive

proxy statement filed with the SEC on March 22, 2010. You can find information

about Progress Energy’s executive officers and directors in its definitive proxy statement filed with the SEC on March 31, 2010.

Additional information about Duke Energy’s executive officers and directors and

Progress Energy’s executive officers and directors can be found in

the

above-referenced

Registration

Statement

on

Form

S-4

when

it

becomes

available.

You

can

obtain

free

copies

of

these

documents

from

Duke Energy and Progress Energy using the contact information above.

3 |

Creating

the Leading U.S. Utility – January 10, 2011

Safe Harbor (cont’d)

REG G DISCLOSURE

In addition, today's discussion includes certain non-GAAP financial measures as

defined under SEC Regulation G. A reconciliation of those measures

to

the

most

directly

comparable

GAAP

measures

is

available

on

our

Investor

Relations

websites

at

www.duke-energy.com

and

www.progress-energy.com. 4

|

Creating

the Leading U.S. Utility – January 10, 2011

Agenda

Transaction Overview

Company Highlights

Financial Summary

Closing |

Creating

the Leading U.S. Utility – January 10, 2011

Transaction Overview |

Creating

the Leading U.S. Utility – January 10, 2011

7

Compelling Strategic Transaction

Creates largest U.S. utility, supported by substantial, diversified regulated earnings

and cash flows

Unmatched financial and operational scale, scope and strength

Principally regulated earnings base supports dividend

Significant scale of operating cash flows

Highly-regulated business mix

Regulated: comprises approximately 85% of combined company adjusted

segment EBIT

Non-regulated: comprises approximately 15% of combined company adjusted

segment EBIT

Overall

Strategic

Benefits

1

Duke Energy’s forecasted 2010 adjusted EBIT based upon midpoint of

original 2010 adjusted diluted EPS range of $1.25 - $1.30; excludes operations labeled

as ‘Other’; Progress Energy’s forecasted 2010 adjusted EBIT based upon

midpoint of original 2010 ongoing EPS range of $2.85 - $3.05 1

1

Leverages “best-in-class” operational and customer service practices

Enhances industry leadership position to shape federal and state energy policies

|

Creating

the Leading U.S. Utility – January 10, 2011

8

Compelling Strategic Transaction (cont’d)

Earnings

accretive

in

year

one

Attractive total shareholder return proposition supported by strong dividend

Maintain Duke Energy dividend and policy

Significant

rate

base

growth

expected

to

drive

4-6%

long-term

EPS

growth

Strong balance sheet and credit profile

Investor

Benefits

Ability to derive meaningful operational efficiencies for regulated electric customers

over time

Significant benefits to Carolinas customers from fuel and joint dispatch

efficiencies Continued commitment to delivering clean, affordable and reliable

energy to our customers

Strong, complementary management teams

Experience with execution of large-scale merger transactions

Management

Expertise

Customer

Benefits

1

Based upon adjusted diluted earnings per share. Long-term EPS growth rate off

a stand-alone Duke Energy base year of 2011 1

1 |

Creating

the Leading U.S. Utility – January 10, 2011

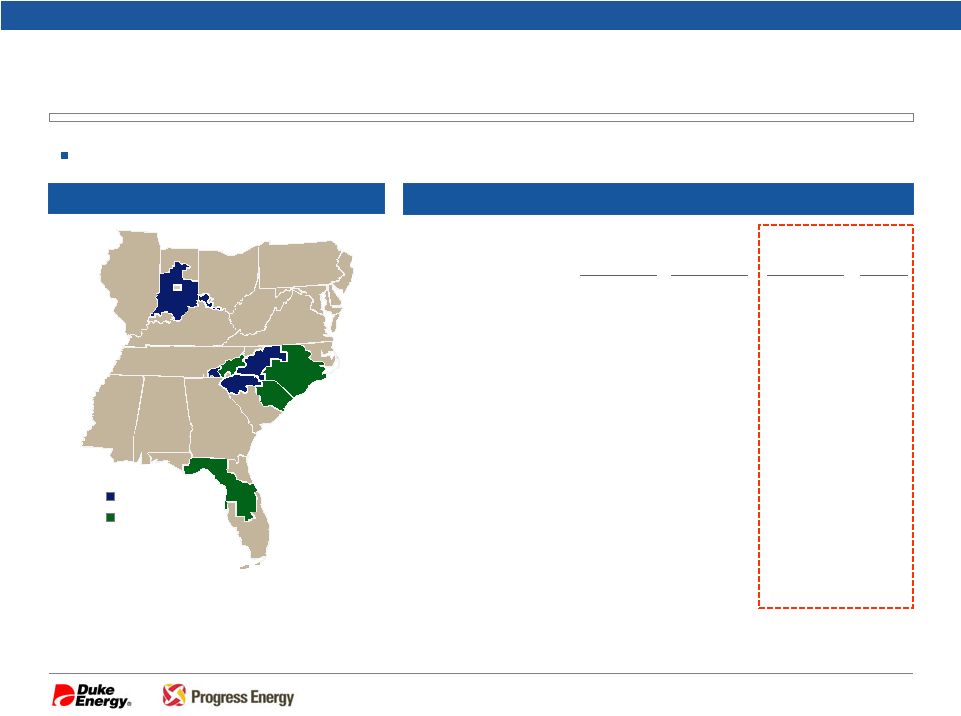

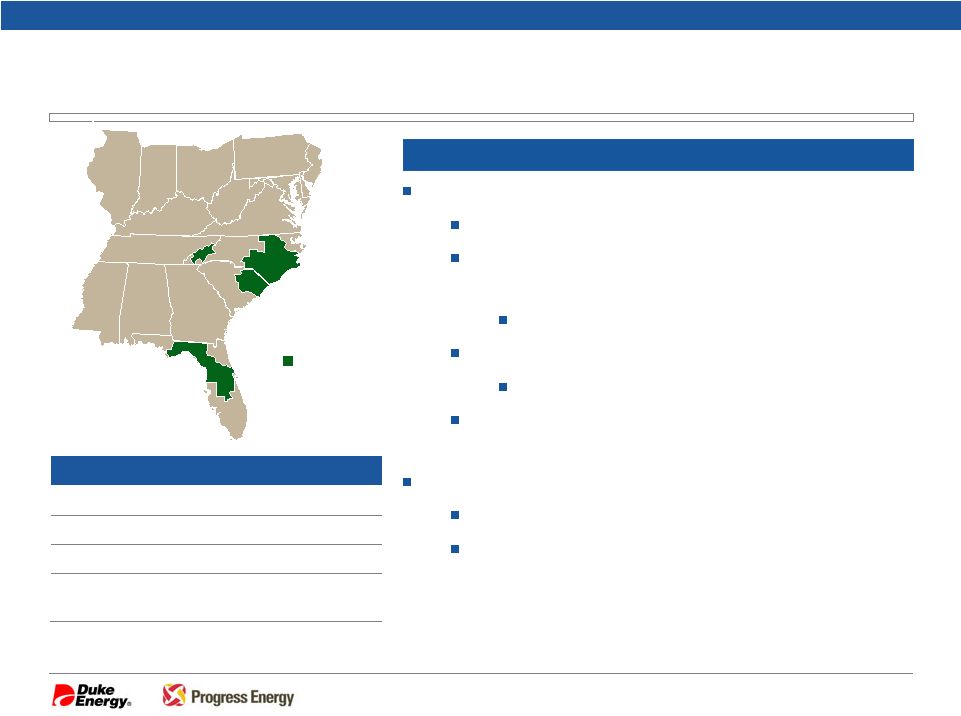

Diverse Service Territories

Creating the Largest U.S. Utility

The combined company will create the largest U.S. utility, with unmatched scale and

scope Combined Statistics

Enterprise Value

$40.2 B

$25.1 B

$65.3 B

#1

Market Cap.

$23.6 B

$12.8 B

$36.5 B

#1

Electric Customers

4.0 M

3.1 M

7.1 M

#1

Generation Capacity

35.4 GW

21.8 GW

57.2 GW¹

#1

Total Assets

$57.9 B

$32.7 B

$90.6 B

#1

Rate Base

$23 B

$17 B

$40 B

#1

Regulated EBIT Mix

77%

100%

85%

N/A

Duke

Energy

Progress

Energy

Combined

Rank

IN

Duke Energy

Progress Energy

IN

9

OH

KY

NC

SC

FL

2

3

1

Source: FactSet as 12/31/2010

Note: Customer data as of 12/31/2009; rate base data estimated as of 12/31/2010; total

assets and generation capacity as of 09/30/2010 ¹ Excludes purchased power

and approximately 4 GW of Duke Energy International assets ² Total assets

are a summation of the two stand-alone companies and do not include any purchase accounting adjustments from this transaction.

3

Duke Energy’s forecasted 2010 adjusted EBIT based upon midpoint of original 2010

adjusted diluted EPS range of $1.25 - $1.30; excludes operations labeled as ‘Other’; Progress Energy’s forecasted 2010 adjusted EBIT

based upon midpoint of original 2010 ongoing EPS range of $2.85 - $3.05

|

Creating the Leading U.S. Utility –

January 10, 2011

10

Key Transaction Terms

Following shareholder vote and regulatory approvals, targeting closing transaction

by end of 2011

Timing/Approvals

Corporate: Charlotte; significant presence in Raleigh

Utilities: No change

Headquarters

100% stock

2.6125 shares of Duke Energy per Progress Energy share

Consideration

Duke Energy shareholders: 63%

Progress Energy shareholders: 37%

Pro Forma Ownership

Executive Chairman: Jim Rogers

President and CEO: Bill Johnson

Board

composition

11 nominated

by Duke Energy, including

Jim Rogers

7 nominated

by Progress Energy, including

Bill Johnson

Lead

Director

to be

designated

by Duke Energy

Governance

Duke Energy Corporation

Company Name |

Creating the Leading U.S. Utility –

January 10, 2011

11

Duke Energy Transaction Rationale

Investor and strategic benefits

EPS accretive in year one¹

Creates unmatched financial and operational scale,

scope and strength

Poised for strong growth and economic recovery

Expanded U.S. regulated earnings base and cash flows

Operating in constructive regulatory environments

Improved business risk profile due to increased

proportion of regulated earnings and cash flows

Significant customer benefits

Fuel and joint dispatch savings in the Carolinas

Operational efficiencies through leveraging mutual “best-

in-class”

customer

service

capabilities

Transaction Rationale

¹

Based on adjusted diluted EPS

2

Generation capacity as of 09/30/2010; excludes purchased power

Progress Energy at a Glance

Generation

21.8 GW

Rate base

~$17 B (estimated as of 12/31/10)

Customers

3.1 M (electric)

Jurisdictions

North Carolina, South Carolina and

Florida

Progress Energy

NC

SC

OH

KY

IN

FL

2 |

Creating the Leading U.S. Utility –

January 10, 2011

12

Progress Energy Transaction Rationale

Transaction Rationale

¹

Premium expressed relative to unaffected Progress Energy 1/05/2011 closing share price

of $43.39. The premium to the Progress Energy 1/07/2011 closing share price of $44.72 is 3.9%.

²

Based on adjusted diluted EPS

3

Generation capacity as of 09/30/2010; excludes purchased power and approximately 4 GW

of Duke Energy International assets Investor and strategic benefits

7.1%

premium

to

Progress

Energy

shareholders

1

Dividend

and

EPS

accretive

in

year

one

2

Improved EPS & dividend growth

Increased regulatory and earnings diversity in six

service territories

Improved business risk profile due to stronger balance

sheet and credit metrics

Enhanced growth opportunities and strategic optionality

Significant customer benefits

Fuel and joint dispatch savings in the Carolinas

Operational efficiencies through leveraging mutual

“best-in-class”

customer service capabilities

Duke Energy at a Glance

Generation

35.4 GW

Rate base

~$23 B (estimated as of 12/31/10)

Customers

4.0 M (electric); 0.5 M (gas)

Jurisdictions

North Carolina, South Carolina,

Indiana, Ohio and Kentucky

Duke Energy

IN

NC

FL

OH

KY

SC

3 |

Creating the Leading U.S. Utility –

January 10, 2011

Highly Experienced Leadership Team

18 Member Board of Directors

Bill Johnson

President & CEO

Lynn Good

Chief Financial Officer

Mark Mulhern

Chief Administrative Officer

Keith Trent

Commercial Businesses

Jennifer Weber

Chief Human Resources Officer

Dhiaa

Jamil

Nuclear Generation

John McArthur

Regulated Utilities

Marc Manly

General Counsel

Jeff Lyash

Energy Supply

Lloyd Yates

Customer Operations

Chief Integration Officers

A.R. Mullinax

Paula Sims

Jim Rogers

Executive Chairman

13 |

Creating the Leading U.S. Utility –

January 10, 2011

Indicative Timeline to Close and Regulatory Approvals

Q1 2011

Q2 2011

Q3 2011

Q4 2011

Merger announcement

Make regulatory filings

North Carolina,

South Carolina,

U.S. DOJ,

FERC, and NRC

File joint proxy

statement

Secure appropriate state and

federal regulatory approvals

Duke Energy and Progress

Energy shareholder meetings

Develop and initiate transition implementation plans

Close merger

(Targeted)

We will work collaboratively with all of our state regulators

14 |

Creating the Leading U.S. Utility –

January 10, 2011

Company Highlights |

Creating the Leading U.S. Utility –

January 10, 2011

16.0

21.8

23.7

24.9

25.6

27.9

28.3

37.0

42.7

42.9

35.4

57.2

PF DUK

SO

NEE

AEP

DUK

CPN

ETR

D

EXC

FE/AYE

PGN

PEG

Enterprise Value ($ B)

$23.6

$24.9

$25.1

$32.5

$33.6

$35.0

$37.8

$40.2

$41.5

$41.6

$65.3

$52.7

PF DUK

SO

D

NEE

DUK

EXC

AEP

FE/AYE

PCG

PGN

PEG

ETR

Market Capitalization ($ B)

$12.8

$12.9

$15.4

$16.1

$17.3

$19.3

$21.8

$23.6

$24.8

$27.5

$36.5

$32.4

PF DUK

SO

EXC

D

DUK

NEE

PCG

AEP

PEG

FE/AYE

ETR

PGN

The Leading U.S. Utility

#1 U.S. utility by enterprise value

$65.3 B enterprise value

24% larger than the #2 utility

$90.6

B

in

total

assets

#1 U.S. utility by market capitalization

$36.5 B equity value

13% larger than the #2 utility

#1 U.S. utility by generation capacity

57.2 GW total capacity

33% larger than the #2 generator

Capacity Owned (GW)

16

1

Source: Market data as of 12/31/2010, company filings; capacity owned as of 09/30/2010

for Duke Energy and Progress Energy; as of 12/31/2009 for other companies Total assets are as of 9/30/2010 and are a summation of the two stand-alone

companies and do not include any purchase accounting adjustments from this transaction.

1 |

Creating the Leading U.S. Utility –

January 10, 2011

By Type: 235 TWh

By Geography

Attractive, Diversified Operations

Presence in six attractive growth service territories with constructive regulatory

traditions More electric

customers

than

any

other

U.S.

utility,

serving

7.1

M

domestic

regulated

electric

customers

Customer Diversity: 7.1 M regulated customers

FL

23%

Carolinas

54%

Residential

35%

Commercial

30%

Wholesale/Other

15%

Industrial

20%

IN

16%

Carolinas

54%

OH

6%

FL

22%

KY

2%

IN

11%

OH

10%

KY

2%

Rate Base Diversity: $40 B

Note: Customer data as of 12/31/2009; rate base data estimated as of 12/31/2010

(see Note on slide 24); customer data only includes regulated customers

Duke Energy

Progress Energy

NC

SC

FL

OH

Diverse Service Territories

17

IN

KY |

Creating the Leading U.S. Utility –

January 10, 2011

Highly diversified generation capacity and fuel profile

Capacity and

fuel

diversity

projected

to

increase,

migrating

the

combined

fleet

to

greater

gas

and

less

coal

exposure

By Actual Generation: 231 TWh¹

Source: SNL Energy, Ventyx, company filings

¹

Note: Capacity owned as of 09/30/2010 excludes approximately 4 GW of Duke Energy

International assets. Actual generation includes twelve-months ended 12/31/2009 and excludes purchased power

U.S. Generation Diversity

Nuclear

15%

Gas/Oil

27%

Coal

42%

By Owned Capacity: 57 GW¹

Gas/Oil

48%

Coal

48%

Hydro/Wind

11%

Nuclear

16%

Gas/Oil

35%

Coal

33%

Hydro/Wind

7%

Coal

42%

Gas/Oil

25%

Nuclear

32%

Duke Energy

Progress Energy

Combined

Hydro/Wind

1%

Duke Energy

Progress Energy

Combined

Hydro/Wind

1%

Coal

62%

Nuclear

31%

Coal

54%

Nuclear

31%

Gas/Oil

13%

Hydro/Wind

2%

Nuclear

17%

Gas/Oil

5%

Hydro/Wind

2%

18 |

Creating the Leading U.S. Utility –

January 10, 2011

19

U.S. Generation Well Positioned for Pending

Environmental Regulations

Announced Retirements

Duke Energy

1.9

Progress Energy

1.5

Subtotal

3.4

Potential Additional Retirements/Investments

Duke Energy

2.2

Progress Energy

1.0

Subtotal

3.2

Total Unscrubbed Coal

6.6

Unscrubbed

Coal Capacity (GW)

Generation Capacity by Technology (GW / %)

Duke Energy

Progress Energy

Combined

Unscrubbed

Coal

4.0 GW / 11%

Gas/Oil

9.4 GW / 27%

Non-Emitting¹

9.1 GW / 26%

Scrubbed Coal

12.9 GW / 36%

Unscrubbed

Coal

6.6 GW / 11%

Gas/Oil

19.9 GW / 35%

Non-Emitting¹

13.1 GW / 23%

Scrubbed Coal

17.6 GW / 31%

Unscrubbed

Coal

2.5 GW / 12%

Gas/Oil

10.5 GW / 48%

Non-Emitting¹

4.0 GW / 18%

Scrubbed Coal

4.7 GW / 22%

¹ Duke Energy: Nuclear (15%), Hydro (9%), Renewables (2%); Progress Energy:

Nuclear (17%), Hydro (1%); Combined: Nuclear (16%), Hydro (6%), Renewables (1%)

Note: Generation capacity as of 09/30/2010 excludes approximately 4 GW of Duke

Energy International assets |

Creating the Leading U.S. Utility –

January 10, 2011

Source: SNL Energy, Ventyx, company filings

Note: Capacity owned as of 09/30/2010 for Duke Energy and Progress Energy; as of

12/31/2009 for other companies Nuclear Generation Overview

Nuclear Generation Capacity Owned (GW)

17.0

10.1

2.2

2.2

3.7

3.7

3.8

4.0

5.2

5.5

5.8

9.0

EXC

ETR

PF

DUK

D

NEE

DUK

FE/AYE

PGN

SO

PEG

PCG

AEP

Combination creates the largest U.S. regulated nuclear fleet

7 stations and 12 units with ~9 GW of owned generation

Commitment to top quartile operational performance for nuclear

fleet

Combination of nuclear fleets to drive best practices and

achieve operating efficiencies

Size and scale better positions combined company for the

continued pursuit of new nuclear development opportunities

COLs

have been filed with the NRC for three potential

sites

New nuclear will only be pursued with the appropriate

regulatory recovery mechanisms in place

Duke Energy

Progress Energy

NC

SC

FL

Oconee

McGuire

Catawba

Crystal

River

Robinson

Brunswick

Harris

Combined Nuclear Generation Fleet

20

Creating the Leading U.S. Utility –

January 10, 2011 |

Creating the Leading U.S. Utility –

January 10, 2011

Financial Summary |

Creating the Leading U.S. Utility –

January 10, 2011

Accretive

to

earnings

in

the

first

year

after

close

Joint dispatch

and

fuel

savings

will

immediately

benefit

Carolinas’

customers

($600

-

800

M

from

2012 -

2016)

Non-fuel merger benefits help achieve first year earnings accretion

No equity issuance requirements assumed

Long-term adjusted diluted EPS CAGR target: 4 –

6%

Principally driven by significant regulated capital investment opportunities

Duke Energy reverse stock split at transaction close

Split ratio to be determined prior to closing

Exchange ratio in the merger will be appropriately adjusted to reflect the reverse

split Pro Forma Earnings Profile

Based upon adjusted diluted earnings (excludes costs to achieve)

Based upon base year of 2011

22

1

1

2

2 |

Creating the Leading U.S. Utility –

January 10, 2011

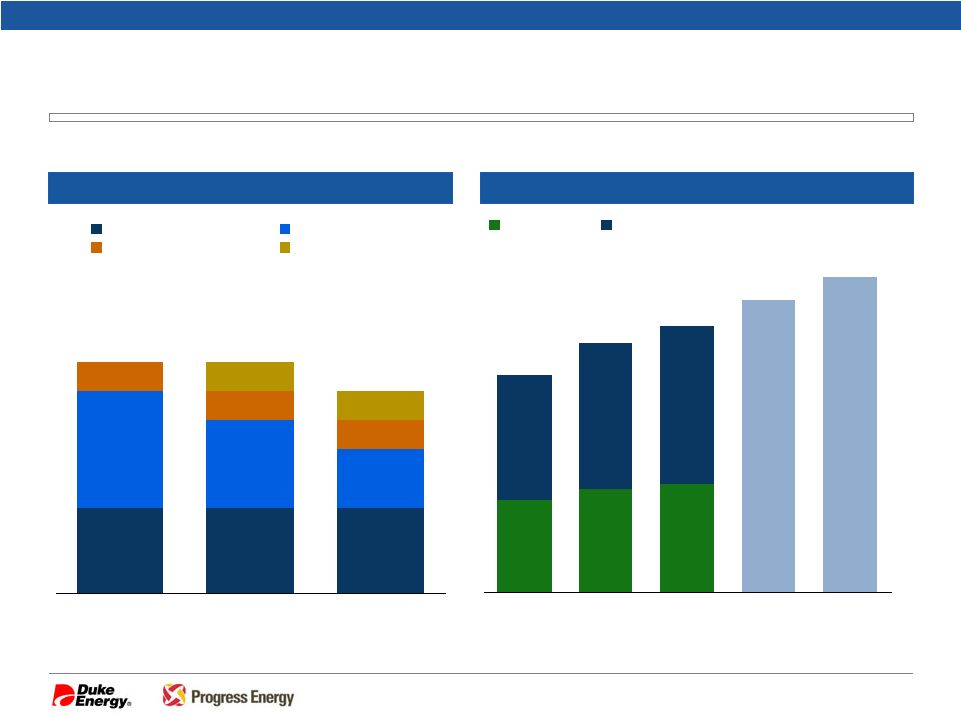

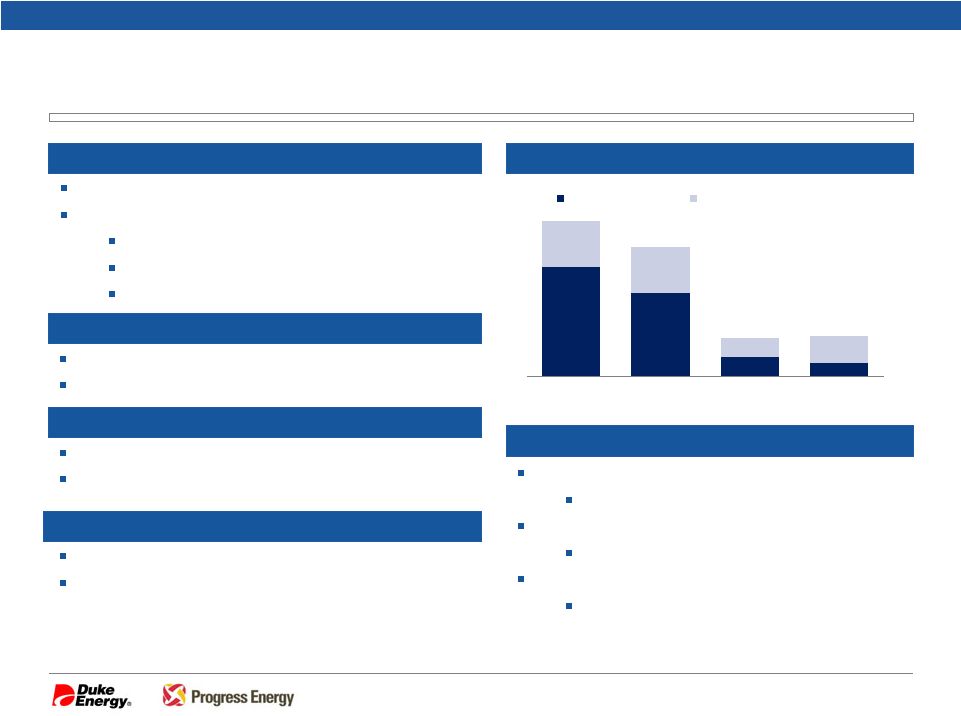

Predominantly Regulated Earnings Base

and Cash Flows

Business Mix

Commercial

Power

9%

Regulated

~100%

Duke Energy

2010E EBIT: ~$3.4 B

Progress Energy

Combined

Regulated

77%

2010E EBIT: ~$2.1 B

DEI

9%

2010E EBIT: ~$5.5 B

Regulated

85%

DEI

14%

Commercial

Power

6%

Regulated EBIT contribution of the combined operations will be approximately 85%

Duke Energy is committed to growing its strong regulated earnings base

23

Note: Duke Energy’s forecasted 2010 adjusted EBIT based upon midpoint of original

2010 adjusted diluted EPS range of $1.25 - $1.30; excludes operations labeled as ‘Other’

Progress Energy’s forecasted 2010 adjusted EBIT based upon midpoint of original

2010 ongoing EPS range of $2.85 - $3.05 |

Creating the Leading U.S. Utility –

January 10, 2011

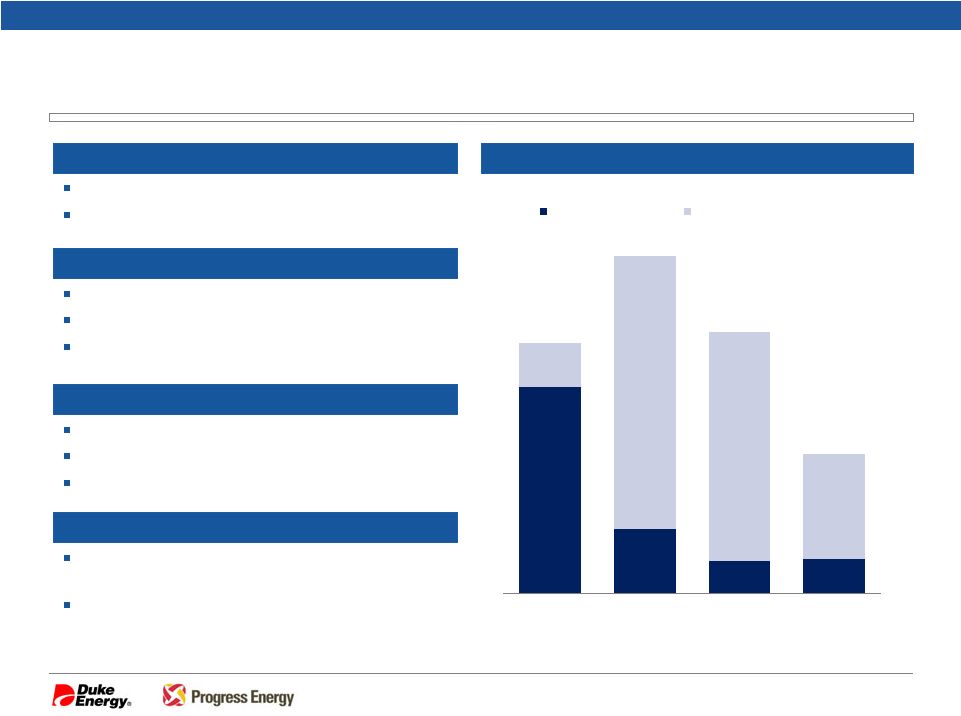

Projected Rate Base ($ B)

Attractive Rate Base Growth

$17

$19

$20

$23

$27

$29

$49

$46

$40

2010E

2011E

2012E

2013E

2014E

Progress Energy

Duke Energy

$3

$3

$3

$4

$3

$2

$1

$1

$1

$1

$1

$8

$8

$7

2010E

2011E

2012E

Regulated Maintenance

Regulated Growth

Non-Regulated

Discretionary Range

Projected Capital Expenditures ($ B)

Illustrative

24

Note: Forecasted capital expenditures are based on the original 2010-2012E

standalone forecasts of Duke Energy and Progress Energy, as disclosed in February 2010, respectively, as well as the midpoint of Duke

Energy’s expected discretionary capital expenditure range; Projected rate base

includes both retail and wholesale; Duke Energy’s projected rate base is based upon estimated amounts which would be expected to

qualify for rate base treatment at each period and is not based upon actual expected

timing of rate base changes resulting from rate cases. |

Creating the Leading U.S. Utility –

January 10, 2011

Attractive Dividend Policy

Duke Energy dividend and policy to be maintained

Continued growth in dividend at a rate slower than growth of adjusted diluted

EPS Targeting a long-term payout range of 65% to 70%

Attractive payout and yield underscores compelling shareholder value proposition

Dividend quality supported by strong pro forma regulated earnings base

Duke Energy and Progress Energy have 84 and 65-year histories, respectively, of

consecutive quarterly cash dividend payments

DUK Annual Dividend Per Share History

Source: FactSet

Based upon adjusted diluted EPS

2007 decrease due to the spin-off of Spectra Energy to shareholders on 1/2/2007 as

dividends subsequent to the spin-off were split proportionately between Duke Energy and Spectra Energy such that the sum of the

dividends of the two stand-alone companies approximated the former total dividend

prior to the spin-off Note: Annual dividends are split-adjusted and

reflect annualized Q4 dividend per share for each year $0.98

$0.96

$0.92

$0.88

$1.28

$1.24

$1.10

$1.10

$1.10

$1.10

$1.10

$1.10

$1.10

$1.10

$1.06

$1.02

$0.98

$0.94

$0.90

$0.86

$0.82

$0.78

$0.74

$0.70

$0.67

$0.65

$0.62

$0.59

$0.57

$0.55

$0.51

1985

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

Spectra

Energy

Spin-Off²

1980

1981

1982

1983

1984

1986

25

1

1

2 |

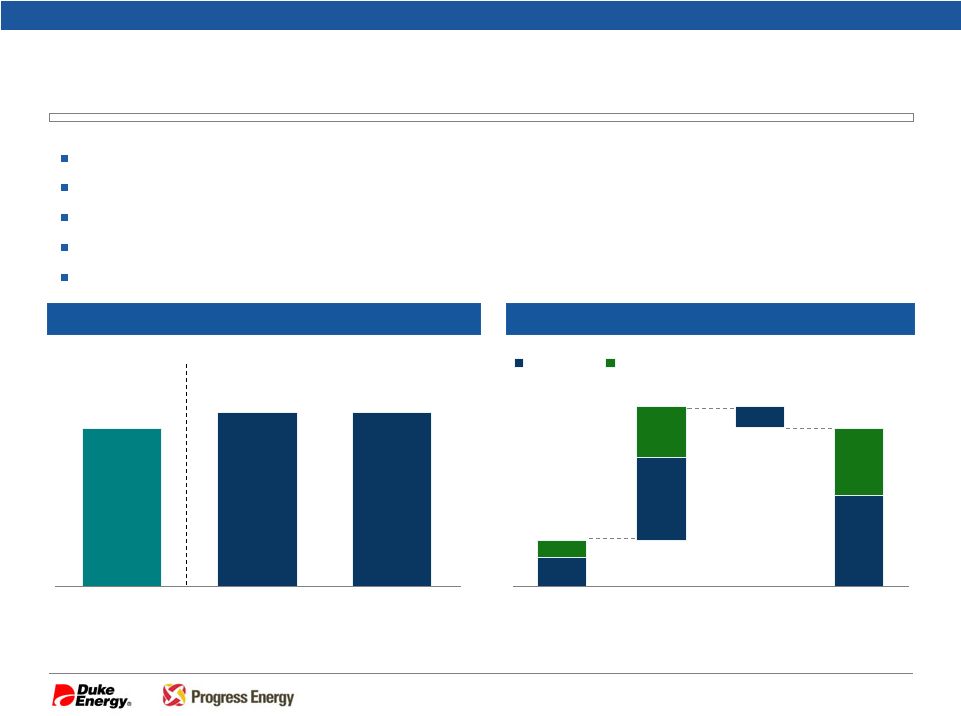

Creating the Leading U.S. Utility –

January 10, 2011

Strong Credit Quality and Liquidity

$0.7

$2.0

$2.7

$1.1

$3.3

$3.6

$0.8

$1.8

$5.3

$6.3

$0.8

Duke Energy

Progress Energy

Pro Forma Liquidity ($ B)

Projected Debt/Total Capitalization

50%

51%

51%

Note: Debt/Total Capitalization is unadjusted; 2011E is estimated as transaction is not

targeted to close until end of 2011

1

2012E

2013E

2011E

Cash and

equivalents

Total Available

Credit Facilities

Utilized

Amount

Available

Liquidity

Highly committed to Duke Energy’s current strong credit ratings

Lower overall risk profile resulting from increased regulated earnings base and cash

flows Strong

balance

sheet

strength

with

$91

B

in

total

assets

Increased regulatory diversity with presence in six traditionally constructive

regulatory jurisdictions Broad and reliable access to capital markets and

liquidity 26

Total assets are as of 9/30/2010 and are a summation of the two

stand-alone companies and do not include any purchase accounting adjustments

from this transaction. Note: Pro forma liquidity is as of 09/30/2010; Duke Energy cash and equivalents

excludes certain cash and short-term investments in foreign

jurisdictions of approximately $675 M 1 |

Creating the Leading U.S. Utility –

January 10, 2011

Shareholder Value Track Record

15.1%

(8.3%)

12.0%

5.7%

(15.4%)

20.9%

9.5%

4.7%

44.2%

12.6%

7.9%

32.3%

Total Shareholder Return (%)

S&P 500

UTY

Duke

Energy

Progress

Energy

1 year

S&P 500

UTY

3 year

S&P 500

UTY

5 year

Source: Bloomberg as of 12/31/2010

Duke

Energy

Progress

Energy

Duke

Energy

Progress

Energy

27 |

Creating the Leading U.S. Utility –

January 10, 2011

Closing |

Creating the Leading U.S. Utility –

January 10, 2011

29

Summary Highlights

Creates largest U.S. utility, supported by substantial, diversified regulated earnings

and cash flows Unmatched financial and operational scale, scope and

strength Principally regulated earnings base supports dividend

Significant scale of operating cash flows

Leverages

“best-in-class”

operational

and

customer

service

practices

Enhances

industry

leadership

position

to

shape

federal

and

state

energy

policies

Highly-regulated business mix

Regulated:

comprises

approximately

85%

of

combined

company

adjusted

segment

EBIT

Non-regulated:

comprises

approximately

15%

of

combined

company

adjusted

segment

EBIT

1

1

Duke Energy’s forecasted 2010 adjusted EBIT based upon midpoint of original 2010

adjusted diluted EPS range of $1.25 - $1.30; excludes operations labeled as ‘Other’; Progress Energy’s forecasted

2010 adjusted EBIT based upon midpoint of original 2010 ongoing EPS range of $2.85

- $3.05 1 |

Creating the Leading U.S. Utility –

January 10, 2011

Appendix |

Creating

the Leading U.S. Utility – January 10, 2011

31

Simplified Financing Structure by Legal Entity

Commercial Paper and LT Financings

Project / International Financings

Money Pool and LT Financings

Duke Energy

(HoldCo)

Duke Energy

(HoldCo)

Duke Energy

Carolinas

Duke Energy

Carolinas

Duke Energy

International

Duke Energy

International

Duke Energy

Ohio

Duke Energy

Ohio

Duke Energy

Kentucky

Duke Energy

Kentucky

Duke Energy

Indiana

Duke Energy

Indiana

Other Non-Reg

Other Non-Reg

Progress Energy

Carolinas

Progress Energy

Carolinas

Progress Energy

Florida

Progress Energy

Florida

Issuer Legend

Dormant Entity

Existing Debt But No Future Issuance

Cinergy Corp.

(HoldCo)

Progress Energy

(HoldCo) |

Creating the Leading U.S. Utility –

January 10, 2011

Duke Energy –

Summary of Major Capital Projects

32

1

Project costs include direct capital and AFUDC

Edwardsport

–

Indiana

618 MW IGCC facility expected in-service in 2012

Project status (as of 09/30/10)

Overall project: 74% complete

Final engineering: over 90% complete

Construction: 52% complete

Cliffside –

Carolinas

825 MW advanced clean-coal unit expected in-service in 2012

Project is 72% complete and on budget (as of 09/30/10)

Buck –

Carolinas

620 MW combined-cycle gas-fired plant expected in-service in 2011

Project is 15% complete (as of 09/30/10)

Dan River –

Carolinas

620 MW combined-cycle gas-fired plant expected in-service in 2012

Project broke ground Q4-2010

US FE&G Major Construction Projects¹

($ M)

Renewables

Projects

Top of the World –

200 MW

In-service ahead of schedule and under budget

Kit Carson –

51 MW

In-service ahead of schedule and under budget

Blue Wing –

14 MW

In-service ahead of schedule and on budget

$2,025

$1,550

$350

$225

$855

$850

$350

$485

Edwardsport

Cliffside

Buck CC

Dan River CC

Spent as of 09/30/10

Estimated expenditures to complete project |

Creating the Leading U.S. Utility –

January 10, 2011

Progress Energy –

Summary of Major Capital Projects

33

$475

$150

$75

$80

$100

$625

$525

$240

Richmond

County

Lee

Sutton

Smart Grid

Spent as of 09/30/10

Estimated expenditures to complete project

Richmond County CCGT –

North Carolina

635 MW combined-cycle gas-fired plant

Expected in-service in June 2011

Lee CCGT –

North Carolina

920 MW combined-cycle gas-fired plant

Project broke ground in September 2010

Expected in-service in January 2013

Sutton CCGT –

North Carolina

625 MW combined-cycle gas-fired plant

Construction is expected to begin in 2H-2011

Expected in-service in January 2014

Smart Grid –

Carolinas & Florida

Received $200M grant from the DOE in August 2009

($100M each for PEC and PEF)

Leverages already-planned investments of $320M

($200M for PEC and $120M for PEF)

Progress

Energy

Major

Construction

Projects¹

($

M)

Project costs include direct capital, AFUDC and the cost of all transmission additions

and upgrades necessary to integrate the generator into the system.

1 |

Creating the Leading U.S. Utility –

January 10, 2011

Example calculation of Progress Energy dividend based on Duke Energy’s

current annual dividend per share

Duke Energy annual dividend

Multiplied by: exchange ratio

Progress Energy exchange-ratio adjusted dividend

Progress Energy current annual dividend

Progress Energy expected dividend accretion

Dividend Accretion to Progress Energy –

Illustrative Example

Current

$0.98

2.6125x

$2.56

$2.48

$0.08 or 3.2%

Pro Forma

1-for-2

Stock Split

$1.96

1.30625x

$2.56

$2.48

$0.08 or 3.2%

Dividend accretion to Progress Energy is expected to increase over time given Duke

Energy’s historical dividend per share growth rate of ~2%

1

Stock split ratio to be determined subsequently; 1-for-2 used for illustrative

purposes only 34

1 |

Creating the Leading U.S. Utility –

January 10, 2011 |