Attached files

| file | filename |

|---|---|

| EX-5.1 - LEGAL OPINION WITH CONSENT - WD Hall Exploration Co | wdhallex51.htm |

| EX-3.2 - BY-LAWS - WD Hall Exploration Co | wdhalls1121610ex32.htm |

| EX-14.1 - CODE OF ETHICS - WD Hall Exploration Co | wdhalls1121610ex14.htm |

| EX-23.1 - CONSENT OF ACCOUNTANT - WD Hall Exploration Co | wdhalls1121610ex23.htm |

| EX-3.1 - ARTICLES OF INCORPORATION - WD Hall Exploration Co | wdhalls1121610ex31.htm |

| EX-10.1 - OPTION TO PURCHASE AGREEMENT DATED NOVEMBER 30, 2010 - WD Hall Exploration Co | wdhalls1121610ex10.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

WD HALL EXPLORATION COMPANY

(Name of Small Business Issuer in its charter)

|

Wyoming

|

1090

|

27-3894323

|

|

(State or jurisdiction of incorporation or organization)

|

(Primary Standard Industrial Classification Code Number)

|

(I.R.S. Employer ID No.)

|

1869 East Seltice Way, Suite 363

Post Falls, Idaho 83854

Phone (208) 651-6374

(Address and telephone number of principal executive offices)

SmallBiz Agents, Inc.

109 West 17th Street

Cheyenne, WY 82001

800-457-8878

(Name, address and telephone number of agent for service)

Copies to:

Timothy S. Orr, Esq.

4328 West Hiawatha Drive, Suite 101

Spokane, WA 99205

Phone: (509) 462.2926 Fax: (509) 769.0303

APPROXIMATE DATE OF PROPOSED SALE TO THE PUBLIC:

From time to time after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. (Check one):

Large Accelerated Filer ¨ Accelerated Filer ¨ Non-Accelerated Filer ¨ Smaller Reporting Company x

1

CALCULATION OF REGISTRATION FEE

|

Title of each class of

securities to be registered

|

Amount to

be registered

|

Proposed maximum

offering price per unit

|

Proposed maximum

aggregate offering price

|

Amount of

registration fee

|

||||

|

Common

|

5,000,000

|

$0.05 [1]

|

$250,000

|

$29.03 [2]

|

[1] No exchange or over-the-counter market exists for WD Hall Exploration Company’s common stock. The offering price has been arbitrarily determined and bears no relationship to assets, earnings, or any other valuation criteria. No assurance can be given that the shares offered hereby will have a market value or that they may be sold at this, or at any price.

[2] Fee calculated in accordance with Rule 457(o) of the Securities Act of 1933, as amended “Securities Act”. Estimated for the sole purpose of calculating the registration fee.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may determine.

2

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

|

PROSPECTUS

|

Subject To Completion: Dated ______, 20__

WD HALL EXPLORATION COMPANY

5,000,000 shares of common stock, no minimum / 5,000,000 maximum Offered at $0.05 per share

|

Securities Being Offered by WD Hall Exploration

|

Wd Hall Exploration Company is offering 5,000,000 shares at an offering price of $0.05 per share. There is currently no public market for the common stock

|

|

|

Minimum Number of Shares To Be Sold in This Offering

|

None

|

This is a "self-underwritten" public offering, with no minimum purchase requirement.

1. WD Hall Exploration Company is not using an underwriter for this offering.

2. The offering expenses shown do not include legal, accounting, printing and related costs incurred in making this offering. WD Hall Exploration Company will pay all such costs, which it believes to be $6,500.

3. There is no arrangement to place the proceeds from this offering in an escrow, trust or similar account.

|

|

Per Share

(Non Minimum)

|

If Maximum Shares are Sold (5,000,000)

|

||||||

|

Price to Public

|

$

|

0.05

|

$

|

0.05

|

||||

|

Underwriting Discounts/Commissions

|

0.00

|

0.00

|

||||||

|

Proceeds to Registrant

|

$

|

0.05

|

$

|

250,000

|

||||

This offering involves a high degree of risk; see "Risk Factors" beginning on page 8 to read about factors you should consider before buying shares of the common stock.

WD Hall Exploration Company is an exploration stage company and currently has no operations. There is a high degree of risk involved with any investment in the shares offered herein. You should only purchase shares if you can afford a loss of your entire investment. Our independent auditor has issued an audit opinion for WD Exploration Company which includes a statement expressing substantial doubt as to our ability to continue as a going concern. As of the date of this prospectus, our stock is presently not traded on any market or securities exchange. Further, there is no assurance that a trading market for our securities will ever develop.

These securities have not been approved or disapproved by the Securities and Exchange Commission or any state securities commission, nor has the Securities and Exchange Commission or any state securities commission passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The Date of this Prospectus is ______________, 20___

4

TABLE OF CONTENTS

|

Page

|

||||

|

FORWARD-LOOKING STATEMENTS

|

6

|

|||

|

SUMMARY INFORMATION

|

7

|

|||

|

RISK FACTORS AND UNCERTAINTIES

|

8

|

|||

|

USE OF PROCEEDS

|

12

|

|||

|

DETERMINATION OF OFFERING PRICE

|

14

|

|||

|

DILUTION

|

14

|

|||

|

PLAN OF DISTRIBUTION

|

15

|

|||

|

DESCRIPTION OF SECURITIES

|

15

|

|||

|

INTEREST OF NAMED EXPERTS AND COUNSEL

|

16

|

|||

|

DESCRIPTION OF BUSINESS

|

16

|

|||

|

DESCRIPTION OF PROPERTY

|

18

|

|||

|

LEGAL PROCEEDINGS

|

23

|

|||

|

MARKET FOR COMMON EQUITY AND RELATED SHAREHOLDER MATTERS

|

24

|

|||

|

FINANCIAL STATEMENTS

|

25

|

|||

|

MANAGEMENT’S DISCUSSION AND ANALYSIS

|

26

|

|||

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

|

32

|

|||

|

DIRECTORS, EXECUTIVE OFFICERS, AND CONTROL PERSONS

|

33

|

|||

|

EXECUTIVE COMPENSATION

|

34

|

|||

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

|

35

|

|||

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

|

35

|

|||

|

DISCLOSURE OF COMMISSION POSITION OF INDEMNIFICATION FOR SECURITIES ACT LIABILITIES

|

35

|

|||

|

CORPORATE GOVERNANCE

|

36

|

|||

|

THE SEC’S POSITION ON INDEMNIFICATION FOR LIABILITIES

|

36

|

|||

|

TRANSFER AGENT AND REGISTRAR

|

36

|

|||

|

LEGAL MATTERS

|

36

|

|||

|

WHERE YOU CAN FIND MORE INFORMATION

|

36

|

|||

|

GLOSSARY OF CERTAIN MINING TERMS

|

37

|

|||

|

PART II - INFORMATION NOT REQUIRED IN THE PROSPECTUS

|

II-1

|

|||

|

OTHER EXPENSES OF ISSUANCE AND DISTRIBUTION

|

II-1

|

|||

|

INDEMNIFICATION OF DIRECTORS AND OFFICERS

|

II-1

|

|||

|

RECENT SALES OF UNREGISTERED SECURITIES

|

II-2

|

|||

|

EXHIBITS

|

II-2

|

|||

|

UNDERTAKINGS

|

II-3

|

|||

|

SIGNATURES

|

II-6

|

|||

5

FORWARD-LOOKING STATEMENTS

This prospectus and the exhibits attached hereto contain “forward-looking statements”. Such forward-looking statements concern the Company’s anticipated results and developments in the Company’s operations in future periods, planned exploration and development of its properties, plans related to its business and other matters that may occur in the future. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management.

Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “estimates” or “intends”, or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking statements, including, without limitation:

risks related to our properties being in the exploration stage;

risks related our mineral operations being subject to government regulation;

risks related to our ability to obtain additional capital to develop our resources, if any;

risks related to mineral exploration and development activities;

risks related to our insurance coverage for operating risks;

risks related to the fluctuation of prices for precious and base metals, such as gold, silver, zinc and copper;

risks related to the competitive industry of mineral exploration;

risks related to our title and rights in our mineral properties;

risks related to our limited operating history;

risks related the possible dilution of our common stock from additional financing activities;

risks related to potential conflicts of interest with our management;

risks related to our subsidiaries activities; and

risks related to our shares of common stock.

This list is not exhaustive of the factors that may affect our forward-looking statements. Some of the important risks and uncertainties that could affect forward-looking statements are described further under the section headings “Risk Factors and Uncertainties”, “Description of the Business” and “Management’s Discussion and Analysis” of this prospectus. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, believed, estimated or expected. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. We disclaim any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

We qualify all the forward-looking statements contained in this prospectus by the foregoing cautionary statements.

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information different from the information contained in this prospectus. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of when this prospectus is delivered or when any sale of our common stock occurs.

This summary does not contain all of the information you should consider before buying shares of our common stock. You should read the entire prospectus carefully, especially the “Risk Factors and Uncertainties” section and our consolidated financial statements and the related notes before deciding to invest in shares of our common stock.

6

SUMMARY INFORMATION

The Offering

WD Hall Exploration Company's common stock is presently not traded on any market or securities exchange. 2,200,000 shares of restricted common stock are issued and outstanding as of the date of this prospectus.

WD Hall Exploration Company is offering up to 5,000,000 shares of common stock at an offering price of $0.05 per share. There is currently no public market for the common stock. WD Hall intends to apply to have the common stock quoted on the OTC Bulletin Board (OTCBB). Currently, there is no trading symbol assigned. WD Hall's Officer (William Hall and Brett Wyatt) own 2,200,000 shares of Restricted Common Stock collectively. If WD Hall is unable to sell its stock and raise money, WD Hall’s business would fail as it would be unable to complete its business plan and any investment made into the Company would be lost in its entirety.

The purchase of the securities offered through this prospectus involves a high degree of risk. See section entitled "Risk Factors" on pages 8 - 12.

Company History

Unless otherwise indicated, any reference to WD Hall or as “we”, “us”, or “our” refers to WD Hall Exploration Company. WD Hall Exploration Company is an exploration stage company that was incorporated on November 3, 2010 under the laws of the State of Wyoming. Our fiscal year end is December 31. The principal offices are located at 1869 East Seltice Way Ste 363, Post Falls, Idaho 83854--Phone (208) 651-637/Fax (208) 773-1493.

Since becoming incorporated, WD Hall has not made any significant purchases or sale of assets, nor has it been involved in any mergers, acquisitions or consolidations. WD Hall has never declared bankruptcy, it has never been in receivership, and it has never been involved in any legal action or proceedings.

We are an exploration stage corporation. We intend to be in the business of mineral property exploration. We do not own any interest in any property, but simply have the right to conduct exploration activities on one property. The property is comprised of 20 unpatented mining claims and 17 patented claims located in Shoshone County, in the northern panhandled of Idaho State known as the Douglas Property. We intend to explore for lead-zinc, gold, silver, and copper on the property. Currently, we have no further business planned if mineralized material is not found on the property.

As of November 30, 2010 the date of company's last audited financial statements, WD Hall had raised $5,500 through the sale of common stock. This sale was a subscription of 1,200,000 shares by the Company’s president and director William Hall and 1,000,000 shares purchased by its secretary/treasurer, Brett Wyatt.

The Company anticipates expense of $6,500 relating to legal/bookkeeping/auditing/filing fees for this filing. As of the date of this prospectus, we have not yet generated or realized any revenues from our business operations. The following financial information summarizes the more complete historical financial information as indicated on the audited financial statements of WD Hall filed with this prospectus.

Management

Currently, WD Hall has one Director, William Hall and two Officers William Hall (president/CEO/CFO) and Brett Wyatt (secretary/treasurer). Our Officers/Director have assumed responsibility for all planning, development and operational duties, and will continue to do so throughout the beginning stages of the business plan. Other than the Officers/Director, there are no employees at the present time and there are no plans to hire employees during the next twelve months.

7

Summary of Financial Data

|

As of

November 30, 2010

|

||||

|

Revenues

|

$

|

0

|

||

|

Operating Expenses

|

$

|

495

|

||

|

Loss

|

$

|

495

|

||

|

Total Assets

|

$

|

5,500

|

||

|

Shareholder’s Equity

|

$

|

5,005

|

||

RISK FACTORS AND UNCERTAINTIES

An investment in an exploration stage mining company with no history of operations such as ours involves an unusually high amount of risk, unknown and known, present and potential, including, but not limited to the risks enumerated below.

Our failure to successfully address the risks and uncertainties described below would have a material adverse effect on our business, financial condition and/or results of operations, and the trading price of our common stock may decline and investors may lose all or part of their investment. We cannot assure you that we will successfully address these risks or other unknown risks that may affect our business.

Estimates of mineralized material are forward-looking statements inherently subject to error. Although resource estimates require a high degree of assurance in the underlying data when the estimates are made, unforeseen events and uncontrollable factors can have significant adverse or positive impacts on the estimates. Actual results will inherently differ from estimates. The unforeseen events and uncontrollable factors include: geologic uncertainties including inherent sample variability, metal price fluctuations, variations in mining and processing parameters, and adverse changes in environmental or mining laws and regulations. The timing and effects of variances from estimated values cannot be accurately predicted.

RISKS ASSOCIATED WITH WD HALL EXPLORATION COMPANY:

Because our auditors have issued a going concern opinion, there is substantial uncertainty we will continue activities in which case you could lose your investment.

Our auditors have issued a going concern opinion. This means that there is substantial doubt that we can continue as an ongoing business for the next twelve months. As such we may have to cease activities and you could lose your entire investment.

There is no assurance that we can establish the existence of any mineral reserve in commercially exploitable quantities. Until we can do so, we cannot earn any revenues from this property and if we do not do so we will lose all of the funds that we expend on exploration. If we do not discover any mineral reserve in a commercially exploitable quantity, our business would fail and any investment made would be lost in its entirety.

We have not established any mineral reserve according to recognized reserve guidelines on any property we intend to explore, nor can there be any assurance that we will be able to do so. [A mineral reserve is defined by the Securities and Exchange Commission in its Industry Guide (http://www.sec.gov/divisions/corpfin/forms/industry.htm#secguide7) as that part of a mineral deposit, which could be economically and legally extracted or produced at the time of the reserve determination.]

8

The probability of an individual prospect ever having a "reserve" that meets the requirements of the Securities and Exchange Commission's Industry Guide 7 is extremely remote; in all probability our mineral property does not contain any 'reserve' and any funds that we spend on exploration will probably be lost. Even if we do eventually discover a mineral reserve on one or more of our properties, there can be no assurance that they can be developed into producing mines and extract those minerals. Both mineral exploration and development involve a high degree of risk and few properties, which are explored, are ultimately developed into producing mines.

The commercial viability of an established mineral deposit will depend on a number of factors including, by way of example, the size, grade and other attributes of the mineral deposit, the proximity of the mineral deposit to infrastructure such as a smelter, roads and a point for shipping, government regulation and market prices. Most of these factors will be beyond our control, and any of them could increase costs and make extraction of any identified mineral deposit unprofitable.

Mineral operations are subject to applicable law and government regulation. Even if we discover a mineral reserve in a commercially exploitable quantity, these laws and regulations could restrict or prohibit the exploitation of that mineral reserve. If we cannot exploit any mineral reserve that we might discover on our properties, our business may fail.

Both mineral exploration and extraction require permits from various foreign, federal, state, provincial and local governmental authorities and are governed by laws and regulations, including those with respect to prospecting, mine development, mineral production, transport, export, taxation, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. Regarding our future ground disturbing activity on federal land, we will be required to obtain a permit from the US Forest Service or the Bureau of Land Management prior to commencing exploration. There can be no assurance that we will be able to obtain or maintain any of the permits required for the continued exploration of our mineral properties or for the construction and operation of a mine on our properties at economically viable costs. If we cannot accomplish these objectives, our business could face difficulty and/or fail.

We believe that we are in compliance with all material laws and regulations that currently apply to our activities but there can be no assurance that we can continue to do so. Current laws and regulations could be amended and we might not be able to comply with them, as amended. Further, there can be no assurance that we will be able to obtain or maintain all permits necessary for our future operations, or that we will be able to obtain them on reasonable terms. To the extent such approvals are required and are not obtained, we may be delayed or prohibited from proceeding with planned exploration or development of our mineral properties.

Environmental hazards unknown to us, which have been caused by previous or existing owners or operators of the properties, may exist on the properties in which we hold an interest. At the date of this Prospectus, the Company is not aware of any environmental issues or litigation relating to any of its current or former properties.

Future legislation and administrative changes to the mining laws could prevent us from exploring our properties.

New state and U.S. federal laws and regulations, amendments to existing laws and regulations, administrative interpretation of existing laws and regulations, or more stringent enforcement of existing laws and regulations, could have a material adverse impact on our ability to conduct exploration and mining activities. Any change in the regulatory structure making it more expensive to engage in mining activities could cause us to cease operations.

If we establish the existence of a mineral reserve on our property in a commercially exploitable quantity, we will require additional capital in order to develop the property into a producing mine. If we cannot raise this additional capital, we will not be able to exploit the reserve, and our business could fail.

If we do discover mineral reserves in commercially exploitable quantities on our property, we will be required to expend substantial sums of money to establish the extent of the reserve, develop processes to extract it and develop extraction and processing facilities and infrastructure.

9

Although we may derive substantial benefits from the discovery of a major deposit, there can be no assurance that such a resource will be large enough to justify commercial operations, nor can there be any assurance that we will be able to raise the funds required for development on a timely basis. If we cannot raise the necessary capital or complete the necessary facilities and infrastructure, our business may fail.

Mineral exploration and development is subject to extraordinary operating risks. We do not currently insure against these risks. In the event of a cave-in or similar occurrence, our liability may exceed our resources, which would have an adverse impact on our Company.

Mineral exploration, development and production involve many risks, which even a combination of experience, knowledge and careful evaluation may not be able to overcome. Our operations will be subject to all the hazards and risks inherent in the exploration, development and production of resources, including liability for pollution, cave-ins or similar hazards against which we cannot insure or against which we may elect not to insure. Any such event could result in work stoppages and damage to property, including damage to the environment. We do not currently maintain any insurance coverage against these operating hazards. The payment of any liabilities that arise from any such occurrence would have a material, adverse impact on our Company.

Third parties may challenge our rights to our mineral properties or the agreements that permit us to explore our properties may expire if we fail to timely renew them and pay the required fees.

In connection with the acquisition of our mineral properties, we sometimes conduct only limited reviews of title and related matters, and obtain certain representations regarding ownership. These limited reviews do not necessarily preclude third parties from challenging our title and, furthermore, our title may be defective. Consequently, there can be no assurance that we hold good and marketable title to all of our mining concessions and mining claims. If any of our concessions or claims were challenged, we could incur significant costs and lose valuable time in defending such a challenge. These costs or an adverse ruling with regards to any challenge of our titles could have a material adverse affect on our financial position or results of operations. There can be no assurance that any such disputes or challenges will be resolved in our favor.

We are not aware of challenges to the location or area of any of our mining claims. There is, however, no guarantee that title to the claims will not be challenged or impugned in the future.

Our management has no technical training and no experience in mineral activities and consequently our activities, earnings and ultimate financial success could be irreparably harmed.

Our management has no technical training and experience with exploring for, starting, and operating a mine. With no direct training or experience in these areas, management may not be fully aware of many of the specific requirements related to working within the industry. Management's decisions and choices may not take into account standard engineering or managerial approaches mineral exploration companies commonly use. Consequently, our activities, earnings and ultimate financial success could suffer irreparable harm due to management's lack of experience in the industry.

Our success is dependent on current management, who may be unable to devote sufficient time to the development of our business; this potential limitation could cause the business to fail.

WD Hall is heavily dependent on the experience that our Officers, William Hall and Brett Wyatt. If something were to happen to them, it would greatly delay its daily operations until further industry contacts could be established. Furthermore, there is no assurance that suitable people could be found to replace current management. In that instance, WD Hall may be unable to further its business plan.

Additionally, Mr. Hall and Mr. Wyatt are employed outside of WD Hall Exploration Company. Mr. Hall and Mr. Wyatt expect to be able to commit approximately 10 hours per week of their time, to the development of our business for the next twelve months. If management is required to spend additional time with their outside employment, they may in turn not have sufficient time to devote to the Company, and as a result we would be unable to develop our business plan.

10

Because title to the property is held in the name of another person, if he transfers the property to someone other than us, we will cease activities.

Title to the property upon which we intend to conduct exploration activities is not held in our name. Title to the property is recorded in the name of American Mining Corporation whom has an agreement with Mr. Hall for exploration upon the property. If the owner transfers the property to a third person, the third person will obtain good title and we will have nothing. If this should occur, we will subsequently not own any property and we will have to cease all exploration activities.

RISKS ASSOCIATED WITH THIS OFFERING:

Because we have only two officers who are responsible for our managerial and organizational structure, in the future, there may not be effective disclosure and accounting controls to comply with applicable laws and regulations which could result in fines, penalties and assessments against the Company.

We currently have only two officers, William Hall and Brett Wyatt. As such, they are solely responsible for our managerial and organizational structure which will include preparation of disclosure and accounting controls under the Sarbanes-Oxley Act of 2002. When these controls are implemented, they will be responsible for the administration of the controls. Should they not have sufficient experience, they may be incapable of creating and implementing the controls which may cause the Company to be subject to sanctions and fines by the Securities Exchange.

If we complete a financing through the sale of additional shares of our common stock in the future, then shareholders will experience dilution.

The most likely source of future financing presently available to us is through the sale of shares of our common stock. Any sale of common stock will result in dilution of equity ownership to existing shareholders. This means that if we sell shares of our common stock, more shares will be outstanding and each existing shareholder will own a smaller percentage of the shares then outstanding. To raise additional capital we may have to issue additional shares, which may substantially dilute the interests of existing shareholders. Alternatively, we may have to borrow large sums, and assume debt obligations that require us to make substantial interest and capital payments.

Because there is no public trading market for our common stock, you may not be able to resell your stock.

There is currently no public trading market for our common stock. Therefore there is no central place, such as stock exchange or electronic trading system to resell your shares.

There is currently no market for WD Hall Exploration Company’s common stock; however, if and when a market for our common stock does develop, our stock price would likely be volatile.

There is currently no market for our common stock and there is no assurance that a market will develop. If and when a market should develop, it is anticipated that the market price of our common stock would be subject to wide fluctuations in response to several factors including:

|

·

|

The ability to complete the development of WD Hall’s anticipated exploration plan;

|

|

|

·

|

The market price of the commodities WD Hall anticipates exploring and mining; and

|

|

|

·

|

The ability to hire and retain competent personal in the future.

|

11

While WD Hall Exploration Company expects to apply for listing on the OTC Bulletin Board (OTCBB), we may not be approved, and even if approved, we may not be approved for trading on the OTCBB; therefore shareholders may not have a market to sell their shares, either in the near term or in the long term, or both.

We can provide no assurance to investors that our common stock will be traded on any exchange or electronic quotation service. While we expect to apply to the OTC Bulletin Board, we may not be approved to trade on the OTCBB, and we may not meet the requirements for listing on the OTCBB. If we do not meet the requirements of the OTCBB, our stock may then be traded on the "Pink Sheets," and the market for resale of our shares would decrease dramatically, if not be eliminated.

We have limited financial resources at present, and proceeds from the offering may not be used to fully develop its business.

WD Hall Exploration has limited financial resources at present; as of November 30th it had $2,500 of cash on hand with liabilities of $495. If it is unable to develop its business plan, it may be required to divert certain proceeds from the sale of WD Hall Exploration's stock to general administrative functions. If WD Hall is required to divert some or all of proceeds from the sale of stock to areas that do not advance the business plan, it could adversely affect its ability to continue by restricting the Company's ability to become listed on the OTCBB; advertise and promote the Company and its products; travel to develop new marketing, business and customer relationships; and retaining and/or compensating professional advisors.

Because our securities are subject to penny stock rules, you may have difficulty reselling your shares.

Our shares are penny stocks are covered by section 15(g) of the Securities Exchange Act of 1934 which imposes additional sales practice requirements on broker/dealers who sell the Company's securities including the delivery of a standardized disclosure document; disclosure and confirmation of quotation prices; disclosure of compensation the broker/dealer receives; and, furnishing monthly account statements. For sales of our securities, the broker/dealer must make a special suitability determination and receive from its customer a written agreement prior to making a sale. The imposition of the foregoing additional sales practices could adversely affect a shareholder's ability to dispose of his stock.

Because we do not have an Escrow or Trust Account for Investor’s Subscriptions, if we file for Bankruptcy Protection or are forced into Bankruptcy Protection, Investors will lose their entire investment.

Invested funds for this offering will not be placed in an escrow or trust account. Accordingly, if we file for bankruptcy protection or a petition for involuntary bankruptcy is filed by creditors against us, your funds will become part of the bankruptcy estate and administered according to the bankruptcy laws. As such, you will lose your investment and your funds will be used to pay creditors and will not be used for the sourcing and sale of promotional products.

These risk factors, individually or occurring together, would likely have a substantially negative effect on WD Hall’s business and would likely cause it to fail.

USE OF PROCEEDS

Our offering is being made on a self-underwritten basis - no minimum of shares must be sold in order for the offering to proceed. The offering price per share is $0.05. There is no assurance that we will raise the full $250,000 as anticipated.

12

The following table below sets forth the uses of proceeds assuming the sale of 25%, 50%, 75% and 100% of the securities offered for sale in this offering by the company. For further discussion see Plan of Operation.

|

If 25% of

|

If 50% of

|

If 75% of

|

If 100% of

|

|||||||||||||

|

Shares Sold

|

Shares Sold

|

Shares Sold

|

Shares Sold

|

|||||||||||||

|

GROSS PROCEEDS FROM THIS OFFERING

|

$

|

62,500

|

$

|

125,000

|

$

|

187,500

|

$

|

250,000

|

||||||||

|

Less: OFFERING EXPENSES

|

||||||||||||||||

|

SEC Filing Expenses

|

$

|

4,500

|

$

|

4,500

|

$

|

4,500

|

$

|

4,500

|

||||||||

|

Printing

|

$

|

500

|

$

|

500

|

$

|

500

|

$

|

500

|

||||||||

|

Transfer Agent

|

$

|

1,500

|

$

|

1,500

|

$

|

1,500

|

$

|

1,500

|

||||||||

|

SUB-TOTAL

|

$

|

6,500

|

$

|

6,500

|

$

|

6,500

|

$

|

6,500

|

||||||||

|

Less: PHASE I

|

||||||||||||||||

|

Soil Geochem grid soil samples (250 samples)

|

$

|

15,000

|

$

|

15,000

|

$

|

15,000

|

$

|

15,000

|

||||||||

|

Geologist

|

$

|

10,000

|

$

|

10,000

|

$

|

10,000

|

$

|

10,000

|

||||||||

|

Geophysical survey-Mag/VLF;SP Survey; IP Survey

|

$

|

15,000

|

$

|

15,000

|

$

|

15,000

|

$

|

15,000

|

||||||||

|

Geological Mapping and Rock Geochem (100 samples)

|

$

|

10,000

|

$

|

10,000

|

$

|

10,000

|

$

|

10,000

|

||||||||

|

Travel

|

$

|

1,000

|

$

|

1,000

|

$

|

1,000

|

$

|

1,000

|

||||||||

|

Surface sampling of Tailings

|

$

|

5,000

|

$

|

5,000

|

$

|

5,000

|

$

|

5,000

|

||||||||

|

SUB-TOTAL

|

$

|

56,000

|

$

|

56,000

|

$

|

56,000

|

$

|

56,000

|

||||||||

|

|

||||||||||||||||

|

Less: PHASE II

|

||||||||||||||||

|

Geologic Mapping (surface & underground rock units, veins and structure) /Rock Sampling (100+ samples)

|

$

|

0

|

$

|

15,000

|

$

|

15,000

|

$

|

15,000

|

||||||||

|

Geophysical Survey (Mag/VLF;SP; and IP survey over selected SP lines) over property

|

$

|

$

|

40,000

|

$

|

40,000

|

$

|

40,000

|

|||||||||

|

Geophysical Data Interpretation Report

|

$

|

0

|

$

|

7,500

|

$

|

7,500

|

$

|

7,500

|

||||||||

|

SUB-TOTAL

|

$

|

0

|

$

|

62,500

|

$

|

62,500

|

$

|

62,500

|

||||||||

|

Less: PHASE III

|

||||||||||||||||

|

Permits

|

0

|

$

|

0

|

$

|

1,500

|

$

|

1,500

|

|||||||||

|

Road Building

|

$

|

0

|

$

|

0

|

$

|

6,000

|

$

|

6,000

|

||||||||

|

Drilling (rotary drilling up to 2000 ft @ $50 per ft)

|

$

|

0

|

$

|

0

|

$

|

40,000

|

$

|

90,000

|

||||||||

|

Core logging, sampling, & assay

|

$

|

$

|

0

|

$

|

8,000

|

$

|

16,000

|

|||||||||

|

Geological reporting, survey, & management

|

$

|

0

|

$

|

0

|

$

|

7,000

|

$

|

11,500

|

||||||||

|

SUB-TOTAL

|

$

|

0

|

$

|

0

|

$

|

62,500

|

$

|

125,000

|

||||||||

|

TOTAL

|

$

|

62,500

|

$

|

125,000

|

$

|

187,500

|

$

|

250,000

|

||||||||

The above figures represent only estimated costs.

Legal and accounting fees refer to the normal legal and accounting costs associated with filing this Registration Statement under the 1933 Act as amended and maintaining the status of a Reporting Company under the 1934 Act.

A total of $5,500 has been raised from the sale of stock to our two current Officers - this stock is restricted and is not being registered in this offering. The offering expenses associated with this offering are estimated at $6,500. As of November 30, 2010, WD Hall had a balance (less outstanding checks) of $2,500 in cash with liabilities of $495.

One of the purposes of the offering is to create an equity market, which may allow WD Hall Exploration Company to more easily raise capital, since a publicly traded company has more flexibility in its financing offerings than one that does not. However, management cannot provide any guarantee that this will be the case.

13

DETERMINATION OF OFFERING PRICE

WD Hall Exploration Company’s offering price for shares sold pursuant to this offering is set at $0.05 per share. Factors that were considered in determining the offering price for the shares included the lack of liquidity (since there is no present market for stock), the high level of risk considering the lack of operating history of WD Hall Explorations, and the nominal amount of assets the Company currently has on hand.

DILUTION

"Dilution" represents the difference between the offering price of the shares of common stock and the net book value per share of common stock immediately after completion of the offering. "Net book value" is the amount that results from subtracting total liabilities from total assets. In this offering, the level of dilution is increased as a result of the relatively low book value of our issued and outstanding stock. Assuming all shares offered herein are sold, and given effect to the receipt of the maximum estimated proceeds of this offering from shareholders net of the offering expenses, our net book value will be $250,000 or $0.0347 per share. Therefore, the purchasers of the common stock in this offering will incur an immediate dilution of approximately $0.015 per share while our present stockholders will receive an increase of $0.023 per share in the net tangible book value of the shares they hold. This will result in an approximately 30% dilution for purchasers of stock in this offering.

|

Number of shares offered

|

5,000,000

|

|||

|

Selling price per share

|

0.05

|

|||

|

Total proceeds (if 100% are sold)

|

250,000.00

|

|||

|

Current NBV

|

5,005.00

|

|||

|

Current number of shares outstanding

|

2,200,000

|

|||

|

NBV per share

|

0.002275

|

|||

|

25%

|

50%

|

75%

|

100%

|

|

|

Offering Price Per Share

|

0.05

|

0.05

|

0.05

|

0.05

|

|

Book Value per Share Before Offering

|

0.002275

|

0.002275

|

0.002275

|

0.002275

|

|

Book Value per Share After Offering

|

0.019567

|

0.027661

|

0.032354

|

0.035417

|

|

Net Increase to Original Shareholders

|

0.017292

|

0.025386

|

0.030079

|

0.033142

|

|

Net Decrease to New Shareholders

|

0.030433

|

0.022339

|

0.017646

|

0.014583

|

|

Dilution to New Shareholders (%)

|

60.87%

|

44.68%

|

35.29%

|

29.17%

|

14

PLAN OF DISTRIBUTION

The offering consists of a maximum number of 5,000,000 common shares being offered by WD Hall Exploration Company at $0.05 per share with no minimum offering requirement.

Company Offering

WD Hall is offering for sale common stock. If WD Hall is unable to sell its stock and raise money, it will not be able to complete its business plan and its business would fail.

There will be no underwriters used, no dealer's commissions, no finder's fees, and no passive market making for the shares being offered by WD Hall. All of these shares will be issued to business associates, friends, and family of the management of the Company. The Officers, William Hall and Brett Wyatt, will not register as broker-dealers in connection with this offering. Mr. Hall and Mr. Wyatt will not be deemed to be a broker pursuant to the safe harbor provisions of Rule 3a4-1 of the Securities and Exchange Act of 1934, since he is not subject to statutory disqualification, will not be compensated directly or indirectly from the sale of securities, is not an associated person of a broker or dealer, nor has he been so associated within the previous twelve months, and primarily performs substantial duties as Officer and Director that are not in connection with the sale of securities, and has not nor will not participate in the sale of securities more than once every twelve months.

Our Common Stock is currently considered a "penny stock" under federal securities laws (Penny Stock Reform Act, Securities Exchange Act Section 3a (51(A)) since its market price is below $5.00 per share. Penny stock rules generally impose additional sales practice and disclosure requirements on broker-dealers who sell or recommend such shares to certain investors.

Broker-dealers who sell penny stock to certain types of investors are required to comply with the SEC's regulations concerning the transfer of penny stock. If an exemption is not available, these regulations require broker-dealers to: make a suitability determination prior to selling penny stock to the purchaser; receive the purchaser's written consent to the transaction; and, provide certain written disclosures to the purchaser. These rules may affect the ability of broker-dealers to make a market in, or trade our shares. In turn, this may make it very difficult for investors to resell those shares in the public market.

DESCRIPTION OF SECURITIES

General

The authorized capital stock consists of 50,000,000 shares of common stock at a par value of $0.001 per share. We plan to offer 5,000,000 common shares at a price of $0.05 per share. We will not sell any of the 5,000,000 common shares until the registration statement is deemed effective.

Common Stock

As of November 30, 2010, there are 2,200,000 shares of common stock issued and outstanding. 1,200,000 shares are held by our current president and director, William Hall and 1,000,000 shares are held by our current secretary Brett Wyatt.

Holders of common stock are entitled to one vote for each share on all matters submitted to a stockholder vote. Holders of common stock do not have cumulative voting rights. Therefore, holders of a majority of the shares of common stock voting for the election of directors can elect all of the directors. Holders of common stock representing a majority of the voting power of WD Hall’s capital stock issued and outstanding and entitled to vote, represented in person or by proxy, are necessary to constitute a quorum at any meeting of company stockholders. A vote by the holders of a majority of the outstanding shares is required to effectuate certain fundamental corporate changes such as liquidation, merger or an amendment to the articles of incorporation.

15

Holders of common stock are entitled to share in all dividends that the board of directors, in its discretion, declares from legally available funds. In the event of liquidation, dissolution or winding up, each outstanding share entitles its holder to participate pro rata in all assets that remain after payment of liabilities and after providing for each class of stock, if any, having preference over the common stock. Holders of the common stock have no pre-emptive rights, no conversion rights and there are no redemption provisions applicable to the common stock.

Shareholders

Each shareholder has sole investment power and sole voting power over the shares owned by such shareholder.

INTERESTS OF NAMED EXPERTS AND COUNSEL

No expert or counsel named in this prospectus as having prepared or certified any part of this prospectus or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of the common stock was employed on a contingency basis, or had, or is to receive, in connection with the offering, a substantial interest, direct or indirect, in the registrant or any of its parents or subsidiaries. Nor was any such person connected with the registrant or any of its parents or subsidiaries as a promoter, managing or principal underwriter, voting trustee, director, officer, or employee.

Timothy S. Orr, Esquire, of Spokane, Washington, an independent legal counsel, has provided an opinion on the validity of WD Hall Exploration’s issuance of common stock and is presented as an exhibit to this filing.

The financial statements included in this Prospectus and in the Registration Statement have been audited by Kyle L. Tingle, CPA, LLC, 3145 East Warm Springs Road, Suite 450, Las Vegas, NV 89120 to the extent and for the period set forth in their report (which contains an explanatory paragraph regarding WD Hall' ability to continue as a going concern) appearing elsewhere herein and in the Registration Statement, and are included in reliance upon such report given upon the authority of said firm as experts in auditing and accounting.

DESCRIPTION OF BUSINESS

General

WD Hall Exploration Company was incorporated on November 3, 2010, in the state of Wyoming. WD Hall has never declared bankruptcy, it has never been in receivership, and it has never been involved in any legal action or proceedings. Since becoming incorporated, WD Hall Exploration has not made any significant purchase or sale of assets, nor has it been involved in any mergers, acquisitions or consolidations. WD Hall is not a blank check registrant as that term is defined in Rule 419(a)(2) of Regulation C of the Securities Act of 1933, since it has a specific business plan or purpose.

We intend to commence operations as an exploration stage company. We will be engaged in the exploration of mineral properties with a view to exploiting any mineral deposits we discover. We own an option to acquire an undivided 100% beneficial interest in mineral claims in located in Shoshone County, Idaho State; known as the Douglas Property. The property is comprised of 20 unpatented mining claims, and 17 patented claims. The property is located in Shoshone County along the southwestern portion of the Couer D’Alene Mining District, known as Pine Creek, and on what is considered an offset segment of the Yreka shear zone, one of the two primary productive mineral belts south of the Osburn Fault Shoshone approximately 15km south east of the community of Pinehurst, Idaho. The Douglas Property has potential for lead (Pb), zinc (Zn), copper (Cu) and silver (Ag) prospect with minor Gold (Au) potential. We do not have any current plans to acquire interests in additional mineral properties, though we may consider such acquisitions in the future.

Unless otherwise indicated, any reference to WD Hall, or “we”, “us”, “our”, etc. refers to WD Hall Exploration Company.

16

Our Competition

Both the mineral exploration and drilling industries are intensely competitive in all phases. In our mineral exploration activities, we will compete with many companies possessing greater financial resources and technical facilities than us for the acquisition of mineral concessions, claims, leases and other mineral interests as well as for the recruitment and retention of qualified employees. We must overcome significant barriers to enter into the business of mineral exploration as a result of our limited operating history.

Similarly, in our drilling business, our competition includes many companies with significantly greater experience, larger client bases, and substantially greater financial resources. There are significant barriers to entry including large capital requirements and the recruitment and retention of qualified, experienced employees.

We cannot assure you that we will be able to compete in any of our business areas effectively with current or future competitors or that the competitive pressures faced by us will not have a material adverse effect on our business, financial condition and operating results.

Our Office

The principal offices are located at 1869 E SELTICE WAY, STE 363, POST FALLS, ID 83854 Phone: (208) 651-6374 Fax: (208) 773-1493.

Our Employees

Other than our officers, William Hall and Brett Wyatt, we have no employees. Assuming financing can be obtained, management expects to hire additional staff and employees as necessary as implement of our business plan requires.

Regulation

The exploration, drilling and mining industries operate in a legal environment that requires permits to conduct virtually all operations. Thus permits are required by local, state and federal government agencies. Federal agencies that may be involved include: The U.S. Forest Service (USFS), Bureau of Land Management (BLM), Environmental Protection Agency (EPA), National Institute for Occupational Safety and Health (NIOSH), the Mine Safety and Health Administration (MSHA) and the Fish and Wildlife Service (FWS). Individual states also have various environmental regulatory bodies, such as Departments of Ecology and so on. Local authorities, usually counties, also have control over mining activity. The various permits address such issues as prospecting, development, production, labor standards, taxes, occupational health and safety, toxic substances, air quality, water use, water discharge, water quality, noise, dust, wildlife impacts, as well as other environmental and socioeconomic issues.

Prior to receiving the necessary permits to explore or mine, the operator must comply with all regulatory requirements imposed by all governmental authorities having jurisdiction over the project area. Very often, in order to obtain the requisite permits, the operator must have its land reclamation, restoration or replacement plans pre-approved. Specifically, the operator must present its plan as to how it intends to restore or replace the affected area. Often all or any of these requirements can cause delays or involve costly studies or alterations of the proposed activity or time frame of operations, in order to mitigate impacts. All of these factors make it more difficult and costly to operate and have a negative and sometimes fatal impact on the viability of the exploration or mining operation. Finally, it is possible that future changes in these laws or regulations could have a significant impact on our business, causing those activities to be economically reevaluated at that time.

17

Mineral property exploration is typically conducted in phases. Each subsequent phase of exploration work is recommended by a geologist based on the results from the most recent phase of exploration. We have not yet commenced the initial phase of exploration on the claims. Once we have completed each phase of exploration, we will make a decision as to whether or not we proceed with each successive phase based upon the analysis of the results of that program. Our director will make this decision based upon the recommendations of the independent geologist who oversees the program and records the results. Even if we complete our proposed exploration programs on the claims and we are successful in identifying a mineral deposit, we will have to spend substantial funds on further drilling and engineering studies before we will know if we have a commercially viable mineral deposit.

Overview of Our Mineral Exploration Business

Mineral exploration is essentially a research activity that does not produce a product. Successful exploration often results in increased project value that can be realized through the optioning or selling of the claimed site to larger companies. As such, we intend to acquire properties which we believe have potential to host economic concentrations of minerals. These acquisitions have and may take the form of unpatented mining claims on federal land, or leasing claims, or private property owned by others. An unpatented mining claim is an interest that can be acquired to the mineral rights on open lands of the federally owned public domain. Claims are staked in accordance with the Mining Law of 1872, recorded with the federal government pursuant to laws and regulations established by the Bureau of Land Management (the Federal agency that administers America’s public lands), and grant the holder of the claim a possessory interest in the mineral rights, subject to the paramount title of the United States.

We plan to perform basic geological work to identify specific drill targets on the properties, and then collect subsurface samples by drilling to confirm the presence of mineralization (the presence of economic minerals in a specific area or geological formation). We may enter into joint venture agreements with other companies to fund further exploration work. By such prospects, we mean properties that may have been previously identified by third parties, including prior owners such as exploration companies, as mineral prospects with potential for economic mineralization. Often these properties have been sampled, mapped and sometimes drilled, usually with indefinite results. Accordingly, such acquired projects will either have some prior exploration history or will have strong similarity to a recognized geologic ore deposit model. Geographic emphasis will be placed on the western United States. The focus of our activity will be to acquire properties that we believe to be undervalued; including those that we believe to hold previously unrecognized mineral potential.

Our current mineral property (Douglas Property) is owned by a third party, with an option to purchase in the future. This agreement is held by our Company with American Mining Corporation, Osburn Idaho. Our strategy with this property is to explore the property for potential commercial grade/quantity minerals and present our findings to larger companies for potential joint venture in the extraction of the minerals. Our joint venture strategy is intended to maximize the abilities and skills of the management group, conserve capital, and provide superior leverage for investors.

DESCRIPTION OF PROPERTY

The principal offices are located at1869 E SELTICE WAY, STE 363, POST FALLS, ID 83854 Phone: (208) 651-6374 Fax: (208) 773-1493. WD Hall’s management does not currently have policies regarding the acquisition or sale of real estate assets primarily for possible capital gain or primarily for income. WD Hall does not presently hold any investments or interests in real estate, investments in real estate mortgages or securities of or interests in persons primarily engaged in real estate activities.

We own an option to the mineral exploration rights relating to the claims on the Douglas Property, Shoshone County in the State of Idaho. We do not own any real property interest in the claims or any other property.

18

Summary of WD Hall’s Mineral Exploration Prospects

November 30, 2010, WD Hall acquired mineral prospect rights for exploration in the State of Idaho, Shoshone County for target commodities of lead-zinc, copper, silver and gold. The prospects are held by twenty (2) unpatented mining claims owned by American Mining Company and seventeen (17) patented claims through legal agreements conveying exploration and development rights to the Company. Most of our prospects have had a prior exploration history and this is typical in the mineral exploration industry. Most mineral prospects go through several rounds of exploration before an economic ore body is discovered and prior work often eliminates targets or points to new ones. Also, prior operators may have explored under a completely different commodity price structure or technological regime. Mineralization which was uneconomic in the past may be ore grade at current market prices when extracted and processed with modern technology.

19

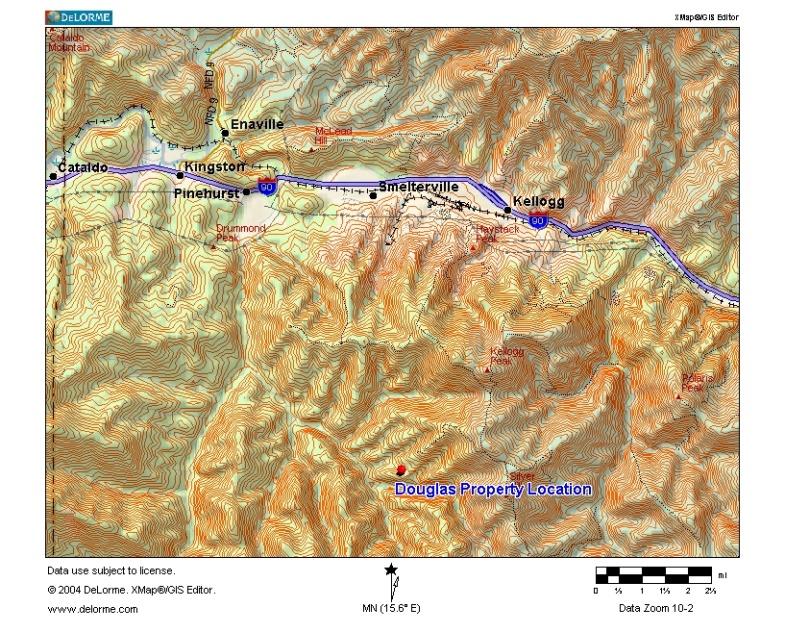

Douglas Property-Idaho State, Shoshone County-Regional Map

20

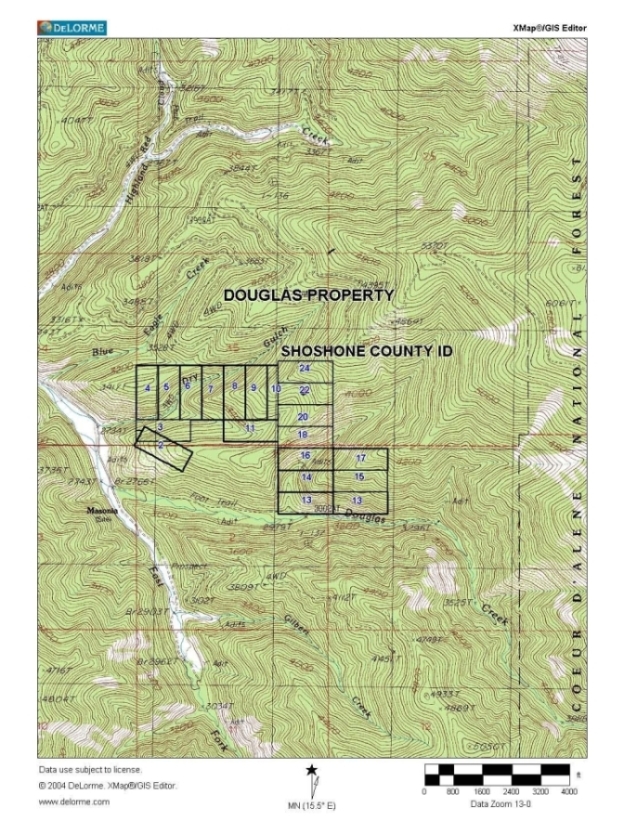

Douglas Property Claim Block Map

21

WD Hall Exploration Company Claim Purchase/Option Agreement

On November 30, 2010, we entered into an Option to Purchase Agreement with America Mining Corporation for the Douglas Property who is the sole beneficial owner of 100% of the mineral claims identified as:

|

Unpatented Claims

|

IMC Number

|

|

DGL2-DGL18

|

IMC #'s 440386-440402

|

|

DGL20

|

IMC # 440404

|

|

DGL22

|

IMC # 440406

|

|

DGL24

|

IMC # 440408

|

|

Patented Claims

|

Survey Number

|

|

Travers

|

3178

|

|

Olliver

|

“

|

|

Bessie

|

“

|

|

Ruth

|

“

|

|

Owl

|

“

|

|

Greeley

|

2319

|

|

Sherman

|

“

|

|

Grant

|

“

|

|

Apex

|

“

|

|

Douglas

|

“

|

|

Gordon

|

“

|

|

St. Joe Fraction

|

“

|

|

Marmion

|

“

|

|

St. Paul Fraction

|

“

|

|

Douglas Fraction

|

“

|

|

Mitchell

|

3405

|

|

Mitchell Fraction

|

“

|

Location, Access and Description

The Douglas Property is located along the southwestern portion of the Couer D’Alene Mining District, known as Pine Creek, and on what is considered an offset segment of the Yreka shear zone, one of the two primary productive mineral belts south of the Osburn Fault. The physical description is; Township 47 North, Range 2 East, sections 35 & 36, and Township 48 North, Range 2 E, sections 1 & 2, Yreka Mining District, county of Shoshone approximately 15km south east of the community of Pinehurst, Idaho. The property is comprised of 20 unpatented mining claims, owned by American Mining Company of Osburn, Idaho, and 17 patented claims. The property is accessible by dirt road; however, if and when drilling should take place additional road work will need to be completed for the equipment mobilization.

The Douglas Property encompasses a complex zone of structures and lithologies, which management believes is favorable for exploration and potential production in the future. This property has shown extensive historical ore production. Based on previous work and the properties position within the Couer D'Alene District, we believe this property is a good exploration target for Zn, Ag, Pb, Cu, and to a small degree, Au. The Yreka Shear Zone is a broad and productive zone of mineralization, which apparently controls the ore distribution on the Douglas Property. We believe there is a high probability of ore grade and mineralization increasing with depth, based upon district wide trends of mineralized veins thickening at depth, as well as prospective exploration targets to the northwest and southwest of the developed area In addition, there are similar structures, parallel to the Douglas vein, contained within the Yreka Shear Zone, that warrant exploration.

22

Overview of Regulatory, Economic and Environmental Issues

Hard rock mining and drilling in the United States is a closely regulated industrial activity. Mining and drilling operations are subject to review and approval by a wide variety of agencies at the federal, state and local level. Each level of government requires applications for permits to conduct operations. The approval process always involves consideration of many issues including but not limited to air pollution, water use and discharge, noise issues, and wildlife impacts. Mining operations always involve preparation of an environmental impact statement that examines the probable effect of the proposed site development. Federal agencies that may be involved include: The U.S. Forest Service (USFS), Bureau of Land Management (BLM), Environmental Protection Agency (EPA), National Institute for Occupational Safety and Health (NIOSH), the Mine Safety and Health Administration (MSHA) and the Fish and Wildlife Service (FWS). Individual states also have various environmental regulatory bodies, such as Departments of Ecology and so on. Local authorities, usually counties, also have control over mining activity.

Underground metal mines generally involve higher grade ore bodies. Less tonnage is mined underground, and generally the higher grade ore is processed in a mill or other refining facility. This process results in the accumulation of waste by-products from the washing of the ground ore. Mills require associated tailings ponds to capture waste by-products and treat water used in the milling process.

Capital costs for mine, mill and tailings pond construction can easily run into the hundreds of millions of dollars. These costs are factored into the profitability of a mining operation. Metal mining is sensitive to both cost considerations and to the value of the metal produced. Metals prices are set on a world-wide market and are not controlled by the operators of the mine. Changes in currency values or exchange rates can also impact metals prices. Thus changes in metals prices or operating costs can have a huge impact on the economic viability of a mining operation.

Environmental protection and remediation is an increasingly important part of mineral economics. Estimated future costs of reclamation or restoration of mined land are based principally on legal and regulatory requirements. Reclamation of affected areas after mining operations may cost millions of dollars. Often governmental permitting agencies are requiring multi-million dollar bonds from mining companies prior to granting permits, to insure that reclamation takes place. All environmental mitigation tends to decrease profitability of the mining operation, but these expenses are recognized as a cost of doing business by modern mining and exploration companies.

Mining and exploration activities are subject to various laws and regulations governing the protection of the environment. These laws and regulations are continually changing and are generally becoming more restrictive. We conduct our operations so as to protect the public health and environment and believe our operations are in compliance with applicable laws and regulations in all material respects. We have made, and expect to make in the future, expenditures to comply with such laws and regulations, but cannot predict the full amount of such future expenditures.

Every mining activity has an environmental impact. In order for a proposed mining project to be granted the required governmental permits, mining companies are required to present proposed plans for mitigating this impact. In the United States, where our properties are located, no mine can operate without obtaining a number of permits. These permits address the social, economic, and environmental impacts of the operation and include numerous opportunities for public involvement and comment.

LEGAL PROCEEDINGS

WD Hall Exploration Company is not currently a party to any legal proceedings. WD Hall’s agent for service of process in Wyoming is: SmallBiz Agents, Inc., 109 West 17th Street, Cheyenne, WY 8200. Phone 800-457-8878.

23

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

No Public Market for Common Stock

There is presently no public market for the common stock. WD Hall anticipates applying for trading of the common stock on either the OTCBB upon the effectiveness of the registration statement of which this prospectus forms a part. However, WD Hall can provide no assurance that the shares will be traded on the OTCBB or, if traded, that a public market will materialize.

Purchases of Equity Securities by the Small Business Issuer and Affiliates

There were no purchases of our equity securities by us or any of our affiliates during the year ended November 30, 2010 other than the purchase made by our officers William Hall and Brett Wyatt. Mr. Hall subscribed 1,200,000 common shares and Mr. Wyatt purchased 1,000,000 common shares issued on November 30, 2010.

Holders of the Common Stock

As of the date of this registration statement, WD Hall had two (2) registered shareholders. William Hall, Officer and Director currently hold 1,200,000 common shares, which represent 54.5% of the issued and outstanding common stock and Brett Wyatt, Officer whom currently hold 1,000,000 common shares which represents 45.5% of the issued and outstanding common stock.

Dividend Policy

We anticipate that we will retain any earnings to support operations and to finance the growth and development of our business. Therefore, we do not expect to pay cash dividends in the foreseeable future. Any further determination to pay cash dividends will be at the discretion of our board of directors and will be dependent on the financial condition, operating results, capital requirements and other factors that our board deems relevant. We have never declared a dividend.

Equity Compensation Plan

To date, WD Hall has no equity compensation plan, has not granted any stock options and has not granted registration rights to any person(s).

24

WD HALL EXPLORATION COMPANY

(A Exploration Stage Enterprise)

Financial Statements

November 30, 2010

25

WD HALL EXPLORATION COMPANY

(A Exploration Stage Enterprise)

Financial Statements

November 30, 2010

CONTENTS

|

Page(s)

|

|||

|

Report of Independent Registered Public Accounting Firm

|

1

|

||

|

Balance Sheet as of November 30, 2010

|

2

|

||

|

Statement of Operations for the period of November 3, 2010 (inception) to November 30, 2010

|

3

|

||

|

Statement of Changes in Stockholders' Equity cumulative from November 3, 2010 (inception) to November 30, 2010

|

4

|

||

|

Statement of Cash Flows for the period of November 3, 2010 (inception) to November 30, 2010

|

5

|

||

|

Notes to the Financial Statements

|

6-11

|

||

Report of Independent Registered Public Accounting Firm

To the Board of Directors

WD Hall Exploration Company

We have audited the accompanying balance sheet of WD Hall Exploration Company (An Exploration Stage Enterprise) as of November 30, 2010 and the related statements of operations, stockholder’s equity, and cash flows for the period November 3, 2010 (inception) through November 30, 2010. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of WD Hall Exploration Company (An Exploration Stage Enterprise) as of November 30, 2010 and the results of its operations and cash flows for the period November 3, 2010 (inception) through November 30, 2010, in conformity with U.S. generally accepted accounting principles.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the financial statements, the Company has limited operations and has no established source of revenue. This raises substantial doubt about its ability to continue as a going concern. Management’s plan in regard to these matters is also described in Note 2. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Kyle L. Tingle, CPA, LLC

December 10, 2010

Las Vegas, Nevada

1

|

WD Hall Exploration Company

|

||||

|

(A Exploration Stage Enterprise)

|

||||

|

Balance Sheet

|

||||

|

November 30, 2010

|

||||

|

ASSETS

|

||||

|

Current assets

|

||||

|

Cash

|

$ | 2,500 | ||

|

Total current assets

|

2,500 | |||

|

Total assets

|

$ | 2,500 | ||

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

||||

|

Current liabilities

|

||||

|

Accrued liabilities

|

$ | 495 | ||

|

Total current liabilities

|

495 | |||

|

Commitments and Contingencies

|

||||

|

Stockholders' Equity

|

||||

|

Subscriptions receivable

|

(3,000 | ) | ||

|

Common stock, $0.001 par value; 50,000,000 shares authorized; 2,200,000 issued and outstanding at November 30, 2010

|

2,200 | |||

|

Additional paid in capital

|

3,300 | |||

|

Deficit accumulated during the Exploration Stage

|

(495 | ) | ||

|

Total stockholders' equity

|

2,005 | |||

|

Total liabilities and stockholders' equity

|

$ | 2,500 | ||

|

See accompanying notes to financial statements.

|

||||

2

|

WD Hall Exploration Company

|

||||

|

(A Exploration Stage Enterprise)

|

||||

|

Statement of Operations

|

||||