Attached files

| file | filename |

|---|---|

| EX-32 - PERPETUAL TECHNOLOGIES, INC. | v206730_ex32.htm |

| EX-3.2 - PERPETUAL TECHNOLOGIES, INC. | v206730_ex3-2.htm |

| EX-3.1 - PERPETUAL TECHNOLOGIES, INC. | v206730_ex3-1.htm |

| EX-31.1 - PERPETUAL TECHNOLOGIES, INC. | v206730_ex31-1.htm |

| EX-31.2 - PERPETUAL TECHNOLOGIES, INC. | v206730_ex31-2.htm |

UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark

One)

|

þ

|

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT

OF 1934.

|

For

the fiscal year ended September 30, 2010

or

|

o

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT

OF 1934.

|

For

the transition period from ________ to __________

File

number: 000-53010

CHINA

SLP FILTRATION TECHNOLOGY, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware

|

84-1465393

|

|

|

(State or Other Jurisdiction

of Incorporation or Organization)

|

(I.R.S. Employer

Identification No.)

|

Shishan

Industrial Park

Nanhai

District

Foshan

City

Guangdong

Province, PRC

(Address

of Principal Executive Offices) (Zip Code)

Registrant’s

telephone number, including area code: (011) 86-757-86683197

Securities registered pursuant to

Section 12(b) of the Act: None

Securities

registered pursuant to Section 12(g) of the Act:

|

Title of each class

|

|

Common Stock, par value $0.001 per share

|

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act. Yes ¨ No

þ

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the

Act. Yes ¨ No

þ

Indicate

by check mark whether the registrant: (1) has filed all reports required to

be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to

such filing requirements for the past

90 days. Yes þ No

¨

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files).

Yes ¨ No

¨

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K (§ 229.405 of this chapter) is not contained herein,

and will not be contained, to the best of registrant’s knowledge, in definitive

proxy or information statements incorporated by reference in Part III of

this Form 10-K or any amendment to this Form 10-K. ¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act. (Check

one):

|

Large

accelerated filer ¨

|

Accelerated

filer ¨

|

Non-accelerated

filer ¨

|

Smaller

reporting company þ

|

Indicate

by check mark whether the registrant is a shell company (as defined in Exchange

Act Rule 12b-2). Yes ¨ No

þ

The

aggregate market value of the registrant’s common stock, $0.001 par value

per share, held by non-affiliates of the registrant on March 31, 2010, was

approximately $2,784,751. As our common stock is not publicly

traded this is based on as assumed value of $2.45 per

share. Shares of the registrant’s common stock held by

each officer and director and each person known to the registrant to own 10% or

more of the outstanding voting power of the registrant have been excluded in

that such persons may be deemed to be affiliates. This determination of

affiliate status is not a determination for other purposes.

As of

December 28, 2010 there were 15,265,714 shares of common stock

outstanding.

DOCUMENTS

INCORPORATED BY REFERENCE: None

CHINA

SLP FILTRATION TECHNOLOGY, INC.

ANNUAL

REPORT ON FORM 10-K

FOR

THE FISCAL YEAR ENDED SEPTEMBER 30, 2010

TABLE OF

CONTENTS

|

PART

I

|

2

|

|||

|

ITEM

1

|

BUSINESS

|

2

|

||

|

ITEM

1A

|

RISK

FACTORS

|

22

|

||

|

ITEM

1B

|

UNRESOLVED

STAFF COMMENTS

|

39

|

||

|

ITEM

2

|

PROPERTIES

|

39

|

||

|

ITEM

3

|

LEGAL

PROCEEDINGS

|

39

|

||

|

ITEM

4

|

(REMOVED

AND RESERVED)

|

39

|

||

|

PART

II

|

40

|

|||

|

ITEM

5

|

MARKET

FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER

PURCHASES OF EQUITY SECURITIES

|

40

|

||

|

ITEM

6

|

SELECTED

FINANCIAL DATA

|

43

|

||

|

ITEM

7

|

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

|

43

|

||

|

ITEM

7A

|

QUANTITATIVE

AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

51

|

||

|

ITEM

8

|

FINANCIAL

STATEMENTS AND SUPPLEMENTARY DATA

|

51

|

||

|

ITEM

9

|

CHANGES

IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL

DISCLOSURE

|

51

|

||

|

ITEM

9A

|

CONTROLS

AND PROCEDURES

|

52

|

||

|

ITEM

9B

|

OTHER

INFORMATION

|

53

|

||

|

PART

III

|

54

|

|||

|

ITEM

10

|

DIRECTORS,

EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

|

54

|

||

|

ITEM

11

|

EXECUTIVE

COMPENSATION

|

61

|

||

|

ITEM

12

|

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED

STOCKHOLDER MATTERS

|

65

|

||

|

ITEM

13

|

CERTAIN

RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR

INDEPENDENCE

|

67

|

||

|

ITEM

14

|

PRINCIPAL

ACCOUNTING FEES AND SERVICES

|

69

|

||

|

PART

IV

|

71

|

|||

|

ITEM

15

|

EXHIBITS,

FINANCIAL STATEMENT SCHEDULES

|

71

|

i

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS AND

OTHER

INFORMATION CONTAINED IN THIS REPORT

This

annual report contains forward-looking statements. Forward-looking statements

give our current expectations or forecasts of future events. You can identify

these statements by the fact that they do not relate strictly to historical or

current facts. Forward-looking statements involve risks and uncertainties.

Forward-looking statements include statements regarding, among other things, (a)

our projected sales, profitability and cash flows, (b) our growth strategies,

(c) anticipated trends in our industries, (d) our future financing plans and (e)

our anticipated needs for working capital. They are generally identifiable by

use of the words “may,” “will,” “should,” “anticipate,” “estimate,” “plan,”

“potential,” “projects,” “continuing,” “ongoing,” “expects,” “management

believes,” “we believe,” “we intend” or the negative of these words or other

variations on these words or comparable terminology. In particular, these

include statements relating to future actions, future performance, sales

efforts, expenses, the outcome of contingencies such as legal proceedings, and

financial results.

Any or

all of our forward-looking statements in this annual report may turn out to be

inaccurate. They can be affected by inaccurate assumptions we might make or by

known or unknown risks or uncertainties. Consequently, no forward-looking

statement can be guaranteed. Actual future results may vary materially as a

result of various factors, including, without limitation, the risks outlined

under “Risk Factors” and matters described in this annual report generally. In

light of these risks and uncertainties, there can be no assurance that the

forward-looking statements contained in this filing will in fact occur and you

should not place undue reliance on these forward-looking

statements.

1

PART

I

Item

1. Business

Overview

We are a

manufacturer of nonwoven fabric in the PRC. Nonwovens are synthetic

fabrics, such as felt or polyester, which are neither woven nor knitted,

but instead made from long fibers, bonded together by chemical, mechanical, heat

or solvent treatment.

Our total

revenues for the year ended September 30, 2010 were approximately $19.95

million, an increase of $8.1 million, or approximately 68%, compared to total

revenues of $11.85 million for the prior year. Our net income was approximately

$2.22 million, a decrease of $0.22 million, or approximately 9%, from

approximately $2.45 million for the prior year.

We

currently manufacture two types of polyester, or PET, nonwoven

fabrics. Our PET nonwoven fabrics are used in a wide range of

products, including filtration products, road construction materials, home

furnishings, automobile interior insulation and industrial

packaging.

We sell

our nonwoven fabrics primarily to PRC-based manufacturers that incorporate our

fabric products into end products which are sold to customers operating in the

heavy industrial, automotive, construction and home furnishing industries. Given

the broad range of applications for our products, we are not dependent on

any single industry sector or customer to generate revenues. We have many active

customers and our two largest clients in 2010, were Dalian Jier Linke Geotextile

Material Co., Ltd. and Chendu Sanya Building Material Co., Ltd. which accounted

for approximately 19% of our revenues. Our two largest customers in 2009,

Chengdu Sanya and Xiantao Ruixin, accounted for approximately 18% of our

revenues.

Although

we intend to continue to generate revenues from the sale of PET nonwovens, the

key component to our growth strategy is the successful commercialization and

sale of polyphenylene-sulfide fiber, or PPS, nonwoven fabric. PPS nonwoven

fabric is a heat resistant, corrosion-proof and flame retardant nonwoven fabric

and can be used in many different applications, including as the material for

dust filter bags for pollutant dust removal in smoke stacks in coal-fired power

plants, garbage incinerators and cement factories. We recently developed a

manufacturing process to manufacture polyphenylene-sulfide fiber, or PPS

nonwoven fabric, which is the key product line around which our long-term growth

strategy is centered. We believe that this manufacturing process is

proprietary and have applied for a process patent in the PRC and intend to apply

for a process patent in the US and Europe.

We

believe that although PPS filtration materials have been used since 1979 in bag

filters that are attached to smoke stacks in many of the coal-fired boilers

operating in Europe and the United States, less than 10% of the coal fired

power plants operating in the PRC are equipped with dust removal filtration bags

and less than 10% of the filtration bags in use were made from PPS fiber.

(Source “China Power

Industry”, issue 4, 2006, page 36.)

Under

recently adopted PRC environmental regulations that are being imposed on

operators of coal-fired power plants, garbage incinerators and cement factories,

which came into effect in January 1, 2010, carbon and other emissions are

required to be less than 50 milligrams per cubic meter by the end of

2010. Some of the larger, more developed cities, for example

Beijing and Tianjin, have adopted even more stringent rules requiring that

emissions be less than 30 milligrams per cubic meter. (Source "Electric Power," May,

2008.)

We

believe, based on an article published in China Nonwoven & Industrial

Textile (CNIT) in 2010, that less than 10% of the coal-fired boilers in China

were equipped with dust removal filtration bags and less than 10% of the

filtration bags in use are made from PPS fiber.

2

Filtration

bags offer these and other plant operators a cost effective way of meeting these

new emission and dust pollutant standards in the PRC because the installation of

bag filters is a significantly cheaper method of achieving compliance with these

regulations than installing costly pollutant dust removal equipment such as

engineered scrubbing systems, the installation of which would we believe be cost

prohibitive for many of these smaller coal fired power plants and other

polluters.

Based on

laboratory tests which we conducted internally, we believe that our PPS nonwoven

fabric is superior to other high temperature filtration materials currently

available because it is lighter, thicker, stronger, has higher air permeability

and filtration efficiency and is significantly cheaper to

produce. As nonwovens are sold by weight, our product will also

be cheaper as it is lighter. Due to the superior

characteristics of our PPS product coupled with the demand created by these new

regulations, we believe that our PPS material will ultimately replace other high

temperature filtration materials currently available in the market place, such

as PTFE (or Teflon), fiber glass, P84 (polyimide), PBI (polybenzimidazole

fiber), PMIA and PSA and the demand for our PPS nonwovens will be

significant.

Comparison-Our PPS Product to Other Filtration Materials

|

Our PPS

Product

|

PPS

needle

punching

felting

|

Metamax

needle

punching

felting

|

P84

needle

punching

felting

|

PTFE

needle

punching

felting

|

|||||||||||||||||

|

Gram

weight(g/m2)(1)

|

450 | 500 | 500 | 500 | 800 | ||||||||||||||||

|

Thickness

(mm) (2)

|

2.2 | 1.8 | 2 | 2 | 2.5 | ||||||||||||||||

|

Air

permeability (L/m2/s) (3)

|

300~400

|

200~300

|

200~400

|

200~300

|

200~300

|

||||||||||||||||

|

Break

strength (N/5cm)(4)

|

Vertical

|

1400 | 1250 | 1300 | 1100 | 3260 | |||||||||||||||

|

Horizontal

|

1250 | 1350 | 1460 | 1200 | 3300 | ||||||||||||||||

|

Break

elongate(%)

(5)

|

Vertical

|

25 | 40 | 50 | 25 | 10 | |||||||||||||||

|

Horizontal

|

30 | 60 | 55 | 35 | 15 | ||||||||||||||||

|

Working

temperature (6)

|

Continuous

|

190 | 190 | 204 | 260 | 260 | |||||||||||||||

|

Moment

|

220 | 220 | 240 | 280 | 300 | ||||||||||||||||

|

Price

of fiber (in K USD$) (7)

|

$ | 14.68 | $ | 20.56 | $ | 22.03 | $ | 55.80 | $ | 41.12 | |||||||||||

|

Materials

saved (%) (8)

|

0.0 | % | 10.0 | % | 10.0 | % | 10.0 | % | 43.8 | % | |||||||||||

|

Filtration

Efficiency (mg/cbm) (9)

|

<30

|

50~100

|

50~100

|

50~100

|

50~100

|

||||||||||||||||

(1) Gram

weight: (g/m2) means grams per meter squared. The higher the gram per

meter squared weight, the heavier the fabric/material.

(2)

Thickness (mm): the higher the millimeter figure, the thicker

the material.

(3) Air

permeability: (L/m2/s) means liters per meter squared per

second. The more liters that pass per second, the higher the

permeability of the fabric/material.

(4) Break

strength: (N/5cm) is a unit of measure to demonstrate breakage

strength. 1 N ≈ 0.1 KG so that N/5cm = .02. So, a 1400

value = 28. The higher the value, the stronger the

material.

(5) Break

elongate (%) refers to the amount of stretching of a fabric/material before

breakage expressed as a percentage. So, a 25% value indicates the

material can be stretched 25% prior to breakage.

(6)

Working temperature means the continuous operating temperature that a

fabric/material can operate in.

(7) Price

of fiber (in K USD$) = Price of the fabric/material expressed as K USD$ ($1,000)

per metric ton.

(8) Materials

saved (%) = Referencing the SLP PPS Product as the denominator, the amount of

material that can be saved by utilizing the more efficient PPS material as

compared to the other materials.

(9) Filtration

Efficiency (mg/cbm) = milligrams per cubic meter. The ability of the

fabric/material to eliminate airborne particles. This figure is the

minimum size of particles.

We plan

to begin commercial production of our PPS nonwoven fabric using our patent

pending process in the early part of 2011 with the addition of three high tech

production lines with annual output capacity of 3,600 tons. Although

prototype bag filters made of our PPS product have been tested in laboratories,

they have not been tested on site by any potential end user and we do not expect

to develop prototypes for testing by any end user prior to beginning commercial

production.

Our manufacturing facility, which uses manufacturing equipment

imported from Germany, is located in Foshan City, Guangdong Province, PRC and

occupies more than 10,000 square meters. We currently have three production

lines for PET nonwovens with total annual capacity of 8,000 tons of nonwoven

fabric.

3

Recent

Events

Reverse

Merger

On

February 12, 2010, we acquired control of Foshan SLP Special Materials Company,

Limited (“Foshan”), our PRC-based operating company through a “reverse merger”

transaction. Upon completion of the reverse merger transaction, we

ceased to be a shell company (as that term is defined in Rule 12b-2 under the

Securities Exchange Act of 1934 (the “Exchange Act”)).

Private

Placement Transaction

On

February 12, 2010, we completed a financing transaction in which we raised gross

proceeds of $4,140,000 through a private placement of convertible notes and

warrants to certain accredited investors.

For more

information about the private placement, you should read the section of this

report entitled “Our History and Corporate Structure.”

Name

Change

On March

24, 2010, we changed our name from Perpetual Technologies to China Filtration

Technology, Inc.

On June

1, 2010, we changed our name from China Filtration Technology, Inc. to China SLP

Filtration Technology, Inc.

Planned

Initial Public Offering

On July

8, 2010, we filed a registration statement on Form S-1 with the Securities

Exchange Commission (File No: 333-168028) to register for sale to the public

4,166,677 shares of our common stock. Such registration statement is

hereinafter referred to as the Public Offering Registration Statement. The

Public Offering Registration Statement is currently being reviewed by the SEC

and has not been declared effective. We intend to use the net proceeds of that

offering to purchase polyphenylene-sulfide fiber, or PPS, manufacturing

equipment. We cannot assure you that our planned public offering will

be successful and we cannot be certain that additional funding will be available

on acceptable terms, if at all.

Executive

Offices

Our

executive offices are located at Shishan Industrial Park, Nanhai District,

Foshan City, Guangdong Province, PRC and our telephone number is (011)

757-86683197. Our corporate website is www.silepu.com. Information contained on,

or accessed through, our website is not intended to constitute and shall not be

deemed to constitute part of this report.

4

Our

Industry

We

operate in the nonwoven segment of the technical textiles industry which is one

of the fastest growing sectors of the textile industry worldwide.

Since

1985, the global market size of the technical textiles sector has grown at an

average growth rate of 3.8% per year. Total consumption of technical textiles in

2008 reached 19.6 million tons and has been projected to reach 33.8 million tons

in 2010 on a worldwide basis. (Source: Textile

Lead).

The

nonwoven fabric industry in the PRC is large and growing, driven primarily by

China’s continued economic development. China has experienced rapid economic and

industrial growth in the past 30 years. China’s output of iron and steel,

cement, coal, fertilizer and power generation all currently rank as first or

second in the world (Source:

US Department of Commerce and US Department of the Interior). China’s

consumption of raw materials currently ranks second in the world (Source: Report from the EIA Energy

Information Administration). Due to outdated technology and equipment in

China’s chemical, raw materials and energy industries, China has encountered

problems of inefficient utilization of energy and resources, as well as heavy

pollution due to accelerated urbanization. Reducing emission pollution has been

a focus for the Chinese Central Government for several years and is expected to

remain a focus moving forward. As China’s government imposes stricter policies

on environmental protection, industrial gas and dust emission limits have become

stricter. We believe this creates a significant market opportunity for the

commercialization of our PPS nonwovens materials.

China now

manufactures about 20% of the world’s nonwovens and this market share is

expected to reach 25% by 2015 according to statistics released by INDA (Association of the Nonwoven

Fabrics Industry) in North America and EDANA (European Disposables and Nonwovens

Association) in Europe.

Currently

in the PRC, there are estimated 500-600 nonwovens manufacturers producing

nonwovens on an estimated 1,000 to 1,500 lines. (Source: Chinese Technical Textiles

and Nonwovens Industry, 2009).

We

believe that there is a significant gap between the nonwovens industry in China

and the nonwovens industry in Europe and the United States in terms of technical

level, quality level, and competitiveness. China’s nonwovens market is still

emerging and we believe has a large capacity to develop and expand and we

believe that the following factors will contribute to growth in the nonwovens

industry in China and our ability to grow as a company:

|

·

|

Lack

of market segments: Nonwoven

products are used in a variety of applications. Existing markets are

expanding and new markets are emerging. China’s nonwoven

industry production capacity is still concentrated on normal traditional

products, such as polyester wadding, interlining, geo-textile, hygiene,

packaging materials and normal filtration materials. Many companies lack

clear market focus and are competing in the same market segments which

have caused capacity concentration and fierce

competition.

|

|

·

|

Strength

for market and product development is not substantial: In

China, market demand for higher technology based PET spun-bond

product is currently over 40 million cubic meters. These products are

currently all imported, mainly from Freudenberg

(Taiwan). Some of the domestic Chinese companies have

been trying to develop these products but, to date, no such products have

been launched. If these products are developed at a lower cost

in the domestic market, then the Chinese domestic market for highly

technical nonwovens will

expand.

|

5

Our

Growth Strategy

Our

growth strategy centers around the following strategic initiatives:

|

·

|

Commence

production of our PPS nonwoven fabric product. We plan to commence

production of PPS nonwoven fabric using our patent pending manufacturing

process in the early part of 2011 for sale to PRC-based operators of

coal-fired power plants, garbage incinerators and other manufacturers that

need to comply with recently adopted PRC environmental

regulations.

|

|

·

|

Expand

our manufacturing facilities. In order to commence

production of PPS nonwoven fabric, we plan to significantly expand our

manufacturing facilities and acquire three new production lines to

manufacture PPS nonwoven material. This will increase our total

annual manufacturing capacity from 8,000 tons to 11,600 tons of nonwoven

material.

|

|

·

|

Develop,

protect and commercialize our proprietary technology. We hold

a number of authorized patents and have a patent application

currently pending in the PRC for our PPS nonwoven manufacturing

process which we believe is entitled to patent protection. We

intend to apply for a process patent for this process in North America and

Europe. We intend to capitalize on our proprietary

technology by developing and commercializing our products for numerous

applications and believe our proprietary technology gives us a competitive

advantage and acts as a barrier to entry for our

competitors.

|

|

·

|

Commence

marketing and sale of our PPS products to coal fired power plants.

To capitalize on

China’s “green movement”, we plan to focus our sales efforts for our PPS

nonwoven material on coal-fired power plants as we believe it is currently

the most suitable and largest market for PPS filtration materials. The

sales to the coal-fired power plants will be made directly using our

existing sales team. We also expect to double the size of our

outside sales force to cover the PPS products and

market.

|

Our

Competitive Strengths

We

believe our competitive strengths are as follows:

|

·

|

We

offer high quality products with low production costs. We manufacture our products

using what we believe to be proprietary, low cost manufacturing processes

with quality manufacturing equipment which allows us to offer PET and PPS

nonwoven products which have lower operational and production costs than

our competitors’ products.

|

|

·

|

We

believe our PPS material is a superior product. We believe, based on

laboratory tests which we conducted internally, that our PPS nonwoven

fabric is superior to other currently available types of PPS fabric

because it is lighter, thicker, stronger, has higher air permeability and

filtration efficiency and significantly cheaper to produce and will

ultimately replace other high temperature filter materials, such as PTFE

(or teflon), fiber glass, P84 (polyimide), PBI (polybenzimidazole fiber),

PMIA and PSA. Similar to most new product offerings, widespread market

acceptance of our PPS products for use in dust bag filters by coal fired

power plants and other intended users is uncertain before a product is

launched.

|

|

·

|

Our

proprietary manufacturing processes present a significant barrier to entry

for our potential competitors. We hold a number

of authorized patents and have a patent application currently

pending in the PRC, including a process patent for the manufacture of

PPS nonwovens, and we intend to apply for a process patent in North

America and Europe for our PPS nonwoven manufacturing process.

Additionally, we have made significant investments in research and

development and we believe these proprietary processes could give us a

competitive advantage over our competitors and act as a barrier to

entry.

|

6

|

·

|

We

have efficient production and operations management. As a result of our manufacturing

equipment and proprietary manufacturing processes, we believe that we

exceed industry standards in productivity, reduction of variability and

delivery lead time for our existing products. This results in fewer

product warranty claims and greater customer

satisfaction.

|

Our

Products and Market

We

currently manufacture two types of polyester, or PET, nonwoven fabrics: (i) PET

continuous filament spun-bond thermal calendared nonwoven fabric, which we began

manufacturing in 2006; and (ii) PET filament spun-bond needle-punched

geo-membrane and waterproof fabrics, which we began manufacturing in

2009.

In our

operations and in this report, we use a variety of technical terms to describe

our products based on the manufacturing process used or raw material included in

our products. Some of these terms are described below:

“Continuous

filament” refers to strands of polymer (plastic) that are continuous as opposed

to chopped or cut to certain length.

“Spun

Bond” refers to a process of melting polymer pellets melted producing continuous

filaments that are cooled and stretched. The filaments are then cut and laid on

a moving belt to form a web.

“Thermal

Calendered” refers to a process for using heat to bond nonwoven

fabric. A calendar is a machine consisting of cylinders or rolls that

are stacked and heated to precise temperature. The nonwoven material

is passed through (pressed) the cylinders and the polymer based material is

bonded using heat and the partial melting of the polymer (plastic).

“Needlepunched”

refers to a process where precision cut fibers are distributed onto and across a

mesh substrate that is moving. The fibers are then needled (bound together

mechanically) by an oscillating needle board (the needle board consists of

thousands of evenly spaced needles). The fibers are mechanically bonded by

barbed needles entangling the fibers. The density of the fabric is controlled by

the number of needle boards used.

“Geo-membranes”

refers to types of nonwoven fabric that are permeable fabrics which are designed

and applied to be permeable in one direction only. Geo membranes

provide a waterproof barrier that allows moisture to penetrate (drain) from one

direction while limiting or eliminating the penetration (drainage) from the

opposite direction.

Polyester

(PET) filament spun-bond thermal calendared nonwoven fabrics.

Our

polyester (PET) filament spun-bond thermal calendared nonwoven fabric is made

from polyester and performs effectively in high temperatures. It is

anti-corrosive, has a long lifespan (between 1 to 2 years for filtration, 5 to

10 years for automotive applications, and 5 years for other applications) and

maintains its shape and penetration. This nonwoven is used for filtration and

water-drainage, packing and automobile interior decoration and

insulation.

Polyester (PET)

filament spun-bond needle-punched geo-membrane and waterproof

materials.

Geo-membranes

are used in engineering, heavy construction, building and pavement construction,

hydrogeology and environmental engineering. Geo-membranes are permeable fabrics

which have the ability to separate, filter, reinforce, protect and/or drain.

These products have a wide range of applications and are currently used in many

civil engineering applications including the construction of roads, airfields,

railroads, embankments, retaining structures, reservoirs, canals, dams, soil

bank protection and coastal engineering.

7

Our

geo-membrane products are made from polyester and are primarily used in the

construction industry to improve soil strength and for roof waterproofing.

Geo-membranes can be used as a cost-effective alternative to improve soil

strength instead of the conventional manner of soil nailing which is a technique

for stabilizing slopes and for constructing retaining walls from the top down.

With the use of geo-membrane, steep slopes can be planted with vegetation to

enhance the aesthetic value. In addition, our geo-membrane product line is used

for roof waterproofing based on its excellent water resistant qualities and

performance.

In

February 2009, we installed a production line with annual capacity of 4,000 tons

for the production of polyester (PET) filament, needle-punched, geo-membrane and

waterproof materials.

PPS

nonwoven fabric product

Our

growth strategy centers around the production and commercialization of our PPS

nonwoven products which are manufactured using a proprietary continuous

filament, spun-bond, needle-punched manufacturing process which we recently

developed.

Although

PPS filtration materials have been used since 1979 in bag filters that are

attached to smoke stacks in nearly 80% of the coal-fired boilers operating in

Europe and the United States, the use of bag filters made from PPS fabric is not

currently widespread in China. (Source “China Power Industry”,

issue 4, 2006, page 36 and

http://www.resinda.com/product2.asp?brand_id=10&series_id=57)

Our

proprietary PPS manufacturing process involves a PPS slice purification

technique designed to get sufficiently pure raw materials to produce PPS

filtration materials. As part of this process we have developed web

formation techniques so that filaments can be used to increase strength and

short fibers are no longer necessary. PPS nonwovens made from

filaments are stronger than PPS nonwovens made from short fibers.

Our PPS

material is produced by the filament spun-bond needle-punched

method. Our product can bear temperatures of up to 230 degrees

Celsius and is resistant to degradation caused by exposure to acid, alkali

or oxidization. In comparison to other high temperature

filtration materials, our product has a longer life (3 years at 190 - 230

degrees Celsius), is stronger (because we use filaments rather than short

fibers), and has lower operation and production costs.

Market

Demand for PPS Products

Under PRC

environmental regulations that became effective on January 1, 2010 and which are

being imposed on operators of coal-fired power plants, garbage incinerators and

cement factories, carbon and other emissions are required to be less than 50

milligrams per cubic meter by the end of 2010. Some of the larger,

more developed cities, for example Beijing and Tianjin, have adopted even more

stringent rules requiring that emissions be less than 30 milligrams per cubic

meter. (Source: "Electric Power”

May, 2008).

We

believe, based on an article published in China Nonwoven & Industrial

Textile (CNIT) in 2001, that less than 10% of the coal-boilers in China were

equipped with dust removal filtration bags and of the filtration bags in use

less than 10% are made from PPS fiber.

Initially,

we intend to market our PPS nonwovens to the coal-fired power plants in the PRC

as we believe that this is the largest and most immediately accessible market

for our PPS filtration materials. After we have established a foothold in that

market, we intend to begin marketing our PPS nonwovens to cement factories and

waste incinerators.

PTFE (or

teflon), fiber glass, P84 (polyimide), PBI (polybenzimidazole fiber), PMIA and

PSA are other materials that are also used to make needle-punched felt that is

suitable for high temperature applications such as in bag filters for coal-fired

power plants. In comparison to these other high temperature filter

materials, we believe, based on laboratory testing, that our PPS nonwoven fabric

is stronger, has lower production and operating costs, and has higher filtration

efficiency.

8

Due to

the characteristics of our PPS product coupled with the demand created by these

new regulations, we believe that our PPS material will ultimately replace other

high temperature filtration materials currently available in the market place,

such as PTFE (or teflon), fiber glass, P84 (polyimide), PBI (polybenzimidazole

fiber), PMIA and PSA and become a widely used filtration material

for use in high temperature environments such as coal-fired power plants,

garbage incinerators and cement factories.

Although

prototype bag filters made of our PPS product have been tested in laboratories,

they have not been tested on site by any potential end user and we do not expect

to develop prototypes for testing by any end user prior to beginning commercial

production.

We have

been supported by the Chinese SEPA (State Environmental Protection Agency) in

the development and application of our PPS fabric for the coal-fired power

plants. Our PPS fabric utilized in the bag filter application is the

recommended solution to the carbon emissions standard by SEPA. Mr. Su Lei,

one of our directors, is a government official within SEPA and has direct

responsibility for implementing the recently introduced carbon emission

standards at coal fired power plants. With the support of Mr. Su, we

have introduced our material as the solution to the carbon emissions control

problem to dozens of coal-fired power plants in China. All of these

meetings resulted in interest in our PPS fabric and the majority of the

coal-fired power plants we have met with have given us indications of specific

purchasing interests as soon as we produce the PPS fabric material in our new

facility.

Our

Manufacturing Facility and Production Lines

Our

manufacturing facility is located in Foshan City, Guangdong Province, PRC and

has over 10,000 square meters of operating space on 33,074 square meters of

land. Our land use rights for this facility expire in October 2052. We use

manufacturing equipment imported from Germany.

We

currently operate three spun-bond production lines. Two of these production

lines are thermal calendared lines with annual capacity of 4,000 tons of

polyester filament, thermal calendared, nonwoven fabric. The third spun-bond

line is a needle-punched production line which commenced operation in February

2009. This production line has an annual capacity of 4,000 tons of polyester

filament, needle-punched, geo-membrane and waterproofing

material. Currently, we have total annual production capacity of

8,000 tons.

We are

adding capacity to our existing manufacturing facility with a construction

project to increase the factory size, which will house our new PPS lines.

A new production line in currently being installed and is expected to be

completed in January 2011. We plan to order and install two

additional PPS lines using the proceeds of our planned initial public

offering. These three production lines will have an annual output

capacity of 3,600 tons of PPS nonwoven material. We have obtained

approval from the local foreign trade and economic cooperation bureau to install

these three new production lines for this total output capacity. To

comply with PRC environmental regulations, we are required to obtain a

construction commencement approval from the local environmental protection

bureau for the installation of a new production line currently under

construction before we begin installation.

On

November 9, 2010, we submitted the application for the construction commencement

approval for the new production line under construction to the local

environmental protection bureau and on November 10, 2010, we received comments

from them requesting us to complete the environment impact assessment of the new

production line before submitting the application for the construction

commencement approval. The environmental impact assessment is currently

being conducted by a third party authorized by the local environmental

bureau. We anticipate that it will be completed within 60 days from

commencement (on or about January 10, 2011), but we cannot assure that this will

be the case. Once the environmental impact assessment is completed, we

intend to resubmit the application for the construction commencement approval

together with the environmental impact assessment to the local environmental

protection bureau. We anticipate that the construction commencement

approval will be issued within 60 days from the submission date, but we cannot

assure that this will be the case.

9

In

addition, we are required to obtain a pollution emission permit for the disposal

of waste gases, waste water, waste dust and other waste materials. We do

not currently have a pollution emission permit, but we are preparing the

application for this permit and intend to submit the application after the new

production line is completed. The process of obtaining this permit can

take up to 5 months after the application has been submitted.

We cannot

assure you that we will be able to obtain the construction commencement approval

or the pollution emission permit in a timely manner or at all. Failure to

obtain this approval and permit may subject us to fines or disrupt our

operations and construction, which may materially and adversely affect our

business, results of operations and financial condition. See “—

Environmental Matters.”

Quality

Control

We

received the ISO9001-9002 Quality Management System Certification in 2003 and

again in 2009. We adopted what we believe to be the highest quality standards in

the industry and maintain quality control and product quality at high levels. We

have strictly embraced the ISO9001 Management System Standards in order to

integrate our quality management process and enhance the management system and

manufacturing process. We closely inspect our products to guarantee quality

according to Q/NHJL1-2008 Enterprise Quality Standards and strictly control the

manufacturing process and quality control before any products leave our

factory.

Our

Customers

We sell

our existing products to over 200 customers primarily in the PRC, and

also internationally, to manufacturers and converters, which incorporate

our products into their finished goods.

In fiscal

year 2010, approximately 84% of our net sales were to entities in the PRC and

approximately 7% and approximately 9% were made to customers in North America

and Europe and other regions, respectively. In fiscal year

2009, approximately 81% of our net sales were to entities in the PRC and

approximately 6% and approximately 7% were made to customers in North America

and Europe, respectively.

: Dalian

Geolink Geotextile Material Co., Ltd., our largest customer, accounted for

approximately 10.3% of our fiscal year 2010 net sales. In fiscal year

2009, net sales to this customer accounted for 4.92% of our net

sales.

Sales to

our top 20 customers represented approximately 65% of our total net sales in

fiscal year 2010.

The

following chart shows our top ten customers in fiscal year 2010

|

Name

|

Location

|

Product

Type

|

Application

|

Revenue

(USD$)

|

Percentage

of Sales

|

|||||||||

|

Geolink Geotextile Material

Co., Ltd

|

Dalian

|

Geotextile

|

Construction

|

2,054,787 | 10.30 | % | ||||||||

|

Chendu

Sanya Building Material Co., Ltd.

|

Chengdu

|

Geotextile

|

Construction

|

1,816,293 | 9.10 | % | ||||||||

|

WuJiang

Jing shan Fabric

|

Suzhou

|

PET

|

Filtration

|

1,731,611 | 8.68 | % | ||||||||

|

Pentair

Water Pool & Spa Inc

|

USA

|

PET

|

Filtration

|

1,322,095 | 6.63 | % | ||||||||

|

Zhuzhou

Shidai

|

Shanghai

|

PET

|

Construction

|

1,047,566 | 5.25 | % | ||||||||

|

Shanghai

Rundong Nonwoven Fabric Co., Ltd

|

Shanghai

|

PET

|

Filtration

|

856,147 | 4.29 | % | ||||||||

|

Xiantao

Ruixin

|

Hubei

|

Geotextile

|

Construction

|

760,395 | 3.81 | % | ||||||||

|

Guangzhou

Baiyun Meihao Filter Cleaner Factory

|

Guangzhou

|

PET

|

Filtration

|

560,284 | 2.81 | % | ||||||||

|

Nordic

Air Filtration A/S

|

Denmark

|

PET

|

Filtration

|

486,086 | 2.44 | % | ||||||||

|

Nan

Hai Ying Sheng Trading Ltd

|

Guangdong

|

PET

|

Filtration

|

452,243 | 2 | % | ||||||||

10

Sales to

our top 20 customers represented approximately 49% of our total net sales in

fiscal year 2009.

The

following chart shows our top ten customers in fiscal year 2009:

|

Name

|

Location

|

Product

Type

|

Application

|

Revenue

(USD$)

|

Percentage of

Sales

|

|||||||||

|

Chendu

Sanya building Material Co., Ltd.

|

Chengdu

|

Geotextile

|

Construction

|

1,068,438 | 9.01 | % | ||||||||

|

Xiantao

Ruixin

|

Xiantao

|

Geotextile

|

Construction

|

1,037,883 | 8.75 | % | ||||||||

|

Sichuan

Tianqiang

|

Sichuan

|

Geotextile

|

Construction

|

706,286 | 5.95 | % | ||||||||

|

Geolink

Geotextile Material Co. Ltd.

|

Dalian

|

Geotextile

|

Construction

|

583,192 | 4.92 | % | ||||||||

|

Shenzhen

Yaming Civil Engineering Equipment Co.,

|

Shenzhen

|

PET

|

Filtration

|

570,567 | 4.81 | % | ||||||||

|

Pentair

Water

|

USA

|

PET

|

Filtration

|

517,467 | 4.36 | % | ||||||||

|

Guangzhou

Baiyun Meihao Filter Cleaner Factory

|

Guangzhou

|

PET

|

Filtration

|

435,380 | 3.67 | % | ||||||||

|

Shanghai

Rundong Nonwoven Fabric Co., Ltd.

|

Shanghai

|

PET

|

Filtration

|

422,559 | 3.56 | % | ||||||||

|

Foshan

Nanhai Yingsheng Trading Co., Ltd.

|

Foshan

|

PET

|

Trading

|

257,546 | 2.17 | % | ||||||||

|

Guangzhou

Groundsill Basis Engineering Co., Ltd.

|

Guangzhou

|

PET

|

Filtration

|

227,259 | 1.92 | % | ||||||||

Raw

Materials

The

primary raw material that we use to manufacture most of our products is

polyester resin. The price of polyester resin fluctuates based on capacity,

demand and the price of crude oil.

Our major

suppliers of raw materials are Foshan Chemical Fibers Co., Ltd., Kaiping Chunhui

Co., Ltd., and Zhuhai Yuhua Polyester Co., Ltd. We believe that the

loss of any one or more of our suppliers would not have a long-term material

adverse effect on our business because other manufacturers with whom we conduct

business would be able to fulfill our requirements. We do not have long term

supply contracts with any of our suppliers of raw materials.

During

fiscal years 2010 and 2009, we paid approximately $10.9 million and $5.6

million, respectively, for the purchase of raw materials.

Our PPS

product will be made from high quality polyphenylene sulfide resin, which we

intend to purchase in the United States. Accordingly, the cost of this raw

material will fluctuate with the value of the RMB against the

dollar.

Sales

and Marketing

Our

nonwoven products are distributed in 20 provinces in the PRC. In

2003, we began selling our products in Europe, North America and South East

Asia.

In fiscal

year 2010, approximately 84% and 16% of our sales revenues were generated from

sales made in the PRC and internationally, respectively, compared to

approximately 81% and 19%, respectively, in fiscal year 2009.

11

As of

September 30, 2010, we employed 11 direct sales representatives, 8 of whom are

engineers who have advanced technical knowledge of our products and the

applications for which they are used. 7 of these sales representatives are

responsible for national sales and 4 are responsible for international sales. We

plan to double the size of our sales force for the PPS product line in the

next year to take advantages of an anticipated market for our products.

Representatives receive a salary plus commission of the revenues they

generate.

Our sales

process consists of identifying potential customers through cold calls,

responses to marketing efforts, and customer referrals. Once a potential

customer is identified, our sales people aid in identifying the prospect’s

technical requirements and help the customer’s engineers to produce drawings of

the finished products desired. Armed with this technical information, our sales

personnel then quote pricing, production quantities, and lead times. Most of our

customers are repeat customers and the sales force is also responsible for

after-sale support, including quality assurances, dispute resolution, and

relationship-building.

We

promote our products primarily through exhibitions, internet advertising and

marketing, and referrals from existing customers as well as

suppliers.

We intend

to capitalize on China’s “green” movement. We will focus our sales

efforts for our PPS nonwoven fabric material on operators of coal-fired power

plants as this is currently the most suitable and largest market for PPS

filtration materials. The sales to the coal-fired power plants will be made

directly using our existing sales team and sales process described

above.

12

Research

and Development

Our

research and development department has what we believe to be one of the

strongest research and development capabilities in the development of products,

processes and equipment in the nonwovens industry in China.

As of

September 30, 2010, our research and development staff consisted of 20

scientists, professional, engineering and technical personnel. Our research and

development team is lead by Mr. Yao Mu, a senior engineer in the industry and

the former president of Northwestern Polytechnical University.

We spent

approximately $200,000 for each of the last two fiscal years on research and

development activities.

In

addition, we believe that each of our senior managers possesses a

comprehensive technical background. Mr. Li Jie, our chief executive officer and

a senior engineer is a certified chemical engineer, the Associate President of

the China Industrial Textile Association and is considered an expert in his

field. His independent research has been funded by the Central Government. Mr.

Ye Xi-Ping, Vice President of Production, is a senior engineer and certified

automation engineer.

Intellectual

Property

We have

three utility model patents and one patent application:

|

Name

|

|

Applicant

|

|

Patent

Application

Date

|

|

Patent

Application

Number

|

|

Basis for

patent

|

|

Status

|

|

Polyphenylene

sulfide nonwoven spunbond needle production method and

device

|

Foshan

SLP Special Materials Company

|

January 26, 2010

|

2010101026602

|

Invention

|

Pending

|

|||||

|

Tube-type

air distraction apparatus

|

Dalian

Huayang Chemical Fiber Engineering technology Co., Ltd

|

March

12, 2009

|

200920011528.3

|

Utility

model

|

Authorized

|

|||||

|

New

spinning box structure

|

Dalian

Huayang Chemical Fiber Engineering technology Co., Ltd

|

March

12, 2009

|

200920011529.8

|

Utility

model

|

Authorized

|

|||||

|

Lapper

|

Dalian

Huayang Chemical Fiber Engineering technology Co., Ltd

|

March

19, 2009

|

200920012058.2

|

Utility

model

|

Authorized

|

The three

utility model patents were applied for and were originally owned by Dalian

Huayang Chemical Fiber Engineering Technology Co., Ltd., or Dalian. Dalian has

taken steps to transfer the three utility patents to Foshan and the State

Intellectual Property in the PRC approved the transfer of these three utility

patents from Dalian to Foshan on March 29, 2010.

The

duration of utility model rights in the PRC is 10 years from the application

date and the duration of invention rights in the PRC is 20 years from the

application date.

13

Our

patent application for our process invention is currently pending. No

significant patents are expected to expire in the next five years. We expect

that additional patent applications will be filed as more processes are

developed and specific applications are identified.

We have

the following registered trademarks in the PRC:

|

Trademark

|

Registration

Number

|

Term of Validity

|

|||

|

Jinglong

Nonwoven

|

3571234 |

October 21, 2005 to

October 20, 2015

|

|||

|

Si

Le Pu

|

7161478 |

September

28, 2010 to September 27, 2020

|

|||

|

Graphic

|

7162185 |

October

14, 2010 to October 13,

2020

|

|||

We have

the following additional trademark application:

|

Trademark

Application

|

Application

Number

|

Application Date

|

|||

|

S.L.P

|

7161477 |

January

12, 2009

|

|||

To

safeguard our proprietary knowledge, trade secrets, and technology, we rely

heavily on trade secret protection and non-disclosure/confidentiality agreements

with our employees, consultants and third party collaboration partners with

access to our confidential information.

Competition

We

primarily face domestic competition in our industry. Our main competitors in the

PRC are Jiangxi Guoqiao Industrial Corporation Limited and Shaoxing Yaolong

Spunbonded Nonwoven Technology Co., Ltd. We compete based on our reputation for

quality, product innovation, performance, service and technical support.

Our

competitors in PPS nonwoven fabric industry will be other

manufacturers of PPS material and other materials that are suitable to make bag

filters to be used in coal-fired power plants, garbage incinerators and cement

plants and other potential end users.

Environmental

Matters

As a

manufacturer we are subject to a broad range of national, provincial and local

laws and regulations relating to the pollution and protection of the

environment. Among the many environmental laws applicable to us are laws

relating to air emissions, wastewater discharges and the handling, disposal and

release of solid and hazardous substances and wastes.

In

addition, we are required to obtain a construction commencement approval and a

completion examination approval for each of our three new production lines. We

are adding capacity to our existing manufacturing facility with a construction

project to increase the factory size, which will house our new PPS line(s). A

new production line is currently being installed. The installation is

expected to be completed in January 2011. We plan to order and install two

additional PPS lines using the proceeds of our planned initial public offering.

We have obtained approval from the local foreign trade and economic

cooperation bureau to install these three new production lines for this total

output capacity. To comply with PRC environmental regulations, we are required

to obtain a construction commencement approval from the local environmental

protection bureau for the installation of a new production line currently under

construction before we begin installation.

14

On

November 9, 2010, we submitted the application for the construction commencement

approval for the new production line under construction to the local

environmental protection bureau and on November 10, 2010, we received comments

from them requesting us to complete the environment impact assessment of the new

production line before submitting the application for the construction

commencement approval. The environmental impact assessment is currently

being conducted by a third party authorized by the local environmental

bureau. We anticipate that it will be completed within 60 days from

commencement (on or about January 10, 2011), but we cannot assure that this will

be the case. Once the environmental impact assessment is completed, we

intend to resubmit the application for the construction commencement approval

together with the environmental impact assessment to the local environmental

protection bureau. We anticipate that the construction commencement

approval will be issued within 60 days from the submission date, but we cannot

assure that this will be the case.

In

addition, we are required a pollution emission permit for the disposal of waste

gases, waste water, waste dust and other waste materials. We do not

currently have a pollution emission permit, but we are preparing the application

for this permit and intend to submit the application after the new production

line is completed. The process of obtaining this permit after the

application has been submitted can take up to 5 months.

We cannot

assure you that we will be able to obtain the construction commencement approval

or the pollution emission permit in a timely manner or at all. Failure to

obtain this approval and permit may subject us to fines or disrupt our

operations and construction, which may materially and adversely affect our

business, results of operations and financial condition. As of

December 19, 2010, no such penalties had been imposed on us.

Insurance

We

maintain worker's insurance and social welfare insurance for our employees. Our

operating subsidiary, Foshan, has not purchased social insurance for all of its

employees, as of December 28, 2010, the accumulated unpaid amount is

approximately RMB 1.49 million (approximately $216,493). If the local labor

authority orders us to pay unpaid insurance premiums, we may become obligated to

do so thereby increasing our labor costs. We provide life insurance

to our executive officers and D & O insurance for two of our independent

directors. We do not presently maintain product liability insurance.

We maintain property and equipment insurance; however, it does not cover the

full value of our property and equipment, which leaves us exposed in the event

of loss or damage to our properties or claims filed against us. Other than the

above mentioned, we do not maintain any other business or liability

insurance.

Employees

As of

December 15, 2010, we had a total of 176 employees, including over 20 engineers.

The following chart shows the number of our employees involved in the various

aspects of our business:

|

Category

|

Number of Employees

|

|||

|

Manufacturing

|

109 | |||

|

Sales

and Marketing

|

11 | |||

|

Research

and Development

|

5 | |||

|

Administrative

|

11 | |||

|

Finance

|

4 | |||

|

Quality

Control

|

8 | |||

|

Equipment

|

15 | |||

|

Logistics

|

13 | |||

Employee

compensation is composed of a salary plus subsidies based on position, education

level, length of service and performance.

15

PRC

Government Regulations

Business

license

A company

that conducts business in the PRC must have a business license that usually

prescribes a scope of business likely to be conducted. Our business license

covers our present business to manufacture and sell nonwoven fabrics overseas

and domestically. Prior to expanding our business beyond the scope of our

business license, we are required to apply for and receive approval from the PRC

government.

Employment

laws

On

June 29, 2007, the Standing Committee of the National People’s Congress of

the PRC promulgated the Labor Contract Law of

PRC, or the Labor Contract Law, which became effective as of January 1,

2008. On September 18, 2008, the PRC State Council issued the

Implementing Rules for the PRC Labor Contract Law, which became effective as of

the date of issuance. The Labor Contract Law and its implementing rules

impose requirements concerning, among others, the types of contracts to be

executed between an employer and its employees and establish time limits for

probationary periods and for how long an employee can be placed in a fixed-term

labor contract. The Labor Contract Law and its implementation rules also

impose greater liabilities on employers, require certain terminations to be

based upon seniority rather than merit and significantly affect the cost of an

employer’s decision to reduce its workforce. In addition, according to the Labor

Contract Law and its implementing rules, if an employer intends to enforce the

non-compete provision with its employees in the labor contracts or

confidentiality agreements, it has to compensate its employees on a monthly

basis during the term of the restriction period after the termination or ending

of the labor contract. The Labor Contract Law also requires employers in

most cases to provide a severance payment to their employees after their

employment relationships are terminated. Due to the limited period

of effectiveness of the Labor Contract Law and its implementing rules and the

lack of clarity with respect to their implementation and potential penalties and

fines, it is uncertain how it will impact our current employment policies and

practices.

Environmental

regulations

We are

subject to various national and local environmental laws and regulations,

including those governing the use, discharge and disposal of hazardous

substances in the ordinary course of our manufacturing process. The major

environmental regulations applicable to us include the PRC Environmental

Protection Law, the PRC Environmental Impact Assessment Law, the PRC Regulation

on the Administration of Construction Project Environmental Protection, the PRC

Law on the Prevention and Control of Water Pollution and its Implementation

Rules, the PRC Law on the Prevention and Control of Air Pollution and its

Implementation Rules, the PRC Law on the Prevention and Control of Solid Waste

Pollution, and the PRC Law on the Prevention and Control of Noise

Pollution.

In

accordance with the PRC Environmental Impact Assessment Law and the PRC

Regulation on the Administration of Construction Project Environmental

Protection, we are required to obtain a construction commencement

approval and a completion examination approval for each of our three

finished production lines and we are also required to obtain a construction

commencement approval from the local environmental protection bureau for one of

our production lines that is currently under

construction. We have received construction commencement

approval and the completion examination approval for our three finished

production lines. However, we have not obtained the construction

commencement approval for the new production line under construction and the

pollution emission permits from the local environmental protection

bureau.

On

November 9, 2010, we submitted the application for the construction commencement

approval for the new production line under construction to the local

environmental protection bureau and on November 10, 2010, we received comments

from them requesting us to complete the environment impact assessment of the new

production line before submitting the application for the construction

commencement approval. The environmental impact assessment is currently

being conducted by a third party authorized by the local environmental

bureau. We anticipate that it will be completed within 60 days from

commencement (on or about January 10, 2011), but we cannot assure that this will

be the case. Once the environmental impact assessment is completed, we

intend to resubmit the application for the construction commencement approval

together with the environmental impact assessment to the local environmental

protection bureau. We anticipate that the construction commencement

approval will be issued within 60 days from the submission date, but we cannot

assure that this will be the case.

16

In

addition, we are required to obtain a pollution emission permit for the disposal

of waste gases, waste water, waste dust and other waste materials. We do

not currently have a pollution emission permit, but we are preparing the

application for this permit and intend to submit the application after the new

production line is completed. The process of obtaining this permit after

the application has been submitted can take up to 5 months.

We cannot

assure you that we will be able to obtain the construction commencement approval

or the pollution emission permit in a timely manner or at all. Failure to

obtain this approval and permit may subject us to fines or disrupt our

operations and construction, which may materially and adversely affect our

business, results of operations and financial condition.

Patent

protection in China

The PRC’s

intellectual property protection regime is consistent with those of other modern

industrialized countries. The PRC has domestic laws for the protection of rights

in copyrights, patents, trademarks and trade secrets.

The PRC

is also a signatory to most of the world’s major intellectual property

conventions, including:

|

—

|

Convention establishing the World

Intellectual Property Organization (WIPO Convention) (June 4,

1980);

|

|

—

|

Paris Convention for the

Protection of Industrial Property (March 19,

1985);

|

|

—

|

Patent Cooperation Treaty

(January 1, 1994); and

|

|

—

|

The Agreement on Trade-Related

Aspects of Intellectual Property Rights (TRIPs) (December 11,

2001).

|

Patents

in the PRC are governed by the China Patent Law and its Implementing

Regulations, each of which went into effect in 1985. Amended versions of

the China Patent Law and its Implementing Regulations came into effect in 2008

and 2010, respectively.

The PRC

is signatory to the Paris Convention for the Protection of Industrial Property,

in accordance with which any person who has duly filed an application for a

patent in one signatory country shall enjoy, for the purposes of filing in the

other countries, a right of priority during the period fixed in the convention

(12 months for inventions and utility models, and 6 months for industrial

designs).

The

Patent Law covers three kinds of patents, namely, patents for inventions,

utility models and designs. The Chinese patent system adopts the principle of

first to file. Therefore, where more than one person files a patent application

for the same invention, a patent can only be granted to the person who first

filed the application. Consistent with international practice, the PRC

only allows the patenting of inventions or utility models that possess the

characteristics of novelty, inventiveness and practical applicability. For a

design to be patentable, it cannot be identical with or similar to any design

which, before the date of filing, has been publicly disclosed in publications in

the country or abroad or has been publicly used in the country, and should not

be in conflict with any prior right of another.

17

PRC law

provides that anyone wishing to exploit the patent of another must enter

into a written licensing contract with the patent holder and pay the patent

holder a fee. One broad exception to this rule, however, is that, where a party

possesses the means to exploit a patent but cannot obtain a license from the

patent holder on reasonable terms and in reasonable period of time, the PRC

State Intellectual Property Office, or SIPO, is authorized to grant a compulsory

license. A compulsory license can also be granted where a national emergency or

any extraordinary state of affairs occurs or where the public interest so

requires. The patent holder may appeal such decision within three months from

receiving notification by filing a suit in a people’s court.

PRC law

defines patent infringement as the exploitation of a patent without the

authorization of the patent holder. Patent holders who believe their patent is

being infringed may file a civil suit or file a complaint with a PRC local

Intellectual Property Administrative Authority, which may order the infringer to

stop the infringing acts. A preliminary injunction may be issued by the

People’s Court upon the patentee’s or the interested parties’ request before

instituting any legal proceedings or during the proceedings. Damages in

the case of patent infringement is calculated as either the loss suffered

by the patent holder arising from the infringement or the benefit gained by the

infringer from the infringement. If it is difficult to ascertain damages in this

manner, damages may be reasonably determined in an amount ranging from one or

more times the license fee under a contractual license. The infringing party may

be also fined by the Administration of Patent Management in an amount of up to

four times the unlawful income earned by such infringing party. If there is no

unlawful income so earned, the infringing party may be fined in an amount of up

to RMB200,000, or approximately $29,500.

Value

added tax

Pursuant

to the Provisional Regulation of China on Value Added Tax and their implementing

rules, all entities and individuals that are engaged in the sale of goods, the

provision of repairs and replacement services and the importation of goods in

China are generally required to pay VAT at a rate of 17.0% of the gross sales

proceeds received, less any deductible VAT already paid or borne by the

taxpayer. When exporting goods, the exporter is entitled to a portion or

all of the refund of VAT that it has already paid or borne. We are subject to

the foresaid rules, and currently we are required to pay VAT at a rate of 17% in

our sale or importation of goods while we are entitled to VAT refund at the rate

of 16% for our exported goods. We do not enjoy any VAT deduction or

exemption treatment.

Foreign

currency exchange

Under the

PRC foreign currency exchange regulations applicable to us, the Renminbi is

convertible for current account items, including the distribution of dividends,

interest payments, trade and service-related foreign exchange transactions.

Conversion of Renminbi for capital account items, such as direct investment,

loan, securities investment and repatriation of investment, however, is still

subject to the approval of the PRC State Administration of Foreign Exchange, or

SAFE. Foreign-invested enterprises may only buy, sell and/or remit foreign

currencies at those banks authorized to conduct foreign exchange business after

providing valid commercial documents and, in the case of capital account item

transactions, obtaining approval from the SAFE. Capital investments by

foreign-invested enterprises outside of China are also subject to limitations,

which include approvals by the Ministry of Commerce, the SAFE and the National

Development and Reform Commission. We currently do not hedge

our exposure to fluctuations in currency exchange rates.

Mandatory

statutory reserve and dividend distributions

Under

applicable PRC regulations, foreign-invested enterprises in China may pay

dividends only out of their accumulated profits, if any, determined in

accordance with PRC accounting standards and regulations. In addition, a

foreign-invested enterprise in China is required to set aside at least 10.0% of

its after-tax profit based on PRC accounting standards each year for its general

reserves until the cumulative amount of such reserves reaches 50.0% of its

registered capital. These reserves are not distributable as cash dividends. The

board of directors of a foreign-invested enterprise has the discretion to

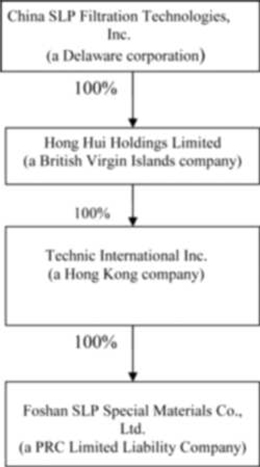

allocate a portion of its after-tax profits to staff welfare and bonus funds,