Attached files

| file | filename |

|---|---|

| EX-23.1 - Innolog Holdings Corp. | v206715_ex23-1.htm |

AS

FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON DECEMBER 30,

2010

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-1

REGISTRATION

STATEMENT

UNDER

THE SECURITIES ACT OF 1933

INNOLOG

HOLDINGS CORPORATION

(Exact

name of registrant as specified in its charter)

|

Nevada

|

68-048-2472

|

|

|

(State

or other jurisdiction of

|

(Primary

Standard Industrial

|

(IRS

Employee Identification No.)

|

|

incorporation

or organization)

|

Classification

Code Number)

|

4000

Legato Road, Suite 830

Fairfax, VA 22033

(703)

766-1412

(Address,

including zip code, and telephone number,

including

area code, of registrant’s principal executive offices)

Capitol

Corporate Services

202

South Minnesota St.

Carson

City, NV 89703

(800)

899-0490

(Name,

address, including zip code, and telephone number,

including

area code, of agent for service)

COPIES

TO:

William

P. Danielczyk

Executive

Chairman

Innolog

Holdings Corporation

4000

Legato Road, Suite 830

Fairfax, VA 22033

Kevin

Friedmann, Esq.

Richardson

& Patel, LLP

750

Third Avenue, 9th

Floor

New

York, New York 10017

Phone:

(212) 561-5559

Fax:

(917) 591-6898

APPROXIMATE

DATE OF COMMENCEMENT OF PROPOSED SALE TO THE PUBLIC: FROM TIME TO TIME AFTER THE

EFFECTIVE DATE OF THIS REGISTRATION STATEMENT.

If any of

the securities being registered on this Form are to be offered on a delayed or

continuous basis pursuant to Rule 415 under the Securities Act of 1933, check

the following box. x

If this

form is filed to register additional securities for an offering pursuant to Rule

462(b) under the Securities Act, please check the following box and list the

Securities Act registration statement number of the earlier effective

registration statement for the same offering. ¨

If this

form is a post-effective amendment filed pursuant to Rule 462(c) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same

offering. ¨

If this

form is a post-effective amendment filed pursuant to Rule 462(d) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same

offering. ¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large

accelerated filer ¨

|

Accelerated

filer ¨

|

|

|

Non-accelerated

filer ¨ (Do

not check if a smaller reporting company)

|

Smaller

reporting company x

|

CALCULATION

OF REGISTRATION FEE

|

Amount to be

Registered

(1)

|

Proposed

Maximum

Offering

Price Per

Share

|

Proposed

Maximum

Aggregate

Offering

Price

|

Amount of

Registration

Fee

|

|||||||||||||

|

Title of Each

Class of Securities to be Registered

|

||||||||||||||||

|

Common

stock, par value $0.001 per share,

|

8,882,545 | $ | 0.035 | (2) | $ | 310,889.08 | $ | 36.09 | ||||||||

|

Common

stock, par value $0.001 per share, issuable upon conversion of Series A

Convertible Preferred Stock

|

37,394,758 | $ | 0.035 | (3) | $ | 1,308,816.53 | $ | 151.95 | ||||||||

|

Total

|

46,277,303 | $ | 1,619,705.61 | $ | 188.04 | |||||||||||

|

(1)

|

Pursuant

to Rule 416 under the Securities Act of 1933, this Registration Statement

also covers any additional securities that may be offered or issued in

connection with any stock split, stock dividend or similar

transaction.

|

|

(2)

|

Estimated

solely for the purpose of calculating the registration fee pursuant to

Rule 457(c) under the Securities Act of 1933, based on $0.035, the average

of the bid and ask prices of the registrant’s common stock on December 27,

2010.

|

|

(3)

|

Calculated

in accordance with Rule 457(g) of the Securities Act of

1933.

|

The registrant hereby amends this

Registration Statement on such date or dates as may be necessary to delay

its effective date until the registrant shall file a further amendment which

specifically states that this Registration Statement shall thereafter become

effective in accordance with Section 8(a) of the Securities Act, as amended, or

until this Registration Statement shall become effective on such date as the

Commission, acting pursuant to Section 8(a), may

determine.

The

information in this prospectus is not complete and may be

changed. The selling stockholders may not sell these securities until

the registration statement filed with the Securities and Exchange Commission is

effective. This prospectus is not an offer to sell these securities

and is not soliciting an offer to buy these securities in any jurisdiction where

the offer or sale is not permitted.

SUBJECT

TO COMPLETION, DATED DECEMBER 30, 2010

PROSPECTUS

INNOLOG

HOLDINGS CORPORATION

46,277,303shares

of common stock

This

prospectus covers the resale by selling stockholders named on page 49 of up

to 46,277,303 shares of our common stock, $0.001 par value, which

include:

|

|

·

|

8,882,545 shares of common stock;

and

|

|

|

·

|

37,394,758 shares of common stock issuable

upon conversion of Series A Convertible Preferred

Stock.

|

These

securities will be offered for sale by the selling stockholders identified in

this prospectus in accordance with the methods and terms described in the

section of this prospectus titled “Plan of Distribution.” We will not

receive any of the proceeds from the sale of these shares. The selling

stockholders may be deemed “underwriters” within the meaning of the Securities

Act of 1933, as amended, in connection with the sale of their common stock under

this prospectus. We will pay all the expenses incurred in connection with

the offering described in this prospectus, with the exception of brokerage

expenses, fees, discounts and commissions, which will all be paid by the selling

stockholders. Our common stock is more fully described in the section

of this prospectus titled “Description of Securities.”

The

prices at which the selling stockholders may sell the shares of common stock

that are part of this offering will be determined by the prevailing market price

for the shares at the time the shares are sold, a price related to the

prevailing market price, at negotiated prices or prices determined, from time to

time, by the selling stockholders. See the section of this prospectus

titled “Plan of Distribution.”

Our

common stock is currently quoted on the OTC Bulletin Board under the symbol

“INHC.” On December 28, 2010, the closing price of our common stock was

$0.02 per share.

AN

INVESTMENT IN OUR COMMON STOCK INVOLVES A HIGH DEGREE OF RISK. SEE “RISK

FACTORS” BEGINNING ON PAGE 5.

NEITHER

THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS

APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR

ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A

CRIMINAL OFFENSE.

The date

of this prospectus is _______________

TABLE

OF CONTENTS

|

Prospectus

Summary

|

3

|

|

Risk

Factors

|

5

|

|

Special

Note Regarding Forward Looking Statements

|

22

|

|

Use

of Proceeds

|

23

|

|

Market

for Common Equity

|

23

|

|

Management’s

Discussion and Analysis of Financial Conditions and Results of

Operations

|

24

|

|

Changes

in and Disagreements with Accountants on Accounting and Financial

Disclosure

|

32

|

|

Business

|

32

|

|

Description

of Property

|

38

|

|

Legal

Matters

|

38

|

|

Directors

and Executive Officers

|

39

|

|

Executive

Compensation

|

45

|

|

Certain

Relationships and Related Transactions and Director

Independence

|

46

|

|

Selling

Stockholders

|

49

|

|

Plan

of Distribution

|

56

|

|

Security

Ownership of Certain Beneficial Owners and Management

|

58

|

|

Description

of Securities

|

60

|

|

Disclosure

of Commission Position of Indemnification for Securities Act

Liabilities

|

60

|

|

Transfer

Agent and Registrar

|

62

|

|

Interests

of Named Experts and Counsel

|

62

|

|

Experts

|

62

|

|

Where

You Can Find More Information

|

62

|

|

Index

to Financial Statements – September 30, 2010

|

|

|

Index

to Financial Statements – December 31, 2009

|

PROSPECTUS

SUMMARY

This

summary highlights information contained elsewhere in this

prospectus. It does not contain all of the information that you

should consider before investing in our common stock. You should read

the entire prospectus carefully, including the section titled “Risk Factors” and

our consolidated financial statements and the related notes. You

should only rely on the information contained in this prospectus. We

have not, and the selling stockholders have not, authorized any other person to

provide you with different information. This prospectus is not an

offer to sell, nor is it seeking an offer to buy, these securities in any state

where the offer or sale is not permitted. The information in this

prospectus is accurate only as of the date on the front cover, but the

information may have changed since that date.

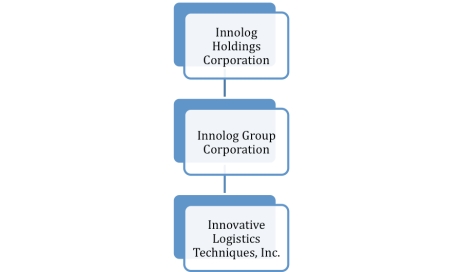

Unless

the context otherwise requires, when we use the words “Innolog,” “the Company,”

“we,” “us” or “our company” in this prospectus, we are referring to Innolog

Holdings Corporation., a Nevada corporation, and all of its

subsidiaries.

OUR

COMPANY

Through

our subsidiary, Innovative Logistics Techniques, Inc. (“Innovative”), we provide

logistics services to government agencies and to private

business. These services allow our customers to manage the flow of

goods, information or other resources. Innovative began its business

in March 1989. Currently, our largest customer is the U.S. government

and we provide most of our services to the U.S. Departments of Army and

Navy. Our goal is to expand our business through the acquisition of

additional contracts and by acquiring businesses that provide services to

government. Innovative is the first such acquisition.

Our

principal executive offices are located at 4000 Legato Road, Suite 830, Fairfax,

Virginia 22033. Our telephone number is (703) 766-1412, and our fax

number is (703) 766-1425. We also have five additional offices

located in Washington D.C., Tennessee and Florida.

MERGER

TRANSACTION

On August

18, 2010, uKarma Corporation, GCC Merger Sub Corp., uKarma Corporation’s

wholly-owned Nevada subsidiary (“Merger Sub”), Galen Capital Corporation, a

Nevada corporation (“Galen”), and Innolog Holdings Corporation, a Nevada

corporation (“Innolog”) completed a merger (the “Merger”) pursuant to an Amended

and Restated Merger Agreement dated August 11, 2010 (the “Merger

Agreement”). The Merger Agreement provided that Innolog would be

merged with Merger Sub such that Innolog would become uKarma Corporation’s

wholly-owned subsidiary. Pursuant to the Merger Agreement, the

Innolog common stockholders received one share of uKarma Corporation’s common

stock for every share of Innolog common stock they held (“Common Stock

Ratio”). Likewise, holders of Innolog Series A Preferred Stock

received one share of uKarma Corporation’s Series A Preferred Stock for every

share of Innolog Series A Preferred Stock they held. Holders of

options and warrants to purchase Innolog common stock received comparable

options and warrants to purchase uKarma Corporation’s common stock with the

exercise price and number of underlying shares proportional to the Common Stock

Ratio. Innolog also paid uKarma Corporation $525,000 in cash (which

included past advances from Galen) in connection with the

Merger. Following the Merger, uKarma Corporation changed its name to

Innolog Holdings Corporation. A complete description of the Merger

can be found in our Current Report on Form 8-K, as it was amended, which was

originally filed with the Securities and Exchange Commission on August 16,

2010.

THE

OFFERING

In

conjunction with the Merger, we agreed to register for sale the shares of our

common stock received by the Innolog stockholders, who are identified in the

section of this prospectus titled “Selling Stockholders.” The shares

consist of:

|

|

·

|

8,882,545

shares of common stock issued pursuant to the Merger Agreement;

and

|

3

|

|

·

|

37,394,758

shares of common stock underlying Series A Convertible Preferred Stock

issued pursuant to the Merger Agreement and in transactions other than the

Merger.

|

Immediately

prior to the Merger and the issuance of the common stock and Series A

Convertible Preferred Stock specified above, we had 4,747,319 shares of common

stock outstanding, not including the following:

|

|

·

|

13,451,980

shares of common stock issuable upon the exercise of outstanding stock

options granted pursuant to our 2006 Stock Option, Deferred Stock and

Restricted Stock Plan at exercise prices ranging from $0.50 to $2.22 per

share;

|

|

|

·

|

177,884

shares of common stock reserved for awards under our 2006 Stock Option,

Deferred Stock and Restricted Stock Plan which have not yet been

issued;

|

|

|

·

|

1,760,000

shares of common stock issuable upon the exercise of warrants held by

eight individuals, some of which are directors of Innolog, with an

exercise price of $0.0227 per share and an expiration date of March 31,

2016, issued pursuant to a loan agreement in consideration of a loan and

loan guarantee provided by those individuals to Innolog in connection with

its acquisition of Innovative;

|

|

|

·

|

40,771,856

shares of common stock issuable upon the exercise of warrants issued

pursuant to the Merger Agreement and in transactions other than the

Merger, with an exercise price of $0.50 per share and expiration dates

ranging from June 1 to November 1, 2015;

and

|

|

|

·

|

142,272 shares

of common stock issuable upon the exercise of warrants outstanding prior

to the consummation of the Merger

Agreement.

|

If all of

the outstanding options and warrants specified above are exercised and our

outstanding shares of Series A Convertible Preferred Stock are converted to

common stock, we will have a total of 107,150,730 shares of common stock issued

and outstanding.

Information

regarding our common stock is included in the section of this prospectus titled

“Description of Securities to be Registered.”

The

shares of common stock offered under this prospectus may be sold by the selling

stockholders in the public market, in negotiated transactions with a

broker-dealer or market maker as principal or agent, or in privately negotiated

transactions not involving a broker or dealer. Information regarding the

selling stockholders, the common shares they are offering to sell under this

prospectus, and the times and manner in which they may offer and sell those

shares is provided in the sections of this prospectus titled “Selling

Stockholders” and “Plan of Distribution.” We will not receive any of the

proceeds from those sales. The registration of common shares

pursuant to this prospectus does not necessarily mean that any of those shares

will ultimately be offered or sold by the selling

stockholders.

4

RISK

FACTORS

This

offering involves a high degree of risk. You should carefully

consider the risks described below and the other information in this prospectus,

including our financial statements and the notes to those statements, before you

purchase our common stock. The risks and uncertainties described

below are those that we currently believe may materially affect our

company. Additional risks and uncertainties may also impair our

business operations. If the following risks actually occur, our

business, financial condition and results of operations could be seriously

harmed, the trading price of our common stock could decline and you could lose

all or part of your investment.

RISKS

RELATED TO CHANGES IN ECONOMIC AND POLITICAL CLIMATE

Current

or worsening economic conditions could adversely affect our

business.

The

United States and global economies are currently experiencing a period of

substantial economic uncertainty with wide-ranging effects, including the

disruption of global financial markets. Some, but not all, of the possible

effects of these economic events are outlined in the risk factors described

below, including those relating to levels and priorities of federal and state

spending, access to capital and credit markets, effects on commercial and other

clients, and potential impairment of our goodwill and other long-lived assets.

Although governments worldwide, including the federal government of the United

States, have initiated actions in response to the current situation, we are

unable to predict the impact, severity, and duration of these economic

conditions. The economic environment or related factors may adversely impact our

business, financial condition, results of operations, cash flows, and/or stock

price.

The

combination of the adverse economic climate and challenges faced by federal and

state governments could result in changes in spending priorities and adversely

affect our ability to grow or maintain our revenues and

profitability.

The

combination of the challenging economic climate, related budgetary pressures at

the federal and state levels, the wide range of issues facing the current

presidential administration in the United States (that may result in spending

policies that are disadvantageous to us, including regulatory reform), and

changes in the composition of the U.S. Congress may affect agencies,

departments, projects, or programs we currently support, or that we may seek to

support in the future. The programs and projects we support must compete with

other programs and projects for consideration during budget formulation and

appropriation processes, and may be affected by the general economic conditions.

Budget decisions made in this environment are difficult to predict and may have

long-term consequences for certain programs and projects. We believe that many

of the programs and projects we support are a high priority, and that changing

priorities may present opportunities for us, but there remains the possibility

that one or more of the programs and projects we support will be reduced,

delayed, or terminated. We engage in a number of programs and projects that may

be perceived as being favored by the presidential administration and may receive

funding under the American Recovery and Reinvestment Act. On the other hand, the

President has proposed a freeze on the federal government’s non-security

discretionary funding for three years. This freeze may affect some programs and

projects more than others and may adversely affect programs and projects we

support. Reductions in, or delays or terminations of, any of the existing

programs or projects we support, or of anticipated programs and projects, unless

offset by other programs, projects, or opportunities, could adversely affect our

ability to grow or maintain our revenues and profitability. We are focused on

meeting these challenges and taking advantage of related opportunities. If we

are not successful in this effort, we may not be able to grow or maintain our

revenues and profitability.

Recent

levels of market volatility are unprecedented and adverse capital and credit

market conditions may affect our ability to access cost-effective sources of

funding.

The

capital and credit markets recently have been experiencing extreme volatility

and disruption. Liquidity has contracted significantly, borrowing rates have

varied significantly, and borrowing terms have become more restrictive.

Historically, we have believed that we could access these markets to support our

business activities, including operations, acquisitions, and refinancing debt.

In the future, we may not be able to obtain credit or capital market financing

(such as through equity offerings) on acceptable terms, or at all, which could

have an adverse effect on our financial position, results of operations, and

cash flows. In addition, the state of the capital and credit markets could also

affect other entities with which we do business, including our commercial and

other clients and our suppliers, subcontractors, and team members, which could

also have an adverse effect on our financial position, results of operations,

and cash flows.

5

RISKS

RELATED TO OUR INDUSTRY

We

rely substantially on government clients for our revenue, and government

spending priorities may change in a manner adverse to our business.

We derive

100% of our revenue directly or indirectly (through subcontracts with U.S.

government prime contractors) from contracts with federal and state government

agencies and departments. Virtually all of our major government

clients have experienced reductions in budgets at some time, often for a

protracted period, and we expect similar reductions in the future. Expenditures

by our federal clients may be restricted or reduced by presidential or

congressional action or by action of the Office of Management and Budget or

otherwise limited. In addition, many states are not permitted to operate with

budget deficits, and nearly all states face considerable challenges in balancing

budgets that anticipate reduced revenues. In such a situation, a state which has

recently been dealing with a multi-billion-dollar budget deficit

may delay some payments due to us, may eventually fail to pay what

they owe us, and may delay some programs and projects. For some clients, we may

face an unwelcome choice: turn down (or stop) work with the risk of damaging a

valuable client relationship, or perform work with the risk of not getting paid

in a timely fashion or perhaps at all. For a discussion of the risks associated

with incurring costs before a contract is executed or appropriately modified,

see “Risks Related to Our Business—We sometimes incur costs before a contract is

executed or appropriately modified. To the extent a suitable contract or

modification is not subsequently signed or we are not paid for our work, our

revenue and profit will be reduced.”

Federal,

state, and local elections could also affect spending priorities and budgets at

all levels of government, and the current national and worldwide economic

downturn may result in changes in government priorities in ways that could be

disadvantageous to us. For example, addressing the financial crisis and economic

downturn has required the use of substantial government resources, which may

lower the amounts available for agencies, departments, projects, or programs we

support. In addition, some governments may not have sufficient resources to

continue spending at previous levels. A decline in expenditures, or a shift in

expenditures away from agencies, departments, projects, or programs that we

support, whether to pay for other programs or projects within the same or other

agencies or departments, to reduce budget deficits, to fund tax reductions, or

for other reasons, could materially adversely affect our business, prospects,

financial condition, or operating results. Moreover, the perception that a cut

in appropriations or spending may occur, such as the recent proposal by the

President to limit certain spending, could adversely affect investor sentiment

about our stock and cause our stock price to fall.

The

failure of Congress to approve budgets in a timely manner for the federal

agencies and departments we support could delay and reduce spending and cause us

to lose revenue and profit.

On an

annual basis, Congress must approve budgets that govern spending by each of the

federal agencies and departments we support. When Congress is unable to agree on

budget priorities, and thus is unable to pass the annual budget on a timely

basis, it typically enacts a continuing resolution. Continuing resolutions

generally allow federal agencies and departments to operate at spending levels

based on the previous budget cycle. When agencies and departments must operate

on the basis of a continuing resolution, funding we expect to receive

from clients for work we are already performing and new

initiatives may be delayed or cancelled. Thus, the failure by Congress to

approve budgets in a timely manner can result in the loss of revenue and profit

in the event federal agencies and departments are required to cancel or change

existing or new initiatives, or the deferral of revenue and profit to later

periods due to delays in implementing existing or new initiatives. The budgets

of many of our state and local government clients are also subject to similar

budget processes, and thus subject us to similar risks and

uncertainties.

Our

failure to comply with complex laws, rules, and regulations relating to

government contracts could cause us to lose business and subject us to a variety

of penalties.

We must

comply with laws, rules, and regulations relating to the formation,

administration, and performance of government contracts, which affect how we do

business with our government clients and impose added costs on our business.

Each government client has its own laws, rules, and regulations affecting its

contracts. Among the more significant strictures affecting federal government

contracts are:

6

|

|

·

|

the Federal Acquisition

Regulation, and agency regulations analogous or supplemental to it, which

comprehensively regulate the formation, administration, and performance of

federal government

contracts;

|

|

|

·

|

the Truth in Negotiations Act,

which requires certification and disclosure of cost and pricing data in

connection with some contract

negotiations;

|

|

|

·

|

the Procurement Integrity Act,

which, among other things, defines standards of conduct for those

attempting to secure federal contracts, prohibits certain activities

relating to federal procurements, and limits the employment activities of

certain former federal

employees;

|

|

|

·

|

the Cost Accounting Standards,

which impose accounting requirements that govern our right to payment

under federal contracts; and

|

|

|

·

|

laws, rules and regulations

restricting (i) the use and dissemination of information classified

for national security purposes, (ii) the exportation of specified

products, technologies, and technical data, and (iii) the use and

dissemination of sensitive but unclassified

data.

|

The

federal government and other governments with which we do business may in the

future change their procurement practices or adopt new contracting laws, rules,

or regulations, including cost accounting standards, that could be costly to

satisfy or that could impair our ability to obtain new contracts. Any failure to

comply with applicable federal, state, or local strictures could subject us to

civil and criminal penalties and administrative sanctions, including termination

of contracts, repayment of amounts already received under contracts, forfeiture

of profits, suspension of payments, fines, and suspension or debarment from

doing business with federal and even state and local government agencies and

departments, any of which could adversely affect our reputation, our revenue,

our operating results, and the value of our stock. Failure to abide by laws

applicable to our work for governments outside the United States could have

similar effects. Unless the content requires otherwise, we use the term

“contracts” to refer to contracts and any task orders or delivery orders issued

under a contract.

Unfavorable

government audit results could force us to adjust previously reported operating

results, could affect future operating results, and could subject us to a

variety of penalties and sanctions.

The

federal government and many states audit and review our contract performance,

pricing practices, cost structure, financial responsibility, and compliance with

applicable laws, regulations, and standards. Like most major government

contractors, we have our business processes, financial information, and

government contracts audited and reviewed on a continual basis by federal

agencies, including the Defense Contract Audit Agency. Audits, including audits

relating to companies we have acquired or may acquire or subcontractors we have

hired or may hire, could raise issues that have significant adverse effects on

our operating results. For example, audits could result in substantial

adjustments to our previously reported operating results if costs that were

originally reimbursed, or that we believed would be reimbursed, are subsequently

disallowed, or if invoices that have been paid, or that

we expected to be paid, are subsequently rejected, or otherwise not paid in

full. In addition, cash we have already collected may need to be refunded, past

and future operating margins may be reduced, and we may need to adjust our

practices, which could reduce profit on other past, current, and future

contracts. Moreover, a government agency could withhold payments due to us under

a contract pending the outcome of any investigation with respect to a contract

or our performance under it.

If a

government audit, review, or investigation uncovers improper or illegal

activities, we may be subject to civil and criminal penalties and administrative

sanctions, including termination of contracts, repayment of amounts already

received under contracts, forfeiture of profits, suspension of payments, fines,

and suspension or debarment from doing business with federal and even state and

local government agencies and departments. We may also lose business if we are

found not to be sufficiently financially responsible. In addition, we could

suffer serious harm to our reputation and our stock price could decline if

allegations of impropriety are made against us, whether or not true. Federal

DCAA audits have been completed on our incurred contract costs through 2005;

audits for costs incurred on work performed since then have not yet been

completed. In addition, non-audit reviews by the government may still be

conducted on all our government contracts.

7

If

significant civil or criminal penalties or administrative sanctions are imposed

on us or if the federal or state governments otherwise cease doing business with

us or significantly decrease the amount of business they do with us, our revenue

and operating results would be materially harmed.

Our

government contracts contain provisions that are unfavorable to us and permit

our government clients to terminate our contracts partially or completely at any

time prior to completion.

Our

government contracts contain provisions not typically found in commercial

contracts, including provisions that allow our clients to terminate or modify

these contracts at the government’s convenience upon short notice. If a

government client terminates one of our contracts for convenience, we may only

bill the client for work completed prior to the termination, plus any project

commitments and settlement expenses the client agrees to pay, but not for any

work not yet performed. In addition, many of our government contracts and task

and delivery orders are incrementally funded as appropriated funds become

available. The reduction or elimination of such funding can result in options

not being exercised and further work on existing contracts and orders being

curtailed. In any such event, we would have no right to seek lost fees or other

damages. If a government client were to terminate, decline to exercise an option

under, or curtail further performance under one or more of our significant

contracts, our revenue and operating results would be materially

harmed.

Adoption

of new procurement practices or contracting laws, rules, and regulations and

changes in existing procurement practices or contracting laws, rules, and

regulations could impair our ability to obtain new contracts and cause us to

lose revenue and profit.

In the

future, the federal government may change its procurement practices or adopt new

contracting laws, rules, or regulations that could cause its agencies and

departments to curtail the use of services firms or increase the use of

companies with a “preferred status,” such as small businesses. For example,

legislation restricting the procedure by which services are outsourced to

federal contractors has been proposed in the past, and if such legislation were

to be enacted, it would likely reduce the amount of services that could be

outsourced by the federal government. Any such changes in procurement practices

or new contracting laws, rules, or regulations could impair our ability to

obtain new contracts and materially reduce our revenue and profit. Other

government clients could enact changes to their procurement laws and regulations

that could have similar adverse effects on us.

In

addition, our business activities may be or may become subject to international,

foreign, U.S., state, or local laws or regulatory requirements that may limit

our strategic options and growth and may increase our expenses and reduce our revenue and profit, negatively affecting

the value of our stock. We generally have no control over the effect of such

laws or requirements on us and they could affect us more than they affect other

companies.

RISKS

RELATED TO OUR BUSINESS

We

may be unable to continue as a going concern.

Our

financial statements have been prepared on a going concern basis which assumes

that we will be able to realize our assets and discharge our liabilities in the

normal course of business for the foreseeable future. We generated a

net loss of $4,432,622 and used cash in operating activities of $481,346 for the

nine months ended September 30, 2010. At this date, we had negative

working capital of $6,595,498. At September 30, 2010 we had an

accumulated deficit of $7,462,707 and our total stockholders’ deficiency was

$6,549,059. There are

many delinquent claims and obligations, such as payroll taxes, employee income

tax withholdings, employee benefit plan contributions, loans payable and

accounts payable that could ultimately cause the Company to cease

operations.

Our

ability to continue as a going concern is in substantial doubt as it is

dependent on a number of factors including, but not limited to, the receipt of

continued financial support from our stockholders, our ability to control and

reduce our expenses and our ability to raise equity or debt financing as we need

it. The outcome of these matters is dependent on factors outside of our control

and cannot be predicted at this time. We may never be

profitable.

Due

to a shortage of cash for operations, we have failed to remit payroll taxes as

required by state and federal law. If we cannot negotiate an

agreement with the taxing authorities to pay these taxes over time, we could be

forced to cease our operations.

During

2009 and 2010, we were late in making deposits of federal and state employer

payroll taxes and employee income tax withholdings. As of September

30, 2010 and December 31, 2009, the total of payroll tax accrued and the balance

of income tax not withheld, including penalties and interest, amounted to

$1,396,241 and $277,762, respectively. We are not currently in a

position to remit the tax and pay the penalties and interest in

full. If we cannot negotiate an agreement for payment of the tax,

penalties and interest over time, we could incur civil and criminal penalties

and the taxing authorities could seize our assets and force us to close our

business. We cannot guarantee you that we will be able to negotiate

an acceptable agreement with the taxing authorities.

8

We

depend on contracts with federal agencies and departments for a substantial

portion of our revenue and profit, and our business, revenue, and profit levels

could be materially and adversely affected if our relationships with these

agencies and departments deteriorate.

We derive

100% of our revenue directly or indirectly (through subcontracts with

U.S. government prime contractors) from contracts with federal and state

government agencies and departments. We believe that federal

contracts will continue to be a significant source of our revenue and profit for

the foreseeable future.

Because

we have a large number of contracts with our clients, we continually bid for and

execute new contracts, and our existing contracts continually become subject to

recompetition and expiration. Upon the expiration of a contract, we typically

seek a new contract or subcontractor role relating to that client to replace the

revenue generated by the expired contract. There can be no assurance that the

requirements those expiring contracts were satisfying will continue after their

expiration, that the client will re-procure those requirements, that any such

re-procurement will not be restricted in a way that would eliminate us from the

competition (e.g., set aside for small business), or that we will be successful

in any such re-procurements. If we are not able to replace the revenue from

these contracts, either through follow-on contracts or new contracts for those

requirements or for other requirements, our revenue and operating results will

be materially harmed.

Among the

key factors in maintaining our relationships with government agencies and

departments (and other clients) are our performance on individual contracts, the

strength of our professional reputation, and the relationships of our managers

with client personnel. Because we have many contracts, we expect disagreements

and performance issues with clients to arise from time to time. To the extent

that such disagreements arise, our performance does not meet client

expectations, our reputation or relationships with one or more key clients are

impaired, or one or more important client personnel leave their employment, are

transferred to other positions, or otherwise become less involved with our

contracts, our revenue and operating results could be materially harmed. Our

reputation could also be harmed if we work on or are otherwise associated with a

project that receives significant negative attention in the news media or

otherwise for any reason.

Our

dependence on GSA Schedule and other IDIQ contracts creates the risk of

increasing volatility in our revenue and profit levels.

We

believe that one of the key elements of our success is our position as a prime

contractor under GSA Schedule contracts and other IDIQ contracts. As these types

of contracts have increased in importance over the last several years, we

believe our position as a prime contractor has become increasingly important to

our ability to sell our services to federal clients. However, these contracts

require us to compete for each delivery order and task order, rather than having

a more predictable stream of activity and, therefore, revenue and profit, during

the term of a contract. There can be no assurance that we will continue to

obtain revenue from such contracts at these levels, or in any amount, in the

future. To the extent that federal agencies and departments choose to employ GSA

Schedule and other contracts encompassing activities for which we are not able

to compete or provide services, we could lose business, which would negatively

affect our revenue and profitability.

We

may not receive revenue corresponding to the full amount of our backlog, or may

receive it later than we expect, which could materially and adversely affect our

revenue and operating results.

The

calculation of backlog is highly subjective and is subject to numerous

uncertainties and estimates, and there can be no assurance that we will in fact

receive the amounts we have included in our backlog. Our assessment of a

contract’s potential value is based on factors such as the amount of revenue we

have recently recognized on that contract, our experience in utilizing contract

capacity on similar types of contracts, and our professional judgment. In the

case of contracts that may be renewed at the option of the client, we generally

calculate backlog by assuming that the client will exercise all of its renewal

options; however, the client may elect not to exercise its renewal options. In

addition, federal contracts rely on congressional appropriation of funding,

which is typically provided only partially at any point during the term of

federal contracts, and all or some of the work to be performed under a contract

may require future appropriations by Congress and the subsequent allocation of

funding by the procuring agency to the contract. Our estimate of the portion of

backlog that we expect to recognize as revenue in any future period is likely to

be inaccurate because the receipt and timing of this revenue often depends on

subsequent appropriation and allocation of funding and is subject to various

contingencies, such as timing of task orders and delivery orders, many of which

are beyond our control. In addition, we may never receive revenue from some of

the engagements that are included in our backlog, and this risk is greater with

respect to unfunded backlog and backlog related to IDIQ contracts. Further, the

actual receipt of revenue on engagements included in backlog may never occur or

the amount or timing of such revenue may change because client priorities could

change, a program or project schedule could change, the program or project could

be canceled, the government agency or other client could elect not to exercise

renewal options under a contract or could select other contractors to perform

services, or a contract could be reduced, modified, or terminated. Although we

adjust our backlog periodically to reflect modifications to or renewals of

existing contracts, awards of new contracts, or approvals of expenditures, if we

fail to realize revenue corresponding to our backlog, our revenue and operating

results could be materially adversely affected.

9

Because

much of our work is performed under task orders, delivery orders, and short-term

assignments, we are exposed to the risk of not having sufficient work for our

staff, which can affect revenue and profit.

We

perform some of our work under short-term contracts. Even under many of our

longer-term contracts, we perform much of our work under individual task orders

and delivery orders, many of which are awarded on a competitive basis. If we

cannot obtain new work in a timely fashion, whether through new contracts, task

orders, or delivery orders, modifications to existing contracts, task orders, or

delivery orders, or otherwise, we may not be able to keep our staff profitably

utilized. It is difficult to predict when such new work or modifications will be

obtained. Moreover, we need to manage our staff utilization carefully to ensure

that those with appropriate qualifications are available when needed and that

staff do not have excessive down-time when working on multiple projects, or as

projects are beginning or nearing completion. There can be no assurance that we

can profitably manage the utilization of our staff. In the short run, our costs

are relatively fixed, so sub-optimal staff utilization hurts revenue, profit,

and operating results.

Loss

of key members of our senior operating leadership team could impair our

relationships with clients and disrupt the management of our

business.

Although

the depth of our organization has grown in recent years, we believe that our

success depends on the continued contributions of the members of our senior

operating leadership. We rely on our senior leadership to generate business and

manage and execute projects and programs successfully. In addition, the

relationships and reputation that many members of our operating leadership team

have established and maintain with client personnel contribute to our ability to

maintain good client relations and identify new business opportunities. Apart

from our most senior executive officers, we do not generally have agreements

with members of our operating leadership providing for a specific term of

employment. The loss or rumored loss of any member of our senior operating

leadership could adversely affect our stock price.

If

we fail to attract and retain skilled employees, we will not be able to continue

to win new work, staff engagements, and sustain our profit margins and revenue

growth.

We must

continue to hire significant numbers of highly qualified individuals who have

technical skills and who work well with our clients. These employees are in

great demand and are likely to remain a limited resource for the foreseeable

future. If we are unable to recruit and retain a sufficient number of these

employees, our ability to staff engagements and to maintain and grow our

business could be limited. In such a case, we may be unable to win or perform

contracts, and we could be required to engage larger numbers of subcontractor

personnel, any of which could adversely affect our revenue, profit, operating

results, and reputation. We could even default under one or more contracts for

failure to perform properly in a timely fashion, which could expose us to

additional liability and further harm our reputation and ability to compete for

future contracts. In addition, some of our contracts contain provisions

requiring us to commit to staff an engagement with personnel the client

considers key to our successful performance under the contract. In the event we

are unable to provide these key personnel or acceptable substitutes, or

otherwise staff our work, the client may reduce the size and scope of our

engagement under a contract or terminate it, and our revenue and operating

results may suffer.

Growing

through acquisitions is a key element of our business strategy, and we are

constantly reviewing acquisition opportunities. These activities may involve

significant costs, be disruptive, or not be successful. These activities may

divert the attention of management from existing operations and

initiatives.

One of

our principal growth strategies is to make selective acquisitions. We believe

pursuing acquisitions actively is necessary for a public company of our size in

our business. As a result, at any given time, we may be evaluating several

acquisition opportunities. We may also have outstanding, at any time, one or

more expressions of interest, agreements in principle, letters of intent, or

similar agreements regarding potential acquisitions, which are subject to

completion of due diligence and other significant conditions, as well as

confidentiality agreements with potential acquisition targets. Our experience

has been that potential acquisition targets demand confidentiality as a matter

of course and allow relatively little due diligence before entering into a

preliminary agreement in principle. We insist on including due diligence and

other conditions in such preliminary agreements and engage in due diligence

prior to executing definitive agreements regarding potential acquisitions. We

find that potential acquisitions subject to preliminary agreements in principle

often are not consummated, or are consummated on terms materially different than

those to which the parties initially agreed. Accordingly, our normal practice is

not to disclose potential acquisitions until definitive agreements are executed

and, in some cases, material conditions and precedent are

satisfied.

10

When we

are able to identify an appropriate acquisition candidate, we may not be able to

negotiate the price and other terms of the acquisition successfully or finance

the acquisition on terms satisfactory to us. Our out-of-pocket expenses in

identifying, researching, and negotiating potential acquisitions has been and

will likely continue to be significant, even if we do not ultimately acquire

identified businesses. In addition, negotiations of potential acquisitions and

the integration of acquired business operations may divert management attention

away from day-to-day operations and may reduce staff utilization and adversely

affect our revenue and operating results.

When

we undertake acquisitions, they may present integration challenges, fail to

perform as expected, increase our liabilities, and/or reduce our

earnings.

When we

complete acquisitions, it may be difficult and costly to integrate the acquired

businesses due to differences in the locations of personnel and facilities,

differences in corporate cultures, disparate business models, or other reasons.

If we are unable to integrate companies we acquire successfully, our revenue and

operating results could suffer. In addition, we may not be successful in

achieving the anticipated cost efficiencies and synergies from these

acquisitions, which could include offering our services to existing clients of

acquired companies or offering the services of acquired companies to our

existing clients to increase our revenue and profit. In fact, our costs for

managerial, operational, financial, and administrative systems may increase and

be higher than anticipated. We may also experience attrition, including key

employees of acquired and existing businesses, during and following integration

of an acquired business into our Company. We could also lose business during any transition, whether related to this attrition

or caused by other factors. Any attrition or loss of business could adversely

affect our future revenue and operating results and prevent us from achieving

the anticipated benefits of the acquisition. In addition, acquisitions of

businesses or other material operations may require additional debt or equity

financing or both, resulting in additional leverage or dilution of ownership, or

both.

Businesses

we acquire may have liabilities or adverse operating issues, or both, that we

fail to discover through due diligence or the extent of which we underestimate

prior to the acquisition. These liabilities and/or issues may include failure to

comply with, or other violations of, applicable laws, rules, or regulations or

contractual or other obligations or liabilities. We, as the successor owner, may

be financially responsible for, and may suffer harm to our reputation and

otherwise be adversely affected by, such liabilities and/or issues. An acquired

business also may have problems with internal controls over financial reporting,

which could in turn lead us to have significant deficiencies or material

weaknesses in our own internal controls over financial reporting. These and any

other costs, liabilities, issues, and/or disruptions associated with any of our

past acquisitions or any future acquisitions could harm our operating

results.

As

a result of future acquisitions, we may accumulate substantial amounts of

goodwill and intangible assets. Any changes in business conditions

could cause these assets to become impaired, requiring substantial write-downs

that would adversely affect our operating results.

All of

our acquisitions have been accounted for as purchases and involved purchase

prices well in excess of tangible asset values, resulting in the creation of a

significant amount of goodwill and other intangible assets. We plan to continue

acquiring businesses if and when opportunities arise, further increasing these

amounts. Under generally accepted accounting principles, we do not amortize

goodwill and intangible assets acquired in a purchase business combination that

are determined to have indefinite useful lives, but instead review them annually

(or more frequently if impairment indicators arise) for impairment. To the

extent that we determine that such an asset has been impaired, we will write

down its carrying value on our balance sheet and book an impairment charge in

our statement of earnings.

11

We

face intense competition from many firms that have greater resources than we do,

as well as from smaller firms that have narrower service offerings and serve

niche markets. This competition could result in price reductions, reduced

profitability, and loss of market share.

We

operate in highly competitive markets and generally encounter intense

competition to win contracts, task orders, and delivery orders. If we are unable

to compete successfully for new business, our revenue and operating margins may

decline. Many of our competitors are larger and have greater financial,

technical, marketing, and public relations resources, larger client bases, and

greater brand or name recognition than we do. We also have numerous smaller

competitors, many of which have narrower service offerings and serve niche

markets. Our competitors may be able to compete more effectively for contracts

and offer lower prices to clients, causing us to lose contracts, as well as

lowering our profit or even causing us to suffer losses on contracts that we do

win. Some of our subcontractors are also competitors, and some of them may in

the future secure positions as prime contractors, which could deprive us of work

we might otherwise have won under such contracts. On contracts where we are a

subcontractor, the prime contractors or our teaming partners may also deprive us

of work we might otherwise have performed. Our competitors may be able to

provide clients with different and greater capabilities and benefits than we can

provide in areas such as technical qualifications, past performance on relevant contracts, geographic presence, ability to keep pace

with the changing demands of clients, and the availability of key personnel. Our

competitors also have established or may establish relationships among

themselves or with others, or may, through mergers and acquisitions, increase

their ability to address client needs. Accordingly, it is possible that new

competitors or alliances among competitors may emerge. In addition, our

competitors may also be able to offer higher prices for acquisition candidates,

which could harm our strategy of growing through selected

acquisitions.

We

derive significant revenue and profit from contracts awarded through a

competitive bidding process, which can impose substantial costs on us, and we

will lose revenue and profit if we fail to compete effectively.

We derive

significant revenue and profit from contracts that are awarded through a

competitive bidding process. We expect that most of the government business we

seek in the foreseeable future will be awarded through competitive bidding.

Competitive bidding imposes substantial costs and presents a number of risks,

including:

|

|

·

|

the substantial cost and

managerial time and effort that we spend to prepare bids and proposals for

contracts that may or may not be awarded to

us;

|

|

|

·

|

the need to estimate accurately

the resources and costs that will be required to service any contracts we

are awarded, sometimes in advance of the final determination of their full

scope;

|

|

|

·

|

the expense and delay that may

arise if our competitors protest or challenge awards made to us pursuant

to competitive bidding, and the risk that such protests or challenges

could result in the requirement to resubmit bids, and in the termination,

reduction, or modification of the awarded contracts;

and

|

|

|

·

|

the opportunity cost of not

bidding on and winning other contracts we might otherwise

pursue.

|

To the

extent we engage in competitive bidding and are unable to win particular

contracts, we not only incur substantial costs in the bidding process that

negatively affect our operating results, but we may lose the opportunity to

operate in the market for the services provided under those contracts for a

number of years. Even if we win a particular contract through competitive

bidding, our profit margins may be depressed or we may even suffer losses as a

result of the costs incurred through the bidding process and the need to lower

our prices to overcome competition.

We

may lose money on some contracts if we underestimate the resources we need to

perform under them.

We

provide services to clients primarily under three types of contracts:

time-and-materials contracts; cost-based contracts; and fixed-price contracts.

Each of these types of contracts, to differing degrees, involves the risk that

we could underestimate our cost of fulfilling the contract, which may reduce the

profit we earn or lead to a financial loss on the contract, which would

adversely affect our operating results.

|

|

·

|

Under time-and-materials

contracts, we are paid for labor at negotiated hourly billing rates and

for certain expenses, and we assume the risk that our costs of performance

may exceed the negotiated hourly

rates.

|

12

|

|

·

|

Under our cost-based contracts,

which frequently cap many of the various types of costs we can charge and

which impose overall and individual task order or delivery order ceilings,

we are reimbursed for certain costs incurred, which must be allowable and

at or below the caps under the terms of the contract and applicable

regulations. If we incur unallowable costs in the performance of a

contract, the client will not reimburse those costs, and if our allowable

costs exceed any of the applicable caps or ceilings, we will not be able

to recover those costs. Under some cost-based contracts, we receive no

fees.

|

|

|

·

|

Under fixed-price contracts, we

perform specific tasks for a set price. Compared to cost-plus-fee

contracts and time-and-materials contracts, fixed-price contracts involve

greater financial risk because we bear the full impact of cost

overruns.

|

In order

to determine the appropriate revenue to recognize on our contracts in each

accounting period, we must use judgment relative to assessing risks, estimating

contract revenue and costs, and making assumptions for schedule and technical

issues. From time to time, facts develop that require us to revise our estimated

total costs and revenue on a contract. To the extent that a revised estimate

affects contract profit or revenue previously recognized, we record the

cumulative effect of the revision in the period in which the facts requiring the

revision become known. Provision for the full amount of an anticipated loss on

any type of contract is recognized in the period in which it becomes probable

and can be reasonably estimated. As a result, our operating results could be

affected by revisions to prior accounting estimates.

Systems

or service failures could interrupt our operations, leading to reduced revenue

and profit.

Any

interruption in our operations or any systems failures, including, but not

limited to: (i) inability of our staff to perform their work in a timely

fashion, whether caused by limited access to, or closure of, our or our clients’

offices or otherwise; (ii) failure of network, software, or hardware

systems; and (iii) other interruptions and failures, whether caused by us,

subcontractors, team members, third-party service providers, unauthorized

intruders or hackers, computer viruses, natural disasters, power shortages,

terrorist attacks, or otherwise, could cause loss of data and interruptions or

delays in our business or that of our clients, or both. In addition, failure or

disruption of mail, communications, or utilities could cause an interruption or

suspension of our operations or otherwise harm our business.

If

we fail to meet client expectations or otherwise fail to perform our contracts

properly, the value of our stock could decrease.

We could

lose revenue, profit, and clients, and be exposed to liability if we have

disagreements with our clients or fail to meet their expectations. We create,

implement, and maintain solutions that are often critical to our clients’

operations, and the needs of our clients are rapidly changing. Our ability to

secure new work and hire and retain qualified staff depends heavily on our

overall reputation, as well as the individual reputations of our staff members.

Perceived poor performance on even a single contract could seriously impair our

ability to secure new work and hire and retain qualified staff. In addition, we

have experienced, and may experience in the future, some systems and service

failures, schedule or delivery delays, and other problems in connection with our

work.

Moreover,

a failure by one or more of our subcontractors to perform satisfactorily the

agreed-upon services on a timely basis may compromise our ability to perform our

obligations as a prime contractor. In some cases, we have limited involvement in

the work performed by subcontractors and may have exposure as a result of

problems caused by subcontractors. In addition, we may have disputes with our

subcontractors that could impair our ability to execute our contracts as

required and could otherwise increase our costs. Such disputes and problems with

subcontractors could, among other things, cause us to lose future contracts,

suffer negative publicity, or otherwise incur liability for performance

deficiencies we did not create. In turn, these negative outcomes could have a

material adverse effect upon our operations, our financial performance, and the

value of our stock.

13

Our

failure to obtain and maintain necessary security clearances may limit our

ability to perform classified work for federal clients, which could cause us to

lose business.

Some

federal contracts require us to maintain facility security clearances and

require some of our employees to maintain individual security clearances. The

federal government has the right to grant and terminate such clearances. If our

employees lose or are unable to obtain needed security clearances in a timely

manner, or we lose or are unable to obtain a needed facility clearance in a

timely manner, federal clients can limit our work under or terminate some

contracts. To the extent we cannot obtain the required facility clearances or

security clearances for our employees or we fail to obtain them on a timely

basis, we may not derive our anticipated revenue and profit, which could harm

our operating results. In addition, a security breach relating to any classified

or sensitive but unclassified information entrusted to us could cause serious

harm to our business, damage our reputation, and result in a loss of our

facility or individual employee security clearances.

Our

relations with other contractors are important to our business and, if

disrupted, could cause us damage.

We derive

a portion of our revenue from contracts under which we act as a subcontractor or

from “teaming” arrangements in which we and other contractors jointly bid on

particular contracts, projects, or programs. As a subcontractor or team member,

we often lack control over fulfillment of a contract, and poor performance on

the contract could tarnish our reputation, result in a reduction of the amount

of our work under or termination of that contract or other contracts, and cause

us not to obtain future work, even when we perform as required. We expect to

continue to depend on relationships with other contractors for a portion of our

revenue and profit in the foreseeable future. Moreover, our revenue and

operating results could be materially and adversely affected if any prime

contractor or teammate does not pay our invoices in a timely fashion, chooses to

offer products or services of the type that we provide, teams with other

companies to provide such products or services, or otherwise reduces its

reliance upon us for such products or services.

We

sometimes incur costs before a contract is executed or appropriately modified.

To the extent a suitable contract or modification is not subsequently signed or

we are not paid for our work, our revenue and profit will be

reduced.

When

circumstances warrant, we sometimes incur expenses and perform work without a

signed contract or appropriate modification to an existing contract to cover

such expenses or work. When we do so, we are working “at-risk,” and there is a

chance that the subsequent contract or modification will not ensue, or if it

does, that it will not allow us to be paid for expenses already incurred, work

already performed, or both. In such cases, we have generally been successful in

obtaining the required contract or modification, but any failure to do so in the

future could affect our operating results.

As

we develop new services, new clients, new practices, and enter new lines of

business, our risk of making costly mistakes increases.

We

currently assist our clients both in advisory capacities and by helping them

implement and improve solutions to their problems. As part of our corporate

strategy, we are attempting to sell more services, and searching for ways to

provide new services to clients. In addition, we plan to extend our services to

new clients, into new practice areas, into new lines of business, and into new

geographic locations. As we change our focus toward implementation and

improvement; attempt to develop new services, new clients, new practice areas,

and new lines of business; open new offices; and do business in new geographic

locations, those efforts could harm our results of operations and could be

unsuccessful.

Efforts

involving a different focus, new services, new clients, new practice areas, new

lines of business, new offices, or new geographic locations entail inherent

risks associated with inexperience and competition from other participants in

those areas. Our inexperience may result in costly decisions that could harm our

profit and operating results. In particular, implementation services often

relate to development and implementation of critical infrastructure or operating

systems that our clients view as “mission critical,” and if we fail to satisfy

the needs of our clients in providing these services, our clients could incur

significant costs and losses for which they could seek compensation from

us.

14

Claims

in excess of our insurance coverage could harm our business and financial

results.

When

entering into contracts with clients, we attempt, where feasible and

appropriate, to negotiate indemnification protection from our clients, as well

as monetary limitation of liability for professional acts, errors, and

omissions, but it is not always possible to do so. In addition, we cannot be

sure that these contractual provisions will protect us from liability for

damages if action is taken against us. Claims against us, both under our client

contracts and otherwise, have arisen in the past, exist currently, and will

arise in the future. These claims include actions by employees, clients, and

others. Some of the work we do, for example, in the environmental area, is

potentially hazardous to our employees, our clients, and others and they may

suffer damage because of our actions or inaction. We have various policies and

programs in the environmental, health, and safety area, but they may not prevent

harm to employees, clients, and others. Our insurance coverage may not be

sufficient to cover all the claims against us, insurance may not continue to be

available on commercially reasonable terms in sufficient amounts to cover such

claims, or at all, and our insurers may disclaim coverage as to any or all such

claims and otherwise may be unwilling or unable to cover such claims. The

successful assertion of any claim or combination of claims against us could

seriously harm our business. Even if not successful, such claims could result in

significant legal and other costs, harm our reputation, and be a distraction to

management.

Our

business will be negatively affected if we are not able to anticipate and keep

pace with rapid changes in technology or if growth in technology use by our

clients is not as rapid as in the past.

Our

success depends, partly, on our ability to develop and implement technology

services and solutions that anticipate and keep pace with rapid and continuing

changes in technology, industry standards, and client preferences. We may not be

successful in anticipating or responding to these developments on a timely

basis, and our offerings may not be successful in the marketplace. In addition,

the costs we incur in anticipation or response may be substantial and may be

greater than we expect, and we may never recover these costs. Also, our clients

and potential clients may slow the growth in their use of technology, or

technologies developed by our competitors may make our service or solution

offerings uncompetitive or obsolete. Any one of these circumstances could have a

material adverse effect on our revenue or profits or ability to obtain and

complete client engagements successfully.

Moreover,

we use technology-enabled tools to differentiate us from our competitors and

facilitate our service offerings that do not require the delivery of technology

services or solutions. If we fail to keep these tools current and useful, our

ability to sell and deliver our services could suffer, and so could our

operating results.

Our

limited operating history makes it difficult to evaluate our future prospects

and results of operations.

Our

limited operating history makes it difficult to evaluate our business. In

addition, the limited performance history of our management and sales team and

the uncertainty of our future performance and ability to maintain or improve our

financial, sales and operating systems, procedures and controls increase the

risk that we may be unable to continue to successfully operate our business. In

the event that we are not able to manage our growth and operate as a public

company due to our limited experience, our business may suffer uncertainty and

failures, which makes it difficult to evaluate our business.

Various

GSA Schedules and Contract vehicles are required to win contracts and task

orders from the federal government. The loss of or failure to renew

any or all of these schedules and vehicles could materially adversely affect our

business.

We hold

GSA Schedules and IDIQ contracts with the federal government. The

government can elect to suspend our eligibility to win task orders under the

vehicles and schedules. The loss of or suspension of any such

contracts or GSA Schedule, would materially adversely affect our

business.

Our inability to obtain capital, use

internally generated cash, or use shares of our common stock or debt to

finance future expansion efforts could impair the growth and expansion of

our business.

Reliance

on internally generated cash or debt to finance our operations or complete

business expansion efforts could substantially limit our operational and

financial flexibility. The extent to which we will be able or willing to use

shares of common stock to consummate expansions will depend on our market value

from time to time and the willingness of potential sellers to accept it as full

or partial payment. Using shares of common stock for this purpose also may