Attached files

| file | filename |

|---|---|

| EX-32.1 - MyStarU.com,Inc. | v206299_ex32-1.htm |

| EX-31.2 - MyStarU.com,Inc. | v206299_ex31-2.htm |

| EX-32.2 - MyStarU.com,Inc. | v206299_ex32-2.htm |

| EX-31.1 - MyStarU.com,Inc. | v206299_ex31-1.htm |

| EX-21.1 - MyStarU.com,Inc. | v206299_ex21-1.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

|

þ

|

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For the

fiscal year ended September 30, 2010

|

¨

|

TRANSITION

REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

Commission

file number: 333-62236

SUBAYE,

INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

35-2089848

|

|

|

(State

or other jurisdiction

|

(I.R.S.

Employer

|

|

|

of

incorporation or organization)

|

Identification

No.)

|

|

|

9/F.,

Beijing Business World,

56

East Xinglong Street, Chongwen District,

Beijing,

China 100062

(Address

of principal executive offices)

|

||

|

(86)

20 3999 0266

(Registrant’s

telephone number, including area code)

|

||

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

Name

of each exchange on which registered

|

|

|

Common

Stock, par value $0.001 per share

|

Nasdaq

Global Market Stock Exchange,

Inc.

|

Securities

registered pursuant to section 12(g) of the Act:

Not

applicable

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act.

¨ Yes þ No

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or 15(d) of the Act.

¨ Yes þ No

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days.

þ Yes ¨ No

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Website, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files).

¨ Yes þ No

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not

be contained, to the best of the registrant’s knowledge, in definitive proxy or

information statements incorporated by reference in Part III of this Form 10-K

or any amendment to this Form

10-K.

¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,”

“accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act.

|

Large

accelerated filer

|

¨

|

Accelerated

filer

|

¨

|

|

Non-accelerated

filer

|

¨

(do not check if a smaller reporting company)

|

Smaller

reporting company

|

þ

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Act).

¨ Yes þ No

Revenues

for the year ended September 30, 2010: $39,141,000

Based on

the closing prices of the Registrant’s common stock on the last business day of

the Registrant’s most recently completed second quarter, which was March 31,

2010, the aggregate market value of the registrant’s voting common stock (based

on a closing price of $15.27) held by non-affiliates was approximately

$41,576,000. For purposes of the above statement only, all directors,

executive officers and 10% shareholders are assumed to be affiliates. This

determination of affiliate status is not necessarily a conclusive determination

for any other purpose.

As of

December 22, 2010, the registrant had 9,374,916 * shares of its common stock

issued and outstanding.

*The

number of shares outstanding reflects a 100 to 1 reverse split of the

registrant’s common stock, effectuated on October 23, 2009. Figures

referring to shares of the registrant’s common stock in this Form 10-K for the

reporting periods ending September 30, 2010 and September 30, 2009,

respectively, are provided on a post-reverse split basis.

DOCUMENTS

INCORPORATED BY REFERENCE

Portions

of the Registrant’s definitive proxy statement for its fiscal 2010 Annual

Meeting of Stockholders (the “Proxy Statement”), to be filed within 120 days of

the Registrant’s fiscal year ended September 30, 2010, are incorporated by

reference in Part III of this Report on Form 10-K. Except with respect to

information specifically incorporated by reference in this Form 10- K, the Proxy

Statement is not deemed to be filed as part of this Form 10-K.

TABLE

OF CONTENTS

|

PART

I

|

||

|

Item

1. Business.

|

3

|

|

|

Item

1A. Risk Factors.

|

15

|

|

|

Item

2. Properties.

|

28

|

|

|

Item

3. Legal Proceedings.

|

28

|

|

|

Item

4. Removed and Reserved.

|

28

|

|

|

PART

II

|

||

|

Item

5. Market for Registrant’s Common Equity, Related Stockholder Matters and

Issuer Purchases of Equity Securities.

|

29

|

|

|

Item

6. Selected Financial Data

|

30

|

|

|

Item

7. Management’s Discussion and Analysis of Financial Condition and Results

of Operations.

|

30

|

|

|

Item

7A. Quantitative and Qualitative Disclosures About Market

Risk

|

37

|

|

|

Item

8. Financial Statements and Supplementary Data.

|

37

|

|

|

Item

9. Changes in and Disagreements with Accountants on Accounting and

Financial Disclosure

|

38

|

|

|

Item

9A. Controls and Procedures.

|

38

|

|

|

Item

9B. Other Information

|

39

|

|

|

PART

III

|

||

|

Item

10. Directors, Executive Officers, and Corporate

Governance.

|

41

|

|

|

Item

11. Executive Compensation.

|

44

|

|

|

Item

12. Security Ownership of Certain Beneficial Owners and Management and

Related Stockholder Matters.

|

47

|

|

|

Item

13. Certain Relationships and Related Transactions, and Director

Independence.

|

48

|

|

|

Item

14. Principal Accounting Fees and Services.

|

49

|

|

|

PART

IV

|

||

|

Item

15. Exhibits, Financial Statement Schedules.

|

50

|

|

2

PART

I

Item

1. Business

Overview

Subaye, Inc. (“Subaye,” the “Company”

or “we”) is a leading provider of online business services in China. We offer

our bundled cloud product (“BCP”) to small-to-medium sized enterprises (“SMEs”)

in the People’s Republic of China (“China” or the “PRC”).

For the

year ended September 30, 2010, the Company’s revenues increased 46.4% to $39.1

million as compared to $26.7 million for the year ended September 30, 2009. Net

loss from continuing operations before income taxes totaled $7.9 million for

2010 as compared to net income of $8.6 million for 2009. Cash flows provided by

operations totaled $3.6 million for 2010 as compared to $9.0 million for

2009.

We were incorporated in Indiana in

January 1997 and re-domiciled to Delaware in 2005. Between January 1997 and

February 2010 we operated various business models and maintained numerous

product offerings, including our online video marketing product (“Online

Video”). Our primary web property, www.subaye.com, was initially launched in

October 2006. Online Video was offered through www.subaye.com and generated

revenue growth for the fiscal years ended September 30, 2009 and 2008 of 181%

and 23.4%, respectively, and was also able to generate very strong gross and net

margins for each of our four fiscal years ending after its initial launch in

2006. Revenue growth for the eleven months ended August 31, 2010 was

approximately 11.2%.

In October 2008, we made an initial

investment in our first collaboration relationship management (“CRM”) product

(the “Cloud Product”). This software was originally developed by a Fortune 100

company in the United States of America (“U.S.”). We completed minor

localization revisions to the software with the intent of ensuring the software

was user-friendly to our potential Chinese customers. Revenue growth for the

Cloud Product was 68.2% for the eleven months ended August 31, 2010. During 2010

and 2009 we began focusing our business planning on cloud computing and

committed to launching our second generation cloud computing

product.

During 2010, we acknowledged the growth

prospects of our Cloud Product were greater than that of Online Video. In July

2010, the second generation cloud computing product was completed. On September

1, 2010, we fully committed to one business model focused entirely on the second

generation cloud computing product we now refer to as the BCP. We no longer

offer Online Video as a separate product. We now offer Online Video as a core

component of our BCP. We market our BCP to our customers in China under the

“eNabler 2.0” brandname. The eNabler 2.0 is a CRM software. eNabler 2.0 includes

numerous improvements and localized enhancements which were completed in July

2010. Online Video and the Cloud Product included many web-based business

development-focused management tools. Customers were able to utilize a video

management and “video shuffling” module, a business lead tracking module, and an

advertising campaign budgeting module, among others. The BCP is an enhanced and

more robust product than we had previously provided our customers. We believe

our BCP has the potential to generate revenue growth at a far faster rate than

Online Video, and is potentially a higher margin business than Online Video. We

also believe the demand for cloud computing products potentially represents the

single most significant market opportunity of all internet-based businesses in

China in the next several years. During 2010, we expanded our business

operations from our primary market of Guangdong Province to a total of twenty

two (22) markets within China as of September 30, 2010. We believe we can

continue to grow at a significant pace as a result of maintaining a high quality

product offering in a product space and geographic area that is exhibiting signs

of significant growth in the years ahead.

3

According

to a May 2010 report entitled “China’s Pragmatic Path to Cloud Computing” issued

jointly by the Accenture Institute for High Performance and the Chinese Insitute

of Electronics, “Cloud computing is coming to China. It may not be coming quite

as fast as it is to other parts of the world, owing especially to China’s

cautious, pragmatic approach to this new technology. But the Chinese are likely

to make up for any lag time quickly…while the challenges and risks are real,

cloud computing also has the potential not only to cut IT costs dramatically but

even to transform how business is conducted.” Source: China’s Pragmatic Path to

Cloud Computing, Accenture Institute for High Performance, May 2010

Cloud

Computing

Cloud computing combines today’s

extraordinary computing power with a new level of flexibility and user

efficiency. Cloud computing allows a user, wherever they may be, to obtain

computing capabilities and access specific data of interest to them, through the

Internet, from a remote location at any time. We believe cloud computing will

soon change the way enterprise computing is conducted in China. We believe SMEs

understand that they no longer need to create and maintain their own internal

infrastructure of computer servers, storage systems, network devices, and

purchase operating system software in order to operate their businesses. The

entire enterprise computer infrastructure can be managed by third parties who

specialize in outsourced computer infrastructure management for enterprises. A

CRM product will suffice and will increase employee productively while

decreasing overall computing costs for a typical enterprise.

We also

believe, with the availability of CRM products, that businesses in China can

begin to operate on a broader scale and throughout a certain market, whether a

certain city or a certain province within China, and potentially can operate

throughout the entire country. Businesses that operate on a nation-wide basis in

China are currently very rare. We believe the availability of CRM products will

change this dynamic. CRM users can all generally share and routinely access CRM

solutions through an internet connection. These abilities will potentially

create new and powerful business models and further drive economic growth in

China.

Cloud

computing is generally segregated into three classes of products as described

below:

SAAS –

software as a service, generally describes the hosting of computer software

applications on remote computer servers that are accessed remotely at any time

by a user through an internet connection as opposed to the user running the

computer software on their own computer hardware directly, as is traditionally

the case;

PAAS –

platform as a service, generally describes an online service that is used to

create, test and host computing applications whereby the user can access the

platform to complete their work at any time through an internet connection as

opposed to the user working with computer applications running on their own

computer hardware directly, as is traditionally the case;

IAAS –

infrastructure as a service, generally describes a system used to process and

store data at a remote location whereby the user can acess the data and process

data at any time from anywhere as opposed to having the data and the computer

applications needed to process and store the data running on their own computer

hardware directly, as is traditionally the case.

There are

several key technologies that have allowed cloud computing to be embraced by

enterprises on a global scale in recent years. These technologies are inclusive

but not limited to the following:

Virtualization

– a way to run more applications or store more data on fewer

computers

Grid

computing – programming and networking which divides processing among computers;

resulting in increased computing speed and scalability

Broadband

internet – enables vast amounts of data to quickly travel over the

internet

Web 2.0 –

applications and technologies that make the Internet a vehicle for

collaboration

Service-oriented

architecture – design systems to act like interconnected services

4

Cloud

Computing in China

Market

research related to the cloud computing industry in China are wide-ranging.

Springboard Research projected 56% growth in the cloud computing industry in

China, such that the industry would reach $171 million by the end of 2010. IDC

estimated $17.4 billion was spent on cloud computing worldwide in 2009. China

has been slow to adopt cloud computing as compared to the rest of the world.

Springboard Research’s projection suggests that less than 1% of the total global

cloud computing industry is in China.

CCW

Research stated that they expect the cloud computing market in China will reach

approximately $9 billion (61.3 billion RMB) by 2013.

Chinese

organizations that are interested in cloud services have fewer choices than in

other countries. Elsewhere, a few large global vendors have begun to roll out a

wide range of cloud services, and are on the way to establishing themselves as

first tier suppliers. But in China, the same global firms are less visible. They

are establishing themselves through partnerships with local development

agencies, companies and universities. Few domestic firms have ventured into

cloud computing, and their offerings are primarily focused on SaaS.

Our

BCP

Our BCP is similar to other cloud

computing products in that it uses Internet-based computing, storage and

connectivity technology to deliver a variety of different services to our

customers. We developed our BCP to be an easy-to-use solution that can be

deployed rapidly to our customers, customized easily and potentially integrated

with other computer software applications. We understand that our customers have

a variety of needs and our customers cannot afford to be delayed in conducting

business for reasons such as a lack of access to key data at a critical moment.

We also understand that our customers in China generally have many hundreds or

thousands of employees and these employees’ needs cannot always be met with a

traditional local hardware-based solution. We believe our customers can increase

the individual productivity of each of their employees and can do so at a lesser

cost than traditional enterprise software and hardware solutions.

We market our BCP to SMEs on a monthly

non-contractual subscription basis, primarily through our direct sales efforts

as well as through selected third party agencies in China.

The

primary advantages of our BCP include:

Lower cost and fixed cost solution

to the computing needs of every SME. Our customers can achieve

significant upfront savings and significant long term savings as compared to the

alternative solutions to our BCP, such as a traditional enterprise software and

hardware solution. Customers benefit from a fixed cost structure for all of

their significant computing needs. All upgrades to our BCP are included in our

fee structure and are completed on our servers and are thus available to our

customers on a real time basis as soon as we install and launch an update on our

servers. Customers are not burdened by periodic system upgrades to their own

computer hardware or computer software.

Secure, scalable and reliable

Internet platform. The Internet is used to deliver our services to our

customers. In recent years the quality of the Internet within China has

dramatically improved. We believe we can provide our customers with high levels

of performance, reliability, and data security. We believe our customers can

continue to utilize our BCP as they grow their businesses. We believe our BCP is

viable solution for all SMEs. Our target market is not just a specific segment

or industry classification within the SME market within China.

Immediate activation of services.

Our BCP is activated immediately upon our customer providing verbal or

written acceptance of our fee structure and payment terms. Our BCP customers do

not spend their time procuring, installing and maintaining servers, data

storage, networking components, computer and Internet security products, or

other computer hardware and software necessary to maintain a functional

enterprise computer network.

5

Commitment to innovation. We

understand that the success of our BCP will largely depend on the quality of the

BCP and that without constant updating of the technology and web interface

associated with our BCP, we will be at a disadvantage as compared to our

competitors. As a result, we employ a team of approximately 40 computer

engineers who are focused on tracking technology developments and ensuring that

our web properties are updated and functioning at the leading edge of technology

as it relates to the business that we operate.

Intuitive solution. Our BCP

was designed to be user friendly such that an individual can utilize the BCP

offerings easily and with little training or phone support from us. We believe

our BCP is a fully localized product offering that contains many user interface

features that are likely familiar to our Chinese customers such that the

training and potential phone support related to the initial use of our BCP by a

new customer should be minimal. We conduct customer surveys to gauge their

experiences with our BCP in order to continue to seek new ways to improve our

BCP.

“Sticky” solution. We believe

our BCP is a solution that offers our customers a chance to fully embrace the

online experience with our BCP and commit time and effort towards the process of

fully utilizing the BCP. Additionally, as customers continue to rely on and use

our BCP, we believe the databases they develop and customer-specific

modifications they make to their customer and business data will ensure that our

customers continue to use our BCP absent any significant reasons or motivations

to discontinue the use of our BCP. As a result, we believe we have a revenue

stream associated with the BCP that is insulated from large scale customer

defections or extreme and sudden decreases in revenues and net

profits.

Our

Strategy

Our primary objective is to be the

leading provider of CRM products in China.

Key

elements of our strategy include:

Aggressive expansion. We

believe that our BCP can provide significant value for SMEs. We began our

expansion outside of Guangdong Province in 2010. We will continue these

expansion efforts and will seek out customers of all sizes, primarily through

our direct sales force. We have recently completed an aggressive expansion of

our internal sales force and will look to further increase the size of our sales

force in order to meet the demands of the various specific markets in China that

we now operate in. We intend to develop additional distribution channels and

joint ventures related to our BCP.

Continuing to support the industry

transformation to cloud computing. We believe that the market

transformation to cloud applications and platforms is a growing trend in the

information technology industry. In recent years cloud computing has been

recognized as achieving record growth in other markets, namely in the U.S. We

believe China will be one of the next markets to aggressively adopt cloud

computing and could represent the largest potential market in the world for

cloud computing due to China’s status as the largest base of Internet users in

the world and also because of China’s robust economic growth. We enable

customers of all sizes to benefit from the capabilities of enterprise software

applications. We believe we can establish a leadership position in China’s

enterprise cloud computing industry.

Strengthening our existing CRM

applications and extending into new functional areas within CRM. We

designed our service to easily accommodate new features and functions. We intend

to continue to add CRM features and functionality to our core service that we

will make available to customers at no additional charge. We will likely enhance

our CRM offering again by offering advanced editions for an additional

subscription fee to customers that require enhanced CRM

capabilities.

Operations

Our

employees, including senior management, conduct our operations primarily out of

our office in Panyu City, Guangdong Province, China. We also operate our

headquarters and sales office in Beijing, China, and have senior executive

officers based in Shanghai, China.

6

We currently serve our customers from

our data center hosting facilities located in Guangzhou City, Guangdong

Province, China. In 2011 we expect to add additional data centers in other

primary market locations. These locations have yet to be determined as of the

date of this annual report. However, considerations such as the potential local

market size, the data transmission speeds between locations we are active

within, as well as the estimated costs to operate the data centers, will be

utilized to determine the location of our future data centers.

Our facilities in Guangzhou City are

secured by an electronic security system and only a few employees of the Company

have access to the data center hardware and software applications. The data

center includes on-site backup generators. As part of our current disaster

recovery arrangements, all of our customers’ data is currently replicated in

near real-time. We are protecting our customers’ data and ensuring service

continuity in the event of a major disaster. Even with the disaster recovery

arrangements, our service could be interrupted.

In

addition we have a data center in Panyu City, Guangdong Province, China. This

data center is primarily for internal information, business development and

quality assurance tasks.

Sales

Strategy

Direct sales. We sell

subscriptions to our service primarily through our direct sales force comprised

of inside sales, which consists of personnel that sell to customers primarily by

phone, and field sales personnel, that are primarily based in geographic

territories comprising customers and prospects. Both our inside sales and field

sales personnel are supported by telesales representatives who are primarily

responsible for generating qualifying leads. Our small business, general

business and enterprise account executives and account managers focus their

efforts on SMEs in China.

Indirect sales. We have a

network of customer relationship agents (the “Agents”) who manage specific

markets for us and conduct business development efforts on our behalf within

these markets. As of September 30, 2010, this network included Agents in twenty

two (22) markets within China. In return, we are contractually obligated to pay

these partners a fee equal to 30% of the revenues generated by the customers

within the market managed by the Agent. These fees are classified as a reduction

of revenues within our financial statements and are recorded on a monthly basis

as each individual unit of revenue is generated from a customer.

Marketing

Strategy

Our marketing strategy is to continue

to reach out to potential new customers in new markets, develop and strengthen

our local contacts within each market and increase our brand awareness

throughout China. We use a variety of marketing programs to achieve these

goals.

Our

primary marketing activities include:

|

•

|

local

press releases and public relations actions focused on the widespread

distribution of significant news related to the BCP or the Company

itself;

|

|

•

|

attendance

at local government events, trade shows and industry or specific business

events;

|

|

•

|

development

and support for localized industry and business-centric social networking

websites sponsored by Subaye or benefitting Subaye or its business

partners in some way;

|

|

•

|

email

and direct mail campaigns to generate business

leads;

|

|

•

|

use

of sales tools and internally developed materials, some of which are

created using our video marketing expertise;

and

|

|

•

|

search

engine marketing and online

advertising.

|

Customer

Service

Our customer service team responds to

both general and technical inquiries from our customers or potential customers

that generally relate to products use issues or basic product training and user

interface related questions. Our customer service inquiries are processed

through the phone, email and through web-based chat.

7

A

customer service is available to all of our customers during business hours at

no charge.

Customers

Subaye’s

customers consist of SMEs in China. SMEs have been utilizing Subaye’s Video

Online and Cloud Product historically and, as of September 1, 2010, the SMEs

began utilizing the BCP. As of September 30, 2010, the Company’s customer base

consisted of 13,531 SMEs, most of whom operate their businesses in Guangdong

Province, China.

Intellectual

Property

We invest

regularly in computer software and computer hardware applications, and

Internet-based applications, including our BCP, our www.subaye.com website and a

variety of other web-based properties that are operated or in the process of

being developed to augment our primary www.subaye.com website.

Research

and Development

We

incurred research and development expenses for the years ended September 30,

2010 and 2009 of $237 thousand and $118 thousand, respectively. The Company’s

primary research and development activities involve website and software

development, which the Company has historically always outsourced to third party

providers in Guangdong Province, China.

Personnel

As of

September 30, 2010 and 2009, we had a total of 1,539 and 311 employees,

respectively. The chart below provides a general breakout of our employee ranks

as of each of the two most recent fiscal years.

|

As of September 30,

|

||||||||

|

2010

|

2009

|

|||||||

|

Management

and Administrative

|

63 | 51 | ||||||

|

Research

and Development

|

71 | 48 | ||||||

|

Sales

and Marketing

|

1,405 | 212 | ||||||

|

Total

Employees

|

1,539 | 311 | ||||||

Competition

We expect the market for enterprise CRM

to become highly competitive within China in 2011. We expect to see new

competition and significant investment in CRM. However, most of our potential

SME customers have invested substantially in order to implement and integrate a

traditional enterprise software into their business operations. As a result,

they may be reluctant or unwilling to transition to an enterprise cloud

computing application service. Additionally, SMEs may not believe a transition

to a CRM will be as smooth and effortless as is generally the case.

We compete with vendors of packaged CRM

software, whose software is installed by the customer directly, and companies

offering on-demand CRM applications available through the Internet. Our current

principal competitors in China include:

8

|

Name

|

Type

of

Product

|

Description of Product

|

||

|

21

Vianet

|

IAAS

|

Data

center service provider

|

||

|

800Apps

|

SAAS

|

Start-up

provides CRM services

|

||

|

Alisoft

(Alibaba)

|

SAAS

|

CRM,

sales force management, inventory management, financial and marketing

information management service

|

||

|

China

Mobile

|

PAAS

|

Mobile

Internet cloud services

|

||

|

CNSaaS.com

|

SAAS

|

Joint

venture uses Microsoft SAAS technology

|

||

|

eAbex

|

SAAS

|

Management

software and e-business services

|

||

|

Infobird

|

SAAS

|

Call

center systems and service provider partnering with Dell to provide

cloud-based services

|

||

|

Jingoal

|

SAAS

|

Management

software and service provider

|

||

|

Lenovo

|

SAAS

|

SaaS

services, cloud-based storage, thin-client PCs for cloud

computing

|

||

|

Sogou.com

|

SAAS

|

Free

cloud-based input service for entering Chinese pinyin

|

||

|

Wecoo.com

|

SAAS

|

Online

marketing and management services

|

||

|

Xtools

|

SAAS

|

CRM

|

||

|

Youshang.com

|

SAAS

|

Online

management e-business services

|

||

|

Yoyo

Systems

|

PAAS

|

Has

cloud R&D centers in China and

US

|

We also compete with global technology

providers who offer alternative solutions to cloud computing products. We also

anticipate most of these global technology providers will eventually enter the

cloud computing market in China if they have not already done so. However, for a

variety of reasons including Chinese Internet regulations and security and

privacy concerns, we anticipate these global technology providers will not

compete directly with us. It is more likely that these global technology

providers will look to partner with Chinese companies in order to develop their

business within the cloud computing industry in China. A selected list of these

global technology providers is provided below:

|

•

|

enterprise

software application vendors including Google, Microsoft Corporation,

Oracle Corporation, and SAP AG;

|

|

•

|

on-demand

CRM application service providers such as Microsoft Corporation, NetSuite,

Inc., Oracle Corporation, RightNow Technologies, Inc. and SAP

AG.;

|

|

•

|

enterprise

application service providers including IBM Corporation and Oracle

Corporation; and

|

|

•

|

traditional

platform development environment companies, including established vendors,

such as IBM Corporation, Microsoft Corporation, and Oracle

Corporation.

|

We believe that as enterprise software

application and platform vendors shift more of their focus to cloud computing,

they will be a greater competitive threat.

We believe the principal competitive

factors in our market include the following:

|

•

|

proven

track record of customer success;

|

|

•

|

speed

and ease of implementation, transition from traditional enterprise

computer solutions;

|

|

•

|

product

functionality and quality;

|

|

•

|

financial

stability and viability of the

vendor;

|

|

•

|

product

adoption;

|

|

•

|

ease

of use and rates of user adoption;

|

|

•

|

low

total cost of ownership and demonstrable cost-effective benefits for

customers;

|

|

•

|

performance,

security, scalability, flexibility and reliability of the

service;

|

|

•

|

ease

of integration with existing

applications;

|

|

•

|

quality

of customer support;

|

|

•

|

availability

and quality of implementation, consulting and training services;

and

|

|

•

|

vendor

reputation and brand awareness.

|

9

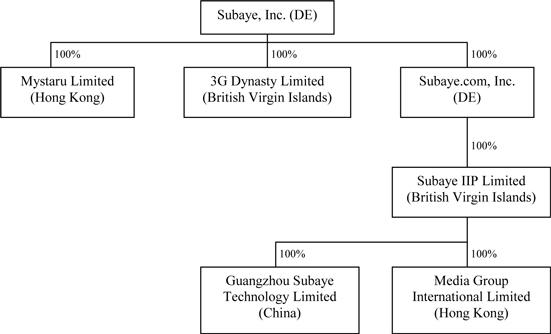

Corporate

Structure

Our

corporate structure is illustrated by the chart below.

Government

Regulation

Overview

Substantially

all of our operations are, and will be, based in China. Accordingly, our

business is subject to extensive regulations by the Chinese government. These

regulations govern a wide range of areas including, among others, Internet

advertising, Internet video and Internet content provider (“ICP”) licenses. In

addition, our operations are subject to general regulations in China without

industry-specific requirements, such as foreign investments, foreign exchange

control, and taxation.

We incur

significant costs to operate our business and monitor our compliance with these

laws, regulations, and rules. Any changes to the existing applicable laws,

regulations, or rules, or any determination that other laws, regulations, or

rules are applicable to us, could increase our costs or impede our ability to

provide our services to our customers, which could have a material adverse

effect on our business, prospects, financial condition, and operating results.

In addition, any of these laws, regulations, or rules are subject to revision,

and we cannot predict the impact of such changes on our business. Further, any

determination that we have violated any of these laws, regulations, or rules may

result in liability for fines, damages, or other penalties, which could have a

material adverse impact on our business, prospects, financial condition, or

operating results.

Principal

Rules, Regulations, and Laws Relating to the Internet Industry

Certain areas related to the Internet,

such as telecommunications, Internet information services, international

connections to computer information networks, information security and

censorship are covered extensively by a number of existing laws and regulations

issued by various PRC governmental authorities, including:

|

•

|

the

Ministry of Industry and Information Technology

(“MIIT”);

|

|

•

|

the

Ministry of Culture (“MOC”);

|

|

•

|

the

Ministry of Public Security;

|

|

•

|

the

State Administration of Industry and Commerce (“State

AIC”);

|

|

•

|

the

General Administration for Press and Publication (“GAPP,” formerly the

State Press and Publications Administration,

“SPPA”);

|

10

|

•

|

the

State Administration for Radio, Film and Television

(“SARFT”);

|

|

•

|

the

State Council Information Office

(“SCIO”);

|

|

•

|

the

State Administration of Foreign Exchange

(“SAFE”).

|

ICP

License

The MIIT promulgated on July 13, 2006 a

Notice of the Ministry of

Information Industry on Intensifying the Administration of Foreign Investment in

Value-added Telecommunications Services (the “Notice”). The Notice is

designed to strengthen foreign investment in PRC telecommunication businesses,

particularly those involving value-added telecommunications services, which

encompass a wide variety of activities related to the provision of

service/content via telecommunications networks. The Notice requires

telecommunication companies to hold the domain names and trademarks that they

use in their provision of value-added telecommunication services, and necessary

business premises and facilities within the region covered by their ICP licenses

which correspond to the ICP services. In compliance with the Notice, an

enterprise holding an ICP license must be the entity that possesses the key

intellectual property rights associated with the business, namely the domain

names and trademarks. All of the Company’s operations related to the BCP, Cloud

Product and Video Online have been conducted through our subsidiary, Guangzhou

Subaye Computer Tech Limited (“GZ Subaye”), a PRC entity, which holds all of the

necessary licenses we require in order to operate our business. In the opinion

of our PRC legal counsel, Guangdong Zhengda Joint Attorney Offices, the

ownership structure of our PRC subsidiary complies with all existing laws, rules

and regulations of the PRC, and GZ Subaye, on behalf of Subaye, has the full

legal right, power and authority, and has been duly approved to carry on and

engage in the business as described in its business license.

Telecommunication

Laws and Regulations

Among all of the applicable laws and

regulations, the Telecommunications Regulations of

the People’s Republic of China (“Telecom Regulations”),

implemented on September 25, 2000, are the primary governing laws, and set out

the general framework for the provision of telecommunication services by

domestic PRC companies. Under the Telecom Regulations, it is a requirement that

telecommunications service providers procure operating licenses prior to their

commencement of operations. The Telecom Regulations draw a distinction between

“basic telecommunications services” and “value-added telecommunications

services.” Value-added telecommunications services are defined as

telecommunications and information services provided through public networks. A

“Catalogue of

Telecommunications Business” (“Catalog”) was issued as an attachment to

the Telecom Regulations to categorize telecommunications services as basic or

value-added. In February 2003, the Catalogue was updated, categorizing online

data and transaction processing, on-demand voice and image communications,

domestic Internet virtual private networks, Internet data centers, message

storage and forwarding (including voice mailbox, e-mail and online fax

services), call centers, Internet access, and online information and data search

as value-added telecommunications services. Accordingly, there are various types

of telecommunications services, in which we are engaged that are regulated as

value-added telecommunications services. Our valued-added telecom operating

license number is “Guangdong B2-20060606.”

Laws

and Regulations Related to Content Provision Internet Information

Services

On September 25, 2000, the State

Council approved the Measures

for the Administration of Internet Information Services (“ICP Measures”).

Under the ICP Measures, any entity that provides information to online users on

the Internet is obliged to obtain an operating license from the MIIT or its

local branch at the provincial or municipal level in accordance with the Telecom

Regulations described above. Our operating license was received from the

Guangdong Province in 2006.

The ICP Measures stipulate further that

entities providing online information services regarding news, publishing,

education, medicine, health, pharmaceuticals and medical equipment must procure

the consent of the national authorities responsible for such areas prior to

applying for an operating license from the MIIT or its local branch at the

provincial or municipal level. Moreover, ICPs must display their operating

license numbers in conspicuous locations on their home pages. ICPs are required

to police their Websites and remove certain prohibited content. This obligation

reiterates Internet content restrictions that have been promulgated by other PRC

ministries.

11

Most importantly for foreign investors,

the ICP Measures stipulate that ICPs must obtain the prior consent of the MIIT

prior to establishing an equity or cooperative joint venture with a foreign

partner.

Online

Audiovisual Transmission

On December 20, 2007, the SARFT and the

MIIT jointly issued the Rules

for the Administration of Internet Audiovisual Program Services

(“Document 56”), which came into effect as of January 31, 2008. The rules

require all online audio and video service providers to be either state-owned or

state-controlled. They also encourage state-owned entities to actively invest in

online audiovisual services. However, further to this, in a press conference on

February 3, 2008, the SARFT and the MIIT clarified that online audio-visual

service providers that were already lawfully operating prior to the issuance of

Document 56 may re-register and continue to operate without becoming state-owned

or controlled, provided that such providers do not engage in any unlawful

activities. This exemption will not be granted to service providers set up after

Document 56 was issued. As we were already engaged in online audiovisual

transmission prior to the issuance of Document 56, we are presumably exempted

from the requirement of being state-owned or state-controlled.

Information

Security and Censorship

The principal pieces of PRC legislation

concerning information security and censorship are:

|

•

|

The

Law of the People’s Republic of China on the Preservation of State Secrets

(1988) and its Implementing Rules

(1990);

|

|

•

|

The

Law of the People’s Republic of China Regarding State Security (1993) and

its Implementing Rules (1994);

|

|

•

|

Rules

of the People’s Republic of China for Protecting the Security of Computer

Information Systems (1994);

|

|

•

|

Notice

Concerning Work Relating to the Filing of Computer Information Systems

with International Connections

(1996);

|

|

•

|

Administrative

Regulations for the Protection of Secrecy on Computer Information Systems

Connected to International Networks

(1999);

|

|

•

|

Regulations

for the Protection of State Secrets for Computer Information Systems on

the Internet (2000);

|

|

•

|

Notice

issued by the Ministry of Public Security of the People’s Republic of

China Regarding Issues Relating to the Implementation of the

Administrative Measure for the Security Protection of International

Connections to Computer Information Networks

(2000);

|

|

•

|

The

Decision of the Standing Committee of the National People’s Congress

Regarding the Safeguarding of Internet Security (2000);

and

|

|

•

|

Measures

for the Administration of Commercial Website Filings for the Record (2002)

and their Implementing Rules

(2002).

|

Our management team is responsible for

ensuring that we are in compliance with the legislation noted above. As of the

date of this annual report, we believe we are in compliance with the legislation

noted above.

These pieces of legislation

specifically prohibit the use of Internet infrastructure where it results in a

breach of public security, the provision of socially destabilizing content or

the divulgence of State secrets, as follows:

|

•

|

“A

breach of public security” includes breach of national security or

disclosure of state secrets; infringement on state, social or collective

interests or the legal rights and interests of citizens or illegal or

criminal activities.

|

12

|

•

|

“Socially

destabilizing content” includes any action that incites defiance or

violation of Chinese laws; incites subversion of state power and the

overturning of the socialist system; fabricates or distorts the truth,

spreads rumors or disrupts social order; advocates cult activities; or

spreads feudal superstition, involves obscenities, pornography, gambling,

violence, murder, or horrific acts or instigates criminal

acts.

|

|

•

|

“State

secrets” are defined as “matters that affect the security and interest of

the state”. The term covers such broad areas as national defense,

diplomatic affairs, policy decisions on state affairs, national economic

and social development, political parties and “other State secrets that

the State Secrecy Bureau has determined should be

safeguarded.”

|

Our management team is responsible for

ensuring that we are in compliance with the legislation noted above. As of the

date of this annual report, we believe we are in compliance with the legislation

noted above.

Laws

and Regulations Related to Online Advertisings Services

Under the Administrative Regulations for

Advertising Licenses and the Implementation Rules for the

Administrative Regulations for Advertising, both of which were issued by

the State AIC on November 30, 2004 and effective as of January 1, 2005,

enterprises (except for broadcast stations, television stations, newspapers and

magazines, non-corporate entities and other entities specified in laws or

administrative regulations) are generally exempted from the previous requirement

to obtain an advertising license. Exempted enterprises are only required to

apply for the inclusion of advertising services in their business license. We do

not currently believe our operations are appropriately classified as online

advertising services. As a result we do not maintain an advertising

license.

Software

Products Registration

On October 27, 2000, the MIIT issued

the Measures Concerning Software Products Administration, or Software Measures,

to regulate software products and promote the development of the software

industry in the PRC. These Software Measures have been amended and replaced by

the new Software Measures issued by the MIIT on March 1, 2009, effective as of

April 10, 2009. Pursuant to the new Software Measures, software developers or

producers are allowed to sell or license their software products independently

or through agents. Software products developed in the PRC can be registered with

the local provincial government authorities in charge of the information

industry and filed with the MIIT. Upon registration, the software products shall

be granted registration certificates. Each registration certificate is valid for

five years and may be renewed upon expiration. Software products developed in

the PRC which satisfy the requirements of the Software Measures and have been

registered and filed in accordance with the Software Measures may enjoy

preferential treatments under relevant policy of the State Council. The MIIT and

other relevant departments may supervise and inspect the development,

production, sale and import and export of software products in the PRC. We have

registered all software products which we currently operate.

Privacy

Protection

Chinese law does not prohibit Internet

content providers from collecting and analyzing personal information from their

customers. Chinese law prohibits ICPs from disclosing to any third parties any

information transmitted by users through their networks unless otherwise

permitted by law. If an Internet content provider violates these regulations,

the MIIT or its local bureaus may impose penalties and the Internet content

provider may be liable for damages caused to its users. Our management team is

responsible for ensuring that we are in compliance with all privacy protection

laws in China. As of the date of this annual report, we believe we are in

compliance with all privacy protection laws in China.

13

Stock

Option Rule

PRC residents who control our company

from time to time are required to register with the SAFE in connection with

their investments in us. On December 25, 2006, the PBOC issued the Administration Measures on

Individual Foreign Exchange Control, and its Implementation Rules was

issued by SAFE on January 5, 2007, both of which became effective on February 1,

2007. Under these regulations, all foreign exchange matters involved in the

employee stock ownership plan, stock option plan or other issuances of shares of

our common stock or other financial instuments, in which onshore individuals

participated will require the approval from the SAFE or its authorized branch.

On March 28, 2007, SAFE promulgated the Application Procedure of Foreign

Exchange Administration for Domestic Individuals Participating in Employee Stock

Holding Plan or Stock

Option Plan of Overseas Listed Company, or the Stock Option Rule. Under

the Stock Option Rule, PRC citizens who are granted stock options or restricted

share units, or issued restricted shares by an overseas publicly listed company

are required, through a PRC agent or PRC subsidiary of such overseas publicly

listed company, to complete certain other procedures and transactional foreign

exchange matters under the Stock Option Plan upon the examination by, and

approval of, SAFE. We and our employees, who are PRC citizens and have been

granted stock options or restricted share units or issued restricted shares, are

subject to the Stock Option Rule. We and our employees intend to make such

application and complete all the requisite procedures in accordance with the

Stock Option Rule. However, we cannot assure you that we can complete all the

procedures in a timely manner. If the relevant PRC regulatory authority

determines that our PRC employees who hold such options, restricted share units

or restricted shares or their PRC employer fail to comply with these

regulations, such employees and their PRC employer may be subject to fines and

other legal sanctions.

Safety

and Labor Protection

The Work

Safety Law of the PRC, which became effective on November 1, 2002, is the

principal law governing the supervision and administration of work safety and

labor protection for our operations. The main Chinese employment laws and

regulations applicable to our power plants include the Labor Law of the PRC, the

Employment Contract Law of the PRC and the Implementing Regulations of the

Employment Contract Law of the PRC. The Employment Contract Law of

the PRC was promulgated on June 29, 2007 and became effective on January 1,

2008. This law governs the establishment of employment relationships

between employers and employees, and the execution, performance, termination of,

and the amendment to, employment contracts. Compared to the PRC Labor

Law, the new PRC Employment Contract Law provides additional protection to

employees by requiring written labor employment contracts and long-term

contractual employment relationships, limiting the scope of the circumstances

under which employees could be required to pay penalties for breach of

employment contracts and imposing stricter sanctions on employers who fail to

pay remuneration or social security premiums for their employees. Our management

team is responsible for ensuring that we are in compliance with all safety and

labor protection laws in China. As of the date of this annual report, we believe

we are in compliance with all safety and labor protection laws in

China.

Taxation

Income

Tax on Foreign Investment Enterprises

Before

the implementation of the Enterprise Income Tax (“EIT”) law (as discussed

below), Foreign Invested Enterprises established in the People’s Republic of

China were generally subject to an EIT rate of 33.0%, which included a 30.0%

state income tax and a 3.0% local income tax. On March 16, 2007, the

National People’s Congress of China passed the new Corporate Income Tax Law

(“CIT Law”), and on November 28, 2007, the State Council of China passed the

Implementation Rules for the CIT Law (“Implementation Rules”), which took effect

on January 1, 2008. The CIT Law and Implementation Rules impose a unified EIT of

25.0% on all domestic-invested enterprises and foreign invested enterprises

(“FIEs”), unless they qualify under certain limited exceptions. Therefore,

nearly all FIEs are subject to the new tax rate alongside other domestic

businesses rather than benefiting from the old tax laws applicable to FIEs, and

its associated preferential tax treatments, beginning January 1,

2008. Subaye is therefore subject to income tax at a rate of 25.0% of

the Company’s taxable income starting from January 1, 2008 according to the

Enterprise Income Tax Law and its Implementation Rules of People’s Republic of

China.

14

Effective

Tax Rate and Tax Holiday

Enterprise

income tax in China is generally charged at 25% of a company’s assessable

profit, of which 22% is a national tax and 3% is a local tax. The Company’s

subsidiary, Guangzhou Subaye, is incorporated in China, and is subject to

Chinese enterprises income tax at the applicable tax rates on the taxable income

as reported in their Chinese statutory accounts in accordance with the relevant

enterprises income tax laws.

The

provision for enterprise income tax in China is $0 and $2,932 thousand for the

year ended September 30, 2010 and 2009, respectively. No provision for

enterprise income tax in China had been made the year ended September 30, 2009

due to the fact that certain subsidiaries of the Company are exempt from Chinese

enterprise income tax based on the statutory provisions granting a tax holiday

for a two year period, as stated above, specifically for the years ended

September 30, 2009 and 2008, respectively. The Company’s Chinese tax

holiday expired on October 1, 2009.

Item

1A. Risk Factors.

Risks

Related to Our Business

Our

limited operating history makes it difficult to evaluate our future prospects

and results of operations.

We have a

limited operating history. Accordingly, you should consider our future prospects

in light of the risks and uncertainties experienced by early stage companies in

evolving industries such as the Internet industry in China. As a result of our

limited operating history, we have limited financial data that you can use to

evaluate our business and prospects. As a result of these factors, the future

revenue and income potential of our business is uncertain. If we are

unsuccessful in addressing any of these risks and uncertainties, our business

may be materially and adversely affected.

We

have generated profits in the past but our historical financial information may

not be representative of our future results of operations.

We have

experienced growth in recent periods, in part, due to the growth in China’s

Internet industry, which may not be representative of future growth or be

sustainable. We cannot assure you that our historical financial information is

indicative of our future operating results or financial performance, or that our

profitability will be sustained.

Most

potential customers of our BCP have previously and possibly recently invested

significantly in traditional enterprise computer hardware and computer software

products. As a result, these potential customers may be unwilling or

unable to justify a transition to a cloud computing product such as our

BCP.

We focus

our business development efforts on SMEs. Cloud computing is at an early stage

of development and deployment in China. As a result, we acknowledge that most of

our potential customers currently utilize traditional enterprise computer

hardware and computer software. Transitioning to cloud computing would result in

the traditional enterprise computer hardware and software being replaced not

just on a temporary basis but more likely on a permanent basis. As a result, the

loss on the investment in the traditional enterprise computer hardware and

computer software may be difficult for our potential customers to accept in the

near future and there may be an inherent delay in the adoption of cloud

computing by these potential customers.

15

We

face significant competition and may suffer from a loss of customers as a

result.

We face

significant competition in almost every aspect of our business, particularly

from other companies that seek to provide Internet-based business services such

as cloud computing and video-based marketing services to SMEs. Our main

competitors include both Chinese companies and global technology providers. We

compete with these entities for customers on the basis of the quality of our

online business services, user traffic, quality (relevance) and quantity (index

size) of the information being searched, availability and ease restriction of

use of products and services, the number of customers, distribution channels and

the number of associated third-party websites. In addition, we may face greater

competition from global technology providers as a result of, among other things,

a relaxation on the foreign ownership restrictions of Chinese Internet content

and advertising companies, improvements in online payment systems and Internet

infrastructure in China and increased business activities by global technology

providers in China.

Many of

these competitors have significantly greater financial resources than we do.

They also have longer operating histories and more experience in attracting and

retaining users and managing customers than we do. They may use their experience

and resources to compete with us in a variety of ways, including by competing

more heavily for users, customers, distributors and networks of third-party

websites, investing more heavily in research and development and making

acquisitions. If any of our competitors provide comparable or better Chinese

language cloud computing and online marketing services, our revenues could

decline significantly. Any such decline in revenues could weaken our brand,

result in a loss of other customers and have a material adverse effect on our

results of operations.

We also

face competition from traditional advertising media, such as newspapers,

magazines, yellow pages, billboards and other forms of outdoor media, television

and radio. Most large companies in China allocate, and will likely continue to

allocate, most of their marketing budgets to traditional advertising media and

only a small portion of their budgets to online marketing. If these companies do

not devote a larger portion of their marketing budgets to online marketing

services provided by us, or if our existing customers reduce the amount they

spend on online marketing, our results of operations and future growth prospects

could be adversely affected.

Our

business depends on a strong network, and if we are not able to maintain and

enhance our network, we may lose customers, resulting in a reduction in

revenue.

We

developed our customer base primarily by word-of-mouth and incurred limited

brand promotion expenses prior to December 2008. We have committed to brand

promotion efforts, but we cannot assure you that our marketing efforts will be

successful in further promoting our brand. If we fail to promote and maintain

the "Subaye" brand, or if we incur excessive expenses in this effort, our

business and results of operations could be materially and adversely

affected.

If

we fail to continue to innovate and provide relevant products and services, we

may not be able to generate maintain our customer base such that the customer

base is large enough to allow us to remain competitive, resulting in a loss of

customers and reduction in revenue.

Our

success depends on providing products and services that people use for a

high-quality cloud computing and online marketing purposes. Our competitors are

constantly developing innovations in cloud computing and online marketing as

well as enhancing their customers’ online experience. As a result, we must

continue to invest significant resources in research and development to enhance

our technology and our existing products and services and introduce additional

high quality products and services to attract and retain customers. If we are

unable to anticipate customer preferences or industry changes, or if we are

unable to modify our products and services on a timely basis, we may lose

customers and customers. Our operating results would also suffer if our

innovations do not respond to the needs of our customers and customers, or are

not appropriately timed with market opportunities or are not effectively brought

to market. As online services technology continues to develop, our competitors

may be able to offer products or services that are, or that are perceived to be,

substantially similar to or better than our services. This may force us to

expend significant resources in order to remain competitive.

16

If

we fail to keep up with rapid technological changes, our future success may be

adversely affected due to a loss of customers and reduced ability to attract new

customers.

The

Internet industry is subject to rapid technological changes. Our future success

will depend on our ability to respond to rapidly changing technologies, adapt

our services to evolving industry standards and improve the performance and

reliability of our services. Our failure to adapt to such changes could harm our

business. New marketing media could also adversely affect us. For example, the

number of people accessing the Internet through devices other than personal

computers, including mobile telephones and hand-held devices, has increased in

recent years. If we are slow to develop products and technologies that are more

compatible with those devices or non-PC communications devices, we may not be

successful in capturing a significant share of this increasingly important

market for media and other services. In addition, the widespread adoption of new

Internet, networking or telecommunications technologies or other technological

changes could require substantial expenditures to modify or adapt our products,

services or infrastructure. If we fail to keep up with rapid technological

changes to remain competitive in our rapidly evolving industry, our future

success may be adversely affected.

We

may not be able to prevent others from unauthorized use of our intellectual

property, which could result in a reduction of income and loss of

customers.

We rely

on a combination of copyright, trademark and trade secret laws, as well as

nondisclosure agreements and other methods to protect our intellectual property

rights. The protection of intellectual property rights in China may not be as

effective as those in the U.S. or other countries. The steps we have taken may

be inadequate to prevent the misappropriation of our technology. Reverse

engineering, unauthorized copying or other misappropriation of our technologies

could enable third parties to benefit from our technologies without paying us.

Moreover, unauthorized use of our technology could enable our competitors to

offer online services that are comparable to or better than ours, which could

harm our business and competitive position. From time to time, we may have to

enforce our intellectual property rights through litigation. Such litigation may

result in substantial costs and diversion of resources and management

attention.

Cloud

Computing and online marketing are relatively novel concepts in China and our

business strategy may prove to be ineffective, resulting in loss of customers

and revenue.

If our

business fails to retain existing customers or attract new customers for our

online marketing services, our business and growth prospects could be seriously

harmed. Our cloud computing and online marketing customers will not continue to

do business with us if their investment does not increase their employee

productivity and generate sales growth. Our customers may discontinue their

business with us at any time and for any reason as they are not subject to

fixed-term contracts. Failure to retain our existing online marketing customers

or attract new customers for our online marketing services could seriously harm

our business and growth prospects.

Our

reliance on third-party distribution agents poses operational risks to our

business.

Because

we primarily rely on distribution agents in providing services through

www.subaye.com, our failure to retain key distribution agents or attract

additional distribution agents could materially and adversely affect our

business.

Cloud

computing and online marketing are both at early stages of development in China

and are not as widely accepted by or available to businesses in China as in the

U.S. As a result, we rely heavily on a nationwide distribution network of

third-party distributors for our sales to, and collection of payment from our

customers. If our distribution agents do not provide quality services to our

customers or otherwise breach their contracts with us, we may lose customers and

our results of operations may be materially and adversely affected. We have

long-term agreements with most of our distribution agents, including our key

distribution agents, but we cannot assure you that we will continue to maintain

favorable relationships with them. Our distribution arrangements, except for

those with our key distribution agents, are non-exclusive. Furthermore, some of

our distribution agents also contract with our competitors or potential

competitors and may not renew their distribution agreements with us. In

addition, as new methods for accessing the Internet, including the use of

wireless devices, become available, we may need to expand our distribution

network. If we fail to retain our key distribution agents or attract additional

distribution agents on terms that are commercially reasonable, our business and

results of operations could be materially and adversely

affected.

17

Our

strategy of acquiring complementary businesses, assets and technologies may fail

which could reduce our ability to compete for customers.

As part

of our business strategy, we have pursued, and intend to continue to pursue,

selective strategic acquisitions of businesses, assets and technologies that

complement our existing business. We may make other acquisitions in the future

if suitable opportunities arise. Acquisitions involve uncertainties and risks,

including:

• potential

ongoing financial obligations and unforeseen or hidden liabilities;

• failure

to achieve the intended objectives, benefits or revenue-enhancing

opportunities;

• costs

and difficulties of integrating acquired businesses and managing a larger

business; and

• diversion

of resources and management attention.

Our

failure to address these risks successfully may have a material adverse effect

on our financial condition and results of operations. Any such acquisition may

require a significant amount of capital investment, which would decrease the

amount of cash available for working capital or capital expenditures. In

addition, if we use our equity securities to pay for acquisitions, we may dilute

the value of your shares. If we borrow funds to finance acquisitions, such debt

instruments may contain restrictive covenants that could, among other things,

restrict us from distributing dividends. Such acquisitions may also generate

significant amortization expenses related to intangible assets.

We

may not be able to manage our expanding operations effectively which could

impede our growth.

The

Company was organized on January 6, 1997 and we have expanded our operations

rapidly. We anticipate significant continued expansion of our business as we

address growth in our customer-base, customer-base and market opportunities. To

manage the potential growth of our operations and personnel, we will be required

to improve operational and financial systems, procedures and controls, and

expand, train and manage our growing employee base. Furthermore, our management

will be required to maintain and expand our relationships with other websites,

Internet companies and other third parties. We cannot assure you that our

current and planned personnel, systems, procedures and controls will be adequate

to support our future operations.

Our

operating results may fluctuate, which makes our results difficult to predict

and could cause our results to fall short of expectations.

Our

operating results may fluctuate as a result of a number of factors, many of

which are outside of our control. For these reasons, comparing our operating

results on a period-to-period basis may not be meaningful, and you should not

rely on our past results as an indication of our future performance. Our

quarterly and annual revenues and costs and expenses as a percentage of our

revenues may be significantly different from our historical or projected rates.

Our operating results in future quarters may fall below expectations. Any of

these events could cause the price of our common stock to fall.

Our

customer traffic tends to be seasonal. For example, we generally experience less

customer traffic during public holidays in China. In addition, business spending

in China has historically been cyclical, reflecting overall economic conditions

as well as budgeting and buying patterns. Our rapid growth has lessened the

impact of the cyclicality and seasonality of our business. As we continue to

grow, we expect that the cyclicality and seasonality in our business may cause

our operating results to fluctuate.

18

Our

business may be adversely affected by third-party software applications that

interfere with our receipt of information from, and provision of information to,

our customers, which may impair our customers’ experience, resulting in a loss

of customers.

Our

business may be adversely affected by third-party malicious or unintentional

software applications that make changes to our customers’ computers and

interfere with our products and services. These software applications may change

our customers’ Internet experience by hijacking queries to our websites,

altering or replacing our video play results, or otherwise interfering with our