Attached files

| file | filename |

|---|---|

| EX-21.1 - EXHIBIT 21.1 - Rodobo International Inc | ex21x1.htm |

| EX-31.2 - EXHIBIT 31.2 - Rodobo International Inc | ex31x2.htm |

| EX-31.1 - EXHIBIT 31.1 - Rodobo International Inc | ex31x1.htm |

| EX-32.1 - EXHIBIT 32.1 - Rodobo International Inc | ex32x1.htm |

| EX-32.2 - EXHIBIT 32.2 - Rodobo International Inc | ex32x2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended September 30, 2010

OR

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Commission file number: 000-50340

RODOBO INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

75-2980786

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

|

380 Changjiang Road, Nangang District, Harbin, PRC

|

150001

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number: +86 0451 82260522

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.0001

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

|

Large accelerated filer o

|

Accelerated filer o

|

|

|

Non-accelerated filer o

|

Smaller reporting company x

|

|

|

(Do not check if a smaller reporting company)

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).Yes o No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates as of March 31, 2010, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $47,278,521.

The number of shares outstanding of capital stock as of December 20, 2010 was 28,003,726.

DOCUMENTS INCORPORATED BY REFERENCE

N/A.

|

TABLE OF CONTENTS

|

||

|

Part I

|

||

|

Item 1.

|

Business.

|

2 |

|

Item 1A.

|

Risk Factors.

|

15 |

|

Item 2.

|

Properties.

|

35 |

|

Item 3.

|

Legal Proceedings.

|

36 |

|

Item 4.

|

Removed and Reserved.

|

36 |

|

Part II

|

||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

|

37 |

|

Item 6.

|

Selected Financial Data.

|

37 |

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations.

|

38 |

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk.

|

43 |

|

Item 8.

|

Financial Statements and Supplementary Data.

|

43 |

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

|

43 |

|

Item 9A.

|

Controls and Procedures.

|

43 |

|

Item 9B.

|

Other Information.

|

44 |

|

Part III

|

||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance.

|

44 |

|

Item 11.

|

Executive Compensation.

|

47 |

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

|

48 |

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence.

|

50 |

|

Item 14.

|

Principal Accounting Fees and Services.

|

52 |

|

Part IV

|

||

|

Item 15.

|

Exhibits, Financial Statement Schedules.

|

52 |

|

Signatures

|

53 | |

i

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

In addition to historical information, this Annual Report contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. The forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those reflected in such forward-looking statements. Factors that might cause such a difference include, but are not limited to, those discussed in the sections entitled “Business”, “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect management’s opinions only as of the date of this Annual Report. Readers should carefully review the risk factors described in this Annual Report and in other documents that we file from time to time with the SEC.

In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “projects,” “potential,” “proposed,” “intended,” or “continue” or the negative of these terms or other comparable terminology. You should read statements that contain these words carefully, because they discuss our expectations about our future operating results or our future financial condition or state other forward-looking information. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, growth rates, and levels of activity, performance or achievements. There may be events in the future that we are not able to accurately predict or control. You should be aware that the occurrence of any of the events described in these risk factors and elsewhere in this Annual Report could substantially harm our business, results of operations and financial condition, and that upon the occurrence of any of these events, the trading price of our securities could decline. Moreover, new risks regularly emerge and it is not possible for our management to predict all risks, nor can we assess the impact of all risks on our business or the extent to which any risk, or combination of risks, may cause actual results to differ from those contained in any forward-looking statements.

These forward-looking statements represent our estimates and assumptions only as of the date of this Annual Report. Forward-looking statements in this Annual Report include, but are not necessarily limited to, those relating to:

|

·

|

liquidity of the market for the common shares;

|

|

·

|

actual or anticipated fluctuations in our quarterly or annual operating results;

|

|

·

|

changes in the economic performance or market valuations of other producers and distributors of powdered milk formula companies;

|

|

·

|

announcements by us or our competitors of new products, acquisitions, strategic partnerships, joint ventures or capital commitments;

|

|

·

|

addition or departure of key personnel;

|

|

·

|

fluctuations of exchange rates between RMB and the U.S. dollar; and

|

|

·

|

general legal, economic or political conditions in China.

|

All forward-looking statements included in this Annual Report are based on information available to us on the date of this Annual Report. Except to the extent required by applicable laws or rules, we undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained throughout this Annual Report.

1

PART I

ITEM 1. BUSINESS.

Overview

We are a producer and distributor of powdered milk formula products in the PRC. Our target consumers include infants, children, middle-aged and elderly people in China. Our products for infants and children are currently sold under the brand name of “Rodobo” and “Peer”, and our products for middle-aged and elderly consumers are currently sold under the brand name of “Healif”. As of the date of this Annual Report, we have 15 company-owned raw milk collection stations and a new dairy farm which started its operation in July 2009, which has 2,165 cows and provides on average 30 tons of raw milk per day.

On February 5, 2010, through our wholly-owned subsidiary Harbin Tengshun Technical Development Co., Ltd. (“Tengshun Technology”), we entered into agreements and acquired Ewenkeqi Beixue Dairy Co., Ltd. (“Ewenkeqi Beixue”), Hulunbeier Beixue Dairy Co., Ltd. (“Hulunbeier Beixue”) and Hulunbeier Hailaer Beixue Dairy Factory (“Hulunbeier Hailaer Beixue,” collectively, the “Beixue Goup”), which are all located in China and are engaged in research and development, packaging, manufacturing and marketing of whole milk powder and formula milk powder products. As a result of these acquisitions, we were able to increase our milk powder processing capacity from 7,000 tons to 42,000 tons per year, or raw milk processing capacity from 200 tons to 1,200 tons per day. Through the business channels established by our new subsidiaries, we are now able to secure higher quality milk supplies, which is a critical component of our products. We have also expanded our distribution range to Inner-Mongolia as a result of these acquisitions.

On April 21, 2010, Hulunbeier Hailaer Mega Profit Agriculture Co., Ltd. (“Hulunbeier Mega”) was incorporated under the PRC laws, which is engaged in dairy farming. Hunlunbeier Mega is a wholly owned subsidiary of Tengshun Technology.

Our products were not implicated in the 2008 scandal in China involving the wide-spread melamine contamination of milk products. As a result of the scandal, the Chinese government determined that many of our large competitors violated food safety regulations, therefore we intend to leverage our superior quality control in the market to attempt to gain an competitive advantage.

Our shares of common stock, par value at $0.0001 per share (“Common Stock”), are currently quoted on the OTCBB under the symbol “RDBO.OB”.

Corporate History

We were originally incorporated on January 28, 2002 as a Nevada corporation under the name Premier Document Services, Inc. (“Premier”), which provided document preparation and signatory services to mortgage, real estate and other financial services firms in the Las Vegas, Nevada market. On November 30, 2005, Premier acquired 100% of the capital stock of Navstar Communications Holdings, Ltd., and changed its name to Navstar Media Holdings, Inc. (“Navstar”). As of January 1, 2007, Navstar ceased all of its operations and focused on identifying companies with substantial operations that were interested in merging with Navstar.

On September 30, 2008, our predecessor, Navstar, entered into a Merger Agreement with Navstar’s wholly owned acquisition subsidiary, Rodobo International, Inc. (“Rodobo Merger Sub”), Mega Profit Limited (“Cayman Mega”) and the sole shareholder of Cayman Mega. Pursuant to the Merger Agreement, Rodobo Merger Sub acquired all of the ownership interest in Cayman Mega and then merged with and into Navstar (the “Merger”). In exchange for Navstar obtaining all of the issued and outstanding capital stock of Cayman Mega, the then sole shareholder of Cayman Mega received shares of Common Stock and shares of convertible preferred stock in Navstar, which upon conversion of the preferred stock into Common Stock, was equal to approximately 93% of the issued and outstanding shares of Common Stock of Navstar. Following the Merger and Navstar’s acquiring ownership of Cayman Mega, Cayman Mega continued to own and control its existing subsidiaries, including Harbin Rodobo Dairy Co., Ltd (“Harbin Rodobo”). Concurrent with the Merger, Navstar changed its name to “Rodobo International, Inc.”, adopting the existing name of our Company.

On November 12, 2008, we affected a reverse stock split of our then outstanding Common Stock based on a ratio of 37.4 to 1 and, effective on April 2, 2009, we increased our authorized shares of capital stock from 16,604,278 shares, consisting of 1,604,278 shares of Common Stock, and 15,000,000 shares of Preferred Stock, to 230,000,000 authorized shares of capital stock, consisting of 200,000,000 shares of Common Stock, and 30,000,000 shares of Preferred Stock.

In connection with the Merger, we issued 10,293,359 shares of Common Stock to our former employees and shareholders. Pursuant to an understanding with certain convertible note holders, who collectively held convertible notes in the original aggregate principal amount of $1,000,000 (“Notes”), and the holder of a pre-Merger bridge loan note, the foregoing were converted into 452,830 and 152,003 shares of Common Stock, respectively. In addition, the outstanding shares of Preferred Stock were converted into 12,976,316 shares of Common Stock.

2

In July 2009, we began operations of our own cow farm through our VIE, Qinggang Mega, and as of September 30, 2010, we have 2,165 cows providing 30 tons of raw milk per day to Harbin Rodobo for further processing. On November 9, 2009, Tengshun Technology was formed as a wholly-owned subsidiary of Harbin Mega under the PRC laws.

On February 5, 2010, through our wholly-owned subsidiary Tengshun Technology, we entered into agreements and acquired Ewenkeqi Beixue, Hulunbeier Beixue, and Hulunbeier Hailaer Beixue. Tengshun Technology acquired 100% of the equity interests in Ewenkeqi Beixue and Hulunbeier Beixue directly on February 5, 2010. Hulunbeier Hailaer Beixue is a sole proprietary enterprise and therefore may only be owned by a natural person under the laws of the PRC. For this reason, although the acquisition of Hulunbeier Hailaer Beixue has closed (and no additional consideration is required to be paid in connection with the acquisition), Mr. Honghai Zhang, the former owner of Hulunbeier Hailaer Beixue, is temporarily holding 100% of the equity interests in Hulunbeier Hailaer Beixue for the benefit of Tengshun Technology pursuant to the terms of a supplemental agreement entered into in connection with the acquisition. In accordance with such supplemental agreement, Mr. Honghai Zhang has agreed to transfer all of his interests and ownership in Hulunbeier Hailaer Beixue to Tengshun Technology or its designee. To complete the Hulunbeier Hailaer Beixue acquisition transfer process, in addition to such equity interest transfer, Mr. Honghai Zhang has also agreed to transfer to Tengshun Technology all of the equity interest in Hulunbeier Hailaer Beixue Dairy Co., Ltd., an unrelated PRC limited liability company owned by Mr. Honghai Zhang (“Hulunbeier Hailaer Beixue Dairy”), and Hulunbeier Hailaer Beixue has agreed to then transfer its assets to Hulunbeier Hailaer Beixue Dairy. Once the foregoing transfers have taken place Hulunbeier Hailaer Beixue will be deregistered. We are currently in the process of effecting this entity conversion process which we expect to be completed by the end of March 2011, at which time Tengshun Technology will own all the equity interests in Hulunbeier Hailaer Beixue Dairy. Once the conversion process is complete we will file for approval of the Hulunbeier Hailaer Beixue Dairy’s acquisition by the local Administration for Industry and Commerce, or AIC. The acquisitions of Ewenkeqi Beixue and Hulunbeier Beixue have already been approved by the AIC.

Pursuant to the Equity Transfer Agreements entered into with the Beixue Group on February 5, 2010, we paid RMB 500,000 (approximately $73,236) in cash and issued 800,000 shares of Common Stock in exchange for 100% of the equity interests in Ewenkeqi Beixue; RMB 1,000,000 (approximately $146,473) in cash and 1,000,000 shares of Common Stock in exchange for 100% of the equity interests in Hulunbeier Beixue; and RMB 600,000 (approximately $87,884) in cash, 8,800,000 shares of Common Stock and 2,000,000 shares of our Series A Preferred Stock, par value $0.0001, in exchange for 100% of the equity interests in Hulunbeier Hailaer Beixue (which is temporarily being held by Mr. Honghai Zhang for the benefit of Tengshun Technology, as described in more detail above) Mr. Yanbin Wang, who owned 51% of the equity interests in Hulunbeier Beixue and Ewenkeqi Beixue prior to the acquisitions, is also our Chairman, Chief Executive Officer and a major stockholder. An unaffiliated third-party owned 49% of the equity interests in Hulunbeier Beixue and Ewenkeqi Beixue and 100% of the equity interests in Hulunbeier Hailaer Beixue prior to the acquisitions. The Equity Transfer Agreements also provided that the equity portion of the consideration consisting of an aggregate of 10,600,000 shares of Common Stock and 2,000,000 shares of Series A Preferred Stock shall be issued to the designee(s) of the former shareholders of Ewenkeqi Beixue, Hulunbeier Beixue and Hulunbeier Hailaer Beixue.

As contemplated in the Equity Transfer Agreements with each of the Beixue Group entities, the Common Stock and Series A Preferred Stock issued as part of the consideration in these transactions were issued directly to the designees of the Beixue Group shareholders. Accordingly, on February 5, 2010, we entered into Securities Purchase Agreements with three British Virgin Islands corporations: August Glory Limited, Fame Ever Limited, and Fortune Fame International Limited, which, as designees of the former shareholders of Ewenkeqi Beixue, Hulunbeier Beixue and Hulunbeier Hailaer Beixue, were issued 1,250,000 shares of Common Stock, 3,050,000 shares of Common Stock, and 6,300,000 shares of Common Stock and 2,000,000 shares of Series A Preferred Stock, respectively, as consideration for the acquisitions. We have temporarily suspended operations in Hulunbeier Beixue and Ewenkeqi Beixue while they undergo renovations and upgrades to their equipment and technology, however Hulunbeier Hailaer Beixue, is fully operational.

In addition, on February 5, 2010, the sole shareholder of both Fortune Fame International Limited and Fame Ever Limited (the “Sole Shareholder”) entered into an Incentive Option Agreement with each of Mr. Yanbin Wang, our Chairman, and Chief Executive officer and major shareholder, and Mr. Honghai Zhang in order to comply with certain laws of the PRC concerning acquisitions of equity interests in Chinese domestic companies by foreign entities. Under the Incentive Option Agreement between the Sole Shareholder and Mr. Yanbin Wang, the Sole Shareholder agreed, upon exercise of the option, to transfer up to 100% of the shares of Fortune Fame International Limited within the next 3 years to Mr. Yanbin Wang for nominal consideration, which would give Mr. Yanbin Wang indirect ownership of an additional significant percentage of our Common Stock and 100% of our Series A Preferred Stock. Mr. Yanbin Wang also serves as the sole executive director of Fortune Fame International Limited. Under the Incentive Option Agreement between the Sole Shareholder and Mr. Honghai Zhang, the Sole Shareholder agreed, upon exercise of the option, to transfer up to 100% of the shares of Fame Ever Limited within the next three years to Mr. Honghai Zhang for nominal consideration, which would give Mr. Honghai Zhang indirect ownership of a significant percentage of our Common Stock. Mr. Honghai Zhang also serves as the sole executive director of Fame Ever Limited. The Incentive Option Agreements also provide that the Sole Shareholder may not dispose of any of the shares of Fortune Fame International Limited or Fame Ever Limited without Mr. Yanbin Wang or Mr. Honghai Zhang’s prior written consent, as applicable.

3

The acquisitions of Ewenkeqi Beixue, Hulunbeier Beixue, and Hulunbeier Hailaer Beixue that were consummated in accordance with the terms of the Equity Transfer Agreements required the approval of the AIC in the PRC which reviewed and approved the acquisitions of Ewenkeqi Beixue and Hulunbeier Beixue, and completed equity governmental registration by issuance of a new business license on March 2, 2010. Once the conversion process as described above whereby Mr. Honghai Zhang will transfer to Tengshun Technology all of the equity interest in Hulunbeier Hailaer Beixue Dairy and Hulunbeier Hailaer Beixue will then transfer its assets to Hulunbeier Hailaer Beixue Dairy, is completed, we will file for AIC’s approval of the Hulunbeier Hailaer Beixue Dairy’s acquisition. We cannot assure you that the AIC will approve the acquisition of Hulunbeier Hailaer Beixue Dairy.

During the review of the Ewenkeqi Beixue and Hulunbeier Beixue acquisitions, we did not inform the AIC of the equity consideration component of the purchase price paid to the selling shareholders’ designees. Under PRC law, the use of equity consideration of certain foreign entities in acquiring a domestic PRC entity is permitted; however, equity securities of a public company trading on the OTCBB is not a recognized form of consideration permitted by the AIC in the context of an acquisition of a domestic Chinese company by a foreign investor. In addition, such equity consideration was issued outside the PRC to the three British Virgin Island companies, as described above. As such, Tengshun Technology disclosed only the cash consideration payments paid to acquire Ewenkeqi Beixue and Hulunbeier Beixue, at the time of filing the application with the AIC relating to the acquisitions. You should also refer to the risk factor entitled “Our recent acquisition of the Beixue Group may have required approval from the MOFCOM or other PRC authorities, and our failure to obtain such approval could result in fines, penalties or other actions by PRC authorities that could restrict our ability to implement our acquisition strategy and adversely affect our business, reputation and prospects, as well as the trading price of our shares,” which describes the risks associated with the failure to inform the AIC of the equity consideration paid by the Company in connection with the acquisitions, beginning on page 27 of this Annual Report.

On June 17, 2010, we entered into a Securities Purchase Agreement with certain institutional investors, pursuant to which we sold such investors an aggregate of 1,111,112 shares of our Common Stock and warrants to purchase an aggregate of 555,556 shares of our Common Stock, for an aggregate purchase price of $3,000,000. From the proceeds of this private placement, the Company paid an aggregate fee of $230,000 to the placement agents for the offering and issued to the placement agents warrants to purchase an aggregate of 66,666 shares of our Common Stock. Pursuant to the SPA, the shares of our Common Stock were sold at a price of $2.70 per share, and the warrants have an exercise price of $3.50 per share, subject to customary future adjustment for certain events, such as stock dividends and splits. The warrants to purchase Common Stock are exercisable at any time following issuance and expire on June 17, 2015.

4

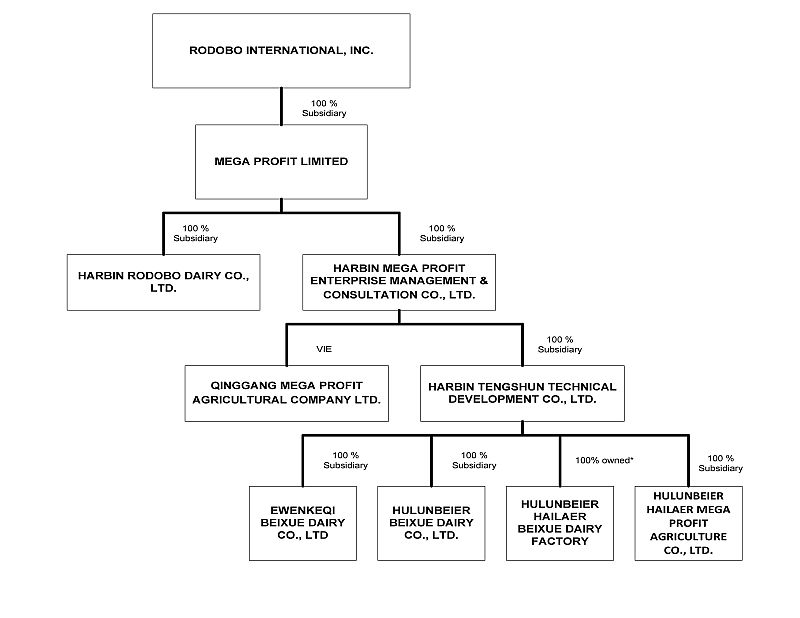

The following table sets forth our corporate structure as of the date of this Annual Report.

* Hulunbeier Hailaer Beixue is a sole proprietary enterprise and therefore may only be owned by a natural person under the laws of the PRC. For this reason, although the acquisition of Hulunbeier Hailaer Beixue has closed (and no additional consideration is required to be paid in connection with the acquisition), Mr. Honghai Zhang, the former owner of Hulunbeier Hailaer Beixue, is temporarily holding 100% of the equity interests in Hulunbeier Hailaer Beixue for the benefit of Tengshun Technology pursuant to the terms of a supplemental agreement entered into in connection with the acquisition. In accordance with such supplemental agreement, Mr. Honghai Zhang has agreed to transfer all of his interests and ownership in Hulunbeier Hailaer Beixue to Tengshun Technology or its designee. To complete the Hulunbeier Hailaer Beixue acquisition transfer process, in addition to such the equity interest transfer, Mr. Honghai Zhang has also agreed to to transfer to Tengshun Technology all of the equity interest in Hulunbeier Hailaer Beixue Dairy and Hulunbeier Hailaer Beixue has agreed to to then transfer its assets to Hulunbeier Hailaer Beixue Dairy. Once the foregoing transfers have taken place Hulunbeier Hailaer Beixue will be deregistered. We are currently in the process of effecting this entity conversion process which we expect to be completed by the end of March 2011, at which time Tengshun Technology will own all the equity interests in Hulunbeier Hailaer Beixue Dairy.

5

VIE Arrangement

On January 1, 2009, Harbin Mega, our indirect wholly owned subsidiary, entered into a series of VIE Arrangements with Qinggang Mega and its two shareholders, pursuant to which Harbin Mega effectively assumed management of the business activities of Qinggang Mega and has the right to appoint all executives and senior management and the members of the Board of Directors of Qinggang Mega. The VIE Arrangements are comprised of a series of agreements, including a Consulting Services Agreement, Operating Agreement, Proxy Agreement, Equity Pledge Agreement and Option Agreement, through which Harbin Mega has the right to advise, consult, manage and operate Qinggang Mega for an annual fee in the amount of Qinggang Mega’s yearly net profits after tax. Additionally, Qinggang Mega’s shareholders have pledged their rights, title and equity interest in Qinggang Mega as security for Harbin Mega to collect consulting and services fees provided to Qinggang Mega through an Equity Pledge Agreement. The pledge rights under the Equity Pledge Agreement have not been perfected or registered with the PRC authorities at this time. We are in the process of obtaining the required governmental registration which is expected to be completed by the end of January 2011.

In order to further reinforce Harbin Mega’s rights to control and operate Qinggang Mega, Qinggang Mega’s shareholders have granted Harbin Mega an exclusive right and option to acquire all of their equity interests in Qinggang Mega through an Option Agreement. Through these contractual arrangements, Harbin Mega has the ability to substantially influence Qinggang Mega’s daily operations and financial affairs, appoint its senior executives and approve all matters requiring stockholders’ approval.

Business Overview

Our indirect wholly owned operating subsidiary, Harbin Rodobo, started to manufacture a series of dairy products in 2003 and has developed markets in Sichuan, Zhejiang, Fujian, Henan, Hebei, Hubei, Shandong, Jiangsu and Anhui provinces since then. In 2004, Harbin Rodobo reconstructed its production facilities to meet the Good Manufacturing Practices, or GMP, standard of the Chinese government. Harbin Rodobo also maintains the Quality Management System Certificate for GB/T 19001-2008/ISO9001:2008 Standard and Hazard Analysis and Critical Control Point System Certification Certificate (“HACCP”) issued on November 29, 2010 and valid up to November 28, 2012 for GB 12693-2003, GB/T 27341-2009 and GB/T 27342-2009 standards. In 2005, Harbin Rodobo was awarded the “Heilongjiang Famous Brand” designation for the agricultural industry. On July 1, 2008, Harbin Rodobo entered into a Technology Transfer Agreement with CNS, pursuant to which we received a 10 year exclusive right to manufacture and market a powdered milk formula specifically developed for middle-aged and elderly consumers, which began on July 1, 2008. CNS is a national scientific social group made up of nutrition professionals and is a unit of the China Association for Science and Technology and a country member of the International Union of Nutrition Sciences. We currently market this powdered milk formula under the brand name of “Healif” (which means “Healthy Elderly” in Chinese). On October 30, 2008, we entered into a Product Development Agreement with Heilongjiang Shi Jie Research and Development Service Ltd. Co. (“Shi Jie”) to acquire powdered milk product formulas specifically developed for infants and children for approximately US $439,477. We started to produce and market these formulas under the brand name of “Peer” in July 2009.

On February 5, 2010, we acquired the Beixue Group, which is comprised of three PRC companies engaged in research and development, packaging, manufacturing and marketing of whole milk powder and formula milk powder products. As a result of these acquisitions, we were able to increase our production capacity from 7,000 to 42,000 tons of milk powder processing per year, or raw milk processing capacity from 200 tons to 1,200 tons per day. Through the business channels established by our new subsidiaries, we are now able to secure higher quality milk supplies, which is a critical component of our products. We have also expanded our distribution range to Inner-Mongolia.

6

Principal Products or Services and their Markets

Formula Milk Powder

Our primary product is formula milk powder which can be divided into two major sub-categories, formula for infants and children and formula for middle-aged and elderly consumers. As of September 30, 2010, our branded products were distributed to over 5,000 retail outlets throughout nine provinces in China by our network of over 126 distributors.

We produce formula milk powder for infants and young children formulated for age ranges of zero to 6 months old, 6 months to 1 year old and 1 to 3 years old. These products are marketed under the brand name of “Rodobo” and “Peer”.

We also produce formula milk powder specially designed to combat the health issues experienced by middle-aged and elderly people in China. For example, these products are enriched with high levels of calcium and iron in order to decrease the typical rate of calcium loss which occurs in the aging process. Additionally, these products are formulated to alleviate problems related to lactose intolerance. These products are marketed under the brand name of “Healif” (which means “Healthy Elderly” in Chinese).

Whole Milk Powder

We also offer fresh, sterilized, and spray-dried raw whole milk powder and whole milk with supplemental ingredients to our customers under the brand name “Rodobo”. Raw milk powder is typically used to produce ice-cream, candies and other food products. It is also used as a raw material to produce baked food, instant beverages, nutritional food and fast food.

Sales generated from whole milk powder formula accounted for 43.2% of total sales in the fiscal year ended September 30, 2010. Sales generated from baby/infant formula accounted for 45.6% of total sales in the fiscal year ended September 30, 2010. Sales generated from middle-aged and elderly formula accounted for 11.2% of our total sales for the fiscal year ended September 30, 2010.

Brand Development and Marketing

Our marketing strategy emphasizes national distribution of our products, careful product positioning and targeted marketing. Our marketing and promotional efforts will continue to include:

|

·

|

Periodically introducing new product packaging to promote a premium brand image;

|

|

·

|

Enhancing the brand image exposure in the retail outlets to expand our brand awareness; and

|

|

·

|

Continuing to conduct promotional campaigns to increase the recognition of our premium brand as well as our sales volume.

|

We incurred advertising costs of $697,315 and $494,148 for the fiscal year ended September 30, 2010 and 2009, respectively.

Production

Raw Milk Sourcing and Pretreating

Processing of our powdered formula begins with the collection of raw milk. We collect raw milk partially from our company-owned dairy farm in Qinggang County, Heilongjiang province. We also purchase raw milk from dairy farmers directly. After the milking process, raw milk is chilled and transported to our milk processing facilities in fully enclosed, stainless-steel tanks. Once received, the raw milk is immediately processed with refrigeration equipment that cools the raw milk, through use of ammonia gas, to less than 4 degrees Celsius. The raw milk is then stored in air-tight tanks in preparation for advanced processes.

7

Milk Powder Processing

Through sterilization, concentration and our spray-drying processes, the raw milk is converted to whole milk powder. The whole milk powder is then mixed with various vitamins, microelements, whey protein, and other ingredients. The mixture is sterilized, concentrated and spray-dried again and then, depending on the specific formula used, turns into formulated milk powder for infants, children, middle-aged or elderly consumers.

Milk Processing Environment

The Chinese government conducts compulsory inspections of milk processing facilities. The manufacturer is licensed to produce infant milk formula by passing the inspection carried out by the relevant government authority. The facility should be in compliance with international GMP standard and operated under ISO9001 and HACCP quality assurance.

Milk Processing Facilities

Our milk processing facility is installed with state-of-the-art equipment including standardized sterilization serial equipment, three-way evaporation devices, a drying tower, a pelletized fluidized bed device and Cleaning-In-Place (CIP) cleaning technologies, a method of cleaning the interior surfaces of our equipment. We believe that our processing methods increase economic efficiency during production, improve product quality and enhance market competitiveness.

Among the 399 employees of our milk processing facility as of September 30, 2010, 62 were management, 44 were technicians and 293 were engaged in manufacturing. The factory operates continuously throughout the year.

Sources and Availability of Raw Materials

Our business depends on maintaining a regular and adequate supply of high-quality raw materials. A key ingredient for our powdered formulas is high-quality raw milk. We have 15 company-owned raw milk collection stations and purchase raw milk directly from dairy farmers and certain dealers. Our new dairy farm, which has 2,165 cows as of the date of this Annual Report, started its operation in July 2009. The new dairy farm currently provides 30 tons of raw milk per day. The remainder of our raw milk supply is derived from the purchase from dairy farmers. We pay market prices or premium prices in certain regions for our raw milk. Our milk suppliers are primarily dairy farmers located throughout Heilongjiang and Inner Mongolia provinces.

Whey protein powder is another key ingredient used in the production of our powdered infant formula products and our other dairy-based products. Like other powdered milk producers, we use whey protein powder as the active ingredient to help reconstituted dairy-based formula mimic the consistency of breast milk. Whey protein powder can constitute as much as 40.0% of the final powdered infant formula product by weight. We purchase most of the whey protein from Harbin Huijiabei Foods Co., Ltd. and Beijing Pulitong Trading Co., Ltd.

Based on our experience, prices of milk powder and whey protein powder can fluctuate over relatively short periods of time depending on market conditions. Our sourcing team carefully monitors price movements and makes major purchases at times when prices are low, subject to projected customer order flow and other factors.

For the fiscal year ended September 30, 2010, our five largest raw material suppliers accounted for 13.6% of our total raw material expenses. We did not have any single supplier which accounted for over 10% of our total raw material costs.

Distribution Methods of the Products

We utilize a dealer distribution model to deliver our products to end-users. Currently, our powdered milk products are sold through distributors and our whole milk powder products are sold directly to end users’ processing plants. We have a distribution team working out of our headquarters in Harbin, PRC, and a coordinating network of over 126 distributors covering over 5,000 retail stores across China. The distributors, in turn, each hire one or two secondary agents who assist them in the distribution process, including inventory management, product sales and service and payments.

Generally, our products are delivered only after receipt of payment from the distributors. Distributors usually have a one year agreement with us and enter into new agreements each year which specify sales targets and territories among other provisions. We seek to expand the number of key provinces served by our distribution network as part of our growth strategy.

We emphasize inventory management and carry minimal amounts of inventory to meet customers’ delivery requirements. We do not provide customers with the right to return merchandise, except in some special cases (for example, during the nation-wide melamine contamination that occurred in 2008, we allowed customers to return our merchandise, even though our products were not affected by the contamination, and none of our products were returned in connection with that event). We only extend credit for 90 days to customers who have steady orders, good payment history and good credit.

8

Dependence On A Few Major Customers

All our revenue comes from customers who are based in the nine PRC provinces in which we currently sell our products. In the fiscal year ended September 30, 2010, no single customer accounts for more than 10% of our sales. Sales from our five largest customers in the fiscal year ended September 30, 2010 amounted to $6.0 million, which represented approximately an aggregate of 12.8% of our total sales. No other single customer accounts for more than 10% of our sales. Sales from our five largest customers in the fiscal year ended September 30, 2009 amounted to $15.7 million, which represented approximately an aggregate of 45.0% of our total sales.

Patents, Trademarks, Licenses, Franchises, Concessions, Royalty Agreements or Labor Contracts

We have registered our brand names “Rodobo”, “Peer” and “Healif” with the Trademark Bureau under the State Administration for Industry and Commerce of the PRC.

On July 1, 2008, we entered into a Technology Transfer Agreement with China Nutrition Society, pursuant to which we were granted an exclusive right for 10 years starting on July 1, 2008 to produce a powdered milk product formula specifically developed for middle-aged and elderly consumers. During that period, we are also authorized to use the name of “China Nutrition Society Development” on our packaging.

On October 30, 2008, we entered into a Product Development Agreement with Heilongjiang Shi Jie to purchase powdered milk product formulas specifically developed for infants and children for a total fee of RMB 3,000,000 (approximately $439,477).

We rely on trade secret protection and confidentiality agreements to protect our proprietary information and know-how. Our management and each of our research and development personnel have entered into the basic and standard annual employment contracts required under the law of the PRC, which does not include a confidentiality clause; however, they have all entered into a separate confidentiality agreement with us. We currently do not hold any patents.

Research and Development Activities

As of September 30, 2010, we had 44 technicians, of which 15 were engaged in research and development activities. These technicians monitor quality control at our milk processing plants to ensure that our processing, packaging and distribution result in high quality premium milk products that are safe and healthy for our customers. These technicians also pursue methods and techniques to improve the taste and quality of our milk products and to evaluate new milk products for further production based upon changes in consumer tastes, trends and the introduction of competitive products by other milk producers. We also conduct research and development efforts with third parties. Our strategy is to acquire rights or to obtain licenses to technologies and products that are being developed by third parties and develop new products through sponsored research and development agreements. In the fiscal year ended September 30, 2008 and 2009, we further expanded our product categories by purchasing the exclusive right to manufacture and market a powdered milk product formula specially formulated for middle-aged and elderly consumers and acquiring powdered milk product formulas specifically developed for infants and children from Shi Jie.

Employees

As of September 30, 2010, we had 2,767 employees on our payroll, all of which are full-time employees, as follows: 62 are management staff, 44 are technical personnel, 293 are involved in manufacturing and 2,368 are sales and marketing employees. Our employees are not represented by a labor organization or covered by a collective bargaining agreement. We have not experienced any significant labor disputes and generally consider our relationship with our employees to be good.

We provide our full time employees with employee benefits, including the following three state-mandated insurance plans:

|

·

|

Retirement insurance: We withhold a portion of each employee’s salary determined by the provincial government, generally 8%, and contribute an additional amount required under the PRC laws, up to approximately 20% of the employee’s salary (this 20% represents our contribution as employer only);

|

|

|

|

·

|

Medical insurance: We withhold approximately 2% of each employee’s salary, and contribute an additional amount totaling approximately 10% of total payroll expense; and

|

|

|

|

·

|

Unemployment Insurance: We withhold approximately 1% of each employee’s salary, and contribute an additional amount totaling approximately 2% of total payroll expense.

|

We also pay social security insurance for every employee who enters into a long-term contract with us.

We also have workers’ compensation insurance for our employees. Our employees’ workers’ compensation insurance is registered at our human resources department and becomes effective on their start date. The workers’ compensation insurance is terminated upon the employee’s termination of employment with us. Our human resources department completes a “Workers’ Compensation Insurance Adjustment Form” when the workers’ compensation insurance adjusts due to other factors. The human resources department files employees’ personal workers’ compensation insurance information on record for reference. The human resources department calculates the workers’ compensation insurance fees and transfers the data to our finance department annually. The finance department withholds the insurance fees from each employee’s salary.

9

We have a system of human resource performance review and incentive policies that allow personnel reviews to be conducted monthly, quarterly or annually.

Government Approval and Regulation of Our Principal Products or Services

Our PRC consolidated operating subsidiaries and VIE are subject to PRC laws at the state, provincial and county levels. The following information summarizes the most important regulations that are applicable to us and is qualified in its entirety by reference to all particular statutory or regulatory provisions.

Food Hygiene and Safety Laws and Regulations

As a producer of nutritional products, and particularly dairy-based infant formula products, in China, we are subject to a number of PRC laws and regulations governing the manufacturing (including composition of ingredients), labeling, packaging, safety and hygiene of food products:

|

·

|

the PRC Product Quality Law;

|

||

|

·

|

the Industrial Policy for the Dairy Products Industry;

|

||

|

·

|

the Implementation Rules on the Administration and Supervision of Quality and Safety in Food Producing and Processing Enterprises;

|

||

|

·

|

the Regulation on the Administration of Production Licenses for Industrial Products;

|

||

|

·

|

the General Standards for the Labeling of Prepackaged Foods;

|

||

|

·

|

the Implementation Measures on Examination of Dairy Product Production Permits;

|

||

|

·

|

the Standardization Law;

|

||

|

·

|

the Raw Milk Collection Standard;

|

||

|

·

|

the National Standard for Infant Formula Powder I, the National Standard for Infant Formula Powder II & III, the National Standard for Milk Powder and the National Standard for Hygienic Practice for Dried Milk;

|

||

|

·

|

the PRC Food Safety Law;

|

||

|

·

|

the amended Detailed Examination Rules Regarding Licensing Conditions for Production of Dairy Products; and

|

||

|

·

|

the amended Detailed Examination Rules Regarding Licensing Conditions for Production of Infant Formula Powder.

|

||

These laws and regulations set forth safety and hygiene standards and requirements for various aspects of food production, such as the use of additives, production, packaging, handling, labeling and storage, as well as facilities and equipment. Failure to comply with these laws and regulations may result in confiscation of our products and proceeds from the sales of non-compliant products, destruction of our products and inventory, fines, suspension of production and operation, product recalls, revocation of licenses, and, in extreme cases, criminal liability.

Since the melamine contamination incident in 2008, the PRC government authorities have conducted several dairy industry inspections. In addition to the initial 22 companies implicated in the incident, these subsequent government inspections of milk manufacturers have identified other companies with unacceptable contamination in their products.

In March 2008, the PRC National Development and Reform Commission (“NDRC”) promulgated the Access Conditions for Dairy Products Processing Industry (“Access Conditions”). In addition, in May 2008, the NDRC issued certain “Dairy Industry Policies”. The Access Conditions were amended and such Dairy Industry Policies were amended, consolidated and replaced by the Industrial Policies for the Dairy Products Industry (the “Industrial Policies”) in June 2009. The Industrial Policies set forth the conditions an entity must satisfy in order to engage, or continue to engage in the dairy products processing business in China, including technique and equipment, product quality, energy and water consumption, sanitation and environmental protection, as well as production safety. Any new or continuing dairy products, processing projects or enterprises will be required to meet all the conditions and requirements set forth in the Industrial Policies.

The Industrial Policies also set forth requirements relating to the location, processing capacity and raw milk source for any new or continuing dairy products processing project or enterprise. Any new or continuing dairy processing projects or enterprises that fail to meet the requirements will not be able to procure land, license, permits, loan facilities and electricity necessary for the processing of dairy products.

According to the PRC government, the Industrial Policies for the Dairy Industry Policies are the first set of comprehensive government policies on the dairy industry in China, covering a broad range of matters such as industry planning, closure of inefficient capacity, milk supply, quality control and product safety, environmental protection and promotion of milk consumption. Moreover, the Industrial Policies provide more stringent guidelines and conditions that new entrants to the dairy industry or new dairy products must meet, including obtaining governmental approvals, requirements pertaining to minimum production scales, a stable milk base and certain asset related financial ratios.

10

On October 7, 2008, the State General Administration of Quality Supervision, Inspection and Quarantine (“AQSIQ”) issued a national standard on the detection of melamine in raw milk and dairy based products. On October 9, 2008, the Chinese State Council promulgated with immediate effect the Regulation for the Quality and Safety Supervision of Dairy Based Products, which, among other things, imposes more stringent requirements for inspection, production, packaging, labeling and product recall on dairy product producers. This regulation also established a “Black-List” system to ensure that illegal business operators in the dairy production chain are timely disclosed and severely punished.

On November 1, 2010, the PRC promulgated new regulations requiring that (i) producers of dairy products and infant formula powder (even if they have obtained the production license previously) must re-apply for the production license prior to December 31, 2010, according to the requirements set forth in the Industrial Policies and other relevant regulations, and (ii) if a producer is not able to obtain the new production license by March 1, 2011, such producer must stop its production of dairy products and infant formula powder.

It is possible that additional regulatory requirements will be implemented, and governmental enforcement efforts are likely to be more stringent. Since the 2008 melamine scandal, the Chinese government has regulated the industry further. Per new regulations, each dairy company must purchase a melamine testing device and products must be tested for possible melamine contamination before leaving the production lines. Additionally, a representative from the Bureau of Quality Supervision, Inspection and Quarantine will test the products. We have purchased one such device for RMB 140,000 (approximately $20,300).

As a manufacturer and distributor of food products, we are subject to the regulations of China’s Ministry of Agriculture. This regulatory scheme governs the manufacture (including composition and ingredients), labeling, packaging and safety of food. It also (i) regulates manufacturing practices, including quality assurance programs, for foods through its current good manufacturing practice regulations; (ii) specifies the standards of identity for certain foods, including our products; (iii) prescribes the format and content of many of the products we sell; (iv) prescribes the format and content of certain nutritional information required to appear on food product labels we use; and (v) approves and regulates claims of health benefits of food products such as ours.

In addition, China’s Ministry of Agriculture authorizes regulatory activity necessary to prevent the introduction, transmission or spread of communicable diseases. These regulations require, for example, pasteurization of milk and milk products. Our Company and our products are also subject to province and county regulations including such measures as the licensing of dairy manufacturing facilities, enforcement of standards for products, inspection of facilities and regulation of trade practices in connection with the sale of dairy products.

Approvals, Licenses and Certificates

Currently, we believe we are in compliance in all material respects with all applicable laws, regulations, rules, specifications and have obtained all material permits, approvals and registrations relating to our business. Regulations at the national, provincial and county levels are subject to change. To date, compliance with governmental regulations has not had a material adverse impact on our level of capital expenditures, earnings or competitive position. However, because of the evolving nature of such regulations, management is unable to predict the impact such regulations may have in the foreseeable future.

Environmental Matters

Our manufacturing facilities are subject to various pollution control regulations with respect to noise, water and air pollution and the disposal of waste and hazardous materials. We are also subject to periodic inspections by local environmental protection authorities.

The major environmental regulations applicable to us include:

|

·

|

the Environmental Protection Law of the PRC;

|

|

·

|

the Law of PRC on the Prevention and Control of Water Pollution;

|

|

·

|

the Implementation Rules of the Law of PRC on the Prevention and Control of Water Pollution;

|

|

·

|

the Law of PRC on the Prevention and Control of Air Pollution;

|

|

·

|

the Law of PRC on the Prevention and Control of Solid Waste Pollution; and

|

|

·

|

the Law of PRC on the Prevention and Control of Noise Pollution.

|

11

We are periodically inspected by local environmental protection authorities. Our operating subsidiaries have received certifications from the relevant PRC government agencies in charge of environmental protection indicating that their business operations are in material compliance with the relevant PRC environmental laws and regulations. We are not currently subject to any pending actions alleging any violations of applicable PRC environmental laws. To date, our cost of compliance has been insignificant. We do not believe the existence of these environmental laws, as currently written and interpreted, will materially hinder or adversely affect our business operations. However, there can be no assurances of future events or changes in laws, or the interpretation or enforcement of laws, governing our industry.

Industry Overview

We believe China’s population of 1.3 billion people offers a vast market for the developing dairy industry. The dairy industry is growing much faster than the growth of China’s gross domestic product (“GDP”). According to the statistics from the Food and Agriculture Organization of the United Nations (“FAO”), total Chinese milk production was the third largest in the world during 2008.

We believe the Chinese government views the dairy industry as an instrumental component in reforming China’s agricultural system and concurrently increasing the income of farmers. Additionally, we believe the dairy industry plays a key role in improving the diet and overall welfare of the Chinese people. Milk and dairy products have gradually become a staple in the daily food intake of the Chinese.

Because China’s dairy market is highly fragmented, we believe that current market dynamics provide a significant opportunity for us to acquire a larger market share. We plan to increase market share through a roll-up strategy whereby we acquire some of our competitors. In addition, we are planning marketing initiatives to increase market penetration with existing customers. We also recently hired additional sales force personnel that have significant prior industry experience.

According to the “China Food and Nutrition Development outline (2001-2010)” approved by the Chinese State Council, the dairy industry is one of the three food industries that should be developed first. The outline required that the average consumption of dairy per person in China should reach 16kg by 2010, of which, the average consumption of dairy per person for rural habitants and those who live in cities and towns will be 7kg and 32kg, respectively. Therefore, over the next few years, it is expected that the Chinese dairy industry should maintain a fast and sound growth momentum and the consumption of dairy should continue to increase with the rise in living standards and changes in consumption behavior. We believe this means the Chinese dairy market has tremendous room for growth.

According to the National Bureau of Statistics of the PRC, approximately 15 million babies are born in China each year. Each 0 – 6 month old baby will need 27.2 kilograms milk powder, for an annual total demand of 90,000 tons. Each baby that is 6 months and slightly older will need 31 kilograms of milk powder per year, for an annual total demand of 110,000 tons. Current annual supply levels are only 80,000 to 100,000 tons which leaves considerable room for growth. The infant dairy market in China is estimated to be growing by 15% annually, and has surpassed Japan, becoming the second largest infant formula dairy market in the world behind the U.S.

In September 2008, some of our competitors’ businesses were severely interrupted by the melamine contamination incident in which the products of 22 Chinese formula producers were found to be contaminated by melamine, a substance not approved for use in food and linked to approximately 300,000 kidney illnesses among infants and children in China. Certain milk supplies in Hebei and Inner Mongolia were found to be contaminated by melamine. The milk supplies from Heilongjiang province (where we operate) were not seriously affected, and our products did not test positive for melamine in the contamination crackdown in China. This incident prompted the Chinese government to conduct a nationwide investigation into how the milk powder was contaminated, and caused a worldwide recall of certain milk powder products produced within China. On September 16, 2008, AQSIQ revealed that it had tested samples from 175 dairy manufacturers, and published a list of 22 companies whose products contained melamine. We passed the emergency inspection and were not included on AQSIQ’s list. We believe that the contraction in the Chinese milk powder industry caused by this crisis will lead to increased demand for our products and present acquisition opportunities.

12

Infant/Children Milk Formula

China’s baby food industry, dominated by infant formula, is a multi-billion dollar business and has experienced an annual double-digit growth rate from 2002 to 2007. This growth resulted from increased demand which was the cumulative byproduct of three factors: (a) increase in disposable income; (b) penetration of milk formula into the rural market; and (c) female working population growth. We anticipate that as income levels rise, Chinese parents will spend more on infant formula due to demand for higher quality and greater variety. China’s per capita dairy consumption is still relatively low, which we believe provides ample room for continued industry growth. In 2005, China’s per capita dairy intake was only 21.7 kg or about 20% of the global average. Milk consumption in China is not uniform across the population. The majority of consumption occurs in large cities and economically developed regions, whereas the consumption of the rural population is less than 10% of that of the urban population. We believe this disparity represents a substantial opportunity for distribution to rural regions. There are approximately 15 million new babies born each year in China according to the National Statistics Bureau of the PRC. Our management initially estimates that an average infant in China should consume approximately 31 kilograms of dairy products per year, and that infants generally consume dairy based formula products for approximately 2.5 years. Therefore, our management has estimated the potential market demand for infant formula products per year in China to be approximately 1.45 million tons. Based on Chinese industry statistics, management has estimated that the actual production volume of infant formula dairy products was more than 300,000 tons in 2006. Therefore, management believes there is great potential for demand-side growth for infant formula dairy products in China. Our management estimates that the total market size of dairy based nutritional products for infants and children, in terms of sales in China, was about $2 billion during 2006, representing a 5% growth rate over 2005. Currently sales growth has been mainly derived from increasing demand driven by medium sized urban areas.

Our management believes that Chinese women generally only breastfeed babies for the first six months of an infant’s life. After the first 6 months, mothers usually choose infant formula over breastfeeding for two primary reasons: (a) many mothers have to return to work after 6 months, making breastfeeding harder to manage; and (b) infant formula products currently available in the Chinese market provide adequate nutritional value. Accordingly, mothers are becoming more comfortable using formula as an adequate breast milk substitute. Empirical evidence also reflects the trend of Chinese mothers’ increased acceptance and use of infant formula as a breast milk substitute.

China’s consumer goods market has rapidly developed in recent years, leading to increased demand for more modern food products. Rising income levels have allowed consumers to buy better quality and more sophisticated food products, including those in the baby food sector. In addition, because of the One Child Policy (state policy allowing most Chinese families to have only one child), parents and extended families tend to lavish a great amount of money, time and attention on the only child. The demand for better quality products is derived from parents being able to spend more on baby formula and nutritional products. This market demand has led to the development of new products containing additional nutrients, including various essential fatty acids, vitamins and minerals.

Middle-Aged and Elderly Milk Formula

China’s middle-aged and elderly milk formula industry is gradually emerging. China’s large aging population has provided the basis for the formation and development of the elderly market. At present, China’s elderly population has reached 174 million, accounting for nearly 12.8% of the total population. In the next 50 years, it is expected that China will experience a rapid growth trend for its aging population.

We believe the increase in the disposable income for the elderly population, as well as the improving awareness of health and wellness, create enormous opportunities for the development of the elderly market. About 45% of the people aged 60-65 years old in urban areas are still working. As a result, in addition to pension income, they also have additional stable income. According to a survey done by the China Aging Research Center, 42.8% of the elderly in urban areas have savings. Additionally, pensions are expected to increase to 838.3 billion RMB by 2010 and 2.8 trillion RMB by 2020.

Seasonality/ Climate

Dairy cows generally produce more milk in temperate weather than in cold or hot weather and extended unseasonably cold or hot weather could lead to lower than expected production. However, we believe this fluctuation is not material to our business and in any event is mitigated by the fact that our adult formula milk powder business also has a certain level of seasonality, as adults tend to consume less milk powder in the summer.

Competition

Competitive Environment

The milk powder formula industry in China is highly competitive. We generally compete with both multinational and domestic Chinese infant milk powder formula producers and milk and dairy producers. Competitive factors include brand recognition, perceived quality, taste, freshness, advertising, formulation, packaging and price. Many of our competitors have a significant market share in our product markets.

13

Our products are positioned as premium products and, accordingly, are generally priced higher than certain similar competitive products. While we believe that we compete favorably in terms of quality, taste and freshness, our products may have higher prices yet less brand recognition than certain other established brands. Our premium products may also be considered in competition with non-premium quality dairy products for discretionary food dollars. The melamine contamination in 2008 has severely affected many of our competitors and resulted in a major reshuffling within our industry. Our management views this as a competitive opportunity to provide safe products to our customers and develop further brand loyalty. Further, we believe that as the Chinese government has implemented new regulations following the contamination scandal, consumers have rebuilt their confidence in formula and will continue to use formula. Our products were tested by AQSIQ and were not implicated in the scandal. We did not experience a decline in sales following the scandal.

Our Competitors

We believe that the following dairy companies are our most significant direct competitors based in China: American Dairy, Inc., Synutra International, Inc. and Guangdong Yashili Group Co., Ltd. These are much larger producers with a dominating market share and more established brand awareness, but we believe these competitors have lower profit margins than ours. In September 2008, some of our competitors’ businesses were severely interrupted by the melamine contamination incident in which the products of 22 Chinese formula producers were found to be contaminated by melamine, a substance not approved for use in food and linked to approximately 300,000 kidney illnesses among infants and children in China.

We believe our competitive advantages are as follows:

|

▪

|

Production license advantage: We hold two infant formula production licenses issued by the Chinese government. Our two licenses are among the total of 151 licenses that the Chinese government has issued to qualified infant milk formula manufacturers in the PRC.

|

|

▪

|

Favorable geographic location: We have two production bases strategically located in Heilongjiang and Inner Mongolia. The two provinces have the most dairy production in China due to abundant grasslands and fertile black soil, which we believe contribute to a higher milk yield and nutritionally rich content.

|

|

▪

|

Secured raw milk resources: We own 15 proprietary milk collection stations where raw milk is automatically received using fully enclosed, stainless-steel vacuum milking machines that prevents human contact and contamination. We also own a dairy farm in Qinggang County, Heilongjiang province which currently houses 2,165 Holstein cows which provide on average 30 tons of raw milk per day.

|

|

▪

|

Strong distribution network: We have a well established distribution network with footholds in the following nine provinces of the PRC: Zhejiang; Fujian; Shandong; Hebei; Henan; Sichuan; Anhui, Jiangsu and Hubei. We have a sales team of approximately 2,000 people covering approximately 5,000 retail stores in the PRC.

|

|

▪

|

Exclusive right: We were granted an exclusive right for 10 years starting on July 1, 2008 to produce a powdered milk product formula specifically developed for middle-aged and elderly consumers by China Nutrition Society. We are also authorized to use the name of ‘China Nutrition Society Development’ on our package. We believe there will be a significant market potential for our elderly milk formula product, which is currently in a less competitive niche market.

|

14

ITEM 1A. RISK FACTORS.

Investing in our securities involves a great deal of risk. You should carefully consider the risks described below as well as other information provided to you in this document, including information in the section of this document entitled “Cautionary Statement Regarding Forward-Looking Statements.” The risks and uncertainties described below are not the only ones facing Rodobo. Additional risks and uncertainties not presently known to us or that we currently believe are immaterial may also impair our business operations. If any of the following risks actually occur, the Company’s business, financial condition or results of operations could be materially adversely affected, the value of our Common Stock could decline, and you may lose all or part of your investment.

Risks Relating to Our Business

Our limited operating history may not serve as an adequate basis to judge our future prospects and results of operations.

We have a limited operating history, having commenced operations in 2002. We grew to our present size in 2008 following our acquisition of Cayman Mega. Accordingly, you should consider our future prospects in light of the risks and uncertainties experienced by early-stage companies in evolving markets in the PRC. Some of these risks and uncertainties relate to our ability to:

|

·

|

offer new products to attract and retain a larger customer base;

|

|

·

|

attract additional customers and increase spending per customer;

|

|

·

|

increase awareness of our brand and continue to develop customer loyalty;

|

|

·

|

respond to competitive market conditions;

|

|

·

|

respond to changes in our regulatory environment;

|

|

·

|

manage risks associated with intellectual property rights;

|

|

·

|

maintain effective control of our costs and expenses;

|

|

·

|

raise sufficient capital to sustain and expand our business; and

|

|

·

|

attract, retain and motivate qualified personnel.

|

Because we are a relatively new company, we may not be experienced enough to address all the risks in our business or in our expansion. If we are unsuccessful in addressing any of these risks and uncertainties, it may have a negative impact on our results of operations.

The milk products business is highly competitive and, therefore, we face substantial competition in connection with the marketing and sale of our products.

Our products compete with other premium quality dairy brands as well as less expensive, non-premium brands. Our milk products face competition from non-premium milk producers distributing milk in our marketing area and other milk producers packaging their milk in glass bottles and other special packaging which serve portions of our marketing area. Most of our competitors are well-established, have greater financial, marketing, personnel and other resources, have been in business for longer periods of time than we have, and have products that have gained wide customer acceptance in the marketplace. The largest of our competitors are state-owned dairies owned by the government of China. Large foreign milk companies have also entered the milk industry in China. Greater financial resources of such competitors will permit them to procure retail store shelf space and to implement extensive marketing and promotional programs, both generally and in direct response to our advertising claims. The milk industry is also characterized by the frequent introduction of new products, accompanied by substantial promotional campaigns. We may be unable to compete successfully or our competitors may develop products which have superior qualities or gain wider market acceptance than ours.

Changing consumer preferences make demand for our products unpredictable.

We are subject to changing consumer preferences and nutritional and health-related concerns. Our business could be affected by certain consumer concerns about dairy products, such as the fat, cholesterol, calorie, sodium and lactose content of such products. Many potential customers in China are lactose intolerant, and may therefore prefer other beverages. We could become subject to increased competition from companies whose products or marketing strategies address these consumer concerns more effectively, which could have a material adverse effect on our business, operating results and financial condition.

15

We are subject to market and channel risks.

We primarily sell our products through distributors. Because of this, we are dependent to a large degree upon the success of our PRC-based distribution channel as well as the success of specific retailers in the distribution channel. We rely on these distribution channels to purchase, market, and sell our products. Our success is dependent, to a large degree, on the growth and success of retail stores, which may be outside our control. There can be no assurance that the retail channels will be able to grow or prosper as they face price and service pressure from other channels. There can be no assurance that retailers in the retail store distribution channel, in the aggregate, will respond or continue to respond to our marketing commitment in these channels. The result of such potential negative changes to our market channels could have a material adverse effect on our business, operating results and financial condition.

We are highly dependent upon consumers’ perception of the safety and quality of our products. Any ill effects, product liability claims, recalls, adverse publicity or negative public perception regarding particular ingredients or products or our industry in general, could harm our reputation and damage our brand, result in costly and damaging recalls, and expose us to government investigations and sanctions, which would materially and adversely affect our results of operations.

We sell products for human consumption, which involves risks such as product contamination, spoilage and tampering. We may be subject to liability if the consumption of any of our products causes injury, illness or death. Adverse publicity or negative public perception regarding particular ingredients, our products, our actions relating to our products, or our industry in general could result in a substantial drop in demand for our products. Negative public perception may include publicity regarding the safety or quality of particular ingredients or products in general, of other companies or of our products or ingredients specifically. Negative public perception may also arise from regulatory investigations or product liability claims, regardless of whether those investigations involve us or whether any product liability claim is successful against us.

In 2008, sales in China of substandard milk formula contaminated with a substance known as melamine caused the death of six infants as well as illness in nearly 300,000 others. Although this incident did not involve any of our products, China’s Administration of Quality Supervision, Inspection and Quarantine found that the products of 22 Chinese milk and formula producers were contaminated by melamine, a substance not approved for use in food, which caused significant negative publicity for the entire dairy industry in China. Although we believe that the inevitable contraction in the Chinese milk powder industry caused by this crisis should lead to increased demand for our products, the illnesses caused by contamination in the milk powder industry, whether or not related to our products, may lead to a sustained decrease in demand for milk powder products produced within China, thereby having a negative impact on our results of operations.

In addition, we believe that the 2008 melamine incident and any other adverse news related to formula products in China will also result in increased regulatory scrutiny of our industry, which may result in increased costs and reduce our margins and profitability. The government of the PRC has enhanced its regulations on the industry aimed to ensure the safety and quality of dairy products, including but not limited to, compulsory batch-by-batch inspection. Compliance with these enhancements is likely to increase our operating costs and capital expenditures.

We may experience problems with product quality or product performance, or the perception of such problems, which could adversely affect our reputation or result in a decrease in customers and revenue, unexpected expenses and loss of market share.

Our operating results depend, in part, on our ability to deliver high quality products in a timely and cost-effective manner. Our quality control and food safety management systems are complex. If the quality of any of our products deteriorates, it could result in shipment delays, order cancellations, customer returns, customer complaints, loss of goodwill, and harm to our brand and reputation.