Attached files

| file | filename |

|---|---|

| 8-K - Frontier Communications Parent, Inc. | c63669_8k.htm |

| EX-99.2 - Frontier Communications Parent, Inc. | c63669_ex99-2.htm |

Exhibit 99.1

Investor Presentation

December 2010

Safe Harbor Statement

Forward-Looking Language

This document contains forward-looking statements that are subject to risks and uncertainties that could cause actual results to

differ materially from those expressed or implied

in the statements. Statements that are not historical facts are forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform

Act of 1995. Words

such as “believe,” “anticipate,” “expect” and similar expressions are intended to identify forward-looking statements. Forward-looking statements (including

oral representations) are only predictions or statements

of current plans, which we review continuously. Forward-looking statements may differ from actual future results due to,

but not limited to, and our future results may be materially affected by, potential risks or uncertainties. You

should understand that it is not possible to predict or identify all

potential risks or uncertainties. We note the following as a partial list: limitations on the amount of capital stock that we can issue to make acquisitions or to raise additional

capital

during the two years after the Merger; our indemnity obligation to Verizon for taxes which may be imposed upon them as a result of changes in ownership of our stock may

discourage, delay or prevent a third party from acquiring control of us

during the two-year period following the merger in a transaction that stockholders might consider favorable;

our ability to successfully integrate the operations of the acquired business into Frontier’s existing operations; the effects of increased

expenses incurred due to activities related

to the transaction and the integration of the acquired business; the risk that the growth opportunities and cost synergies from the transaction may not be fully realized or may take

longer to realize than

expected; our ability to maintain relationships with customers, employees or suppliers; the effects of greater than anticipated competition requiring new

pricing, marketing strategies or new product or service offerings and the risk that we will not respond

on a timely or profitable basis; reductions in the number of our access lines

that cannot be offset by increases in High-Speed Internet (HSI) subscribers and sales of other products and services; the effects of ongoing changes in the regulation of the

communications

industry as a result of federal and state legislation and regulation; the effects of changes in the availability of federal and state universal funding to us and our

competitors; the effects of competition from cable, wireless and other wireline carriers

(through Voice over Internet Protocol (VOIP), DOCSIS 3.0, 4G or otherwise); our ability to

adjust successfully to changes in the communications industry and to implement strategies for growth; adverse changes in the credit markets or in the ratings given

to our debt

securities by nationally accredited ratings organizations, which could limit or restrict the availability, or increase the cost, of financing; continued reductions in switched access

revenues as a result of regulation, competition or technology

substitutions; our ability to effectively manage service quality in our territories and meet mandated service quality

metrics; our ability to successfully introduce new product offerings, including our ability to offer bundled service packages on terms

that are both profitable to us and attractive to

customers; changes in accounting policies or practices adopted voluntarily or as required by generally accepted accounting principles or regulations; our ability to effectively

manage our operations,

operating expenses and capital expenditures, and to repay, reduce or refinance our debt; the effects of changes in both general and local economic

conditions on the markets that we serve, which can affect demand for our products and services, customer purchasing

decisions, collectability of revenues and required levels of

capital expenditures related to new construction of residences and businesses; the effects of customer bankruptcies and home foreclosures, which could result in difficulty in

collection of

revenues and loss of customers; the effects of technological changes and competition on our capital expenditures and product and service offerings, including the

lack of assurance that our network improvements will be sufficient to meet or exceed the capabilities

and quality of competing networks; the effects of increased medical, retiree

and pension expenses and related funding requirements; changes in income tax rates, tax laws, regulations or rulings, or federal or state tax assessments; the effects of state

regulatory cash management policies on our ability to transfer cash among our subsidiaries and to the parent company; our ability to successfully renegotiate union contracts

expiring in 2010 and thereafter; declines in the value of our pension plan

assets, which would require us to make increased contributions to the pension plan in 2011 and beyond;

our ability to pay dividends on our common shares, which may be affected by our cash flow from operations, amount of capital expenditures, debt service

requirements, cash paid

for income taxes and liquidity; the effects of any unfavorable outcome with respect to any current or future legal, governmental or regulatory proceedings, audits or disputes; the

possible impact of adverse changes to regulatory

requirements imposed by various political bodies or other external factors over which we have no control; and the effects of

severe weather events such as hurricanes, tornados, ice storms or other natural or man-made disasters. These and other

uncertainties related to our business are described in

greater detail in our filings with the Securities and Exchange Commission, including our reports on Forms 10-K and 10-Q, and the foregoing information should be read in

conjunction with these filings. We

undertake no obligation to publicly update or revise any forward-looking statements or to make any other forward-looking statement, whether

as a result of new information, future events or otherwise unless required to do so by securities laws.

2

Non-GAAP Financial Measures

Non-GAAP Financial Measures

The Company uses certain non-GAAP financial measures in evaluating its performance. These include free cash flow, EBITDA or “operating cash flow”, which we define

as

operating income plus depreciation and amortization, and Adjusted EBITDA; a reconciliation of the differences between EBITDA and free cash flow and the most comparable

financial measures calculated and presented in accordance with GAAP is included

in the tables that follow. The non-GAAP financial measures are by definition not measures of

financial performance under generally accepted accounting principles and are not alternatives to operating income or net income reflected in the statement

of operations or to

cash flow as reflected in the statement of cash flows and are not necessarily indicative of cash available to fund all cash flow needs. The non-GAAP financial measures used by

the Company may not be comparable to similarly

titled measures of other companies.

The Company believes that the presentation of non-GAAP financial measures provides useful information to investors regarding the

Company’s financial condition and results of

operations because these measures, when used in conjunction with related GAAP financial measures, (i) together provide a more comprehensive view of the Company’s core

operations and ability to generate

cash flow, (ii) provide investors with the financial analytical framework upon which management bases financial, operational, compensation and

planning decisions and (iii) presents measurements that investors and rating agencies have indicated to management

are useful to them in assessing the Company and its

results of operations. Management uses these non-GAAP financial measures to plan and measure the performance of its core operations, and its divisions measure performance

and report to management

based upon these measures. In addition, the Company believes that free cash flow and EBITDA, as the Company defines them, can assist in

comparing performance from period to period, without taking into account factors affecting cash flow reflected in the

statement of cash flows, including changes in working capital

and the timing of purchases and payments.

The Company has shown adjustments to its financial presentations to exclude $78.5 million and $3.7 million of acquisition and integration costs in the third quarters of 2010 and

2009,

respectively, and $125.9 million and $14.5 million of acquisition and integration costs in the first nine months of 2010 and 2009, respectively, because the Company

believes that such costs in the third quarter and first nine months of 2010 are unusual,

and that the magnitude of such costs in the third quarter and first nine months of 2010

materially exceed the comparable costs in the third quarter and first nine months of 2009. In addition, the Company has shown adjustments to its financial

presentations to

exclude $12.1 million and $8.4 million of non-cash pension and other postretirement benefit costs in the third quarters of 2010 and 2009, respectively, and $24.2 million and $24.8

million of non-cash pension and other postretirement

benefit costs in the first nine months of 2010 and 2009, respectively, and $7.0 million of severance and early retirement

costs in the third quarter of 2010, and $7.7 million and $2.6 million of severance and early retirement costs in the first nine months

of 2010 and 2009, respectively, because

investors have indicated to management that such adjustments are useful to them in assessing the Company and its results of operations.

Management uses these non-GAAP financial measures to (i) assist in analyzing the Company’s underlying financial performance

from period to period, (ii) evaluate the financial

performance of its business units, (iii) analyze and evaluate strategic and operational decisions, (iv) establish criteria for compensation decisions, and (v) assist management in

understanding the

Company’s ability to generate cash flow and, as a result, to plan for future capital and operational decisions. Management uses these non-GAAP financial

measures in conjunction with related GAAP financial measures. The Company

believes that the non-GAAP financial measures are meaningful and useful for the reasons

outlined above.

While the Company utilizes these non-GAAP financial measures in managing and analyzing its business and financial condition and believes that they are useful to management

and to

investors for the reasons outlined above, these non-GAAP financial measures have certain shortcomings. In particular, free cash flow does not represent the residual cash

flow available for discretionary expenditures, since items such as debt

repayments and dividends are not deducted in determining such measure. EBITDA has similar

shortcomings as interest, income taxes, capital expenditures, debt repayments and dividends are not deducted in determining this measure. Management

compensates for the

shortcomings of these measures by utilizing them in conjunction with their comparable GAAP financial measures. The information in this document should be read in conjunction

with the financial statements and footnotes

contained in our documents filed with the U.S. Securities and Exchange Commission.

3

Frontier Introduction

Frontier Communications (NYSE: FTR)

was founded in 1935 as Citizens

Utilities and became a pure-play

telecom network operator in 2004

Frontier’s network provides fast,

reliable data, voice, and video service

to 3.5 million residential customers

and 381,000 business customers

across 27 states

Frontier is the largest communications

company focused on rural America

A transformational

acquisition of

properties from

Verizon tripled

Frontier’s

business size on

July 1, 2010

Key Stats (September 30, 2010)

1

States

27

Total Access Lines

5,875

High Speed Internet Subscribers

1,693

Satellite & FiOS Video Subscribers

516

Employees

14,758

Revenues

$5,747

% Business Customer

42

%

% Residential Customer

45

%

% Regulatory

12

%

EBITDA

$2,746

% Revenues

48

%

Free Cash Flow

$1,281

% Paid as Dividends

58

%

Total Debt

$8,262

Cash

$351

Net Leverage

2.8

(1) $ Millions; Units 000s. May not sum due to rounding. Pro forma for

acquisitions. Revenues, EBITDA, and FCF are for the Last Twelve Months.

4

Investment Summary

Opportunity

Manage the acquired properties with Frontier’s proven Local

Engagement Model and innovative marketing

Bring margins up to Legacy levels

Harness economics of scale from business that is 3x its

former size

Markets

Expand broadband availability in new markets from 68%

towards Legacy Frontier’s 92%

Rural profile, less competition, less regulatory reform

exposure

Business & Broadband are 62% of customer revenues

Returns

Revenue upside from increased product penetration

$550 million operating expense synergy target by 2013

Consistent execution, solid free cash flow, stable dividend

Credit

Quality

Significantly deleveraged on July 1, 2010, now 2.8x

Target leverage of 2.5x or below

Well structured maturity schedule

5

Frontier Local Engagement

Local Area Manager

High Speed Internet (DSL

& FTTP)

Voice

Video (Satellite & FiOS)

Wireless Data (WiFi mesh)

Online backup

24/7 U.S. Tech Support

Residential

Managed IP VPN

VoIP systems

High-Capacity fiber data

Metro Ethernet

Wireless backhaul

Managed router

Business

Over 120 Local Area Managers at the community level respond to unique

customer needs in each market across Frontier’s 27 states

Employees live in the markets they serve, and put the customer first

Innovative marketing, 2-hour appointment windows, exceptional service

levels

6

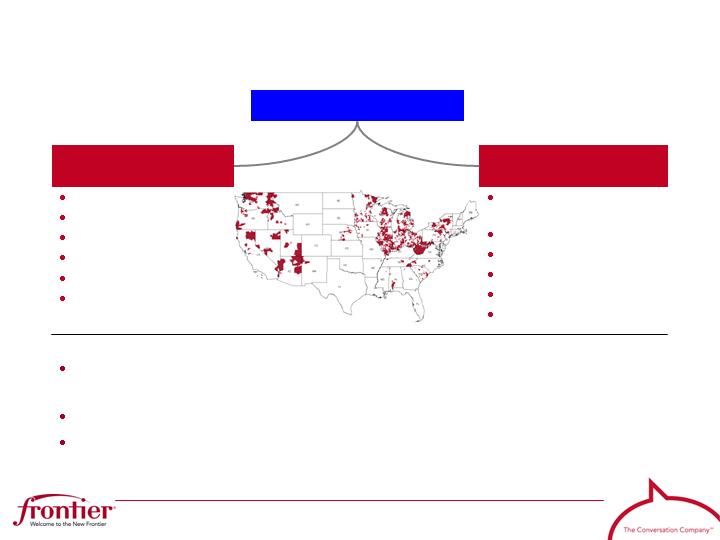

Robust Local Network

Extensive Local Networks

2,609 ILEC exchanges, 2,700 central

offices

Fiber-to-the-Home in all greenfield

builds

Linked by national fiber backbone

Expansion to Drive Penetration

• Acquired

network has 68% broadband

availability vs. Legacy 92%

• FCC Commitments:

1.

12/31/13 – 3Mbps for 85% of households

2.

12/31/15 – 4Mbps for 85% of households

Note: 1) Based on product availability to customers; loop length availability is higher.

Frontier Broadband Network Availability

1

92%

68%

43%

14%

75%

62%

50%

13%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

1+ Mbps

3+ Mbps

6+ Mbps

20 Mbps

Jun '10 Legacy

Sep '10 New Frontier

7

High-Capacity National Backbone

Frontier’s fiber network interconnects its 27-state footprint

Phoenix

Palo Alto

Chicago

Salt Lake

Rochester

Atlanta

Ashburn

20

GigE

OC

48

/

Gig

/

e

Core POP

Core POP

/

Peering

Frontier

13

Aggregation POP

Mound

Bloomington

Ft

.

Wayne

Norwalk

Athens

Charleston

Clarksburg

Durham

Myrtle Beach

Beaverton

La Grande

Everett

Kennewick

Gardnerville

Moscow

Wausau

Lakeville

Muskegon

Bluefield

Charles Town

Coos Bay

Portland

Seattle

Carbondale

DeKalb

Sun Prairie

Redmond

Tigard

8

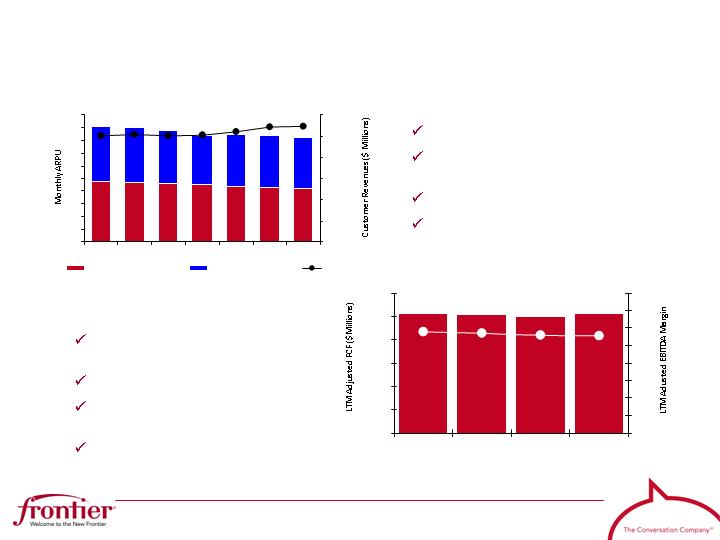

Consistent Execution

Stability of Revenues

Driving recurring customer revenues

Delivering reliable, quality products

and services at a good price

Reducing churn with bundles

Maintaining strong

Business/Enterprise exposure

Notes: Customer revenue is defined as total revenue

less access services revenue. Access services include

switched network access and subsidies.

Stability of Cash Flows

Focus on expense reduction;

competitively fit and flexible

Disciplined capital spending

Legacy EBITDA margins of 54% for

10 quarters through Q2 2010

High conversion rate of EBITDA into

free cash flow (FCF)

Note: Broadband expansion capital expenditures will increase significantly from 4Q10 through 2012.

Pro Forma Frontier

$1,277

$1,264

$1,252

$1,281

$0

$250

$500

$750

$1,000

$1,250

$1,500

4Q09

1Q10

2Q10

3Q10

20

%

25

%

30

%

35

%

40

%

45

%

50

%

55

%

60

%

Pro Forma Frontier Customer Revenue

$67

$67

$67

$67

$68

$70

$71

$25

$30

$35

$40

$45

$50

$55

$60

$65

$70

$75

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

$0

$250

$500

$750

$1,000

$1,250

$1,500

Residential Revenue

Business Revenue

ARPU

9

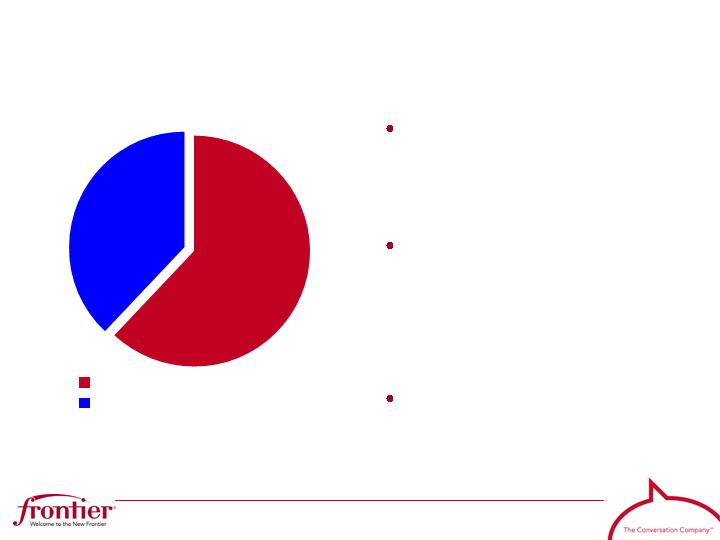

Attractive Revenue Base

For the quarter ended 9/30/10

62%

38%

Business & Broadband Revenue

Other Customer Revenue

Frontier generates 62% of

its customer revenue from

Business and Broadband

sources

Our business capabilities

are very broad and include:

- Advanced IP switching

- VoIP systems

- High-capacity fiber data systems

- Wireless cell site backhaul

- Ethernet

We are re-focusing the

residential relationship on

broadband

10

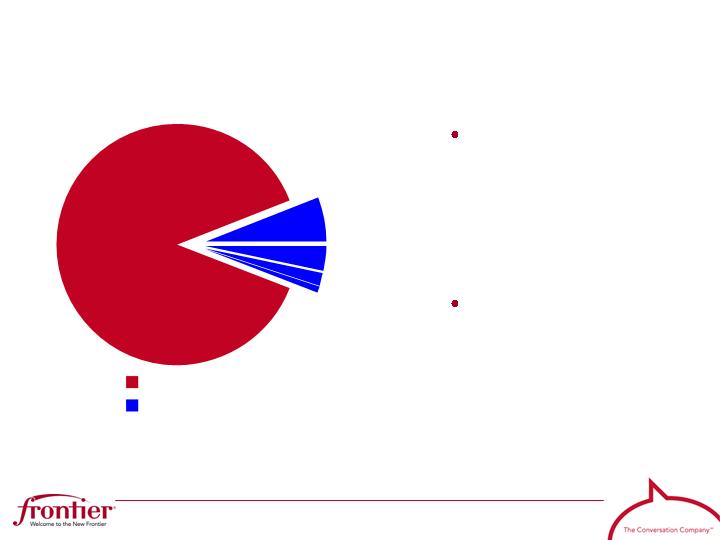

Minimizing Regulatory Risk

For the quarter ended 9/30/10

88.5 %

Switched 5.8 %

Federal 3.1 %

Surcharge 1.9 %

State 0.7 %

Regulatory Revenue

Customer Revenue

The acquired

properties reduced

Frontier’s Regulatory

Revenue exposure

from 17.3% at 3Q09 to

11.5% at 3Q10

We continue to

replace this uncertain,

high-margin revenue

stream with Customer

Revenue

11

Key Pro Forma Financial Data

Notes: ($ millions)

1) See adjustments in Appendix, Reconciliation of Non-GAAP Financial Measures.

(2 Adjusted to exclude $52 million of non-cash pension and OPEB expense.

(3) Annualized actual 3 Months Ended 9/30/10.

(4) Represents $550 million estimate less annualized synergies realized through 9/30/10

LTM 3Q10

LTM 3Q10

LTM 3Q10

Actual

Pro Forma

Pro Forma

Legacy

Acquired

New

Statistics

Frontier

Properties

Frontier

Synergies

Total

Revenue

$2,070

$3,677

$5,747

$0

$5,747

Adjusted EBITDA

(1)

1,105

1,641

(2)

2,746

298

(4)

3,044

% EBITDA Margin

53.4%

44.6%

47.8%

53.0%

Bridge to Free Cash Flow:

Interest Expense

(666)

(3)

(666)

Cash Taxes

(139)

(113)

(252)

Capital Expenditures

(217)

(449)

(666)

(666)

Other

7

7

Free Cash Flow

$1,281

$185

$1,466

Net Debt / Adj. EBITDA

3.93x

1.82x

2.84x

2.56x

Adj. EBITDA / Interest Exp.

2.90x

5.76x

4.12x

4.57x

Dividend ($0.75 / share)

$744

$744

FCF Dividend Payout Ratio

58%

51%

12

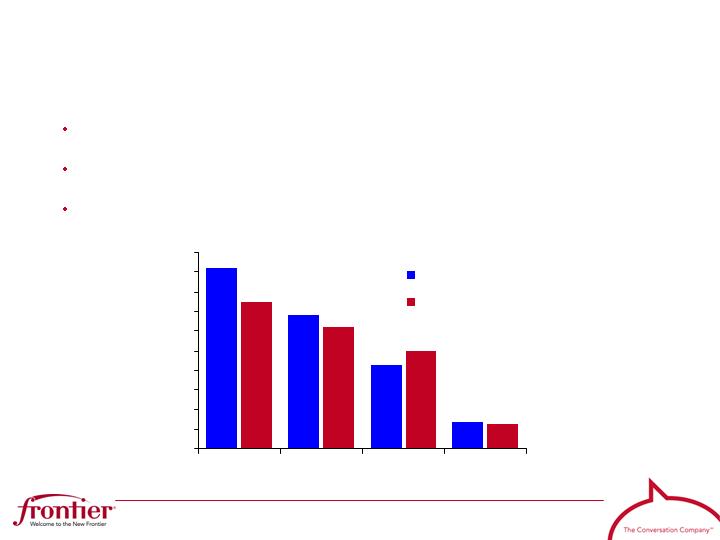

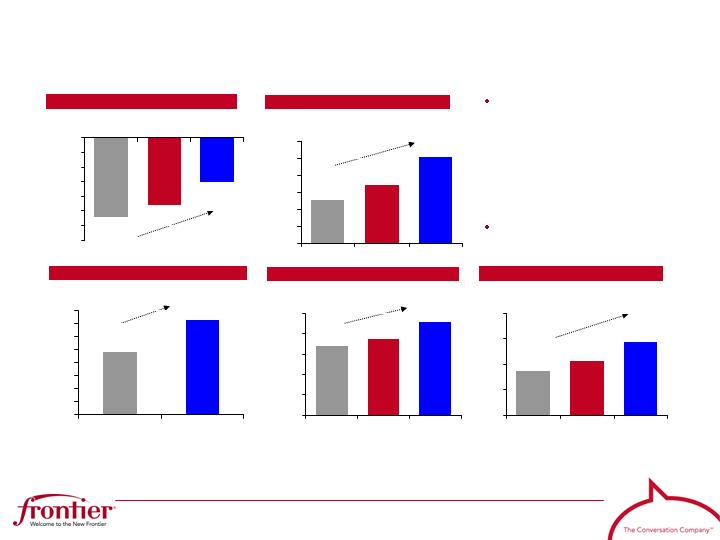

Revenue Opportunity

Our ability to migrate

the acquired properties

to Frontier

’s

performance metrics

offers the potential for

significant operational

enhancement

Driven by broadband

and Local Engagement

Long Distance Penetration

Satellite TV Penetration

Access Line Decline

HSI Penetration

Note: As of 9/30/2010.

Broadband Availability

(10.9)%

(9.3)%

(6.0)%

(14)%

(12)%

(10)%

(8)%

(6)%

(4)%

(2)%

0

%

Acq Prop

Pro Forma

Legacy

27.1

%

28.8

%

32.2

%

22

%

24

%

26

%

28

%

30

%

32

%

34

%

Acq Prop

Pro Forma

Legacy

48.1

%

72.4

%

0

%

10

%

20

%

30

%

40

%

50

%

60

%

70

%

80

%

Acq Prop

Legacy

68.0

%

75.0

%

92.0

%

0

%

20

%

40

%

60

%

80

%

100

%

Acq Prop

Pro Forma

Legacy

8.7

%

10.6

%

14.3

%

0

%

5

%

10

%

15

%

20

%

Acq Prop

Pro Forma

Legacy

13

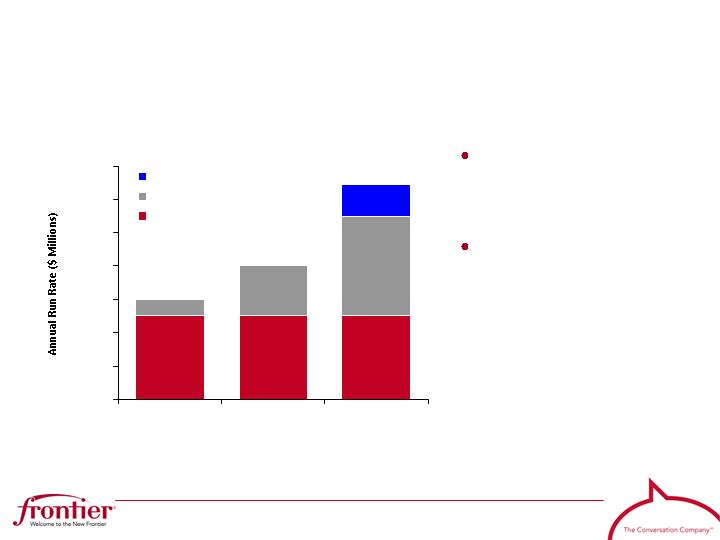

Broadband Buildout Drives Growth

Revenue opportunity

driven by 850,000 new

broadband homes

open for sale

Emphasis on double

and triple-play

packages, which

lower churn

significantly

9/30/10

12/31/11

12/31/12

12/31/13

Acquired

Properties

Legacy

Note:

(i) Based on

Frontier

commitments

to the FCC on

5/21/10 for

3Mbps

broadband

availability.

This chart

assumes no

change in

Legacy

footprint.

68%

72%

80%

85%

92%

92%

92%

92%

i

i

i

14

Cost Synergy Overview

Significant savings

from reducing cash

operating expenses

Numerous projects

underway; synergy

estimates include:

- Network savings

- Outside contractors

- IT savings from conversion

- Real estate savings

- Operations

Estimated Cost Synergies

$252

$252

$252

$48

$148

$298

$94

$0

$100

$200

$300

$400

$500

$600

$700

2010

2011

2012

Software License

Other Projects

Allocated Overhead

$300

$400

$550

15

Systems Integration Plan

System mapping and analysis in

process

Systems are identical across all

13 states; processes on the first

conversions will be replicated

Initial expectation is a few states

in the second half of 2011, and

the remaining states in two

groups by end of 2012

Successful conversion despite a

firm July 1 deadline

Billing cycles kept within days of

prior scheduled dates, and all

systems functional out of the

gate

Backlog managed downward

with “bubble workforce” and

current levels within normal

range

Frontier 13

West Virginia

Frontier converted West Virginia, which utilized BellAtlantic

systems, on July 1, 2010

The remaining 13 states of the acquired properties (detailed in the

appendix) will be converted off Verizon (GTE) systems onto

existing Frontier systems by the end of 2012

16

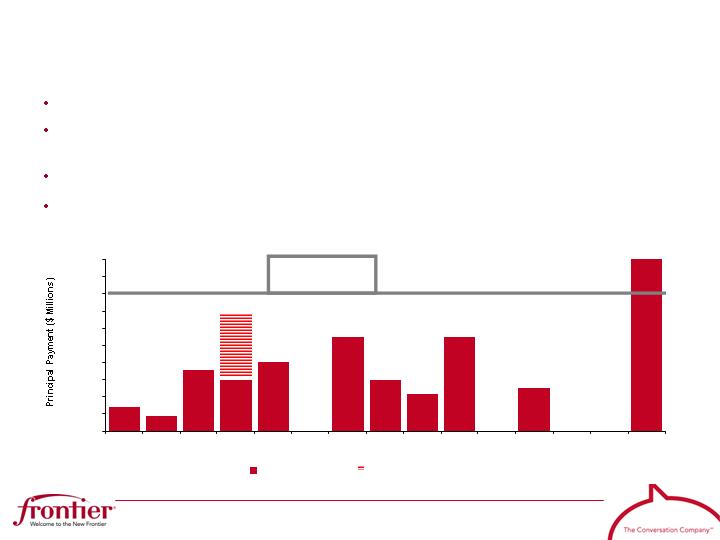

Financing Overview

Deleveraged from 4.0x (6/30/10) to 2.8x (9/30/10)

Strong $1.0 billion liquidity with an undrawn $750M R/C and $250M minimum

cash-on-hand objective

Maturity schedule is well balanced and below run rate FCF levels

Free cash flow levels match well with scheduled debt amortization.

17

$-

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

$1,800

$2,000

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

2024

2025+

Existing FTR Debt

Undrawn Revolver

LTM 3Q10 Pro Forma

Frontier FCF with

Synergies = $1.6B

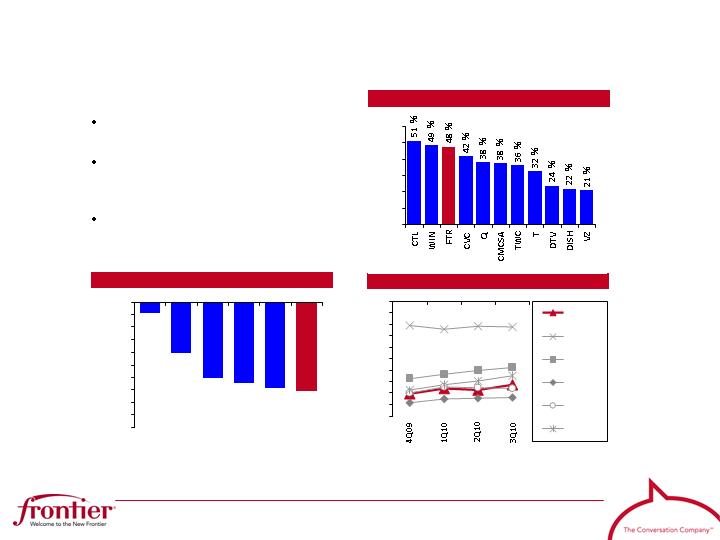

Industry Comparisons

Line Loss Yr/Yr (3)

EBITDA Margin (1)

Change in Lines + HSI Subs (2)

Pro Forma Frontier Results

Results, as expected, weakened by

the acquired properties

Excellent comps going forward as

Frontier turns around the new

markets

Strong starting point on EBITDA

margin

Notes:

1.

Data for the 3-months ended 9/30/10. Adjusted EBITDA; excludes wireless; Cable is network operations only.

2.

Data for the 3-months ended 9/30/10. Represents the yr/yr change in the combined ending base of total access lines and HSI subscribers.

3.

Data for the 3-months ended 9/30/10.

Source: SEC filings; Wall Street research; Frontier.

0%

10%

20%

30%

40%

50%

60%

(0.9)%

(4.1)%

(6.0)%

(6.5)%

(6.9)%

(7.2)%

(10)%

(9)%

(8)%

(7)%

(6)%

(5)%

(4)%

(3)%

(2)%

(1)%

0

%

WIN

CTL

VZ

T

Q

FTR

(12)%

(11)%

(10)%

(9)%

(8)%

(7)%

(6)%

(5)%

(4)%

(3)%

(2)%

New FTR

WIN

CTL

Q

T

VZ

18

Doing What We Say…

Goal

Status

Regulatory approval with appropriate conditions

Completion of financing within expected cost

Distribution of shares with minimal market disruption

Completion of West Virginia systems conversion

Continued delivery of solid Legacy Frontier results

Customer metric improvement and synergy realization

of acquired properties

In Process

19

Appendix

20

Pro Forma Combined Financials

Notes

1. Total revenues including Switched Access & Subsidy.

2. Customer revenue is defined as total revenue less access services. Access services include switched network access and subsidies.

3. Represents Operating Cash Flow (EBITDA), as adjusted. Please see Non-GAAP Reconciliations.

4. Capital expenditures exclude integration capital expenditures related to the acquisition of Verizon lines.

5. Free cash flow as defined by Frontier, and excluding integration costs and capex. Please see Non-GAAP Reconciliations.

$ Millions

3Q09

4Q09

1Q10

2Q10

3Q10

Revenue

(1)

$1,514

$1,454

$1,456

$1,434

$1,403

Customer Revenue

(2)

$1,318

$1,264

$1,266

$1,260

$1,241

Adjusted EBITDA

(3)

$736

$723

$697

$655

$671

EBITDA Margin

48.6%

49.7%

47.9%

45.7%

47.9%

Capital Expenditures

(4)

$193

$209

$136

$162

$159

% Revenue

12.8%

14.4%

9.3%

11.3%

11.3%

Free Cash Flow

(5)

$310

$300

$357

$285

$339

Access Lines (000s)

6,475

6,315

6,171

6,014

5,875

% Change Yr/Yr

NA

NA

(9.6)%

(9.7)%

(9.3)%

Business

2,246

2,212

2,180

2,150

2,140

Residential

4,229

4,103

3,992

3,863

3,735

High Speed Internet

1,676

1,697

1,712

1,698

1,693

Net Adds

15

20

16

(14)

(5)

Penetration

25.9%

26.9%

27.7%

28.2%

28.8%

21

Access Lines by State

As of 9/30/10

FRONTIER

ACQUIRED

COMBINED

% Total

West Virginia

135,656

498,995

634,651

10.8

%

Indiana

4,143

581,334

585,477

10.0

%

Illinois

91,114

473,860

564,974

9.6

%

Ohio

519

516,154

516,673

8.8

%

Michigan

17,105

389,923

407,028

6.9

%

Wisconsin

54,684

230,250

284,934

4.8

%

Oregon

11,883

246,635

258,518

4.4

%

California

129,581

20,216

149,797

2.5

%

Arizona

132,364

2,944

135,308

2.3

%

Idaho

17,987

93,560

111,547

1.9

%

Nevada

22,069

27,916

49,985

0.9

%

COMBINED

617,105

3,081,787

3,698,892

63.0

%

Washington

0

452,768

452,768

7.7

%

North Carolina

0

218,013

218,013

3.7

%

South Carolina

0

99,669

99,669

1.7

%

NEW STATES

0

770,450

770,450

13.1

%

New York

597,409

0

597,409

10.2

%

Pennsylvania

380,622

0

380,622

6.5

%

Minnesota

192,123

0

192,123

3.3

%

Tennessee

71,029

0

71,029

1.2

%

Iowa

40,865

0

40,865

0.7

%

Nebraska

39,180

0

39,180

0.7

%

Alabama

24,142

0

24,142

0.4

%

Utah

20,312

0

20,312

0.3

%

Georgia

17,212

0

17,212

0.3

%

New Mexico

7,437

0

7,437

0.1

%

Montana

7,356

0

7,356

0.1

%

Mississippi

5,081

0

5,081

0.1

%

Florida

3,336

0

3,336

0.1

%

FRONTIER

1,406,104

0

1,406,104

23.9

%

TOTAL

2,023,209

3,852,237

5,875,446

100.0

%

22

Legacy Selected Financials

Notes

1. Revenue for 2007 excludes the favorable one-time impact of $38.7 million for a significant settlement of a carrier dispute.

2. Customer revenue is defined as total revenue less access services. Access services include switched network access and subsidies.

3. Represents Operating Cash Flow (EBITDA), as adjusted. Please see Non-GAAP Reconciliations.

4. Capital expenditures for 2007 and 2009 exclude $9.6 million and $25.0 million, respectively, related to integration activities.

5. Free cash flow includes ELI for all years prior to its sale in July 2006. Please see Non-GAAP Reconciliations.

$ Millions

2005

2006

2007

2008

2009

Revenue

(1)

2,017

$

2,025

$

2,249

$

2,237

$

2,118

$

Customer Revenue

(2)

1,586

$

1,597

$

1,809

$

1,832

$

1,758

$

Adjusted EBITDA

(3)

1,116

$

1,128

$

1,213

$

1,214

$

1,149

$

EBITDA Margin

55.3%

55.7%

53.9%

54.3%

54.2%

Capital Expenditures

(4)

259

$

269

$

306

$

288

$

231

$

% Revenue

12.9%

13.3%

13.6%

12.9%

10.9%

Free Cash Flow

(5)

544

$

562

$

538

$

493

$

491

$

Access Lines (000s)

2,238

2,127

2,429

2,254

2,118

High Speed Internet

318

393

523

580

636

Penetration

14.2

%

18.5

%

21.5

%

25.7

%

30.0

%

23

Reconciliation of Non-GAAP Financial Measures

2009 Pro Forma Frontier and Acquired Properties

Verizon's Separate

Pro Forma

Total

($ in millions)

Frontier

Telephone Operations

Adjustments

Pro Forma

EBITDA

Operating Income

606

$

542

$

219

$

1,367

$

Add back:

Depreciation and amortization

477

781

253

1,511

EBITDA, as reported

1,083

$

1,323

$

472

$

2,878

$

Add/(subtract):

34

52

-

86

Severance and early retirement costs

4

-

-

4

Acquisition and integration costs

28

-

(28)

-

Adjusted EBITDA

1,149

$

1,375

$

444

$

2,968

$

Reconciliation of Non-GAAP Financial Measures

For the year ended December 31, 2009

Non-cash pension and other

postretirement costs

24

Reconciliation of Non-GAAP Financial Measures

Frontier (Legacy)

($ in 000's)

2005

2006

2007

2008

2009

EBITDA (Operating Cash Flow)

Operating Income

588,968

$

644,490

$

705,416

$

642,456

$

606,165

$

Add back:

Depreciation and amortization

520,204

476,487

545,856

561,801

476,391

EBITDA (Operating Cash Flow), as reported

1,109,172

$

1,120,977

$

1,251,272

$

1,204,257

$

1,082,556

$

Add / (Subtract)

Severance and early retirement costs

6,981

7,193

13,874

7,598

3,788

Pension curtailment gain (Non-Cash)

-

-

(14,379)

-

-

Non-Cash Pension Costs

-

-

-

-

34,196

Legal settlement costs

-

-

816

2,113

-

Carrier dispute settlement

-

-

(38,700)

-

-

Acquisition and integration costs

-

-

-

-

28,334

Adjusted EBITDA

1,116,153

$

1,128,170

$

1,212,883

$

1,213,968

$

1,148,874

$

Revenue, as reported

2,017,041

$

2,025,367

$

2,288,015

$

2,237,018

$

2,117,894

$

Deduct:

Favorable revenue settlement (one-time)

-

-

(38,700)

-

-

Revenue, as adjusted

2,017,041

$

2,025,367

$

2,249,315

$

2,237,018

$

2,117,894

$

Adjusted EBITDA as % of Adj. Revenue

55.3%

55.7%

53.9%

54.3%

54.2%

For the years ended December 31,

25

Reconciliation of Non-GAAP Financial Measures

Frontier (Legacy)

($ in 000's)

2005

2006

2007

2008

2009

Net income

202,375

$

344,555

$

216,514

$

184,274

$

123,181

$

Add back:

Depreciation and amortization

520,204

476,487

545,856

561,801

476,391

Income tax expense

75,270

136,479

128,014

106,496

69,928

Acquisition and integration costs

-

-

-

-

28,334

Pension expense (non-cash)

-

-

-

-

34,196

Stock based compensation

8,427

10,340

9,022

7,788

9,368

Subtract:

Cash paid (refunded) for income taxes

4,711

5,365

54,407

78,878

59,735

Pension Curtailment Gain (Non-Cash)

-

-

14,379

-

-

Other income (loss), net

(2,843)

60,271

(13,178)

20

(40,133)

Capital expenditures - business operations

259,448

268,806

306,203

288,264

230,966

Gain on sale of discontinued operations

1,167

71,635

-

-

-

Free cash flow

543,793

$

561,784

$

537,595

$

493,197

$

490,830

$

Revenue

2,017,041

$

2,025,367

$

2,288,015

$

2,237,018

$

2,117,894

$

Free cash flow as % of Revenue, as reported

27.0%

27.7%

23.5%

22.0%

23.2%

For the years ended December 31,

26

Reconciliation of Non-GAAP Financial Measures

Notes

1. Includes pension and other

postretirement benefit

(OPEB) expense of $22.2

million and $10.0 million, less

amounts

capitalized into the

cost of capital expenditures

of $2.0 million and $1.6

million, for the quarters

ended September 30, 2010

and 2009, respectively, and

pension/OPEB expense of

$40.3 million and $30.3

million, less amounts

capitalized

into the cost of

capital expenditures of $5.4

million and $5.5 million, for

the nine months ended

September 30, 2010 and

2009, respectively. Amounts

for the quarter and nine

months ended September

30, 2010 have also

been

reduced by $8.1 million and

$10.7 million, respectively,

for cash

pension

contributions.

2. Includes gain on debt

repurchases of $4.1 million

and $7.8 million for the

quarter and nine months

ended September 30, 2009,

respectively.

3. Excludes capital expenditures

for integration activities.

(Amounts in thousands)

2010

2009

2010

2009

Net Income to Free Cash Flow;

Net Cash Provided by Operating Activities

Net income

29,684

$

52,746

$

109,095

$

118,011

$

Add back:

Depreciation and amortization

339,894

103,123

540,917

373,499

Income tax expense

40,358

29,021

88,752

65,328

Acquisition and integration costs

78,533

3,706

125,867

14,457

Pension/OPEB costs (non-cash)

(1)

12,065

8,348

24,224

24,802

Stock based compensation

4,702

2,413

9,930

6,974

Subtract:

Cash paid for income taxes

4,847

19,495

4,042

59,953

Other income, net

(2)

2,315

5,373

17,069

14,038

Capital expenditures - Business operations

(3)

159,010

54,136

252,360

161,893

Free cash flow

339,064

120,353

625,314

367,187

Add back:

Deferred income taxes

3,856

2,778

10,092

11,097

Non-cash (gains)/losses, net

26,056

9,665

40,020

25,314

Other income, net

(2)

2,315

5,373

17,069

14,038

Cash paid for income taxes

4,847

19,495

4,042

59,953

Capital expenditures - Business operations

(3)

159,010

54,136

252,360

161,893

Subtract:

Changes in current assets and liabilities

(169,110)

8,021

(186,046)

37,300

Income tax expense

40,358

29,021

88,752

65,328

Acquisition and integration costs

78,533

3,706

125,867

14,457

Pension/OPEB costs (non-cash)

(1)

12,065

8,348

24,224

24,802

Stock based compensation

4,702

2,413

9,930

6,974

Net cash provided by operating activities

568,600

$

160,291

$

886,170

$

490,621

$

For the quarter ended September 30,

For the nine months ended September 30,

27

Reconciliation of Non-GAAP Financial Measures

Notes

1. Includes pension and other postretirement benefit (OPEB) expense of $22.2 million and $10.0 million, less amounts

capitalized into the cost of capital expenditures of $2.0

million and $1.6 million, for the quarters ended September 30, 2010 and 2009, respectively, and pension/OPEB expense of $40.3 million and $30.3 million, less amounts

capitalized into the cost

of capital expenditures of $5.4 million and $5.5 million, for the nine months ended September 30, 2010 and 2009, respectively. Amounts for the quarter

and nine months ended September 30, 2010 have also been reduced by $8.1 million and

$10.7 million, respectively, for cash pension contributions.

(Amounts in thousands)

Acquisition

Severance

Acquisition

and

Non-cash

and Early

and

Non-cash

Operating Cash Flow and

As

Integration

Pension/OPEB

Retirement

As

As

Integration

Pension/OPEB

As

Operating Cash Flow Margin

Reported

Costs

Costs

(1)

Costs

Adjusted

Reported

Costs

Costs

(1)

Adjusted

Operating Income

234,045

$

(78,533)

$

(12,065)

$

(6,945)

$

331,588

$

172,490

$

(3,706)

$

(8,348)

$

184,544

$

Add back:

Depreciation and

amortization

339,894

-

-

-

339,894

103,123

-

-

103,123

Operating cash flow

573,939

$

(78,533)

$

(12,065)

$

(6,945)

$

671,482

$

275,613

$

(3,706)

$

(8,348)

$

287,667

$

Revenue

1,402,968

$

1,402,968

$

526,816

$

526,816

$

Operating income margin

(Operating income divided

by revenue)

16.7%

23.6%

32.7%

35.0%

Operating cash flow margin

(Operating cash flow divided

by revenue)

40.9%

47.9%

52.3%

54.6%

Acquisition

Severance

Acquisition

Severance

and

Non-cash

and Early

and

Non-cash

and Early

Operating Cash Flow and

As

Integration

Pension/OPEB

Retirement

As

As

Intregration

Pension/OPEB

Retirement

As

Operating Cash Flow Margin

Reported

Costs

Costs

(1)

Costs

Adjusted

Reported

Costs

Costs

(1)

Costs

Adjusted

Operating Income

532,318

$

(125,867)

$

(24,224)

$

(7,658)

$

690,067

$

448,616

$

(14,457)

$

(24,802)

$

(2,567)

$

490,442

$

Add back:

Depreciation and

amortization

540,917

-

-

-

540,917

373,499

-

-

-

373,499

Operating cash flow

1,073,235

$

(125,867)

$

(24,224)

$

(7,658)

$

1,230,984

$

822,115

$

(14,457)

$

(24,802)

$

(2,567)

$

863,941

$

Revenue

2,438,954

$

2,438,954

$

1,596,914

$

1,596,914

$

Operating income margin

(Operating income divided

by revenue)

21.8%

28.3%

28.1%

30.7%

Operating cash flow margin

(Operating cash flow divided

by revenue)

44.0%

50.5%

51.5%

54.1%

For the quarter ended September 30, 2010

For the quarter ended September 30, 2009

For the nine months ended September 30, 2010

For the nine months ended September 30, 2009

28

Frontier Values

Put the customer first

Treat one another with respect

Keep our commitments; be accountable

Be ethical in all of our dealings

Take the initiative

Be team players

Be innovative; practice continuous improvement

Be active in our communities

Do it right the first time

Use resources wisely

Have a positive attitude

Use Frontier products and services

29

Frontier Communications Corp.

(NYSE: FTR)

Investor Relations

3 High Ridge Park

Stamford, CT 06905

203.614.4606

IR@FTR.com