Attached files

Table of Contents

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended: September 30, 2010

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 1-9481

ARCHON CORPORATION

(Exact name of registrant as specified in its charter)

| Nevada | 88-0304348 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

2200 Casino Drive, Laughlin, NV 89029

(Address of principal executive office and zip code)

(702) 732-9120

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

| Common Stock, par value $.01 per share | Over the Counter Bulletin Board | |

| (Title of Class) | ||

| Exchangeable Redeemable Preferred Stock | Over the Counter Bulletin Board | |

| (Title of Class) | ||

Indicate by a check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S

Indicate by a check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer, accelerated filer” and “small reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer: ¨ |

Accelerated filer: ¨ | Non-accelerated filer: ¨ | Small reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the common stock held by non-affiliates of the registrant was approximately $24,365,425. The market value was computed by reference to the closing price of the common stock as of March 31, 2010.

APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. YES ¨ NO ¨

APPLICABLE ONLY TO CORPORATE ISSUERS:

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

5,792,944 as of December 20, 2010

DOCUMENTS INCORPORATED BY REFERENCE

None

Indicate by checkmark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K). YES x

Table of Contents

ARCHON CORPORATION AND SUBSIDIARIES

ANNUAL REPORT ON FORM 10-K FOR THE FISCAL

YEAR ENDED SEPTEMBER 30, 2010

TABLE OF CONTENTS

| Page No. | ||||||

| PART I |

||||||

| Item 1. |

1 | |||||

| 1 | ||||||

| 1 | ||||||

| 2 | ||||||

| 3 | ||||||

| 4 | ||||||

| Item 1A. |

7 | |||||

| Item 2. |

9 | |||||

| Item 3. |

10 | |||||

| Item 4. |

11 | |||||

| PART II |

||||||

| Item 5. |

Market for the Registrant’s Common Stock and Related Security Holders Matters |

12 | ||||

| Item 6. |

14 | |||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

15 | ||||

| Item 7A. |

26 | |||||

| Item 8. |

27 | |||||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

62 | ||||

| Item 9A. |

62 | |||||

| PART III |

||||||

| Item 10. |

65 | |||||

| Item 11. |

68 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management |

72 | ||||

| Item 13. |

72 | |||||

| Item 14. |

74 | |||||

| PART IV |

||||||

| Item 15. |

75 | |||||

i

Table of Contents

PART I

| Item 1. | BUSINESS |

Archon Corporation, (the “Company” or “Archon”), is a Nevada corporation. The Company’s primary business operations are conducted through a wholly-owned subsidiary corporation, Pioneer Hotel Inc. (“PHI”), which operates the Pioneer Hotel & Gambling Hall (the “Pioneer”) in Laughlin, Nevada. In addition, the Company owns real estate on Las Vegas Boulevard South (the “Strip”) in Las Vegas, Nevada, and properties in the Dorchester section of Boston, Massachusetts and Gaithersburg, Maryland. (See Rental Properties)

Through the Securities and Exchange Commission’s (“SEC”) website, at http://www.sec.gov/ the Company’s annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchanges Act, are made available free of charge, as soon as reasonably practical after such information has been filed or furnished to the SEC.

The principal executive office of the Company is located at 2200 Casino Drive, Laughlin, Nevada, 89029, and the telephone number is (702) 732-9120.

The Pioneer

The Pioneer, built in 1982, features a classical western architecture style, and is located in Laughlin, Nevada, an unincorporated town on the Colorado River bordering Arizona. The Pioneer is located on approximately 12 acres of land, with Colorado River frontage of approximately 770 feet, and is situated near the center of Laughlin’s Casino Drive. Approximately 6 1/2 acres of the 12 acres are leased pursuant to a 99-year ground lease (the “Ground Lease”) which, by its terms, is scheduled to terminate in December 2078. The leased land lies between and separates the remaining two parcels of land that are held in fee simple. The Pioneer is comprised of four buildings. One of the three motel buildings together with a portion of both the Pioneer’s casino building and a second motel building are located on land subject to the Ground Lease. The casino is located in the main building, totaling approximately 50,000 square feet, of which approximately 21,500 square feet house the casino. The first floor includes the casino, two bars, snack bar and gift shop, as well as a twenty-four hour restaurant, kitchen, special events area, restrooms and storage areas. The first floor also includes a Lucky’s Sports Book operated by Brandywine Bookmaking, a tenant. A partial second floor houses administrative offices and banquet rooms. The three motel buildings were built in 1984 and comprise approximately 66,000, 54,000 and 30,000 square feet, respectively. A total of 416 motel rooms are housed in the three buildings with improvements including a swimming pool and spa.

Revenues. The primary source of revenues to the Company’s hotel-casino operations is gaming, which represented approximately 80% in 2010 and 79% in 2009 of total revenues. The Pioneer contributed 100% in fiscal 2010 and 2009 to total gaming revenues. As of September 30, 2010, the

1

Table of Contents

Pioneer had approximately 686 slot machines, six blackjack tables (“21”), one craps table, one roulette wheel and five other gaming tables. In addition, the Pioneer offered keno in fiscal 2009, but has subsequently ceased offering keno as of November 30, 2009.

Market. The Pioneer targets primarily mature, out-of-town customers residing in Central Arizona and Southern California; retirees who reside in the Northeast and Midwest United States and Canada and travel to the Southwest United States during the winter months and local residents who reside in Laughlin, Nevada, and in Bullhead City, Kingman and Lake Havasu, Arizona, and in Needles, California. The average occupancy rates at the Pioneer were approximately 31% and 35% in fiscal years 2010 and 2009, respectively.

Business Strategy. The Pioneer attempts to attract and retain customers by offering slot and video poker machine payouts that compare favorably to the competition. A visible means used by the Pioneer to accomplish this marketing program is to offer what management believes to be a large number of quarter video poker machines with liberal theoretical pay outs, compared to other casinos in Laughlin. The Pioneer periodically sponsors detailed product research of its competitors to categorize the number and type of video poker games by payouts and monitors changes in game products to assist it in developing competitive products.

The Pioneer has a program called the “Round-Up Club” (the “Club”) established to encourage repeat business from frequent and active slot and table game customers. A member of the Club accumulates points in the member’s account for play on slot machines and table games that can be redeemed for cash, free gifts, food and beverages and additional points redeemable for free play. Pioneer management also uses the Club membership list for direct mail marketing.

Management and Personnel

As of December 9, 2010 the Company employed 11 executive and administrative personnel and the Pioneer employed approximately 310 persons.

Competition

In addition to competing with the hotel-casinos in Laughlin, the Pioneer also competes with the hotel-casinos in Las Vegas and those situated on Interstate-15 (the principal highway between Las Vegas and Southern California) near the California-Nevada state line. In March 2000, California voters approved an amendment to the California constitution that permits compacts allowing Native American tribes to operate in excess of 100,000 slot machines in addition to banked card games and lotteries. Management believes that Native American casinos in Southern California, Arizona and New Mexico have had an adverse impact on the Laughlin market, including the Pioneer, by drawing visitors away from the market.

On May 28, 2009, the Company, through its wholly owned subsidiary SFHI, LLC (“SFHI”), entered into a Purchase and Sale Agreement (the “Agreement”) with Montgomery County, Maryland (the “County”) whereby the County will purchase SFHI’s 51.57 acre parcel of land together with an approximately 341,693 square feet office building erected thereon (the “Gaithersburg Property”), located

2

Table of Contents

at 100 Edison Park Drive in Gaithersburg, Maryland. The purchase price for the Property will be seventy-six million three hundred forty thousand dollars ($76,340,000). The Agreement provided the County with a 90-day feasibility period during which the County determined that the Property is suitable for its intended use, and the County will now proceed to close escrow by notifying the Company of the closing date, which date may be no sooner than 90 days from the date of notice and no later than April 30, 2014.

Simultaneous with the execution of the Purchase and Sale Agreement, the County entered into a sublease with the existing tenant of SFHI at this location, GXS, Inc., whereby the County, as of October 1, 2009, leased and occupied the entire Property until the earlier of (i) completion of its purchase of the Property or (ii) April 30, 2014. Pursuant to the applicable provisions of the existing lease with GXS, Inc., SFHI consented to the sublease. In addition, GXS, Inc. agreed to pay SFHI the sum of $2,125,000, $1,725,000 of which was paid on October 1, 2009, with the balance of $400,000 paid on July 1, 2010. Due to the pending sale of this property, the related results of operations have been reported as discontinued operations.

The property in Gaithersburg, Maryland is located on 51 acres and includes one building with approximately 342,000 square feet of commercial office space. The property was acquired for $62.6 million, plus debt issuance costs of $2.7 million. The Company paid $9.9 million in cash and issued $55.4 million in nonrecourse first mortgage indebtedness. The property is under a net lease through 2014 with a single tenant with an investment grade credit rating. Under the lease, the tenant is responsible for substantially all obligations related to the property. The Gaithersburg, Maryland, property is under contract to be sold. See Notes to Consolidated Financial Statements, Note 5, Sale of Gaithersburg Property.

See also Item 2., “Properties”

The Company acquired rental properties in the Dorchester section of Boston, Massachusetts and Gaithersburg, Maryland in March 2001. The Dorchester section of Boston, Massachusetts property is located on 12 acres and includes several buildings with approximately 425,000 square feet of commercial office space. The property was acquired for approximately $82.4 million plus $0.5 million in debt issuance costs. The Company paid $5.6 million in cash and assumed $77.3 million in nonrecourse debt associated with the property. The property is under a net lease through 2020 with a single tenant with an investment grade credit rating. Under the lease, the tenant is responsible for substantially all obligations related to the property.

See also Item 2., “Properties”

The Company owns, through its wholly owned subsidiary, Sahara Las Vegas Corp. (“SLVC”), an approximately 27-acre parcel of land (the “Property”) located on the east side of Las Vegas Boulevard South, just south of Sahara Avenue. The Company presently leases the Property to two different lessees for an aggregate amount of $9,500 per month. The leases may be terminated in the event the property is sold or developed by the Company.

See also Item 2., “Properties”

The Company has provided financial segment information in the Notes to Consolidated Financial Statements, Note 17. Segment Information.”

3

Table of Contents

Nevada Regulations and Licensing

The Company and PHI (collectively, the “Archon Group”) are subject to extensive state and local regulation by the Nevada Gaming Commission (the “Commission”), the Nevada State Gaming Control Board (the “Board”) and in the case of PHI, the Clark County Liquor and Gaming Licensing Board (collectively the “Nevada Gaming Authorities”).

The laws, regulations and supervisory procedures of the Nevada Gaming Authorities seek (i) to prevent unsavory or unsuitable persons from having any direct or indirect involvement with gaming at any time or in any capacity, (ii) to establish and maintain responsible accounting practices and procedures, (iii) to maintain effective control over the financial practices of licensees, including establishing minimum procedures for internal fiscal affairs and the safeguarding of assets and revenues, providing reliable record-keeping and making periodic reports to the Nevada Gaming Authorities, (iv) to prevent cheating and fraudulent practices and (v) to provide a source of state and local revenues through taxation and licensing fees. Changes in such laws, regulations and procedures could have an adverse effect on any or all of the members of the Archon Group. Management believes the Archon Group is in compliance with regulations promulgated by the Nevada Gaming Authorities.

Licensing and Registration. PHI holds Nevada State gaming licenses to operate the Pioneer. The Company has been approved by the Nevada Gaming Authorities to own, directly or indirectly, a beneficial interest in PHI.

The licenses held by members of the Archon Group are not transferable. Each issuing agency may at any time revoke, suspend, condition, limit or restrict licenses or approvals to own a beneficial interest in PHI for any cause deemed reasonable by such agency. Any failure to retain a valid license or approval would have a material adverse effect on all members of the Archon Group.

If it is determined that PHI or, when applicable, new members of the Archon Group, have violated the Nevada laws or regulations relating to gaming, PHI or, when applicable, new members of the Archon Group, could, under certain circumstances, be fined and the licenses of PHI or, when applicable, new members of the Archon Group, could also be limited, conditioned, revoked or suspended. A violation under any of the licenses held by the Company, or PHI or, when applicable, new members of the Archon Group, may be deemed a violation of all the other licenses held by the Company and PHI or, when applicable, new members of the Archon Group. If the Commission does petition for a supervisor to manage the affected casino and hotel facilities, the suspended or former licensees shall not receive any earnings of the gaming establishment until approved by the court, and after deductions for the costs of the supervisor’s operation and expenses and amounts necessary to establish a reserve fund to facilitate continued operation in light of any pending litigation, disputed claims, taxes, fees and other contingencies known to the supervisor which may require payment. The supervisor is authorized to offer the gaming establishment for sale if requested by the suspended or former licensee, or without such a request after six months after the date the license was suspended, revoked or not renewed.

Individual Licensing. Certain stockholders, directors, officers and key employees of corporate gaming licensees must be licensed by the Nevada Gaming Authorities. An application for licensing of an individual may be denied for any cause deemed reasonable by the issuing agency. Changes in licensed positions must be reported to the Nevada Gaming Authorities. In addition to its authority to deny an application for an individual license, the Nevada Gaming Authorities have jurisdiction to disapprove a change in corporate position. If the Nevada Gaming Authorities were to find any such person unsuitable for licensing or unsuitable to continue to have a relationship with a corporate licensee, such licensee would have to suspend, dismiss and sever all relationships with such person. Such corporate licensee would have similar obligations with regard to any person who refuses to file appropriate applications, who is denied licensing following the filing of an application or whose license is revoked. Each gaming employee must obtain a work permit which may be revoked upon the occurrence of certain specified events.

4

Table of Contents

Any individual who is found to have a material relationship or a material involvement with a gaming licensee may be investigated to be found suitable or to be licensed. The finding of suitability is comparable to licensing and requires submission of detailed financial information and a full investigation. Key employees, controlling persons or others who exercise significant influence upon the management or affairs of a gaming licensee may be deemed to have such a relationship or involvement.

Beneficial owners of more than 10% of the voting securities of a corporation or partner interests of a partnership registered with the Nevada Gaming Authorities that is “publicly traded” (a “Registered Entity”) must be found suitable by the Nevada Gaming Authorities, and any person who acquires more than 5% of the voting securities or partner interests, as the case may be, of a Registered Entity must report the acquisition to the Nevada Gaming Authorities in a filing similar to the beneficial ownership filings required by the Federal securities laws. Under certain circumstances an institutional investor, as such term is defined in the Nevada Gaming Control Act and the regulations of the Commission and Board (collectively, the “Nevada Gaming Regulations”), that acquires more than 10% of the Company’s voting securities may apply to the Commission for a waiver of such finding of suitability requirement. If the stockholder who must be found suitable is a corporation, partnership or trust, it must submit detailed business and financial information including a list of beneficial owners. Any beneficial owner of equity or debt securities of a Registered Entity (whether or not a controlling stockholder) may be required to be found suitable if the relevant Nevada Gaming Authorities have reason to believe that such ownership would be inconsistent with the declared policy of the State of Nevada. If the beneficial owner who must be found suitable is a corporation, partnership or trust, it must submit detailed business and financial information, including a list of its securities.

Any stockholder found unsuitable and who beneficially owns, directly or indirectly, any securities or partner interests of a Registered Entity beyond such period of time as may be prescribed by the Nevada Gaming Authorities may be guilty of a gross misdemeanor. Any person who fails or refuses to apply for a finding of suitability or a license within 30 days after being ordered to do so may be found unsuitable. A Registered Entity is subject to disciplinary action if, after it receives notice that a person is unsuitable to be a security holder or partner, as the case may be, or to have any other relationship with it, such Registered Entity (i) pays the unsuitable person any dividends or property upon any voting securities or partner interests or makes any payments or distributions of any kind whatsoever to such person; (ii) recognizes the exercise, directly or indirectly, of any voting rights in its securities or partner interests by the unsuitable person; (iii) pays the unsuitable person any remuneration in any form for services rendered or otherwise, except in certain and specific circumstances or; (iv) fails to pursue all lawful efforts to require the unsuitable person to divest himself of his voting securities, including, if necessary, the immediate purchase of the voting securities for cash at fair market value.

Registered Entities must maintain current stock ledgers in the State of Nevada that may be examined by the Nevada Gaming Authorities at any time. If any securities or partner interests are held in trust by an agent or by a nominee, the record holder may be required to disclose the identity of the beneficial owner to the Nevada Gaming Authorities. A failure to make such disclosure may be grounds for finding the record owner unsuitable. Record owners are required to conform to all applicable rules and regulations of the Nevada Gaming Authorities. Licensees also are required to render maximum assistance in determining the identity of a beneficial owner.

The Nevada Gaming Authorities have the power to require that certificates representing voting securities of a corporate licensee bear a legend to the effect that such voting securities or partner interests are subject to the Nevada Gaming Regulations. The Nevada Gaming Authorities, through the power to regulate licensees, have the power to impose additional restrictions on the holders of such voting securities at any time.

5

Table of Contents

Financial Responsibility. The Company and PHI are required to submit detailed financial and operating reports to the Nevada Gaming Authorities. Substantially all loans, leases, sales of securities and other financial transactions entered into by the Company or PHI must be reported to and, in some cases, approved by the Nevada Gaming Authorities.

Certain Transactions. None of the Archon Group may make a public offering of its securities without the approval of the Commission if the proceeds therefrom are intended to be used to construct, acquire or finance gaming facilities in Nevada, or retire or extend obligations incurred for such purposes. Such approval, if given, will not constitute a recommendation or approval of the investment merits of the securities offered. Any public offering requires the approval of the Commission.

Changes in control of the Company through merger, consolidation, acquisition of assets, management or consulting agreements or any form of takeover cannot occur without the prior investigation of the Board and approval of the Commission. The Commission may require controlling stockholders, partners, officers, directors and other persons who have a material relationship or involvement in the transaction to be licensed.

The Nevada legislature has declared that some corporate acquisitions opposed by management, repurchases of voting securities and other corporate defense tactics that affect corporate gaming licensees in Nevada, and corporations whose securities are publicly traded that are affiliated with those operations, may be injurious to stable and productive corporate gaming. The Commission has established a regulatory scheme to ameliorate the potentially adverse effects of these business practices upon Nevada’s gaming industry and to further Nevada’s policy to (i) assure the financial stability of corporate or partnership gaming operators and their affiliates; (ii) preserve the beneficial aspects of conducting business in the corporate form; and (iii) promote a neutral environment for the orderly governance of corporate or partnership affairs. Approvals are, in certain circumstances, required from the Commission before the Company can make exceptional repurchases of voting securities above the current market price thereof (commonly referred to as “greenmail”) and before an acquisition opposed by management can be consummated. Nevada’s gaming regulations also require prior approval by the Commission if the Company were to adopt a plan of recapitalization proposed by the Company’s Board of Directors in opposition to a tender offer made directly to the stockholders for the purpose of acquiring control of the Company.

Miscellaneous. The Company and its Nevada-based affiliates, including subsidiaries, may engage in gaming activities outside the State of Nevada without seeking the approval of the Nevada Gaming Authorities provided that such activities are lawful in the jurisdiction where they are to be conducted and that certain information regarding the foreign operation is provided to the Board on a periodic basis. The Company and its Nevada-based affiliates may be disciplined by the Commission if any of them violates any laws of the foreign jurisdiction pertaining to the foreign gaming operation, fails to conduct the foreign gaming operation in accordance with the standards of honesty and integrity required of Nevada gaming operations, engages in activities that are harmful to the State of Nevada or its ability to collect gaming taxes and fees, or employs a person in the foreign operation who had been denied a license or finding of suitability in Nevada on the ground of personal unsuitability.

License fees and taxes, computed in various ways depending on the type of gaming involved, are payable to the State of Nevada and to the counties and cities in which the Company and PHI conduct their respective operations. Depending upon the particular fee or tax involved, these fees and taxes are payable either monthly, quarterly or annually and are based upon: (i) a percentage of the gross gaming revenues received by the casino operation; (ii) the number of slot machines operated by the casino; or (iii) the number of table games operated by the casino. A casino entertainment tax is also paid by the licensee where entertainment is furnished in connection with the selling of food or refreshments.

Finally, the Nevada Gaming Authorities may require that lenders to licensees be investigated to determine if they are suitable and, if found unsuitable, may require that they dispose of their loans.

6

Table of Contents

| Item 1A. | RISK FACTORS |

The following are currently known and material risks. Other material risks may develop in the future; provided, however, as they remain unidentified they cannot be disclosed. You are encouraged to review the following discussion of specific known material risks and uncertainties that could affect our business. These include, but are not limited to, the following:

Our Business is Vulnerable to Changing Economic Conditions. Unfavorable changes in general economic conditions including recession, economic slowdown, or higher fuel or other transportation costs, may reduce disposable income of casino patrons or result in fewer patrons visiting casinos. Our operating results may be negatively impacted by an increase in interest rates causing an increase in interest expense.

Our Laughlin Property is Vulnerable to Existing Competitors and Their Capital Investments. Competitors of casino/hotel properties in Laughlin could produce unfavorable operating results if the investments by competitors are successful in capturing market share from the Company’s Laughlin property. These new competitors may have greater capital resources and liquidity than the Company.

Redemption of the Company’s Preferred Stock and Redemption Price Disputes. The Company called all outstanding shares of its Exchangeable Redeemable Preferred Stock for redemption on and as of August 31, 2007, at a redemption price of $5.241 per share, which sum included accrued and unpaid dividends to the date of redemption. From and after August 31, 2007, all shares of the Exchangeable Redeemable Preferred Stock ceased to be outstanding and to accrue dividends. As of December 20, 2010, the holders of 4,264,312 shares of the Exchangeable Redeemable Preferred Stock have surrendered their shares and received payment of the redemption price; while 152,265 shares have yet to be surrendered and still have the right to receive their payment due without interest. As of September 30, 2010 and 2009, exchangeable redeemable preferred stock – unredeemed was $813,665 and $821,259, respectively.

On August 27, 2007, a group of institutional investors filed an action, in Nevada, against the Company. The Complaint was subsequently amended to add an additional party plaintiff (collectively, the “Plaintiffs”). The Amended Complaint: (i) seeks a finding by the Court that the Company has breached its obligations under the Company’s Certificate of Designation of the Preferred Stock, dated September 30, 1993 (the “Certificate”), and awarding the Plaintiffs full compensation of any and all available damages suffered by the Plaintiffs as a result of the Company’s breach of the Certificate; (ii) seeks a finding by the Court that the Company’s issuance of its redemption notice with an improper redemption price is an anticipatory breach of a material term of the Certificate and awarding the Plaintiffs full compensation of any and all available damages suffered as a result of the Company’s anticipatory breach of the Certificate; (iii) seeks a declaration by the Court that the dividends be properly calculated and compounded per the terms of the Certificate in an amount not less than $7,235,351 up through and including the date of final judgment; (iv) seeks an order from the Court calling for the Company to reimburse the Plaintiffs’ attorneys’ fees, expenses and costs incurred in enforcing their rights; and (v) seeks such other and further relief as the Court may deem appropriate.

The Plaintiffs, thereafter, filed a motion for partial summary judgment, seeking a ruling from the court that the Company breached its obligations under the Certificate by calculating the redemption price as it did. The Court granted that motion on August 8, 2008, finding the language of the Certificate to be unambiguous and that the redemption price should have been calculated differently. The Court has not yet issued a monetary judgment against the Company. Subsequent to the Court’s ruling on the motion for partial summary judgment, Plaintiffs filed a motion for entry of final judgment, seeking entry of judgment that the redemption price for the preferred shares should have been $8.69 per share. At the same time,

7

Table of Contents

the Company filed a request for certification asking the Court to certify its partial summary judgment order for immediate interlocutory appeal. The Court granted the request for certification and denied the request for entry of final judgment without prejudice. The Company filed a Petition for Permission to Appeal with the Ninth Circuit Court of Appeals and the Ninth Circuit declined to accept the matter for interlocutory review.

Recently, Plaintiffs have filed a second motion for entry of final judgment, again seeking entry of judgment that the redemption price for the preferred shares should have been $8.69 per share. The Company has substantively opposed that motion and has urged the Court to reconsider its August 8, 2008 order. Briefing on Plaintiffs’ second motion for entry of final judgment has been completed and a hearing was held before the Court and the parties are awaiting a ruling.

The Company has initiated proceedings against a third-party law firm concerning that firm’s potential liability related to the drafting of the Certificate of Designation. This third-party action has subsequently been removed by the defendant law firm to Federal Court in April, 2009 and is at an early stage of resolution. The defendant law firm has moved to compel arbitration of the dispute. The Magistrate Judge issued an order that the matter be referred to arbitration and the District Court confirmed that order. The Company intends to pursue its claims against the defendant law firm in arbitration. The Company is also considering rights and remedies it may have with regard to other parties who participated in the issuance of the Preferred Stock in the event that the Company does not prevail on its interpretation of the Certificate.

Also, two other holders of the Exchangeable Redeemable Preferred Stock filed Complaints, both alleging essentially the same claim as the first complaint related to the case set forth immediately above. The two other lawsuits brought by former holders of the Exchangeable Redeemable Preferred Stock are entitled Rainero v. Archon Corporation, District of Nevada, Case No. 2:07-cv-01553, and Leeward Capital, L.P. v. Archon Corporation, District of Nevada Case No. 2:08-cv-00007. If the plaintiffs in these two additional actions are correct, the redemption price as of August 31, 2007 should have been $8.69 per share and not $5.241 per share as calculated by the Company. If applied to all the then outstanding shares of Exchangeable Redeemable Preferred Stock, including the shares held by the Company’s officers and directors, valuation of the redemption price at $8.69 per share would increase the redemption price in excess of $15.2 million.

In the Leeward Capital matter, both the Leeward Plaintiffs and the Company have filed motions for summary judgment. The Leeward Plaintiffs have made arguments similar to the Laminar Plaintiffs in their motion. In its motion for summary judgment, the Company argues that the request for a redemption price of $8.69 per share is contrary to the express language of the Certificate and that the Leeward Plaintiffs purchased their shares with actual knowledge of how the Company was calculating the redemption price. No hearing has been held on the motions and the Company is awaiting the decision from the District Court.

The Rainero action is purported to be brought on behalf of David Rainero individually as well as a class of all former preferred shareholders, although a class has not yet been certified by the District Court. The District Court has set a deadline of December 6, 2010 by which Mr. Rainero must file any motion for class certification. Mr. Rainero is scheduled to be deposed in early January of 2011. The Company intends to oppose any motion for class certification that may be filed.

Management is unable to estimate the minimum liability that may be incurred, if any, as a result of the outcome of each of these lawsuits and, therefore, has made no provision in the financial statements for liability related to these cases.

8

Table of Contents

A Significant Decline in Real Estate Values may have an Adverse Impact on the Company’s Financial Condition. The Company owns real estate on the Strip and on the East Coast of the United States. Although the Company is presently not dependent on cash flows from these properties, a significant decline in real estate values in these markets could have an impact on the Company’s ability to readily generate cash flow from the real estate.

Our Outstanding Debt Obligations Subject us to Additional Risks. The Company’s wholly owned subsidiary, SLVC, secured and maintains a $15.0 million line of credit loan granted by a Nevada bank. The loan and promissory note are secured by deed of trust on SLVC’s approximate 27 acre parcel of land on Las Vegas Boulevard South (the “Strip Property”). The line of credit loan is revolving and is subject to additional lending requirements. The line of credit loan in the amount of $5.0 million at the end of the fiscal year is reported as a current liability, and any outstanding balance under the line of credit will become due in February 2011. The initial advance under the line of credit loan was used to pay in full the previous line of credit loan secured by the Strip Property. The SLVC line of credit loan is guaranteed by SLVC and the Company, as well as, personally guaranteed by Paul W. Lowden, President of SLVC, and by Suzanne Lowden, Secretary/Treasurer of SLVC.

| Item 2. | PROPERTIES |

The Pioneer is located on approximately 12 acres of land, with Colorado River frontage of approximately 770 feet, and is situated near the center of Laughlin’s Casino Drive. See Item 1., “Business – Hotel and Casino Operations” for more detailed information regarding the Pioneer.

The Company’s rental property in the Dorchester section of Boston, Massachusetts is located on 12 acres and includes several buildings with approximately 425,000 square feet of commercial office space. The property was acquired for approximately $82.4 million plus $0.5 million in debt issuance costs. The Company paid $5.6 million in cash and assumed $77.3 million in nonrecourse debt associated with the property. The property is under a net lease through 2020 with a single tenant with an investment grade credit rating. Under the lease, the tenant is responsible for substantially all obligations related to the property.

The Company’s property under contract for sale in Gaithersburg, Maryland is located on 51 acres and includes one building with approximately 342,000 square feet of commercial office space. The property was acquired for $62.6 million, plus debt issuance costs of $2.7 million. The Company paid $9.9 million in cash and issued $55.4 million in nonrecourse first mortgage indebtedness. The property is under a net lease through 2014 with a single tenant with an investment grade credit rating. Under the lease, the tenant is responsible for substantially all obligations related to the property. The Gaithersburg, Maryland, property is under contract to be sold. See Notes to Consolidated Financial Statements, Note 5, Purchase and Sale Agreement of Gaithersburg Property

The Company owns, through its wholly owned subsidiary, SLVC, an approximately 27-acre parcel of land (the “Property”) located on the east side of Las Vegas Boulevard South, just south of Sahara Avenue. The Company presently leases the Property to two different lessees for an aggregate amount of $9,500 per month. The leases may be terminated in the event the property is sold or developed by the Company.

9

Table of Contents

| Item 3. | LEGAL PROCEEDINGS |

Mercury Real Estate Securities Fund, LP and Mercury Real Estate Securities Offshore Limited v. Archon Corporation

The Company called all outstanding shares of its Exchangeable Redeemable Preferred Stock for redemption on and as of August 31, 2007, at a redemption price of $5.241 per share, which sum included accrued and unpaid dividends to the date of redemption. From and after August 31, 2007, all shares of the Exchangeable Redeemable Preferred Stock ceased to be outstanding and to accrue dividends. As of December 20, 2010, the holders of 4,264,312 shares of the Exchangeable Redeemable Preferred Stock have surrendered their shares and received payment of the redemption price; while 152,265 shares have yet to be surrendered and still have the right to receive their payment due without interest. As of September 30, 2010 and 2009, exchangeable redeemable preferred stock – unredeemed was $813,665 and $821,259, respectively.

On August 27, 2007, a group of institutional investors filed an action, in Nevada, against the Company. The Complaint was subsequently amended to add an additional party plaintiff (collectively, the “Plaintiffs”). The Amended Complaint: (i) seeks a finding by the Court that the Company has breached its obligations under the Company’s Certificate of Designation of the Preferred Stock, dated September 30, 1993 (the “Certificate”), and awarding the Plaintiffs full compensation of any and all available damages suffered by the Plaintiffs as a result of the Company’s breach of the Certificate; (ii) seeks a finding by the Court that the Company’s issuance of its redemption notice with an improper redemption price is an anticipatory breach of a material term of the Certificate and awarding the Plaintiffs full compensation of any and all available damages suffered as a result of the Company’s anticipatory breach of the Certificate; (iii) seeks a declaration by the Court that the dividends be properly calculated and compounded per the terms of the Certificate in an amount not less than $7,235,351 up through and including the date of final judgment; (iv) seeks an order from the Court calling for the Company to reimburse the Plaintiffs’ attorneys’ fees, expenses and costs incurred in enforcing their rights; and (v) seeks such other and further relief as the Court may deem appropriate.

The Plaintiffs, thereafter, filed a motion for partial summary judgment, seeking a ruling from the court that the Company breached its obligations under the Certificate by calculating the redemption price as it did. The Court granted that motion on August 8, 2008, finding the language of the Certificate to be unambiguous and that the redemption price should have been calculated differently. The Court has not yet issued a monetary judgment against the Company. Subsequent to the Court’s ruling on the motion for partial summary judgment, Plaintiffs filed a motion for entry of final judgment, seeking entry of judgment that the redemption price for the preferred shares should have been $8.69 per share. At the same time, the Company filed a request for certification asking the Court to certify its partial summary judgment order for immediate interlocutory appeal. The Court granted the request for certification and denied the request for entry of final judgment without prejudice. The Company filed a Petition for Permission to Appeal with the Ninth Circuit Court of Appeals and the Ninth Circuit declined to accept the matter for interlocutory review.

Recently, Plaintiffs have filed a second motion for entry of final judgment, again seeking entry of judgment that the redemption price for the preferred shares should have been $8.69 per share. The Company has substantively opposed that motion and has urged the Court to reconsider its August 8, 2008 order. Briefing on Plaintiffs’ second motion for entry of final judgment has been completed and a hearing was held before the Court and the parties are awaiting a ruling.

The Company has initiated proceedings against a third-party law firm concerning that firm’s potential liability related to the drafting of the Certificate of Designation. This third-party action has subsequently been removed by the defendant law firm to Federal Court in April, 2009 and is at an early stage of resolution. The defendant law firm has moved to compel arbitration of the dispute. The Magistrate Judge issued an order that the matter be referred to arbitration and the District Court confirmed that order. The

10

Table of Contents

Company intends to pursue its claims against the defendant law firm in arbitration. The Company is also considering rights and remedies it may have with regard to other parties who participated in the issuance of the Preferred Stock in the event that the Company does not prevail on its interpretation of the Certificate.

Also, two other holders of the Exchangeable Redeemable Preferred Stock filed Complaints, both alleging essentially the same claim as the first complaint related to the case set forth immediately above. The two other lawsuits brought by former holders of the Exchangeable Redeemable Preferred Stock are entitled Rainero v. Archon Corporation, District of Nevada, Case No. 2:07-cv-01553, and Leeward Capital, L.P. v. Archon Corporation, District of Nevada Case No. 2:08-cv-00007. If the plaintiffs in these two additional actions are correct, the redemption price as of August 31, 2007 should have been $8.69 per share and not $5.241 per share as calculated by the Company. If applied to all the then outstanding shares of Exchangeable Redeemable Preferred Stock, including the shares held by the Company’s officers and directors, valuation of the redemption price at $8.69 per share would increase the redemption price in excess of $15.2 million.

In the Leeward Capital matter, both the Leeward Plaintiffs and the Company have filed motions for summary judgment. The Leeward Plaintiffs have made arguments similar to the Laminar Plaintiffs in their motion. In its motion for summary judgment, the Company argues that the request for a redemption price of $8.69 per share is contrary to the express language of the Certificate and that the Leeward Plaintiffs purchased their shares with actual knowledge of how the Company was calculating the redemption price. No hearing has been held on the motions and the Company is awaiting the decision from the District Court.

The Rainero action is purported to be brought on behalf of David Rainero individually as well as a class of all former preferred shareholders, although a class has not yet been certified by the District Court. The District Court has set a deadline of December 6, 2010 by which Mr. Rainero must file any motion for class certification. Mr. Rainero is scheduled to be deposed in early January of 2011. The Company intends to oppose any motion for class certification that may be filed.

Management is unable to estimate the minimum liability that may be incurred, if any, as a result of the outcome of each of these lawsuits and, therefore, has made no provision in the financial statements for liability related to these cases.

| Item 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

None

11

Table of Contents

PART II

| Item 5. | MARKET FOR THE REGISTRANT’S COMMON STOCK AND RELATED SECURITY HOLDERS MATTERS |

The Company’s common stock is traded on the Over the Counter Bulletin Board (the “OTCBB”) under the symbol “ARHN”.

The closing price of the Common Stock on December 20, 2010 was $11.75 per share. The tables below set forth the high and low closing prices by quarter for the fiscal years ended September 30, 2010 and 2009 of the common stock, as reported by the OTCBB.

| First Quarter |

Second Quarter |

Third Quarter |

Fourth Quarter |

|||||||||||||

| Fiscal 2010 |

||||||||||||||||

| High |

$ | 14.25 | $ | 19.00 | $ | 17.50 | $ | 16.00 | ||||||||

| Low |

11.50 | 13.00 | 13.50 | 13.70 | ||||||||||||

| Fiscal 2009 |

||||||||||||||||

| High |

$ | 32.00 | $ | 23.00 | $ | 14.25 | $ | 14.25 | ||||||||

| Low |

12.00 | 14.25 | 12.50 | 13.00 | ||||||||||||

The Company has never paid cash dividends on its Common Stock, nor does it anticipate paying such dividends in the foreseeable future. There were 362 common stockholders of record as of December 20, 2010.

12

Table of Contents

Performance Graph

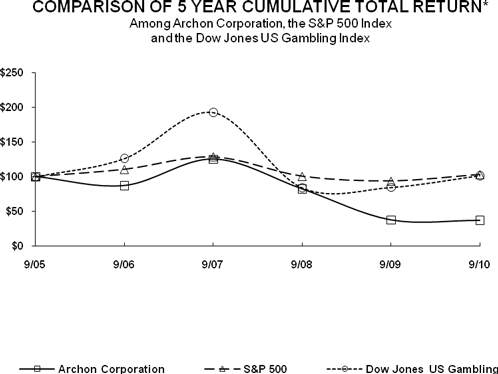

The following graph compares the cumulative total return on the Company’s common stock with the cumulative total return of the Standard & Poor’s 500 and the Dow Jones US Gambling index for the five-year period ended September 30, 2010. The graph assumes that the value of the investment in the Company and in each index was $100 on September 30, 2005 and assumes that all dividends were reinvested.

| 9/30/05 | 9/30/06 | 9/30/07 | 9/30/08 | 9/30/09 | 9/30/10 | |||||||||||||||||||

| Archon Corporation |

$ | 100.00 | $ | 87.13 | $ | 125.13 | $ | 82.23 | $ | 37.74 | $ | 37.08 | ||||||||||||

| S&P 500 |

100.00 | 110.79 | 129.01 | 100.66 | 93.70 | 103.22 | ||||||||||||||||||

| Dow Jones US Gambling |

100.00 | 126.22 | 192.56 | 84.00 | 84.62 | 101.54 | ||||||||||||||||||

13

Table of Contents

| Item 6. | SELECTED FINANCIAL DATA |

The table below sets forth a summary of selected financial data of the Company and its subsidiaries for the years ended September 30, 2010 through 2008:

| 2010 | 2009 | 2008 | ||||||||||

| Not covered by auditors’ report (dollars in thousands, except per share amounts) |

||||||||||||

| Net operating revenues, continuing operations(1) |

$ | 23,466 | $ | 31,973 | $ | 37,784 | ||||||

| Discontinued operations, net |

2,355 | 961 | 890 | |||||||||

| Net income (loss) |

1,231 | (1,535 | ) | 58,802 | ||||||||

| Net income (loss) applicable to common shares |

1,231 | (1,535 | ) | 58,802 | ||||||||

| Net income (loss) per common share - basic |

0.19 | (0.24 | ) | 9.27 | ||||||||

| Total assets |

184,017 | 196,984 | 210,307 | |||||||||

| Long-term debt |

31,199 | 31,199 | 31,199 | |||||||||

| Long-term debt on assets held for sale |

33,541 | 37,115 | 40,301 | |||||||||

| Exchangeable redeemable preferred stock(2) |

814 | 821 | 834 | |||||||||

| (1) | Net operating revenues for fiscal years 2008 through 2010 are derived primarily from operations at the Pioneer and revenues from the rental properties. |

| (2) | The Company’s Board of Directors had not declared dividends on its preferred stock since fiscal 1996. The Company redeemed its outstanding exchangeable redeemable preferred stock at $5.241 per share. As of December 20, 2010, the Company had repurchased and retired 4,264,312 shares of exchangeable redeemable preferred stock. The legal proceeding set forth in Item 3 relates to the exchangeable redeemable preferred stock. |

14

Table of Contents

| Item 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

This discussion is intended to further the reader’s understanding of the consolidated financial condition and results of operations of Archon Corporation (the “Company” or “Archon”).

GENERAL

Overview of Business Operations and Trends

Historically, the Company, has owned, managed and operated hotel/casino properties through a number of acquisitions or developments, and it has divested itself of certain of these properties. Presently, the Company operates the Pioneer in Laughlin, Nevada.

The Pioneer has experienced a decline of its revenues over the last few years after experiencing strong revenue and profit growth in the early 1990’s. Management believes the increase in the number of casino properties on Native American lands in such nearby locations as California and Arizona within the last decade has caused revenue declines. In response, the Company has focused on market definition and development in the local Laughlin area to maintain profitability. Unexpectedly difficult economic conditions impacting customers, including relatively high fuel costs, has significantly reduced disposable income, and limited customer travel and gaming activity. Management believes Laughlin is a mature market with marginal growth forecasted for the next few years based on its current development plans. Management believes the recent revenue and expense trends in its Laughlin hotel/casino property may not change significantly over the next few years, or until the current economic conditions and trends begin to materially improve.

The Company also owns rental properties on the East Coast and on the Las Vegas Strip, but revenues from these rental properties are used to meet their related mortgages and thus do not contribute significant net cash flow to the Company.

Assets Held for Sale

During fiscal year 2001, the Company acquired certain properties as part of an IRS Section 1031 exchange. The property held for sale is located in Gaithersburg, Maryland (the “Gaithersburg Property”). The Company acquired the Gaithersburg Property and nonrecourse debt associated with the Gaithersburg Property which is subject to a long-term lease. A tenant remits payment to the bank according to the terms of the lease and note. The payments are used to liquidate the nonrecourse debt obligations. Rental income is recorded by the Company on a straight-line basis and totals approximately $5.6 million annually and will remain at this level until approximately 2014 or until the asset is sold, otherwise disposed of or becomes impaired. The buildings on the Gaithersburg Property are no longer being depreciated subsequent to the classification being changed from a rental property held for investment to assets held for sale. Interest expense is also recorded based on the outstanding nonrecourse debt remaining to be paid and based on unamortized loan issue costs and remaining debt amortization timetables. At any time during the term of the lease and debt amortization, the fair market value of the Gaithersburg Property may be different from its book values. Interest is presently being expensed at approximately $2.8 million annually and will decrease in relation to debt principal reductions through 2014 or until the asset is sold, otherwise disposed of or becomes impaired.

15

Table of Contents

On May 28, 2009, the Company, through its wholly owned subsidiary SFHI, LLC (“SFHI”), entered into a Purchase and Sale Agreement (the “Agreement”) with Montgomery County, Maryland (the “County”) whereby the County will purchase SFHI’s 51.57 acre parcel of land together with an approximately 341,693 square feet office building erected thereon comprising the Gaithersburg Property, located at 100 Edison Park Drive in Gaithersburg, Maryland. The purchase price for the Gaithersburg Property will be seventy-six million three hundred forty thousand dollars ($76,340,000). The Agreement provided the County with a 90-day feasibility period during which the County determined that the Gaithersburg Property is suitable for its intended use, and the County will now proceed to close escrow by notifying the Company of the closing date, which date may be no sooner than 90 days from the date of notice and no later than April 30, 2014.

Simultaneous with the execution of the Purchase and Sale Agreement, the County entered into a sublease with the existing tenant of SFHI at this location, GXS, Inc., whereby the County, as of October 1, 2009, leased and occupied the entire Gaithersburg Property until the earlier of (i) completion of its purchase of the Gaithersburg Property or (ii) April 30, 2014. Pursuant to the applicable provisions of the existing lease with GXS, Inc., SFHI consented to the sublease. In addition, GXS, Inc. agreed to pay SFHI the sum of $2,125,000, $1,725,000 of which was paid on October 1, 2009, with the balance of $400,000 paid on July 1, 2010. Due to the pending sale of the Gaithersburg Property, the related results of operations have been reported as discontinued operations. See Notes to Consolidated Financial Statements, Note 5, Purchase and Sale Agreement of Gaithersburg Property

Rental Properties

During fiscal year 2001, the Company acquired certain rental property as part of an IRS Section 1031 exchange. The rental property is located in the Dorchester section of Boston, Massachusetts (the “Dorchester Property”). The Company acquired the Dorchester Property with improvements and nonrecourse debt associated with the Dorchester Property which is subject to a long-term lease. A tenant remits payments to a bank according to the terms of the lease and note. The payments are used to liquidate the nonrecourse debt obligations. Rental income is recorded by the Company on a straight-line basis and totals approximately $6.7 million annually and will remain at this level until approximately 2020 or until the asset is sold, otherwise disposed of or becomes impaired. The buildings on the Dorchester Property are also being depreciated on a straight-line basis and the depreciation expense is approximately $1.7 million annually and will remain at this level until approximately 2041 or until the asset is sold, otherwise disposed of or becomes impaired. Interest expense is also recorded based on the outstanding nonrecourse debt remaining to be paid based on unamortized loan issue costs and remaining debt amortization timetables. At any time during the term of the lease and debt amortization, the fair market values of the Dorchester Property may be different from its book value. Interest is presently being expensed at approximately $4.5 million annually and will decrease in relation to debt principal reductions through 2020 or until the asset is sold, otherwise disposed of or becomes impaired.

The Company owns, through its wholly owned subsidiary, Sahara Las Vegas Corp. (“SLVC”), an approximately 27-acre parcel of land (the “Strip Property”) located on the east side of Las Vegas Boulevard South, to the south of Sahara Avenue. The Company presently leases the Property to two different lessees for an aggregate amount of $9,500 per month. The leases may be terminated in the event the property is sold or developed by the Company.

Critical Accounting Policies and Estimates

The preparation of these consolidated financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. On an ongoing basis, management evaluates its estimates and judgments, including those related to customer incentives, bad debts, inventories, investments, estimated

16

Table of Contents

useful lives for depreciable and amortizable assets, valuation reserves and estimated cash flows in assessing the recoverability of long-lived assets, estimated liabilities for slot club bonus point programs, income taxes, contingencies and litigation. Management bases its estimates and judgments on historical experience and on various other factors that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

Management believes the following critical accounting policies, among others, affects its more significant judgments and estimates used in the preparation of its consolidated financial statements:

Allowance for Doubtful Accounts: The Company allows for an estimated amount of receivables that may not be collected. The Company estimates its allowance for doubtful accounts using a specific formula applied to aged receivables as well as a specific review of large balances. Historical experience is considered, as are customer relationships, in determining specific reserves.

Property and Equipment: At September 30, 2010, the Company had net property and equipment of $97.2 million, representing 52.8% of total assets. Management depreciates property and equipment on a straight-line basis over their estimated useful lives. The estimated useful lives are based on the nature of the assets as well as current operating strategy and legal considerations such as contractual life. Future events, such as property improvements, technological obsolescence, new competition, or new regulations, could result in a change in the manner in which the Company uses certain assets requiring a change in the estimated useful lives of such assets.

For assets to be held and used, fixed assets are reviewed for impairment whenever indicators of impairment exist. If an indicator of impairment exists, we first group our assets with other assets and liabilities at the lowest level for which identifiable cash flows are largely independent of the cash flows of other assets and liabilities (the “asset group”). Secondly, we estimate the undiscounted future cash flows that are directly associated with and expected to arise from the use of and eventual disposition of such asset group. We estimate the undiscounted cash flows over the remaining useful life of the primary asset within the asset group. If the undiscounted cash flows exceed the carrying value, no impairment is indicated. If the undiscounted cash flows do not exceed the carrying value, then an impairment is measured based on fair value compared to carrying value, with fair value typically based on a discounted cash flow model. If an asset is still under development, future cash flows include remaining construction costs.

For assets to be held for sale, the fixed assets (the “property held for sale”) are measured at the lower of their carrying amount or fair value less cost to sell. Losses are recognized for any initial or subsequent write-down to fair value less cost to sell, while gains are recognized for any subsequent increase in fair value less cost to sell, but not in excess of the cumulative loss previously recognized. Any gains or losses not previously recognized that result from the sale of the disposal group shall be recognized at the date of sale. Fixed assets are not depreciated while classified as held for sale.

Income Taxes: The Company has recorded deferred tax assets related to net operating losses as the Company is able to offset these assets with deferred tax liabilities. Realization of the net deferred tax assets is dependent on the Company’s ability to generate profits from operations or from the sale of long-lived assets that would reverse the temporary differences which established the deferred tax liabilities. There can be no assurance that the Company will generate profits from operations or sell those assets or will generate profits from sales if they were to occur in the future. In the event the Company does generate profits from sales of long-lived assets in the future a valuation allowance may need to be recorded, which would impact the Company’s future results of operations. Annualized effective income tax rates for calculating interim period provisions and benefits have been estimated to be not significantly different from the estimated annual effective rate and the statutory rate. Although Financial Accounting

17

Table of Contents

Standards Board, Accounting Standard Codification (FASB ASC) 740-10, Income Taxes, became effective for the year ending September 30, 2008, based on its evaluation, management determined that FASB ASC 740-10 did not have a material effect on the financial statements or the net operating loss carryovers or the related deferred tax assets or valuation allowance.

Revenue Recognition: Casino revenue is recorded as gaming wins minus losses. Hotel, food and beverage, entertainment and other operating revenues are recognized as the services are performed. Casino revenues are recognized net of certain sales incentives in accordance with FASB ASC 605-50 Revenue Recognition, Customer Payments and Incentives. Accordingly, cash incentives to customers for gambling, and the cash value of points and coupons earned by the slot club members totaling $0.4 million and $0.6 million for the years ended September 30, 2010 and 2009, respectively, have been recognized as a direct reduction of casino revenue.

Advance deposits on hotel rooms, if any, are recorded as deferred revenue until services are provided to the customer. Hotel, food and beverage revenues are recognized as the services are performed.

Rental revenue from rental properties is recognized as earned on a straight-line basis over the term of the lease. When rental payments received exceed rents earned and recognized, the difference is recorded as deferred rental income in the current liabilities section of the balance sheet, and conversely, when rents earned and recognized exceed rental payments received, the difference is recorded as other assets.

RESULTS OF OPERATIONS – FISCAL 2010 COMPARED TO FISCAL 2009

General

During fiscal 2010, the Company’s consolidated net operating revenues decreased approximately $8.5 million, and operating expenses decreased approximately $8.2 million, resulting in a decrease of $0.3 million in operating income. These results were achieved in part through aggressive cost cutting measures. These operating results were due to decreases in all of the operating expenses including a $3.5 million reduction in the loss incurred on the impairment of Pioneer assets.

Consolidated

Net Operating Revenues. Consolidated net operating revenues for the year ended September 30, 2010 decreased by approximately $8.5 million from the year ended September 30, 2009. Revenues from the rental properties decreased approximately $3.1 million during fiscal 2010 as compared to the 2009 fiscal year, due to lower rental revenue from the Strip Property in Las Vegas. Net revenues decreased approximately $5.0 million during fiscal 2010 at the Pioneer compared to the 2009 fiscal year, as a result of a marketwide declining trend of gaming revenues in Laughlin discussed in greater detail under Pioneer. Other net revenues decreased during fiscal 2010, by approximately $0.4 million as compared to the 2009 fiscal year.

In fiscal 2010, 65% of the Company’s net revenues were derived from the Pioneer and 32% from rental properties. The Company’s business strategy at the Pioneer emphasizes slot and video poker machine play. For fiscal 2010, approximately 80% of the Pioneer’s net revenues were derived from casino operations. Approximately 92% of gaming revenues at the Pioneer were derived from slot and video poker machines, while 8% of such revenues were from table games.

18

Table of Contents

Operating Expenses. Total operating expenses decreased approximately $8.2 million, or 26%, to $23.5 million for the year ended September 30, 2010, from $31.7 million for the year ended September 30, 2009. Total operating expenses as a percentage of net revenues increased to 100% for the year ended September 30, 2010 from 99% in the year ended September 30, 2009. All of the operating expenses decreased in the year ended September 30, 2010 from the prior year. The decrease in operating expenses was principally the result of declining business levels. Casino, hotel, food and beverage, and other operating expenses declined a total of $3.9 million; combined with $0.2 million in legal expense. Other reductions included $0.6 million in utilities and property expenses and a $3.5 million decrease in the loss on the impairment of Pioneer assets.

Interest Expense. Consolidated interest expense for the year ended September 30, 2010 was $4.4 million, a $0.9 million decrease compared to $5.3 million for the year ended September 30, 2009, due to a decrease in the amount of debt associated with the interest expense.

Interest and Other Income. Interest and other income for the year ended September 30, 2010 was $1.1 million, a decrease of $0.1 million from $1.2 million for the year ended September 30, 2009.

Gain (Loss) on Sale of Marketable Securities. The gain on marketable securities for the year ended September 30, 2010 was $0.1 million, an increase of $1.1 million from a loss of $1.0 million for the year ended September 30, 2009. The increase is due to realized gains from available-for-sale marketable securities.

Income Tax. The Company recorded a federal income tax benefit, combined with a tax expense associated with discontinued operations, totaling approximately $1.0 million (an approximate 51% rate) for the year ended September 30, 2010, a change of $0.9 million from a $1.9 million tax benefit (an approximate 55% rate) for the year ended September 30, 2009. The benefit consisted primarily of the NOL carryforward from prior years.

Discontinued Operations, Net of Tax. Discontinued operations associated with the assets held for sale during the year ended September 30, 2010 was $2.4 million, an increase of $1.4 million from $1.0 million for the year ended September 30, 2009.

Rental Properties

General. The rental properties segment includes operations at the Las Vegas Strip property in Nevada, and the Dorchester property in Massachusetts. The Gaithersburg property in Maryland is not included because it is under contract to sell and is reported separately under discontinued operations. The rental properties revenues and expenses comprise a substantial portion of the revenues and expenses included in the Company’s consolidated statements of operations and are discussed separately below.

Net Operating Revenues. Net revenues at the rental properties decreased $3.1 million, or approximately 29%, to $7.6 million for the fiscal year ended September 30, 2010 from $10.7 million for the fiscal year ended September 30, 2009, due to a reduction in the rent income related to a lease termination for the Las Vegas Strip property.

Operating Expenses. Operating expenses remained unchanged at $2.5 million, for the fiscal years ended September 30, 2010 and 2009. Operating expenses as a percentage of net revenues increased to 33% in fiscal 2010 from 23% in fiscal 2009.

Depreciation expense remained the same at $1.7 million, during the fiscal years ended September 30, 2010 and 2009. Depreciation expenses as a percentage of revenues increased to 22% for the fiscal year ended September 30, 2010, from 16% for the fiscal year ended September 30, 2009.

19

Table of Contents

Interest Expense. Interest expense for the fiscal year ended September 30, 2010 was $4.3 million, a $0.3 million decrease compared to $4.6 million for the fiscal year ended September 30, 2009, due to a decrease in the amount of debt associated with the interest expense.

Pioneer

General. The Pioneer has experienced a decline of its revenues over the last few years after experiencing strong revenue and profit growth in the early 1990’s. Management believes the increase in the number of casino properties on Native American lands in such nearby locations as California and Arizona within the last decade has caused revenue declines. In response, the Company has focused on market definition and development in the local Laughlin area to maintain profitability. Unexpectedly difficult economic conditions impacting customers, including relatively high fuel costs, has significantly reduced disposable income, and limited customer travel and gaming activity. Management believes Laughlin is a mature market with marginal growth forecasted for the next few years based on its current development plans. Management believes the recent revenue and expense trends in its Laughlin hotel/casino property may not change significantly over the next few years, or until the current economic conditions and trends begin to materially improve.

Casino, hotel and food/beverage revenues and expenses at the Pioneer comprise the majority of consolidated casino, hotel, and food/beverage revenues and expenses included in the Company’s consolidated statements of operations and are discussed separately below.

Net Operating Revenues. Net revenues at the Pioneer decreased $5.0 million, or approximately 25%, to $15.3 million for the year ended September 30, 2010 from $20.3 million for the year ended September 30, 2009.

Gross casino revenues decreased approximately $3.8 million, or 24%, to $12.2 million for the year ended September 30, 2010 from $16.0 million for the year ended September 30, 2009. Slot and video poker revenues decreased approximately $3.2 million, or 22%, to $11.2 million for the year ended September 30, 2010 from $14.4 million for the year ended September 30, 2009. Other gross gaming revenues, including table games, decreased approximately $0.6 million, or 38%, to $1.0 million for the year ended September 30, 2010 compared to approximately $1.6 million for the 2009 year. Management believes this decrease was a result of declining market trends in the local area. Casino promotional allowances decreased approximately $0.9 million, or 23%, to approximately $3.1 million in year ended September 30, 2010 compared to $4.0 million for year ended September 30, 2009 primarily due to the aforementioned decline in the local gaming market.

Hotel revenues decreased $0.2 million, or 12%, to $1.5 million for the year ended September 30, 2010 from $1.7 million in fiscal 2009 due to a decrease in the number of rooms occupied. Food and beverage revenues decreased $1.4 million, or 24%, to $4.4 million for the year ended September 30, 2010 from $5.8 million for the year ended September 30, 2009. Other revenues decreased $0.3 million, or 43%, to $0.4 million for the year ended September 30, 2010 from $0.7 million for the year ended September 30, 2009 due to decreased retail sales and increased allowance for bad debt.

Operating Expenses. Operating expenses decreased $8.8 million, or 33%, to $17.5 million for the year ended September 30, 2010 from $26.3 million for the year ended September 30, 2009, as a result of a decline of $3.5 million related to the impairment of assets, combined with a $5.3 million reduction in expenses associated with reduced customer activity since many such expenses vary with related revenues and for other reasons noted below. Operating expenses as a percentage of net revenues decreased to 114% in fiscal 2010 from 130% in fiscal 2009.

Casino expenses decreased $2.2 million, or 22%, to $7.6 million for the year ended September 30, 2010 from $9.8 million for the year ended September 30, 2009, primarily related to a decrease in casino promotional allowances, and lower gaming volumes. Casino expenses as a percentage of casino revenues increased to 62% for the year ended September 30, 2010 from 61% for the year ended September 30, 2009.

20

Table of Contents

Hotel expenses decreased $0.2 million, or 25%, to $0.6 million for the year ended September 30, 2010, compared to $0.8 million for the year ended September 30, 2009, primarily due to a reduction in the number of hotel rooms rented. Hotel expenses as a percentage of hotel revenues decreased to 40% for the 2010 year from 47% for the 2009 year. Food and beverage expenses decreased $1.2 million, or 31%, to $2.7 million for the year ended September 30, 2010, compared to $3.9 million for the year ended September 30, 2009. Food and beverage expenses as a percentage of revenues decreased to 61% for the 2010 year from 67% for the 2009 year. Other expenses decreased $0.3 million, or 50%, to $0.3 million for the year ended September 30, 2010 compared to $0.6 million for the year ended September 30, 2009 due to the decrease in retail revenues. Other expenses as a percentage of other revenues decreased to 75% for the 2010 year from 86% for the 2009 year.

Selling, general and administrative expenses decreased $1.0 million, or 26%, to $2.8 million for the year ended September 30, 2010 compared to $3.8 million for the year ended September 30, 2009. Selling, general and administrative expenses as a percentage of revenues decreased to 18% for the 2010 year from 19% for the 2009 year. The decrease in selling, general and administrative expenses was a result of lower business levels. Pioneer’s selling, general and administrative expenses are greater than the consolidated total due to the elimination of intercompany transactions in consolidation. Utilities and property expenses decreased $0.4 million, or 12%, to $2.9 million in fiscal year 2010 compared to $3.3 million for the year ended September 30, 2009. Utilities and property expenses as a percentage of revenues increased to 19% for the 2010 year from 16% for the 2009 year. Energy consumption decreased as a result of lower business levels and energy efficient lighting, but was offset by energy rate increases. Depreciation expenses decreased $0.3 million, or 38%, to $0.5 million in the year ended September 30, 2010, from $0.8 million in the year ended September 30, 2009.

Interest Expense. Interest expense decreased $0.8 million, or 89%, to $0.1 million for the year ended September 30, 2010 compared to $0.9 million for the year ended September 30, 2009.

LIQUIDITY AND CAPITAL RESOURCES; TRENDS AND FACTORS RELEVANT TO FUTURE OPERATIONS

The United States has been experiencing a recession that has resulted in highly curtailed economic activity including, among other things, reduced casino gaming and declining real estate values, both nationwide and particularly in the Southern Nevada local market. The effects and duration of these developments and related uncertainties on the Company’s future operations and cash flows cannot be estimated at this time but may likely be significant.

21

Table of Contents

Contractual Obligations and Commitments

The following table summarizes the Company’s fiscal year contractual obligations and commitments as of September 30, 2010 and for the fiscal years ending September 30, 2011, 2012, 2013, 2014, 2015, 2016 and thereafter:

| Payments Due By Period | ||||||||||||||||||||||||||||

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016

and Thereafter |

Total | ||||||||||||||||||||||

| (Amounts in Thousands) | ||||||||||||||||||||||||||||

| Continuing Operations | ||||||||||||||||||||||||||||

| Nonrecourse debt: |

||||||||||||||||||||||||||||

| Dorchester |

$ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 31,199 | $ | 31,199 | ||||||||||||||

| Long-term debt: |

||||||||||||||||||||||||||||

| Mortgage obligation |

7,813 | 0 | 0 | 0 | 0 | 0 | 7,813 | |||||||||||||||||||||

| Operating leases: |

||||||||||||||||||||||||||||

| Ground lease |

392 | 392 | 392 | 392 | 392 | 24,698 | 26,658 | |||||||||||||||||||||

| Corporate warehouse |

24 | 25 | 19 | 0 | 0 | 0 | 68 | |||||||||||||||||||||

| Total Continuing Operations |