Attached files

| file | filename |

|---|---|

| 8-K - HINES REIT THIRD QUARTER STOCKHOLDER PRESENTATION 8-K - HINES REAL ESTATE INVESTMENT TRUST INC | hr_q3stockholderpresentation.htm |

Hines Real Estate Investments, Inc., Member FINRA/SIPC, is the Dealer Manager. 9/10

Hines Real Estate Investment Trust, Inc. (Hines REIT) is closed to new investors.

Hines REIT Update

As of September 30, 2010

Jeffrey C. Hines and Gerald D. Hines

Hines History

Gerald D. Hines founded Hines Interests Limited

Partnership (Hines)1 upon a single premise: buildings

of superior quality and architectural merit backed by

responsive, professional management attract better

tenants; command higher rents; and retain their value

longer despite the ups and downs of real estate cycles.

He also imbued the organization with a constant quest

for excellence and an adherence to the highest tenets

of ethical behavior. This foundation, coupled with the

firm’s sound financial policies, has fueled Hines’

growth from a one-person endeavor to a fully

integrated, international real estate firm of

approximately 3,300 employees.

Partnership (Hines)1 upon a single premise: buildings

of superior quality and architectural merit backed by

responsive, professional management attract better

tenants; command higher rents; and retain their value

longer despite the ups and downs of real estate cycles.

He also imbued the organization with a constant quest

for excellence and an adherence to the highest tenets

of ethical behavior. This foundation, coupled with the

firm’s sound financial policies, has fueled Hines’

growth from a one-person endeavor to a fully

integrated, international real estate firm of

approximately 3,300 employees.

2

1. Hines REIT Investors do not receive an interest in Hines or its affiliates. The performance and experience of Hines may not be indicative of

future results for Hines REIT.

future results for Hines REIT.

Ownership & Structure of Hines1

§ Hines personnel living

and working in 100 cities

worldwide

and working in 100 cities

worldwide

§ Local market knowledge

and expertise

and expertise

§ Fully integrated

– acquisitions

– development

– dispositions

– leasing

– finance

– asset management

– property management

|

TENURE OF HINES EXECUTIVES

WORLDWIDE |

||

|

TITLE

|

NO. OF

EMPLOYEES |

AVG.

TENURE (YEARS) |

|

EVP

|

10

|

31

|

|

SVP

|

43

|

22

|

|

VP

|

131

|

15

|

3

1. All data as of June 30, 2010.

4

Calgary

Seattle

Redmond

San Mateo

Emeryville

Palo Alto

Pleasanton

Sacramento

Roseville

San Jose

Tempe

Albuquerqu

e

e

Salt Lake

City

City

Denver

Broomfield

Aspen

Woodland Hills

Austin

Louisville

Kansas City

Richardson

Dallas

Irving

St. Augustine

Miami

Charlotte

Orlando

Alpharetta

Cincinnati

Minneapolis

Bloomington

Detroit

Southfield

Toledo

Bannockburn

Deerfield

Omaha

Cleveland

Hartford

Purchase

Queens

Rye

Boston

Wellesley

Washington, D.C.

Columbus

Richmond

Melville

Greenwich

Milford

Stamford

Toronto

Miami Beach

Oklahoma

City

City

Los Angeles

Torrance

San Diego

Phoenix

Irvine

Fountain Valley

|

§ 20 Officers / Avg. Tenure 20 yrs.

|

||

|

§ Office Established

|

1957

|

|

|

§ Total Personnel

|

369

|

|

|

|

SF (m)

|

SM (m)

|

|

§ Project Experience

|

95.5

|

8.9

|

|

§ Property Management

|

19.2

|

1.8

|

|

§ 43 Officers / Avg. Tenure 19 yrs.

|

||

|

§ Office Established

|

1957

|

|

|

§ Total Personnel

|

368

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

§ 11 Officers / Avg. Tenure 19 yrs.

|

||

|

§ Office Established

|

1982

|

|

|

§ Total Personnel

|

136

|

|

|

|

SF (m)

|

SM (m)

|

|

§ Project Experience

|

30.2

|

2.8

|

|

§ Property Management

|

6.3

|

0.6

|

MIDWEST REGION

CANADA

WEST REGION

|

§ 29 Officers / Avg. Tenure 19 yrs.

|

||

|

§ Office Established

|

1981

|

|

|

§ Total Personnel

|

429

|

|

|

|

SF (m)

|

SM (m)

|

|

§ Project Experience

|

34.8

|

3.2

|

|

§ Property Management

|

14.7

|

1.4

|

|

§ 1 Officer / 12 yrs. Tenure

|

||

|

§ Office Established

|

2004

|

|

|

§ Total Personnel

|

32

|

|

|

|

SF (m)

|

SM (m)

|

|

§ Project Experience

|

5.1

|

0.5

|

|

§ Property Management

|

1.0

|

0.1

|

|

§ 19 Officers / Avg. Tenure 21 yrs.

|

||

|

§ Office Established

|

1986

|

|

|

§ Total Personnel

|

456

|

|

|

|

SF (m)

|

SM (m)

|

|

§ Project Experience

|

51.2

|

4.8

|

|

§ Property Management

|

29.5

|

2.7

|

|

§ 11 Officers / Avg. Tenure 21 yrs.

|

||

|

§ Office Established

|

1979

|

|

|

§ Total Personnel

|

465

|

|

|

|

SF (m)

|

SM (m)

|

|

§ Project Experience

|

47.3

|

4.4

|

|

§ Property Management

|

28.2

|

2.6

|

EAST REGION

SOUTHWEST REGION

SOUTHEAST REGION

CENTRAL RESOURCES

Offices

Regional Offices

as of June 30, 2010

Project Experience: Projects completed, acquired, under development or in design (1957-06/30/10)

Property Management: Properties under management as of June 30, 2010

Property Management: Properties under management as of June 30, 2010

|

PROPERTY TYPES

|

|

Office

|

|

Retail

|

|

Industrial

|

|

Residential

|

|

Mixed-use

|

|

Land Development

|

LEADERSHIP

Name

Tenure w/Hines

(yrs)

Jeffrey C. Hines

28

C. Hastings Johnson

32

Charles M. Baughn

26

Thomas D. Owens

37

James C. Buie, Jr. (West)

30

Mark A. Cover (Southwest)

27

Christopher D. Hughes (East)

24

C. Kevin Shannahan (MW/SE)

28

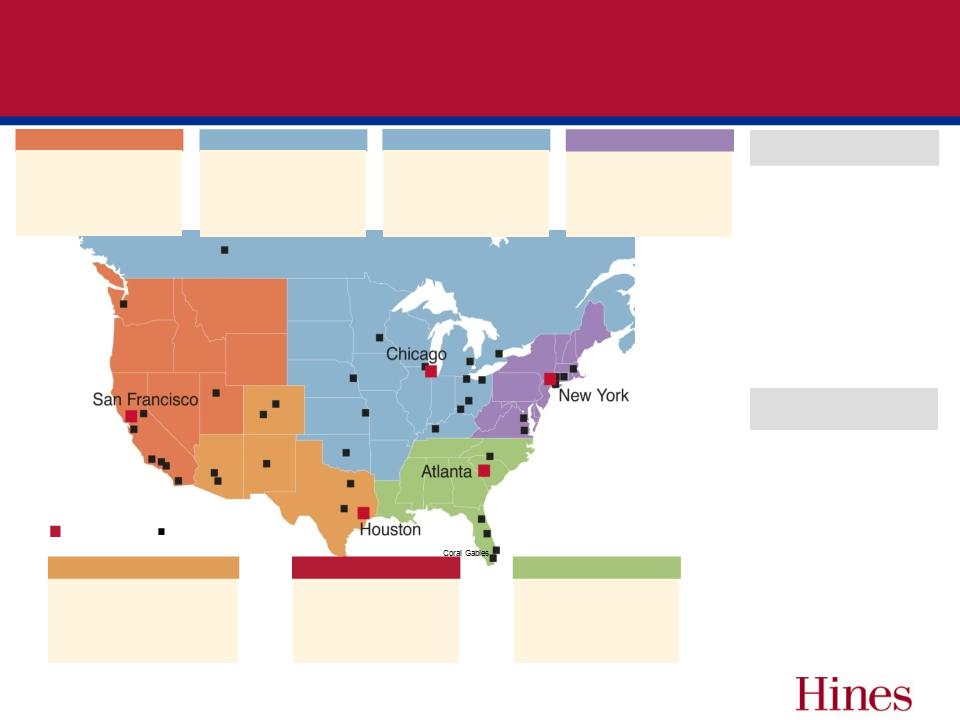

Hines U.S./Canada Presence

Projects Completed, Acquired, Under Development, In Design and/or Under Management

Projects Completed, Acquired, Under Development, In Design and/or Under Management

5

Offices

as of June 30, 2010

Regional Offices

Project Experience: Projects completed, acquired, under development or in design (1957-6/30/10)

Property Management: Properties under management as of June 30, 2010

Property Management: Properties under management as of June 30, 2010

§ Approximately 3,300

employees worldwide

employees worldwide

§ Operations in 17 countries;

offices in 100 cities

offices in 100 cities

§ Local market knowledge and

expertise

expertise

LEADERSHIP

Name

Tenure w/Hines

(yrs)

Gerald D. Hines

54

Jeffrey C. Hines

28

C. Hastings Johnson

32

Charles M. Baughn

26

James C. Buie, Jr.

30

Mark A. Cover

27

Christopher D. Hughes

24

E. Staman Ogilvie

37

Thomas D. Owens

37

C. Kevin Shannahan

28

Michael J. G. Topham

35

|

TENURE OF HINES

|

||

|

TITLE

|

NO. OF

EMPLOYEES |

AVG.

TENURE (YEARS) |

|

EVP

|

10

|

31

|

|

SVP

|

43

|

22

|

|

VP

|

131

|

15

|

HINES CANADA

HINES EUROPE / MENA

HINES EURASIA

HINES MEXICO/CENTRAL AMERICA

HINES SOUTH AMERICA

HINES ASIA PACIFIC

|

§ Office Established

|

1992

|

|

|

§ Total Personnel

|

139

|

|

|

|

SF (m)

|

SM (m)

|

|

§ Project Experience

|

11.4

|

1.1

|

|

§ Property Management

|

9.5

|

0.88

|

|

§ Office Established

|

1991 / 2007

|

|

|

§ Total Personnel

|

219 / 18

|

|

|

|

SF (m)

|

SM (m)

|

|

§ Project Experience

|

22.0

|

2.0

|

|

§ Property Management

|

0.0

|

0.0

|

|

§ Office Established

|

2004

|

|

|

§ Total Personnel

|

32

|

|

|

|

SF (m)

|

SM (m)

|

|

§ Project Experience

|

5.1

|

0.5

|

|

§ Property Management

|

1.0

|

0.1

|

|

§ Office Established

|

1992

|

|

|

§ Total Personnel

|

313

|

|

|

|

SF (m)

|

SM (m)

|

|

§ Project Experience

|

8.3

|

0.8

|

|

§ Property Management

|

3.9

|

0.37

|

|

§ Office Established

|

1998

|

|

|

§ Total Personnel

|

158

|

|

|

|

SF (m)

|

SM (m)

|

|

§ Project Experience

|

18.8

|

1.7

|

|

§ Property Management

|

10.2

|

0.95

|

|

§ Office Established

|

1996

|

|

|

§ Total Personnel

|

206

|

|

|

|

SF (m)

|

SM (m)

|

|

§ Project Experience

|

10.6

|

1.0

|

|

§ Property Management

|

0.6

|

0.05

|

HINES USA

|

§ Office Established

|

1957

|

|

|

§ Total Personnel

|

2,223

|

|

|

|

SF (m)

|

SM (m)

|

|

§ Project Experience

|

259.0

|

24.1

|

|

§ Property Management

|

97.9

|

9.1

|

MOSCOW

GDANSK

WARSAW

LODZ

BERLIN

STUTTGART

BARCELONA

MILAN

PARIS

MUNICH

MARBELLA

MADRID

LONDON

LOUVEIRA

RIO DE JANEIRO

BELFORD ROXO

PANAMA CITY

MANAUS

LUXEMBOURG CITY

ABU DHABI

SHANGHAI

DELHI /

GURGAON

BEIJING

DALIAN

ISTANBUL

SÃO PAULO

CAJAMAR

CHICAGO

ATLANTA

HOUSTON

SAN FRANCISCO

NEW YORK

MONTERREY

QUERÉTARO

MEXICO CITY

GUADALAJARA

TOLUCA

ACAPULCO

HERMOSILLO

MERIDA

Hines Worldwide Operations

Projects Completed, Acquired, Under Development, In Design and/or Under Management

Projects Completed, Acquired, Under Development, In Design and/or Under Management

6

TENANT SATISFACTION

TENANT RETENTION

HIGHER OCCUPANCY

PROPERTY

OUTPERFORMANCE

OUTPERFORMANCE

|

TENURED HINES PROPERTY MANAGEMENT AND LEASING PERSONNEL

|

|

|

|

AVERAGE HINES

U.S. TENURE (YRS)1

|

|

Property Managers

|

9

|

|

Assistant Property Managers

|

3+

|

|

Chief Engineers (First Line Managers) and Engineering Managers

|

11+

|

|

Assistant Chief Engineers

|

7+

|

|

Building Engineers / Maintenance Technicians / Apprentice Engineers

|

5+

|

|

Marketing / Leasing Managers

|

6+

|

1. Average Hines U.S. Tenures as of 12/31/2009

Superior Property Management

Over 120 Million Square Feet Managed Daily by Hines

Over 120 Million Square Feet Managed Daily by Hines

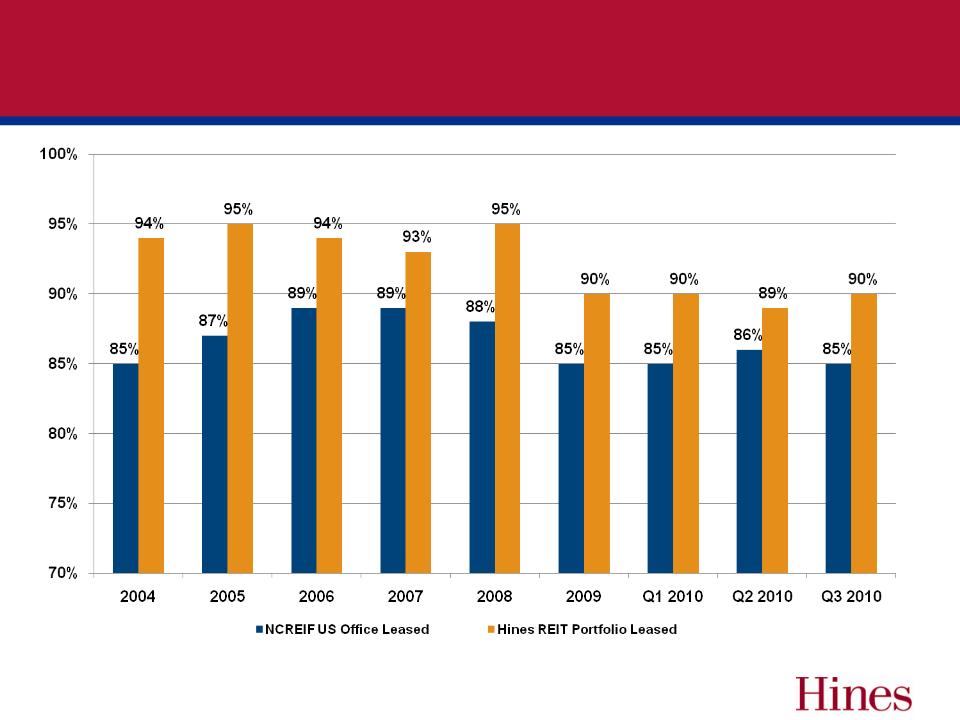

U.S. OFFICE MARKET LEASED PERCENTAGE

Source: NCREIF, Hines

Hines REIT Portfolio*

* As of September 30, 2010.

Corporate Headquarters

Williams Tower

Houston, Texas

Houston, Texas

One North Wacker

Chicago, Illinois

Atrium on Bay

Toronto, Ontario

Toronto, Ontario

7

Hines REIT in Summary (as of September 30, 2010)

§ Holds a diversified portfolio of commercial real estate assets including:

– Primarily institutional-quality office properties

– Grocery-Anchored Retail

– Mixed-Use office

– Industrial

§ Invests through direct acquisitions and joint ventures

§ As of 9/30/10 owns directly or indirectly 59 properties:

– Over 29 million square feet

– Portfolio 90% leased

– Both domestic and international holdings:

§ 57 domestic assets totaling approximately 27.5 million square feet

§ 2 international assets totaling in excess of 1.7 million square feet

– Total real estate assets of $3.7 billion acquired

– Minimal near term rollover with an average annual lease roll of 7.2% through 2012

– Current leverage 59.7%

– Current refinancing exposure is approximately $45M in 2010 and 2011 and represents

approximately 3% of the fund’s total debt.

approximately 3% of the fund’s total debt.

§ Proceeds raised in excess of $2.5 billion

§ In excess of 58,000 shareholders

§ Delivered annualized distributions at a rate of 5.0% - 6.35% since inception in

November 2004 through September 2010*

November 2004 through September 2010*

*effective July 1, 2010, the dividend was lowered to 5% primarily as a result of lower occupancy and lower rental rates

8

9

San Diego

Houston

Chicago

San Francisco

Seattle

Atlanta

Los Angeles

Richmond

Sacramento

Charlotte

Dallas

Miami

East Bay

Toronto

Minneapolis

Phoenix

Kansas City

Denver

Orlando

San Antonio

Memphis

New York

Washington, D.C.

Raleigh

Rio de Janeiro

Chase Tower

Dallas, TX

1,246,652 Square Feet

Acquired 11/07

90% leased

Minneapolis Office/Flex

Portfolio

Portfolio

Minneapolis, MN

767,700 Square Feet

Acquired 9/07

83% leased

Williams Tower

Houston, TX

1,479,683 Square Feet

Acquired 05/08

87% leased

2555 Grand Blvd

Kansas City, MO

595,607 Square Feet

Acquired 2/08

100% leased

4050/4055 Corporate

Drive

Drive

Dallas, TX

643,429 Square Feet

Acquired 05/08

100% leased

Citymark

Dallas, TX

218,722 Square Feet

Acquired 8/05

95% leased

321 North Clark

Chicago, IL

888,837 Square Feet

Acquired 4/06

82% leased

Three Huntington

Quadrangle

Quadrangle

Long Island, NY

407,731 Square Feet

Acquired 7/07

73% leased

Airport Corporate

Center

Miami, FL

1,018,428 Square Feet

Acquired 1/06

83% leased

Hines REIT Portfolio

(as of September 30, 2010)

(as of September 30, 2010)

10

San Diego

Houston

Chicago

San Francisco

Seattle

Atlanta

Los Angeles

Richmond

Sacramento

Charlotte

Dallas

Miami

East Bay

Toronto

Minneapolis

Phoenix

Kansas City

Denver

Orlando

San Antonio

Memphis

New York

Washington, D.C.

Raleigh

Rio de Janeiro

Denver Industrial

Denver, CO

484,737 Square Feet

Acquired 12/08

85% leased

5th & Bell

Seattle, WA

197,135 Square Feet

Acquired 6/07

98% leased

Seattle Design Center

Redmond, WA

390,684 Square Feet

Acquired 6/07

75% leased

Daytona-Hart Portfolio

Redmond, WA

711,974 Square Feet

Acquired 12/06, 1/07

86% leased

1900/2000 Alameda

San Mateo, CA

253,187 Square Feet

Acquired 6/05

94% leased

1515 S Street

Sacramento, CA

351,745 Square Feet

Acquired 11/05

98% leased

3400 Data Drive

Sacramento, CA

149,703 Square Feet

Acquired 11/06

100% leased

2100 Powell

Emeryville, CA

344,433 Square Feet

Acquired 12/06

100% leased

One Wilshire

Los Angeles, CA

661,553 Square Feet

Acquired 8/07

96% leased

Hines REIT Portfolio

(as of September 30, 2010)

(as of September 30, 2010)

11

Atrium on Bay

Toronto, ON

1,077,496 Square Feet

Acquired 2/07

98% leased

Distribution Park Rio

Rio de Janeiro, Brazil

693,115 Square Feet

Acquired 07/07

100% leased

50%1

San Diego

Houston

Chicago

San Francisco

Seattle

Atlanta

Los Angeles

Richmond

Sacramento

Charlotte

Dallas

Miami

East Bay

Toronto

Minneapolis

Phoenix

Kansas City

Denver

Orlando

San Antonio

Memphis

New York

Washington, D.C.

Raleigh

Rio de Janeiro

Weingarten Retail

Portfolio

Portfolio

Various locations

1,497,298 Square Feet

Acquired 11/08 - 3/09

95% leased

70%1

Raytheon/DirecTV

El Segundo, CA

550,579 Square Feet

Acquired 3/08

100% leased

Hines REIT Portfolio

(as of September 30, 2010)

(as of September 30, 2010)

1. Italicized percentage numbers represent Hines REIT’s effective ownership in each property listed.

12

San Francisco

Houston

Chicago

Seattle

Atlanta

San Diego

Los Angeles

New York

Richmond

Charlotte

Phoenix

Sacramento

Washington D.C.

499 Park Ave

New York, NY

291,515 Square Feet

Acquired 8/03

92% leased

11%2

425 Lexington Ave

New York, NY

700,034 Square Feet

Acquired 8/03

100% leased

11%2

Riverfront Plaza

Richmond, VA

951,616 Square Feet

Acquired 11/06

95% leased

23%2

Charlotte Plaza

Charlotte, NC

625,026 Square Feet

Acquired 06/07

90% leased

23%2

Carillon

Charlotte, NC

472,644 Square Feet

Acquired 07/07

88% leased

23%2

1200 19th Street

Washington D.C.

337,250 Square Feet

Acquired 8/03

55% leased

11%2

Hines US Core Office Fund Portfolio

(as of September 30, 2010)1

(as of September 30, 2010)1

1. As of September 30, 2010, Hines REIT owned a 27.7% interest in the Hines US Core Office Fund.

2. Italicized percentage numbers represent Hines REIT’s effective ownership in each property listed.

13

One Shell Plaza

Houston, TX

1,230,395 Square Feet

Acquired 5/04

100% leased

11%2

Two Shell Plaza

Houston, TX

565,573 Square Feet

Acquired 5/04

95% leased

11%2

One Atlantic Center

Atlanta, GA

1,100,312 Square Feet

Acquired 7/06

78% leased

23%2

Three First National

Chicago, IL

1,423,515 Square Feet

Acquired 3/05

91% leased

18%2

One North Wacker

Chicago, IL

1,373,754 Square Feet

Acquired 3/08

94% leased

23%2

Renaissance

Square

Square

Phoenix, AZ

965,508 Square Feet

Acquired 12/07

88% leased

23%2

333 West Wacker

Chicago, IL

854,873 Square Feet

Acquired 4/06

72% leased

18%2

101 Second Street

San Francisco, CA

388,370 Square Feet

Acquired 9/04

87% leased

23%2

The KPMG Building

San Francisco, CA

379,328 Square Feet

Acquired 9/04

88% leased

23%2

Golden Eagle Plaza

San Diego, CA

449,181 Square Feet

Acquired 8/05

94% leased

23%2

Warner Center

Los Angeles, CA

808,274 Square Feet

Acquired 10/06

91% leased

18%2

720 Olive Way

Seattle, WA

300,710 Square Feet

Acquired 1/06

76% leased

18%2

Douglas Boulevard

Sacramento, CA

882,636 Square Feet

Acquired 05/07

61% leased

18%2

Wells Fargo Center

Sacramento, CA

502,365 Square Feet

Acquired 05/07

93% leased

18%2

Hines US Core Office Fund Portfolio

(as of September 30, 2010)1

(as of September 30, 2010)1

1. As of September 30, 2010, Hines REIT owned a 27.7% interest in the Hines US Core Office Fund.

2. Italicized percentage numbers represent Hines REIT’s effective ownership in each property listed.

14

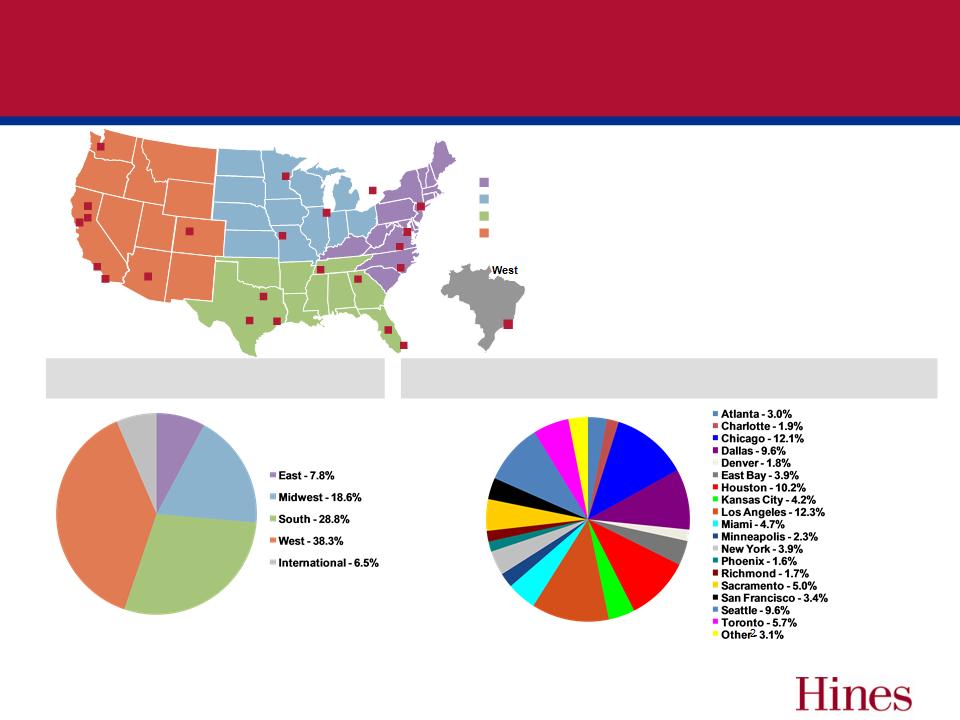

REGIONAL MIX1

% OF TOTAL PORTFOLIO—BASED ON PURCHASE PRICE

1. Weighted by Hines REIT’s effective ownership

2. Other consists of Memphis (0.8%), Orlando (0.3%), Raleigh (0.2%), Rio De Janeiro (0.7%), San Antonio (0.2%), San Diego (0.7%) and

Washington D.C. (0.2%)

Washington D.C. (0.2%)

CITY MIX1

% OF TOTAL PORTFOLIO—BASED ON PURCHASE PRICE

East

Midwest

South

San Francisco

Houston

Chicago

Seattle

Atlanta

San Diego

Los Angeles

Washington, DC

New York

Dallas

Sacramento

Miami

Richmond

East Bay

Toronto

Charlotte

Minneapolis

Rio de Janeiro

Phoenix

Kansas City

San Antonio

Orlando

Memphis

Denver

Hines REIT Portfolio Summary - Geographical

Diversification

Diversification

15

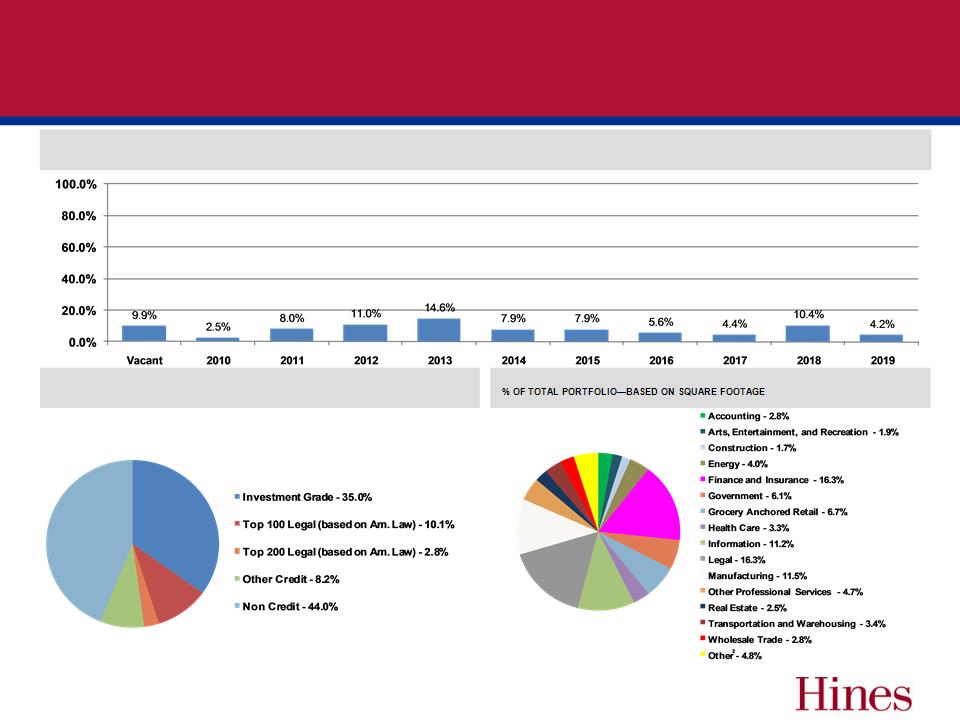

ROLLOVER1

% OF TOTAL LEASABLE SQUARE FEET IN PORTFOLIO

TENANT CREDIT QUALITY1

% OF TOTAL PORTFOLIO—BASED ON SQUARE FOOTAGE

TENANT INDUSTRY MIX1

1. Weighted by Hines REIT’s effective ownership as of 9/30/10

2. Other represents all of the tenant industry mix categories that have less than 1% of the total portfolio

Hines REIT Lease Rollover and Tenant Industry

Hines REIT - Tracking Occupancy

16

Source: NCREIF

17

Finding Success in Challenging Markets

§ San Francisco - 101 Second Street

– Executed a lease with Karum Group for 8,645 SF for a 5-year term. Karum Group, founded in 1988 and based

in San Francisco, offers credit management solutions and is in the business of helping companies issue private

label credit cards.

in San Francisco, offers credit management solutions and is in the business of helping companies issue private

label credit cards.

– Executed a lease for 18,261 SF for a 9-year term with the California Appellate Courts.

§ San Francisco - 55 Second Street

– Executed three leases totaling 10,000 SF with an average lease length of 2.5 years. The tenants represent the

advertising, banking and staffing industries.

advertising, banking and staffing industries.

§ Sacramento - Douglas Boulevard Portfolio

– Executed a renewal and expansion lease with Composite Engineering, Inc. for 42,445 SF for a 2-year term.

Composite Engineering, Inc. offers composite design and manufacturing services.

Composite Engineering, Inc. offers composite design and manufacturing services.

– Executed 13 leases totaling approximately 55,000 SF. No lease exceeds 8,500 SF and the average lease term

is a 4-year lease. These tenants represent the financial, banking and insurance industries.

is a 4-year lease. These tenants represent the financial, banking and insurance industries.

§ Denver - Arapahoe

– Executed a 5-year 43,000 SF lease with Santander Bank; a firm founded in Northern Spain in 1857 with a

history in retail and commercial banking.

history in retail and commercial banking.

§ Charlotte - Carillon

– Executed a 42,000 SF renewal with law firm Cadwalader, Wickersham and Taft, the asset’s largest tenant for a

12-year term. The firm, founded in 1792, is one of the nation's oldest law firms and has a presence in New York,

London, Charlotte, N.C., Washington, D.C., and Beijing .

12-year term. The firm, founded in 1792, is one of the nation's oldest law firms and has a presence in New York,

London, Charlotte, N.C., Washington, D.C., and Beijing .

18

Finding Success in Challenging Markets

§ Charlotte - Charlotte Plaza

– Successfully leased 24,000 SF to Citco, a financial services firm new to the Charlotte market for a 10-year term,

backfilling one of two Wachovia floors that expired in Q1 2010. The Citco Group of Companies is a worldwide

group of independent financial service providers offering hedge fund administration, custody and fund trading,

financial products and corporate and trust planning solutions.

backfilling one of two Wachovia floors that expired in Q1 2010. The Citco Group of Companies is a worldwide

group of independent financial service providers offering hedge fund administration, custody and fund trading,

financial products and corporate and trust planning solutions.

§ New York - 499 Park Avenue

– Executed a 17,500 SF lease with Halstead Property for 15 years. Halstead Property, founded in 1984, is a

residential real estate brokerage firm headquartered in New York City with agents in offices throughout New

York, New Jersey and Connecticut.

residential real estate brokerage firm headquartered in New York City with agents in offices throughout New

York, New Jersey and Connecticut.

– Collected a $1 million payment in connection with the Dreier bankruptcy proceedings which was awarded by the

court. The property had previously drawn down a $15.5 million letter of credit in 2009.

court. The property had previously drawn down a $15.5 million letter of credit in 2009.

§ Chicago - 321 North Clark

– Executed a 15-year lease with the Laborer’s and Retirement Employees’ Annuity and Benefit Fund of Chicago, a

municipal pension fund, for 9,979 SF.

municipal pension fund, for 9,979 SF.

– Executed a 15-year lease with the Municipal Employees’ Annuity and Benefit Fund of Chicago, a municipal

pension fund, for 16,367 SF.

pension fund, for 16,367 SF.

19

Debt Maturity Chart

9/30/10 - Hines REIT

9/30/10 - Hines REIT

WA Rate represents the weighted average rate of the interest on the outstanding loan balance

$224

0

Debt Maturity Chart 9/30/10 - Hines REIT

20

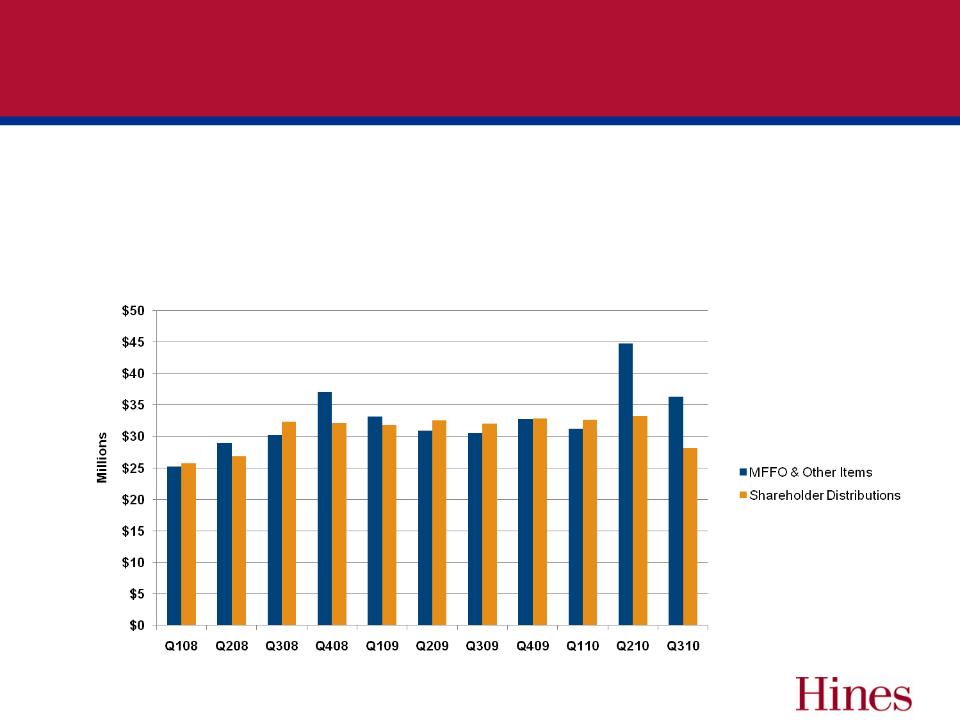

Evaluating Operating Performance

Modified Funds from Operations

§ Modified funds from operations (“MFFO”) is a non-GAAP supplemental financial performance measure that our management uses in evaluating

the operating performance of the Company. It includes funds generated by the operations of our real estate investments and funds used in the

Company’s corporate-level operations. Similar to Funds from Operations (“FFO”), a non-GAAP financial performance measure defined by the

National Association of Real Estate Investment Trusts (“NAREIT”) widely recognized as a measure of operating performance, MFFO excludes

items such as depreciation and amortization. However, changes in the accounting and reporting rules under GAAP that have been put into

effect since the establishment of NAREIT’s definition of FFO have prompted a significant increase in the magnitude of non-cash and non-

operating items included in FFO, as defined. Such items include amortization of certain in-place lease intangible assets and liabilities and the

amortization of certain tenant incentives. MFFO excludes these items, the effects of straight-line rent revenue recognition, fair value

adjustments to derivative instruments that do not qualify for hedge accounting treatment, non-cash impairment charges and certain other items

as described in the footnotes found on slides 22, 23 and 24, and also includes items such as master lease rental receipts, which are excluded

from net income (loss) and FFO, but which we consider in the evaluation of the operating performance of our real estate investments. We

believe that MFFO reflects the overall impact on the performance of our real estate investments of occupancy rates, rental rates, property

operating costs, as well as corporate-level general and administrative expenses and interest costs, which is not immediately apparent from net

income (loss). As such, we believe MFFO, in addition to net income (loss) and cash flows from operating activities as defined by GAAP, is a

meaningful supplemental performance measure and is useful in understanding how the Company’s management evaluates the Company’s

ongoing operating performance.

the operating performance of the Company. It includes funds generated by the operations of our real estate investments and funds used in the

Company’s corporate-level operations. Similar to Funds from Operations (“FFO”), a non-GAAP financial performance measure defined by the

National Association of Real Estate Investment Trusts (“NAREIT”) widely recognized as a measure of operating performance, MFFO excludes

items such as depreciation and amortization. However, changes in the accounting and reporting rules under GAAP that have been put into

effect since the establishment of NAREIT’s definition of FFO have prompted a significant increase in the magnitude of non-cash and non-

operating items included in FFO, as defined. Such items include amortization of certain in-place lease intangible assets and liabilities and the

amortization of certain tenant incentives. MFFO excludes these items, the effects of straight-line rent revenue recognition, fair value

adjustments to derivative instruments that do not qualify for hedge accounting treatment, non-cash impairment charges and certain other items

as described in the footnotes found on slides 22, 23 and 24, and also includes items such as master lease rental receipts, which are excluded

from net income (loss) and FFO, but which we consider in the evaluation of the operating performance of our real estate investments. We

believe that MFFO reflects the overall impact on the performance of our real estate investments of occupancy rates, rental rates, property

operating costs, as well as corporate-level general and administrative expenses and interest costs, which is not immediately apparent from net

income (loss). As such, we believe MFFO, in addition to net income (loss) and cash flows from operating activities as defined by GAAP, is a

meaningful supplemental performance measure and is useful in understanding how the Company’s management evaluates the Company’s

ongoing operating performance.

§ However, MFFO should not be considered as an alternative to net income (loss) or to cash flows from operating activities and is not intended to

be used as a liquidity measure indicative of cash flow available to fund the Company’s cash needs. Additionally, please see the limitations

listed below associated with the use of MFFO as compared to net income (loss):

be used as a liquidity measure indicative of cash flow available to fund the Company’s cash needs. Additionally, please see the limitations

listed below associated with the use of MFFO as compared to net income (loss):

§ MFFO excludes gains (losses) related to changes in estimated values of derivative instruments related to our interest rate swaps. Although

we expect to hold these instruments to maturity, if we were to settle these instruments currently, it would have an impact on our operations.

we expect to hold these instruments to maturity, if we were to settle these instruments currently, it would have an impact on our operations.

§ MFFO excludes the Participation Interest component of the acquisition and asset management fees. Although we believe the settlement of

this liability will be funded using proceeds from the sale of properties in the future, if we were to settle it currently it would have an impact on our

operations.

this liability will be funded using proceeds from the sale of properties in the future, if we were to settle it currently it would have an impact on our

operations.

§ MFFO excludes impairment charges related to long-lived assets that have been written down to current market valuations. Although these

losses are included in the calculation of net income (loss), we have excluded them from MFFO because we believe doing so more

appropriately presents the operating performance of our real estate investments on a comparative basis.

losses are included in the calculation of net income (loss), we have excluded them from MFFO because we believe doing so more

appropriately presents the operating performance of our real estate investments on a comparative basis.

§ MFFO excludes organizational and offering expenses and acquisition expenses payable to our Advisor. Although these amounts reduce net

income, we fund such costs with proceeds from our offerings and acquisition-related indebtedness and do not consider these expenses in the

evaluation of the operating performance of the Company and determining MFFO.

income, we fund such costs with proceeds from our offerings and acquisition-related indebtedness and do not consider these expenses in the

evaluation of the operating performance of the Company and determining MFFO.

21

§ MFFO is used by Senior Management and the Board of Directors to evaluate

operating performance

operating performance

§ The graph below includes MFFO and certain other items we believe may be helpful

in assessing our operating performance results such as gains on the sale of assets

in assessing our operating performance results such as gains on the sale of assets

Evaluating Operating Performance

Ø Cumulative Excess of

MFFO over Shareholder

Distributions is approximately

$20.9 million

MFFO over Shareholder

Distributions is approximately

$20.9 million

Evaluating Operating Performance

22

|

1

|

)

|

Represents the depreciation and amortization of various real estate assets. Historical cost accounting for real estate assets in accordance with GAAP

implicitly assumes that the value of real estate assets diminishes predictably over time. Since real estate values have historically risen or fallen with market conditions, we believe that such depreciation and amortization may be of limited relevance in evaluating current operating performance and, as such, these items are excluded from our determination of MFFO. |

|

2

|

)

|

Represents components of net income (loss) related to the estimated changes in the values of our interest rate swap derivatives. We have excluded these

changes in value from our evaluation of the operating performance of the Company and MFFO because we expect to hold the underlying instruments to their maturity and accordingly the interim gains or losses will remain unrealized. |

|

|

2008

|

2009

|

2010

|

||||||||

|

|

Q1

|

Q2

|

Q3

|

Q4

|

Q1

|

Q2

|

Q3

|

Q4

|

Q1

|

Q2

|

Q3

|

|

Net income (loss)

|

($43,187)

|

$8,837

|

($23,780)

|

($104,213)

|

$3,805

|

$23,549

|

($25,789)

|

$5,120

|

($12,938)

|

($8,419)

|

($28,302)

|

|

Adjustments:

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization(1)

|

25,381

|

32,216

|

32,888

|

32,313

|

31,779

|

31,010

|

31,859

|

31,423

|

28,876

|

27,372

|

28,380

|

|

(Gain) loss on derivative instruments(2)

|

27,445

|

(26,780)

|

10,530

|

74,685

|

(10,896)

|

(35,895)

|

11,701

|

(14,207)

|

5,854

|

24,374

|

15,441

|

|

Participation interest expense (3)

|

4,205

|

4,642

|

3,115

|

6,686

|

(28)

|

4,949

|

3,708

|

3,795

|

3,877

|

3,864

|

3,179

|

|

Impairment on land parcel (4)

|

-

|

-

|

-

|

-

|

-

|

-

|

3,415

|

-

|

-

|

-

|

811

|

|

Other components of revenues and expenses (5)

|

(4,561)

|

(4,137)

|

(3,201)

|

(1,532)

|

(4,896)

|

(3,251)

|

(4,133)

|

(3,402)

|

(2,431)

|

(977)

|

(3,947)

|

|

Master lease rents (6)

|

3,464

|

1,239

|

1,058

|

1,223

|

721

|

479

|

-

|

-

|

-

|

-

|

-

|

|

Gain on sale of investment property (7)

|

-

|

1,695

|

34

|

2,012

|

-

|

-

|

-

|

-

|

(4,225)

|

(18,311)

|

-

|

|

Acquisition fees (8)

|

1,447

|

1,572

|

-

|

8,122

|

1,160

|

-

|

-

|

-

|

-

|

-

|

-

|

|

Organization and offering expenses (9)

|

1,918

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments to equity in losses in unconsolidated

entities, net (10) |

9,779

|

10,502

|

10,335

|

16,425

|

11,313

|

10,624

|

10,264

|

10,133

|

11,243

|

(2,432)

|

9,560

|

|

Adjustments for noncontrolling interests (11)

|

(632)

|

(754)

|

(796)

|

(896)

|

(929)

|

(930)

|

(964)

|

(1,089)

|

(1,013)

|

(892)

|

(917)

|

|

MFFO Attributable to Common Shareholders

|

$25,259

|

$29,032

|

$30,183

|

$32,907

|

$32,029

|

$30,535

|

$30,061

|

$31,773

|

$29,243

|

$24,579

|

$24,205

|

|

MFFO per Common Share

|

$0.15

|

$0.16

|

$0.16

|

$0.17

|

$0.16

|

$0.15

|

$0.14

|

$0.15

|

$0.13

|

$0.11

|

$0.11

|

|

Weighted Average Shares Outstanding

|

165,144

|

178,536

|

192,012

|

183,776

|

201,428

|

204,152

|

210,298

|

207,807

|

218,666

|

220,421

|

221,649

|

|

3

|

)

|

Represents the portion of the acquisition and asset management fees that are paid in equity, which we expect will be settled in the future using proceeds

from the sale of properties or other non-operating sources, and which we therefore do not consider in evaluating the operating performance of the Company and determining MFFO. |

Evaluating Operating Performance

23

|

5

|

)

|

Includes the following components of revenues and expenses that we do not consider in evaluating the operating performance of the Company and

determining MFFO for the three and nine months ended September 30, 2010 and 2009 (in thousands): |

|

|

|

a

|

)

|

Represents the adjustments to rental revenue as required by GAAP to recognize minimum lease payments on a straight-line basis over the

respective lease terms. We have excluded these adjustments from our evaluation of the operating performance of the Company and in determining MFFO because we believe that the rent that is billable during the current period is a more relevant measure of the Company’s operating performance for such period. |

|

|

|

b

|

)

|

Represents the amortization of lease incentives, out-of-market leases and deferred financing costs. As stated in Note 1 above, historical cost

accounting for real estate assets in accordance with GAAP implicitly assumes that the value of real estate assets diminishes predictably over time. Since real estate values have historically risen or fallen with market conditions, we believe that such amortization may be of limited relevance in evaluating current operating performance and, as such, these items are excluded from our determination of MFFO. |

|

4

|

)

|

Represents an impairment charge recorded in accordance with the Property, Plant and Equipment topic of the FASB Accounting Standards Codification.

Although such charges are included in the calculation of net income (loss), we have excluded them from MFFO because we believe doing so more appropriately presents the operating performance of our real estate investments on a comparative basis. |

|

|

2008

|

2009

|

2010

|

||||||||

|

|

Q1

|

Q2

|

Q3

|

Q4

|

Q1

|

Q2

|

Q3

|

Q4

|

Q1

|

Q2

|

Q3

|

|

Other components of revenues and expenses is comprised of:

|

($3,925)

|

($4,653)

|

($4,244)

|

($3,566)

|

($3,440)

|

($1,839)

|

($2,633)

|

($1,523)

|

($1,978)

|

($724)

|

($2,934)

|

|

Straight-line rent adjustment (a)

|

773

|

879

|

1,077

|

1,489

|

1,270

|

1,265

|

1,302

|

1,469

|

1,788

|

1,958

|

2,237

|

|

Amortization of lease incentives (b)

|

(2,055)

|

(1,078)

|

(765)

|

(438)

|

(3,625)

|

(3,628)

|

(3,789)

|

(3,706)

|

(3,196)

|

(3,156)

|

(4,164)

|

|

Amortization of out-of-market leases (b)

|

379

|

412

|

446

|

462

|

522

|

737

|

772

|

752

|

740

|

732

|

701

|

|

Amortization of deferred financing costs (b)

|

267

|

285

|

285

|

539

|

377

|

214

|

215

|

(394)

|

215

|

213

|

213

|

|

Other

|

($4,561)

|

($4,137)

|

($3,201)

|

($1,532)

|

($4,896)

|

($3,251)

|

($4,133)

|

($3,402)

|

($2,431)

|

($977)

|

($3,947)

|

Evaluating Operating Performance

24

|

|

|

|

|

|

6

|

)

|

Includes master lease rents related to master leases entered into in conjunction with certain asset acquisitions. In accordance with GAAP, these rents

are not included in rental revenue; however, we consider this rent in evaluating the operating performance of the Company and determining MFFO. |

|

|

7

|

)

|

Represents the gain on disposition of our real estate investments. Although this gain is included in the calculation of net income (loss), we have

excluded it from MFFO because we believe doing so more appropriately presents the operating performance of our real estate investments on a comparative basis. |

|

|

8

|

)

|

Represents acquisition fees paid to our Advisor that are expensed in our condensed consolidated statements of operations. We fund such costs with

proceeds from our offering and acquisition-related indebtedness, and therefore do not consider these expenses in evaluating the operating performance of the Company and determining MFFO. |

|

|

9

|

)

|

Represents organizational and offering expenses paid to our Advisor that are expensed in our condensed consolidated statements of operations. We

fund such costs with proceeds from our offering and acquisition-related indebtedness, and therefore do not consider these expenses in evaluating the operating performance of the Company and determining MFFO. |

|

|

10

|

)

|

Includes adjustments to equity in losses of unconsolidated entities, net, similar to those described in Notes 1, 4, 5 and 7 above for our unconsolidated

entities, which are necessary to convert the Company's share of income (loss) from unconsolidated entities to MFFO. |

|

|

11

|

)

|

Includes income attributable to non-controlling interests and all adjustments to eliminate the non-controlling interests’ share of the adjustments to

convert the Company’s net income (loss) to MFFO. |

25

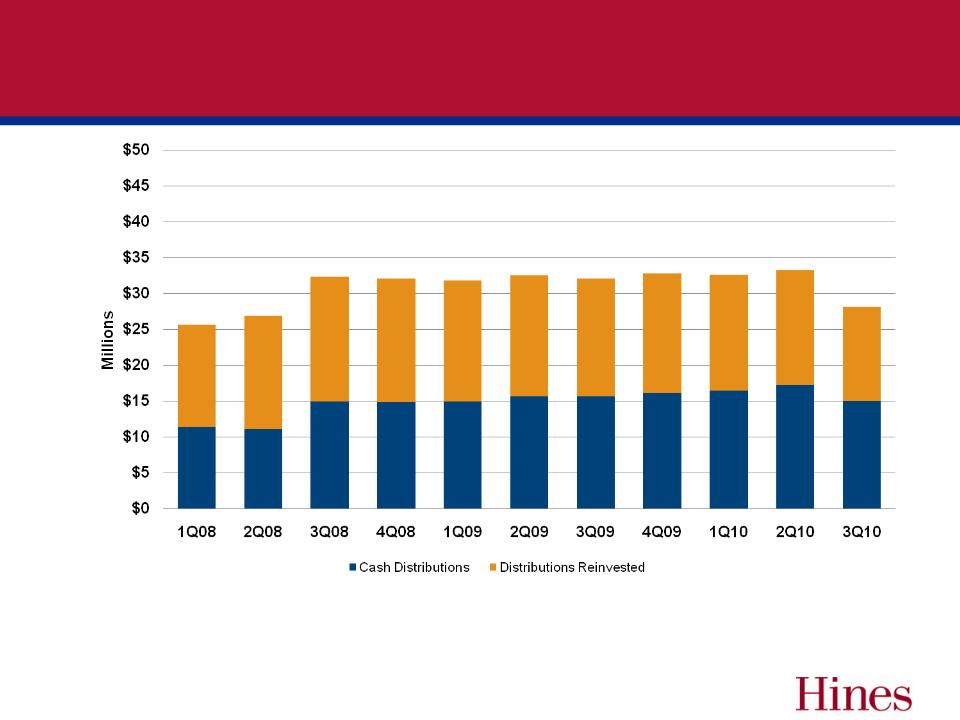

Distribution History - Quarterly in Dollars

We funded our cash distributions with cash flows from operating activities, distributions received from our unconsolidated investments,

proceeds from the sales of our real estate investments and cash generated during prior periods, which had cash flows from operating

activities and distributions received from our unconsolidated investments in excess of distributions.

proceeds from the sales of our real estate investments and cash generated during prior periods, which had cash flows from operating

activities and distributions received from our unconsolidated investments in excess of distributions.

26

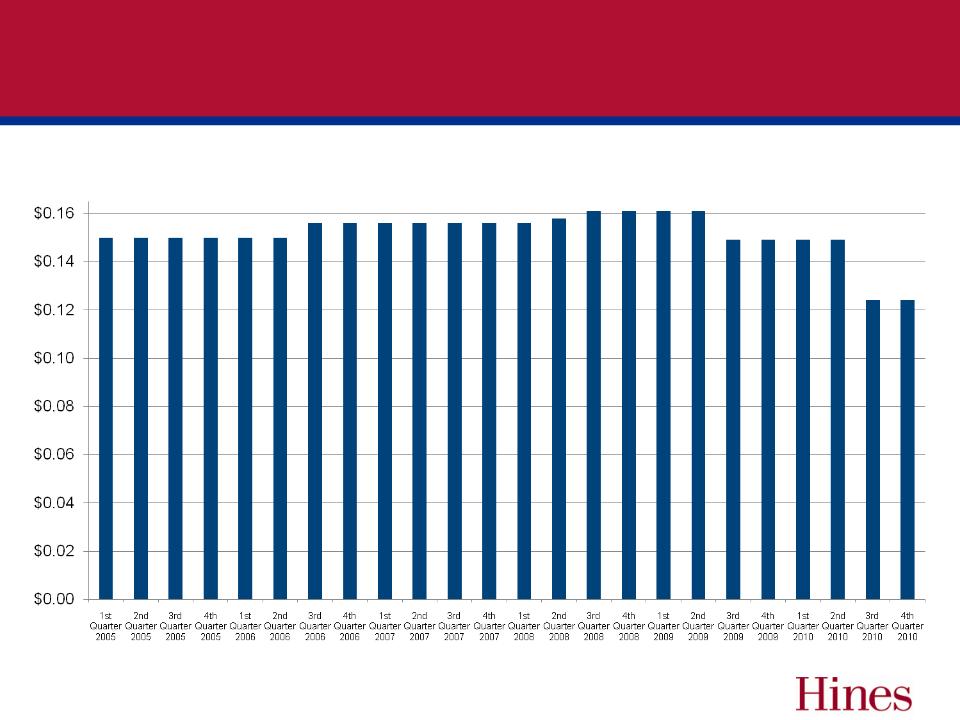

Relatively Stable Distribution

Distribution History -

Cents Per Share Paid Quarterly

Cents Per Share Paid Quarterly

Current Priorities & Focus

§ Our Near-Term Priorities Consist of:

– Leasing of Existing Assets in Our Portfolio

– Targeted Asset Sales

– Managing Liquidity & Maximizing Distributions to Shareholders

§ Our Long-Term Priorities Consist of:

– Evaluating Future Capital Raising Alternatives

– Evaluating Potential Exit Strategies

– Managing Our Debt Maturities

§ These Priorities are Designed to Assist Us in Meeting Our

Primary Objective of Maximizing Shareholder Returns

over the Long Term

Primary Objective of Maximizing Shareholder Returns

over the Long Term

27

“Hines began as a one-man operation in 1957

with the sole focus of delivering better quality

services and products to tenants and investors.

More than half a century later, with 3,300

professionals working on four continents, our

philosophy has not wavered and our

commitment to excellence in the built

environment is stronger than ever.”

with the sole focus of delivering better quality

services and products to tenants and investors.

More than half a century later, with 3,300

professionals working on four continents, our

philosophy has not wavered and our

commitment to excellence in the built

environment is stronger than ever.”

Gerald D. Hines

28

Thank You