Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DUKE REALTY CORP | d8k.htm |

| EX-99.1 - PRESS RELEASE - DUKE REALTY CORP | dex991.htm |

Duke

Realty Announces Major Transactions December 20, 2010

Exhibit 99.2 |

2

Forward-Looking Statements

This slide

presentation

and

certain

of

our

other

filings

with

the

Securities

and

Exchange

Commission

contain

statements

that

constitute

“forward-looking

statements”

within

the

meaning

of

the

Securities

Act

of

1933 and the Securities Exchange Act of 1934 as amended by the Private Securities

Litigation Reform Act of 1995. These forward-looking statements

include, among others, our statements regarding (1) our differentiated

portfolio and market-specific asset strategy; (2) strategic initiatives with respect to our assets,

operations and capital; (3) our pro forma capital position following the execution

of the industrial joint venture acquisition; and (4) the assumptions

underlying our expectations. Prospective investors are cautioned that

any such forward-looking statements are not guarantees of future performance and involve

risks and uncertainties, and that actual results may differ materially from those

contemplated by such forward-looking statements. A number of

important factors could cause actual results to differ materially from those

contemplated by forward-looking statements in this slide presentation and our filings with the

Securities and Exchange Commission. Many of these factors are beyond our

ability to control or predict. Factors that could cause actual results

to differ materially from those contemplated in this slide presentation and

our filings with the Securities and Exchange Commission include the other factors set

forth in our filings with the Securities and Exchange Commission, including our

annual report on Form

10-K, quarterly reports on Form 10-Q and current reports on Form

8-K. We believe these forward- looking statements

are

reasonable,

however,

undue

reliance

should

not

be

placed

on

any

forward-looking

statements, which are based on current expectations. We do not assume any

obligation to update any forward-looking statements as a result of new

information or future developments or otherwise. |

Asset

Strategy

Operations

Strategy

Capital

Strategy

Focused on executing our business strategy

3

Continued Progress On Strategic Initiatives

•

2010

Asset

dispositions

of

$630

million,

including

the

announced

joint

venture transaction with CB Richard Ellis Realty Trust (“CBRERT”) ($414

million proceeds to Duke Realty)

•

60% Office; 70% Midwest

•

Total acquisitions of $930 million, including announced $450 million South

Florida portfolio and $300 million Dugan Realty joint venture

•

78% Industrial; 22% Office

•

Strong leasing momentum: over 20 million square feet of new and renewal

leasing activity

•

Increasing occupancy; currently 89%

•

High tenant retention rate of 78.8%

•

Raised $1.2 billion of capital year-to-date; including disposition transactions

•

Bond tender/refinance of $280 million and repurchased $109 million shares

of preferred Series O

•

Approximately $770 million undrawn LOC; $21 million cash at 9/30/10

Note: Third Quarter Year to Date plus Pro forma effect of CBRERT and Premier transactions

|

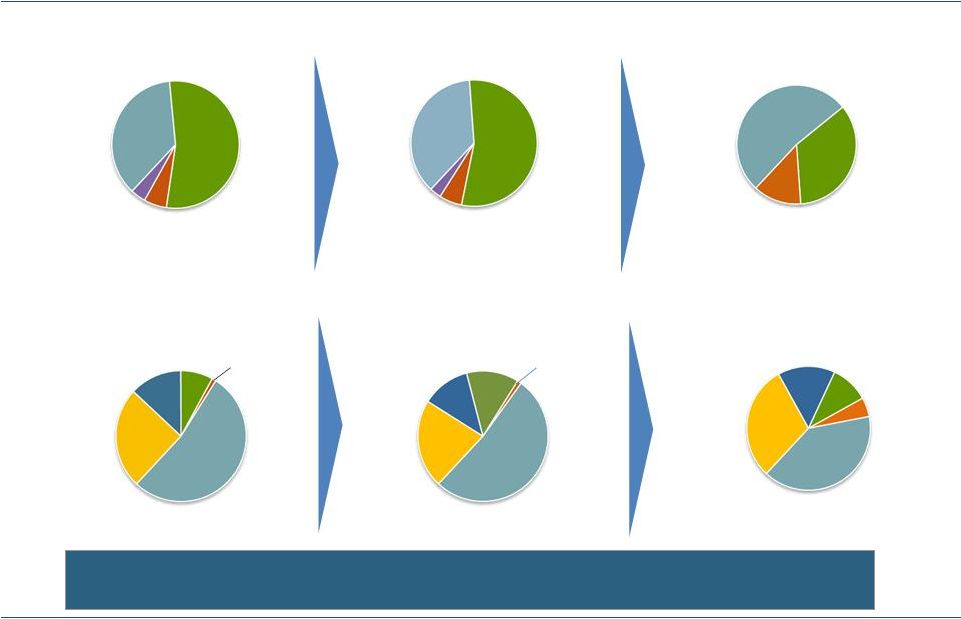

4

Asset Strategy: Overview

Portfolio by product type

September 30, 2009

Southeast

25%

Midwest

53%

West

1%

South

8%

East

13%

Southeast

30%

Midwest

40%

West

5%

South

10%

East

15%

Portfolio by region

Office

55%

Industrial

36%

Medical Office

5%

Office

25%

Industrial

60%

Medical Office

15%

After CBRERT and Premier

Industrial

42%

Office

49%

Retail 3%

Medical

Office 6%

Midwest

49%

Southeast

27%

South

11%

East

12%

West

1%

2013 Goal

Retail

4%

Strategic transactions reduce office concentration in Midwest and

increase industrial and medical office investment |

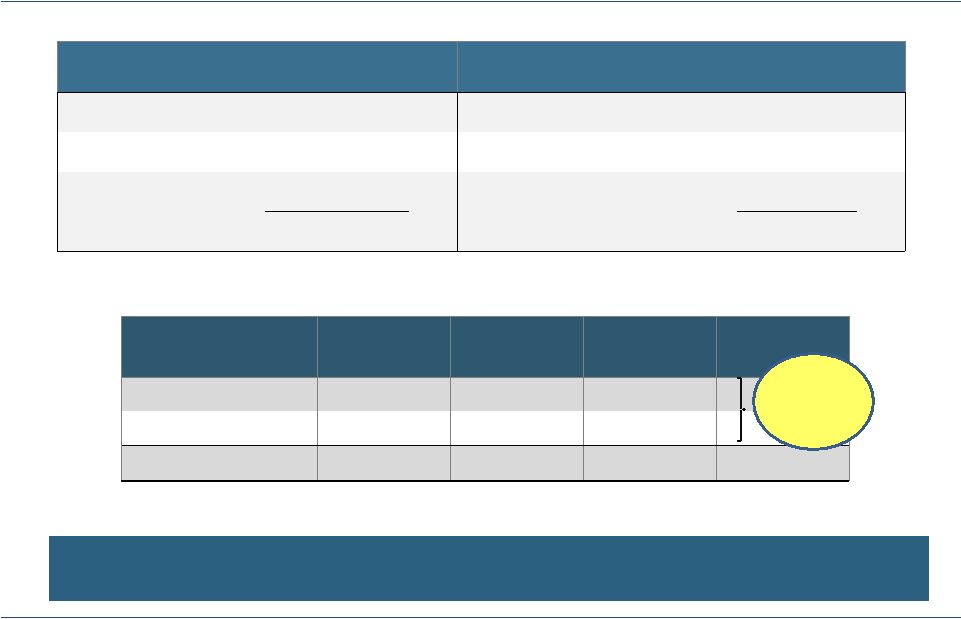

5

Asset Strategy: Progress To Date

ACQUISITIONS

DISPOSITIONS

Q4 2009

$15

Q4 2009

$144

Q1 -

Q3 2010

479

Q1 -

Q3 2010

196

Q4 2010 –

Premier

450

Q4 2010 –

CBRERT

414

Proforma Total

$944

Proforma Total

$754

Progress to Date

Total Value

Assumed Debt

Net

Dispositions

$754

($0)

$754

Acquisitions

$944

($450)

$494

Excess Cash

$260

Significant progress on Asset Strategy with negligible effect on

current

earnings and positive growth profile on assets acquired

Less than 50 Bps

difference in Cap

Rates |

6

Contribution to CBRERT Joint Venture

On December 15, 2010, Duke Realty announced an agreement to contribute $517

million of suburban office assets into its existing joint venture with CBRERT

First closing to be completed by December 31, 2010; value at $174 million

Remaining $343 million of assets contributed by end of second quarter 2011

Duke Realty will retain a 20% ownership interest

Consistent with long-term strategy of decreasing investment in suburban office

Reduces

suburban

office

concentration

from

55%

at

September

30,

2009

to

49%

(1)

Continued fee generation from asset management and other property related services

Generates capital that can be re-deployed into targeted acquisitions and deleveraging

Estimated proceeds of $414 million

Enhances relationship with a strategic Partner

Strategic disposition of suburban office in alignment with objectives

(1) Pro forma for both CBRERT and Premier transactions |

7

Suburban Office Joint Venture Portfolio Overview

Geographic Footprint % Square Footage

Asset Snapshots

Minneapolis

( 17%)

Chicago

(7%)

Houston

(5%)

Dallas

(6%)

South Florida

(13%)

Cincinnati

(18%)

Columbus

(22%)

St. Louis

(8%)

Raleigh

(4%)

3.1 Million Square Feet

Pointe West I

Dallas

Norman Pointe I and II

Minneapolis

Sam Houston Crossing

Houston

One and Two Easton Oval

Columbus

Strategic contribution reduces office concentration in Midwest markets

Regency Creek I

Raleigh

One Conway Park

Chicago

533 and 555 Maryville Ctr

St. Louis

Landings Building I and II

Cincinnati

Nationwide

Columbus |

8

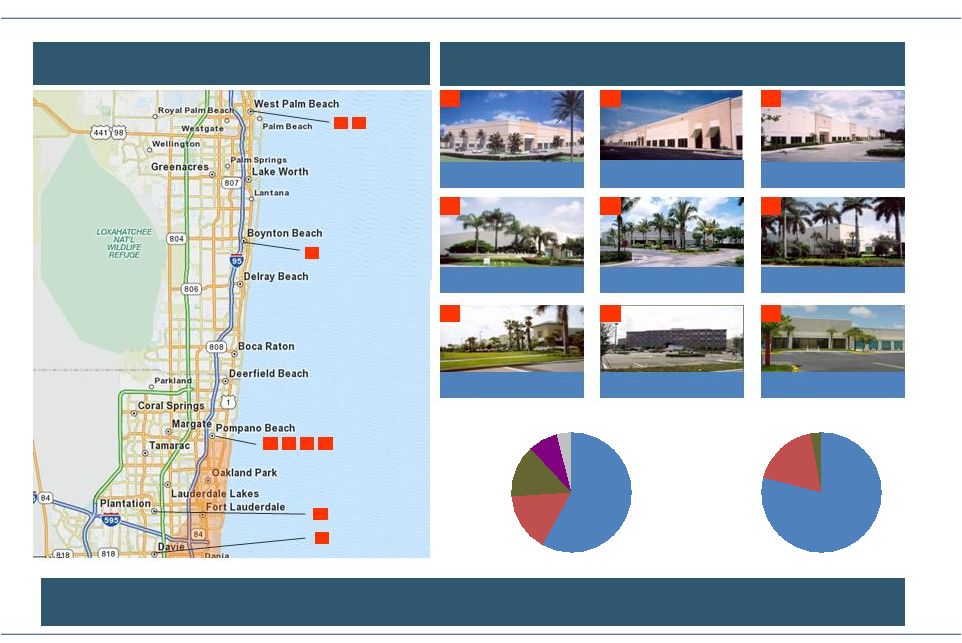

On December 15, 2010, Duke Realty announced its agreement to acquire a $450 million

portfolio of primarily industrial properties from Premier Commercial Realty totaling over 4.9

million square feet located in South Florida

–

Portfolio is approximately 86% leased

Creates dominant industrial market position in Broward and Palm Beach counties

Acquisition is consistent with stated strategy

–

Increasing investment in high-growth, high barrier to entry industrial markets

–

Rapid deployment of proceeds from CBRERT joint venture transaction

–

Portfolio composition:

–

4.5 million square feet of industrial

–

400,000 square feet of office

Premier Realty Portfolio Acquisition

Attractive acquisition consistent with our strategy |

Premier

Portfolio Overview Geographic Footprint

Asset Snapshots

Strategic acquisition of bulk industrial in high barrier markets

9

Premier Gateway Center @

Quantum

Premier Park of Commerce

Park Central Business Park

Sample 95 Business Park

Copans

Business Park

Westport Business Park

Atlantic Business Center

Crossroads Business Park

A

B

C

B

A

C

D

E

F

E

D

F

G

H

I

G

H

I

16%

14%

4%

8%

58%

Pompano Beach

Plantation

(office)

Boyton

Beach

Palm Beach

Central Broward

18%

3%

79%

Bulk

Industrial

Service Center

Office

Premier Airport Center |

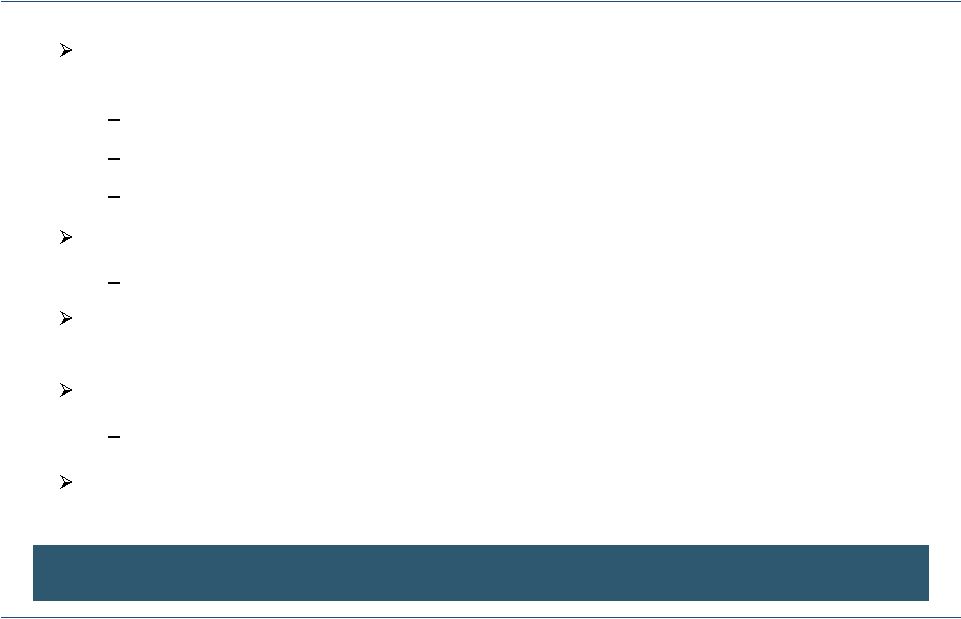

10

Our Goals

Our Targets to Obtain These Goals

•

Lower leveraged

•

Reduce to 45% leverage

Non-Strategic property and land sales

Increase portfolio occupancy to normalized

levels

•

Product focused

•

Increase bulk industrial investment

Industrial

>

60%

Office < 25%

Medical >15%

•

Concentrated in high

growth markets

•

Align investment and resources to high

growth markets; dispose/exit non-strategic

areas

Differentiated asset strategy within tighter

geographic focus

Vision Road Map: Future Duke Realty

The announced transactions are consistent with our vision

|