Attached files

| file | filename |

|---|---|

| EX-21 - EXHIBIT 21 - China Nutrifruit Group LTD | exhibit-21.htm |

| EX-23.1 - EXHIBIT 23.1 - China Nutrifruit Group LTD | exhibit23-1.htm |

As filed with the Securities and Exchange Commission on December 20, 2010

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C.

20549

____________________________

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

China Nutrifruit Group Limited

(Exact name of registrant as specified in its

charter)

| Nevada | 2033 | 87-0395695 |

| (State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer |

| incorporation or organization) | Classification Code Number) | Identification No.) |

5th Floor, Chuangye Building, Chuangye Plaza

Industrial Zone

3, Daqing Hi-Tech Industrial Development Zone

Daqing, Heilongjiang China

163316

(86) 459-8972870

(Address, including zip code, and telephone

number, including area code, of registrant’s principal executive offices)

____________________________

Changjun

Yu

5th Floor, Chuangye Building, Chuangye Plaza

Industrial Zone 3,

Daqing Hi-Tech Industrial Development Zone

Daqing, Heilongjiang China 163316

(86) 459-8972870

Copies to:

Louis A. Bevilacqua, Esq.

Joseph R. Tiano, Jr., Esq.

Jing Zhang, Esq.

Pillsbury

Winthrop Shaw Pittman LLP

2300 N Street, N.W.

Washington, D.C. 20037

(202) 663-8000

(Names, addresses and telephone numbers of

agents for service)

____________________________

Approximate date of commencement of proposed sale to public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. [ ]

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] (Do not check if a smaller reporting company) | Smaller reporting company [ X ] |

CALCULATION OF REGISTRATION FEE

| Title of each class of securities to be registered | Proposed maximum aggregate offering price(1) | Amount of registration fee(2) | ||||

| Taiwan Depositary Receipt |

$ |

28,324,000 |

$ |

2,020 | ||

| Common stock, $0.001 par value (3) | - | (4) |

| (1) |

Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

| (2) |

Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price. |

| (3) |

There are being registered hereunder 7,300,000 shares of common stock represented by the Taiwan Depositary Receipt. Each Taiwan Depositary Receipt represents 0.1 share of common stock of the registrant. |

| (4) |

No fee is required pursuant to Rule 457 (i) under the Securities Act. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall hereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to such Section 8(a), may determine.

2

EXPLANATORY NOTE

This registration statement relates to an underwritten public offering of Taiwan Depositary Receipts, or TDRs, of China Nutrifruit Group Limited in Taiwan. Each TDR will represent 0.1 share of the common stock. China Nutrifruit plans to have its TDRs listed on the Taiwan Stock Exchange upon completion of this offering. The form of U.S. prospectus follows immediately after this Explanatory Note. An offering circular prepared in the Chinese language will be filed with the Taiwan Stock Exchange Corporation and the Taiwan Securities and Futures Bureau, an English translation of which is attached as Appendix A to the U.S. prospectus. Such offering circular is hereinafter referred to as the Taiwan Offering Circular.

As the Taiwan Offering Circular is prepared in Chinese and will be submitted to the Taiwan Stock Exchange Corporation and Taiwan Securities and Futures Bureau in Chinese, the English translation of the Taiwan Offering Circular is prepared for your information only. U.S. federal securities laws and the laws of the Republic of China, or Taiwan, and the Taiwanese Stock Exchange have different requirements regarding the contents of and information required in, a prospectus or offering circular. We also note that linguistic differences naturally occur in a literal translation of a document from one language into another language. We urge U.S. investors to rely on the U.S. prospectus. The Taiwan Offering Circular is intended to be used by investors based in Taiwan. Such investors should refer to the Taiwan Offering Circular in Chinese language, which will be available at http://mops.twse.com.tw/mops/web/index once it is published.

PRELIMINARY PROSPECTUS

The information in this preliminary prospectus is not complete and may be changed. We may not sell securities until the Securities and Exchange Commission declares our registration statement effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated , 2010

73,000,000 Taiwan Depositary Receipt

representing

7,300,000 Shares of Common Stock

CHINA NUTRIFRUIT GROUP LIMITED

This is a public offering of Taiwan Depositary Receipt, or TDRs, representing shares of common stock of China Nutrifruit Group Limited. We are selling TDRs and the selling shareholders identified in this prospectus are offering additional TDRs. Each TDR will represent the right to receive 0.1 share of common stock, par value $0.001 per share. We will not receive any of the proceeds from the sale of TDRs by the selling shareholders.

We plan to apply for and intend to have our TDRs listed on the Taiwan Stock Exchange under the symbol “ ” upon completion of this offering. Our common stock is listed on the NYSE Amex under the symbol “CNGL.” The last reported sale price of our common stock on December 15, 2010 was $2.78 per share.

Investing in our TDRs and common stock involves a high degree of risk. See “Risk factors” beginning on page 9.

| Per TDR | Total | |||

| Public offering price | TWD | TWD | ||

| Underwriting discount | ||||

| Proceeds, before expenses, to China Nutrifruit Group Limited | ||||

| Proceeds, before expenses, to the selling stockholder |

The Taiwan underwriters expect to deliver the TDRs against payment therefor in New Taiwan Dollar in Taipei through the Taiwan Depository & Clearing Corporation on or around , Taipei time.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of anyone’s investment in these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Prospectus is , 2010.

| TABLE OF CONTENTS |

| Page | |

| SUMMARY | 1 |

| RISK FACTORS | 9 |

| SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS | 25 |

| USE OF PROCEEDS | 26 |

| PRICE RANGE OF OUR COMMON STOCK | 27 |

| DIVIDEND POLICY | 28 |

| CAPITALIZATION | 29 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 30 |

| CORPORATE STRUCTURE AND HISTORY | 43 |

| OUR BUSINESS | 44 |

| MANAGEMENT | 58 |

| EXECUTIVE COMPENSATION | 63 |

| TRANSACTIONS WITH RELATED PERSONS, PROMOTERS AND CERTAIN CONTROL PERSONS; | |

| CORPORATE GOVERNANCE | 64 |

| PRINCIPAL AND SELLING STOCKHOLDER | 65 |

| DESCRIPTION OF CAPITAL STOCK | 67 |

| DESCRIPTION OF TAIWAN DEPOSITARY RECEIPT | 69 |

| SHARES ELIGIBLE FOR FUTURE SALE | 72 |

| U.S. FEDERAL INCOME TAX CONSIDERATIONS | 73 |

| UNDERWRITING | 78 |

| LEGAL MATTERS | 79 |

| EXPERTS | 79 |

| WHERE YOU CAN FIND MORE INFORMATION | 79 |

You should only rely on the information contained in this prospectus. We have not, and the underwriters and the selling stockholder have not, authorized any other person to provide you with different information. This prospectus is not an offer to sell, nor is it seeking an offer to buy, these securities in any state where the offer or sale is not permitted. The information in this prospectus is accurate only as of the date on the front cover, but the information may have changed since that date.

This prospectus contains market data and industry forecasts that were obtained from industry publications. We have not independently verified any of this information.

i

SUMMARY

The items in the following summary are described in more detail later in this prospectus. This summary provides an overview of selected information and does not contain all of the information you should consider. Therefore, you should also read the more detailed information contained in this prospectus, including our financial statements and the notes thereto and matters set forth under “Risk Factors.”

Our Business

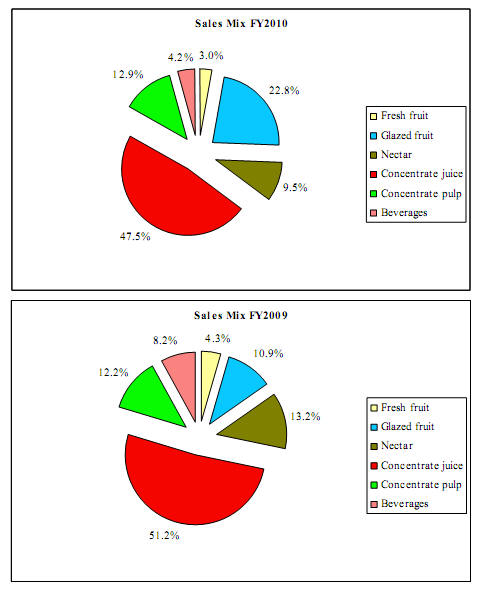

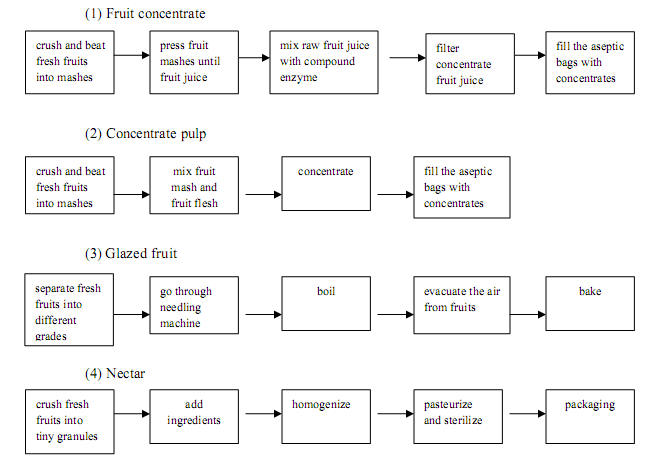

We are a holding company that operates through our indirect, wholly-owned subsidiary Daqing Longheda Food Company Limited, or Longheda, a leading producer of premium specialty fruit-based products in China. We specialize in developing, processing, marketing and distributing a variety of food products processed primarily from premium specialty fruits grown in Northeast China, including golden berry, crab apple, blueberry, raspberry, blackcurrant and seabuckthorn. Our primary product offering includes fruit concentrate, nectar, glazed fruits, concentrate pulp as well as fresh fruits. We have been producing our premium specialty fruit based products since 2004.

We sell our products through a nationwide sales and distribution network covering 17 provinces in China. As of September 30, 2010, this network was comprised of approximately 38 distributors. Our processed fruit products are mainly sold to food producers for further processing into fruit juice and other fruit related foods, and our fresh fruits are mainly sold to fruit supermarkets.

Quality and safety are of primary importance to us. We have established quality control and food safety management systems for all stages of our business, including raw material sourcing, producing, packaging, storage and transportation of our products. We currently operate from our manufacturing facilities located in Daqing and Mu Dan Jiang, Heilongjiang province, China where abundant supply of a variety of premium specialty fruits is available. We have five fruit processing lines with an aggregate capacity of 17,160 tons.

Our Industry

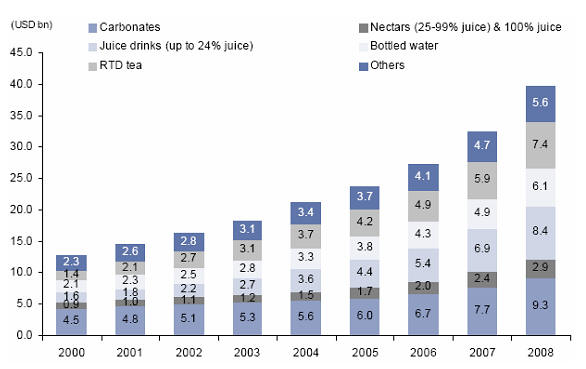

According to a report on China’s fruit processing industry issued by Beijing Business & Intelligence Consulting Co. Ltd., an independent market research firm, which is hereinafter referred to as the “BBIC Report”, China’s fruit processing industry has grown significantly in the past several years. The total output of processed fruit products in China grew from $16.8 billion in 2005 to $49.7 billion in 2009, representing a compound annual growth rate, or CAGR, of 31.15%. The sales value of processed fruit products in China grew from $17.0 billion in 2005 to $47.0 billion in 2009, representing a CAGR of 28.95%.

With approximately a quarter of the world’s population, China represents a key growth driver for the global fruit food market. According to Euromonitor, the per capita fruit juice consumption in China is currently well below that of major developed countries, indicating that there is significant growth potential for products like ours. We believe the growth of China’s fruit based products has been, and will continue to be, driven by growing acceptance and increasing affordability of fruit based products in China and enhanced health consciousness.

Our Competitive Strengths

We believe the following competitive strength will contribute our future growth:

-

High-end niche products. In our market, we position our products as high-end premium products due to a high nutrient content.

1

-

Solid market position and rapid growth. We believe that we are one of the largest processors of golden berries in China. In the past several fiscal years, our revenue has grown from $23.0 million in fiscal year 2007 to $72.9 million in fiscal year 2010. Our net income has grown from $7.6 million in fiscal year 2007 to $19.3 million in fiscal year 2010.

-

Established raw material procurement network. Our facilities are located close to major premium specialty fruit orchards in Northeastern China which allows us to have easy access to the supply of the source fruits, enjoy sourcing stability and maintain a competitive cost structure.

-

Emphasis on quality control and food safety. We have quality control and food safety management systems for all stages of our business from raw materials sourcing to production, packaging and storage to product transportation. We adhere to internal quality standards that we believe are stricter than the PRC national standards. Our processing facility possesses ISO9001 and HACCP series qualifications.

-

Extensive nationwide sales and distribution network. As of September 30, 2010, we had approximately 38 regional distributors in 17 provinces in China which allows us to sell our products to customers throughout China.

-

Experienced management team with a strong track record. Our management team has extensive operating experience and industry knowledge. Changjun Yu, our founder and chairman, has over 15 years of experience in the fruit based product industry. This extensive local industry experience is combined with international experience. Our chief financial officer Colman Cheng has over 14 years of auditing, accounting and financial management experience in international companies.

Our Strategy

As an established premium specialty fruit based product company in China, we believe we are well positioned to capitalize on future industry growth in China. We are dedicated to providing healthy and high nutritional premium specialty fruit based products. We will implement the following strategic plans to take advantage of industry opportunities and our competitive strengths:

-

Increase production capacity. Our existing production lines have been running at close to full capacity in fiscal year 2010 even as market demand for our existing products grows. We are building our new fruit and vegetable powder production line with an annual production capacity of 10,000 tons and plan to build another fruit and vegetable powder production line with an expected annual production capacity of 10,000 tons in Daqing and a new factory facility in Mu Dan Jiang with a new multi-purpose concentrate juice/pulp production line with an expected annual production capacity of 8,000 tons in 2011.

-

Further strengthen our raw materials procurement network. We believe that a reliable supply of principal raw materials is crucial to our future success. Hence, we intend to further strengthen our existing cooperative relationship with the two golden berry farm bases from which we procure golden berries and develop new relationship with other golden berry farm bases.

-

Further expand our distribution network to increase the prevalence of our products nationwide. Our current sales depend heavily on our regional distributors and their network. To support our rapid growth in sales, we plan to further expand our distribution network.

-

Continue to diversify our product portfolio to satisfy different customer preferences. We currently offer four series of products processed primarily from six types of source fruits, concentrate pulp and fresh golden berries. We constantly evaluate our products and seek to adapt to changing market conditions by updating our products to reflect new trends in consumer preferences.

2

Risk Factors

Our ability to successfully operate our business and achieve our goals and strategies is subject to numerous risks as discussed more fully in the section titled “Risk Factors,” including for example:

-

Our ability to acquire raw materials in sufficient quantity and on commercially competitive terms, and at quality levels meeting our stringent standards;

-

Our dependence on consumer perception of safety and quality of our products as well as similar products distributed by other companies in our industry;

-

Our ability to expand our operations and production capacities sufficiently to meet our customers’ demands;

-

Our ability to effectively manage rapid growth and accurately project market demand for our products; and

-

Unexpected change in China’s political or economic situation or legal environment.

Any of the above risks could materially and negatively affect our business, financial position and results of operations. An investment in our TDR and common stock involves risks. You should read and consider the information set forth in “Risk Factors” and all other information set forth in this prospectus before investing in our TDR and common stock.

Corporate Information

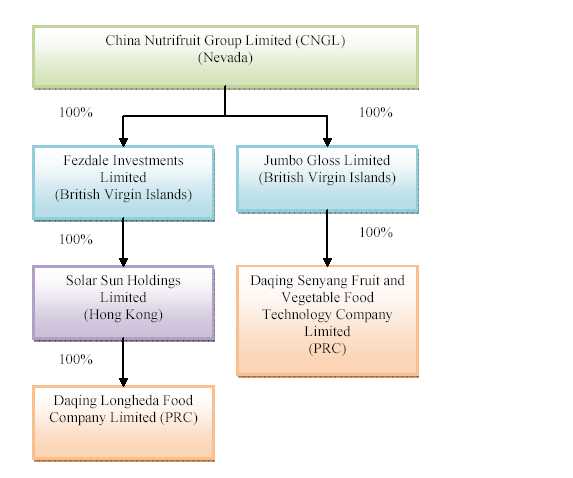

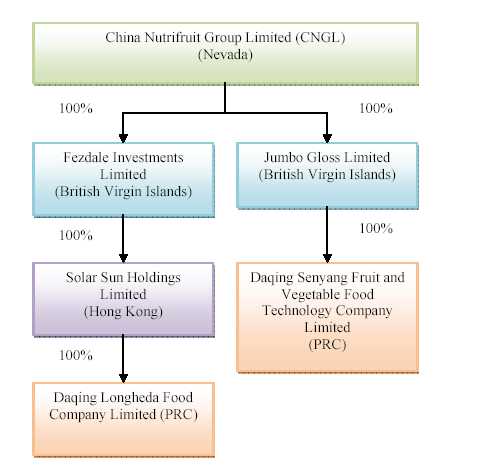

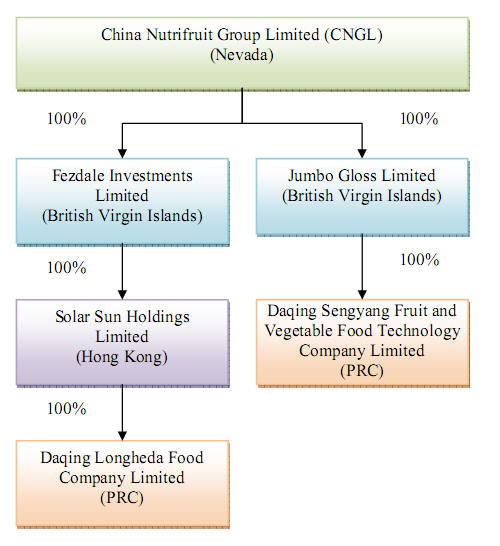

We were originally incorporated in the state of Utah in 1983, but changed our state of incorporation to Nevada on April 16, 1999. On August 14, 2008, we acquired Fezdale Investments Limited, or Fezdale, a British Virgin Islands corporation, in a reverse acquisition transaction. We conduct our operations in China through our indirect PRC subsidiary Longheda. We amended our Articles of Incorporation to change our name to China Nutrifruit Group Limited on August 14, 2008 to better reflect our business after the acquisition. See “Corporate Structure and History – Our Corporate History.”

The following chart reflects our organizational structure as of the date of this prospectus.

3

The address of our principal executive office in 5th Floor, Chuangye Building, Chuangye Plaza Industrial Zone 3, Daqing Hi-Tech Industrial Development Zone, Daqing, Heilongjiang China 163316, and our telephone number is (86) 459-8972870. We maintain a website at www.chinanutrifruit.com. Information available on our website is not incorporated by reference in and is not deemed a part of this prospectus.

Conventions

In this prospectus, unless indicated otherwise, references to

-

“TDRs” are to our Taiwan depositary receipt, each of which represents one tenth share of our common stock;

-

“common stock” are to our common stock, par value $0.001 per share;

-

“TSE” are to the Taiwan Stock Exchange;

-

“China,” “Chinese” and “PRC” refer to the People’s Republic of China;

-

“Taiwan” refer to the Republic of China;

-

“RMB” refers to Renminbi, the legal currency of China;

-

“TWD” refers to New Taiwan dollar, the legal currency of the Republic of China; and

-

“U.S. dollars,” “dollars” and “$” refer to the legal currency of the United States.

Unless the context indicates otherwise, “we,” “us,” “our company,” “our” and “China Nutrifruit” refer to the combined business of China Nutrifruit Group Limited and its consolidated subsidiaries, but do not include the stockholders of China Nutrifruit Group Limited. See “Corporate Structure and History.”

4

Unless otherwise indicated, our financial information presented in this prospectus has been prepared in accordance with U.S. GAAP.

The Offering

TDRs offered:

|

By China Nutrifruit Group Limited |

50,000,000 TDRs, representing 5,000,000 shares of common stock |

|

By the selling stockholder |

23,000,000 TDRs, representing 2,300,000 shares of common stock |

|

TDRs outstanding immediately after this offering |

73,000,000 TDRs |

|

Common stock outstanding after the offering |

41,794,532 shares |

|

Offering price per TDR |

$ per TDR |

|

Use of proceeds |

We intend to use the net proceeds from this offering for construction of a new fruit and vegetable production line in Daqing, a new factory facility with a new multi-purpose concentrate juice/pulp production line in Mu Dan Jiang. |

|

|

|

|

|

We will not receive any proceeds from sale of the TDRs by the selling stockholder. |

|

|

|

|

The TDRs |

Each TDR represents one-tenth share of common stock, par value $0.001 per share. The depositary will be the registered holder of the shares of common stock underlying your TDRs. |

|

|

|

|

You will have the rights of a TDR holder as provided in a deposit agreement among us, the depositary bank and holders and beneficial owners of TDRs from time to time. You will be required to pay fees to the depositary upon issuance and cancellation of TDRs and distributions of cash or securities, and certain fees, charges, costs or expenses incurred by the depositary. | |

|

|

|

|

To better understand the terms of our TDRs, including fees, charges, costs or expenses, you should carefully read the section in this prospectus entitled “Description of Taiwan Depositary Receipt.” We also encourage you to read the deposit agreement, which is an exhibit to the registration statement that includes this prospectus. We may amend or terminate the deposit agreement for any reason without your consent. If an amendment becomes effective, you will be considered, by continuing to hold your TDRs, to have agreed to be bound by the deposit agreement as amended. |

5

|

Dividend policy |

Our board of directors does not intend to declare cash dividends on our common stock for the foreseeable future. |

|

|

|

|

Listing |

We plan to apply for and intend to have our TDRs listed on the Taiwan Stock Exchange under the symbol “ ” upon completion of this offering. |

|

|

|

|

Our common stock is listed on the NYSE Amex under the symbol “CNGL.” | |

|

|

|

|

Depository |

China Development Industrial Bank |

|

|

|

|

Payment and settlement |

We expect our TDRs to be delivered against payment on or about , 2010 |

Proposed Taiwan Stock Exchange Symbol

Currently, there is no public market for our TDRs in the United States, Taiwan or anywhere else in the world and no assurances can be given that a public market will develop in the United States or Taiwan or, if developed, that it will be sustained. We plan to apply for and intend to have our TDRs listed on the TSE promptly after the registration statement filed with the SEC of which this prospectus is a part is declared effective. We do not expect any TDRs to be traded on the NYSE Amex or any other U.S. based securities exchange.

We plan to submit an offering circular in Chinese language with the Taiwan Stock Exchange Corporation and the Taiwan Securities and Future Bureau as practical as possible, which is hereinafter referred to as the “Taiwan Offering Circular.” The English translation of such offering circular is attached as Appendix A to this prospectus and is translated from Chinese into English for your information only. U.S. federal securities laws and the laws of the Republic of China, or Taiwan, and the Taiwanese Stock Exchange have different requirements regarding the contents of and information required in, a prospectus or offering circular. We also note that linguistic differences naturally occur in a literal translation of a document from one language into another language. The Taiwan Offering Circular is intended to be used by investors based in Taiwan. Such investors should refer to the Taiwan Offering Circular in Chinese language, which will be available at http://mops.twse.com.tw/mops/web/index once it is published.

6

Summary Consolidated Financial Information

The following table summarizes selected financial data regarding our business and should be read in conjunction with our consolidated financial statements and related notes contained elsewhere in this prospectus and the information under “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

The summary consolidated statement of income for the years ended March 31, 2009 and 2010 and the summary balance sheet data as of March 31, 2010 are derived from our audited consolidated financial statements included elsewhere in this prospectus. We derived our summary consolidated financial data as of September 30, 2009 and 2010 and for the six months ended September 30, 2009 and 2010 from our unaudited consolidated financial statements included in this prospectus, which include all adjustments, consisting of normal recurring adjustments, that our management considers necessary for a fair presentation of our financial position and results of operations as of the dates and for the periods presented. The results of operations for past accounting periods are not necessarily indicative of the results to be expected for any future accounting period.

(All amounts, except earnings per share date, in thousands of U.S. dollars)

| (Unaudited) | (Audited) | |||||||||||

| Six Months Ended | Fiscal Year Ended | |||||||||||

| September 30, | March 31, | |||||||||||

| 2010 | 2009 | 2010 | 2009 | |||||||||

| Summary Consolidated Statement of Operations: | ||||||||||||

| Net sales | $ | 32,819 | $ | 28,684 | $ | 72,917 | $ | 56,419 | ||||

| Cost of sales | 17,744 | 15,054 | 39,656 | 31,778 | ||||||||

| Gross profit | 15,075 | 13,630 | 33,261 | 24,641 | ||||||||

| Selling expenses | 1,258 | 1,498 | 3,547 | 2,930 | ||||||||

| General and administrative expenses | 1,696 | 1,515 | 3,977 | 12,409 | ||||||||

| Interest expenses | - | - | - | 480 | ||||||||

| Other income | 48 | 39 | 361 | 32 | ||||||||

| Income before noncontrolling interests and income taxes | 12,170 | 10,656 | 26,098 | 8,854 | ||||||||

| Provision for income taxes | 3,187 | 2,770 | 6,849 | 4,128 | ||||||||

| Noncontrolling interests | - | - | - | 209 | ||||||||

| Net income | 8,983 | 7,886 | 19,249 | 4,517 | ||||||||

| As of | As of | |||||||||||

| September 30, 2010 | March 31, 2010 | |||||||||||

| Summary balance sheet data: | ||||||||||||

| Cash and cash equivalent | 7,154 | 35,994 | ||||||||||

| Total current asset | 53,215 | 52,270 | ||||||||||

| Total assets | 80,352 | 70,591 | ||||||||||

| Current liabilities | 4,776 | 4,763 | ||||||||||

| Total long-term liabilities | - | - | ||||||||||

| Total liabilities | 4,776 | 4,763 | ||||||||||

| Total stockholders’ equity | 75,576 | 65,828 | ||||||||||

7

| Six Months Ended | Fiscal Year Ended | |||||||||||

| September 30, | March 31, | |||||||||||

| 2010 | 2009 | 2010 | 2009 | |||||||||

| Summary state of cash flow: | ||||||||||||

| Net cash (used in)/provided by operating activities | (20,708 | ) | (162 | ) | 21,667 | 6,301 | ||||||

| Net cash used in investing activities | (9,418 | ) | - | (1,701 | ) | (19,956 | ) | |||||

| Net cash provided by financing activities | 122 | 10,874 | 11,283 | 11,748 | ||||||||

| Effect of exchange rate on cash and cash equivalents | 1,163 | (16 | ) | (24 | ) | (429 | ) | |||||

| Cash and cash equivalents at beginning of the period | 35,994 | 4,769 | 4,769 | 7,105 | ||||||||

| Cash and cash equivalents at end of period | 7,154 | 15,465 | 35,994 | 4,769 | ||||||||

.

8

RISK FACTORS

An investment in our securities involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this prospectus, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our securities could decline, and you may lose all or part of your investment.

RISKS RELATED TO OUR BUSINESS

The recent financial crisis could negatively affect our business, results of operations, and financial condition.

While the financial crisis has stabilized in China, the global economy remains precarious and faces many challenges, which affect our business in a variety of ways. Our ability to access the capital markets may be restricted at a time when we would like, or need, to raise capital, which could have an impact on our flexibility to react to changing economic and business conditions. In addition, these economic conditions also impact levels of consumer spending, which have recently deteriorated significantly and may remain depressed for the foreseeable future. Consumer purchases of discretionary items generally decline during recessionary periods and other periods where disposable income is adversely affected. If demand for our products fluctuates as a result of economic conditions or otherwise, our revenue and gross margin could be harmed.

Any ill effects, product liability claims, recalls, adverse publicity or negative public perception regarding particular fruits we use as raw materials, our products or our industry in general could harm our sales and cause consumers to avoid our products.

The food industry is subject to risks posed by food spoilage and contamination, product tampering, product recall, and consumer product liability claims. Our operations could be impacted by both genuine and fictitious claims regarding our and our competitors’ products. In the event of product contamination or tampering, we may need to recall some of our products. A widespread product recall could result in significant loss due to the cost of conducting a product recall including destruction of inventory and the loss of sales resulting from the unavailability of the product for a period of time.

In addition, any adverse publicity or negative public perception regarding particular fruits we use as raw materials, our products, our actions relating to our products, or our industry in general could result in a substantial drop in demand for our products. This negative public perception may include publicity regarding the safety or quality of particular fruits we use as raw materials or products in general, of other companies or of our products specifically. Negative public perception may also arise from regulatory investigations or product liability claims, regardless of whether those investigations involve us or whether any product liability claim is successful against us. We could also suffer losses from a significant product liability judgment against us. Either a significant product recall or a product liability judgment, involving either our company or our competitors, could also result in a loss of consumer confidence in our products or the food category, and an actual or perceived loss of value of our brands, materially impacting consumer demand.

Any fluctuations in raw material supply and prices may negatively impact our revenue.

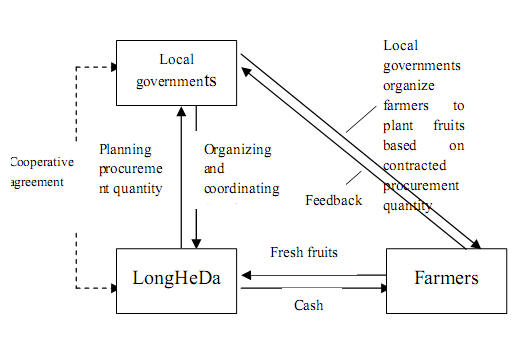

A secure supply of principal raw materials is crucial to our operation. Fresh fruits accounted for approximately 74% of our cost of sales in fiscal year 2010. The per unit costs of producing our products are subject to the supply and price volatility of raw materials, especially fresh fruits which are affected by factors such as weather, growing condition and pest that are beyond our control. According to the BBIC Report, approximately 20-30% of fruit grown in China is lost. Historically, we have been able to meet our fresh fruit supply needs by building our processing facilities in close proximity to orchards and by collaborating with local government and establishing an effective group of vendors. Increases in the price of fresh fruits would negatively impact our gross margins if we are not able to offset such price increases through increases in our selling price or changes in our product mix.

9

If we cannot maintain a consistent and cost-effective supply of source fruits, our results of operations, financial condition and business prospects will deteriorate.

The availability, size, quality and cost of source fruits for the production of our products are subject to operational risks inherent to farming, such as crop size, quality, and yield fluctuation caused by poor weather and growing conditions, pest and disease problems, and other factors beyond our control. These and other operational risks could cause significant fluctuations in the availability and cost of the source fruits we use as raw materials. The prices of our fresh source fruits and other raw materials are generally determined by the market, and may change at any time. Increases in prices for any of these raw materials could have a material adverse impact on our ability to achieve profitability.

Currently, we source our fresh golden berries primarily from two fruit farms pursuant to cooperation agreements with local governments and other fruits from agents who procure fruit for us from individual farmers. While we believe that we have adequate sources of raw materials and that we in general maintain good supplier relationships, if we are unable to continue to find adequate suppliers for our raw materials on economic terms acceptable to us, it will adversely affect our results of operations, financial condition and business prospects.

We compete in an industry that is brand-conscious, and unless we are able to establish and maintain brand name recognition our sales may be negatively impacted.

Our business is substantially dependent upon awareness and market acceptance of our products and brand by our targeted consumers. In addition, our business depends on acceptance by our independent distributors and consumers of our brand. Although we believe that we have made progress towards establishing market recognition for our brand “农珍之冠” in the Chinese fruit products industry, it is too early in the product life cycle of the brand to determine whether our products and brand will achieve and maintain satisfactory levels of acceptance by independent distributors and retail consumers.

We compete in an industry characterized by rapid changes in consumer preferences, so our inability to continue developing new products to satisfy our consumers’ changing preferences would have a material adverse effect on our sales volumes.

Our products are processed from premium specialty fruits and sell at a high price. A decline in the consumption of our products could occur as a result of a change in consumer preferences, perceptions and spending habits at any time. Future success will depend partly on our ability to anticipate or adapt to such changes and to offer, on a timely basis, new products that meet consumer preferences. Our failure to adapt our product offering to respond to such changes may result in reduced demand and lower prices for our products, resulting in a material adverse effect on our sales volumes, sales and profits.

Our current market distribution and penetration is limited as compared with the potential market and so our initial views as to customer acceptance of a particular product can be erroneous, and there can be no assurance that true market acceptance will ultimately be achieved. In addition, customer preferences are also affected by factors other than taste. If we do not adjust to respond to these and other changes in customer preferences, our sales may be adversely affected.

10

We rely primarily on third-party distributors, which could affect our ability to efficiently and profitably distribute and market our products, maintain our existing markets and expand our business into other geographic markets.

We do not sell our products directly to end customers. Instead, we rely on third-party distributors for the sale and distribution of our products. As of September 30, 2010, this network comprised approximately 38 distributors. We typically do not enter into long-term agreements with distributors and have no control over their everyday business activities. To the extent that our distributors are distracted from selling our products or do not expend sufficient efforts in managing and selling our products, our sales will be adversely affected. Our ability to maintain our distribution network and attract additional distributors will depend on a number of factors, many of which are outside of our control. Some of these factors include: (i) the level of demand for our brand and products in a particular distribution area; (ii) our ability to price our products at levels competitive with those offered by competing products and (iii) our ability to deliver products in the quantity and at the time ordered by distributors.

There can be no assurance that we will be able to meet all or any of these factors in any of our current or prospective geographic areas of distribution. Furthermore, shortage of adequate working capital may make it impossible for us to do so. Our inability to achieve any of these factors in a geographic distribution area will have a material adverse effect on our relationships with our distributors in that particular geographic area, thus limiting our ability to maintain and expand our market, which will likely adversely effect our revenues and financial results.

We generally do not have long-term agreements with our distributors, and we may need to spend significant time and incur significant expense in attracting and maintaining key distributors.

Our marketing and sales strategy presently, and in the future, will rely on the performance of our independent distributors and our ability to attract additional distributors. We generally have one-year written agreements with our distributors which are renewable at the beginning of every year. In addition, despite the terms of the written agreements with certain of our significant distributors, we have no assurance as to the level of performance under those agreements, or that those agreements will not be terminated. There is also no assurance that we will be able to maintain our current distribution relationships or establish and maintain successful relationships with distributors in new geographic distribution areas. Moreover, there is the additional possibility that we will have to incur significant expenses to attract and maintain key distributors in one or more of our geographic distribution areas in order to profitably exploit our geographic markets. We may not have sufficient working capital to allow us to do so.

Failure to execute our business expansion plan could adversely affect our financial condition and results of operations.

We are currently building a new fruit and vegetable powder facility which is expected to start production in early 2011. We also plan to build another fruit and vegetable powder production line with an expected annual production capacity of 10,000 tons in Daqing and a new factory facility in Mu Dan Jiang with a new multi-purpose concentrate juice/pulp production line with an expected annual production capacity of 8,000 tons. Our decision to increase our production capacity was based in part on our projections of increases in our sales volume and growth in the size of the premium specialty fruit and vegetable based product market in China. If actual customer demand does not meet our projections, we will likely suffer overcapacity problems and may have to leave capacity idle, which may reduce our overall profitability and adversely affect our financial condition and results of operations. Our future success depends on our ability to expand our business to address growth in demand for our current and future products. Our ability to add production capacity and increase output is subject to significant risks and uncertainties, including:

-

the unavailability of additional funding to expand our production capacity, purchase additional fixed assets and purchase raw materials on favorable terms or at all;

-

delays and cost overruns as a result of a number of factors, many of which may be beyond our control, such as problems with equipment vendors and suppliers of raw materials;

11

-

failure to maintain high quality control standards;

-

shortage of source fruits;

-

our inability to obtain, or delays in obtaining, required approvals by relevant government authorities;

-

diversion of significant management attention and other resources; and

-

failure to execute our expansion plan effectively.

As our business grows, we will need to implement a variety of new and upgraded operational and financial systems, procedures and controls, including improvements to our accounting and other internal management systems by dedicating additional resources to our reporting and accounting functions, and improvements to our record keeping and contract tracking system. We will need to respond to competitive market conditions and continue to enhance existing products and develop new products, and retain existing customers and attract new customers. We will also need to recruit more personnel and train and manage our growing employee base. Furthermore, we will need to maintain and expand our relationships with our current and future customers, suppliers, distributors and other third parties, and there is no guarantee that we will succeed.

If we encounter any of the risks described above, or are otherwise unable to establish or successfully operate additional production capacity or to increase production output, we may be unable to grow our business and revenues, reduce our operating costs, maintain our competitiveness or improve our profitability, and our business, financial condition, results of operations and prospects may be adversely affected.

Because we experience seasonal fluctuations in our sales, our quarterly results will fluctuate and our annual performance will depend largely on results from three quarters.

Our business is highly seasonal in production, reflecting the harvest season of our primary source fruits during the months from mid-July to mid-November. Typically, a substantial portion of our revenues are earned during our second, third and forth fiscal quarters. We generally experience lowest revenues during our first fiscal quarter. Sales in the second, third and forth fiscal quarters accounted for approximately 26.5%, 24.4% and 36.2% of our total revenues for the fiscal year ended March 31, 2010, respectively. If sales in these quarters are lower than expected, our operating results would be adversely affected, and it would have a disproportionately large impact on our annual operating results.

Due to our rapid growth in recent years, our past results may not be indicative of our future performance and evaluating our business and prospects may be difficult.

Our business has grown and evolved rapidly in recent years as demonstrated by our growth in net sales for the fiscal year ended March 31, 2010 to $72.9 million from $56.4 million during the prior fiscal year and $32.8 million for the six months ended September 30, 2010 from $28.7 million for the same period in 2009. We may not be able to achieve similar growth in future periods, and our historical operating results may not provide a meaningful basis for evaluating our business, financial performance and prospects. Moreover, our ability to achieve satisfactory production results at higher volumes is unproven. Therefore, you should not rely on our past results or our historical rate of growth as an indication of our future performance.

12

We depend heavily on key personnel, and turnover of key employees and senior management could harm our business.

Our future business and results of operations depend in significant part upon the continued contributions of our key technical and senior management personnel, including Changjun Yu, our Chairman and Chief Executive Officer and Colman Cheng, our Chief Financial Officer. None of these key management members currently owns any shares of common stock or any other equity interest in the Company. Although they have signed employment agreements with our subsidiary Fezdale which include a non-competition provision which prohibits them from engaging in the food processing industry during the term of the agreement and for two years after the termination of employment, such employment agreements can be terminated at will. If we lose any of these key employees and are unable to find a qualified replacement in a timely manner, our business will be negative impacted. In addition, if a key employee fails to perform in his or her current position, or if we are not able to attract and retain skilled employees as needed, our business could suffer. Significant turnover in our senior management could significantly deplete the institutional knowledge held by our existing senior management team. We depend on the skills and abilities of these key employees in managing the reclamation, technical, and marketing aspects of our business, any part of which could be harmed by turnover in the future.

The concentration of ownership of our securities by our controlling stockholders who do not participate in the management of our business can result in stockholder votes that are not in our best interests or the best interests of our minority stockholders.

Mr. Yiu Fai Kung and Mr. Kwan Mo Ng, collectively own approximately 79% of our outstanding voting securities, giving them controlling interest in the Company. However, neither Mr. Kung nor Mr. Ng is an executive officer or director of the Company and is not a participant in any way in the day to day affairs of the Company. Mr. Kung and Mr. Ng may have little or no knowledge of the details of the Company’s operations and do not participate in the corporate governance of the Company. In addition, this concentration of ownership may also have the effect of discouraging, delaying or preventing a future change of control, which could deprive our stockholders of an opportunity to receive a premium for their shares as part of a sale of our company and might reduce the price of our shares.

Our inability to protect our trademarks, patent and trade secrets may prevent us from successfully marketing our products and competing effectively.

Failure to protect our intellectual property could harm our brands and our reputation, and adversely affect our ability to compete effectively. Further, enforcing or defending our intellectual property rights, including our trademarks, patents, copyrights and trade secrets, could result in the expenditure of significant financial and managerial resources. We produce, market and sell our products under “农珍之冠.” We regard our intellectual property, particularly our trademarks and trade secrets to be of considerable value and importance to our business and our success. We rely on a combination of trademark, patent, and trade secrecy laws, and contractual provisions to protect our intellectual property rights. There can be no assurance that the steps taken by us to protect these proprietary rights will be adequate or that third parties will not infringe or misappropriate our trademarks, trade secrets (including our flavor concentrate trade secrets) or similar proprietary rights. In addition, there can be no assurance that other parties will not assert infringement claims against us, and we may have to pursue litigation against other parties to assert our rights. Any such claim or litigation could be costly and we may lack the resources required to defend against such claims. In addition, any event that would jeopardize our proprietary rights or any claims of infringement by third parties could have a material adverse affect on our ability to market or sell our brands, and profitably exploit our products.

We may be exposed to potential risks relating to our internal controls over financial reporting and our ability to have those controls attested to by our independent auditors.

As directed by Section 404 of the Sarbanes-Oxley Act of 2002, or “SOX 404”, the SEC adopted rules requiring public companies to include a report of management on the company’s internal controls over financial reporting in their annual reports, including Form 10-K. In addition, the independent registered public accounting firm auditing a company’s financial statements must also attest to the operating effectiveness of the company’s internal controls. As a smaller reporting company, we are currently exempt from the auditor attestation requirements. We can provide no assurance that we will comply with all of the requirements imposed thereby. There can be no positive assurance that we will receive a positive attestation from our independent auditors, when required. In the event we identify significant deficiencies or material weaknesses in our internal controls that we cannot remediate in a timely manner or we are unable to receive a positive attestation from our independent auditors with respect to our internal controls, investors and others may lose confidence in the reliability of our financial statements.

13

We have limited insurance coverage and do not carry any business interruption insurance, third-party liability insurance for our production facilities or insurance that covers the risk of loss of our products in shipment.

Operation of our facilities involves many risks, including equipment failures, natural disasters, industrial accidents, power outages, labor disturbances and other business interruptions. Furthermore, if any of our products are faulty, then we may become subject to product liability claims or we may have to engage in a product recall. We do not carry any business interruption insurance, product recall or third-party liability insurance for our production facilities or with respect to our products to cover claims pertaining to personal injury or property or environmental damage arising from defects in our products, product recalls, accidents on our property or damage relating to our operations. Therefore, our existing insurance coverage may not be sufficient to cover all risks associated with our business. As a result, we may be required to pay for financial and other losses, damages and liabilities, including those caused by natural disasters and other events beyond our control, out of our own funds, which could have a material adverse effect on our business, financial condition and results of operations.

We may be exposed to liabilities under the Foreign Corrupt Practices Act and Chinese anti-corruption laws, and any determination that we violated these laws could have a material adverse effect on our business.

We are subject to the Foreign Corrupt Practice Act, or FCPA, and other laws that prohibit improper payments or offers of payments to foreign governments and their officials and political parties by U.S. persons and issuers as defined by the statute, for the purpose of obtaining or retaining business. We have operations, agreements with third parties and we make most of our sales in China. PRC also strictly prohibits bribery of government officials. Our activities in China create the risk of unauthorized payments or offers of payments by the employees, consultants, sales agents or distributors of our Company, even though they may not always be subject to our control. It is our policy to implement safeguards to discourage these practices by our employees. However, our existing safeguards and any future improvements may prove to be less than effective, and the employees, consultants, sales agents or distributors of our Company may engage in conduct for which we might be held responsible. Violations of the FCPA or Chinese anti-corruption laws may result in severe criminal or civil sanctions, and we may be subject to other liabilities, which could negatively affect our business, operating results and financial condition. In addition, the U.S. government may seek to hold our Company liable for successor liability FCPA violations committed by companies in which we invest or that we acquire.

RISKS RELATED TO DOING BUSINESS IN CHINA

Adverse changes in political and economic policies of the PRC government could impede the overall economic growth of China, which could reduce the demand for our products and damage our business.

We conduct substantially all of our operations and generate most of our revenue in China. Accordingly, our business, financial condition, results of operations and prospects are affected significantly by economic, political and legal developments in China. The PRC economy differs from the economies of most developed countries in many respects, including:

14

-

a higher level of government involvement;

-

a early stage of development of the market-oriented sector of the economy;

-

a rapid growth rate;

-

a higher level of control over foreign exchange; and

-

the allocation of resources.

As the PRC economy has been transitioning from a planned economy to a more market-oriented economy, the PRC government has implemented various measures to encourage economic growth and guide the allocation of resources. While these measures may benefit the overall PRC economy, they may also have a negative effect on us.

Although the PRC government has in recent years implemented measures emphasizing the utilization of market forces for economic reform, the PRC government continues to exercise significant control over economic growth in China through the allocation of resources, controlling the payment of foreign currency-denominated obligations, setting monetary policy and imposing policies that impact particular industries or companies in different ways.

Any adverse change in economic conditions or government policies in China could have a material adverse effect on the overall economic growth in China, which in turn could lead to a reduction in demand for our services and consequently have a material adverse effect on our business and prospects.

PRC food hygiene and safety laws may become more onerous, which may adversely affect our operations and financial performance and lead to an increase in our costs which we may be unable to pass on to our customers.

Operators within the PRC fruit processing industry are subject to compliance with PRC food hygiene and safety laws and regulations. Such laws and regulations require all enterprises engaged in the production of fruit based products to obtain a hygiene license. They also set out hygiene standards with respect to food and food additives, packaging and containers, labeling on packaging as well as hygiene requirements for food production and sites, facilities and equipment used for the transportation and the sale of food. Failure to comply with PRC food hygiene and safety laws may result in fines, suspension of operations, loss of hygiene license and, in certain cases, criminal proceedings against an enterprise and its management. Although we are in compliance with current PRC food hygiene and safety laws and regulations, in the event that such laws and regulations become more stringent or widen in scope, we may fail to comply with such laws, or if we comply, our production and distribution costs may increase, and we may be unable to pass these additional costs on to our customers.

Uncertainties with respect to the PRC legal system could limit the legal protections available to you and us.

We conduct substantially all of our business through our operating subsidiary in the PRC. Our operating subsidiary is generally subject to laws and regulations applicable to foreign investments in China and, in particular, laws applicable to foreign-invested enterprises. The PRC legal system is based on written statutes, and prior court decisions may be cited for reference but have limited precedential value. Since 1979, a series of new PRC laws and regulations have significantly enhanced the protections afforded to various forms of foreign investments in China. However, since the PRC legal system continues to rapidly evolve, the interpretations of many laws, regulations and rules are not always uniform and enforcement of these laws, regulations and rules involve uncertainties, which may limit legal protections available to you and us. In addition, any litigation in China may be protracted and result in substantial costs and diversion of resources and management attention. In addition, all of our executive officers and most of our directors are residents of China and not of the United States, and substantially all the assets of these persons are located outside the United States. As a result, it could be difficult for investors to affect service of process in the United States or to enforce a judgment obtained in the United States against our Chinese operations and subsidiary.

15

You may have difficulty enforcing judgments against us.

We are a Nevada holding company and most of our assets are located outside of the United States. All of our current operations are conducted in the PRC. In addition, most of our directors and officers are nationals and residents of countries other than the United States. A substantial portion of the assets of these persons is located outside the United States. As a result, it may be difficult for you to effect service of process within the United States upon these persons. It may also be difficult for you to enforce in U.S. courts judgments on the civil liability provisions of the U.S. federal securities laws against us and our officers and directors, most of whom are not residents in the United States and the substantial majority of whose assets are located outside of the United States. In addition, there is uncertainty as to whether the courts of the PRC would recognize or enforce judgments of U.S. courts. Grandall Legal Group, our counsel as to PRC law, has advised us that the recognition and enforcement of foreign judgments are provided for under the PRC Civil Procedures Law. Courts in China may recognize and enforce foreign judgments in accordance with the requirements of the PRC Civil Procedures Law based on treaties between China and the country where the judgment is made or on reciprocity between jurisdictions. China does not have any treaties or other arrangements that provide for the reciprocal recognition and enforcement of foreign judgments with the United States. In addition, according to the PRC Civil Procedures Law, courts in the PRC will not enforce a foreign judgment against us or our directors and officers if they decide that the judgment violates basic principles of PRC law or national sovereignty, security or the public interest. So it is uncertain whether a PRC court would enforce a judgment rendered by a court in the United States.

If we are found to have failed to comply with applicable laws, we may incur additional expenditures or be subject to significant fines and penalties.

Our operations are subject to PRC laws and regulations applicable to us. However, many PRC laws and regulations are uncertain in their scope, and the implementation of such laws and regulations in different localities could have significant differences. In certain instances, local implementation rules and/or the actual implementation are not necessarily consistent with the regulations at the national level. Although we strive to comply with all the applicable PRC laws and regulations, we cannot assure you that the relevant PRC government authorities will not later determine that we have not been in compliance with certain laws or regulations.

In addition, our facilities and products are subject to many laws and regulations administered by the PRC State Administration for Industry and Commerce, the PRC State Administration of Taxation, the PRC Ministry of Health and Hygiene Permitting Office, the PRC General Administration of Quality Supervision, Inspection and Quarantine, and the PRC State Food and Drug Administration Bureau relating to the processing, packaging, storage, distribution, advertising, labeling, quality, and safety of food products. Our failure to comply with these and other applicable laws and regulations in China could subject us to administrative penalties and injunctive relief, as well as civil remedies, including fines, injunctions and recalls of our products. It is possible that changes to such laws or more rigorous enforcement of such laws or with respect to our current or past practices could have a material adverse effect on our business, operating results and financial condition. Further, additional environmental, health or safety issues relating to matters that are not currently known to management may result in unanticipated liabilities and expenditures.

16

The PRC government exerts substantial influence over the manner in which we must conduct our business activities.

The PRC government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to taxation, import and export tariffs, environmental regulations, land use rights, property and other matters. We believe that our operations in China are in material compliance with all applicable legal and regulatory requirements. However, the central or local governments of the jurisdictions in which we operate may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations.

Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions thereof and could require us to divest ourselves of any interest we then hold in Chinese properties or joint ventures.

Future inflation in China may inhibit our ability to conduct business in China.

In recent years, the Chinese economy has experienced periods of rapid expansion and highly fluctuating rates of inflation. During the past ten years, the rate of inflation in China has been as high as 5.9% and as low as -0.8%. These factors have led to the adoption by the Chinese government, from time to time, of various corrective measures designed to restrict the availability of credit or regulate growth and contain inflation. High inflation may in the future cause the Chinese government to impose controls on credit and/or prices, or to take other action, which could inhibit economic activity in China, and thereby harm the market for our products and our company.

Restrictions on currency exchange may limit our ability to receive and use our sales revenue effectively.

All our sales revenue and expenses are denominated in RMB. Under PRC law, the RMB is currently convertible under the “current account,” which includes dividends and trade and service-related foreign exchange transactions, but not under the “capital account,” which includes foreign direct investment and loans. Currently, our PRC operating subsidiary may purchase foreign currencies for settlement of current account transactions, including payments of dividends to us, without the approval of the State Administration of Foreign Exchange, or SAFE, by complying with certain procedural requirements. However, the relevant PRC government authorities may limit or eliminate our ability to purchase foreign currencies in the future. Since a significant amount of our future revenue will be denominated in RMB, any existing and future restrictions on currency exchange may limit our ability to utilize revenue generated in RMB to fund our business activities outside China that are denominated in foreign currencies.

Foreign exchange transactions by our PRC operating subsidiary under the capital account continue to be subject to significant foreign exchange controls and require the approval of or need to register with PRC government authorities, including SAFE. In particular, if our PRC operating subsidiary borrows foreign currency through loans from us or other foreign lenders, these loans must be registered with SAFE, and if we finance the subsidiary by means of additional capital contributions, these capital contributions must be approved by certain government authorities, including the Ministry of Commerce, or MOFCOM, or their respective local counterparts. These limitations could affect their ability to obtain foreign exchange through debt or equity financing.

17

Fluctuations in exchange rates could adversely affect our business and the value of our securities.

The value of our common stock will be indirectly affected by the foreign exchange rate between the U.S. dollar and RMB and between those currencies and other currencies in which our sales may be denominated. Appreciation or depreciation in the value of the RMB relative to the U.S. dollar would affect our financial results reported in U.S. dollar terms without giving effect to any underlying change in our business or results of operations. Fluctuations in the exchange rate will also affect the relative value of any dividend we issue that will be exchanged into U.S. dollars, as well as earnings from, and the value of, any U.S. dollar-denominated investments we make in the future.

Since July 2005, the RMB has no longer been pegged to the U.S. dollar. Although the People’s Bank of China regularly intervenes in the foreign exchange market to prevent significant short-term fluctuations in the exchange rate, the RMB may appreciate or depreciate significantly in value against the U.S. dollar in the medium to long term. Moreover, it is possible that in the future PRC authorities may lift restrictions on fluctuations in the RMB exchange rate and lessen intervention in the foreign exchange market.

Very limited hedging transactions are available in China to reduce our exposure to exchange rate fluctuations. To date, we have not entered into any hedging transactions. While we may enter into hedging transactions in the future, the availability and effectiveness of these transactions may be limited, and we may not be able to successfully hedge our exposure at all. In addition, our foreign currency exchange losses may be magnified by PRC exchange control regulations that restrict our ability to convert RMB into foreign currencies.

Restrictions under PRC law on our PRC subsidiary’s ability to make dividends and other distributions could materially and adversely affect our ability to grow, make investments or acquisitions that could benefit our business, pay dividends to you, and otherwise fund and conduct our businesses.

Substantially all of our revenues are earned by our PRC subsidiary. However, PRC regulations restrict the ability of our PRC subsidiary to make dividends and other payments to its offshore parent company. PRC legal restrictions permit payments of dividend by our PRC subsidiary only out of its accumulated after-tax profits, if any, determined in accordance with PRC accounting standards and regulations. Our PRC subsidiary is also required under PRC laws and regulations to allocate at least 10% of our annual after-tax profits determined in accordance with PRC GAAP to a statutory general reserve fund until the amounts in said fund reaches 50% of our registered capital. Allocations to these statutory reserve funds can only be used for specific purposes and are not transferable to us in the form of loans, advances or cash dividends. Any limitations on the ability of our PRC subsidiary to transfer funds to us could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our business, pay dividends and otherwise fund and conduct our business.

Failure to comply with PRC regulations relating to the establishment of offshore special purpose companies by PRC residents may subject our PRC resident stockholders to personal liability, limit our ability to acquire PRC companies or to inject capital into our PRC subsidiaries, limit our PRC subsidiaries’ ability to distribute profits to us or otherwise materially adversely affect us.

Our ability to conduct foreign-exchange activities in the PRC is subject to uncertainties surrounding the interpretation of SAFE regulations, one of which is Circular 75. Under the Notice on Relevant Issues in the Foreign Exchange Control over Financing and Return Investment Through Special Purpose Companies by Residents Inside China (as amended and supplemented, “Circular 75”), PRC residents must register with a local branch of SAFE (1) before they establish or gain control of an overseas special purpose vehicle, or SPV, for the purpose of overseas equity financing (including convertible debt financing); (2) when they contribute their assets or equity interests in a domestic enterprise to an SPV or engage in overseas financing after contributing assets or equity interests to an SPV; and (3) when their SPV undergoes a material change outside of China, such as a change in share capital or merger or acquisition. If any PRC resident who holds stock in an SPV fails to make the required SAFE registration and make any amended registration, the onshore PRC subsidiaries of that offshore company may be prohibited from distributing their profits and the proceeds from any reduction in capital, share transfer or liquidation to the offshore SPV. Failure to comply with the SAFE registration and amendment registration requirements described above could result in liability for evading PRC laws applicable to foreign exchange restrictions.

18

We have advised our shareholders who are PRC residents, as defined in Circular 75, to register with the relevant branch of SAFE, as currently required, in connection with their equity interests in us and our acquisitions of equity interests in our PRC subsidiaries. However, we cannot provide any assurances that their existing registrations have fully complied with, and they have made all necessary amendments to their registration to fully comply with, all applicable registrations or approvals required by Circular 75. Moreover, because of uncertainty over how Circular 75 will be interpreted and implemented, and how or whether SAFE will apply it to us, we cannot predict how it will affect our business operations or future strategies. For example, our present and prospective PRC subsidiaries’ ability to conduct foreign exchange activities, such as the remittance of dividends and foreign currency-denominated borrowings, may be subject to compliance with Circular 75 by our PRC resident beneficial holders. In addition, such PRC residents may not always be able to complete the necessary registration procedures required by Circular 75. We also have little control over either our present or prospective direct or indirect shareholders or the outcome of such registration procedures. A failure by our PRC resident beneficial holders or future PRC resident shareholders to comply with Circular 75, if SAFE requires it, could subject these PRC resident beneficial holders to fines or legal sanctions, restrict our overseas or cross-border investment activities, limit our subsidiaries’ ability to make distributions or pay dividends or affect our ownership structure, which could adversely affect our business and prospects.

The M&A Rule establishes more complex procedures for some acquisitions of Chinese companies by foreign investors, which could make it more difficult for us to pursue growth through acquisitions in China.

On August 8, 2006, six PRC regulatory agencies, including the CSRC, promulgated the Provisions Regarding Mergers and Acquisitions of Domestic Enterprises by Foreign Investors, or the “M&A Rule”, which became effective on September 8, 2006 and was amended on June 22, 2009. The M&A Rule establishes additional procedures and requirements that could make some acquisitions of Chinese companies by foreign investors more time-consuming and complex, including requirements in some instances that MOFCOM be notified in advance of any change-of-control transaction and in some situations, require approval of MOFCOM when a foreign investor takes control of a Chinese domestic enterprise. In the future, we may grow our business in part by acquiring complementary businesses, although we do not have any plans to do so at this time. The M&A Rule also requires MOFCOM antitrust review of any change-of-control transactions involving certain types of foreign acquirers. Complying with the requirements of the M&A Rule to complete such transactions could be time-consuming, and any required approval processes, including obtaining approval from MOFCOM, may delay or inhibit our ability to complete such transactions, which could affect our ability to expand our business or maintain our market share.

We face uncertainty from the Circular on Strengthening the Administration of Enterprise Income Tax on Non-resident Enterprises’ Share Transfer (“Circular 698”) released in December 2009 by China's State Administration of Taxation (SAT), effective as of January 1, 2008.

Where a foreign investor indirectly transfers equity interests in a Chinese resident enterprise by selling the shares in an offshore holding company, and the latter is located in a country (jurisdiction) where the effective tax burden is less than 12.5% or where the offshore income of its residents is not taxable, the foreign investor must provide the PRC tax authority in charge of that Chinese resident enterprise with the relevant information within 30 days of the transfer.

19

Where a foreign investor indirectly transfers equity interests in a Chinese resident enterprise through the “abuse of form of organization” and there are no reasonable commercial purposes for such form with the result that the corporate income tax liability is avoided, the PRC tax authorities shall have the power to reassess the nature of the equity transfer in accordance with the “substance-over-form” principle and deny the existence of an offshore holding company that is used for tax planning purposes.

“Income derived from equity transfers” as mentioned in this circular refers to income derived by nonresident enterprises from direct or indirect transfers of equity interest in China resident enterprises, excluding shares in Chinese resident enterprises that are bought and sold openly on the stock exchange.

While the term "indirectly transfer" is not defined, we understand that the relevant PRC tax authorities have jurisdiction regarding requests for information over a wide range of foreign entities having no direct contact with China. The relevant PRC tax authorities have not yet promulgated any formal provisions or formally declared or stated how to calculate the effective tax in the offshore country (jurisdiction) and to what extent and the process of the disclosure to the PRC tax authority in charge of that Chinese resident enterprise. Meanwhile, there are not any formal declarations with regard to how to decide “abuse of form of organization” and “reasonable commercial purpose,” which can be utilized by us to determine if our company complies with the Circular 698.

Under the Enterprise Income Tax Law, we may be classified as a “resident enterprise” of China. Such classification will likely result in unfavorable tax consequences to us and our non-PRC stockholders.

China passed a new Enterprise Income Tax Law, or the EIT Law, and its implementing rules, both of which became effective on January 1, 2008. Under the EIT Law, an enterprise established outside of China with “de facto management bodies” within China is considered a “resident enterprise,” meaning that it can be treated in a manner similar to a Chinese enterprise for enterprise income tax purposes. The implementing rules of the EIT Law define de facto management as “substantial and overall management and control over the production and operations, personnel, accounting, and properties” of the enterprise.