Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(MARK ONE)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED OCTOBER 3, 2010

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO .

COMMISSION FILE NUMBER 0-20225

ZOLL MEDICAL CORPORATION

(Exact name of registrant as specified in its charter)

| MASSACHUSETTS | 04-2711626 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 269 MILL ROAD, CHELMSFORD, MASSACHUSETTS |

01824 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code (978) 421-9655

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, $0.01 Par Value |

The NASDAQ Stock Market LLC | |

| Stock Purchase Rights |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

Large accelerated filer ¨ Accelerated filer x Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting stock held by non-affiliates of the registrant as of April 2, 2010 was $560,431,040 based on a closing sales price of $26.30 (the closing price on April 1, 2010) per share as reported on the NASDAQ Global Select Market (for this computation, the registrant has excluded the market value of all shares of Common Stock reported as beneficially owned by directors and executive officers of the registrant, but includes certain shares beneficially owned by persons known to the registrant to beneficially own more than 10% of the registrant’s Common Stock.)

The number of shares of the registrant’s single class of common stock outstanding as of December 3, 2010 was 21,598,402.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive Proxy Statement for the Registrant’s 2011 Annual Meeting of Shareholders that the Registrant intends to file with the Securities and Exchange Commission within 120 days of the Registrant’s fiscal year ended October 3, 2010 are incorporated by reference into Part III of the Annual Report on Form 10-K.

Table of Contents

Annual Report on Form 10-K

For the Year Ended October 3, 2010

Table of Contents

| Page No. |

||||||

| Item 1. |

3 | |||||

| Item 1A. |

22 | |||||

| Item 1B. |

37 | |||||

| Item 2. |

37 | |||||

| Item 3. |

38 | |||||

| Part II |

||||||

| Item 5. |

39 | |||||

| Item 6. |

42 | |||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

42 | ||||

| Item 7A. |

57 | |||||

| Item 8. |

59 | |||||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

91 | ||||

| Item 9A. |

91 | |||||

| Item 9B. |

91 | |||||

| Part III |

||||||

| Item 10. |

93 | |||||

| Item 11. |

93 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

93 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

93 | ||||

| Item 14. |

93 | |||||

| Part IV |

||||||

| Item 15. |

95 | |||||

| 99 | ||||||

| 59 | ||||||

2

Table of Contents

Except for historical information, the matters discussed in this Annual Report on Form 10-K are forward-looking statements that involve risks and uncertainties. The Company makes such forward-looking statements under the provision of the “Safe Harbor” section of the Private Securities Litigation Reform Act of 1995. Actual future results may vary materially from those projected, anticipated, or indicated in any forward-looking statements as a result of certain known and unknown risk factors. Readers should pay particular attention to the considerations described in Part I, Item 1A. of this Annual Report on Form 10-K entitled “Risk Factors.” Readers should also carefully review the risk factors described in the other documents that the Company files from time to time with the Securities and Exchange Commission. In this Annual Report on Form 10-K, the words “anticipates,” “believes,” “expects,” “intends,” “sees,” “future,” “may,” “will,” “could,” “estimates,” “plans,” and similar words or expressions (as well as other words or expressions referencing future events, conditions or circumstances) identify forward-looking statements. The Company assumes no obligation to update forward-looking statements or update the reasons actual results, performance or achievements could differ materially from those provided in the forward-looking statements, except as required by law.

Overview

ZOLL Medical Corporation (ZOLL, the Company, we or us) develops, manufactures and markets resuscitation devices and related software solutions. ZOLL is continuing its transition from its founding focus on external pacemakers and defibrillators for the treatment of cardiac arrest to a much broader focus on a range of resuscitation devices. This new focus involves not only initial care but prevention of sudden cardiac death in patients with a known risk, as well as care after an event, where initial resuscitation success can be enhanced with specific strategies for improving recovery and reducing morbidity. As the science of resuscitation continues to expand, so does our business opportunity and the potential for revenue growth. We believe there is a substantially greater opportunity to improve operating profitability and achieve significant recurring revenues as we provide products and services to a much larger resuscitation market.

Historically, ZOLL grew primarily from its core defibrillation and pacing technologies used to treat victims of sudden cardiac arrest (SCA) and other heart arrhythmias. This involved the sale of capital equipment to the Hospital and Emergency Medical Services (EMS) markets, which, through expansion and growth, have become relatively mature competitive environments. With a strong product differentiation strategy, ZOLL has been successful at driving long-term revenue growth by increasing its market share through significant investments in research and development and building direct sales and distribution channels.

Late in the 1990’s, ZOLL entered the data management software business seeking to gain leverage in the pre-hospital market. Although these software solutions offer higher profitability, with margins significantly greater than the capital equipment products, and recurring revenues, the revenues generated by this business are relatively modest in comparison to defibrillator revenue. The addition of AEDs (automatic external defibrillators) in 2002 to our product portfolio targeting the Public Access portion of the defibrillator market, again provided new opportunities to drive revenue growth through market expansion. We built market share with our introduction of a truly unique CPR feedback technology, although operating profitability was constrained by the highly fragmented nature of this new, highly competitive part of the market.

Also in the early 2000’s, ZOLL recognized the growth opportunity associated with improving resuscitation and redefined our strategy to focus on the broader resuscitation opportunity. Expanding product offerings to address each of the links in the American Heart Association’s (AHA) Chain of Survival (COS) was a key element of our strategy to provide leadership in the resuscitation market. In fiscal 2005, ZOLL acquired the AutoPulse® to offer enhanced circulatory support and chest compression capability, and also acquired the Power Infuser® fluid resuscitation product, which is used primarily in military applications. In 2006, ZOLL completed a long-term plan to acquire the LifeVest® wearable defibrillator business, whose product is worn by patients at risk

3

Table of Contents

of SCA as a preventative device. In 2007 and 2009, ZOLL acquired therapeutic hypothermia technology and products that are used to provide therapeutic management of patients’ core body temperatures, including as part of post-resuscitation care. Throughout this period, ZOLL’s data management offering was also expanded.

We believe ZOLL’s focus on the much larger resuscitation market has opened up significant new, long-term market opportunities beyond our core business of defibrillation and pacing. The current defibrillation/pacing market is estimated to approximate $1.5 billion annually. The annual U.S. market for the LifeVest, which achieved $68 million of revenue in 2010, has a long-term potential of growing to approximately $1.9 billion annually. While our AutoPulse and temperature management products compete in markets of modest annual size currently, the potential worldwide markets for these products long-term are estimated at $600 million and $2.5 billion, respectively. These new markets will develop over a number of years, accelerating as they grow beyond initial adopters and indications, offering opportunity to expand ZOLL’s growth.

As important, we believe there is significant opportunity to increase ZOLL’s profitability well above our historical levels due to the business models associated with these new markets. In particular, the LifeVest has been built as a service business relying on new and recurring physician prescriptions. The AutoPulse leverages our existing capital equipment distribution channels. Our temperature management solutions offer both a capital equipment product and a steady stream of recurring revenue, which has significant long-term profit potential, from single-use, proprietary disposable catheters used for each treated patient. Finally, we expect that our broader focus on resuscitation will give rise to opportunities to develop or acquire additional resuscitation products to further leverage existing infrastructure.

As ZOLL continues its transition over the next few years to a much broader resuscitation Company, we expect to realize greater opportunities for revenue growth. In addition, we believe there is significantly greater opportunity to improve our rate of operating profitability.

The Clinical Need and Opportunity

Sudden Cardiac Arrest and Resuscitation

An estimated 300,000 people die from SCA annually in the United States. Approximately 1,000 people die of SCA every day outside of the hospital and similar unexpected deaths occur in hospitalized patients at a rate of nearly 100,000 per year. Estimates of the worldwide deaths exceed 1,000,000 each year, making SCA one of the largest public health problems in the world.

Resuscitation in this context refers to the restoration of normal physiological function in a patient who has had an episode of sudden cardiac arrest. More than a 500% difference in survival is reported across communities in the United States, and international results are similar. According to the AHA, the median survival to discharge rate after SCA was 6.4% in the United States. Medical interventions can treat this disease and many tens of thousands of lives could be saved with better quality of resuscitation care.

For SCA victims, time is the most critical element for survival. For every minute of delay in the restoration of effective cardiac function provided by defibrillation—the process of delivering electrical current to the heart to stop the fibrillation and permit the return of coordinated cardiac contractions—survival decreases by as much as 10%. According to the AHA, about 95% of SCA victims in the United States die, in many cases because life-saving defibrillators arrive too late, if at all.

Providing temporary circulatory support with chest compressions and artificial ventilation (i.e., Cardiopulmonary Resuscitation, “CPR”) is also critical to survival when sudden cardiac arrest occurs. When appropriate care is provided in the form of CPR, early defibrillation, advanced life support, and continuing post-resuscitation care, as many as 50% of victims can survive SCA resulting from ventricular fibrillation. For some patients with a known and identified risk of SCA, immediate defibrillation with an external defibrillator or implanted defibrillator can be highly effective, and survival rate can near 100%.

4

Table of Contents

Chain of Survival

A useful metaphor to describe dependent relationships among different aspects of care contributing to survival is the “Chain of Survival.” The metaphor suggests that survival is dependent on the strength of each link, and that any weakness in one link will break the chain and reduce the likelihood of survival. ZOLL’s resuscitation business strategy seeks to provide products that support and strengthen each link in the chain.

Historically, the AHA’s Chain Of Survival (COS) defined the four key steps that rescuers should follow in treating sudden cardiac arrest. The four traditional links in the chain were: early access, circulation, defibrillation, and advanced cardiac life support (ACLS). Historically, heavy emphasis was focused by the market on the defibrillation link in the chain. Over the past decade, the AHA’s view of this COS has emerged to place balanced emphasis on all links of the chain. In addition, the AHA has recently added a fifth link, post-resuscitation care. From our viewpoint, we believe the COS should also include an additional link, preventive care, at the beginning of the COS, and utilize data collection and analysis to tie it all together.

Three Phase Model of CPR/ Resuscitation and ZOLL

Relationships between interventions are well described by the Chain of Survival. Increasingly, the medical community is beginning to understand more about the pathophysiology of cardiac arrest and resuscitation. A Three Phase Model of CPR has been proposed to reflect the time sensitive progression of resuscitation physiology, which in turn requires time-sensitive interventions, many of which are offered by ZOLL. This Three Phase Model suggests that the optimal treatment of cardiac arrest is phase specific and includes an electrical phase in the first four minutes of an arrest, for which early and rapid defibrillation is the foundation for successful resuscitation; a circulatory phase, up to about ten minutes after an arrest where chest compressions and oxygen delivery take priority over other interventions; and a metabolic phase from ten minutes after arrest, where protection of brain and other sensitive organs and tissue should be the focus of care.

In addition to addressing the links in the COS, ZOLL’s approach to the business of resuscitation also recognizes these three phases, and addresses each of them with products that provide and strengthen the distinct therapies needed to insure successful patient outcomes. Our LifeVest wearable defibrillator, our AEDs, and our conventional defibrillators are therapeutic in the electrical phase; our Real CPR Help® to improve manual CPR, and AutoPulse to provide chest compressions, address the circulatory phase; and our temperature management products are directly targeted at the metabolic phase, during which therapeutic hypothermia is associated with protection and improved neurologic outcomes.

ZOLL’s version of the Chain of Survival adds to the AHA’s 5-link chain Early Intervention as the first link, with data management and analysis tying all the links together.

5

Table of Contents

ZOLL Products as Related to the Chain of Survival

Early Intervention Link: The LifeVest Wearable Defibrillator

ZOLL manufactures and markets the world’s only wearable defibrillator, the LifeVest, worn by patients at risk for SCA, providing protection during their changing medical condition and while permanent SCA risk has not been established. The LifeVest allows a patient’s physician time to assess their long-term arrhythmic risk and implement appropriate treatment. The LifeVest is lightweight and easy to wear, allowing patients to return to their activities of daily living, while having the peace of mind that they are protected from SCA. The LifeVest continuously monitors the patient’s heart and, if a life-threatening heart rhythm is detected, the device delivers a treatment shock to restore normal heart rhythm.

The LifeVest is used for a wide range of indications, including following a heart attack, before or after bypass surgery or stent placement, as well as for those with cardiomyopathy or congestive heart failure that places them at particular risk of SCA. In addition, the LifeVest is worn by patients awaiting an implantable defibrillator or after removal of an implantable device due to infection or other reasons. We believe there are a wide range of patient conditions with risk of SCA for which the LifeVest could be an attractive treatment option.

The LifeVest is prescribed by a physician, typically a cardiologist, for a patient to wear during a period of temporary risk of a fatal arrhythmic event and is covered by most health plans in the United States, including commercial, state, and federal plans. Medicare provides coverage for the device rental for patients satisfying specific medical criteria and physician prescription requirements. As of 2010, the LifeVest has been used on more than 30,000 patients.

The LifeVest durable medical equipment (DME) rental business model allows a physician to protect a specific patient from SCA by placing a medical order (i.e., prescription) directly with ZOLL. From this point, ZOLL manages the process, which includes fitting the LifeVest to the specific patient, educating the patient in the hospital, managing the medical documentation and insurance paperwork, and being available to address patient needs once discharged from the hospital.

Potential applications of the LifeVest are broad and the understanding of the factors placing patients at risk of SCA continues to evolve. Wearable defibrillation remains in the early stages of market development. We believe that there is ever-growing awareness of the LifeVest system as a treatment option for patients with SCA risk, and some physicians have incorporated the LifeVest into their practice standards. Despite this progress, market penetration remains low, and we believe that there is substantial opportunity for growth to the extent that the LifeVest becomes accepted as a standard of care. Our ongoing commercial efforts focus on generating growth through clinical acceptance and research demonstrating patient benefit. In our model of potential acceptance across current coverage indications, we estimate that the LifeVest’s market in the United States has the potential to grow over many years to be approximately $1.9 billion annually.

Key Differentiators

The LifeVest is the only non-invasive wearable defibrillator on the market or commercially available today.

Competition

At the present time there is no other device in the market similar to the ZOLL LifeVest. Other treatment options for physicians managing patients at high risk of SCA are an automatic external defibrillator that requires bystander intervention by a family member or an implantable cardiac defibrillator (ICD) that requires surgery. Advances in implantable devices may someday provide for less invasive and less expensive therapies, such as subcutaneous implantable defibrillators, but the noninvasive nature of the LifeVest is a strong differentiator whenever SCA risk is considered temporary or changing. Finally, we believe that any interested, potential competitor would need to follow the same clinical and regulatory path that was required of the LifeVest to prove both safety and efficacy.

6

Table of Contents

CPR Link: AutoPulse

CPR is a means to provide temporary circulation of blood for patients whose hearts have stopped beating. It can be a lifesaving intervention before the arrival or availability of skilled medical care. It is a standard of care and public safety personnel, hospital medical personnel, and many others are required to be regularly trained in the skill. It consists of pressing hard on the patient’s chest at least 100 times per minute and, in some cases, providing ventilation with mouth-to-mouth breathing or mechanical ventilating devices. It is demanding physically and difficult to perform effectively especially over long periods, when a patient needs to be moved, or in a moving ambulance. When performed effectively, about 30% of normal blood flow can be provided to temporarily support a patient and preserve cardiac and brain function (i.e., prevent irreversible death before restoration of normal heart function).

ZOLL develops and markets the AutoPulse®, an automated CPR device. The AutoPulse is battery operated and portable and is designed for use in emergency medical services applications and in hospitals. It is comprised of a backboard and a simple disposable load-distributing band that fastens across a victim’s chest. The AutoPulse automatically calculates the patient’s shape and size for maximum compression/decompression benefit without the need to enter patient information or make manual adjustments. The AutoPulse improves the consistency of circulatory support, reduces the manpower required to perform CPR, and enhances the safety of rescue personnel in a moving vehicle.

The AutoPulse compresses the entire upper chest (thorax) in a unique, circumferential “hands-free” manner, circulating more blood than is customary with manual chest compressions. Studies of the device have shown that it can achieve coronary perfusion pressures equal to normal heart function in some patients. Additionally, it offers the benefit of providing CPR without the need for additional personnel to provide the required manpower to sustain CPR over a long period. It is also permits rescuers to focus on other life-saving interventions while CPR is being done mechanically. At the end of fiscal 2010, there were approximately 5,000 AutoPulse units installed in hospitals and emergency services worldwide.

More recently, significant attention has been directed to decreasing the risk of injury to the rescuers when providing care during ambulance transport, since rescuers are often unrestrained while providing care and subject to serious injury in the event of a crash. The National Association of EMS Physicians, The International Association of Fire Chiefs, and a number of other interested parties have initiatives in this area. Providing manual CPR in a moving vehicle while unrestrained has been identified as an area of focus. The AutoPulse addresses this risk and facilitates the provision of CPR in a moving ambulance while the rescuers are safely restrained.

Key Differentiators

The AutoPulse uses a unique and proprietary mechanism of action (e.g., a load distributing band vs. sternal compression) to provide blood flow nearly equal to or better than normal circulation.

ZOLL has the largest body of clinical research specifically related to the AutoPulse’s clinical performance in both animals and humans. Research supporting the AutoPulse is more extensive than for any other mechanical chest compression device. We are also sponsoring a landmark clinical trial “CIRC” (Circulation Improving Resuscitation Care) to assess the performance of the AutoPulse in comparison to manual CPR in survival to hospital discharge. If the CIRC trial results in data indicating that the AutoPulse is superior to manual CPR, we will have strong clinical evidence supporting improved outcomes in resuscitation. Similar research to support competitive devices is not expected in the near future.

The AutoPulse is designed for uninterrupted use during patient movement. It can be used under a wide range of extrication and transport conditions, including with conventional stretchers, soft stretchers, standard backboards, and extrication chairs with the patient in a horizontal or upright position.

7

Table of Contents

Competition

Two competitors offer devices that are powered with batteries and/or compressed gas to provide mechanical CPR. These devices both essentially duplicate the mechanism of manual CPR by compressing the sternum (i.e., the center of the chest.)

Michigan Instruments, which originally pioneered the introduction of a mechanical CPR device known as a “Thumper”, manufactures the Life-Stat® Model 1108, the newest model, which competes with the AutoPulse as an alternative means of providing mechanical CPR. It is sold through independent distributors in the United States and internationally.

The LUCAS device, similar to the Michigan Instruments device in terms of its mechanism of operation, was developed by Jolife AB, a Swedish company and is distributed globally through Physio-Control, a division of Medtronic, Inc. The product is available in both an air-powered piston-type device and a battery-operated piston-type device.

Defibrillation Link: Professional Defibrillators and AEDs

Professional Defibrillators

Professional defibrillators are used by healthcare professionals to treat patients experiencing SCA in all areas of healthcare. They are installed on all ambulances that provide advanced cardiac life support and in virtually all healthcare facilities. They are typically placed on “crash carts” located on either every hospital unit and care area or placed strategically so they may be rapidly brought to a patient’s bedside by trained staff in the event of need.

When a patient’s condition deteriorates, he or she typically requires emergency monitoring to determine cardiovascular status as part of determining the cause of the event. These events typically occur suddenly, and quick response by emergency medical and healthcare personnel, and the availability of rapid treatment and immediate defibrillation are critical for survival.

Professional defibrillators incorporate monitoring capabilities so professionals can review a patient’s heart rhythm on the device’s associated monitor. The electrocardiogram (ECG) displayed helps to determine the need for a defibrillating shock or external pacing. They also permit the user to manually select the level of energy (“dose”), calculated in joules, used to defibrillate. They incorporate a wide range of energy outputs to cover different defibrillating energy doses required for adult, pediatric and neonatal patients. They are typically equipped with defibrillating “paddles” placed on the chest to deliver the shock, but also increasingly utilize disposable electrodes for combined monitoring and delivery of defibrillation and pacing energy. These defibrillators also include a capability to synchronize the shock to the patient’s heart rhythm by monitoring the ECG, and signaling a specific point in the ECG to discharge. Called “cardioversion,” this specialized procedure is for converting atrial dysrhythmias, which are not life-threatening.

ZOLL’s professional defibrillators also include many selectable monitoring parameters (e.g., oxygen saturation levels (SPO2), 12-lead acquisition and analysis, invasive and non-invasive blood pressure, end tidal CO2 concentrations (ETCO2), carbon monoxide (CO) blood stream levels, blood hemoglobin levels (HbG), and patient temperature) to provide a detailed assessment of a patient’s condition.

Professional defibrillators may also incorporate some features that allow operation with automated ECG analysis and permit use as both an AED and manual device by different levels of care providers in either the organization or facility. These devices typically operate from both AC power and batteries.

ZOLL currently offers many different models of professional defibrillators that are targeted to various use-specific needs.

8

Table of Contents

Our R Series® models are offered mainly to hospitals, where various features, like self-testing and communication with programs to monitor their status, enhance hospital operations and reduce the need for maintenance monitoring of their condition. The “Simple, Smart and Ready” R Series offers multiple channels on a color monitor display. We supply it in versions that allow for use as both a conventional defibrillator and an AED.

The E Series® models are primarily designed for use in EMS, where its rugged design and reliability is matched to the rugged environment of use on ambulances, fire apparatus and other applications outside of the hospital. This device combines both conventional defibrillator and AED capabilities, although it is primarily used as a conventional device.

We recently began marketing a new device called the Propaq® MD specifically for military applications, as well as air medical applications, where its very small, lightweight size makes it ideally suited for these highly specialized uses. A companion device, the Propaq M, which features just the monitoring capabilities, is also being offered to the military. This permits a set of common user interfaces, common accessories, and common batteries to support both products. This commonality is well-suited for the military environment.

Other professional defibrillators we market include the M Series®, which has been sold for both hospitals and EMS applications, and the M Series® CCT device for critical care transport that has been widely adopted in military applications. Our AED Pro® device, which is primarily sold as an AED, also can be operated as a conventional defibrillator and is sometimes purchased for this purpose.

Key Differentiators

We have, with few exceptions, maintained a unique user interface on our defibrillators for more than two decades to ensure consistency from one generation of product to another. This Uniform Operating System has been an important differentiator in our devices, which allows staff familiar with the operation of one model to easily use a new model in an emergency situation.

We maintain many common accessories across our products, enhancing the value of the investments in accessories as they may be used with both old and new models of devices.

Our devices incorporate a unique proprietary feature called “Real CPR Help®,” which provides both visual and audible feedback to rescuers when they are administering CPR, with the purpose of coaching performance and improving the quality of the CPR they provide. Significant research in this area demonstrates both the need for this feedback technology and improvements in performance when it is provided. No other competitor matches the breadth and depth of this technology across their products. We have specific displays on our monitors to show rescuers their performance, and extensive capabilities in data collection to provide post-event data for education and performance assessment. This technology has been licensed to Laerdal Corporation for incorporation into defibrillators manufactured by Philips Medical, a division of Royal Philips Electronics, NV (Philips).

Our defibrillators offer another unique feature, See-Thru CPR®, which can reduce interruptions to CPR by filtering out CPR “noise” in the monitor traces. By allowing rescuers to see the patient’s cardiac electrical activity, the need to stop CPR, which can reduce its effectiveness, is avoided.

We utilize a proprietary Rectilinear Biphasic™ defibrillating waveform in all of our products, which delivers higher current than other manufacturers’ waveforms to high impedance patients. This defibrillating waveform is the only waveform reviewed by the FDA and allowed to have a claim of superiority to monophasic waveforms. We use a unique external pacing waveform originally developed by the late Paul Zoll, M.D., one of the company’s co-founders, that provides electrical capture at substantially lower current and energy than other external pacing waveforms and with far less muscle artifact and patient discomfort during external pacing.

9

Table of Contents

Automated External Defibrillators

An automated external defibrillator (AED) includes only basic defibrillation technology. AEDs have an algorithm that analyzes the heart’s rhythm and, if necessary, allows a rescuer to deliver an electric shock to a victim of SCA. An AED can automatically determine the appropriate treatment for the victim and provide rescuers with instructions usually via audio and text prompts.

The AED Plus® was introduced in 2002. A second AED, the AED Pro, was introduced in 2005. The primary difference from the AED Plus is a large display that allows users to see the patient’s ECG. It also offers advanced capabilities for Basic Life Support (BLS) and ALS users. These features include ECG monitoring with standard ECG electrodes; combined AED capability with manual defibrillation, with controlled access for ALS users; and heightened ruggedness and durability.

Key Differentiators

ZOLL’s AEDs are the only automated external defibrillators to provide real-time feedback related to both rate and depth of chest compressions to a rescuer. Research on AED usage suggests that rescuers using AEDs will advise shocking a victim only approximately half of the time an AED is used to treat sudden collapse. If no shock is advised, a rescuer should provide chest compressions and ventilation (CPR) until other rescuers arrive to improve the victim’s chances of survival. Most other AEDs now incorporate rescuer assistance for CPR in the form of prompts or metronomes, but no other AED approved in the United States provides real-time monitoring of CPR rate and depth. The Company believes this capability is an important element to improving resuscitation outcomes. Strong support for CPR improvement by the American Heart Association and other similar authoritative bodies provides validation of the importance of this feature in ZOLL devices.

In the AED Plus, the use of readily-available consumer batteries is an important feature for maintaining the device over long standby periods due to the convenience of supply. Consumer batteries are also lower in cost than other manufacturers’ dedicated batteries.

Competition for Professional Defibrillators and AEDs

The principal competitors in the area of conventional defibrillators (in hospital and EMS) are Physio-Control and Philips. Both Physio-Control and Philips compete across our entire defibrillator product line. ZOLL also competes with Cardiac Science Corporation, Heartsine Technologies, and Defibtech in the lower cost AED market. In the International market, ZOLL competes with Physio-Control, Philips, most AED competitors, and several other companies varying by country. Physio-Control has generally been the market leader in the industry, mainly due to the large installed base of product accumulated over their years of operation. Today this leadership is challenged by ZOLL and, to a lesser extent, Philips. Medtronic has announced its intention to spin off its external defibrillator business (Physio-Control) into a separate, publicly traded company.

Two large competitors in Japan are Nihon Kohden and Fukuda Denshi. Nihon Kohden competes across all conventional defibrillator products and AEDs, with products of their own and some OEM devices in Japan and outside of the U.S., but has no approvals for U.S. sales of defibrillators. Fukuda Denshi sells Philips conventional defibrillators and AEDs in Japan.

In 2009, Mindray, a Chinese medical device manufacturer, with global headquarters in China and U.S. headquarters in New Jersey, announced the marketing of a monitor/defibrillator product.

Disposable Defibrillator Electrodes

Proprietary disposable electrodes are a key component of both our conventional defibrillators and AEDs. ZOLL manufactures, markets, and sells approximately a dozen different types of electrodes suited for different applications, including monitoring and delivering electrical therapy to patients, as well as providing CPR feedback.

10

Table of Contents

ZOLL’s Real CPR Help electrodes provide a unique, proprietary disposable CPR sensor to enable real-time CPR feedback in the form of Real CPR Help. ZOLL brands that employ this technology include the OneStep™ Resuscitation electrodes, CPR stat-padz®, and the CPR-D•padz®.

Key Differentiators

Electrode shelf-life for proprietary electrodes used with the ZOLL AED is the longest of all manufacturers at five years. This feature is based on a proprietary ZOLL technology. This reduces the frequency of replacement required to maintain device readiness and associated cost of ownership.

Our pro•padz® family of electrodes is designed specifically for elective procedures in hospitals. ZOLL is the only electrode manufacturer that offers a liquid gel electrolyte, which is designed to minimize skin damage. We also offer sterile versions for operating room environments.

Competition

Competition by third-party manufactures includes Kendall-Cadence (a division of Covidien plc) and ConMed Corporation. Neither of these companies manufactures electrodes with a CPR sensor that enables feedback during CPR compressions, liquid gel for elective procedures, or automatic joules setting for pediatrics. While both companies claim that their electrodes have been validated with ZOLL defibrillators, this is true only for earlier ZOLL monophasic devices, but not the biphasic defibrillators that ZOLL manufactures and sells today.

Post Resuscitation Care Link: Temperature Management

Cooling and warming of patients in emergency settings and during hospitalization is a standard of care for many situations, including management of fever, management of patient temperature, and anesthetic effects on body temperature during surgery. More recently the use of cooling, in particular, has been associated with improved outcomes in patients that have been resuscitated from out-of-hospital ventricular fibrillation (VF) sudden cardiac arrest.

The therapy is typically administered with either a non-invasive technique that can range from simple application of ice to patient extremities for cooling, and warm blankets for warming, to invasive techniques that include the placement of a heat exchange catheter in the blood stream of the patient to regulate the temperature of circulating blood. Sometimes both non-invasive and invasive techniques are combined over the course of patient treatment in order to initiate therapy earlier.

ZOLL acquired intravascular temperature management technology related to therapeutic hypothermia and rewarming from Radiant Medical, Inc. in September 2007, and entered the commercial market after the purchase of substantially all of the assets of Alsius Corporation in May 2009. ZOLL Temperature Management products include a portable cooling and warming console and a selection of intravascular catheters. The resulting heat transfer between the catheter and circulating blood can, at a very controlled rate, lower or raise body temperature.

This therapy has established benefits in fever management in patients with cerebral infarction and intracranial hemorrhage (e.g., stroke). This therapy is also used to induce, maintain and reverse mild hypothermia in neurosurgery, recovery, and intensive care. In addition, cardiac surgery patients benefit from the ability of the system to achieve or maintain normothermia during surgery, recovery, and intensive care. The International Liaison Committee on Resuscitation (ILCOR) and the AHA recommend mild therapeutic hypothermia for post-resuscitation care of patients, in spite of the fact that no product has been cleared or approved by the FDA for such use.

A sophisticated portable console, with advanced feedback control systems that carefully regulate cooling and warming of the circulating fluid (normal saline) within the catheter, is the primary reusable element of the

11

Table of Contents

ZOLL IVTM™ system. It interfaces with “single use” disposable proprietary intravascular catheters. These catheters, sized appropriately for insertion into the patient via blood vessels in the thigh and neck, are designed for specific uses. Catheters are packaged in kits containing various accessories to facilitate and provide convenience during the insertion. Catheters are assembled from physiologically compatible materials, including special coatings, and are sterilized as part of production.

Fluid Delivery and Resuscitation Devices

ZOLL manufactures and markets the Power Infuser®, a small, lightweight, easy-to-use device that provides highly controlled, rapid delivery of intravenous (IV) fluids. While primarily used to date in trauma, and sold for military applications related to fluid resuscitation, this product has applications for delivery of cold saline solution associated with early administration of hypothermia in air medical transport, EMS, and emergency room settings. It is expected to add to our therapeutic temperature management product portfolio.

The Power Infuser utilizes a patented process to precisely control the infusion of fluid into the patient. Its automated fluid control features are suited to the harsh conditions typically found on a battlefield or in EMS environments. The technology is highly efficient, allowing the device to be extremely small and portable and to run on standard AAA batteries.

Key Differentiators

ZOLL believes that the advantages of invasive therapeutic hypothermia technology as embodied in our products offers significant advantages in speed of achieving therapy and precise control of achieving and maintaining target temperatures in comparison to noninvasive techniques. The ability to tightly control the rate of rewarming patients following the therapeutic hypothermia therapy is a key advantage of the intravascular approach when compared to non-invasive technologies.

The proprietary design of ZOLL’s catheters, which include additional lumens for sampling, is unique and reduces the need for multiple catheters in patients.

The technique of catheter insertion for ZOLL’s technology is similar to many other catheter placements commonly administered in similarly acute situations. This approach is superior for control of the therapy and overall patient care. Intravascular delivery of hypothermia eliminates the potential for skin injury associated with blanket and pad-type disposables, and also lowers the doses of paralytics and sedation to control patient discomfort and shivering associated with external cooling.

Competition

In the non-invasive portion of the market, Cincinnati Sub-Zero, Gaymar, and MTRE Corporation are the major competitors in North America. Products from these competitors are widely used across all hospitals for a variety of both cooling and warming applications, ranging from reducing fever to warming patients who are cold due to circulatory disorders. The products typically have a console component and a disposable component, such as a mat that circulates warm or cold fluid under or around the patient.

These noninvasive devices and techniques can be used to achieve a reduction in body core temperature (e.g. therapeutic hypothermia) but often interfere with other aspects of patient care due to the nature of their heat exchange interface and coverage of the patient’s body. However, because they are non-invasive, they can be easily applied to a patient by nursing staff, not requiring a physician to place the device. Disposables are typically less expensive than those used with invasive products.

The primary non-invasive competitor for the induction of hypothermia is Medivance Corporation. Their system, which consists of a console and proprietary patient applied adhesive cooling pads, is more sophisticated

12

Table of Contents

than the other surface devices achieving more rapid cooling and incorporating feedback control. It is sold by a direct sales organization in the United States and by distributors in other markets in the rest of the world. A newer surface competitor is EMCools, which manufactures a device that consists of mats that are chilled in a refrigerator/freezer and then laid on the patient.

Our primary competitor in intravascular cooling is InnerCool Therapies, acquired by Philips in July 2009. Philips also competes in the surface cooling market with InnerCool’s STx™ system. Since acquiring InnerCool, Philips has recently announced the funding of a significant clinical trial in the area of therapeutic hypothermia for victims of stroke. Since most critically ill patients requiring this therapy need monitoring or sampling of blood and delivery of medications, combining temperature management and the critical care function of a central venous catheter in one design is preferred. Although the InnerCool catheter is placed in the blood stream, it does not have the triple lumen capability of the ZOLL system.

What Unifies All Links: Data Management and Analysis – The RescueNet Suite of Software

ZOLL develops and markets a suite of software products supporting EMS, fire service and hospital needs in the area of data management information.

ZOLL markets ZOLL RescueNet®, an integrated suite of data management solutions that is designed to maximize specific business processes through the information presented via a common database. RescueNet gathers and centralizes information and links the pre-hospital chain of events into a single system.

Included in the wide range of products offered by ZOLL are electronic patient records, computer assisted dispatching programs, crew and vehicle scheduling software, fire records management software for fire department incident reporting and pre-planning, and billing software. Data reporting to federal agencies, such as the National Fire Incident Reporting System (NFIRS) and the National Emergency Medical Services Information System (NEMSIS), is also incorporated into many of the software products. Other capabilities include reporting for EMS events and patient data provided in required formats to meet requirements from multiple state EMS agencies. Products also provide for the collection and review of information from ZOLL devices like AEDs and manual defibrillators to permit post event documentation and review of device use and related patient information for documentation of care, post event review and training and assessment of quality of care provided.

These software products support EMS and fire organizations by reducing duplication of processes and data entry, improving data accuracy, facilitating data sharing to increase operational efficiency, and—most importantly—improving patient care and enhancing quality of service. RescueNet software solutions allow these organizations to obtain measurable process and quality improvements such as better clinical documentation, improved quality management, more efficient cash flow, and improved operational effectiveness. Furthermore, RescueNet solutions allow customers to review data to make better-informed decisions that help improve resuscitation protocols and outcomes. More than 1600 EMS, fire and ambulance customer locations in the United States, Canada, the United Kingdom, Germany and Australia use ZOLL RescueNet software products in their operations.

ZOLL also develops and markets software for data collection related to resuscitation practices in hospitals. ZOLL offers a system called CodeNet® to provide data collection during resuscitation and to later organize this data into useful information related to performance measures for resuscitation practices. CodeNet also provides for the collection of resuscitation data from ZOLL devices like AEDs and manual defibrillators to permit post-event documentation and review of device use and related patient information, which is useful for documentation of care, post event review and training, and assessment of quality of care provided. CodeNet electronically documents the chain of events during a cardiac arrest event in a hospital, with automatic time stamping. The individual patient record can be combined with the defibrillator record after the event, resulting in complete time synchronization of all interventions during a cardiac arrest event. Additionally, CodeNet provides a link to download case event information to the AHA’s National Registry of Cardiopulmonary Resuscitation, a database of in-hospital cardiac arrest events.

13

Table of Contents

ZOLL’s products are designed to efficiently exchange and share data and work in conjunction with each other to reduce the need for custom interfaces between different manufacturers’ products. These interfaces often add operating complexity and potential issues in reliable data exchange among applications. The suite of software products we offer is designed to operate as a system as well as standalone products.

Most ZOLL data products are sold in the United States and Canada, with emerging sales prospects outside of North America driven mainly by the highly specialized nature of software for emergency services and resuscitation. Overseas sales have commenced recently in Germany, where our direct operations can provide sales, deployment and maintenance contracts associated with software products. We are exploring additional opportunities in international markets, as sales of other products, such as conventional defibrillators, AED and temperature management devices, expand.

The software business also derives ongoing revenue from contracts that provide for initial deployment of software products in an organization, support for the application, updates to software programs, and training in the use of the products, all under the category of ongoing support.

Key Differentiators

The RescueNet software suite is a fully integrated information management system that has the ability to improve clinical and operational performance by collecting and analyzing data across EMS or Fire organizations, including medical device data. We work closely with customers to develop and improve software solutions that are highly specific to the unique market we serve and include many products features and benefits that are unique to our applications.

Strong customer support and service in the areas of deployment, after-sale support, software upgrades, and education are important to customer satisfaction.

ZOLL believes that its software solutions offer the most comprehensive set of applications to export data from its software products to various state and national database applications to facilitate customers in maintaining compliance with regulatory and reporting requirements, as well as supporting benchmarking and quality programs.

Competition

Because of the specialized nature of information management in emergency services, medicine and resuscitation, the number of competitors is fairly diverse. Competition includes many smaller organizations, since the barriers to software development are relatively low. In addition, many agencies develop and support “in house” software and systems to meet their information management needs. Different competitors compete across our suite of products, so depending on the application the competitive environment will vary. We also may “compete” in the software area with agencies to which we sell other ZOLL products and which develop and utilize their own software and maintain an IT support staff for one or more applications.

The largest competitor in this product area is TriTech Corporation, which competes directly in computer assisted dispatch (CAD) and billing software products. In CAD software alone, Intergraph Corporation, Tiburon, Inc. and Motorola, Inc., and approximately six other manufacturers, comprise most of the balance of the market. In the area of billing software, our biggest competitors other than TriTech are Ortius AB (recently acquired by TriTech) and RAM Software Systems, Inc. In the area of electronic records for EMS (ePCR), our largest competitor is Image Trend, Inc., who develops software products that compete directly with our ePCR applications. ZOLL, Image Trend, Sansio Corporation, Medusa Corporation, and ems Charts, Inc. cover a significant portion. Many smaller companies and in-house solutions comprise the balance of this market.

ZOLL competes in the area of software applications to manage records associated with fire suppression and prevention. Fire Records Management Systems products are sold to many of the same customers who purchase

14

Table of Contents

other ZOLL software products and services that link data between software products such as Computer Assisted Dispatch. Our largest competitor is Firehouse Software Corporation. Tiburon Systems is our next largest competitor, with the balance of the market split among the many other software providers that offer these types of applications.

In the hospital market, both Medtronic/Physio-Control and Philips offer software products that collect and store information related to resuscitation, defibrillator use and monitoring, and receipt and storage of 12-lead information from the field related to diagnosis and treatment of myocardial infarction. ZOLL believes their products are generally much more limited in scope and capability than the RescueNet products and the applications it offers. No other competitive products are currently capable of exporting data to the National Registry of Cardiopulmonary Resuscitation, a registry sponsored by the American Heart Association that helps hospitals assess the quality of their services associated with resuscitation and post-resuscitation care.

ZOLL’s Markets

North American Hospital

The North American hospital market consists of approximately 6,000 acute care community hospitals and 1,000 additional hospitals. ZOLL also includes in this market sales to U.S. military hospitals and applications used in this market.

ZOLL defibrillators are used extensively in top hospitals included on the 2010 U.S. News and World Report “Honor Roll” list. To be on the “Honor Roll,” a hospital had to demonstrate breadth of excellence by achieving a high ranking in no fewer than six specialties. More than half of the 20 “Honor Roll” hospitals use ZOLL products, and ten of the 20 are completely standardized to ZOLL defibrillators.

ZOLL believes that overall long-term market growth for hospital defibrillator sales will be driven primarily by increased capabilities including monitoring parameters, CPR support, ECG filtering and analysis to minimize interruptions in CPR, along with data, communication, and asset management support. Additional growth potential for ZOLL arises from the Propaq MD and Propaq M products for critical care transport and military applications.

The North American hospital market for circulation devices like the ZOLL AutoPulse is currently modest. Sales to hospitals of the AutoPulse and other mechanical CPR devices are small in relation to the pre-hospital sales at this stage in market development due to the availability of staff to perform CPR, constraints in hospital spending and the need for continuing education about the advantages of mechanical devices.

ZOLL estimates that the North American market for temperature management devices and accessories is currently modest. ZOLL believes it has a significant portion of invasive temperature management sales and a more modest share of sales of combined invasive and noninvasive products. Future growth is expected to be significant, driven by increasing adoption of therapeutic hypothermia as a treatment for post-resuscitation care. In addition, there is a potential opportunity for long-term growth from a number of other indications being driven by research in areas like myocardial infarction, stroke and neurological injury.

Electrodes and other supplies contribute mainly to North American Hospital revenues and, in general, are specific to use on ZOLL devices. ZOLL believes that the increased sales and use of electrodes will be driven by increased use of interpretive algorithms for automated defibrillation, and the adoption of CPR feedback.

Distribution

ZOLL sells its products to hospitals and military customers primarily through direct sales channels in North America.

15

Table of Contents

North American Pre-hospital

The North American Pre-hospital market for defibrillators includes an EMS component that consists of care providers such as paramedics, Emergency Medical Technicians (EMTs), firefighters, and other first-response personnel with responsibilities for public safety. There are approximately 30,000 — 40,000 ambulances in North America, most equipped with defibrillation capability. Other vehicles, such as fire apparatus, also carry defibrillators. Presently, ZOLL believes that most of the estimated 40,000 ambulances in North America are equipped with defibrillators and that other first-response emergency vehicles will represent an increasingly important market for cardiac resuscitation equipment as the medical community places increased priority on providing such equipment and the necessary training to all first responders. As older defibrillators are replaced on ambulances and other emergency vehicles, we expect that many new purchases will include additional monitoring capabilities and features necessary to provide better patient care.

ZOLL currently estimates that overall market growth for EMS defibrillator sales remains constrained by economic uncertainty and challenging customer budgets. ZOLL believes that it has a solid position in the ALS portion of the North American Pre-hospital market and the overall EMS market.

As part of the Pre-hospital market, Public Access includes non-traditional, non-healthcare users of AEDs. ZOLL believes this market will grow because of the increased awareness of the life-saving potential of simplified lower-cost devices, which can be used before the arrival of professional rescuers. We expect that efforts by the AHA, American Red Cross, National Safety Council, Sudden Cardiac Arrest Association, and Sudden Cardiac Arrest Foundation should help to expand public knowledge of AEDs and increase demand for these devices.

The existence of Federal and state Good Samaritan legislation in the United States increases the likelihood that non-medically trained personnel will be providing care to victims of SCA. Furthermore, some states are passing legislation encouraging, even requiring, AEDs in public places (e.g., schools, health clubs, state buildings). These legislative efforts continue to expand AED usage by non-traditional users including police, fire, and highway patrol personnel. The AHA and virtually all corresponding international organizations have established programs to bring early defibrillation to communities. Early defibrillation is included in the AHA CPR training for all healthcare personnel and some laypersons. ZOLL believes that these developments, together with the introduction of AEDs in highly visible places, will lead to a larger market for AEDs.

The North American pre-hospital market for circulation devices like the ZOLL AutoPulse was modest in 2010. Short-term growth opportunities will remain somewhat constrained by current economic conditions, including lower tax receipts, tight budgets, and lower levels of government spending. ZOLL believes it has a solid position in this market. Adoption of this technology and other mechanical CPR devices in EMS organizations is moving more rapidly than in hospitals at present due to the more limited number of staff available to perform CPR in the pre-hospital setting, and the needs associated with safely restraining ambulance staff when CPR is required during ambulance transport.

The market for data management products is diverse and many companies provide competitive software applications. Historically, ZOLL’s position has been strongest among private ambulance and fire services. In the public safety CAD software market, ZOLL is a new competitor. We believe our position in the EMS data management market for software and data products give us a position to expand into the public safety market and leverage sales coverage and support resources necessary to be successful that are already in place. ZOLL believes that the market for EMS and fire field data management is significant and growing rapidly.

Distribution

ZOLL distributes defibrillation and circulation products, as well as software products, for the EMS pre-hospital market through a direct sales force. Because of the diverse nature of AED customers and sales opportunities across many applications, ZOLL uses a mix of alternate distribution approaches, including direct

16

Table of Contents

sales staff, distributors, and manufacturers’ representatives. The Company has agreements with approximately 400 independent distributors and manufacturers’ representatives to sell AEDs to non-traditional providers of healthcare.

International

The International market for professional defibrillators and AEDs varies considerably from country to country, but is generally less developed than the market in North America. Unlike the North American market, the administration of pacing and defibrillation in hospitals and EMS is generally viewed as a skill reserved for physicians. ZOLL believes it has a modest share of the overall international market for conventional defibrillators, AEDs, electrodes and supplies, and accessories. Demand for defibrillators will grow as more hospitals are built and existing hospitals modernize and update their approaches to cardiac and emergency care. Emerging standards of care and the acceptance of automated equipment should result in increased emphasis on cardiac resuscitation and demand for resuscitation products.

ZOLL believes that the international market for mechanical chest compression devices like the AutoPulse is currently modest, but the opportunity for growth is significant.

While not significant in terms of market share or sales revenue in 2010, we believe there are many opportunities to leverage our success with conventional defibrillators and AEDs with our expertise in data management products in select international markets. Currently, we are selling ePCR software products in Germany, and we expect to add additional sales resources internationally.

Sales of our temperature management products in international markets were $8.5 million in fiscal 2010. We believe we are solidly positioned in this early stage market. Therapeutic hypothermia is being adopted for post-resuscitation care and other indications, and there are much fewer regulatory restrictions on the marketing of the technology for post-resuscitation care relative to those that exist in the United States.

Distribution

ZOLL has direct sales operations in the major developed markets, including the United Kingdom, Germany, France, Netherlands, Austria, and Australia. These subsidiaries all have direct sales representatives who target the professional markets for conventional defibrillators, data products localized for the market, and temperature management products in Germany. We typically rely on independent distributors for other markets like Public Access defibrillation sales of AEDs in countries with direct subsidiaries.

In Japan, a major market for our products, we have a country manager and a large Japanese medical company as a distributor focused on the market for circulation devices. We have recently received approval of our AEDs and defibrillator waveform in Japan from Japanese regulatory authorities. We are currently finalizing distribution arrangements for our defibrillators.

We have country managers or representative liaison offices in most other major international medical device markets, and rely on local independent distributors assigned to focus on different products in the markets.

LifeVest Wearable Defibrillators

ZOLL revenues for the LifeVest wearable defibrillator in fiscal 2010 were $70.7 million up 61% from fiscal 2009. We believe we can drive significant growth in this market, as penetration is low and alternative treatment options are limited. Acceptance of the concept of a wearable defibrillator by professional organizations like the American College of Cardiology, American Heart Association, and the Heart Rhythm Society in North America also represents an opportunity for growth. These organizations’ guidelines are typically driven by clinical studies demonstrating efficacy and improvements to the outcomes of patients treated with new devices. ZOLL is

17

Table of Contents

currently participating in such clinical studies to provide the requisite data to demonstrate the efficacy and successful reduction of mortality in high-risk SCA patients with the LifeVest.

We estimate that the annual market opportunity in the United States for these potential applications when fully penetrated over many years is approximately $1.9 billion. In Germany, where we have recently established direct sales and services for the LifeVest, we estimate the market opportunity at full penetration to be approximately $500 million annually. Similar opportunity exists in other international markets subject to the same prerequisites for sales and revenue in the United States, such as regulatory approval of the device and therapy, adequate patient service capabilities, and reimbursement coverage.

The market for a wearable defibrillator is currently served only by ZOLL.

Distribution

We currently rent the LifeVest to patients for whom the device is prescribed in the United States via a direct sales organization of more than 100 field representatives, 16 managers and over 500 independent patient service representatives, most of whom are part-time medical professionals. We expect to expand this organization as revenues continue to grow.

A similar, but initially smaller, sales model is being implemented in Germany to support sales in the German market.

Foreign Operations

ZOLL currently conducts business outside of the United States through subsidiaries in Canada, Germany, Austria, The Netherlands, France, Australia, New Zealand, and the United Kingdom. The Company operates a number of additional international offices and has entered into distributor and sales representative business relationships in the world’s major markets. ZOLL sells its products in more than 140 countries. For additional information concerning foreign operations, see Note O of the Notes to Consolidated Financial Statements.

Research and Development

ZOLL’s research and development strategy is to continually improve and expand its product lines by combining existing proprietary technologies, newly developed proprietary technologies and the technologies of ZOLL’s suppliers into new product offerings that provide additional valued benefits to its customers.

ZOLL pursues a multi-disciplinary approach to product design that includes substantial electrical, mechanical, software and biomedical engineering efforts. The Company is currently focusing research and development programs in temperature management, data management, next-generation product platforms, clinical trials, expansion of its long-term technical research efforts, and other initiatives. Research and development expenses for fiscal 2010, 2009, and 2008 were approximately $45.9 million, $39.5 million and $32.4 million, respectively.

Manufacturing

ZOLL’s primary manufacturing facilities are located in Chelmsford, Massachusetts; Pawtucket, Rhode Island; Sunnyvale, California; and Pittsburgh, Pennsylvania. In Chelmsford, ZOLL generally assembles its defibrillation devices and the Power Infuser from components produced to its specifications by ZOLL’s suppliers. In Pawtucket, ZOLL manufactures its electrode products. The AutoPulse and temperature management products are manufactured at the facility located in Sunnyvale, and the LifeVest is built at the facility in Pittsburgh.

18

Table of Contents

Patents and Proprietary Information

ZOLL and its subsidiaries currently hold approximately 250 U.S., and over 180 foreign patents, and numerous pending applications. The Company’s patents and patent applications relate to pacing, defibrillation, CPR, temperature management and other resuscitation therapies.

Customers

There is no customer whose purchases accounted for 10% or more of the Company’s revenues or accounts receivable in any of the years presented in this annual report on Form 10-K or whose loss the Company believes would have a material adverse effect on the Company and its subsidiaries taken as a whole. Total sales to various branches of the United States military were approximately $22 million in fiscal 2010, $23 million in fiscal 2009 and $18 million in fiscal 2008.

Employees

As of October 3, 2010, ZOLL employed approximately 1,679 people on a full-time basis, with approximately 1,535 in the United States and the remainder outside the U.S. None of ZOLL’s employees is subject to collective bargaining agreements.

Executive Officers of the Registrant

| Name |

Age |

Position | ||||

| Richard A. Packer |

53 | Chief Executive Officer | ||||

| Jonathan A. Rennert |

46 | President | ||||

| A. Ernest Whiton |

49 | Vice President of Administration and Chief Financial Officer | ||||

| Ward M. Hamilton |

63 | Senior Vice President; Vice President, Marketing | ||||

| Steven K. Flora |

59 | Senior Vice President; Vice President, North American Sales | ||||

| John P. Bergeron |

59 | Vice President and Corporate Treasurer | ||||

| Alexander N. Moghadam |

46 | Vice President, International Operations | ||||

| Stephen Korn |

65 | Vice President, General Counsel and Secretary | ||||

| E. Jane Wilson, Ph.D |

61 | Vice President, Research and Development | ||||

Mr. Packer joined the Company in 1992 and in 1999 was appointed Chairman of the Board, Chief Executive Officer and President. Mr. Packer served as President until 2008 and as Chairman until November 2010, and he continues to serve as Chief Executive Officer. Mr. Packer served as President, Chief Operating Officer and director from 1996 to his appointment as CEO. From 1992 to 1996 he served as Vice President of Operations of the Company, and, additionally, as Chief Financial Officer from 1995 to 1996. From 1987 to 1992, Mr. Packer served as Vice President of various functions for Whistler Corporation, a consumer electronics company. Prior to this, Mr. Packer was a manager with the consulting firm of PRTM/KPMG, specializing in operations of high technology companies. Since April 2007, Mr. Packer has also served as a director of Bruker Corporation, a scientific instruments company. Mr. Packer provides a critical contribution to the Board of Directors as a result of his extensive and detailed knowledge of the Company and of the Company’s industry, prospects, customers and strategic marketplace. Mr. Packer received B.S. and M. Eng. degrees from the Rensselaer Polytechnic Institute and a M.B.A. from the Harvard Graduate School of Business Administration.

Mr. Rennert joined the Company as President in June 2008. Prior to joining ZOLL, Mr. Rennert served starting in January 2007 as President and Chief Executive Officer of BioProcessors Corporation, a venture-financed life science tools developer, based in Woburn, Massachusetts. Prior to that position, Mr. Rennert held positions in general management, manufacturing and engineering with PerkinElmer, Inc. and United Technologies’ Carrier Corporation. Earlier in his career, he was employed by General Electric and Andersen Consulting. Mr. Rennert holds M.S. degrees in Management and Mechanical Engineering from the Massachusetts Institute of Technology (MIT) and a B.S. degree in Engineering from Princeton University.

19

Table of Contents

Mr. Whiton joined the Company as Vice President of Administration and Chief Financial Officer in January 1999. Prior to joining the Company, Mr. Whiton was Vice President and Chief Accounting Officer of Ionics, Incorporated, a global separations technology company, which he joined in 1993. Prior to Ionics, he was a manager at Price Waterhouse. Mr. Whiton has received a B.S. in Accounting from Bentley College and a M.B.A. from the Harvard Graduate School of Business Administration.

Mr. Hamilton joined the Company as Vice President of Marketing in February 1992. Prior to this time, Mr. Hamilton served from 1985 to 1991 as Director of New Business Development and Director of Marketing for ACLS products for Laerdal Medical Corporation, a manufacturer of portable automated defibrillators, and from 1977 to 1985 as Marketing Manager for defibrillators and non-invasive blood pressure monitors for Datascope Corporation. Mr. Hamilton received a B.A. in political science from Hartwick College and a M.P.A. from the University of Southern California.

Mr. Flora joined the Company as Vice President of North American Sales in September 1998. Prior to joining the Company, Mr. Flora served from 1981 to 1998 in various positions with Marquette Medical systems, a manufacturer of cardiovascular and physiological monitoring systems, most recently as Vice President of Sales. Mr. Flora received his B.S. in Biology from the University of Illinois.

Mr. Bergeron joined the Company as Vice President and Corporate Treasurer in August 2000. Prior to joining the Company, Mr. Bergeron was Vice President at Ionics, Incorporated, a global separations technology company, where he also served as Corporate Treasurer and Tax Director. Prior to joining Ionics in 1988, Mr. Bergeron served in a variety of tax positions at other multinational corporations. Mr. Bergeron received a B.B.A. from the University of Massachusetts at Amherst and a M.S. in Taxation from Bentley College.

Mr. Moghadam joined the Company as Vice President of International Operations in January 2005. Prior to joining the Company, from 1995 to 2005 Mr. Moghadam held a variety of commercial and operational roles with Thermo Electron Corporation, a scientific instrument and supply company, which included eight years of overseas assignments in Asia (Shanghai and Hong Kong) and France. Mr. Moghadam holds a M.B.A. from DePaul University, a Master of International Management from American Graduate School of International Management (Thunderbird), and a B.S. in biology from Loyola University of Chicago.

Mr. Korn joined the Company in 2005, and serves as Vice President, General Counsel, and Secretary. From 1989 to 2005 Mr. Korn was Vice President, General Counsel and Secretary of Ionics, Incorporated, a global separations technology company. Prior to his employment with Ionics, Mr. Korn served as Vice President, General Counsel and Secretary of Symbolics, Inc., a developer of artificial intelligence hardware and software, and was a member of the Boston law firm of Widett, Slater & Goldman, P.C. Mr. Korn holds a J.D. degree from Harvard Law School, an M.A. degree in organic chemistry from Columbia University, and a B.A. degree in chemistry from Brandeis University.

Ms. Wilson joined the Company as Vice President of Research and Development in April 2007. Prior to joining the Company, Ms. Wilson was Vice President of Research and Development of Haemonetics Corp., a developer and manufacturer of blood processing technology, from 2005 to 2007. Prior to Haemonetics, Ms. Wilson held executive research and development positions at Baxter Healthcare and Abbott Laboratories. Ms. Wilson received a B.S. in Chemistry from the University of Virginia and an M.S. and Ph.D. in Nuclear Chemistry from Carnegie-Mellon University.

Marketing and Sales

ZOLL operates with sales and managerial staff composed of direct representatives and their managers, distribution managers, special account representatives, distributors and manufacturer’s representatives throughout the world. In the United States, the staff is split into dedicated groups, focused on the hospital, EMS, and public safety markets. In the United States, ZOLL sells products directly to hospitals and

20

Table of Contents

EMS organizations and through distributors, manufacturer’s representatives, and other indirect channels in the public safety market. The organization is similar in its international markets, and a mix of both direct and indirect channels are maintained relative to a country’s size and business potential. ZOLL sells its RescueNet, LifeVest and temperature management products through separate, dedicated sales forces.

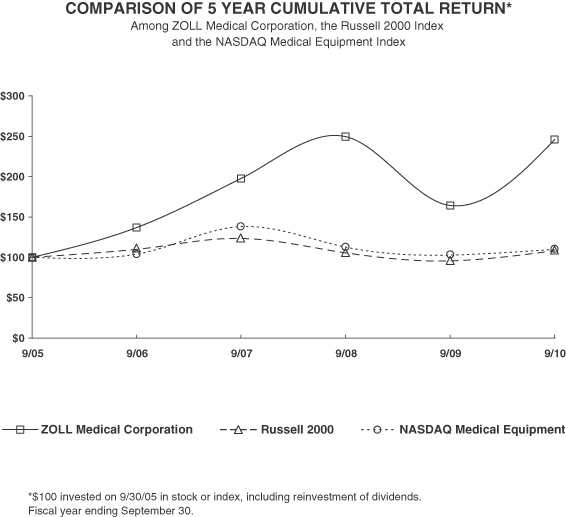

Backlog