Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended October 1, 2010

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-04762

ARAMARK CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 95-2051630 | |

| (State of Incorporation) | (I.R.S. Employer Identification No.) |

ARAMARK Tower

1101 Market Street

Philadelphia, Pennsylvania 19107

(Address of principal executive offices)

Telephone Number: 215-238-3000

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

There is no established public trading market for any of the common stock of the registrant. The aggregate market value of the voting securities held by non-affiliates of the registrant as of April 2, 2010 was $-0-. As of November 26, 2010, the common stock of the registrant was owned by ARAMARK Intermediate Holdco Corporation.

DOCUMENTS INCORPORATED BY REFERENCE

None

| Item 1. |

BUSINESS

Overview

ARAMARK Corporation (“ARAMARK,” the “Company,” “we” or “us”) is a leading provider of a broad range of managed services to business, educational, healthcare and governmental institutions and sports, entertainment and recreational facilities.

In the United States, we are one of the largest food, hospitality and facility services companies, and in most of the other countries in which we operate, we are one of the leading providers. Our uniform and career apparel business is the second largest in the United States and provides both rental and direct marketing services. Through our geographic presence and our approximately 254,000 employees (including seasonal employees), we serve thousands of clients and millions of customers in 22 countries around the world. In this Annual Report, when we refer to our fiscal years, we say “fiscal” and the year number, as in “fiscal 2010,” which refers to our fiscal year ended October 1, 2010.

Segment and geographic information is incorporated by reference to Note 14 to the consolidated financial statements.

On January 26, 2007, we completed a merger whereby prior ARAMARK stockholders received $33.80 in cash for each share of ARAMARK common stock held. Investment funds associated with or designated by the GS Capital Partners, CCMP Capital Advisors, J.P. Morgan Partners, Thomas H. Lee Partners and Warburg Pincus (our “Sponsors”) invested $1,705.0 million in equity securities of ARAMARK Holdings Corporation (“Holdings” or the “Parent Company”), our ultimate parent company, as part of our going-private transaction (the “Transaction”). In addition, Joseph Neubauer contributed 7,055,172.83 shares of Class A common stock (having an aggregate value of $200.0 million) to Holdings. In addition, approximately 250 members of the Company’s management were offered the opportunity to invest in the equity of Holdings in connection with the Transaction and such members of management contributed approximately $143.4 million in the aggregate. Since the closing of the Transaction, additional members of the Company’s management also have invested.

Fiscal 2010 Acquisitions

During fiscal 2010, the Company completed the acquisition of the facilities management and property management businesses of Veris plc, an Irish company, for cash consideration of approximately $74.3 million (see Note 2 to the consolidated financial statements). The Company also acquired several local uniform rental companies during fiscal 2010.

1

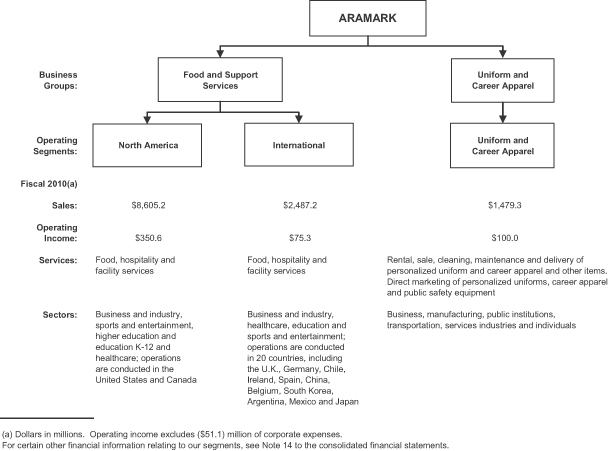

The following chart provides a brief overview of our business:

History

Our business traces its history back to the 1930s, when we began providing vending services to plant employees in the aviation industry in Southern California. In 1959, our founders, Davre J. Davidson and William S. Fishman, combined their two businesses to form our predecessor company, which became publicly traded in 1960. In the ensuing years, we broadened our service offerings and expanded our client base, including through the acquisition of our uniform services business in 1977. In 1984, we completed a management buyout, and from 1984, our management and employees increased their ownership of the Company and, directly and through our employee benefit plans, owned approximately 90% of our equity capital until our public offering was completed in December 2001. On January 26, 2007, the Company completed a going-private transaction and became a subsidiary of a holding company owned by our Sponsors and members of the Company’s management.

Food and Support Services

Our Food and Support Services group manages a number of interrelated services—including food, hospitality and facility services—for businesses, healthcare facilities, school districts, colleges and universities, sports, entertainment and recreational venues, conference and convention centers, national and state parks and correctional institutions. In fiscal 2010, our Food and Support Services—North America segment generated $8.6 billion in sales, or 68% of our total sales, and our Food and Support Services—International segment generated $2.5 billion in sales, or 20% of our total sales. No individual client represents more than 2% of our consolidated sales, other than, collectively, a number of U.S. government agencies.

2

We are the exclusive provider of food and beverage services at most of the facilities we serve and are responsible for hiring, training and supervising substantially all of the food service personnel in addition to ordering, receiving, preparing and serving food and beverage items sold at those facilities. In governmental, business, educational and healthcare facilities (for example, offices and industrial plants, schools and universities and hospitals), our clients generally provide us access to customers, namely their employees, students and patients. At sports, entertainment and recreational facilities, which include convention centers, our clients generally are responsible for attracting patrons, usually on an event-specific basis. We focus on new business development, client retention and sales growth at existing locations through marketing efforts directed toward customers and potential customers at the locations we serve.

Industry Overview

The food and support service industry involves the supply of food and beverage services and facility services to a range of clients, including businesses, educational, governmental, correctional and healthcare facilities, and operators of sports, entertainment and recreational facilities in a variety of formats and service levels.

Although we provide a range of services and call on a wide variety of clients, in recent years the food and support services industry has experienced some consolidation and multi-national expansion. We believe that other recent dynamics in the food and support services industry include continued growth in the outsourcing of food service and facilities management as a result of:

| • | clients focusing on their core competencies and outsourcing their non-core activities and services; |

| • | clients addressing the need to satisfy demanding customers; |

| • | clients facing increasing cost pressures and looking for cost-effective alternatives to self-administered food and support activities; |

| • | an increase in the retail orientation of food service management; and |

| • | continuing client interest in obtaining multiple support services from one supplier. |

Customers and Services—North America Segment

Our Food and Support Services—North America segment serves a number of client sectors in the United States and Canada, distinguished by the types of customers served and types of services offered. Our Food and Support Services operations focus on serving clients in four principal sectors:

Business and Industry. We provide a range of business dining services, including on-site restaurants, catering, convenience stores and executive dining rooms.

We provide coffee and vending services to business and industry clients at thousands of locations in the United States and Canada. Our service and product offerings include a full range of coffee and beverage offerings, “grab and go” food operations, convenience stores and a proprietary drinking water filtration system.

We also offer a variety of facility management services to business and industry clients. These services include the management of housekeeping, plant operations and maintenance, energy management, laundry and linen, groundskeeping, landscaping, transportation, capital program management and commissioning services and other facility consulting services relating to building operations.

We provide correctional food services, operate commissaries, laundry facilities and property rooms and/or provide facilities management services for state, county and municipal clients.

Sports and Entertainment. We provide concessions, banquet and catering services, retail, merchandise and novelty sales, recreational and lodging services and facilities management services at sports, entertainment and recreational facilities. We serve 122 professional (including minor league affiliates) and college sports teams,

3

including 39 teams in Major League Baseball, the National Basketball Association, the National Football League and the National Hockey League. We also serve 28 convention and civic centers, 17 national and state parks and other resort operations, plus numerous concert venues, entertainment complexes and other popular tourist attractions in the United States and Canada.

Higher Education and Education K-12. We provide a wide range of food and facility services at more than 1,000 colleges, universities, school systems and districts and private schools. We offer our education clients a single source provider for managed service solutions, including dining, catering, food service management, convenience-oriented retail operations, facilities maintenance, custodial, grounds, energy management, construction management, capital project management and building commissioning.

Healthcare. We provide a wide range of non-clinical support services to approximately 1,000 healthcare and senior living facilities in the United States and Canada. We offer healthcare organizations a single source provider for managed service solutions, including patient food and nutrition services, retail food services, clinical equipment maintenance, environmental services, laundry and linen distribution, plant operations, energy management, strategic/technical services, supply chain management and central transportation.

Customers and Services—International Segment

Our Food and Support Services—International segment provides a similar range of services as that provided to our Food and Support Services—North America segment clients and operates in several sectors, including business and industry, sports and entertainment, healthcare and education. Our international services are provided in 20 countries outside the United States and Canada. Our largest international operations are in the United Kingdom, Germany, Chile, Ireland and Spain, and in each of these countries we are one of the leading food service providers. We also have operations in China, Belgium, South Korea, Argentina and Mexico and we own 50% of AIM Services Co., Ltd., a leader in providing outsourced food services in Japan. The clients we serve in each country are typically similar to those served in the United States and Canada and vary by country depending upon local dynamics and conditions. There are particular risks attendant with our international operations. Please see the “Risk Factors” section.

Purchasing

We negotiate the pricing and other terms for the majority of our purchases of food and related products in the U.S. and Canada directly with national manufacturers. We purchase these products and other items through SYSCO Corporation and other distributors. We have a master distribution agreement with SYSCO that covers a significant amount of our purchases of these products and items in the United States and another distribution agreement with SYSCO that covers our purchases of these products in Canada. SYSCO and other distributors are responsible for tracking our orders and delivering products to our specific locations. Due to our ability to negotiate favorable terms with our suppliers, we receive vendor consideration, including rebates, allowances and volume discounts. See “Types of Contracts” below. With respect to purchases from SYSCO, these discounts include discounts on SYSCO-branded products. Our location managers also purchase a number of items, including bread, dairy products and alcoholic beverages from local suppliers, and we purchase certain items directly from manufacturers.

Our agreements with our distributors are generally for an indefinite term, subject to termination by either party after a notice period, which is generally 60 to 120 days. The pricing and other financial terms of these agreements are renegotiated periodically. We have had distribution agreements with SYSCO for more than 20 years. Our current agreement with SYSCO is terminable by either party with 180 days notice.

Our relationship with SYSCO is important to our operations. In fiscal 2010, SYSCO distributed approximately 57% of our food and non-food products in the United States and Canada, and we believe that we

4

are one of SYSCO’s largest customers. However, we believe that the products acquired through SYSCO can, in significant cases, be purchased through other sources and that termination of our relationship with SYSCO or any disruption of SYSCO’s business would cause only short-term disruptions to our operations.

Sales and Marketing

We employ sales personnel focused on each specific client or service sector who are responsible for identifying and pursuing potential new business opportunities, analyzing and evaluating such opportunities together with our operational and financial management and developing specific contract proposals. In addition to these professionals dedicated exclusively to sales efforts, our food and support field management shares responsibility for identifying and pursuing new sales opportunities, both with the clients for which they are directly responsible and for potential clients in their geographic area of responsibility. In addition, in several sectors we also have dedicated client retention teams.

Types of Contracts

We use two general contract types in our Food and Support Services segments: profit and loss contracts and client interest contracts. These contracts differ in their provision for the amount of financial risk that we bear and, accordingly, the potential compensation, profits or fees we may receive. Commission rates and management fees, if any, may vary significantly among contracts based upon various factors, including the type of facility involved, the term of the contract, the services we provide and the amount of capital we invest.

Profit and Loss Contracts. Under profit and loss contracts, we receive all of the revenue from, and bear all of the expenses of, the provision of our services at a client location. Expenses under profit and loss contracts sometimes include commissions paid to the client, typically calculated as a fixed or variable percentage of various categories of sales, and, in some cases, require minimum guaranteed commissions. While we may benefit from greater upside potential with a profit and loss contract, we are responsible for all the operating costs and consequently bear greater downside risk than with a client interest contract. For fiscal 2010, approximately 74% of our food and support services sales were derived from profit and loss contracts.

Client Interest Contracts. Client interest contracts include management fee contracts, under which our clients reimburse our operating costs and pay us a management fee, which may be calculated as a fixed dollar amount or a percentage of sales or operating costs. Some management fee contracts entitle us to receive incentive fees based upon our performance under the contract, as measured by factors such as sales, operating costs and customer satisfaction surveys. Client interest contracts also include limited profit and loss contracts, under which we receive a percentage of any profits earned from the provision of our services at the facility and we generally receive no payments if there are losses. As discussed above under “Purchasing,” we receive vendor consideration, including rebates, allowances and volume discounts that we retain except in those cases and to the extent that, under certain arrangements, they are passed through to our clients. For our client interest contracts, both our upside potential and downside risk are reduced compared to our profit and loss contracts. For fiscal 2010, approximately 26% of our food and support services sales were derived from client interest contracts.

Generally, our contracts require that the client’s consent be obtained in order to raise prices on the food, beverages and merchandise we sell within a particular facility. The length of contracts that we enter into with clients varies. Contracts generally are for fixed terms, some of which may be well in excess of one year. Client contracts for sports, entertainment and recreational services typically require larger capital investments, but have correspondingly longer and fixed terms, usually from five to fifteen years.

When we enter into new contracts, or extend or renew existing contracts, particularly those for stadiums, arenas, convention centers, colleges and universities, we are sometimes contractually required to make some form of up-front or future capital investment to help finance improvement or renovation, typically to the food and beverage facilities of the venue from which we operate. Contractually required capital expenditures typically take

5

the form of investment in leasehold improvements, food service equipment and/or grants to clients. At the end of the contract term or its earlier termination, assets such as equipment and leasehold improvements typically become the property of the client, but generally the client must reimburse us for any undepreciated or unamortized capital expenditures.

Contracts within the Food and Support Services group are generally obtained and renewed either through a competitive process or on a negotiated basis, although contracts in the public sector are frequently awarded on a competitive bid basis, as required by applicable law. Contracts for food services with school districts and correctional clients are typically awarded through a formal bid process. Contracts in the private sector may be entered into on a less formal basis, but we and other companies will often compete in the process leading up to the award or the completion of contract negotiations. Typically, after the award, final contract terms are negotiated and agreed upon.

Competition

There is significant competition in the food and support services business from local, regional, national and international companies, as well as from the businesses, healthcare institutions, colleges and universities, correctional facilities, school districts and public assembly facilities that decide to provide these services themselves. Institutions may decide to operate their own services following the expiration or termination of contracts with us or with our competitors. In our Food and Support Services—North America segment, our external competitors include other multi-regional food and support service providers, such as Centerplate, Inc., Compass Group plc, Delaware North Companies Inc. and Sodexo Alliance SA. Internationally, our external food service and support service competitors include Compass Group plc, Elior SA, International Service System A/S and Sodexo Alliance SA. We also face competition from many regional and local service providers.

We believe that the principal competitive factors in our business include:

| • | quality and breadth of services and management talent; |

| • | service innovation; |

| • | reputation within the industry; |

| • | pricing; and |

| • | financial strength and stability. |

Seasonality

Our sales and operating results have varied, and we expect them to continue to vary, from quarter to quarter as a result of different factors. Within our Food and Support Services—North America segment, historically there has been a lower level of activity during the first and second fiscal quarters in the generally higher margin sports, entertainment and recreational services. This lower level of activity historically has been partially offset during our first and second fiscal quarters by the increased provision in our educational operations. Conversely, historically there has been a significant increase in the provision of sports, entertainment and recreational services during the third and fourth fiscal quarters, which is partially offset by the effect of summer recess at colleges, universities and schools.

Uniform and Career Apparel

Our Uniform and Career Apparel segment provides uniforms, career and image apparel, safety equipment, work clothes and accessories to meet the needs of clients in a wide range of industries in the United States, including manufacturing, transportation, construction, restaurants and hotels, public safety, healthcare and pharmaceutical industries and many others. We supply garments, other textile and paper products, public safety

6

equipment and other accessories through rental and direct purchase programs to businesses, government agencies and individuals. Through our rental and direct marketing businesses, we provide a total uniform solution to our clients. In fiscal 2010, our Uniform and Career Apparel segment generated $1.5 billion in sales, or 12% of our total fiscal 2010 sales.

Customers use our uniforms to meet a variety of needs, including:

| • | establishing corporate identity and brand awareness—uniforms can help identify employees working for a particular company or department and promote a company’s brand identity; |

| • | projecting a professional image—uniformed employees are perceived as trained, competent and dependable, and uniforms provide a professional image of employees by enhancing the public appearance of those employees and their company; |

| • | protecting workers—uniforms can help protect workers from difficult environments such as heavy soils, heat, flame or chemicals; |

| • | protecting products—uniforms can help protect products against contamination in the food, pharmaceutical, electronics, health care and automotive industries; and |

| • | retaining employees—uniforms can enhance worker morale and help promote teamwork. |

We provide a full service employee uniform solution, including design, sourcing and manufacturing, delivery, cleaning and maintenance. We rent or lease uniforms, career and image apparel, work clothing, outerwear, particulate-free garments and additional textile and related products to businesses in a wide range of industries throughout the United States, including manufacturing, food services, automotive, healthcare, construction, utilities, repair and maintenance services, restaurant and hospitality. Our uniform products include shirts, pants, jackets, coveralls, jumpsuits, smocks, aprons and specialized protective wear. We also offer nongarment items and related services, including industrial towels, floor mats, mops, linen products, as well as paper products and safety products.

The outsourcing of career apparel needs through a uniform rental program offers customers advantages over ownership. Renting eliminates investment in uniforms and the related costs associated with employee turnover, offers flexibility in styles, colors and quantities as customer requirements change, assures consistent professional cleaning, finishing, repair and replacement of items in use and decreases expense and management time necessary to administer a uniform program. Centralized services, specialized equipment and economies of scale generally allow us to be more cost effective in providing garments and garment services than customers could be by themselves.

We also design, sell and distribute personalized uniforms, rugged work clothing, outerwear, business casual apparel and footwear, public safety equipment and accessories through mail order catalogs, the internet, telemarketing, retail and field sales representatives.

Customers and Services

As part of our full service approach, we offer fabric, style and color options specific to a customer’s needs. We stock a broad product line of uniforms and career apparel. We typically visit our customers’ sites weekly, delivering clean, finished uniforms and, at the same time, removing the soiled uniforms or other items for cleaning, repair or replacement. Under our leasing program, we provide the customer with rental garments that are cleaned either by the customer or individual employees. This program benefits clients by reducing their capital investment in garments. We administer and manage the program, and repair and replace garments as necessary.

We serve businesses of all sizes in many different industries. We have a diverse customer base, serving customers in 45 states, Puerto Rico and one Canadian province, from over 200 service location and distribution centers across the United States and one service center in Ontario, Canada. We offer a range of garment rental

7

service options, from full-service rental programs in which we clean and service garments and replace uniforms as needed, to lease programs in which garments are cleaned and maintained by individual employees. We also clean and service customer-owned uniforms. None of our customers individually represents a material portion of our sales.

Our cleanroom service offers advanced static dissipative garments, barrier apparel, sterile garments and cleanroom application accessories for customers with contamination-free operations in the technology, food, healthcare and pharmaceutical industries.

We conduct our direct marketing business through four primary brands—WearGuard, Crest, Galls and ARAMARK. We design, source or manufacture and distribute distinctive image apparel to workers in a wide variety of industries. We deliver expanded services to customers through catalog, the Internet, dedicated sales representatives and telemarketing sales channels. We customize and embroider personalized uniforms and logos for customers through an extensive computer assisted design center and distribute work clothing, outerwear, business casual apparel and footwear throughout the United States. During fiscal 2009, we initiated a repositioning effort to reduce the cost structure and address the demand softness in the WearGuard direct marketing business (see Note 11 to the consolidated financial statements).

Galls is one of the country’s leading suppliers of uniforms and equipment to public safety professionals. This multi-channel business (catalog, telemarketing sales, field sales, the Internet and retail) caters to the special needs of people involved in public safety, law enforcement, fire fighting, federal government agency, military and emergency medical services. Galls markets public safety equipment and apparel under the Galls, Dynamed and other brand names to over 650,000 customers, as well as to public safety departments, private security companies and the military. Galls also operates six retail store locations in California and Kentucky.

Operations

We operate our uniform rental business as a network of 76 laundry plants and 150 satellite plants and depots supporting over 2,500 pick-up and delivery routes. We operate a fleet of service vehicles that pick up and deliver uniforms for cleaning and maintenance. We operate a cutting and sewing plant in Mexico, which satisfies a substantial amount of our standard uniform inventory needs. We also purchase additional uniform and textile products as well as equipment and supplies from domestic and international suppliers. The loss of any one vendor would not have a significant impact on us.

We conduct our direct marketing activities principally from our facilities in Lexington, Kentucky; Salem, Virginia; Norwell, Massachusetts; and Reno, Nevada. We market our own brands of apparel and offer a variety of customized personalization options such as embroidery and logos. We also source uniforms and other products to our specifications from a number of domestic and international suppliers and also manufacture a significant portion of our uniform requirements.

Sales and Marketing

Our route sales drivers and sales representatives are responsible for selling our services to current and potential customers and developing new accounts through the use of an extensive, proprietary database of pre-screened and qualified business prospects. Our customer service representatives and district managers are active salespeople as well. We build our brand identity through local advertising, promotional initiatives and through our distinctive service vehicles. Our customers frequently come to us through client referrals, either from our uniform rental business or from our other service sectors. Our customer service representatives generally interact on a weekly basis with their clients, while our support personnel are charged with expeditiously handling customer requirements regarding the outfitting of new customer employees and other customer service needs.

8

In connection with the provision of our services, we have developed or acquired long-standing brand name recognition through our ApparelOne®, WearGuard® and Crest® uniform programs. Our ApparelOne program assists customers in meeting their specific needs by offering quality and brand name products through a combination of rental, lease or purchase options. We customize the program on an individual client basis to offer a single catalog and/or website specifically tailored to the client’s needs.

Our direct marketing businesses distribute approximately 7.5 million catalogs annually to approximately 1.1 million existing and prospective customers. Catalog distribution is based on the selection of recipients in accordance with predetermined criteria from customer lists developed by WearGuard and Galls as well as those purchased or rented from other organizations. Our in-bound and out-bound telemarketing operations are staffed by approximately 160 trained professionals. We also sell across the Internet at www.aramark-uniform.com and www.galls.com.

Types of Contracts

We typically serve our rental customers under written service contracts for an initial term of three to five years. While customers are not required to make an up-front investment for their uniforms, in the case of nonstandard uniforms and certain specialty products or programs, customers typically agree to reimburse us for our costs if they terminate their agreement before completion of the current service term.

Because the bulk of our customers purchase on a recurring basis, our backlog of orders at any given time consists principally of orders in the process of being filled. With the exception of certain governmental bid business, most of our direct marketing business is conducted under invoice arrangement with repeat customers. Our direct marketing business is, to a large degree, relationship-centered. While we have long term relationships with some of our larger customers, we generally do not have contracts with these customers.

Competition

Although the U.S. rental industry has experienced some consolidation, there is significant competition in all the areas that we serve, and such competition varies from location to location. Although much of the competition consists of smaller local and regional firms, we also face competition from other large national firms such as Cintas Corporation, G&K Services, Inc. and Unifirst Corporation. We believe that the primary competitive factors that affect our operations are quality, service, design, consistency of product, garment cost and distribution capability, particularly for large multi-location customers, and price. We believe that our ability to compete effectively is enhanced by the quality and breadth of our product line.

Competition for direct sales varies based on numerous factors such as geographic, product, customer and marketing issues. We believe that the primary competitive factors that affect our direct marketing operations are quality, service, design, consistency of products, distribution and price. While there are other companies in the uniform, work clothing or public safety direct marketing business that have financial resources comparable to ours, much of the competition consists of smaller local and regional companies and numerous retailers, including some large chain apparel retailers, as well as numerous catalog sales sources.

Employees of ARAMARK

As of October 1, 2010, we had a total of approximately 254,000 employees, including seasonal employees, consisting of approximately 162,000 full-time and approximately 92,000 part-time employees in our three business segments. The number of part-time employees varies significantly from time to time during the year due to seasonal and other operating requirements. We generally experience our highest level of employment during the fourth quarter. The approximate number of employees by segment is as follows: Food and Support Services—North America: 157,000; Food and Support Services—International: 83,000; Uniform and Career Apparel—14,000. In addition, the ARAMARK corporate staff is approximately 200 employees. Approximately 39,000 employees in the

9

United States are covered by collective bargaining agreements. We have not experienced any material interruptions of operations due to disputes with our employees and consider our relations with our employees to be satisfactory.

Governmental Regulation

We are subject to various governmental regulations, such as environmental, labor, employment, immigration, health and safety laws and liquor licensing and dram shop laws. In addition, our facilities and products are subject to periodic inspection by federal, state, and local authorities. We have established, and periodically update, various internal controls and procedures designed to maintain compliance with these regulations. Our compliance programs are subject to changes in federal or state legislation, or changes in regulatory interpretation, implementation or enforcement. From time to time both federal and state government agencies have conducted audits of certain of our practices as part of routine investigations of providers of services under government contracts, or otherwise. Like others in our business, we receive requests for information from governmental agencies in connection with these audits. If we fail to comply with applicable laws, we may be subject to criminal sanctions or civil remedies, including fines, injunctions, seizures or debarment from government contracts.

Our operations are subject to various governmental regulations, including those governing:

| • | the service of food and alcoholic beverages; |

| • | minimum wage, overtime, wage payment and employment discrimination; |

| • | immigration; |

| • | governmentally funded entitlement programs; |

| • | environmental protection; |

| • | human health and safety; |

| • | customs, import and export control laws; |

| • | federal motor carrier safety; and |

| • | privacy and customer data security. |

There are a variety of regulations at various governmental levels relating to the handling, preparation and serving of food, including in some cases requirements relating to the temperature of food, the cleanliness of the kitchen, and the hygiene of personnel, which are enforced primarily at the local public health department level. While we attempt to comply with applicable laws and regulations, we cannot assure you that we are in full compliance at all times with all of the applicable laws and regulations referenced above. Furthermore, legislation and regulatory attention to food safety is very high. Additional or amended regulations in this area may significantly increase the cost of compliance.

In addition, various federal and state and provincial agencies impose nutritional guidelines and other requirements on us at certain of the education and corrections facilities we serve. We may also be subject to regulations that limit or restrict the use of trans fats in the food we serve or other requirements relating to ingredient or nutrient labeling. There can be no assurance that federal or state legislation, or changes in regulatory implementation or interpretation of government regulations, would not limit our activities in the future or significantly increase the cost of regulatory compliance.

Because we serve alcoholic beverages at many sports, entertainment and recreational facilities, including convention centers and national and state parks, we also hold liquor licenses incidental to our contract food service business and are subject to the liquor license requirements of the jurisdictions in which we hold a liquor license. As of October 1, 2010, our subsidiaries held liquor licenses in 42 states and the District of Columbia, two

10

Canadian provinces and certain other countries. Typically, liquor licenses must be renewed annually and may be revoked or suspended for cause at any time. Alcoholic beverage control regulations relate to numerous aspects of our operations, including minimum age of patrons and employees, hours of operation, advertising, wholesale purchasing, inventory control and handling, and storage and dispensing of alcoholic beverages. We have not encountered any material problems relating to alcoholic beverage licenses to date. The failure to receive or retain a liquor license in a particular location could adversely affect our ability to obtain such a license elsewhere. Some of our contracts require us to pay liquidated damages during any period in which our liquor license for the facility is suspended, and most contracts are subject to termination if we lose our liquor license for the facility. Our service of alcoholic beverages is also subject to state, provincial and local service laws, commonly called dram shop statutes. Dram shop statutes generally prohibit serving alcoholic beverages to minors or visibly intoxicated persons. If we violate dram shop laws, we may be liable to the patron or to third parties for the acts of the patron. We sponsor regular training programs designed to minimize the likelihood of such a situation. However, we cannot guarantee that intoxicated or minor patrons will not be served or that liability for their acts will not be imposed on us.

Our uniform rental business and our food and support service business are subject to various federal, state and local environmental protection laws and regulations, including the federal Clean Water Act, Clean Air Act, Resource Conservation and Recovery Act, Comprehensive Environmental Response, Compensation, and Liability Act and similar state statutes and regulations governing the use, management, and disposal of chemicals and hazardous materials. In particular, industrial laundries use certain detergents and cleaning chemicals to launder garments and other merchandise. The residues from such detergents and chemicals and residues from soiled garments and other merchandise laundered at our facilities may result in potential discharges to air and to wastewaters that are discharged through sanitary sewer systems to publicly owned treatment works and may be contained in waste generated by our wastewater treatment systems. Our industrial laundries are subject to certain volume and chemical air and water pollution discharge limits, monitoring, permitting and recordkeeping requirements. Our food and support service business owns and operates underground storage tank systems to store petroleum products for use in our or our clients’ operations. These underground storage tank systems also are subject to performance standards, periodic monitoring, and recordkeeping requirements. We also may use and manage chemicals and hazardous material in our operations from time to time. We are mindful of the environmental concerns surrounding the use, management, and disposal of these chemicals and hazardous materials, and have taken and continue to take measures to maintain compliance with environmental protection laws and regulations. Given the regulated nature of our operations, we could face penalties and fines for non-compliance. In the past, we have settled, or contributed to the settlement of, actions or claims relating to the management of underground storage tanks and the handling and disposal of chemicals or hazardous materials, either on or off-site. We may, in the future, be required to expend material amounts to rectify the consequences of any such events. Under federal and state environmental laws, we may be liable for the costs of removal or remediation of certain hazardous materials located on or in or emanating from our owned or leased property or our clients’ properties, as well as related costs of investigation and property damage. Such laws may impose liability without regard to our fault, knowledge, or responsibility for the presence of such hazardous substances. We may not know whether our clients’ properties or our acquired or leased properties have been operated in compliance with environmental laws and regulations or that our future uses or conditions will not result in the imposition of liability upon us under such laws or expose us to third party actions such as tort suits.

We do not anticipate any capital expenditures for environmental remediation that would have a material effect on our financial condition.

Intellectual Property

We have the patents, trademarks, trade names and licenses that are necessary for the operation of our business. Other than the ARAMARK brand, we do not consider our patents, trademarks, trade names and licenses to be material to the operation of our business in any material respect.

11

Available Information

We file annual, quarterly and current reports and other information with the Securities and Exchange Commission (the “SEC”). These filings are available to the public over the Internet at the Securities and Exchange Commission’s web site at http://www.sec.gov. You may also read and copy any document we file at the Securities and Exchange Commission’s public reference room at 100 F. Street, N.E., Washington, D.C. 20549. Please call the Securities and Exchange Commission at 1-800-SEC-0330 for further information on the public reference room.

Our principal Internet address is www.aramark.com. We make available free of charge on www.aramark.com our annual, quarterly and current reports, and amendments to those reports, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC.

Our Business Conduct Policy includes a code of ethics for our principal executive officer, our principal financial officer and our principal accounting officer and applies to all of our employees and non-employee directors. Our Business Conduct Policy is available on the Investor Relations section of our website at www.aramark.com and is available in print to any person who requests it by writing or telephoning us at the address or telephone number set forth below.

You may request a copy of our SEC filings (excluding exhibits) and our Business Conduct Policy at no cost by writing or telephoning us at the following address or telephone number:

ARAMARK Corporation

1101 Market Street

Philadelphia, PA 19107

Attention: Assistant Corporate Secretary

Telephone: (215) 238-3000

The references to our web site and the SEC’s web site are intended to be inactive textual references only and the contents of those websites are not incorporated by reference herein.

The Company files with each of its Form 10-Qs and its Form 10-K certifications by the CEO and the CFO under sections 302 and 906 of the Sarbanes Oxley Act of 2002.

12

| Item 1A. | Risk Factors |

Risks related to our business

General

Unfavorable economic conditions and increased operating costs have, and in the future could, adversely affect our results of operations and financial condition.

A national or international economic downturn has, and in the future could, reduce demand for our services in each of our operating segments, which may result in the loss of business or increased pressure to contract for business on less favorable terms than our generally preferred terms. Economic hardship among our client base can also impact our business. For example, during the recent period of economic distress, certain of our businesses have been negatively affected by reduced employment levels at our clients’ locations and declining levels of business and consumer spending. In addition, insolvency experienced by clients, especially larger clients, particularly in the financial services, non-profit healthcare, automotive and airline industries, has, and in the future could, make it difficult for us to collect amounts we are owed and could result in the voiding of existing contracts. Similarly, financial distress or insolvency, if experienced by our key vendors and service providers such as insurance carriers, could significantly increase our costs. Any terrorist attacks, particularly against venues that we serve, and the national and global military, diplomatic and financial response to such attacks or other threats, also may adversely affect our sales and operating results. Natural disasters, including hurricanes and earthquakes, or global calamities have, and in the future could, affect our sales and operating results. In the past, ARAMARK experienced lost and closed client locations, business disruptions and delays, the loss of inventory and other assets, and the effect of the temporary conversion of a number of ARAMARK client locations to provide food and shelter to those left homeless by storms.

Our profitability can be adversely affected to the extent we are faced with cost increases for food, wages, other labor related expenses (including workers’ compensation, state unemployment insurance and state mandated health benefits and other healthcare costs), insurance, fuel, utilities, piece goods, clothing and equipment, especially to the extent we are unable to recover such increased costs through increases in the prices for our products and services, due to one or more of general economic conditions, competitive conditions or contractual provisions in our client contracts. Oil and natural gas prices have fluctuated significantly in the last several years. Substantial increases in the cost of fuel and utilities have historically resulted in substantial cost increases in our uniform services business, and to a lesser extent in our food and support services segments. From time to time we have experienced increases in our food costs. While we believe a portion of these increases were attributable to fuel prices, we believe the increases also resulted from rising global food demand and the increased production of biofuels such as ethanol. In addition, food prices can fluctuate as a result of temporary changes in supply, including as a result of incidences of severe weather such as droughts, heavy rains and late freezes.

Approximately 74% of our food and support services sales are from profit and loss contracts under which we have limited ability to pass on cost increases to our clients.

Our business may suffer if we are unable to hire and retain sufficient qualified personnel or if labor costs increase.

In the past, at times when the United States has periodically experienced reduced levels of unemployment, there has been a shortage of qualified workers at all levels. Given that our workforce requires large numbers of entry level and skilled workers and managers, low levels of unemployment when such conditions exist can compromise our ability in certain of our businesses to continue to provide quality service or compete for new business. From time to time, we have had difficulty in hiring and maintaining qualified management personnel, particularly at the entry management level. We will continue to have significant requirements to hire such personnel. Our success also depends to a substantial extent on the ability, experience and performance of our management, particularly our Chairman and Chief Executive Officer, Joseph Neubauer.

13

We also regularly hire a large number of part-time workers, particularly in our food and support services segments. Any difficulty we may encounter in hiring such workers could result in significant increases in labor costs, which could have a material adverse effect on our business, financial condition and results of operations. Competition for labor has at times resulted in wage increases in the past and future competition could substantially increase our labor costs. Due to the labor intensive nature of our businesses and the fact that 74% of our food and support services segments’ sales are from profit and loss contracts under which we have limited ability to pass along cost increases, a shortage of labor or increases in wage levels in excess of normal levels could have a material adverse effect on our results of operations.

Healthcare reform legislation could have an impact on our business.

During fiscal 2010, the Patient Protection and Affordable Care Act and the Health Care and Education Reconciliation Act of 2010 were signed into law in the United States. Certain of the provisions that could most significantly increase our healthcare costs in the near term include the removal of annual plan limits, the changes in rules regarding eligibility for dependents and the mandate that health plans cover 100% of preventative care. In addition, our healthcare costs could increase if the new legislation and accompanying regulations require us to cover more employees than we do currently or pay penalty amounts in the event that employees do not elect our offered coverage. While much of the cost of the recent healthcare legislation enacted will occur on or after 2014 due to provisions of the legislation being phased in over time, changes to our healthcare cost structure could have an impact on our business and operating costs.

Our expansion strategy involves risks.

We may seek to acquire companies or interests in companies or enter into joint ventures that complement our business, and our inability to complete acquisitions, integrate acquired companies successfully or enter into joint ventures may render us less competitive. We may be evaluating acquisitions or engaging in acquisition negotiations at any given time. We cannot be sure that we will be able to continue to identify acquisition candidates or joint venture partners on commercially reasonable terms or at all. If we make additional acquisitions, we also cannot be sure that any benefits anticipated from the acquisitions will actually be realized. Likewise, we cannot be sure that we will be able to obtain necessary financing for acquisitions. Such financing could be restricted by the terms of our debt agreements or it could be more expensive than our current debt. The amount of such debt financing for acquisitions could be significant and the terms of such debt instruments could be more restrictive than our current covenants. In addition, our ability to control the planning and operations of our joint ventures and other less than majority owned affiliates may be subject to numerous restrictions imposed by the joint venture agreements and majority shareholders. Our joint venture partners may also have interests which differ from ours.

The process of integrating acquired operations into our existing operations may result in operating, contract and supply chain difficulties, such as the failure to retain clients or management personnel and problems coordinating technology and supply chain arrangements. Also, in connection with any acquisition, we could fail to discover liabilities of the acquired company for which we may be responsible as a successor owner or operator in spite of any investigation we make prior to the acquisition. In addition, labor laws in certain countries may require us to retain more employees than would otherwise be optimal from entities we acquire. Such difficulties may divert significant financial, operational and managerial resources from our existing operations, and make it more difficult to achieve our operating and strategic objectives. The diversion of management attention, particularly in a difficult operating environment, may affect our sales. Similarly, our business depends on effective information technology systems and implementation delays or poor execution of the integration of different information technology systems could disrupt our operations and increase costs. Possible future acquisitions could result in the incurrence of additional debt and related interest expense or contingent liabilities and amortization expenses related to intangible assets, which could have a material adverse effect on our financial condition, operating results and/or cash flow. In addition, goodwill resulting from business combinations represents a significant portion of our assets. If the goodwill were deemed to be impaired, we would need to take a charge to earnings to write down the goodwill to its fair value.

14

If we fail to comply with requirements imposed by applicable law or other governmental regulations, we could become subject to lawsuits, investigations and other liabilities and restrictions on our operations that could significantly and adversely affect our business.

We are subject to governmental regulation at the federal, state, international, national, provincial and local levels in many areas of our business, such as food safety and sanitation, the sale of alcoholic beverages, minimum wage, overtime, wage payment, wage and hour and employment discrimination, immigration, human health and safety, including regulations of the U.S. Occupational Safety and Health Administration, federal motor carrier safety, data privacy, environmental protection, the import and export of goods and customs regulations, the False Claims Act, the Foreign Corrupt Practices Act and the services we provide in connection with governmentally funded entitlement programs.

From time to time, both federal and state governmental agencies have conducted audits of our billing practices as part of investigations of providers of services under governmental contracts, or otherwise. We also receive requests for information from governmental agencies in connection with these audits. While we attempt to comply with all applicable laws and regulations, we cannot assure you that we are in full compliance with all applicable laws and regulations or interpretations of these laws and regulations at all times or that we will be able to comply with any future laws, regulations or interpretations of these laws and regulations.

If we fail to comply with applicable laws and regulations, including those referred to above, we may be subject to investigations, criminal sanctions or civil remedies, including fines, injunctions, prohibitions on exporting, seizures or debarments from government contracts or the loss of liquor licenses. The cost of compliance or the consequences of non-compliance, including debarments, could have a material adverse effect on our business and results of operations. In addition, governmental units may make changes in the regulatory frameworks within which we operate that may require either the corporation as a whole or individual businesses to incur substantial increases in costs in order to comply with such laws and regulations.

Changes in or new interpretations of the governmental regulatory framework may affect our contract terms and may reduce our sales or profits.

A portion of our sales, estimated to be approximately 12% in fiscal 2010, is derived from business with U.S. federal, state and local governments and agencies. Changes or new interpretations in, or changes in the enforcement of, the statutory or regulatory framework applicable to services provided under governmental contracts or bidding procedures, particularly by our food and support services businesses, could result in fewer new contracts or contract renewals, modifications to the methods we apply to price government contracts, or in contract terms of shorter duration than we have historically experienced, any of which could result in lower sales or profits than we have historically achieved, which could have an adverse effect on our results of operations. For example, the Child Nutrition Programs, including the National School Lunch Program and the School Breakfast Program, are in the process of being reauthorized by the federal government. The reauthorization legislation passed by the Senate and pending before the House includes a variety of potential programmatic changes, including changes to the reimbursement rates and nutritional requirements for meals served to students, which could impact our operations and/or our results of operations in those accounts where the client participates in one of the Child Nutrition Programs.

Further unionization of our workforce may increase our costs.

Approximately 39,000 employees in our U.S. operations are represented by unions and covered by collective bargaining agreements. Certain unions representing employees in our Food and Support Services—North America and Uniform and Career Apparel segments have targeted us and the other major companies in our industries for increased representation of our workforce. We have always respected our employees’ right to unionize or not to unionize. However, the unionization of a significantly greater portion of our workforce could increase our overall costs at the affected locations and adversely affect our flexibility to run our business in the

15

most efficient manner to remain competitive or acquire new business. In addition, any significant increase in the number of work stoppages at our various operations could adversely affect our business, financial condition or results of operations.

We may incur significant liability as a result of our participation in multi-employer defined benefit pension plans.

We operate at a number of locations under collective bargaining agreements. Under some of these agreements, we are obligated to participate in and contribute to multi-employer defined benefit pension plans. As a contributing employer to such plans, should ARAMARK withdraw, either totally or satisfy certain triggers for a statutory “partial withdrawal,” we would be subject to withdrawal liability (or partial withdrawal liability) for our proportionate share of any unfunded vested benefits. In addition, if a multi-employer defined benefit pension plan fails to satisfy the minimum funding rules, we could be liable to increase our contributions to meet minimum funding contributions. The financial status of certain of the plans in which ARAMARK participates has deteriorated in the recent past. In addition, any increased funding obligations for underfunded multi-employer defined benefit pension plans could have a financial impact on us.

Our international business results are influenced by currency fluctuations and other risks that could have an effect on our results of operations and financial condition.

A significant portion of our sales is derived from international business. During fiscal 2010, approximately 20% of our sales was generated outside the United States and Canada. We currently have a presence in 20 countries outside of the United States and Canada with approximately 83,000 personnel. The operating results of our Canadian business and our international subsidiaries are translated into U.S. dollars and such results are affected by movements in foreign currencies relative to the U.S. dollar. Our international operations are also subject to other risks, including the requirement to comply with changing and conflicting national and local regulatory requirements; Foreign Corrupt Practices Act compliance matters; potential difficulties in staffing and labor disputes; differing local labor laws; managing and obtaining support and distribution for local operations; credit risk or financial condition of local customers; potential imposition of restrictions on investments; potentially adverse tax consequences, including imposition or increase of withholding, VAT and other taxes on remittances and other payments by subsidiaries; foreign exchange controls; and local political and social conditions. There can be no assurance that the foregoing factors will not have a material adverse effect on our international operations or on our consolidated financial condition and results of operations. We intend to continue to develop our business in emerging countries over the long term. Emerging international operations present several additional risks, including greater fluctuation in currencies relative to the U.S. dollar; economic and governmental instability; civil disturbances; volatility in gross domestic production; and nationalization and expropriation of private assets.

Our failure to retain our current clients and renew our existing client contracts could adversely affect our business.

Our success depends on our ability to retain our current clients and renew our existing client contracts. Our ability to do so generally depends on a variety of factors, including the quality, price and responsiveness of our services, as well as our ability to market these services effectively and differentiate ourselves from our competitors. We cannot assure you that we will be able to renew existing client contracts at the same or higher rates or that our current clients will not turn to competitors, cease operations, elect to self-operate or terminate contracts with us. The failure to renew a significant number of our existing contracts would have a material adverse effect on our business and results of operations.

We may be adversely affected if customers reduce their outsourcing or use of preferred vendors.

Our business and growth strategies depend in large part on the continuation of a current trend toward outsourcing services. Customers will outsource if they perceive that outsourcing may provide higher quality

16

services at a lower overall cost and permit them to focus on their core business activities. We cannot be certain that this trend will continue or not be reversed or that customers that have outsourced functions will not decide to perform these functions themselves. In addition, labor unions representing employees of some of our current and prospective customers have occasionally opposed the outsourcing trend to the extent that they believed that current union jobs for their memberships might be lost. In these cases, unions typically seek to ensure that jobs that are outsourced continue to be unionized and thus, the unions seek to direct to union employees jobs in our industry. We have also identified a trend among some of our customers toward the retention of a limited number of preferred vendors to provide all or a large part of their required services. We cannot be certain that this trend will continue or not be reversed or, if it does continue, that we will be selected and retained as a preferred vendor to provide these services. Unfavorable developments with respect to either of these trends could have a material adverse effect on our business and results of operations.

Our operations are seasonal and quarter to quarter comparisons may not be a good indicator of our performance.

In the first and second fiscal quarters, within the Food and Support Services—North America segment, there historically has been a lower level of sales at the historically higher margin sports, entertainment and recreational food service operations, which is partly offset by increased activity in the educational sector. In the third and fourth fiscal quarters, there historically has been a significant increase in sales at sports, entertainment and recreational accounts, which is partially offset by the effect of summer recess in the educational sector. For these reasons, a quarter-to-quarter comparison is not a good indication of our performance or how we will perform in the future.

Environmental regulations may subject us to significant liability and limit our ability to grow.

We are subject to various federal, state and local environmental protection laws and regulations, including the federal Clean Water Act, Clean Air Act, Resource Conservation and Recovery Act, Comprehensive Environmental Response, Compensation, and Liability Act and similar state statutes and regulations governing the use, management, and disposal of chemicals and hazardous materials. In particular, industrial laundries in our uniform rental segment use certain detergents and cleaning chemicals to launder garments and other merchandise. The residues from such detergents and chemicals and residues from soiled garments and other merchandise laundered at our facilities may result in potential discharges to air and to wastewaters that are discharged through sanitary sewer systems to publicly owned treatment works and may be contained in waste generated by our wastewater treatment systems. Our industrial laundries are subject to certain volume and chemical air and water pollution discharge limits, monitoring, permitting and recordkeeping requirements. Our food and support service business owns and operates underground storage tank systems to store petroleum products for use in our or our clients’ operations. These underground storage tank systems also are subject to performance standards, periodic monitoring, and recordkeeping requirements. We also may use and manage chemicals and hazardous material in our operations from time to time. In the course of our business, we may be subject to penalties and fines for non-compliance with environmental protection laws and regulations and we may settle, or contribute to the settlement of, actions or claims relating to the management of underground storage tanks and the handling and disposal of chemicals or hazardous materials. We may, in the future, be required to expend material amounts to rectify the consequences of any such events. In addition, changes to federal or state environmental laws may subject us to additional costs or cause us to change aspects of our business. Under federal and state environmental protection laws, as an owner or operator of real estate we may be liable for the costs of removal or remediation of certain hazardous materials located on or in or emanating from our owned or leased property or our client’s properties, as well as related costs of investigation and property damage, without regard to our fault, knowledge, or responsibility for the presence of such hazardous materials. There can be no assurances that locations that we own, lease or otherwise operate, either for ourselves or for our clients, or that we may acquire in the future, have been operated in compliance with environmental laws and regulations or that future uses or conditions will not result in the imposition of liability upon us under such laws or expose us to third party actions such as tort suits. In addition, such regulations may limit our ability to identify suitable sites for new or expanded plants. In connection with our present or past operations and the present or

17

past operations of our predecessors or companies that we have acquired, hazardous substances may migrate from properties on which we operate or which were operated by our predecessors or companies we acquired to other properties. We may be subject to significant liabilities to the extent that human health is damaged or the value of such properties is diminished by such migration.

Our Sponsors can strongly influence us and may have conflicts of interest with us in the future.

The Sponsors indirectly own, through their ownership in Holdings, a substantial majority of our capital stock on a fully-diluted basis because of the Transaction. As a result, the Sponsors have the ability to prevent any transaction that requires the approval of stockholders. Additionally, the Sponsors are in the business of making investments in companies and may from time to time acquire and hold interests in businesses that compete directly or indirectly with us. One or more of the Sponsors may also pursue acquisition opportunities that may be complementary to our business and, as a result, those acquisition opportunities may not be available to us. So long as the Sponsors, or funds controlled by or associated with the Sponsors, continue to own a significant amount of the outstanding shares of Holdings’ common stock, even if such amount is less than 50%, the Sponsors will continue to be able to strongly influence our decisions.

Food and Support Services

Competition in our industry could adversely affect our results of operations.

There is significant competition in the food and support services business from local, regional, national and international companies, of varying sizes, many of which have substantial financial resources. Our ability to successfully compete depends on our ability to provide quality services at a reasonable price and to provide value to our customers. Certain of our competitors have been and may in the future be willing to underbid us or accept a lower profit margin or expend more capital in order to obtain or retain business. Also, certain regional and local service providers may be better established than we are within a specific geographic region. In addition, existing or potential clients may elect to self operate their food service, eliminating the opportunity for us to serve them or compete for the account. While we have a significant international presence, should business sector clients require multinational bidding, we may be placed at a competitive disadvantage because we may not be able to offer as extensive a portfolio of services or services in as many countries as some of our competitors.

Sales of sports, entertainment and recreational services have been, and in the future would be, adversely affected by a decline in attendance at client facilities or by a reduction or cessation of events.

The portion of our food and support services business which provides services in public facilities such as convention centers and tourist and recreational attractions is sensitive to an economic downturn, as expenditures to take vacations or hold or attend conventions are funded to a partial or total extent by discretionary income. A decrease in such discretionary income on the part of potential attendees at our clients’ facilities have, and in the future could, result in a reduction in our sales. For example, our convention centers business has experienced softness due to declining levels of business and consumer spending as a result of the weakened economy. Further, because our exposure to the ultimate consumer of what we provide is limited by our dependence on our clients to attract customers to their facilities and events, our ability to respond to such a reduction in attendance, and therefore our sales, is limited. There are many factors that could reduce the numbers of events in a facility or attendance at an event, including labor disruptions involving sports leagues, poor performance by the teams playing in a facility, inclement weather and adverse economic conditions which would adversely affect sales and profits. For example, in 2011, collective bargaining agreements for the players in the National Football League, Major League Baseball and the National Hockey League will expire. If the players and owners in one or more of such leagues fail to come to terms on new collective bargaining agreements, a strike, lock-out or cancelled season could result. Any ensuing decrease in the number of games played would mean a loss of sales and reduced profits at the venues we service.

18

The pricing and cancellation terms of our food and support services contracts may constrain our ability to recover costs and to make a profit on our contracts.

The amount of risk that we bear and our profit potential vary depending on the type of contract under which we provide food and support services. We may be unable to fully recover costs on contracts that limit our ability to increase prices. In addition, we provide many of our services under contracts of indefinite term, which are subject to termination on short notice by either party without cause. Some of our profit and loss contracts contain minimum guaranteed remittances to our client regardless of our sales or profit at the facility involved. If sales do not exceed costs under a contract which contains minimum guaranteed commissions, we will bear any losses which are incurred, as well as the guaranteed commission. Generally, our contracts limit our ability to raise prices on the food, beverages and merchandise we sell within a particular facility without the client’s consent. In addition, some of our contracts exclude certain events or products from the scope of the contract, or give the client the right to modify the terms under which we may operate at certain events. The refusal by individual clients to permit the sale of some products at their venues, the imposition by clients of limits on prices which are not economically feasible for us, or decisions by clients to curtail their use of the services we provide could adversely affect our sales and results of operations.

Our business is contract intensive and may lead to client disputes.

Our business is contract intensive and we are parties to many contracts with clients all over the world. Our client interest contracts provide that client billings, and for some contracts the sharing of profits and losses, are based on our determinations of costs of service. Contract terms under which we base these determinations may be subject to differing interpretations which could result in disputes with our clients from time to time. Clients generally have the right to audit our contracts, and we periodically review our compliance with contract terms and provisions. If clients were to dispute our contract determinations, the resolution of such disputes in a manner adverse to our interests could negatively affect sales and operating results. While we do not believe any reviews, audits or other such matters should result in material adjustments, if a large number of our client arrangements were modified in response to any such matter, the effect could be materially adverse to our business or results of operations.

Claims of illness or injury associated with the service of food and beverage to the public could adversely affect us.

Claims of illness or injury relating to food quality or food handling are common in the food service industry, and a number of these claims may exist at any given time. As a result, we could be adversely affected by negative publicity resulting from food quality or handling claims at one or more of the facilities that we serve. In addition to decreasing sales and profitability at our facilities, adverse publicity could negatively impact our service reputation, hindering our ability to renew contracts on favorable terms or to obtain new business. In addition, future food product recalls and health concerns associated with food contamination may from time to time disrupt our business.

In fiscal 2010, one distributor provided approximately 57% of our food and non-food products in the United States and Canada, and if our relationship or their business were to be disrupted, we could experience disruptions to our operations and cost structure in such countries.