Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FARMER BROTHERS CO | d8k.htm |

| EX-99.1 - PRESS RELEASE OF FARMER BROS. CO. - FARMER BROTHERS CO | dex991.htm |

Exhibit 99.2

FARMER BROS. CO.

2010 Annual Stockholders Meeting

December 9, 2010

State of the Company Address (edited)

Reference herein to trade names and brand names not owned by the Company are intended for general informational and comparative purposes only. All trade names and brand names used herein are the property of their respective owners.

State of the Company Presentation by

Roger M. Laverty III, President and Chief Executive Officer and

Jeffrey A. Wahba, Treasurer and Chief Financial Officer

Roger Laverty: Good morning everyone.

The Farmer Brothers Annual Meeting is a unique opportunity to talk not only to our shareholders, but also to our employees who are our shareholders in large part. I am pleased to take this opportunity to update everyone, shareholders, employees and retirees alike, on the steps the Company has taken over the past year, and more importantly on how the Company is positioned for the future, and what steps we are going to be taking in the months and years to come to take advantage of the marketplace and to leverage the assets that Farmer Brothers has invested in, both in terms of our hard assets like our roasters and our plants, and our people.

And so, today what I would like to do is talk a little bit about where we are, talk a little bit about the environment that we face and talk about not only the challenges that we face, but the opportunities that we have as a company in the months and years to come.

At Farmer Brothers we start everything from the mission and vision we have for the Company. The mission is really important to revisit this every time we talk about what we are doing and why we are doing it because it is what we do here every day.

We sell great coffee, tea, culinary products. So, it is great products, great service and more importantly one customer at a time because no matter how big we get, no matter how many states we are in, no matter how representative we are and even if we start going international, if we don’t keep that focus, that mission of one customer at a time, then we are at risk of losing the bond, losing the tie that keeps the Company strong.

Our vision is to become the preeminent roaster and distributor of coffee, tea and culinary products in every key market in the United States. This vision has largely been accomplished as we sit here today with many of the steps we have taken over the past couple years, and we will talk about why we did some of those, why we made some of those changes and how it positions us for the future.

Before I get into that, though, I would like to take just a minute and talk about change. I have talked with many of you over the course of the years and everybody, especially people that are here on a day-to-day basis, knows the amount of activity that has taken place over the last 24 to 36 months.

The Company has gone through dramatic changes virtually in every area, whether it is a support area like manufacturing, finance or accounting, or in the field – with the new markets that we have entered and the integration of the acquisitions we have made. So, there have been a tremendous number of changes that the Company has gone through. Change is always difficult.

So the obvious question is — why do it? Why make any changes? Why not just keep things the way we were — though I’m not quite sure what that way was exactly because Farmer Brothers has changed dramatically over time since its founding. So, what point in time should we pick if we are not going to change? And what happens if we don’t?

Well, I would ask everybody to consider this question. Ten years ago, how many people in this room were using a computer at home with high-speed DSL? How many people were buying music online ten years ago? How many people were reading the LA Times or the New York Times online as opposed to getting it at their home and reading it on newsprint?

How many people had ever heard of Kindle or any other e-reader for books? How many of you have ever, in fact, a show of hands, how many people out there had a Facebook account or even knew what that meant ten years ago?

How many of you follow the Tweets of everybody from the President of the United States on down? Now those are changes, dynamic changes in the marketplace that obviously if anyone wants to stay current they have to react to and change their own lives to be current.

Now the coffee industry is no different in the last ten years. Ten years ago Starbucks had 2,600 stores, and everybody was saying this is a passing fad; they have way too many stores; the market is saturated; we don’t need another Starbucks store. Today, they have 30,000 stores and it’s a $10 billion company.

Ten years ago nobody had heard of Keurig Single Serve. Today, it’s a company worth $6 billion. Ten years ago, McDonald’s was about selling hamburgers and french fries. Today they are about selling coffee, both hot and cold.

Ten years ago, Dunkin’ Donuts was a doughnut company. Today, I think they are the second largest coffee company in the United States. Ten years ago specialty coffee was about 10% of the coffee market. Today, it is 40% of the coffee market.

So if we were to do nothing, these changes would be taking place without us. And if we are not reacting to those changes we are risking our place and our preeminence in the industry. So, that gets to what we have done and what resources we have today at Farmer Brothers to react to the changes in the marketplace, and to make sure that we are as competitive going forward for our next 100 years as we have been for the past 100 years.

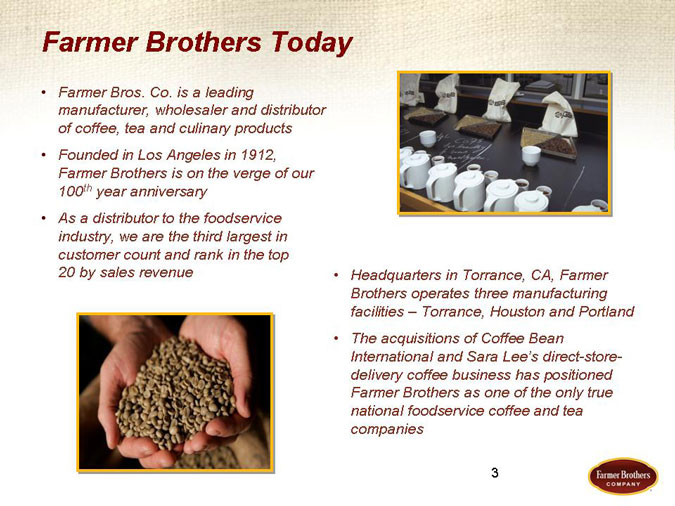

Today we are the leading manufacturer, wholesaler and distributor of coffee, tea and culinary products. As the distributor to the food service industry we are number three in the country in terms of number of customers served every day. We are in the Top 20 in terms of total revenue.

Our headquarters — While our headquarters remains in Torrance, California, today we operate three manufacturing plants — in Torrance, Houston and Portland. And the acquisitions in the last three years of CBI in Portland and the Sara Lee Direct Store Delivery business have now positioned us as one of the true national food service, coffee and tea companies in the United States. But, it’s not being national that makes a difference.

If you go to a customer they don’t care if you are national. They don’t care how big you are. They care about the service and the products that you can provide them and how you compare to the other coffee companies or the other distributors who compete with you for their business.

So that is why we have really focused on what our points of difference are that allow us to be competitive, we believe, to offer better products, better service and better overall support than anybody in the marketplace. And these five points of pride are something that we live and breathe every day.

The products — to make sure our products remain the best. The products we offer are second to none in the industry, and we have the capability to deliver direct to the customer with over three million square miles of direct and multichannel distribution. Not only do we buy our raw materials through brokers and representatives, we go to the source. We know the source, where products are and we can guarantee the quality of that product all the way from source to cup.

Equipment — we have representatives from the best equipment companies across the US. We have a network in place to make sure that that equipment gets placed and serviced which enables our customers to stay in business because without that service and without that trust in us their business would be affected.

And programs — every customer is different. Every segment is different and we have been able to customize programs to meet the needs of every customer segment, whether it be a Target store, or a chain of doughnut stores or an association of Greek restaurants. We can put together programs that are unique to that customer to allow them to compete better in the marketplace.

As we sit here today, our business units include the Farmer Brothers Foodservice division, which is the combination of the Farmer Brothers route sales and Sara Lee DSD business; Coffee Bean International, which specializes in the specialty coffee sector and in retail; Custom Coffee Plan, the office coffee service division of Farmer Brothers; and our industrial spice company, Spice Products Company, which continues to be one of the highest quality spice manufacturing producers in the US.

As anybody around here who uses Tapatio Hot Sauce knows, we are making the peppers for that, so you can rely on the quality.

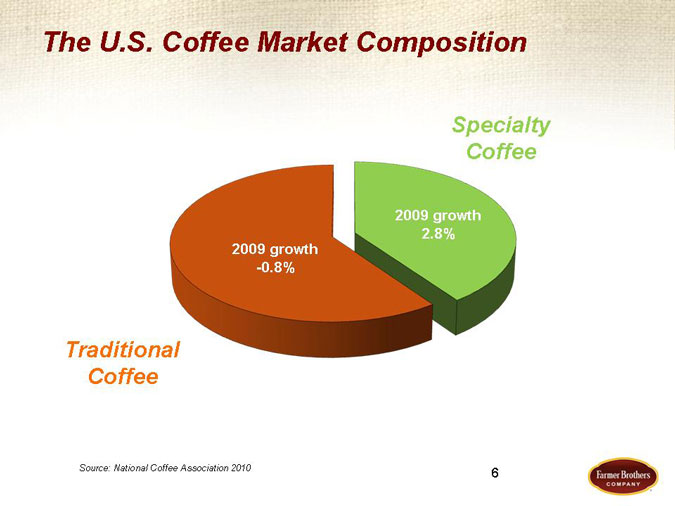

Now I talked a little bit about the why and the how of the dramatic market change. This data came out in 2009 and you can see the changes every year as we go forward. Specialty coffee is now 40% of the entire coffee market. Ten years ago, specialty coffee was just getting started and was a very small piece of the market. It was bigger in other countries than in the US, but in the US specialty coffee was a small piece of the market.

Today, it is 40% of the market. And you can see in the growth trends with traditional coffees going negative and specialty coffees still growing, even in the midst of tougher economic times at a much greater rate. So, that change in relationship between specialty coffee and traditional coffee will continue to change.

And you have seen that dramatically happen in some of the retailers — everyone from McDonald’s to Dunkin’ Donuts — that have upgraded their coffee programs to take advantage of these trends. They are looking at these numbers too. And that is why they are making the changes to their assortment of offerings, to take advantage of these changes in the marketplace.

So today, because of that Farmer Brothers has in its assortment of product offerings this entire pyramid. Everything from the top of the pyramid, even though it is still a smaller piece of the market in the specialty and gourmet coffees to the premium and traditional coffees to the value coffees, that continue to make up the bulk of the market, that I said is growing at a much slower pace than the other coffees. Today, Farmer Brothers has the capability to meet the needs in every one of these categories.

Now our challenge over time is to move our customers up this pyramid because specialty coffees sell for more dollars. They are of a different quality. Similar to the wine industry, as people become more discriminating in this product we can take advantage of that learned expertise in the market and provide products that respond to those changes in the marketplace.

It is not only our products, but also our team. Now as we sit here, with these combinations and the restructure of the Company, not only has the leadership of the Company expanded and added expertise and talent in many different areas, but in the coffee area in particular we have individuals within our Company today that participate in all the key organizations in the coffee industry, from the NCA, to the SEAA to the PCAA. We have the past Chair and founder of the Roasters Guild of America, the head of the Technical Standards Committee of the SEAA, and Chair of the Advisory Panel of the Coffee Quality Institute. Bottom line — we are coffee experts. And now we have the capability throughout our organization to respond again to the changing needs of our customers. No matter which customer comes in — and we will see this a little bit later today as we take a tour of our new coffee lab and R&D center — the kind of capabilities that we have as a company to respond again to the changing needs of our customers.

Technical expertise. We just completed a coffee R&D center which is the state of the art in the entire coffee industry. We had an individual from PROBAT in visiting us the other day, and for those of you who don’t know, PROBAT is the largest manufacturer of coffee roasters in the world, and does work for almost every coffee company. He walked our lab and looked at the capabilities. It wasn’t just the facility, which is nice, but the capabilities that this lab has, the equipment it has and the talent that we have in the people working there.

He said he has been all over the world. He has been to every coffee company. He said there are only three other competitors in the world that have labs of this caliber. Those were Douwe Egberts in Europe, Lavazza in Italy and Nestle in Switzerland. Our lab is equal to every one of those in its capabilities.

So, again, this is not about just having a nice facility to show people, but having a facility that enables us to serve whoever the customer is and whatever their needs are in such a way that the customer can trust that the products they are getting, not only from a quality standpoint, but from the standpoint of our ability to conduct research and development and customize the product to meet their specific needs, are the best there is and that no one can do it better than we can.

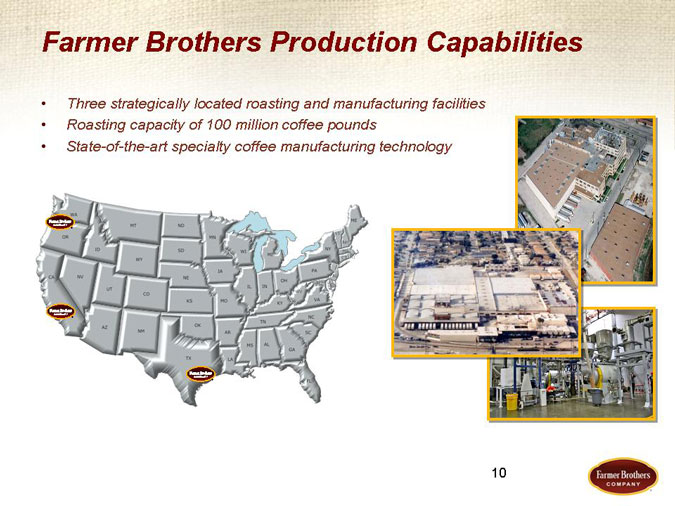

So as we mentioned, today we have three strategically located roasting and manufacturing facilities, a roasting capacity of almost 100 million pounds and state of the art specialty coffee manufacturing technology, both here in Torrance now with our new roaster, our R1000 which is up and running, and up in Portland — with the roasting capabilities up in Portland to meet the needs of our specialty customers.

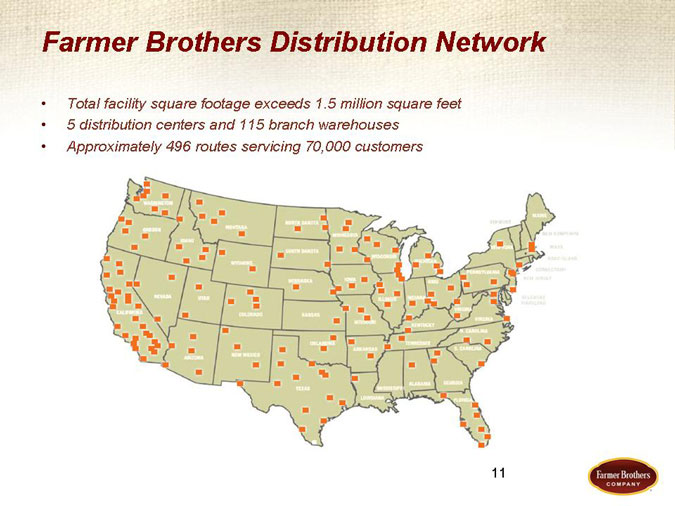

Here is our distribution network. This is one of the major changes that has taken place over the last three years. Total facility square footage exceeds 1.5 million square feet, five distribution centers, 115 branch warehouses, almost 500 routes serving 70,000 customers. And these are the locations that Farmer Brothers covers across the entire 48 states of the United States.

Now when people ask me, why aren’t we in the last two states? We actually do ship coffee to customers in Hawaii and Alaska. And as of, I think, last week or the week before we began shipping coffee to a customer in Canada. So, we are beginning to expand even beyond the 48 states.

We also offer our customers a portfolio of brands that I believe is second to none in the food service industry, brands that are respected, trusted and have equity among various segments of customers wherever they do business and wherever they operate, both in the coffee category with Farmer Brothers’ SUPERIOR®, PREBICA®, MCGARVEY®, CAIN’S® and other regional brands, and in the tea category with our SIERRA®, JUSTIN LLOYD®, ISLAND MEDLEY® and SIERRA® teas.

These brands are well known in the food service industry. This portfolio allows us, again, to be flexible to whatever the customer needs, as you notice back to one customer at a time. Whatever that one customer needs we have the offering that will meet those needs.

We have expanded our penetration of national accounts greatly in the past three years. Today, we have many of the country’s leading retailers and food service chains who choose Farmer Brothers to be their partner. They value our beverage, and culinary solutions and service capabilities, back to the products, the customization ability, our distribution capability and our service ability.

This is an example of the other items that we have that allow us to customize programs for customers that is second to none in the industry, everything from jams, jellies and preserves to soup bases. We have added liquid dressings, mayonnaise categories, iced coffee and specialty coffee. We are continuing to respond literally on a daily basis to changes in customer demand for specialty products like cappuccino, iced tea and iced coffee. We will talk a little bit about that later.

Based on these offerings, today we are proud to say that in the national account and the larger customer category this is a representative number of customers that Farmer Brothers services today that relies on Farmer Brothers, that trusts Farmer Brothers to meet their needs — everything from over 2,000 Target stores in the US, Macy’s, Hilton, Embassy Suites and Best Western.

In the restaurant category, our customers include Morton’s, Daily Grill, Einstein Bros. Bagels. In the gaming category, our customers include Mohegan Sun, Stations, MGM Grand, Hard Rock. In the convenience store category where we have made huge inroads in the past couple of years our customers include Pilot, Sunoco, Flying J, Sheetz and others.

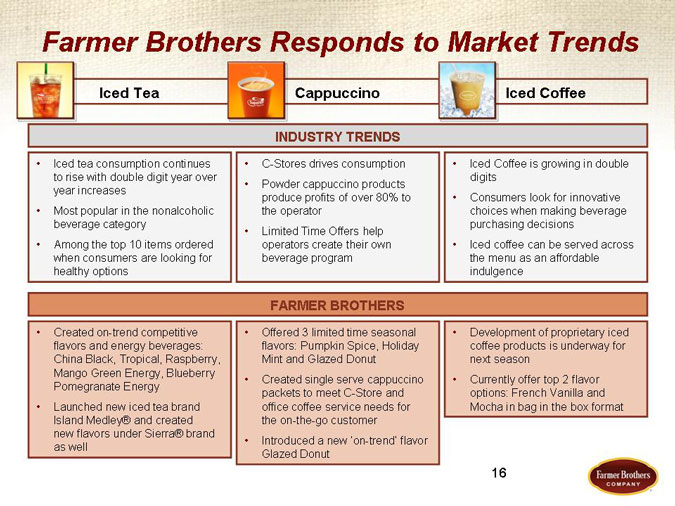

We said there are trends in the marketplace that you need to respond to. The market has changed dramatically in the last ten years, but it is not stopping. Every year there are new trends. There are new customer demands. There are new hot products that customers are looking for, and if customers are looking for them then our customers are looking for solutions to meet those needs and those demands.

Some of the key areas that we have been responding to in the last year are: iced tea, cappuccino and iced coffee. The consumption of iced tea continues to rise double digit year-over-year. If you go out to eat anytime after the morning and ask what they want to drink more people say “iced tea.” Customers are looking for different iced tea solutions than any other beverage. It is the most popular nonalcoholic beverage category there is and among the top ten items ordered.

So, what are we doing? We have created on trend competitive flavors and energy beverages, China Black, Tropical Raspberry, Mango, Green Energy, Blueberry, and Pomegranate Energy. If you have had an opportunity to try some of these teas — I don’t think we have any here today — but if you have an opportunity these are terrific products and they are right on the hottest trends in the marketplace.

C-Stores continue to drive the consumption of cappuccino. Especially with McDonald’s going into some of the flavored coffees and flavored drinks, C-Stores are trying to compete with McDonald’s and they are looking for solutions that allow them to keep the customer that used to come to the C-Store for their coffee and cappuccino in the morning and are now are going to McDonald’s for it. So, C-Stores are trying to lure that customer back.

We have some of the best brands in the C-Store business in cappuccino. This year we even added some specialty items, Pumpkin Spice, Holiday Mint and Glazed Doughnut, which tastes a lot better than it sounds to be drinking. But these drinks were very, very popular in the C-Store category. And we were able again from a customization standpoint package these, not only in the large sizes to go in the machines in the C-Stores, but allow them to do single serving packets so they could sell them to their customers, and again try to keep their business to continue to be competitive with the changes in the marketplace.

Iced coffee is another category that is growing in double-digit rates and McDonald’s again is driving this business. And if you look at McDonald’s latest results — I use McDonald’s only because they are so big and they do represent some of the trends — you have seen them roll out this huge new coffee category, both hot and cold coffees. They just released numbers showing that their cold specialty coffee beverages are outperforming their hot ones.

So people are looking for these beverages. People want them and we are helping with our product development to provide flavors in French Vanilla and Mocha bag-in-the-box format, again, to respond to these customers’ needs and allow them to continue to compete in the marketplace.

Okay. It goes beyond product. One of the other dramatically growing areas in the coffee industry is private label. Some of the nation’s biggest retailers are spending huge dollars in developing their private label. The equity in the private label for the simple reason is that it allows them to own the brand. It allows them to generate greater margins than they can in buying a national brand. And it allows them to take advantage of their shelf space to drive customers, key that customer in and lock them in to their store format and not be able to go to a competitor.

So we have the ability today, at Farmer Brothers, to meet and create programs for a retailer of any size, again, because Target is a customer and they are one of the largest, all the way down to smaller retailers and create programs — customize programs to allow them to develop these brands and create tremendous equity in these brands within their customer base.

This is an example of a brand we created for Nordstrom’s that has been a customer for many, many years and continues to grow at terrific rates year-over-year with us, as well as the products. People ask me where they should buy coffee. If they want to go to a supermarket to buy coffee and if they are not taking it from our own company store, they should go to Target because that is our coffee. All the Archer Farms coffees are Farmer Brothers products and Archer Farms is a terrific coffee.

As any good corporate citizen in today’s world, we are also beginning to adopt more and more socially and environmentally conscious programs to be able to share them with our customers who are looking for them from their vendors. So whether it is an internal program like our seed program and our LEED certification of our new Portland plants, or whether it is some of our project direct programs where we go direct to source, we have adopted socially and environmentally conscious programs.

We have done this now in a couple of areas in the world, in Indonesia where Jonathan Waite and Jose have been to source, to work with farmers, and all the way to South America — Peru, Nicaragua and others, where we work directly with the farmers in these regions to bring product of tremendous quality back to our customers. A component of the project is to reinvest in those communities to ensure the sustainability of our source product and our source materials and tie us closer to those sources of product.

With all these capabilities we have had some big wins in the past year. These are our larger customers that take a long time. The pipeline to get into winning this kind of account can take months and sometimes even years because they are mostly contractual accounts. They are larger accounts. The accounts are more reluctant to change and when you go in to try to win this business you have to go in with a whole portfolio of goods and services that you know are better than anyone else in the industry. Otherwise, there is no incentive to change from where they are today.

We have been able to win these in the past year — the Wyndham Resorts and Hotels and all the brands associated with Wyndham, was a huge win. Sheetz convenience stores based in Western Pennsylvania is, I think, the second largest convenience store chain in the country today after Wawa on the East, and Flying J which was acquired by Pilot and which we were able to add to our portfolio of Pilot products.

While it is not up here, the one we just recently won and will be more relevant to everybody in this room who likes hamburgers is that beginning in January you will be able to get Farmer Brothers coffee in In-N-Out Burger, which was a big win and prestigious win for Farmer Brothers.

Looking ahead — well I mentioned that we have been through a tremendous amount of change and not all of it has been easy. In fact, some of it has been downright challenging. We have taken our organization and almost doubled its size, brought together individuals from different business cultures, and put them into the Farmer Brothers family.

We have introduced internal systems and controls and capabilities that we have never had before. We have had to go through some of the wrenching restructuring associated with integrating two companies of almost equal size. But the good news is, as we sit here today much of that difficult work is now behind us. And as we look forward our opportunity is to take advantage of all the work we have put in and to get the benefit from that investment.

Some of that is to realize the synergies from the recently completed acquisition and integration activities. We have done a lot of work in putting all the branches together, the routes together, distribution centers, et cetera. Now is the time to take advantage of all that work and realize the benefits.

We can leverage our local, regional and national service capabilities to a broader customer base. We have salespeople now literally covering every region in the United States, and not only every region, but every customer segment. So whether it be our broadened and expanding activities in retail, where we have several large retail accounts that we are very close to getting new business with, or the hotel industry, or gaming expansion, (we are even looking at international support of gaming operations in Asia as an opportunity) we can take our expertise and expand the business there.

We can grow all tiers of our food service business, again, national, regional, independents with sales organizations targeted to these different customer segments. And we can continue to leverage our expertise in developing and supporting the private label brand opportunities while we are focusing on the new categories, the emerging categories like specialty coffee, iced tea, cappuccino and culinary products.

So the bottom line is we are at a point now where we have made some acquisitions. We have made a bunch of changes in the organization and all that investment — and that is what it has been. It has been investment, both in dollars, and in time and energy of all the people in our organization to create a platform that can take advantage of the dynamically changing marketplace.

We ignore the changes in the marketplace at our own peril. And I think at Farmer Brothers we not only have not ignored those changes, but we have invested and tried to position ourselves so that as we come up on the end of our first 100 years in business we can look forward to our next 100 years in business with the confidence that that the next 100 years will have the same opportunity for success, innovation and business results that we have had in our first 100 years of business.

So, with that I am going to turn over the mike to Jeff Wahba who is going to walk through some of the financial results and talk about some of the key performance indicators. And at the end of that we will both be available for your questions. Thank you, very much.

Jeff Wahba: Thank you, Rocky. Farmer Brothers has emerged as a national player, as both a manufacturing distributor for coffee and related products as a result of two unprecedented acquisitions over the last four years. I want to quickly review the results from those acquisitions.

One, we have been able to more than double our revenue from 2007 to 2010. We have increased our product offerings, and when you look at our sales per order we have accomplished our objectives by increasing that.

Our national footprint has now allowed us to win national accounts and we wouldn’t have been able to do that without the recent acquisitions. We have realized synergies from our consolidation of over 50 facilities in the last year and a half, and we have improved our truck and branch operations.

We have leveraged our overhead structure over a much larger revenue base and so, as you look at overhead expense as a percent of revenue it continues to decline year-over-year. And, finally, as we look at our increase in size we have increased our purchasing power and believe that we are now a low cost manufacturer in our industry.

In 2010, we focused on integrating our acquisition. Our corporate sales exceeded $450 million, which was a 69% increase from 2008 which was the year prior to the Sara Lee DSD acquisition. At the same time, CBI continues to gain market share and revenues we were up over 8% at CBI last year.

We completed nearly all of our capital expenditure requirements related to the DSD acquisition in 2009. And as we head into this fiscal year, we are looking at capital expenditure requirements that are at least 30% less than the prior year due to the substantial investment we made last year. Despite the challenging economic environment and the fact of many integration related costs, we continue to increase our earnings per share metrics, and thus, we were able to pay continued dividends through each of the four quarters of fiscal year 2010.

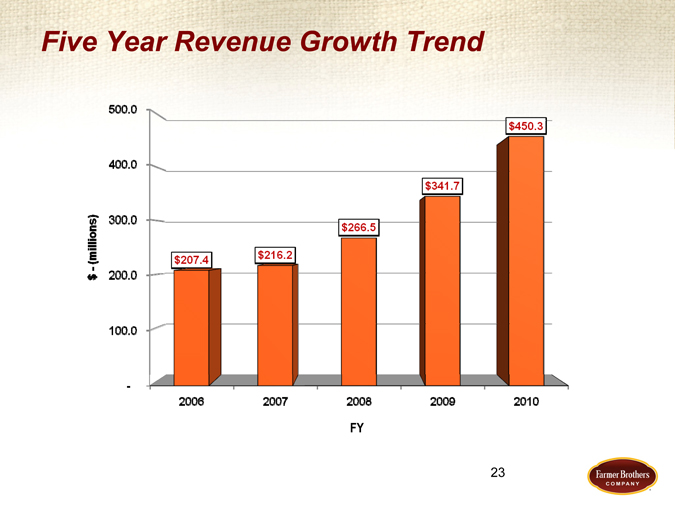

Our revenue growth trend is very impressive. When you look over a five-year basis you see 125% growth. We were at $207 million in revenue in 2006, and today and ending 2010 we are at $450 million. With this impressive growth, though, it is important to look back and now focus on maximizing our profitability as we look forward to improve our operations.

Our first quarter of 2011 was certainly challenged by the economy and our customers have certainly been impacted with their own revenue metrics, but those items we can control continue to improve. Same store sales, average size of new customers and revenue per order were all up; those are metrics we can control.

Despite our overall revenue being somewhat impacted by, again, the economic factors, our revenue per employee increased quarter-over-quarter when you compare the first quarter of this year with last year, a clear sign that we are getting productivity benefits out of the acquisition. Our operating expenses reduced 6% when you look at the comparable quarter run rate for fiscal year 2010 compared to the first quarter of 2011. And we were able to renegotiate our bank line in 2010 and in the first quarter of 2011, giving us greater flexibility and availability for our line of credit.

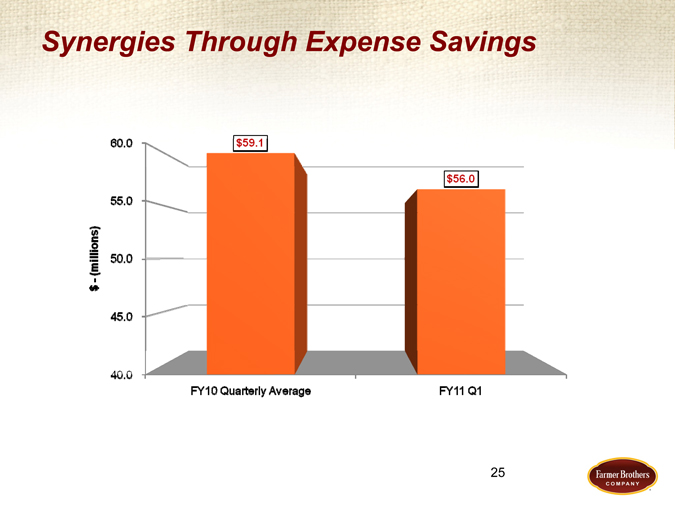

You can see the synergies being realized in the reduction in operating expenses. In the first quarter of 2011, we had $56 million in operating expenses, about a 6% decline from the run rate of $59 million and we are very confident that our operating expenses will continue to decline in the subsequent quarters.

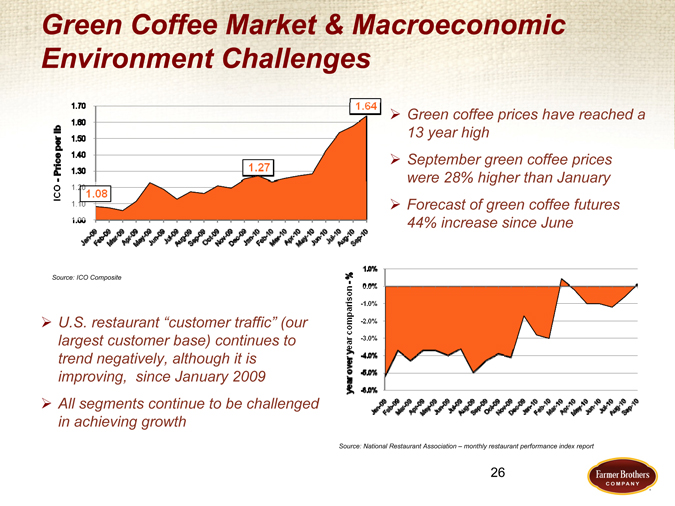

Certainly, there are a couple of macroeconomic factors that are impacting our business. The green coffee market continues to escalate in an unprecedented fashion. Green coffee costs are up over 60% since January of 2010. Like our competitors, we attempt to pass along these raw material cost increases to our customers, but when they are increasing as rapidly as they have been in this last year, obviously this can’t be done in a simultaneous exercise and so our gross margins have been impacted to some extent.

Likewise, US restaurant traffic on a year-over-year basis has been down for the past three years, but as you can see by the chart restaurant traffic continues to improve and many of our customers in the last couple of months are starting to see year-over-year traffic increases. We believe that trend will continue, and will certainly positively impact our revenue trends as we go into the third and fourth quarters of this year.

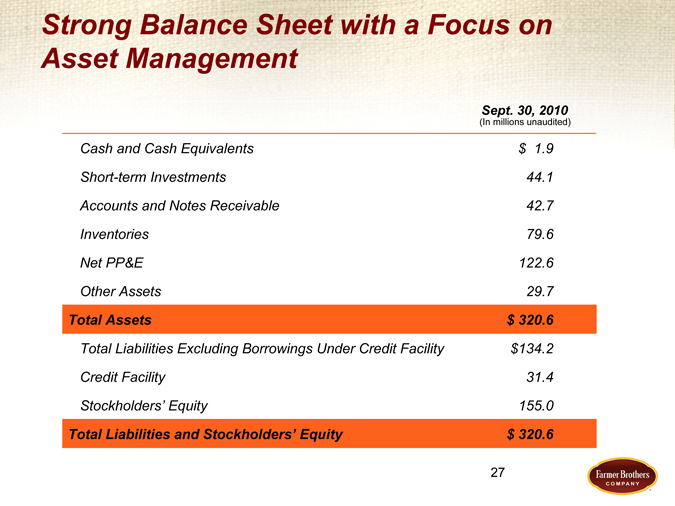

We have a very strong balance sheet. As you can see in the second to last line, our stockholders equity of $155 million is impressive. And when you look at accounts receivable inventories and net property, plant and equipment we have almost $250 million of operating assets. Clearly, our focus at this point is to manage those as efficiently as possible.

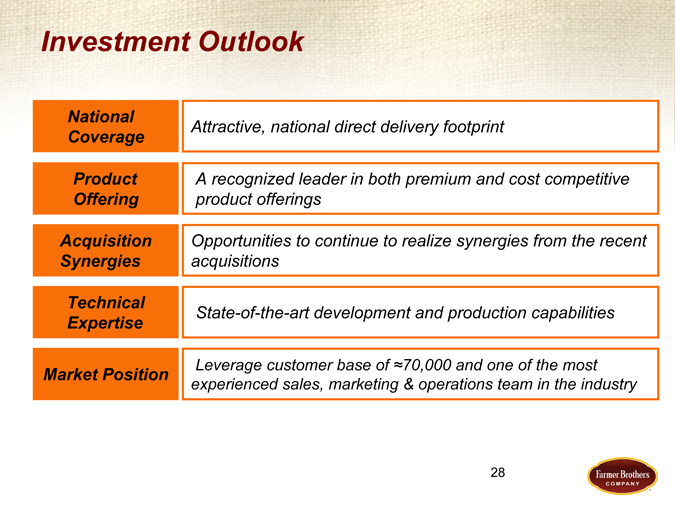

Finally, Farmer Brothers is poised more than ever to capitalize on our core markets. I think there are five key investment strategies as we go forward. Farmer Brothers is now a national entity with an attractive national footprint, and as Rocky mentioned, we won a number of key national accounts over the last year.

Our product offering now appeals both to the cost competitive and premium segments. We are now ready to take advantage of acquisition synergies and we are seeing that already in our operating expenses. At CBI and in our Torrance facilities, we have done significant investment in upgrading our technical capabilities and production capabilities. And as Rocky mentioned, they are unparalleled in the industry.

And finally, we have a very enviable market position. We have 70,000 customers, one of the most experienced sales and marketing staff in the industry and a 99 year reputation of quality and success.

With that, I will turn it over to Rocky to field any questions that you might have.

Roger Laverty: So, Jeff and I will take questions from anybody on whether it be operational, strategic or financial questions. And at the end of that, again, we will give everybody the opportunity to tour our new R&D facility.