Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - INNOVATIVE SOLUTIONS & SUPPORT INC | a2201359zex-23_1.htm |

| EX-21 - EX-21 - INNOVATIVE SOLUTIONS & SUPPORT INC | a2201359zex-21.htm |

| EX-31.1 - EX-31.1 - INNOVATIVE SOLUTIONS & SUPPORT INC | a2201359zex-31_1.htm |

| EX-31.2 - EX-31.2 - INNOVATIVE SOLUTIONS & SUPPORT INC | a2201359zex-31_2.htm |

| EX-32.1 - EX-32.1 - INNOVATIVE SOLUTIONS & SUPPORT INC | a2201359zex-32_1.htm |

Use these links to rapidly review the document

Table of Contents

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended September 30, 2010 |

||

OR |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to . |

||

Commission File No. 0-31157

INNOVATIVE SOLUTIONS AND SUPPORT, INC.

(Exact name of registrant as specified in its charter)

| Pennsylvania (State or other jurisdiction of incorporation) |

23-2507402 (IRS Employer Identification No.) |

|

720 Pennsylvania Drive, Exton, Pennsylvania (Address of principal executive offices) |

19341 (Zip Code) |

(610) 646-9800

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: | Name of each exchange on which registered | |

|---|---|---|

| Common Stock par value $.001 per share | The NASDAQ Stock Market, LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act Yes o No ý

Note: Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or section 15(d) of the Exchange Act from their obligations under those sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer," "non-accelerated filer," and "smaller reporting company," in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller Reporting Company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

The aggregate market value of the Registrant's common stock held by non-affiliates of the Registrant as of March 31, 2010 (the last business day of the registrant's most recently completed second quarter) was approximately $80.1 million. Shares of common stock held by each executive officer and director and by each person who owns 10% or more of our outstanding common stock have been excluded since such persons may be deemed affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of December 04, 2010, there were 16,770,415 outstanding shares of the Registrant's Common Stock

Documents Incorporated by Reference

Portions of the Registrant's Proxy Statement for the 2011 Annual Meeting of Shareholders to be filed prior to January 28, 2010 are incorporated by reference into Part III of this Report. Such Proxy Statement, except for the parts therein which have been specifically incorporated by reference, shall not be deemed "filed" for the purposes of this Report on Form 10-K.

INNOVATIVE SOLUTIONS AND SUPPORT, INC.

2010 Annual Report on Form 10-K

1

This report contains forward looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934. We have based these forward looking statements largely on our current expectations and projections about future events and trends affecting our business. In this report, the words "believe," "may," "will," "estimate," "continue," "anticipate," "intend," "forecast," "expect," "plan," "should," "is likely" and similar expressions, as they relate to our business or our management, are intended to identify forward looking statements, but they are not exclusive means of identifying them.

The forward looking statements in this report are only predictions and actual events or results may differ materially. In evaluating such statements, a number of risks, uncertainties and other factors could cause our actual results, performance, financial condition, cash flows, prospects and opportunities to differ materially from those expressed in, or implied by, the forward-looking statements. These risks, uncertainties and other factors include those set forth in Item 1A (Risk Factors) of this Annual Report on Form 10-K and the following factors:

- •

- the impact of general economic trends on our

business;

- •

- the deferral or termination of programs or contracts for convenience by

customers;

- •

- difficulties in developing and producing our COCKPIT/IP™ Flat Panel Display System or

other planned products or product enhancements;

- •

- market acceptance of our flat COCKPIT/IP™ Flat Panel Display System or other planned

products or product enhancements;

- •

- our ability to gain regulatory approval of our products in a timely

manner;

- •

- failure to retain/recruit key personnel;

- •

- continued market acceptance of our air data systems and

products;

- •

- the availability of government funding;

- •

- delays in receiving components from third party

suppliers;

- •

- the competitive environment;

- •

- the bankruptcy or insolvency of one or more key

customers;

- •

- new product offerings from competitors;

- •

- protection of intellectual property rights;

- •

- our ability to service the international

market;

- •

- potential future acquisitions; and

- •

- other factors disclosed from time to time in our filings with the Securities and Exchange Commission.

Except as expressly required by the federal securities laws, we undertake no obligation to publicly update or revise any forward looking statements, whether as a result of new information, future events or otherwise after the date of this report. Our results of operations in any past period should not be considered indicative of the results to be expected for future periods. Fluctuations in operating results may also result in fluctuations in the price of our common stock.

Investors should also be aware that while we do, from time to time, communicate with securities analysts, it is against our policy to disclose any material non-public information or other confidential commercial information. Accordingly, shareholders should not assume that we agree with any statement or report issued by any analyst irrespective of the content of the statement or report. Furthermore, we have a policy against issuing or confirming financial forecasts or projections issued by others. Thus, to the extent that reports issued by securities analysts contain any projections, forecasts or opinions, such reports are not the responsibility of Innovative Solutions and Support, Inc.

2

Overview

Innovative Solutions and Support, Inc. (the "Company," "IS&S" or "we") was founded in 1988. The Company designs, manufactures and sells Flat Panel Display Systems, Flight Information Computers and advanced monitoring systems to the Department of Defense (DoD), government agencies, defense contractors, commercial air transport carriers, original equipment manufacturers (OEMs), and corporate/general aviation markets. The Company is increasingly positioning itself as a system integrator; this capability provides the Company with the potential to generate more substantive orders over a broader product base. The Company has demonstrated an ability to incorporate added functionality such as electronic flight bags, charting and mapping systems into its Flat Panel Display System product line. Our strategy as both a manufacturer and integrator is to leverage the latest technologies developed for the personal computer and telecommunications industries into advanced, cost-effective solutions for both the aviation industry and DoD. We believe this approach, combined with our industry experience, enables us to develop high-quality products and systems, substantially reduce product time to market and achieve cost advantages over products offered by our competitors.

For several years the Company has been working with advances in technology to provide pilots increasing amounts of information that enhance both the safety and efficiency of flying. These advances have come together in the Company's COCKPIT/IP™ (Cockpit Information Portal or CIP) Flat Panel Display System product line that incorporates proprietary technology, low cost, reduced power consumption, decreased weight and increased functionality. The Company's Flat Panel Display System product line is suited to address market demand that we believe will be driven by regulatory mandates, new technologies and aging equipment on airplanes that have been in service for up to fifty years. We believe the transition to Flat Panel Display Systems as part of airplane retrofit requirements continues. This shift in regulatory and technological environment is illustrated by the dramatic increase in the number of Wide Area Augmentation System (WAAS) approach qualified airports. Aircraft equipped with our Flat Panel Display System product line will be qualified to land at such airports, which we believe will further increase the demand for our products.

In fiscal 2010, IS&S announced it received FAA certification for its Class 3 Electronic Charts and XM Satellite Weather upgrade to the AVIO NG integrated cockpit system of the Eclipse Aerospace, Inc. (EAI) EA500 Very Light Jet. IS&S commenced sales to EAI of the upgrade for installation on existing aircraft. IS&S introduced and began sales of increased functionality for its COCKPIT/IP™ Flat Panel Display System for application on the B757/B767 platform. The company also received additional Transport Canada Supplement Type Certificate (STC) certification for the B757 to further address the needs of that market.

In fiscal 2009, IS&S announced it began delivering a new product to the U.S. military: high resolution, 20 inch diagonal displays. These displays are used in the rear of the aircraft by tactical mission officers. The Company also initiated shipments of the Flat Panel Display System being marketed by Cessna as the "AdViz" cockpit upgrade solution for legacy Citation 500/501, 550/551, S550 and 560 aircraft. "AdViz" provides access to navigational aids such as XM Weather, navigation charts, remote radio tuning, and enhanced video all while improving reliability and reducing weight. IS&S received an amended Supplement Type Certificate (STC) on the PC-12 Flat Panel Display System for the WAAS program with Lateral and Vertical Precision Performance with a fully coupled auto-pilot. The company also received a Supplemental Type Certificate (STC) for RVSM Compliance of its PC-12 Flat Panel Display System in fiscal 2009.

In fiscal 2008, IS&S announced an addition to its COCKPITt/IPTM Flat Panel Display System product line: the IS&S Vantage COCKPIT/IP™ Flat Panel Display System, an open architecture flat

3

panel display system capable of interfacing with most third party avionics. The Vantage system can be retrofitted into a variety of airframes. The Company launched a Wide Area Augmentation System (WAAS) program with Lateral and Vertical Precision Performance with a fully coupled auto-pilot for its PC-12 COCKPIT/IP™ Flat Panel Display System. WAAS capability allows PC-12 operators to fly precision approaches at smaller airports. This capability is also available on other aircraft platforms. IS&S received amended Supplemental Type Certificates (STC) for the Boeing 757/767 platform from the Federal Aviation Administration (FAA) adding increased functionality to the COCKPIT/IP™ Flat Panel Display System. The Company increased the volume of work it is conducting for Homeland Security's Pilatus PC-12 and Lockheed Martin C-130 fleets.

Our Industry

A wide range of information, including airspeed and altitude, is critical for proper and safe operation of aircraft. With advances in technology, new types of information to assist pilots, such as satellite based weather and ground terrain maps, are becoming available for display in cockpits. We believe aircraft cockpits will increasingly become information centers, capable of delivering additional information that is either mandated by regulation or demanded by pilots to assist in the safe and efficient operation of aircraft.

There are three general types of flight data: aircraft heading and altitude information, flight critical aircraft control data and navigation data. Aircraft heading and altitude information includes aircraft speed, altitude and rates of ascent and descent. Flight critical aircraft control information includes engine data such as fuel and oil quantity and other engine measurements. Navigation data includes radio position, flight management, Global Positioning System (GPS) and alternative source information; which is information not originating on the aircraft, including weather depiction maps, GPS navigation and surface terrain maps. Air data calculations are based primarily on air pressure measurements derived from sensors on the aircraft. Engine data are determined by measuring various indices such as temperature, volume, revolutions per minute (RPM) and pressure within an aircraft's engines and other mechanical equipment. GPS and alternative source information is typically derived from satellites or equipment located on land and fed by satellite or radio signals to the aircraft. Pilots can then display this information in the cockpit for reference and enhanced position awareness.

Traditionally, flight data and other cockpit information were displayed on a series of separate analog instruments. In the early 1980s, digital displays using Cathode Ray Tubes (CRT) began to replace some individual analog instruments. The industry now offers high resolution color flat panels using Active Matrix Liquid Crystal Displays (AMLCD) to replace traditional analog instruments or CRT displays. We expect that the ability to display more information in a space efficient and customized platform will become increasingly important if additional information, such as weather depiction maps, traffic information and surface terrain maps, become mandated by regulation or demanded by pilots. Accordingly, we believe flat panel displays, which can integrate and display a "suite" of information, will increasingly replace individual instruments and CRTs as the method for delivering and ordering information displayed in cockpits.

Equipment data, such as engine and fuel related information, were traditionally displayed on conventional analog instruments. Engine and fuel instruments provide information on engine activity, including oil and hydraulic pressures and temperature. These instruments are clustered throughout an aircraft's cockpit. Engine and fuel instruments tend to be replaced more frequently than other instruments due to increased obsolescence problems and normal wear-and-tear. As information displayed by this instrumentation is vital for safe and efficient flight, aircraft operators continue to purchase individual conventional engine and fuel instruments to replace older or non-functioning instruments. Increasingly, operators are replacing their individual instrument clusters with integrated COCKPIT/IP™ Flat Panel Display Systems.

4

As the skies and airports are becoming more crowded, the aviation industry and regulators are concentrating on new technologies, procedures and regulations that allow more aircraft to operate in the skies and on the ground safely, efficiently and with less impact on the environment. These new technologies and procedures, such as traffic avoidance, ground awareness, increased precision of navigation and vertical position, runway incursion prevention and increased digital communication, will require innovation and intuitive methods to display situational awareness information for the pilots. The Company believes that flat panel displays are the best method to handle these and future requirements.

Strategy

Our objective is to become a leading supplier and integrator of cockpit information. We believe our industry experience and reputation, our technology and products and our business strategy provide a basis to achieve this objective. Key elements of our strategy include:

- •

- Retrofit focus. We believe offering cockpit avionics

upgrades for existing aircraft is of great interest in today's economic environment. Retrofitting an aircraft with the COCKPIT/IP™ Flat Panel Display System is cost effective compared to

acquiring a new aircraft and yet can provide the same functionality. When the economy returns to more robust levels, we believe lead times to acquire new aircraft will lengthen and demand for

retrofits will continue as operators update their existing fleets to provide needed lift capacity.

- •

- Establishing leadership in the flat panel display

market. We expect that over the next several years, many aircraft will be retrofitted with flat panel displays. Given the versatility,

visual appeal and lower cost of displaying a series of instruments and other flight relevant information on a single flat panel, we believe flat panel displays will increasingly replace individual

analog and digital instruments and CRTs. We also believe our COCKPIT/IP™ has significant benefits over flat panel displays currently offered by competitors, including lower cost, larger

size, reduced weight, enhanced viewing angles and a broad array of functions. Our patented and proprietary Integrity Checking Processor and Zooming features provide increased situational awareness,

reliability, performance and utility to the owner/operator. Accordingly, we believe these advantages will allow us to generate significant revenues from our COCKPIT/IP™ and increase market

share. Demand for new aircraft, FAA mandates to upgrade older aircraft and obsolescence issues on older aircraft will fuel this growth.

- •

- Continuing our engineering and product development

successes. We developed innovative products by combining our avionics, engineering and design expertise with commercially available

technologies, components and products from non-aviation applications, including the personal computer and telecommunications industries. Our COCKPIT/IP™ Flat Panel Display

System is an example of our ability to engineer products through the selective application of non-avionic technology. Our research and development expenses were $5.2 million,

$5.3 million and $10.3 million for fiscal years ended September 30, 2010, 2009 and 2008, respectively.

- •

- Maintaining our leadership in air data markets. We believe

we are one of the largest suppliers of air data products to the U.S. retrofit market. Significant demand remains to retrofit aging aircraft with newer, more advanced and more supportable air data

systems. Additionally upgrading business jets with higher performance engines is driving a need for more sophisticated air data products supplied by us.

- •

- Increasing our sales to the DoD, other government agencies, defense contractors, commercial air transport and corporate/general aviation markets. We strengthened efforts to diversify our sales to include all end user markets of the aviation industry, particularly legacy military aircraft programs and the commercial air transport market. This includes national and regional carriers and other fleet operators, the corporate/general aviation market, primarily through aircraft

5

- •

- Expanding our international presence. We plan to increase

our international sales by adding sales and marketing personnel and foreign offices. As large flat panel displays become more prevalent, we believe European and other international aircraft operators

and aircraft modification centers will accelerate retrofitting activities, thereby increasing demand for large flat panel displays. Presently, we are in the process of obtaining EASA approval for

European installations.

- •

- Growth through acquisitions or joint ventures. We may pursue strategic acquisitions or joint ventures as a means of growing our business with respect to technology, distribution, customers or products. We may seek to acquire developers or suppliers of complementary products, technology or information, or we may acquire suppliers of similar products as a means of increasing our product offerings and market share.

modification centers, and the OEM market. We continue to build a sales and marketing force dedicated to expanding our sales efforts to these markets while at the same time maintaining our position as a provider of avionics products for the DoD.

Our Products

Our current line of products includes:

Flat Panel Display Systems

In recent years color flat panel displays have been introduced into aircraft cockpits. Flat Panel Displays are Liquid Crystal Display (LCD) screens that can replicate the display of one or a suite of analog or digital displays on one screen. Like other instrumentation, flat panel displays can be installed in new aircraft or used to replace existing displays in aircraft already in use. LCDs are also used for security monitoring on-board aircraft and as tactical workstations on military aircraft. The flat panel product line also presents numerous advantages for presentation of engine performance data. During fiscal 2010, 2009 and 2008 we derived 68%, 75% and 77% respectively, of our total revenues from sales of Flat Panel Display Systems.

We developed a Flat Panel Display System that can replace conventional analog and digital displays currently used in a cockpit and can display additional information that is not now commonly displayed in the cockpit. Our COCKPIT/IP™ is capable of displaying nearly all types of air data, engine and fuel data, altitude, heading and navigational data, and alternative source information. As technology and information delivery systems further develop, additional information, such as surface terrain maps and data link messaging, will be displayed in the cockpit. We designed our COCKPIT/IP™ to be capable of displaying information generated from a variety of sources, including our Reduced Vertical Separation Minimum (RVSM) air data system, engine and fuel instrumentation, and third-party data and information products.

From time to time customers may order one or more flat panel display systems customized to their particular requirements. Depending on the amount of non-recurring engineering effort needed to accommodate the customized request, the Company has and will continue to charge a fee for added development cost. This will result in revenue to the Company that is characterized as Engineering- modification and development on the income statement. Consistent with this approach, engineering cost incurred in the performance of customizing the flat panel display system will be allocated from Operating expenses (Research and development) to Cost of Sales (Engineering—modification and development) and will be included in the Company's gross profit calculations.

6

Air Data Systems and Components

Our air data products calculate and display various measures such as aircraft speed, altitude and rate of ascent and descent. The functionality of our air data systems use advanced sensors to gather air pressure data and use customized algorithms to interpret data, thus allowing the system to more accurately calculate altitude. During fiscal 2010, 2009, and 2008 we derived 32%, 25%, and 23%, respectively, of our total revenues from sales of air data systems and related products.

We sell individual components as well as partial and complete air data systems. Our components and systems include:

- •

- digital air data computers, which calculate various air data parameters such as altitude, airspeed, vertical speed, angle

of attack and other information derived from the measure of air pressure;

- •

- integrated air data computers and display units, which calculate and convey air data information;

- •

- altitude displays, which convey aircraft altitude measurements;

- •

- airspeed displays, which convey various types of airspeed measurements including vertical airspeed and rates of ascent and

descent; and

- •

- altitude alerters, which allow the pilot to select a desired cruising altitude that the aircraft will reach and maintain, and also provide warnings to pilots when an unacceptable deviation occurs.

We develop, manufacture and market engine and fuel displays. Our solid-state multifunction displays convey information with respect to fuel and oil levels and engine activity, such as oil and hydraulic pressure and temperature. This instrumentation includes individual and multiple displays clustered throughout an aircraft's cockpit. Our displays can be used in conjunction with our own engine and fuel data equipment or that of other manufacturers.

Engine and fuel displays are found in all aircraft and are vital to safe and proper aircraft flight. In addition, accurate conveyance of engine and fuel information is critical for monitoring of engine stress and maintenance of engine parts. Engine and fuel displays tend to be replaced more frequently than other displays and have remained largely unchanged since their introduction due to their low cost, standard design and universal use.

We believe our air data engine and fuel displays are extremely reliable, and we have designed them to be programmable to adapt easily without major modification to most modern aircraft. Our products have been installed on C-130H, DC-9, DC-10, P-3, F-16 and A-10 aircraft.

Customers

Our customers include the United States government (including DoD and Homeland Security), ABX Air, American Airlines, The Boeing Company, Bombardier Aerospace, Cessna Aircraft Corporation, Eclipse Aerospace, Inc., Federal Express Corporation, L-3 Communication, Lockheed Martin Corporation, Raytheon, Rockwell Collins, Marshalls of Cambridge, United Kingdom, and the Department of National Defense, Canada, among others.

Retrofit Market

Historically, a majority of our sales have come from the retrofit market. Among other reasons, we have pursued the retrofit market because of its continued rapid growth in response to the increasing need to support the world's aging fleet of aircraft. In fiscal 2010, our two largest customers, Lockheed Martin and FedEx, accounted for 11% and 10% of our total revenue, respectively. In fiscal year 2009, our two largest customers, American Airlines and DoD, accounted for 24% and 11% of our total revenue, respectively. In fiscal year 2008 our two largest customers, Eclipse Aviation, Inc. and FedEx, accounted for 42%, and 10% of our total revenue, respectively.

7

Updating an individual aircraft's existing electronics equipment has become increasingly common as new technology makes existing instrumentation outdated while an aircraft is still structurally and mechanically sound. Retrofitting an aircraft is generally a substantially less expensive alternative to purchasing a new aircraft. We expect our main customers in the retrofit market to be:

- •

- the DoD and defense contractors;

- •

- aircraft operators; and

- •

- aircraft modification centers.

Department of Defense and Defense Contractors. We sell our products directly to the DoD as well as to domestic and international defense contractors for end use on military aircraft retrofit programs. DoD programs generally take one of two forms, a subcontract with a prime government contractor, such as Boeing, Lockheed Martin or Rockwell Collins, or a direct contract with the appropriate government agency such as the U.S. Air Force to satisfy its requirement for replacing Central Air Data Computers on its fleet of A-10 aircraft. The government's desire for cost-effective retrofitting of aircraft has led it to purchase commercial off-the-shelf equipment rather than requiring development of specially designed products, which are usually more costly and take longer to develop. These contracts tend to be on arms length commercial terms, although some termination and other provisions of government contracts described under "Government Regulation" below are typically applicable to these contracts. Each government agency or general contractor retains the right to terminate a contract at any time at its convenience. Upon such alteration or termination, we typically would be entitled to an equitable adjustment to the contract price so that we would receive the purchase price for already delivered items and reimbursement for allowable costs incurred.

Aircraft Operators. We also sell our products to aircraft operators, including commercial airlines, cargo carriers and business and general aviation. Our products are used mostly in retrofitting aircraft owned or operated by these customers, which generally retrofit and maintain their aircraft themselves. Our commercial fleet customers include or have included, among others, American Airlines, ABX Air, Air Canada, Federal Express and Northwest Airlines. We sell these customers a range of products from flat panel display systems to air data systems.

Aircraft Modification Centers. The primary retrofit market for private and corporate jets is through aircraft modification centers, which repair and retrofit private aircraft in a manner similar to the way auto mechanics service a person's car. We have established relationships with a number of aircraft modification centers throughout the United States. These modification centers essentially act as distribution outlets for our products. We believe our air data systems and related components are being promoted by aircraft modification centers to update older or outdated equipment. Our large modification center customers include Bombardier Learjet, Western Aircraft, Aeromech, Star Aviation, Duncan Aviation, and Raytheon Aircraft Services.

OEM Market

In fiscal 2008 the Company suspended work on the Eclipse VLJ program and Eclipse Aviation Inc. filed for Chapter 11 Bankruptcy. New owners have resurrected the former Eclipse Aviation, Inc. and formed a new entity named Eclipse Aerospace, Inc to purchase Eclipse Aviation, Inc's assets. At the 2010 National Business Aviation Association (NBAA) convention, it was announced that Sikorsky Aircraft intends to invest in Eclipse Aviation, Inc. In fiscal 2010 the Company resumed deliveries to Eclipse Aerospace, Inc. of equipment and functionality to support upgrades to their existing fleet of approximately 250 aircraft. The Company believes that Eclipse aspires to begin new aircraft production.

We also market our products to other original equipment manufacturers, particularly manufacturers of corporate and private jets as well as to contractors manufacturing military jets.

8

Customers of our products have included Bombardier, Gulfstream, Boeing, Raytheon, Piaggio and Lockheed Martin.

Backlog

As of September 30, 2010 and 2009, our backlog was $32.3 million and $34.1 million, respectively. The year over year decrease of $1.8 million or 5.3% was the result of $29.9 million in new business offset by $25.3 million of recognized revenue and $6.4 million of order de-bookings. The preponderance of the de-bookings relate to one customer and is due to the requirement to rebid the project in accordance with the procurement procedures. Air Data product backlog as of September 30, 2010 decreased by $2.4 million from September 30, 2009; while Flat Panel Display Systems backlog as of September 30, 2010 increased by $0.6 million from September 30, 2009.

Sales and Marketing

We focus our sales efforts on passenger and cargo carrying aircraft operators, general aviation operators, aircraft modification centers, the DoD, DoD contractors and OEMs. We continually evaluate our sales and marketing efforts with respect to these focus areas and, where appropriate, have made use of third-party sales representatives who receive compensation through commissions based on performance.

We believe our ability to provide prompt and effective repair and upgrade service is critical to our marketing efforts. As part of our customer service program, we offer a 24-hour hotline that customers can call for product repair or upgrade concerns. We employ field service engineers to service our equipment and, depending on the service required, we may either dispatch a service crew to make necessary repairs or request the customer return the product to us for repairs or upgrades at our facility. In the event repairs or upgrades are required to be made at our facility, we provide spare products for use by our customers during the repair time. Our in-house turnaround times for both repairs and upgrades average less than 30 days. Before returning our products to customers, all repaired or upgraded products are retested for airworthiness.

In connection with our customer service program, we typically provide customers with a two-year warranty on new products. We also offer customers extended warranties of varying terms for additional fees.

The majority of the Company's sales, operating results and identifiable assets are in the United States. In fiscal year 2010, 2009, and 2008 net sales outside the United States amounted to $2.8 million, $4.4 million and $1.7 million, respectively.

Government Regulation

The manufacture and installation of our products in aircraft owned and operated in the United States is governed by FAA regulations. We maintain a production facility that is FAA certified. The most significant of the product and installation regulations focus on Technical Standard Order Authorizations and Supplemental Type Certificates. These certifications set forth the minimum performance standards that a certain type of equipment should meet. As required, we deliver our product in accordance with FAA regulations.

Sales of our products to European or other non-U.S. owners of aircraft also typically require approval of the European Aviation Safety Agency (EASA), the European counterpart of the FAA, or another appropriate governmental agency. EASA certification requirements for manufacturing and installation of our products in European owned aircraft mirror FAA regulations. Much like the FAA certification process, the EASA has established a process for granting European Certifications.

9

In addition to product related regulations, we are also subject to U.S. Government procurement regulations with respect to sale of our products to government entities or government contractors. These regulations dictate the manner in which products may be sold to the government and set forth other requirements that must be met in order to do business with or on behalf of government entities. For example, the government agency or general contractor may alter the price, quantity or delivery schedule of our products. In addition, the government agency or general contractor retains the right to terminate the contract at any time at its convenience. Upon such alteration or termination, we would typically be entitled to an equitable adjustment to the contract price so that we would receive the purchase price for already delivered items and reimbursement for allowable costs incurred.

Manufacturing, Assembly and Materials Acquisition

Our manufacturing activities consist primarily of assembling and testing components and subassemblies and integrating them into a fully tested finished system. We believe this method allows us to achieve relatively flexible manufacturing capacity while minimizing expenses. We typically purchase components for our products from third-party suppliers and assemble them in a clean room environment to reduce impurities and improve the performance of our products. Many of the components we purchase are standard products, although certain parts are made to our specifications.

When appropriate, we enter into long-term supply agreements and use our relationships with long-term suppliers to improve product quality and availability and to reduce delivery times and product costs. In addition, we continually identify alternative suppliers for important component parts. Using component parts from new suppliers in our products generally requires FAA certification of the entire finished product if the newly sourced component varies significantly from our original drawings and specifications. To date, we have not experienced any significant delays in delivery of our products caused by the inability to obtain either component parts or FAA approval of products incorporating new component parts.

Quality Assurance

Product quality is of vital importance to our customers, and we have taken steps to enhance the overall quality of our products. We are ISO 9001 and AS 9100B certified. ISO 9001 and AS 9100B standards are an international consensus on effective management practices with the goal of ensuring a company can consistently deliver its products and related services in a manner that meets or exceeds customer quality requirements. These standards allow us to represent to customers that we maintain high quality industry standards in the education of our employees and the design and manufacture of our products. In addition, our products undergo extensive quality control testing prior to being delivered to customers. As part of our quality assurance procedures, we maintain detailed records of test results and our quality control processes.

Our Competition

The market for our products is highly competitive and characterized by several industry niches in which a number of manufacturers specialize. Our competitors vary in size and resources, and substantially all of our competitors are much larger than we are and have substantially greater resources than we do. With respect to air data systems and related products, our principal competitors include Honeywell International Inc., Rockwell Collins, Inc., Thales, and GE Aviation. With respect to flat panel displays, our principal competitors currently include Honeywell, Rockwell Collins, Inc., L-3 Communications and GE Aviation. However, because the flat panel display industry is a new and evolving market, as the demand for flat panel displays increases we may face competition in this area from additional companies in the future.

10

We believe the principal competitive factors in markets we serve are cost, development cycle time, responsiveness to customer preferences, product quality, technology and reliability. We believe our significant and long-standing customer relationships reflect our ability to compete favorably with respect to these factors.

Intellectual Property and Proprietary Rights

We rely on patents to protect our proprietary technology. As of September 30, 2010 the Company holds 22 U.S. patents and has 2 U.S. patent applications pending relating to our technology. In addition, we hold 27 international patents and have 24 international patent applications pending. Certain of these patents and patent applications cover technology relating to air data measurement systems and calibration techniques while others cover technology relating to flat panel display systems and other aspects of our COCKPIT/IP™ solution. While we believe these patents have significant value in protecting our technology, we believe also that the innovative skill, technical expertise and know-how of our personnel in applying the technology reflected in our patents would be difficult, costly and time consuming to reproduce.

While we are not aware of any pending lawsuits against us alleging patent infringement or the violation of other intellectual property rights, we cannot be certain such infringement claims will not be asserted against us in the future.

Our Employees

As of September 30, 2010, we had 133 employees, 45 were in engineering, research and development, 55 in manufacturing and assembly operations, 8 in quality and 25 in selling and general administrative positions.

Our future success depends on our ability to attract, train and retain highly qualified personnel. We plan to hire additional personnel, including, in particular, sales and marketing personnel, during the next twelve months. Competition for such qualified personnel is intense and we may not be able to attract, train and retain highly qualified personnel in the future. Our employees are not represented by a labor union.

Executive Officers of the Registrant

The following is a list of our executive officers, their ages and their positions:

Name

|

Age | Position | |||

|---|---|---|---|---|---|

| Geoffrey S. M. Hedrick | 68 | Chairman of the Board and Chief Executive Officer | |||

| Roman G. Ptakowski | 62 | President | |||

| Ronald C. Albrecht | 65 | Chief Financial Officer | |||

Geoffrey S. M. Hedrick was the Chief Executive Officer from the time he founded the Company in February 1988 through June 4, 2007 and was reappointed as Chief Executive Officer on September 8, 2008. He has also been Chairman of the Board since 1997. Prior to founding IS&S, Mr. Hedrick served as President and Chief Executive Officer of Smiths Industries North American Aerospace Companies. He also founded Harowe Systems, Inc. in 1971, which was subsequently acquired by Smiths Industries. Mr. Hedrick has over 35 years of experience in the avionics industry, and he holds a number of patents in the electronics, optoelectric, electromagnetic, aerospace and contamination-control fields.

Roman G. Ptakowski has been President since March 2003. Prior to that, Mr. Ptakowski served as a Group Vice President and General Manager and, before that, as a Vice President of Sales and Marketing at B/E Aerospace, Inc. Previously, Mr. Ptakowski held a number of positions with increasing responsibility within ASEA Brown Boveri Power T&D Company, Inc. There, he was General Manager

11

of the Protective Relay Division before leaving to join B/E Aerospace, Inc. Mr. Ptakowski received a B.S. in Electrical Engineering from New York University and a MBA from Duke University.

Ronald C. Albrecht has been Chief Financial Officer since August 2010. Prior to joining the Company, Mr. Albrecht served in a number of executive positions, both operational and financial, with Smiths Aerospace (UK) and later GE Aviation Systems (GEAS) following the GEAS purchase of Smiths Aerospace in 2007. Recently he has served as Vice President and General Manager of Smiths and later GEAS' Electro Mechanical Business. Prior to his operational roles, he served as Chief Financial Officer of Smiths Aerospace, based in London and has substantial mergers & acquisition and strategic planning experience. Mr. Albrecht received a B.A. in Government and Economics from Dartmouth College and an MBA in Finance from Stanford University. He is a Certified Public Accountant (California/Inactive).

Other

The public may read and copy any materials filed by us with the SEC at the SEC's public reference room located at 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information about the operation of the SEC's public reference rooms by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website at http://www.sec.gov that contains reports, proxy and information statements and other information about issuers that file electronically with the SEC.

Our primary website is http://www.innovative-ss.com. We make available, free of charge, at our corporate website our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. The information on our web site is not incorporated as part of this annual report.

12

You should carefully consider the risks, uncertainties and other factors described below, in addition to the other information set forth in this report, because they could materially and adversely affect our business, operating results, financial condition, cash flows and prospects as well as adversely affect the value of an investment in our common stock.

Risks Related to Our Business

The recent global recession and credit tightening could adversely affect us.

The recent global recession and continued concern regarding credit availability, including failures of financial institutions, has initiated unprecedented government intervention in the U.S., Europe and other regions of the world. If these concerns continue or worsen, risks to us include:

- •

- Declines in revenues and profitability from reduced orders, payment delays or other factors caused by the economic

problems of customers;

- •

- reprioritization of government spending away from defense programs in which we participate;

- •

- adverse impacts on our access to credit sources; and

- •

- supply problems associated with any financial constraints faced by our vendors.

A portion of our sales have been, and we expect will continue to be, to defense contractors or government agencies in connection with government aircraft retrofit or original equipment manufacturing contracts. Sales to government contractors and government agencies could decline as a result of DoD spending cuts and general budgetary constraints which may become more frequent as tax revenues decline due to the weakening of general economic conditions.

The loss of a key customer or a significant deterioration in the financial condition of a key customer could have a material adverse effect on our results of operations.

Our revenue is concentrated with a limited number of customers. During fiscal year 2010 we derived 48% of revenue from five customers. We derived 56% of revenue during fiscal year 2009 from five customers. We derived 72% of revenue during fiscal year 2008 from five customers. We expect a relatively small number of customers to account for a majority of our revenues for the foreseeable future. As a result of our concentrated customer base, a loss of one or more of these customers or a dispute or litigation with one of these key customers could have a material adverse effect on our revenue and results of operations. In addition, we continually monitor and evaluate the credit status of our customers and attempt to adjust sales terms as appropriate. Despite these efforts, a significant deterioration in the financial condition or bankruptcy filing of a key customer could have a material adverse effect on our business, results of operations and financial condition.

On November 25, 2008, Eclipse Aviation, Inc. filed a voluntary petition for relief under Chapter 11 of the U.S. Bankruptcy Code. New owners have resurrected the former Eclipse Aviation, Inc. and formed a new entity named Eclipse Aerospace, Inc. to purchase Eclipse Aviation, Inc.'s assets. In fiscal 2010 the Company began deliveries to Eclipse Aerospace, Inc. of equipment and functionality to support upgrades to their existing fleet of approximately 250 aircraft. The Company has not received and does not anticipate receiving any payment on its pre-petition claims. Additionally, claims have been made against the Company to try to recover amounts paid to the Company during the 90 days preceding the filing of the bankruptcy petition. See Item 3, Legal Proceedings.

13

Growth of our customer base could be limited by delays or difficulties in completing development and introduction of our planned products or product enhancements. If we fail to enhance existing products or develop and achieve market acceptance for flat panel displays and other new products that meet customer requirements, our business will be adversely affected.

Although historically a substantial majority of our revenue has come from sales of air data systems and related products, we currently spend a large portion of our research and development efforts in developing and marketing our flat panel display systems and complementary products. Our ability to grow and diversify our operations through introduction and sale of new products is dependent upon our success in continuing product development and engineering activities as well as our sales and marketing efforts and our ability to obtain requisite approvals to sell such products. Our sales growth will also depend in part on market acceptance of and demand for our CIP and future products. We cannot be certain we will be able to develop, introduce or market our CIP or other new products or product enhancements in a timely or cost-effective manner or that any new products will receive market acceptance or necessary regulatory approval.

During fiscal 2010, 2009, and 2008 we derived 68%, 75% and 77% of our total revenue from the sale of flat panel display systems, respectively. We expect revenues from our air data products will decline as a percent of total sales as peak demand associated with the FAA's Reduced Vertical Separation Minimum (RVSM) mandate has been accommodated. Our revenues and profitability will decrease if new products such as our Flat Panel Display Systems do not receive market acceptance or if our existing customers do not continue to incorporate our products in their retrofitting or manufacturing of aircraft. In seeking new customers, it may be difficult for our products to displace competing products. Accordingly, we cannot be assured that potential customers will accept our products or that existing customers will not abandon them.

Our revenue and operating results may vary significantly from quarter to quarter, which may cause our stock price to decline.

Our revenue and operating results may vary significantly from quarter to quarter due to a number of factors, including:

- •

- demand for our products and/or delivery schedule changes by our customers;

- •

- capital expenditure budgets of aircraft owners and operators and appropriation cycles of the U.S. government;

- •

- changes in the use of our products, including air data systems and flat panel displays;

- •

- delays in introducing or obtaining government approval for new products;

- •

- new product introductions by competitors;

- •

- changes in our pricing policies or pricing policies of our competitors, and

- •

- costs related to possible acquisition of technologies or businesses.

We plan to expand our sales and marketing operations and fund levels of product development proportionate to our total sales. As a result, a delay in generating revenues could cause significant variations in our operating results from quarter to quarter.

Contracts can be terminated by customers at any time and therefore may not result in sales.

Our retrofit projects are generally pursuant to either a direct contract with a customer or a subcontract with a general contractor to a customer (including government agencies). Each contract, including our contracts with government agencies, includes various terms and conditions that impose certain requirements on us, including the ability of the customer or general contractor to alter the

14

price, quantity or delivery schedule of our products. In addition, the customer or general contractor typically retains the right to terminate the contract at any time at its convenience. Upon alteration or termination of these contracts, we could be entitled to an equitable adjustment to the contract price so we may receive the purchase price for items we have delivered and reimbursement for allowable costs we have incurred. Accordingly, because these contracts can be terminated, we cannot be assured that our retrofit backlog will result in sales.

We depend on key personnel to manage our business effectively, and if we are unable to retain our key employees, our ability to compete could be harmed.

Our success depends on the efforts, abilities and expertise of our senior management and other key personnel. There can be no assurance we will be able to retain such employees, the loss of some of whom could hurt our ability to execute our business strategy. We intend to continue hiring key management and sales and marketing personnel. In spite of a U.S. unemployment rate of 9.6% as of October, 2010, competition for such personnel is intense, and we may not be able to attract or retain additional qualified personnel.

Our future success will depend in part on our ability to implement and improve our operational, administrative and financial systems and controls and to manage, train and expand our employee base. We cannot be assured that after giving effect to our cost containment initiatives that our current and planned personnel levels, systems, procedures and controls will be adequate to support our current and future customer base. If inadequate, we may not be able to exploit existing and potential market opportunities. Any delays or difficulties we encounter could impair our ability to attract new customers or maintain our relationships with existing customers.

We rely on third party suppliers for components of our products, and any interruption in supply of these components could hinder our ability to deliver our products.

Our manufacturing process consists primarily of assembling components purchased from our supply chain. These suppliers may not continue to be available to us. If we are unable to maintain relationships with key third party suppliers, the development and distribution of our products could be delayed until equivalent components can be obtained and integrated into our products. In addition, substitution of certain components from other manufacturers may require product redesign, FAA or other approval, which could delay our ability to ship products.

Our competition includes other manufacturers of air data systems and flight information displays against whom we may not be able to compete successfully.

The markets for our products are intensely competitive and subject to rapid technological change. Our competitors include Honeywell International Inc., Rockwell Collins, Inc., Thales, GE Aviation and L-3 Communications. Substantially all of our competitors have significantly greater financial, technical and human resources than we do. In addition, our competitors have much greater experience in and resources for marketing their products. As a result, our competitors may be able to respond more quickly to new or emerging technologies and customer preferences or devote greater resources to development, promotion and sale of their products than we can. Our competitors may also have greater name recognition and more extensive customer bases that they can use to their benefit. This competition could result in price reductions, fewer customer orders, reduced gross margins and loss of market share.

15

Our success depends on our ability to protect our proprietary rights against potential risk of infringement. If we are unable to protect and enforce our intellectual property rights, we may be unable to compete effectively.

Our success and ability to compete will depend in part on our ability to obtain and maintain patent or other protection for our technology and products, both in the United States and abroad. In addition, we must operate without infringing the proprietary rights of others.

We currently hold 22 U.S. patents and have 2 U.S. patent applications pending. In addition, we hold 27 international patents and have 24 international patent applications pending. We cannot be certain that patents will be issued on any of our present or future applications. In addition, our existing patents or any future patents may not adequately protect our technology if they are not broad enough, are successfully challenged or other entities are able to develop competing methods without violating our patents. If we are not successful in protecting our intellectual property, competitors could begin to offer products that incorporate our technology. Patent protection involves complex legal and factual questions and, therefore, is highly uncertain, and litigation relating to intellectual property is often very time consuming and expensive. If a successful claim of patent infringement were made against us or we are unable to develop non-infringing technology or license the infringed or similar technology on a timely and cost-effective basis, we might not be able to produce and sell some of our products. In addition, we have incurred in the past and may continue in the future to incur significant legal and other costs in defense of our intellectual property.

Potential lenders may have suffered losses related to the weakening economy and may not be able to provide us with needed financing.

Potential lenders may have suffered losses related to their lending and other financial relationships, especially because of the general weakening of the national economy and increased financial instability of many borrowers. As a result, lenders may become insolvent or tighten their lending standards, which could make it more difficult for us to borrow or to obtain new financing on favorable terms or at all, if we determine that it would be in our interests to obtain such financing, whether to finance acquisitions or otherwise. Our financial condition and results of operations could be adversely affected if we were unable to obtain cost-effective financing in the future.

We may not be able to identify or complete acquisitions or we may consummate an acquisition that adversely affects our operating results.

One of our strategies is to acquire businesses or technologies that complement our existing operations. We have limited experience in acquiring businesses or technologies. There can be no assurance we will be able to acquire or profitably manage acquisitions or successfully integrate them into our operations. Furthermore, certain risks are inherent in pursuing acquisitions, such as the demands of management's time and attention and combining disparate company cultures and facilities. Acquisitions may have an adverse effect on our operating results, particularly in quarters immediately following the consummation of such transactions, as we integrate operations of acquired businesses into our operations. Once integrated, acquisitions may not perform as expected.

Risks Related to Our Industry

If we are unable to respond to rapid technological change, our products could become obsolete and our reputation could suffer.

Future generations of air data systems, engine and fuel displays, and flat panel displays embodying new technologies or new industry standards could render our products obsolete. The market for

16

aviation products is subject to rapid technological change, new product introductions, changes in customer preferences and evolving industry standards. Our future success will depend on our ability to:

- •

- adapt to rapidly changing technologies;

- •

- adapt our products to evolving industry standards; and

- •

- develop and introduce a variety of new products and product enhancements to address the increasingly sophisticated needs of our customers.

Our future success will also depend on our developing high quality, cost-effective products and enhancements to our products that satisfy needs of customers and on our introducing these new technologies to the marketplace in a timely manner. If we fail to modify or improve our products in response to evolving industry standards, our products could rapidly become obsolete.

Our products are currently subject to direct regulation by the FAA, its European counterpart, the European Aviation Safety Administration (EASA), and other comparable organizations. Our products, as they relate to aircraft applications, must be approved by the FAA, EASA or other comparable organizations before they can be used in an aircraft. To be certified, we must demonstrate that our products are accurate and able to maintain certain levels of repeatability over time. Although certification requirements of the FAA and the EASA are substantially similar, there is no formal reciprocity between the two systems. Accordingly, even though some of our products are FAA-approved, we may need to obtain approval from the EASA or other appropriate organizations to have them certified for installation outside the United States.

Significant delay in receiving certification for newly developed products or enhancements to our products or losing certification for our existing products could result in lost sales or delays in sales. Furthermore, adoption of additional regulations or product standards, as well as changes to existing product standards, could require us to change our products and underlying technology. We cannot assure you that we will receive regulatory approval on a timely basis or at all.

Because our products utilize sophisticated technology and are deployed in complex aircraft cockpit environments, problems with these products may arise that could seriously harm our reputation for quality assurance and our business.

Our products use complex system designs and components that may contain errors, omissions or defects, particularly when we incorporate new technologies into our products or we release new versions or enhancements of our products. Despite our quality assurance process, errors, omissions or defects could occur in our current products, in new products or in new versions or enhancements of existing products after commercial shipment has begun. We may be required to redesign or recall those products or pay damages. Such an event could result in the following:

- •

- delay or loss of revenues;

- •

- cancellation of customer contracts;

- •

- diversion of development resources;

- •

- damage to our reputation;

- •

- increased service and warranty costs; or

- •

- litigation costs.

Although we currently carry product liability insurance, this insurance may not be adequate to cover our losses in the event of a product liability claim. Moreover, we may not be able to maintain such insurance in the future.

17

We have limited experience in marketing and distributing our products internationally.

We expect to derive an increasing amount of our revenues from sales outside the United States, particularly in Europe. There are certain risks inherent in doing business on an international basis, such as:

- •

- differing regulatory requirements for products being installed in aircraft;

- •

- legal uncertainty regarding liability;

- •

- tariffs, trade barriers, and other regulatory barriers;

- •

- political and economic instability;

- •

- changes in diplomatic and trade relationships;

- •

- potentially adverse tax consequences;

- •

- the impact of recessions in economies outside the United States; and

- •

- variance and unexpected changes in local laws and regulations.

Currently, all of our international sales are denominated in U.S. dollars. An increase in the dollar's value compared to other currencies could make our products less competitive in foreign markets. In the future, we may be required to conduct sales in local currencies, exposing us to changes in exchange rates that could adversely affect our operating results.

Item 1B. Unresolved Staff Comments.

None

In fiscal 2001 we purchased 7.5 acres of land in the Eagleview Corporate Park in Exton, Pennsylvania. Shortly thereafter the Company constructed a 44,800 square foot design, manufacturing and office facility on this site. Land development approval allows for expansion of up to 20,400 square feet. This would provide for a 65,200 square foot facility. The construction was principally funded with a Chester County, Pennsylvania, Industrial Revenue Bond. The building served as security for the Industrial Revenue Bond until the bond was repaid in August 2009.

In the ordinary course of business, we are at times subject to various legal proceedings and claims. We do not believe any such matters that are currently pending will have a material adverse effect on our results of operations or financial position.

On November 18, 2010, Jeoffrey L. Burtch, the Chapter 7 Trustee for AE Liquidation, Inc. (formerly Eclipse Aviation Corporation), filed avoidance actions against IS&S on behalf of AE Liquidation, Inc. for the avoidance of seven payments totaling $321,095 as allegedly preferential transfers paid to the Company during the 90 days preceding the filing of the bankruptcy petition of Eclipse Aviation Corporation on November 25, 2008. The Company believes it has meritorious defenses to these avoidance actions, intends to vigorously defend against them, and believes that the likelihood of the avoidance actions prevailing is remote. Accordingly, the Company has not accrued any loss reserve related to this claim.

On January 17, 2007 the Company filed suit in the Court of Common Pleas for Delaware County, Pennsylvania against Strathman Associates, a former software consultant for IS&S, alleging that Strathman had improperly used IS&S trade secret and proprietary information in assisting J2 and Kollsman in developing the J2/Kollsman Air Data Computer. The case is ongoing.

18

Item 5. Market for the Registrant's Common Equity, Related Stockholder Matters and Issuer Repurchases of Equity Securities.

Our common stock has been traded on the Nasdaq Stock Market, LLC under the symbol "ISSC" since our initial public offering on August 4, 2000. The following table lists the high and low per share sale prices for our common stock for the periods indicated:

| |

Fiscal Year 2010 |

Fiscal Year 2009 |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Period

|

High | Low | High | Low | |||||||||

First Quarter |

$ | 5.37 | $ | 4.17 | $ | 7.65 | $ | 3.02 | |||||

Second Quarter |

7.14 | 3.81 | 6.06 | 2.52 | |||||||||

Third Quarter |

6.72 | 4.32 | 5.90 | 4.02 | |||||||||

Fourth Quarter |

6.28 | 2.12 | 6.00 | 3.34 | |||||||||

On December 06, 2010, there were 15 holders of record of the shares of outstanding common stock. This does not reflect beneficial shareholders who hold their stock in nominee or "street" name through brokerage firms.

No dividends were paid in fiscal 2009 or fiscal 2010. The Company does not expect to declare or pay cash dividends on our common stock in the near future. We intend to retain any earnings to finance the growth of our business.

On February 16, 2010, the Company's Board of Directors approved the Company's repurchase program to acquire up to 1,000,000 shares of the Company's outstanding Common Stock. Under the repurchase program, the Company may purchase shares of its common stock through open market transactions or in privately negotiated block purchases or other private transactions (either solicited or unsolicited). The timing and amount of repurchase transactions under this program will depend on market conditions and corporate and regulatory considerations. The plan will expire on February 16, 2011, unless extended by the Board of Directors; however, the program may be discontinued or suspended at any time. During the year ended September 30, 2010 the Company purchased 12,000 shares of common stock under the program at a cost of $48,630, or an average market price of $4.03 per share, financed with available cash. The following table sets forth the purchases made under this new plan for each month since the extension date through September 30, 2010:

Period

|

Total Number of Shares Purchased |

Average Price Paid per Share |

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs |

Number of Shares that May Yet Be Purchased Under the Program |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

January, 2010 |

— | — | — | — | |||||||||

February, 2010 |

4,100 | $ | 4.16 | 4,100 | 995,900 | ||||||||

March, 2010 |

1,100 | 4.20 | 1,100 | 994,800 | |||||||||

April, 2010 |

— | — | — | 994,800 | |||||||||

May, 2010 |

— | — | — | 994,800 | |||||||||

June, 2010 |

— | — | — | 994,800 | |||||||||

July, 2010 |

6,800 | 3.93 | 6,800 | 988,000 | |||||||||

August, 2010 |

— | — | — | 988,000 | |||||||||

September, 2010 |

— | — | — | 988,000 | |||||||||

|

12,000 | 4.03 | 12,000 | ||||||||||

19

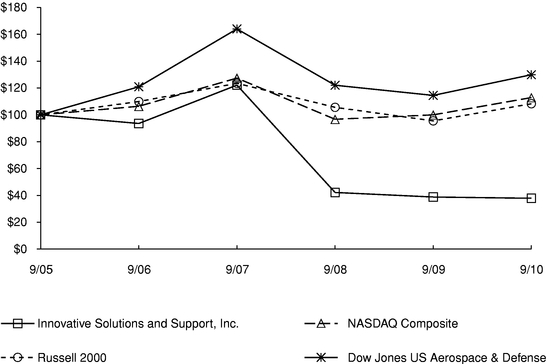

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among Innovative Solutions and Support, Inc., The NASDAQ Composite Index,

The Russell 2000 Index And Dow Jones US Aerospace & Defense

Index

| |

9/05 | 9/06 | 9/07 | 9/08 | 9/09 | 9/10 | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Innovative Solutions and Support, Inc. |

100.00 | 93.56 | 122.15 | 42.18 | 38.78 | 37.85 | |||||||||||||

NASDAQ Composite |

100.00 | 106.39 | 127.37 | 96.70 | 100.00 | 112.86 | |||||||||||||

Russell 2000 |

100.00 | 109.92 | 123.49 | 105.60 | 95.52 | 108.27 | |||||||||||||

Dow Jones US Aerospace & Defense |

100.00 | 120.91 | 164.01 | 122.06 | 114.49 | 129.88 | |||||||||||||

- *

- $100

invested on 9/30/05 in stock or index—including reinvestment of dividends.

Fiscal year ending September 30.

The graph above shows the cumulative shareholder return on $100 invested at the market close on September 30, 2005 through and including September 30, 2010, the last trading day before the end of our most recently completed fiscal year, with the cumulative total return over the same time period of the same amount invested in the Nasdaq, Composite Index, the Russell 2000 Index and the Dow Jones US Aerospace & Defense Index.

20

Item 6. Selected Consolidated Financial Data.

The following tables present portions of our consolidated financial statements. The following selected consolidated financial data set forth below should be read together with "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and related notes to our financial statements appearing elsewhere herein. The selected statement of operations data for the fiscal years ended September 30, 2010, 2009 and 2008 and the balance sheet data as of September 30, 2010 and 2009 are derived from our audited consolidated financial statements included elsewhere in this Annual Report on Form 10-K. The selected statements of operations data for the fiscal years ended September 30, 2007 and 2006 and the balance sheet data as of September 30, 2008, 2007 and 2006 are derived from our audited consolidated financial statements that are not included in this Annual Report on Form 10-K.

| |

Fiscal year ended September 30, | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||

Statement of Operations Data: |

|||||||||||||||||

Net Sales |

25,257,323 | 36,734,150 | 30,533,311 | 18,348,128 | 16,721,967 | ||||||||||||

Cost of sales |

11,520,029 | 17,895,984 | 20,551,857 | 14,154,425 | 8,631,761 | ||||||||||||

Gross profit |

13,737,294 | 18,838,166 | 9,981,454 | 4,193,703 | 8,090,206 | ||||||||||||

Research and development |

5,234,240 | 5,313,007 | 10,304,279 | 5,180,360 | 6,749,426 | ||||||||||||

Selling, general and administrative |

8,099,587 | 8,647,506 | 22,306,016 | 15,840,255 | 9,863,758 | ||||||||||||

Asset Impairment |

— | — | 2,475,000 | — | — | ||||||||||||

Total operating expenses |

13,333,827 | 13,960,513 | 35,085,295 | 21,020,615 | 16,613,184 | ||||||||||||

Operating income (loss) |

403,467 | 4,877,653 | (25,103,841 | ) | (16,826,912 | ) | (8,522,978 | ) | |||||||||

Interest income, net |

185,815 | 315,765 | 1,415,732 | 2,886,602 | 3,091,986 | ||||||||||||

Other income |

50,000 | 50,099 | 17,300,000 | — | — | ||||||||||||

Income (loss) before income taxes |

639,282 | 5,243,517 | (6,388,109 | ) | (13,940,310 | ) | (5,430,992 | ) | |||||||||

Income tax expense (benefit), net |

(109,094 | ) | 234,856 | 1,509,139 | (5,095,022 | ) | (2,548,600 | ) | |||||||||

Net income (loss) |

748,376 | 5,008,661 | (7,897,248 | ) | (8,845,288 | ) | (2,882,392 | ) | |||||||||

Net income (loss) per common share: |

|||||||||||||||||

Basic |

0.04 | 0.30 | (0.47 | ) | (0.52 | ) | (0.17 | ) | |||||||||

Diluted |

0.04 | 0.30 | (0.47 | ) | (0.52 | ) | (0.17 | ) | |||||||||

Weighted average shares outstanding: |

|||||||||||||||||

Basic |

16,751,528 | 16,745,379 | 16,887,049 | 16,865,028 | 17,388,524 | ||||||||||||

Diluted |

16,777,886 | 16,760,500 | 16,887,049 | 16,865,028 | 17,388,524 | ||||||||||||

Cash dividends declared per Common Share |

— |

1.00 |

— |

— |

|||||||||||||

| |

As of September 30, | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2009 | 2008 | 2007 | 2006 | |||||||||||

Balance Sheet Data: |

||||||||||||||||

Cash and cash equivalents |

40,916,346 | 35,565,694 | 35,031,932 | 49,151,078 | 62,984,829 | |||||||||||

Working capital |

46,311,056 | 44,624,477 | 42,491,253 | 62,453,234 | 73,751,866 | |||||||||||

Total assets |

57,590,522 | 57,536,012 | 59,896,714 | 84,585,785 | 87,232,880 | |||||||||||

Debt and capital lease obligations, less current portion |

15,560 | 26,991 | 4,362,725 | 4,382,542 | 4,339,587 | |||||||||||

Total shareholders' equity |

53,468,037 | 52,398,742 | 46,804,126 | 70,733,779 | 78,201,353 | |||||||||||

21

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion and analysis should be read in conjunction with "Selected Consolidated Financial Data" and our financial statements and related notes included in this report.

Overview

Innovative Solutions and Support was founded in 1988. The Company designs, develops, manufactures and sells flight information computers, large flat-panel displays, and advanced monitoring systems that measure and display critical flight information, including data relative to aircraft separation, airspeed, altitude as well as engine and fuel data measurements.

Our sales are derived from the sale of our products to the retrofit market and, to a lesser extent, original equipment manufacturers ("OEMs"). Our customers include the United States Department of Defense ("DoD") and their commercial contractors, aircraft operators, aircraft modification centers and various OEMs. Although we occasionally sell our products directly to the DoD, we have sold our products primarily to commercial customers for end use in DoD programs. Sales to defense contractors are on commercial terms, although some of the termination and other provisions of government contracts are applicable to these contracts.

Our cost of sales related to product sales is comprised of material and components purchased through our supplier base and direct in-house assembly labor and overhead costs. Many components we use in assembling our products are standard, although certain parts are manufactured to meet our specifications. The overhead portion of cost of sales is primarily comprised of salaries and benefits, building occupancy, supplies, and outside service costs related to our production, purchasing, material control and quality departments, and warranty costs.

Our cost of sales related to Engineering—modification and development ("EMD") is comprised of engineering labor, consulting services, and other cost associated with specific design and development projects that are billable under specific customer agreements.

We intend to continue investing in development of new products that complement our current product offerings and will expense associated costs as they are incurred.

Our selling, general and administrative expenses consist of sales, marketing, business development, professional services, and salaries and benefits for executive and administrative personnel as well as facility costs, recruiting, legal, accounting, and other general corporate expenses.