Attached files

| file | filename |

|---|---|

| EX-1.1 - EX-1.1 - CLOUD PEAK ENERGY INC. | a2201382zex-1_1.htm |

| EX-23.1 - EX-23.1 - CLOUD PEAK ENERGY INC. | a2201382zex-23_1.htm |

| EX-23.2 - EX-23.2 - CLOUD PEAK ENERGY INC. | a2201382zex-23_2.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS PROSPECTUS SUPPLEMENT

TABLE OF CONTENTS

As filed with the Securities and Exchange Commission on December 13, 2010

Registration No. 333-170744

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2

TO

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

CLOUD PEAK ENERGY INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation) |

1221 (Primary Standard Industrial Classification Code Number) |

26-3088162 (I.R.S. Employer Identification Number) |

505 S. Gillette Ave.

Gillette, Wyoming 82716

(307) 687-6000

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Colin Marshall

Chief Executive Officer

Cloud Peak Energy Inc.

505 S. Gillette Ave.

Gillette, Wyoming 82716

(307) 687-6000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies to: | ||

Michael C. Ryan, Esq. Cadwalader, Wickersham & Taft LLP One World Financial Center New York, New York 10281 Tel: (212) 504-6000 Fax: (212) 504-6666 |

Bryan Pechersky, Esq. Cloud Peak Energy Inc. 385 Interlocken Crescent, Suite 400 Broomfield, Colorado 80021 (720) 566-2900 |

|

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (the "Securities Act"), check the following box. ý

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act of 1934, as amended. (Check one):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

|

||||||||

| Title of each class of securities to be registered |

Amount to be Registered |

Proposed maximum offering price per share(1) |

Proposed maximum aggregate offering price(1) |

Amount of Registration Fee(2) |

||||

|---|---|---|---|---|---|---|---|---|

Common stock, par value $0.01 per share |

29,400,000(3)(4) | $19.78 | $581,605,500.00 | $41,468.47 | ||||

|

||||||||

- (1)

- Estimated

solely for the purposes of calculating the registration fee pursuant to Rule 457(c) under the Securities Act. The price per share and

aggregate offering price are based on the average of the high and low sales prices of the registrant's common stock on November 16, 2010, as reported on the New York Stock Exchange.

- (2)

- Previously

paid.

- (3)

- This

amount represents shares of common stock of Cloud Peak Energy Inc. to be offered by the selling shareholders from time to time after the

effective date of this registration statement. Such shares are issuable upon the exercise by the selling shareholders of the selling shareholders' right to require Cloud Peak Energy

Resources LLC to redeem their common membership units of Cloud Peak Energy Resources LLC and the subsequent exercise by Cloud Peak Energy Inc. of its assumption right and election

to acquire such common membership units for its common stock granted pursuant to the limited liability company agreement of Cloud Peak Energy Resources LLC.

- (4)

- All of the shares will be offered by the selling shareholders. Accordingly, this registration statement includes an indeterminate number of additional shares of common stock of Cloud Peak Energy Inc. issuable for no additional consideration pursuant to any stock dividend, stock split, recapitalization or other similar transaction effected without the receipt of consideration. In the event of a stock split, stock dividend or similar transaction involving the common stock of Cloud Peak Energy Inc., in order to prevent dilution, the number of shares registered shall be automatically increased to cover the additional shares in accordance with Rule 416(a) under the Securities Act.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus supplement is not complete and may be changed. The selling shareholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission of which this prospectus supplement forms a part is effective. This prospectus supplement does not constitute an offer to sell these securities or solicitation of an offer to buy these securities in any jurisdiction where such offer, sale or solicitation is not permitted.

SUBJECT TO COMPLETION, DATED DECEMBER 13, 2010

PROSPECTUS SUPPLEMENT

To Prospectus Dated , 2010

25,600,000 Shares

CLOUD PEAK ENERGY INC.

Common Stock

This prospectus supplement supplements and amends the prospectus dated , 2010 relating to the resale from time to time of up to 29,400,000 shares of common stock of Cloud Peak Energy Inc., par value $0.01 per share, by Rio Tinto Energy America Inc. and Kennecott Management Services Company, the selling shareholders.

This prospectus supplement should be read in conjunction with and accompanied by the prospectus and is qualified by reference to the prospectus, except to the extent that the information in this prospectus supplement modified or supersedes the information contained in the prospectus.

Our common stock is traded on the New York Stock Exchange ("NYSE") under the symbol "CLD." On December 10, 2010, the last reported trading price for our common stock on the NYSE was $22.92 per share.

The selling shareholders will bear all commissions and discounts, if any, attributable to the sales of common stock. We will not receive any of the proceeds from the sale of our common stock by the selling shareholders.

Investing in our common stock involves risks. See "Risk Factors" beginning on page S-13 of this prospectus supplement and on page 13 of the accompanying prospectus.

| |

Price to Public |

Underwriting Discounts and Commissions |

Proceeds to Selling Shareholders |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Per Share | $ | $ | $ | |||||||

| Total | $ | $ | $ | |||||||

The underwriters have the option for a period of 30 days to purchase a maximum of 3,800,000 additional shares of common stock from the selling shareholders to cover over-allotments of shares of common stock.

Delivery of the shares of common stock will be made on or about , 2010.

Neither the Securities and Exchange Commission (the "SEC") nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

Credit Suisse Morgan Stanley RBC Capital Markets J.P. Morgan

The date of this prospectus supplement is , 2010.

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

We have not, and the underwriters or the selling shareholders have not, authorized anyone to provide any information other than that contained or incorporated by reference in this prospectus supplement, the accompanying prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We have not, and the underwriters or the selling shareholders have not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus supplement does not constitute an offer to sell, or solicitation of an offer to buy, these securities in any jurisdiction where such offer, sale or solicitation is not permitted. You should assume that the information appearing in this prospectus supplement is accurate only as of the date on the front cover of this prospectus supplement.

ABOUT THIS PROSPECTUS SUPPLEMENT

This document consists of two parts. The first part is this prospectus supplement, which contains specific information about the terms and conditions of this particular offering of our common stock by the selling shareholders. The second part is the accompanying prospectus dated , which contains and incorporates by reference important business and financial information about us and other

S-i

information about the offering. This prospectus supplement and the accompanying prospectus are part of a registration statement on Form S-1, as amended by the Amendment No. 1 to Registration Statement on Form S-1/A (File No. 333-170744), that we filed with the SEC using a "shelf" registration or continuous offering process. Under this shelf process, the selling shareholders may from time to time sell the shares of common stock covered by the accompanying prospectus in one or more offerings. Before investing in our common stock, you should carefully read the registration statement (including the exhibits thereto) of which this prospectus supplement and the accompanying prospectus form a part, this prospectus supplement, the accompanying prospectus and the documents incorporated by reference into the accompanying prospectus. The incorporated documents are described under "Incorporation of Certain Documents by Reference" in the accompanying prospectus. This prospectus supplement may add information to, or update or change information contained in, the accompanying prospectus. To the extent that any statement that we make in this prospectus supplement is inconsistent with the statements made in the accompanying prospectus, including the documents incorporated therein by reference, the statements made in the accompanying prospectus are deemed amended, modified or superseded by the statements made in this prospectus supplement.

S-ii

This summary highlights information contained elsewhere in this prospectus supplement and the accompanying prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should read the entire prospectus supplement and the accompanying prospectus carefully, including the section describing the risks of investing in our common stock under "Risk Factors." You should also read carefully the information incorporated by reference in the accompanying prospectus before making an investment decision.

In this prospectus supplement, unless the context otherwise requires, references to:

- •

- "Cloud Peak Energy," "we,"

"us," "our" or the "company" refer collectively to Cloud

Peak Energy Inc., a Delaware corporation, and its consolidated subsidiary, CPE Resources, together with the businesses that CPE Resources operates;

- •

- "CPE Resources" refers to Cloud Peak Energy Resources LLC, a

Delaware limited liability company, formerly known as Rio Tinto Sage LLC, which is the operating company for our business, and of which Cloud Peak Energy Inc. is the sole managing

member;

- •

- "IPO Structuring Agreements" refers to the following agreements entered

into in connection with our November 2009 initial public offering (the "IPO"): the master separation agreement, the acquisition agreement, the assignment agreement, the agency contract, the promissory

note, the employee matters agreement, the escrow agreement, the third amended and restated limited liability company agreement of CPE Resources (the "LLC Agreement"), the management services agreement

(the "Management Services Agreement"), the registration rights agreement (the "Registration Rights Agreement"), the Rio Tinto Energy America coal supply agreement, the software license agreement, the

tax receivable agreement (the "Tax Receivable Agreement"), the trademark assignment agreement, the trademark license agreement, and the transition services agreement. For a description of our

agreements with Rio Tinto and its affiliates, see the information set forth under the caption "Corporate Governance—Certain Relationships and Related Transactions" in the 2010 Proxy

Statement (defined below), which is incorporated by reference in the accompanying prospectus. We refer generally to the transactions we entered into in connection with these IPO Structuring Agreements

as the IPO structuring transactions or the structuring transactions. See "Initial Public Offering and Related IPO Structuring Transactions" in "Note 2. Basis of Presentation" of "Notes to

Consolidated Financial Statements" contained in the 2009 Form 10-K (defined below), which is incorporated by reference in the accompanying prospectus;

- •

- "RTEA" refers to Rio Tinto Energy America Inc., our predecessor for

accounting purposes;

- •

- "RTA" refers to Rio Tinto America Inc. ("RTA"), which is the owner

of RTEA;

- •

- "KMS" refers to Kennecott Management Services Company, a wholly-owned

subsidiary of RTA;

- •

- "Rio Tinto" refers to Rio Tinto plc and Rio Tinto Limited and their

subsidiaries, collectively. Rio Tinto plc is the ultimate parent of RTA and RTEA;

- •

- "2009 Form 10-K" refers to our annual report on

Form 10-K for the year ended December 31, 2009, filed with the SEC on March 17, 2010;

- •

- "2010 3Q Form 10-Q" refers to our quarterly report on

Form 10-Q for the quarter ended September 30, 2010, filed with the SEC on November 5, 2010; and

- •

- "2010 Proxy Statement" refers to our definitive proxy statement on Schedule 14A for our 2010 annual meeting of stockholders, filed with the SEC on April 29, 2010.

S-1

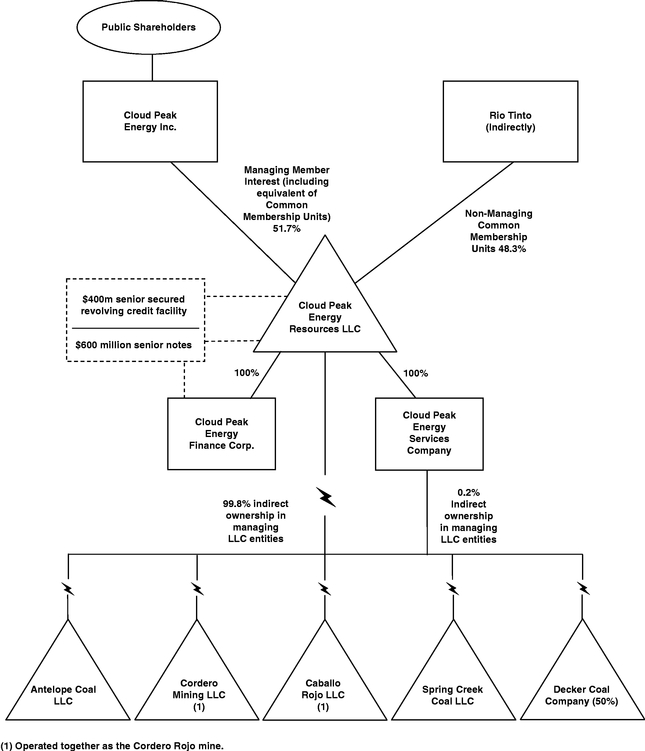

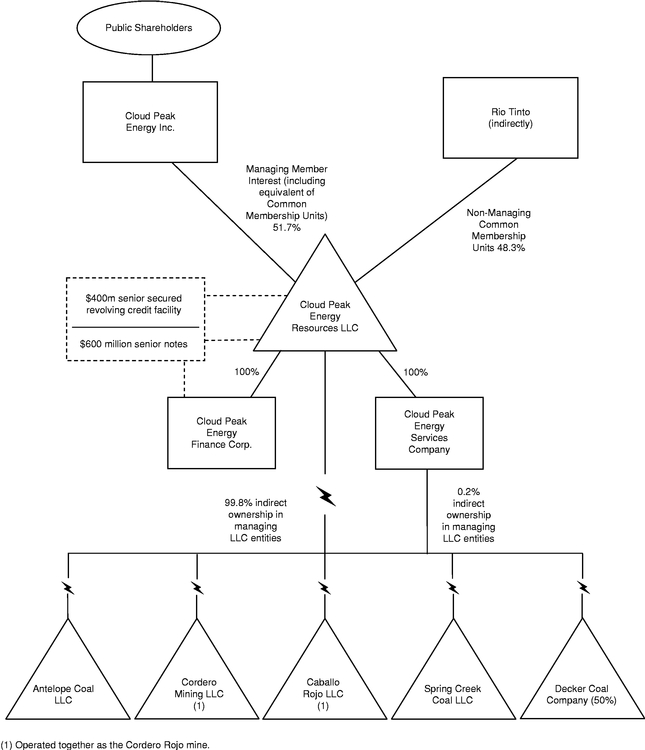

Our Corporate History and Structure

Cloud Peak Energy is the third largest producer of coal in the U.S. and in the Powder River Basin (the "PRB"), based on our 2009 coal production of 93.3 million tons. We had revenues from our continuing operations of $1.4 billion in 2009. We operate some of the safest mines in the industry. According to data from the Mine Safety and Health Administration (the "MSHA"), in 2009, we had the lowest employee all injury incident rate among the ten largest U.S. coal producing companies. We operate solely in the PRB, the lowest cost major coal producing region in the U.S., and operate two of the four largest coal mines in the region and in the U.S. Our operations include three wholly-owned surface coal mines, two of which are in Wyoming and one of which is in Montana. We also own a 50% interest in a fourth surface coal mine located in Montana. We produce sub-bituminous steam coal with low sulfur content and sell our coal primarily to domestic electric utilities, supplying approximately 70 customers with over 100 domestic plants. We do not produce any metallurgical coal. Steam coal is primarily consumed by electric utilities and industrial consumers as fuel for electricity generation. In 2009, the coal we produced generated approximately 4% of the electricity produced in the U.S. As of December 31, 2009, we controlled approximately one billion tons of proven and probable reserves.

Rio Tinto initially formed RTEA in 1993 as Kennecott Coal Company, which was subsequently renamed Kennecott Energy and Coal Company. Between 1993 and 1998, Kennecott Energy and Coal Company acquired the Antelope, Colowyo, Jacobs Ranch and Spring Creek mines and the Cordero mine and Caballo Rojo mine, which are currently operated together as the Cordero Rojo mine, and a 50% interest in the Decker mine, which is operated by a third-party mine operator. In 2006, Kennecott Energy and Coal Company was renamed Rio Tinto Energy America Inc., as part of Rio Tinto's global branding initiative.

CPE Resources was formerly known as Rio Tinto Sage LLC, a Delaware limited liability company formed as a wholly-owned subsidiary of RTEA on August 19, 2008. In order to separate certain businesses from RTEA, in December 2008, RTEA contributed RTA's western U.S. coal business to CPE Resources (other than the Colowyo mine, which is now indirectly owned by RTA). On October 1, 2009, CPE Resources sold the Jacobs Ranch mine to Arch Coal, Inc. and did not retain the proceeds from that sale. CPE Resources currently holds, directly or indirectly, all of the equity interests of each of our mining entities, including a 50% interest in the Decker mine, which is managed by a third party mine operator.

Cloud Peak Energy Inc. is a Delaware corporation organized on July 31, 2008. On November 19, 2009, Cloud Peak Energy Inc. acquired from RTEA approximately 51% of the common membership units in CPE Resources in exchange for a promissory note. As a result of these transactions, Cloud Peak Energy Inc. became the sole managing member of CPE Resources with a controlling interest in CPE Resources and its subsidiaries. Cloud Peak Energy Inc. used the proceeds from the IPO to repay the promissory note upon the completion of the IPO on November 25, 2009. Cloud Peak Energy Inc. is a holding company and its only business and material asset is its managing member interest in CPE Resources. Cloud Peak Energy Inc.'s only source of cash flow from operations is distributions from CPE Resources pursuant to the LLC Agreement and management fees and cost reimbursements pursuant to the Management Services Agreement. As of September 30, 2010, Cloud Peak Energy Inc. owned approximately 51.7% of the common membership units in CPE Resources, and subsidiaries of Rio Tinto held the remaining 48.3%.

S-2

The following condensed diagram depicts our current organizational structure as of September 30, 2010, and does not reflect the sale of the shares of our common stock offered hereby:

S-3

On November 4, 2010, the company issued a press release announcing its results for the third quarter 2010. With respect to its contracted coal position, the company provided that:

- •

- for 2010, it had contracted all of its tons and expected to deliver approximately 94 million tons with an estimated

realized price of around $12.33 per ton;

- •

- for 2011, 92 million tons were contracted from the three company owned and operated mines. Of this committed 2011

production, 81 million tons are under fixed price contracts. Assuming a recent market price of $14.20 per ton for 8800 BTU coal and $11.60 per ton for 8400 BTU coal for unpriced tons, the

estimated 2011 full-year weighted average realized price would be approximately $13.04 per ton; and

- •

- for 2012, it had contracted 65 million tons from the three company owned and operated mines, of which 51 million tons are under fixed price contracts.

Our principal executive office is located at 505 S. Gillette Ave., Gillette, Wyoming 82716, and our telephone number at that address is (307) 687-6000. Our website is located at www.cloudpeakenergy.com. The information that is contained on, or is or becomes accessible through, our website is not part of this prospectus supplement.

"Cloud Peak Energy" and the Cloud Peak Energy logo are trademarks and service marks of Cloud Peak Energy Inc. or its affiliates. All other trademarks, service marks or trade names appearing in this prospectus supplement are owned by their respective holders.

| Common stock offered by the selling shareholders | 25,600,000 shares (29,400,000 shares if the underwriters' option to purchase additional shares is exercised in full). Such shares were issued to the selling shareholders upon the exercise of their right to require CPE Resources to acquire by redemption 29,400,000 common membership units in CPE Resources held by the selling shareholders and the exercise by Cloud Peak Energy Inc. of its right to assume CPE Resources' obligation to acquire such common membership units in exchange for common stock of Cloud Peak Energy Inc. | |

Common stock to be outstanding after this offering |

57,081,652 shares (60,881,652 shares if the underwriters' option to purchase additional shares is exercised in full), based on the number of shares outstanding as of October 31, 2010. |

|

Over-allotment option |

The selling shareholders have granted the underwriters a 30-day option to purchase up to 3,800,000 additional shares of our common stock to cover over-allotments of shares of common stock. |

S-4

| Common membership units in CPE Resources held by Cloud Peak Energy Inc. and Rio Tinto | After giving effect to this offering, Cloud Peak Energy Inc. will hold approximately 93.8% (100% if the underwriters' option to purchase additional shares is exercised in full) of the common membership units in CPE Resources and RTEA and KMS will hold approximately 6.2% (0% if the underwriters' option to purchase additional shares is exercised in full) of the common membership units. | |

Use of proceeds |

We will not receive any proceeds from the sale of these shares of our common stock. The selling shareholders will receive all of the net proceeds from the sales of common stock offered by them pursuant to this prospectus supplement. The selling shareholders will bear any underwriting commissions and discounts attributable to the sale of our common stock by the selling shareholders pursuant to this prospectus supplement. |

|

Risk factors |

See "Risk Factors" beginning on beginning on page S-13 of this prospectus supplement and on page 13 of the accompanying prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock. |

|

NYSE symbol |

"CLD" |

Unless otherwise indicated, the information regarding common membership units in CPE Resources presented in this prospectus supplement excludes any common membership units that will be issued to Cloud Peak Energy Inc. on a one-for-one basis upon the exercise by holders of options to acquire our common stock.

S-5

Summary Historical and Unaudited Pro Forma Consolidated Financial Data

The following tables set forth selected historical and unaudited pro forma consolidated financial data for the periods indicated. This information should be read in conjunction with "Unaudited Pro Forma Condensed Consolidated Financial Information" in this prospectus supplement, as well as "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and related notes thereto contained in the 2009 Form 10-K and in the 2010 3Q Form 10-Q, which are incorporated by reference in the accompanying prospectus.

Our historical consolidated financial statements are not comparable to the unaudited pro forma condensed consolidated financial information included elsewhere in this prospectus supplement or to the results investors should expect after the offering pursuant to this prospectus supplement. Cloud Peak Energy Inc. is a holding company and its only business and material asset is its managing member interest in CPE Resources. As of September 30, 2010, Cloud Peak Energy Inc. owned approximately 51.7% of the common membership units in CPE Resources.

We have derived the historical consolidated financial data as of December 31, 2009 and 2008 and for each of the three years in the period ended December 31, 2009, from our audited consolidated financial statements contained in the 2009 Form 10-K, which is incorporated by reference in the accompanying prospectus. We have derived the historical condensed consolidated financial data as of September 30, 2010 and 2009 and for the nine months ended September 30, 2010 and 2009 from our unaudited condensed consolidated financial statements contained in the 2010 3Q Form 10-Q, which is incorporated by reference in the accompanying prospectus. We have derived the historical consolidated balance sheet data as of December 31, 2007, from the audited consolidated financial statements of RTEA, our predecessor for accounting purposes, not included in this prospectus supplement.

The historical financial information included in this prospectus supplement for all periods prior to our IPO was derived from the consolidated financial statements of RTEA and does not reflect what our financial position, results of operations, and cash flows would have been had we been a separate, stand-alone public company during those periods. We were not operated as a separate, stand-alone public company for the historical periods presented prior to our IPO. The historical costs and expenses reflected in our consolidated financial statements include allocations of certain general and administrative expenses incurred by RTA and other Rio Tinto affiliates. We believe these allocations were reasonable; however, the allocated expenses are not necessarily indicative of the expenses that would have been incurred if we had been a separate, independent entity.

The unaudited pro forma consolidated financial data as of September 30, 2010 and for the year ended December 31, 2009 and for the nine months ended September 30, 2010, was derived from the unaudited pro forma condensed consolidated financial information, included elsewhere in this prospectus supplement. See "Unaudited Pro Forma Condensed Consolidated Financial Information" in this prospectus supplement. The unaudited pro forma condensed consolidated financial information is based on our historical consolidated financial statements contained in the 2009 Form 10-K and in the 2010 3Q Form 10-Q, which are incorporated by reference in the accompanying prospectus. The unaudited pro forma adjustments are based on available information and certain assumptions that we believe are reasonable and are described below in the accompanying notes. The unaudited pro forma condensed consolidated balance sheet as of September 30, 2010 and the unaudited pro forma condensed consolidated statements of operations for the year ended December 31, 2009 and for the nine months ended September 30, 2010 are presented on a pro forma basis to give effect, in each case, to the issuance of the shares of our common stock covered by this prospectus supplement as if issued on September 30, 2010 for balance sheet adjustments and January 1, 2009 for statement of operations adjustments.

When we refer to our pro forma financial information, we are giving effect to (1) the issuance of the 29,400,000 shares of common stock covered by this prospectus supplement to RTEA and KMS

S-6

pursuant to the terms and conditions of the LLC Agreement (assuming the exercise of the underwriters' over-allotment option in full), (2) an estimated public offering price of $20.87 per share, the five-day average closing price of our common stock on the NYSE from November 9, 2010 through November 15, 2010, (3) the increase in Cloud Peak Energy Inc.'s ownership in CPE Resources from 51.7% to 100% (assuming the exercise of the underwriters' over-allotment option in full), and (4) changes in our estimated undiscounted future liability under the Tax Receivable Agreement of $93.1 million, resulting increases in our deferred tax asset balances of $160.1 million and estimates of future realizability, and re-calculation of our estimated effective income tax rate. An increase in the estimated per share price would increase our tax basis in the acquired assets. On a pro forma basis, we estimate that a $1.00 per share increase from the assumed $20.87 per share price would increase total deferred income taxes, total tax agreement liability, and total equity by approximately $14 million, $6 million, and $8 million, respectively. A $1.00 per share decrease from the assumed $20.87 per share price would have a similar inverse impact on the same items.

The estimates and assumptions used in preparation of the pro forma financial information may be materially different from our actual experience in connection with this offering by the selling shareholders.

The pro forma condensed consolidated statement of operations presents financial information through income (loss) from continuing operations. Accordingly, the income (loss) from discontinued operations related to the Colowyo mine, the Jacobs Ranch mine and the uranium mining venture are not reflected in continuing operations and no pro forma adjustment will be necessary in the pro forma condensed consolidated statement of operations.

The unaudited pro forma consolidated financial data is for informational purposes only, and is not intended to represent what our results of operations would be after giving effect to this offering, or to indicate our results of operations for any future period. Therefore, investors should not place undue reliance on the unaudited pro forma consolidated financial data.

S-7

Summary Unaudited Pro Forma Consolidated Financial Data

(dollars in thousands, except per share amounts)

| |

For the Nine Months Ended September 30, 2010 |

For the Year Ended December 31, 2009 |

||||||

|---|---|---|---|---|---|---|---|---|

| |

Pro Forma |

Pro Forma |

||||||

Statement of Operations Data |

||||||||

Revenues |

$ | 1,024,960 | $ | 1,398,200 | ||||

Costs and expenses |

||||||||

Cost of product sold (exclusive of depreciation, depletion, amortization and accretion, shown separately) |

719,007 | 933,489 | ||||||

Depreciation and depletion |

75,212 | 97,869 | ||||||

Amortization |

3,197 | 28,719 | ||||||

Accretion |

9,903 | 12,587 | ||||||

Selling, general and administrative expenses |

47,159 | 69,835 | ||||||

Asset impairment charges |

— | 698 | ||||||

Total costs and expenses |

854,478 | 1,143,197 | ||||||

Interest expense |

(36,186 | ) | (5,992 | ) | ||||

Tax agreement expense |

(19,669 | ) | — | |||||

Other, net |

534 | 329 | ||||||

Total other expense |

(55,321 | ) | (5,663 | ) | ||||

Income from continuing operations before income tax provision and earnings from unconsolidated affiliates |

115,161 | 249,340 | ||||||

Income tax provision |

(47,133 | ) | (79,278 | ) | ||||

Earnings from unconsolidated affiliates, net of tax |

1,965 | 1,387 | ||||||

Income from continuing operations |

$ | 69,993 | $ | 171,449 | ||||

Income from continuing operations per share |

||||||||

Basic |

$ | 1.17 | $ | 2.86 | ||||

Diluted |

$ | 1.16 | $ | 2.86 | ||||

Weighted-average shares outstanding |

||||||||

Basic |

60,000,000 | 60,000,000 | ||||||

Diluted |

60,168,263 | 60,000,000 | ||||||

| |

As of September 30, 2010 | |||

|---|---|---|---|---|

| |

Pro Forma |

|||

Balance Sheet Data |

||||

Cash and cash equivalents |

$ | 287,713 | ||

Accounts receivable, net |

87,542 | |||

Inventories, net |

66,705 | |||

Property, plant and equipment, net |

965,130 | |||

Intangible assets, net |

35,634 | |||

Deferred income taxes |

235,230 | |||

Total assets |

1,953,203 | |||

Tax agreement liability |

161,389 | |||

Total long-term debt (including current portion)(7) |

717,373 | |||

Total liabilities |

1,345,977 | |||

Shareholders' equity attributable to controlling interest |

607,226 | |||

S-8

Summary Historical Consolidated Financial Data

(dollars in thousands, except per share amounts)

| |

For the Years Ended December 31, | For the Nine Months Ended September 30, | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2009 | 2008 | 2007 | 2010 | 2009 | ||||||||||||

Statement of Operations Data |

|||||||||||||||||

Revenues(1) |

$ | 1,398,200 | $ | 1,239,711 | $ | 1,053,168 | $ | 1,024,960 | $ | 1,061,286 | |||||||

Operating income(2)(3) |

255,003 | 124,936 | 102,731 | 170,482 | 206,931 | ||||||||||||

Income from continuing operations |

182,472 | 88,340 | 53,789 | 87,448 | 147,268 | ||||||||||||

Income (loss) from discontinued operations(4) |

211,078 | (25,215 | ) | (21,482 | ) | — | 42,790 | ||||||||||

Net income |

393,550 | 63,125 | 32,307 | 87,448 | 190,058 | ||||||||||||

Amounts attributable to controlling interest(5) |

|||||||||||||||||

Income from continuing operations |

170,623 | 88,340 | 53,789 | 20,856 | 147,268 | ||||||||||||

Income (loss) from discontinued operations(4) |

211,078 | (25,215 | ) | (21,482 | ) | — | 42,790 | ||||||||||

Net income |

381,701 | 63,125 | 32,307 | 20,856 | 190,058 | ||||||||||||

Earnings per share—basic(5)(6) |

|||||||||||||||||

Income from continuing operations |

$ | 3.01 | $ | 1.47 | $ | 0.90 | $ | 0.68 | $ | 2.45 | |||||||

Income (loss) from discontinued operations(4) |

$ | 3.73 | $ | (0.42 | ) | $ | (0.36 | ) | $ | — | $ | 0.72 | |||||

Net income |

$ | 6.74 | $ | 1.05 | $ | 0.54 | $ | 0.68 | $ | 3.17 | |||||||

Earnings per share attributable to controlling interest—diluted(5)(6) |

|||||||||||||||||

Income from continuing operations |

$ | 2.97 | $ | 1.47 | $ | 0.90 | $ | 0.68 | $ | 2.45 | |||||||

Income (loss) from discontinued operations(4) |

$ | 3.52 | $ | (0.42 | ) | $ | (0.36 | ) | $ | — | $ | 0.72 | |||||

Net income |

$ | 6.49 | $ | 1.05 | $ | 0.54 | $ | 0.68 | $ | 3.17 | |||||||

| |

As of the Years Ended December 31, | As of the Nine Months Ended September 30, |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2009 | 2008 | 2007 | 2010 | 2009 | |||||||||||

Balance Sheet Data |

||||||||||||||||

Cash and cash equivalents |

$ | 268,316 | $ | 15,935 | $ | 23,616 | $ | 287,713 | $ | 18,319 | ||||||

Property, plant and equipment, net |

987,143 | 927,910 | 719,743 | 965,130 | 981,248 | |||||||||||

Assets of discontinued operations(4) |

— | 587,168 | 721,835 | — | 582,304 | |||||||||||

Total assets |

1,677,596 | 1,785,191 | 1,781,201 | 1,793,144 | 1,977,312 | |||||||||||

Senior notes, net of unamortized discount |

595,321 | — | — | 595,592 | — | |||||||||||

Other long-term debt(7) |

178,367 | 209,526 | 571,559 | 131,201 | 175,604 | |||||||||||

Liabilities of discontinued operations(4) |

— | 127,220 | 270,049 | — | 139,359 | |||||||||||

Total liabilities |

1,232,118 | 800,025 | 1,446,240 | 1,252,828 | 796,924 | |||||||||||

Controlling interest equity(5) |

252,905 | 985,166 | 334,961 | 282,019 | 1,180,388 | |||||||||||

Noncontrolling interest equity(5) |

192,573 | — | — | 258,297 | — | |||||||||||

| |

For the Years Ended December 31, |

For the Nine Months Ended September 30, |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2009 | 2008 | 2007 | 2010 | 2009 | |||||||||||

Other Data |

||||||||||||||||

Adjusted EBITDA(8) |

$ | 320,582 | $ | 207,229 | $ | 160,809 | $ | 253,092 | $ | 254,205 | ||||||

Tons sold—company owned and operated mines (millions) |

90.9 | 93.7 | 90.7 | 70.4 | 68.0 | |||||||||||

Tons sold—Decker mine (millions)(9) |

2.3 | 3.3 | 3.5 | 1.0 | 1.7 | |||||||||||

Tons sold—total production (millions) |

93.3 | 97.0 | 94.2 | 71.4 | 69.7 | |||||||||||

Tons purchased and resold (millions) |

10.1 | 8.1 | 8.1 | 1.4 | 8.0 | |||||||||||

Total tons sold (millions) |

103.3 | 105.1 | 102.3 | 72.8 | 77.7 | |||||||||||

- (1)

- Billings

for freight and delivery services accounted for 6.9%, 4.5% and 1.4% of our total revenues for the years ended December 31, 2009, 2008 and

2007, respectively, and 11.2% and 6.9% of our total revenues for the nine months ended September 30, 2010 and 2009, respectively.

- (2)

- Operating income reflects allocations of general and administrative expenses incurred by RTA and other Rio Tinto affiliates of $20.7 million, $25.4 million and $24.4 million for the years ended December 31, 2009, 2008 and 2007, respectively, and $0 and $19.8 for the nine months ended September 30, 2010 and 2009,

S-9

respectively. Also reflected in operating income are costs incurred as a result of Rio Tinto's actions to divest our business, either through a trade sale or an initial public offering, of $18.3 million, $25.8 million and $11.3 million for the years ended December 31, 2009 and 2008, and the nine months ended September 30, 2009, respectively.

- (3)

- Operating

income reflects an asset impairment charge of $0.7 million for costs incurred on an abandoned time-keeping software project for

the year ended December 31, 2009. For the year ended December 31, 2008, operating income reflects a $4.6 million charge to write-off certain contract rights, a

$1 million charge for an abandoned cost efficiency project, and a $3 million favorable adjustment to the enterprise resource planning ("ERP") system costs that were included in the 2007

asset impairment charge. For the year ended December 31, 2007, operating income reflects an $18.3 million asset impairment charge related to an abandoned ERP systems implementation. The

ERP systems implementation was a worldwide Rio Tinto initiative designed to align processes, procedures, practices and reporting across all Rio Tinto business units. The implementation was abandoned

in connection with Rio Tinto's actions to divest our business.

- (4)

- Discontinued

operations includes the operations, net of related income taxes, of the Colowyo coal mine, the Jacobs Ranch coal mine and the uranium mining

venture. For the year ended December 31, 2009, discontinued operations includes the $264.8 million pre-tax gain on sale of the Jacobs Ranch coal mine. Assets and liabilities

of continuing operations exclude balances associated with discontinued operations. See "Note 4. Discontinued Operations" of "Notes to Consolidated Financial Statements" contained in the 2009

Form 10-K, which is incorporated by reference in the accompanying prospectus.

- (5)

- For

periods prior to our IPO, income or loss attributable to controlling interest reflects income or loss attributable to RTEA as the former parent company,

and includes 100% of income or loss from CPE Resources and its subsidiaries. For the period following our IPO, income or loss attributable to controlling interest reflects our interest (approximately

51.7% as of September 30, 2010) in CPE Resources and its subsidiaries. Noncontrolling interest equity at September 30, 2010 reflects the 48.3% interest in CPE Resources held collectively

by RTEA and KMS.

- (6)

- Earnings

per share for periods prior to the IPO assumes 60,000,000 outstanding shares, which is the number of shares that our predecessor, RTEA, would have

been required to have outstanding in prior periods based on the capital structure of CPE Resources, which requires a one-to-one ratio between the number of common membership

units held by Cloud Peak Energy Inc. and the number of shares of Cloud Peak Energy Inc. common stock outstanding. See "Note 15. Earnings Per Share" of "Notes to Consolidated

Financial Statements" contained in the 2009 Form 10-K, which is incorporated by reference in the accompanying prospectus.

- (7)

- Other

long-term debt includes the current and long-term portions of other long-term debt, which included discounted

obligations pursuant to federal coal leases of $169.1 million, $206.3 million and $67.6 million as of December 31, 2009, 2008 and 2007, respectively, and

$121.8 million and $169.1 million for the nine months ended September 30, 2010 and 2009, respectively.

- (8)

- This

prospectus supplement includes the non-GAAP financial measure of Adjusted EBITDA. Adjusted EBITDA is intended to provide additional

information only and does not have any standard meaning prescribed by generally accepted accounting principles in the U.S., or U.S. GAAP. A quantitative reconciliation of Adjusted EBITDA to

income from continuing operations is found in the table below.

EBITDA represents income from continuing operations before (1) interest income (expense) net, (2) income tax provision, (3) depreciation and depletion, (4) amortization, and (5) accretion. Adjusted EBITDA represents EBITDA as further adjusted to exclude specifically identified items that management believes do not directly reflect our core operations. For the periods presented herein, the specifically identified items are the income statement impacts of: (1) the tax agreement and (2) our significant broker contract that expired in the first quarter of 2010.

Adjusted EBITDA is an additional tool intended to assist our management in comparing our performance on a consistent basis for purposes of business decision-making by removing the impact of certain items that management believes do not directly reflect our core operations. Adjusted EBITDA is a metric intended to assist management in evaluating operating performance, comparing performance across periods, planning and forecasting future business operations and helping determine levels of operating and capital investments. Period-to-period comparisons of Adjusted EBITDA are intended to help our management identify and assess additional trends potentially impacting our company that may not be shown solely by period-to-period comparisons of income from continuing operations. Adjusted EBITDA may also be used as part of our incentive compensation program for our executive officers and others.

S-10

We believe Adjusted EBITDA is also useful to investors, analysts and other external users of our consolidated financial statements in evaluating our operating performance from period to period and comparing our performance to similar operating results of other relevant companies. Adjusted EBITDA allows investors to measure a company's operating performance without regard to items such as interest expense, taxes, depreciation and depletion, amortization and accretion and other specifically identified items that are not considered to directly reflect our core operations.

Our management recognizes that using Adjusted EBITDA as a performance measure has inherent limitations as compared to income from continuing operations or other U.S. GAAP financial measures, as this non-GAAP measure excludes certain items, including items that are recurring in nature, which may be meaningful to investors. Adjusted EBITDA excludes interest expense and interest income; however, as we have historically borrowed money in order to finance transactions and operations, and have invested available cash to generate interest income, interest expense and interest income are elements of our cost structure and influence our ability to generate revenue and returns for shareholders. Adjusted EBITDA excludes depreciation and depletion and amortization; however, as we use capital and intangible assets to generate revenues, depreciation, depletion and amortization are necessary elements of our costs and ability to generate revenue. Adjusted EBITDA also excludes accretion expense; however, as we are legally obligated to pay for costs associated with the reclamation and closure of our mine sites, the periodic accretion expense relating to these reclamation costs is a necessary element of our costs and ability to generate revenue. Adjusted EBITDA excludes income taxes; however, as we are organized as a corporation, the payment of taxes is a necessary element of our operations. Adjusted EBITDA excludes tax agreement expense; however, this represents our current estimate of payments we will be required to make to RTEA under our Tax Receivable Agreement. Finally, Adjusted EBITDA excludes income statement amounts attributable to our significant broker contract that expired in the first quarter of 2010; however, this historically represented a positive contribution to our operating results.

As a result of these exclusions, Adjusted EBITDA should not be considered in isolation and does not purport to be an alternative to income from continuing operations or other U.S. GAAP financial measures as a measure of our operating performance.

When using Adjusted EBITDA as a performance measure, management intends to compensate for these limitations by comparing it to income from continuing operations in each period, so as to allow for the comparison of the performance of the underlying core operations with the overall performance of the company on a full-cost, after-tax basis. Using Adjusted EBITDA and income from continuing operations to evaluate the business allows management and investors to (a) assess our relative performance against our competitors and (b) ultimately monitor our capacity to generate returns for shareholders.

Because not all companies use identical calculations, our presentation of Adjusted EBITDA may not be comparable to other similarly titled measures of other companies. Moreover, our presentation of Adjusted EBITDA is different than EBITDA as defined in our debt financing agreements.

- (9)

- Decker tons sold represent our portion (50%) of Decker operations.

S-11

The following table presents a reconciliation of income from continuing operations to Adjusted EBITDA for each of the periods presented is as follows:

| |

For the Years Ended December 31, |

For the Nine Months Ended September 30, |

|||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2009 | 2008 | 2007 | 2010 | 2009 | ||||||||||||

| |

(dollars in thousands) |

(dollars in thousands) |

|||||||||||||||

Income from continuing operations |

$ | 182,472 | $ | 88,340 | $ | 53,789 | $ | 87,448 | $ | 147,268 | |||||||

Depreciation and depletion |

97,869 | 88,972 | 80,133 | 75,212 | 68,383 | ||||||||||||

Amortization(1) |

28,719 | 45,989 | 34,512 | 3,197 | 24,770 | ||||||||||||

Accretion |

12,587 | 12,742 | 12,212 | 9,903 | 8,402 | ||||||||||||

Interest expense |

5,992 | 20,376 | 40,930 | 36,186 | 1,007 | ||||||||||||

Interest income |

(320 | ) | (2,865 | ) | (7,302 | ) | (411 | ) | (228 | ) | |||||||

Income tax provision |

68,249 | 25,318 | 18,050 | 30,212 | 59,888 | ||||||||||||

EBITDA |

$ | 395,568 | $ | 278,872 | $ | 232,324 | $ | 241,747 | $ | 309,490 | |||||||

Tax agreement expense |

— | — | — | 19,669 | — | ||||||||||||

Expired long-term broker contract |

(74,986 | ) | (71,643 | ) | (71,515 | ) | (8,324 | ) | (55,285 | ) | |||||||

Adjusted EBITDA |

$ | 320,582 | $ | 207,229 | $ | 160,809 | $ | 253,092 | $ | 254,205 | |||||||

- (1)

- The impact of the expired significant broker contract on the Statement of Operations is a combination of net income and the amortization expense related to the contract. All amortization expense for the periods presented was attributable to the significant broker contract.

S-12

Investing in our common stock involves risks. You should carefully consider the risk factors described below, the risk factors described in the accompanying prospectus and all of the information set forth in this prospectus supplement and the accompanying prospectus and incorporated by reference in the accompanying prospectus before you decide to invest in our common stock. If any of these risk factors, as well as other risks and uncertainties that are not currently known to us or that we currently believe are not material, actually occur, our business, financial condition and results of operations could be materially and adversely affected. In such a case, you may lose part or all of your investment.

Risks Related to Ownership of Our Common Stock

Our common stock has only traded since November 20, 2009 and our stock price could be volatile and could decline for a variety of reasons, resulting in a substantial loss on your investment.

Our common stock has only traded since November 20, 2009. The stock markets generally have experienced extreme volatility, often unrelated to the operating performance of the individual companies whose securities are traded publicly. Broad market fluctuations and general economic conditions may materially adversely affect the trading price of our common stock.

Significant price fluctuations in our common stock could result from a variety of other factors, including, among other things, actual or anticipated fluctuations in our operating results or financial condition, new laws or regulations or new interpretations of existing laws or regulations applicable to our business, sales of our common stock by our shareholders and any other factors described in this "Risk Factors" section of this prospectus supplement and the "Risk Factors" section of the accompanying prospectus.

If securities analysts cease coverage about our company and our industry, or if they issue unfavorable commentary about us or our industry or downgrade our common stock, the price of our common stock could decline.

The trading market for our common stock depends in part on the research and reports that third-party securities analysts publish about our company and our industry. One or more analysts could downgrade our stock or issue other negative commentary about our company or our industry. If one or more of these analysts cease coverage of our company, we could lose visibility in the market. The occurrence of one or more of these factors could cause the trading price for our stock to decline.

Future sales of our common stock or other securities convertible into our common stock could cause our stock price to decline.

Sales of substantial amounts of our common stock in the public market, including in this offering or in future offerings by RTEA or KMS if they exercise their right to require CPE Resources to acquire by redemption their remaining common membership units in CPE Resources and we choose to issue shares of our common stock, if applicable following this offering, or the perception that these sales may occur, could cause the market price of our common stock to decrease significantly.

We also may offer additional shares of our common stock to the public in order to satisfy any additional redemption request by RTEA or KMS with cash in connection with the CPE Assumption Right, if applicable following this offering, or for other corporate purposes. In addition, if applicable following this offering, we have granted RTEA, KMS and their permitted transferees certain "piggyback" registration rights which will allow them to include their shares of our common stock in any future registrations of our equity securities, whether or not that registration relates to a primary offering by us or a secondary offering by or on behalf of any of our stockholders. In particular, during the first three years following our IPO, RTEA and KMS have priority over us and any other of our

S-13

stockholders in any registration that is an underwritten offering. Any such filing or the perception that such a filing may occur could cause the prevailing market price of our common stock to decline and may impact our ability to sell equity to finance the operations of CPE Resources or make strategic acquisitions.

A decline in the trading price of our common stock due to the occurrence of any future sales of stock might impede our ability to raise capital through the issuance of additional shares of our common stock or other equity securities and may cause you to lose part or all of your investment in our shares of common stock.

Anti-takeover provisions in our charter documents and other aspects of our structure could discourage, delay or prevent a change in control of our company and may adversely affect the trading price of our common stock.

Certain provisions in our amended and restated certificate of incorporation and amended and restated bylaws and other aspects of our structure may discourage, delay or prevent a change in our management or a change in control over us that stockholders may consider favorable. Among other things, our amended and restated certificate of incorporation and amended and restated bylaws:

- •

- provide for a classified board of directors, which may delay the ability of our stockholders to change the membership of a

majority of our board of directors;

- •

- authorize the issuance of "blank check" preferred stock that could be issued by our board of directors to thwart a

takeover attempt;

- •

- do not provide for cumulative voting;

- •

- provide that vacancies on the board of directors, including newly created directorships, may be filled only by a majority

vote of directors then in office;

- •

- limit the calling of special meetings of stockholders;

- •

- provide that stockholders may not act by written consent;

- •

- provide that our directors may be removed only for cause;

- •

- require supermajority voting to effect certain amendments to our certificate of incorporation and our bylaws; and

- •

- require stockholders to provide advance notice of new business proposals and director nominations under specific procedures.

In addition, the LLC Agreement requires that we conduct all our business operations through CPE Resources.

S-14

CAUTIONARY NOTICE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement and the accompanying prospectus and the information incorporated by reference in the accompanying prospectus contain forward-looking statements that involve substantial risks and uncertainties. You can identify these statements by forward-looking words such as "anticipate," "believe," "could," "estimate," "expect," "intend," "may," "plan," "potential," "should," "will," "would" or similar words. You should read statements that contain these words carefully because they discuss our plans, strategies, prospects and expectations concerning our business, operating results, financial condition and other similar matters. We believe that it is important to communicate our future expectations to our investors. Our forward-looking statements include, but are not limited to, information in this prospectus supplement and the accompanying prospectus and the information incorporated by reference in the accompanying prospectus regarding general domestic and global economic conditions, our reserves, the Lease by Application ("LBA") acquisition process, our business and growth strategy, our costs, expectations for pricing conditions and demand in the U.S. and foreign coal industries and in the PRB, the amount of cash or other collateral needed to secure our surety bond arrangements and market data related to the domestic and foreign coal industry. In particular, there are forward-looking statements in this prospectus supplement and in the accompanying prospectus under the headings "Prospectus Supplement Summary," "Risk Factors" and "Unaudited Pro Forma Condensed Consolidated Financial Information," and in the various sections of the 2009 Form 10-K and the 2010 3Q Form 10-Q, which are incorporated by reference in the accompanying prospectus. There may be events in the future, however, that we are not able to predict accurately or control. The factors listed under "Risk Factors," as well as any cautionary language in this prospectus supplement and the accompanying prospectus and the information incorporated by reference in the accompanying prospectus, provide examples of risks, uncertainties and events that may cause our actual results to differ materially from the expectations we describe in our forward-looking statements. Before you invest in our common stock, you should be aware that the occurrence of the events described in these risk factors and elsewhere in this prospectus supplement and the accompanying prospectus and the information incorporated by reference in the accompanying prospectus could have a material adverse effect on our business, results of operation and financial position. Any forward-looking statement made by us in this prospectus supplement and the accompanying prospectus and the information incorporated by reference in the accompanying prospectus speak only as of the date on which we make it. Additional factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

The following factors are among those that may cause actual results to differ materially from our forward-looking statements:

- •

- future economic conditions, including impacts of efforts to recover from an economic downturn;

- •

- the contract prices we receive for coal and our customers' ability to honor contract terms;

- •

- market demand for domestic and foreign coal, electricity and steel;

- •

- safety and environmental laws and regulations, including those directly affecting our coal mining and production, and

those affecting our customers' coal usage, gaseous emissions or ash handling as well as related costs and liabilities;

- •

- future legislation, changes in regulations or governmental policies or changes in interpretations thereof, and third-party

regulatory legal challenges, including with respect to carbon emissions, safety standards and regulatory processes and approvals required to lease and obtain permits for coal mining operations;

- •

- our ability to produce coal at existing and planned volumes and costs;

S-15

- •

- the availability and cost of coal reserve acquisitions and surface rights and our ability to successfully acquire new coal

reserves and surface rights at attractive prices and in a timely manner;

- •

- the impact of any offerings pursuant to this prospectus supplement, including resulting tax implications and changes to

our valuation allowance on our deferred tax assets;

- •

- our assumptions regarding payments arising under the Tax Receivable Agreement and other IPO Structuring Agreements;

- •

- our plans and objectives for future operations and the development of additional coal reserves or acquisition

opportunities;

- •

- our relationships with, and other conditions affecting, our customers, including economic conditions and the credit

performance and credit risks associated with our customers;

- •

- timing of reductions or increases in customer coal inventories;

- •

- risks inherent to surface coal mining;

- •

- weather conditions or catastrophic weather-related damage;

- •

- changes in energy policy;

- •

- competition;

- •

- the availability and cost of competing energy resources, including changes in the price of crude oil and natural gas

generally, as well as subsidies to encourage use of alternative energy sources;

- •

- railroad and other transportation performance and costs;

- •

- disruptions in delivery or changes in pricing from third-party vendors of raw materials and other consumables that are

necessary for our operations, such as explosives, petroleum-based fuel, tires, steel and rubber;

- •

- our assumptions concerning coal reserve estimates;

- •

- the terms of CPE Resources' indebtedness;

- •

- changes in costs that we incur as a stand-alone public company as compared to our expectations;

- •

- inaccurately estimating the costs or timing of our reclamation and mine closure obligations;

- •

- liquidity constraints, including those resulting from the cost or unavailability of financing due to credit market

conditions;

- •

- our liquidity, results of operations and financial condition, including amounts of working capital that are available; and

- •

- other factors, including those discussed in "Risk Factors" in this prospectus supplement and the accompanying prospectus.

Our forward-looking statements also include estimates of the total amount of payments, including annual payments, under the Tax Receivable Agreement. These estimates are based on assumptions that are subject to change due to various factors, including, among other factors, changes in our operating plan or performance, the acquisition of new LBAs and the prices of those new LBAs, tax law changes, and/or the timing and amounts paid when RTEA and/or KMS redeems their remaining common membership units, if applicable following this offering. See "Risk Factors—Risks Related to Our Corporate Structure and the IPO Structuring Transactions—We are required to pay RTEA for most of the tax benefits we may claim as a result of the tax basis step-up we received in connection with our IPO and related IPO structuring transactions. In certain cases, payments to RTEA may be accelerated

S-16

or exceed our actual cash tax savings. These provisions may deter a change in control of our company" in the accompanying prospectus.

PRICE RANGE OF OUR COMMON STOCK

Our common stock, $0.01 par value, has traded on the NYSE under the symbol "CLD" since November 20, 2009. Prior to November 20, 2009, there was no public market for our common stock. The following table sets forth the high and low closing sales prices of our common stock, as reported by the NYSE, for each of the periods listed.

| |

High | Low | |||||

|---|---|---|---|---|---|---|---|

Fiscal 2009 |

|||||||

(commencing November 20, 2009) |

15.04 | 12.69 | |||||

Fiscal 2010 |

|||||||

First Quarter 2010 |

16.84 | 13.51 | |||||

Second Quarter 2010 |

17.15 | 13.26 | |||||

Third Quarter 2010 |

18.37 | 13.20 | |||||

October 1, 2010—December 10, 2010 |

23.56 | 16.86 | |||||

The last reported sale price of our common stock on the NYSE on December 10, 2010 was $22.92 per share. As of the close of business on November 17, 2010, we have 1,463 holders of record of our common stock.

S-17

The following table sets forth our capitalization as of September 30, 2010 on an actual and a pro forma basis giving effect to this offering and the pro forma adjustments set forth under "Unaudited Pro Forma Condensed Consolidated Financial Information" and the related notes thereto (and assuming no exercise of the underwriters' over-allotment option).

This table should be read in conjunction with "Unaudited Pro Forma Condensed Consolidated Financial Information" in this prospectus supplement, as well as "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the consolidated financial statements and related notes thereto contained in the 2009 Form 10-K and in the 2010 3Q Form 10-Q, which are incorporated by reference in the accompanying prospectus.

| |

Historical | Adjustments | Pro Forma | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| |

(dollars in thousands, except per share amounts) |

||||||||||

Revolving credit facility(1) |

— | — | — | ||||||||

Senior notes due 2017 and 2019 |

595,592 | — | 595,592 | ||||||||

Federal coal lease obligations (including current portion) |

121,781 | — | 121,781 | ||||||||

Total long-term debt (including current portion)(2) |

717,373 | — | 717,373 | ||||||||

Equity: |

|||||||||||

Common stock ($0.01 par value; 200,000,000 shares authorized; 31,482,594 shares issued and outstanding on a historical basis; 60,882,594 shares issued and outstanding on a pro forma basis) |

315 | 294 | 609 | ||||||||

Additional paid-in capital |

258,875 | 264,162 | 523,037 | ||||||||

Retained earnings (accumulated deficit) |

29,420 | 66,910 | 96,330 | ||||||||

Accumulated other comprehensive income (loss) |

(6,591 | ) | (6,159 | ) | (12,750 | ) | |||||

Shareholders' equity attributable to controlling interest |

282,019 | 325,207 | 607,226 | ||||||||

Noncontrolling interest |

258,297 | (258,297 | ) | — | |||||||

Total equity |

540,316 | 66,910 | 607,226 | ||||||||

Total capitalization(3) |

$ | 1,257,689 | $ | 66,910 | $ | 1,324,599 | |||||

- (1)

- We

currently use $10.5 million of the capacity under our revolving credit facility to issue letters of credit. We may use additional capacity to

secure our reclamation obligations going forward.

- (2)

- Total

long-term debt includes current portion of long-term debt. For additional information on our long-term debt, see

"Note 9. Long-Term Debt" of "Notes to Consolidated Financial Statements" contained in the 2009 Form 10-K, which is incorporated by reference in the accompanying

prospectus.

- (3)

- As the Tax Receivable Agreement liability does not meet the definition of either debt or equity we have not included the Tax Receivable Agreement liability within the capitalization table above. As described in our pro forma financial statements, the Tax Receivable Agreement liability is estimated to increase from $66.6 million to $159.7 million, an increase of $93.1 million as a result of this offering and the corresponding tax benefit expected to be generated in future years from this transaction.

S-18

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED FINANCIAL INFORMATION

The following unaudited pro forma condensed consolidated information sets forth our unaudited pro forma and historical consolidated statements of operations for the year ended December 31, 2009 and for the nine months ended September 30, 2010 and the unaudited pro forma and historical consolidated balance sheets at September 30, 2010. Such information for 2009 is based in part on the audited and unaudited consolidated financial statements of RTEA, our predecessor for accounting purposes, contained in the 2009 Form 10-K, which is incorporated by reference in the accompanying prospectus. RTEA's consolidated financial statements were prepared on a carve-out basis from our previous ultimate parent company, Rio Tinto plc. Such carve-out information is not intended to be a complete presentation of the financial position or results of operations of our company had we operated as a stand-alone public company for the entire year ended December 31, 2009. RTEA is considered to be our predecessor for accounting purposes and its consolidated financial statements are our historical consolidated financial statements for periods prior to our IPO. Cloud Peak Energy Inc. is a holding company that manages its consolidated subsidiary CPE Resources, but has no business operations or material assets other than its ownership interest as of September 30, 2010 of approximately 51.7% of the common membership units in CPE Resources.

The unaudited pro forma condensed consolidated balance sheet at September 30, 2010, and the unaudited pro forma condensed consolidated statements of operations for the nine months ended September 30, 2010 and for the year ended December 31, 2009, give effect to the issuance of the 29,400,000 shares of common stock covered by this prospectus supplement (assuming the exercise of the underwriters' over-allotment option in full) as if it had occurred on September 30, 2010 for the unaudited pro forma condensed consolidated balance sheet and on January 1, 2009 for the unaudited pro forma condensed consolidated statements of operations. On a pro forma basis, we estimate that a $1.00 per share increase from the assumed $20.87 per share price would increase total deferred income taxes, total tax agreement liability, and total equity by approximately $14 million, $6 million, and $8 million, respectively. A $1.00 per share decrease from the assumed $20.87 per share price would have a similar inverse impact on the same items.

The unaudited pro forma adjustments are based on available information and certain assumptions that we believe are reasonable. Presentation of the unaudited pro forma financial information is prepared in conformity with Article 11 of Regulation S-X.

The unaudited pro forma condensed consolidated financial information should be read in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and related notes thereto contained in the 2009 Form 10-K and in the 2010 3Q Form 10-Q, which are incorporated by reference in the accompanying prospectus. The unaudited pro forma condensed consolidated financial information is for informational purposes only and is not intended to represent or be indicative of the consolidated results of operations or financial position that we would have reported had this offering been completed on the dates indicated and should not be taken as representative of our future consolidated results of operations or financial position.

The estimates and assumptions used in preparation of the pro forma financial information may be materially different from our actual experience in connection with this offering by the selling shareholders. For additional information on the pro forma adjustments, see "Pro Forma Adjustments" of the "Notes to Unaudited Pro Forma Condensed Consolidated Financial Information" in this prospectus supplement.

S-19

Unaudited Pro Forma Consolidated Balance Sheet

As of September 30, 2010

(dollars in thousands, except per share amounts)

| |

Historical | Adjustments | Pro Forma | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

ASSETS |

||||||||||||

Current assets |

||||||||||||

Cash and cash equivalents |

$ | 287,713 | $ | — | $ | 287,713 | ||||||

Restricted cash |

218,397 | — | 218,397 | |||||||||

Accounts receivable, net |

87,542 | — | 87,542 | |||||||||

Due from related parties |

2,898 | — | 2,898 | |||||||||

Inventories |

66,705 | — | 66,705 | |||||||||

Deferred income taxes |

1,738 | 1,057 | (a) | 2,795 | ||||||||

Other assets |

15,096 | — | 15,096 | |||||||||

Total current assets |

680,089 | 1,057 | 681,146 | |||||||||

Non-current assets |

||||||||||||

Property, plant and equipment, net |

965,130 | — | 965,130 | |||||||||

Intangible assets, net |

— | — | — | |||||||||

Goodwill |

35,634 | — | 35,634 | |||||||||

Deferred income taxes |

73,433 | 159,002 | (a) | 232,435 | ||||||||

Other assets |

38,858 | — | 38,858 | |||||||||

Total assets |

$ | 1,793,144 | $ | 160,059 | $ | 1,953,203 | ||||||

LIABILITIES AND EQUITY |

||||||||||||

Current liabilities |

||||||||||||

Accounts payable |

$ | 51,670 | — | $ | 51,670 | |||||||

Royalties and production taxes |

134,302 | — | 134,302 | |||||||||

Accrued expenses |

66,014 | — | 66,014 | |||||||||

Current portion of tax agreement liability |

1,685 | — | 1,685 | |||||||||

Current portion of federal coal lease obligations |

54,394 | — | 54,394 | |||||||||

Other liabilities |

4,543 | — | 4,543 | |||||||||

Total current liabilities |

312,608 | — | 312,608 | |||||||||

Non-current liabilities |

||||||||||||

Tax agreement liability, net of current portion |

66,555 | 93,149 | (b) | 159,704 | ||||||||

Senior notes |

595,592 | — | 595,592 | |||||||||

Federal coal lease obligations, net of current portion |

67,387 | — | 67,387 | |||||||||

Asset retirement obligations, net of current portion |

181,437 | — | 181,437 | |||||||||

Other liabilities |

29,249 | — | 29,249 | |||||||||

Total liabilities |

1,252,828 | 93,149 | 1,345,977 | |||||||||

Equity |

||||||||||||

Common stock ($0.01 par value; 200,000,000 shares authorized; 31,482,594 shares issued and outstanding on a historical basis; 60,882,594 shares issued and outstanding on a pro forma basis) |

315 | 294 | 609 | |||||||||

Additional paid-in capital |

258,875 | 264,162 | (c) | 523,037 | ||||||||

Retained earnings |

29,420 | 160,059 | (a) | 96,330 | ||||||||

|

(93,149 | )(b) | ||||||||||

Accumulated other comprehensive loss |

(6,591 | ) | (6,159 | )(c) | (12,750 | ) | ||||||

Total Cloud Peak Energy Inc. shareholders' equity |

282,019 | 325,207 | 607,226 | |||||||||

Noncontrolling interest |

258,297 | (258,297 | )(c) | — | ||||||||

Total equity |

540,316 | 66,910 | (d) | 607,226 | ||||||||

Total liabilities and equity |

$ | 1,793,144 | $ | 160,059 | $ | 1,953,203 | ||||||

The accompanying notes are an integral part of these unaudited pro forma consolidated financial statements.

S-20

Unaudited Pro Forma Condensed Consolidated Statement of Operations

For the Nine Months Ended September 30, 2010

(dollars in thousands, except per

share amounts)

| |

Historical | Adjustments | Pro Forma | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

Revenues |

$ | 1,024,960 | $ | — | $ | 1,024,960 | ||||||

Costs and expenses |

||||||||||||

Cost of product sold (exclusive of depreciation, depletion, amortization and accretion, shown separately) |

719,007 | — | 719,007 | |||||||||

Depreciation and depletion |

75,212 | — | 75,212 | |||||||||

Amortization |

3,197 | — | 3,197 | |||||||||

Accretion |

9,903 | — | 9,903 | |||||||||

Selling, general and administrative expenses |

47,159 | — | 47,159 | |||||||||

Total costs and expenses |

854,478 | — | 854,478 | |||||||||

Operating income |

170,482 | — | 170,482 | |||||||||

Other income (expense) |

||||||||||||

Interest income |

411 | — | 411 | |||||||||

Interest expense |

(36,186 | ) | — | (36,186 | ) | |||||||

Tax agreement expense |

(19,669 | ) | — | (19,669 | ) | |||||||

Other, net |

123 | — | 123 | |||||||||

Total other expense |

(55,321 | ) | — | (55,321 | ) | |||||||

Income from continuing operations before income tax provision and earnings from unconsolidated affiliates |

115,161 | — | 115,161 | |||||||||

Income tax provision |

(30,212 | ) | (16,921 | )(e) | (47,133 | ) | ||||||

Earnings from unconsolidated affiliates, net of tax |

2,499 | (534 | )(e) | 1,965 | ||||||||

Income from continuing operations |

87,448 | (17,455 | ) | 69,993 | ||||||||

Income from discontinued operations, net of tax |

— | — | — | |||||||||

Net income |

87,448 | (17,455 | ) | 69,993 | ||||||||

Less: Net income attributable to noncontrolling interest |

66,592 | (66,592 | )(f) | — | ||||||||

Net income attributable to controlling interest |

$ | 20,856 | $ | 49,137 | $ | 69,993 | ||||||

Amounts attributable to controlling interest common shareholders: |

||||||||||||

Income from continuing operations |

$ | 20,856 | $ | 49,137 | $ | 69,993 | ||||||

Income from discontinued operations |

— | — | — | |||||||||

Net income |

$ | 20,856 | $ | 49,137 | $ | 69,993 | ||||||

Earnings per common share attributable to controlling interest: |

||||||||||||

Basic |

||||||||||||

Income from continuing operations |

$ | 0.68 | $ | 1.17 | (g) | |||||||

Income from discontinued operations |

— | — | (g) | |||||||||

Net income |

$ | 0.68 | $ | 1.17 | ||||||||

Weighted-average shares outstanding—basic |

30,600,000 | 60,000,000 | (f) | |||||||||

Diluted |

||||||||||||

Income from continuing operations |

$ | 0.68 | $ | 1.16 | (g) | |||||||

Income from discontinued operations |

— | — | (g) | |||||||||

Net income |

$ | 0.68 | $ | 1.16 | ||||||||

Weighted-average shares outstanding—diluted |

30,600,000 | 60,168,263 | (f) | |||||||||

The accompanying notes are an integral part of these unaudited pro forma consolidated financial statements.

S-21

Unaudited Pro Forma Condensed Consolidated Statement of Operations