Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT ON FORM 8-K - Expedia Group, Inc. | d8k.htm |

EXPEDIA, INC.

A complete travel commerce experience

Exhibit 99.1 |

EXPEDIA, INC.

Forward-Looking Statements

This presentation contains “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995, including statements about the future

financial and operational performance of the Company. These statements are not guarantees of future performance.

These forward-looking statements are based on management’s expectations as of December 6,

2010, and assumptions which are inherently subject to uncertainties, risks and changes in

circumstances that are difficult to predict. The use of words such as “believe,” “forecast,”

“opportunity,” “intends,” “anticipates,” and “expects,” among

others, generally identifies forward-looking statements. However, these words are not the

exclusive means of identifying such statements. In addition, any statements that refer to expectations, projections or other characterizations of

future events or circumstances are forward-looking statements and may include statements relating

to future revenues, expenses, margins, profitability, net income, earnings per share and other

measures of results of operations and the prospects for future growth of Expedia, Inc.’s

business.

Actual results and the timing and outcome of events may differ materially from those expressed or

implied in the forward-looking statements for a variety of reasons, including, among

others: continued or prolonged adverse economic conditions leading to decreased consumer and business

spending; changes in our relationships and contractual agreements with travel suppliers or global

distribution system partners; adverse changes in senior management; the rate of growth of online

travel; our inability to recognize the benefits of our investment in technologies; changes in the

competitive environment, the e-commerce industry and broadband access and our ability to respond

to such changes; declines or disruptions in the travel industry (including those caused by

adverse weather, bankruptcies, health risks, war and/or terrorism); the rate of online migration in the

various geographies and markets in which Expedia, Inc. operates, including Eastern Europe and Asia,

fluctuations in foreign exchange rates, risks related to our long term indebtedness, including

the ability to access funds as and when needed; changing laws, rules and regulations and legal

uncertainties relating to our business; Expedia, Inc.’s ability to expand successfully in

international markets; possible charges resulting from, among other events, platform migration;

failure to realize cost efficiencies; the successful completion of any future corporate transactions or

acquisitions; the integration of current and acquired businesses; and other risks detailed in

Expedia’s, Inc.’s public filings with the SEC, including Expedia, Inc.’s annual

report on Form 10-K for the year ended December 31, 2009 and subsequent Forms 10-Q. Except as required by law, Expedia, Inc. undertakes no obligation to update any

forward-looking or other statements in this presentation, whether as a result of new

information, future events or otherwise. Reconciliations of non-GAAP measures included in this presentation to the most comparable GAAP

measures are included in Appendix A. Trademarks and logos are the property of their respective owners. © Expedia, Inc. All rights

reserved. CST: #2029030-50 |

Expedia, Inc. is building the world’s largest

and most intelligent travel marketplace.

We generate revenue by addressing the entire

travel commerce experience, enabling travelers to

research, plan and book their trip, offering service

while they travel, and providing the online forums

to review hotels, discuss destinations and share

experiences. |

Number of unique

visitors to Expedia, Inc. sites

worldwide each month

73+

million

The world’s largest

travel marketplace

Source: comScore Sept. 2010, unduplicated |

Serving travelers in over

60

countries

The world’s largest

travel marketplace |

160+

booking and travel media sites

The world’s largest

travel marketplace |

Offering hotels in over

200

countries

The world’s largest

travel marketplace |

EXPEDIA, INC.

Where to go

Pricing and deals

Where to stay

Best airplane seat

Things to do

Research &

Planning

Addressing the entire travel commerce experience |

EXPEDIA, INC.

Air

Hotel

Vacation packages

Cruise

Rental car

Insurance

Activities

Booking

Research &

Planning

Addressing the entire travel commerce experience |

EXPEDIA, INC.

Concierge services

Destination guides

Mobile apps

24-hour customer service

Booking

Research &

Planning

Addressing the entire travel commerce experience

Traveler forums

Hotel reviews

Destination videos

Travel &

Sharing |

|

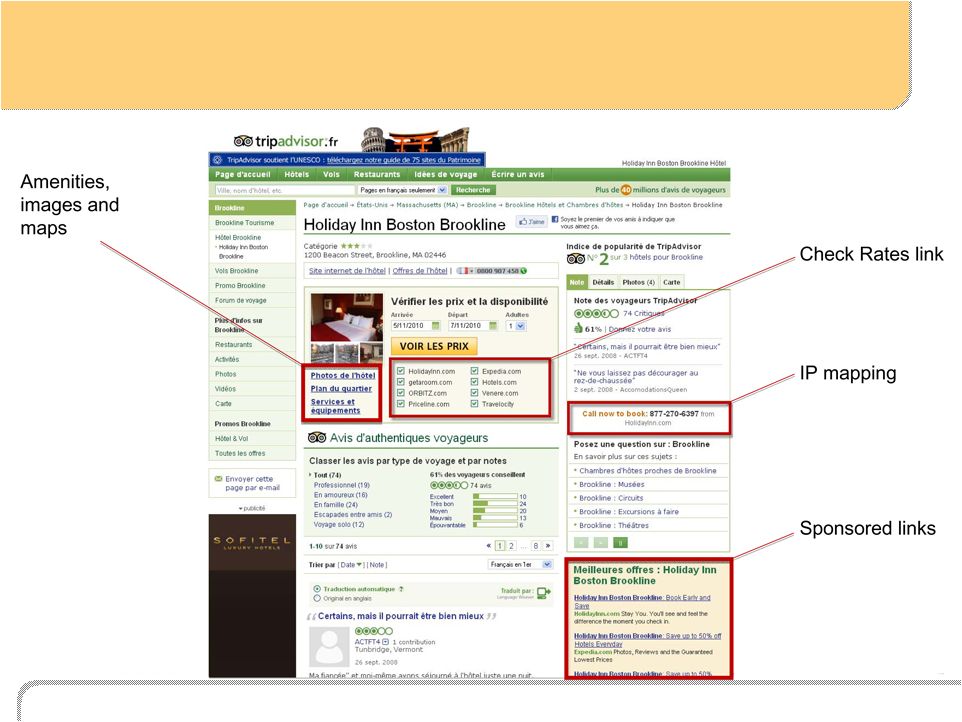

TripAdvisor

®

is the world’s

largest travel community,

with the largest collection of

traveler reviews and content

on destinations and travel

accommodations.

TripAdvisor Media Network

40

million

monthly unique visitors

Source: comScore August 2010, unduplicated |

TripAdvisor is the world’s

largest travel community,

with the largest collection of

traveler reviews and content

on destinations and travel

accommodations.

TripAdvisor Media Network

20

million

registered users |

18

TripAdvisor Media

Network brands

TripAdvisor is the world’s

largest travel community,

with the largest collection of

traveler reviews and content

on destinations and travel

accommodations.

TripAdvisor Media Network |

Operating in

24

countries

TripAdvisor is the world’s

largest travel community,

with the largest collection of

traveler reviews and content

on destinations and travel

accommodations.

TripAdvisor Media Network |

TripAdvisor is the world’s

largest travel community,

with the largest collection of

traveler reviews and content

on destinations and travel

accommodations.

TripAdvisor Media Network

40

million

hotel reviews |

EXPEDIA, INC.

Content and advice for all aspects of travel

World’s largest travel community

Air travel content & community |

EXPEDIA, INC.

Content and advice for all aspects of travel

Traveler content and community sites |

EXPEDIA, INC.

Content and advice for all aspects of travel

Travel deals and price comparison |

EXPEDIA, INC.

77%

58%

22%

+10%

+11%

+15%

54%

37%

21%

Internet penetration

Estimated online advertising growth

Estimated online share of consumer travel spending

Global online ad market expected to reach

~$100 billion by 2014

Global market opportunity for online travel media

Sources: www.internetworldstats.com

Online Advertising growth = CAGR 2010 - 2014 estimated using eMarketer Sept.

2010 report as the primary source PhoCusWright studies spanning 2009 and 2010

Online Advertising market eMarketer September 2010 report

|

EXPEDIA, INC.

Serving travelers across the globe

100% YOY growth in each of the last four quarters

TripAdvisor international third-party revenue now ~40%

|

TTM revenue of

$401

million

Monetizing travel media

Expedia’s robust and fast-

growing advertising and

media businesses make us

unique in the industry, and

allow us maximum flexibility

as the industry evolves.

As of Sept. 30, 2010 |

Monetizing travel media

Expedia’s robust and fast-

growing advertising and

media businesses make us

unique in the industry, and

allow us maximum flexibility

as the industry evolves.

An increase of

+34%

year over year |

Monetizing travel media

Expedia’s robust and fast-

growing advertising and

media businesses make us

unique in the industry, and

allow us maximum flexibility

as the industry evolves.

Percent of EI revenue TTM

12% |

Monetizing travel media

Expedia’s robust and fast-

growing advertising and

media businesses make us

unique in the industry, and

allow us maximum flexibility

as the industry evolves.

OIBA margins of

>50% |

We believe this can be a

$1 Billion

business.

Monetizing travel media |

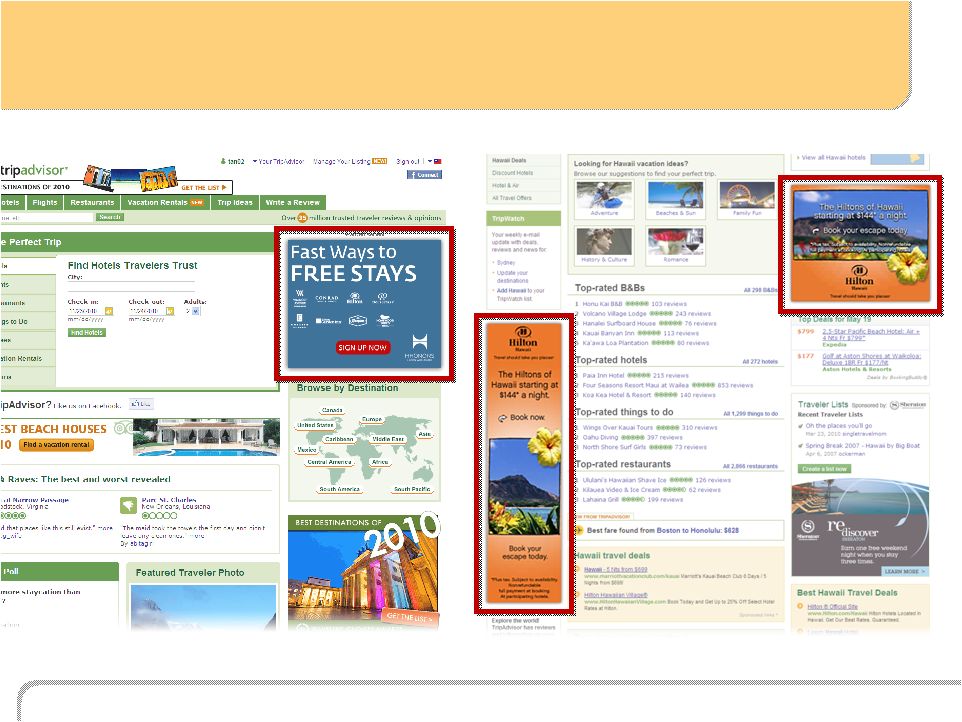

TripAdvisor Media Network

A range of opportunities for travel advertisers |

EXPEDIA, INC.

Cost-Per-Click (CPC) |

EXPEDIA, INC.

Display (CPM) |

EXPEDIA, INC.

Subscription-based Business Listings |

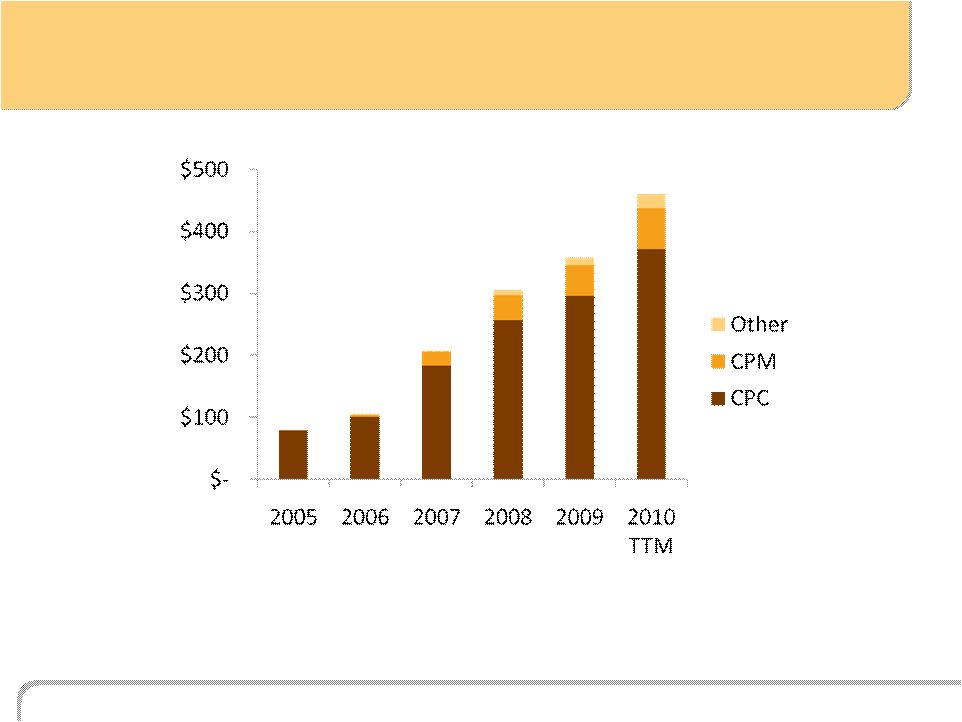

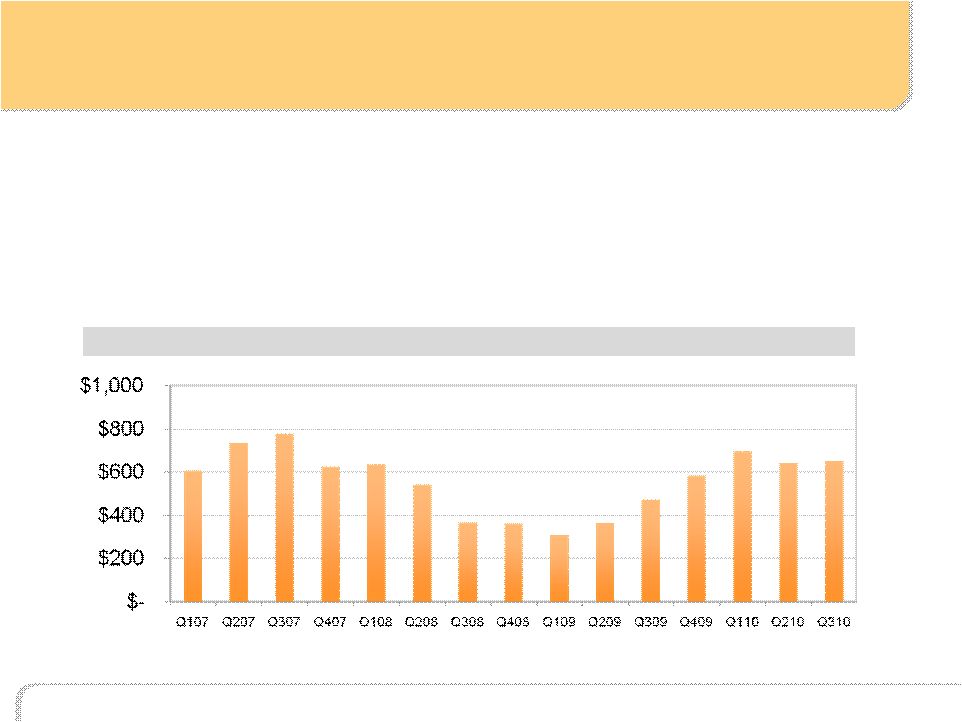

EXPEDIA, INC.

A

range

of

opportunities

for

travel

advertisers

Total TripAdvisor

Gross Revenue

(in millions) |

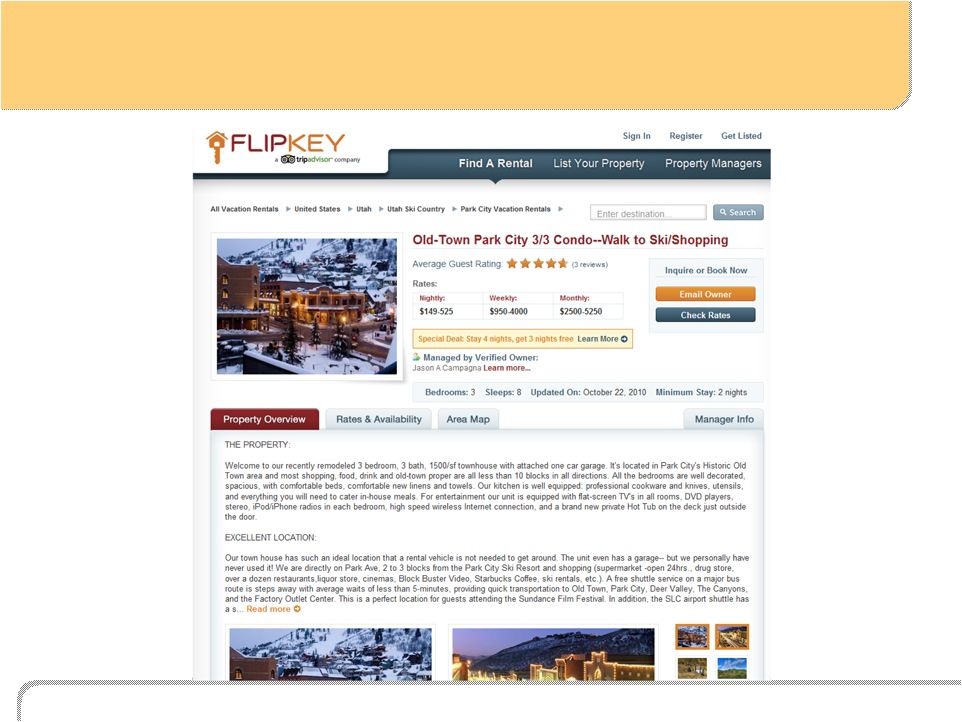

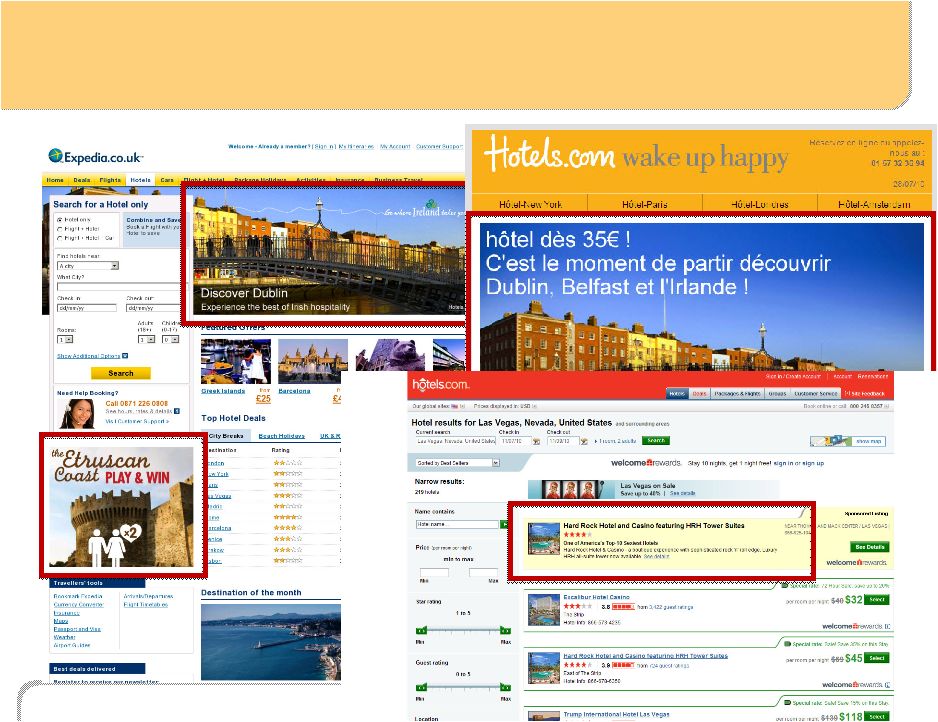

EXPEDIA, INC.

Media products on booking sites |

|

96

leisure booking sites

Nobody matches supply

with demand on a global

basis at our scale.

Booking the trip |

Nobody matches supply

with demand on a global

basis at our scale.

Booking the trip

Serving travelers in over

60

countries |

Nobody matches supply

with demand on a global

basis at our scale.

Booking the trip

300+

airlines |

130K

hotels

Nobody matches supply

with demand on a global

basis at our scale.

Booking the trip |

EXPEDIA, INC.

Unpublished rate booking site

Hotel specialist with over 70 sites

in over 60 countries

Booking the trip

World’s largest OTA, focusing

on the whole trip

5

th

largest full-service corporate travel

management company in the world |

EXPEDIA, INC.

Booking the trip

Luxury travel provider

Offline cruise travel agency

with retail presence

Leading Chinese OTA

Italy-based agency

hotel bookings provider

Online car rentals consolidator |

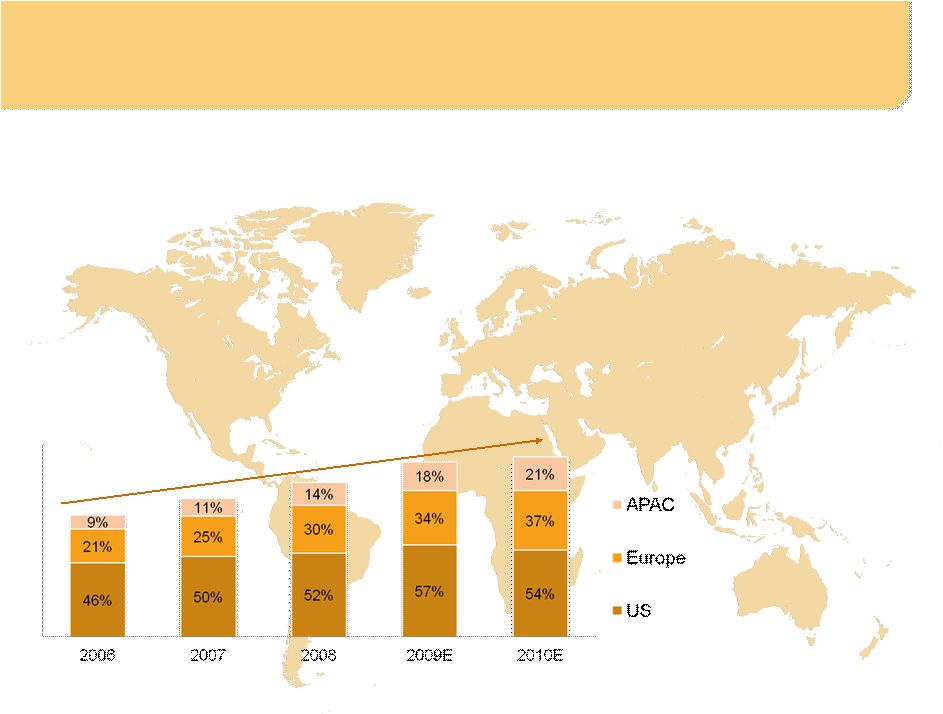

EXPEDIA, INC.

$255B

$293B

$212B

Size of travel market

Online penetration

54%

37%

21%

Source: PhoCusWright studies

spanning 2009 and 2010

Global market opportunity for online travel bookings

Estimated Online Penetration

Estimated Online Penetration |

EXPEDIA, INC.

Serving travelers across the globe |

EXPEDIA, INC.

Maintaining the broadest supply portfolio

Hotel

•

>130,000 hotels offered making up ~60% of EXPE worldwide annual

revenue (TTM)

•

~55% merchant model hotels

•

~25% agency model hotels

•

Expedia accounts for 7% of room nights in the Top 20 U.S. markets

Air

•

Air revenue ~12% of EXPE worldwide annual revenue (TTM)

•

Revenue largely unit / volume driven

Cruise, Car and Destination Services comprise >10% worldwide

annual revenue (TTM)

>15% of EXPE gross bookings are package or multi-component transactions

for same itinerary (TTM)

Source for 7% room night share stat = STR YTD through Sept. 2010

|

EXPEDIA, INC.

Collaboration & Integration = Growth

Global supply team serves booking brands

Booking sites in

over 60 countries

Enters new markets

TripAdvisor’s first advertisers

Drives traffic to booking sites

Customer volume and reach = value to suppliers |

EXPEDIA, INC.

There is a huge worldwide market opportunity as additional

travel dollars move online around the world.

Taking flight off an extended runway

Worldwide travel market

$>760

billion

<40%

online

penetration

Worldwide Internet penetration

29%

445%

growth rate

Expedia 9.30 TTM leisure revenue

$2.8

billion

9%

growth rate

Expedia 9.30 TTM media revenue

$401

million

34%

growth rate

Sources: PhoCusWright studies spanning 2009 and 2010,

www.internetworldstats.com |

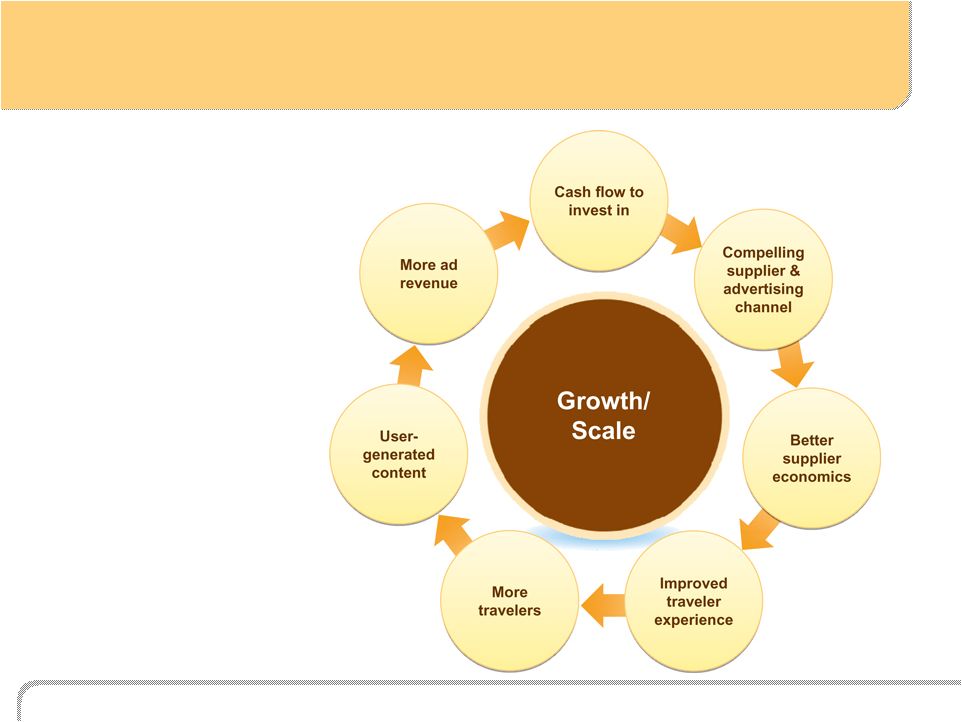

EXPEDIA, INC.

Virtuous Cycle

The bigger and

better we get,

the bigger and

better we get. |

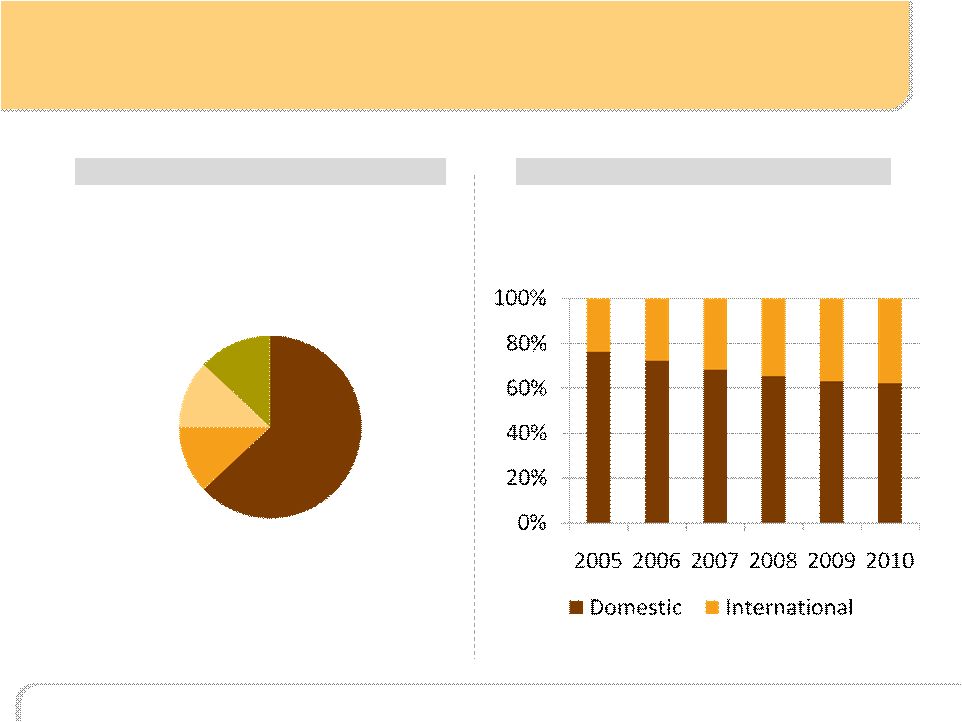

EXPEDIA, INC.

Diverse revenue streams

Geographic Split (TTM 9.30.10)

Revenue

Product Categories (TTM 9.30.10)

Hotel

63%

Revenue

Air

12%

Advertising & Media

12%

Car, Cruise & Other

13% |

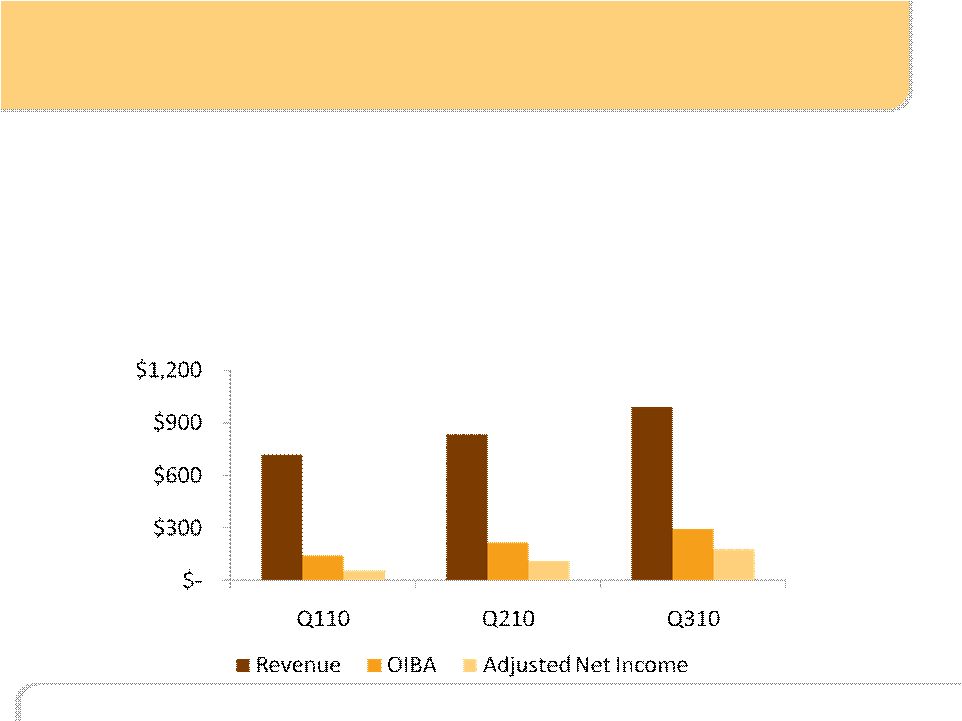

EXPEDIA, INC.

Solid performance…

•

Positive top-line growth

•

3Q10 YOY revenue growth two times faster than 2Q10 YOY revenue

growth

•

Continue to generate substantial revenue, profits and free cash flow

13%

8%

16%

10%

24%

3%

15%

14%

32%

See Appendix A for reconciliation to GAAP number |

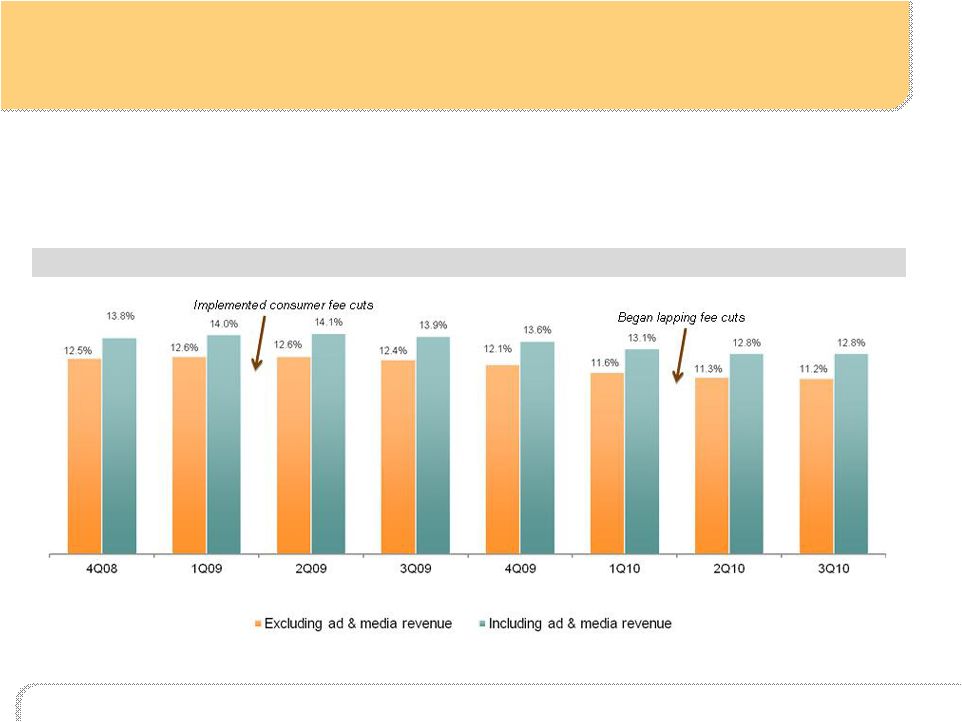

EXPEDIA, INC.

Stable supplier economics

Trended Revenue Margin (TTM) |

EXPEDIA, INC.

Since 2006 generated $2.9B in free cash flow and

returned $2.1B to shareholders through share

repurchases and dividends

Generating cash, returning it to shareholders

Trended Free Cash Flow (TTM) |

|

EXPEDIA, INC.

Appendix A -

Non-GAAP Items

Operating Income Before Amortization (“OIBA”) is defined as operating income plus: (1)

stock-based compensation expense, including compensation expense related to certain

subsidiary equity plans; (2) acquisition-related impacts, including (i) amortization of intangible assets and

goodwill and intangible asset impairment, and (ii) gains (losses) recognized on changes in the value

of contingent consideration arrangements; (3) certain infrequently occurring items, including

restructuring; (4) charges incurred, if any, for monies that may be required to be paid in advance of

litigation in certain occupancy tax proceedings; and (5) gains (losses) realized on revenue hedging

activities that are included in other, net. OIBA margin is OIBA divided by net revenue.

Adjusted Net Income generally captures all items on the statements of operations that occur in normal

course operations and have been, or ultimately will be, settled in cash and is defined as net

income/(loss) attributable to Expedia, Inc. plus net of tax: (1) stock-based compensation

expense, including compensation expense related to certain subsidiary equity plans; (2)

acquisition-related impacts, including (i) amortization of intangible assets, including as

part of equity-method investments, and goodwill and intangible asset impairment, (ii) gains (losses) recognized on

changes in the value of contingent consideration arrangements, and (iii) gains (losses) recognized on

noncontrolling investment basis adjustments when we acquire controlling interests; (3) mark to

market gains and losses on derivative instruments assumed at Spin-off; (4) currency gains or

losses on U.S. dollar denominated cash or investments held by eLong; (5) certain other infrequently

occurring items, including restructuring charges; (6) charges incurred, if any, for monies that

may be required to be paid in advance of litigation in certain occupancy tax proceedings; (7)

discontinued operations; and (8) the noncontrolling interest impact of the aforementioned adjustment

items. We believe Adjusted Net Income is useful to investors because it represents Expedia,

Inc.’s combined results, taking into account depreciation, which management believes is an

ongoing cost of doing business, but excluding the impact of other non-cash expenses, infrequently

occurring items and items not directly tied to the core operations of our businesses.

|

EXPEDIA, INC.

Appendix A -

Non-GAAP Items

(figures in $000s)

3 Months

Ended

3 Months

Ended

3 Months

Ended

31-Mar-10

30-Jun-10

30-Sep-10

OIBA

$142,544

$219,472

$293,650

Amortization of intangible assets

(9,028)

(8,344)

(8,126)

Stock-based compensation

(18,892)

(14,651)

(13,021)

Restructuring charges

-

-

-

Occupancy tax assessments and legal reserves

-

-

Realized loss (gain) on revenue hedges

(2,450)

(2,787)

4,301

Operating income

112,174

193,690

276,804

Interest expense, net

(20,608)

(18,988)

(24,539)

Other, net

568

817

(13,657)

Provision for income taxes

(31,535)

(60,166)

(60,584)

Net income attributable to noncontrolling interests

(1,204)

(1,091)

(1,474)

Net income attributable to Expedia, Inc.

$59,395

$114,262

$176,550

Source: Company reports

OIBA (Operating Income Before Amortization) |

EXPEDIA, INC.

Appendix A -

Non-GAAP Items

Source: Company reports

(figures in $000s)

3 Months

Ended

3 Months

Ended

3 Months

Ended

31-Mar-10

30-Jun-10

30-Sep-10

Net income attributable to Expedia, Inc.

$ 59,395

$ 114,261

$ 176,550

Amortization of intangible assets

9,028

8,344

8,126

Stock-based compensation

18,892

14,651

13,021

Restructuring charges

-

-

-

Foreign currency gain on U.S. dollar

cash balances held by eLong

(125)

873

1,358

Amortization of intangible assets as part

of equity method investments

-

-

-

Noncontrolling interests

(436)

(783)

(954)

Provision for income taxes

(9,023)

(8,061)

(6,838)

Adjusted net income

$ 77,731

$ 129,285

$ 191,263

Adjusted Net Income |

EXPEDIA, INC.

Appendix A -

Non-GAAP Items

Free Cash Flow

(figures in $000s)

31-Dec-06

31-Dec-07

31-Dec-08

31-Dec-09

30-Sep-10

Total

Net cash provided by operating activities

$617,440

$712,069

$520,688

$676,004

$937,717

$3,463,918

Less: capital expenditures

(92,631)

(86,658)

(159,827)

(92,017)

(113,324)

(544,457)

Free cash flow

$524,809

$625,411

$360,861

$583,987

$824,393

$2,919,461

Source: Company reports |