Attached files

| file | filename |

|---|---|

| EX-10.6 - China Energy CORP | v204575_ex10-6.htm |

| EX-10.2 - China Energy CORP | v204575_ex10-2.htm |

| EX-10.7 - China Energy CORP | v204575_ex10-7.htm |

| EX-10.5 - China Energy CORP | v204575_ex10-5.htm |

| EX-10.8 - China Energy CORP | v204575_ex10-8.htm |

| EX-10.3 - China Energy CORP | v204575_ex10-3.htm |

| EX-10.4 - China Energy CORP | v204575_ex10-4.htm |

| EX-10.1 - China Energy CORP | v204575_ex10-1.htm |

| EX-10.14 - China Energy CORP | v204575_ex10-14.htm |

| EX-10.12 - China Energy CORP | v204575_ex10-12.htm |

| EX-10.11 - China Energy CORP | v204575_ex10-11.htm |

| EX-10.13 - China Energy CORP | v204575_ex10-13.htm |

| EX-10.10 - China Energy CORP | v204575_ex10-10.htm |

| EX-10.9 - China Energy CORP | v204575_ex10-9.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act 1934

Date of

Report (date of earliest event reported): November 30, 2010

CHINA

ENERGY CORPORATION

(Exact

name of registrant as specified in charter)

|

Nevada

|

000-52409

|

98-0522950

|

|

(State

of Incorporation)

|

(Commission

File No.)

|

(IRS

Employer

Identification

No.)

|

No.

57 Xinhua East Street

Hohhot,

Inner Mongolia, People’s Republic of China

(Address

Of Principal Executive Offices) (Zip Code)

+86-0471-466-8870

(Registrant’s

Telephone Number, Including Area Code)

(Former

Name or Former Address, is Changed Since Last Report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of registrant under any of the following

provisions:

o Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

o Soliciting

material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR

240.14a-12(b))

o Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

o Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

Item

1.01. Entry Into a Material Definitive Agreement.

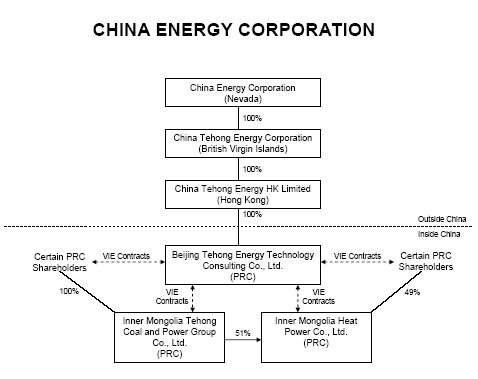

China

Energy Corporation (the “Company”) has entered into a series of contractual

arrangements pursuant to which the control and the economic benefits and costs

of ownership of the two operating companies known as Inner Mongolia Tehong Coal

And Power Group Co., Ltd. (“Coal Group”), and Inner Mongolia Heat Power Co.,

Ltd. (“Heat Power,” and together with the Coal Group, the “Operating Companies”)

in the Peoples Republic of China (“PRC”) would flow directly to Beijing Tehong

Energy Technology Consulting Co., Ltd. (the “WFOE”), an indirect, wholly owned

subsidiary of the Company.

The

Company first entered into a Termination And Restructuring Agreement with the

Operating Companies, the WFOE, Pacific Projects Inc. (“PPI”) and the respective

stockholders of the Operating Companies (collectively, the “PRC Shareholders”)

dated November 30, 2010 pursuant to which the parties agreed (i) to terminate

the Trust Agreement dated as of December 31, 2007 under which the PRC

Shareholders agreed to hold their equity interests in the Operating Companies in

trust for PPI, (ii) to the merger of PPI into the Company and (iii) to enter

into Management and Control Agreements.

On

November 30, 2010, the WFOE entered into (i) an Exclusive Business Cooperation

Agreement with Coal Group, (ii) an Equity Interest Pledge Agreement and an

Exclusive Option Agreement with Coal Group and the stockholders of Coal Group

and (iii) a Power of Attorney, with each of the stockholders of the Coal

Group. The WFOE also entered into (i) an Exclusive Business

Cooperation Agreement with Heat Power, (ii) an Equity Interest Pledge Agreement

and an Exclusive Option Agreement with Heat Power and the stockholders of Heat

Power and (iii) a Power of Attorney with each of the stockholders of Heat

Power. The foregoing agreements are herein collectively referred to

as the “Management and Control Agreements.”

The

Management and Control Agreements described below allow the WFOE to exercise

control over, and derive all economic benefits from Coal Group and Heat

Power. Previously, our operating businesses were controlled pursuant

to a trust arrangement which has been terminated as part of the restructuring

described herein.

Exclusive Business

Cooperation Agreements.

Pursuant

to the Exclusive Business Cooperation Agreements, the WFOE provides technical

and consulting services related to the business operations of each of Coal Group

and Heat Power. In consideration for such services, each of Coal Group and Heat

Power has agreed to pay an annual service fee to the WFOE in an amount equal

100% of Coal Group and Heat Power’s annual net income,

respectively. Each Exclusive Business Cooperation Agreement has a

term of 10 years, which automatically renews unless terminated by the

WFOE. The WFOE may terminate the agreements at any time upon 30 days’

prior written notice to Coal Group or Heat Power, as the case may

be.

2

Exclusive Option

Agreements.

Pursuant

to the Exclusive Option Agreements, the WFOE has an exclusive option to

purchase, or to designate another qualified person to purchase, to the extent

permitted by PRC law and foreign investment policies, part or all of the equity

interests in each of the Coal Group and Heat Power held by the stockholders of

Coal Group and the stockholders of Heat Power, respectively. To the

extent permitted by the PRC laws, the purchase price for the entire equity

interest is RMB1.00 or the minimum amount required by PRC law or government

practice. Each of the exclusive option agreements has a term of 10 years, with

renewal for an additional 10 years at the option of the WFOE.

Powers of

Attorney. Each of the stockholders of the Coal

Group and Heat Power, respectively, executed a Power of Attorney that provides

the WFOE with the power to act as such stockholder’s exclusive agent with

respect to all matters related to such stockholder’s ownership interest in each

of Coal Group or Heat Power, respectively, including the right to attend

stockholders’ meetings and the right to vote, dispose or pledge such

shares.

Equity Interest Pledge

Agreements.

Pursuant

to such agreements, each of the stockholders of Coal and the Heat Power pledged

their shares in Heat Power and Coal Group, respectively, to the WFOE, to secure

the obligations of each of Coal Group and Heat Power under the Exclusive

Business Cooperation Agreements. In addition, the stockholders of

Coal Group and the Heat Power agreed not to transfer, sell, pledge, dispose of

or create any encumbrance on any equity interests in Coal Group or Heat Power

that would affect the WFOE’s interests. The Equity Interest Pledge Agreement

expire when Coal Group and Heat Power, respectively, fully perform their

obligations under the Exclusive Business Cooperation Agreements.

Termination of Trust

Arrangements.

Prior to

entering into the Management and Control Agreements, the Company controlled Coal

Group and Heat Power through a series of trust agreements which were terminated

contemporaneously with the execution of the Management and Control

Agreements. In connection with the termination of such trust

arrangements, ownership of 68% of the shares of the Company previously held by

Georgia Pacific Investments Inc. and Axim Holdings Ltd. was transferred to

Fortune Place Holdings Ltd. (“Fortune Place”).

Entrustment Agreement and

Share Option Agreement.

Ninghua

Xu, owner of 100% equity interests of Fortune Place, entered into an entrustment

agreement with WenXiang Ding, our Chief Executive Officer, pursuant to Mr. Ding

was entrusted to manage the Operating Companies and related entities as provided

in the agreement as the agent of Mr. Xu. The agreement also

appoints Mr. Ding as the exclusive agent with respect to all matters

concerning 100% of Mr. Xu’s equity interest in Fortune Place.

In

addition, Mr. Xu and Mr. Ding entered into a share option agreement pursuant to

which Mr. Ding has the option to purchase all of the shares of Fortune Place

from Mr. Xu upon the achievement of certain performance targets by the Operating

Companies and related entities.

Revised Corporate

Structure

As a

result of the entry into the foregoing agreements, and the termination of the

trust arrangements, we have a revised corporate structure which is set forth

below:

3

Item

1.02 Termination of a Material Definitive Agreement

The

information set forth in response to Item 1.01 is incorporated by reference

herein.

Item

9.01 Financial Statements and Exhibits

(d)

Exhibits.

Exhibit

No. Description

|

10.1

|

Exclusive

Business Cooperation Agreement by and between Beijing Tehong Energy

Technology Consulting Co., Ltd. and Inner Mongolia Tehong Coal Power Group

Co., Ltd., dated November 30, 2010.

|

|

10.2

|

Form

of Exclusive Option Agreement by and among Beijing Tehong Energy

Technology Consulting Co., Ltd., Inner Mongolia Tehong Coal Power Group

Co., Ltd. and each of WenXiang Ding, Yanhua Li, Yi Ding and Biao Ding,

dated November 30, 2010.

|

|

10.3

|

Form

of Equity Interest Pledge Agreement by and among

Beijing Tehong Energy Technology Consulting Co., Ltd., Inner Mongolia

Tehong Coal Power Group Co., Ltd. and each of WenXiang Ding, Yanhua Li, Yi

Ding and Biao Ding, dated November 30, 2010.

|

|

10.4

|

Form

of Power of Attorney by and between Beijing Tehong

Energy Technology Consulting Co., Ltd. and each of WenXiang Ding, Yanhua

Li, Yi Ding and Biao Ding, dated November 30, 2010.

|

|

10.5

|

Exclusive

Business Cooperation Agreement by and between Beijing Tehong Energy

Technology Consulting Co., Ltd. and Inner Mongolia Zhunger Heat Power Co.,

Ltd., dated November 30, 2010.

|

4

|

10.6

|

Form

of Exclusive Option Agreement by and among Beijing Tehong Energy

Technology Consulting Co., Ltd., Inner Mongolia Zhunger Heat Power Co.,

Ltd. and each of Ordos City YiYuan Investment Co., Ltd., and Inner

Mongolia Yiduoda Mining Co., Ltd., dated November 30,

2010.

|

|

10.7

|

Form

of Equity Interest Pledge Agreement by and among

Beijing Tehong Energy Technology Consulting Co., Ltd., Inner Mongolia

Zhunger Heat Power Co., Ltd. and each of Ordos City YiYuan Investment Co.,

Ltd., Inner Mongolia Yiduoda Mining Co., Ltd., dated November 30,

2010.

|

|

10.8

|

Form

of Power of Attorney by and between Beijing Tehong

Energy Technology Consulting Co., Ltd. and each of Ordos City YiYuan

Investment Co., Ltd., Inner Mongolia Yiduoda Mining Co., Ltd., dated

November 30, 2010.

|

|

10.9

|

Termination

and Restructuring Agreement by and among the Company, Inner Mongolia

Tehong Coal And Power Group Co., Ltd., Inner Mongolia Heat Power Co.,

Ltd., the Beijing Tehong Energy Technology Consulting Co., Ltd., Pacific

Projects Inc. and the respective stockholders of Inner Mongolia Tehong

Coal And Power Group Co., Ltd., and Inner Mongolia Heat Power Co., Ltd.,

dated November 30, 2010.

|

|

10.10

|

Termination

and Transfer Agreement by and between Georgia Pacific Investments Inc.,

Wenxiang Ding, Yanhua Li, Fortune Place Holdings Limited, and Ninghua Xu

dated November 30, 2010.

|

|

10.11

|

Termination

and Transfer Agreement among Axim Holdings Ltd., Yi Ding, Biao Ding,

Fortune Place Holdings Limited, and Ninghua Xu dated as of November 30,

2010.

|

|

10.12

|

Termination

Agreement among the Company, Georgia Pacific Investments Inc. and Axim

Holdings Ltd. dated as of November 30, 2010 .

|

| 10.13 |

Entrustment

Agreement between Wenxiang Ding and Ninghua Xu dated

November

30, 2010.

|

| 10.14 |

Share

Option Agreement between Wenxiang Ding and Ninghua Xu dated November

30, 2010.

|

5

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has

duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

Dated: December

6, 2010

|

CHINA ENERGY

CORPORATION.

|

||

|

|

By:

|

/s/ WenXiang Ding | |

| Name: WenXiang Ding | |||

| Title: President and CEO | |||

6

EXHIBIT

INDEX

|

Exhibit

No.

|

Description

|

|

10.1

|

Exclusive

Business Cooperation Agreement by and between Beijing Tehong Energy

Technology Consulting Co., Ltd. and Inner Mongolia Tehong Coal Power Group

Co., Ltd., dated November 30, 2010.

|

|

10.2

|

Form

of Exclusive Option Agreement by and among Beijing Tehong Energy

Technology Consulting Co., Ltd., Inner Mongolia Tehong Coal Power Group

Co., Ltd. and each of WenXiang Ding, Yanhua Li, Yi Ding and Biao Ding,

dated November 30, 2010.

|

|

10.3

|

Form

of Equity Interest Pledge Agreement by and among

Beijing Tehong Energy Technology Consulting Co., Ltd., Inner Mongolia

Tehong Coal Power Group Co., Ltd. and each of WenXiang Ding, Yanhua Li, Yi

Ding and Biao Ding, dated November 30, 2010.

|

|

10.4

|

Form

of Power of Attorney by and between Beijing Tehong

Energy Technology Consulting Co., Ltd. and each of WenXiang Ding, Yanhua

Li, Yi Ding and Biao Ding, dated November 30, 2010.

|

|

10.5

|

Exclusive

Business Cooperation Agreement by and between Beijing Tehong Energy

Technology Consulting Co., Ltd. and Inner Mongolia Zhunger Heat Power Co.,

Ltd., dated November 30, 2010.

|

|

10.6

|

Form

of Exclusive Option Agreement by and among Beijing Tehong Energy

Technology Consulting Co., Ltd., Inner Mongolia Zhunger Heat Power Co.,

Ltd. and each of Ordos City YiYuan Investment Co., Ltd., and Inner

Mongolia Yiduoda Mining Co., Ltd., dated November 30,

2010.

|

|

10.7

|

Form

of Equity Interest Pledge Agreement by and among

Beijing Tehong Energy Technology Consulting Co., Ltd., Inner Mongolia

Zhunger Heat Power Co., Ltd. and each of Ordos City YiYuan Investment Co.,

Ltd., Inner Mongolia Yiduoda Mining Co., Ltd., dated November 30,

2010.

|

|

10.8

|

Form

of Power of Attorney by and between Beijing Tehong

Energy Technology Consulting Co., Ltd. and each of Ordos City YiYuan

Investment Co., Ltd., Inner Mongolia Yiduoda Mining Co., Ltd., dated

November 30, 2010.

|

|

10.9

|

Termination

and Restructuring Agreement by and among the Company, Inner Mongolia

Tehong Coal And Power Group Co., Ltd., Inner Mongolia Heat Power Co.,

Ltd., the Beijing Tehong Energy Technology Consulting Co., Ltd., Pacific

Projects Inc. and the respective stockholders of Inner Mongolia Tehong

Coal And Power Group Co., Ltd., and Inner Mongolia Heat Power Co., Ltd.,

dated November 30, 2010.

|

|

10.10

|

Termination

and Transfer Agreement by and between Georgia Pacific Investments Inc.,

Wenxiang Ding, Yanhua Li, Fortune Place Holdings Limited, and Ninghua Xu

dated November 30, 2010.

|

|

10.11

|

Termination

and Transfer Agreement among Axim Holdings Ltd., Yi Ding, Biao Ding,

Fortune Place Holdings Limited, and Ninghua Xu dated as of November 30,

2010.

|

|

10.12

|

Termination

Agreement among the Company, Georgia Pacific Investments Inc. and Axim

Holdings Ltd. dated as of November 30, 2010 .

|

| 10.13 |

Entrustment

Agreement between Wenxiang Ding and Ninghua Xu dated

November

30, 2010.

|

| 10.14 |

Share

Option Agreement between Wenxiang Ding and Ninghua Xu dated November

30, 2010.

|

7