Attached files

| file | filename |

|---|---|

| 8-K - UIL FORM 8-K DATED DECEMBER 2, 2010 - UIL HOLDINGS CORP | uil_form8kdated12022010.htm |

1

JPM SMid Cap Conference

J.P. Morgan SMid Cap Conference

December 3, 2010

EXHBIT 99.1

2

JPM SMid Cap Conference

2

Important Note to Investors

James P. Torgerson

President and Chief Executive Officer, UIL Holdings Corporation

Richard J. Nicholas

Executive Vice President and Chief Financial Officer, UIL Holdings Corporation

Safe Harbor Provision

Certain statements contained herein, regarding matters that are not historical facts, are forward-looking statements (as defined in the Private Securities

Litigation Reform Act of 1995). These include statements regarding management's intentions, plans, beliefs, expectations or forecasts for the future

including, without limitation, UIL's expectations with respect to the benefits, costs and other anticipated financial impacts of the gas company

acquisition transaction; future financial and operating results of the corporation; and the corporation’s plans, objectives, expectations and intentions

with respect to future operations and services. Such forward-looking statements are based on the corporation's expectations and involve risks and

uncertainties; consequently, actual results may differ materially from those expressed or implied in the statements. Such risks and uncertainties

include, but are not limited to, general economic conditions, legislative and regulatory changes, changes in demand for electricity, gas and other

products and services, changes in financial markets, unanticipated weather conditions, changes in accounting principles, policies or guidelines, and

other economic, competitive, governmental, and technological factors affecting the operations, timing, markets, products, services and prices of the

corporation's subsidiaries. Examples of such risks and uncertainties specific to the transaction include, but are not limited to the possibility that the

expected benefits will not be realized, or will not be realized within the expected time period. The foregoing and other factors are discussed and should be

reviewed in the corporation's most recent Annual Report on Form 10-K and other subsequent periodic filings with the Securities and Exchange

Commission. Forward-looking statements included herein speak only as of the date hereof and the corporation undertakes no obligation to revise or

update such statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events or circumstances.

Litigation Reform Act of 1995). These include statements regarding management's intentions, plans, beliefs, expectations or forecasts for the future

including, without limitation, UIL's expectations with respect to the benefits, costs and other anticipated financial impacts of the gas company

acquisition transaction; future financial and operating results of the corporation; and the corporation’s plans, objectives, expectations and intentions

with respect to future operations and services. Such forward-looking statements are based on the corporation's expectations and involve risks and

uncertainties; consequently, actual results may differ materially from those expressed or implied in the statements. Such risks and uncertainties

include, but are not limited to, general economic conditions, legislative and regulatory changes, changes in demand for electricity, gas and other

products and services, changes in financial markets, unanticipated weather conditions, changes in accounting principles, policies or guidelines, and

other economic, competitive, governmental, and technological factors affecting the operations, timing, markets, products, services and prices of the

corporation's subsidiaries. Examples of such risks and uncertainties specific to the transaction include, but are not limited to the possibility that the

expected benefits will not be realized, or will not be realized within the expected time period. The foregoing and other factors are discussed and should be

reviewed in the corporation's most recent Annual Report on Form 10-K and other subsequent periodic filings with the Securities and Exchange

Commission. Forward-looking statements included herein speak only as of the date hereof and the corporation undertakes no obligation to revise or

update such statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events or circumstances.

Reconciliation of Non-GAAP Financial Measures

Financial measures highlighted in this presentation may be considered non-GAAP financial measures such as Earnings Before Interest Expense,

Income Tax, Depreciation and Amortization (“EBITDA”), Adjusted EBITDA and Adjusted Net Income. Comparable GAAP financial measures and a

reconciliation of GAAP financial measures to non-GAAP financial measures are available in the Appendix to this presentation.

Income Tax, Depreciation and Amortization (“EBITDA”), Adjusted EBITDA and Adjusted Net Income. Comparable GAAP financial measures and a

reconciliation of GAAP financial measures to non-GAAP financial measures are available in the Appendix to this presentation.

3

JPM SMid Cap Conference

Today’s Topics

Ø YTD Accomplishments

Ø Gas Companies - Acquisition, Integration & Outlook

Ø Near-term Capital Expenditures Forecast

Ø Electric Base 10-year Capital Expenditure Forecast

Ø NEEWS

Ø Gas Base 2011 Capital Expenditure Forecast

Ø GenConn

Ø Near-term Average Rate Base Forecast

Ø UI Transmission Growth

Ø Near-term Debt Maturities & Liquidity Profile

Ø 2010 Earnings Guidance

Ø Looking Forward to 2011

4

JPM SMid Cap Conference

4

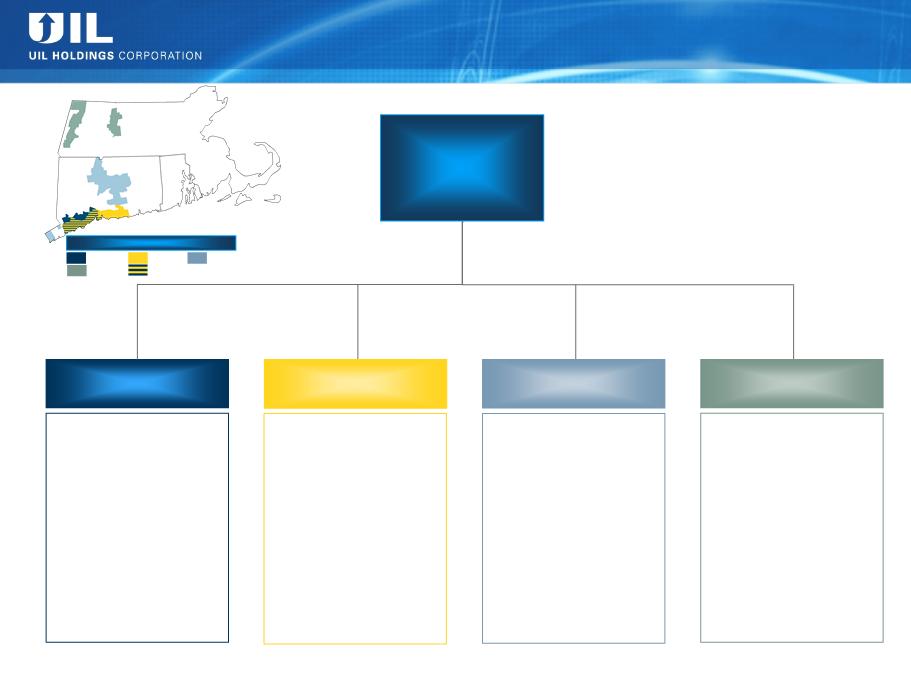

UIL - Corporate Structure

› Service territory: 335 sq

miles

miles

› ~324,000 customers

› 1,066 employees

› Allowed Distribution ROE

of 8.75%

of 8.75%

› Allowed ’09 Transmission

ROE (composite) of 12.52%

ROE (composite) of 12.52%

› 50% interest in GenConn

Energy LLC

Energy LLC

The United Illuminating

Company (UI)

Company (UI)

Note: (1) Includes 10 basis point penalty reduction

UIL Holdings

Corporation

Corporation

Service Area Key

SCG

CNG

UI

Berkshire

Overlapping Territory

› Service territory: 716 sq

miles in Greater Hartford-

New Britain area and

Greenwich

miles in Greater Hartford-

New Britain area and

Greenwich

› ~158,000 customers

› 341 employees

› 2,011 miles of mains with

~124,000 services

~124,000 services

› 2009 rate case allowed ROE

of 9.31% (1)

of 9.31% (1)

Connecticut Natural Gas

(CNG)

(CNG)

› Service territory: 738 sq

miles in Western MA

including Pittsfield and

North Adams

miles in Western MA

including Pittsfield and

North Adams

› ~35,000 customers

› 127 employees

› 738 miles of mains

› Allowed ROE of 10.50%

Berkshire Gas Company

(Berkshire)

(Berkshire)

› Service territory: 512 sq

miles from Westport, CT to

Old Saybrook, CT

miles from Westport, CT to

Old Saybrook, CT

› ~173,000 customers

› 324 employees

› 2,269 miles of mains with

~131,000 services

~131,000 services

› 2009 rate case allowed ROE

of 9.26% (1)

of 9.26% (1)

Southern Connecticut Gas

(SCG)

(SCG)

5

JPM SMid Cap Conference

5

Investment Highlights

Attractive Dividend

(5.8% Yield) (2)

› Current annual dividend of $1.728 per share

› Core regulated earnings combined with the enhanced cash flow and expected earnings per

share accretion from the acquisition provide continued support for UIL’s dividend

share accretion from the acquisition provide continued support for UIL’s dividend

Visible Regulated

Growth

Opportunities

Growth

Opportunities

› Approximately $2.1B of regulated electric capital investment in The United Illuminating

Company (UI) 10-year plan

Company (UI) 10-year plan

» UI 5-year Rate Base CAGR of 8.2% (9.4% including equivalent GenConn rate base) (1)

» Includes $0.6B of highly attractive transmission projects

› Approximately $316M of regulated gas distribution capital investment over the 5 year

period 2011 - 2015

period 2011 - 2015

Conservative

Financial Strategy

Financial Strategy

› Maintenance of investment grade credit ratings is an important objective

FERC-Regulated

Electric

Transmission

Electric

Transmission

› 2009 earned composite return on equity of 12.52%

› Proven ability to partner reaching beyond service territory

› New England renewable portfolio standards driving need for major transmission build

Attractive Regulated

Electric and Gas

Utility

Electric and Gas

Utility

› Proven ability to earn allowed electric return

› Highly experienced with Connecticut regulatory proceedings

› Constructive long-term rate plan for Berkshire in Massachusetts

Note: (1) CAGRs calculated based on annual average rate base from 2010 - 2015, excluding Gas Companies

(2) Based on share price of $29.55 as of November 29, 2010

6

JPM SMid Cap Conference

(1) The revenue decoupling mechanism was allowed to continue until the Department issues its final ruling in 2011 on the

evaluation of this adjustment mechanism.

evaluation of this adjustment mechanism.

YTD Accomplishments/Milestones

ü Transformative Acquisition of Three Gas Companies

ü Successful Execution of Financing Plan

ü Executing on 10-year Capital Expenditure Plan

ü GenConn Devon is Operational

ü Collaborating on CT Portion of New England East West

Solution Projects

Solution Projects

ü Continued Enhancement of UI’s Smart System

ü Continuation of Revenue Decoupling (1)

7

JPM SMid Cap Conference

UIL Becomes A Stronger, More Diverse Energy Company

Acquisition of SCG, CNG & Berkshire

Closed on Acquisition on November 16, 2010

› $1.296B less net debt of approximately $331.1M and a preliminary working

capital adjustment of approximately $47M, resulting in cash consideration at

closing of approximately $917.9M

capital adjustment of approximately $47M, resulting in cash consideration at

closing of approximately $917.9M

» Cash consideration at closing greater than prior estimate of $885M due to:

4Lower level of debt reflected prior principal payments of $43.8M on long-term debt

4$38.9M of additional cash generated by Gas Companies

4Working capital adjustment primarily from a seasonal decrease of $45.7 million in

accounts receivable

accounts receivable

Financings

› $501.5M net proceeds equity financing completed on 9/22

› $442.9M net proceeds 4.625% UIL senior unsecured debt issued on 10/7

› UIL $400M Credit Facility with Operating Co. sub-limits finalized on 11/17

Working diligently through transition and integration plan

8

JPM SMid Cap Conference

2011 Will Be A Transition Year - Financially and Operationally

Integration of SCG, CNG & Berkshire

Implementing Transition Plan

› Day 1 focus during planning phase paid off with no significant Day 1 issues

encountered

encountered

› Turning our attention to internalizing the Transition Services Agreement (TSA)

» Support services such as Information Technology, Finance and Human Resources

provided at cost by Iberdrola, USA with the ability to terminate any service given 90

days notice

provided at cost by Iberdrola, USA with the ability to terminate any service given 90

days notice

› Internalizing of TSA will be phased in throughout 2011 with the goal to be

completely off of the TSA by the end of 2011 or sooner

completely off of the TSA by the end of 2011 or sooner

9

JPM SMid Cap Conference

Gas Companies Outlook Beyond 2011

Realizing Savings Opportunities - Quantified

› 2009 allocated corporate overheads, support costs and shared services totaled

$23M at the gas LDCs

$23M at the gas LDCs

» Opportunity to realize savings of roughly half of the allocated amount is expected

to help the LDCs earn their allowed return in 2012

to help the LDCs earn their allowed return in 2012

Additional Savings Opportunities - Not Quantified

› Operational savings relating to overlapping electric and gas service territories

» Approximately 130,000 shared customers between UI and SCG

» Billing, Metering, Postage, Customer and Field Services

› Operational savings relating to best practices and process improvements

» UIL will look to apply the best practices employed at each operating company across all

of its operating companies and will be opportunistic in implementing process

improvements to capture additional savings

of its operating companies and will be opportunistic in implementing process

improvements to capture additional savings

Gas Conversion Opportunities - Not Quantified

› Current penetration off the mains approximately 60-65%

› Marketing efforts to be reviewed and potentially expanded

10

JPM SMid Cap Conference

10

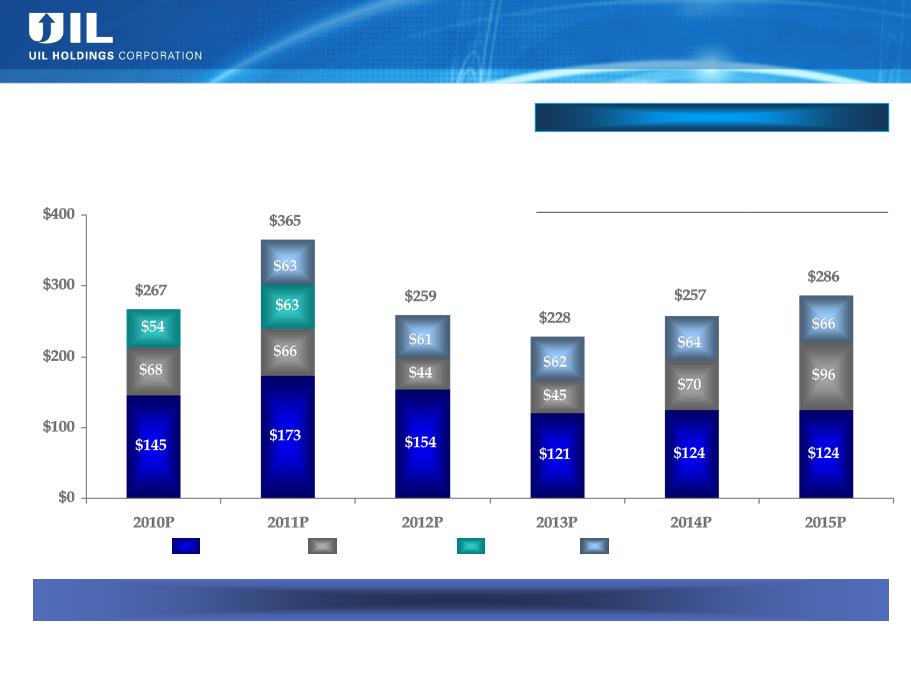

Total Capex ($M)

2011P - 2015P

Electric Distribution

$695

Electric Transmission

321

Gas Distribution (1)

GenConn

316

63

UIL (Total)

$1,395

UIL Near-Term Regulated Capital Investment

($M)

Identified Projects With Clear Need

Electric

Distribution

GenConn

Electric

Transmission

Gas Distribution

Note: (1) Gas Distribution projected capex provided by Iberdrola, USA prior to closing on the acquisition.

Amounts may not add due to rounding.

20%

27%

53%

18%

17%

48%

24%

17%

59%

27%

20%

53%

25%

27%

48%

17%

23%

34%

43%

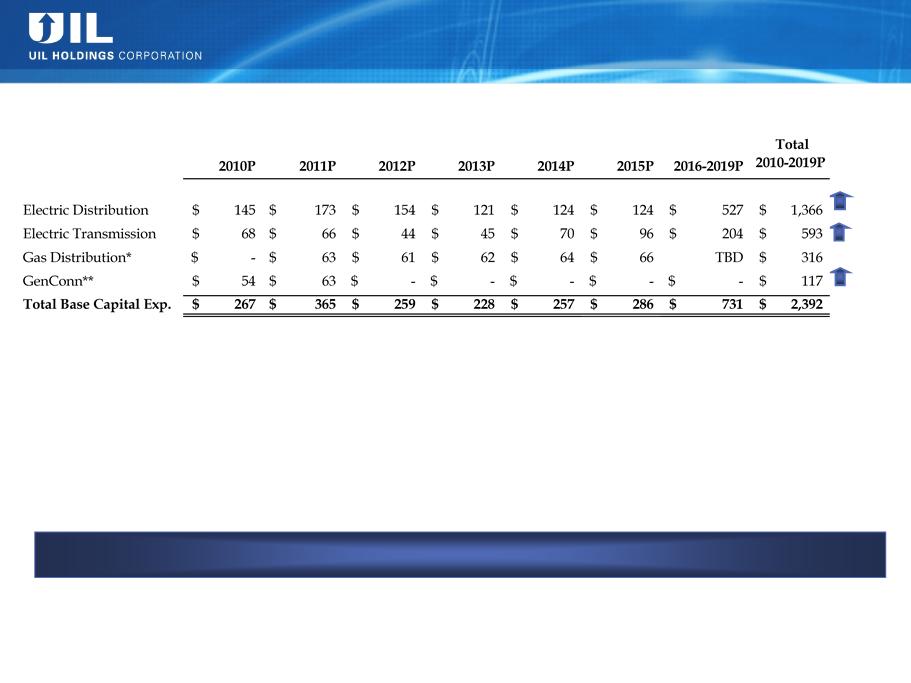

11

JPM SMid Cap Conference

Note: (1) Gas Distribution projected capex provided by Iberdrola, USA prior to closing on the acquisition.

* Gas Distribution projected capex provided by Iberdrola, USA

** Equity investment - Devon plant now operating, Middletown expected operation June 2011.

Amounts may not add due to rounding.

Explanations to Previous Plan

› Distribution

» 2 additional substation rebuilds

» Increases in IT related/Core

Support

Support

7%

10%

8%

Identified projects with clear need and regulatory support

› Transmission

» Timing and amount of NEEWS

investments

investments

» 2 additional substation rebuilds

($ in millions)

Base 10-yr CapEx Forecast

12

JPM SMid Cap Conference

12

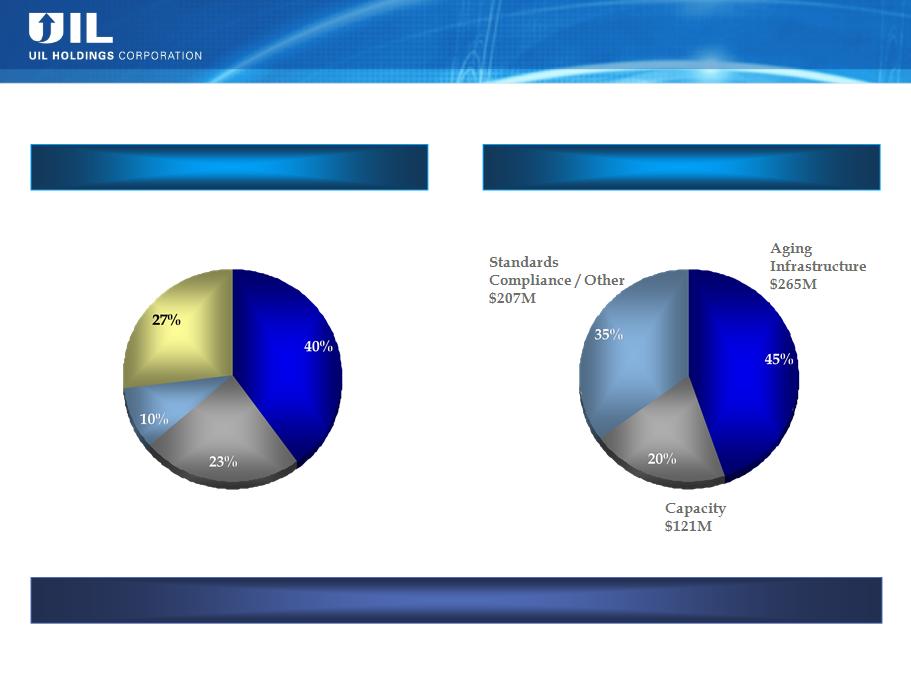

Electric Transmission Investments

Electric Distribution Investments

Electric Base 10-Year T&D Capital

Investment Program

Investment Program

2010P - 2019P: $1,366M

2010P - 2019P: $593M

Capacity

$320M

$320M

Aging

Infrastructure

$547M

Infrastructure

$547M

System

Operations

$130M

Operations

$130M

Core Support

$369M

$369M

Note: (1) Includes $117M of GenConn capital expenditures

Amounts may not add due to rounding.

Approximately $2.1B (1) of Regulated Electric Investment in Base Program for 2010P - 2019P

13

JPM SMid Cap Conference

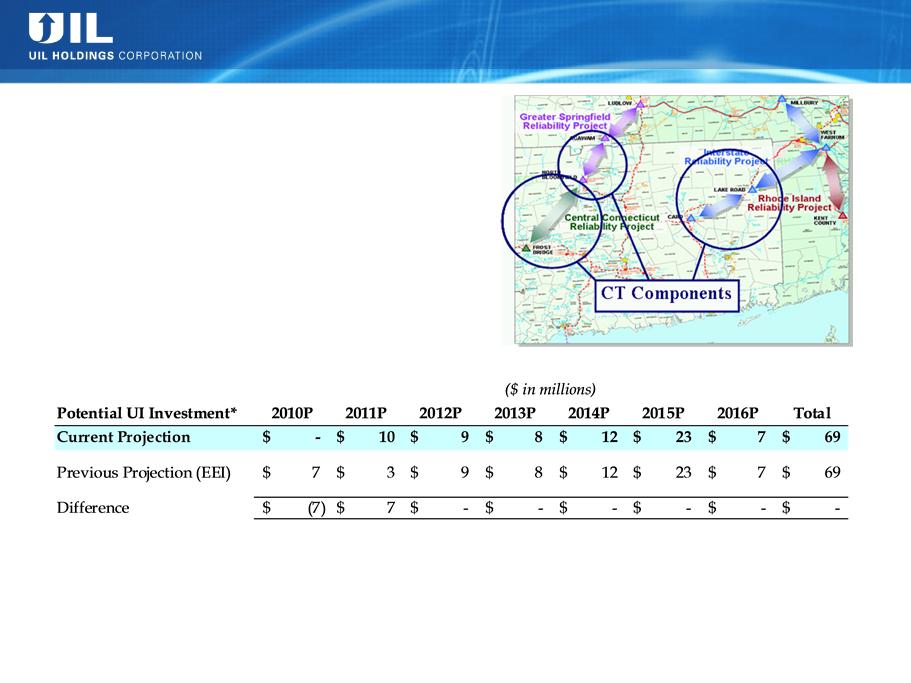

UI Transmission - Participation in NEEWS

» UI’s portion - increased to the greater

of $69M or 8.4% of CL&P’s costs for

the CT portions

of $69M or 8.4% of CL&P’s costs for

the CT portions

UI’s Investment increased from

$60M to $69M

$60M to $69M

* Based on NU's projection as of 10/31/10 of UI's Investment in CL&P's portion of the NEEWS Projects.

14

JPM SMid Cap Conference

14

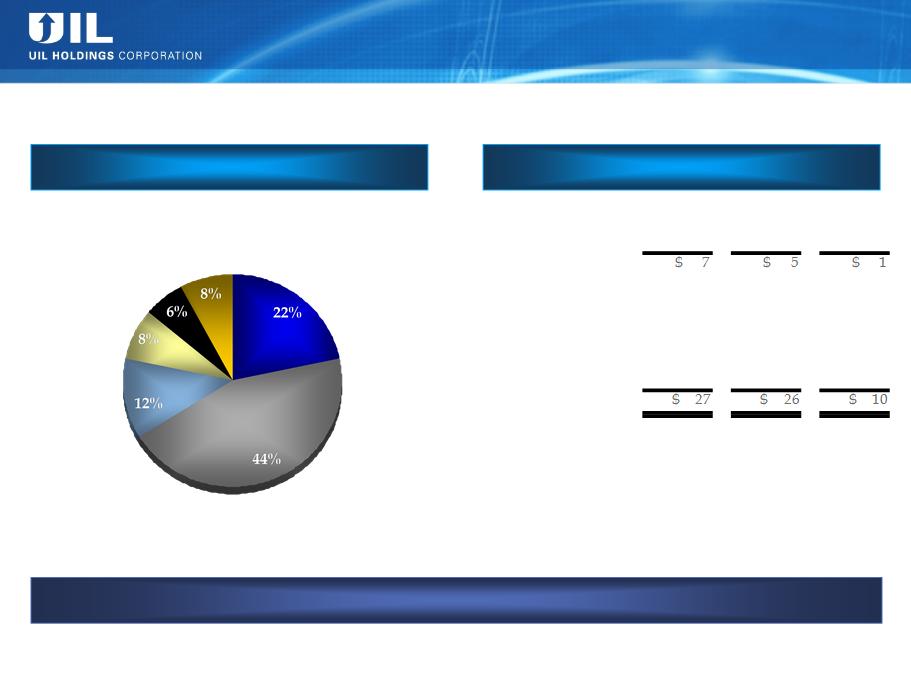

2011P Gas LDC Investments

2011P Gas Distribution Investments

Gas Base 2011 Distribution Capital

Investment Details

Investment Details

2011P: $63M

Replacement & Reliability

$29M

$29M

New Business

$14M

$14M

Meters &

Regulators

$8M

$8M

System

Improvements

$5M

Approximately $316M of Regulated Gas Investment in Base Program for 2011P - 2015P

Fleet

$4M

Other Core Support

$5M

($ in millions)

SCG

CNG

Berkshire

New Business

Replacement & Reliability

13

14

2

Meters and Regulators

3

3

1

System Improvements

2

1

2

Fleet

2

2

0

Other Core Support

1

2

2

Total

Amounts may not add due to rounding.

15

JPM SMid Cap Conference

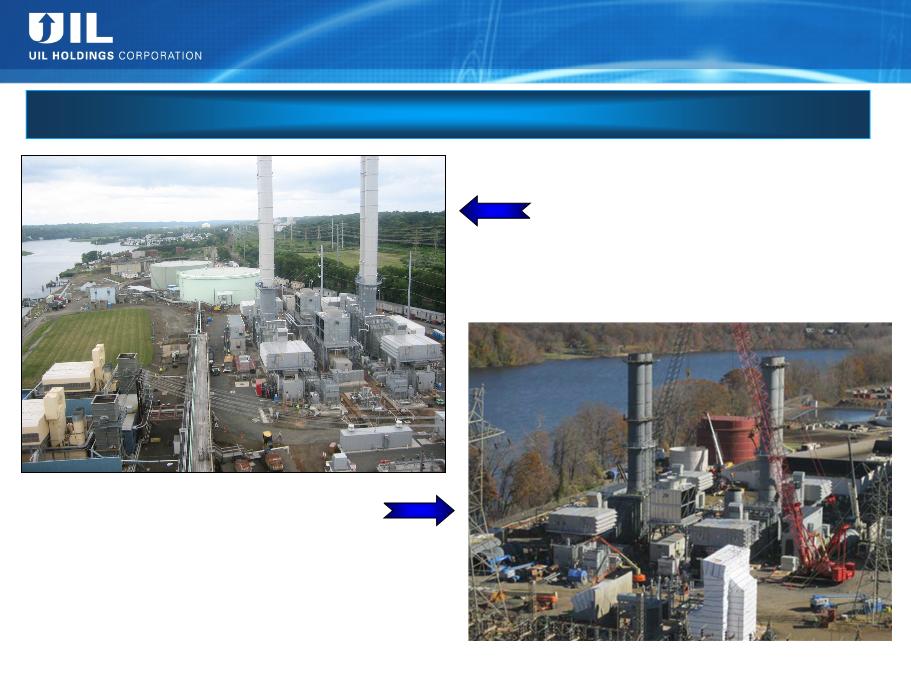

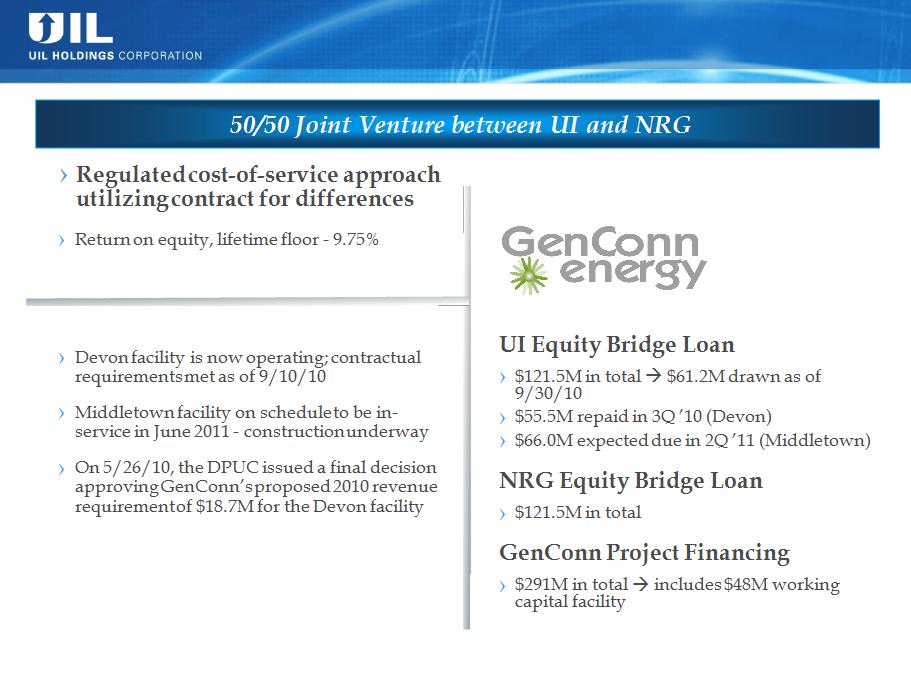

Devon Facility

› Operating

› Contractual requirements met on

9/10/10

9/10/10

Middletown Facility

› 84.5% complete as of week ending 12/4

› Expected to be operational in June 2011

50/50 Joint Venture between UI and NRG

UI GenConn Energy

16

JPM SMid Cap Conference

16

Near-Term Average Rate Base Profile

(Excluding GenConn Equity Investments)

(Excluding GenConn Equity Investments)

($M)

48%

40%

12%

29%

21%

5%

35%

3%

41%

Attractive Rate Base Growth Even With a Declining CTA Balance

1%

23%

38%

38%

39%

45%

21%

38%

23%

37%

40%

23%

* Gas Distribution rate base projections provided by Iberdrola, USA prior to closing on the acquisition.

Amounts may not add due to rounding.

Electric

Distribution

CTA

Gas Distribution*

Electric

Transmission

UI’s 50% Share ($M): 2010P 2011P 2012P 2013P 2014P 2015P

Avg. GenConn RB Equivalent

$147

Avg. GenConn Equity “Rate Base”

$74

$175

$88

$166

$83

$185

$92

$51

$25

$158

$79

17

JPM SMid Cap Conference

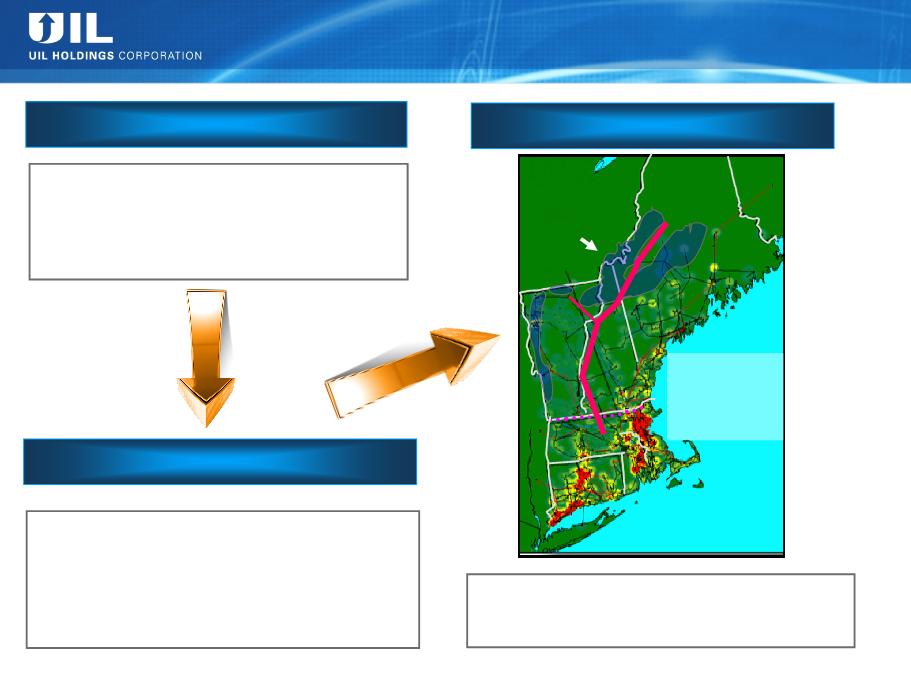

Electric Transmission Growth

Renewable Requirement, Potential Solution

Renewable Requirement, Potential Solution

Need Statement

Potential Solution

› Renewable Portfolio Standard (RPS)

Requirement is ~3x current renewables level

Requirement is ~3x current renewables level

› CT requirement is > than UI’s entire load

› Gap will likely be filled by renewables remote

from load

from load

17

Assessment

Governors’ Blueprint, ISO-NE Study

› Significant Transmission build-out indicated

› Potential $7B - $10B range, could be higher or

lower to satisfy a 4,000 - 12,000 MW need

lower to satisfy a 4,000 - 12,000 MW need

› Cost to New England likely to be significantly

less than importation of midwestern wind

less than importation of midwestern wind

North-South

Interface:

Interface:

80% of NE

electric load is

below this line

electric load is

below this line

Vast majority of

potential onshore

renewables (wind)

potential onshore

renewables (wind)

are in northern NE

Collaborative effort between UI, NU, NSTAR and

NGrid to research and develop potential

solutions to the region’s RPS requirements

NGrid to research and develop potential

solutions to the region’s RPS requirements

18

JPM SMid Cap Conference

UI Equity Bridge Loan

Other

Liquidity outlook

Short-term

› UIL & Operating Companies $400M joint credit facility

» Established on 11/17/10

» Full amount available to UIL with sub-limits for Op. Cos.

› No outstanding balance as of 9/30/10 under UIL

uncommitted money market loan facility

uncommitted money market loan facility

› $61.2M borrowed as of 9/30/10 under $66.0M GenConn

Middletown equity bridge loan at UI

Middletown equity bridge loan at UI

» UI must pay off the outstanding balance on the commercial

operation date of the Middletown facility in 2Q ’11

operation date of the Middletown facility in 2Q ’11

» The equity bridge loan in the amount of $55.5M for the

Devon facility was repaid in the 3Q ’10

Devon facility was repaid in the 3Q ’10

Long-term

› UIL Issued $450M 10-year senior unsecured 4.625% notes on

10/7/10

10/7/10

» $49.3M of UIL long-term debt at the holding company maturing in

February 2011 covered by recent UIL debt offering

February 2011 covered by recent UIL debt offering

› UI closed on $100M 30-year 6.09% Private Placement Debt

on 7/27/10

on 7/27/10

Solid liquidity position enabling future CapEx plans

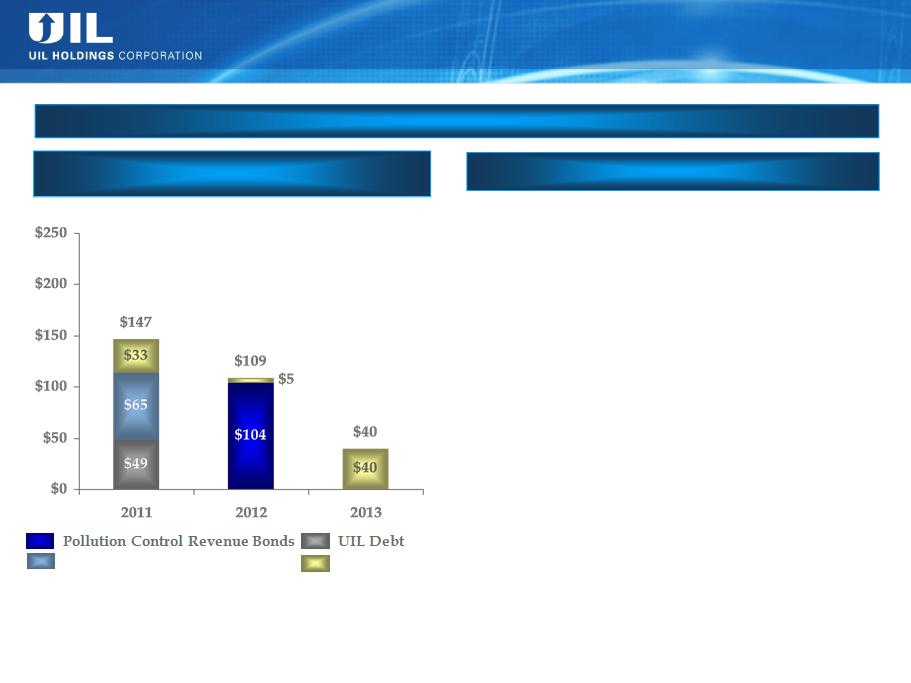

Near-Term Debt Maturities

($M)

*

Notes: All 2010 debt maturities have either been remarketed or repaid

* To be remarketed

Amounts may not add due to rounding.

Debt Maturity and Liquidity Profile

19

JPM SMid Cap Conference

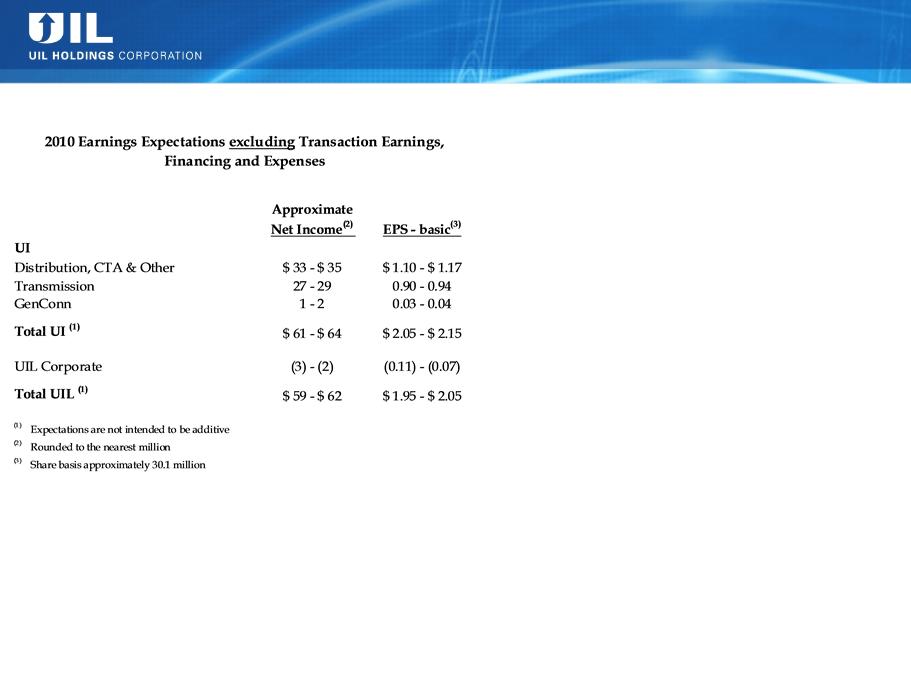

Guidance Assumptions

2010 Earnings Guidance as of November 1, 2010

› Better than anticipated Distribution, CTA &

Other earnings performance for first nine

months of 2010 with updated projections for 4Q

’10 O&M expenses

Other earnings performance for first nine

months of 2010 with updated projections for 4Q

’10 O&M expenses

› Increase in Transmission Allowance for Funds

Used During Construction

Used During Construction

› Earnings impact from a delay in GenConn

Devon achieving commercial operation

Devon achieving commercial operation

› UIL Corporate updated to reflect tax rate true-

ups

ups

20

JPM SMid Cap Conference

Looking Forward to 2011

› Gas companies acquisition

» Transition year - work through Transitional Services Agreement

› Driving to earn allowed returns on all regulated businesses

› Continual management of O&M expenses

› Executing on capital expenditure plan à realizing rate base growth

› GenConn Middletown scheduled to be operational June 2011

21

JPM SMid Cap Conference

21

Attractive Dividend

› UIL has paid a consecutive quarterly dividend for over 100 years (1)

› Dividend has been set at current annual level of $1.728 per share for

more than 14 years

more than 14 years

› Management is focused on maintaining the dividend and reducing

the payout ratio over time through earnings growth

the payout ratio over time through earnings growth

Note: (1) Refers to UIL and UI

22

JPM SMid Cap Conference

22

Investment Highlights

Attractive Dividend

(5.8% Yield) (2)

› Current annual dividend of $1.728 per share

› Core regulated earnings combined with the enhanced cash flow and expected earnings per

share accretion from the acquisition provide continued support for UIL’s dividend

share accretion from the acquisition provide continued support for UIL’s dividend

Visible Regulated

Growth

Opportunities

Growth

Opportunities

› Approximately $2.1B of regulated electric capital investment in The United Illuminating

Company (UI) 10-year plan

Company (UI) 10-year plan

» UI 5-year Rate Base CAGR of 8.2% (9.4% including equivalent GenConn rate base) (1)

» Includes $0.6B of highly attractive transmission projects

› Approximately $316M of regulated gas distribution capital investment over the 5 year

period 2011 - 2015

period 2011 - 2015

Conservative

Financial Strategy

Financial Strategy

› Maintenance of investment grade credit ratings is an important objective

FERC-Regulated

Electric

Transmission

Electric

Transmission

› 2009 earned composite return on equity of 12.52%

› Proven ability to partner reaching beyond service territory

› New England renewable portfolio standards driving need for major transmission build

Attractive Regulated

Electric and Gas

Utility

Electric and Gas

Utility

› Proven ability to earn allowed electric return

› Highly experienced with Connecticut regulatory proceedings

› Constructive long-term rate plan for Berkshire in Massachusetts

Note: (1) CAGRs calculated based on annual average rate base from 2010 - 2015, excluding Gas Companies

(2) Based on share price of $29.55 as of November 29, 2010

23

JPM SMid Cap Conference

Q&A

24

JPM SMid Cap Conference

Appendix

25

JPM SMid Cap Conference

Acquisition of SCG, CNG and Berkshire

Description

ü Acquisition of three regulated gas LDCs owned by Iberdrola USA with

approximately 366,000 customers(1) completed on November 16, 2010

approximately 366,000 customers(1) completed on November 16, 2010

» Southern Connecticut Gas - 173,000 customers(1)

» Connecticut Natural Gas - 158,000 customers(1)

» Berkshire Gas Company - 35,000 customers(1)

Purchase Price

› $1.296B less net debt of approximately $331.1M and a preliminary working

capital adjustment of approximately $47M, resulting in cash consideration at

closing of approximately $917.9M, subject to post closing adjustments

capital adjustment of approximately $47M, resulting in cash consideration at

closing of approximately $917.9M, subject to post closing adjustments

Tax Treatment

Financing Plan

ü Completed $524M equity issuance, 20.355 million shares @ $25.75

ü Issued $450M of 4.625%UIL Holdings senior unsecured debt

Note: (1) As of 6/30/10.

› UIL expects to realize transaction related tax benefits of approximately

$135M on a net present value basis (19 year schedule)

$135M on a net present value basis (19 year schedule)

» Front-end loaded with over half of the expected benefits realized in the first

six years following closing due to accelerated tax depreciation on the

majority of the tax write-up

six years following closing due to accelerated tax depreciation on the

majority of the tax write-up

» $20M of cash tax benefit expected in the first year following closing (2011)

Status Update

ü Connecticut Department of Public Utility Control (DPUC) à filed 7/16;

hearings concluded; draft decision 10/27, final decision 11/10

ü Massachusetts Department of Public Utilities (DPU) à 8/31 ruling stating

ü DPU approval not required under Massachusetts law à 9/20 Massachusetts

AG filed motion for reconsideration àUIL/Iberdrola joint response filed 10/4

AG filed motion for reconsideration àUIL/Iberdrola joint response filed 10/4

ü HSR (Hart-Scott-Rodino) à expired without comment

ü No shareowner vote required

26

JPM SMid Cap Conference

|

|

||||||

|

|

|

› Connecticut Department of Public Utility Control (DPUC)

› Distribution currently operating under 2 year rate plan with full revenue decoupling pilot*

› Allowed ROE of 8.75%, based on a capital structure of 50.0% equity

|

||||

|

|

|

› Federal Energy Regulatory Commission (FERC)

› Transmission trued up on an annual basis to allowed composite ROE based on FERC approved formula rate

› 2010 composite ROE of approximately 12.4%-12.5%, based on a capital structure of 50.0% equity

|

||||

|

› DPUC Contracts for Differences with CL&P (subsidiary of Northeast Utilities) and cost sharing agreement (80% CL&P /

20% UI) › Allowed ROE has a lifetime floor of 9.75% based on a capital structure of 50.0% equity

|

||||||

|

|

|

› Connecticut Department of Public Utility Control (DPUC)

› 2009 Rate Case decision is under appeal and has been stayed pending determination of the appeal

› Currently operating under old rates with embedded overearnings credit - new rates per rate case virtually the same as old

rates currently in place › Allowed ROE of 9.26%, based on a capital structure of 52.0% equity

|

||||

|

|

|

› Massachusetts Department of Public Utilities (DPU)

› 10 year constructive rate plan expiring 1/31/12

› Rates adjusted annually based on inflation and other factors

|

||||

26

Regulatory Overview

Distribution

Transmission

(1) The revenue decoupling mechanism was allowed to continue until the Department issues its final ruling in 2011 on the

evaluation of this adjustment mechanism.

evaluation of this adjustment mechanism.

› Connecticut Department of Public Utility Control (DPUC)

› 2009 Rate Case decision is under appeal and has been stayed pending determination of the appeal

› Currently operating under old rates with embedded overearnings credit - new rates per rate case virtually the same as old

rates currently in place

rates currently in place

› Allowed ROE of 9.31%, based on a capital structure of 52.5% equity

27

JPM SMid Cap Conference

27

|

|

2009

|

|

9 Months Ended Sept 30, 2010

|

||||

|

($M)

|

UIL

|

Target

|

Pro Forma (1)

|

|

UIL

|

Target

|

Pro Forma (1)

|

|

Gross Margin

|

$563

|

$323

|

$887

|

|

$469

|

$236

|

$706

|

|

Adjusted EBITDA (2)

|

$220

|

$128

|

$348

|

|

$176

|

$97

|

$286

|

|

Adjusted Net Income (2)

|

$54

|

$37

|

$79

|

$42

|

$29

|

$70

|

|

|

Average Basic Shares

Outstanding (000s)

|

28,027

|

|

48,382

|

|

30,743

|

|

50,427

|

|

Adjusted Net Income per

Basic Share

|

$1.94

|

NA

|

$1.62

|

|

$1.38

|

NA

|

$1.39

|

|

Long-Term Debt,

Excluding Current Portion

|

|

|

|

|

$715

|

$348

|

$1,509

|

Summary Pro Forma Financials

Note: (1) $446M of debt acquisition financing with 4.625% coupon, and $524M of equity acquisition financing issued at September, 22, 2010 price of $25.75; does not include any expected savings

(2) Non-GAAP financial measure. For a reconciliation to net income on next 2 slides.

Amounts may not add due to rounding.

28

JPM SMid Cap Conference

28

Net Income to Adjusted EBITDA Reconciliation

|

|

UIL Holdings

|

Target

|

Pro Forma

|

|||

|

($M)

|

FY 2009

|

9 Months

Ended Sep 30, 2010 |

FY 2009

|

9 Months

Ended Sep 30, 2010 |

FY 2009

|

9 Months

Ended Sep 30, 2010

|

|

Net Income (GAAP)

|

$54

|

$42

|

$25

|

($240)

|

$67

|

($199)

|

|

Adjustments

|

|

|

|

|

|

|

|

Interest Expense, Net

|

$40

|

$33

|

$35

|

$25

|

$95

|

$73

|

|

Income Tax Expense

|

33

|

32

|

4

|

16

|

29

|

46

|

|

Depreciation and Amortization

|

98

|

83

|

46

|

35

|

144

|

118

|

|

Other Deductions / (Income)

|

(6)

|

(14)

|

(3)

|

(6)

|

(8)

|

(20)

|

|

One-Time Adjustments

|

|

|

|

|

|

|

|

Goodwill Impairment

|

$-

|

$-

|

$-

|

$271

|

$-

|

$271

|

|

Workforce Separation Costs

|

-

|

-

|

2

|

(2)

|

2

|

(2)

|

|

Expenses Related to Retirement and Insurance

Plans |

-

|

-

|

13

|

(2)

|

13

|

(2)

|

|

Expense Allocations from Parent and

Miscellaneous Items |

-

|

-

|

6

|

-

|

6

|

-

|

|

Total Pre-tax Adjustments

|

$166

|

$133

|

$103

|

$337

|

$281

|

$485

|

|

Adjusted EBITDA

|

$220

|

$176

|

$128

|

$98

|

$348

|

$286

|

Amounts may not add due to rounding.

Source: Adjustments based on notes in audited financial statements and financials provided by Iberdrola USA management.

28

29

JPM SMid Cap Conference

29

Adjusted Net Income Reconciliation

|

|

UIL Holdings

|

Target

|

Pro Forma

|

|||

|

($M)

|

FY 2009

|

9 Months

Ended Sep 30, 2010 |

FY 2009

|

9 Months

Ended Sep 30, 2010 |

FY 2009

|

9 Months

Ended Sep 30, 2010

|

|

Net Income (GAAP)

|

$54

|

$42

|

$25

|

($240)

|

$67

|

($199)

|

|

One-Time Adjustments

|

|

|

|

|

|

|

|

Goodwill Impairment

|

$-

|

$-

|

$-

|

$271

|

$-

|

$271

|

|

Workforce Separation Costs

|

-

|

-

|

1

|

(1)

|

1

|

(1)

|

|

Expenses Related to Retirement and Insurance

Plans |

-

|

-

|

7

|

(1)

|

7

|

(1)

|

|

Expense Allocations from Parent and

Miscellaneous Items |

-

|

-

|

4

|

-

|

4

|

-

|

|

Total After-tax Adjustments

|

$-

|

$-

|

$12

|

$269

|

$12

|

$269

|

|

Adjusted Net Income

|

$54

|

$42

|

$37

|

$29

|

$79

|

$70

|

Amounts may not add due to rounding.

Source: Adjustments based on notes in audited financial statements and financials provided by Iberdrola USA management.

30

JPM SMid Cap Conference

30

GenConn Energy LLC

› 50/50 debt/equity

Status

› On 7/30/10, the 2011 revenue requirement

application for both the Devon and

Middletown facilities was filed with the DPUC

application for both the Devon and

Middletown facilities was filed with the DPUC

› Final regulatory review of construction costs

will be part of 2013 revenue requirement

proceeding

will be part of 2013 revenue requirement

proceeding

Financing

31

JPM SMid Cap Conference

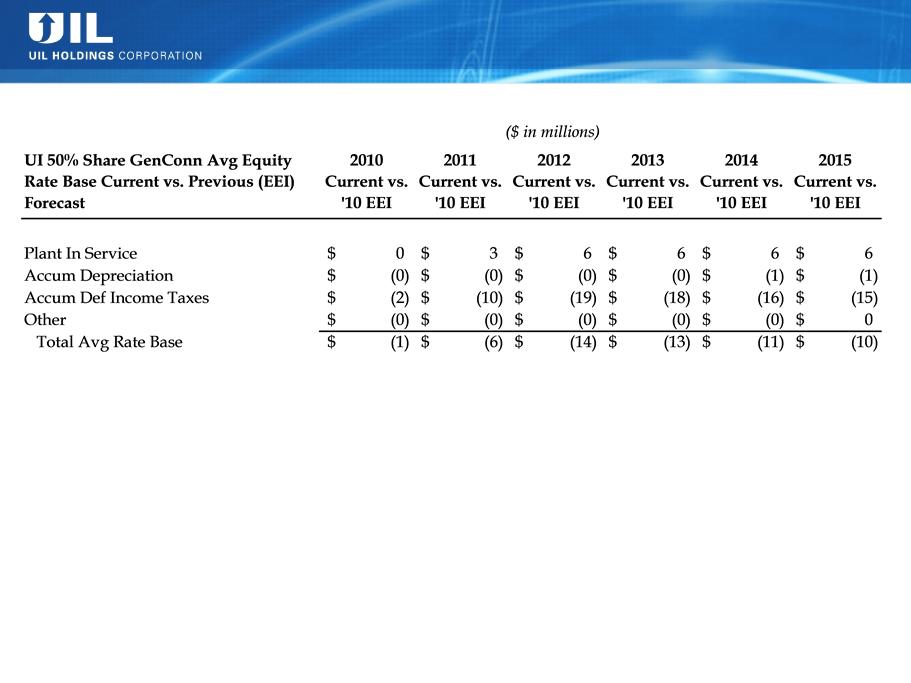

Explanations

› Updated accumulated deferred income tax rate base offsets to reflect the extension of

the 50% bonus depreciation election

the 50% bonus depreciation election

› Rate base impact from updated capital expenditure projection

GenConn Avg Equity Rate Base 2010 - 2015

Current Forecast vs. Previous (EEI) Forecast Bridge

Current Forecast vs. Previous (EEI) Forecast Bridge

32

JPM SMid Cap Conference

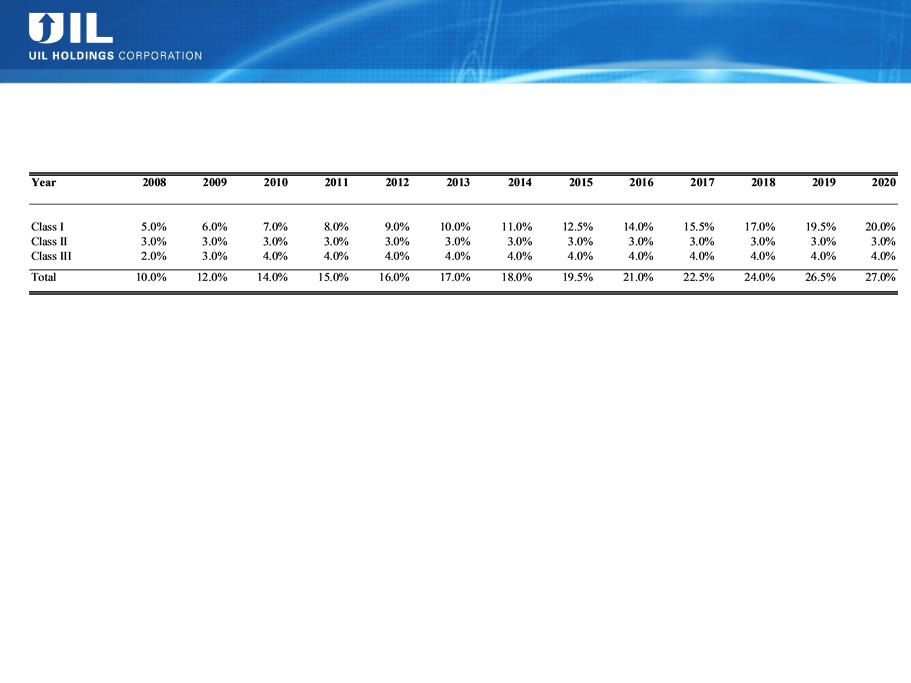

Connecticut RPS Requirements

(Percentage of Retail Load)

Class 1 resources include energy derived from solar, wind, fuel cell, methane gas from landfills, ocean thermal, wave,

tidal, run-of-river hydropower (<5MW, began operation after July 1, 2003), sustainable biomass (NOx emission <0.075

lbs/MMBtu of heat input)

tidal, run-of-river hydropower (<5MW, began operation after July 1, 2003), sustainable biomass (NOx emission <0.075

lbs/MMBtu of heat input)

Class 2 resources include other biomass (NOx emission <0.2 lbs/MMBtu of heat input, began operation before July 1,

1998), small run-of-river hydroelectric (<5MW, began operation before July 1, 2003) and municipal solid waste trash-to-

energy facilities.

1998), small run-of-river hydroelectric (<5MW, began operation before July 1, 2003) and municipal solid waste trash-to-

energy facilities.

Class 3 include customer-sited combined heat and power (with operating efficiency >50% of facilities installed after

January 1, 2006), waste heat recovery systems (installed on or after April 1, 2007), electricity savings from conservation

and load management programs (began on or after January 1, 2006)

January 1, 2006), waste heat recovery systems (installed on or after April 1, 2007), electricity savings from conservation

and load management programs (began on or after January 1, 2006)

CT RPS Requirements