Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TPC Group Inc. | d8k.htm |

Annual Meeting of Shareholders

December 2, 2010

Exhibit 99.1 |

»

Certain statements in this presentation may contain “forward-looking

statements” within the meaning of

Section

27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934,

as amended. These statements include assumptions, expectations, predictions,

intentions or beliefs about future events, particularly statements that may

relate to market outlook and trends in our industry, availability of raw

materials and inventories, future operating results, potential returns of capital to

stockholders, plans related to strategic initiatives or future expansion

activities, growth opportunities and capital expenditures. Although TPC Group

Inc. (the “Company” or “TPC Group”) believes that such

statements are based on reasonable assumptions, no assurance can be given that

such statements will prove to have been correct. A number of

factors could cause actual results to vary materially from those

expressed or implied in any forward-looking

statements, including risks and uncertainties such as volatility

in the petrochemicals industry, limitations on the

Company’s access to capital, the effects of competition, leverage and debt

service, general economic conditions, litigation and governmental

investigations, and extensive environmental, health and safety laws and regulations.

More information about the risks and uncertainties relating to TPC Group and the

forward-looking statements are found in the Company’s SEC filings,

including the Annual Report on Form 10-K, as amended, which are available

free of charge on the SEC’s website at http://www.sec.gov . TPC Group expressly

disclaims any obligation to update any forward-looking statements

contained in this presentation to reflect events or circumstances that may

arise after the date of this presentation, except as otherwise required by applicable law.

»

This presentation may also contain non-GAAP financial measures. Provided

herein is a reconciliation, for each period presented, of such non-GAAP

financial information to the most directly comparable GAAP measures. 2

Forward-Looking Statements &

Non-GAAP Financial Measures |

Our

Past Year “Strengthening Our Business”

»

Continued Investment in Operating Excellence Initiatives

•

Record setting Environmental / Health / Safety Performance

•

No Process Safety Incidents

•

Accelerated investment in High Return / Low Risk Capital Projects

•

Excellent Operating Performance through 2010 year to date

•

Capital Spending at $22 MM (CY’10)

»

Continued Growth of Performance Products

•

Gross profit from $61.5 MM in FY’09 to $73.5 MM FY’10 and sustained (19.5%

increase)

•

Polyisobutylene Volumes grew by 50% (to 182 MM) during FY’10, averaging over

80% of capacity during CY’10

»

Executed our Strategic Initiatives to increase Liquidity of Equity and

Strengthen Capital Structure

•

Public company listing in January

•

Initiated trading on NASDAQ in April (TPCG)

•

Amend / Extend Asset Based Revolver ($175MM) in May

•

Placed $350 MM 8¼

% Sr. Secured Bonds (Replacing Term Loan) in October

•

Initiated Dutch Auction Tender for $130 MM of public shares in November

3 |

Current

Business Environment

“Stable, Consistent Markets”

»

Butadiene markets balanced

•

Global supply remains limited with light feed cracking by ethylene producers

•

Overall global rubber demand stable and improving with economic recovery

•

Natural rubber pricing above synthetic (leading the way on price)

•

Asia capacity additions helping to balance

»

Stable gas, oil and feedstock prices allowing for predictable end

product margins

•

Butene-1, Isobutylene, Raffinates gasoline based

•

Performance Products tied to propylene and butane

»

Butene –

1 market (co-monomer in polyethylene manufacturing)

strong due to North America ethylene cost position

»

Fuel / Lube / Surfactants additives markets for HPIB, PIB, Nonene,

Tetramer are steady and growing outside of North America

4 |

Where

We Are Headed “Investing in our Future”

»

Continue to build on Operating Excellence Efforts

•

Investment in Environmental, Health, Safety

•

New Technical Center in Houston

•

High Return / Low Risk Capital (>50% IRR)

•

Reliability and operability enhancements

»

Targeting EBITDA Growth to $150MM by end of 2012

•

Increased margins in C4 Processing Segment

•

Continued ramp up on Polyisobutylene, Nonene volumes

•

High return projects implementation

•

Capital Spending targeted at $25 -

$30 MM for 2011

•

CY 2011 EBITDA expected to be up from FY’10 and LTM (through September)

»

Strategic Initiatives

•

Continued long term margin expansion across products and services

•

Drive next steps of growth (isobutylene / polyisobutylene) for 2013 and beyond

•

Continue to seek additional CC4 supply / additional processing opportunities

•

Investor relations visibility

5 |

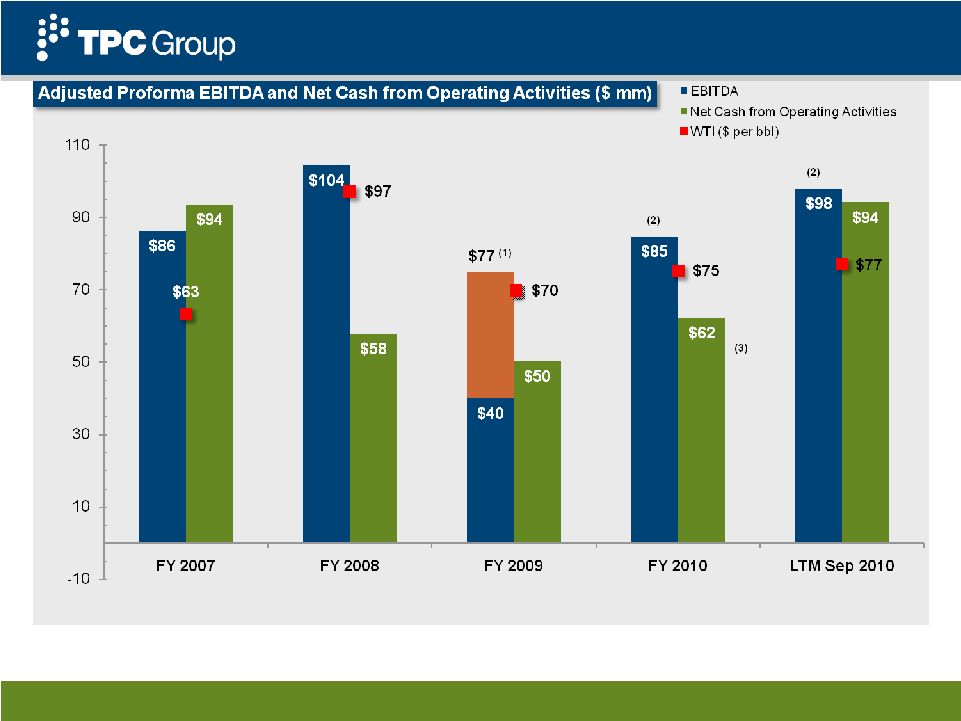

6

(1)

Includes Hurricane Ike loss

(2)

Excludes $17 million insurance recoveries from Hurricane Ike loss

(3)

Excludes $65 million for year end AR collections effort

Adjusted EBITDA and Operating Cash Flow

FY 2007 –

FY 2010 & LTM Sep 2010 |

7

TPC Group Inc

Annual Shareholder Meeting Presentation

Reconciliation

of

Adjusted

Proforma

EBITDA

to

Net

Income

(Loss)

(in

millions)

Fiscal Year Ended June 30,

LTM Sep

2007

2008

2009

2010

2010

Adjusted Proforma

EBITDA

$ 86

$ 104

$ 77

$ 85

$ 98

Proforma Adjustments (1) (2)

-

-

(37)

17

17

Adjusted EBITDA as Reported

86

104

40

102

115

Reconciliation to Net Income (Loss)

Income taxes

(14)

(15)

12

(19)

(23)

Interest expense, net

(17)

(19)

(17)

(15)

(15)

Depreciation and amortization

(29)

(36)

(42)

(40)

(39)

Loss on sale of assets

-

(1)

-

-

-

Asset impairment

-

-

(6)

-

-

Non-cash stock-based compensation

(5)

(6)

(6)

(1)

(1)

Unrealized gain (loss) on derivatives

-

-

(4)

4

3

Net income (loss)

$ 21

$

27 $ (23)

$ 31

$ 40

(1)

FY 2009 reflects proforma adjustment for Hurricane Ike loss.

(2)

FY 2010 and LTM September 30, 2010 reflect proforma adjustment for insurance

recoveries from Hurricane Ike loss. |