Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MOSAIC CO | d8k.htm |

The Mosaic Company

2010 Citi

Basic Materials Conference

December 1, 2010

Larry Stranghoener

Executive Vice President and Chief Financial Officer

Exhibit 99.1 |

| Good morning everyone. I’m delighted to have the opportunity

to speak with you today about Mosaic, the outstanding long-term outlook

for the crop nutrient industry and our strong market position in both potash and

phosphate.

We’d like to thank PJ Juvekar

for coverage of the sector and sponsoring this conference.

This is a great time to be in the ag

business. The world needs crops need nutrients to meet food demand and

Mosaic is positioned to capitalize on this long term opportunity.

|

This presentation contains forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995. Such statements

include, but are not limited to, statements about future financial and

operating results. Such statements are based upon the current beliefs

and expectations of The Mosaic Company’s management and are subject to

significant risks and uncertainties. These risks and uncertainties include

but are not limited to the predictability and volatility of, and customer

expectations about, agriculture, fertilizer, raw material, energy and

transportation markets that are subject to competitive and other pressures and economic and credit

market conditions; the level of inventories in the distribution channels for crop

nutrients; changes in foreign currency and exchange rates; international

trade risks; changes in government policy; changes in environmental and other

governmental regulation, including greenhouse gas regulation; further developments

in the lawsuit involving the federal wetlands permit for the extension of

the Company’s South Fort Meade, Florida, mine into Hardee County,

including orders, rulings, injunctions or other actions by the court or actions by

the plaintiffs, the Army Corps of Engineers or others in relation to the

lawsuit, or any actions the Company may identify and implement in an effort to

mitigate the effects of the lawsuit; other difficulties or delays in receiving, or

increased costs of, or revocation of, necessary governmental permits or

approvals; the effectiveness of the Company’s processes for managing its

strategic priorities; adverse weather conditions affecting operations in Central

Florida or the Gulf Coast of the United States, including potential

hurricanes or excess rainfall; actual costs of asset retirement, environmental

remediation, reclamation or other environmental regulation differing from

management’s current estimates; accidents and other disruptions

involving Mosaic’s operations, including brine inflows at its Esterhazy,

Saskatchewan potash mine and other potential mine fires, floods,

explosions, seismic events or releases of

hazardous or volatile chemicals, as well as other risks and uncertainties reported

from time to time in The Mosaic Company’s reports filed with the

Securities and Exchange Commission. Actual results may differ from those set

forth in the forward-looking statements.

Safe Harbor Statement

2 |

| Before I proceed, I would like to remind you that our presentation

contains forward-looking statements. The statements include, but

are not limited to, statements about future financial and operating results. They are

based upon management’s beliefs and expectations as of today’s date,

December 1, 2010 and are subject to significant risks and

uncertainties. Actual results may differ materially from those projected in the forward-

looking statements. Additional information concerning factors that could cause

actual results to differ materially from those in the forward-looking

statements is included in our reports filed with the Securities and Exchange

Commission. |

Introduction

•

Mosaic is the leading P&K company in the

world

–

Potash growth through expansions

–

Largest

integrated

phosphate

producer

–

low

cost

and geographic advantage

•

Crop nutrient markets extremely tight due

to a variety of supply and demand factors

•

Healthy farmer economics support

continued investment in crop nutrients

3 |

| This

morning

I

will

first

review

Mosaic’s

strategy.

We

are

very

upbeat

about

the

long

term

fundamentals

of

our

business and continue to position ourselves for the growth of this sector.

To meet this growth we are undertaking major expansion projects in our potash business and

strengthening the cost position of our phosphate business.

Current supply and demand factors for each of these nutrients are very tight, as you will hear later

in my remarks.

Finally, I will discuss our market outlook and today’s favorable conditions.

|

Strategic Overview

As a global leader in crop nutrients, Mosaic

is positioned to benefit from attractive long

term agricultural fundamentals:

Potash –

grow volume

–

Brownfield expansion program

Phosphates –

grow value

–

Leverage scale and geographic location

–

Extend phosphate reserves

Global distribution assets aligned with

production

4 |

| At Mosaic, our focus is on shareholder value creation, driven by

the attractive fundamentals of our business.

Our mission is to help the world grow the food it needs. We run

our business with a long term view –

and this

view is compelling!

We are executing well on our strategy. In Potash, we are growing

volume by pursuing brownfield

expansion

opportunities. In Phosphates, we are focusing on growing the value of our

business and maintaining our position as one of the lowest cost phosphate

producers in the world. Our expansive global distribution network,

aligned with our North American production assets, provides us access to the

largest global markets on a counter seasonal basis.

Over time, the combination of two strong product lines has produced great returns

for our shareholders. Our balanced portfolio of both potash and

phosphate gives more stability to our sales volumes and cash flow than

single nutrient focused companies. |

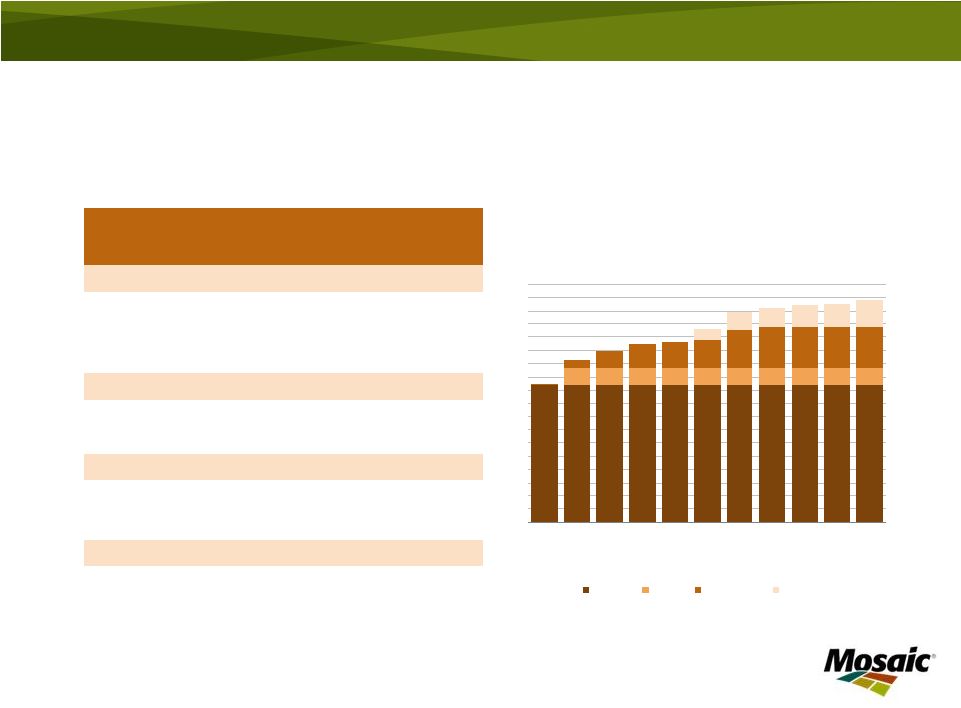

Leader in Potash and Phosphate

5

WORLD’S LARGEST P&K COMPANIES

0

1

2

3

4

5

6

7

8

9

Mosaic

PotashCorp

Belaruskali

Israel Chemicals

OCP

K+S

Silvinit

Uralkali

GCT

Yuntianhua

MILLION TONNES PRODUCTION, 3 YEAR AVERAGE

K2O

P2O5

Source: IFA, company reports and Mosaic estimate

|

| As the leading producer of potash and phosphate, there is no company

better positioned to capture the growth in crop nutrient markets.

Farmers need to plant record areas and harvest ever increasing yields to meet the

world’s accelerating appetite for grains and oilseeds. That

implies strong growth in global crop nutrient markets. Recent

developments reinforce the long-term attractiveness of the crop nutrient sector. Strong agricultural

markets have contributed to high demand for our products. This comes at a

time when producer inventories are low and there are growing supply

concerns. Most of you know about the strong fundamentals for the potash

business. What you may not know is that we are nearly as large as the two

biggest potash companies. When combined with our leading position in phosphates –

which

is

currently

generating

more

profit

than

our

potash

business

–

we

are

the

largest

P&K

company

in

the

world. |

MURIATE OF POTASH CAPACITY

MILLION TONNES KCL

0

2

4

6

8

10

12

14

PotashCorp

Mosaic

Belaruskali

Silvinit

ICL

Uralkali

K+S

Qinghai

APC

Agrium

A Leading Global Potash Producer

6

World capacity

approximates 74 million

tonnes

(all potash

products)

Mosaic FY10 MOP

production share

–

12% Global

–

38% North America

World scale & efficient

operations

Brownfield expansions

underway, projected to

add 5.1 million tonnes

capacity

Peaking capacity for PotashCorp, Mosaic and K+S

Source: Fertecon, Mosaic |

| First, let’s talk about potash.

Mosaic is one

of

the

world’s

top

producers

of

potash

with

an

estimated

12%

of

global

market

share.

Potash

is

produced in only 12 countries in the world, and agricultural giants such as China, India and Brazil

depend on imports. |

Potash –

Grow Volume

Projected additional annual capacity of 5.1

million tonnes

Multiple projects spanning a decade

Reversion of 1.3 million tonnes

currently

produced for a third party under a tolling

agreement expected soon

7 |

| The world will need substantially more potash this decade. In the long-term, we forecast

demand growth of 3.5 –

4% per year.

We believe

the

best

way

to

meet

long

term

demand

growth

is

through

brownfield

expansions

at

existing

mine

sites. Our ongoing expansions in Canada are expected to increase annual capacity by over five

million tonnes by 2020, ensuring that we will maintain our position as one of the premier

potash companies in the world. In addition,

we

have

allocated

up

to

1.3

million

tonnes

of

annual

peaking

capacity

for

Potash

Corp

under

a

tolling agreement. As many of you know the expiration date for this agreement is the subject of

a dispute currently

pending

before

the

Saskatchewan

courts.

Assuming

we

continue

to

deliver

tonnes

at

the

same

rate

as today, we believe that our obligation to provide tonnes to Potash Corp ends next summer, at which

time these tonnes revert to us. |

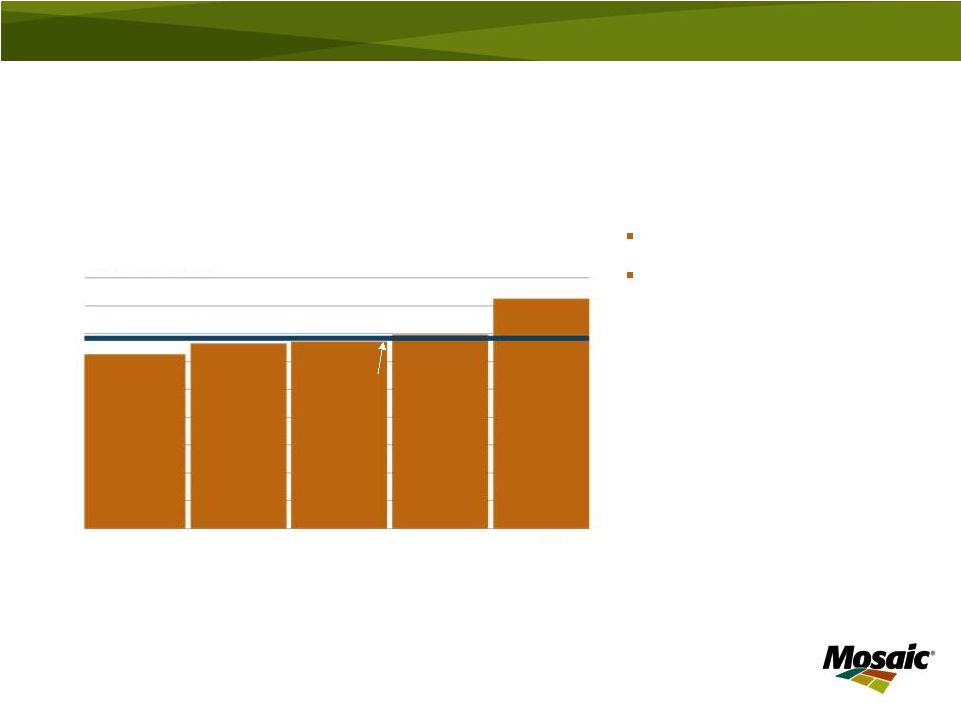

Potash Capacity Expansions

8

PROJECTED CAPACITY

MILLION TONNES

0

2

4

6

8

10

12

14

16

18

2011

2013

2015

2017

2019

2021

FISCAL YEAR

Existing

Tolling

In progress

Future

INVESTMENT

($ IN BILLIONS)

CAPACITY

(MILLION TONNES)

ESTIMATED

CONSTRUCTION

COMPLETION

(FISCAL YEAR)

IN PROCESS

Belle Plaine

0.5

0.6

2012

Colonsay

0.7

0.7

2014

Esterhazy

2.0

1.8

2011-17

FUTURE

Belle Plaine

1.4

2016-19

Colonsay

0.6

2016

5.1

Tolling agreement

1.3

Capacity at May 31, 2010

10.4

16.8 |

| Our expansion program consists of nearly a dozen separate, multi-year

projects at our three Canadian mines. We have made good progress on a number

of these projects and we can adjust the pace of these projects in response

to supply/demand dynamics.

We expect this additional capacity to begin coming on-line over the next few

years. Within a decade, we expect our capacity to reach almost 17

million tonnes of finished product. |

Competitive Cost

Structure 9

Flat cost curve

Expansions to decrease

our per unit costs

MOP

Delivered

US

Cornbelt

weighted

average

cost

as

of

June

30,

2009,

excludes

Canadian resource taxes and royalties for all Canadian potash producers

Source: Mosaic

MOP PRODUCTION COST CURVE

COST PER TONNE

60

MILLION TONNES MOP

Mosaic

average |

| The global potash industry has a relatively flat cost curve. This

chart shows estimated cost per tonne for all

major potash producers. Mosaic’s potash cost structure is competitive and

will improve as our expansions come on line. The expected increase in sales

and production volumes will leverage the existing assets at our three

Canadian mines – thereby driving lower per tonne

costs.

Our industry leadership, together with our investments to expand

capacity, places us in a strong competitive

position to leverage the growth of this market. |

Rebounding Potash Demand

Positive potash market

fundamentals:

Two step recovery underway

Lean inventories

Healthy farmer economics

Expect 2011 global

shipments of 52 to 55 million

tonnes

10

Source: Fertecon

and Mosaic

WORLD MOP DEMAND

MILLION TONNES

0

10

20

30

40

50

60

00

01

02

03

04

05

06

07

08

09

10F

11F

CALENDAR YEAR |

| Turning

to

demand,

market

sentiment

has

finally

caught

up

to

the

fundamentals.

After

a

significant

drop

in

demand during 2009, the potash market is in the midst of a two step recovery.

We project global MOP shipments to rebound sharply this year and then take

another giant step up in 2011. Producers are running hard to keep up

with heavy demand. Potash prices have been firming. As of last week,

prevailing MOP prices were $510 to $515 Midwest warehouse, up from about

$400 last summer and export potash prices are increasing and narrowing the gap

with domestic prices.

The strong North American fall season was a catalyst for potash demand. The

recent signing of Canpotex agreements with our Chinese, Indian and other

Asian customers is a signal that demand is back on track.

Lean inventories, solid crop prices and healthy farmer economics

all point to a great future for potash. We are

very upbeat about the positive fundamentals driving the potash business.

We are not the only ones bullish on potash. M&A and consolidation

activity has been front and center these past few months. These

developments show that others agree this is a great business with a solid

future. |

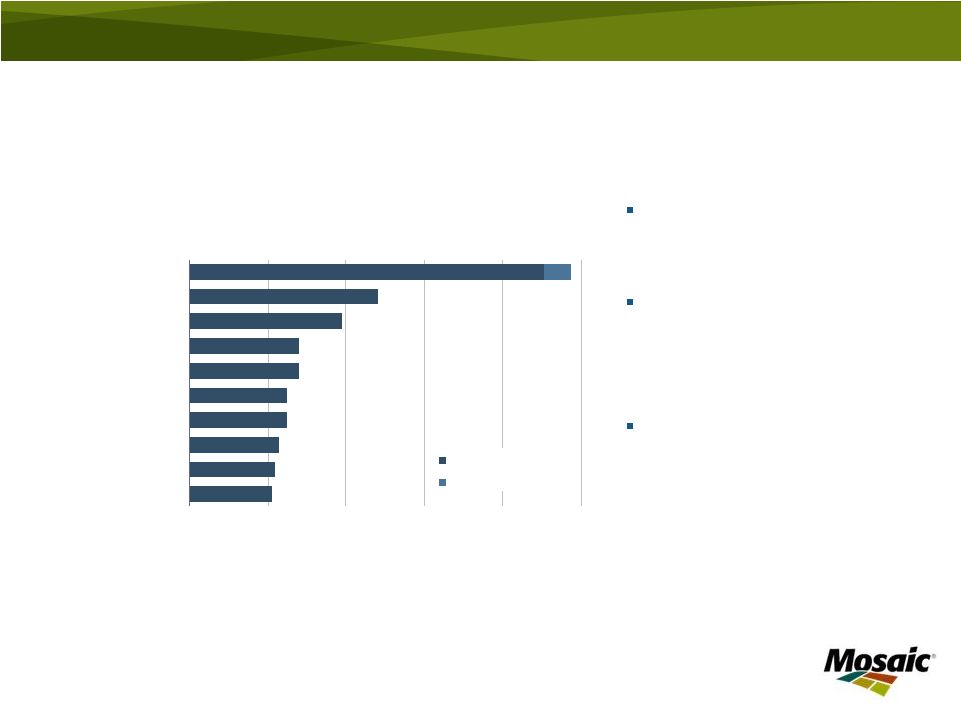

FINISHED PHOSPHATE CAPACITY

MILLION TONNES

0

2

4

6

8

10

Mosaic

YTH

OCP

Kailin

IFFCO

PhosAgro

Wengfu

GCT

Eurochem

Vale

Crop Nutrients

Feed

World’s Largest Phosphate Producer

11

World capacity

approximates 80 million

tonnes

(DAP/MAP/TSP)

Mosaic FY10 phosphate

production share

–

13% Global

–

56% North America

World scale & efficient

operations

Source: company reports, Mosaic |

| Now, let’s move to phosphate.

Mosaic produces more phosphate crop nutrient and animal feed products than any other company in the

world by a wide margin. We rank among the lowest cost producers in the industry today due

to: •The tight vertical integration of our phosphate rock mining and processing

operations; •The large scale of our mines and chemical plants;

•The

important

location

advantages

we

have

from

being

situated

on

the

Gulf

of

Mexico

and

the

Mississippi

River;

•And, our international distribution business. |

Phosphates –

Grow

Value

Leverage scale and location

–

Low cost producer

–

Cost advantaged sulfur, competitive ammonia

–

Procurement leverage

Operational excellence

–

Maintenance practices

–

Capital deployment

–

Energy use and co-generation capacity

–

Improve coordination of sales and operations

planning

Extend phosphate reserves

12 |

| In order to strengthen our competitive advantage, we are focusing on

three strategic priorities for our Phosphates business:

First, we are working on several initiatives to leverage our scale and

geographic location. We have a strong competitive position due to

low rock and conversion costs as well as preferential geographic access to sulfur

and ammonia. We are also working to better leverage our procurement

processes. Next, we are focused on operational efficiency. We are

implementing improved processes for maintenance, capital deployment,

energy use and co-generation capacity. In addition, our global sales and operations teams

are working closely together to optimize production planning in

order to reduce operating costs.

Finally, we continue work to secure the mineral resource base for our U.S.

operations and to obtain advantaged access to rock reserves elsewhere in the

world. We have started receiving rock from our Miski

Mayo joint

venture. In addition, as many of you know, a permit needed to continue

operations at our South Fort Meade mine is the subject of a lawsuit.

We recently entered into a partial settlement of the ongoing litigation that will

allow us to temporarily restart operations there for about four months. The

process for the South Fort Meade permit was robust and we believe it is not

a matter of if we receive the permit, but rather a matter of when. |

Low Cost

Producer 13

Low cost producer

Significant economies of

scale

Focus on operational

excellence

Mosaic

average

DAP FOB plant/port weighted average cost as of July 31, 2010

Source: Mosaic

DAP PRODUCTION COST CURVE

COST PER TONNE

20

MILLION TONNES DAP |

| But it’s not just about being the largest. The size and scale

of our phosphate business produces significant cost efficiencies.

We have one of the lowest cost positions in the phosphate industry and we

plan to maintain this position with our continued focus on operational

excellence. |

Record Phosphate

Demand Positive phosphate market

fundamentals:

Strong demand

Lean inventories

Healthy farmer economics

Expect 2011 global

shipments of 57 to 59 million

tonnes

14

Source: Fertecon

and Mosaic

WORLD PROCESSED PHOSPHATE DEMAND

MILLION TONNES

CALENDAR YEAR |

| Phosphate fundamentals are constructive and we expect the phosphate

market to remain snug for several years. We expect strong demand

coupled with supply uncertainties to keep this market tight during the remainder of this

fertilizer year.

Large shipments to both domestic and offshore destinations have tightened the global

phosphate market. Producer stocks remain at low levels and grain

prices have been supportive. We

forecast

processed

phosphate

demand

will

grow

to

a

record

57

to

59

million

tonnes

in

2011.

Since

last

summer,

prices

have

rebounded

to

the

upper

$500

range

FOB

Tampa

and

dealers

will

soon

position

product for the North American spring season.

In addition to strong demand, several supply uncertainties are exacerbating the

situation. Questions about the Ma’aden

startup

in

Saudi

Arabia,

shut

down

of

Agriphos

and

Fertiberia

phosphate

operations,

raw

material

uncertainty, changes in China’s export duties and permit litigation at our own

South Fort Meade mine have all contributed to the tight market

conditions. |

A

Global Distribution Network Mosaic personnel located

in key global markets

Visibility to the entire

value chain

Our distribution capability

helps balance seasonal

demand

TRADE FLOW MAP

VOLUME IN TONNES*

* Three year average, all products. Includes estimated Mosaic share

of Canpotex

sales

15 |

| Mosaic also has a distribution network without peer in our industry

– allowing us to move our products where

and when needed, efficiently and cost-effectively.

Our industry leading North American distribution capabilities are bolstered by

strong networks in prime Asian and Latin American growth regions where we

combine production assets, blending and bagging facilities, ports and other

capabilities. This global network is especially valuable in balancing

seasonal demand patterns. It allows us to run our North

American production plants more efficiently as we can ship products to key regions

around the world as needed. |

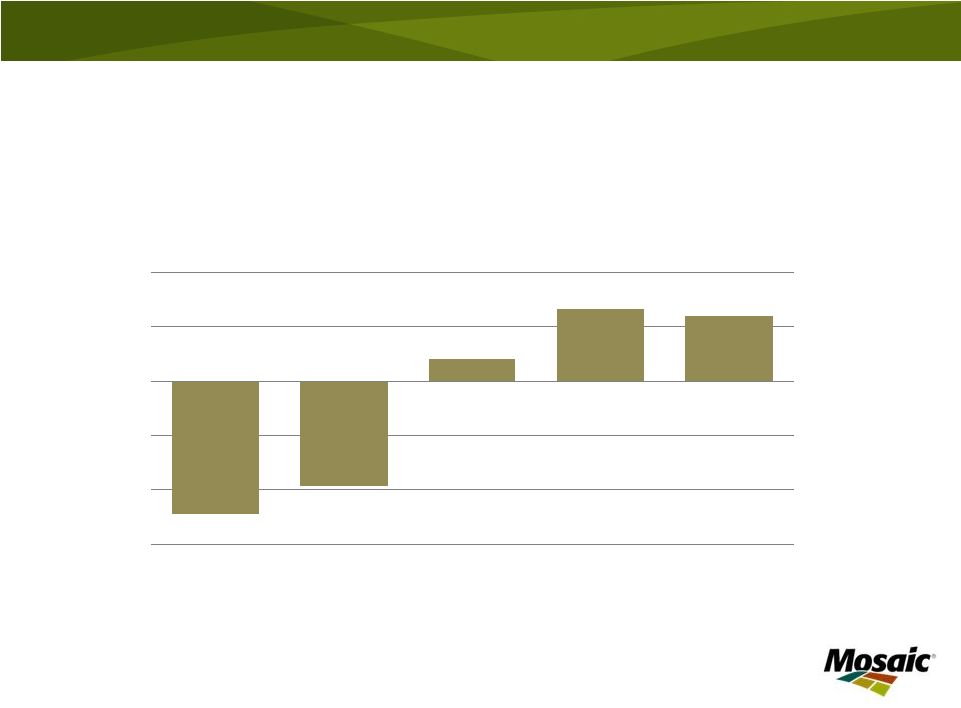

Solid Financial Position

16

*

See appendix for reconciliation of Cash and Cash Equivalents less Debt

TOTAL CASH AND CASH EQUIVALENTS LESS DEBT*

$ IN BILLIONS

(3)

(2)

(1)

-

1

2

2006

2007

2008

2009

2010

FISCAL YEAR |

| As we have noted, our overall strategy is to capitalize on attractive

long-term agriculture fundamentals by investing in and reengineering our

potash and phosphate businesses. Through the ups and downs of the

markets we serve, we have created long-term value through sound capital

allocation decisions. Our strong cash flow has allowed us to build one of the

strongest balance sheets in the industry despite the economic

downturn. We have demonstrated our willingness and ability to make

investments, to divest non-strategic assets and to return cash to shareholders,

as appropriate. Our cash allocation priorities include investing in our

business, maintaining a large liquidity buffer, funding strategic

opportunities and distributing cash to shareholders. |

Market Outlook

17

Disappointing global

harvests

Strong agricultural

commodity prices

Need to re-stock crop

nutrients in the

distribution pipeline and

many farm fields

Source: USDA

WORLD GRAIN AND OILSEED PRODUCTION

AND USE

BILLION TONNES

1.8

2.0

2.2

2.4

2.6

2.8

00/01

02/03

04/05

06/07

08/09

10/11F

CROP YEAR

Production

Use |

| Let me finish with a few thoughts on the market outlook.

As you can see, grain and oilseed use has grown slowly, but consistently.

History has proven that economic slowdowns don’t have a large negative

impact on food consumption – people need to eat regardless of the

economic climate. The most recent global economic downturn was no

exception. On the production side, we have seen significant increases over

the past three years. This growth has come from increased harvested

land and above trend yields. However, we need to continue this above trend growth

just to stay even with projected use. |

Stocks Remain at Low Levels

18

Days of use remains at

low levels

Stocks still not at secure

levels

2011 new crop prices

signaling farmers to

expand planted area and

intensify cropping

practices

Source: USDA

WORLD GRAIN AND OILSEED STOCKS

MILLION TONNES

0

100

200

300

400

500

600

700

90/91

94/95

98/99

02/03

06/07

10/11F

CROP YEAR

0

20

40

60

80

100

120

Stocks

Days of Use

DAYS OF USE |

| Dramatic improvement in production has not translated into improving

stocks. World grain and oilseed stocks continue to remain at low

levels. We believe global grain and oilseed stocks still are not at levels secure

enough to withstand weather or other shocks over a period of time.

Corn looks especially tight at only 56 days of use estimated for

the end of this crop year. That is the second

lowest ratio since the 1970s. This ratio is even lower if you exclude India

and China which hold large strategic reserves.

|

Farmer Economics

19

Farmer profitability remains at

healthy levels:

Grain prices high relative to

historical prices

Input costs well below their

highs

Similar conditions for

cotton, rice and palm oil

China, Brazil and India farm

economics

at, or near,

record

levels

Source: Iowa State University

CROP NUTRIENT COST –

CORN IN IOWA

BUSHELS OF CORN PER ACRE

31

22

16

37

41

20

29

0

10

20

30

40

50

2005

2006

2007

2008

2009

2010E

2011F

CROP YEAR |

| Farm profitability remains at healthy levels.

Grain prices are at relatively high levels compared to historical prices. At

the same time, farmer input costs have fallen from their high levels of 2008

and 2009. This has allowed farmers to remain profitable. The graph shows

the number of bushels of corn that a farmer would have to sell in order to pay for crop

nutrients. This indicates that the cost of crop nutrients, relative to grain

prices, is well within historic norms. Similar conditions exist for

other crops such as wheat, soybeans, cotton, rice and palm oil. In China,

Brazil and India, farm economics are at record or near record levels due to

high domestic crop prices and, in the case of India, subsidized input

costs. |

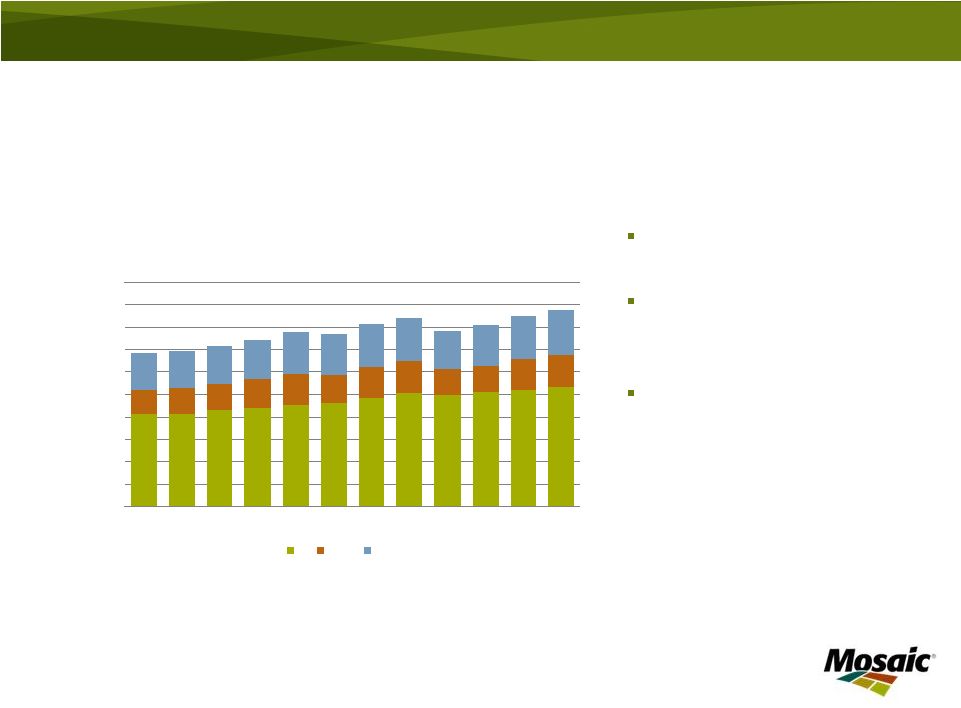

Demand is Back!

20

WORLD NUTRIENT USE

MILLION TONNES

0

20

40

60

80

100

120

140

160

180

200

00

01

02

03

04

05

06

07

08

09

10F

11F

CROP YEAR

N

K2O

P2O5

Adequate and balanced

soil fertility a high priority

Recent commodity price

rallies led to increased

nutrient demand

Projected long-term

growth rates:

–

Phosphate: 2.5% -

3.0%

–

Potash: 3.5% -

4.0%

Source: IFA June 2010 |

| Following

a

drop

in

2008

and

2009,

nutrient

use

has

significantly

rebounded

this

year.

The

science

of

agronomy

and

plant

production

has

not

changed

–

plants

need

balanced

nutrition

to

develop

properly.

Every

plant

and

crop

harvested removes vital and necessary nutrients from the soil. These nutrients must be replaced

in order to maintain productivity of the farm field. To obtain higher yields, crops will

need optimal nutrient application rates. Farmers recognize proper soil fertility is the

foundation on which high yields are built. As world demand for increased yields

stresses the food supply, adequate and balanced soil fertility will continue to be a high

priority. The disappointing global harvest this year combined with continued strong demand has

ignited powerful rallies in a wide array of agricultural commodity prices and bolstered

phosphate and potash demand prospects. Futures markets are sending strong signals to farmers to

expand planted area and intensify cropping practices next year in order for supply to keep pace

with the accelerating demand for agricultural commodities. The increasingly positive outlook

for crop nutrient demand coupled with the need to re-stock both the global distribution

pipeline as well as many farm fields underpins our forecasts for growth in P&K shipments in 2011. |

Key Points

Potash brownfield

expansions on track to

add five million tonnes

additional capacity

Largest integrated phosphate producer –

low cost, geographic advantage and

expanding reserves

Confluence of supply and demand factors

keeping crop nutrient markets extremely

tight

Healthy farmer economics support

continued investment in crop nutrients

21 |

| Let me recap with a few key points.

First, expected potash demand growth requires that we continue to expand our

production capacity. Second, we are the largest integrated phosphate producer

in the world. We have very low production costs, we have advantage

access to raw materials through our location on the US Gulf coast, and, we are expanding

our sources of rock.

Third, a confluence of supply and demand factors will keep crop nutrient markets

extremely tight until new supply comes on-line, with the phosphate

market even tighter than potash. Finally,

crop

prices

are

providing

farmers

with

the

incentive

to

apply

optimal

amounts

of

crop

nutrient

in

order

to maximize yield.

Mosaic is well positioned in both potash and phosphate to take advantage of these

favorable market conditions. |

Thank you |

| Thank you for your time today. Now, I will be glad to answer any

questions you may have. |

Appendix

23

Period Ended

Cash and

Cash

Equivalents

Short-Term

Debt

Current

Maturities

Long-Term

Debt

Total Debt

Net (Debt)

Cash

2006

173.3

152.8

69.3

2,388.1

2,610.2

(2,436.9)

2007

420.6

138.6

403.8

1,818.1

2,360.5

(1,939.9)

2008

1,960.7

133.1

43.3

1,375.0

1,551.4

409.3

2009

2,703.2

92.7

43.3

1,256.5

1,392.5

1,310.7

2010

2,523.0

83.1

15.2

1,245.6

1,343.9

1,179.1

Reconciliation of Cash and Cash Equivalents less Debt

Source: Cash and cash equivalents from 10Q/10K as filed. Total debt includes

Short term debt, current maturities of long-term debt, long-term

debt less current maturities and long-term debt due to Cargill Inc. and Affiliates. We believe this non-GAAP

measure provides additional information regarding the strong financial position of

the Company. |