Attached files

| file | filename |

|---|---|

| EX-5.1 - OPINION OF ANSLOW & JACLIN, LLP FILED HEREIN - China Real Estate Acquisition Corp. | fs12010a2ex5i_linda.htm |

| EX-99.1 - BUSINESS LICENSE - China Real Estate Acquisition Corp. | fs12010a2ex99i_linda.htm |

| EX-99.2 - COMPARABLE COMPANY INFORMATION - China Real Estate Acquisition Corp. | fs12010a2ex99ii_linda.htm |

| EX-10.2 - LAND LEASE CONTRACT - China Real Estate Acquisition Corp. | fs12010a2ex10ii_linda.htm |

| EX-23.2 - CONSENT OF GZTY CPA GROUP, LLC - China Real Estate Acquisition Corp. | fs12010a2ex23ii_linda.htm |

| EX-99.3 - COMPARATIVE FINANCIALS - China Real Estate Acquisition Corp. | fs12010a2ex99iii_linda.htm |

| EX-99.4 - LIST OF CERTIFICATES - China Real Estate Acquisition Corp. | fs12010a2ex99iv_linda.htm |

SECURITIES AND EXCHANGE COMMISSION

Amendment No. 2

To

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

LINDA ILLUMINATION, INC.

(Exact Name of Registrant in its Charter)

|

Delaware

|

6770

|

42-1769314

|

|

(State or other Jurisdiction

of Incorporation)

|

(Primary Standard Industrial

Classification Code)

|

(IRS Employer

Identification No.)

|

No.1 Industrial Garden of Second Economic Cooperative Entity

Ren He Town, Baiyun District

Guangzhou, Guangdong, China 510470

Tel.: +86(0) 20-8603-7011

(Address and Telephone Number of Registrant’s Principal

Executive Offices and Principal Place of Business)

(Name, Address and Telephone Number of Agent for Service)

Copies of communications to:

Gary S. Eaton, Esq.

Anslow & Jaclin, LLP

195 Route 9 South, Suite204

Manalapan, NJ 07726

Tel. No.: (732) 409-1212

Fax No.: (732) 577-1188

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective. If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act registration Statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

¨

|

Accelerated filer

|

¨

|

|

Non-accelerated filer

|

¨

|

Smaller reporting company

|

x

|

CALCULATION OF REGISTRATION FEE

|

Title of Each Class Of

Securities to be Registered

|

Amount to be

Registered

|

Proposed

Maximum

Aggregate

Offering Price

per share

|

Proposed

Maximum

Aggregate

Offering Price

|

Amount of

Registration fee

|

||||||||||||

|

Common Stock, $0.0001 par value per share

|

360,000

|

$

|

0.10

|

$

|

36,000

|

$

|

2.57

|

|||||||||

(1) This Registration Statement covers the resale by our selling shareholders of up to 360,000 shares of common stock previously issued to such selling shareholders.

(2) The offering price has been estimated solely for the purpose of computing the amount of the registration fee in accordance with Rule 457(o). Our common stock is not traded on any national exchange and in accordance with Rule 457; the offering price was determined by the price of the shares that were sold to our shareholders in a private placement memorandum. The price of $0.10 is a fixed price at which the selling security holders may sell their shares until our common stock is quoted on the OTCBB at which time the shares may be sold at prevailing market prices or privately negotiated prices. There can be no assurance that a market maker will agree to file the necessary documents with the Financial Industry Regulatory Authority, which operates the OTC Bulletin Board, nor can there be any assurance that such an application for quotation will be approved.

As discussed herein, the price of $0.10 is based on a private offering completed in July 2010. It is a fixed price at which the selling security holders may sell their shares until our common stock is quoted on the OTC Bulletin Board at which time the shares may be sold at prevailing market prices or privately negotiated prices.

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SUCH SECTION 8(a), MAY DETERMINE.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the U.S. Securities and Exchange Commission (“SEC”) is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

Subject to completion, dated November , 2010

LINDA ILLUMINATION, INC.

360,000 SHARES OF COMMON STOCK

The selling security holders named in this prospectus are offering all of the shares of common stock offered through this prospectus. We will not receive any proceeds from the sale of the common stock covered by this prospectus.

Our common stock is presently not traded on any market or securities exchange. The selling security holders have not engaged any underwriter in connection with the sale of their shares of common stock. Common stock being registered in this registration statement may be sold by selling security holders at a fixed price of $0.10 per share until our common stock is quoted on the OTC Bulletin Board (“OTCBB”) and thereafter at a prevailing market prices or privately negotiated prices or in transactions that are not in the public market. There can be no assurance that a market maker will agree to file the necessary documents with the Financial Industry Regulatory Authority (“FINRA”), which operates the OTCBB, nor can there be any assurance that such an application for quotation will be approved. We have agreed to bear the expenses relating to the registration of the shares of the selling security holders.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 7 to read about factors you should consider before buying shares of our common stock.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The Date of This Prospectus is: _______, 2010

TABLE OF CONTENTS

|

PAGE

|

||

|

5

|

||

|

10

|

||

|

11

|

||

|

18

|

||

|

18

|

||

|

19

|

||

|

19

|

||

|

20

|

||

|

21

|

||

|

21

|

||

|

22

|

||

|

30

|

||

|

30

|

||

|

30

|

||

| F- | ||

|

31

|

||

|

40

|

||

|

47

|

||

|

48

|

||

|

48

|

ITEM 3. Summary Information, Risk Factors and Ratio of Earnings to Fixed Charges

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all the information that you should consider before investing in the common stock. You should carefully read the entire prospectus, including “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Financial Statements, before making an investment decision. In this Prospectus, the terms “Linda Lighting,” “Company,” “we,” “us” and “our” refer to Linda Illumination, Inc.

Overview

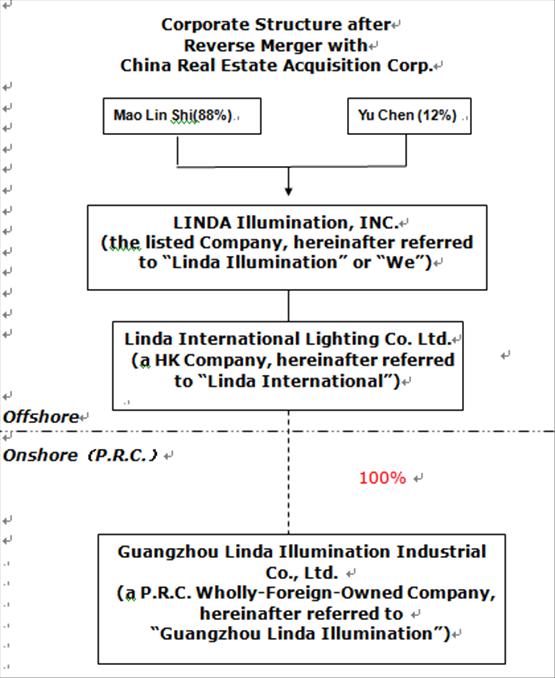

We were incorporated in the State of Delaware on August 14, 2009 as China Real Estate Acquisition Corp. On July 7, 2010 we filed a certificate of amendment to our articles of incorporation changing our name to Linda Illumination, Inc (“Linda Lighting”).

On April 28, 2010, we acquired Linda Lighting, which engages in developing, manufacturing, marketing, and sales of searchlights, spotlights, energy-efficient electronic lamps, and other mobile lighting products in the People’s Republic of China (“China” or the “PRC”). On the Closing Date, we acquired all the Interests of Linda Lighting from the Linda Lighting Shareholders; and the Linda Lighting Shareholders transferred and contributed all of their Interests to us. In exchange, we issued a total of 5,000,000 shares of common stock, Magic Ocean transferred 3,800,000 shares of its common stock to the Linda Lighting Shareholders, their designees or assigns, which totals 88% of the issued and outstanding shares of common stock of the Company on a fully-diluted basis as of and immediately after the closing.

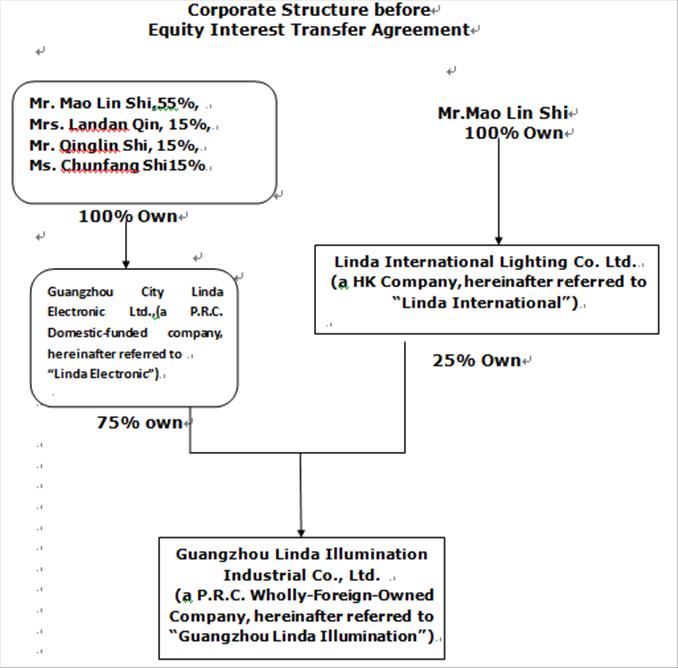

Linda International Lighting Co., Ltd. is a Limited Liability Company established under the laws of Hong Kong Special Administration Region, PRC. The company’s business license was issued by the Registrar of Companies of the Companies Ordinance of Hong Kong on April 16th, 2005. On March 27, 2006, Linda International Lighting CO., Ltd acquired 25% of equity interest of Guangzhou Linda Illumination Industry CO., Ltd, and became one of two shareholders of Guangzhou Linda Illumination Industry Co., Ltd.

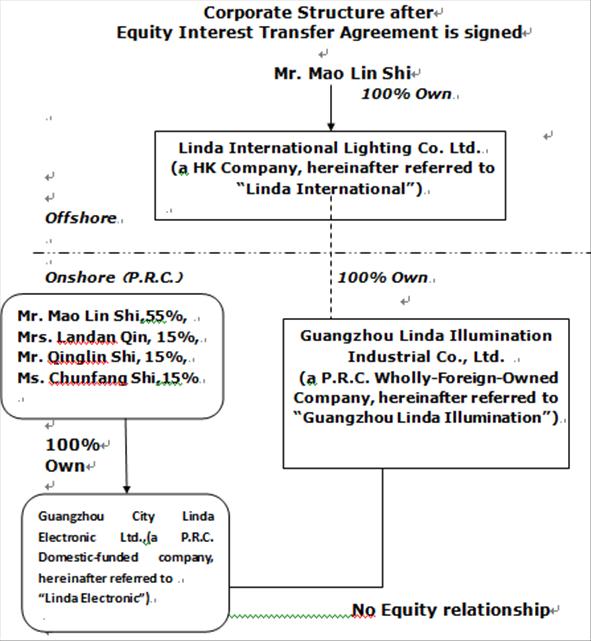

On March 11, 2010, Linda International Lighting Co., Ltd Company entered into an equity transfer agreement with Guangzhou Linda Electric Co., Ltd, another shareholder of Guangzhou Linda Illumination Industry Co., Ltd, to acquire additional 75% equity interest of Guangzhou Linda Illumination Industry Co., Ltd from Guangzhou Linda Electric Co., Ltd. Upon the completion of this equity interest transfer, Linda International Lighting Co., Ltd becomes a holding company that owns 100% of the equity interests of Guangzhou Linda Illumination Industry Co., Ltd.

Guangzhou Linda Illumination Industry CO., Ltd is an operating company incorporated on March 27, 2006, in the City of Guangzhou, Guangdong Province, People’s Republic of China (“PRC”). Guangzhou Linda Illumination Industry CO., Ltd engages in developing, manufacturing, marketing, and sales of CFL light bulbs for household use, digital flashlights specialized for a variety of uses , and other small electronics and mobile lighting products.

Both Linda International Lighting CO., Ltd and Guangzhou Linda Illumination Industry CO., Ltd are under the common control of Mr. Maolin Shi.

5

Equity Transfer Agreement

On March 11, 2010, Mr. Maolin Shi, the sole shareholder of Linda International, on behalf of Linda International, received 33.75% of interest in net assets of Guangzhou Linda Illumination from his wife, Mrs. Landan Qin, his brother, Mr. Qinglin Shi, and his sister, Ms. Chunfang Shi, 11.25% each, through their ownership in Linda Electronic. In addition, Mr. Maolin Shi transferred his own 41.25% interest in Guangzhou Linda Illumination, through his ownership in Linda Electronic, to Linda International. After this transaction, Linda International becomes a 100% shareholder of Guangzhou Linda Illumination. Mr. Maolin Shi becomes the sole owner of Guangzhou Linda Illumination.

The total consideration for the transfer of 75% of equity interest of Guangzhou Linda Illumination was HK$750,000 (or USD $96,653) and was paid in cash on the same day when the transfer was effective.

Before the Equity Interest Transfer Agreement was signed,each of the Individual shareholder of Linda Electronic owned their shares of Guangzhou Linda Illumination, through Linda Electronic,

|

l

|

Mr. Mao Lin Shi, 41.25%,(55% of Linda Electronic*75% of Guangzhou Linda Illumination=41.25% share of Guangzhou Linda Illumination)

|

|

l

|

Mrs. Landan Qin, 11.25%,(15% of Linda Electronic*75% of Guangzhou Linda Illumination=11.25% share of Guangzhou Linda Illumination)

|

|

l

|

Mr. Qinglin Shi, 11.25%,(15% of Linda Electronic*75% of Guangzhou Linda Illumination=11.25% share of Guangzhou Linda Illumination)

|

|

l

|

Ms. Chunfang Shi 11.25%,(15% of Linda Electronic*75% of Guangzhou Linda Illumination=11.25% share of Guangzhou Linda Illumination)

|

6

7

Where You Can Find Us

Our principal executive office is located at 7985 113th Street, Suite 220, Seminole, FL 33772 and our telephone number is (727) 393-7439.

8

The Offering

|

Common stock offered by selling security holders

|

360,000 shares of common stock. This number represents less than one percent of our current outstanding common stock (1).

|

|

|

Common stock outstanding before the offering

|

10,360,000 common shares as of November 22 , 2010.

|

|

|

Common stock outstanding after the offering

|

10,360,000 shares.

|

|

|

Terms of the Offering

|

The selling security holders will determine when and how they will sell the common stock offered in this prospectus.

|

|

|

Termination of the Offering

|

The offering will conclude upon the earliest of (i) such time as all of the common stock has been sold pursuant to the registration statement or (ii) such time as all of the common stock becomes eligible for resale without volume limitations pursuant to Rule 144 under the Securities Act, or any other rule of similar effect.

|

|

|

Use of proceeds

|

We are not selling any shares of the common stock covered by this prospectus.

|

|

|

Risk Factors

|

The Common Stock offered hereby involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investment. See “Risk Factors” beginning on page 4.

|

|

(1)

|

Based on 10,360,000 shares of common stock outstanding as of November 22 , 2010.

|

9

The following summary financial data should be read in conjunction with “Management’s Discussion and Analysis,” “Plan of Operation” and the Financial Statements and Notes thereto, included elsewhere in this prospectus. The statement of operations and balance sheet data from inception for the years ended December 31, 2009 and 2008 are derived from our audited financial statements, and the unaudited financial information for the three months ended June 30, 2010. The data set forth below should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” our consolidated financial statements and the related notes included in this prospectus, and the unaudited financial statements and related notes included in this prospectus.

|

For the Nine Months Ended September 30, 2010

(unaudited)

|

Year ended December 31, 2009

(audited)

|

Year ended December 31, 2008

(audited)

|

|||||||

|

STATEMENT OF OPERATIONS

|

|||||||||

|

Revenues

|

$

|

1,294,655

|

$

|

2,350,246

|

1,020,092

|

||||

|

Total Operating Expenses

|

$

|

280,061

|

$

|

241,558

|

145,369

|

||||

|

Marketing and Selling Expenses

|

$

|

71,841

|

$

|

127,585

|

67,909

|

||||

|

General and Administrative Expenses

|

$

|

208,220

|

$

|

113,973

|

77,460

|

||||

|

Net Income

|

$

|

(106,605

|

)

|

$

|

188,800

|

25,662

|

|||

|

AS OF

September 30,

2010

|

AS OF

December 31, 2009

|

|||||||

|

BALANCE SHEET DATA

|

||||||||

|

Cash and Cash Equivalents

|

$

|

209,915

|

$

|

30,474

|

||||

|

Total Assets

|

$

|

2,613,993

|

$

|

1,621,584

|

||||

|

Total Liabilities

|

$

|

2,726,478

|

$

|

874,631

|

||||

|

Stockholders’ Equity

|

$

|

511,782

|

$

|

613,379

|

||||

10

The shares of our common stock being offered for resale by the selling security holders are highly speculative in nature, involve a high degree of risk and should be purchased only by persons who can afford to lose the entire amount invested in the common stock. Before purchasing any of the shares of common stock, you should carefully consider the following factors relating to our business and prospects. If any of the following risks actually occurs, our business, financial condition or operating results could be materially adversely affected. In such case, you may lose all or part of your investment. You should carefully consider the risks described below and the other information in this process before investing in our common stock.

Risks Related to Our Business

Substantially all of our business, assets and operations are located in the Peoples Republic of China (“PRC”).

Substantially all of our business, assets and operations are located in PRC. The economy of PRC differs from the economies of most developed countries in many respects. The economy of PRC has been transitioning from a planned economy to a market-oriented economy. Although in recent years the PRC government has implemented measures emphasizing the utilization of market forces for economic reform, the reduction of state ownership of productive assets and the establishment of sound corporate governance in business enterprises, a substantial portion of productive assets in PRC is still owned by the PRC government. In addition, the PRC government continues to play a significant role in regulating industry by imposing industrial policies. It also exercises significant control over PRC’s economic growth through the allocation of resources, controlling payment of foreign currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies. Some of these measures benefit the overall economy of PRC, but may have a negative effect on us. Our operations could be affected by among other things:

|

·

|

economic and political instability in China, including problems related to labor unrest,

|

|

|

·

|

lack of developed infrastructure,

|

|

·

|

variances in payment cycles,

|

|

|

·

|

currency fluctuations,

|

|

·

|

overlapping taxes and multiple taxation issues,

|

|

|

·

|

employment and severance taxes,

|

|

·

|

compliance with local laws and regulatory requirements,

|

|

|

·

|

greater difficulty in collecting accounts receivable, and

|

|

·

|

the burdens of cost and compliance with a variety of foreign laws.

|

Our management has no experience in managing and operating a public company. Any failure to comply or adequately comply with federal securities laws, rules or regulations could subject us to fines or regulatory actions, which may materially adversely affect our business, results of operations and financial condition.

Our current management has no experience managing and operating a public company and relies in many instances on the professional experience and advice of third parties including its attorneys and accountants. Failure to comply or adequately comply with any laws, rules, or regulations applicable to our business may result in fines or regulatory actions, which may materially adversely affect our business, results of operation, or financial condition and could result in delays in achieving either the effectiveness of a registration statement relating to the shares being sold in this offering or the development of an active and liquid trading market for our stock.

General business and economic conditions may affect demand for the Company’s products and services which could impact results from operations

The Company competes based on such factors as name recognition and reputation, service, product features, innovation, and price. In addition, the Company operates in a highly competitive environment that is influenced by a number of general business and economic factors, such as general economic vitality, employment levels, credit availability, interest rates and commodity costs. Declines in general economic activity may negatively impact new projects, which in turn may impact demand for the Company’s product and service offerings. The impact of these factors could adversely affect the Company’s financial position, results from operations, and cash flows.

We derive all of our revenues from sales in the PRC and any downturn in the Chinese economy could have a material adverse effect on our business and financial condition.

All of our revenues are generated from sales in the PRC. We anticipate that revenues from sales of our products in the PRC will continue to represent the substantial portion of our total revenues in the near future. Our sales and earnings can also be affected by changes in the general economy since purchases of electronic and mobile products are generally discretionary for consumers. Our success is influenced by a number of economic factors which affect disposable consumer income, such as employment levels, business conditions, interest rates and taxation rates. Adverse changes in these economic factors, among others, may restrict consumer spending, thereby negatively affecting our sales and profitability.

We need to manage growth in operations to maximize our potential growth and achieve our expected revenues and our failure to manage growth will cause a disruption of our operations resulting in the failure to generate revenue at levels we expect.

In order to maximize potential growth in our current and potential markets, we believe that we must expand our manufacturing operations. This expansion will place a significant strain on our management and our operational, accounting, and information systems. We expect that we will need to continue to improve our financial controls, operating procedures, and management information systems. We will also need to effectively train, motivate, and manage our employees. Our failure to manage our growth could disrupt our operations and ultimately prevent us from generating the revenues we expect.

11

We cannot assure you that our growth strategy will be successful which may result in a negative impact on our growth, financial condition, results of operations and cash flow.

One of our strategies is to grow through acquisitions. However, many obstacles to entering such new markets exist including, but not limited to, established companies in such existing markets in the PRC. We cannot, therefore, assure you that we will be able to successfully overcome such obstacles and establish our products in any additional markets. Our inability to implement this organic growth strategy successfully may have a negative impact on our growth, future financial condition, results of operations or cash flows.

If we need additional capital to fund our growing operations, we may not be able to obtain sufficient capital and may be forced to limit the scope of our operations.

If adequate additional financing is not available on reasonable terms, we may not be able to undertake acquisitions of additional business or enter into other strategic alliances, and we would have to modify our business plans accordingly. There is no assurance that additional financing will be available to us.

In connection with our growth strategies, we may experience increased capital needs and accordingly, we may not have sufficient capital to fund our future operations without additional capital investments. Our capital needs will depend on numerous factors, including (i) our profitability; (ii) the release of competitive products by our competition; (iii) the level of our investment in research and development; and (iv) t he amount of our capital expenditures, including acquisitions. We cannot assure you that we will be able to obtain capital in the future to meet our needs.

In recent years, the securities markets in the United States have experienced a high level of price and volume volatility, and the market price of securities of many companies have experienced wide fluctuations that have not necessarily been related to the operations, performances, underlying asset values or prospects of such companies. For these reasons, our securities can also be expected to be subject to volatility resulting from purely market forces over which we will have no control. If we need additional funding we will, most likely, seek such funding in the United States (although we may be able to obtain funding in the P.R.C.) and the market fluctuations affect on our stock price could limit our ability to obtain equity financing.

If we cannot obtain additional funding, we may be required to: (i) limit our expansion; (ii) limit our marketing efforts; and (iii) decrease or eliminate capital expenditures. Such reductions could materially adversely affect our business and our ability to compete.

Even if we do find a source of additional capital, we may not be able to negotiate terms and conditions for receiving the additional capital that are favorable to us. Any future capital investments could dilute or otherwise materially and adversely affect the holdings or rights of our existing shareholders. In addition, new equity or convertible debt securities issued by us to obtain financing could have rights, preferences and privileges senior to the Units. We cannot give you any assurance that any additional financing will be available to us, or if available, will be on terms favorable to us.

Because our principal assets are located outside of the United States and all our directors and officers reside outside of the United States, it may be difficult for you to enforce your rights based on the United States Federal securities laws against us and our officers and directors in the United States or to enforce judgments of United States courts against us or them in the PRC.

All of our officers and directors reside outside of the United States. In addition, our operating subsidiaries are located in the PRC and all of their assets are located outside of the United States. China does not have a treaty with United States providing for the reciprocal recognition and enforcement of judgments of courts. It may therefore be difficult for investors in the United States to enforce their legal rights based on the civil liability provisions of the United States Federal securities laws against us in the courts of either the United States or the PRC and, even if civil judgments are obtained in courts of the United States, to enforce such judgments in PRC courts. Further, it is unclear if extradition treaties now in effect between the United States and the PRC would permit effective enforcement against us or our officers and directors of criminal penalties, under the United States Federal securities laws or otherwise.

Need for additional employees.

The Company’s future success also depends upon its continuing ability to attract and retain highly qualified personnel. Expansion of the Company’s business and the management and operation of the Company will require additional managers and employees with industry experience, and the success of the Company will be highly dependent on the Company’s ability to attract and retain skilled management personnel and other employees. There can be no assurance that the Company will be able to attract or retain highly qualified personnel. Competition for skilled personnel in the electronic industry is significant. This competition may make it more difficult and expensive to attract, hire and retain qualified managers and employees

The loss of the services of our key employees, particularly the services rendered by Maolin Shi our Chief Executive Officer, and President, could harm our business.

Our success depends to a significant degree on the services rendered to us by our key employees. If we fail to attract, train and retain sufficient numbers of these qualified people, our prospects, business, financial condition and results of operations will be materially and adversely affected. In particular, we are heavily dependent on the continued services of Maolin Shi our Chief Executive Officer and President. The loss of any key employees, including members of our senior management team, and our inability to attract highly skilled personnel with sufficient experience in our industry could harm our business.

We will incur significant costs to ensure compliance with United States corporate governance and accounting requirements.

We will incur significant costs associated with our public company reporting requirements, costs associated with newly applicable corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002 and other rules implemented by the Securities and Exchange Commission. We expect all of these applicable rules and regulations to significantly increase our legal and financial compliance costs and to make some activities more time consuming and costly. We also expect that these applicable rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our board of directors or as executive officers. We are currently evaluating and monitoring developments with respect to these newly applicable rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs. We estimate the amounts of additional costs to be $100,000.

12

We may not be able to meet the accelerated filing and internal control reporting requirements imposed by the Securities and Exchange Commission resulting in a possible decline in the price of our common stock and our inability to obtain future financing.

As directed by Section 404 of the Sarbanes-Oxley Act, as amended by SEC Release No. 33-8934 on June 26, 2008, the Securities and Exchange Commission adopted rules requiring each public company to include a report of management on the company’s internal controls over financial reporting in its annual reports. The internal control report must include a statement

|

·

|

Of management’s responsibility for establishing and maintaining adequate internal control over its financial reporting;

|

|

·

|

Of management’s assessment of the effectiveness of its internal control over financial reporting as of year end; and

|

|

·

|

Of the framework used by management to evaluate the effectiveness of our internal control over financial reporting.

|

While we expect to expend significant resources in developing the necessary documentation and testing procedures required by Section 404 of the Sarbanes-Oxley Act, there is a risk that we may not be able to comply timely with all of the requirements imposed by this rule. In the event that we are unable to receive a positive attestation from our independent registered public accounting firm with respect to our internal controls, investors and others may lose confidence in the reliability of our financial statements and our stock price and ability to obtain equity or debt financing as needed could suffer.

The transaction involves a reverse merger of a foreign company into a domestic shell company, so that there is no history of compliance with United States securities laws and accounting rules.

In order to be able to comply with United States securities laws, Linda Lighting prepared its financial statements for the first time under U.S. generally accepted accounting principles and recently had its initial audit of its financial statements in accordance with Public Company Accounting Oversight Board (United States). As the Company does not have a long term familiarity with U.S. generally accepted accounting principles, it may be more difficult for it to comply on a timely basis with SEC reporting requirements than a comparable domestic company.

Linda Lighting may pursue future growth through strategic acquisitions and alliances which may not yield anticipated benefits.

The Company has and may continue to seek to improve its business through strategic acquisitions and alliances. The Company will gain from such activity only to the extent that it can effectively leverage the assets, including personnel, technology and operating processes, of the acquired businesses and alliances. Uncertainty is inherent within the acquisition and alliance process, and unforeseen circumstances arising from recent and future acquisitions or alliances could offset their anticipated benefits. In addition, unanticipated events, negative revisions to valuation assumptions and estimates, and/or difficulties in attaining synergies, among other factors, could adversely affect the Company’s ability to recover initial and subsequent investments, particularly those related to acquired goodwill and intangible assets. Any of these factors could adversely affect the Company’s financial condition, results from operations, and cash flows.

Linda Lighting could be adversely affected by disruption of its operations

The breakdown of equipment or other events, including labor disputes, pandemics or catastrophic events such as war or natural disasters, leading to production interruptions could have a material adverse effect on the Company’s financial results. Further, because many of the Company’s customers are, to varying degrees, dependent on planned deliveries from the Company’s plants, those customers that have to reschedule their own production or delay opening a facility due to the Company’s missed deliveries could pursue financial claims against the Company. The Company may incur costs to correct any of these problems, in addition to facing claims from customers. Further, the Company’s reputation among actual and potential customers may be harmed, resulting in a loss of business.

13

If Linda Lightings’ products are improperly designed, manufactured, packaged, or labeled, the Company may need to recall those items and could be the target of product liability claims if consumers are injured

The Company may need to recall products if they are improperly designed, manufactured, packaged, or labeled and does not maintain insurance for such events. The Company’s quality control procedures relating to the raw materials, including packaging, that it receives from third-party suppliers, as well as the Company’s quality control procedures relating to its products after those products are designed, manufactured and packaged, may not be sufficient. Widespread product recalls could result in significant losses due to the costs of a recall, the destruction of product inventory, and lost sales due to the unavailability of product for a period of time. The Company may also be liable if the use of any of its products causes injury, and could suffer losses from a significant product liability judgment against the Company. A significant product recall or product liability case could also result in adverse publicity, damage to the Company’s reputation, and a loss of consumer confidence in its products, which could have a material adverse effect on the Company’s business, financial results, and cash flow.

PRC law governing these issues is the Law on Product Liability, and the Law on Protection of Interest of Consumers. According to these laws, if any defective product is sold, the seller and the producer take the responsibility of repair, replacement or refunding of the defective products; and if any personal damage or property loss has been caused to the consumers due to the use of the defective products, the seller and producer take all responsibility of such damage or loss, including but not limited to any compensation for property loss, medical expenses, loss of income, expenses related to temporary or permanent disability, and funeral expenses. The producer may receive administrative penalty issued by governmental authorities, including but not limited to forfeit or revoking of the business license. If the Company violates the above laws, damages will be awarded accordingly.

With regard to defective product recall, there is no specific law with clear conditions and procedure thereof in the PRC. Article 18 of the Law on Protection of Interest of Consumers provides that if the producer discovers that products it sells to consumers are defective, it shall report to the government and consumers and take measures against damages caused by its products. This Article constitutes the legal basis of defective product recall in the PRC. And there are cases that producers recall their defective products under such provision. However, controversial issues exist on these cases. Therefore, now in the PRC, laws are often too general to apply when the product recall is necessary.

In 2009, Rules on Defective Products Recall was drafted and announced but is not yet law. According to the provisions of the draft, the procedure of defective product recall includes information collection, investigation of defective products, risk evaluation, recall procedure management and recall effectiveness evaluation. Such rules will be applied to all the products that are manufactured and sold in PRC. If the law is promulgated and comes into effect, the PRC will have specific law governing defective product recall, and such law will affect the Company in the case that a product recall is necessary.

Linda Lighting may be unable to sustain significant customer relationships

Relationships forged with customers are directly impacted by the Company’s ability to deliver high quality products and services. The Company does not have a written contract obligating any clients to purchase its products. The loss of or substantial decrease in the volume of purchases by certain clients would harm the Company’s sales, profitability and cash flow.

Risks Relating To Our Industry

Results may be adversely affected by the Company’s inability to maintain pricing

Aggressive pricing actions by competitors may affect the Company’s ability to achieve desired unit volume growth and profitability levels under its current pricing strategies. The Company may also decide to lower pricing to match the competition. Additionally, the Company may not be able to increase prices to cover rising costs of components and raw materials. Even if the Company were able to increase prices to cover costs, competitive pricing pressures may not allow the Company to pass on any more than the cost increases which could negatively impact gross margin percentages. Alternatively, if component and raw material costs were to decline, the marketplace may not allow the Company to hold prices at their current levels, which could negatively impact both net sales and gross margins.

Linda Lightings’ results may be adversely affected by fluctuations in the cost or availability of raw materials and components

The Company utilizes a variety of raw materials and components in its production process including steel, aluminum, lamps, LEDs, ballasts, power supplies, petroleum-based by-products, natural gas and copper. Failure to effectively manage future increases in the costs of these items could adversely affect operating margins. There can be no assurance that future raw material and component price increases will be successfully passed through to customers. The Company sources these goods from a number of suppliers and is, therefore, reasonably insulated from risks affecting any one supplier. Profitability and volume could be negatively impacted by limitations inherent within the supply chain of certain of these component parts, including competitive, governmental, legal, natural disasters, and other events that could impact both supply and price.

Technological developments and increased competition could affect the Company’s operating profit margins and sales volume

The Company competes in an industry where technology and innovation play major roles in the competitive landscape. The Company is highly engaged in the investigation, development, and implementation of new technologies. Securing key partnerships and alliances as well as employee talent, including having access to technologies generated by others and the obtaining of appropriate patents, play a significant role in protecting the Company’s intellectual property and development activities. Additionally, the continual development of new technologies by existing and new source suppliers looking for either direct market access or partnership with competing large manufacturers, coupled with significant associated exclusivity and/or patent activity, could adversely affect the Company’s ability to sustain operating profit margin and desirable levels of sales volume. Technology developments may also increase competition from non-traditional competitors with greater resources.

Risks Relating to the People's Republic of China

Our operations and assets in China are subject to significant political and economic uncertainties.

Changes in PRC laws and regulations, or their interpretation, or the imposition of confiscatory taxation, restrictions on currency conversion, imports and sources of supply, devaluations of currency or the nationalization or other expropriation of private enterprises could have a material adverse effect on our business, results of operations and financial condition. Under our current leadership, the Chinese government has been pursuing economic reform policies that encourage private economic activity and greater economic decentralization. There is no assurance, however, that the Chinese government will continue to pursue these policies, or that it will not significantly alter these policies from time to time without notice.

14

Currency conversion could adversely affect our financial condition.

The PRC government imposes control over the conversion of Renminbi into foreign currencies. Under the current unified floating exchange rate system, the People’s Bank of China publishes an exchange rate, which we refer to as the PBOC exchange rate, based on the previous day’s dealings in the inter-bank foreign exchange market. Financial institutions authorized to deal in foreign currency may enter into foreign exchange transactions at exchange rates within an authorized range above or below the PBOC exchange rate according to market conditions.

Pursuant to the Foreign Exchange Control Regulations of the PRC issued by the State Council which came into effect on April 1, 1996, and the Regulations on the Administration of Foreign Exchange Settlement, Sale and Payment of the PRC which came into effect on July 1, 1996, regarding foreign exchange control, conversion of Renminbi into foreign exchange by Foreign Investment Enterprises, or FIEs, for use on current account items, including the distribution of dividends and profits to foreign investors, is permissible. FIEs are permitted to convert their after-tax dividends and profits to foreign exchange and remit such foreign exchange to their foreign exchange bank accounts in the PRC. Conversion of Renminbi into foreign currencies for capital account items, including direct investment, loans, and security investment, is still under certain restrictions. On January 14, 1997, the State Council amended the Foreign Exchange Control Regulations and added, among other things, an important provision, which provides that the PRC government shall not impose restrictions on recurring international payments and transfers under current account items.

Enterprises in the PRC (including FIEs) which require foreign exchange for transactions relating to current account items, may, without approval of the State Administration of Foreign Exchange, or SAFE, effect payment from their foreign exchange account or convert and pay at the designated foreign exchange banks by providing valid receipts and proofs.

Convertibility of foreign exchange in respect of capital account items, such as direct investment and capital contribution, is still subject to certain restrictions, and prior approval from the SAFE or its relevant branches must be sought.

The restrictions on conversion of the Renminbi into foreign currencies for capital account items are as follows:

(i) Article 16 of the Foreign Exchange Control Regulations- direct investment in the PRC from offshore entities and individuals shall be approved by the relevant governmental authority and registered with SAFE;

(ii) Article 17 of the Foreign Exchange Control Regulations- direct investment in foreign countries by PRC entities and individuals must be registered with SAFE and if necessary, obtain pre-approval from or registration with the relevant governmental authority;

(iii) Article 18 of the Foreign Exchange Control Regulations- the PRC Government conducts supervision of the scale of foreign exchange loan and if the company makes a foreign exchange loan, it shall register with SAFE;

(iv) Article 21 of the Foreign Exchange Control Regulations- upon approval by SAFE, the revenue from a capital account can be retained or sold to the financial institutions which are permitted to engage in the business of buying and selling foreign exchange, except conditions under which no permission is needed according to the law.

Furthermore, the Renminbi is not freely convertible into foreign currencies nor can it be freely remitted abroad. Under the PRC’s Foreign Exchange Control Regulations and the Administration of Settlement, Sales and Payment of Foreign Exchange Regulations, Foreign Invested Enterprises are permitted either to repatriate or distribute its profits or dividends in foreign currencies out of its foreign exchange accounts, or exchange Renminbi for foreign currencies through banks authorized to conduct foreign exchange business. The conversion of Renminbi into foreign exchange by Foreign Invested Enterprises for recurring items, including the distribution of dividends to foreign investors, is permissible. The conversion of Renminbi into foreign currencies for capital items, such as direct investment, loans and security investment, is subject, however, to more stringent controls.

Our operating company is a FIE to which the Foreign Exchange Control Regulations are applicable. Accordingly, in the future, the company may have to maintain sufficient foreign exchange to pay dividends and/or satisfy other foreign exchange requirements. According to PRC law, there is no minimum requirement for foreign exchange the Company has to maintain and no mechanism for calculating this amount. Further, the Company sells products to the overseas market, is paid in foreign exchange and has no overseas suppliers, so there’s no need for us to remit foreign currency outside of PRC.

Therefore the Company does not currently need to maintain any foreign exchange reserves. However, if circumstances change such that the Company needs to begin maintaining foreign exchange under the trading account, it can obtain the approval from the SAFE and may easily purchase foreign exchange from local banks.

Since our assets are located in the PRC, any dividends of proceeds from liquidation are subject to the approval of the relevant Chinese government agencies.

Our operating assets are located inside the PRC. Under the laws governing Foreign Invested Enterprises in the PRC, dividend distribution and liquidation are allowed but subject to special procedures under the relevant laws and rules. Any dividend payment will be subject to the decision of the board of directors and subject to foreign exchange rules governing such repatriation. Any liquidation is subject to the relevant government agency’s approval and supervision as well as the foreign exchange control. This may generate additional risk for our investors in case of dividend payment and liquidation.

15

The Foreign Exchange Control Regulations and the laws governing foreign invested enterprise allow foreign invested companies to distribute dividends and liquidate upon approval of the relevant local entity as follows:

In general, the foreign invested company will submit the following documents to local banks for buying the foreign exchange and paying the currency out to its shareholders as dividends: (i) application letter, (ii) foreign exchange registration certificate, (iii) board resolution regarding the dividend distribution, (iv) capital verification report, (v) audit report, and (vi) tax receipt.

Foreign invested companies that intend to liquidate shall: (i) be approved by the local business bureau for a liquidation plan; (ii) pay tax in PRC; and (iii) be approved by SAFE for the transferring the remaining money owned by their foreign investors after liquidation.

It may be difficult to affect service of process and enforcement of legal judgments upon our company and our officers and directors because they reside outside the United States.

As our operations are presently based in the PRC and our director and officer resides in the PRC, service of process on our company and such director and officer may be difficult to effect within the United States. Also, our main assets are located in the PRC and any judgment obtained in the United States against us may not be enforceable outside the United States.

Our business could be severely harmed if the Chinese government changes its policies, laws, regulations related to our Value Added Tax Payments.

We are subject to value added tax (“VAT”) for selling merchandise. The applicable VAT rate is 17% for products sold in the PRC. The amount of VAT liability is determined by applying the applicable tax rate to the invoiced amount of goods sold (output VAT) less VAT paid on purchases made with the relevant supporting invoices (input VAT). Under the business practice of the PRC, the Company pays VAT based on tax invoices issued. The tax invoices may be issued subsequent to the date on which revenue is recognized, and there may be a considerable delay between the date on which the revenue is recognized and the date on which the tax invoice is issued. In the event that the PRC tax authorities dispute the date on which revenue is recognized for tax purposes, the PRC tax office has the right to assess a penalty, which can range from zero to five times the amount of the taxes which are determined to be late or deficient. Our operations and results could be materially affected by a number of factors, including, but not limited to

|

·

|

Changes in policies by the Chinese government resulting in changes VAT recognition dates or regulations or the interpretation of laws or regulations relating to VAT,

|

|

|

·

|

changes in taxation,

|

PRC SAFE Regulations regarding offshore financing activities by PRC residents have undertaken continuous changes which may increase the administrative burden we face and create regulatory uncertainties that could adversely affect our business.

Recent regulations promulgated by SAFE, regarding offshore financing activities by PRC residents have undergone a number of changes which may increase the administrative burden we face. The failure by our stockholders and affiliates who are PRC residents to make any required applications and filings pursuant to such regulations may prevent us from being able to distribute profits and could expose us and our PRC resident stockholders to liability under PRC law.

In 2005, SAFE promulgated regulations in the form of public notices, which require registrations with, and approval from, SAFE on direct or indirect offshore investment activities by PRC resident individuals. The SAFE regulations require that if an offshore company directly or indirectly formed by or controlled by PRC resident individuals, known as “SPC,” intends to acquire a PRC company, such acquisition will be subject to strict examination by the SAFE. Without registration, the PRC entity cannot remit any of its profits out of the PRC as dividends or otherwise. This could have a material adverse effect on us given that we expect to be a publicly listed company in the U.S.

However, according to the PRC legal opinion regarding the corporate structure, because the Linda HK was established before the Circular of the State Administration of Foreign Exchange on Relevant Issues Concerning Foreign Exchange Administration of Financing and Round-tripped Investment by Domestic Residents through Offshore Special Purpose Vehicles came into force, our business is not bound by the rule; thus, neither Chen Yu, Shi Maolin, nor the business as a whole need to register with SAFE.

Due to various restrictions under PRC laws on the distribution of dividends by our PRC Operating Companies, we may not be able to pay dividends to our stockholders.

The Wholly-Foreign Owned Enterprise Law (1986), as amended and The Wholly-Foreign Owned Enterprise Law Implementing Rules (1990), as amended and the Company Law of the PRC (2006) contain the principal regulations governing dividend distributions by wholly foreign owned enterprises. Under these regulations, wholly foreign owned enterprises may pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. Additionally, such companies are required to set aside a certain amount of their accumulated profits each year, if any, to fund certain reserve funds. These reserves are not distributable as cash dividends except in the event of liquidation and cannot be used for working capital purposes. The PRC government also imposes controls on the conversion of RMB into foreign currencies and the remittance of currencies out of the PRC. We may experience difficulties in completing the administrative procedures necessary to obtain and remit foreign currency for the payment of dividends from the Company’s profits.

If our subsidiaries in China incur debt on their own in the future, the instruments governing the debt may restrict its ability to pay dividends or make other payments. If we or our subsidiaries are unable to receive all of the revenues from our operations through these contractual or dividend arrangements, we may be unable to pay dividends on our common stock.

At least 10% of net income after tax must be set aside from accumulated profits each year, which is determined under PRC accounting rules and regulations, until the fund amounts to 50% of the Company’s registered capital.

Foreign-funded financial institutions who intend to remit profit outward are governed by Huifa (1998) No. 29, Circular on Issues Concerning Outward Remittance of Profit, Stock Dividends and Stock Bonuses Processed by Designated Foreign Exchange Banks (Promulgated by State Administration of Foreign Exchange on September 22, 1998). Under this law, the remittance has to go through a designated foreign exchange bank with the following documents:Tax payment receipt and tax declarations form, Audit report issued by a CPA, board resolution on paying Profit, Stock Dividends and Stock Bonuses, Foreign Exchange Registration Certificates for FIEs, capital verification report issued by certified public accountants.

SAFE is entitled to review profit, stock dividends and stock bonus remittances that exceed $100,000.

The Foreign Exchange Control Regulations and the laws governing foreign invested enterprise allow foreign invested companies to distribute dividends and liquidate upon approval of the relevant local entity as follows:

In general, the foreign invested company will submit the following documents to local banks for buying the foreign exchange and paying the currency out to its shareholders as dividends: (i) application letter, (ii) foreign exchange registration certificate, (iii) board resolution regarding the dividend distribution, (iv) capital verification report, (v) audit report, and (vi) tax receipt.

Foreign invested companies that intend to liquidate shall: (i) be approved by the local business bureau for a liquidation plan; (ii) pay tax in PRC; and (iii) be approved by SAFE for the transferring the remaining money owned by their foreign investors after liquidation.

Linda International Lighting meets all PRC mandated registered capital requirements. Linda International Lighting is a company established in Hong Kong rather than in China mainland. The share issued is 10,000,the nominal value of each share Issued is HKD 1,the total Nominal Value of Shares Issued is HKD 10,000.No registered capital is stated in Linda International Lighting’s Memorandum of Association . There are no rules and regulations to require a Hong Kong domiciled company to meet PRC mandated registered capital requirements.

16

The Chinese government exerts substantial influence over the manner in which we must conduct our business activities.

We are dependent on our relationship with the local government in the province in which we operate our business. Chinese government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to taxation, environmental regulations, land use rights, property and other matters. We believe that our operations in China are in material compliance with all applicable legal and regulatory requirements. However, the central or local governments of these jurisdictions may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations. Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions thereof, and could require us to divest ourselves of any interest we then hold in Chinese properties.

Future inflation in China may inhibit our ability to conduct business in China. In recent years, the Chinese economy has experienced periods of rapid expansion and high rates of inflation. Rapid economic growth can lead to growth in the money supply and rising inflation. If prices for our products rise at a rate that is insufficient to compensate for the rise in the costs of supplies, it may have an adverse effect on profitability. These factors have led to the adoption by Chinese government, from time to time, of various corrective measures designed to restrict the availability of credit or regulate growth and contain inflation. High inflation may in the future cause Chinese government to impose controls on credit and/or prices, or to take other action, which could inhibit economic activity in China, and thereby harm the market for our products.

If our land use rights are revoked, we would have no operational capabilities.

Under Chinese law land is owned by the state or rural collective economic organizations. The state issues to tenants the rights to use property. Use rights can be revoked and the tenants forced to vacate at any time when redevelopment of the land is in the public interest. The public interest rationale is interpreted quite broadly and the process of land appropriation may be less than transparent. Each of our operating subsidiaries rely on these land use rights as the cornerstone of their operations, and the loss of such rights would have a material adverse effect on our company.

Guangzhou Linda Illumination and Second Economic Cooperative Entity of Baiyun District (hereinafter referred to Lessor) signed a Lease Contract, stipulating that Guangzhou Linda Illumination Industrial Co. Ltd. shall rent No.1, Industrial Garden of Second Economic Cooperative Entity, Ren He Town, Baiyun District, Guangzhou City, Guangdong Province, P.R.C., the rental area is 2200 square meters. The lease period is from July 1, 2007 to July 1, 2017 with an annual rent of RMB 8,000,which increases by 10% per annum.

Guangzhou Linda Illumination has never received a land use certificate from the state or rural collective economic organization, because Guangzhou Linda Illumination is Lessee. A Lessee is not the respective and proper party to receive Land Use Certificate under PRC law. The reason why Guangzhou Linda Illumination can’t obtain land use certificate is as follows:

Second Economic Cooperative Entity of Baiyun District, the Lessor, is the one who possesses the Land Ownership of the respective lease hold. Guangzhou Linda Illumination, the lessee, shall never receive a Land Use Right Certificate issued by the respective government authorities. The lease contract is an accredited document to protect the Lessee’s right to occupy the land.

Under PRC law, land is divided into two categories: stated-owned and rural- collective-economic-organization-owned. Unlike rural- collective-economic-organization-owned land, individuals or Companies normally receive Stated-owned Land Use Certificate from PRC Central Government, a Stated-owned Land Use Certificate is issued to that person and they can then utilize those lands for various uses, including leasing them to a third party. Lessee is not the respective party who is entitled to receive Land Use Certificate.

In case of rural- collective-economic-organization-owned land, Lessee is also not the respective and proper party who is entitled to receive Land Use Certificate under PRC law. The lease contract is an accredited document sufficient enough to protect the Lessee’s right to occupy the land.

Risk Related To Our Capital Stock

We may never pay any dividends to shareholders.

We have never declared or paid any cash dividends or distributions on our capital stock. We currently intend to retain our future earnings, if any, to support operations and to finance expansion and therefore we do not anticipate paying any cash dividends on our common stock in the foreseeable future.

The declaration, payment and amount of any future dividends will be made at the discretion of the board of directors, and will depend upon, among other things, the results of our operations, cash flows and financial condition, operating and capital requirements, and other factors as the board of directors considers relevant. There is no assurance that future dividends will be paid, and, if dividends are paid, there is no assurance with respect to the amount of any such dividend.

Our affiliates have significant voting power and may take actions that may not be in the best interest of all other stockholders

Our affiliates control approximately 95% of our current outstanding shares of voting common stock. They may be able to exert significant control over our management and affairs requiring stockholder approval, including approval of significant corporate transactions. This concentration of ownership may expedite approvals of company decisions, or have the effect of delaying or preventing a change in control or be in the best interests of all our stockholders.

Our articles of incorporation provide for indemnification of officers and directors at our expense and limit their liability which may result in a major cost to us and hurt the interests of our shareholders because corporate resources may be expended for the benefit of officers and/or directors.

Our articles of incorporation and applicable Delaware law provide for the indemnification of our directors, officers, employees, and agents, under certain circumstances, against attorney’s fees and other expenses incurred by them in any litigation to which they become a party arising from their association with or activities on our behalf. We will also bear the expenses of such litigation for any of our directors, officers, employees, or agents, upon such person’s written promise to repay us if it is ultimately determined that any such person shall not have been entitled to indemnification. This indemnification policy could result in substantial expenditures by us which we will be unable to recoup.

We have been advised that, in the opinion of the SEC, indemnification for liabilities arising under federal securities laws is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification for liabilities arising under federal securities laws, other than the payment by us of expenses incurred or paid by a director, officer or controlling person in the successful defense of any action, suit or proceeding, is asserted by a director, officer or controlling person in connection with the securities being registered, we will (unless in the opinion of our counsel, the matter has been settled by controlling precedent) submit to a court of appropriate jurisdiction, the question whether indemnification by us is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue. The legal process relating to this matter if it were to occur is likely to be very costly and may result in us receiving negative publicity, either of which factors is likely to materially reduce the market and price for our shares, if such a market ever develops.

The offering price of the common stock was determined based on the price of our private offering, and therefore should not be used as an indicator of the future market price of the securities. Therefore, the offering price bears no relationship to our actual value, and may make our shares difficult to sell.

Since our shares are not listed or quoted on any exchange or quotation system, the offering price of $0.10 per share for the shares of common stock was determined based on the price of our private offering. The facts considered in determining the offering price were our financial condition and prospects, our limited operating history and the general condition of the securities market. The offering price bears no relationship to the book value, assets or earnings of our company or any other recognized criteria of value. The offering price should not be regarded as an indicator of the future market price of the securities.

17

In order to raise sufficient funds to expand our operations, we may have to issue additional securities at prices which may result in substantial dilution to our shareholders.

If we raise additional funds through the sale of equity or convertible debt, our current stockholders’ percentage ownership will be reduced. In addition, these transactions may dilute the value of our securities outstanding. We may have to issue securities that may have rights, preferences and privileges senior to our common stock. We cannot provide assurance that we will be able to raise additional funds on terms acceptable to us, if at all. If future financing is not available or is not available on acceptable terms, we may not be able to fund our future needs, which would have a material adverse effect on our business plans, prospects, results of operations and financial condition.

Our common stock is considered a penny stock, which may be subject to restrictions on marketability, so you may not be able to sell your shares.

If our common stock becomes tradable in the secondary market, we will be subject to the penny stock rules adopted by the Securities and Exchange Commission that require brokers to provide extensive disclosure to their customers prior to executing trades in penny stocks. These disclosure requirements may cause a reduction in the trading activity of our common stock, which in all likelihood would make it difficult for our shareholders to sell their securities.

Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ system). Penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer’s account. The broker-dealer must also make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These requirements may have the effect of reducing the level of trading activity, if any, in the secondary market for a security that becomes subject to the penny stock rules. The additional burdens imposed upon broker-dealers by such requirements may discourage broker-dealers from effecting transactions in our securities, which could severely limit the market price and liquidity of our securities. These requirements may restrict the ability of broker-dealers to sell our common stock and may affect your ability to resell our common stock.

There is no assurance of a public market or that our common stock will ever trade on a recognized exchange. Therefore, you may be unable to liquidate your investment in our stock.

There is no established public trading market for our common stock. Our shares have not been listed or quoted on any exchange or quotation system. There can be no assurance that a market maker will agree to file the necessary documents with FINRA, which operates the OTCBB, nor can there be any assurance that such an application for quotation will be approved or that a regular trading market will develop or that if developed, will be sustained. In the absence of a trading market, an investor may be unable to liquidate their investment.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

The information contained in this report, including in the documents incorporated by reference into this report, includes some statement that are not purely historical and that are “forward-looking statements.” Such forward-looking statements include, but are not limited to, statements regarding our and their management’s expectations, hopes, beliefs, intentions or strategies regarding the future, including our financial condition, results of operations, and the expected impact of the Share Exchange on the parties’ individual and combined financial performance. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipates,” “believes,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “might,” “plans,” “possible,” “potential,” “predicts,” “projects,” “seeks,” “should,” “will,” “would” and similar expressions, or the negatives of such terms, may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements contained in this report are based on current expectations and beliefs concerning future developments and the potential effects on the parties and the transaction. There can be no assurance that future developments actually affecting us will be those anticipated. These that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements, including the following forward-looking statements involve a number of risks, uncertainties (some of which are beyond the parties’ control) or other assumptions.

We will not receive any proceeds from the sale of common stock by the selling security holders. All of the net proceeds from the sale of our common stock will go to the selling security holders as described below in the sections entitled “Selling Security Holders” and “Plan of Distribution”. We have agreed to bear the expenses relating to the registration of the common stock for the selling security holders.

Since our common stock is not listed or quoted on any exchange or quotation system, the offering price of the shares of common stock was determined by the price of the common stock that was sold to our security holders pursuant to an exemption under Section 4(2) of the Securities Act of 1933 and Rule 506 of Regulation D promulgated under the Securities Act of 1933.

The offering price of the shares of our common stock does not necessarily bear any relationship to our book value, assets, past operating results, financial condition or any other established criteria of value. The facts considered in determining the offering price were our financial condition and prospects, our limited operating history and the general condition of the securities market.

Although our common stock is not listed on a public exchange, we will be filing to obtain a listing on the OTCBB concurrently with the filing of this prospectus. In order to be quoted on the OTCBB, a market maker must file an application on our behalf in order to make a market for our common stock. There can be no assurance that a market maker will agree to file the necessary documents with FINRA, which operates the OTC Bulletin Board, nor can there be any assurance that such an application for quotation will be approved.

18

In addition, there is no assurance that our common stock will trade at market prices in excess of the initial offering price as prices for the common stock in any public market which may develop will be determined in the marketplace and may be influenced by many factors, including the depth and liquidity.

The common stock to be sold by the selling shareholders are provided in Item 7 is common stock that is currently issued. Accordingly, there will be no dilution to our existing shareholders.

The common shares being offered for resale by the selling security holders consist of the 360,000 shares of our common stock held by 36 shareholders. Such shareholders include the holders of the 360,000 shares sold in our private offering pursuant to Regulation D or Regulation S Rule 506 completed in July 2010 at an offering price of $0.10.

The following table sets forth the name of the selling security holders, the number of shares of common stock beneficially owned by each of the selling stockholders as of November 22 , 2010 and the number of shares of common stock being offered by the selling stockholders. The shares being offered hereby are being registered to permit public secondary trading, and the selling stockholders may offer all or part of the shares for resale from time to time. However, the selling stockholders are under no obligation to sell all or any portion of such shares nor are the selling stockholders obligated to sell any shares immediately upon effectiveness of this prospectus. All information with respect to share ownership has been furnished by the selling stockholders.

|

Name

|

Shares

Beneficially

Owned Prior To

Offering

|

Shares to

be Offered

|

Amount Beneficially

Owned After

Offering

|

Percent

Beneficially

Owned

After Offering

|

|

Jianbo Xiao

|

10,000

|

10,000

|

0

|

0%

|

|

Qinglin Shi

|

10,000

|

10,000

|

0

|

0%

|

|

Rong Shi

|

10,000

|

10,000

|

0

|

0%

|

|

Songlin Shi

|

10,000

|

10,000

|

0

|

0%

|

|

Yafu Huang

|

10,000

|

10,000

|

0

|

0%

|

|

Youfu Qiu

|

10,000

|

10,000

|

0

|

0%

|

|

Zhijun Tan

|

10,000

|

10,000

|

0

|

0%

|

|

Gongxiang Xiao