Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - Dragon Acquisition CORP | exhibit23-1.htm |

As filed with the Securities and Exchange Commission on November 24, 2010

| Registration No. 333-166658 |

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________________

AMENDMENT NO. 6

TO

FORM

S-1

REGISTRATION STATEMENT UNDER THE

SECURITIES ACT OF

1933

CHINA OUMEI REAL ESTATE

INC.

(Exact name of registrant as specified in its

charter)

| Cayman Islands | 6552 | N/A |

| (State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer |

| incorporation or organization) | Classification Code Number) | Identification No.) |

Floor 28, Block C

Longhai Mingzhu Building

No.182 Haier

Road, Qingdao 266000

People’s Republic of China

(86) 532 8099

7969

(Address and telephone number of principal executive offices)

____________________________

Mr. Zhaohui John Liang

634 Donna Ct.

River Vale,

NJ 07675

(201) 497-5400

(Names, addresses and telephone numbers

of agents for service)

Copies to:

| Louis A. Bevilacqua, Esq. | Richard I. Anslow, Esq. |

| Thomas M. Shoesmith, Esq. | Gregg E. Jaclin, Esq. |

| Joseph R. Tiano, Jr., Esq. | Anslow & Jaclin, LLP |

| Pillsbury Winthrop Shaw Pittman LLP | 195 Route 9 South |

| 2300 N Street, N.W. | 2nd Floor |

| Washington, D.C. 20037 | Manalapan, NJ 07726 |

| (202) 663-8000 | (732) 409-1212 |

Approximate date of commencement of proposed sale to public: From time to time after the effective date of this Registration Statement, as determined by market conditions and other factors.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box.[ x ]

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.[ ]

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.[ ]

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement the same offering.[ ]

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box.[ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer," "accelerated filer,” and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ x ] | Smaller reporting company [ ] |

| (Do not check if a smaller reporting company) |

CALCULATION OF REGISTRATION FEE

|

|

Amount to be | Proposed maximum | Proposed maximum aggregate | Amount of |

|

Title of securities to be registered |

registered(1) | offering price per share | offering price | registration fee |

|

Primary Offering: |

||||

|

Ordinary Shares, $0.002112 par value per share |

$23,000,000(2) | $1,640(3) | ||

|

Secondary Offering: |

||||

|

Ordinary Shares, $0.002112 par value per share |

765,000(6) | $4.00(4) | $3,060,000 | $219 |

|

Ordinary Shares Underlying 6% Convertible Preference Shares, $0.002112 par value per share |

2,774,700(7) | $4.00(4) | $11,098,800 | $792 |

|

Ordinary Shares Underlying Warrants, $0.002112 par value per share |

1,387,350(8) | $6.00(5) | $8,324,100 | $594 |

|

Ordinary Shares Underlying Warrants, $0.002112 par value per share |

138,735(9) | $5.00(5) | $693,675 | $50 |

|

TOTAL |

$46,176,575 | $3,296(10) |

(1) In accordance with Rule 416(a), the Registrant is also registering hereunder an indeterminate number of additional Ordinary Shares that may be issued and resold resulting from stock splits, stock dividends or similar transactions.

(2) Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o).

(3) Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price.

(4) Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457, based on the last private sales price for ordinary shares of the Registrant as there is currently no public market price for the Registrant’s ordinary shares. Management considered the total number of shares outstanding post offering, the public offering of ordinary shares, estimated market capitalization, forward looking net income, the targeted price-to-earnings ratio and the effect of the current global economic crisis to determine the offering price per share. Accordingly, taking the foregoing factors into consideration, the Registrant arrived at the proposed offering price per share, which is the effective price per share paid by the investors in the Company’s April 2010 private placement.

(5) Calculated in accordance with Rule 457(g) based upon the exercise price of the Warrants held by selling stockholders named in this registration statement.

(6) Represents the Registrant’s ordinary shares being registered for resale that have been issued to the selling stockholders named in this registration statement.

(7) Represents ordinary shares underlying 6% convertible preference shares being registered for resale that have been issued to the selling stockholders named in this registration statement.

(8) Represents ordinary shares issuable upon exercise of five-year warrants to purchase ordinary shares being registered for resale that such warrants have been issued to certain selling stockholders named in this registration statement.

(9) Represents ordinary shares issuable upon exercise of three-year warrants to purchase ordinary shares being registered for resale that such warrants have been issued to certain selling stockholder named in this registration statement.

(10) Previously paid.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall hereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to such Section 8(a), may determine.

EXPLANATORY NOTE

This Registration Statement contains two prospectuses, as set forth below.

-

Public Offering Prospectus. A prospectus, or the Public Offering Prospectus, to be used for the public offering of up to ordinary shares by us (in addition to ordinary shares that may be sold upon exercise of the underwriters’ over-allotment option) through the underwriters named on the cover page of the Public Offering Prospectus.

-

Resale Prospectus. A prospectus, or the Resale Prospectus, to be used for the resale by selling stockholders of 765,000 ordinary shares and 2,774,700 ordinary shares underlying 6% convertible preference shares, $0.002112 par value per share, or Preference Shares. We are also registering 1,526,085 ordinary shares that have been or may be acquired upon the exercise of warrants that have been previously issued to selling stockholders named in the Resale Prospectus.

The Resale Prospectus is substantively identical to the Public Offering Prospectus, except for the following major items:

-

they contain different outside and inside front covers;

-

they contain different Offering sections in the Prospectus Summary section beginning on page 1 and 1A respectively;

-

they contain different Use of Proceeds sections on page 21 and 2A respectively;

-

the Capitalization and Dilution sections on page 23 and page 24, respectively, of the Public Offering Prospectus are deleted from the Resale Prospectus;

-

a Selling Stockholder section is included in the Resale Prospectus beginning on page 3A;

-

references in the Public Offering Prospectus to the Resale Prospectus will be deleted from the Resale Prospectus;

-

the Underwriting section from the Public Offering Prospectus on page 99 is deleted from the Resale Prospectus and a Plan of Distribution is inserted in its place;

-

the Legal Matters section in the Resale Prospectus on page 8A deletes the reference to counsel for the underwriters; and

-

the outside back cover of the Public Offering Prospectus is different from the outside back cover of the Resale Prospectus.

We have included in this Registration Statement, after the financial statements, a set of alternate pages to reflect the foregoing differences of the Resale Prospectus as compared to the Public Offering Prospectus.

The information in this preliminary prospectus

is not complete and may be changed. We may not sell these securities until the

Securities and Exchange Commission declares our registration statement effective.

This prospectus is not an offer to sell these securities and it is not soliciting

an offer to buy these securities in any jurisdiction where the offer or sale

is not permitted.

Subject to completion, dated November 24, 2010

________ Ordinary Shares

We are offering ordinary shares.

Our ordinary shares are not currently listed or quoted for trading on any national securities exchange or national quotation system. We have applied to have our ordinary shares listed on the NASDAQ Global Market under the symbol “OMEI”. There can, however, be no assurance that our listing application will be accepted by the NASDAQ Global Market.

Investing in our ordinary shares involves a high degree of risk. See “Risk Factors” beginning on page 7.

| Per Share | Total | |||||

| Public offering price | $ | $ | ||||

| Underwriting discount | $ | $ | ||||

| Proceeds, before expenses, to China Oumei Real Estate Inc. | $ | $ |

We have granted the underwriters a 45-day option to purchase up to additional ordinary shares from us at the public offering price, less the underwriting discount and commissions.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The ordinary shares are expected to be delivered on or about , 2010.

_________________________________________

| Brean Murray, Carret & Co. | Ladenburg Thalmann & Co. Inc. |

The date of this prospectus is , 2010.

TABLE OF CONTENTS

You should rely only on the information provided in this prospectus. Neither we nor the selling stockholders have authorized anyone to provide you with additional or different information. The selling stockholders are not making an offer of these securities in any jurisdiction where the offer is not permitted. You should assume that the information in this prospectus is accurate only as of the date on the front of the document.

i

PROSPECTUS SUMMARY

The items in the following summary are described in more detail later in this prospectus. Therefore, you should also read the more detailed information set out in this prospectus, including the financial statements, the notes thereto and matters set forth under “Risk Factors.”

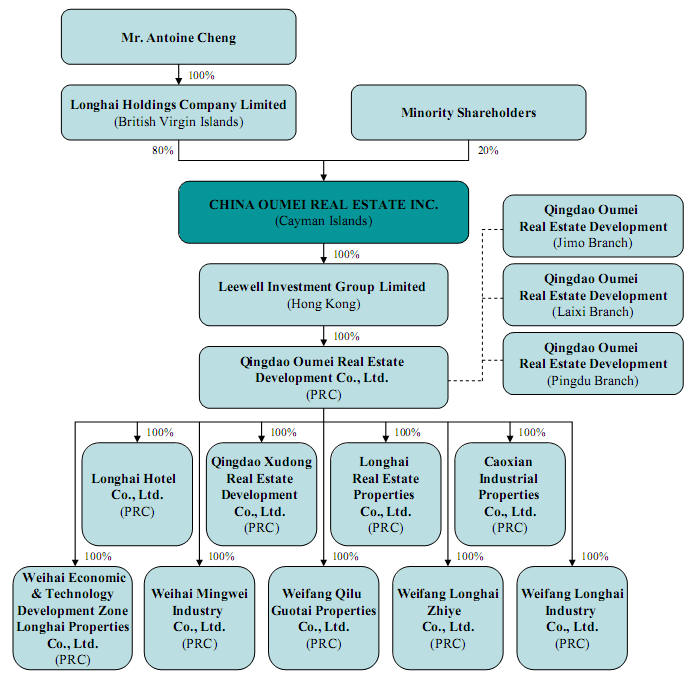

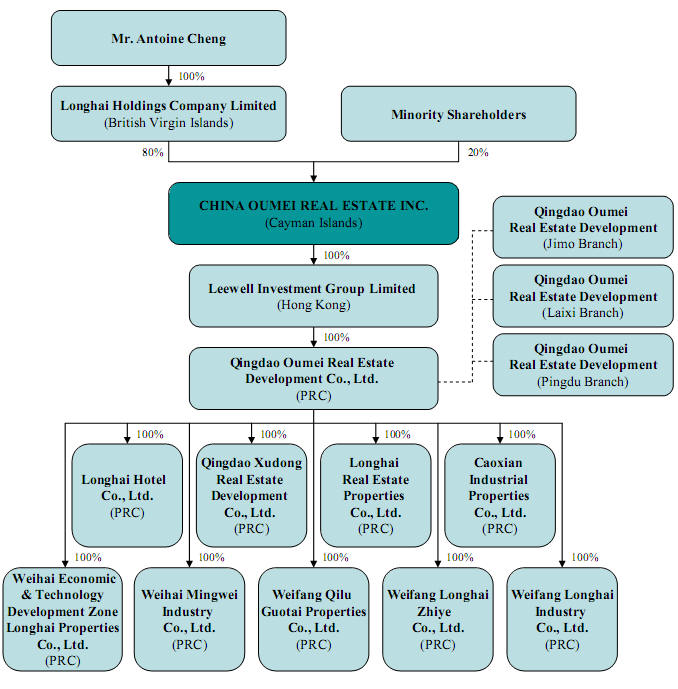

Except as otherwise indicated by the context, references in this prospectus to “we,” “us,” “our,” “our Company,” or “the Company” are to the combined business of China Oumei Real Estate Inc., a Cayman Islands company, and its consolidated subsidiaries, Leewell, Oumei, Caoxian Industrial, Longhai Hotel, Longhai Real Estate, Qingdao Xudong, Weifang Longhai Industry, Weifang Longhai Properties, Weifang Qilu, Weihai Economic and Weihai Mingwei.

In addition, unless the context otherwise requires and for the purposes of this prospectus only:

-

“Caoxian Industrial” refers to Caoxian Industrial Properties Co., Ltd., a PRC limited company;

-

“Exchange Act” refers to the Securities Exchange Act of 1934, as amended;

-

“Hong Kong” refers to the Hong Kong Special Administrative Region of the People’s Republic of China;

-

“Leewell” refers to Leewell Investment Group Limited, a Hong Kong company;

-

“Longhai Hotel” refers to Longhai Hotel Co., Ltd., a PRC limited company;

-

“Longhai Real Estate” refers to Longhai Real Estate Properties Co., Ltd., a PRC limited company;

-

“Oumei” refers to Qingdao Oumei Real Estate Development Co., Ltd., a PRC limited company;

-

“PRC,” “China,” and “Chinese,” refer to the People’s Republic of China;

-

“Qingdao Xudong” refers to Qingdao Xudong Real Estate Development Co., Ltd., a PRC limited company;

-

“Renminbi” and “RMB” refer to the legal currency of China;

-

“SEC” refers to the Securities and Exchange Commission;

-

“Securities Act” refers to the Securities Act of 1933, as amended;

-

“U.S. dollars,” “dollars” and “$” refer to the legal currency of the United States;

-

“Weifang Longhai Industry” refers to Weifang Longhai Industry Co., Ltd., a PRC limited company;

-

“Weifang Longhai Zhiye” refers to Weifang Longhai Zhiye Co., Ltd., a PRC limited company;

-

“Weifang Qilu” refers to Weifang Qilu Guotai Properties Co., Ltd., a PRC limited company;

-

“Weihai Economic” refers to Weihai Economic & Technology Development Zone Longhai Properties Co., Ltd., a PRC limited company; and

-

“Weihai Mingwei” refers to Weihai Mingwei Industry Co., Ltd., a PRC limited company.

In this prospectus we are relying on and we refer to information and statistics regarding the real estate industry in China that we have obtained from various cited public sources. Any such information is publicly available for free and has not been specifically prepared for us for use or incorporation in this prospectus or otherwise.

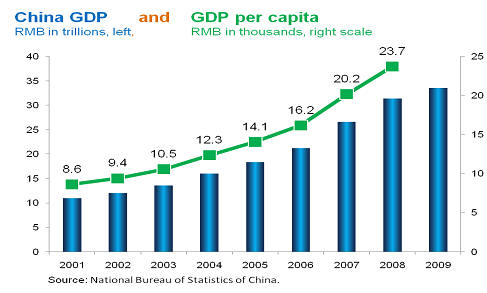

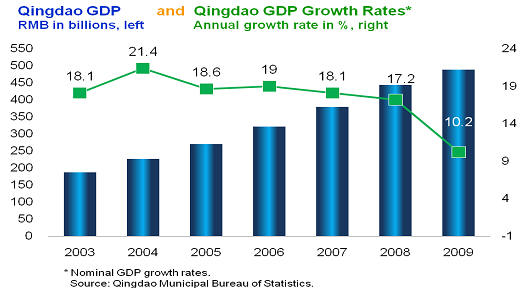

In addition, at present, there is no uniform standard to categorize the different types and sizes of cities in China. In this prospectus, we refer to Beijing, Shanghai, Guangzhou and Shenzhen as tier one cities, which are the most populous, affluent and competitive cities in the country. They also represent the highest standard and concentration of real estate development activities in China. Tier two cities are cities that generally meet the following criteria, excluding the four aforementioned tier one cities:

-

Gross Domestic Product, or GDP, over RMB 200 billion (US$29 billion);

-

GDP per capita over RMB 14,000 (US$2,050);

-

Population with permanent residency in urban area over 1 million;

-

Urban area over 100 km2;

-

Annual sales in residential real estate over 1.5 million square meters; and

-

Average unit selling price of residential real estate over RMB 3,000 (US$439) per square meter.

Tier three cities are the cities that do not meet one or more criteria listed above.

1

The Company

Overview of Our Business

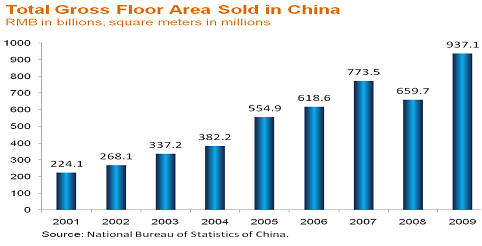

We are one of the leading real estate development companies located in Qingdao, Shandong province, China. We began operations in 2001, and in 2008 we were recognized in the official City of Qingdao Commission of Development & Construction’s evaluation as one of the top ten real estate developers in Qingdao, measured by a combination of revenue, customer satisfaction, as well as several other factors.

We develop and sell residential and commercial properties, targeting middle and upper income customers in the coastal region of the Shandong peninsula (Greater Qingdao) located in northeastern China, including the cities of Qingdao, Weihai and Yantai, as well as other inland locations, such as Weifang.

Since our inception, we have completed 17 projects having a gross floor area, or GFA, of 1,461,991 square meters, of which approximately 95% has been sold. In addition, we have six projects under construction with a total GFA of 508,342 square meters.

In fiscal year 2009, our total sales increased 22.4% to $94.3 million from $77.0 million in fiscal year 2008. Our gross profit increased 17.3% to $36.0 million in fiscal year 2009 from $30.7 million in fiscal year 2008, while our net income before extraordinary item increased 11.6% to $21.2 million in fiscal year 2009 from $19.0 million in fiscal year 2008.

Our Competitive Strengths

We believe the following strengths allow us to compete effectively in the Chinese real estate development industry:

-

We have a proven track record of successful large-scale properties development. Since our inception in 2001, we have sold approximately 95% of our completed 17 projects, which have a GFA of 1,461,991 square meters in aggregate. Our ability to cater to our customers’ preferences has been a major factor in the growth of our business. By leveraging our experience and track record, we believe that we can penetrate into the real estate markets in other tier two and tier three cities in China.

-

We have a widely recognized brand name in an attractive coastal market. We have received many awards that acknowledge the quality of our real estate developments. We believe that the quality of our real estate developments and the recognition of our brand name by our customers are important to our success.

-

We have an experienced management team. We have an experienced management team with extensive operating experience and industry knowledge. Our Chairman, Mr. Antoine Cheng, has many years of experience in working with businesses and has developed good business contacts, including in the real estate development business in China. Our Chief Executive Officer, Mr. Weiqing Zhang, has more than 15 years of experience in real estate development and our Chief Financial Officer, Mr. Zhaohui John Liang, has over 15 years of experience in real estate finance, investment and development. Mr. Yang Chen, our President, has more than 17 years of experience in accounting and financial management. In addition, our staff is well trained and is motivated by our incentive programs.

-

We have substantial land reserves at premier locations for use as new development projects. We believe that our ownership of premium land reserves and the fact that we have already planned the development of specific projects for some of those land reserves gives us an advantage over our competitors who do not have similar reserves and must acquire land before commencing their next projects.

-

We have a strong financial profile and excellent credit record. Through credit facilities with top Chinese banks, including Industrial and Commercial Bank of China, who has given us an AA rating, we are able to prudently leverage our business and take advantage of business opportunities.

-

We have a compelling growth strategy. We expect to continue our growth by achieving higher returns on projects, continuing development of large middle income residential projects, expanding operations to other tier two and tier three cities in China and acquiring projects from distressed developers.

2

Our Growth Strategy

We intend to increase our market share in the Shandong Province and in other provinces in China by pursuing the following strategies:

-

We plan to continue to expand in Shandong Province through new urban development projects. In the next five years we will continue to focus on real estate development along the coastline of the Shandong peninsula, particularly in the Qingdao and Weihai regions. We believe that the real estate market in the Qingdao-Weihai region will remain strong over the next several years, not only due to the market awareness created by the global media coverage of Qingdao and its Olympic sailing events, but also because of the unique attraction the region holds for international customers, travelers and investors.

-

We plan to continue to provide cost-effective properties for middle income customers. We intend to capitalize on growth opportunities by continuing to offer high-quality mid-sized residential units featuring modern designs and convenient facilities at competitive prices to middle-income consumers in China.

-

We plan to penetrate the high-end real estate market. We intend to penetrate into the high-end real estate market by developing villas, hotels, and commercial and office buildings that generate high returns. We expect these high-end projects to generate higher returns on investment than middle-income residential properties.

-

We plan to improve project management and cost control. We expect to improve our project management by adopting more stringent financial disciplines in our operations at each stage that will help us to increase our returns on our project investments. We will use our capital more effectively by better managing our assets, receivables and expenditures to attain pre-set targets. We will better anticipate the best land rights reserves for development and will be able to capture them at the lowest prices to maximize our potential returns on our land and on our project investments.

Our Corporate History and Background

We organized under the laws of the Cayman Islands on March 10, 2006 as a blank check development stage company formed for the purpose of acquiring an operating business, through a stock exchange, asset acquisition or similar business combination. From our inception until we completed our reverse acquisition of Leewell on April 14, 2010, our operations consisted entirely of identifying, investigating and conducting due diligence on potential businesses for acquisition.

On April 14, 2010, we completed a reverse acquisition transaction through a share exchange with Leewell whereby we acquired 100% of the issued and outstanding capital stock of Leewell. As a result of the reverse acquisition, Leewell became our wholly-owned subsidiary and Longhai Holdings Company Limited, or Longhai Holdings, the former shareholder of Leewell, became our controlling shareholder. The share exchange transaction with Leewell was treated as a reverse acquisition, with Leewell as the acquirer and China Oumei Real Estate Inc. as the acquired party.

On April 14, 2010, we also completed a private placement transaction with a group of accredited investors. Pursuant to a subscription agreement with the investors, or the Subscription Agreement, we issued to the investors an aggregate of 2,774,700 units, or the Units, for a purchase price of $11,098,800, or $4.00 per Unit. Each Unit consists of one Preference Share, and one warrant to purchase 0.5 ordinary shares, or the Warrants. See “History and Corporate Structure” below for a detailed description of the reverse acquisition and the private placement transaction.

3

Our Corporate Structure

All of our business operations are conducted through our Chinese subsidiaries. The chart below presents our corporate structure:

Office Location

Our principal business office is located in China at Floor 28, Block C Longhai Mingzhu Building, No.182 Haier Road, Qingdao 266000. The telephone number at our executive offices is (86) 532 8099 7969. Our registered office is PO Box 309, Ugland House, Grand Cayman, KY1-1104, Cayman Islands and our registered agent is Maples Corporate Services Limited. We maintain a website at http://www.chinaoumeirealestate.com that contains information about our company, but that information is not part of this prospectus.

4

The Offering

| Ordinary shares offered(1) |

shares, ( shares, if the underwriters exercise the overallotment option) |

| Ordinary shares outstanding immediately after the offering(2) |

shares, ( shares, if the underwriters exercise the overallotment option) |

| Offering price |

$ per share |

| Use of proceeds |

We intend to use the net proceeds from this offering for working capital and general corporate purposes. See “Use of Proceeds” on page 21 for more information on the use of proceeds. |

| Risk factors |

See “Risk Factors” and other information included in this prospectus for a discussion of the risks you should carefully consider before deciding to invest in our ordinary shares. |

| Proposed trading market and symbol |

We have applied for the listing of our ordinary shares on the NASDAQ Global Market under symbol “OMEI”. There can, however, be no assurance that our ordinary shares will be accepted for listing on the NASDAQ Global Market. |

(1) We are also concurrently registering for resale under a separate Resale Prospectus 765,000 ordinary shares and 2,774,700 ordinary shares underlying the Preference Shares held by the selling stockholders named under such prospectus and 1,526,085 ordinary shares that have been or may be acquired upon the exercise of warrants that have been previously issued to the selling stockholders named in such prospectus. None of these securities registered under the Resale Prospectus are being offered by us and we will not receive any proceeds from the sale of these shares.

(2) Based on (i) 31,000,062 ordinary shares issued and outstanding as of the date of this prospectus and (ii) ordinary shares issued in the public offering (excluding 1,526,085 ordinary shares underlying warrants that were issued on April 14, 2010).

5

Summary Consolidated Financial Information

The following selected historical financial information should be read in conjunction with our consolidated financial statements and related notes and the information contained in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” below. The selected consolidated statement of operations data and statement of cash flows data for the years ended December 25, 2007, 2008, and 2009 and the selected balance sheet data as of December 25, 2008 and 2009 are derived from the audited consolidated financial statements of Leewell included elsewhere in this prospectus. The selected balance sheet data as of December 25, 2007 are derived from the unaudited consolidated financial statements of Leewell not included in this prospectus. We derived our selected consolidated financial data as of September 25, 2010 and for the nine months ended September 25, 2009 and 2010 from our unaudited consolidated financial statements included elsewhere in this prospectus, which include all adjustments, consisting of normal recurring adjustments, that our management considers necessary for a fair presentation of our financial position and results of operations as of the dates and for the periods presented.

The audited consolidated financial statements of Leewell for the fiscal years ended December 25, 2007, 2008, and 2009 and our unaudited consolidated financial statements for the nine months ended September 25, 2009 and 2010 are prepared and presented in accordance with generally accepted accounting principles in the United States, or U.S. GAAP. The selected financial data information is only a summary and should be read in conjunction with the historical consolidated financial statements and related notes contained elsewhere herein. The financial statements contained elsewhere fully represent our financial condition and operations; however, they are not indicative of our future performance.

| Fiscal Year Ended | Nine Months Ended | ||||||||||||||

| U.S. dollars, except shares | December 25, | September 25, | |||||||||||||

| 2007 | 2008 | 2009 | 2009 | 2010 | |||||||||||

| Statements of Operations Data | (Unaudited) | (Unaudited) | |||||||||||||

| Total sales | $ | 51,850,312 | $ | 77,032,561 | $ | 94,315,500 | $ | 42,545,067 | $ | 88,842,133 | |||||

| Total cost of sales | (36,243,778 | ) | (46,321,251 | ) | (58,296,408 | ) | (28,397,838 | ) | (60,110,257 | ) | |||||

| Gross profit | 15,606,534 | 30,711,310 | 36,019,092 | 14,147,229 | 28,731,876 | ||||||||||

| Advertising expenses | (46,492 | ) | (112,263 | ) | (268,222 | ) | (209,036 | ) | (203,004 | ) | |||||

| Commission expenses | (134,989 | ) | (574,262 | ) | (84,982 | ) | (104,071 | ) | (188,341 | ) | |||||

| Selling expenses | (2,187 | ) | (81,415 | ) | (49,800 | ) | (32,750 | ) | (56,076 | ) | |||||

| Bad debt recovery (expense) | (245,243 | ) | (1,198,942 | ) | (207,523 | ) | (331,680 | ) | 432,455 | ||||||

| General and administrative expenses | (807,589 | ) | (2,283,744 | ) | (4,655,596 | ) | (1,745,329 | ) | (5,639,461 | ) | |||||

| Income from operations | 14,370,034 | 26,460,684 | 30,752,969 | 11,724,363 | 23,077,449 | ||||||||||

| Income before income taxes and extraordinary item | 14,309,351 | 25,583,919 | 30,213,512 | 11,067,969 | 23,005,207 | ||||||||||

| Income taxes | (5,090,161 | ) | (6,602,194 | ) | (9,058,226 | ) | (3,822,071 | ) | (7,768,007 | ) | |||||

| Income before extraordinary item | 9,219,190 | 18,981,725 | 21,155,286 | 7,245,898 | 15,237,200 | ||||||||||

| Extraordinary item, net | - | 12,499,576 | - | - | - | ||||||||||

| Net income | $ | 9,219,190 | $ | 31,481,301 | $ | 21,155,286 | $ | 7,245,898 | 15,237,200 | ||||||

| Earnings per common share basic | $ | 921.92 | $ | 0.31 | $ | 0.21 | $ | 0.24 | $ | 0.50 | |||||

| Earnings per common share diluted | $ | 921.92 | $ | 0.31 | $ | 0.21 | $ | 0.24 | $ | 0.47 | |||||

| Weighted average common shares outstanding basic | 10,000 | 102,566,690 | 102,566,690 | 30,692,945 | 30,692,945 | ||||||||||

| Weighted average common shares outstanding diluted | 10,000 | 102,566,690 | 102,566,690 | 30,692,945 | 32,353,715 | ||||||||||

| As of December 25, | As of | |||||||||||

| September | ||||||||||||

| 2007 | 2008 | 2009 | 25, 2010 | |||||||||

| Balance Sheet Data | (Unaudited) | (Unaudited) | ||||||||||

| Working capital | $ | 9,465,778 | $ | 18,831,257 | $ | 44,207,072 | $ | 107,599,262 | ||||

| Total assets | 87,822,788 | 178,648,355 | 196,332,843 | 231,482,426 | ||||||||

| Total liabilities | 59,977,634 | 115,401,647 | 101,981,897 | 107,902,398 | ||||||||

| Stockholders’ equity | 27,845,154 | 63,246,708 | 94,350,946 | 123,580,028 | ||||||||

6

RISK FACTORS

The ordinary shares being offered by us are highly speculative in nature, involve a high degree of risk and should be purchased only by persons who can afford to lose the entire amount invested in our ordinary shares. Before purchasing any of our ordinary shares, you should carefully consider the following factors relating to our business and prospects. You should pay particular attention to the fact that we conduct all of our operations in China and are governed by a legal and regulatory environment that in some respects differs significantly from the environment that may prevail in the U.S. and other countries. If any of the following risks actually occurs, our business, financial condition or operating results will suffer, the trading price of our ordinary shares could decline, and you may lose all or part of your investment.

RISKS RELATED TO OUR BUSINESS

The recent financial crisis could negatively affect our business, results of operations, and financial condition.

The recent credit crisis and turmoil in the global financial system may have an impact on our business and our financial condition, and we may face challenges if conditions in the financial markets do not improve. Our ability to access the capital markets may be restricted at a time when we would like, or need, to raise capital, which could have an impact on our flexibility to react to changing economic and business conditions. Our business requires access to substantial financing. If we are not able to obtain adequate financing in a timely manner, our ability to complete existing projects and expand our business could be materially adversely affected. In addition, these economic conditions also impact levels of consumer spending, which have recently deteriorated significantly and may remain depressed for the foreseeable future. Real estate market generally declines during recessionary periods and other periods where disposable income is adversely affected. If demand for our products fluctuates as a result of economic conditions or otherwise, our revenue and gross margin could be harmed.

Our business is susceptible to fluctuations in the real estate market of China, especially in certain areas of eastern China where our operations are concentrated, which may adversely affect our sales and results of operations.

Our business depends substantially on the conditions of the PRC real estate market. Demand for real estate in China has grown rapidly in the recent decade but such growth is often coupled with volatility in market conditions and fluctuations in real estate prices. For example, the rapid expansion of the real estate market in major provinces and cities in China in the early 1990s, such as Shanghai, Beijing and Guangdong province, led to an oversupply in the mid-1990s and a corresponding fall in real estate values and rentals in the second half of the decade. Following a period of rising real estate prices and transaction volume in most major cities, the industry experienced a severe downturn in 2008, with transaction volume in many major cities declining by more than 40% compared to 2007.

Average selling prices also declined in many cities during 2008. Fluctuations of supply and demand in China’s real estate market are caused by economic, social, political and other factors. To the extent fluctuations in the real estate market adversely affect real estate transaction volumes or prices, our financial condition and results of operations may be materially and adversely affected.

We are heavily dependent on the performance of the residential property market in China, which is at a relatively early development stage.

The residential property industry in the PRC is still in a relatively early stage of development. Although demand for residential property in the PRC has been growing rapidly in recent years, such growth is often coupled with volatility in market conditions and fluctuation in property prices. It is extremely difficult to predict how much and when demand will develop, as many social, political, economic, legal, and other factors, most of which are beyond our control, may affect the development of the market. The level of uncertainty is increased by the limited availability of accurate financial and market information and the overall low level of transparency in the PRC, especially in tier-two cities that have lagged in progress in these aspects when compared to tier-one cities.

The lack of a liquid secondary market for residential property may discourage investors from acquiring new properties. The limited amount of property mortgage financing available to PRC individuals may further inhibit demand for residential developments.

7

The PRC government has recently introduced certain policy and regulatory measures to control the rapid increase in housing prices and cool down the real estate market and our business may be materially and adversely affected by these government measures.

Since the second half of 2009, the PRC real estate market has experienced strong recovery from the financial crisis and housing prices rose rapidly in certain cities. In response to concerns over the scale of the increase in property investments, the PRC government has implemented measures and introduced policies to curtail property speculation and promote the healthy development of the real estate industry in China. On January 7, 2010, the PRC State Council issued a circular to control the rapid increase in housing prices and cool down the real estate market in China. It reiterated that the purchasers of a second residential property for their households must make down payments of no less than 40% of the purchase price and real estate developers must commence the sale within the mandated period as set forth in the pre-sale approvals and at the publicly announced prices. The circular also requested the local government to increase the effective supply of low-income housing and ordinary commodity housing and instructed the People's Bank of China, or PBOC, and the China Bank Regulatory Commission to tighten the supervision of the bank lending to the real estate sector and mortgage financing. On February 25, 2010, the PBOC increased the reserve requirement ratio for commercial banks by 0.5% to 16.5% and has further increased it from 16.5% to 17.0% effective May 10, 2010. Further, in order to implement the requirements set out in the State Council's circular, the Ministry of Land and Resources, or the MLR, issued a notice on March 8, 2010 in relation to increasing the supply of, and strengthening the supervision over, land for real estate development purposes. MLR's notice stipulated that the floor price of a parcel of land must not be lower than 70% of the benchmark land price set for the area in which the parcel is located, and that real estate developers participating in land auctions must pay a deposit equivalent to 20% of the land parcel's floor price. In April 2010, the PRC State Council issued a further circular, which provided as follows: purchasers of a first residential property for their households with a gross floor area of greater than 90 square meters must make down payments of no less than 30% of the purchase price; purchasers of a second residential property for their households must make down payments of no less than 50% of the purchase price and the interest rate of any mortgage for such property must equal at least the benchmark interest rate plus 10%; and for purchasers of a third residential property, both the minimum down payment amount and applied interest rate must be significantly higher than the relevant minimum down payment and interest rate which would have been applicable prior to the issuance of the circular (the specific figures shall be decided by the relevant bank on a case-by-case based on the principle of proper risk management). Moreover, the circular provided that banks can decline to provide mortgage financing to either a purchaser of a third residential property or a non-resident purchaser. It is possible that the government agencies may adopt further measures to implement the policies outlined in the January and April circulars. The full effect of the circulars on the real estate industry and our business will depend in large part on the implementation and interpretation of the circulars by governmental agencies, local governments and banks involved in the real estate industry. The PRC government's policies and regulatory measures on the PRC real estate sector could limit our access to required financing and other capital resources, adversely affect the property purchasers' ability to obtain mortgage financing or significantly increase the cost of mortgage financing, reduce market demand for our properties and increase our operating costs. We cannot be certain that the PRC government will not issue additional and more stringent regulations or measures or that agencies and banks will not adopt restrictive measures or practices in response to PRC governmental policies and regulations, which could substantially reduce pre-sales of our properties and cash flow from operations and substantially increase our financing needs, which would in turn materially and adversely affect our business, financial condition, results of operations and prospects.

Our sales will be affected if mortgage financing becomes more costly or otherwise becomes less attractive.

Substantially all purchasers of our residential properties rely on mortgages to fund their purchases. An increase in interest rates may significantly increase the cost of mortgage financing, thus affecting the affordability of residential properties. In 2008, PBOC changed the lending rates five times. The benchmark lending rate for loans with a term of over five years, which affects mortgage rates, was increased to 5.94% on December 31, 2008. The PRC government and commercial banks may also increase the down payment requirement, impose other conditions or otherwise change the regulatory framework in a manner that would make mortgage financing unavailable or unattractive to potential property purchasers. If the availability or attractiveness of mortgage financing is reduced or limited, many of our prospective customers may not be able to purchase our properties and, as a result, our business, liquidity and results of operations could be adversely affected.

If we are prevented from guaranteeing loans to prospective home purchasers, our sales and pre-sales may decline.

In line with industry practice, we provide guarantees to PRC banks with respect to loans procured by the purchasers of our properties, in the form of a transfer of 5% of the home purchasers’ loan amount from our bank account to a bank designated account, as collateral for the home purchasers’ timely debt service payments. The bank will release these deposits after construction is completed, final deliveries are made, and home purchasers have obtained the ownership documents necessary to secure a mortgage loan. If there are changes in laws, regulations, policies, and practices that would prohibit property developers from providing guarantees to banks in respect of mortgages offered to property purchasers and as a result, banks would not accept any alternative guarantees by third parties, or if no third party is available or willing in the market to provide such guarantees, it may become more difficult for property purchasers to obtain mortgages from banks and other financial institutions during sales and pre-sales of our properties. Such difficulties in financing could result in a substantially lower rate of sale and pre-sale of our properties, which would adversely affect our cash flow, financial condition, and results of operations. We are not aware of any impending changes in laws, regulations, policies, or practices that will prohibit such practice in China. However, there can be no assurance that such changes in laws, regulations, policies, or practices will not occur in China in the future.

8

We may be unable to acquire land use rights from the government through Longhai Group as we currently do which could increase our cost of sales.

Our revenue depends on the completion and sale of our projects, which in turn depends on our ability to acquire land use rights for such projects. Our land use rights costs are a major component of our cost of real estate sales and increases in such costs could diminish our gross margin. From time to time, we acquire our land use rights through companies owned by Longhai Group, a company wholly-owned by Mr. Antoine Cheng, our Chairman. Longhai Group’s primary business is infrastructure and building construction. Through its infrastructure construction business, Longhai Group works with local governments and often finances (by agreeing to be paid sometime following the completion of construction instead of being paid as construction progresses) the government’s public infrastructure projects that can include old city relocation projects. In exchange for such financing, the local governments invite Longhai Group to bid for premium parcels of land for residential use at public auction as a preferred candidate or grant Longhai Group the right of first refusal to bid for industrial parcels for which the Longhai Group already has land use rights, but whose use has been changed to real estate development. Since Longhai Group does not have the necessary license to engage in residential development in China, it typically sold companies owning these land use rights to us so that we could develop these parcels using our real estate development license.

Although we believe that the aforementioned way in which Longhai Group obtains land use rights is consistent with the PRC government’s long-term policy to develop healthy real estate market, we cannot assure you that the local government will continue to provide Longhai Group land use rights in this way in the future. If this happens, we will have to acquire our land use rights primarily through a public tender, auction or listing-for-sale. Competition in these bidding processes can result in higher land use rights costs for us. In addition, we may not successfully obtain desired land use rights at commercially reasonable costs due to the increasingly intense competition in the bidding processes. We may also need to acquire land use rights through acquisition, which could increase our costs.

We have significant short-term debt obligations, which mature in less than one year. Failure to extend those maturities of, or to refinance, that debt could result in defaults, and in certain instances, foreclosures on our assets. Moreover, we may be unable to obtain financing to fund ongoing operations and future growth.

The real estate development industry is capital intensive, and development requires significant up-front expenditures to acquire land and begin development. Accordingly, we incur substantial indebtedness to finance our development activities.

At September 25, 2010, we had short-term bank loans outstanding of $1,649,636, long-term bank loans of $3,286,800 maturing within one year, long-term bank loans of $32,270,400 maturing in more than one year, and notes payable of $0, which were secured by our land use rights and projects under construction. Failure to obtain extensions of the maturity dates of, or to refinance, these obligations or to obtain additional equity financing to meet these debt obligations would result in an event of default with respect to such obligations and could result in the foreclosure on the collateral. The sale of such collateral at foreclosure would significantly disrupt our business, which could significantly lower our sales and profitability. We may be able to refinance or obtain extensions of the maturities of all or some of such debt only on terms that significantly restrict our ability to operate, including terms that place additional limitations on our ability to incur other indebtedness, to pay dividends, to use our assets as collateral for other financing, to sell assets or to make acquisitions or enter into other transactions. Such restrictions may adversely affect our ability to finance our future operations or to engage in other business activities. If we finance the repayment of our outstanding indebtedness by issuing additional equity or convertible debt securities, such issuances could result in substantial dilution to our stockholders.

While we believe that our revenue growth projections and our ongoing cost controls will allow us to generate cash and achieve profitability in the foreseeable future, there is no assurance as to when or if we will be able to achieve our projections. Our future cash flows from operations, combined with our accessibility to cash and credit, may not be sufficient to allow us to finance ongoing operations or to make required investments for future growth. We may need to seek additional credit or access capital markets for additional funds. There is no assurance that we would be successful in this regard.

9

Our practice of pre-selling projects may expose us to substantial liabilities.

It is common practice by property developers in China, including us, to pre-sell properties (while still under construction), which involves certain risks. For example, we may fail to complete a property development that may have been fully or partially pre-sold, which would leave us liable to purchasers of pre-sold units for losses suffered by them without adequate resources to pay the liability if funds have been used on the project. In addition, if a pre-sold property development is not completed on time, the purchasers of pre-sold units may be entitled to compensation for late delivery. If the delay extends beyond a certain period, the purchasers may be entitled to terminate the pre-sale agreement and pursue a claim for damages that exceeds the amount paid and our ability to recoup the resulting liability from future sales.

We may not be able to successfully execute our strategy of expanding into new geographical markets in China, which could have a material adverse effect on our business and results of operations.

We plan to continue to expand our business into new geographical areas in China. Since China is a large and diverse market, consumer trends and demands may vary significantly by region and our experience in the markets in which we currently operate may not be applicable in other parts of China. As a result, we may not be able to leverage our experience to expand into other parts of China. When we enter new markets, we may face intense competition from companies with greater experience or an established presence in the targeted geographical areas or from other companies with similar expansion targets. Therefore, we may not be able to grow our sales in the new cities we enter due intense competitive pressures and or the substantial costs involved.

We are dependent on third-party subcontractors, manufacturers, and distributors for all architecture, engineering and construction services, and construction materials. A discontinued supply of such services and materials will adversely affect our projects.

We are dependent on third-party subcontractors, manufacturers, and distributors for all architecture, engineering and construction services, and construction materials. Services and materials purchased from our five largest subcontractors or suppliers accounted for 96.9% for the year ended December 25, 2009. A discontinued supply of such services and materials will adversely affect our construction projects and the success of the Company.

We are subject to extensive government regulation that could cause us to incur significant liabilities or restrict our business activities.

Regulatory requirements could cause us to incur significant liabilities and operating expenses and could restrict our business activities. We are subject to statutes and rules regulating, among other things, certain developmental matters, building and site design, and matters concerning the protection of health and the environment. Our operating expenses may be increased by governmental regulations, such as building permit allocation ordinances and impact and other fees and taxes, that may be imposed to defray the cost of providing certain governmental services and improvements. Any delay or refusal from government agencies to grant us necessary licenses, permits, and approvals could have an adverse effect on our operations.

We depend on the availability of additional human resources for future growth.

We are currently experiencing a period of significant growth in our sales volume. We believe that continued expansion is essential for us to remain competitive and to capitalize on the growth potential of our business. Such expansion may place a significant strain on our management and operations and financial resources. As our operations continue to grow, we will have to continually improve our management, operational, and financial systems, procedures and controls, and other resources infrastructure, and expand our workforce. There can be no assurance that our existing or future management, operating and financial systems, procedures, and controls will be adequate to support our operations, or that we will be able to recruit, retain, and motivate our employees. Further, there can be no assurance that we will be able to establish, develop, or maintain the business relationships beneficial to our operations, or to do so or to implement any of the above activities in a timely manner. Failure to manage our growth effectively could have a material adverse effect on our business and the results of our operations and financial condition.

10

We may be adversely affected by the fluctuation in raw material prices and selling prices of our products.

The land and raw materials used in our projects have experienced significant price fluctuations in the past. There is no assurance that they will not be subject to future price fluctuations or pricing control. The land and raw materials used in our projects may experience price volatility caused by events such as market fluctuations or changes in governmental programs. The market price of land and raw materials may also experience significant upward adjustment, if, for instance, there is a material under-supply or over-demand in the market. These price changes may ultimately result in increases in the selling prices of our products, and may, in turn, adversely affect our sales volume, sales, operating income, and net income.

We face intense competition from other real estate developers.

The property industry in the PRC is highly competitive. In the tier-two cities we focus on, local and regional property developers are our major competitors, and an increasing number of large state-owned and private national property developers have started entering these markets. Many of our competitors, especially the state-owned and private national property developers, are well capitalized and have greater financial, marketing, and other resources than we have. Some also have larger land banks, greater economies of scale, broader name recognition, a longer track record, and more established relationships in certain markets. In addition, the PRC government’s recent measures designed to reduce land supply further increased competition for land among property developers.

Competition among property developers may result in increased costs for the acquisition of land for development, increased costs for raw materials, shortages of skilled contractors, oversupply of properties, decrease in property prices in certain parts of the PRC, a slowdown in the rate at which new property developments will be approved and/or reviewed by the relevant government authorities and an increase in administrative costs for hiring or retaining qualified personnel, any of which may adversely affect our business and financial condition. Furthermore, property developers that are better capitalized than we are may be more competitive in acquiring land through the auction process. If we cannot respond to changes in market conditions as promptly and effectively as our competitors, or effectively compete for land acquisition through the auction systems and acquire other factors of production, our business and financial condition will be adversely affected.

In addition, risk of property over-supply is increasing in parts of China, where property investment, trading and speculation have become overly active. We are exposed to the risk that in the event of actual or perceived over-supply, property prices may fall drastically, and our revenue and profitability will be adversely affected.

We may have to suffer monetary losses by reducing up to $0.80 of the excise price of the warrants that we issued to our investors in the April 2010 private placement since the registration statement of which this prospectus is a part has not been declared effective within the time periods specified.

In connection with the April 2010 private placement described above, we entered into a Subscription Agreement. Under the terms of the Subscription Agreement, if this registration statement is not declared effective by the SEC within 180 days following the closing of the April 2010 private placement, then we are required to pay the investors, as liquidated damages, 1.0% of the amount invested for each 30-day period during which such failure continues, for up to a maximum of 10% of each investor’s investment pursuant to the Subscription Agreement. On October 11, 2010, we entered into Amendment No. 1 to the Subscription Agreement with certain investors, pursuant to which we amended Section 8.1 of the Subscription Agreement with respect to the liquidated damages that we may be liable for. Pursuant to Amendment No. 1, in lieu of the cash liquidated damages amount that would otherwise have been payable by us for our failure to cause this registration statement to be declared effective within the prescribed period, we are required to reduce the initial exercise price of the warrants issued to each investor by $0.08 per calendar month, or portion thereof, until such time that this registration statement is declared effective by the SEC; provided that, in no event will we be obligated to reduce the initial exercise price of the warrants by more than $0.80 in aggregate. We have failed to cause this registration statement to be declared effective by the SEC with the prescribed period. There can be no assurance that this registration statement will be declared effective by the SEC in the coming future. Therefore, we may have to suffer monetary losses by reducing up to $0.80 of the exercise price of the warrants.

We could be adversely affected by the occurrence of natural disasters.

From time to time, our developed sites may experience strong winds, storms, flooding and earth quakes. Natural disasters could impede operations, damage infrastructure necessary to our constructions and operations. The occurrence of natural disasters could adversely affect our business, the results of our operations, prospects and financial condition.

11

We have limited insurance coverage against damages or loss we might suffer.

The insurance industry in China is still in an early stage of development and business interruption insurance available in China offers limited coverage compared to that offered in many developed countries. We carry insurance for potential liabilities related to our vehicles, but we do not carry business interruption insurance and therefore any business disruption or natural disaster could result in substantial damages or losses to us. In addition, there are certain types of losses (such as losses from forces of nature) that are generally not insured because either they are uninsurable or insurance cannot be obtained on commercially reasonable terms. Should an uninsured loss or a loss in excess of insured limits occur, our business could be materially adversely affected. If we were to suffer any losses or damages to our properties, our business, financial condition and results of operations would be materially and adversely affected.

Our operating subsidiaries must comply with environmental protection laws that could adversely affect our profitability.

We are required to comply with the environmental protection laws and regulations promulgated by the national and local governments of the PRC. Some of these regulations govern the level of fees payable to government entities providing environmental protection services and the prescribed standards relating to construction. Although our construction technologies allow us to efficiently control the level of pollution resulting from our construction process, due to the nature of our business, wastes are unavoidably generated in the processes. If we fail to comply with any of these environmental laws and regulations in the PRC, depending on the types and seriousness of the violation, we may be subject to, among other things, warning from relevant authorities, imposition of fines, specific performance and/or criminal liability, forfeiture of profits made, or an order to close down our business operations and suspension of relevant permits.

Our business depends substantially on the continuing efforts of our senior executives and other key personnel, and our business may be severely disrupted if we lost their services.

Our future success heavily depends on the continued service of our senior executives and other key employees. In particular, we rely on the expertise and experience of Mr. Antoine Cheng, our Chairman, Mr. Weiqing Zhang, our Chief Executive Officer, Mr. Zhaohui John Liang, our Chief Financial Officer, and Mr. Yang Chen, our President. If one or more of our senior executives are unable or unwilling to continue to work for us in their present positions, we may have to spend a considerable amount of time and resources searching, recruiting, and integrating the replacements into our operations, which would substantially divert management’s attention from our business and severely disrupt our business. This may also adversely affect our ability to execute our business strategy. Moreover, if any of our senior executives joins a competitor or forms a competing company, we may lose customers, suppliers, know-how, and key employees.

We may be exposed to potential risks relating to our internal controls over financial reporting and our ability to have those controls attested to by our independent auditors. If we are unable to receive a positive attestation from our independent auditors with respect to our internal controls when we are required under applicable laws, investors and others may lose confidence in the reliability of our financial statements which could affect the trading price of our stock.

Our management is responsible for establishing and maintaining adequate internal controls over financial reporting. Internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements in accordance with U.S. GAAP.

As directed by Section 404 of the Sarbanes-Oxley Act of 2002, or SOX 404, the SEC adopted rules requiring public companies to include a report of management on their internal controls over financial reporting in their annual reports. In addition, the independent registered public accounting firm auditing the financial statements of a company that is not a non-accelerated filer under Rule 12b-2 of the Exchange Act must also attest to the operating effectiveness of the company’s internal controls. Since we just completed the reverse acquisition of Leewell on April 14, 2010, we have not evaluated Leewell and its consolidated subsidiaries’ internal control systems in order to allow our management to report on our internal controls on a consolidated basis as required by these requirements of SOX 404. Under current law, we will be required to complete such evaluation and include the report of management in our annual report for the fiscal year ending December 25, 2010.

We can provide no assurance that our management will conclude that our internal controls over financial reporting are effective, or that our independent registered public accounting firm will issue a positive opinion on our internal controls over financial reporting when we are required under applicable laws. In particular, we may have potential material weaknesses or significant deficiencies in our internal controls over financial reporting due to our accounting staff’s relative lack of experience and knowledge of U.S. GAAP. Our accounting staff (other than our Chief Financial Officer), including the director of our accounting department, have limited experience in preparing financial statements in accordance with U.S. GAAP and will require additional training and assistance in U.S. GAAP. We may also need to hire additional personnel who are experienced in U.S. GAAP.

Failure to achieve and maintain an effective internal control environment could result in our not being able to accurately report our financial results, prevent or detect fraud or provide timely and reliable financial and other information pursuant to the reporting obligations we have as a public company, which could have a material adverse effect on our business, financial condition and results of operations. Further, it could cause our investors to lose confidence in the information we report, which could adversely affect the price of our stock price.

12

RISKS RELATED TO DOING BUSINESS IN CHINA

Uncertainties with respect to the PRC legal system could limit the legal protections available to you and us.

We conduct substantially all of our business through our operating subsidiaries in the PRC. Our operating subsidiaries are generally subject to laws and regulations applicable to foreign investments in China and, in particular, laws applicable to foreign-invested enterprises. The PRC legal system is based on written statutes, and prior court decisions may be cited for reference but have limited precedential value. Since 1979, a series of new PRC laws and regulations have significantly enhanced the protections afforded to various forms of foreign investments in China. However, since the PRC legal system continues to evolve rapidly, the interpretations of many laws, regulations, and rules are not always uniform, and enforcement of these laws, regulations, and rules involve uncertainties, which may limit legal protections available to you and us. In addition, any litigation in China may be protracted and result in substantial costs and diversion of resources and management attention. In addition, most of our executive officers and directors are residents of China and not of the United States, and substantially all the assets of these persons are located outside the United States. As a result, it could be difficult for investors to affect service of process in the United States or to enforce a judgment obtained in the United States against our Chinese operations and subsidiaries.

You may have difficulty enforcing judgments against us.

Most of our assets are located outside of the United States and most of our current operations are conducted in the PRC. In addition, most of our directors and officers are nationals and residents of countries other than the United States. A substantial portion of the assets of these persons is located outside the United States. As a result, it may be difficult for you to effect service of process within the United States upon these persons. It may also be difficult for you to enforce in U.S. courts judgments on the civil liability provisions of the U.S. federal securities laws against us and our officers and directors, most of whom are not residents in the United States and the substantial majority of whose assets are located outside of the United States. In addition, there is uncertainty as to whether the courts of the PRC would recognize or enforce judgments of U.S. courts. Our counsel as to PRC law, has advised us that the recognition and enforcement of foreign judgments are provided for under the PRC Civil Procedures Law. Courts in China may recognize and enforce foreign judgments in accordance with the requirements of the PRC Civil Procedures Law based on treaties between China and the country where the judgment is made or on reciprocity between jurisdictions. China does not have any treaties or other arrangements that provide for the reciprocal recognition and enforcement of foreign judgments with the United States. In addition, according to the PRC Civil Procedures Law, courts in the PRC will not enforce a foreign judgment against us or our directors and officers if they decide that the judgment violates basic principles of PRC law or national sovereignty, security, or the public interest. So it is uncertain whether a PRC court would enforce a judgment rendered by a court in the United States.

The PRC government exerts substantial influence over the manner in which we must conduct our business activities.

The PRC government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to taxation, import and export tariffs, environmental regulations, land use rights, property, and other matters. We believe that our operations in China are in material compliance with all applicable legal and regulatory requirements. However, the central or local governments of the jurisdictions in which we operate may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations.

Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions thereof and could require us to divest ourselves of any interest we then hold in Chinese properties or joint ventures.

13

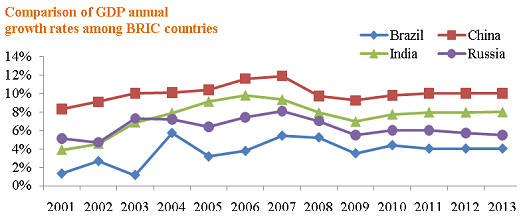

Future inflation in China may inhibit our ability to conduct business in China.

In recent years, the Chinese economy has experienced periods of rapid expansion and highly fluctuating rates of inflation. During the past ten years, the rate of inflation in China has been as high as 5.9% and as low as -0.8%. These factors have led to the adoption by the Chinese government, from time to time, of various corrective measures designed to restrict the availability of credit or regulate growth and contain inflation. High inflation may in the future cause the Chinese government to impose controls on credit and/or prices, or to take other action, which could inhibit economic activity in China, and thereby harm the market for our products and our company.

Restrictions on currency exchange may limit our ability to receive and use our sales effectively.

The majority of our sales will be settled in RMB and U.S. dollars, and any future restrictions on currency exchanges may limit our ability to use revenue generated in RMB to fund any future business activities outside China or to make dividend or other payments in U.S. dollars. Although the Chinese government introduced regulations in 1996 to allow greater convertibility of the RMB for current account transactions, significant restrictions still remain, including primarily the restriction that foreign-invested enterprises may only buy, sell or remit foreign currencies after providing valid commercial documents, at those banks in China authorized to conduct foreign exchange business. In addition, conversion of RMB for capital account items, including direct investment and loans, is subject to governmental approval in China, and companies are required to open and maintain separate foreign exchange accounts for capital account items. We cannot be certain that the Chinese regulatory authorities will not impose more stringent restrictions on the convertibility of the RMB.

Fluctuations in exchange rates could adversely affect our business and the value of our securities.

Because our business transactions are denominated in RMB and our funding and results of operations will be denominated in USD, fluctuations in exchange rates between USD and RMB will affect our balance sheet and financial results. Since July 2005, RMB is no longer solely pegged to the USD but instead is pegged against a basket of currencies as a whole in order to keep a more stable exchange rate for international trading. With the very strong economic growth in China in the last few years, RMB is facing very high pressure to appreciate against USD. Such pressure could result more fluctuations in exchange rates and in turn our business would be suffered from higher exchange rate risk. There are very limited hedging tools available in China to hedge our exposure in exchange rate fluctuations. The hedging tools that are available are also ineffective in the sense that these hedges cannot be freely preformed in the PRC financial market, and more important, the frequent changes in PRC exchange control regulations would limit our hedging ability for RMB.

Restrictions under PRC law on our PRC subsidiaries' ability to make dividends and other distributions could materially and adversely affect our ability to grow, make investments or acquisitions that could benefit our business, pay dividends to you, and otherwise fund and conduct our business.

Substantially all of our sales are earned by our PRC subsidiaries. However, as discussed more fully under “Business – PRC Government Regulations – Dividend Distributions,” PRC regulations restrict the ability of our PRC subsidiaries to make dividends and other payments to their offshore parent company. Any limitations on the ability of our PRC subsidiaries to transfer funds to us could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our business, pay dividends and otherwise fund and conduct our business.

Failure to comply with PRC regulations relating to the establishment of offshore special purpose companies by PRC residents may subject our PRC resident shareholders to personal liability, limit our ability to acquire PRC companies or to inject capital into our PRC subsidiaries, limit our PRC subsidiaries' ability to distribute profits to us or otherwise materially adversely affect us.

In October 2005, the PRC State Administration of Foreign Exchange, or SAFE, issued the Notice on Relevant Issues in the Foreign Exchange Control over Financing and Return Investment Through Special Purpose Companies by Residents Inside China, generally referred to as Circular 75. Circular 75 and its implementing guidelines, issued in June 2007 (known as Notice 106), require PRC residents to register with the competent local SAFE branch before establishing or acquiring control over an offshore special purpose company, or SPV, for the purpose of engaging in an equity financing outside of China. See “Business – PRC Government Regulations – Circular 75” for a detailed discussion of Circular 75 and its implementation.

14

We have asked our shareholders, who are PRC residents as defined in Circular 75, to register with the relevant branch of SAFE, as currently required, in connection with their equity interests in us and our acquisitions of equity interests in our PRC subsidiaries. However, we cannot provide any assurances that they can obtain the above SAFE registrations required by Circular 75 and Notice 106. Moreover, because of uncertainty over how Circular 75 will be interpreted and implemented, and how or whether SAFE will apply it to us, we cannot predict how it will affect our business operations or future strategies. For example, our present and prospective PRC subsidiaries' ability to conduct foreign exchange activities, such as the remittance of dividends and foreign currency-denominated borrowings, may be subject to compliance with Circular 75 and Notice 106 by our PRC resident beneficial holders.

In addition, such PRC residents may not always be able to complete the necessary registration procedures required by Circular 75 and Notice 106. We also have little control over either our present or prospective direct or indirect shareholders or the outcome of such registration procedures. A failure by our PRC resident beneficial holders or future PRC resident shareholders to comply with Circular 75 and Notice 106, if SAFE requires it, could subject these PRC resident beneficial holders to fines or legal sanctions, restrict our overseas or cross-border investment activities, limit our subsidiaries' ability to make distributions or pay dividends or affect our ownership structure, which could adversely affect our business and prospects.

Our business and financial performance may be materially adversely affected if the PRC regulatory authorities determine that our acquisition of Oumei constitutes a Round-trip Investment without MOFCOM approval.

On August 8, 2006, six PRC regulatory agencies promulgated the Regulation on Mergers and Acquisitions of Domestic Companies by Foreign Investors, or the 2006 M&A Rule, which regulate “Round-trip Investments,” defined as having taken place when a PRC business that is owned by PRC individual(s) is sold to a non-PRC entity that is established or controlled, directly or indirectly, by those same PRC individual(s). See “Business – PRC Government Regulations – Mergers and Acquisitions” for a detailed discussion of the 2006 M&A Rule.