Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Local Insight Regatta Holdings, Inc. | d8k.htm |

Exhibit 99.1

Exhibit 99.1

BONDHOLDER DUE DILIGENCE MATERIALS

NOVEMBER 2010

STRICTLY CONFIDENTIAL

NOT TO BE SHARED WITH ANY PARTY

OTHER THAN RECIPIENT WITHOUT PRIOR

WRITTEN CONSENT OF THE COMPANY

Disclaimer

Safe Harbor for Forward-Looking Statements; Cautionary Statements

This presentation contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In some cases, forward-looking statements can be identified by terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue,” “assumption” or the negative of these terms or other comparable terminology. Regardless of any identifying phrases, these statements relate to future events or future financial performance, and involve known and unknown risks, uncertainties and other factors that may cause actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Although Local Insight Media Holdings, Inc. (together with its subsidiaries, the “Company”) believes that the expectations reflected in these forward-looking statements are reasonable, the Company cannot guarantee future results, levels of activity, performance or achievements. The Company cautions that these forward-looking statements are based on assumptions that are subject to a wide range of risks and uncertainties. These and other risks and uncertainties are described in detail in Local Insight Regatta Holdings, Inc.’s (“Regatta”) Annual Report on Form 10-K for the year ended December 31, 2009, Regatta’s Quarterly Report on Form 10-Q fo rthe quarter ended June 30, 2010 and Regatta’s other periodic filings with the SEC, which are available on the SEC’s internet site (http://www.sec.gov). Recipients are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements made herein are only made as of the date of this presentation, and the Company undertakes no obligation to publicly revise or update such forward-looking statements to reflect events or circumstances that occur after the date of this presentation or to reflect the occurrence of any unanticipated event

STRICTLY CONFIDENTIAL

NOT TO BE SHARED WITH ANY PARTY

OTHER THAN RECIPIENT WITHOUT PRIOR

WRITTEN CONSENT OF THE COMPANY

Table of Contents

BERRY LEADS PERFORMANCE 1

FINANCIAL PERFORMANCE DETAIL 3

CAPITAL STRUCTURE AND LIQUIDITY 10

PROJECTED FINANCIALS 13 APPENDIX

STRICTLY CONFIDENTIAL

NOT TO BE SHARED WITH ANY PARTY

OTHER THAN RECIPIENT WITHOUT PRIOR

WRITTEN CONSENT OF THE COMPANY

I Berry Leads Performance

STRICTLY CONFIDENTIAL

NOT TO BE SHARED WITH ANY PARTY

OTHER THAN RECIPIENT WITHOUT PRIOR

WRITTEN CONSENT OF THE COMPANY

BERRY LEADS PERFORMANCE

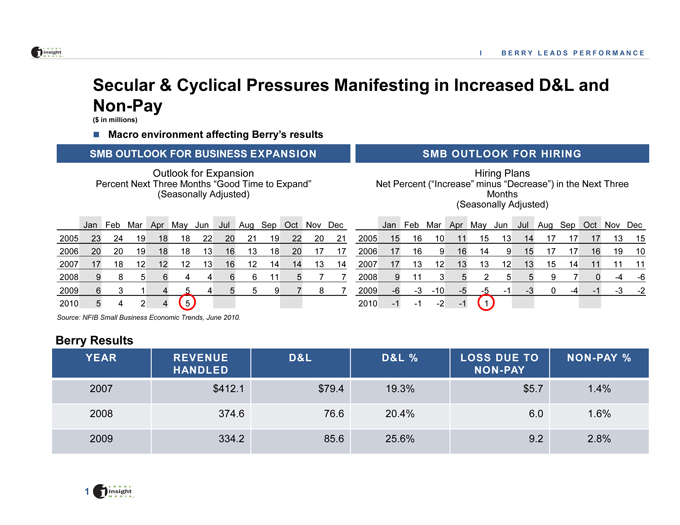

Secular & Cyclical Pressures Manifesting in Increased D&L and Non-Pay

($ in millions)

? Macro environment affecting Berry’s results

Outlook for Expansion Hiring Plans

Percent Next Three Months “Good Time to Expand” Net Percent (“Increase” minus “Decrease”) in the Next Three

(Seasonally Adjusted) Months

(Seasonally Adjusted)

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

23 24 19 18 18 22 20 21 19 22 20 21 2005 15 16 10 11 15 13 14 17 17 17 13 15

20 20 19 18 18 13 16 13 18 20 17 17 2006 17 16 9 16 14 9 15 17 17 16 19 10

17 18 12 12 12 13 16 12 14 14 13 14 2007 17 13 12 13 13 12 13 15 14 11 11 11

9856446611 577 2008 911 35255970-4-6

| 6 |

|

3 14 5 4 5 5 9 7 8 7 2009 -6 -3 -10 -5 -5 -1-3 0-4 -1 -3 -2 |

| 5 |

|

4 2 4 ^5^ 2010 ~A ~A ~2 ~A ^ |

Source: NFIB Small Business Economic Trends, June 2010.

Berry Results

YEAR REVENUE D&L D&L % LOSS DUE TO NON-PAY NON-PAY %

2007 $412.1 $79.4 19.3% $5.7 1.4%

374.6 76.6 20.4% 6.0 1.6%

334.2 85.6 25.6% 9.2 2.8%

STRICTLY CONFIDENTIAL

NOT TO BE SHARED WITH ANY PARTY

OTHER THAN RECIPIENT WITHOUT PRIOR

WRITTEN CONSENT OF THE COMPANY

BERRY LEADS PERFORMANCE

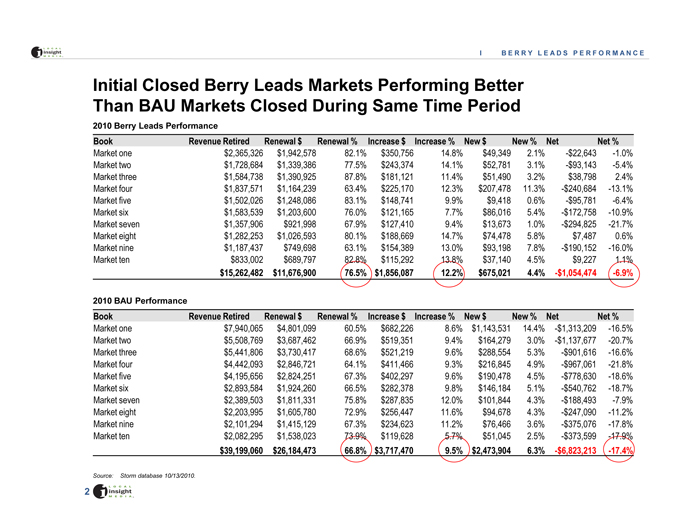

Initial Closed Berry Leads Markets Performing Better Than BAU Markets Closed During Same Time Period

2010 Berry Leads Performance

Book Revenue Retired Renewal $ Renewal % Increase $ Increase % New$ New% Net Net%

Market one $2,365,326 $1,942,578 82.1% $350,756 14.8% $49,349 2.1% -$22,643 -1.0% Market two $1,728,684 $1,339,386 77.5% $243,374 14.1% $52,781 3.1% -$93,143 -5.4% Market three $1,584,738 $1,390,925 87.8% $181,121 11.4% $51,490 3.2% $38,798 2.4% Market four $1,837,571 $1,164,239 63.4% $225,170 12.3% $207,478 11.3% -$240,684 -13.1% Market five $1,502,026 $1,248,086 83.1% $148,741 9.9% $9,418 0.6% -$95,781 -6.4% Market six $1,583,539 $1,203,600 76.0% $121,165 7.7% $86,016 5.4% -$172,758 -10.9% Market seven $1,357,906 $921,998 67.9% $127,410 9.4% $13,673 1.0% -$294,825 -21.7% Market eight $1,282,253 $1,026,593 80.1% $188,669 14.7% $74,478 5.8% $7,487 0.6% Market nine $1,187,437 $749,698 63.1% $154,389 13.0% $93,198 7.8% -$190,152 -16.0% Market ten $833,002 $689,797 82£% $115,292 134% $37,140 4.5% $9,227 $15,262,482 $11,676,900 76.5 $1,856,087 12.2% $675,021 4.4% -$1,054,474 -6.9%

2010 BAU Performance

Book Revenue Retired Renewal $ Renewal % Increase $ Increase % New$ New% Net Net%

Market one $7,940,065 $4,801,099 60.5% $682,226 8.6% $1,143,531 14.4% -$1,313,209 -16.5% Market two $5,508,769 $3,687,462 66.9% $519,351 9.4% $164,279 3.0% -$1,137,677 -20.7% Market three $5,441,806 $3,730,417 68.6% $521,219 9.6% $288,554 5.3% -$901,616 -16.6% Market four $4,442,093 $2,846,721 64.1% $411,466 9.3% $216,845 4.9% -$967,061 -21.8% Market five $4,195,656 $2,824,251 67.3% $402,297 9.6% $190,478 4.5% -$778,630 -18.6% Market six $2,893,584 $1,924,260 66.5% $282,378 9.8% $146,184 5.1% -$540,762 -18.7% Market seven $2,389,503 $1,811,331 75.8% $287,835 12.0% $101,844 4.3% -$188,493 -7.9% Market eight $2,203,995 $1,605,780 72.9% $256,447 11.6% $94,678 4.3% -$247,090 -11.2% Market nine $2,101,294 $1,415,129 67.3% $234,623 11.2% $76,466 3.6% -$375,076 -17.8% Market ten $2,082,295 $1,538,023 Z3£% $119,628 -$373,599 -17.4% $39,199,060 $26,184,473 66.8% $3,717,470 9.5% $2,473,904 6.3% -$6,823,213 -17.4%

Source: Storm database 10/13/2010.

STRICTLY CONFIDENTIAL

NOT TO BE SHARED WITH ANY PARTY

OTHER THAN RECIPIENT WITHOUT PRIOR

WRITTEN CONSENT OF THE COMPANY

II Financial Performance Detail

STRICTLY CONFIDENTIAL

NOT TO BE SHARED WITH ANY PARTY

OTHER THAN RECIPIENT WITHOUT PRIOR

WRITTEN CONSENT OF THE COMPANY

II FINANCIAL PERFORMANCE DETAIL

Overview

? Local Insight Media’s 2010 Corporate Goals:

Committed focus to sustain core print business through secular and economic pressures

Successfully launch our new digital platform

Successfully implement 3L transition

Drive cost reductions to align our expenditures with our strategic objectives

Effective liquidity management

STRICTLY CONFIDENTIAL

NOT TO BE SHARED WITH ANY PARTY

OTHER THAN RECIPIENT WITHOUT PRIOR

WRITTEN CONSENT OF THE COMPANY

II FINANCIAL PERFORMANCE DETAIL

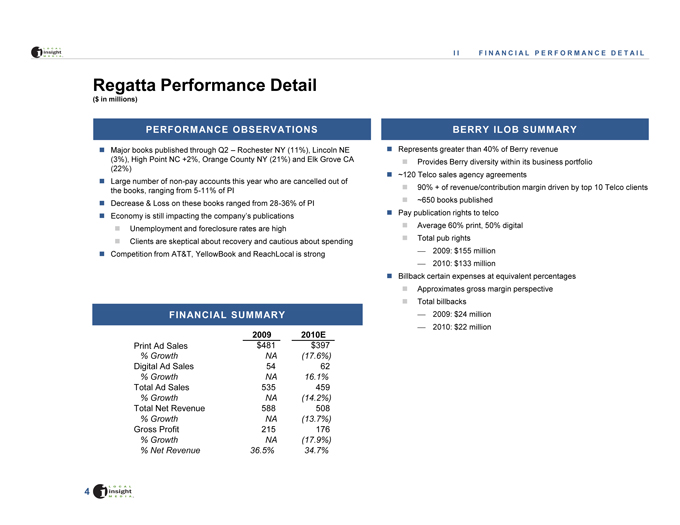

Regatta Performance Detail

($ in millions)

Major books published through Q2—Rochester NY (11 %), Lincoln NE (3%), High Point NC +2%, Orange County NY (21%) and Elk Grove CA (22%)

Large number of non-pay accounts this year who are cancelled out of the books, ranging from 5-11 % of PI

Decrease & Loss on these books ranged from 28-36% of PI

Economy is still impacting the company’s publications

Unemployment and foreclosure rates are high

Clients are skeptical about recovery and cautious about spending

? Competition from AT&T, YellowBook and ReachLocal is strong

2009 2010E

Print Ad Sales $481 $397

% Growth NA (17.6%)

Digital Ad Sales 54 62

% Growth NA 16.1%

Total Ad Sales 535 459

% Growth NA (14.2%)

Total Net Revenue 588 508

% Growth NA (13.7%)

Gross Profit 215 176

% Growth NA (17.9%)

% Net Revenue 36.5% 34.7%

? Represents greater than 40% of Berry revenue

Provides Berry diversity within its business portfolio

? -120 Telco sales agency agreements

90% + of revenue/contribution margin driven by top 10 Telco clients -650 books published

? Pay publication rights to telco

Average 60% print, 50% digital Total pub rights

2009: $155 million

2010: $133 million

? Billback certain expenses at equivalent percentages

Approximates gross margin perspective Total billbacks

2009: $24 million

2010: $22 million

STRICTLY CONFIDENTIAL

NOT TO BE SHARED WITH ANY PARTY

OTHER THAN RECIPIENT WITHOUT PRIOR

WRITTEN CONSENT OF THE COMPANY

II FINANCIAL PERFORMANCE DETAIL

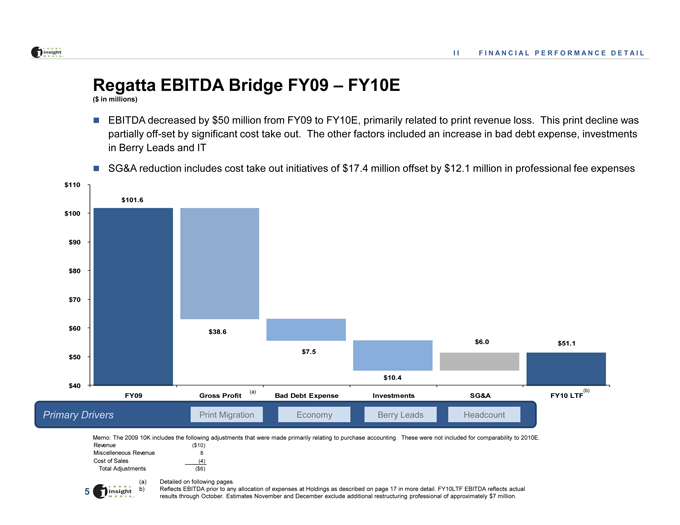

Regatta EBITDA Bridge FY09—FY10E

($ in millions)

EBITDA decreased by $50 million from FY09 to FY10E, primarily related to print revenue loss. This print decline was partially off-set by significant cost take out. The other factors included an increase in bad debt expense, investments in Berry Leads and IT

SG&A reduction includes cost take out initiatives of $17.4 million offset by $12.1 million in professional fee expenses

$101.6

$38.6

$7.5

$6.0

$51.1

$10.4

FY09 Gross Profit (a) Bad Debt Expense Investments SG&A FY10 LTF<b)

Print Migration Economy Berry Leads Headcount

Memo: The 2009 10K includes the following adjustments that were made primarily relating to purchase accounting. These were not included for comparability to 2010E.

Revenue ($10)

Miscellaneous Revenue 8

Cost of Sales (4)

Total Adjustments ($6)

| (a) |

|

Detailed on following pages. |

b) Reflects EBITDA prior to any allocation of expenses at Holdings as described on page 17 in more detail. FY10LTF EBITDA reflects actual results through October. Estimates November and December exclude additional restructuring professional of approximately $7 million.

STRICTLY CONFIDENTIAL

NOT TO BE SHARED WITH ANY PARTY

OTHER THAN RECIPIENT WITHOUT PRIOR

WRITTEN CONSENT OF THE COMPANY

II FINANCIAL PERFORMANCE DETAIL

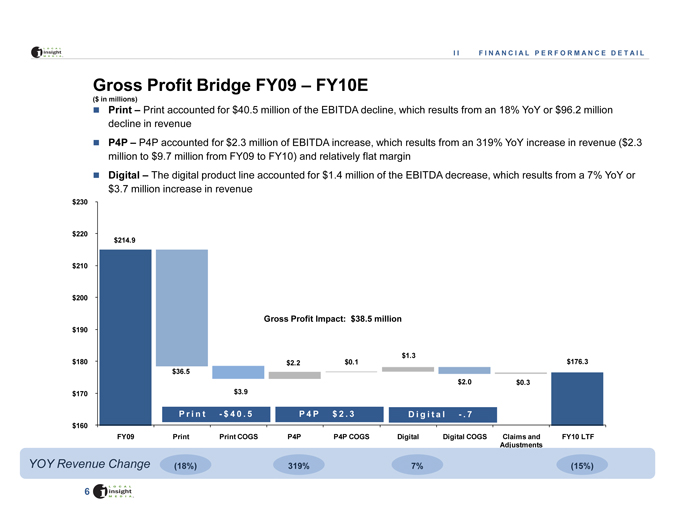

Gross Profit Bridge FY09—FY10E

($ in millions)

Print—Print accounted for $40.5 million of the EBITDA decline, which results from an 18% YoY or $96.2 million decline in revenue

P4P—P4P accounted for $2.3 million of EBITDA increase, which results from an 319% YoY increase in revenue ($2.3 million to $9.7 million from FY09 to FY10) and relatively flat margin

Digital—The digital product line accounted for $1.4 million of the EBITDA decrease, which results from a 7% YoY or $3.7 million increase in revenue

$214.9

Gross Profit Impact: $38.5 million

$2.2 $0.1 $13 $176.3

$36.5

$2.0 $0.3

$3.9

FY09 Print Print COGS P4P P4P COGS Digital Digital COGS Claims and FY10 LTF

Adjustments

Adjustments

YOY Revenue Change (18%) 319% 7% (15%)

STRICTLY CONFIDENTIAL

NOT TO BE SHARED WITH ANY PARTY

OTHER THAN RECIPIENT WITHOUT PRIOR

WRITTEN CONSENT OF THE COMPANY

II FINANCIAL PERFORMANCE DETAIL

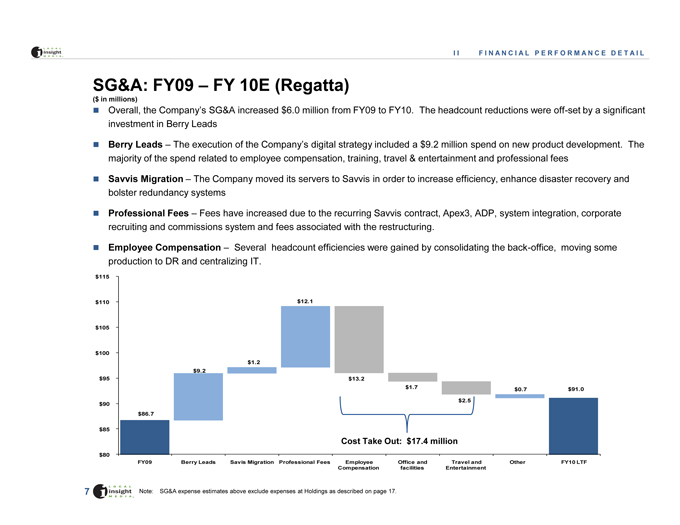

SG&A: FY09—FY 10E (Regatta)

($ in millions)

Overall, the Company’s SG&A increased $6.0 million from FY09 to FY10. The headcount reductions were off-set by a significant investment in Berry Leads

Berry Leads—The execution of the Company’s digital strategy included a $9.2 million spend on new product development. The majority of the spend related to employee compensation, training, travel & entertainment and professional fees

Savvis Migration—The Company moved its servers to Savvis in order to increase efficiency, enhance disaster recovery and bolster redundancy systems

Professional Fees—Fees have increased due to the recurring Savvis contract, Apex3, ADP, system integration, corporate recruiting and commissions system and fees associated with the restructuring.

Employee Compensation—Several headcount efficiencies were gained by consolidating the back-office, moving some production to DR and centralizing IT.

$12.1

$1.2 |

$13.2

$1-7 $0.7 $91.0

Cost Take Out: $17.4 million

FY09 Berry Leads Savis Migration Professional Fees Employee Office and Travel and Other FY10LTF

Compensation facilities Entertainment

Note: SG&A expense estimates above exclude expenses at Holdings as described on page 17.

STRICTLY CONFIDENTIAL

NOT TO BE SHARED WITH ANY PARTY

OTHER THAN RECIPIENT WITHOUT PRIOR

WRITTEN CONSENT OF THE COMPANY

II FINANCIAL PERFORMANCE DETAIL

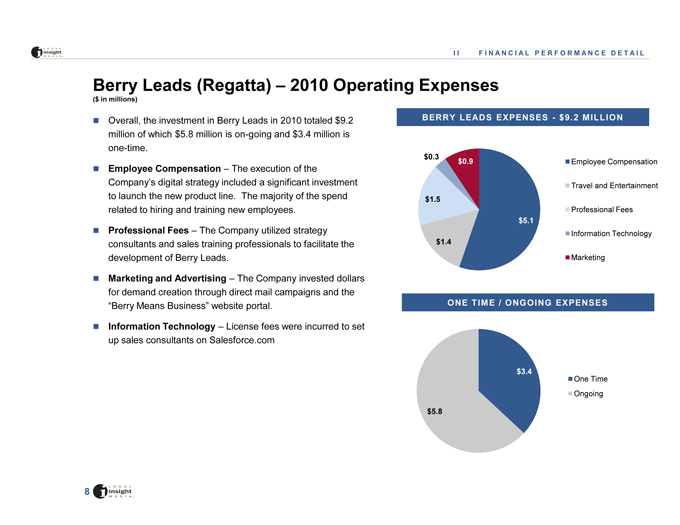

Berry Leads (Regatta)—2010 Operating Expenses

($ in millions)

Overall, the investment in Berry Leads in 2010 totaled $9.2 million of which $5.8 million is on-going and $3.4 million is one-time.

Employee Compensation—The execution of the Company’s digital strategy included a significant investment to launch the new product line. The majority of the spend related to hiring and training new employees.

Professional Fees—The Company utilized strategy consultants and sales training professionals to facilitate the development of Berry Leads.

Marketing and Advertising—The Company invested dollars for demand creation through direct mail campaigns and the “Berry Means Business” website portal.

Information Technology—License fees were incurred to set up sales consultants on Salesforce.com

BERRY LEADS EXPENSES—$9.2 MILLION

$1.5 A

Employee Compensation Travel and Entertainment Professional Fees

Information Technology

Marketing

ONE TIME / ONGOING EXPENSES

$5.8 W

? One Time Ongoing

STRICTLY CONFIDENTIAL

NOT TO BE SHARED WITH ANY PARTY

OTHER THAN RECIPIENT WITHOUT PRIOR

WRITTEN CONSENT OF THE COMPANY

II FINANCIAL PERFORMANCE DETAIL

SG&A Risk and Challenges (Regatta)

Overall, the Company’s SG&A declined by $0.8 million from FY09 to FY10. The headcount reductions were off-set by a significant investment in Berry Leads. These reductions and efficiencies have created a lean organization.

Systems—The core production system implementation began in Q4 2009; system went live in Q1 2010. Issues started to be identified late in Q2 2010 which caused printing errors, delays in production and additional proofing of books. Due to these issues, the decision was made to stop cut-over processes in for books not already converted

Production

Print—Several books have been delayed. Ad copy has been problematic, which will most likely cause an increase in claims & adjustments.

Digital—The backlog has been increasing and fulfillment of orders has been longer than expected.

Additional Resources—Due to the issues which have been identified to date, this will require additional FTEs to address the situation

Accounting -The initial cut-over has caused delays in month-end close for accounting. Application of cash was delayed as well.

Billing—The delays in book production have caused delays in billing. Also, due to the delays in digital fulfillment, bills have been sent prior to final go-live. Both of these have caused increases in claims & adjustment and bad debt.

Professional Fees—Additional fees will likely be necessary, dependent upon the extent of the production and cut-over issues.

Bad Debt—Currently running at -6% but may increase based on the duration of the cyclical downturn

STRICTLY CONFIDENTIAL

NOT TO BE SHARED WITH ANY PARTY

OTHER THAN RECIPIENT WITHOUT PRIOR

WRITTEN CONSENT OF THE COMPANY

Ill Capital Structure and Liquidity

STRICTLY CONFIDENTIAL

NOT TO BE SHARED WITH ANY PARTY

OTHER THAN RECIPIENT WITHOUT PRIOR

WRITTEN CONSENT OF THE COMPANY

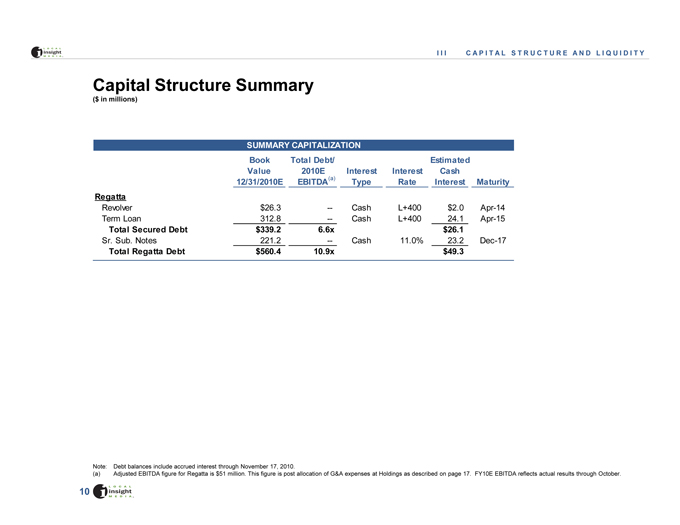

Ill CAPITAL STRUCTURE AND LIQUIDITY

Capital Structure Summary

($ in millions)

Book Total Debt/ Estimated

Value 2010E Interest Interest Cash

12/31/2010E EBITDA(a) Type Rate Interest Maturity

Regatta

Revolver $26.3—Cash L+400 $2.0 Apr-14

Term Loan 312.8 :L_ Cash L+400 24.1 Apr-15

Total Secured Debt $339.2 6.6x $26.1

Sr. Sub. Notes 221.2 -_ Cash 11.0% 23.2 Dec-17

Total Regatta Debt $560.4 10.9x $49.3

Note: Debt balances include accrued interest through November 17, 2010.

(a) Adjusted EBITDA figure for Regatta is $51 million. This figure is post allocation of G&A expenses at Holdings as described on page 17. FY10E EBITDA reflects actual results through October.

STRICTLY CONFIDENTIAL

NOT TO BE SHARED WITH ANY PARTY

OTHER THAN RECIPIENT WITHOUT PRIOR

WRITTEN CONSENT OF THE COMPANY

Ill CAPITAL STRUCTURE AND LIQUIDITY

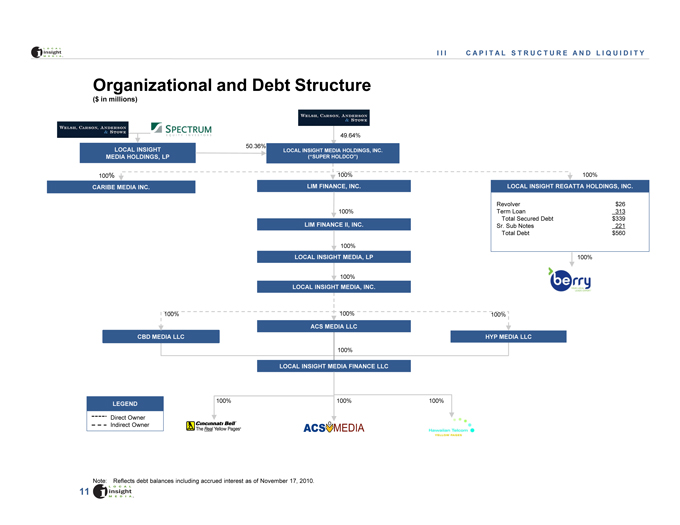

Organizational and Debt Structure

($ in millions)

in iiiiiiiuiis;

49.64%

| 1 |

|

100% |

100% 100%

I

non%”- + iqD%

100% 100% 100% 100%

Direct Owner Indirect Owner

LOCAL INSIGHT REGATTA HOLDINGS, INC.

LOCAL INSIGHT MEDIA HOLDINGS, LP

LOCAL INSIGHT MEDIA FINANCE LLC

ACS MEDIA LLC

LOCAL INSIGHT MEDIA, INC.

LOCAL INSIGHT MEDIA, LP

LIM FINANCE II, INC.

LIM FINANCE, INC.

LOCAL INSIGHT MEDIA HOLDINGS, INC.

_3683(5_+2/’&2´_

CARIBE MEDIA INC.

CBD MEDIA LLC

HYP MEDIA LLC

100%

Revolver $26

Term Loan 313

Total Secured Debt $339

Sr. Sub Notes 221

Total Debt $560

100%

Note: Reflects debt balances including accrued interest as of November 17, 2010.

STRICTLY CONFIDENTIAL

NOT TO BE SHARED WITH ANY PARTY

OTHER THAN RECIPIENT WITHOUT PRIOR

WRITTEN CONSENT OF THE COMPANY

Ill CAPITAL STRUCTURE AND LIQUIDITY

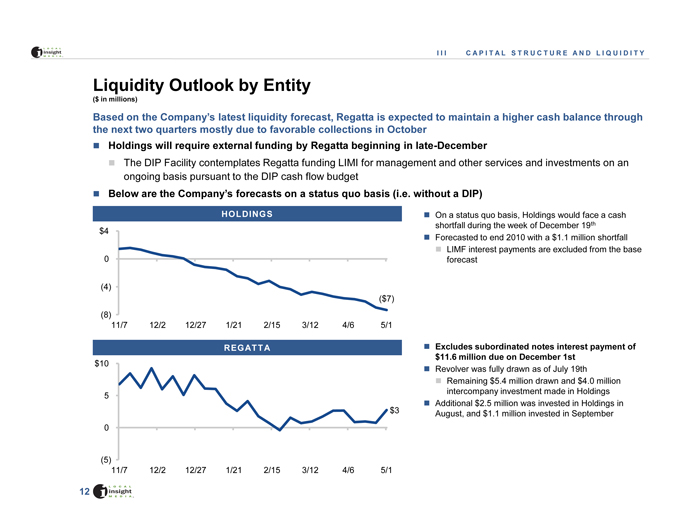

Liquidity Outlook by Entity

($ in millions)

Based on the Company’s latest liquidity forecast, Regatta is expected to maintain a higher cash balance through the next two quarters mostly due to favorable collections in October

? Holdings will require external funding by Regatta beginning in late-December

The DIP Facility contemplates Regatta funding LIMI for management and other services and investments on an ongoing basis pursuant to the DIP cash flow budget

? Below are the Company’s forecasts on a status quo basis (i.e. without a DIP)

HOLDINGS

On a status quo basis, Holdings would face a cash shortfall during the week of December 19th

Forecasted to end 2010 with a $1.1 million shortfall

LIMF interest payments are excluded from the base forecast

($7)

REGATTA

^$3

Excludes subordinated notes interest payment of $11.6 million due on December 1st

Revolver was fully drawn as of July 19th

Remaining $5.4 million drawn and $4.0 million intercompany investment made in Holdings

? Additional $2.5 million was invested in Holdings in August, and $1.1 million invested in September

STRICTLY CONFIDENTIAL

NOT TO BE SHARED WITH ANY PARTY

OTHER THAN RECIPIENT WITHOUT PRIOR

WRITTEN CONSENT OF THE COMPANY

IV Projected Financials

STRICTLY CONFIDENTIAL

NOT TO BE SHARED WITH ANY PARTY

OTHER THAN RECIPIENT WITHOUT PRIOR

WRITTEN CONSENT OF THE COMPANY

IV PROJECTED FINANCIALS

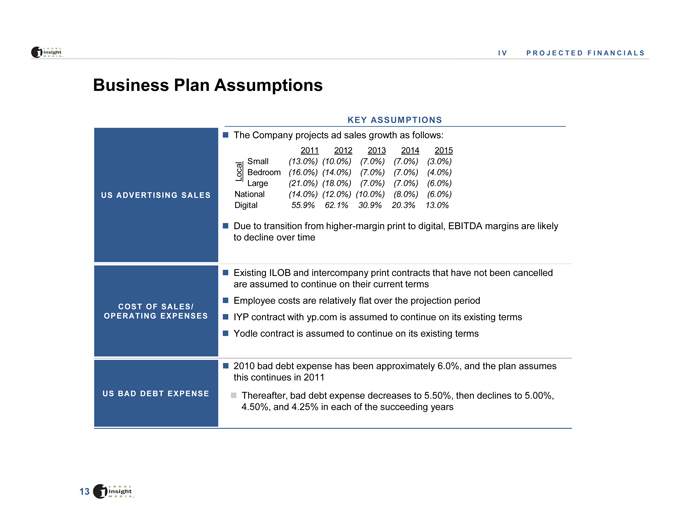

Business Plan Assumptions

KEY ASSUMPTIONS

The Company projects ad sales growth as follows:

US ADVERTISING SALES

COST OF SALES/ OPERATING EXPENSES

US BAD DEBT EXPENSE

2011 2012 2013 2014 2015

- Small (13.0%) (10.0%) (7.0%) (7.0%) (3.0%)

| 8 |

|

Bedroom (16.0%) (14.0%) (7.0%) (7.0%) (4.0%) |

Large (21.0%) (18.0%) (7.0%) (7.0%) (6.0%)

National (14.0%) (12.0%) (10.0%) (8.0%) (6.0%)

Digital 55.9% 62.1% 30.9% 20.3% 13.0%

Due to transition from higher-margin print to digital, EBITDA margins are likely to decline overtime

Existing ILOB and intercompany print contracts that have not been cancelled are assumed to continue on their current terms

Employee costs are relatively flat over the projection period

IYP contract with yp.com is assumed to continue on its existing terms

Yodle contract is assumed to continue on its existing terms

2010 bad debt expense has been approximately 6.0%, and the plan assumes this continues in 2011

Thereafter, bad debt expense decreases to 5.50%, then declines to 5.00%, 4.50%, and 4.25% in each of the succeeding years

STRICTLY CONFIDENTIAL

NOT TO BE SHARED WITH ANY PARTY

OTHER THAN RECIPIENT WITHOUT PRIOR

WRITTEN CONSENT OF THE COMPANY

IV PROJECTED FINANCIALS

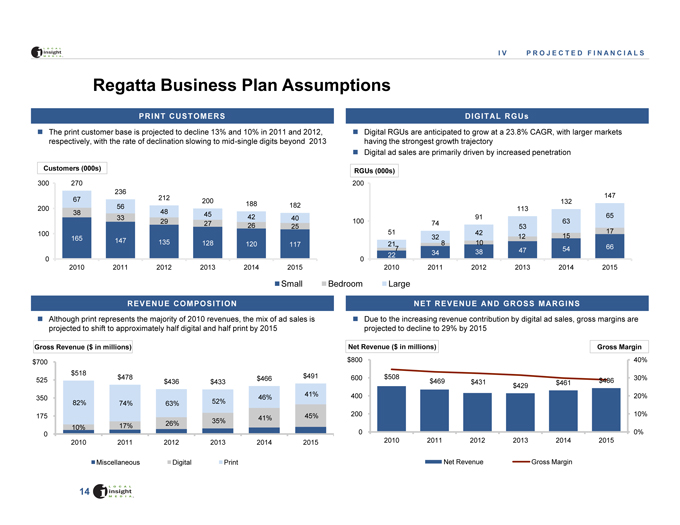

Regatta Business Plan Assumptions

? The print customer base is projected to decline 13% and 10% in 2011 and 2012, respectively, with the rate of declination slowing to mid-single digits beyond 2013

Digital RGUs are anticipated to grow at a 23.8% CAGR, with larger markets having the strongest growth trajectory

Digital ad sales are primarily driven by increased penetration

Customers (000s)

300 270

236

» I » Z m—«

H M — _ S

100

0 I

2010 2011 2012 2013 2014 2015

RGUs (000s)

200

147 132 113

100

51 32 42 12 15 ^_

o i mm o D D D

2010 2011 2012 2013 2014 2015

Bedroom Large

? Although print represents the majority of 2010 revenues, the mix of ad sales is projected to shift to approximately half digital and half print by 2015

? Due to the increasing revenue contribution by digital ad sales, gross margins are projected to decline to 29% by 2015

Gross Revenue ($ in millions)

$700

525 . $518 $478 $436 $433 $466 $491

35°” 82o/0 740/o 63o/o 52o/0 46ro 4iro

175 o, 350/o 41% 45%

10% 17% ^6^ ^5^ ^^^ ^^^

2010 2011 2012 2013 2014 2015

? Miscellaneous Digital Print

Net Revenue ($ in millions) Gross Margin

$800 -I i- 40%

200 10%

2010 2011 2012 2013 2014 2015

Net Revenue —Gross Margin

PRINT CUSTOMERS

DIGITAL RGUs

REVENUE COMPOSITION

NET REVENUE AND GROSS MARGINS

$518 $478 $491 $466 $436 $433

STRICTLY CONFIDENTIAL

NOT TO BE SHARED WITH ANY PARTY

OTHER THAN RECIPIENT WITHOUT PRIOR

WRITTEN CONSENT OF THE COMPANY

IV PROJECTED FINANCIALS

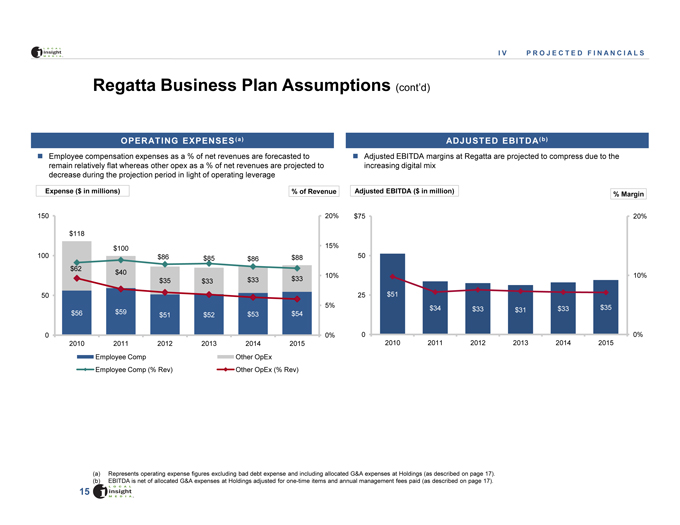

Regatta Business Plan Assumptions (contd)

? Employee compensation expenses as a % of net revenues are forecasted to remain relatively flat whereas other opex as a % of net revenues are projected to decrease during the projection period in light of operating leverage

Expense ($ in millions) [jxTof Revenue

? Adjusted EBITDA margins at Regatta are projected to compress due to the increasing digital mix

Adjusted EBITDA ($ in million)

$118

$100

$86 $85 $86 $88

$62 $4Q —? »

$35 $33 $33 $33

2010 2011 2012 2013 2014 201t>

^^” Employee Comp Other OpEx

‘ Employee Comp (% Rev) » Other OpEx (% Rev)

Represents operating expense figures excluding bad debt expense and including allocated G&A expenses at Holdings (as described on page 17).

EBITDA is net of allocated G&A expenses at Holdings adjusted for one-time items and annual management fees paid (as described on page 17).

STRICTLY CONFIDENTIAL

NOT TO BE SHARED WITH ANY PARTY

OTHER THAN RECIPIENT WITHOUT PRIOR

WRITTEN CONSENT OF THE COMPANY

IV PROJECTED FINANCIALS

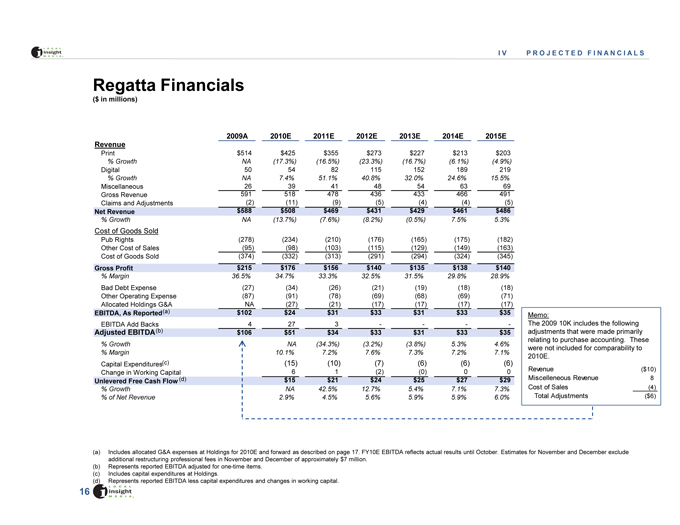

Regatta Financials

($ in millions)

2009A 2010E 2011E 2012E 2013E 2014E 2015E Revenue

Print $514 $425 $355 $273 $227 $213 $203

% Growth NA (17.3%) (16.5%) (23.3%) (16.7%) (6.1%) (4.9%)

Digital 50 54 82 115 152 189 219

%Growth NA 7.4% 51.1% 40.8% 32.0% 24.6% 15.5%

Miscellaneous 26_ 39_ 41_ 48_ 54_ 63_ 69_

Gross Revenue 591 518 478 436 433 466 491

Claims and Adjustments (2)_ (11) (9)_ (5)_ (4)_ (4)_ (5)_

Net Revenue 5588” $508” $”469~ $431” $”429~ $461” $”486~

% Growth NA (13.7%) (7.6%) (8.2%) (0.5%) 7.5% 5.3%

Cost of Goods Sold

Pub Rights (278) (234) (210) (176) (165) (175) (182)

Other Cost of Sales (95) (98) (103) (115) (129) (149) (163)

Cost of Goods Sold (374) (332) (313) (291) (294) (324) (345)

Gross Profit $215 $176 $156 $140 $135 $138 $140

% Margin 36.5% 34.7% 33.3% 32.5% 31.5% 29.8% 28.9%

Bad Debt Expense (27) (34) (26) (21) (19) (18) (18)

Other Operating Expense (87) (91) (78) (69) (68) (69) (71)

Allocated Holdings G&A NA_ (27) (21) (17) (17) (17) (17)

EBITDA, As Reported(a) $102 $24 $31 $33 $31 $33 $35

EBITDA Add Backs 4_ 27_ 3_ -_ -_ -_ -_

Adjusted EBITDA(b> $106 $51 $34 $33 $31 $33 $35

% Growth A NA (34.3%) (3.2%) (3.8%) 5.3% 4.6%

% Margin 10.1% 7.2% 7.6% 7.3% 7.2% 7.1%

Capital Expenditures^) (15) (10) (7) (6) (6) (6)

Change in Working Capital 6 1 (2) (0) 0 0

Unlevered Free Cash Flow <d> $”15 $”21 $”24 $”25 $”27 $”29~

% Growth NA 42.5% 12.7% 5.4% 7.1% 7.3%

% of Net Revenue I 2.9% 4.5% 5.6% 5.9% 5.9% 6.0%

Memo:

The 2009 10K includes the following

adjustments that were made primarily

relating to purchase accounting. These

were not included for comparability to

2010E.

Revenue ($10)

Miscelleneous Revenue 8

Cost of Sales (4)

Total Adjustments ($6)

Includes allocated G&A expenses at Holdings for 2010E and forward as described on page 17. FY10E EBITDA reflects actual results until October. Estimates for November and December exclude additional restructuring professional fees in November and December of approximately $7 million.

Represents reported EBITDA adjusted for one-time items.

Includes capital expenditures at Holdings.

| (d) |

|

Represents reported EBITDA less capital expenditures and changes in working capital. |

STRICTLY CONFIDENTIAL

NOT TO BE SHARED WITH ANY PARTY

OTHER THAN RECIPIENT WITHOUT PRIOR

WRITTEN CONSENT OF THE COMPANY

IV PROJECTED FINANCIALS

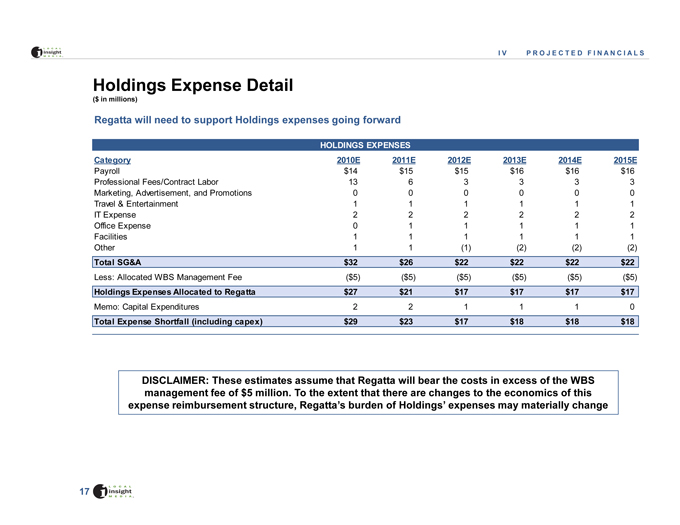

Holdings Expense Detail

($ in millions)

Regatta will need to support Holdings expenses going forward

Category 201OE 2011E 2012E 2013E 2014E 2015E

Payroll $14 $15 $15 $16 $16 $16

Professional Fees/Contract Labor 13 6 3 3 3 3

Marketing, Advertisement, and Promotions 0 0 0 0 0 0

Travel & Entertainment 111111

IT Expense 2 2 2 2 2 2

Office Expense 0 11111

Facilities 111111

Other 1 1 (1) (2) (2) (2)

|Total SG&A~ $32 $26 $22 $22 $22 $22 |

Less: Allocated WBS Management Fee ($5) ($5) ($5) ($5) ($5) ($5)

| Holdings Expenses Allocated to Regatta $27 $21 $17 $17 $17 $17 |

Memo: Capital Expenditures 2 2 1110

[Total Expense Shortfall (including capex) $29 $23 $17 $18 $18 $18 |

DISCLAIMER: These estimates assume that Regatta will bear the costs in excess of the WBS

management fee of $5 million. To the extent that there are changes to the economics of this

expense reimbursement structure, Regatta’s burden of Holdings’ expenses may materially change

STRICTLY CONFIDENTIAL

NOT TO BE SHARED WITH ANY PARTY

OTHER THAN RECIPIENT WITHOUT PRIOR

WRITTEN CONSENT OF THE COMPANY

Appendix

STRICTLY CONFIDENTIAL

NOT TO BE SHARED WITH ANY PARTY

OTHER THAN RECIPIENT WITHOUT PRIOR

WRITTEN CONSENT OF THE COMPANY

List of Defined Terms

Term Meaning

BAU Business as Usual

ILOB Independent Line of Business

IYP Internet Yellow Pages

P4P Pay for Performance

PI Previous Issue

RGU Revenue Generating Unit

SMB Small to Medium-Sized Business

WBS Whole-Business-Securitization

APPENDIX

STRICTLY CONFIDENTIAL

NOT TO BE SHARED WITH ANY PARTY

OTHER THAN RECIPIENT WITHOUT PRIOR

WRITTEN CONSENT OF THE COMPANY