Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - EDIETS COM INC | d8k.htm |

CONFIDENTIAL

Investor Presentation

November 2010

It all starts here with a promise for a future that can be

healthier, better and stronger than today.

Copyright 2010 eDiets.com, Inc. All Rights Reserved

Exhibit 99.1 |

CONFIDENTIAL

2

Forward-Looking Statements

Forward-Looking Statements

Copyright 2010 eDiets.com, Inc. All Rights Reserved

This presentation contains “forward-looking statements”

within the meaning of the federal securities laws and is

intended to qualify for the Safe Harbor from liability established by the Private

Securities Litigation Reform Act of 1995, including statements regarding the

outlook for eDiets.com’s markets, assumptions regarding the cost of acquiring

customers; the ability to meet targeted revenue by segment within the next 3-5

years, that eDiets.com is well positioned to compete and capture market

share, eDiet's growth strategy and business model, the timing of product

launches, projected results and the demand for its products and services.

These projections and statements are based on management’s estimates

and assumptions with respect to future events and financial performance and are

believed to be reasonable, though are inherently uncertain and difficult to

predict. Actual results could differ materially from those projected

as a result of certain factors, including eDiets.com’s ability to raise additional capital through a

private placement or public offering of its common stock or securities convertible

into its common stock, or through a sale of strategic or non-strategic

assets; its ability to improve its meal delivery margin and its effect on total gross

margins; fluctuations in advertising costs; its ability to sufficiently increase

its revenues and maintain expenses and cash capital expenditures at

appropriate levels; the state of the credit markets and capital markets, including the level

of volatility, illiquidity and interest rates; eDiets.com's ability to rapidly

secure alternate technology infrastructure vendors if it experiences Web

site service interruption; and its ability to maintain compliance with

applicable regulatory requirements.

A discussion of factors that could cause results to vary is included in the

Company’s filings with the Securities and Exchange Commission. All

forward-looking statements in this presentation speak only as of the date of this

presentation. The Company expressly disclaims any obligation or

undertaking to update or revise any forward-looking

statements.

This presentation also contains non-GAAP financial measures. For a

reconciliation of the non-GAAP measures to the most comparable GAAP

measure, please refer to the eDiets.com website at www.ediets.com, under the Events and

Presentation section of the Investor Relations page. |

CONFIDENTIAL

3

Company Overview

Company Overview

•

Diet Plans

–

Award winning diet meal delivery program providing weekly fresh

prepared meals

•

Estimated market size: $1.0 billion annually for home delivery of

diet food; $350 million market in our price range

–

State of the art digital diet program including menus, recipes,

shopping lists and tools

•

Estimated market size: $250 million annually

•

Corporate Services

–

White label corporate wellness sites focused on diets and diet-

related tools

•

Estimated market size: $50-$100 million annually

Copyright 2010 eDiets.com, Inc. All Rights Reserved

Market estimates made by eDiets based on data from MarketData 2007 survey

|

CONFIDENTIAL

4

Key Facts

Key Facts

Copyright 2010 eDiets.com, Inc. All Rights Reserved

Symbol

DIET

Corporate Headquarters

Ft. Lauderdale, FL

Stock Price 11/18/10 || 52-week Range

$0.68 || $0.47 -

$2.00

Shares Outstanding (11/18/10)

57,418,520

Market Capitalization (11/18/10)

$39,044,594

Volume (daily 30 day average at 11/18/10))

18,150

Debt (09/30/10)

$0.0

Cash (09/30/10)

$900,000

Revenue TTM (09/30/10)

$20,333,000

Net Loss TTM (09/30/10)

1

$(45,294,767)

EBITDA TTM (09/30/10)

$(7,454,000)

Insider Ownership

5.8%

Institutional Ownership Shares

2.4%

Full Time Employees

70

Fiscal Year

December 31

Accounting Firm

Ernst & Young

1

Net Loss TTM reflects non-cash charges for goodwill impairment and the debt

conversion |

CONFIDENTIAL

5

Management Team

Management Team

Copyright 2010 eDiets.com, Inc. All Rights Reserved

Name

Title

Previous Experience

Kevin McGrath

CEO

DIRECTV, Co-Founder

DIRECTV Latin America, Chairman & CEO

Digital Angel, President & CEO

General Motors

Electronic Data Systems

Hughes Communications

Dartmouth, MBA

Princeton, BA

Thomas Hoyer

CFO

Digital Angel, CFO

Nationsrent Companies, CFO

GLOBEquip, CFO

Fluor Corporation

Clemson, MBA, BS

Joseph Leonardo

VP, Meal

Delivery

EPI Bregos, VP Operations

Meyers Bakeries, VP Operations & Logistics

Edwards Fine Foods, VP Manufacturing

Quaker Oats

Cornell, BS |

CONFIDENTIAL

6

Markets

Markets

•

Over 72 million people are estimated to be dieting

–

Aging population will increase this population for years to come

–

Growing diabetic population, estimated at 23 million, further grows the target

market

•

Dieting products and services provide a necessary aid and

convenience to healthy dieting

–

Typical dieters on our plans lose 1 to 2 pounds per week

•

The market for weight loss products averaged 7%-8% growth per

year in the middle of the decade

–

Recession has slowed growth in market but should return to historical pattern

as economy recovers

•

Barriers to market are significant

–

These include brand recognition and reputation, direct response television and

internet marketing skills, expertise in meal creation and fulfillment,

expertise in nutritional design of diets, and capital

Copyright 2010 eDiets.com, Inc. All Rights Reserved

Market estimates and dieting population estimate based on data from MarketData

2007 survey |

CONFIDENTIAL

7

Revenue By Segment

Revenue By Segment

Copyright 2010 eDiets.com, Inc. All Rights Reserved

Online

Diet Plans

28%

Home

Meal

Delivery

43%

Corporate

Services

22%

Other

7%

Target*

2009

Actual

Online

Diet Plans

15%

Home

Meal

Delivery

74%

Corporate

Services

7%

Other

4%

* Management believes this target can be achieved within the next 3-5 years.

|

CONFIDENTIAL

8

Copyright 2010 eDiets.com, Inc. All Rights Reserved

Meal Delivery -

Meal Delivery -

Overview

Overview

•

Healthy, delicious meals delivered to your door

•

Offers both 5-day ($21.99/day) and 7-day plans ($19.99/day)

•

Over 100 different meals freshly

prepared by our chefs

Meal Delivery

LTM 09/30/2010

Revenue

$12.5 Million

Shipments Per Week

1,900

Gross Margin

1,2

39%

Adjusted EBITDA Margin

1,2

-27%

¹

Excludes depreciation and revenue

share 2

The reconciliation for these non-GAAP measures are on our website

Est. $350M Meal

Delivery Market at

our Price Level

Significant Market Opportunity |

CONFIDENTIAL

9

Meal Delivery Opportunity

Meal Delivery Opportunity

•

Large market

•

Significant revenue growth driven by increased

advertising

•

Improved gross margin

•

Improved customer retention

Copyright 2010 eDiets.com, Inc. All Rights Reserved |

CONFIDENTIAL

10

Copyright 2010 eDiets.com, Inc. All Rights Reserved

Online Diet Plans -

Online Diet Plans -

Overview

Overview

•

Offers a personalized

fitness and eating plan designed by dietitians

and personal trainers

•

Live 24 hour / 7 day support by certified and registered dietitians

•

Online community and motivating member challenges

•

Subscription cost –

$17.96 per month or $149.95 per year (annual plan)

•

Offers plans that are tailored for individual needs including diabetic,

hypoglycemic, high fiber, vegetarian, lactose-free and many more

Diet Plans

LTM 09/30/2010

Revenue

$4.1 Million

Subscribers

18,000

Gross Margin

1,2

92%

EBITDA Margin

1,2

26%

Est. $250M Total

Online Diet

Market

Large Addressable Market

¹

Excludes depreciation and revenue

share 2

The reconciliation for these non-GAAP measures are on our website

|

CONFIDENTIAL

11

Copyright 2010 eDiets.com, Inc. All Rights Reserved

Business Model –

Business Model –

Online Diet Plans

Online Diet Plans

*

Sample

Better Retention

Improves

Customer

Business Model

Retention*

6 Months

8 Months

Average Revenue Per Customer

$

104

$

139 Cost of Goods

$

(8)

$

(11) Margin Before

Customer Acquisition Cost

$

96

$

128 Revenue Share (1.2%)

$

(1)

$

(2) Customer

Acquisition Cost

$

(43)

$

(50) Net Cash Flow

$

52

$

76 Cash Flow Margin

50.0%

54.7%

* Retention based on active customer

pool *

Investments in advertising for Online Diet Plans cycles 4 times per year |

CONFIDENTIAL

12

Online Store

Online Store

•

Launched new store in

August 2009

•

Store is being integrated into

sales process for home-

delivered meals and online

weight loss

•

Opportunity

–

Cross sell new customers,

re-sell current customers

–

Recurring revenue stream

–

High margins on

supplements

Copyright 2010 eDiets.com, Inc. All Rights Reserved |

CONFIDENTIAL

13

Copyright 2010 eDiets.com, Inc. All Rights Reserved

Corporate Services -

Corporate Services -

Overview

Overview

•

White-label online nutrition

and fitness plans for corporate

clientele

•

Offers website design &

hosting capabilities

•

Powering some of the largest

brands in health & wellness

•

Clients mainly comprised of

Fortune 500 businesses

•

Exploring opportunities to

monetize this division

Revenue by Client Type

Corporate Services

LTM 09/30/2010

Revenue

$2.8 Million

Gross Margin

1,2

95%

EBITDA Margin

1,2

26%

¹

Excludes depreciation and revenue

share 2

The reconciliation for these non-GAAP measures are on our website

|

CONFIDENTIAL

14

Competitive Landscape

Competitive Landscape

Meal

Delivery

Online Diet

Plan

Advertising

eCommerce

Retail

Licensing

B2B

eDiets.com

Meal Delivery

NutriSystem

Jenny Craig

Medifast

Other

Weight Watchers

SlimFast

Spark People

WebMD

Everyday Health

Nutrihand

eDiets

is well-positioned to compete and capture market share

eDiets

is well-positioned to compete and capture market share

Copyright 2010 eDiets.com, Inc. All Rights Reserved |

CONFIDENTIAL

15

Key Relationships

Key Relationships

Copyright 2010 eDiets.com, Inc. All Rights Reserved

Whitsons

Meal Plan Manufacturer

iMarketing

Internet Marketing

cMedia

Television Marketing

FedEx / UPS

Meal Delivery Shipper

NBC/Reveille

Biggest Loser Licensor |

CONFIDENTIAL

16

Capitalization

Capitalization

Copyright 2010 eDiets.com, Inc. All Rights Reserved

Note: In November 2010, three company insiders invested a total of $1.0 million in

exchange for promissory notes which will constitute debt 30-Sep-10

Equity (100,000,000 authorized)

Issued Shares

Strike Price

Fully Diluted

Common Stock

57,418,520

57,418,520

Warrants

$1.20

1,689,370

Options

$2.36

5,066,084

Restricted Stock Units

499,000

Total

64,672,974

Debt

Principal Balance

$

- |

CONFIDENTIAL

17

Historical Income Statement

Historical Income Statement

Copyright 2010 eDiets.com, Inc. All Rights Reserved

Year Ended December 31,

Year-to-Date

2007

2008

2009

Q3-2010

REVENUE

Digital Plans

$ 19,482

$ 9,345

$ 4,970

$ 2,970

Meal Delivery

3,994

9,405

7,839

10,836

Business-to-business

2,573

3,646

4,054

1,987

Other

3,680

1,539

1,245

674

TOTAL REVENUE

29,729

23,935

18,108

16,467

COSTS AND EXPENSES

Cost of Revenue

Digital Plans

3,112

2,610

863

421

Meal Delivery

3,665

9,358

5,912

7,123

Business-to-business

200

136

198

95

Other

245

321

236

142

Total cost of revenue

7,222

12,425

7,209

7,781

Technology and development

3,723

4,297

3,710

2,410

Sales, marketing and support

17,029

11,664

8,896

10,852

General and administrative

6,984

6,070

4,882

3,636

Amortization of intangible assets

1,213

882

295

27

Impairment of goodwill and intangible assets

2,296

5,191

-

6,865

Total costs and expenses

38,467

40,529

24,992

31,571

Loss from operations

(8,738)

(16,594)

(6,884)

(15,104)

Interest Income

282

109

11

2

Interest Expense

(781)

(3,357)

(5,170)

(2,733)

Interest expense incurred wih debt conversion

-

-

-

(23,961)

Loss on extinguishment of related party debt

-

-

-

(213)

Loss before income tax provision

(9,237)

(19,842)

(12,043)

(42,009)

Income tax provision

(171)

(6)

(18)

1

Net loss

$ (9,408)

$ (19,848)

$ (12,061)

$ (42,008)

EBITDA

$ (2,270)

$ (7,452)

$ (3,349)

$ (6,214)

Note: In November 2010, three company insiders invested a total of $1.0 million in

exchange for promissory notes which will constitute debt |

CONFIDENTIAL

18

Historical Balance Sheet

Historical Balance Sheet

Copyright 2010 eDiets.com, Inc. All Rights Reserved

December 30,

December 30,

December 30,

September 30,

2007

2008

2009

2010

CURRENT ASSETS

Cash and cash equivalents

$ 7,132

$ 2,523

$ 1,475

$ 900

Accounts receivable, net

1,178

574

546

346

Prepaid advertising costs

321

18

-

-

Prepaid meal delivery and inventory

270

497

359

220

Prepaid expenses and other current assets

493

437

264

722

Total current assets

9,394

4,049

2,644

2,188

Restricted Cash

1,174

544

544

720

Property and office equipment, net

3,633

3,665

2,185

1,452

Intangible assets, net

1,209

334

47

7

Goodwill

12,026

6,835

6,835

-

Other assets

255

244

201

41

Total assets

$ 27,691

$ 15,671

$ 12,456

$ 4,408

CURRENT LIABILITIES

Accounts payable

$ 1,339

$ 1,410

$ 1,117

$ 2,040

Accrued liabilities

2,797

1,748

1,855

1,412

Current portion of capital lease obligations

479

83

23

20

Deferred revenue

1,674

1,612

1,242

1,317

Senior secured note, net -

related party

-

-

11,959

-

Total current liabilities

6,289

4,853

16,196

4,789

Capital lease obligations, net of current portion

303

67

43

28

Deferred revenue

1,990

1,724

922

438

Senior secured notes, net -

related party

6,247

11,808

4,865

-

STOCKHOLDERS' DEFICIT

Common Stock

25

25

29

57

Additional paid-in capital

41,191

45,307

50,596

101,207

Accumulated other comprehensive loss

(150)

(61)

(82)

10

Accumulated deficit

(28,204)

(48,052)

(60,113)

(102,121)

Total stockholders' deficit

12,862

(2,781)

(9,570)

(847)

Total liabilities and stockholders' deficit

$ 27,691

$ 15,671

$ 12,456

$ 4,408

Note: In November 2010, three company insiders invested a total of $1.0 million in

exchange for promissory notes which will constitute debt |

CONFIDENTIAL

19

Growth Strategy

Growth Strategy

1.

Meal Delivery

•

High cash velocity = relatively low investment

•

Rapidly grow meal delivery

•

Achieve positive EBITDA and cash flow

2.

Online Weight Loss

•

Leverage meal delivery infrastructure (IT platform, call center,

TV advertising) to

grow online subscription business

•

Leverage meal delivery TV advertising to keep CPA low and returns high

3.

Health/Wellness Services for Companies

•

Build broad-based health wellness platform based on meal delivery, online

programs and website design/support;

•

combine with other services developed in-house and through partnerships or

acquisitions to build comprehensive health/wellness services targeted at

reducing companies’

healthcare expenses

–

Exploring opportunities to monetize this division

Copyright 2010 eDiets.com, Inc. All Rights Reserved |

CONFIDENTIAL

20

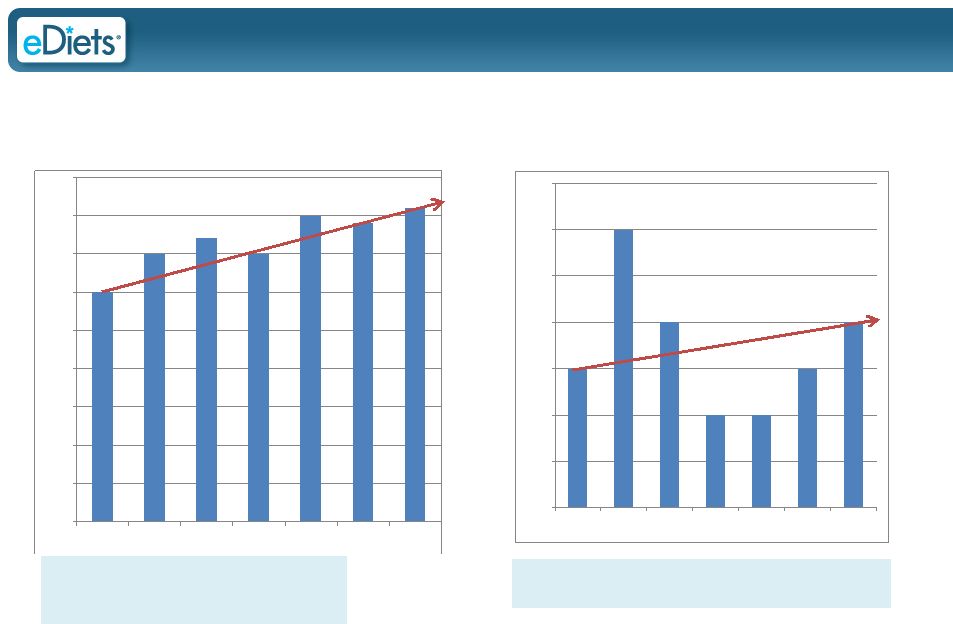

Customer Acquisition Cost Strategy

Customer Acquisition Cost Strategy

Blended Meal Delivery and Online Digital Customer Acquisition Costs

Copyright 2010 eDiets.com, Inc. All Rights Reserved

As meal delivery has

grown in the revenue

mix, the blended cost

of acquisition has

increased because

meal delivery

acquisition costs are

higher than the cost

of acquiring digital

customers |

CONFIDENTIAL

21

Customer Retention

Customer Retention

Meal Delivery

Online

Focused on issues which negatively impacted

retention:

•

Physical state of meals upon receipt by customer

•

Temperature of cooler upon delivery

•

Involuntary menu substitutions

•

On-time delivery

Focused on issues which negatively impacted

retention:

•

Restored tools such as editable shopping lists

•

Implemented better program introduction

•

Instituted low-cost “customer save”

campaigns

•

Implemented an annual plan

Copyright 2010 eDiets.com, Inc. All Rights Reserved |

CONFIDENTIAL

22

92%

95%

93%

91%

91%

92%

93%

89%

90%

91%

92%

93%

94%

95%

96%

Q1-09

Q2-09

Q3-09

Q4-09

Q1-10

Q2-10

Q3-10

Meal Delivery Gross Margin Before

Depreciation and CAC

(Excludes Revenue Share)

Online Subscription Gross Margin Before

Depreciation and CAC

(Excludes Revenue Share)

Improved Gross Margins

Improved Gross Margins

•

Raised price of meal delivery service

•

Moved to lower-cost manufacturer

•

Negotiated lower shipping rates

•

Stabilized IT platform; reduced customer

attrition

Copyright 2010 eDiets.com, Inc. All Rights Reserved

30%

35%

37%

35%

40%

39%

41%

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

Q1-09

Q2-09

Q3-09

Q4-09

Q1-10

Q2-10

Q3-10 |

CONFIDENTIAL

23

Meal Delivery Revenue By Quarter

Meal Delivery Revenue By Quarter

$1,907

$2,289

$1,945

$1,698

$2,997

$3,526

$4,313

Q109

Q209

Q309

Q409

Q110

Q210

Q310E

Q410

Q111

Q211

Copyright 2010 eDiets.com, Inc. All Rights Reserved

Focused on growing the meal delivery business with good results

Launched

Biggest Loser

Meal Program

Launch

Value

Plan

Launch

Men’s

Plan |

CONFIDENTIAL

24

Improving the Revenue/Ad Spend Ratio

Improving the Revenue/Ad Spend Ratio

•

Hired new media purchasing firm to improve auction bidding and

ad placement processes (March 2010)

•

Shifted focus from web sales to call center sales (April 2010)

•

Upgraded email capabilities to improve remarketing (June 2010)

•

Developed new TV ads (August 2010)

•

Add “value plan”

to product lineup to increase conversion

(January 2011)

•

Pursuing low cost/no cost opportunities for media exposure

(Shop NBC, Revshare, PR)

Copyright 2010 eDiets.com, Inc. All Rights Reserved |

CONFIDENTIAL

25

$3.0 Million Investment in Advertising

$3.0 Million Investment in Advertising

(assume advertising investment turns 10X annually)

(assume advertising investment turns 10X annually)

Copyright 2010 eDiets.com, Inc. All Rights Reserved

Meal Delivery Business Model

$ Millions

Ad Spend Scenarios (TV + Online)

$30.0

$30.0

$30.0

$30.0

Revenue/Ad Spend Ratio (revenue /

advertising)

2.00

2.50

3.00

4.00

Implied Revenue

60.0

75.0

90.0

120.0

Variable Cost of Food and Fulfillment

52.0%

(31.2)

(39.0)

(46.8)

(62.4)

Variable Cost of Acquisition

Advertising

25% -

50%

(30.0)

(30.0)

(30.0)

(30.0)

Call Center, Promotions

7.5%

(4.5)

(5.6)

(6.8)

(9.0)

Fixed Cost of Staff and Other Expense

(0.6)

(0.6)

(0.6)

(0.6)

EBITDA

($6.3)

($0.2)

$5.9

$18.0

EBITDA Margin

-10.5%

-0.3%

6.5%

15.0%

Ad Spend Working Capital Investment

Required, assuming 10 turns per year

$3.0

$3.0

$3.0

$3.0 |

CONFIDENTIAL

26

Investment Highlights

Investment Highlights

•

$60 billion weight loss market

–

eDiets

markets comprise approximately $1.4 billion of total

•

Growth strategy –

focus on meal delivery

–

Significantly grow meal delivery business in 2011 by expanding and increasing

TV ad spending

–

Tolerate high customer acquisition cost to achieve critical mass

customer

base

–

Eventually allow customer acquisition cost to settle into profitable range

–

Improve gross margins through shipping cost reductions, volume discounts on

food, and a price increase

–

Target sustainable positive EBITDA and cash flow in 2012

–

Key drivers are meal delivery margins, retention and customer acquisition

cost •

A meal delivery company with $100 million in sales could achieve

5-15%

EBITDA margins in steady-state

Copyright 2010 eDiets.com, Inc. All Rights Reserved |

CONFIDENTIAL

27

Next Steps

Next Steps

•

Order your free sample of food

•

Key vendor calls (we’ll provide contact

information for our key advertisers and

food manufacturer)

•

Meetings with management and review of

detailed forecast (upon signing non-

disclosure agreement)

Copyright 2010 eDiets.com, Inc. All Rights Reserved

27 |

Copyright 2010 eDiets.com, Inc. All Rights Reserved

**************************

**************************

**************************

**************************

**************************

**************************

**************************

**************** |