Attached files

| file | filename |

|---|---|

| EX-3.5 - ZAPNAPS, INC. | v203568_ex3-5.htm |

| EX-2.2 - ZAPNAPS, INC. | v203568_ex2-2.htm |

| EX-3.2 - ZAPNAPS, INC. | v203568_ex3-2.htm |

| EX-2.1 - ZAPNAPS, INC. | v203568_ex2-1.htm |

| EX-3.4 - ZAPNAPS, INC. | v203568_ex3-4.htm |

| EX-10.3 - ZAPNAPS, INC. | v203568_ex10-3.htm |

| EX-10.1 - ZAPNAPS, INC. | v203568_ex10-1.htm |

| EX-10.4 - ZAPNAPS, INC. | v203568_ex10-4.htm |

| EX-10.2 - ZAPNAPS, INC. | v203568_ex10-2.htm |

| EX-21.1 - ZAPNAPS, INC. | v203568_ex21-1.htm |

| EX-10.6 - ZAPNAPS, INC. | v203568_ex10-6.htm |

| EX-10.9 - ZAPNAPS, INC. | v203568_ex10-9.htm |

| EX-10.5 - ZAPNAPS, INC. | v203568_ex10-5.htm |

| EX-10.7 - ZAPNAPS, INC. | v203568_ex10-7.htm |

| EX-10.8 - ZAPNAPS, INC. | v203568_ex10-8.htm |

| EX-99.4 - ZAPNAPS, INC. | v203568_ex99-4.htm |

| EX-99.3 - ZAPNAPS, INC. | v203568_ex99-3.htm |

| EX-10.13 - ZAPNAPS, INC. | v203568_ex10-13.htm |

| EX-10.14 - ZAPNAPS, INC. | v203568_ex10-14.htm |

| EX-10.12 - ZAPNAPS, INC. | v203568_ex10-12.htm |

| EX-10.11 - ZAPNAPS, INC. | v203568_ex10-11.htm |

| EX-10.10 - ZAPNAPS, INC. | v203568_ex10-10.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 22, 2010

FUSIONTECH,

INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

000-53837

|

|

26-1250093

|

|

(State or other Jurisdiction of

Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

No. 26 Gaoneng Street, High Tech Zone, Dalian,

Liaoning Province, China

|

|

116025

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s

telephone number, including area code: (86)

0411-84799486

No.

8 Mingshui Road

Changchun,

Jilin Province, China 130000

(Former

name or former address, if changed since last report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions:

|

¨

|

Written communications pursuant

to Rule 425 under the Securities Act (17 CFR

230.425)

|

|

¨

|

Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

|

|

¨

|

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

|

|

¨

|

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

|

Throughout this

Current Report on Form 8-K, we will refer to FusionTech, Inc. as

“FusionTech,” the “Company,”

“we,” “us” and “our.”

Item

1.01 Entry into a Material Definitive Agreement.

On

November 22, 2010, FusionTech, Inc., a Nevada corporation (the “Company”),

entered into and consummated a series of agreements that resulted in the

acquisition of all of the ownership interests of Dalian Heavy Mining Equipment

Manufacturing Co., Ltd. (“Dalian”), a foreign joint venture company organized

under the laws of the People’s Republic of China (“PRC”).

The

acquisition of Dalian’s ownership interests was accomplished pursuant to the

terms of a Share Exchange Agreement and Plan of Reorganization, dated November

22, 2010 (the “Share Exchange Agreement”), by and between Dalian, its owners,

and the Company. Pursuant to the Share Exchange Agreement, we acquired 100% of

Dalian from the owners of Dalian in exchange for the issuance of 24,990,000

shares of our common stock (the “Share Exchange”). The owners also agreed to

make such administrative filings in the PRC as necessary to record the transfer

of ownership of Dalian to the Company as a wholly foreign owned enterprise.

Concurrent with the closing of the transactions contemplated by the Share

Exchange Agreement and as a condition thereof, we entered into an agreement with

Mr. David Lu, our former Chief Executive Officer and Director, pursuant to which

he returned 80,000,000 shares of our common stock to us for cancellation. Mr. Lu

received compensation of $80,000 from us for the cancellation of his shares of

our common stock. Upon completion of the foregoing Share Exchange transactions,

we had 29,390,000 shares of common stock issued and outstanding. For accounting

purposes, the Share Exchange transaction was treated as a reverse acquisition

and recapitalization of Dalian because, prior to the transaction, the Company

was a non-operating public shell and, subsequent to the transaction, Dalian’s

owners beneficially owned a majority of the outstanding Common Stock of the

Company and will exercise significant influence over the operating and financial

policies of the consolidated entity.

We issued

the shares of common stock to the owners of Dalian in reliance upon the

exemption from registration provided by Regulation S under the Securities Act of

1933, as amended (the “Securities Act”).

Item

2.01 Completion of Acquisition or Disposition of Assets.

We refer

to Item 1.01 above, “Entry into a Material Definitive Agreement,” and

incorporate the contents of that section herein, as if fully set forth under

this Section 2.01.

Description

of Our Company

Historical

Business

Prior to

the transaction described in Item 1.01 above, we were a development stage

company with no revenues and no operations that intended to produce mini-paper

towels. We were incorporated in the State of Nevada on October 10, 2007, under

the name ZapNaps, Inc. On October 28, 2010, we changed our name to FusionTech,

Inc. and authorized an 8-for-1 forward split of our common stock, effective on

November 12, 2010.

Our

common stock will trade under the symbol “ZPNPD” for a 20-day period beginning

on November 12, 2010, pursuant to FINRA rules governing corporate actions, after

which period our symbol will revert to “ZPNP.”

Description

of FusionTech

We

believe we are a leading designer and manufacturer of clean technology

(“CleanTech”) industrial machinery used in the coking process, a critical but

highly pollutive step in the production of crude steel. Our products are sold to

large and medium size steel mills and coking plants in China who use or are

planning to use the coke dry quenching (“CDQ”) method of coking, a more

environmentally friendly and energy conservative method of coking as compared to

the traditional coke wet quenching method.

We

currently design and manufacture CDQ transport cars used in complete CDQ systems

and CleanTech coke oven products such as coke oven elevators, smoke transfer

machines, and coal cleaning machines. These CleanTech coke oven products are

used for maintaining coke ovens and reducing the amount of pollution they

emit. We also design and manufacture core coke oven products, such as

coke drums, coke drum carriers, wet quenching cars, coal freight cars, coke

guide cars, and coke pushers. These core coke oven products are necessary

components for all coke oven systems.

In the

second quarter of 2011, we plan to begin providing our proprietary steel plate

fusion services (“Steel Plate Fusion”) to a large steel plate manufacturer in

northern China, Minmetals Yingkou Medium Plate Co., Ltd. (“Minmetals Yingkou”).

Minmetals Yingkou is an established steel plate manufacturer in China with over

30 years of experience in producing clad steel plates and extra-thick carbon

steel plates. It is a subsidiary of the reputable China Minmetals Corporation, a

Fortune Global 500 Company based in China focusing on the development and

production of metals and minerals. We anticipate that our partnership with

Minmetals Yingkou will increase our revenues in 2011 as we have contracted to

process between 200,000 and 500,000 tons of steel plates using Steel Plate

Fusion.

1

We

believe Steel Plate Fusion is a next generation technology that is superior in

both cost and efficiency to conventional methods used to manufacture clad metal

plates and extra-thick carbon steel plates. Steel Plate Fusion uses an electron

beam welding machine in a vacuum chamber, and a proprietary process of surface

treatment and manipulation of pressure and temperature of the fusion process, to

fuse together metal slabs that can be hot rolled/compressed to

produce:

|

|

·

|

clad

metal plates (“clad metal plates”), manufactured by fusing two dissimilar

metal plates such as stainless steel plates and carbon steel plates (“clad

steel plates”). Clad steel plates offer a more economical alternative to

pure stainless steel plates since they combine inexpensive carbon steel

and stainless steel. In addition, clad steel plates provide similar

functionalities as stainless steel plates and can be used in similar

industrial applications. Clad steel plates are commonly used and highly

demanded in heavy industrial applications such as the construction of

ships, piping, nuclear reactors, pressure vessels, heat exchangers, power

generation equipment, and coking equipment, all of which require the

anti-corrosive properties of clad steel

plates.

|

|

|

·

|

specialty

extra-thick carbon steel plates (“extra-thick carbon steel plates”), more

than 80 millimeters thick, commonly used and highly demanded in heavy

industrial applications such as the construction of large ships, bridges,

buildings, metallurgical equipment, mining equipment, and power generation

equipment, all of which require the strength of extra-thick carbon steel

plates of certain standards and

specifications.

|

We

operate through Dalian Heavy Mining Equipment Manufacturing Co. Ltd., our

subsidiary organized under the laws of the People’s Republic of China (“PRC”).

Our principal executive offices are located at No. 26, Gaoneng Street, High Tech

Zone, Dalian, Liaoning Province, China 116025. Our phone number is (86)

0411-84799486 and our website address is www.cleanfusiontech.com.

Clean

Coking and Related Products

FusionTech

designs and manufactures a wide variety of CleanTech coke oven products

including coke dry quenching (“CDQ”) transport cars, coke oven elevators, smoke

transfer machines, and coal cleaning machines. FusionTech also designs and

manufactures core coke oven products including wet quenching cars, coal freight

cars, coke guide cars, and coke pushers. FusionTech’s products are sold to the

China domestic steel and coking industries and have significant CleanTech

applications including use in complete CDQ systems. A complete CDQ system can

recycle the wasted heat produced during the coking process to generate

electricity and/or steam. CDQ systems are being phased into the coking process

in the China steel and coke industries because of these environmental and energy

conservation benefits. Additionally, PRC regulations set forth by the Ministry

of Industry and Information Technology (“MIIT”) now require all newly

constructed or reconstructed coke ovens to be accompanied by the installation of

a CDQ system. (1)

We were

one of the first manufacturers of CDQ transport cars in China, and believe that

we are a leading manufacturer of coke oven elevators. We have also been

manufacturing core coke oven products since our inception in 1992. Management

estimates that the market demand for coke ovens and related products will

approach the $1 billion mark as 40-60 new coke ovens are expected to be built in

China next year. We believe our eighteen-year operating history and focus on

product quality makes us one of the leading CleanTech focused coke oven product

manufacturers in China.

Industry

Overview

China is

the world’s largest steel producer and is projected to further expand its output

as domestic demand for the metal grows. According to statistics

released on the World Steel Association website, www.worldsteel.org, China

accounted for 47% of the world’s total crude steel output in 2009 and is on pace

to produce a record 600 million metric tons in 2010. As the China domestic steel

industry expands, environmental issues related to its production have become

more pressing. Within China’s industrial sector the steel industry accounts for

15% of aggregate energy consumption, 14% of aggregate wastewater production, and

17% of aggregate solid waste emission. (1)

The processes of smelting, coking, and steel casting,

contribute in excess of 70% of the total pollution and energy consumed within

the steel industry itself.(1)

(1)

Source: PRC Ministry of Industry and Information Technology “Steel

and Coking Industry CDQ Technology Marketing and Implementation Plan” January

20, 2010.

2

Coking is

the process by which coke is produced, a basic raw material used in the

production of iron. Coking involves baking coal at extremely high temperatures

in an oxygen-free oven (“coke oven”) and then rapidly cooling it. In the

conventional cooling process, the hot coke is cooled by drenching it with cold

water (“coke wet quenching”). Cooling the coke in this manner emits noxious

gases and the heat energy contained in the hot coke is lost. The modern CDQ

system cools the coke by circulating an inert gas in an enclosed heat exchange

system. This process reduces the harmful environmental effects associated with

the conventional cooling process as water is not contaminated with toxic

pollutants nor are air pollutants released.

CDQ

systems also promote renewable energy production as the wasted heat is recycled

to generate electricity. Compared to the coke wet quenching process, a steel

mill using two CDQ systems can produce approximately 167 gigawatt hours of

electricity from waste heat annually, saving approximately $9.2 million each

year on electricity costs, saving approximately 3.7 million tons of water, and

reducing its carbon dioxide emissions by approximately 130,000 metric tons.(2)

The PRC

government identified the steel industry as one of its primary targets for

pollution reduction in its 11th Five

Year Plan. In July 2010 China’s MIIT, to reduce emissions in the steel industry,

mandated that China’s existing steel mills consolidate to form larger more

efficient mills. Currently China’s steel industry includes many small steel

mills that use outdated technology. As steel industry consolidation progresses

in China, larger steel mills have sought to produce higher quality steel more

efficiently through the use of production methods which reduce environmental

impact.

In July

2010, China’s MIIT also mandated that the construction of new coke ovens or the

reconstruction of old coke ovens be accompanied by the installation of a

complete CDQ system. MIIT targeted 90% of large steel mills and 40% of all

coking plants to have CDQ systems installed before 2013. (3)

Products

CDQ

Transport Cars

We

believe we are a leading designer and manufacturer of CDQ transport cars

that are key components to a complete CDQ system.

A

complete CDQ system requires two CDQ transport cars, three coke drums, and three

coke drum carriers. A coke drum carrier is a long flatcar that runs along a

railway and is used to hold a coke drum, a large cylindrical container made of

metal used to hold coke. The CDQ transport car is a powered locomotive engine

that connects to the drum carrier and pulls it along the railway from the coke

oven to the CDQ machine for processing. An operator controls the speed of the

car from a control room located ontop of the CDQ transport car.

|

||

|

CDQ

Transport Car for 6.25m Coke Oven

Source:

The Company

|

FusionTech

manufactures CDQ transport cars by welding together steel plates to form the

car’s structure and then integrating electronic components such as engines,

wheels, and mechanical controls. Manufacture of CDQ transport cars requires

advanced technical knowledge as CDQ transport cars must be acutely responsive to

an operator’s commands to ensure the CDQ transport car stops at a precise

location where dangerous hot coke may be loaded and unloaded safely. Management

believes FusionTech’s CDQ transport cars are known in the coking industry for

their high quality and competitive pricing.

The

primary markets for FusionTech’s CDQ transport cars are new steel mills and

coking plants in the China domestic market and existing steel mills and coking

plants being modernized or seeking replacements for existing CDQ transport cars.

Management estimates that CDQ transport cars have a useful life expectancy of

approximately ten years.

(2) United

Nations Framework Convention on Climate Change: Baotou Iron & Steel CDQ and

Waste Heat Utilization for Electricity Generation Project, 03/08/2007, and

“CDQ-Modern coking technology,” by Anhui Vocational College of Metallurgy and

Technology. Assumptions made in calculations: Steel mill using two CDQ systems,

each with 125 tons/hour coal capacity and 15 megawatt electricity generating

capacity, and $0.055/kilowatt hour (based on average cost per KWH paid by

Huaneng in 2009).

(3)

PRC Ministry of Industry and Information Technology “Steel and Coking Industry

CDQ Technology Marketing and Implementation Plan” January 20, 2010.

3

Coke

Oven Elevator

We

believe we are a leading designer and manufacturer of coke oven elevators used

to repair damages and prevent toxic leaks as part of coke oven

maintenance.

|

||

|

Source:

The Company

|

According

to the U.S. Department of Energy, the largest environmental issue with the

steelmaking process is the carburizing of coal into coke for use in the

iron-making process. Coke ovens, in addition to emitting dust and particulate

emissions, produce noxius gases including nitrogen oxide, carbon monoxide, and

carbon dioxide. These

environmental hazards are particularly severe in China, the world’s largest

producer of coke according to the United Nations Statistics Division. The

PRC government has stated publicly that it plans to respond to these

environmental issues by including new pollutants such as nitrogen oxide in its

emission control list in China’s 12th Five

Year Plan.(4) We

believe the demand for coke oven maintenance products will increase as a result

of the inclusion of these pollutants, and that our coke oven elevators are

well-suited to meet this demand.

Coke oven

elevators are used to transport workers to the top of a coke oven where they can

repair damages and inspect for signs of toxic leaks. Regular coke oven

maintenance is one of the primary ways pollution emission can be controlled

during the coking process. Currently, we believe that we are the only domestic

manufacturer in China for coke oven elevators that attach to coke ovens 7 meters

and 7.63 meters in height. Management also believes that FusionTech’s coke oven

elevators with these specifications are 50% cheaper than imported coke oven

elevators, and are of superior quality as our elevators are powered by an

internal battery rather than diesel fuel. Additionally, demand for coke oven

elevators with these specifications is increasing due to the government directed

consolidation of the China steel industry. As small inefficient steel mills and

coking plants are closed and integrated into larger operations, all

reconstructed coke ovens or newly installed coke ovens will likely exceed 5.5

meters in height to take advantage of the increased production efficiencies a

larger coke oven provides. When a coke oven higher than 6 meters high is

installed, an area adjacent to the coke oven is typically reserved for the

installation of a coke oven elevator which can help reduce pollution emission

and maintain the coke oven for optimal performance. The PRC’s current pollution

emission reduction targets for the steel and coking industry also strongly

encourage the installation of these coke oven elevators.

We sell

our coke oven elevators to new steel mills and coking plants in China and to

steel mills and coking plants that are replacing and/or reconstructing old coke

oven elevators. Management estimates that the average coke oven elevator lasts

ten years.

Production

We

manufacture our CleanTech coke oven products and core coke oven products in our

facilities in the city of Dalian, Liaoning Province, China. We base our

production schedule on customer orders and schedule deliveries on a just-in-time

basis. Our manufacturing operations principally involve the welding together of

large steel plates and the integration of electronic components. It takes us

approximately three months to design a CDQ transport car according to our

customers’ specifications, and approximately another three months to

manufacture. Coke oven elevators can be designed and manufactured within three

months. We received ISO 9001:2008 Quality Management System certification in

January 2008. We have implemented comprehensive quality control procedures,

including non-destructive tests for defect detection conducted by our own

quality control group.

Sales and

Marketing

We employ

approximately 10 sales people to sell and market our products directly to

customers. Our sales people also engage in bidding for specific projects and

maintain our relationships with long-term clients. We currently sell our

products directly to large and medium scale China domestic steel mills and

coking plants, and through general contractors that are hired by steel mills and

coking plants to install complete CDQ systems. Management believes that these

general contractors are responsible for the majority of CDQ installations in

China. We fund our marketing costs through our working capital.

Suppliers

Our

principal raw material purchases include carbon steel, stainless steel, and

mechanical and electrical components. We have several suppliers for each of the

materials we use to manufacture our products. We believe we will be able to

obtain an adequate supply of steel and mechanical and electrical components to

meet our manufacturing requirements. We maintain a good business relationship

with all of our suppliers.

(4) Jing,

Li. “New pollution reduction targets listed.” China

Daily. January 26, 2010.

4

Customers

Our

customer base for our coking products includes large and medium scale steel

mills and coking plants in China. We sell our products either directly to these

steel mills and coking plants or through one of four general contractors in

China of CDQ systems. We believe we have strong business relationships with

these four general contractors, ACRE Coking and Refractory Engineering

Consulting Corporation Co., Ltd., Sinosteel Equipment and Engineering Co., Ltd.,

China-Japan Energy and Environment Engineering Technology Co., Ltd., and Jigang

International Engineering Technology Co., Ltd.

In 2009,

our three largest customers, ACRE Coking and Refractory Engineering Consulting

Corporation, Co., Ltd., Sinosteel Equipment and Engineering Co., Ltd., and Jinan

Steel Corp., accounted for approximately 32%, 28%, and 8%, respectively, of our

total revenues.

For the

nine months ended September 30, 2010, our three largest customers, ACRE Coking

and Refractory Engineering Consulting Corporation, Co., Ltd., Jinan Steel Corp.,

and Sinosteel Equipment and Engineering Co. Ltd., accounted for approximately

38%, 28%, and 22%, respectively, of our total revenues.

Intellectual

Property

We rely

on the patent laws in China, along with confidentiality procedures and

contractual provisions, to protect our intellectual property and maintain our

competitive edge in the marketplace. Currently we own seven patents, three for

different models of our CDQ transport cars, one for our coke oven elevator, one

for our coal cleaning machine, one for our steel belt feeding roller, and one

for our charging gas transfer car. One of our CDQ transport car patents will

expire in 2016 and two will expire in 2017. Our coke oven elevator patent will

expire in 2019, our coal cleaning machine patent will expire in 2018, and our

steel belt feeding roller and charging gas patents will expire in 2020. As we

continue to develop our CleanTech coke oven products we will apply for new

patents to protect our innovations. We have also executed non-disclosure

agreements with key employees to protect our patents and other trade secrets

related to our business.

Research and

Development

To

maintain our competitive edge in the marketplace and keep pace with new

technologies, we believe it is important to devote resources to ongoing research

and development to find improved efficiencies in the design, cost, pollution

reduction, and energy conservation capabilities of our products, while

identifying and developing new coking products. We plan to spend approximately

$750,000 on research and development in 2010.

Governmental and

Environmental Regulation

Our

business and company registrations are in compliance in all material respects

with the laws and regulations of the municipal and provincial authorities of the

Liaoning Province and China. We are subject to the National Environmental

Protection Law of the PRC as well as local laws regarding pollutant discharge,

air, water and noise pollution, with which we comply. We currently incur nominal

costs in connection with environmental laws as our manufacturing processes

generate minimal discharge.

We are

not subject to any other government regulations that would require us to obtain

a special license or approval from the PRC government to conduct our CleanTech

coke oven products and related products business.

Competition

Our

coking products compete against both China domestic manufacturers and

international manufacturers. Our deep industry expertise for the past 18 years

has allowed us to successfully design and manufacture products that we believe

meet the demand and satisfaction of our clients. We believe we have strong

relationships with our existing customer base and that our products are

recognized for their high quality and innovation. The manufacturing industry for

coking products in China is highly fragmented with many different manufacturers

holding small shares of the total market. Many of our competitors have

manufacturing operations that span many different heavy machinery industries,

and as a result they may have larger operations and greater financial resources

than us. We plan to remain competitive by continuing to market our eighteen year

operating history, our reputation for superior products, by funding research and

development to improve our current line of CleanTech coke oven products, and by

focusing on developing new innovative products that focus on environmental

conservation.

5

|

|

·

|

Proprietary product

designs - We own seven different patents including three for

different models of our highly demanded CDQ transport cars. Management

estimates that these three models of CDQ transport cars occupy 60% of the

China domestic market.

|

|

|

·

|

Award winning technology

– We designed and manufactured a CDQ transport car which was an integral

component of a major CDQ project in Maanshan, China. This CDQ project

received the Metallurgical Technology First Class Award from the China

Iron and Steel Association and the Chinese Society for Metals in 2005. In

2009 this CDQ project also received the National Science and Technology

Second Class Award.

|

|

|

·

|

Strong business

relationships – We have strong business relationships with the four

CDQ general contractors who management believes occupy the majority of the

domestic China CDQ market. Management believes its relationships with

these contractors will continue, providing the Company with a valuable and

growing distribution channel for its CleanTech coke oven

products.

|

|

|

·

|

Industry Experience – We

have an eighteen year operating history and are led by a management team

with over thirty years of metallurgical, heavy machinery, and coke

industry experience. At our inception we only manufactured

traditional core coke oven products. In 2002 we were able to successfully

expand our product offerings to include coke dry quenching

products.

|

|

|

·

|

Customer Service – We

work closely with our customers to design and manufacture products to

their custom specifications. Our technical staff provides onsite guidance

through the installation process.

|

Seasonality

We

typically experience stronger sales in the third and fourth quarters of our

fiscal year ending December 31st. This

is due to general contractors of CDQ systems, coking plants, and steel mills

typically placing their orders with us at the beginning of each fiscal year. We

typically ship these orders in the second half of the year.

Employees

As of

November 22, 2010 we had approximately 160 full-time employees. We plan to hire

an additional 100 full-time employees by the end of 2011. We believe that

relations with our employees are satisfactory and retention has been stable. We

enter into standard labor contracts with our employees as required by the PRC

government and adhere to state and provincial employment regulations. We provide

our employees with all social insurance as required by state and provincial

laws, including pension, unemployment, basic medical and workplace injury

insurance. We have no collective bargaining agreements with our

employees.

Planned

Expansion: Steel Plate Fusion

In the

second quarter of 2011, we plan to expand our existing operations to offer our

proprietary Steel Plate Fusion services to China steel plate manufacturers of

clad metal plates and extra-thick carbon steel plates.

Clad

metal plates is a general term used to describe metal plates composed of two

dissimilar metals. For example, a clad metal plate may combine stainless and

carbon steel, titanium and steel, aluminum and steel, or nickel and steel. Our

Steel Plate Fusion services will be initially used in the production of clad

steel plates, composed of stainless and carbon steel. However, management

believes that Steel Plate Fusion can be used to manufacture all types of clad

metal plates.

A

clad steel plate is a composite steel plate manufactured by bonding stainless

steel with carbon steel. Currently the most common method of producing clad

steel plates in China is through the use of a technique called explosion

welding. Clad steel plates have the structural strength of carbon steel and the

anticorrosive and heat resistant properties of stainless steel, but are less

costly than pure stainless steel plates because they combine cheaper carbon

steel with stainless steel. In addition, clad steel plates provide

similar functionalities as stainless steel plates and can be used for similar

industrial applications. Clad steel plates have widespread industry

applications, especially in areas of rapid growth in China. Clad steel plates

are used in heavy industrial applications such as in the construction of ships,

piping, nuclear reactors, pressure vessels, heat exchangers, power generation

equipment, and coking equipment, all of which require the anti-corrosive and

heat resistant properties of clad steel plates.

6

An

extra-thick carbon steel plate is a steel plate over 80 millimeters thick and is

currently manufactured through either mold casting or electroslag remelting.

Extra-thick carbon steel plates are also used in heavy industrial applications

such as in the construction of ships, bridges, buildings, metallurgical

equipment, mining equipment, and power generation equipment, all of which

require the strength and endurance of extra-thick carbon steel plates of certain

standards and specifications.

China’s

growing demand for steel is reflected in the China domestic clad steel plate and

extra-thick carbon steel plate market. The market demand for clad steel plates

is estimated to be 2.4 million tons or $6.1 billion. The demand for clad steel

plates is expected to grow to 8.5 million tons or $22 billion by 2015. The

market demand for extra-thick carbon steel plates, or carbon steel plates that

exceed 80 millimeters in thickness, is estimated to be 8.2 million tons or $9

billion. By 2015, demand is expected to increase to 26 million tons or $28.7

billion. 5

We

believe Steel Plate Fusion will transform the way clad steel plates and

extra-thick carbon steel plates are made in China as it is a unique and

innovative method of production that will offer significant cost savings and

production efficiencies to China steel plate manufacturers who currently use

conventional methods.

Conventional Production

Methods

Clad

Steel Plates

Conventional

clad steel plate manufacturing occurs through a three step process:

|

|

1.

|

Continuous

casting - Molten steel is solidified into a thick rectangular slab through

a process known as continuous casting, a low-cost and efficient mass

production method of producing high quality carbon and stainless steel

slabs.

|

|

|

2.

|

The

resulting carbon and stainless steel slabs are hot rolled/compressed

through a steel rolling mill which flattens the slabs into rectangular

carbon and stainless steel plates.

|

|

|

3.

|

The

stainless steel plate is then welded to the carbon steel plate through a

technique known as explosion welding. Explosion welding uses force

generated from controlled explosions to weld together two dissimilar metal

plates. It is the most commonly used method of welding together metal

plates in China.

|

The end

product is a clad steel plate which is comprised of a carbon steel plate and an

anti-corrosive layer of a stainless steel plate. Explosion welding can be

extremely dangerous as the use of explosives to weld together metal plates is an

inherently dangerous activity. Additionally, the explosions used to weld the

plates together can often produce unwanted bubbles on the outer surface of the

plate. These bubbles must be manually corrected, requiring significant time and

expense on the part of the steel plate manufacturer.

Extra-Thick

Carbon Steel Plates

Extra-thick

carbon steel plates are conventionally manufactured through either one of two

processes, mold casting or electroslag remelting.

|

|

1.

|

Mold

Casting - Molten steel is poured into a rectangular cast and cooled within

the cast until it solidifies. The resultant thick steel slab is compressed

through a steel rolling mill to produce an extra-thick carbon steel plate.

Mold casting is currently the most commonly used method to produce

extra-thick carbon steel plates in

China.

|

|

|

2.

|

Electroslag

Remelting (ESR) – Molten steel is solidified into a thick rectangular slab

through continuous casting and then remelted in a metal mold. Once the

remelted slab is cooled and solidified within the mold, it is compressed

through a steel rolling mill to produce an extra-thick carbon steel plate.

ESR is used instead of mold casting for certain industry applications that

require higher quality plates because it produces an extra-thick carbon

steel plate with fewer flaws. However, ESR is costlier than mold casting

because the steel is melted twice and the rejection rate for the final

steel plate is higher.

|

Management

believes that our Steel Plate Fusion services are a more cost effective and

efficient method to produce extra-thick carbon steel plates. As compared to mold

casting, Steel Plate Fusion uses continuous casting in the production of

extra-thick carbon steel plates. Continuous casting is generally accepted as the

cheapest and most efficient method for producing metal slabs up to a certain

thickness and also produces a higher quality end product. As compared to

electroslag remelting, Steel Plate Fusion can produce a similar quality plate

without the added step of remelting the solidified metal slab prior to

compression in the steel rolling mill, thereby saving time and expense in the

production process.

(5) Source: Zero

Power Intelligence Research “China Thick Steel Plate Industry Research and

Analysis” 2010. (the “Steel Plate Report”)

7

Steel Plate

Fusion

Steel

Plate Fusion is our proprietary technology that we believe is the first and only

of its kind in China. We plan to offer Steel Plate Fusion as a value added

service to steel plate manufacturers in China. We believe Steel Plate Fusion

will be in high demand as it will lower production costs and improve

efficiencies in the manufacture of clad and extra-thick carbon steel plates in

China.

Steel

Plate Fusion uses electron-beam welding technology as part of its proprietary

process, which includes the manipulation of pressure and temperature during the

fusion process, to fuse together large metal slabs used in the production of

clad steel plates and extra-thick carbon steel plates. Electron-beam welding is

a fusion welding process that was first developed in 1958 to weld together

component parts used in modern technology such as jet engines, electric motors,

and automobiles. Electron-beam welding employs a high-velocity electron beam in

a vacuum to fuse together desired components. Through research and development,

FusionTech modified traditional electron beam welding technology so it could be

used to fuse together large metal slabs to produce clad steel plates or

extra-thick carbon steel plates. Management believes that Steel Plate Fusion

will be a cheaper, faster, and higher yielding method by which to produce clad

steel plates and extra-thick carbon steel plates in China, as compared to

conventional methods of production.

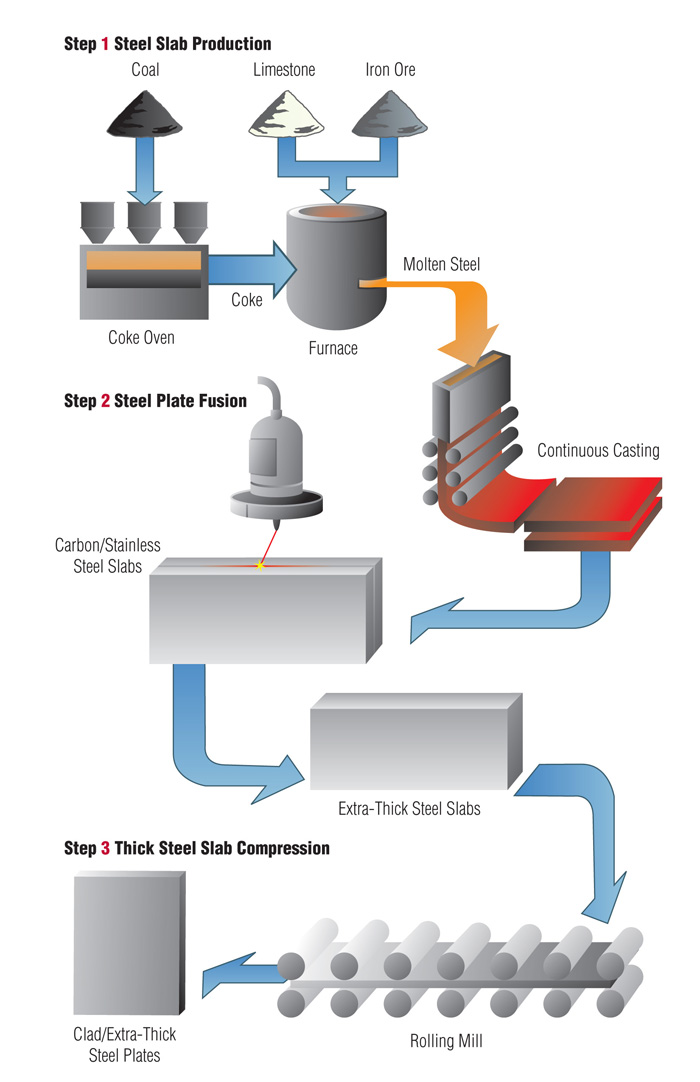

To

manufacture clad steel plates and extra-thick carbon steel plates through Steel

Plate Fusion, coal, limestone and iron ore are first processed by a blast

furnace to produce molten steel. The molten steel is then transformed into

rectangular steel slabs through the continuous casting process. After the slabs

have cooled and solidified, a truck transports the steel slabs to our processing

facilities which are adjacent to the steel plate manufacturing plant. At our

facility our staff mounts the rectangular steel slabs and fuses them together

using Steel Plate Fusion. The fused slab is then transported back to the steel

plate manufacturer where it is heated and compressed through a steel rolling

mill to produce the final clad steel or extra-thick carbon steel

plate.

8

During

our testing of Steel Plate Fusion we successfully produced clad steel plates and

extra-thick carbon steel plates in the facilities of a large steel manufacturer

in China. Microscopic and x-ray testing of the steel slabs fused together

through Steel Plate Fusion exceeded the stringent testing standards required by

steel plate manufacturers who produce clad steel plates and extra-thick carbon

steel plates. According to our tests, the final clad steel plates and

extra-thick carbon steel plates produced through Steel Plate Fusion are of

higher quality than those produced through explosion welding or mold casting

respectively. The clad steel plates produced through Steel Plate Fusion were

free of air bubbles often present in clad steel plates manufactured through

explosion welding. Additionally, we were able to produce extra-thick carbon

steel plates thicker than 100 millimeters and with an overall lower rejection

rate than plates produced through mold casting or electroslag

remelting.

Intellectual

Property

We filed

an application for an invention patent covering Steel Plate Fusion in China on

September 13, 2010. The invention patent offers stronger protection for new

technological processes than the more commonly used utility patent. If granted,

the invention patent will prevent competitors from utilizing Steel Plate Fusion

for a period of twenty years as compared to only ten years for a utility patent.

We strongly believe that the application for the invention patent will be

approved as no other company in China uses technology similar to Steel Plate

Fusion.

Although

the application process takes approximately eighteen months to complete, the

filing of an invention patent in China grants the applicant temporary protection

during this time. Should any competitor in China seek to implement Steel Plate

Fusion in its own operations, FusionTech will have a legal claim against

them.

The

operation of Steel Plate Fusion requires specific skills and operational

knowledge to prevent defects in production and waste of expensive raw materials.

We will protect our operational knowledge of Steel Plate Fusion as a trade

secret. FusionTech has implemented confidentiality procedures and contractual

provisions with its employees who work with Steel Plate Fusion. Steel

plate manufacturers who work with FusionTech will also be required to follow

strict confidentiality procedures with respect to Steel Plate Fusion. We believe

these steps will adequately protect our proprietary knowledge of the operational

and technical aspects of Steel Plate Fusion.

Customers

We

believe our customer base for Steel Plate Fusion will be medium and large-scale

steel plate manufacturers across China who produce clad steel plates and

extra-thick carbon steel plates. We believe that the cost and efficiency

advantages Steel Plate Fusion has over conventional methods of clad and

extra-thick carbon steel plate production will help drive demand for our

services.

We plan

to market our Steel Plate Fusion technology directly to steel plate

manufacturers across China through our existing sales team for our CleanTech

coke oven products. We believe that our pre-existing relationships with steel

manufacturers formed through the sale of our coking products will provide

avenues for marketing and selling the Steel Plate Fusion value added

service.

We have

signed a non-exclusive strategic contract to provide our Steel Plate Fusion

services to Minmetals Yingkou, a large steel plate manufacturer located in

northern China, and a subsidiary of China Minmetals Corporation, a large China

conglomerate with over $26 billion in revenue. Pursuant to the contract,

FusionTech is constructing a Steel Plate Fusion processing facility adjacent to

Minmetals Yingkou’s steel plate production facilities. Minmetals Yingkou will

produce the carbon and stainless steel slabs using its own continuous casting

system, and the slabs will then be sent to the adjacent FusionTech processing

factory to be fused together using Steel Plate Fusion. These fused metal slabs

will then be sent back to the Minmetals Yingkou steel plate rolling mill where

they will be compressed in Minmetals Yingkou’s rolling machinery to produce

finished clad steel plates and extra-thick carbon steel plates.

Minmetals

Yingkou will be responsible for selling the steel plates to end users. Minmetals

Yingkou, an established and reputable steel plate manufacturer in China, plans

to use its existing wide distribution network and customer relationships to sell

and market the steel plates manufactured using Steel Plate

Fusion. The contract requires Minmetals Yingkou to pay FusionTech an

agreed upon processing fee per ton of clad steel plates and extra-thick carbon

steel plates manufactured using Steel Plate Fusion. The contract provides for a

total production of 200,000 to 500,000 tons of plates. The final tonnage

produced will depend on market conditions. We believe that Steel Plate Fusion

will begin generating revenues by the third quarter of 2011. The Company plans

to hire an additional 70 employees to work in the Steel Plate Fusion processing

facility in Yingkou.

9

FusionTech

plans to use a similar business model when partnering with other medium and

large-scale steel plate manufacturers across China. We believe this franchise

model of expansion, where we build processing factories adjacent to major China

steel plate manufacturers, will provide us with first mover advantage and

discourage potential competitors from entering our newly created

market.

Business

Strategy

We

believe that we are the only Company in China to offer Steel Plate Fusion as a

method of producing clad steel plates and extra-thick carbon steel plates. We

believe that the production efficiencies and cost savings offered by Steel Plate

Fusion will enable us to successfully compete in a market dominated by less

efficient and more costly production methods. We plan to remain competitive by

vigorously protecting our intellectual property and heavily marketing our Steel

Plate Fusion technology as the low-cost, higher efficiency alternative to

conventional production methods for clad steel plates and extra-thick carbon

steel plates.

|

|

·

|

First mover advantage

–We believe our Steel Plate Fusion services will be successful because

FusionTech is the only Company to offer this low cost and high efficiency

method of producing clad steel plates and extra-thick carbon steel plates

in China, the market demand for which are expected to grow in the next

five years by 262% and 217% respectively, according to the Steel Plate

Report.

|

|

|

·

|

Established barriers to

entry – The high research and development costs necessary to

develop Steel Plate Fusion technology will prevent competitors from

entering our newly created market. FusionTech has also applied for an

invention patent for Steel Plate Fusion which, if granted, will provide

legal protection for the technology for twenty years. We

strongly believe that the invention patent will be approved. Additionally,

we believe our franchise model of expansion will strengthen our presence

throughout different areas of China. The construction of processing

facilities adjacent to steel plate manufacturers will also create strong

barriers to entry and discourage potential

competitors.

|

|

|

·

|

Significant costs savings and

higher efficiencies over existing technologies – Based on our

testing of Steel Plate Fusion, management estimates that Steel Plate

Fusion technology will save steel plate manufacturers considerable costs,

time, resources, and help to expand production output of both clad steel

plates and extra-thick carbon steel

plates.

|

|

|

·

|

Asset-light, value added

service business model - As management

plans to pursue a strategy where clients pay FusionTech for its Steel

Plate Fusion services rather than for final steel plates produced,

FusionTech will not have to invest in expensive continuous casting and

steel rolling equipment in order to earn revenues from Steel Plate Fusion.

We believe this is a superior business model as compared to producing clad

steel plates and extra-thick carbon steel plates which require high

capital expenditures for steel slab production and their subsequent

compression through hot rolling. We also plan to leverage our steel plate

manufacturer partners’ existing distribution network and customer base to

expand the volume of steel plates produced using Steel Plate

Fusion.

|

Properties

Our

principal executive offices and our designing and manufacturing facilities for

our CleanTech coke oven products and core coke oven products are located in

Dalian, Liaoning Province, China. We lease four buildings in Dalian, and the

land each of them occupy, which include our office headquarters and three

separate manufacturing factories. FusionTech is currently in the process of

obtaining the land-use rights from the PRC government for the land adjacent to

Minmetals Yingkou’s factory, where FusionTech has begun construction of a

processing facility for Steel Plate Fusion, and for another piece of land

located in Dalian, Liaoning Province, China.

Legal

Proceedings

FusionTech

may occasionally become involved in various lawsuits and legal proceedings

arising in the ordinary course of business. Litigation is subject to inherent

uncertainties and an adverse result in these or other matters that may arise

from time to time may have an adverse affect on our business, financial

conditions or operating results. FusionTech is currently not aware of any such

legal proceedings or claims that will have, individually or in the aggregate, a

material adverse affect on our business, financial condition or operating

results.

10

Risk

Factors

Risks

Related to Our Business

Our

plans for growth rely on a new business that we have not yet commenced. This

line of business will be critical to our success in the future, and if it is

unsuccessful our potential for growth may be adversely affected.

Steel

Plate Fusion is a new service offered by the Company that will commence

operations in the second quarter of 2011. While we have already signed a

contract with a large steel plate manufacturer in China to provide these

services, we have not yet commenced mass production at any

facility. We cannot assure you that large scale production will be

profitable or that the production techniques we use will be suitable for mass

production. Moreover, while during the testing of Steel Plate Fusion we

successfully produced clad and extra-thick carbon steel plates, and the final

produced steel plates met or exceeded the quality standards required by our

customer; we cannot assure you that we will be able to maintain such standards

when we commence mass production. Therefore we cannot assure you that Steel

Plate Fusion will be a profitable line of business and will ultimately succeed

as currently planned. Any significant setback in our plans for Steel Plate

Fusion may adversely affect our future profitability and potential for

growth.

We

are a major purchaser of certain raw materials that we use in the manufacturing

process of our clean coking and related products, and price changes for the

commodities we depend on may adversely affect our profitability.

The

Company’s largest raw materials purchases consist of stainless steel and carbon

steel. As such, fluctuations in the price of steel in the China domestic market

will have an impact on the Company’s operating costs and related profits.

International steel prices were lower in 2009 than in 2008, but prices have

increased in 2010 along with the general economic recovery. The iron ore import

price in China has also increased since 2009, which will impact the price and

volume of steel produced by the China domestic steel industry.

Our

profitability depends in part upon the margin between the cost to us of certain

raw materials, such as stainless steel and carbon steel, used in the

manufacturing process, as well as our fabrication costs associated with

converting such raw materials into assembled products, compared to the selling

price of our products, and the overall supply of raw materials. It is our

intention to base the selling prices of our products in part upon the associated

raw materials costs to us. However, we may not be able to pass all increases in

raw material costs and ancillary acquisition costs associated with taking

possession of the raw materials through to our customers. Although we are

currently able to obtain adequate supplies of raw materials, it is impossible to

predict future availability or pricing. The inability to offset price increases

of raw materials by sufficient product price increases, and our inability to

obtain raw materials, would have a material adverse effect on our consolidated

financial condition, results of operations and cash flows.

The

Company does not engage in hedging transactions to protect against raw material

fluctuations, but attempts to mitigate the short-term risks of price swings by

purchasing raw materials in advance.

We

derive a substantial part of our revenues from several major customers. If we

lose any of these customers or they reduce the amount of business they do with

us, our revenues may be seriously affected.

Our three

largest customers accounted for approximately 69% of total sales for the fiscal

year ended December 31, 2009, and our largest customer accounted for

approximately 32% of total sales in the fiscal year ended December 31, 2009. Our

three largest customers accounted for approximately 88% of total sales for the

nine months ended September 30, 2010, and our largest customer accounted for

approximately 38% of total sales for the nine months ended September 30, 2010.

These customers may not maintain the same volume of business with us in the

future. If we lose any of these customers or they reduce the amount of business

they do with us, our revenues and profitability may be seriously affected. We do

not foresee our relying on these same customers for revenue generation as we

introduce new product lines, new generations of existing product lines, and

expand our business to include Steel Plate Fusion services. We cannot be

assured, however, that we will be able to successfully introduce new products or

services.

We

may lose customers for our traditional coke oven products due to consolidation

of the steel industry in China.

We

currently sell our traditional coke oven products to a number of medium size

steel mills and coking plants in China. If these medium size steel mills and

coking plants are forced to close or consolidate with larger operations, we may

lose them as our customers. While we believe that consolidation of the steel

industry in China will increase the demand for our clean coking products as

larger steel mills and coking plants with greater capital resources are formed,

there are no guarantees that we will be able to successfully retain these larger

steel mills and coking plants as our customers.

The

steel industry is cyclical in nature and is subject to the fluctuations of the

global economy, a downturn in which could adversely affect our revenues and the

profitability of our planned expansion into Steel Plate Fusion.

Our clean

coking and related products are used by large and medium size steel mills and

coking plants in China whose businesses are dependent on the strength of the

global steel industry. Any drop in the demand for steel due to global economic

factors may cause these steel mills and coking plants to reduce their level of

capital expenditures which in turn could adversely affect our revenues from our

coke oven products. Such an occurrence may also negatively affect the

profitability of our planned expansion into Steel Plate Fusion.

11

If

we are not able to manage our growth, we may not be profitable.

Our

continued success will depend on our ability to expand and manage our operations

and facilities. There can be no assurance we will be able to manage our growth,

meet the staffing requirements for our current or planned business or

successfully assimilate and train new employees. In addition, to manage our

growth effectively, we may be required to expand our management base and enhance

our operating and financial systems. If we continue to grow, there can be no

assurance the management skills and systems currently in place will be adequate.

Moreover, there can be no assurance we will be able to manage any additional

growth effectively. Failure to achieve any of these goals could have a material

adverse effect on our business, financial condition or results of

operations.

Our

accounts receivables remain outstanding for a significant period of time, which

has a negative impact on our cash flow and liquidity.

Our

agreements with our customers related to our clean coking and related products

generally provide that approximately 30% of the purchase price is due upon the

placement of an order, 30% upon reaching certain milestones in the manufacturing

process and 30% upon customer acceptance of the product. As a common practice in

the manufacturing business in China, payment of the final 10% of the purchase

price is due no later than the termination date of our warranty period, which is

a negotiated term of up to 24 months from the acceptance date. We account for

payments received from customers prior to customer acceptance of the product as

unearned revenue.

We

may experience material disruptions to our operations.

While we

seek to operate our facilities in compliance with applicable rules and

regulations and take measures to minimize the risks of disruption at our

facilities, a material disruption at one of our facilities could prevent us from

meeting customer demand, reduce our sales and/or negatively impact our financial

results. Any of our facilities, or any of our machines within an otherwise

operational facility, could cease operations unexpectedly due to a number of

events, including: prolonged power failures; equipment failures; disruptions in

the transportation infrastructure including roads, bridges, railroad tracks; and

fires, floods, earthquakes, acts of war, or other catastrophes.

We

cannot be certain our innovations and marketing successes will

continue.

We

believe our past performance has been based on, and our future success will

depend, in part, upon our ability to continue to improve our existing products

through product innovation and to develop, market and produce new products and

services. We cannot assure you that we will be successful in introducing,

marketing and producing any new products or services, or that we will develop

and introduce in a timely manner innovations to our existing products which

satisfy customer needs or achieve market acceptance. Our failure to develop new

products or services and introduce them successfully and in a timely manner

could harm our ability to grow our business and could have a material adverse

effect on our business, results of operations and financial

condition.

The

technology used in our products and services may not satisfy the changing needs

of our customers.

While we

believe we have hired or engaged personnel who have the experience and ability

necessary to keep pace with advances in technology, and while we continue to

seek out and develop “next generation” technology through our research and

development efforts, there is no guarantee we will be able to keep pace with

technological developments and market demands in our target industries and

markets. Although certain technologies in the industries we occupy are well

established, we believe our future success depends in part on our ability to

enhance our existing products and develop new products and services in order to

continue to meet customer demands. With any technology, including the technology

of our current and proposed products and services, there are risks that the

technology may not address successfully all of our customers’ needs. Moreover,

our customers’ needs may change or vary. This may affect the ability of our

present or proposed products and services to address all of our customers’

ultimate technology needs in an economically feasible manner, which could have a

material adverse affect on our business.

We

may not be able to keep pace with competition in our industry.

Our clean

coking and related products business is subject to risks associated with

competition from new or existing industry participants who may have more

resources and better access to capital. Many of our competitors and potential

competitors may have substantially greater financial and government support,

technical and marketing resources, larger customer bases, longer operating

histories, greater name recognition and more established relationships in the

industry than we do. Among other things, these industry participants compete

with us based upon price, quality, location and available capacity. We cannot be

sure we will have the resources or expertise to compete successfully in the

future. Some of our competitors may also be able to provide customers with

additional benefits at lower overall costs to increase market share. We cannot

be sure we will be able to match cost reductions by our competitors or that we

will be able to succeed in the face of current or future

competition.

12

We will

face different market dynamics and competition as we develop new products and

services to expand our target markets. In some markets, our future competitors

would have greater brand recognition and broader distribution than we currently

enjoy. We may not be as successful as our competitors in generating revenues in

those markets due to lower recognition of our brand, lower customer acceptance,

lower product quality history and other factors. As a result, any new expansion

efforts could be more costly and less profitable than our efforts in our

existing markets.

If we are

not as successful as our competitors in our target markets, our sales could

decline, our margins could be impacted negatively and we could lose market

share, any of which could materially harm our business.

Our

coking products may contain defects, which could adversely affect our reputation

and cause us to incur significant costs.

Despite

testing by us, defects may be found in existing or new products. Any such

defects could cause us to incur significant return and exchange costs,

re-engineering costs, divert the attention of our engineering personnel from

product development efforts, and cause significant customer relations and

business reputation problems. Any such defects could force us to undertake a

product recall program, which could cause us to incur significant expenses and

could harm our reputation and that of our products. If we deliver defective

products, our credibility and the market acceptance and sales of our products

could be harmed.

The

nature of our products creates the possibility of significant product liability

and warranty claims, which could harm our business.

Material

failure of any of our clean coking or related products would have a material

adverse affect on our business. Customers use some of our products in

potentially hazardous applications that can cause injury or loss of life and

damage to property, equipment or the environment. In addition, some of our

products are integral to the production process for some end-users and any

failure of our products could result in a suspension of their operations.

Although we have a quality control group specifically charged with inspecting

our products prior to delivery, we cannot be certain our products will be

completely free from defects. Moreover, we do not have any product liability

insurance and may not have adequate resources to satisfy a judgment in the event

of a successful claim against us. While we have not yet experienced any product

liability claims against us, we cannot predict whether product liability claims

will be brought against us in the future or the impact of any resulting negative

publicity on our business. The successful assertion of product liability claims

against us could result in potentially significant monetary damages and require

us to make significant payments.

Our

Steel Plate Fusion technology and the steel plates it is used to produce may

contain defects, which could adversely affect our planned business

expansion.

While the

tests we have conducted on our Steel Plate Fusion technology have revealed no

defects in the technology or in the steel plates produced, we have not used

Steel Plate Fusion to produce a large quantity of steel plates, and will not do

so until the second quarter of 2011. We cannot be certain that when the

technology is used to produce a large quantity of steel plates that the final

produced steel plates will be free of defects. Any such defects could adversely

affect our planned business expansion.

We

face risks associated with managing domestic operations.

All of

our operations are conducted in China. There are a number of risks inherent in

doing business in such market, including the following:

|

|

§

|

unfavorable political or

economical factors;

|

|

|

§

|

fluctuations in foreign currency

exchange rates;

|

|

|

§

|

potentially adverse tax

consequences;

|

|

|

§

|

unexpected legal or regulatory

changes;

|

13

|

|

§

|

lack of sufficient protection for

intellectual property

rights;

|

|

|

§

|

difficulties in recruiting and

retaining personnel, and managing international operations;

and

|

|

|

§

|

less developed

infrastructure.

|

Our

inability to manage successfully the risks in our China domestic activities

could adversely affect our business. We can provide no assurances that any new

market expansion will be successful because of the risks associated with

conducting such operations, including the risks listed above.

We

may not be able to protect our technology and other proprietary rights

adequately.

Our

success will depend in part on our ability to obtain and protect our products,

methods, processes and other technologies, to preserve our trade secrets, and to

operate without infringing on the proprietary rights of third parties, both

domestically and abroad. Despite our efforts, any of the following may reduce

the value of our owned and used intellectual property:

|

|

§

|

issued patents and trademarks

that we own or have the right to use may not provide us with any

competitive advantages;

|

|

|

§

|

our efforts to protect our

intellectual property rights may not be effective in preventing

misappropriation of our technology or that of those from whom we license

our rights to use;

|

|

|

§

|

our efforts may not prevent the

development and design by others of products or technologies similar to or

competitive with, or superior to those we use or develop;

or

|

|

|

§

|

another party may obtain a

blocking patent and we or our licensors would need to either obtain a

license or design around the patent in order to continue to offer the

contested feature or service in our

products.

|

Effective

protection of intellectual property rights may be unavailable or limited in

certain foreign countries. If we are unable to protect our proprietary rights

adequately, it would have a negative impact on our operations.

We

may be subject to claims that we have infringed the proprietary rights of

others, which could require us to obtain a license or change

designs.

Although

we do not believe any of our products or services infringe upon the proprietary

rights of others, there is no assurance that infringement or invalidity claims

(or claims for indemnification resulting from infringement claims) will not be

asserted or prosecuted against us or that any such assertions or prosecutions

will not have a material adverse affect on our business. Regardless of whether

any such claims are valid or can be asserted successfully, defending against

such claims could cause us to incur significant costs and could divert resources

away from our other activities. In addition, assertion of infringement claims

could result in injunctions that prevent us from distributing our products. If

any claims or actions are asserted against us, we may seek to obtain a license

to the intellectual property rights that are in dispute. Such a license may not

be available on reasonable terms, or at all, which could force us to change our

designs.

Our

application for an invention patent covering Steel Plate Fusion may not be

granted, which could adversely impact our planned business

expansion.

There can

be no absolute assurances that the PRC State Intellectual Property Officer, or

SIPO, will grant our patent. If we do not obtain a patent covering Steel Plate

Fusion we will have to rely on protecting our Steel Plate Fusion technology from

potential competitors as a trade secret, which may require greater resources and

may not be as effective in protecting the technology from use by potential

competitors.

We

may need additional capital to execute our business plan and fund operations and

may not be able to obtain such capital on acceptable terms or at

all.

In

connection with the planned expansion of our business to offer Steel Plate

Fusion services we will likely incur significant capital and operational

expenses. Management anticipates that our existing capital resources and cash

flows from operations and current short-term bank loans will be adequate to

satisfy our liquidity requirements for the next 12 months. However, if available

liquidity is not sufficient to meet our plans for expansion, current operating

expenses and loan obligations as they come due, our plans include pursuing

alternative financing arrangements. Our ability to obtain additional capital on

acceptable terms or at all is subject to a variety of uncertainties,

including:

14

|

|

§

|

investors’ perceptions of, and

demand for, companies in our

industry;

|

|

|

§

|

investors’ perceptions of, and

demand for, companies operating in

China;

|

|

|

§

|

conditions of the United States

and other capital markets in which we may seek to raise

funds;

|

|

|

§

|

our future results of operations,

financial condition and cash

flows;

|

|

|

§

|

governmental regulation of

foreign investment in companies in particular

countries;

|

|

|

§

|

economic, political and other

conditions in the United States, China, and other countries;

and

|

|

|

§

|

governmental policies relating to

foreign currency borrowings.

|

We may be

required to pursue sources of additional capital through various means,

including joint venture projects and debt or equity financings. There is no

assurance we will be successful in locating a suitable financing transaction in

a timely fashion or at all. In addition, there is no assurance we will obtain

the capital we require by any other means. Future financings through equity

investments are likely to be dilutive to our existing shareholders. Also, the

terms of securities we may issue in future capital transactions may be more

favorable for our new investors. Newly issued securities may include preferences

or superior voting rights, be combined with the issuance of warrants or other

derivative securities, or be the issuances of incentive awards under equity

employee incentive plans, which may have additional dilutive effects.

Furthermore, we may incur substantial costs in pursuing future capital and

financing, including investment banking fees, legal fees, accounting fees,

printing and distribution expenses and other costs. We may also be required to

recognize non-cash expenses in connection with certain securities we may issue,

such as convertible notes and warrants, which will adversely impact our

financial condition.

If we

cannot raise additional funds on favorable terms or at all, we may not be able

to carry out all or parts of our strategy to maintain our growth and

competitiveness or to fund our operations. If the amount of capital we are able

to raise from financing activities, together with our revenues from operations,

is not sufficient to satisfy our capital needs, even to the extent that we

reduce our operations accordingly, we may be required to cease

operations.

We

may not be able to attract the attention of major brokerage firms because we

became public by means of a share exchange.

There may

be risks associated with our becoming public through the Share Exchange

Agreement. Analysts of major brokerage firms may not provide coverage for our

company because there is no incentive for brokerage firms to recommend the

purchase of our common stock. Furthermore, we can give no assurance that

brokerage firms will, in the future, want to conduct any secondary offerings on

our behalf.

Our

business could be subject to environmental liabilities.

As is the

case with manufacturers of similar products, we use certain hazardous substances

in our operations. Currently, we do not anticipate any material adverse effect

on our business, revenues or results of operations as a result of compliance

with the environmental laws and regulations of the PRC. However, the risk of