Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NuStar GP Holdings, LLC | d8k.htm |

RBC Capital Markets –

2010 MLP Conference

November 18, 2010

Exhibit 99.1 |

Statements

contained

in

this

presentation

that

state

management’s

expectations

or

predictions

of

the

future

are

forward-looking

statements

intended

to

be

covered

by

the

safe

harbor

provisions

of

the

Securities

Act

of

1933

and

the

Securities

Exchange

Act

of

1934.

The

words

“believe,”

“expect,”

“should,”

“targeting,”

“estimates,”

and

other

similar

expressions

identify

forward-looking

statements.

It

is

important

to

note

that

actual

results

could

differ

materially

from

those

projected

in

such

forward-looking

statements.

We

undertake

no

duty

to

update

any

forward-looking

statement

to

conform

the

statement

to

actual

results

or

changes

in

the

company’s

expectations.

For

more

information

concerning

factors

that

could

cause

actual

results

to

differ

from

those

expressed

or

forecasted,

see

NuStar

Energy

L.P.’s

annual

report

on

Form

10-K

and

quarterly

reports

on

Form

10-

Q,

filed

with

the

Securities

and

Exchange

Commission

and

available

on

NuStar’s

website

at

www.nustarenergy.com.

Forward

Looking

Statements

2 |

NuStar Overview

3 |

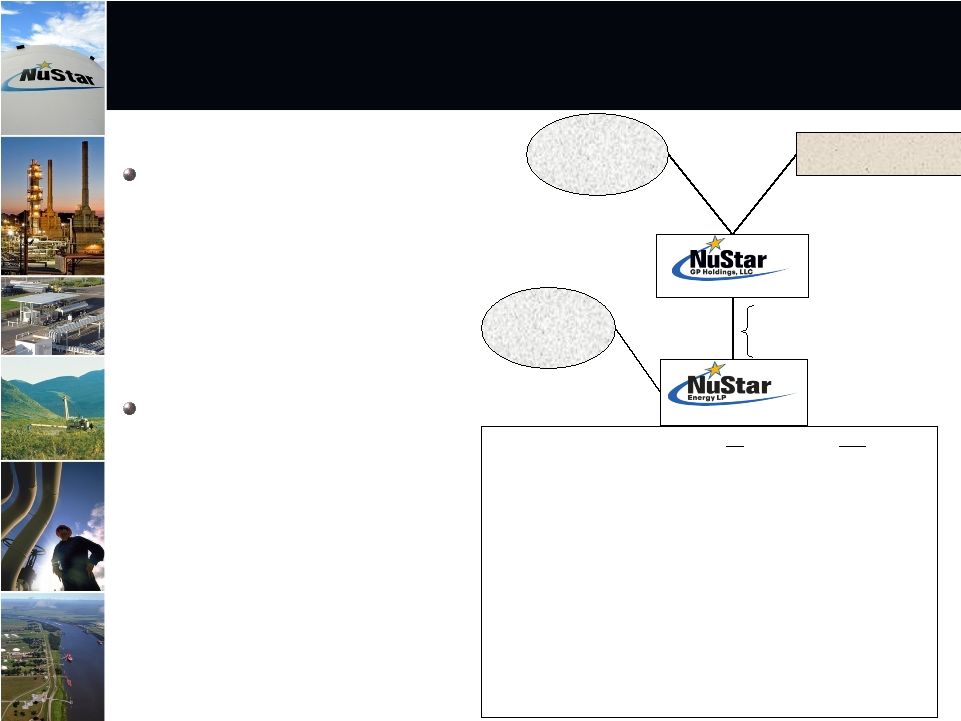

NuStar

Energy L.P. (NYSE: NS) is

a leading publicly traded

partnership with a market

capitalization of around $4.4 billion

and an enterprise value of

approximately $6.3 billion

NuStar

GP Holdings, LLC (NYSE:

NSH) holds the 2% general

partner interest, incentive

distribution rights and 15.6% of the

common units in NuStar

Energy

L.P. with a market capitalization of

around $1.5 billion

Two Publicly Traded Companies

NS

NSH

IPO Date:

4/16/2001

7/19/2006

Unit Price (11/11/10):

$67.71

$35.63

Annual Distribution/Unit:

$4.30

$1.92

Yield (11/11/10):

6.35%

5.39%

Debt Balance (9/30/10)

$1,991 million

$19.5 million

Market Capitalization: (9/30/10)

$4,375 million

$1,516 million

Enterprise Value (9/30/10)

$6,279 million

$1,528 million

Total Assets (9/30/10)

$5,191 million

$618 million

Debt/Cap. (9/30/10)

42.5%

n/a

Credit Ratings –

Moody’s

Baa3/Stable

n/a

S&P and Fitch

BBB-/Stable

n/a

83.1%

Membership Interest

82.4%

L.P. Interest

Public Unitholders

35.4 Million NSH Units

Public Unitholders

54.3 Million NS Units

16.9%

Membership

Interest

2.0% G.P. Interest

15.6% L.P. Interest

Incentive Distribution Rights

William E. Greehey

7.2 Million NSH Units

NYSE: NSH

NYSE: NS

4 |

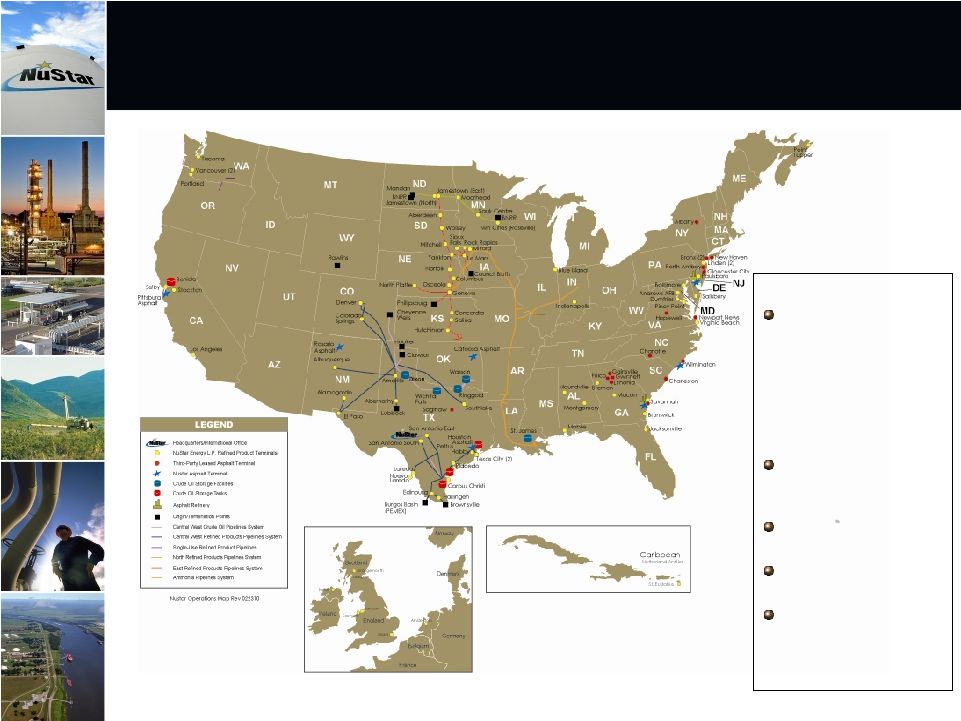

Large

and Diverse Geographic Footprint

with Assets in Key Locations

Asset Stats:

Operations in eight

different countries

including the U.S.,

Mexico, Netherlands,

Netherlands Antilles (i.e.

Caribbean), England,

Ireland, Scotland and

Canada

8,417 miles of crude oil

and refined product

pipelines

Own 88 terminal and

storage facilities

Over 93 million barrels of

storage capacity

2 asphalt refineries on

the U.S. East Coast

capable of processing

104,000 bpd of crude oil

5 |

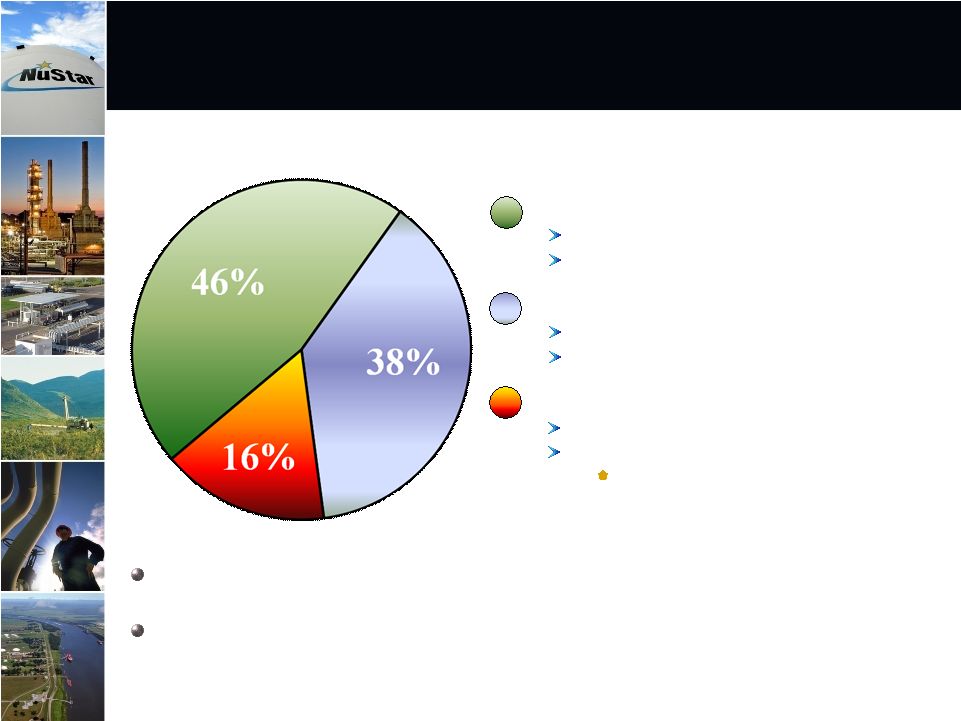

Percentage of 2009

Segment Operating Income

Approximately 84% of NuStar Energy’s segment operating income in 2009 came

from fee-based transportation and storage segments

Remainder of 2009 segment operating income related to margin-based asphalt

and fuels marketing segment

Storage: 46%

Transportation: 38%

Refined Product Terminals

Crude Oil Storage

Refined Product Pipelines*

Crude Oil Pipelines

Asphalt & Fuels Marketing: 16%

Asphalt

Fuels Marketing

Product Supply, Wholesale, Fuel Oil

Marketing and Bunkering

Diversified Operations from Three

Business Segments

* Includes primarily distillates, gasoline, propane, jet fuel, ammonia and

other light products. Does not include natural gas. 6

|

Organic Growth in

Refined Product Infrastructure

7 |

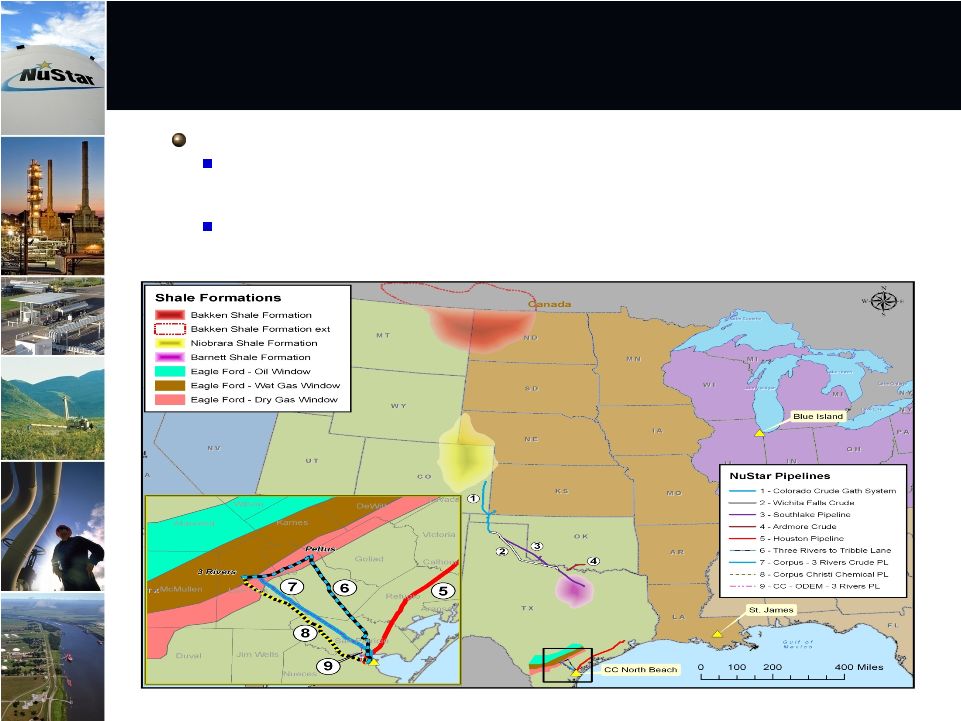

Transportation Segment Assets in close

proximity to key Shale Formations

Transportation Segment Assets in close

proximity to key Shale Formations

Shale Development Strategy

There are four key shale developments located in NuStar’s Mid-Continent and

Gulf Coast regions, including the Bakken, Niobrara, Barnett, and Eagle Ford

developments

Our strategy is to optimize and grow the existing asset base, and maximize the

value of the assets located in or near shale developments

8 |

Recently announced agreement with

Koch Pipeline first NuStar project in

Eagle Ford Shale

Companies agreed to a pipeline connection and capacity lease agreement

Allows NuStar to reactivate a 60 mile pipeline that has been idle since

November 2005

Project connects our existing Pettus, Texas to Corpus Christi pipeline

segment to Koch’s existing pipeline

Initial capacity agreement for 30 thousand BPD, could grow to 50

thousand BPD

Project cost $5 to $10 million

Expected in-service date mid-2011

9 |

Plan

to continue to optimize and grow our existing storage asset base

St. James, LA. Terminal

Expansion

St. Eustatius Terminal

Expansion

Denver Terminal Expansion

Jacksonville Terminal

Expansion

10 |

St.

James, Louisiana terminal expansion expected to occur in two phases

Phase 1 –

Third-Party Crude Oil Storage

Construct

3.1

million

barrels

of

crude

oil

storage

Projected

CAPEX

of

$110

to

$130

million,

with

projected

average

annual

EBITDA

of

$15

to

$25

million

Expected

in-service

August

2011

through

January

2012

Phase 2 –

Third-Party Crude Oil Storage

Project in early planning stages

Should be similar in size to Phase 1 project

Could grow in size based on customer demand

Expected in-service in 2013

11 |

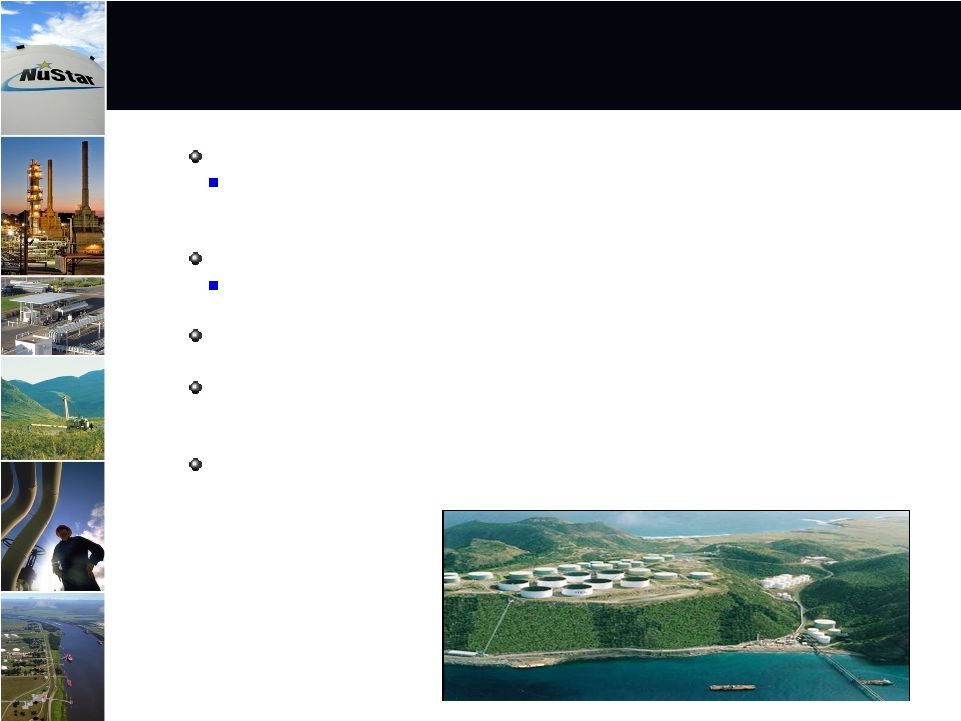

St.

Eustatius project planned to convert existing tanks and construct new tanks

for distillate service

Conversion Project

Convert 600,000 barrels of storage from fuel oil to distillate service

to capture higher storage fees

Expansion Project

Construct 900,000 barrels of new storage for distillate service

Interested customers include several national oil companies

Combined conversion and expansion projected CAPEX of $40 to $50

million, with projected average annual EBITDA of $5 to $10 million

Expected in-service by February 2012 (Conversion Project) and

September 2012 (Expansion Project)

12 |

Jacksonville expansion constructs new tankage

…Denver expansion constructs new loading rack

Jacksonville Storage Expansion

Construct 500,000 barrels of clean products storage

to support a major refiner’s expansion

Projected CAPEX of $20 to $30 million, with projected

average annual EBITDA of $5 to 10 million

Expected in-service by March 2012

Denver Terminal Expansion

Construct a new truck loading rack to serve a Denver

refiner’s refined product output and attract

incremental volumes from other new customers

Projected CAPEX of $10 to $15 million, with projected

average annual EBITDA of $1 to $5 million

Expected in-service by January 2012

13 |

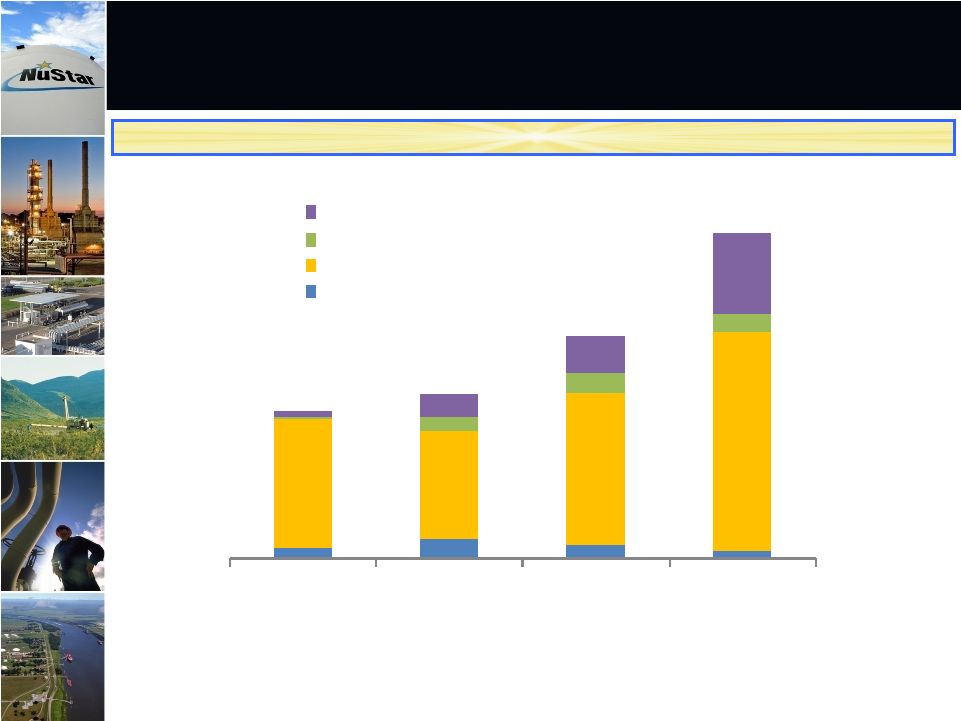

Majority

of

2011

Internal

Growth

Capital

Will

to

be

spent

in

the

Storage

Segment

14

(

Dollars in Millions)

Annual Internal Growth Spending By Business Segment

$11

$20

$13

$8

$128

$107

$153

$218

$3

$14

$20

$19

$36

$80

2008 Actual

2009 Actual

2010 Forecast

2011 Forecast

Corporate

Asphalt & Fuels Marketing

Storage

Transportation

$146

$164

$325

$222

$4

$23 |

Acquisition Growth in

Refined Product Infrastructure

15 |

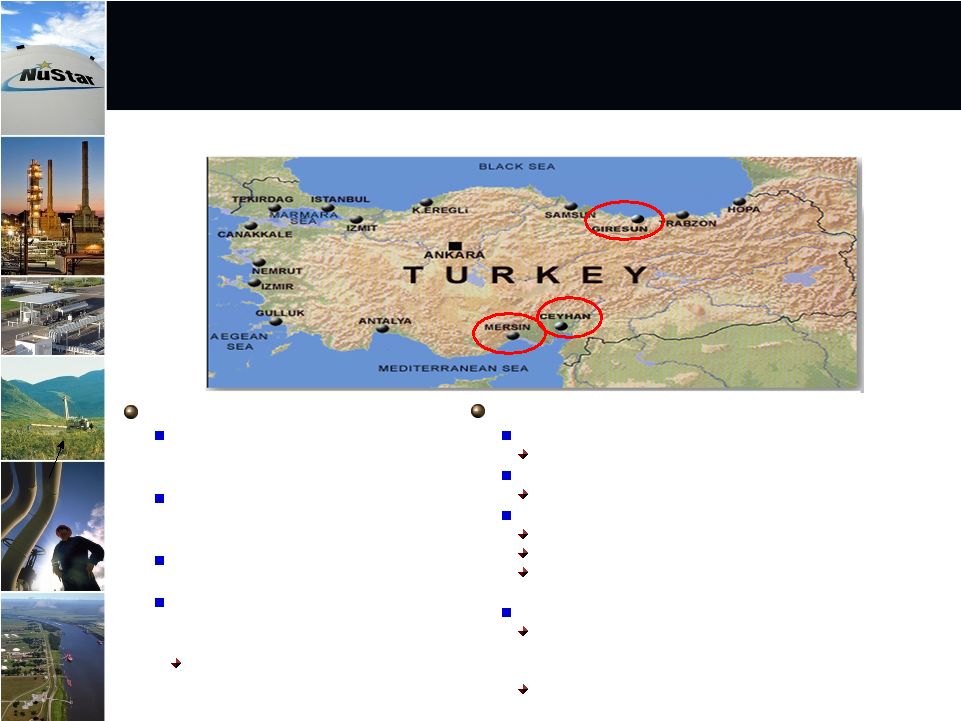

Joint Venture (JV) Overview

NuStar entered into a $50-$60 million

JV agreement with S-Oil and Aves

Oil, two Turkish companies

The JV should own 100% of two

terminals in Mersin and land in

Giresun and Ceyhan

NuStar should own 75% of the JV

and operate the terminals

Both terminals connect via pipeline

to an offshore platform (SAVKA) 5

km off the Turkish coastline

The JV should own 67% of SAVKA

Upon Projected December Closing, Acquired Assets

in Turkey Provide Platform for Internal Growth

Growth Opportunities

Expansion project under development at Mersin

Expands existing storage by about 70 percent

Potential to tie into NATO Pipeline

Provides access to markets for military fuels

New terminal at Giresun

37-acre site with access to Black Sea ports

200,000 barrel fuel oil terminal under development

Second phase build-out to 1.9 million barrels under

evaluation

New terminal at Ceyhan

Ceyhan is the destination for pipelines delivering

crude from northern Iraq and the Caspian area to

the Mediterranean

173 acre property is well-suited for building up to

6.3 million barrels of storage and marine jetty

16 |

|

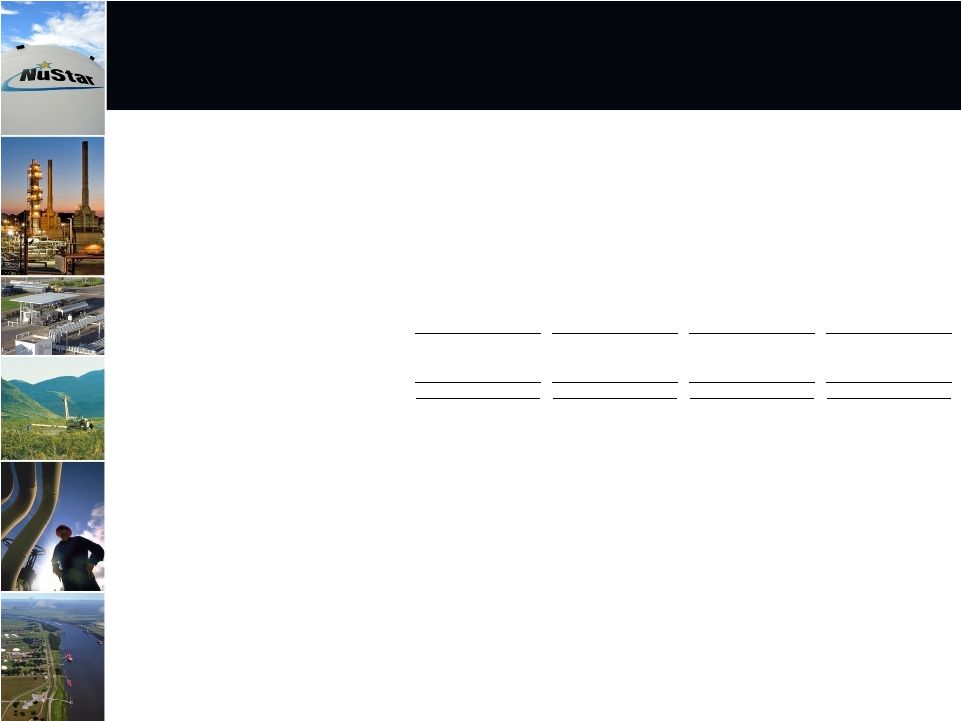

Reconciliation of Non-GAAP Financial Information

Internal Growth Program

18

(Unaudited, Dollars in Thousands)

St. James, LA

Terminal

Expansion Phase 1

St. Eustatius

Distillate Project

Jacksonville

Storage Expansion

Denver Terminal

Expansion

Projected annual operating income range

$ 11,000 - 20,000

$ 4,000 - 8,000

$ 4,500 - 9,000

$ 500 - 4,000

Plus projected annual depreciation and

amortization expense range

4,000 - 5,000

1,000 - 2,000

500 - 1,000

500 - 1,000

Projected annual adjusted EBITDA range

$ 15,000 - 25,000

$ 5,000 - 10,000

$ 5,000 - 10,000

$ 1,000 - 5,000

EBITDA

in

the

following

reconciliations

relate

to

our

reportable

segments

or

a

portion

of

a

reportable

segment.

We

do

not

allocate

general

and

administrative

expenses

to

our

reportable

segments

because

those

expenses

relate

primarily

to

the

overall

management

at

the

entity

level.

Therefore,

EBITDA

reflected

in

the

following

reconciliations

excludes

any

allocation

of

general

and

administrative

expenses

consistent

with

our

policy

for

determining

segmental

operating

income,

the

most

directly

comparable

GAAP

measure.

EBITDA

should

not

be

considered

in

isolation

or

as

a

substitute

for

a

measure

of

performance

prepared

in accordance with GAAP.

The

following

is

a

reconciliation

of

projected

annual

operating

income

to

projected

annual

adjusted

EBITDA

for

certain

projects

in

our

storage

segment

related to our internal growth program: |