Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SPARTON CORP | d8k.htm |

| EX-99.1 - SCRIPT FOR CONFERENCE CALL - SPARTON CORP | dex991.htm |

Fiscal

2011

1

st

Quarter

Financial

Results Conference Call

NYSE: SPA

November 2010

Exhibit 99.2 |

2

Certain

statements

herein

constitute

forward-looking

statements

within

the

meaning

of

the

Securities

Act

of

1933,

as

amended

and

the

Securities

Exchange

Act

of

1934,

as

amended.

When

used

herein,

words

such

as

“believe,”

“expect,”

“anticipate,”

“project,”

“plan,”

“estimate,”

“will”

or

“intend”

and

similar

words

or

expressions

as

they

relate

to

the

Company

or

its

management

constitute

forward-

looking

statements.

These

forward-looking

statements

reflect

our

current

views

with

respect

to

future

events

and

are

based

on

currently

available

financial,

economic

and

competitive

data

and

our

current

business

plans.

The

Company

is

under

no

obligation

to,

and

expressly

disclaims

any

obligation

to,

update

or

alter

its

forward-

looking

statements

whether

as

a

result

of

such

changes,

new

information,

subsequent

events

or

otherwise.

Actual

results

could

vary

materially

depending

on

risks

and

uncertainties

that

may

affect

our

operations,

markets,

prices

and

other

factors.

Important

factors

that

could

cause

actual

results

to

differ

materially

from

those

forward-looking

statements

include

those

contained

under

the

heading

of

risk

factors

and

in

the

management’s

discussion

and

analysis

contained

from

time-to-

time

in

the

Company’s

filings

with

the

Securities

and

Exchange

Commission.

Safe Harbor Statement

Safe Harbor Statement |

3

•

Fiscal 2011 1

st

Quarter Consolidated Results

•

1

st

Quarter Segmented Operating Results

•

SMS Colorado 1

st

Quarter Financial Results

•

Liquidity & Capital Resources

•

Corporate Governance

•

Outlook

•

Q & A

Today’s Agenda

Today’s Agenda |

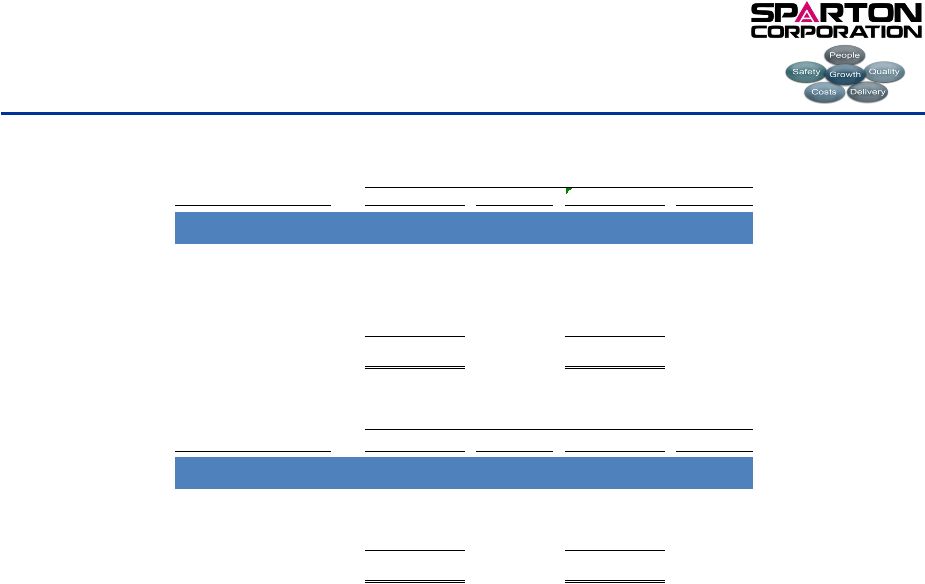

4

1

st

Quarter Consolidated Financial Results

($ in 000’s, except per share)

2010

2009

Net Sales

$ 45,767

$ 48,104

Gross Profit

7,026

7,372

Gross Margin

15.4%

15.3%

Restructuring / Impairment Charges

77

876

Gain On Acquisition

2,400

-

Operating Income

4,104

1,609

Operating Margin

9.0%

3.3%

Income Tax Expense (Benefit)

(14)

34

Net Income

$ 4,080

$ 1,405

Net Profit Margin

8.9%

2.9%

Earnings per share, basic and diluted

0.40

$

0.14

$

Quarter ending Sept 30 |

5

1

st

Quarter Consolidated Financial Results

($ in 000’s, except per share)

2010

2009

Net Sales

$ 45,767

$ 48,104

Gross Profit

7,026

7,372

Gross Margin

15.4%

15.3%

Restructuring / Impairment Charges

77

876

Gain On Acquisition

2,400

-

Operating Income

4,104

1,609

Operating Margin

9.0%

3.3%

Income Tax Expense (Benefit)

(14)

34

Net Income

$ 4,080

$ 1,405

Net Profit Margin

8.9%

2.9%

Earnings per share, basic and diluted

0.40

$

0.14

$

Quarter ending Sept 30 |

6

1

st

Quarter Consolidated Financial Results

($ in 000’s, except per share)

2010

2009

Net Sales

$ 45,767

$ 48,104

Gross Profit

7,026

7,372

Gross Margin

15.4%

15.3%

Restructuring / Impairment Charges

77

876

Gain On Acquisition

2,400

-

Operating Income

4,104

1,609

Operating Margin

9.0%

3.3%

Income Tax Expense (Benefit)

(14)

34

Net Income

$ 4,080

$ 1,405

Net Profit Margin

8.9%

2.9%

Earnings per share, basic and diluted

0.40

$

0.14

$

Quarter ending Sept 30 |

7

SMS Colorado 1

st

Quarter Financial Results

($ in 000’s, except per share)

2009

Pre

Acquisition

Post

Acquisition

Colorado

Pro Forma

Colorado

Pro Forma

Net Sales

$ 3,451

$

5,940 $ 9,391

$ 9,558

Gross Profit

85

557

642

99

Gross Margin

2.5%

9.4%

6.8%

1.0%

Gain on Acquisition

-

2,400

2,400

-

Operating Income (Loss)

(85)

2,381

2,296

(499)

Operating Margin

-2.5%

40.1%

24.4%

-5.2%

Net Income (Loss)

$

(77)

$ 2,419

$ 2,342

$ (474)

Net Profit Margin

-2.2%

40.7%

24.9%

-5.0%

2010

For the 3 Months Ended Sept 30, |

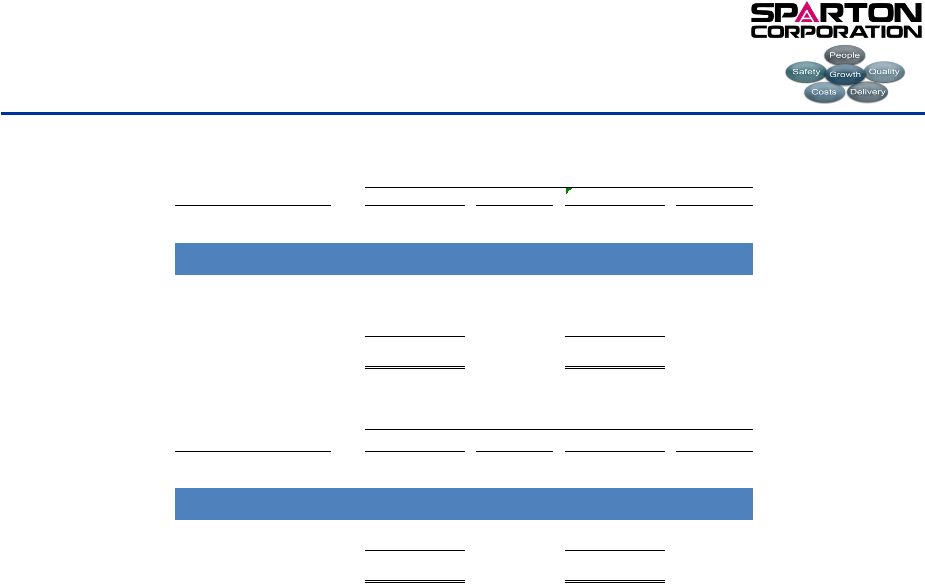

8

Medical Operating Results

Medical Operating Results

SEGMENT

2010

% of Total

2009

% Change

Medical

$ 19,045

42%

$ 19,556

-3%

EMS

12,328

27%

17,603

-30%

DSS

17,597

38%

13,345

32%

Eliminations

(3,203)

-7%

(2,400)

33%

Totals

$ 45,767

100%

$ 48,104

-5%

SEGMENT

2010

GP %

2009

GP %

Medical

$ 1,867

9.8%

$ 2,934

15.0%

EMS

907

7.4%

1,018

5.8%

DSS

4,252

24.2%

3,420

25.6%

Totals

$ 7,026

15.4%

$ 7,372

15.3%

($ in 000’s, except per share)

1st Quarter Sales

1st Quarter Gross Profit |

9

EMS Operating Results

EMS Operating Results

SEGMENT

2010

% of Total

2009

% Change

Medical

$ 19,045

42%

$ 19,556

-3%

EMS

12,328

27%

17,603

-30%

DSS

17,597

38%

13,345

32%

Eliminations

(3,203)

-7%

(2,400)

33%

Totals

$ 45,767

100%

$ 48,104

-5%

SEGMENT

2010

GP %

2009

GP %

Medical

$ 1,867

9.8%

$ 2,934

15.0%

EMS

907

7.4%

1,018

5.8%

DSS

4,252

24.2%

3,420

25.6%

Totals

$ 7,026

15.4%

$ 7,372

15.3%

($ in 000’s, except per share)

1st Quarter Sales

1st Quarter Gross Profit |

10

DSS Operating Results

DSS Operating Results

SEGMENT

2010

% of Total

2009

% Change

Medical

$ 19,045

42%

$ 19,556

-3%

EMS

12,328

27%

17,603

-30%

DSS

17,597

38%

13,345

32%

Eliminations

(3,203)

-7%

(2,400)

33%

Totals

$ 45,767

100%

$ 48,104

-5%

SEGMENT

2010

GP %

2009

GP %

Medical

$ 1,867

9.8%

$ 2,934

15.0%

EMS

907

7.4%

1,018

5.8%

DSS

4,252

24.2%

3,420

25.6%

Totals

$ 7,026

15.4%

$ 7,372

15.3%

($ in 000’s, except per share)

1st Quarter Sales

1st Quarter Gross Profit |

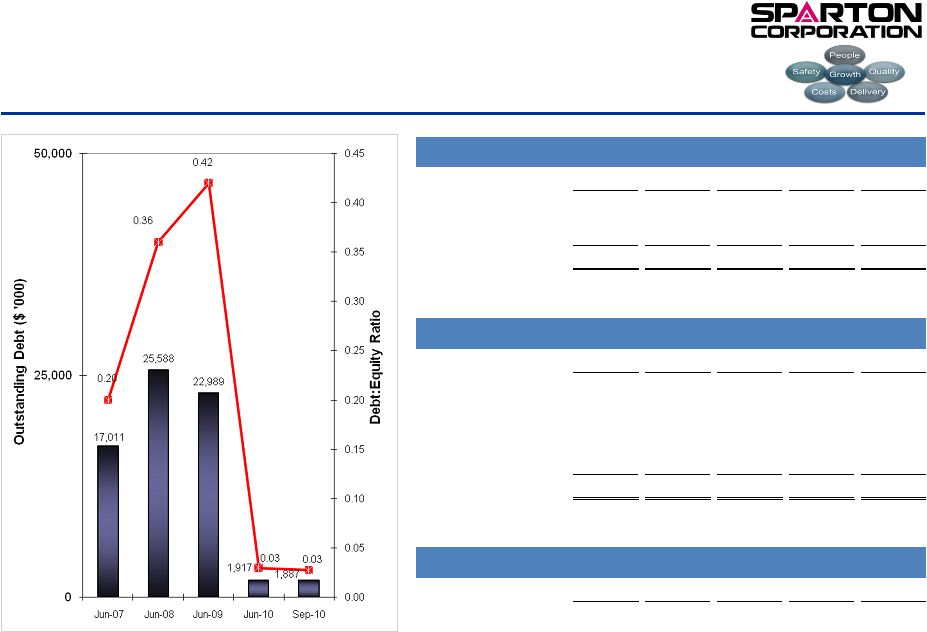

11

Liquidity & Capital Resources

Liquidity & Capital Resources

($ in '000)

Sep-09

Dec-09

Mar-10

Jun-10

Sep-10

Cash and equivalents

20,718

12,012

16,144

30,589

27,281

LOC Availability

3,990

15,461

15,868

16,897

17,769

Total

24,708

27,473

32,012

47,486

45,050

($ in '000)

Sep-09

Dec-09

Mar-10

Jun-10

Sep-10

Credit Revolver

-

-

-

-

-

Long Bank Term Debt

-

-

-

-

-

Former Astro Owners

2,031

1,029

1,029

-

-

IRB (Ohio)

2,000

1,973

1,945

1,917

1,887

Total

4,031

3,002

2,974

1,917

1,887

($ in '000)

Sep-09

Dec-09

Mar-10

Jun-10

Sep-10

Net Inventory

35,454

31,888

28,808

26,514

36,629

Cash Availability

Debt

Inventory |

12

•

Board size reduced from 11 to 9 (8 independent, 1 non-independent) at the

2009 Annual Meeting of Shareholders

•

Updated the Articles of Incorporation and Code of Regulations

•

Revised and updated new charters for the Executive, Governance,

Compensation, and Audit Committees

•

Introduced and received approval to declassifying the board with

all directors

requiring a majority vote threshold in order to be elected at each uncontested

annual meeting

•

Introduced a proposal providing shareholders with an advisory

“say-on-pay” vote on named executive officer

compensation •

Implemented a Short Term Incentive Plan based on annual performance

objectives and a Long Tem Incentive Plan based on long term financial

metrics in alignment with the interests of the shareholders

•

Continued oversight related to the Company’s financial reporting process,

internal controls, risk management, and legal and regulatory requirements

Corporate Governance

Corporate Governance |

13

•

Focus on sustained profitability

–

Continue margin improvements in EMS

–

Further improvements in operating performance through lean and quality

efforts •

Implement the strategic growth plan

–

Anticipate modest organic revenue growth

–

Enhance the Business Development organization

–

Develop and launch a new marketing strategy

–

Invest in new product development

•

Delphi Medical Systems to be accretive no later than Q3

•

Continue to look at complementary and compatible acquisitions

Outlook

Outlook |

14

Q & A

Q & A |