Attached files

| file | filename |

|---|---|

| EX-23.2 - EXHIBIT 23.2 - NUCO2 INC /DE | a2199041zex-23_2.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

Index to consolidated financial statements

As filed with the Securities and Exchange Commission on November 16, 2010

Registration Number 333-166177

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No. 3

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

NuCO2 INC.

(Exact name of Registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

5160 (Primary Standard Industrial Classification Code Number) |

80-0185343 (I.R.S. Employer Identification Number) |

2800 SE Market Place

Stuart, Florida 34997

(772) 221-1754

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Michael E. DeDomenico

Chairman and Chief Executive Officer

2800 SE Market Place

Stuart, Florida 34997

(772) 221-1754

(Name, address and telephone number, including area code, of agent for service)

| Copies to: | ||

Bruce D. Meyer Peter W. Wardle Gibson, Dunn & Crutcher LLP 333 South Grand Avenue Los Angeles, California 90071 (213) 229-7000 |

Christopher D. Lueking Roderick O. Branch Latham & Watkins LLP 233 S. Wacker Drive Chicago, Illinois 60606 (312) 876-7700 |

|

As soon as practicable after this Registration Statement becomes effective.

(Approximate date of commencement of proposed sale to the public)

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act (Check one):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

|

||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee |

||

|---|---|---|---|---|

Common Stock, $.01 par value |

$200,000,000 | $14,260(3) | ||

|

||||

- (1)

- Estimated

solely for the purpose of computing the amount of the registration fee, in accordance with Rule 457(o) promulgated under the Securities Act of

1933.

- (2)

- Includes

offering price of additional shares that the underwriters have the option to purchase. See "Underwriting."

- (3)

- Previously paid.

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933, OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS SUBJECT TO COMPLETION NOVEMBER 16, 2010

Shares

NuCO2 Inc.

Common Stock

This is the initial public offering of our common stock. There has been no public market for our common stock since 2008. We are offering shares of common stock offered by this prospectus. We expect the public offering price to be between $ and $ per share.

We will apply to have our common stock approved for listing on The New York Stock Exchange under the symbol "NUCO."

Investing in our common stock involves a high degree of risk. Before buying any shares, you should carefully read the discussion of material risks of investing in our common stock under "Risk factors" beginning on page 16 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| |

Per share |

Total |

|||||

|---|---|---|---|---|---|---|---|

Public offering price |

$ | $ | |||||

Underwriting discounts and commission |

$ | $ | |||||

Proceeds, before expenses, to us |

$ | $ | |||||

The underwriters may also purchase up to an additional shares of our common stock at the public offering price, less the underwriting discounts and commissions payable by us, to cover over-allotments, if any, within 30 days from the date of this prospectus. If the underwriters exercise this option in full, the total underwriting discounts and commissions will be $ and our total proceeds, before expenses, will be $ .

The underwriters are offering our common stock as set forth under "Underwriting." Delivery of the shares of our common stock will be made on or about , 2010.

| UBS Investment Bank | Goldman, Sachs & Co. | J.P. Morgan |

The date of this prospectus is , 2010

You should rely only on the information contained in this prospectus. We have not, and the underwriters have not, authorized anyone to provide you with additional information or information different from that contained in this prospectus. We are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted.

Through and including , 2010 (the 25th date after the date of this prospectus), federal securities law may require all dealers that effect transactions in these securities, whether or not participating in this offering, to deliver a prospectus. This requirement is in addition to the dealers' obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

Unless specifically noted otherwise, information contained in this prospectus concerning our industry and our markets, our general expectations concerning our industry and market positions and other market share data is based on our management's estimates. Among other things, management bases these estimates on market research sourced from Technomic, Inc. discussed in greater detail below; discussions with our foodservice customers, our competitors and other industry participants; information sharing and discussions with soft drink and beer producers and distributors; and our results of operations and management's past experience in the industry as well as management's assumptions based on its knowledge of this industry, all of which we believe to be reasonable. These estimates and assumptions are inherently subject to uncertainties and may prove to be inaccurate.

We have engaged Technomic, Inc., a fact-based research and consulting firm that assists restaurants, food suppliers and other related firms in the hospitality industry, to conduct certain market research for us. Information contained in this prospectus concerning U.S. fountain locations and related consumption volume is derived from market research conducted by Technomic, Inc. with our participation regarding annual soda syrup consumption per fountain location. Information contained in this prospectus with respect to the size of the draught beer systems market is derived from market

i

research conducted by Technomic, Inc. with our participation regarding U.S. locations operating more than one beer tap.

"NuCO2," "AccuRoute" and "Beverage Carbonation Made Easy" and their respective logos are our registered trademarks and "XactMix," "XactCO2" and "XactN2" and their respective logos are subject to pending trademark applications. Solely for convenience, from time to time, we refer in this prospectus to our registered trademarks without the ® symbols and our unregistered trademarks without the ™ symbols, but such references are not intended to indicate that we will not assert, to the fullest extent under applicable law, our rights to our trademarks.

ii

The following summary should be read together with, and is qualified in its entirety by, the more detailed information and financial statements and related notes included elsewhere in this prospectus. The following summary does not contain all of the information you should consider before investing in our common stock. For a more complete understanding of this offering, we encourage you to read this entire prospectus, including the "Risk factors" section, before making an investment in our common stock.

In this prospectus, unless the context indicates otherwise: "NuCO2," the "Company," "we," "our" or "us" refers to NuCO2 Inc., a Delaware corporation, the issuer of the common stock being offered hereby, and its subsidiaries.

We believe we are the leading national provider of fountain and draught beer beverage carbonation solutions to the restaurant and hospitality industry. Our solutions combine equipment for the storage, blending, and dispensing of beverage grade carbon dioxide, or CO2, and nitrogen, or N2, gases, with continuous, unprompted beverage gas supply service to customer locations via long-term agreements. In combination, our equipment and beverage gas supply services are designed to ensure uninterrupted fountain and draught beer beverage carbonation for our customers. Our customers are primarily quick service restaurant chains, or QSRs, as well as other restaurant chains, bars, convenience store chains, and sports and entertainment venues. Our solutions maximize our customers' cost effectiveness, operational efficiency and carbonation supply reliability by replacing costly, more cumbersome and less reliable high pressure beverage gas cylinders, at a small monthly cost with no upfront investment for the customer. We believe our value proposition remains strong and durable, as beverage carbonation is critically important to our QSR and other customers, who derive the largest portion of store level profitability from high-margin fountain and draught beer beverage revenues. As a result, we have a highly visible revenue base supported by long-term service agreements with high renewal rates and a significant national presence in an industry with substantial barriers to entry. We believe we have strong growth potential, as our solutions remain underpenetrated in our target markets despite our current leading market share position. For the fiscal year ended June 30, 2010, we generated revenues of $167.7 million, Adjusted EBITDA of $65.3 million and operating income of $26.3 million. Our revenues, Adjusted EBITDA and operating income grew at compound annual growth rates of 11.5%, 12.2% and 6.9%, respectively, from the fiscal year ended June 30, 2005. While a portion of this growth is attributable to acquisitions made over these periods, the majority is attributable to new customer additions. Revenues, Adjusted EBITDA and operating income for the three months ended September 30, 2010 were $47.1 million, $18.9 million and $9.4 million, respectively, and increased 11.1%, 12.2% and 28.1%, respectively, when compared to the three month period ended September 30, 2009. For a reconciliation of Adjusted EBITDA to operating income, see the section entitled "—Discussion of EBITDA and Adjusted EBITDA" below.

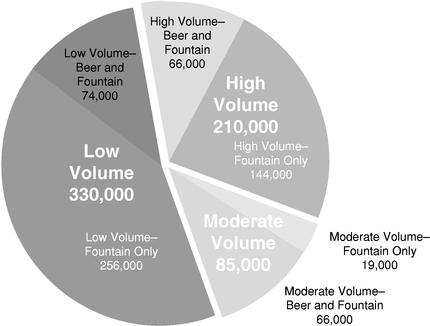

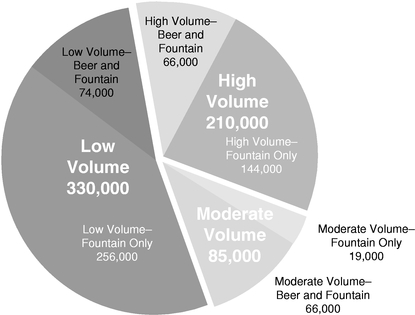

We serve the U.S. fountain and draught beer retail beverage market. Our addressable market consists of all U.S. restaurant and hospitality locations that serve fountain-dispensed soft drinks. We estimate that this market consists of approximately 625,000 locations nationwide. Our fountain beverage bulk CO2 solutions, which currently represent a majority of our revenues, are customized to individually serve both high beverage volume and moderate beverage volume customer locations, as defined by estimated annual soda syrup consumption per fountain location, which we believe, based on the average ratio of CO2 and syrup usage by our fountain beverage customers, is a proxy for store-level beverage gas consumption. Our newly-introduced Mini-Bulk solutions are designed for moderate volume locations. We, and our industry, consider those locations that use more than 500 gallons of

1

fountain syrup per year to be high volume, those locations that use between 300 and 500 gallons of fountain syrup per year to be moderate volume and those locations that use less than 300 gallons of fountain syrup per year to be low volume. We estimate that there are approximately 210,000 locations in the addressable U.S. market for our high volume fountain beverage solutions, of which we currently service approximately 132,500 locations, or 63%. We also estimate the moderate volume market opportunity is approximately 85,000 locations in the U.S., of which we currently service approximately 9,000 locations, or 11%. The remaining approximately 330,000 locations in the U.S. retail fountain beverage market which we do not prioritize are low volume beverage customer locations utilizing conventional high pressure cylinders for fountain beverage carbonation. Our newly debuted draught beer beverage carbonation solutions target a distinct addressable U.S. market that we estimate to be approximately 207,000 locations serving draught beer, approximately 132,000, or 64%, of which also represent target fountain beverage locations of high or moderate volume for our bulk CO2 and Mini-Bulk solutions.

The chart below segments the U.S. fountain and draught beer beverage market into our target high and moderate beverage volume fountain and draught beer markets, as defined by number of customer locations at high, moderate or low volume beverage consumption:

Restaurant and hospitality fountain and draught beer beverage market

total U.S. locations: 625,000

Source: Company estimates

Our fountain beverage solutions—consisting of our bulk CO2 solutions for high volume locations, our Mini-Bulk solutions for moderate volume locations and other carbonation solutions—are used to carbonate fountain beverages on-site at approximately 141,000 locations nationwide. Our market-leading scale in high volume beverage carbonation solutions and differentiated national service infrastructure allow us to successfully service locations affiliated with 99 of the top 100 national restaurant chains that serve fountain beverages, according to National Restaurant News, as well as the top 10 convenience store chains, according to c-stores.com. We serve the majority of these customers, 57 of the top 100, under longer-term Master Service Agreements, or MSAs. These MSAs generally

2

provide long-term contractual exclusivity for the provision of our services in all corporate-owned customer locations, as well as grant us qualified preferred vendor status for associated chain franchisees. Our MSAs include standardized contractual unit pricing and typically have four to six-year terms of service with each customer location. We believe our national reach, sophisticated bulk service capabilities and demonstrated service record with blue chip customers have contributed to our 63% share of the approximately 210,000 high volume U.S. locations. We estimate that our next largest competitor provides bulk CO2 solutions to approximately 10,000, or 5%, of these locations. We believe we maintain an outstanding service record with our customers, including McDonald's, Burger King, Subway, Taco Bell, Chipotle Mexican Grill, Panera Bread, 7-Eleven, Regal Cinemas, Walt Disney World and Yankee Stadium, as evidenced by less than 2% voluntary bulk CO2 customer attrition since July 1, 2008. In addition, we have no significant customer concentration, as our largest customer contract accounted for less than 3% of total revenues for the fiscal year ended June 30, 2010 and the three months ended September 30, 2010.

In February 2010 we launched our Mini-Bulk solution to complement our high volume fountain beverage carbonation solutions. We designed our Mini-Bulk solution for moderate volume locations, which are typically smaller, less trafficked restaurant and hospitality chain locations or non-chain affiliated individual locations. Mini-Bulk is a "slimmed-down" bulk CO2 solution, designed to replicate the value proposition and economics of our high volume fountain beverage solutions. Mini-Bulk utilizes a combination of a lower capacity beverage gas storage and dispensing system and more limited gas supply service frequency to target an addressable U.S. market that we estimate to be approximately 85,000 fountain beverage locations. Today, we provide our solutions for less than 10% of these 85,000 locations and, accordingly, we expect that the Mini-Bulk solution will supplement our growth by expanding the potential number of high pressure cylinder users converting to a bulk solution.

Also, in March 2010 we introduced customized draught beer carbonation solutions, including the XactMix™ beverage control system and XactN2™ nitrogen generator. These systems are designed to ensure appropriate draught beer carbonation, optimize taste and reduce beer waste from overpour and unused product. We expect the XactMix™ beverage control system and XactN2™ nitrogen generator to drive incremental growth from the underpenetrated draught beer carbonation solutions market. We estimate this addressable U.S. market includes approximately 207,000 locations, approximately 132,000 of which also represent target fountain beverage locations of high or moderate volume for our bulk CO2 and Mini-Bulk solutions.

Our high volume bulk CO2, Mini-Bulk and draught beer beverage carbonation solutions collectively leverage our dedicated national service infrastructure. As of September 30, 2010, our beverage carbonation service infrastructure consisted of 140 service locations across 48 states, reaching approximately 141,000 customer fountain and draught beer beverage locations using 265 specialized delivery vehicles and 132 technical service vehicles. When we begin servicing a new customer location, our technicians initially install a bulk CO2, Mini-Bulk or draught beer beverage carbonation system at a customer's location. The system may include a cryogenic tank for bulk CO2, a nitrogen gas generator, a high pressure gas cylinder, and a combination flow control and gas mixing device. We supplement this system with our unprompted delivery and refill services for all supplied beverage gases and any necessary periodic system maintenance, as well as our 24/7 customer service support. The majority of our contracts provide for a single monthly price to the customer for the combination of our beverage system and unprompted, continuous delivery and refill services, with contractual fuel surcharges, annual indexed-based price adjustments and substantial customer termination penalties. Our beverage carbonation solutions incorporate system designs that are developed by us, but manufactured by third-parties on an outsourced basis. We also maintain national beverage grade gas supply arrangements with four major producers, providing for cost effective and reliable beverage gas supply for our operations.

3

The market leader, with significant barriers to entry

We are the market leader in the provision of fountain and draught beer beverage carbonation solutions. We currently manage the nation's sole dedicated and exclusive national service infrastructure and are the only provider capable of delivering a combination beverage carbonation system and gas supply solution on a national scale. We maintain a 63% market share of the estimated 210,000 high volume U.S. locations, and we believe the next largest competitor provides bulk CO2 services to approximately 10,000, or 5%, of these locations. As our target customers prioritize quality systems, reliable maintenance and beverage gas supply services at a low monthly cost across multiple locations, we believe our national presence and deep service capabilities would be difficult, costly, uneconomical and time intensive to replicate. Our robust national service infrastructure, service record with blue chip chain customers, and strong local density provide us with differentiated customer reach, allowing us to service national and regional restaurant and hospitality chain customers under long-term agreements, including MSAs. We believe nationally we have a lower relative cost of service given our installed base and resulting scale advantages over our competitors, who are mainly local or regional industrial gas distributors that lack our service capabilities or are not exclusively focused on beverage carbonation solutions.

Highly compelling value proposition, yet low dollar cost to our customers

Beverage gas remains a critical input in the carbonation of fountain and draught beer beverages, impacting their quality, consistency and taste. Because fountain and draught beer beverages represent the most profitable product in substantially all QSRs, full-service restaurants, bars, and convenience store chains, our beverage carbonation solutions represent a non-discretionary, mission critical purchase by our customers. Despite its importance, beverage gas has a low relative and absolute cost, representing less than one cent of the overall cost of a single fountain or draught beer beverage. Our typical monthly billing to our customers is only approximately one hundred dollars per location. In addition, our customers do not incur any upfront investment associated with our systems. As existing and potential customers come to understand the lost sales and profit forfeiture that results from downtime associated with traditional high pressure cylinder products, as well as the quality, safety and logistical benefits of our beverage carbonation solutions, we believe beverage providers will increasingly choose our solutions at a low-dollar cost for attractive return on their investment.

Contractually secure, low volatility revenue base drives visible, recurring cash flows

Our revenues remain contractually secure and highly visible, as more than 85% of our approximately 141,000 served locations are under some form of long-term agreement. Further, 70% of our annual revenues are fixed under these agreements, regardless of volume, with the remainder of our revenue base demonstrating limited volatility on an annual basis. Our typical new customer contracts have an initial term of four to six years, provide us with the ability to pass along certain commodity costs via annual index-based price inflators and monthly fuel surcharges and include significant breakage penalties for early termination. The net effect of having long-term agreements with most customers and a relatively high percentage of revenue fixed under these agreements regardless of volume is a highly predictable cash flow stream with little volatility. As we typically contract for service with a chain customer's corporate franchisor and its individual franchisee locations, our revenues are also not overly dependent on any individual customer contract or geography. Our largest customer contract represented less than 3% of our total revenues for the fiscal year ended June 30, 2010 and the three months ended September 30, 2010. Because our services represent a critical input to our customers' high margin fountain and draught beer beverage revenues, and because of our integrated system of services, we have not experienced significant customer attrition. Our bulk CO2 customer attrition rates for the fiscal years ended June 30, 2009 and June 30, 2010 have averaged approximately 5%, with

4

voluntary customer contract termination representing less than 2%. Our historical customer retention rates over the past 2 fiscal years have remained in excess of 95%, demonstrating the strength of our customer value proposition. We have more than offset our customer attrition in each of the past five years with new customer installations derived through newly opened customer locations, conversion of existing high pressure beverage gas cylinder locations and share capture from competing beverage gas solutions providers. We expect this trend of net organic customer growth to continue into the foreseeable future.

Predictable and resilient end market demand

We believe our end users are both resilient and demonstrate sustained demand in all economic conditions, particularly QSR chains, representing more than 45% of our customer locations and a disproportionately higher percentage of our revenues, and our chain customers (defined as QSRs, full-service restaurants, convenience store and other customers that have 10 or more locations), which collectively represent 80% of our accounts. We believe QSRs will continue to demonstrate predictable demand. Based on market research conducted by Mintel International Group Ltd., we believe QSR demand growth continues to be buoyed by the high frequency of QSR visits demonstrated by the Asian-American and Hispanic-American population segments, two of the fastest growing U.S. populations, who are two and three times more likely to visit a QSR on a daily basis as compared to the overall U.S. average. We also believe our chain customers, whose new unit growth and real revenue growth from 2000 to 2005 was greater than three and four times that of non-chain restaurants based on research conducted by Euromonitor International, will continue to demonstrate strong relative demand, given their comparative advantages of capital, brand awareness, operating prowess and purchasing power.

The demand of our chain customers is resilient. For example, during the recent recessionary period, as the Consumer Sentiment Index dropped from a 2008 high of 78.4 to a 2009 low of 56.3, U.S. Real GDP contracted 2.4% and U.S. unemployment increased from 5.8% in 2008 to 10.0% in 2009, we increased our revenues, Adjusted EBITDA and operating income from $156.1 million, $57.7 million and $17.7 million for the fiscal year ended June 30, 2009 to $167.7 million, $65.3 million and $26.3 million for the fiscal year ended June 30, 2010, representing a year over year increase of 7.4%, 13.2% and 48.6%, respectively. For a reconciliation of Adjusted EBITDA to operating income, see the section entitled "—Discussion of EBITDA and Adjusted EBITDA" below.

Master service agreements provide a unique, low risk growth channel

We believe our unique service capabilities and dedicated national beverage supply infrastructure have allowed us to secure MSAs with 142 restaurant and convenience store chains that provide fountain beverages, including 57 MSAs with the top 100 U.S. restaurant chains, according to National Restaurant News. These MSAs generally provide for the long-term exclusive provision of beverage carbonation solutions in all corporate-owned customer locations, as well as qualified preferred vendor status for associated chain franchisees, which typically includes standardized contractual unit pricing and four to six-year contractual terms of service with each store location. Our MSAs allow us to leverage our corporate franchisor relationships towards the marketing of our services to newly constructed corporate and franchisee locations or current MSA franchisee locations utilizing high pressure beverage gas cylinders. Since MSAs allow us to negotiate terms with a customer on a national or regional level, we are able to avoid the expense and time necessary to demonstrate our capabilities and to negotiate individual contract terms with each customer. We believe MSAs represent an important growth avenue for us, as we serviced, as of September 30, 2010, approximately 75,800, or 61%, of the approximately 123,700 locations associated with our existing MSAs.

5

Scalable business model with significant operating leverage

As the leading national beverage carbonation solutions supplier and only dedicated supplier with national scale, we maintain a dense, highly scalable service infrastructure that we believe gives us a lower relative cost of service and an attractive margin on incremental customers. Our national reach, combined with our local route density, allows us to efficiently service additional customer locations with minimal, if any, incremental infrastructure or personnel costs, while also minimizing the average driver time and wages, mileage and fuel costs incurred between customer stops. We believe that substantially all of the target accounts not currently served by us are on delivery routes currently served by our network. We believe that the incremental margin on new customers acquired in our service network is well in excess of our consolidated margins at our current capacity levels, with minimal need for network expansion in the coming years. As our business continues to grow, we expect our scale and local route density to continue to drive enhanced operating performance, as demonstrated by the expansion of our Adjusted EBITDA margins from 35.7% in fiscal year 2004 to 38.9% in fiscal year 2010. Our operating income margins increased slightly from 15.4% to 15.7% over this same period. Additionally, we increased our Adjusted EBITDA margins from 39.8% for the three months ended September 30, 2009 to 40.1% for the three months ended September 30, 2010. Our operating income margins increased to 19.9% for the three months ended September 30, 2010 from 17.2% when compared to the three months ended September 30, 2009. This operating leverage allows us to target new growth opportunities with similar barriers to entry and competitive advantages, such as our recent Mini-Bulk and draught beer systems, without significant additional investment. However, as discussed in the section entitled "Risk factors," we may not be able to increase the density of our customer base to allow for increased absorption of fixed costs.

Experienced and proven management team

We are led by a high quality and experienced executive team. Our senior management team members have an average of approximately 21 years of relevant experience in the industrial gas, restaurant and distribution industries and are responsible for having grown our revenues, Adjusted EBITDA and operating income at a compound annual growth rate of 11.5%, 12.2% and 6.9%, respectively, from the fiscal year ended June 30, 2005 to the fiscal year ended June 30, 2010. Under the ownership of affiliates of Aurora Capital Group, which acquired our business in 2008, we have deepened management talent at all levels of the organization, adding 15 new individuals to senior and mid-level management positions since the Acquisition. See "—Corporate Structure and Debt Financing." Eight of these senior and mid-level management positions are newly created positions and did not exist at our predecessor public company prior to the Acquisition.

We believe the combination of our highly compelling customer value proposition, our leading market position in beverage carbonation solutions and our differentiated service capabilities will allow us to continue to derive significant organic growth through new customer additions from further penetration of our existing markets. We do not expect our growth initiatives to require a significant expansion of our existing service infrastructure or other significant capital investment. Given the depth of our beverage carbonation solutions expertise and the scalability of our service infrastructure, we believe we can continue to drive growth in our revenues through additional market penetration at attractive returns on invested capital without significantly increasing the risk of our operations.

We intend to use the cash flow provided by operating activities generated by our business, capacity under our existing revolving credit facilities and a portion of the proceeds from this offering to fund our growth opportunities. Due to the long-term contractual nature of our business, we do not need to commit to the purchase of any components for our systems or incur any installation costs until we

6

have a customer service agreement in place. This provides for an appropriate, timely and highly visible return on each new investment we make.

Our growth strategies include:

- –>

- Further Market Penetration of our Fountain Beverage Solutions. We believe the market for our bulk

CO2 and Mini-Bulk solutions remains underpenetrated. As we currently service approximately 132,500, or 63%, of the estimated 210,000 high volume U.S. fountain beverage locations and

approximately 9,000, or 11%, of the estimated 85,000 moderate volume U.S. fountain beverage locations, we believe our leading market position, national reach, compelling value proposition and

differentiated service capabilities will allow for increased penetration, resulting in significant new customer additions for our business. We are able to achieve new fountain beverage customer

installations through multiple channels, including newly opened customer locations, conversion of existing high pressure beverage gas cylinder locations and share capture from competing beverage gas

providers. To accomplish this, we expect to, in part, leverage our MSAs towards the marketing of our services to newly constructed corporate and franchisee locations or current MSA franchisee

locations using high pressure beverage gas cylinders. We believe MSAs represent an important growth avenue for us, as we serviced, as of September 30, 2010, only approximately 75,800, or 61%,

of the approximately 123,700 locations associated with our existing MSAs.

- –>

- Capitalize on Under-Serviced Demand with our Mini-Bulk Product Solution. We believe the market for our

fountain beverage solutions in moderate consumption locations—typically smaller, less trafficked restaurant and hospitality chain locations or non-chain affiliated

restaurants—is large, fragmented and underpenetrated. We estimate the U.S. market is comprised of approximately 85,000 moderate volume fountain beverage locations, of which we currently

only serve approximately 9,000, or 11%. We have designed our new Mini-Bulk solution to cost effectively address this market opportunity without sacrificing our targeted unit economics or the value

proposition to our customers. Mini-Bulk relies on a smaller storage and dispensing system and a reduced gas supply service frequency to substantially reduce our overall cost of service for each

Mini-Bulk location. However, once in place, it is serviced using our existing infrastructure. We believe our Mini-Bulk capabilities are a competitive advantage for us, extending our beverage

carbonation solutions to under-serviced users who cannot be offered a bulk CO2 solution cost effectively by our competitors. We expect Mini-Bulk to provide an important channel for future

new customer growth.

- –>

- Capitalize on Under-Serviced Demand for Draught Beer Carbonation Solutions. We believe the market for draught beer beverage carbonation solutions is also large and under-serviced. We estimate the U.S. market consists of approximately 207,000 bars and full-service restaurants operating more than one draught beer tap. We have invested significant management resources in the development of our proprietary draught beer solutions, including the XactmiX beverage control system and XactN2 nitrogen generator, to address this market opportunity. Our customizable draught beer solutions now utilize a combination of beverage grade CO2, a draught beer grade nitrogen generator and a gas control and blending device to optimize yield, taste and operational efficiency for higher volume draught beer locations. We estimate 132,000, or 64%, of these locations also operate fountain beverage volumes appropriate for our bulk CO2 or Mini-Bulk fountain beverage solutions. We expect that our new draught beer beverage carbonation solutions will drive significant future new customer account growth from bars and full-service restaurants seeking a cost effective, higher quality beverage carbonation solution. However, as discussed in the section entitled "Risk factors," we may not be able to successfully expand our business into the draught beer market.

7

- –>

- Acquire Customer Portfolios from Local Distributors. Alternative sources of supply for our services

consist predominantly of:

- –>

- local

"mom and pop" gas distributors who cannot offer an integrated equipment system and refill service approach;

- –>

- regional

gas distributors who provide a system and service offering, but lack exclusive focus, competency and cost effectiveness in providing fountain or draught

beer beverage solutions; and

- –>

- large industrial gas distributors that do not possess our service capabilities or consider beverage gas delivery core to their business model.

As the beverage carbonation leader in the U.S. with differentiated service capabilities and the only dedicated national service infrastructure, we believe we have become the "acquiror of choice" for competing beverage gas distributors who find it increasingly difficult to match our cost effectiveness and service intensity. Further, given our dense, nationwide distribution footprint, and the minimal incremental fixed cost and low integration complexity associated with acquired contractual revenues, we are able to acquire incremental revenues at attractive margins. We believe the margins realized on the acquired revenues allow us to significantly enhance our overall operating margins and generate increased equity returns for our stockholders. We have largely operationalized our acquisition program, including dedicating two full-time employees to this function, and have a strong track record of consistently acquiring at least several thousand new accounts from our competitors each year other than in fiscal years 2007 and 2008. We expect that similar opportunities for account acquisition exist and will remain critical to our growth strategy going forward as well as allow us to achieve enhanced operating margins.

- –>

- Capitalize on Recovery in our Customers' End Markets. While a difficult U.S. consumer environment slowed

customer traffic broadly in 2009 by an average of 2% at QSR locations and an average of 4% at U.S. casual dining restaurant locations, according to research conducted by the NPD Group, and

consequently slowed the growth of U.S. new restaurant openings, we continued to grow through a mix of organic new account penetration and acquisitions. We believe as unemployment levels subside and

GDP grows, store level traffic and new store openings will increase, enhancing our already strong growth opportunity. In addition, based on market research conducted by the NPD Group, QSR consumers

continue to shift towards chains versus non-chain locations as shown by traffic distribution. As evidence, this research showed that the percentage of QSR customers visiting chain locations increased

from 62% in 2003 to 68% in 2009. This continuing shift towards QSR chains should benefit our revenues, due to our approximately 80% chain and 20% non-chain customer location mix.

- –>

- Continue to Pursue Innovative Beverage Carbonation Solutions. We have pioneered the development of beverage carbonation solutions for restaurant and hospitality customers with the introduction of our beverage grade bulk CO2 solution, through our most recent innovations, which include the newly debuted Mini-Bulk fountain beverage solution and XactmiX and XactN2 draught beer solutions. We believe our demonstrated ability to uniquely design, develop and introduce innovative beverage carbonation products and solutions for our customers is a competitive advantage and a critical driver of our leading market position. Further, our innovative solutions not only have supported our market leadership, but continue to expand the size of our target markets and potential customer base, therefore creating new avenues for growth. We expect that we will continue to provide innovative beverage carbonation and related solutions to meet the changing needs and demands of our customers. However, as discussed in the section entitled "Risk factors," we cannot assure you that we will continue to bring successful new innovations and new products to the market.

8

An investment in our common stock involves a high degree of risk. You should carefully consider the risks summarized below, the risks described in the section entitled "Risk factors," and the other information contained in this prospectus, including our consolidated financial statements and the related notes, before deciding to purchase any shares of our common stock:

- –>

- the

uncertainty of future operating results;

- –>

- lack

of product diversity, continued market acceptance by the fountain beverage market of our bulk CO2 equipment and consumer preference for carbonated

beverages;

- –>

- our

ability to implement our acquisition strategy;

- –>

- the

competitiveness of the fountain beverage carbonation market and our inability to respond to various competitive factors;

- –>

- dependence

on our existing leadership team;

- –>

- failure

to find suitable replacements if our current suppliers refuse to or otherwise do not provide services to us;

- –>

- the

pricing and availability of beverage grade CO2 and other raw materials and shortages or increases in the prices thereof, or an increase in the cost

of fuel;

- –>

- the

success of our new products;

- –>

- seasonality

of fountain beverage consumption;

- –>

- the

business, credit, financial and other risks of customers;

- –>

- any

collateral impact resulting from the ongoing worldwide financial "downturn," including global capital and credit market issues and any impacts on other

participants in our industry; and

- –>

- the impact of our indebtedness on the operation of our business, including the impact of our securitization structure.

Aurora Equity Partners III L.P., a Delaware limited partnership, and Aurora Overseas Equity Partners III, L.P., a Cayman Islands exempt limited partnership, which we refer to collectively as the Aurora Entities, are affiliates of Aurora Capital Group and control the vote with respect to 100% of our common stock, prior to giving effect to this offering. See "Certain relationships and related party transactions—Related Party Transactions—Securityholders agreement—Proxy and Voting Arrangements." After giving effect to this offering, the Aurora Entities will control the vote with respect to approximately % of our common stock. Because of the Aurora Entities' ability to determine the outcome of stockholder votes, we are subject to additional risks, including that the Aurora Entities may have interests distinct from those of our other stockholders, as discussed in the section entitled "Risk factors."

Aurora Capital Group is a Los Angeles-based private investment firm managing over $2.0 billion of total capital. Aurora Equity Partners, the firm's private equity investment vehicle, focuses principally on control-investments in middle-market industrial, manufacturing and selected service oriented businesses, each with a leading position in sustainable niches, a strong cash flow profile and actionable opportunities for both operational and strategic enhancement.

9

CORPORATE STRUCTURE AND DEBT FINANCING

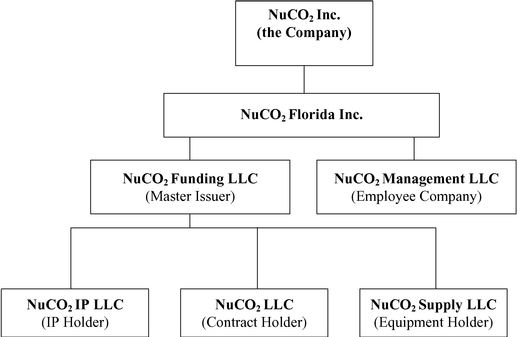

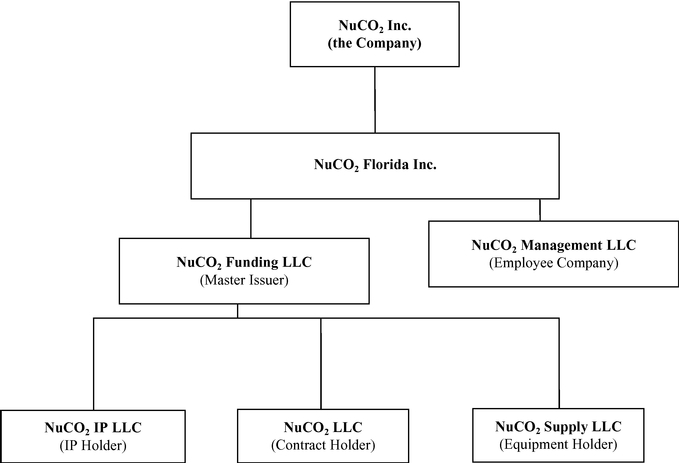

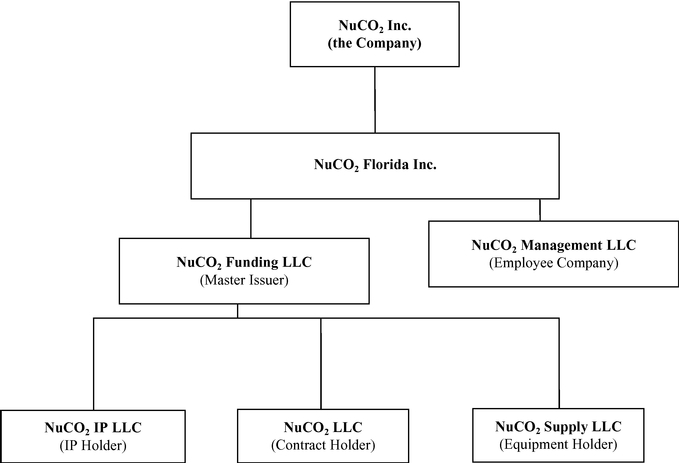

We are a holding corporation that was formed in connection with the acquisition of our business from the prior stockholders of NuCO2 Florida Inc. by affiliates of Aurora Capital Group in May 2008, which we refer to in this prospectus as the Acquisition. The Acquisition was, in part, financed utilizing a whole-business securitization financing, or the Securitization Transactions, for which we formed limited-purpose Delaware limited liability company subsidiaries, or the Securitization Entities, to house all of our revenue-generating assets as collateral in support of our financing. NuCO2 Florida Inc., our wholly-owned direct subsidiary, now acts as our operating company and manages the Securitization Entities. We describe the Securitization Entities in further detail later in this prospectus in the section entitled "Business—Corporate Structure."

We believe our whole business securitization financing is a competitive advantage for us as we are afforded unique financial flexibility at minimal risk and a low cost of funding compared to more conventional financing structures. This structure allows us to fund our operations with highly-rated, lower priced debt, while subjecting us to only one financial covenant, a debt service coverage ratio, or DSCR. This structure also has less onerous restrictions on capital expenditures, acquisitions, dividends and changes of control than typically found in more conventional debt structures. We believe the risk of default in our capital structure is also remote, given that, based on our revenues for the quarter ended September 30, 2010 and our balance sheet as of such date, we expect that we would need to experience a greater than 34.4% decline in our collections over the following three months to breach the DSCR covenant. Our unique capital structure also provides us with a flexible maturity. Upon scheduled maturity in 2013 of our Series 2008-1 Class A-1 Notes, or our 2008 Senior Notes, and our Series 2008-1 Class B-1 Notes, or our Subordinated Notes, we have two successive one-year renewal periods at our sole option which we can utilize to extend this maturity to 2014 or 2015. Our 2010-1 Class A-1 Notes, or our 2010 Senior Notes, mature in 2015. However, as discussed in the section entitled "Risk factors," our whole business securitization does subject us to additional risks, including that we may be required to comply with additional conditions to incur additional new indebtedness and that we have a more limited ability to negotiate with noteholders in an event of default than we would have under a more traditional debt structure.

We maintain our principal executive offices at 2800 SE Market Place, Stuart, Florida 34997 and our telephone number is (772) 221-1754. We maintain a website at www.NuCO2.com. Information contained on our website is not a part of, and is not incorporated by reference into, this prospectus.

10

Issuer |

NuCO2 Inc. | |||

Common stock we are offering |

shares |

|||

Over-allotment option |

We have granted the underwriters a 30-day option to purchase up to additional shares of our common stock from us at the initial public offering price less underwriting discounts and commissions. The option may be exercised only to cover any over-allotments. |

|||

Common stock outstanding after this offering |

shares (or shares if the underwriters exercise their over-allotment option in full). |

|||

Use of proceeds |

We intend to use the net proceeds from this offering to redeem preferred equity and for general corporate purposes, including funding future growth and acquisitions. See "Use of proceeds." |

|||

Dividend policy |

So long as we are in compliance with the DSCR covenant imposed by our indenture, our indebtedness does not impose any individual or aggregate dollar limit on the amount of dividends we can pay. However, currently we do not anticipate paying any cash dividends to our stockholders for the foreseeable future. We will re-evaluate this policy as circumstances warrant. See "Dividend policy." |

|||

Risk factors |

See "Risk factors" beginning on page 16 of this prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock. |

|||

Proposed New York Stock Exchange |

NUCO |

|||

Unless otherwise noted, all information in this prospectus assumes:

- –>

- no

exercise of the underwriters' over-allotment option; and

- –>

- a public offering price of $ per share of our common stock, which is the mid-point of the range set forth on the front cover of this prospectus.

11

Summary consolidated and pro forma combined financial data

The following summary consolidated financial data as of and for the period from July 1, 2007 to May 28, 2008 (Predecessor) and for the period from May 29, 2008 to June 30, 2008 (Successor) and for the fiscal years ended June 30, 2009 and June 30, 2010 (Successor) are derived from our audited consolidated financial statements and related notes included elsewhere in this prospectus. The following pro forma combined financial data for the twelve-month period ended June 30, 2008 is developed by applying pro forma adjustments to the historical audited consolidated financial statements included elsewhere in this prospectus in order to present our financial data for the twelve months ended June 30, 2008 as if the Acquisition had occurred on July 1, 2007. The following summary consolidated financial data as of September 30, 2010 and for the three month periods ended September 30, 2009 and 2010 are derived from our unaudited condensed consolidated financial statements and related notes included elsewhere in this prospectus, which, in the opinion of management, have been prepared on the same basis as the audited consolidated financial statements and include all adjustments, consisting of normal recurring adjustments, necessary for a fair presentation of our operating results and financial position for those periods and as of such dates. The balance sheet data as of September 30, 2009 are derived from our unaudited condensed consolidated financial statements and related notes and are not included elsewhere in this prospectus. The results for any interim period are not necessarily indicative of the results that may be expected for a full year. The results indicated below and elsewhere in this prospectus are not necessarily indicative of our future performance. You should read this information together with the sections entitled "Capitalization," "Unaudited pro forma combined financial data," "Selected consolidated financial data," "Management's discussion and analysis of financial condition and results of operations," "—Discussion of EBITDA and Adjusted EBITDA" and our consolidated financial statements and related notes included elsewhere in this prospectus.

| |

Predecessor | Successor | Pro Forma | Successor | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Selected income statement data:

|

July 1, 2007 to May 28, 2008 |

May 29, 2008 to June 30, 2008 |

Combined Fiscal year ended June 30, 2008 |

Fiscal year ended June 30, 2009 |

Fiscal year ended June 30, 2010 |

Three months ended September 30, 2009 |

Three months ended September 30, 2010 |

|||||||||||||||

| |

|

|

(unaudited)

|

|

|

(unaudited)

|

||||||||||||||||

| |

(in thousands, per share data)

|

|||||||||||||||||||||

Total revenues |

$ | 127,267 | $ | 12,468 | $ | 139,735 | $ | 156,125 | $ | 167,730 | $ | 42,420 | $ | 47,147 | ||||||||

Cost of distribution services, excluding depreciation and amortization |

63,440 | 6,481 | 69,921 | 72,314 | 73,679 | 18,689 | 19,653 | |||||||||||||||

Gross profit, excluding depreciation and amortization |

63,827 | 5,987 | 69,814 | 83,811 | 94,051 | 23,731 | 27,494 | |||||||||||||||

Selling, general and administrative |

26,889 | 1,812 | 29,824 | 29,248 | 32,975 | 7,500 | 9,385 | |||||||||||||||

Depreciation and amortization |

18,529 | 2,096 | 31,093 | 34,734 | 32,597 | 8,483 | 8,312 | |||||||||||||||

Loss on asset disposal |

2,877 | 225 | 3,102 | 2,089 | 2,152 | 431 | 425 | |||||||||||||||

Operating income |

15,532 | 1,854 | 5,795 | 17,740 | 26,327 | 7,317 | 9,372 | |||||||||||||||

Interest expense |

1,863 | 3,270 | 36,153 | 36,307 | 37,103 | 9,196 | 9,492 | |||||||||||||||

Income (loss) before income taxes |

13,669 | (1,416 | ) | (30,358 | ) | (18,567 | ) | (10,776 | ) | (1,879 | ) | (120 | ) | |||||||||

Provision for (benefit from) income taxes |

5,380 | (522 | ) | (11,053 | ) | (6,591 | ) | (4,671 | ) | (698 | ) | (41 | ) | |||||||||

Net income (loss) |

8,289 | (894 | ) | (19,305 | ) | (11,976 | ) | (6,105 | ) | (1,181 | ) | (79 | ) | |||||||||

Dividends on preferred stock |

— | (911 | ) | (911 | ) | (11,232 | ) | (13,381 | ) | (3,373 | ) | (3,715 | ) | |||||||||

Net income (loss) attributable to common shareholders |

$ | 8,289 | $ | (1,805 | ) | $ | (20,216 | ) | $ | (23,208 | ) | $ | (19,486 | ) | $ | (4,554 | ) | $ | (3,794 | ) | ||

Net income (loss) per share attributable to common shareholders—basic |

$ | 0.56 | $ | (18.27 | ) | $ | (195.40 | ) | $ | (217.71 | ) | $ | (162.65 | ) | $ | (38.01 | ) | $ | (31.64 | ) | ||

Net income (loss) per share attributable to common shareholders—diluted |

$ | 0.55 | $ | (18.27 | ) | $ | (195.40 | ) | $ | (217.71 | ) | $ | (162.65 | ) | $ | (38.01 | ) | $ | (31.64 | ) | ||

Weighted average shares outstanding—basic |

14,805 | 98.8 | 98.8 | 106.6 | 119.8 | 119.8 | 119.9 | |||||||||||||||

Weighted average shares outstanding—diluted |

15,200 | 98.8 | 98.8 | 106.6 | 119.8 | 119.8 | 119.9 | |||||||||||||||

12

| |

Predecessor | Successor | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Cash flows data:

|

July 1, 2007 to May 28, 2008 |

May 29, 2008 to June 30, 2008 |

Fiscal year ended June 30, 2009 |

Fiscal year ended June 30, 2010 |

Three months ended September 30, 2009 |

Three months ended September 30, 2010 |

|||||||||||||

| |

|

|

|

|

(unaudited)

|

||||||||||||||

| |

(dollars in thousands)

|

||||||||||||||||||

Cash flows provided by operating activities |

$ | 43,392 | $ | 5,771 | $ | 26,118 | $ | 33,269 | $ | 4,437 | $ | 2,565 | |||||||

Maintenance capital expenditures |

(4,593 | ) | (656 | ) | (9,314 | ) | (13,138 | ) | (2,876 | ) | (3,281 | ) | |||||||

Growth capital expenditures |

(15,226 | ) | (1,294 | ) | (11,643 | ) | (14,905 | ) | (3,288 | ) | (4,693 | ) | |||||||

Acquisitions |

— | (478,299 | ) | (44,390 | ) | (13,873 | ) | (1,161 | ) | (19,360 | ) | ||||||||

Other investing cash flows |

39 | — | 8 | 25 | — | 46 | |||||||||||||

Cash flows used in investing activities |

(19,780 | ) | (480,249 | ) | (65,339 | ) | (41,891 | ) | (7,325 | ) | (27,288 | ) | |||||||

Cash flows provided by (used in) financing activities |

(23,911 | ) | 478,545 | 44,481 | 3,865 | (1,017 | ) | 37,273 | |||||||||||

| |

Predecessor | Successor | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Other data:

|

July 1, 2007 to May 28, 2008 |

May 29, 2008 to June 30, 2008 |

Fiscal year ended June 30, 2009 |

Fiscal year ended June 30, 2010 |

Three months ended September 30, 2009 |

Three months ended September 30, 2010 |

|||||||||||||

| |

|

|

|

|

(unaudited)

|

||||||||||||||

| |

(in thousands, except customer and per customer data)

|

||||||||||||||||||

EBITDA |

$ | 34,061 | $ | 3,950 | $ | 52,474 | $ | 58,924 | $ | 15,800 | $ | 17,684 | |||||||

Adjusted EBITDA |

$ | 42,332 | $ | 4,402 | $ | 57,710 | $ | 65,250 | $ | 16,863 | $ | 18,913 | |||||||

Number of customer locations serviced at period end |

117,000 | 117,000 | 129,000 | 136,000 | 131,000 | 141,000 | |||||||||||||

Average customer locations serviced during the period |

116,000 | 117,000 | 123,000 | 132,000 | 130,000 | 138,000 | |||||||||||||

Average revenues per customer location |

$ | 1,269 | $ | 1,271 | $ | 326 | $ | 342 | |||||||||||

Average gross profit, excluding depreciation and amortization, per customer location |

$ | 681 | $ | 713 | $ | 183 | $ | 199 | |||||||||||

| |

Successor | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Balance sheet data:

|

As of June 30, 2008 |

As of June 30, 2009 |

As of June 30, 2010 |

As of September 30, 2009 |

As of September 30, 2010 |

|||||||||||

| |

|

|

|

(unaudited)

|

||||||||||||

| |

(dollars in thousands)

|

|||||||||||||||

Cash and cash equivalents |

$ | 4,111 | $ | 9,371 | $ | 4,614 | $ | 5,466 | $ | 17,164 | ||||||

Restricted cash(1) |

19,442 | 17,787 | 15,880 | 18,666 | 20,419 | |||||||||||

Total assets |

560,479 | 656,287 | 660,627 | 653,594 | 704,858 | |||||||||||

Total debt |

332,253 | 339,871 | 346,671 | 340,901 | 392,570 | |||||||||||

Preferred stock (not including accrued dividends) |

99,770 | 119,835 | 119,835 | 119,835 | 119,835 | (2) | ||||||||||

Total shareholders' equity |

98,917 | 108,111 | 103,271 | 107,237 | 103,277 | |||||||||||

- (1)

- Restricted cash is cash pledged as collateral to secure certain obligations under our 2008 Senior Notes, our 2010 Senior Notes and Subordinated Notes.

Please see Note 5 to the audited consolidated financial statements.

- (2)

- Total value of accrued and unpaid dividends as of September 30, 2010 was $29.3 million.

13

DISCUSSION OF EBITDA AND ADJUSTED EBITDA

In addition to our results under generally accepted accounting principles in the United States, which we refer to as GAAP, we also use EBITDA and Adjusted EBITDA, both non-GAAP financial measures, which we consider to be important and supplemental measures of our performance. EBITDA represents net income (loss) before interest, taxes, depreciation and amortization; Adjusted EBITDA is further adjusted for the non-cash loss on asset disposals and non-cash stock option expenses, and certain non-operating expenses, including sponsor management fees and expenses, securitization debt-related administration fees, and transaction costs related to our acquisition activity.

We use, and we believe our investors and other external users of our financial statements benefit from, the presentation of both EBITDA and Adjusted EBITDA in evaluating our operating performance. EBITDA permits the measurement of our operating performance without regard to items such as interest expense, taxes, depreciation, and amortization, which can vary substantially from company to company depending upon accounting methods, the book value of assets and liabilities, capital structure, and the method by which assets were acquired. Our management, principal investors and other external users of our financial statements utilize Adjusted EBITDA to further account for non-cash expenses that are unrelated to the core operations of our business, which provides a more appropriate and complete performance benchmark for the business. Our management also uses EBITDA and Adjusted EBITDA for planning purposes, including the preparation of our annual operating budget and financial projections.

You are encouraged to evaluate these measures and the reasons we consider them appropriate for supplemental analysis. In evaluating Adjusted EBITDA, you should be aware that in the future we may incur expenses that are the same as or similar to some of the adjustments in this presentation. Our presentation of EBITDA and Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items.

EBITDA and Adjusted EBITDA have limitations as analytical tools. Some of these limitations are:

- –>

- EBITDA

and Adjusted EBITDA do not reflect our cash expenditures or future requirements for capital expenditures or contractual commitments;

- –>

- EBITDA

and Adjusted EBITDA do not reflect changes in, or cash requirements for, our working capital needs;

- –>

- EBITDA

and Adjusted EBITDA do not reflect the interest expense, or the cash requirements necessary to service interest or principal payments, on our indebtedness;

- –>

- EBITDA

and Adjusted EBITDA do not reflect the impact of certain cash charges resulting from matters we consider not to be indicative of our ongoing operations;

- –>

- EBITDA

and Adjusted EBITDA do not reflect the non-cash component of employee compensation;

- –>

- Although

depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and EBITDA and

Adjusted EBITDA do not reflect any cash requirements for such replacements;

- –>

- Other

companies, including other companies in our industry, may calculate Adjusted EBITDA differently than we do, limiting its usefulness as a comparative measure;

and

- –>

- EBITDA and Adjusted EBITDA do not reflect tax obligations whether current or deferred.

Because of these limitations, you should not consider EBITDA and Adjusted EBITDA in isolation, or as a substitute for net income, operating income, cash flow from operating activities or any other measure of financial performance or liquidity presented in accordance with GAAP. We compensate for

14

these limitations by relying primarily on our GAAP results and using EBITDA and Adjusted EBITDA only supplementally.

The Securities and Exchange Commission, or the SEC, has adopted rules to regulate the use in filings with the SEC and public disclosures and press releases of non-GAAP financial measures, such as EBITDA and Adjusted EBITDA, that are derived on the basis of methodologies other than in accordance with GAAP. These rules require, among other things:

- –>

- a

presentation with equal or greater prominence of the most comparable financial measure or measures calculated and presented in accordance with GAAP; and

- –>

- a statement disclosing the purposes for which our management uses the non-GAAP financial measure.

The rules prohibit, among other things:

- –>

- exclusion

of charges or liabilities that require cash settlement or would have required cash settlement absent an ability to settle in another manner, from non-GAAP

liquidity measures;

- –>

- adjustment

of a non-GAAP performance measure to eliminate or smooth items identified as non-recurring, infrequent or unusual, when the nature of the charge or gain

is such that it is reasonably likely to recur; and

- –>

- presentation of non-GAAP financial measures on the face of any financial information.

The following table presents a reconciliation of operating income, the most comparable GAAP financial measure, to EBITDA and Adjusted EBITDA, for each of the periods indicated:

| |

Predecessor | Successor | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Reconciliation of EBITDA and Adjusted EBITDA to operating income:

|

July 1, 2007 to May 28, 2008 |

May 29, 2008 to June 30, 2008 |

Fiscal year ended June 30, 2009 |

Fiscal year ended June 30, 2010 |

Three months ended September 30, 2009 |

Three months ended September 30, 2010 |

|||||||||||||

| |

(dollars in thousands)

|

||||||||||||||||||

Operating income |

$ | 15,532 | $ | 1,854 | $ | 17,740 | $ | 26,327 | $ | 7,317 | $ | 9,372 | |||||||

Depreciation and amortization |

18,529 | 2,096 | 34,734 | 32,597 | 8,483 | 8,312 | |||||||||||||

EBITDA |

34,061 | 3,950 | 52,474 | $ | 58,924 | $ | 15,800 | $ | 17,684 | ||||||||||

Loss on asset disposal |

2,877 | 225 | 2,089 | 2,152 | 431 | 425 | |||||||||||||

Lost cylinders reserve adjustment(1) |

— | — | — | 1,108 | — | — | |||||||||||||

Franchise taxes included "above the line" |

— | — | — | 238 | — | — | |||||||||||||

Stock option expenses |

4,361 | 41 | 1,105 | 1,259 | 307 | 312 | |||||||||||||

Sponsor management fees and expenses |

— | 83 | 1,211 | 1,190 | 272 | 334 | |||||||||||||

Debt-related administration fees |

— | 15 | 216 | 177 | 43 | 49 | |||||||||||||

Acquisition related costs |

1,033 | 88 | 615 | 202 | 10 | 109 | |||||||||||||

Adjusted EBITDA |

$ | 42,332 | $ | 4,402 | $ | 57,710 | $ | 65,250 | $ | 16,683 | $ | 18,913 | |||||||

- (1)

- The original reserve for lost cylinders was established when Aurora Capital Group purchased the Company and recorded an accrual for a liability to lessors for lost tanks that existed at the time of the Acquisition. This accrual has subsequently been increased by $1.1 million as a result of additional analyses and efforts applied to determining the final liability outstanding for the Company related to such lost cylinders subsequent to the Acquisition. Since the Acquisition occurred in May 2008, this adjustment may not be treated as an adjustment to the purchase price allocation, and must be treated as an expense in the period it was identified. No future adjustments to the reserve are anticipated.

15

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and all of the other information contained in this prospectus before deciding whether to purchase our common stock. Our business, prospects, financial condition and operating results could be materially adversely affected by any of these risks, as well as other risks not currently known to us or that we currently consider immaterial. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment. In assessing the risks described below, you should also refer to the other information contained in this prospectus, including our consolidated financial statements and the related notes, before deciding to purchase any shares of our common stock.

RISKS RELATED TO OUR BUSINESS AND INDUSTRY

Our future operating results are uncertain despite the previous growth rate in our revenues.

Prior growth rates in our revenues should not be considered indicative of future growth rates in our revenues. The timing and amount of future revenues will depend on, among other things:

- –>

- our

ability to renew customer contracts with existing customers upon their expiration and to achieve high customer satisfaction with existing customers;

- –>

- our

ability to acquire additional locations with existing customers;

- –>

- our

ability to obtain agreements with new customers to install bulk CO2 equipment and use our services;

- –>

- our

ability to increase the density of our customer base for existing service locations in order to allow for increased absorption of fixed costs;

- –>

- the

level of annual increase, if any, in the indices to which the monthly fees and surcharge rates in our customer contracts are tied;

- –>

- our

ability to successfully expand our business into the draught beer market;

- –>

- our

ability to develop new and innovative beverage carbonation solutions and products;

- –>

- the

success of any new products or beverage carbonation solutions, including our Mini-Bulk CO2 system and our customized draught beer carbonation

solutions, including the XactmiX beverage control system and XactN2 nitrogen generator; and

- –>

- our ability to grow our business by identifying and consummating acquisitions.

Our operating results will depend on many factors, including:

- –>

- the

level of product and price competition;

- –>

- our

ability to manage revenues, customer turnover and growth;

- –>

- our

ability to hire additional employees; and

- –>

- our ability to control costs.

Although we currently have a contractual backlog, this backlog is not necessarily indicative of future growth rates in our operating results, which will depend in part on our ability to implement new customer contracts. Additionally, such new customer contracts may be subject to modification or termination prior to implementation or may not be implemented for a significant period of time due to

16

Risk factors

customers' prior contractual commitments. If our future operating results suffer as a result of our inability to renew existing customer contracts, obtain new customer contracts, increase the density of our customer base, introduce new and successful products, manage our growth, or for any of the other reasons mentioned above, there could be a material adverse effect on our business, financial condition and results of operations.

Our business lacks product diversity and depends heavily on continued market acceptance by the fountain beverage market of bulk CO2 equipment and consumer preference for carbonated beverages.

Although we are developing new and differentiated products, we depend heavily on continued market acceptance of bulk CO2 equipment by the fountain beverage market, which has accounted for substantially all of our revenues. Unlike many of our competitors for whom bulk CO2 is a secondary business, we have no material lines of business other than the leasing of bulk CO2 equipment and the supply of beverage grade CO2. Total demand for bulk CO2 is limited because the fountain beverage market is mature. While we anticipate future growth from our customized draught beer carbonation solutions and other new products, our current ability to grow is primarily dependent upon the success of our marketing efforts to acquire new customers and the acceptance of bulk CO2 equipment as a replacement for high pressure cylinders. We cannot be certain that the operating results of our installed base of bulk CO2 equipment will continue to be favorable and past results may not be indicative of future market acceptance of our services. In addition, any economic downturn experienced by the fountain beverage market or customers or any significant shift in consumer preferences away from carbonated beverages to other types of beverages could have a material adverse effect on our business, financial condition and results of operations.

Implementing our acquisition strategy involves risk and failure to successfully implement this strategy could have a material adverse effect on our business.

One of our key strategies is to grow our business by selectively pursuing acquisitions of bulk CO2 customer accounts. Acquisitions involve risks, including:

- –>

- identifying

appropriate acquisition candidates or negotiation of acquisitions on favorable terms and valuations;

- –>

- integrating

acquired bulk CO2 customer accounts;

- –>

- implementing

proper business and accounting controls;

- –>

- the

ability to finance acquisitions, on favorable terms or at all;

- –>

- the

diversion of management attention;

- –>

- retaining

customers after acquisitions;

- –>

- failing

to realize anticipated benefits, such as cost savings and revenue enhancements;

- –>

- maintaining

our level of customer service as the business continues to grow;

- –>

- increasing

incremental depreciation and amortization expense; and

- –>

- incurring unexpected costs, expenses and liabilities.

The growth in the size and scale of our business has placed, and is expected to continue to place, significant demands on our personnel and operating systems. Any additional expansion may further strain management and other resources. Our ability to manage growth effectively will depend on our

17

Risk factors

ability to, among other things, improve our operating systems, expand, train and manage our employee base and develop additional service capacity. If we are unable to manage our growth effectively, our customer service levels may decline, which may adversely affect our ability to maintain our customer base. A failure by us to maintain our customer base could have a material adverse effect on our business, financial condition and results of operations.

The beverage carbonation market is highly competitive, and any inability by us to respond to competitive factors may result in a loss of existing customers and a failure to attract new customers.

The beverage carbonation market is highly competitive. Our competitors may substantially increase their installed base of bulk CO2 equipment and expand their service nationwide, provide customer service superior to ours or reduce the price of their services below the prices offered by us. While we believe our national presence and deep service capabilities would be difficult, costly and time-consuming to replicate, we also face the risk of well-capitalized competitors entering our existing or future local or regional markets or developing a new, but competing product. We compete with numerous providers of bulk CO2 solutions, including:

- –>

- industrial

gas and welding supply companies;

- –>

- specialty

gas companies;

- –>

- restaurant

and grocery supply companies; and

- –>

- fountain supply companies.

These suppliers vary widely in size. Some of our competitors may have significantly greater financial, technical or marketing resources than we do. Our competitors might succeed in developing technologies, products or services that are superior, less costly or more widely used than those we have developed or are developing, or that would render our technologies or products obsolete or uncompetitive. In addition, competitors may have an advantage over us with customers who prefer dealing with one company that can supply bulk CO2 solutions as well as fountain syrup. We cannot be certain that we will be able to compete effectively with existing or future competitors. Our failure to compete could have a material adverse effect on our business, financial condition and results of operations.

We depend on the continued contributions of our existing leadership team, each of whom would be difficult to replace.

Our future success depends to a significant degree upon the continued contributions of our leadership team and our ability to attract and retain other highly qualified management personnel. We have entered into executive employment agreements with our leadership team. The employment agreements with our Chief Executive Officer, Executive Vice President and Chief Financial Officer, Senior Vice President of Sales and Senior Vice President of Marketing and Business Development expire in May 2013, June 2013, May 2013 and June 2014, respectively. However, we face competition for management from other companies and organizations. Therefore, in spite of the existence of employment agreements, we may not be able to retain our existing leadership team or fill new management positions or vacancies created by expansion or turnover at existing compensation levels. We also do not have "key-person" insurance on the lives of our leadership team or management personnel to mitigate the impact to us that the loss of any of them would cause. Specifically, the loss of any of our leadership team would disrupt our operations and divert the time and attention of the remaining members of our leadership team. Additionally, failure to retain our current management

18

Risk factors

team or to attract and retain highly qualified management personnel to fill vacancies or newly created positions could have a material adverse effect on our business, financial condition and results of operations.

As we are dependent on third-party suppliers, we may have difficulty finding suitable replacements to meet our needs if these suppliers cease doing business with us.