Attached files

| file | filename |

|---|---|

| EX-99 - PDF OF PRESENTATION - FIRST MIDWEST BANCORP INC | exhibit99.pdf |

| 8-K - SANDLER CONFERENCE - FIRST MIDWEST BANCORP INC | november118k.htm |

1

November 11, 2010

First Midwest Bancorp, Inc.

Sandler O’Neill

2010 East Coast Financial Services

Investment Conference

2

2

Forward Looking Statements &

Additional Information

Additional Information

This presentation may contain, and during this presentation our management may make statements that may

constitute “forward-looking statements” within the meaning of the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995. Forward-looking statements are not historical facts but instead

represent only our beliefs regarding future events, many of which, by their nature, are inherently uncertain and

outside our control. Forward-looking statements include, among other things, statements regarding our

financial performance, business prospects, future growth and operating strategies, objectives and results.

Actual results, performance or developments could differ materially from those expressed or implied by these

forward-looking statements. Important factors that could cause actual results to differ from those in the forward-

looking statements include, among others, those discussed in our Annual Report on Form 10-K, the preliminary

prospectus supplement and other reports filed with the Securities and Exchange Commission, copies of which

will be made available upon request. With the exception of fiscal year end information previously included in the

audited financial statements in our Annual Report on Form 10-K, the information contained herein is unaudited.

Except as required by law, we undertake no duty to update the contents of this presentation after the date of

this presentation.

constitute “forward-looking statements” within the meaning of the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995. Forward-looking statements are not historical facts but instead

represent only our beliefs regarding future events, many of which, by their nature, are inherently uncertain and

outside our control. Forward-looking statements include, among other things, statements regarding our

financial performance, business prospects, future growth and operating strategies, objectives and results.

Actual results, performance or developments could differ materially from those expressed or implied by these

forward-looking statements. Important factors that could cause actual results to differ from those in the forward-

looking statements include, among others, those discussed in our Annual Report on Form 10-K, the preliminary

prospectus supplement and other reports filed with the Securities and Exchange Commission, copies of which

will be made available upon request. With the exception of fiscal year end information previously included in the

audited financial statements in our Annual Report on Form 10-K, the information contained herein is unaudited.

Except as required by law, we undertake no duty to update the contents of this presentation after the date of

this presentation.

The Company’s accounting and reporting policies conform to U.S. generally accepted accounting principles

(“U. S. GAAP”) and general practice within the banking industry. As a supplement to GAAP, the Company has

provided non-GAAP performance results. The Company believes that these non-GAAP financial measures are

useful because they allow investors to assess the Company’s operating performance. Although the non-GAAP

financial measures are intended to enhance investors’ understanding of the Company’s business and

performance, these non-GAAP financial measures should not be considered an alternative to GAAP.

(“U. S. GAAP”) and general practice within the banking industry. As a supplement to GAAP, the Company has

provided non-GAAP performance results. The Company believes that these non-GAAP financial measures are

useful because they allow investors to assess the Company’s operating performance. Although the non-GAAP

financial measures are intended to enhance investors’ understanding of the Company’s business and

performance, these non-GAAP financial measures should not be considered an alternative to GAAP.

3

3

First Midwest Presentation Index

Who We Are

Operating Performance

Credit And Capital

Market Opportunities

Why First Midwest

4

4

Who We Are

5

Loan Mix

Deposit Mix4

Highly Efficient Platform - $67mm

Of Deposits Per Branch Office

Of Deposits Per Branch Office

Leading Market Share In Non-

Downtown Chicago MSA ³

Downtown Chicago MSA ³

#9 In Market Share

3 FDIC Acquisitions Since 4Q09

$5.7bn

$6.7bn

Note: Information as of 30-Sept-10.

¹ Defined as time deposits less than $100,000.

² Defined as time deposits greater than $100,000.

³ Source: SNL Financial. Non-downtown ranking and market share based on total deposits in Chicago MSA less deposits in the city of Chicago. Data as of 31-Dec-09.

4 Based on average deposit mix as of 30-Sept-10.

5 Includes $488mm in covered loans stemming from three FDIC transactions since 30-Sept-09.

Consumer

12%

Commercial

& Industrial

& Industrial

30%

Commercial

Real Estate

Real Estate

50%

Savings &

NOW

NOW

31%

Demand

19%

Money

Market

Market

19%

Retail

Time¹

Time¹

21%

Jumbo Time²

10%

Covered Loans

8%

Overview Of First Midwest

Headquartered In Suburban

Chicago

Chicago

$8.4bn Assets

$5.7bn Loans (5)

$6.7bn Deposits

68% Transactional

$4.3bn Trust Assets

6

6

Operating Performance

7

7

Third Quarter Results

|

Key Metrics

|

3Q10

|

2Q10

|

3Q09

|

|

$34.9

|

$34.7

|

$30.2

|

|

|

Net Income (millions)

|

$2.6

|

$7.8

|

$3.4

|

|

Net Interest Margin

|

4.05%

|

4.21%

|

3.66%

|

|

Efficiency Ratio

|

59.9%

|

57.9%

|

59.1%

|

|

Loans (2) (billions)

|

$5.7

|

$5.4

|

$5.3

|

|

Avg. Transactional Deposits (billions)

|

$4.5

|

$4.3

|

$3.9

|

|

Tier 1 Common

|

10.45%

|

10.89%

|

8.43%

|

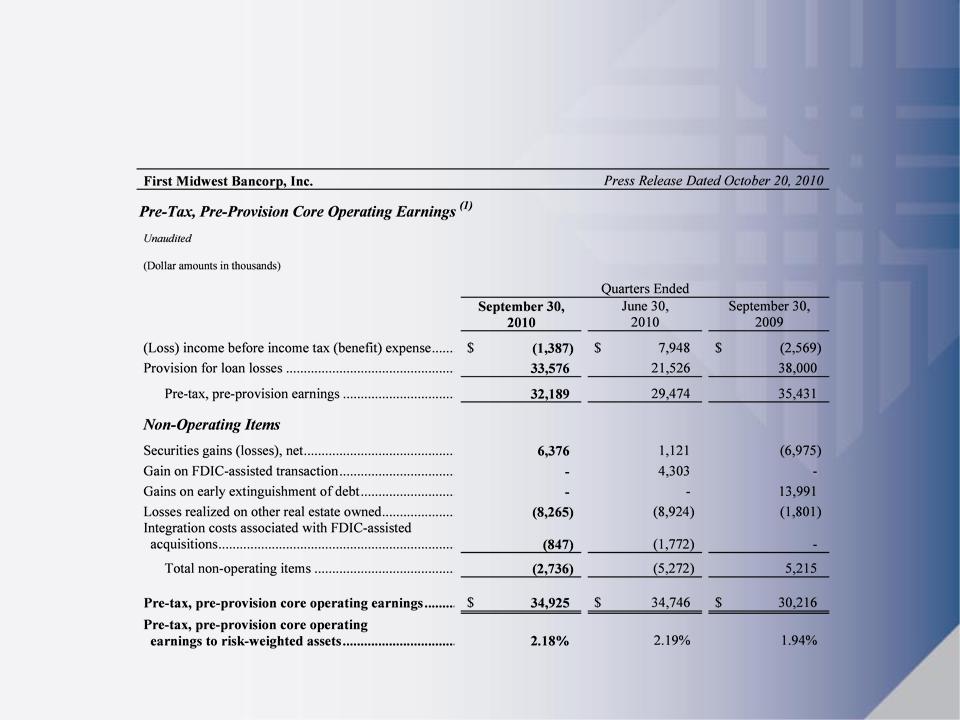

1 PTPP Represents Pre-Tax, Pre-Provision earnings, which is a non-GAAP financial measure. For reconciliation to GAAP measure, please refer to the appendix.

2 Includes $488mm in covered loans stemming from three FDIC transactions since 30-Sept-09.

8

Third Quarter Highlights

Strong Core Earnings

Top Line Revenues, Solid Margin

Fee-Based Business Improvement

Acquisition Integration

Continued Lending; Elevated Credit Costs

Loan Growth Offset By Remediation

Peer Leading Capital And Liquidity

9

Source: FMBI based on internal data; peer data from SNL Financial.

¹ Equal to non-interest expense divided by fully taxable equivalent (FTE) net interest income and non-interest income. Excludes nonrecurring items, sourced from SNL.

² This is a non-GAAP financial measure. For reconciliation to GAAP measure, please refer to the appendix.

³ Chicago Peers based on median of MBFI, OSBC, PVTB, TAYC and WTFC.

4 Metro Peers based on median of CATY, CBSH, CFR, FCF, FMER, FULT, MBFI, ONB, PVTB, SUSQ, UMPQ, VLY, WTFC, and WTNY.

Efficiency Ratio % ¹

Net Interest Margin %

2.18%

4.05%

58.03%

Core Business Is Solid

10

Continued Business Investment

Strengthening Sales

Sales Staff Isolated From Remediation

Household Growth Up 10%

JD Power Retail Client Satisfaction: Second In Midwest

Internet Enhancement

Streamlined Account Opening And Navigation

34% Increase In Web Usage, 115% In Applications

Product Enhancement

Mortgage Program

Overdraft Program

E-Statements

11

11

Credit And Capital

12

~95% in footprint

Diversified + granular

Most have personal guarantees

Consumer Loans = $656mm

Home Equity

8%

8%

Other

Consumer

1%

Consumer

1%

C&I

30%

30%

Office,

Retail &

Industrial

22%

Retail &

Industrial

22%

Residential

Construction

4%

Construction

4%

Commercial

Construction &

Land 3%

Construction &

Land 3%

Multi-family

6%

6%

Other CRE

15%

15%

Commercial Loans = $4.5bn

Real Estate - 1- 4

Family

3%

Family

3%

Total Loans = $5.7bn

People we know, businesses we know, markets we understand

Note: Loan data as of 30-Sept-10.

Covered 8%

Addressing Realities Of Credit Cycle

- Loan Portfolio Overview

- Loan Portfolio Overview

Branch originated

Home equity dominated

13

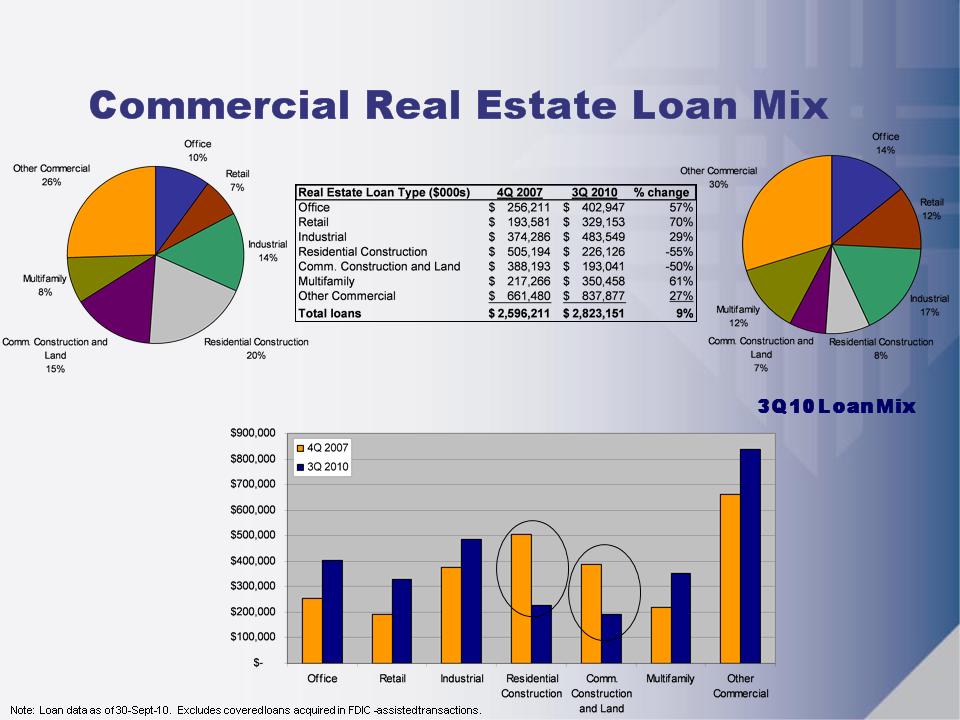

$2.8bn

2007 Loan Mix

$2.6bn

14

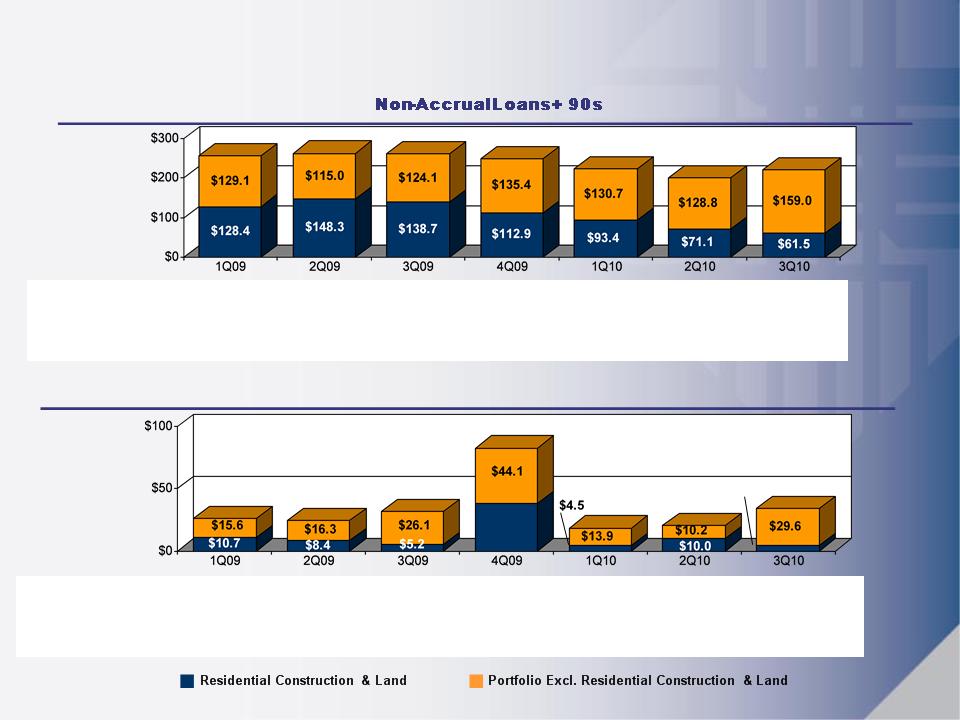

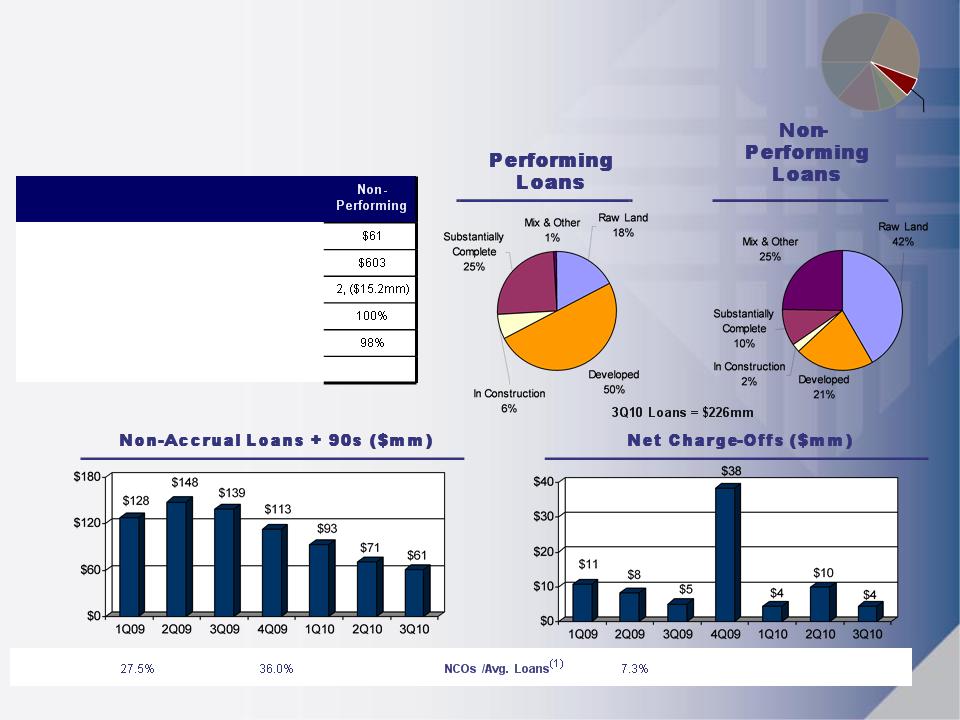

Net Charge-Offs

Note: Excludes covered loans acquired in FDIC-assisted transactions.

|

NALs + 90s / Loans

|

|

|

|

|

|

|

Residential Construction & Land

|

27.5

% |

32.3%

|

34.6%

|

36.0%

|

33.8% 29.7% 27.2%

|

|

Portfolio Excl. Resi. Const. & Land

|

2.6%

|

2.4%

|

2.5%

|

2.8%

|

2.7% 2.6% 3.2%

|

|

Total

|

4.8%

|

4.9%

|

5.0%

|

4.8%

|

4.3% 3.8% 4.3%

|

|

NCOs / Avg. Loans - Annualized

|

|

|

|

|

|

|

Residential Construction & Land

|

8.91%

|

7.31%

|

4.78%

|

42.55%

|

6.00% 14.97% 7.44%

|

|

Portfolio Excl. Resi. Const. & Land

|

1.29%

|

1.33%

|

2.10%

|

3.54%

|

1.15% 0.83% 2.36%

|

|

Total

|

1.98%

|

1.85%

|

2.32%

|

6.17%

|

1.43% 1.56% 2.59%

|

$257.5

$263.3

$262.8

$248.3

$82.4

$38.3

$24.7

$26.3

$224.1

$18.4

$200.0

$20.2

$220.5

$31.3

$34.0

$4.4

Historical Credit Performance

15

4%

|

|

Performing

|

|

|

Size of Portfolio ($mm)

|

$165

|

|

|

Median Loan Size ($000s)

|

$189

|

|

|

Loans > $5mm, (Total Value)

|

2, ($16.0mm)

|

|

|

% of Loans In-Market

|

96%

|

|

|

% with Current (<1 yr.) Appraisal

|

66%

|

|

|

% Maturing in 1 Year

|

75%

|

NM

|

|

NALs + 90s /

Loans |

32.3%

|

34.6%

|

33.8% 29.7% 27.2%

|

8.9%

|

4.8%

|

42.6%

|

6.0% 15.0% 7.4%

|

Note: Loan data as of 30-Sept-10.

¹ Annualized

Residential Construction

16

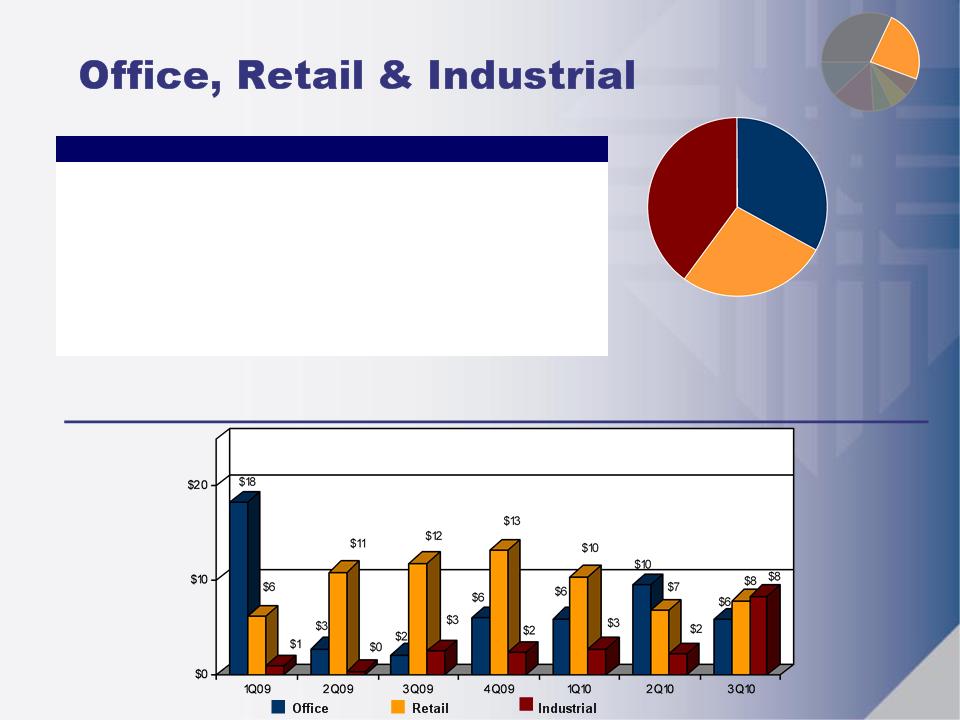

|

|

Office

|

Retail

|

Industrial

|

|

Size of Portfolio ($mm)

|

$403

|

$329

|

$484

|

|

% Performing Loans Maturing Pre- 2012

|

33%

|

29%

|

25%

|

|

Median Loan Size ($000s)

|

$287

|

$314

|

$428

|

|

Loans > $5mm, (Total Value)

|

18, ($142mm)

|

10, ($91mm)

|

12, ($87mm)

|

|

Owner Occupied

|

30%

|

20%

|

40%

|

|

% of Loans In-Market

|

93%

|

96%

|

96%

|

|

NCOs YTD ($000s)

|

$1,586

|

$4,366

|

$870

|

|

NCO / Avg. Loans (Annualized)

|

53bps

|

179bps

|

25bps

|

Non-Accrual Loans + 90s ($mm)

3Q10 Loans: $1.2bn

Office

33%

33%

Retail

27%

27%

Industrial

40%

40%

24%

Note: Loan data as of 30-Sept-10.

17

$128.2

$64.2

$50.3

$42.0

$36.0

$38.3

$50.7

Note: Excludes covered loans acquired in FDIC-assisted transactions.

18

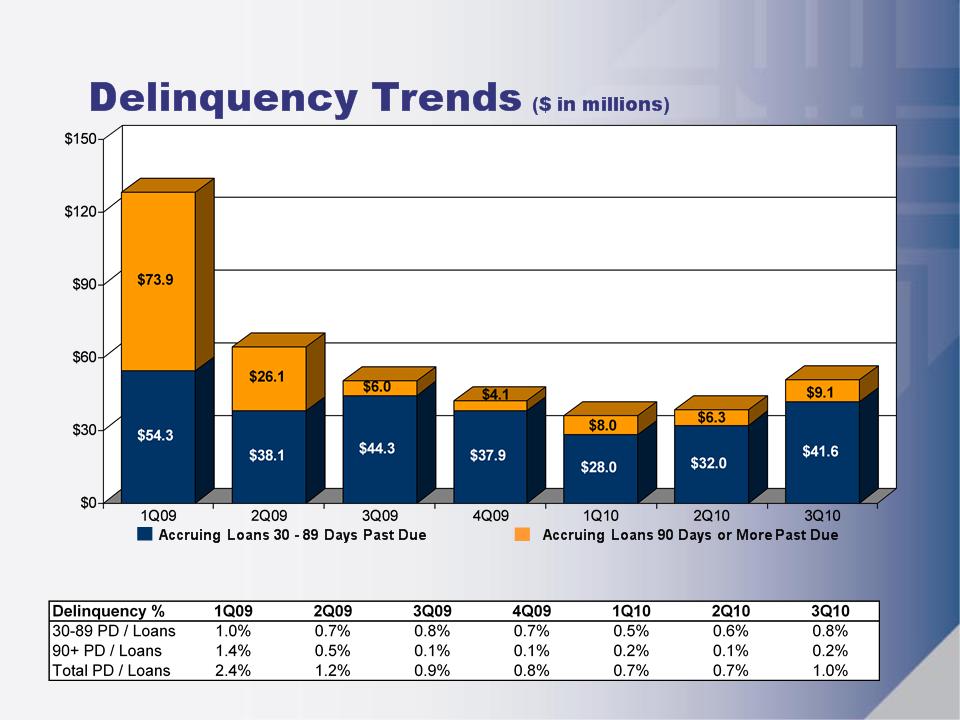

Levels Reflect Improvement; Influenced By Seasonality And Disposition Strategy

Quarterly

Year Over Year

Nonperforming Asset Trends

$s In Millions

$s In Millions

19

Addressing Reality of Credit Cycle

Problems Concentrated In Residential Construction

Reflects Illiquidity Of Suburban Market

Performance Influenced By Sales And Property Values

Portfolio Exposure Reduced

Credit Pressure Shifting

Cash Flowing Properties

Influenced By Consumer Demand

Continued Investment In Remediation

Focus On Reducing NPA Levels

30 - 89 Day Delinquencies Down 6% From 3Q09

Adjusting Carrying Values To Market And Disposition Strategy

Continued Progress Influenced By Market Liquidity

20

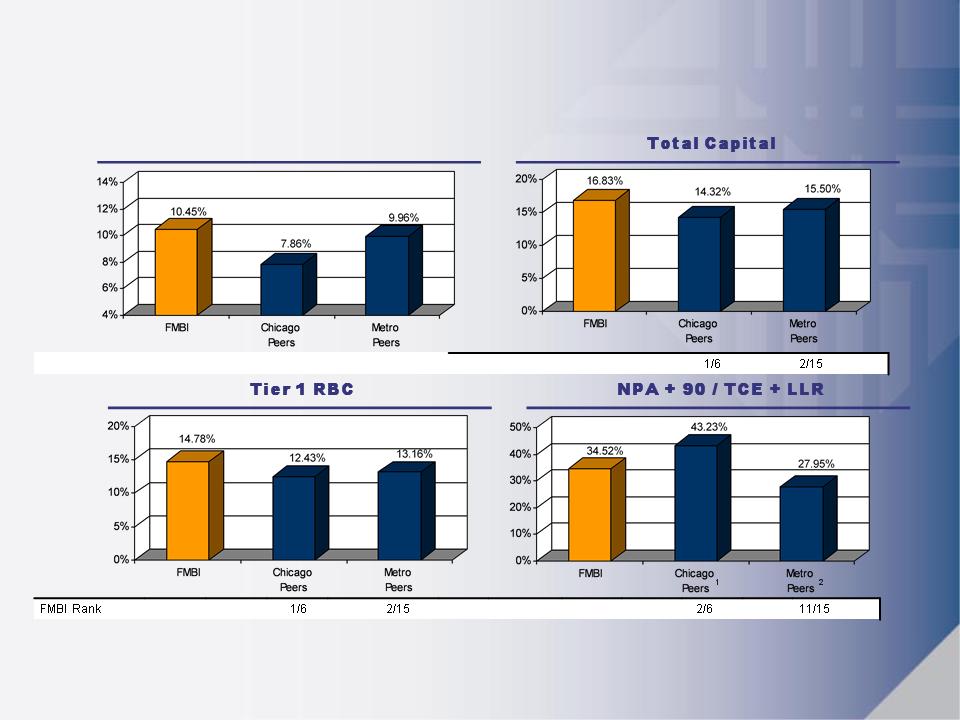

Leading Capital Foundation

First Midwest vs. Peers

First Midwest vs. Peers

Source: company data and SNL Financial. FMBI as of a 30-Sept-10 and other companies as of 30-Jun-10. FMBI Tier 1 Common excludes equity credit allocated to TARP warrants.

1 Chicago Peers based on median of MBFI, OSBC, PVTB, TAYC and WTFC.

2 Metro Peers based on median of CATY, CBSH, CFR, FCF, FMER, FULT, MBFI, ONB, PVTB, SUSQ, UMPQ, VLY, WTFC, and WTNY.

Tier 1 Common

|

FMBI Rank

|

|

|

1/6

|

6/15

|

|

|

1

1

1

2

2

2

21

21

Market Opportunities

22

11 10 10 14 14

Market Disruption

Environment Creates Opportunities

Within Chicago Market

~ 40 Failures Since Start Of 2009

~ 45 Institutions ($14 Billion) With Texas Ratio > 100%

Well Positioned To Benefit

Strong Capital Position

Solid Reputation: In Marketplace 70+ Years

Tenured Sales Force

Experienced Management

23

11 10 10 14 14

Acquisition Opportunities

Selective Criteria

Strategically And Financially Accretive

Ability To Strengthen The Company

Leverages Our Skills

Local Market Knowledge

Experienced And Successful Acquirer

7 Deals, $2.7bn Since 2003

FDIC Becoming More Competitive

Deals Likely Smaller

Eventual Shift From Assisted To Unassisted

23

24

24

|

Acquisition

|

Date

|

Deposit

s |

Core

(1) |

Loans

|

Branche

s |

~

House -holds

|

Pre-

Tax Gain

|

|

First DuPage

|

4Q09

|

$232

|

26%

|

$212

|

1

|

3,000

|

$13

|

|

Peotone Bank

And Trust |

2Q10

|

$84

|

73%

|

$53

|

2

|

4,000

|

$4

|

|

Palos Bank

And Trust |

3Q10

|

$462

|

47%

|

$297

|

5

|

18,000

|

$0

|

|

Total

|

|

$778

|

|

$562

|

8

|

25,000

|

$17

|

Acquisitions Made

(1) Defined as total deposits less time deposits.

Expanded Footprint, Financially Accretive,

Solid Deposit Retention (90+%)

All dollar amounts in millions.

25

25

Why First Midwest

26

Manage Through Credit Cycle

Continued Remediation Focus

Manage Capital And Changing Regulatory Environment

Position For Long-term Success

Investment In Sales

Expand Market Presence

Pursue Growth Opportunities

Priorities for 2010

27

Positioned For Long-term Success

Why First Midwest

Strong Core

Working Through Cycle

Solid Capital; Liquidity

Experienced Team

Market Opportunities Available

28

Questions?

28

29

29

30

30

Appendix

31

Reconciliation of Non-GAAP Measures

($ in 000s)

($ in 000s)