Attached files

| file | filename |

|---|---|

| 8-K - DARLING INGREDIENTS INC. | mm11-0810_8k.htm |

| EX-2.1 - EX.2.1 - AGREEMENT AND PLAN OF MERGER - DARLING INGREDIENTS INC. | mm11-0810_8ke0201.htm |

| EX-10.1 - EX.10.1 - ROLLOVER AGREEMENT - DARLING INGREDIENTS INC. | mm11-0810_8ke1001.htm |

| EX-99.2 - EX.99.2 - PRESS RELEASE - DARLING INGREDIENTS INC. | mm11-0810_8ke9902.htm |

EXHIBIT 99.1

Combining Darling with Griffin creates America’s largest independent

renderer and recycler serving the nation’s food industry

renderer and recycler serving the nation’s food industry

Key considerations:

National platform with scale

Diversified base of raw material supply

Entrenched customer relationships

Insulation from commodity price fluctuations

through raw material pricing formulas

Global distribution of finished products

High free cash flow generation

Strong balance sheet

Experienced management team

Key Highlights

2

National Platform

with Scale

with Scale

Largest independent

rendering provider with

operations nationwide

rendering provider with

operations nationwide

Breadth to service

national accounts

national accounts

Diverse mix of beef, pork and

poultry raw materials and the

largest recycler of bakery

waste

poultry raw materials and the

largest recycler of bakery

waste

Pricing formulas insulate from

commodity price fluctuations

commodity price fluctuations

Diversified Base of

Material Inputs

Material Inputs

Permits by local

governments to operate

each plant

governments to operate

each plant

Comply with complex food

safety regulations

safety regulations

Regulatory

Compliance and

Permitting

Compliance and

Permitting

Both Darling and Griffin

senior management have

an average of more than

25 years of industry

experience

senior management have

an average of more than

25 years of industry

experience

Experienced

Management Team

Management Team

Created value-added feed

formulations that improve

digestibility and caloric

content

formulations that improve

digestibility and caloric

content

Implementing next-

generation green diesel

technology to open a new

market for fats and oils

generation green diesel

technology to open a new

market for fats and oils

Culture of Innovation

Average length of top ten

supply relationships is

24+ years

supply relationships is

24+ years

Processing plants

generally within 100 miles

of supplier facilities

generally within 100 miles

of supplier facilities

Long-term

Relationships with

Raw Material Suppliers

Relationships with

Raw Material Suppliers

Competitive Strengths

3

The only independent recycling/rendering company with a national footprint

— Network of 45 processing facilities from coast to coast

Darling’s National Platform

4

Darling 2009

Diversifies into Poultry and Bakery

Diversification of raw material supply, providing Darling with

greater exposure to poultry

greater exposure to poultry

— Griffin is one of the three largest non-captive US processors of

poultry by-products

poultry by-products

— Reduces Darling’s reliance on beef as their #1 raw material source

— Poultry consumption growth outpaces other protein consumption

Entry into bakery recycling business

— Griffin is the largest US producer of bakery by-products

— High margin due to lower processing requirement and high caloric

content of finished product

content of finished product

Complementary footprint resulting in increased scale and broader

geographic presence

geographic presence

— Fills in Darling’s footprint in the southeast United States

— Greater customer diversification

— Provides entry into new products and premium feed formulations

— Scale arbitrage on fat and grease volume

Improves feedstock sourcing alternatives for Valero renewable

fuels JV

fuels JV

— Poultry fat works well to Louisiana

— Doubles feedstock available in the eastern region

Operating cost synergy and revenue enhancement potential

— Formulation and branding opportunities

— Overhead reductions

Poultry

11%

Cooking oil

12%

Beef/Pork

77%

Poultry

47%

Cooking oil 11%

Bakery

32%

Beef/Pork 10%

Poultry

29%

Cooking oil

11%

Bakery 21%

Beef/Pork

40%

Strategic rationale

Griffin 2009

Pro Forma 2009

Acquisition Rationale

5

6

Griffin Industries Business Model

Commodity Products

(<45% of 2009 Sales)

Griffin Premium, Value

-

Added, or Branded Products

(>55% of 2009 Sales)

Raw

Materials

Poultry By

-

Products

Beef & Pork By

-

Products

Spent Cooking Oil

Bakery & Snack Food Waste

Bakery Feed

Yellow Grease, Tallow,

Poultry Grease, Feed Fats

Meat & Bone Meal,

Poultry Meal,

Feather Meal,

Blood Meal

Griffin’s premium, branded organic

fertilizer

Unique service program that allows

small feed mills and large farms to

purchase fats and other feed

additives direct from Griffin

Griffin’s clean

-

burning biodiesel

produced from rendered animal by-

products and recycled cooking oil

Griffin’s premium poultry meal

processed at lower temperatures to

increase digestibility and palatability

Griffin’s branded high quality

animal protein designed for dairy

cows

Griffin’s high quality pet

-

food additive

made from chicken by-products

Griffin’s branded grease product

that can be burned for fuel

Griffin’s high energy content

animal feed additive

Poultry

47%

Bakery

32

%

Cookie® Meal

Flash

Dried

Poultry Meal

Pet

-

Grade

Poultry Meal

Beef &

Pork

Pork

10%

Spent

Cooking

Cooking

Oil

11%

Griffin Industries Overview

7

100% of rendering business under formula pricing

100% of bakery business under formula pricing

Over 60% of restaurant cooking oil customers under

formula pricing agreements

Contracts typically 3-5 years

Griffin Procurement and Risk Management

8

Griffin Industries Premium Products

Strategic focus on premium and value-added products

Griffin is able to drive premium pricing

through differentiated and value-added

products

through differentiated and value-added

products

(As a % of total sales)

2005

2009

+65%

+70%

+75%

Commodity Feed

Grade Poultry Meal

Griffin Pet

-

Grade

Poultry Meal

Griffin Poultry Meal

(Flash Dried)

Griffin Low Ash

Poultry Meal

Expanded premium, value-added and branded

sales from 25% in 2005 to 57% in 2009

sales from 25% in 2005 to 57% in 2009

Enhanced nutritional content, consistency and

customization drives premium pricing

customization drives premium pricing

Processing capacity and proprietary equipment

and methods allow Griffin to focus on raw

material segregation which facilitates the

production of specialized, custom blends

and methods allow Griffin to focus on raw

material segregation which facilitates the

production of specialized, custom blends

Premium products pricing relative to commodity meals

Expansion of premium, value-added and branded sales

2005

2009

25%

57%

Value-added products sell for a

significant premium to commodity

products

significant premium to commodity

products

9

Griffin’s Operating Divisions

Operating segment overview

2009 sales mix by segment2

Rendering

59%

59%

1Restaurant cooking oil raw material volumes are divided between the Rendering (92%) and Bakery Feeds (8%) divisions

2 Other includes Hides & Skins (2%), Fertilizer (1%), and Biodiesel (1%)

Export 9%

Other 5%

Bakery

26%

Rendering

Bakery Feeds

Hides &

Skins

Export

Fertilizer

Biodiesel

Jay Gee

Year Established

1943

1993

1976

1986

1995

1999

1978

Processing Facilities

12 facilities

9 facilities

2 facilities

1 facility

1 facility

1 facility

2 facilities

Transfer Stations

24

3

N/A

N/A

N/A

N/A

N/A

Raw Material Processing and Production

& Sale of Finished Goods

Production & Sale of Finished Goods

Support

Bakery

32%

Spent

Cooking Oil

11%

Beef/Pork

10%

Poultry

47%

2009 raw materials mix1

10

Fills in the U.S. Southeast Footprint

Griffin Industries

Darling International

Darling and Griffin locations

Griffin locations only

Darling locations only

11

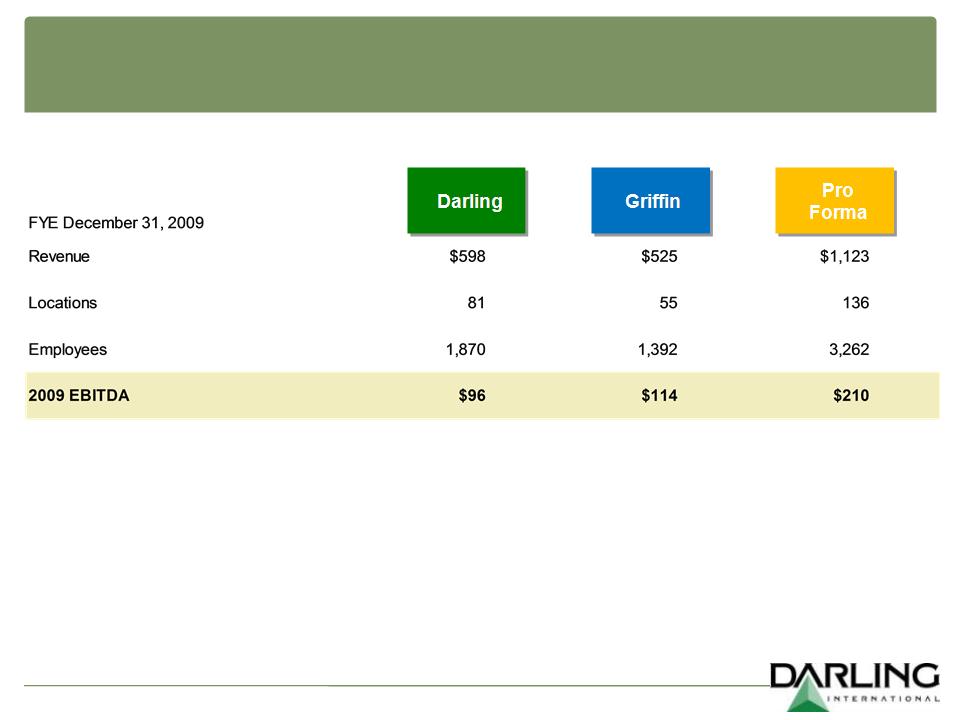

Similar Size Companies

12

Griffin will operate as a wholly-owned subsidiary of Darling

and over time will create synergies through:

and over time will create synergies through:

Routing improvements (Florida, Georgia, Indiana, Ohio in 2011)

Implementation of best practices from Darling and Griffin to achieve

plant processing efficiencies

Scale arbitrage on fat & grease volume for green diesel opportunity

Expanded footprint to better serve national accounts

SG&A reduction opportunities

Transaction Synergy Potential

13

Successful Acquisition

Integration Track Record

Integration Track Record

2004

2005

2006

2007

2008

2009

July

07

07

Dec

08

08

Aug

08

08

Oct

05

05

FL, GA

KC metro

NYC metro

GA

GA

So CA

Burrows Industries, Inc.

dba Minuteman Pumping

dba Minuteman Pumping

Ace Grease

Service

Service

J&R

Rendering, Inc.

Rendering, Inc.

Southeastern Maintenance &

Construction Inc.

Construction Inc.

National

By-Products, LLC

By-Products, LLC

API Recycling,

div of American

Proteins Inc.

div of American

Proteins Inc.

Boca

Transport, Inc.

Transport, Inc.

Midwest

US

US

2010

Sanimax USA

June

10

NE, KS

Nebraska

By-Products

Dec

09

Great Lakes

Since 2004, Darling has acquired and integrated 9 companies investing a total of $212 million

Feb

09

Dec

04

May

06

14

Griffin Enhances Existing Management Team

Griffin

Name

Years at Griffin

Robert Griffin

President & CEO

37

37

Years in Industry

Martin Griffin

Chief Operating Officer

30

30

Anthony Griffin

Chief Financial Officer

17

17

Thomas Griffin

Senior Vice President

31

31

William Reagor

President of Bakery Division

17

17

Rick Elrod

Executive Vice President

26

26

Darling

Name

Years at Darling

Randy Stuewe

Chairman & CEO

8

27

Years in Industry

John Muse

EVP & CFO

13

40

John Sterling

EVP, Secretary & GC

3

13

Michael Rath,

EVP Commodities

& Risk Management

& Risk Management

2

24

Neil Katchen

EVP, Operations

40

40

Dr. Ross Hamilton

VP Technology &

Government Affairs

14

14

15

Transaction Overview

Transaction Overview

Transaction Overview

|

Target &

Purchase Price |

Griffin Industries (“Target”)

One of the largest independent providers of value-added rendering, bakery feed and

cooking oil recycling services $840mm purchase price

|

|

|

Capital Structure

|

$325mm Revolver due 2015

$300mm Term Loan B due 2016

$250mm High Yield Bond due 2018

$100mm Equity to Target

|

|

|

Acquisition

Rationale |

Diversification of raw material supply

Entry into bakery recycling business

Complementary footprint in the southeast

|

|

|

Projected Closing

|

Week of December 13th

|

|

17