Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NTELOS HOLDINGS CORP. | d8k.htm |

Investor Presentation

Third Quarter 2010 Update

Exhibit 99.1 |

1

Use of Non-GAAP Financial Measures

Included in this presentation are certain non-GAAP financial measures that

are not determined in accordance with US generally accepted accounting

principles. These financial performance measures are not indicative of cash

provided or used by operating activities and exclude the effects

of certain

operating, capital and financing costs and may differ from comparable

information provided by other companies, and they should not be considered

in isolation, as an alternative to, or more meaningful than measures of

financial performance determined in accordance with US generally

accepted

accounting principles. These financial performance measures are

commonly

used in the industry and are presented because NTELOS believes they

provide relevant and useful information to investors. NTELOS utilizes these

financial performance measures to assess its ability to meet future capital

expenditure and working capital requirements, to incur indebtedness if

necessary, and to fund continued growth. NTELOS also uses these

financial

performance measures to evaluate the performance of its business, for

budget planning purposes and as factors in its employee compensation

programs. |

2

Special Note Regarding Forward-Looking

Statements

Any statements contained in this presentation that are not statements of

historical fact, including statements about our beliefs and expectations, are

forward-looking statements and should be evaluated as such. The words

“anticipates,”

“believes,”

“expects,”

“intends,”

“plans,”

“estimates,”

“targets,”

“projects,”

“should,”

“may,”

“will”

and similar words and expressions are

intended to identify forward-looking statements. Such forward-looking

statements reflect, among other things, our current expectations, plans and

strategies, and anticipated financial results, all of which are subject to known

and unknown risks, uncertainties and factors that may cause our actual

results to differ materially from those expressed or implied by these forward-

looking statements. Many of these risks are beyond our ability to control or

predict. Because of these risks, uncertainties and assumptions, you should not

place undue reliance on these forward-looking statements. Furthermore,

forward-looking statements speak only as of the date they are made. We do

not undertake any obligation to update or review any forward-looking

information, whether as a result of new information, future events or

otherwise. Important factors with respect to any such forward-looking

statements,

including

certain

risks

and

uncertainties

that

could

cause

actual

results to differ from those contained in the forward-looking statements,

include, but are not limited to: |

3

Special Note Regarding Forward-Looking Statements

(cont.)

rapid development and intense competition in the telecommunications industry;

adverse economic conditions; operating and financial restrictions imposed by our

senior credit facility; our cash and capital requirements; declining prices for our

services; the potential to experience a high rate of customer turnover; our

dependence on our affiliation with Sprint Nextel (“Sprint”); a potential increase in

our roaming rates and wireless handset subsidy costs; the potential for Sprint to build

networks in our markets; federal and state regulatory fees, requirements and

developments; loss of our cell sites; the rates of penetration in the wireless

telecommunications industry; our reliance on certain suppliers and vendors; the

successful completion of the pending acquisition of the FiberNet business, and the

effect thereof on our business; our ability to successfully integrate the operations of

the FiberNet business upon its acquisition; the failure to realize synergies and cost

savings from the pending acquisition of the FiberNet business or delay in realization

thereof; and other unforeseen difficulties that may occur. These risks and

uncertainties are not intended to represent a complete list of all risks and

uncertainties inherent in our business, and should be read in conjunction with the

more detailed cautionary statements and risk factors included in our SEC filings,

including our Annual Reports filed on Forms 10-K.

|

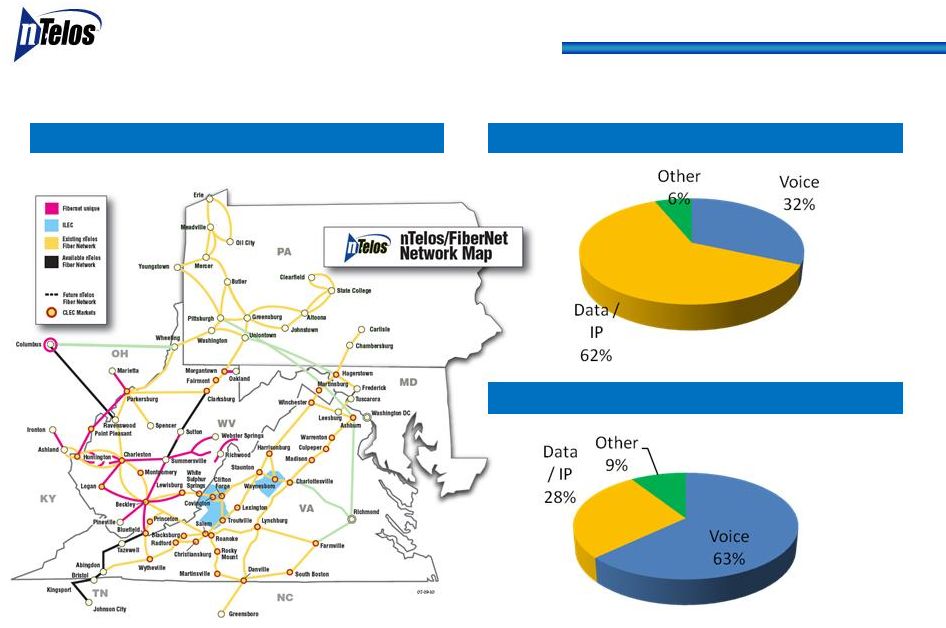

Company Overview |

Company

Overview •

Leading provider

of

wireless

and

wireline

communications

services

in

Virginia,

West

Virginia,

Pennsylvania and Maryland

•

Strategies

•

Facilities based

•

Retail & Wholesale

•

Multiple products

•

Disciplined approach to capital investments

•

Leverage brand

•

Leverage common cost

•

Wireless revenue 5-year CAGR of 11%

•

Exclusive strategic wholesale Sprint agreement through July 2015

•

Wireline business includes a fiber-based CLEC with double digit strategic high-speed

broadband product revenue growth and an RLEC with strong Adjusted EBITDA margins

•

Continued

revenue

growth

fueled

by

investments

in

cell

sites

and

fiber

network

upgrades

and acquisitions

•

Strong growth in Free Cash Flows

5 |

6

Regionally-Focused Service Provider

($ in millions)

(1)

As of September 30, 2010 or for the twelve months ended September 30, 2010.

(2)

Throughout this presentation, year over year (YOY) comparisons are calculated using

the twelve months ended on September 30, 2009 and September 30, 2010.

•

Average of 23.0 MHz of spectrum

•

5.6 million covered POPs

•

434K

(1)

retail subscribers

•

Data ARPU growth of 37% driven by EV-DO

upgrade and expanded prepay data offerings

•

Wholesale revenues (primarily Sprint Nextel

agreement) of $113 million

•

37% YTD Adjusted EBITDA margin

Wireless ($406M Revenue / $149M Adj. EBITDA)

(1) (2) |

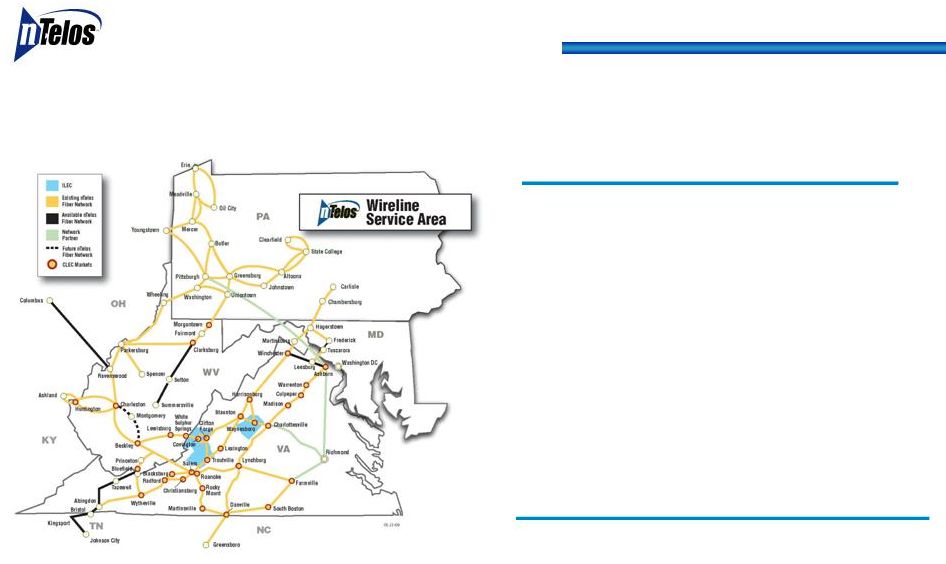

7

Wireline: Repositioning as High Speed Data Provider

(1)

($ in millions)

(1)

As of September 30, 2010 or for the twelve months ended September 30, 2010.

•

Competitive Segment

•

Commercial or Institutional

Healthcare

Government

Education

Regional Banking

•

26% YoY

growth in strategic broadband and

video services

•

45% Adjusted EBITDA margin

•

Integration of 2,200 fiber route mile assets of

Allegheny Energy, Inc. complete

•

Acquisition of FiberNet

expected to close 4Q10

•

RLEC -

Growth in Data and Video

•

98% DSL coverage with 6 MB speed

•

23% IPTV penetration of homes passed with fiber;

30%-35% penetration of neighborhoods available over

18 months

Wireline

($131M Revenue / $75M Adj. EBITDA)

(1)

Proforma

for FiberNet

Acquisition |

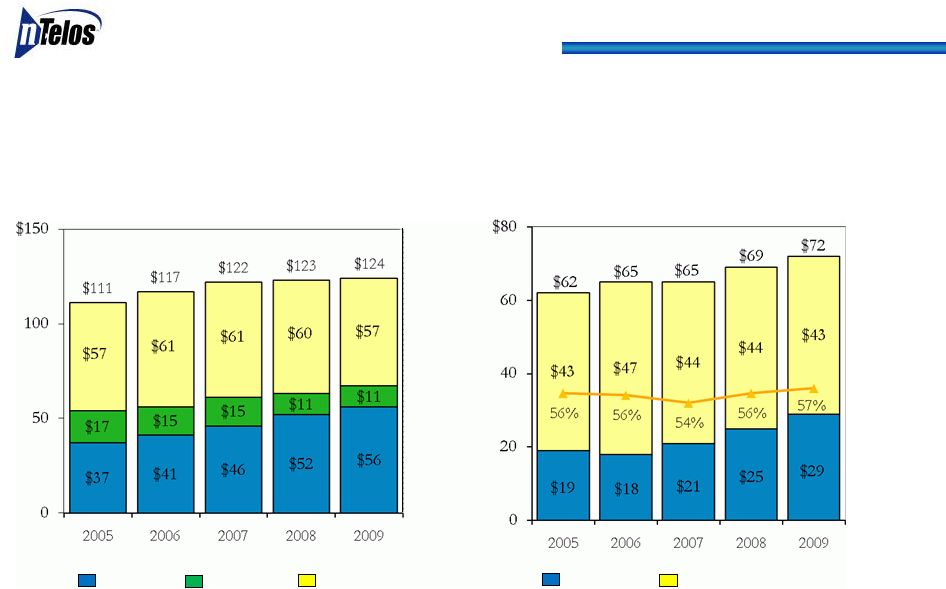

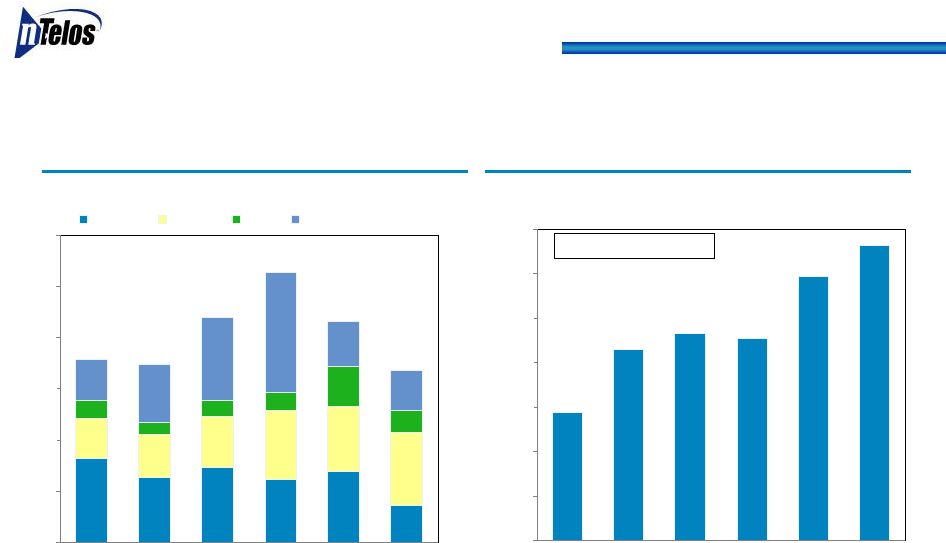

8

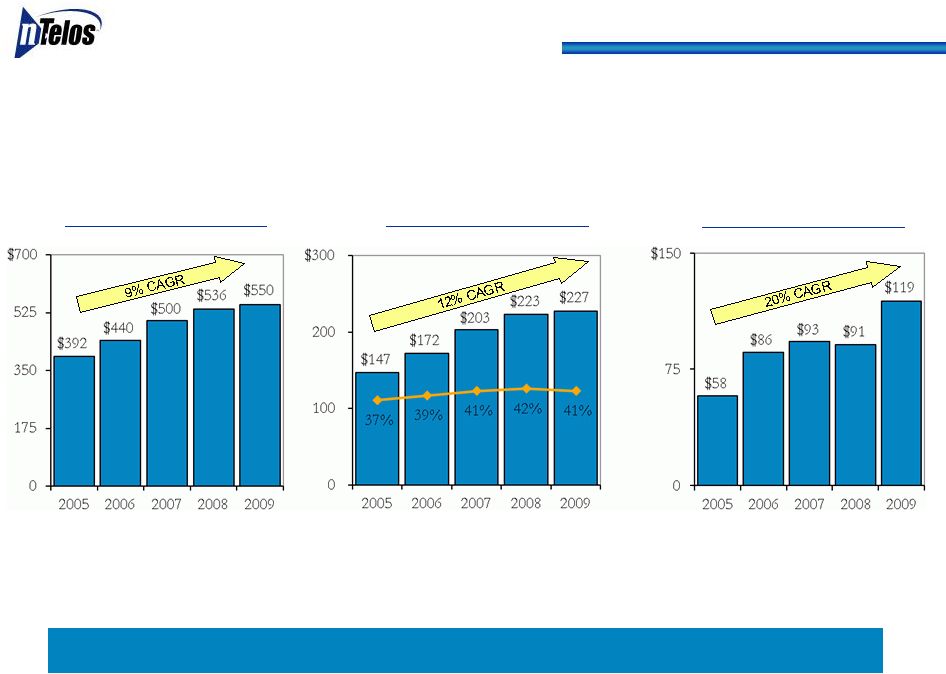

Focused on Growth Opportunities

($ in millions)

Total Revenue

Total Adj. EBITDA/

Margin %

Free Cash Flow Growth

(1)

Throughout this presentation, Free Cash Flow is defined as Consolidated Adjusted EBITDA less

CAPEX, exclusive of $26.7 million of fiber optics and network assets and transport and

data service contract assets acquired from Allegheny Energy, Inc. on December 31, 2009.

Note: Throughout

this

presentation,

Compound

Annual

Growth

Rates

(CAGR)

presented

are

calculated

over

the

period

of

2005

to

2009.

Free Cash Flow

(1) |

9

Revenue

(1)

Network Upgrade and Data Drives Wireless

($ in millions)

Adjusted EBITDA/Margin %

(1)

Refer to Form 10-K for 2009 for explanation and impact of change from gross to net

reporting of handset insurance revenues and costs effective April 1, 2008.

Retail

Wholesale

Roaming |

10

3Q‘09 to 3Q‘10 Wireless Results

($ in millions)

Revenue

Adjusted EBITDA/Margin %

Postpay

subscriber

revenues

increased

$1.2

million

from

2Q’10

to

3Q’10

$69

$68

$68

$66

$66

$29

$28

$28

$28

$29

$5

$5

$8

$6

$6

$100

$104

$104

$102

$100

$0

$50

$100

3Q’09

4Q’09

1Q’10

2Q’10

3Q'10

Subscriber

Wholesale

Equipment/Other

$36

$38

$38

$36

$39

36%

39%

37%

38%

35%

$0

$25

$50

3Q’09

4Q’09

1Q’10

2Q’10

3Q'10

10%

15%

20%

25%

30%

35%

40%

45%

50%

55%

60% |

•

NTELOS brand positioned as the best value in wireless

•

Leveraging

extensive

retail

presence

while

growing

indirect

distribution

channel

“Hub

and

Spoke”

distribution

Branded exclusive dealers program launched

Overall refurbish of retail stores

•

Approximately

91,000

total

device

upgrades

YTD

as

of

9/30/10,

up

9%

from

9/30/09

•

The

most

complete

nationwide

coverage

with

no

roaming

–

“Same

Nation.

Better

Price.”

•

Hagerstown and Martinsburg markets launched in 3Q’10

•

Emphasis on Postpay

plans

Expansion of data products and services

Device

line

up

includes

a

variety

of

smartphones

& data-centric brands and models

Smartphone

and

data

card

penetration

of

postpay

base 18% for 3Q’10, up from 11% in 3Q’09

•

FRAWG expansion to western markets 3Q’10

•

New

Prepay

pricing

July

1

–

ARPU for new sales up more than $3

•

Focus on churn improvement resulting in positive trends:

Churn

.

3Q’09

4Q’09

Postpay

2.4% 2.2%

Total

3.6% 3.4% Wireless Growth

Initiatives 1Q’10

2Q’10

3Q’10

2.3% 1.8%

3.1% 3.0%

3.4%

11

2.1% |

2010

Distribution Update Shifting

direct

distribution

to

Postpay

focused, company owned locations

Relocation of Corporate Retail locations to high profile, highly visible locations:

Portsmouth, Harrisonburg,

Winchester,

Military,

Morgantown

Mall,

Huntington,

Suffolk

Redesign

of

larger

new

company

owned

stores

that

incorporates

brand

position

with

hi-tech,

modern look and feel

Corporate

Retail

overhaul

–

cultural change focused on Customer

Satisfaction

Training

Optimizing Full-Time/Part-Time employee usage for proper store coverage

Enhanced compensation rewards for upgrading and renewing customers

Explode Indirect Dealer channel to support higher prepay growth

New Exclusive Retailer Program (ERP)

ERP

dealers

expected

to

more

than

double

from

September

30,

2009

to

year-end

2010

12 |

Feature 1X

and Value

BlackBerry

Curve 8530

Data

Card

QWERTY

Feature

EV-DO

Touch

LG Script

HTC Snap

Windows

Mobile

Novatel

MC760

Axesstel

MV440

HTC Hero

Android

Motorola

Quantico

BlackBerry

Tour 9630

Device Line-up 4Q 2010

Samsung

Stunt

LG 100

Smartphone

Novatel

MiFi

Franklin Wireless

U210

LG Ellipse

Kyocera

Torino

LG Nite

LG Wine II

Motorola

Grasp

LG Samba

Samsung

Messager

Touch

BlackBerry

Bold 9650

BlackBerry

Storm2 9550

(Nov)

Motorola

Milestone

Android

HTC Desire

Android

LG Axis

Android

(Nov)

Blackberry

Samsung

Profile

(Nov)

13 |

14

Successful Growth in Data Subscribers and Postpay

ARPU

Postpay

Retail ARPU

Postpay

Subscribers with EV-DO

Data Devices

77%

30%

47%

59%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

6/30/08

6/30/09

6/30/10

9/30/10 |

15

Wireless

Wholesale

Revenue

(1)

Strategic

Network

Alliance

Leverages

NTELOS’

Network

•

Sprint Nextel Strategic Network

Alliance through at least July 2015

•

$9 million monthly minimum revenue

guarantee

•

Attractive contribution margin

•

Growing Usage

•

Significant growth in both home &

travel data usage since EV-DO

launched

•

Voice traffic back on the rise

•

October 2010 calculated revenues

exceeded the $9 million monthly

minimum –

first time since rate reset

in July 2009

($ in millions)

Attractive Margin Revenue Stream

$27

$27

$27

$27

$27

(1)

Dollars in millions, excludes roaming. |

16

Greensboro, NC

(1)

As of September 30, 2010 or for the twelve months ended

September 30, 2010.

($ in millions)

Data Driving Wireline

Growth

(1)

Competitive

($75M Revenues / $34M Adj. EBITDA)

(1)

•

Revenue growth of 13% YoY

•

Adjusted EBITDA growth of 24% YoY

•

45% YTD Adjusted EBITDA margin

•

Strategic broadband and video revenue

growth of 21% YOY to $51 million

•

4,900 mile existing fiber network including

recently acquired 2,200 mile Allegheny

fiber network

•

3 markets launched in late 2009

•

4 markets launched by

year-end 2010

•

Repositioning assets (data/video)

•

Broadband customer penetration at 55%

•

IPTV now is available to over 10,000 homes

•

Continued strong Adjusted EBITDA margin

RLEC ($55M Revenue / $41M Adj. EBITDA)

(1) |

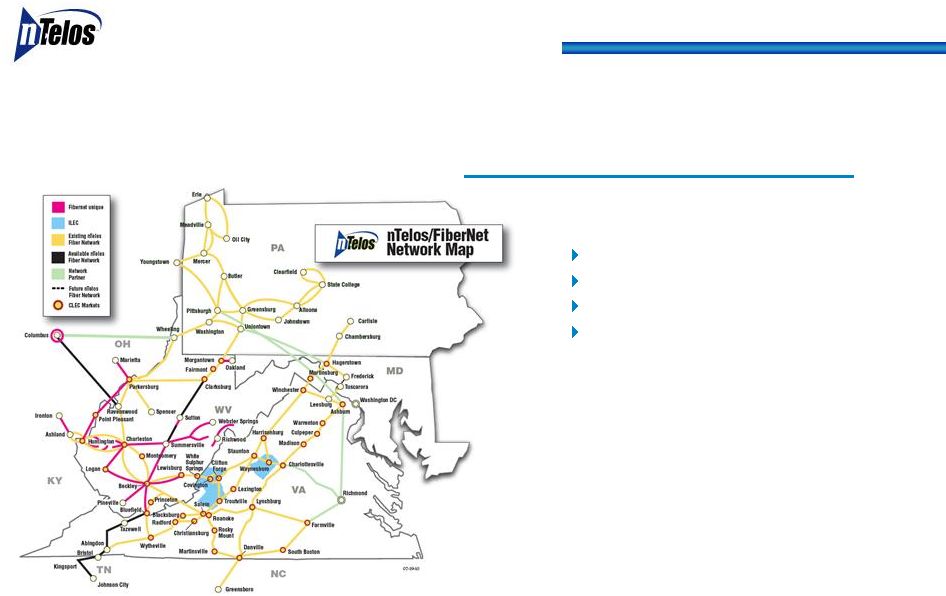

NTELOS–FiberNet

Offers Strong Combination

Strategic Benefits of a Robust Mid-Atlantic Network

Continues regional broadband acquisition strategy

Enhances position in West Virginia and accelerates growth in Pennsylvania and

Maryland with more capacity

Increases capacity and growth potential for carrier transport and fiber to the cell

Significant Financial Benefits

Free cash flow accretive day one with growth potential

Significant synergies from network operations with more diverse routes into

more second tier and rural markets

Value enhancement with improved competitive position and growth profile

Stronger Regional Operations

Opportunity to extend “best-in-class”

operator in West Virginia

Add key

personnel

resources

to

NTELOS’

wireline

operations

Existing technology and systems can be leveraged and integrated quickly

17 |

18

Consolidated Network

($ in millions)

NTELOS

Competitive Revenue

FiberNet

Revenue

(1)

Network Overlap Map

(1)(2)

(1)

FY 2009

(2)

NTELOS before intercompany eliminations

Proforma

for FiberNet

Acquisition |

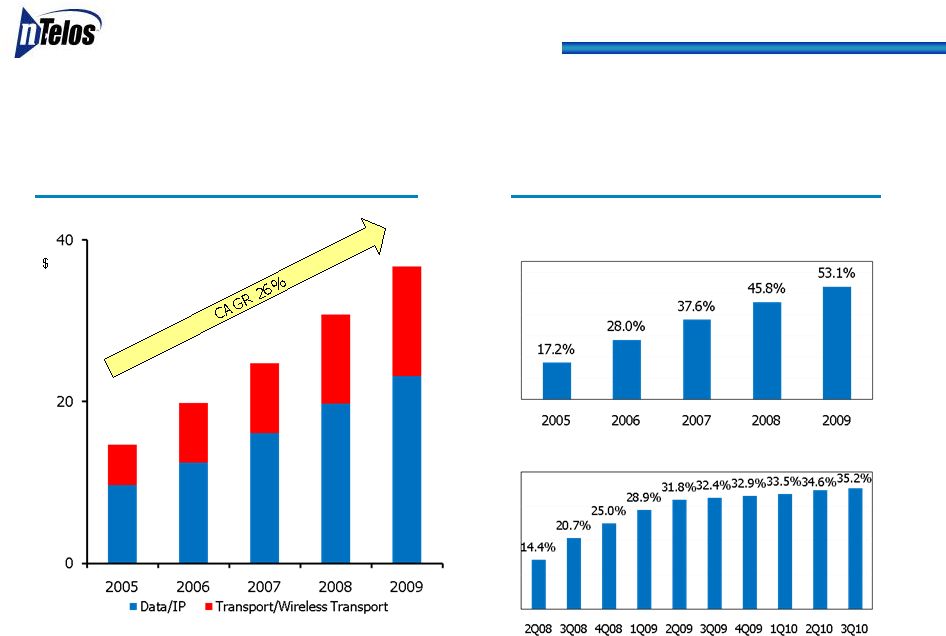

19

Adjusted EBITDA/Margin%

Revenue

Wireline

Provides Strong, Stable Cash Flow

($ in millions)

Note: Competitive -

Strategic includes voice and broadband data services, IPTV video, high-capacity network

access and transport services.

Competitive

-

Strategic

Competitive

-

Other

RLEC

Competitive

RLEC |

20

Penetration

Transport/Data/IP Revenue

Competitive Growth Drivers

($ in millions)

Video –

Neighborhoods open in 1Q`08

Broadband –

Customer Penetration

(1) Revenue before intercompany eliminations

(1)

$14.7

$19.8

$24.8

$30.8

$36.8 |

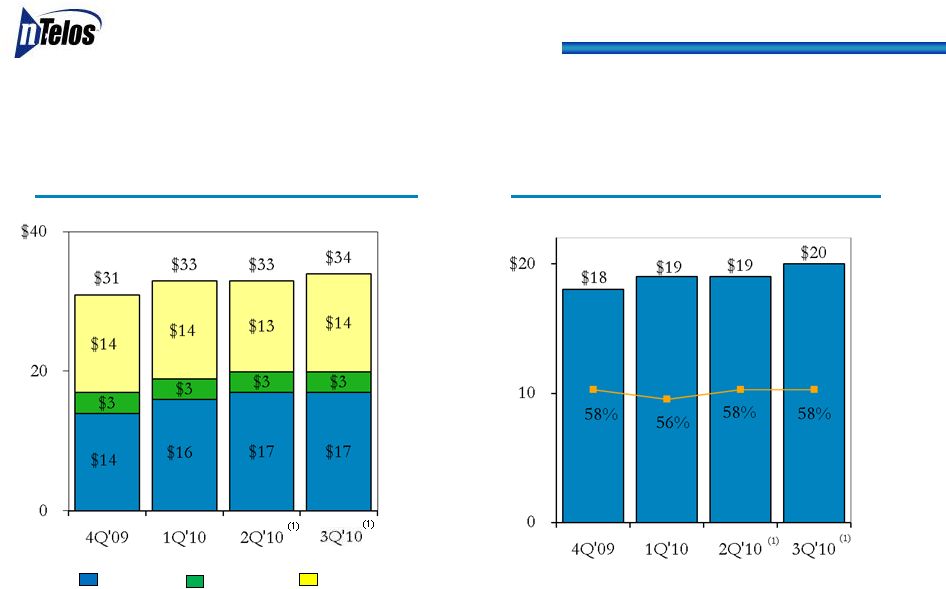

21

Adjusted EBITDA/Margin%

Revenue

Wireline

YTD ‘10 over YTD ‘09 Strong, Stable Cash Flow

($ in millions)

(1)

Includes contributions from acquisition of certain Allegheny fiber optic and

network assets and related transport and data service contracts on 12/31/09.

Competitive

-

Strategic

Competitive

-

Other

RLEC

(1)

(1) |

Financial

Overview |

$119

$91

$93

$86

$58

$133

$0

$20

$40

$60

$80

$100

$120

$140

2005

2006

2007

2008

2009

LTM

9/30/10

Free Cash Flow

Consolidated CapEx

($ in millions)

Accelerating Consolidated Free Cash Flow

$41

$32

$37

$31

$35

$18

$20

$21

$25

$33

$31

$36

$8

$6

$7

$9

$20

$28

$41

$59

$22

$20

$10

$84

$110

$132

$87

$89

$108

$0

$25

$50

$75

$100

$125

$150

2005

2006

2007

2008

2009

LTM

9/30/10

Wireless

Wireline

Other

Discretionary

(1)

(1)

Includes incremental EVDO investment and strategic fiber builds.

(2)

Includes approximately $11M for a new wireless prepaid billing platform and a web portal.

2005 -

LTM: 23% CAGR

(2)

23 |

($ in

millions) (1)

Debt balances and related ratios are based on actual debt outstanding. Refer

to Form 10-K for the year ended December 31, 2009 for carrying basis of

debt obligations which are reported net of unamortized original issuance discounts.

(2)

Pro forma cash

reflects

reduction

in

cash

for

estimated

FiberNet

purchase

cost

and

related

fees

of approximately $173 million.

(3)

Pro

forma

LTM

9/30/10

reflects

FiberNet

adjusted

EBITDA of $26.0 million, before synergies of $7 million to $9 million expected to

be achieved during the year following the completion of integration.

Capitalization

24

PF LTM

2008

2009

LTM 9/30/10

9/30/10

1st lien senior secured credit facility

(1)

606.5

$

633.4

$

753.3

$

753

$

Capital Leases

1.4

$

1.5

$

1.8

$

2

$

Revolver

-

$

-

$

-

$

-

$

Total Debt

607.9

$

634.9

$

755.1

$

755

$

Cash

(2)

65.7

$

51.1

$

188.8

$

16

$

Net Debt (total Debt less Cash)

542.2

$

583.8

$

566.3

$

739

$

Adjusted EBITDA

223.2

$

227.1

$

217.2

$

243

$

(3)

Net Debt Leverage Ratio

2.4x

2.6x

2.6x

3.0x

(3) |

Consistently

Strong Financial Performance Numerous Catalysts for Sustainable Topline

Growth

Focused on Long-Term Net Income and Free Cash Flow Growth

Diversified Business Model

Network Upgrade Drives Wireless Growth

Data Revenue Growth

High-Margin Wholesale Revenue

Strong Performing and Growing Regional Wireline

Business Focused on

Data Transport and IP based Services

Scalable Systems for Continued Expansion

Experienced Management Team

Successful acquisition integration track record

Summary

25 |

Appendix

|

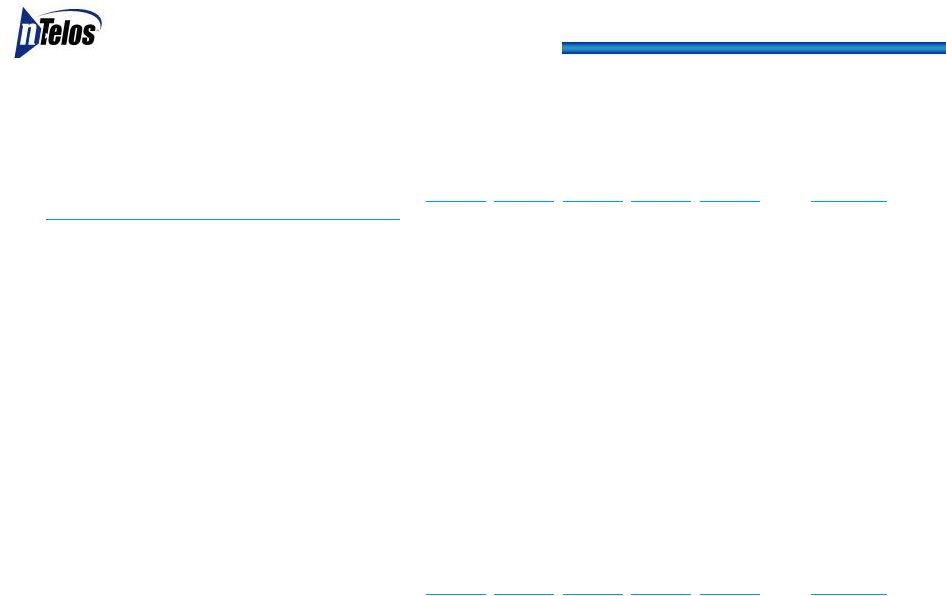

27

Adjusted EBITDA Reconciliation

($ in millions)

9-months ended:

2005

2006

2007

2008

2009

9/30/10

Consolidated

Operating Income

$53

$61

$100

$115

$130

$94

Depreciation and Amortization

83

85

97

103

92

65

Capital and Operational Restructuring

Charges

15

-

-

-

-

-

Accretion of Asset Retirement Obligations

1

1

1

1

1

1

Advisory Termination Fees

-

13

-

-

-

-

Gain on Sale of Assets

(9)

-

-

-

-

-

Secondary Offering Costs

-

-

1

-

-

-

Equity Based Compensation

4

13

4

3

3

4

Acquisition Related Charges

-

-

-

-

-

1

Voluntary Early Retirement and Workforce Reduction Plans

-

-

-

1

1

-

Adjusted EBITDA

$147

$173

$203

$223

$227

$165 |

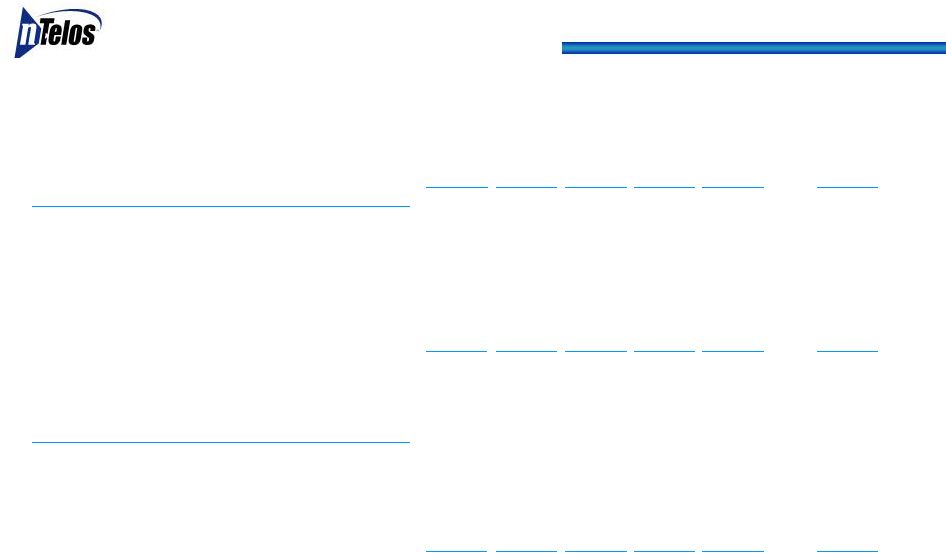

28

Adjusted EBITDA Reconciliation

($ in millions)

9-months ended:

2005

2006

2007

2008

2009

9/30/10

Wireless

Operating Income

$32

$53

$71

$85

$97

$69

Depreciation and Amortization

57

58

70

73

63

43

Voluntary Early Retirement and Workforce Reduction Plans

-

-

-

-

1

-

Accretion of Asset Retirement Obligations

1

1

1

1

1

1

Adjusted EBITDA

$90

$112

$142

$159

$162

$113

Wireline

Operating Income

$36

$39

$38

$41

$43

$34

Depreciation and Amortization

25

26

27

27

29

23

Voluntary Early Retirement and Workforce Reduction Plans

-

-

-

1

-

-

Adjusted EBITDA

$61

$65

$65

$69

$72

$57 |

29

ARPU

Reconciliation

($ in thousands, except for subscribers and ARPU data)

Nine Months Ended:

Three Months Ended:

September 30, 2009

September 30, 2010

September 30, 2009

September 30, 2010

Average Revenue per Handset/Unit (ARPU)

1

(amounts in thousands except for subscribers and ARPU)

Operating Revenues

135,686

$

134,267

$

416,351

$

404,140

$

Less: Wireline and other operating revenue

(31,460)

(33,895)

(94,061)

(100,120)

Wireless

communications revenue 104,226

100,372

322,290

304,020

Less: Equipment revenue from sales to new customers

(1,525)

(1,695)

(4,408)

(6,296)

Less: Equipment revenue from sales to existing customers

(4,788)

(3,621)

(14,537)

(11,653)

Less: Wholesale revenue

(28,507)

(28,713)

(89,870)

(85,060)

Plus (Less): Other revenues, eliminations and adjustments

856

(276)

51

(659)

Wireless

gross subscriber revenue 70,262

$

66,067

$

213,526

$

200,352

$

Less: Paid in advance subscriber revenue

(15,535)

(13,930)

(51,784)

(45,583)

(Less) Plus: Adjustments

(1,121)

211

(870)

151

Wireless

gross postpay subscriber revenue 53,606

$

52,348

$

160,872

$

154,920

$

Average subscribers

440,052

435,042

441,287

439,930

Total ARPU

53.22

$

50.62

$

53.76

$

50.60

$

Average postpay subscribers

310,601

303,329

312,348

303,463

Postpay ARPU

57.53

$

57.53

$

57.23

$

56.72

$

Wireless gross subscriber revenue

70,262

$

66,067

$

213,526

$

200,352

$

Less:

Wireless voice and other feature revenue

(57,942)

(49,845)

(177,686)

(154,455)

Wireless

data revenue 12,320

$

16,222

$

35,840

$

45,897

$

Average subscribers

440,052

435,042

441,287

439,930

Total Data ARPU

9.33

$

12.43

$

9.02

$

11.59

$

Wireless gross postpay subscriber revenue

53,606

$

52,348

$

160,872

$

154,920

$

Less: Wireless postpay voice and other feature revenue

(44,047)

(39,557)

(133,228)

(119,300)

Wireless

postpay data revenue 9,559

$

12,791

$

27,644

$

35,620

$

Average postpay subscribers

310,601

303,329

312,348

303,463

Postpay data ARPU

10.26

$

14.06

$

9.83

$

13.04

$

(1)

Average monthly revenues per subscriber/unit with service, or ARPU, is an industry metric that

measures service revenues per period divided by the weighted average number of

subscribers with service during that period. ARPU as defined may not be similar to ARPU measures of other companies, is

not a measurement under GAAP and should be considered in addition to, but not as a substitute

for, the information contained in the Company’s statement of operations. The

Company closely monitors the effects of new rate plans and service offerings on ARPU in order to determine their

effectiveness. ARPU provides management useful information concerning the appeal of

NTELOS rate plans and service offerings and the Company’s performance in attracting

and retaining high value customers. |

30

Summary of Operating Results

($ in thousands)

Nine Months Ended:

Three Months Ended:

(1)

First

quarter

2010

includes

a

$0.9

million

charge

related

to

severance

benefits

pursuant

to

an

executive

employment

agreement.

Please see Form 8-K filed with

the

SEC

on

March

12,

2010

for

additional

information.

First

quarter

2009

includes

a

one-time

cash

payment

of

$1.0

million

to

James

A.

Hyde,

NTELOS'

then

newly

hired president and COO.

September 30, 2009

September 30, 2010

September 30, 2009

September 30, 2010

Operating Revenues

Wireless PCS Operations

104,226

$

100,372

$

322,290

$

304,020

$

Subscriber Revenues

69,060

65,983

212,438

199,920

Wholesale/Roaming Revenues, net

28,507

28,713

89,870

85,060

Equipment Revenues

6,313

5,316

18,945

17,949

Other Revenues

346

360

1,037

1,091

Wireline

Operations

RLEC

14,395

13,933

43,543

41,595

Competitive Wireline

16,944

19,851

50,154

58,148

WirelineTotal

31,339

33,784

93,697

99,743

Other

121

111

364

377

135,686

$

134,267

$

416,351

$

404,140

$

Operating Expenses

Wireless PCS Operations

65,106

$

63,956

$

196,363

$

191,090

$

Cost of Sales and Services

Cost of Sales -Equipment

8,509

7,246

27,323

21,622

Cost of Sales -Access & Other

11,389

9,669

33,228

28,283

Maintenance and Support

15,004

15,870

44,005

46,266

Customer Operations

24,938

25,301

75,016

76,517

Corporate Operations

5,266

5,870

16,791

18,402

Wireline

Operations

RLEC

3,326

3,428

10,792

11,028

Competitive Wireline

9,446

10,687

29,129

31,669

WirelineTotal

12,772

14,115

39,921

42,697

Other

1

1,170

1,112

5,041

5,274

79,048

$

79,183

$

241,325

$

239,061

$

Adjusted

EBITDA

(a

non-GAAP

Measure)

Wireless PCS Operations

39,120

$

37.5%

36,416

$

36.3%

125,927

$

112,930

$

Wireline

Operations

RLEC

11,069

76.9%

10,505

75.4%

32,751

30,567

Competitive Wireline

7,498

44.3%

9,164

46.2%

21,025

26,479

WirelineTotal

18,567

59.2%

19,669

58.2%

53,776

57,046

Other

1

(1,049)

(1,001)

(4,677)

(4,897)

56,638

$

41.7%

55,084

$

41.0%

175,026

$

165,079

$

Capital Expenditures

Wireless PCS Operations

7,759

$

9,669

$

42,381

$

29,754

$

Wireline

Operations

RLEC

3,636

2,411

10,498

7,904

Competitive Wireline

5,914

5,339

21,270

22,429

WirelineTotal

9,550

7,750

31,768

30,333

Other

4,161

2,291

16,863

7,445

21,470

$

19,710

$

91,012

$

67,532

$

Wireless PCS Operations

31,361

$

26,747

$

83,546

$

83,176

$

Wireline

Operations

RLEC

7,433

8,094

22,253

22,663

Competitive Wireline

1,584

3,825

(245)

4,050

WirelineTotal

9,017

11,919

22,008

26,713

Other

(5,210)

(3,292)

(21,540)

(12,342)

35,168

$

35,374

$

84,014

$

97,547

$

(before depreciation & amortization, asset

impairment charges, accretion of asset retirement obligations, equity based compensation, acquisition related charges and

charges from voluntary early retirement and workforce reduction plans, a non-GAAP

Measure of operating expenses) Adjusted

EBITDA

less

Capital

Expenditures

(a

non-GAAP

measure)

1

1 |