UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K/A

Amendment No. 1

(Mark

One)

x

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

For the

fiscal year ended: June 30, 2010

or

¨

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the

transition period from _______________ to _______________

Commission

file number: 333-149338

Li3

Energy, Inc.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

20-3061907

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

(IRS

Employer Identification

No.)

|

|

Av.

Pardo y Aliaga 699 Of. 802

San

Isidro, Lima, Peru

|

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

Registrant’s

telephone number, including area code (51) 1-212-1040

Securities

registered under Section 12(b) of the Act: None

Securities

registered under Section 12(g) of the Act: None

Indicate by check mark if the

registrant is a well-known seasoned issuer, as defined in Rule 405 of the

Securities Act. Yes ¨ No x

Indicate by check mark if the

registrant is not required to file reports pursuant to Section 13 or 15(d) of

the Exchange Act. Yes ¨ No x

Indicate by check mark whether the

registrant (1) has filed all reports required to be filed by Section 13 or 15(d)

of the Exchange Act during the preceding 12 months (or for such shorter period

that the registrant was required to file such reports), and (2) has been subject

to such filing requirements for the past 90 days. Yes x No ¨

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of registrant's knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. ¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, or a smaller reporting company. See the definitions of

the “large accelerated filer,” “accelerated filer” and “smaller reporting

company” in Rule 12b-2 of the Exchange Act.

|

Large

Accelerated Filer ¨

|

Accelerated

Filer ¨

|

|

Non-Accelerated

Filer ¨ (Do not check if a smaller

reporting company)

|

Smaller

reporting company x

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act). Yes o No x

On

December 31, 2009, the last business day of the registrant’s most recently

completed second fiscal quarter, 48,113,767 shares of its common

stock, par value $0.001 per share (its only class of voting or non-voting common

equity), were held by non-affiliates of the registrant. The aggregate

market value of such shares was approximately $32,236,224, based on the price at

which the registrant’s common stock was last sold at such time (i.e., $0.67 per share on

December 31, 2009). For purposes of making this calculation, shares

beneficially owned at such time by each executive officer and director of the

registrant and by each beneficial owner of greater than 10% of the voting stock

of the registrant have been excluded because such persons may be deemed to be

affiliates of the registrant. This determination of affiliate status is

not necessarily a conclusive determination for other purposes.

As of

October 29, 2010, there were 87,109,033 shares of the registrant's common stock,

par value $0.001, issued and outstanding.

DOCUMENTS

INCORPORATED BY REFERENCE

None.

Explanatory

Note

This Amendment No. 1 to the Annual Report on

Form 10-K of Li3 Energy, Inc., for the fiscal year

ended June 30, 2010, is being filed solely to correct the table of persons known

by us to beneficially own more than 5% of our Common Stock

as of October 29, 2010, contained in Part III, Item 12, of this

Report.

Except as described above, this Amendment No. 1

to Form 10-K does not revise, update or in any way affect any information or

disclosure contained in our Annual Report on Form 10-K for the fiscal year

ended June 30, 2010, as filed with the Securities and Exchange Commission on

November 4, 2010, and we have not updated the disclosures contained therein to

reflect any events that have occurred after that date.

TABLE

OF CONTENTS

|

Item Number and Caption

|

Page

|

||

|

Forward-Looking

Statements

|

3

|

||

|

PART

I

|

4

|

||

|

1.

|

Business

|

4

|

|

|

1A.

|

Risk

Factors

|

24

|

|

|

1B.

|

Unresolved

Staff Comments

|

37

|

|

|

2.

|

Properties

|

37

|

|

|

3.

|

Legal

Proceedings

|

37

|

|

|

4.

|

Submission

of Matters to a Vote of Security Holders

|

37

|

|

|

PART

II

|

38

|

||

|

5.

|

Market

for Registrant’s Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities

|

38

|

|

|

6.

|

Selected

Financial Data

|

41

|

|

|

7.

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

|

41

|

|

|

7A.

|

Quantitative

and Qualitative Disclosures About Market Risk

|

50

|

|

|

8.

|

Financial

Statements and Supplementary Data

|

50

|

|

|

9.

|

Changes

in and Disagreements with Accountants on Accounting, and Financial

Disclosure

|

50

|

|

|

9A

|

Controls

and Procedures

|

50

|

|

|

9B.

|

Other

Information

|

52

|

|

|

PART

III

|

52

|

||

|

10.

|

Directors,

Executive Officers, and Corporate Governance

|

52

|

|

|

11.

|

Executive

Compensation

|

57

|

|

|

12.

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters

|

62

|

|

|

13.

|

Certain

Relationships and Related Transactions, and Director

Independence

|

65

|

|

|

14.

|

Principal

Accounting Fees and Services

|

66

|

|

|

PART

IV

|

67

|

||

|

15.

|

Exhibits,

Financial Statement Schedules

|

67

|

|

2

FORWARD-LOOKING

STATEMENTS

Various

statements in this Annual Report, including those that express a belief,

expectation or intention, as well as those that are not statements of historical

fact, are “forward-looking statements.” The forward-looking

statements may include projections and estimates concerning the timing and

success of specific projects, revenues, income and capital spending.

Forward-looking statements are often (but not always) accompanied by words such

as “believe,” “intend,” “expect,” “seek,” “may,” “should,” “anticipate,”

“could,” “estimate,” “plan,” “predict,” “project,” “target,” “goal,” “objective”

or other similar expressions. These statements are likely to address our growth

strategy, financial results and exploration and development programs, among

other things.

Forward-looking

statements are subject to risks and uncertainties that may change at any time.

The forward-looking statements contained in this Annual Report are largely based

on our expectations, which reflect many estimates and assumptions made by our

management. These estimates and assumptions reflect our best judgment based on

currently known market conditions and other factors. Although we believe such

estimates and assumptions are reasonable, we caution that it is very difficult

to predict the impact of known factors and it is impossible for us to anticipate

all factors that could affect our actual results. In addition, management’s

assumptions about future events may prove to be inaccurate. Management

cautions all readers that the forward-looking statements contained in this

Annual Report are not guarantees of future performance, and we cannot assure any

reader that such statements will be realized or the forward looking events and

circumstances will occur. There are a number of risks, uncertainties and

other important factors that could cause our actual results to differ materially

from those anticipated or implied in the forward-looking statements, including,

but not limited to, those described in the “Risk Factors” section and elsewhere

in this Annual Report.

All

forward-looking statements are based upon information available to us on the

date of this Annual Report. Except as otherwise required by the federal

securities laws, we disclaim any obligations or undertaking to publicly release

any updates or revisions to any forward-looking statement contained in this

Report to reflect any change in our expectations with regard thereto or any

change in events, conditions or circumstances on which any such statement is

based.

3

PART

I

|

ITEM

1.

|

BUSINESS

|

Overview

of Our Business

Li3

Energy, Inc. (“Li3 Energy,” the “Company,” “we,” “us” or “our”) is an emerging

exploration company, focused on the discovery and development of lithium and

potassium brine and nitrate and iodine deposits in Chile, Argentina and

Peru.

|

|

·

|

In

the course of the fiscal year ended June 30, 2010, we acquired, or signed

definitive agreements to acquire, several properties in Nevada, Argentina,

Peru and Chile.

|

|

|

·

|

During

the course of our evaluation of the properties, we determined that the

Nevada and Chile properties did not meet the requirements of our technical

and business strategy criteria and decided not to pursue or maintain these

claims.

|

|

|

·

|

The

results of the exploration work completed over the past year on the

various Argentina properties were encouraging; however, based on the

advice of our technical team, we have determined that most of the projects

do not meet our integration and deposit criteria, and the options for

these properties were terminated, as further discussed

below.

|

|

|

·

|

We

have also acquired mineral claims prospective for lithium and potassium

that cover a total area of 19,500 acres in Peru. We continue to evaluate

these properties to determine if they meet our

criteria.

|

|

|

·

|

Subsequent

to the end of the fiscal year, we acquired all of the outstanding share

capital of Alfredo Holdings, Ltd. (“Alfredo”), which, through its Chilean

subsidiary, Pacific Road Mining Chile S.A. (“PRMC”), has an option to

purchase mining concessions on approximately 6,670 acres of mining

tenements near Pozo Almonte, Chile, from which we expect to produce

saleable iodine and (aided by the potassium we expect to generate from our

prospective lithium carbonate brine properties) nitrate

products.

|

|

|

·

|

In

the course of the year and the interim period since the end of the fiscal

year, we have focused on evaluating and seeking other opportunities that

will enhance the opportunities of the Alfredo properties, including

lithium brine projects and potassium

projects.

|

Our

strategic plan is to explore and develop our existing projects and to identify

additional opportunities and generate new projects with near-term production

potential, with the goal of becoming a significant player in the lithium and

industrial minerals industry.

We were

incorporated on June 24, 2005, as Mystica Candle Corp. and were originally in

the business of manufacturing, marketing and distributing soy-blend scented

candles and oils. We determined that we could not continue with our business

operations as outlined in our original business plan because of a lack of

financial results and resources; therefore, we redirected our focus towards

identifying and pursuing options regarding the development of a new business

plan and direction. In July 2008 we changed our name from Mystica Candle Corp.

to NanoDynamics Holdings, Inc., to facilitate discussions with NanoDynamics,

Inc., a Delaware corporation, regarding a possible business combination.

However, we determined not to proceed with that business combination. In

October 2009 we changed our name from NanoDynamics Holdings, Inc., to Li3

Energy, Inc., as we refocused our business strategy on the energy sector and

lithium mining opportunities.

4

Plan

of Operation for the Remainder of Fiscal 2011

Our

primary objective is to become a low cost lithium producer as well as a

significant producer of potassium nitrate. The key to achieving this objective

is to become an integrated chemical company through the strategic acquisition

and development of lithium assets as well as other assets that have by-product

synergies.

Recently,

we acquired an option on the Alfredo project near Pozo Almonte in Chile (the

“Alfredo Property”). We believe that this is a very important and

economically significant acquisition for us on the road to becoming a low cost

lithium producer. The property is prospective for potassium nitrate and

iodine, which we believe will be important as part of our integration as a

significant chemical producer. The Alfredo Property hosts caliche

mineralization. Caliche deposits are sources of sodium nitrate and iodine.

Sodium nitrate can be reacted with potash (KCl) to produce potassium nitrate

(KNO3), a

valuable product used in fertilizers, rocket propellants and fireworks and as a

food additive. The property is located in a region of caliche mining and

processing, and we believe it demonstrates reasonable prospects for

development. We are in the process of obtaining a Canadian National

Instrument 43-101 report (“NI 43-101”) on the Alfredo Property. The NI

43-101 is a codified set of rules and guidelines for reporting and displaying

information related to mineral properties owned or explored by companies which

generally report these results on stock exchanges within Canada. We

are not listed on any stock exchanges within Canada.

We are

currently pursuing an advanced lithium and potassium chloride project in Chile,

although there can be no assurance that this project will meet our technical and

other due diligence requirements or that we will successfully negotiate an

acquisition, and we continue to explore other lithium and industrial minerals

prospects in the region, located to complement the Alfredo project, in order to

achieve integration of operations to produce metallurgical grade lithium,

commercial grade fertilizer and pharmaceutical grade iodine.

Lithium

and Lithium Mining

Lithium

is the lightest metal. It is a soft, silver white metal and belongs to the

alkali group of elements, which includes sodium, potassium, rubidium, caesium

and francium. The chemical symbol for lithium is “Li,” and its atomic number is

3.

Like the

other alkali metals, lithium has a single valence electron that is easily given

up to form a cation (positively charged ion). Because of this, it is a good

conductor of both heat and electricity and highly reactive, though it is the

least reactive of the alkali metals. Lithium possesses a low coefficient

of thermal expansion (which describes how the size of an object changes with a

change in temperature) and the highest specific heat capacity (a measure of the

heat, or thermal energy, required to increase the temperature of a given

quantity of a substance by one unit of temperature) of any solid

element.

5

No other

metal is as lightweight, better at holding a charge or as good at dissipating

heat as Lithium. These properties make lithium an excellent material for

manufacturing batteries (lithium-ion batteries). According to the U.S.

Geological Survey’s “Mineral Commodity Summaries 2010,” batteries accounted for

23% of lithium end-usage globally, and we expect demand for lithium from the

battery segment to grow along with demand for such batteries. Although

lithium markets vary by location, global end-usage was estimated by the U.S.

Geological Survey as follows: ceramics and glass, 31%; batteries,

23%; lubricating greases, 10%; air treatment, 5%; continuous casting, 4%;

primary aluminum production, 3%; and other uses, 24%. Lithium use in

batteries expanded significantly in recent years, because rechargeable lithium

batteries are being used increasingly in portable electronic devices and

electrical tools.

As

mentioned earlier, lithium belongs to the alkali group of metals. This group of

metals is typically extracted from solutions called brines, which are associated

with evaporite deposits. Lithium is also contained in the mineral

spodumene, which occurs in a rock called pegmatite. To a lesser extent

lithium occurs as a component of certain clay minerals

Historically,

and especially during the period leading up to and during World War II, lithium

was designated a strategic metal, heavily used in the aircraft industry because

it is light and strong. During this period the mineral spodumene (a lithium

aluminum silicate) was mined by open pit hard rock mining methods and processed

to recover the lithium. During the post-war period, lithium production

from the higher cost hard rock mines was replaced by the lower cost extraction

of lithium from the mineral rich brines associated with evaporite deposits.

Evaporite deposits occur in environments characterized by arid conditions with

extremely high evaporation rates. This environment typically occurs at high

altitudes, greater than 12,000 feet above sea level, so evaporite deposits occur

in only a very few locations in the world, including China (the province of

Qinghai and the Autonomous Region of Tibet); the Puna Plateau, a high altitude

plateau covering part of Argentina, Chile, Bolivia and the southern portion of

Peru; and in a small region in Nevada, which is the core of what is called the

Great Basin of the western United States. Over 70% of the world’s lithium

is produced from the brines associated with the evaporite deposits on the Puna

Plateau of South America.

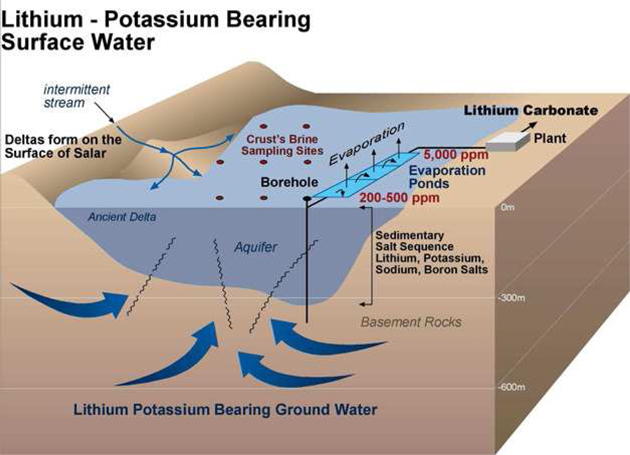

Brine

extraction (mining) and the recovery of lithium and other economic compounds is

analogous to pumping water from an aquifer, but instead of fresh water, the

water contains a variety of mineral salts in solution, including lithium,

potassium (K), magnesium (Mg) and sodium (Na). This form of “mining” is

much more efficient, cost effective and environmentally friendly than open pit

mining. Lithium production from spodumene can typically cost in the range

of $4,300 to $4,800 per metric ton of lithium carbonate and is a process that is

highly sensitive to energy costs. On the other hand, lithium production

from brines can be accomplished at costs in the range of $2,200 to $2,600 per

metric ton of lithium carbonate. However, the processing cost can vary by

a wide range, depending largely on:

|

|

·

|

lithium

concentration in the particular

brine;

|

|

|

·

|

evaporation

rates at the site, which determine how quickly the brine can be

concentrated; and

|

6

|

|

·

|

the

balance of other minerals in the brine, which effects the degree of

processing needed to remove

impurities.

|

Lithium

in Batteries

Lithium

demand is being driven by its increasing use in the batteries of portable

consumer electronics, including mobile phones and laptop computers, and in a

range of industrial applications including ceramics and lubricants. The

most dramatic increase in demand is being spurred by auto makers racing to bring

lithium-ion battery powered and hybrid electric cars to market.

A

lithium-ion battery (Li-ion battery) is a type of rechargeable battery in which

lithium ions move from the anode (negative terminal) to the cathode (positive

terminal) during discharge, and from the cathode to the anode when

charging. Lithium-ion batteries are one of the most popular types of

battery, because they have one of the best energy-to-weight ratios, no memory

effect (the effect in which certain other rechargeable batteries lose their

maximum energy capacity if they are repeatedly recharged after being only

partially discharged) and a slow loss of charge when not in use.

Rechargeable

battery materials used in electric vehicles include lead-acid (traditional “wet”

and gel or “valve regulated”), nickel-cadmium, nickel-metal-hydride,

lithium-ion, lithium-ion polymer, and, less commonly, zinc-air and molten

salt. Ideally, a battery for an electric car needs to be light, small,

energy dense, quick to recharge, relatively inexpensive, long lasting, and

safe. Today’s electric and hybrid vehicles are primarily powered by

nickel-metal-hydride (NiMH) batteries. NiMH batteries are safe,

abuse-tolerant and offer much longer life cycles than older lead-acid batteries,

while providing reasonable energy density. However, NiMH batteries

are more expensive than lead-acid batteries, as a result of the high nickel

content.

Li-ion

batteries have a higher energy density than most other types of

rechargeables. A Li-ion battery can achieve power density of 100-170 watt

hours (Wh) per kilogram (kg) of weight, versus NiMH’s 30-80 Wh/kg. This

means that for their size or weight they can store more energy than other

rechargeable batteries. Li-ion batteries also operate at higher voltages than

other rechargeables, typically about 3.7 volts for Li-ion vs. 1.2 volts for NiMH

or NiCd. This means a single cell can often be used rather than multiple

NiMH or NiCd cells.

Finally,

Li-ion batteries have a lower self discharge rate than other types of

rechargeable batteries. This means that once they are charged they will

retain their charge for a longer time than other types of rechargeable

batteries. NiMH and NiCd batteries can lose anywhere from 1-5% of their

charge per day, (depending on the storage temperature) even if they are not

installed in a device. Li-ion batteries, on the other hand, can retain most of

their charge even after months of storage.

Ideal

Brine Conditions

The most

important metrics when evaluating lithium brine resources are:

7

|

1)

|

lithium

content;

|

|

2)

|

evaporation

rate;

|

|

3)

|

magnesium

to lithium ratio;

|

|

4)

|

potassium

content; and

|

|

5)

|

sulphate

to lithium ratio.

|

The boron

content is also important, as it allows for the production of another saleable

product, boric acid.

The

lithium concentration in the brines is typically measured in parts per million

(ppm) or weight percentage. The higher the lithium concentration the

better. However, high local evaporation rates can compensate for lower

lithium concentrations.

Providing

that lithium contents are high enough, the magnesium to lithium (Mg:Li) ratio is

another important chemical feature in assessing favorable brine chemistry and

the ultimate economic viability of a site at an early stage. The lower the

ratio the better, as a high ratio means that, during the evaporation process, an

increasing amount of lithium will be trapped (“entrained”) in the magnesium

salts when they crystallize early. This will ultimately lead to a lower

lithium recovery rate and thus less profitability. High Mg:Li ratios also

generally mean that more soda ash (Na2CO3) reagent

is required during the processing of the brine (as described below) and,

therefore, may add significantly to costs.

The

potassium (K) concentration in the brines is typically measured as a weight

percentage. The higher the K concentration the better.

The lower

the sulphate (SO4) to

lithium ratio in the final lithium brine pond, the more the brine will be

amenable to lithium extraction via the conventional solar evaporation

process. This is because lithium sulphate (Li2SO4) is highly

soluble and so, to the extent that it is able to form, the lithium recovery will

suffer.

Key

Stages of Lithium Recovery

The most

economic way to recover lithium from a salar (a dry lake or salt flat) is by

solar evaporation. However, the process is subject to natural conditions,

and the evaporation rate, relative humidity, wind velocity, temperature and

brine composition have a tremendous influence on the solar pond requirements and

in turn on pumping and settling rates to meet production

quotas.

8

Each

lithium recovery process has a unique design based on the concentrations of Li,

Na, K, Mg, calcium (Ca) and SO4 in the

brine, and, although there may be some similarities, each salar has its own

customized methodology for optimum recovery due to the varying ionic

concentrations. Wells are drilled, and the mineral rich brine is pumped to

the surface into a series of large shallow ponds of increasing

concentration. As water evaporates, the concentration of minerals in

solution increases. The brine evaporates over an 18-24 month period until

it has a sufficient concentration of lithium salts. At that point, the

concentrate is shipped by truck or pipelined to processing plants where it is

converted to usable salt products. In the plant, sodium carbonate (soda

ash) is added to precipitate lithium carbonate, which is dried and shipped to

end users to be further processed into pure lithium metal. The by-products

such as potassium chloride (potash), sodium borate (borax) and other salts may

also be recovered and sold to end users.

The

primary reagents used to produce lithium from brine are lime and soda ash. Both

substances are natural materials, commonly used in many processes and have no

detrimental environmental effect when used properly. Other than solar energy,

only minor amounts of fuels are consumed in the production process (pumping the

brines into the ponds, etc.).

Potentially

economic salts produced from the salar brine are NaCl, carnallite, sylvinite and

bischoffite, as well as the final end-point brine. The chemical pond to

pond process from the brine feed from the salar to the end-point brine ready for

the processing plant is as follows:

|

|

·

|

Calcium

Chloride (CaCl2) is

added at the beginning in the first pond in order to precipitate out most

of the sulphate (SO4) in

the form of gypsum (CaSO4).

Removal of the sulphate is important, as it is detrimental in downstream

processing. Furthermore, the gypsum itself has multiple uses from

agriculture to construction.

|

|

|

·

|

In

the next two ponds and after solar evaporation, sylvinite will begin to

precipitate, which is a combination of table salt and potash (KCl).

The sylvinite can be harvested and sent to a froth flotation circuit to

produce potash.

|

|

|

·

|

Finally,

the sequential ponding process moves to the lithium ponds until the

end-point brine is sufficiently rich in lithium. The lithium is

still largely in the final ponds, because it is extremely soluble (likes

to stay dissolved in solution), although there will be some lithium

entrained in Mg and K salts in previous

ponds.

|

9

Global

Market

We

believe that the lithium mining industry is just under $1 billion in market size

in terms of annual sales of lithium carbonate, and is characterized by a high

degree of geographic and corporate concentration. In 2008, Chile produced 46% of

the lithium carbonate worldwide, while Argentina and Australia produced 14% and

23%, respectively.

At the

World Lithium Supply and Markets 2009 conference in Santiago, Chile, the world’s

top three lithium producers, Sociedad Quimica y Minera de Chile SA (“SQM”),

Chemetall Lithium and FMC Lithium, along with research groups TRU Group and

Roskill, presented an outlook for lithium. According to the forecast, world

lithium demand is expected to grow as much as three-fold in just over ten years.

Growth is driven by secondary (rechargeable) batteries and electric vehicle (EV)

batteries. Current demand for lithium, measured as lithium carbonate equivalent

(LCE), is around 110,000 metric tons per annum (tpa). This is expected to

rise to around 250,000 to 300,000 tpa in 2020 driven by rechargeable batteries

and EV batteries, according to the outlook. Lithium carbonate is

approximately 18.9% lithium by weight, so each metric ton of LCE includes

approximately 189 kilograms of lithium.

According

to the U.S. Geological Survey (“USGS”), Chile is the leading lithium producer in

the world. Argentina, China, and the United States are also major

producers. The 2010 edition of the USGS Mineral Commodity Summaries gives

the following estimated world lithium mine production and reserves (in metric

tons of lithium content), including the footnoted information :

10

|

Mine production

|

Reserves1

|

|||||||||||

|

2008

|

2009 (est.)

|

|||||||||||

|

United

States

|

Withheld

|

Withheld

|

38,000 | |||||||||

|

Argentina

|

3,170 | 2,200 | 800,000 | |||||||||

|

Australia

|

6,280 | 4,400 | 580,000 | |||||||||

|

Brazil

|

160 | 110 | 190,000 | |||||||||

|

Canada

|

690 | 480 | 180,000 | |||||||||

|

Chile

|

10,600 | 7,400 | 7,500,000 | |||||||||

|

China

|

3,290 | 2,300 | 540,000 | |||||||||

|

Portugal

|

700 | 490 |

Not

available

|

|||||||||

|

Zimbabwe

|

500 | 350 | 23,000 | |||||||||

|

World

total (rounded)

|

325,400 | 2 | 318,000 | 2 | 9,900,000 | |||||||

Identified

lithium resources3 total

2.5 million metric tons in the United States and approximately 23 million metric

tons in other countries. Among the other countries, identified lithium resources

for Bolivia and Chile total 9 million metric tons and in excess of 7.5 million

metric tons, respectively. Argentina and China each contain approximately 2.5

million metric tons of identified lithium resources.

|

1

|

Reserves

means that part of the reserve base which could be economically extracted

or produced. The term reserves need not signify that extraction facilities

are in place and operative. Reserves include only recoverable materials.

The reserves base is that part of an identified resource that meets

specified minimum physical and chemical criteria related to current mining

and production practices, including those for grade, quality, thickness,

and depth. The reserve base is the in-place demonstrated (measured plus

indicated) resource from which reserves are estimated. It may encompass

those parts of the resources that have a reasonable potential for becoming

economically available within planning horizons beyond those that assume

proven technology and current economics. The reserve base includes those

resources that are currently economic (reserves), marginally economic

(marginal reserves), and some of those that are currently subeconomic

(subeconomic resources).

|

|

2

|

Excludes

U.S. production.

|

|

3

|

Identified resources are

resources whose location, grade, quality, and quantity are known or

estimated from specific geologic evidence. Identified resources include

economic, marginally economic, and subeconomic

components.

|

Iodine

Market and Mining

Iodine is

a chemical element that has the symbol “I,” and its atomic number is 53. It

belongs to the halogen group of elements and is considered to be the heaviest

essential element utilized biologically. In nature, Iodine is a relatively rare

element, ranking 47th in

abundance.

Under

standard conditions, iodine is a bluish black solid that dissolves easily in

most organic solvents due to its lack of polarity. Iodine salts are often very

soluble in water and are found in greater concentrations in seawater than in

rocks. On the other hand, minerals containing iodine include caliche, which are

found in Chile.

11

Caliche

is one of the two sources used for the production of iodine, the other being the

brines of gas and oil fields. The caliche contains sodium nitrate, which is the

main product of mining activities, and small amounts of iodate minerals, sodium

chloride and sodium sulfate, which are extracted during leaching and production

of pure sodium nitrate.

Mining

operations for iodine salt extraction from caliche include drilling, blasting,

loading and hauling to heap leach pads. These pads are constructed with an

impervious membrane and a leached solution collection system. The minerals in

the leach pads are then sprinkled with water in order to dissolve the salts,

leaving brine that contains nitrate and iodine salts as well as sodium sulfate

salt. At the end of the process iodine is packaged after being removed from the

brine via a reaction with sulfur dioxide gas.

One of

the uses of iodine is as a co-catalyst for the production of acetic acid and for

the production of ethylenediammonium diiodide (EDDI), a nutritional supplement

provided to livestock. Elemental iodine is also used as a disinfectant for use

in dairies, food processing plants, hospitals and laboratories. The National

Aeronautics and Space Administration (NASA) uses iodine in its water

disinfection process on all manned space flights and in the international space

station. Iodine is a cost-efficient, effective and simple means of water

disinfection. In addition, iodine is used for nutrition purposes (iodized salt),

as iodine deficiency can cause increased child mortality, irreversible mental

retardation, and reproductive failure. Other uses for iodine are for

pharmaceutical purposes and for the manufacture of liquid crystal displays

(LCD), which are used for electronic equipments including appliances, computers,

digital cameras, personal handheld devices, and televisions.

According

to the U.S. Geological Survey Minerals Yearbook (2008), world consumption of

iodine and its derivatives was estimated to be about 20% for x-ray contrast

media, 13% for pharmaceuticals, 10% of LCD manufacture, 9% each for animal

nutrition and iodophors, 5% each for biocides and nylon manufacture, 3% for

human nutrition, and 26% for other applications.

The

leading consumption regions for iodine was Western Europe with 39% of world

consumption, followed by the Unites States with 24%, China with 8%, Japan with

7%, India with 6%, and other regions with the remaining 16%.

Prices

for iodine and its derivatives have continued to increase over the years. During

2008, the average free alongside ship for exported crude iodine was $18.30 per

kilogram, an increase from $18.16 per kilogram from 2007. The average declared

cost, insurance and freight value imported from Chile, the major source of

imported iodine for the United States, was $23.58 per kilogram in 2008,

representing a 7% increase from 2007. Actual prices for iodine are negotiated on

long and short term contracts between buyers and sellers.

The U.S.

Geological Survey (USGS) report titled “Mineral Commodity Summaries 2010,”

states that demand for iodine in applications such a biocides, iodine salts,

liquid crystal displays (LCD), synthetic fabric treatments, and x-ray contrast

media are expected to increase at a rate of 3.5% to 4% per year over the next

decade. Global shipments of LCD televisions were expected to double by 2012,

which would in turn result in the consumption of iodine by LCD producers. In

addition, as more countries implement legislation mandating salt iodization in

order to combat iodine deficiency, the global demand for iodized salt would be

expected to increase.

12

Chile is

the leading iodine producer in the world and is followed by Japan and the United

States. Chile accounted for more than 50% of world production, with two of the

leading iodine producers in the world based in Chile. A large portion of the

Chilean iodine was produced as a byproduct or co-product of nitrates. Japanese

iodine was extracted from underground natural gas brines.

The 2010

edition of the USGS Mineral Commodity Summaries gives the following estimated

world iodine mine production and reserves (in metric tons of iodine content),

including the footnoted information:

|

Mine production

|

Reserves1

|

|||||||||||

|

2008

|

2009 (est.)

|

|||||||||||

|

United States

|

Withheld

|

Withheld

|

250,000 | |||||||||

|

Azerbaijan

|

300 | 300 | 170,000 | |||||||||

|

Chile

|

15,500 | 16,000 | 9,000,000 | |||||||||

|

China

|

570 | 580 | 4,000 | |||||||||

|

Indonesia

|

75 | 75 | 100,000 | |||||||||

|

Japan

|

9,500 | 9,300 | 4,900,000 | |||||||||

|

Russia

|

300 | 300 | 120,000 | |||||||||

|

Turkmenistan

|

270 | 300 | 170,000 | |||||||||

|

Uzbekistan

|

2 | 2 |

Not available

|

|||||||||

|

World

total (rounded)

|

26,500 | 2 | 27,000 | 2 | 15,000,000 | |||||||

In

addition to the reserves shown above, seawater contains 0.05 parts per million

iodine, or approximately 34 million tons. Seaweeds of the Laminaria family are

able to extract and accumulate up to 0.45% iodine on a dry basis. Although not

as economical as the production of iodine as a byproduct of gas, nitrate and

oil, the seaweed industry represented a major source of iodine prior to 1959 and

remains a large resource.

|

|

1

|

See

definition of “reserves” above.

|

|

|

2

|

Excludes

U.S. production.

|

Nitrate

Market and Production

Potassium

nitrate is a chemical compound with the formula KNO3. It occurs

as a mineral niter and is a natural solid source of nitrogen. Its common names

include saltpeter and nitrate of potash. Major uses of potassium nitrate

are in fertilizers, rocket propellants and fireworks. When used as a food

additive in the European Union, the compound is referred to as

E252.

13

Potassium

nitrate can be produced through various chemical reactions,

including:

NH4NO3 (ammonium

nitrate) + KCl (potash) → NH4Cl

(ammonium chloride) + KNO3

NH4NO3 + KOH

(potassium hydroxide) → NH3 (ammonia)

+ KNO3

+ H2O

NaNO3 (sodium

nitrate) + KCl → NaCl (table salt) + KNO3

Potassium

nitrate is mainly used in fertilizers, as a source of nitrogen and potassium,

two of the macro nutrients for plants. Potassium nitrate is also one of the

three components of black powder (gunpowder), along with powdered charcoal

(substantially carbon) and sulfur, where it acts as an oxidizer.

In the

process of food preservation, potassium nitrate, more commonly known as

saltpeter, has been a common ingredient of salted meat since the Middle Ages,

but its use has been mostly discontinued due to inconsistent results compared to

more modern nitrate and nitrite compounds. Even so, saltpeter is still used in

some food applications, such as charcuterie and the brine used to make corned

beef.

Potassium

nitrate is an efficient oxidizer, which produces a lilac flame upon burning due

to the presence of potassium. It is therefore used in amateur rocket propellants

and in fireworks. It is also added to pre-rolled cigarettes to maintain an

even burn of the tobacco.

Potassium

nitrate is the main component (usually about 98%) of tree stump remover, as it

accelerates the natural decomposition of the stump. It is also commonly used in

the heat treatment of metals as a solvent in the post-wash. The oxidizing, water

solubility and low cost make it an ideal short-term rust inhibitor.

Potassium

nitrate can also be found in some toothpastes for sensitive teeth.

Recently, the use of potassium nitrate in toothpastes for treating sensitive

teeth (dentine hypersensitivity) has increased dramatically, even though studies

to this effect have been inconclusive.

World

population growth and its effects on the scarcity of water and increased

competition on land use for living, industry, nature and agriculture, increase

the need for agriculture efficiency. The amount of land in agriculture per

capita will further decrease in the future as world population is expected to

grow faster than the growth of arable land. Therefore, crop productivity has to

increase in order to provide the same amount of food in relation to the growing

world population. The growing importance of specialty plant nutrition products,

such as potassium nitrate, has been driven by these factors as one of its main

uses is for premium crops.

Our

Projects

Peru

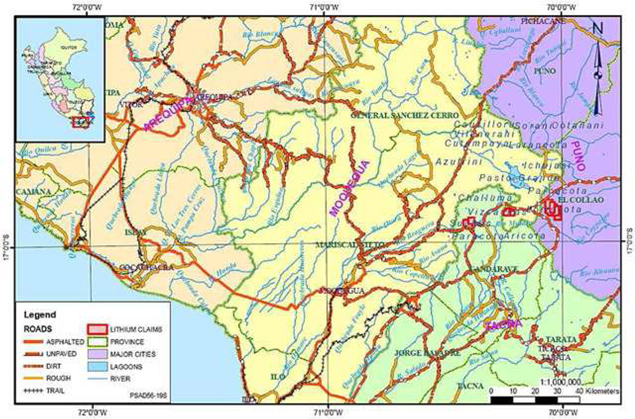

In

February 2010, we acquired 100% of the assets of the Loriscota, Suches and

Vizcachas Projects located respectively in the Regions of Puno, Tacna and

Moquegua, Peru, from a private owner. The aggregate purchase price for these

assets was $50,000.

14

These

projects are prospective for lithium and potassium and comprise nine mineral

claims that cover a total area of 19,500 acres at an elevation of 14,000 feet

(approximately 4,300 meters) above sea level. The projects are in recently

reinterpreted areas previously studied by the Peruvian Mining Ministry in 1981,

whose survey concluded that the projects contain high lithium and potassium

values. Subsequent to the Mining Ministry’s survey, preliminary sampling was

conducted on these projects and was found to contain similar lithium values to

those reported in the evaporite deposits in the southern parts of the Puna, some

of which are currently under development for commercial production.

To date

there has been no systematic brine sample reported on these properties, and

we continue to evaluate them to determine if they meet our development

criteria.

The maps

below show the project area and the locations of the Loriscota, Suches and

Vizcachas mineral claims.

15

Chile

Alfredo

On August

3, 2010, we acquired all of the outstanding share capital of Alfredo from

Pacific Road Resources Fund A (“Fund A”), Pacific Road Capital B Pty. Limited,

as trustee for Pacific Road Resources Fund B (“Fund B”), and Pacific Road

Capital Management G.P. Limited, as General Partner of Pacific Road Resources

Fund L.P. (“PR Partnership” and, together with Fund A and Fund B,

“Sellers”). Alfredo, through its Chilean subsidiary PRMC, has an

option to purchase mining concessions with respect to approximately 6,670 acres

of mining tenements near Pozo Almonte, Chile, pursuant to an Option to Purchase

Agreement between PRMC and Sociedad Contractual Minera La Fortaleza (the

“OPA”).

We do not

expect to extract any lithium from the Alfredo Property. Provided that we

successfully develop the Alfredo Property, we expect it to produce saleable

iodine and (by combining sodium nitrate (NaNO3) from

Alfredo with potassium chloride (potash) that we expect to generate from our

prospective lithium brine properties) potassium nitrate (KNO3).

The

Alfredo Property is located in the Tarapacá Region in northern Chile, which is

southeast of the city of Iquique and has excellent infrastructure access, as it

is situated near the mining community of Pozo Almonte, which is the base of

operations of Chile’s three primary iodine-nitrate production companies. Pozo

Almonte holds a significant pool of experienced caliche mining personnel, who

could be transported by shuttle to and from the property, removing the necessity

of a remote camp. Water and electricity are also available by purchase from

water utility ESSAT and from the Chilean national grid substation,

respectively.

16

Alfredo

comprises six mining concessions that cover a total area of 2,700 hectares

(6,670 acres) at an elevation between 870 and 1,070 meters above sea level. The

Project occupies the southern extension of a rich iodine nitrate belt and is

also located near the operating caliche mines of Sociedad Química y Minera de

Chile S.A. (SQM) and ACF Minera S.A., both of which are producing both iodine

and nitrates. Below is a map showing the location of Alfredo.

The

property is classified as a shallow caliche deposit mineralized by layers of

sand, gravel and clay, which contain iodine and nitrates. This potassium-iodine

caliche deposit has a similar chemical composition and grade to the deposits

currently mined by SQM and Cosayach Nitratos SA. The deposition of the nitrates

and iodine in Alfredo is such that the higher grade iodine is generally separate

from the high nitrates, thus facilitating selective mining. PRMC has previously

conducted certain work on Alfredo to define a nitrate-iodine inferred resource,

and we have engaged an independent qualified person for purposes of preparing an

NI 43-101 report on the property.

17

We have

estimated that three years will be required for feasibility and engineering

studies and have established a 21-year mine plan that would require capital

expenditures of $117 million, which consists of a two phase approach that delays

the production of potassium nitrate until the sixth year, with the higher grade

iodine areas being mined first.

We

believe the Alfredo project would create the following synergies:

|

|

·

|

We

are pursuing brine projects that have the potential to produce lithium as

well as a significant amount of potassium chloride. Production of

potassium would significantly improve the economics of the Alfredo nitrate

operation, as sodium nitrate from the caliche deposits can be reacted with

potassium chloride (potash) to produce potassium nitrate (KNO3).

|

|

|

·

|

Surrounding

the Alfredo property are similar deposits with limited resources, but

comparable grade, which are too small to be economic. However, if we

construct a processing plant at Alfredo, we could seek to acquire these

properties and/or provide processing capacity to the

owners.

|

Pursuant

to the stock purchase agreement (“SPA”), we issued an aggregate of 10,000,000

shares of our common stock (the “Purchase Price Shares”) to the Sellers and

their designees. Of the Purchase Price Shares, 8,800,000 that we issued

directly to the Sellers are subject to an 18-month lock-up period. If and

when the following milestones are achieved with respect to a mine that we may

dig on the Alfredo Property to recover iodine or nitrate (the “Alfredo Mine”),

the SPA requires us to make the following additional payments to the

Sellers:

|

|

·

|

$1,000,000

upon our Board of Directors’ resolution to commence final engineering and

design of the Alfredo Mine;

|

|

|

·

|

A

further $2,000,000 upon our Board of Directors’ resolution to commence

construction of the Alfredo Mine;

and

|

|

|

·

|

A

further $2,500,000 upon commencement of commercial production from the

Alfredo Mine (meaning production at a rate of 75% of design capacity for 3

months).

|

Sellers

have the right to take any or all of the above milestone payments in shares of

our common stock instead of cash, valued at the greater of (i) $0.25 per share

and (ii) the average of the closing price for our common stock on the 30 trading

days immediately preceding the relevant payment date. We are under no

obligation to achieve or pursue any of the milestones.

18

The SPA

provides Sellers with the right to designate one or more persons to be nominated

for election to our Board of Directors if Sellers hold at least 10% of our

outstanding common stock. The number of such nominees that Sellers may

designate will be the greater of (i) one and (ii) a portion of our full Board

that is proportional to Sellers’ ownership of our outstanding common stock

(rounding down). This right would allow the Sellers to nominate one Board member

at the date of this filing. To date, the Sellers have not exercised their

right to nominate Board members.

The SPA

provides Sellers with preemptive rights in

certain future financing transactions by us, provided that Sellers still own at

least 50% of the Purchase Price Shares. Such preemptive rights are subject

to customary exceptions, and generally give Sellers the right to purchase up to

25% of the securities that we sell in any offering to which they

apply.

The SPA

also grants Sellers two interrelated options to purchase additional shares of

our common stock.

|

|

·

|

First,

within 60 days of closing under the SPA, Sellers may purchase between

$2,500,000 and $10,000,000 of Units (as defined below) at a price of

$25,000 per Unit. Each “Unit” would have consisted of (i) 100,000

shares of our common stock; and (ii) five-year warrants to purchase

100,000 shares of our common stock at an exercise price of $0.50 per

share. This option has

expired.

|

|

|

·

|

Second,

upon our completion of Canadian National Instrument 43-101 Inferred

Resource Reports on the Alfredo Property and on at least one lithium

property in Argentina, Sellers will have the right to subscribe for shares

of our common stock having an aggregate purchase price of at least

$2,500,000 if the first option was not exercised, and in any event not

less than $1,000,000, up to a maximum of $10,000,000 less any amounts

subscribed for pursuant to the first option. If Sellers exercise

this second option, then Sellers will pay a price per share equal to the

greater of (i) $0.25 per share, and (ii) the thirty day volume-weighted

average price of our common stock on its principal market at the time we

notify Sellers of our having completed the relevant 43-101 Inferred

Resources Reports.

|

The OPA

gives us the option to acquire 100% of the six mining concessions constituting

the Alfredo Property. Under the OPA, we must make periodic payments

aggregating $360,000 between June 30, 2010 and December 30, 2010. We paid

$80,000 in August 2010 and must make payments of $100,000 by October 30,

2010 and $180,000 by December 30, 2010 in order to maintain our option

rights. Then, in order to exercise the option and purchase the Alfredo

Property, we must pay the option exercise price of $4,860,000 by March 30,

2011.

Puna

We had

signed a letter of intent to acquire the assets of Puna Lithium Corporation

(“Puna”), which has an option to acquire up to an aggregate 80% interest in nine

salars covering 123,000 acres on the Puna Plateau of Chile. The

transaction was subject to legal and financial due diligence by us and

negotiation of definitive documentation. We have determined that these

properties did not meet the requirements of our technical and business strategy

criteria and have decided not to pursue this acquisition.

19

Argentina

Puna Lithium Corporation,

Lacus Minerals S.A and Noto Energy S.A Transactions

On March

12, 2010, the Company entered into an assignment agreement (the “Assignment

Agreement”) whereby the Company would purchase all of Puna Lithium Corporation’s

(“Puna”) interests in and rights under a letter of intent dated November 23,

2009, as amended (the “Letter of Intent”), entered into by Puna, Lacus Minerals

S.A. (“Lacus”), and the shareholders of Noto Energy S.A.. The Company

entered into a Master Option Agreement with Lacus (the “Master Option

Agreement”), for the acquisition of three options (collectively, the “Options”),

to acquire up to an 85% interest in: (a) approximately 70,000 acres situated on

prospective brine salars in Argentina, known as Rincón, Centenario and Pocitos

(the “Master Lacus Properties”); and (b) salt-mining claims on approximately

9,000 additional acres in certain other areas of mutual interest on some of

those same salars (the “Third Parties Properties” and, together with the Master

Lacus Properties, the “Lacus Properties”) that may be acquired upon exercise of

the two options (collectively, the “Third Parties Options”).

In

accordance with the Assignment Agreement, the Company was also required to issue

8,000,000 shares of common stock to Puna upon the date of the closing

(“Closing”) as defined in the Master Option Agreement. As the Closing did

not occur, the Company did not issue the 8,000,000 shares of common

stock.

In March

2010, we also entered into an agreement to acquire 100% of the issued and

outstanding shares of Noto Energy S.A., an Argentinean corporation ("Noto"),

which beneficially owns a 100% interest over 2,995 acres situated on brine

salars in Argentina, known as Cauchari. In July 2010, we closed on the

acquisition of Noto.

In July

2010, we entered into a preliminary and non-binding Letter of Intent (the “LOI”)

with the shareholders of Lacus (the “Lacus Shareholders”) for a

proposed transaction that would have involved the restructuring of our existing

Master Option Agreement with Lacus, pursuant to which we would have acquired

100% of the issued and outstanding shares of Lacus, and salt-mining claims on

approximately 156,000 acres on the Centenario, Rincón and Pocitos salars would

be added to our portfolio of mining properties under option.

However,

our Board of Directors has since determined that the brine chemistry results

from surface pit sampling on the Rincon, Pocitos and Centerario salars, received

after signing the LOI, did not meet our criteria for economic brine reserves,

that the work plan recommended by Lacus was not acceptable and that funding of a

drilling program should be suspended. Subsequently, we received a notice

from Lacus purporting to terminate the Master Option Agreement and the Services

Agreement because of our failure to pay certain amounts alleged to be due under

these agreements. Accordingly, we have made no further payments under the

Master Option Agreement. We have notified the Lacus Shareholders that,

based on the unsatisfactory results of our due diligence, we do not intend to

execute any definitive agreements for the transaction detailed in the LOI, and

the LOI has terminated.

20

As

consideration for entering the Master Option Agreement and as a condition to

maintain the first Option in good standing until exercised, we have paid

$942,178 to Lacus (of which $700,000 pertained to work commitments), and were to

pay $500,000 to Lacus on or before March 12, 2011. We were to complete

$1,688,000 in work commitments on or before August 31, 2010, and an additional

$1,312,000 in work commitments a year from closing. However,

following termination of the Master Option Agreement, we have made no further

payments. We have recorded $965,000 of exploration expenses related to

our obligations under the Master Option Agreement.

Rincón

South

We signed

a letter of intent in January 2010 with a private Argentinean company to acquire

additional lithium brine assets in the Puna region of Argentina. The prospective

location, known as the Rincón South Property, covers approximately 4,250 acres,

comprising 18 claims on the southern portion of the Salar de Rincón. The

proposed transaction was subject to our geological, engineering, legal and

financial due diligence. We have subsequently determined that these properties

do not meet the requirements of our technical and business strategy criteria and

have decided not to pursue this acquisition.

Nevada

In March

2010, we purchased all of Next Lithium Corp.’s interests in (a) an option

agreement (the “CSV, LM and MW Option Agreement”), pursuant to which Geoxplor

Corp, a Nevada corporation (“Geoxplor”), granted to Next Lithium the option to

acquire a 100% beneficial interest in the placer mining claims known as the CSV

Placer Mineral Claims, LM Placer Mineral Claims and MW Placer Mineral Claims;

and (b) an option agreement (the “BSV Option Agreement,” and, together with the

CSV, LM and MW Option Agreement, the “Nevada Option Agreements”), pursuant to

which Geoxplor granted to Next Lithium the option to acquire a 100% beneficial

interest in the placer mining claims known as the BSV Placer Mineral Claims; as

well as all associated rights and records. The CSV Placer Mineral Claims,

LM Placer Mineral Claims, MW Placer Mineral Claims and BSV Placer Mineral Claims

(the “Nevada Claims”) cover up to approximately 60,600 acres in Big

Smoky Valley near Tonopah in west central Nevada. During the 1970’s and

1980’s, the USGS carried out a series of reconnaissance geological programs in

Big Smoky Valley, including one hole drilled on the property covered by the

Nevada Claims that intersected geochemically anomalous concentrations of lithium

in the brines, and gravity surveys over the region also confirmed the existence

of various structures that may have created a favorable environment, which

potentially could host commercially viable lithium-rich brines. However, there

has been no systematic brine sampling on the Nevada Claims in Big Smoky

Valley.

We

acquired the options on the Nevada Claims in exchange for 4,000,000 restricted

shares of our common stock. 2,500,000 of these shares of our common stock

are being held in escrow until March 2011 against any indemnifiable liabilities

that may arise. If the shares of our common stock retained by Next Lithium

cannot be resold under Rule 144 under the Securities Act of 1933 without

restriction at any time following the 13th month after closing due to our status

as a former “shell” company and our failure to file required reports with

the Securities and Exchange Commission, and not because of any fault of Next

Lithium, then we must register such shares for resale under the Securities

Act. Next Lithium assigned to Geoxplor 1,500,000 of the 4,000,000

restricted shares of our common stock received by Next Lithium. These

1,500,000 shares assigned to Geoxplor will carry “piggyback” registration rights

until the earlier of: (a) February 16, 2012, or (b) the date on which all such

shares may immediately be sold under Rule 144 during any 90-day

period.

21

Under the

CSV, LM and MW Option Agreement, we paid to Geoxplor $236,607. We also

agreed to pay additional amounts totaling $75,000 contingent upon future

events which had not occurred as of the date of our financial statements or this

filing. Further, under the BSV Option Agreement, we were required to pay

to Geoxplor $100,000 on June 30, 2010. The $100,000 owed to GeoXplor

is recorded in accrued expenses as of June 30, 2010. Under both the Nevada

Option Agreements, we would have paid Geoxplor a 3.0% net smelter return royalty

on the proceeds from production of all ores, minerals, metals, concentrates and

mineral resources (an “NSR”) derived from mining operations on the related

properties.

We have

subsequently determined that these properties do not meet the requirements of

our technical and business strategy criteria and have decided not to pursue

these options. We have not paid the $100,000 payable under the BSV Option

Agreement on June 30, 2010.

Subsequent

to June 30, 2010, we were also obligated to pay approximately $57,000 of claim

maintenance fees on the Nevada Claims and approximately $32,600 of Nevada state

taxes, which we have not paid.

Competition

We are a

mineral resource exploration company. We compete with other mineral resource

exploration companies for financing, personnel and equipment and for the

acquisition of mineral properties. Many of the mineral resource exploration

companies with whom we compete have greater financial and technical resources

than those available to us. Accordingly, these competitors may be able to spend

greater amounts on acquisitions of mineral properties of merit, on exploration

of their mineral properties and on development of their mineral properties. In

addition, they may be able to afford more geological expertise in the targeting

and exploration of mineral properties. This competition could result in

competitors having mineral properties of greater quality and interest to

prospective investors who may finance additional exploration and/or development.

This competition could adversely impact on our ability to finance further

exploration and to achieve the financing necessary for us to develop our mineral

properties.

Compliance

with Government Regulation

We are

committed to complying with and are, to our knowledge, in compliance with, all

governmental and environmental regulations applicable to our company and our

properties. Permits from a variety of regulatory authorities are required for

many aspects of mine operation and reclamation. We cannot predict the extent to

which these requirements will affect our company or our properties if we

identify the existence of minerals in commercially exploitable quantities. In

addition, future legislation and regulation could cause additional expense,

capital expenditure, restrictions and delays in the exploration of our

properties.

22

Research

and Development Expenditures

We have

incurred no research and development expenditures over the last fiscal year and

do not anticipate significant future research and development

expenditures.

Employees

Our only

current full-time employee is our Chief Operating Officer. We currently

have six part-time employees, including our Chief Executive Officer, and we

engage several consultants, including our Interim Chief Financial

Officer.

We engage

contractors from time to time to consult with us on specific corporate affairs

or to perform specific tasks in connection with our exploration

programs.

Subsidiaries

We

currently have four subsidiaries:

|

|

·

|

Li3

Energy Peru SRL, a private limited company organized under the laws of

Peru

|

|

|

·

|

Alfredo

Holdings, Ltd., an exempted limited company incorporated under the laws of

the Cayman Islands

|

|

|

·

|

Pacific

Road Mining Chile, SA, a Chilean corporation (“PRMC”). PRMC is a

subsidiary of Alfredo

|

|

|

·

|

Noto

Energy S.A., an Argentinean

corporation.

|

Intellectual

Property

We do not

own, either legally or beneficially, any patent or trademark nor any material

license, and are not dependent on any such rights.

23

|

ITEM

1A.

|

RISK

FACTORS

|

THIS

ANNUAL REPORT ON FORM 10-K CONTAINS CERTAIN FORWARD-LOOKING STATEMENTS. YOU ARE

CAUTIONED THAT SUCH STATEMENTS ARE ONLY PREDICTIONS AND ARE SUBJECT TO VARIOUS

RISKS AND UNCERTAINTIES, MANY OF WHICH CANNOT CONTROL OR PREDICT. ACTUAL

EVENTS OR RESULTS MAY DIFFER MATERIALLY FROM THOSE EXPRESSED OR IMPLIED BY

FORWARD-LOOKING STATEMENTS. IN EVALUATING SUCH STATEMENTS, YOU SHOULD

SPECIFICALLY CONSIDER, AMONG OTHER THINGS, THE VARIOUS FACTORS IDENTIFIED IN

THIS ANNUAL REPORT ON FORM 10-K, INCLUDING THE MATTERS SET FORTH BELOW. IF

ANY OF THE FOLLOWING RISKS ACTUALLY OCCURS, THEN OUR BUSINESS, PROSPECTS,

FINANCIAL CONDITION AND RESULTS OF OPERATIONS COULD BE MATERIALLY ADVERSELY

AFFECTED.

RISKS

RELATED TO OUR BUSINESS AND FINANCIAL CONDITION

We

are an exploration stage company and have no revenues. Our business plan depends

on our ability to explore for and develop mineral reserves and place any such

reserves into extraction. Because we have a limited operating history, it is

difficult to predict our future performance.

Although

we were formed in June 2005, we have been and continue to be an exploration

stage company. Therefore, we have limited operating and financial history

available to help potential investors evaluate our past performance and the

risks of investing in us. Moreover, our limited historical financial results may

not accurately predict our future performance. Companies in their initial stages

of development present substantial business and financial risks and may suffer

significant losses. As a result of the risks specific to our new business and

those associated with new companies in general, it is possible that we may not

be successful in implementing our business strategy.

We have

generated no revenues to date and do not anticipate generating any revenues for

the foreseeable future. Our activities to date have been limited to capital

formation, organization, and development of our business. We have yet to

generate positive earnings and there can be no assurance that we will ever

operate profitably. Our success is significantly dependent on a successful

exploration, mining and production program. Our operations will be subject to

all the risks inherent in the establishment of a developing enterprise and the

uncertainties arising from the absence of a significant operating history. We

may be unable to locate exploitable quantities of mineral resources or operate

on a profitable basis. We are in the exploration stage and potential investors

should be aware of the difficulties normally encountered by enterprises in the

exploration stage. If our business plan is not successful, and we are not able

to operate profitably, investors may lose some or all of their investment in our

Company.

24

Our

past losses raise doubt about our ability to continue as a going

concern.

The

Consolidated Financial Statements contained in our report on Form 10-K for the

year ended June 30, 2010 have been prepared assuming we will continue as a going

concern. We have incurred losses since inception, resulting in cumulative losses

of $16,242,392 through June30, 2010. We do not anticipate positive cash flow

from operations before 2013 and cannot predict if and when we may generate

profits. We expect to finance our operations primarily through future

financings. However, as discussed in Note 3 to our Consolidated Financial

Statements included in this Annual Report on Form 10-K, there exists substantial

doubt about our ability to continue as a going concern because there is no

assurance that we will be able to obtain such capital, through equity or debt

financing, or any combination thereof, on satisfactory terms or at all.

The Consolidated Financial Statements do not include any adjustments that might

result from the outcome of this uncertainty.

We

have not made certain scheduled payments under agreements with respect to

prospective properties. If we are deemed to be liable for such payments

(and/or damages arising out of their non-payment), then our business, financial

condition and prospects could be materially adversely affected.

Pursuant

to our Master Option Agreement with Lacus, we have paid $942,178 to Lacus

(of which $700,000 pertained to work commitments), and were to pay an additional

$500,000 to Lacus on or before March 12, 2011. Furthermore, we were to

complete $1,688,000 in additional work commitments on or before August 31, 2010,

and a further $1,312,000 in work commitments a year from closing. On

August 24, 2010, we received a notice from Lacus purporting to terminate the

Master Option Agreement and the Services Agreement because of our failure to pay

certain amounts alleged to then be due under such agreements. We have

recorded $965,000 of exploration expenses related to our obligations under the

Master Option Agreement, however, there can be no assurance that we will not

ultimately pay more than that amount with respect to this matter.

Pursuant

to our Option Agreements with GeoXplor Corp. on the Nevada Claims, we were

required to make periodic and milestone payments and also to maintain the

relevant mineral claims in good standing for certain time periods. We

failed to make a periodic payment of $100,000 due on June 30, 2010.

Subsequent to year-end, we were also obligated to pay approximately $57,000 of

claim maintenance fees on the Nevada Claims and approximately $32,600 of Nevada

state taxes, which we have not paid.

If and to

the extent we are found liable for, or deliver value in settlement of, any

claims that may arise from the foregoing, and/or our expenses related to those

matters become significant, then our business, financial condition and prospects

could be materially adversely affected and the value of our stockholders'

interests in us could be impaired.

Proposed

transactions discussed in our Exchange Act reports that have not been

consummated are subject to various conditions and/or further agreement among the

parties, and may ultimately not be consummated on the terms described herein, or

at all.

We

discuss in our Exchange Act reports certain proposed transactions that have not

yet been consummated, including letters of intent and definitive purchase

agreements to acquire mineral interests. There can be no assurance that any such

letter of intent will progress to definitive agreements or that the conditions

to closing of any such definitive agreement will be satisfied and a closing

held. For reasons that may be within or beyond our control, such transactions

may never come to fruition. Nonetheless, we spend funds and management’s

attention on pursuing such transactions which may materially adversely affect

our liquidity and results of operations.

25

All

of our properties are in the exploration stage. Investment in exploration

projects increases the risks inherent in our mining activities. There is no

assurance that we can establish the existence of any mineral resource on any of

our properties in commercially exploitable quantities, and our mining operations

may not be successful.

We have

not established that any of our mineral properties contains any meaningful

levels of mineral reserves. There can be no assurance that that future

exploration and mining activities will be successful.

A mineral

reserve is defined by the SEC in its Industry Guide 7 (which can be viewed at

http://www.sec.gov/divisions/corpfin/forms/industry.htm#secguide7)

as that part of a mineral deposit which could be economically and legally

extracted or produced at the time of the reserve determination. There can be no

assurance that we will ever establish any mineral reserves.

Even if

we do eventually discover a meaningful mineral reserve on one or more of our

properties, there can be no assurance that we will be able to develop our

properties into producing mines and extract those resources. Both mineral

exploration and development involve a high degree of risk and few properties

which are explored are ultimately developed into producing mines. Furthermore,

we cannot be sure that an overall exploration success rate or extraction

operations within a particular area will ever come to fruition and, in any

event, production rates inevitably decline over time. The commercial viability

of an established mineral deposit will depend on a number of factors including,

by way of example, the size, grade and other attributes of the mineral deposit,

the proximity of the resource to infrastructure such as a smelter, roads and a

point for shipping, government regulation and market prices. Most of these

factors will be beyond our control, and any of them could increase costs and

make extraction of any identified mineral resource unprofitable.

We

have limited financial resources and may not be able to fund our anticipated

exploration activities. If we are unable to fund our exploration activities, our

potential profitability will be adversely affected.

Our

anticipated exploration activities will require financial resources

substantially in excess of our current working capital. If we are not able to

finance our exploration activities, then we will be unable to identify

commercially exploitable resources even if present on our properties. If we fail

to adequately support our exploration activities, it could have a material

adverse effect on our results of operations and the market price of our shares.