Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - GOLD RESOURCE CORP | grc_8k.htm |

Exhibit 99.1

Nov. 4, 2010 ANNUAL MEETING

Positioned for Aggressive Growth

This brochure contains statements that plan for or anticipate the future.

Forward-looking statements include statements about the Company's ability

to develop and produce gold or other precious metals, statements about our

future business plans and strategies, statements about future revenue and

the receipt of working capital, and most other statements that are not

historical in nature. Forward-looking statements are often identified by

words such as "anticipate," "plan," "believe," "expect," "estimate," and the

like. Because forward-looking statements involve future risks and

uncertainties, there are factors that could cause actual results to differ

materially from those expressed or implied, including those described in our

filings with the SEC. Prospective investors are urged not to put undue

reliance on these forward-looking statements.

Forward-looking statements include statements about the Company's ability

to develop and produce gold or other precious metals, statements about our

future business plans and strategies, statements about future revenue and

the receipt of working capital, and most other statements that are not

historical in nature. Forward-looking statements are often identified by

words such as "anticipate," "plan," "believe," "expect," "estimate," and the

like. Because forward-looking statements involve future risks and

uncertainties, there are factors that could cause actual results to differ

materially from those expressed or implied, including those described in our

filings with the SEC. Prospective investors are urged not to put undue

reliance on these forward-looking statements.

This presentation is to be read in conjunction with the most current 10K

available at the Securities & Exchange Commission website www.sec.gov. or

www.Goldresourcecorp.com

available at the Securities & Exchange Commission website www.sec.gov. or

www.Goldresourcecorp.com

Forward Looking Statements

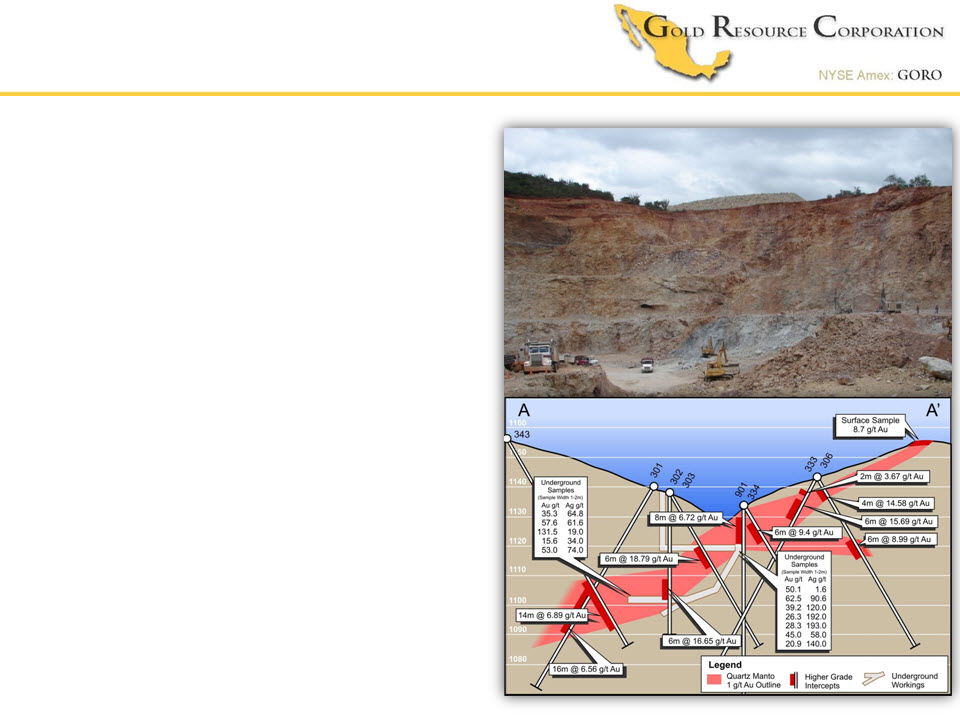

High-Grade Asset Base with Significant Exploration Potential

Gold Producer Focused on Growth

Low Cost Production

Focused on Cash Flow and Dividends

Engineered To Maximize Shareholder Value

Gold and Silver Producer

Gold and Silver Producer

Internal Estimate, Not SEC Proven & Probable Reserves; see Risk Factors in Company’s 10K

ØMineralized Material(1):

Company estimate of 330,000

tonnes @

Company estimate of 330,000

tonnes @

Au 7.5 grams / tonne

Ag 63 grams / tonne

ØOpen Pit viewed as cash

flow generator to finance La

Arista underground

development

flow generator to finance La

Arista underground

development

Gold and Silver Producer

Ore Body

Potential Feeder Vein

100% waste rock needed to build tailings dam

98% ore mined; stockpiled awaiting processing

Gold and Silver Producer

Miguel C. Mill Superintendent

Gold and Silver Producer

Gold and Silver Producer

9/14/2006: Begins trading on

OTCBB after completing IPO

in August 2006

OTCBB after completing IPO

in August 2006

2/4/2008: Begins construction

on El Aguila Project

on El Aguila Project

6/12/2008: Received federal

permit to build mill for El

Aguila project

permit to build mill for El

Aguila project

12/9/2009: Begins commissioning its El

Aguila mill

Aguila mill

12/14/2009: Granted approval to

develop the Arista mine

develop the Arista mine

2/3/2010: Produces

first concentrates at

El Aguila mill

first concentrates at

El Aguila mill

7/1/2010: Commercial

production begins

production begins

7/8/2010: Applies

for AMEX listing

for AMEX listing

7/29/2010 : Declares

initial special cash

dividend of $0.03

per share

initial special cash

dividend of $0.03

per share

“IPO” Sept. 2006 to Oct. 2010

Delivering Shareholder Value

8/13/2009: Receives

permit to begin open

pit mining at El Aguila

permit to begin open

pit mining at El Aguila

10/30/2010 : Declares

4th special cash

dividend of $0.03 per

share

4th special cash

dividend of $0.03 per

share

Targets

Accelerate Development of Oaxaca Mining Unit

Increase Shareholder Value

Become “Main Stream” for Institutional Investors

Position GORO as “GO TO” Gold Investment

Where We Are Going / Longevity

Accelerate Development of Oaxaca Mining Unit

Open Pit

La Arista

Internal Estimate, Not SEC Proven & Probable Reserves; see Risk Factors in Company’s 10K

Where We Are Going / Longevity

Accelerate Development of Oaxaca Mining Unit

Internal Estimate, Not SEC Proven & Probable Reserves; see Risk Factors in Company’s 10K

December 2009:

Mineralized Material

Polygonal Envelopes

8 years estimated

mine life

mine life

Potential to double

current Arista mine

life estimate

current Arista mine

life estimate

Baja vein 12/09

Arista vein 12/09

Veins remain open on strike and depth

200 m

100 m

100 m to surface

Recent Market Benchmark

ØMineralized Material(1): Company estimate

of 2,962,000 tonnes @

of 2,962,000 tonnes @

Au 6.5 grams / tonne

Ag 506 grams / tonne

Cu 0.60%

Pb 2.24%

Zn 6.75%

ØCurrent Mine Life Estimate(1): 8 years

ØPotential to double

ØTargeting polymetallic stockpiles in Q4

2010 for seamless transition from open pit

ore to underground ore by July 2011

2010 for seamless transition from open pit

ore to underground ore by July 2011

ØTargeted production on July 1, 2011

Projecting up to 200,000 ounces or more of

gold equivalent (gold and silver) annually by

year 3

gold equivalent (gold and silver) annually by

year 3

“Zero” cash cost per ounce expected after

using industry standard base metal byproduct

credits

using industry standard base metal byproduct

credits

ØProcessed at El Aguila mill, 2km

distance from mine

distance from mine

Where We Are Going / Longevity

Arista Vein Deposit

15 grams/t

(1/2oz) AuEq

$0 cost target

w/ byproducts

Ø3 million ounces AuEq = $3 billion

valuation in market place

valuation in market place

ØGORO targets 3 million ounces AuEq

La Arista Deposit

•Multiple en echelon veins

•~500 meters of strike

•~500 meters of depth

•Deposit remains open

Arista Vein

Baja Vein

Primary Decline

Safety/Ventilation

Decline

Decline

Open

Decline Development

Arista Mine

Arista Mine

Carlos T.

Mine Superintendent

Fidel L.

Maintenance Superintendent

Jorge S.

Project Manager

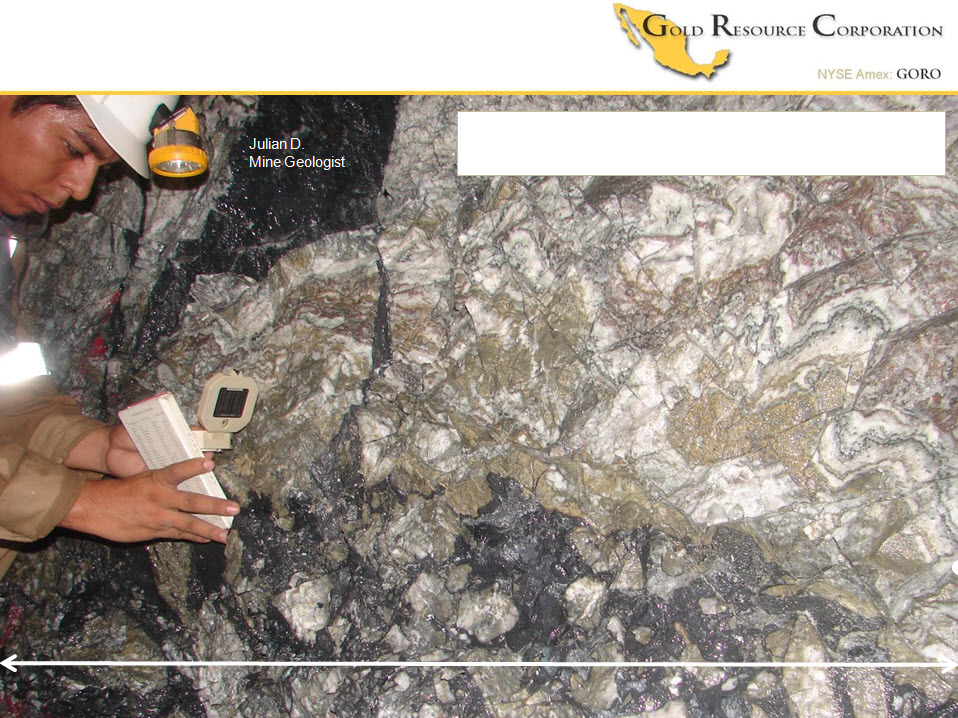

Julian D.

Mine Geologist

Jason R.

President

Arista Mine

INTERCEPTED BAJA VEIN

3 METERS OF 6 METER WIDE VEIN

Arista Mine

INTERCEPTED BAJA VEIN

PORTION OF 6 METER WIDE EPITHERMAL VEIN

Where We Are Going

Accelerate Exploration of 5 Potential High-Grade Properties

Acceleration of current 2 drill rig exploration

program targeting 4-6 drill rigs

program targeting 4-6 drill rigs

ØLarge dominant land position with 5 properties

ØConcessions consolidate 3 historic mining

districts (100% interest)

districts (100% interest)

ØEl Aguila Project; 3 deposits discovered to date

El Aguila Open Pit

Metals: Au, Ag

La Arista Underground

Metals: Au, Ag, Cu, Pb, Zn

El Aire Underground

Metals: Au, Ag, Cu, Pb, Zn

Ø99% of concessions yet to be drilled

ØSignificant exploration potential

El Rey

Solaga

Where We Are Going

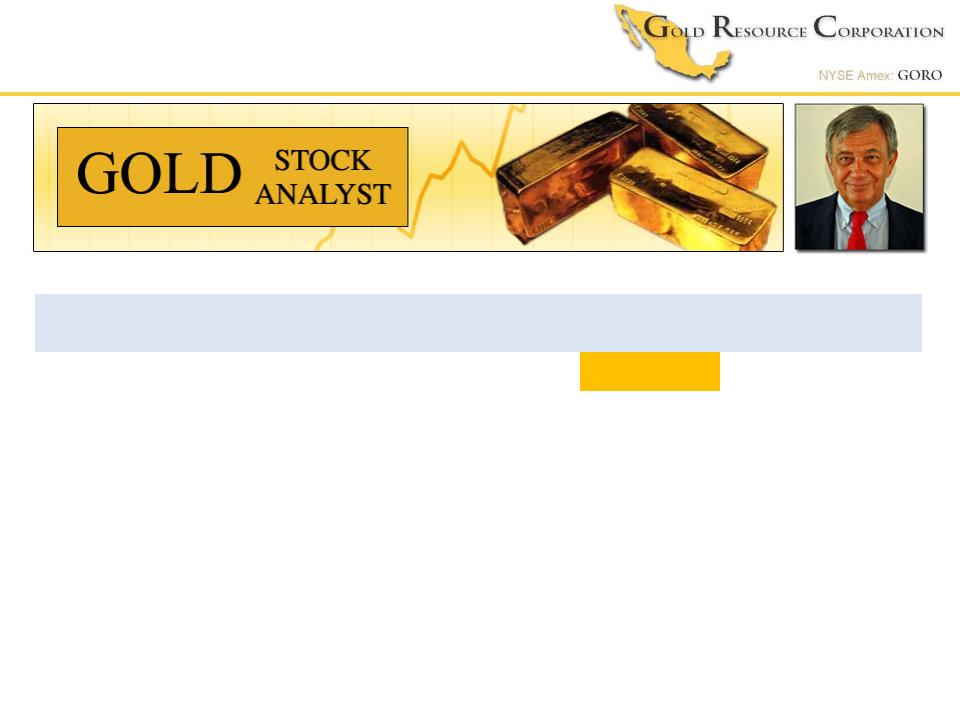

Formal Resource Report

NYSE Amex Listing

“Main Stream” for Institutional Investors

Coverage

(GRC targets, performance not guaranteed, see Risk Factors in Company’s 10K)

“Main Stream” traction

www.goldstockanalyst.com

Gold Stock Analyst newsletter for Professional Investors

Reports on 70+ Gold miners plus the GSA-Top10 newsletter

in mid-month

in mid-month

|

GSA-Top 10 Stocks October 2010

|

||||||

|

Stock

|

US trading

Symbol |

2010

Production

Forecast

|

Last Full

Report |

Mentions Since

Last Full Report Pro /Top10

|

US$ Target

|

Price

Added

US$

|

|

Gold Resource

|

GORO

|

35k

|

Oct-10

|

Apr / -

|

$36

|

Added @ $18.66

|

John C. Doody

(GSA is property of John C. Doody; GORO has been given express written consent for this mention)

“Main Stream” traction

August 31, 2010

|

Company

|

Annual Dividend

Estimate

|

Yield

%

|

Share Price Open

10/18/2010 |

|

Agnico Eagle

|

C$0.18

|

0.3%

|

C$71.96

|

|

Barrick

|

U.S.$0.48

|

1.0%

|

U.S.$47.54

|

|

Goldcorp

|

U.S.$0.18

|

0.4%

|

U.S.$44.45

|

|

Kinross

|

U.S.$0.10

|

0.5%

|

U.S.$18.83

|

|

Newmont

|

U.S.$0.60

|

1.0%

|

U.S.$61.66

|

|

Yamana

|

U.S.$0.08

|

0.7%

|

U.S.$11.11

|

|

Royal Gold

|

U.S.$0.36

|

0.7%

|

U.S.$48.90

|

|

PEER AVERAGE

|

|

0.7%

|

|

|

Source: Based on each company’s annual public filing and Bloomberg.

|

|||

Dividend & Yields

“Main Stream” traction

October 1, 2010

GORO is focused on cash flow and dividends.

The Company is estimating:

The Company is estimating:

~1/3 cash flow for taxes

~1/3 cash flow targeted for growth

~1/3 cash flow targeted to be paid back to

shareholders as dividends

shareholders as dividends

GORO’s 2010 DIVIDEND

|

Commercial Production Announced July 1, 2010

|

|||

|

Special

dividend declared |

Paid or payable

to shareholders of record as of |

Special

dividend amount |

Total Special

Dividends Returned to Shareholders in 2010 |

|

July 29

|

August 16

|

$0.03

|

$0.12

|

|

Aug. 31

|

September 17

|

$0.03

|

|

|

Sept. 30

|

October 15

|

$0.03

|

|

|

Oct. 29

|

November 12

|

$0.03

|

|

|

|

|

|

|

|

|

|

|

|

|

Special dividends should not be considered a prediction or

guarantee of future dividends. Potential special dividends may vary in amount and consistency or be discontinued at management’s discretion depending on variables including but not limited to operational cash flows, Company development requirements and strategies, spot gold and silver prices, taxation, general market conditions and other factors described in the Company’s public filings. |

|||

GORO; Unique Gold Investment

(GRC targets, performance not guaranteed, see Risk Factors in Company’s 10K)

Cash Flow

Become the “Go To” Gold Investment

Dividends

“In Kind”

Growth

Treasury %

in Physical

in Physical

Adding Ounces

Capitalize on

Opportunities

Opportunities

Low Cost

Producer

Producer

The “Go To” Gold Company

(GRC targets, performance not guaranteed, see Risk Factors in Company’s 10K)

The “Go To” Gold Company

(GRC targets, performance not guaranteed, see Risk Factors in Company’s 10K)

Dividends “In Kind”

Design Drafts

Gold Resource

Corporation

“Double Eagle”

Corporation

“Double Eagle”

Exchange NYSE Amex: GORO

Present Capitalization

Shares Outstanding 52,998,303

52 wk Range Low/Hi $7.21-$24.75

Substantial Shareholders

Management ~19%

Hochschild Mining plc ~28%

Tocqueville Asset Management ~8%

Tight Capital Structure

Conclusion

Engineered From Day One To Maximize Shareholder Value

Executed And Built $1B MC Company To Date

Positioned for Aggressive Growth