Attached files

Table of Contents

As filed with the Securities and Exchange Commission on November 3, 2010

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Graham Packaging Company Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 3080 | 52-2076126 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

2401 Pleasant Valley Road

York, Pennsylvania 17402

(717) 849-8500

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

David W. Bullock

2401 Pleasant Valley Road

York, Pennsylvania 17402

(717) 849-8500

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With a copy to:

Richard A. Fenyes, Esq.

Simpson Thacher & Bartlett LLP

425 Lexington Avenue

New York, New York 10017

(212) 455-2000

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ |

Accelerated filer ¨ | Non-accelerated filer x (Do not check if a smaller reporting company) |

Smaller reporting company ¨ |

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Amount to be Registered |

Proposed Maximum Offering Price Per Share (1) |

Proposed Maximum Offering Price (2) |

Amount of Registration Fee | ||||

| Common stock, par value $0.01 per share (1) |

6,507,550 shares | $11.79 | $76,724,015 | $5,471 | ||||

| (1) | This Registration Statement registers 6,507,550, of which 6,298,279 are issuable upon the exchange of an equivalent number of limited partnership units of Graham Packaging Holdings Company (“Holdings”) pursuant to an Exchange Agreement, dated as of February 10, 2010, by and among the registrant, Holdings, Graham Packaging Corporation and GPC Holdings, L.P. This Registration Statement also relates to such additional shares of Common Stock as may be issued with respect to such shares of Common Stock by way of a stock dividend, stock split or similar transaction. |

| (2) | Estimated solely for the purpose of calculating the registration fee under Rule 457(c) of the Securities Act of 1933, as amended (the “Securities Act”), based on the average of high and low prices of the common stock on October 27, 2010, as reported on the New York Stock Exchange. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

SUBJECT TO COMPLETION, DATED NOVEMBER 3, 2010.

The information in this preliminary prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

Graham Packaging Company Inc.

6,507,550 Shares

Common Stock

$ per share

We may issue from time to time up to 6,298,279 shares of our common stock to holders of an equivalent number of limited partnership units of Graham Packaging Holdings Company (“Holdings”). The selling stockholders identified in this prospectus may sell up to 209,271 shares of our common stock currently held by them and up to 6,298,279 shares of our common stock that they may receive in exchange for an equivalent number of limited partnership units of Holdings.

In addition to registering shares currently held by the selling stockholders, we are registering the issuance of our common stock to permit holders of limited partnership units of Holdings who exchange their partnership units to sell in the open market or otherwise any of our shares of common stock that they receive upon exchange. However, the registration of our common stock does not necessarily mean that any holders will exchange their Holdings limited partnership units for shares of our common stock. We will not receive any cash proceeds from the issuance of any shares of our common stock upon the exchange of Holdings limited partnership units, but we will receive one Holdings limited partnership unit for each share of common stock that we issue to an exchanging holder. The selling stockholders will receive all of the net cash proceeds from this offering.

Our common stock is listed on the New York Stock Exchange under the symbol “GRM.” The last reported sale price of our common stock on the New York Stock Exchange on November 2, 2010 was $11.87 per share.

Investing in our common stock involves risk. See “Risk Factors” beginning on page 13.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Prospectus dated , 2010.

Table of Contents

You should rely only on the information contained in this prospectus, incorporated by reference into this prospectus, or in any free writing prospectus that we authorize be delivered to you. We and the selling stockholders have not authorized anyone to provide you with additional or different information from that contained in, or incorporated by reference into, this prospectus. If anyone provides you with additional, different or inconsistent information, you should not rely on it. The selling stockholders are not making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. You should assume that the information in this prospectus or incorporated by reference into this prospectus is accurate only as of the date on the front cover, regardless of the time of delivery of this prospectus or of any sale of our common stock. Our business, prospects, financial condition and results of operations may have changed since that date.

| Page | ||||

| 1 | ||||

| 13 | ||||

| 27 | ||||

| 29 | ||||

| 31 | ||||

| 32 | ||||

| 33 | ||||

| 34 | ||||

| 36 | ||||

| 39 | ||||

| 47 | ||||

| 53 | ||||

| 59 | ||||

| Material United States Federal Income and Estate Tax Consequences to Non-U.S. Holders |

61 | |||

| 64 | ||||

| 65 | ||||

| 66 | ||||

| 67 | ||||

| 68 | ||||

This prospectus incorporates by reference important information. You should read the information incorporated by reference before deciding to invest in shares of our common stock and you may obtain this information without charge by following the instructions under “Where You Can Find More Information” appearing elsewhere in this prospectus.

Market data and certain industry forecasts used herein were obtained from internal surveys, market research, publicly available information and industry publications. While we believe that market research, publicly available information and industry publications we use are reliable, we have not independently verified market and industry data from third-party sources. Moreover, while we believe our internal surveys are reliable, they have not been verified by any independent source.

All brand names and trademarks appearing in this prospectus are the property of their respective holders.

i

Table of Contents

This summary highlights certain significant aspects of our business and this offering, but it is not complete and does not contain all of the information that you should consider before making your investment decision. You should carefully read the entire prospectus and the information incorporated by reference into this prospectus, including the information presented under the section entitled “Risk Factors” and the financial data and related notes, before making an investment decision. This summary contains forward-looking statements that involve risks and uncertainties. Our actual results may differ significantly from future results contemplated in the forward-looking statements as a result of factors such as those set forth in “Risk Factors” and “Special Note Regarding Forward-Looking Statements.”

Unless the context otherwise requires, all references herein to “we,” “our,” “us” or “GPC” refer to Graham Packaging Company Inc. and its subsidiaries, including, since our acquisition of Liquid Container, Liquid Container’s Entities and their subsidiaries (as such terms are defined under “—Recent Developments”). All references herein to “Holdings” refer to Graham Packaging Holdings Company and its subsidiaries. All references herein to the “Operating Company” refer to Graham Packaging Company, L.P. and its subsidiaries. All references herein to “Liquid Container” refer to Graham Packaging LC, L.P. (formerly known as Liquid Container L.P.) and its subsidiaries. All references herein to “selling stockholders” refer to the Graham Family (as defined below); Roger M. Prevot; G. Robinson Beeson; Scott G. Booth; William J. Mertens; Robert E. Cochran, Jr.; George Stevens; David W. Cargile and Geoffrey Lu. All references herein to “Blackstone” refer to The Blackstone Group L.P. and its affiliates. All references herein to the “Graham Family” refer to GPC Holdings, L.P.; Graham Alternative Partners I; Graham Capital Company; Graham Engineering Corporation; and their affiliates or other entities controlled by Donald C. Graham and his family. Unless the context otherwise requires, all references herein to the “Board” refer to the board of directors of Graham Packaging Company Inc. All references herein to “on a pro forma basis” or “pro forma” mean after giving effect to the Transactions (as described under “—Recent Developments”).

Our Company

We are a worldwide leader in the design, manufacture and sale of value-added, custom blow molded plastic containers for branded consumer products. We operate in product categories where customers and end users value the technology and innovation that our custom plastic containers offer as an alternative to traditional packaging materials such as glass, metal and paperboard. We selectively pursue opportunities where we can leverage our technology portfolio to continue to drive the trend of conversion to plastic containers from other packaging materials. Our customers include leading multi-national and regional blue-chip consumer product companies that seek customized, sustainable plastic container solutions in diverse and stable end markets, such as the food and beverage and the household consumer products markets. We believe we are well-positioned to meet the evolving needs of our customers who often use our technology to differentiate their products with value-added design and performance characteristics such as smooth-wall panel-less bottles, unique pouring and dispensing features, multilayer bottles incorporating barrier technologies to extend shelf life, and ultra lightweight bottles with “hot-fill” capabilities that allow containers to be filled at high temperatures.

We believe we have the number one market share positions in North America for hot-fill juices, sports drinks/isotonics, yogurt drinks, liquid fabric care, dish detergents, hair care, skin care and certain other products. For the year ended December 31, 2009, approximately 90% of our net sales from continuing operations were realized in these product categories. We do not participate in markets where technology is not a differentiating factor, such as the carbonated soft drink or bottled water markets.

1

Table of Contents

Our value-added products are supported by more than 1,000 issued or pending patents. We strive to provide the highest quality products and services to our customers, while remaining focused on operational excellence and continuous improvement. These priorities help to reduce our customers’ costs, while also maximizing our financial performance and cash flow. As of June 30, 2010, we had a network of 82 manufacturing facilities (and have since acquired a manufacturing facility in Guangzhou, China) through which we supply our customers. Approximately one-third of these 82 manufacturing facilities are located on site at our customers’ plants. The vast majority of our sales are made pursuant to long-term customer contracts that include the pass-through of the cost of plastic resin, as well as mechanisms for the pass-through of certain other manufacturing costs.

Collectively, our product portfolio, technologies, end markets and operations all contribute to our industry-leading margins and strong cash flow.

On September 23, 2010, we acquired the Liquid Container Entities, which we view as strategically important to us. Liquid Container is a custom blow molded plastic container manufacturer based in West Chicago, Illinois, that primarily services food and household product categories. In the food category, Liquid Container produces packaging for peanut butter, mayonnaise, coffee, creamer, cooking oil, nuts, instant drink mixes, and other food items. The household category consists of containers for bleach, laundry detergent, spray cleaners, automotive cleaning products, drain cleaners, and other consumer-based household products. Liquid Container utilizes high density polyethylene (“HDPE”), polyethylene teraphthalate (“PET”), and polypropylene resins to manufacture their containers. Liquid Container employs approximately 1,000 employees in its 14 non-union plants located across the United States. Seven of the plants are “near sites,” operating within a few miles of their customers’ production facilities. For the year ended December 31, 2009, on a pro forma basis for the Transactions, we would have generated net sales of approximately $2,626.5 million.

Our Markets

We supply plastic containers to a significant number of end markets and geographies. Our products provide differentiated packaging for consumer products that help address basic needs such as nutrition, hygiene and home care. The end markets we supply are generally characterized by stable, long-term demand trends that are relatively insulated from economic cycles.

In our food and beverage product category, which represented 61.0% of our net sales from continuing operations for the year ended December 31, 2009, we produce containers for a broad array of end markets that have accepted plastic as the preferred packaging material, such as the markets for juices and juice drinks, yogurt drinks, teas, sports drinks/isotonics and vitamin enhanced waters, as well as snacks, liquor, toppings, jellies and jams. Based on our knowledge and experience in the industry, our focus on markets which are likely to convert to plastic and the technology and innovation we bring to our customers and our current market position, we believe we are strategically positioned to benefit from the considerable market opportunity that remains in categories yet to convert, or that are in the early stages of conversion, to plastic containers, including beer, sauces, salsas and nutritional products.

In addition, we supply the household, personal care/specialty and automotive lubricants product categories, which represented 18.6%, 7.6% and 12.8%, respectively, of our net sales from continuing operations for the year ended December 31, 2009. We produce containers for liquid fabric care, dish care, hard-surface cleaners, hair care, skin care and oral care products, as well as automotive lubricants.

For the year ended December 31, 2009, we generated approximately 86% of our net sales from continuing operations in North America. We have a meaningful international presence, and we expect to continue to grow alongside our multi-national customers as they expand into new geographies. We are well-positioned through our existing international locations, customer partnerships and joint ventures to take advantage of emerging demand

2

Table of Contents

trends in markets such as Latin America, Eastern Europe, India and the rest of Asia. These markets offer compelling opportunities for our custom plastic containers due to changing consumption patterns, increasing penetration rates of packaged goods and emerging consumer bases.

Our Strengths

Global Leader in the Value-Added Plastic Packaging Market. We believe we are one of the few companies that can provide value-added custom plastic containers on a global scale, manufactured from a variety of resins. For the year ended December 31, 2009, approximately 90% of our net sales from continuing operations were realized in our custom product categories. We have deliberately focused our technologies and assets on key custom markets that tend to support higher global growth and margins. We believe we have the leading domestic market position for custom plastic containers for juice, beer, yogurt drinks, frozen concentrate and pasta sauce and the leading position in Europe for custom plastic containers for yogurt drinks. In addition, we have grown internationally alongside our multi-national consumer product customers. Our proven business model positions us to benefit from the continued growth of our existing consumer product customers in international markets where we anticipate significant demand for plastic containers.

Strategically Positioned to Benefit from Secular Trends in Packaging. We believe we are a leader in the conversion to plastic containers for many major product categories such as shelf-stable, chilled and frozen concentrate juices, beer, food products, energy drinks and ready-to-drink teas. The conversion to plastic containers from other packaging materials has been accelerated by technological advancements, changing consumer preferences and an increased focus on lightweight, sustainable packaging. The advantages of plastic containers, such as shatter resistance, reduced shipping weight, ease of opening and dispensing and resealability, have established plastic as the packaging material of choice on a global basis. We believe we are well positioned to use our technology to help drive the conversion in categories yet to convert, or that are in the early stages of conversion, to plastic containers.

Stable, Long-Term Customer Relationships. We have enjoyed long-standing relationships with our largest and most important customers due to our technology, innovation, product quality and our ability to reduce our customers’ packaging costs. The majority of these customers are under long-term contracts and have been doing business with us, on average, for over 20 years. We believe we have helped establish the branding for many of our top customers, and in some cases, we are the sole source provider in multiple geographies. These efforts have led to awards from several of our major customers, including Heinz Supplier of the Year (2006, 2007, 2008 and 2009), 2008 Anheuser Busch Select Supplier, 2007 Dannon Supplier of the Year, 2005 Miller Beer Supplier of the Year and 2008 Abbott Supplier Excellence Award.

Superior Technology with Long History of Innovation. We use technology and innovation to drive conversions, as well as to deliver solutions that meet our customers’ needs for new designs, product performance requirements, cost management and sustainability. We have demonstrated significant success in designing plastic containers that include customized features such as smooth-wall panel-less bottles, complex shapes, reduced weight, handles, grips, view stripes, pouring features and graphic-intensive customized labeling. Our products must often meet specialized performance and structural requirements, such as hot-fill capability, recycled material usage, oxygen and carbon dioxide barriers, flavor protection and multi-layering. Our strong design capabilities have been especially important to our customers, who generally use packaging to differentiate and add value to their brands, which enable them to spend less on promotion and advertising. We have filed for over 1,000 patents over the past five years for our design and functional package innovations.

“On-Site” Model Provides Stability and Global Opportunities. Approximately one third of our 82 manufacturing facilities are located “on-site” at our customers’ plants. Our on-site plants enable us to work closely with our customers, reducing working capital needs through just-in-time inventory management,

3

Table of Contents

generating significant savings opportunities through process re-engineering and eliminating freight and warehouse expenses. In many cases, our on-site operations are integrated with our customers’ manufacturing operations, so our products are delivered by direct conveyance to the customers’ filling lines. As our customers expand globally, our on-site model offers us opportunities to expand alongside our customers in attractive, high-growth markets, while minimizing our investment risk.

Leader in Sustainability. We have emerged as a leader in sustainability initiatives within the packaging industry. We believe we are the only provider of 100% post-consumer resin (“PCR”) containers for food and juice applications. Our product design capabilities capitalize on the inherent benefits of plastic to produce lightweight bottles that help our customers reduce material usage, lower container weight, save freight costs and improve product-to-package ratios. Our on-site business model also helps eliminate unnecessary freight costs by providing a product source close to our customers, as well as helping to synchronize demand planning with our customers’ plants to further reduce inefficiency. We also provide PCR as a resin source alternative for our customers and produce PCR ourselves at our Graham Recycling Plant in York, Pennsylvania.

Focus on Operational Excellence. We strive to provide the highest quality products to our customers, while continually eliminating inefficiency and reducing costs. We are committed to improve productivity and reduce non-value-added activities and costs in our production processes, purchasing activities, selling, general and administrative expenses, capital expenditures and working capital. For example, from January 1, 2006, through June 30, 2010, we closed or merged several plants that did not meet our internal performance criteria; we implemented information systems to analyze customer profitability and drove subsequent improvement actions and exited certain relationships; we centralized nearly all procurement activities; and we benchmarked and subsequently reduced selling, general and administrative expenses. We utilize our Graham Performance System, a bi-weekly performance management review of our continuous improvement process, where we measure performance and track progress on initiatives relating to safety, quality, productivity, capital expenditures, working capital and other actions leading to improved financial performance. Overall, we have a strong pipeline of specific cost reduction opportunities, which we intend to implement to optimize our cost structure.

Attractive, Stable Margins and Strong Cash Flow Generation. Our strong profit margins, combined with our disciplined approach to capital expenditures, focus on higher margin business opportunities and stringent working capital management, enable us to generate strong and recurring cash flow. The stability of our margins is enhanced by the pass-through of the cost of resin to customers by means of corresponding changes in product pricing. For the six months ended June 30, 2010, we generated $99.2 million in cash flow from operations, which reduced our net debt (total outstanding indebtedness net of cash and cash equivalents) and enabled us to make strategic investments in our business. We also have, and will have following the Transactions, a very strong liquidity position with $127.4 million of cash and cash equivalents as of June 30, 2010 on a pro forma basis for the Transactions and significant availability under our senior secured revolving credit facility. Additionally, the majority of our indebtedness, on a pro forma basis after giving effect to the Transactions, matures in 2014 and beyond. In addition, our cash taxes are minimized by net operating losses and other tax assets. We believe our strong financial position allows us to serve our customers effectively and pursue our strategic plan of stable and profitable growth while maximizing cash flow, reducing financial leverage and increasing stockholder returns.

Experienced Management Team with Meaningful Equity Incentives. We have recruited a world-class management team that has successfully executed on transformational company initiatives over the past three years. Their achievements include: increasing our gross margin; decreasing our selling, general and administrative expenses; reducing our annual capital expenditures; generating improved cash flow; reducing our financial leverage; improving our return on capital employed; executing our sustainability initiatives; and expanding our business in high-growth markets, including India and China. Our senior managers are meaningfully invested in our performance, which gives them an ongoing stake in the creation of stockholder value. After giving effect to the offering contemplated in this prospectus, management currently owns approximately 2.0% of our common stock on a fully diluted basis.

4

Table of Contents

Our Strategy

We intend to capitalize on our leadership positions in value-added custom plastic containers to increase our earnings before interest, taxes, depreciation and amortization (“EBITDA”) and cash flow in order to reduce our financial leverage and increase stockholder return. We seek to achieve this objective by pursuing the following strategies:

Manage our Business for Stable Growth and Strong Cash Flow Generation. We primarily serve the food and beverage and the household consumer products markets, which tend to be relatively stable due to the underlying demand characteristics of these markets. We will continue to manage our business for growth that meets our disciplined financial performance criteria. We plan to continue to generate cash flow through EBITDA growth and disciplined capital expenditure and working capital management. Our stable growth and strong cash flow will allow us to reduce our financial leverage and increase stockholder return.

Leverage Our Technology Portfolio to Meet the Needs of Our Customers. Most of our customers use packaging to differentiate their products in order to improve their profit margins and market share. We plan to build on our track record of delivering innovations that add value through differentiated shapes and features, and technologies that provide specialized performance and structural attributes. We will also continue to build on our long history of success in meeting the evolving sustainability needs of our customers including reduced raw material content (lightweighting) and increased use of recycled content.

Targeted Organic Growth in Attractive Markets Utilizing Our Proven Business Model. We intend to drive conversions to plastic packaging in markets such as beer, sauces, salsas and nutritional products. These markets allow us to grow through the deployment of our proven technologies to new applications which can often result in new on-site opportunities. We will also seek opportunities in new markets, including high-growth emerging markets such as Latin America, Eastern Europe, India and the rest of Asia. These markets offer compelling opportunities for our custom plastic containers due to changing consumption patterns, increasing penetration rates of packaged goods and emerging consumer bases.

Continue to Focus on Operational Excellence. Our goal is to be the highest quality, most cost-effective provider of value-added custom plastic containers in our markets. We believe we have established a track record of implementing operational improvements and building a lean operating and overhead structure. We intend to focus on further cost reductions through continuous improvement initiatives, leveraging our design and process technology and maintaining our rigorous operational management systems. We believe our focus on operational improvement will continue to drive customer quality, capital efficiency, cash flow and ultimately return on capital employed.

Supplement Organic Growth with Opportunistic and Accretive Strategic Investments. In addition to our primary organic growth strategy, we plan to consider selective investments, joint ventures and strategic acquisitions to supplement our growth objectives. We intend to focus on disciplined and accretive investments that leverage our core strengths in custom plastic containers and enhance our current product, market, geography and customer strategies.

Liquid Container Acquisition Strategy

Liquid Container represents a strategically important acquisition for us as it expands our customer reach within our existing food and consumer products end markets while providing us with additional technological capabilities and an expansion of our geographical reach.

5

Table of Contents

Customer Expansion within Existing End Markets. The Liquid Container Acquisition will significantly increase the size and scope of our operations, particularly in the food category (which represents approximately 76% of Liquid Container’s unit sales volume) and provide us with considerable opportunities to convert new products to plastic containers. At the same time, we believe that the Liquid Container Acquisition will introduce us to new customers, particularly in the smaller-sized branded consumer products company space. Liquid Containers’ top five customers, who comprised approximately $186 million, or 52%, of their sales in 2009, purchased only $3 million from us, which is less than 1% of our 2009 net sales, providing us with the opportunity to cross-sell to each other’s customers.

Access to New Technologies. Liquid Container has been a leader in custom blow molded plastic containers used in cold fill applications (peanut butter, mayonnaise, coffee, and creamer) as well as has new hot-fill technologies (ThermaSetTM ), which complement ours, and we believe can help drive new conversions. Additionally, we believe that Liquid Container’s process and operational expertise, combined with ours, can create additional efficiencies across the combined manufacturing footprint.

Geographical Expansion. Liquid Container’s 14 plants are located in the U.S. and bring us additional manufacturing capacity in regions where our business lacks a robust footprint. In particular, Liquid Container has two plants in California and three in the southern U.S., as well as some additional capacity on the East Coast, that can provide a base for future production. While Liquid Container has been focused solely on the U.S. market, their key customers do have multinational presence. We believe there is an opportunity to service those customers’ international operations with our existing footprint, especially in Latin America.

Similar Attractive Financial Profile. Liquid Container has strong, long-term customer relationships, serving consumer staple markets in the food and household categories. Similar to us, Liquid Container uses technology and operational excellence to serve their customer base with innovation and cost effective packaging solutions. Liquid Container has resin pass through mechanisms in the majority of their contracts, helping to further stabilize margins from resin commodity price swings. Liquid Container’s strong profit margins and disciplined capital spending have led to strong cash flow generation.

Opportunity for Cost Savings. We believe the combined purchasing power can yield savings in freight, energy, outside services, leased equipment, and miscellaneous raw materials such as packaging, pallets, shrink wrap, and spare parts. We also believe we can gain operating efficiencies at Liquid Container’s facilities by implementing projects from our Graham Performance System continuous improvement process. These projects range from energy and air compression audits to outside warehousing, material handling efficiencies, and line speed improvements. Additionally, we believe we can eliminate overlapping corporate functions and expenses.

Risks Related to Our Business, Our Indebtedness and this Offering

Before you invest in our common stock, you should be aware that there are various risks related to, among other things: competition; development of product innovations; protection of proprietary technology; reliance on our largest customers; decreases in customer purchase amounts; increases in resin prices or decreases in resin supply; foreign currency fluctuations; local laws in several countries; asset impairment charges; goodwill impairment charges; our dependence on key personnel; new acquisitions; labor relations; our dependence on blow molding equipment; environmental costs and liabilities; risks associated with being deemed an “investment company;” difficulties in profit generation; our substantial leverage; the possibility that we may incur additional leverage; restrictive covenants in our debt agreements; inability to renew or replace our debt on favorable terms or at all; the possibility of default under our credit agreement if a change of control occurs; the volatility of the market price of our common stock; sales of additional common stock or Holdings limited partnership units by existing owners; payments of certain tax benefits attributable to our existing owners; that we are dependent on

6

Table of Contents

Holdings for distributions; the possibility that we may not pay cash dividends; anti-takeover provisions; the control of our company by Blackstone; and being a “controlled company” under New York Stock Exchange rules. For more information about these and other risks, please read “Risk Factors.” You should carefully consider these risk factors together with all of the other information in this prospectus or incorporated by reference into this prospectus.

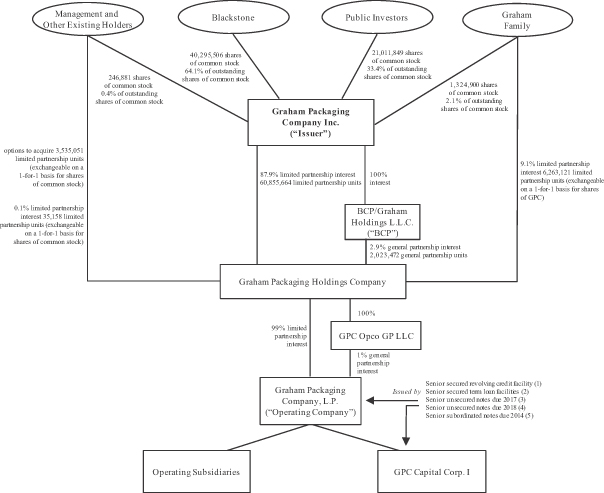

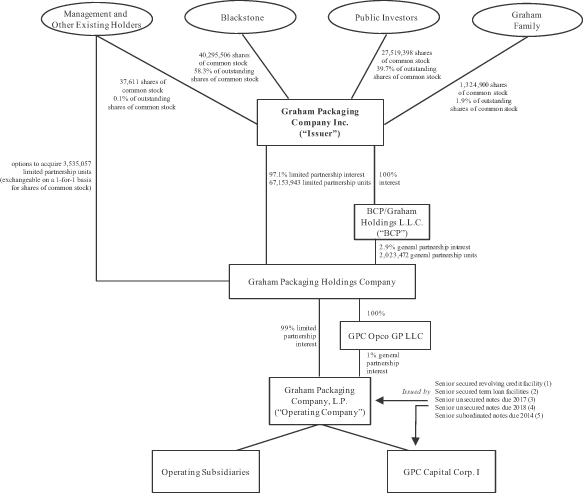

Corporate History and Information

We were incorporated in Delaware under the name “BMP/Graham Holdings Corporation” on November 5, 1997 in connection with the recapitalization transaction in which Blackstone, management and other investors became the indirect holders of 85.0% of the partnership interests of Holdings, which was completed on February 2, 1998. We are a holding company whose only material assets are the direct ownership of an 87.9% limited partnership interest in Holdings and 100% of the limited liability company interests of BCP/Graham Holdings L.L.C. (“BCP”), which holds a 2.9% general partnership interest in Holdings. We changed our name to “Graham Packaging Company Inc.” on December 10, 2009. We completed the initial public offering of our common stock on February 17, 2010, in which we issued 16,666,667 common shares and raised net proceeds of approximately $150.0 million. On March 16, 2010, we completed the sale of additional 1,565,600 common shares offered to the underwriters and received approximately $14.7 million of net proceeds. Our common stock is listed on the New York Stock Exchange and is traded under the symbol “GRM.”

The predecessor to Holdings, controlled by the predecessors of the Graham Family, was formed in the mid-1970s as a regional domestic custom plastic container supplier. Holdings was formed under the name “Sonoco Graham Company” on April 3, 1989, as a Pennsylvania limited partnership. It changed its name to “Graham Packaging Company” on March 28, 1991, and to “Graham Packaging Holdings Company” on February 2, 1998. The primary business activity of Holdings is its direct and indirect ownership of 100% of the partnership interests in the Operating Company. The Operating Company was formed under the name “Graham Packaging Holdings I, L.P.” on September 21, 1994, as a Delaware limited partnership and changed its name to “Graham Packaging Company, L.P.” on February 2, 1998, in connection with the 1998 recapitalization. On October 7, 2004, we acquired the blow molded plastic container business of Owens-Illinois, Inc. (“O-I Plastic”), which essentially doubled our size. Our operations have included the operations of O-I Plastic since the acquisition date.

Our principal executive offices are located at 2401 Pleasant Valley Road, York, Pennsylvania 17402, telephone (717) 849-8500. We and Holdings file annual, quarterly and current reports and other information with the Securities and Exchange Commission (the “SEC”). Those filings with the SEC are, and will continue to be, available to the public on the SEC’s website at http://www.sec.gov. Those filings are, and will continue to be, also available to the public on, or accessible through, our corporate web site at http:/www.grahampackaging.com. The information contained on our website or that can be accessed through our website neither constitutes part of this prospectus nor is incorporated by reference into this prospectus.

7

Table of Contents

Recent Developments

On July 1, 2010, we acquired China Roots Packaging PTE Ltd. (“China Roots”), a plastic container manufacturing company located in Guangzhou, China. We had previously signed a Share Purchase Agreement to acquire from PCCS Group Berhad, a Malaysian company, 100% of the shares of Roots Investment Holding Private Limited, which is the sole equity holder of China Roots. China Roots manufactures plastic containers and closures for food, health care, personal care and petrochemical products. Its customers include several global consumer product marketers. In 2009, China Roots’ sales were approximately $16.3 million.

On September 23, 2010, we acquired the Liquid Container Entities (as defined below) from each of Liquid Container’s limited partners (the “Liquid Container Limited Partners”) and each of the stockholders (the “Stockholders”) of (i) Liquid Container Inc. (the “Liquid Container Managing General Partner”), a Delaware corporation, (ii) CPG-L Holdings, Inc. (“CPG”), a Delaware corporation, and (iii) WCK-L Holdings, Inc. (“WCK” and, together with the Liquid Container Managing General Partner and CPG, the “Liquid Container General Partners”), a Delaware corporation. Liquid Container and the Liquid Container General Partners are collectively referred to as the “Liquid Container Entities.” We purchased all the shares from the Stockholders and all of the limited partnership units from the Liquid Container Limited Partners (collectively, the “Liquid Container Acquisition”) for a purchase price of $568.0 million plus cash on hand, minus certain indebtedness and including a preliminary net working capital adjustment.

In connection with the Liquid Container Acquisition, on September 23, 2010, we issued the 8.25% senior notes due 2018 in the aggregate amount of $250.0 million (the “2018 Senior Notes”).

On September 23, 2010, we also entered into a new $913.1 million aggregate principal amount term loan facility under our existing senior secured credit agreement (“Term Loan D”). The Term Loan D will mature on the earliest of (i) September 23, 2016, (ii) the date that is 91 days prior to the maturity of our 8.25% senior notes due January 2017 if such senior notes have not been repaid or refinanced in full by such date or (iii) the date that is 91 days prior to the maturity of our 9.875% senior subordinated notes due October 2014 if such senior notes have not been repaid or refinanced in full by such date. The Term Loan D was issued with a $6.8 million offering discount. We used $347.4 million borrowed under the Term Loan D to finance the Liquid Container Acquisition and $558.9 million, plus existing cash, to repay in full the amount outstanding under the Term Loan B of our senior secured credit agreement (the “Refinancing”).

In connection with the Liquid Container Acquisition, we were also required to pay existing indebtedness of the Liquid Container Entities, including accrued interest, then outstanding, in the amount of approximately $193.7 million. Of this amount, approximately $7.1 million remains outstanding and will be repaid in the fourth quarter of 2010.

The Liquid Container Acquisition, the related borrowings under the Term Loan D, the issuance of the 2018 Senior Notes, the repayment of the Liquid Container Entities’ existing indebtedness, the Refinancing and the payment of related fees and expenses are collectively referred to in this prospectus as the “Transactions.”

8

Table of Contents

The Offering

| Common stock issued by us and offered by the selling stockholders |

Up to 6,507,550 shares of our common stock may be offered by the selling stockholders, of which 6,298,279 are issuable by us to the selling stockholders upon the exchange of an equivalent number of limited partnership units of Holdings. |

| Common stock outstanding immediately after this offering |

69,177,415 shares, assuming the exchange of 6,298,279 limited partnership units of Holdings for 6,298,279 of shares of our common stock. |

| Use of proceeds |

The selling stockholders will receive all net cash proceeds from the sale of the shares of our common stock in this offering. We will not receive any cash proceeds from the issuance of shares of our common pursuant to this prospectus, but we will receive one Holdings limited partnership unit for each share of common stock that we issue to an exchanging holder. |

| Dividend policy |

We currently expect to retain future earnings, if any, for use in the operation and expansion of our business and in the repayment of our debt and do not anticipate paying any cash dividends in the foreseeable future. Our ability to pay dividends on our common stock is limited by the covenants of our senior secured credit agreement and indentures and may be further restricted by the terms of any future debt or preferred securities. See “Dividend Policy” and “Description of Indebtedness.” |

| NYSE ticker symbol |

“GRM” |

9

Table of Contents

SUMMARY FINANCIAL DATA

The following tables set forth our summary historical consolidated financial data for and at the end of each of the years in the five-year period ended December 31, 2009, and for the six-month periods ended June 30, 2009 and 2010, respectively.

The summary consolidated statement of operations data and the summary consolidated cash flow data for the years ended December 31, 2007, 2008 and 2009 and the summary consolidated balance sheet data as of December 31, 2008 and 2009 have been derived from our audited consolidated financial statements included in reports incorporated herein by reference. The summary consolidated statement of operations data and the summary consolidated cash flow data for the year ended December 31, 2006, and the summary consolidated balance sheet data as of December 31, 2007, presented below, have been derived from our audited consolidated financial statements not incorporated herein by reference. The summary consolidated statement of operations data and the summary consolidated cash flow data for the year ended December 31, 2005, and the summary consolidated balance sheet data as of December 31, 2005 and 2006, presented below, are unaudited.

The summary consolidated financial data as of and for the six-month periods ended June 30, 2009 and 2010, have been derived from unaudited consolidated financial statements included in reports incorporated herein by reference. In the opinion of management, these unaudited consolidated financial statements include all adjustments, consisting only of usual recurring adjustments, necessary for fair presentation of such data. The results of operations for the interim periods are not necessarily indicative of the results to be expected for the full year or any future period.

The information in the following tables gives effect to the 1,465.4874-for-one stock split of our common stock which occurred on February 4, 2010.

On November 12, 2009, the Company paid 2.3 million euros (approximately $3.5 million) to sell all of the shares of its wholly-owned subsidiary Graham Emballages Plastiques S.A.S., located in Meaux, France, to an independent third party. The Company’s exit from this location was due to its failure to meet internal financial performance criteria. The Company determined that the results of operations for this location, which had previously been reported in the Europe segment, would be reported as discontinued operations, in accordance with the guidance under Accounting Standards Codification (“ASC”) 205-20, “Discontinued Operations.” The Company’s consolidated statements of operations have been restated to reflect these discontinued operations. Accordingly, the selected financial data below, unless otherwise indicated, is based on results from continuing operations.

The following tables are qualified in their entirety by, and should be read in conjunction with, the information under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2009 and our Quarterly Report on Form 10-Q for the quarter ended June 30, 2010, which are incorporated herein by reference, and the historical financial statements and related notes included in reports incorporated herein by reference.

10

Table of Contents

| Year Ended December 31, | Six Months Ended June 30, |

|||||||||||||||||||||||||||

| 2005 | 2006 | 2007 | 2008 | 2009 | 2009 | 2010 | ||||||||||||||||||||||

| (Unaudited) | (In millions) | (Unaudited) | ||||||||||||||||||||||||||

| STATEMENT OF OPERATIONS DATA: |

||||||||||||||||||||||||||||

| Net sales (1) |

$ | 2,447.8 | $ | 2,500.4 | $ | 2,470.9 | $ | 2,559.0 | $ | 2,271.0 | $ | 1,147.6 | $ | 1,238.4 | ||||||||||||||

| Cost of goods sold (1) |

2,153.3 | 2,212.3 | 2,129.4 | 2,183.3 | 1,866.6 | 941.3 | 1,015.5 | |||||||||||||||||||||

| Gross profit (1) |

294.5 | 288.1 | 341.5 | 375.7 | 404.4 | 206.3 | 222.9 | |||||||||||||||||||||

| Selling, general and administrative expenses |

127.2 | 131.3 | 136.2 | 127.6 | 122.4 | 57.5 | 95.9 | |||||||||||||||||||||

| Asset impairment charges (2) |

7.0 | 25.9 | 157.7 | 96.1 | 41.8 | 8.0 | 2.8 | |||||||||||||||||||||

| Net loss on disposal of fixed assets |

13.7 | 14.3 | 19.5 | 6.8 | 6.5 | 2.3 | 1.0 | |||||||||||||||||||||

| Operating income |

146.6 | 116.6 | 28.1 | 145.2 | 233.7 | 138.5 | 123.2 | |||||||||||||||||||||

| Interest expense |

184.7 | 205.3 | 205.9 | 180.0 | 176.9 | 76.9 | 87.3 | |||||||||||||||||||||

| Interest income |

(0.6 | ) | (0.6 | ) | (0.9 | ) | (0.8 | ) | (1.1 | ) | (0.5 | ) | (0.3 | ) | ||||||||||||||

| Net loss (gain) on debt extinguishment (3) |

— | 2.1 | 4.5 | — | 8.7 | (0.8 | ) | 2.7 | ||||||||||||||||||||

| Increase in income tax receivable agreements |

— | — | — | — | — | — | 4.9 | |||||||||||||||||||||

| Other expense (income), net |

1.0 | 2.2 | 2.0 | 0.4 | (1.6 | ) | (1.5 | ) | 3.2 | |||||||||||||||||||

| Income tax provision |

14.4 | 27.5 | 20.3 | 13.0 | 27.0 | 12.7 | 12.1 | |||||||||||||||||||||

| (Loss) income from continuing operations |

(52.9 | ) | (119.9 | ) | (203.7 | ) | (47.4 | ) | 23.8 | 51.7 | 13.3 | |||||||||||||||||

| Loss from discontinued operations |

(0.6 | ) | (1.1 | ) | (3.7 | ) | (10.5 | ) | (9.5 | ) | (1.8 | ) | — | |||||||||||||||

| Net (loss) income |

(53.5 | ) | (121.0 | ) | (207.4 | ) | (57.9 | ) | 14.3 | 49.9 | 13.3 | |||||||||||||||||

| Net income attributable to noncontrolling interests (4) |

— | — | — | — | 3.2 | 8.1 | 2.0 | |||||||||||||||||||||

| Net income (loss) attributable to Graham Packaging Company Inc. stockholders |

$ | (53.5 | ) | $ | (121.0 | ) | $ | (207.4 | ) | $ | (57.9 | ) | $ | 11.1 | $ | 41.8 | $ | 11.3 | ||||||||||

| Year Ended December 31, | Six Months Ended June 30, |

|||||||||||||||||||||||||||

| 2005 | 2006 | 2007 | 2008 | 2009 | 2009 | 2010 | ||||||||||||||||||||||

| (Unaudited) | (Unaudited) | |||||||||||||||||||||||||||

| EARNINGS PER SHARE (4): |

||||||||||||||||||||||||||||

| (Loss) income from continuing operations per share: |

||||||||||||||||||||||||||||

| Basic |

$(1.23 | ) | $(2.79 | ) | $(4.74 | ) | $(1.10 | ) | $0.45 | $1.01 | $0.20 | |||||||||||||||||

| Diluted |

$(1.23 | ) | $(2.79 | ) | $(4.74 | ) | $(1.10 | ) | $0.44 | $1.01 | $0.19 | |||||||||||||||||

| Loss from discontinued operations per share: |

||||||||||||||||||||||||||||

| Basic |

$(0.02 | ) | $(0.03 | ) | $(0.09 | ) | $(0.25 | ) | $(0.19 | ) | $(0.04 | ) | $— | |||||||||||||||

| Diluted |

$(0.02 | ) | $(0.03 | ) | $(0.09 | ) | $(0.25 | ) | $(0.19 | ) | $(0.04 | ) | $— | |||||||||||||||

| Net (loss) income attributable to Graham Packaging Company Inc. stockholders per share: |

||||||||||||||||||||||||||||

| Basic |

$(1.25 | ) | $(2.82 | ) | $(4.83 | ) | $(1.35 | ) | $0.26 | $0.97 | $0.20 | |||||||||||||||||

| Diluted |

$(1.25 | ) | $(2.82 | ) | $(4.83 | ) | $(1.35 | ) | $0.25 | $0.97 | $0.19 | |||||||||||||||||

| Weighted average shares outstanding: |

||||||||||||||||||||||||||||

| Basic |

42,975,419 | 42,975,419 | 42,975,419 | 42,975,419 | 42,981,204 | 42,975,419 | 57,780,042 | |||||||||||||||||||||

| Diluted |

42,975,419 | 42,975,419 | 42,975,419 | 42,975,419 | 42,985,179 | 42,975,419 | 57,780,042 | |||||||||||||||||||||

11

Table of Contents

| Year Ended December 31, | Six Months Ended June 30, |

|||||||||||||||||||||||||||

| 2005 | 2006 | 2007 | 2008 | 2009 | 2009 | 2010 | ||||||||||||||||||||||

| (Unaudited) | (Dollars in millions) | (Unaudited) | ||||||||||||||||||||||||||

| BALANCE SHEET DATA (at period end): |

||||||||||||||||||||||||||||

| Cash and cash equivalents |

$ | 26.7 | $ | 13.3 | $ | 18.3 | $ | 43.9 | $ | 147.8 | $ | 148.9 | $ | 136.1 | ||||||||||||||

| Working capital (6) |

249.2 | 158.4 | 186.2 | 190.3 | 120.1 | 99.3 | 126.9 | |||||||||||||||||||||

| Total assets |

2,707.1 | 2,586.0 | 2,377.3 | 2,149.8 | 2,126.3 | 2,192.3 | 2,096.9 | |||||||||||||||||||||

| Total debt (7) |

2,638.3 | 2,546.9 | 2,534.3 | 2,499.2 | 2,436.9 | 2,444.8 | 2,240.8 | |||||||||||||||||||||

| Equity (deficit) |

(350.2 | ) | (454.9 | ) | (645.8 | ) | (818.4 | ) | (763.1 | ) | (758.5 | ) | (612.2 | ) | ||||||||||||||

| OTHER DATA: |

||||||||||||||||||||||||||||

| Cash flow provided by (used in) (5): |

||||||||||||||||||||||||||||

| Operating activities |

$ | 120.0 | $ | 263.0 | $ | 174.2 | $ | 211.2 | $ | 325.5 | $ | 218.1 | $ | 99.2 | ||||||||||||||

| Investing activities |

(261.4 | ) | (172.4 | ) | (149.1 | ) | (144.4 | ) | (150.5 | ) | (71.2 | ) | (75.7 | ) | ||||||||||||||

| Financing activities |

147.9 | (104.6 | ) | (23.2 | ) | (33.6 | ) | (73.9 | ) | (42.8 | ) | (33.0 | ) | |||||||||||||||

| Depreciation and amortization (8) |

201.9 | 206.1 | 203.7 | 177.8 | 159.4 | 80.0 | 77.6 | |||||||||||||||||||||

| (1) | Net sales and Cost of goods sold increase or decrease based on fluctuations in resin prices. Consistent with industry practice and as permitted under agreements with our customers, resin price changes are passed through to customers by means of corresponding changes in product pricing. Net sales and cost of goods sold are also impacted by changes in exchange rates and other factors, as further described in “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Results of Operations” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2009 and our Quarterly Report on Form 10-Q for the quarter ended June 30, 2010, which are incorporated by reference into this prospectus. |

| (2) | We evaluated the recoverability of our long-lived tangible and intangible assets in selected locations, due to indicators of impairment, and recorded impairment charges of $6.6 million, $14.2 million, $156.6 million, $94.7 million, $41.8 million, $8.0 million and $6.5 million for the years ended December 31, 2005, 2006, 2007, 2008 and 2009 and for the six months ended June 30, 2009 and 2010, respectively. Goodwill is reviewed for impairment on at least an annual basis. The resulting impairment charges recognized were $0.4 million, $11.7 million, $1.1 million and $1.4 million for the years ended December 31, 2005, 2006, 2007 and 2008, respectively. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Results of Operations” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2009 and our Quarterly Report on Form 10-Q for the quarter ended June 30, 2010, which are incorporated by reference into this prospectus, for a further discussion. |

| (3) | Reclassifications have been made from interest expense to reflect as a separate line the net loss on debt extinguishment for all periods presented. |

| (4) | Earnings per share is calculated based on amounts attributable to Graham Packaging Company Inc. stockholders and excludes amounts attributable to noncontrolling interests. Net income attributable to noncontrolling interests consists of $4.6 million of income related to continuing operations and $1.4 million of loss related to discontinued operations for the year ended December 31, 2009. |

| (5) | Includes both continuing and discontinued operations. |

| (6) | Working capital is defined as current assets, less cash and cash equivalents, minus current liabilities, less current maturities of long-term debt. |

| (7) | Total debt includes capital lease obligations and current portion of long-term debt. |

| (8) | Depreciation and amortization includes continuing and discontinued operations, and excludes asset impairment charges and amortization of debt issuance fees, which is included in interest expense. |

12

Table of Contents

An investment in our common stock involves risk. You should carefully consider the following risks as well as the other information included in this prospectus or incorporated herein by reference, including “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2009 and our Quarterly Report on Form 10-Q for the quarter ended June 30, 2010, and our financial statements and related notes, included in reports incorporated herein by reference, before investing in our common stock. If any of the events described below actually occurred, it could materially and adversely affect our business, financial condition or results of operations. In such a case, the trading price of the common stock could decline and you may lose all or part of your investment in our company.

Risks Related to Our Business

We may not be able to successfully integrate Liquid Container, or other businesses we may acquire in the future, and we may not be able to realize anticipated cost savings, revenue enhancements or other synergies from such acquisitions.

Our ability to successfully implement our business plan and achieve targeted financial results depends on our ability to successfully integrate Liquid Container or other businesses we may acquire in the future. The process of integrating Liquid Container, or any other acquired businesses, involves risks. These risks include, but are not limited to:

| • | demands on management related to the significant increase in the size of our business; |

| • | diversion of management’s attention from the management of daily operations; |

| • | difficulties in conforming the acquired business’ accounting principles to ours; |

| • | retaining the loyalty and business of the customers of the acquired businesses; |

| • | retaining employees that may be vital to the integration of departments, information technology systems, including accounting systems, technologies, books and records, and procedures, and maintaining uniform standards, such as internal accounting controls and procedures, and policies; and |

| • | costs and expenses associated with any undisclosed or potential liabilities. |

Failure to successfully integrate Liquid Container, or any other acquired businesses, may result in reduced levels of revenue, earnings or operating efficiency that might have been achieved if we had not acquired such businesses.

In addition, the Liquid Container Acquisition will result, and any future acquisitions could result, in the incurrence of additional debt and related interest expense, contingent liabilities and amortization expenses related to intangible assets, which could have a material adverse effect on our financial condition, operating results and cash flow.

We may not be able to achieve the estimated future cost savings expected to be realized as a result of the Liquid Container Acquisition or other future acquisitions. Failure to achieve such estimated future cost savings could have an adverse effect on our financial condition and results of operations.

We may not be able to realize anticipated cost savings, revenue enhancements, or other synergies from the Liquid Container Acquisition or other future acquisitions, either in the amount or within the time frame that we expect. In addition, the costs of achieving these benefits may be higher than, and the timing may differ from, what we expect. Our ability to realize anticipated cost savings, synergies, and revenue enhancements may be affected by a number of factors, including, but not limited to, the following:

| • | the use of more cash or other financial resources on integration and implementation activities than we expect; |

13

Table of Contents

| • | increases in other expenses unrelated to the acquisition, which may offset the cost savings and other synergies from the acquisition; |

| • | our ability to eliminate duplicative back office overhead and redundant selling, general and administrative functions, obtain procurement related savings, rationalize our distribution and warehousing networks, rationalize manufacturing capacity and shift production to more economical facilities; and |

| • | our ability to avoid labor disruptions in connection with any integration, particularly in connection with any headcount reduction. |

Specifically, the significant anticipated cost savings and operating cost reductions in respect of the Liquid Container Acquisition reflect estimates and assumptions made by our management as to the benefits and associated expenses and capital spending with respect to our cost savings initiatives, and it is possible that these estimates and assumptions may not reflect actual results. In addition, these estimated cost savings may not actually be achieved in the timeframe anticipated or at all.

If we fail to realize anticipated cost savings, synergies or revenue enhancements, our financial results may be adversely affected, and we may not generate the cash flow from operations that we anticipate.

Our industry is very competitive and increased competition could reduce prices and our profit margins.

We operate in a competitive environment. In the past, we have encountered pricing pressures in our markets and could experience further declines in prices of plastic packaging as a result of competition. Although we have been able over time to partially offset pricing pressures by reducing our cost structure and making the manufacturing process more efficient by providing new and innovative technology, we may not be able to continue to do so in the future. Our business, results of operations and financial condition may be materially and adversely affected by further declines in prices of plastic packaging and such further declines could lead to a loss of business and a decline in our margins.

If we are unable to develop product innovations and improve our production technology and expertise, we could lose customers or market share.

Our success may depend on our ability to adapt to technological changes in the plastic packaging industry. If we are unable to timely develop and introduce new products, or enhance existing products, in response to changing market conditions or customer requirements or demands, our competitiveness could be materially and adversely affected.

We may be unable to protect our proprietary technology from infringement.

We rely on a combination of patents and trademarks, licensing agreements and unpatented proprietary know-how and trade secrets to establish and protect our intellectual property rights. We enter into confidentiality agreements with customers, vendors, employees, consultants and potential acquisition candidates as necessary to protect our know-how, trade secrets and other proprietary information. However, these measures and our patents and trademarks may not afford complete protection of our intellectual property, and it is possible that third parties may copy or otherwise obtain and use our proprietary information and technology without authorization or otherwise infringe on our intellectual property rights. We cannot assure that our competitors will not independently develop equivalent or superior know-how, trade secrets or production methods. Significant impairment of our intellectual property rights could harm our business or our ability to compete. For example, if we are unable to maintain the proprietary nature of our technologies, our profit margins could be reduced as competitors could more easily imitate our products, possibly resulting in lower prices or lost sales for certain products. In such a case, our business, results of operations and financial condition may be materially and adversely affected.

14

Table of Contents

We are periodically involved in litigation in the course of our business to protect and enforce our intellectual property rights, and third parties from time to time initiate claims or litigation against us asserting infringement or violation of their intellectual property rights. We cannot assure that our products will not be found to infringe upon the intellectual property rights of others. Further, we cannot assure that we will prevail in any such litigation, or that the results or costs of any such litigation will not have a material adverse effect on our business. Any litigation concerning intellectual property could be protracted and costly and is inherently unpredictable and could have a material adverse effect on our business, results of operations or financial condition regardless of its outcome.

We would lose a significant source of revenues and profits if we lost any of our largest customers.

The loss of one of our largest customers could result in: (i) our having excess capacity if we are unable to replace that customer; (ii) our having excess overhead and fixed costs and possible impairment of long-lived assets; and (iii) our selling, general and administrative expenses and capital expenditures representing increased portions of our revenues.

In 2009 and the first six months of 2010, our top 20 customers comprised 68.8% and 72.2% of our net sales, respectively. PepsiCo, Inc. (collectively, with its affiliates, such as Frito-Lay, Gatorade and Tropicana, “PepsiCo”) is our largest customer, with all product lines we provide to PepsiCo collectively accounting for approximately 10.8% of our net sales for the year ended December 31, 2009. Liquid Container’s top five customers comprised approximately $186 million, or 52%, of their sales in 2009.

If any of our large customers terminated its relationship with us, we would lose a significant source of revenues and profits.

Contracts with customers generally do not require them to purchase any minimum amounts of products from us, and customers may not purchase amounts that meet our expectations.

The majority of our sales are made pursuant to long-term customer purchase orders and contracts. Customers’ purchase orders and contracts typically vary in length with terms up to ten years. The contracts, including those with PepsiCo, generally are requirements contracts which do not obligate the customer to purchase any given amount of product from us. Prices under these arrangements are tied to market standards and therefore vary with market conditions. Changes in the cost of resin, the largest component of our cost of goods sold, are passed through to customers by means of corresponding changes in product pricing in accordance with our agreements with these customers and industry practice. Increases in resin prices relative to alternative packaging materials, or other price increases, may cause customers to decrease their purchases from us. Additionally, if customers undertake transformational initiatives to their product lines, such as concentrate conversions or product obsolescence actions, we may lose a source of revenues and profits. As a result, despite the existence of supply contracts with our customers, we face the risk that in the future customers will not continue to purchase amounts that meet our expectations.

Increases in resin prices, relative to alternative packaging materials, and reductions in resin supplies could significantly slow our growth and disrupt our operations.

We depend on large quantities of PET, HDPE and other resins in manufacturing our products. One of our primary strategies is to grow the business by capitalizing on the conversion from glass, metal and paper containers to plastic containers. Resin prices can fluctuate significantly with fluctuations in crude oil and natural gas prices, as well as changes in refining capacity and the demand for other petroleum-based products. A sustained increase in resin prices, relative to alternative packaging materials, to the extent that those costs are not passed on to the end-consumer, would make plastic containers less economical for our customers and could result in a slower pace of conversions to, or reductions in the use of, plastic containers. Changes in the cost of resin are passed through to customers by means of corresponding changes in product pricing, in accordance with

15

Table of Contents

our agreements with these customers and industry practice. However, if we are not able to do so in the future and there are sustained increases in resin prices, relative to alternative packaging materials, our operating margins could be affected adversely.

While there is currently an adequate supply of resin available from many sources, this may not be the case in the future. Several of our larger suppliers have either entered, or are emerging from, bankruptcy protection. If the number of suppliers is significantly reduced in the future, this could affect our ability to obtain resin timely, or obtain resin at favorable prices, and our operations and profitability may be impaired.

Our international operations are subject to a variety of risks related to foreign currencies and local law in several countries.

We have significant operations outside the United States, and therefore hold assets, incur liabilities, earn revenues and pay expenses in a variety of currencies other than the U.S. dollar. The financial statements of our foreign subsidiaries are translated into U.S. dollars. Our operations outside the United States accounted for approximately 19.9%, 20.9%, 21.5% and 20.3% of our net sales for the years ended December 31, 2007, 2008 and 2009, and for the six months ended June 30, 2010, respectively. As a result, we are subject to risks associated with operating in foreign countries, including fluctuations in currency exchange and interest rates, imposition of limitations on conversion of foreign currencies into U.S. dollars or remittance of dividends and other payments by foreign subsidiaries, imposition or increase of withholding and other taxes on remittances and other payments by foreign subsidiaries, labor relations problems, hyperinflation in some foreign countries and imposition or increase of investment and other restrictions by foreign governments or the imposition of environmental or employment laws. Furthermore, we typically price our products in our foreign operations in local currencies. As a result, an increase in the value of the U.S. dollar relative to the local currencies of profitable foreign subsidiaries can have a negative effect on our profitability. In our consolidated financial statements, we translate our local currency financial results into U.S. dollars based on average exchange rates prevailing during a reporting period or the exchange rate at the end of that period. During times of a strengthening U.S. dollar, at a constant level of business, our reported international sales, earnings, assets and liabilities will be reduced because the local currency will translate into fewer U.S. dollars. Exchange rate fluctuations decreased comprehensive loss by $36.3 million, increased comprehensive loss by $65.9 million, increased comprehensive income by $19.6 million, and decreased comprehensive income by $24.5 million for the years ended December 31, 2007, 2008 and 2009, and for the six months ended June 30, 2010, respectively. In addition to currency translation risks, we incur a currency transaction risk whenever one of our operating subsidiaries enters into either a purchase or a sale transaction using a currency different from the operating subsidiary’s functional currency. In several countries where we operate, resin purchases must be made in U.S. dollars. Furthermore, changes in local economic conditions can affect operations. Our international operations also expose us to different local political and business risks and challenges. For example, in certain countries, such as Venezuela and Argentina, we are faced with periodic political issues which could result in currency risks or the risk that we are required to include local ownership or management in our businesses. The above mentioned risks in North America, Europe and South America may hurt our ability to generate revenue in those regions in the future.

We may not be able to recover the carrying value of our long-lived assets, which could require us to record additional asset impairment charges and materially and adversely affect our results of operations.

We had net property, plant and equipment of $992.2 million at June 30, 2010, or 47.3% of our total assets ($1,181.6 million, or 43.2% of our total assets, on a pro forma basis for the Transactions). We recorded asset impairment charges to property, plant and equipment of $135.5 million, $93.2 million, $41.8 million and $2.8 million for the years ended December 31, 2007, 2008 and 2009, and for the six months ended June 30, 2010, respectively. We operate in a competitive industry with rapid technological innovation. In order to remain competitive, we develop and invest in new equipment which enhances productivity, often making older equipment obsolete. In addition, changing market conditions can also impact our ability to recover the carrying value of our long-lived assets. The continuing presence of these factors, as well as other factors, could require us

16

Table of Contents

to record additional asset impairment charges in future periods which could materially and adversely affect our results of operations.

Goodwill and other identifiable intangible assets represent a significant portion of our total assets, and we may never realize the full value of our intangible assets.

As of June 30, 2010, goodwill and other identifiable intangible assets were approximately $476.3 million, or 22.7% of our total assets ($846.3 million, or 30.9% of our total assets, on a pro forma basis for the Transactions). Goodwill and other identifiable intangible assets are recorded at fair value on the date of acquisition. In accordance with the guidance under Financial Accounting Standards Board (“FASB”) ASC 350-20, “Intangibles—Goodwill and Other,” we review such assets at least annually for impairment. Impairment may result from, among other things, deterioration in performance, adverse market conditions, adverse changes in applicable laws or regulations, including changes that restrict the activities of or affect the products and services we sell, challenges to the validity of certain registered intellectual property, reduced sales of certain products incorporating registered intellectual property, and a variety of other factors. The amount of any quantified impairment must be expensed immediately as a charge to results of operations. Depending on future circumstances, it is possible that we may never realize the full value of our intangible assets. Any future determination of impairment of goodwill or other identifiable intangible assets could have a material adverse effect on our financial position and results of operations.

Our ability to operate effectively could be impaired if we lost key personnel.

Our success depends to a large extent on a number of key employees, and the loss of the services provided by them could have a material adverse effect on our ability to operate our business and implement our strategies effectively. The loss of members of our senior management team could have a material adverse effect on our operations. We do not maintain “key” person insurance on any of our executive officers.

If we make acquisitions in the future, we may experience assimilation problems and dissipation of management resources and we may need to incur additional indebtedness.

Our future growth may be a function, in part, of acquisitions of other consumer goods packaging businesses, including investments in geographic regions we are not familiar with. To the extent that we grow through acquisitions, we will face operational and financial risks, such as the risk of failing to assimilate the operations and personnel of the acquired businesses, disrupting our ongoing business, dissipating our limited management resources and impairing relationships with employees and customers of the acquired business as a result of changes in ownership and management. Additionally, we have incurred indebtedness to finance past acquisitions, and would likely incur additional indebtedness to finance future acquisitions, as permitted under our senior secured credit facilities (the “Credit Agreement”) and the indentures governing our senior notes and senior subordinated notes, in which case we would also face certain financial risks associated with the incurrence of additional indebtedness to make an acquisition, such as a reduction in our liquidity, access to capital markets and financial stability.

Additionally, the types of acquisitions we will be able to make are limited by our Credit Agreement, which limits the amount that we may pay for an acquisition to $200 million plus additional amounts based on an unused available capital expenditure limit, certain proceeds from new equity issuances and other amounts.

Our operations and profitability could suffer if we experience labor relations problems.

As of June 30, 2010, approximately 3,100 of our approximately 7,300 employees were covered by collective bargaining agreements with various international and local labor unions. In addition, as of June 30, 2010, we operated 82 facilities, of which 38 were union facilities operated primarily by union employees. In the U.S. our union agreements typically have a term of three or four years and thus regularly expire and require negotiation in

17

Table of Contents

the course of our business. In 2010, collective bargaining agreements covering approximately 750 employees in the U.S. will expire. Upon the expiration of any of our collective bargaining agreements, we may be unable to negotiate new collective bargaining agreements on terms favorable to us, and our business operations at one or more of our facilities may be interrupted as a result of labor disputes or difficulties and delays in the process of renegotiating our collective bargaining agreements. A work stoppage at one or more of our facilities could have a material adverse effect on our business, results of operations and financial condition.

Our ability to expand our operations could be adversely affected if we lose access to additional blow molding equipment.

Access to blow molding equipment is important to our ability to expand our operations. We have access to a broad array of blow molding equipment and suppliers. However, if we fail to continue to access this new blow molding equipment or these suppliers, our ability to expand our operations may be materially and adversely affected until alternative sources of technology can be arranged.