Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - COLONIAL BANCGROUP INC | d8k.htm |

EXHIBIT 99.1

UNITED STATES BANKRUPTCY COURT

FOR THE MIDDLE DISTRICT OF ALABAMA

NORTHERN DIVISION

| x |

||||

| : |

||||

| In re | : | Chapter 11 | ||

| : | ||||

| THE COLONIAL BANCGROUP, INC., | : | Case No. 09-32303 (DHW) | ||

| : | ||||

| Debtor. |

: | |||

| : | ||||

| x | ||||

NOTICE OF FILING OF THIRD AMENDMENT TO SCHEDULE B - PERSONAL PROPERTY

The Colonial BancGroup, Inc., as debtor and debtor in possession herein (the “Debtor”), hereby gives notice of its filing of the attached Third Amendment to Schedule B - Personal Property, in which the Debtor (i) strikes the Attachment to Schedule B - Item 13, as amended [Doc. No. 655, pg. 2], in its entirety and substitutes in lieu thereof the attached amended Item 13 for the purpose of providing information regarding the Debtor’s possible ownership interest in CBG Florida REIT Corp. and (ii) strikes the Attachment to Schedule B - Item 21, as amended [Doc. No. 854, pgs. 2-5], in its entirety and substitutes in lieu thereof the attached amended Item 21 for the purpose of providing an update on the Debtor’s recent tax filings and information regarding the Debtor’s possible claims arising out of the disposition of the preferred securities of CBG Florida REIT Corp.

Case 09-32303 Doc 971 Filed 11/03/10 Entered 11/03/10 14:13:07 Desc Main Document Page 1 of 21

| Dated: | November 3, 2010 | |

| Montgomery, Alabama |

| C. Edward Dobbs |

| E-mail: ced@phrd.com |

| Rufus T. Dorsey, IV |

| E-mail: rtd@phrd.com |

| PARKER, HUDSON, RAINER & DOBBS LLP |

| 1500 Marquis Two Tower |

| 285 Peachtree Center Avenue, N.E. |

| Atlanta, Georgia 30303 |

| Telephone No.: (404) 523-5300 |

| Facsimile: (404) 522-8409 |

| By: | /s/ Rufus T. Dorsey, IV | |

| Rufus T. Dorsey, IV | ||

| Attorneys for Debtor and Debtor in Possession | ||

Case 09-32303 Doc 971 Filed 11/03/10 Entered 11/03/10 14:13:07 Desc Main Document Page 2 of 21

THIRD AMENDMENT TO SCHEDULE B - PERSONAL

PROPERTY: AMENDMENT TO ATTACHMENT TO SCHEDULE B - ITEM 13

Attachment

Schedule B - Item 13

| Colonial Brokerage, Inc. |

100% | Unknown | ||||||

| Centralite |

12.50% | Unknown | ||||||

| Colonial Capital Trust IV |

3% | Unknown | ||||||

| CBG Real Estate, LLC |

100% | $ | 1,818,148 | * | ||||

| CBG Florida REIT Corp. |

Unknown | Unknown | ** | |||||

| * | CBG Real Estate, LLC (“CBG Real Estate”) is an Alabama limited liability company that was organized pursuant to the Alabama Limited Liability Company Act on or about May 2, 2008. The avowed purpose of CBG Real Estate was to own, develop, improve, maintain, lease and manage real and personal property and to do everything necessary, proper, advisable or convenient for the accomplishment of such purposes. Based upon the value that the Debtor believes was assigned on its books and records, as of the petition date, to the equity interests in CBG Real Estate, the Debtor believes that the value of such equity interests is at least $1,818,148. However, the Debtor is unable to confirm the accuracy of this estimation due to a lack of access to its books and records, some or all of which are in the custody or control of the FDIC-Receiver and/or BB&T. |

Due to this lack of access, the Debtor is also unable to determine the extent to which the Debtor’s books and records take into consideration information set forth below. On information and belief, CBG Real Estate holds (i) an undivided 35% participation interest in secured real estate loans originated by Colonial Bank and having an original principal balance in excess of $120,000,000 (which participation is asserted to be subordinated to the interest in the loans claimed by BB&T); (ii) approximately $502,853 in cash; (iii) a 100% interest in a secured real estate loan to an entity known as Riverwalk Freeport having an approximate unpaid balance of $11,000,000; and (iv) rights to condemnation proceeds in connection with the Florida Department of Transportation’s eminent domain action affecting mortgaged collateral (estimated value exceeding $340,000). It is possible that CBG Real Estate has an interest in other loans, but the Debtor is unable to determine the existence of an interest in such loans due to a lack of access to records, some or all of which are in the custody or control of the FDIC-Receiver and/or BB&T. Substantially all of the secured real estate loans in which CBG Real Estate has an interest, whether by way of participation or outright ownership, are delinquent and have a value that is not able to be readily determined at this time. The Debtor does not believe that CBG Real Estate has any outstanding obligations, but the Debtor continues to investigate both the assets and liabilities of this entity.

| ** | See Schedule B - Item 21, ¶ 7. |

Case 09-32303 Doc 971 Filed 11/03/10 Entered 11/03/10 14:13:07 Desc Main Document Page 3 of 21

THIRD AMENDMENT TO SCHEDULE B - PERSONAL

PROPERTY: AMENDMENT TO ATTACHMENT TO SCHEDULE B - ITEM 21

The Debtor estimates, based on the information available to the Debtor as of November 3, 2010, that the value of the property responsive to this category is well in excess of $882,805.00, but the Debtor is unable to provide at this time a definitive statement of value. The Debtor cautions all interested parties not to place undue reliance upon the information contained in this Third Amendment, which was not prepared to provide the basis of an investment decision relating to any of the debt or equity securities of the Debtor and is subject to further refinement and review. Subject to the foregoing, the following paragraphs contain information relevant to property falling within this category.

1. A dispute exists between the Debtor and the Federal Deposit Insurance Corporation (the “FDIC”), in its capacity as receiver for Colonial Bank (in such capacity, the “FDIC-Receiver”), regarding entitlement to any tax refunds that may be received from any federal, state or local taxing authority. The Debtor asserts that in the ordinary course of its business, the Debtor and its direct and indirect subsidiaries conducted themselves in accordance with an intercorporate tax sharing arrangement, a copy of which is annexed hereto as Exhibit A (the “Tax Sharing Agreement”). The Debtor further asserts that, based on the Tax Sharing Agreement and/or other applicable law, the Debtor is entitled to all or a substantial part of any tax refunds received. In opposition to the Debtor’s position, the FDIC-Receiver asserts entitlement to all or substantially all of any refund of taxes paid on the asserted grounds that the Tax Sharing Agreement is unenforceable and that the refunds sought are based upon taxes paid by Colonial Bank or losses sustained by Colonial Bank in the years at issue. Absent a final adjudication of ownership or settlement of this dispute with the FDIC-Receiver, it is not possible to state with certainty at this time the amount of the Debtor’s entitlement to any tax refund received from any federal, state or local taxing authorities. The issue of ownership of tax refunds is presently pending before the United States District Court for the Middle District of Alabama, Honorable Myron H. Thompson presiding. If any tax refund is received by the Debtor or the FDIC-Receiver, that refund is required to be deposited into a separate, segregated account in the Debtor’s name pursuant to the Stipulation and Order Regarding Establishment of Segregated Account for Tax-Related Payments [Doc. No. 621] (the “Tax Deposit Account”) pending resolution of the issue of ownership.

2. The Debtor filed state and federal income tax returns for its 2008 tax year. The Debtor received in June of 2009 a tax refund from the United States Treasury Department in the amount of approximately $166,000,000, and, on information and belief, transferred that approximate amount to Colonial Bank in connection with the Debtor’s receipt of such tax refund. The Debtor believes that it is entitled to an additional tax refund from the State of Tennessee in the amount of approximately $73,552, but is indebted to the States of Idaho and Texas for income taxes in the approximate amounts of $528 and $120,850, respectively. As noted above, it is anticipated that the FDIC-Receiver will challenge the Debtor’s entitlement to all refunds of state income taxes referred to herein.

3. The Debtor believes that it may be entitled to additional federal income tax refunds as a result of losses for tax purposes during tax years 2008 and 2009. The Debtor has retained the services of PricewaterhouseCoopers LLP to assist the Debtor in analyzing how to maximize the value of the Debtor’s tax attributes. The Debtor has also conferred with the Official Committee of Unsecured Creditors and its professionals on this issue. At this time, the Debtor is unable to state with any degree of certainty all steps that may be taken or issues which may need to be addressed in connection with the Debtor’s request for a refund of taxes from the Internal Revenue Service or the amount or timing of any refund. However, the Debtor timely filed its 2009 federal income tax return and has made its 5-year carryback election. As noted above, all or substantially all of any tax refunds received by the Debtor are claimed by the FDIC-Receiver. Subject to the foregoing, the Debtor states as follows:

Case 09-32303 Doc 971 Filed 11/03/10 Entered 11/03/10 14:13:07 Desc Main Document Page 4 of 21

(a) With regard to the 2008 federal income tax return, as currently filed, the Debtor believes it may be entitled to an additional refund of up to $4,600,000. By order of the United States Bankruptcy Court for the Middle District of Alabama (the “Bankruptcy Court”) entered on August 17, 2010 [Doc. No. 843], the Debtor received (and deposited into the Tax Deposit Account) approximately $573,172 from the Internal Revenue Service resulting from the Debtor’s overpayment of federal income taxes for the 2008 tax year. Nothing in the Bankruptcy Court’s order or in the relief provided therein constitutes a finding for any purpose of the relative ownership of, or other rights with respect to, any tax refunds, tax-related assets or other tax attributes as between the Debtor and either Colonial Bank or the FDIC-Receiver.

(b) With regard to the Debtor’s 2009 federal income tax return, the Debtor believes that it is entitled to a so-called “worthless stock deduction” based upon events surrounding the commencement of the receivership of its wholly-owned subsidiary, Colonial Bank, on August 14, 2009. The Debtor believes that its federal income tax filing for 2009 supports a request for tax refunds from the Internal Revenue Service of approximately $247,000,000. On information and belief, the FDIC-Receiver filed a federal income tax return and refund request with the Internal Revenue Service as an asserted fiduciary for Colonial Bank and its subsidiaries that allegedly supports a request for tax refunds from the Internal Revenue Service of the same amount (approximately $247,000,000).

4. The Debtor has requested refunds for unearned premiums under various policies of insurance, the aggregate amount of which has not been determined with precision. The amount of premium refunds received to date totals approximately $1,277,320. The Debtor also asserts entitlement to all or a substantial portion of certain policy claims made under certain fidelity insurance policies with a coverage limit of approximately $25,000,000. The Debtor’s interest in this and other proceeds of insurance policies is the subject of litigation presently pending before the United States District Court for the Middle District of Alabama, Honorable Myron H. Thompson presiding

5. The Debtor has requested refunds from debt rating agencies for annual rating assessments, the amount of or entitlement to which is not capable of precise estimate at this time.

6. The Debtor has potential refunds for prepaid annual copyright licenses, unused and potentially refundable service fees, and unused and potentially refundable allotments of software maintenance support, the amount of or entitlement to which is not capable of precise estimate at this time.

7. The Debtor may hold certain preferred securities relating to CBG Florida REIT Corp. (the “Trust”) or claims relating to such preferred securities or the value thereof. On or about May 21, 2007, the Trust, an indirect subsidiary of Colonial Bank and The Colonial BancGroup, Inc., issued 300,000 shares of preferred stock, par value $1,000 (the “REIT Preferred Securities”), to certain investors (the “Investors”). In connection with the formation of the Trust, Colonial Bank contributed to the Trust a 100% participation interest in the approximate face amount of $1 billion of mortgage loans represented to be secured by commercial property in Florida. According to the offering documentation, the Investors, as holders of the REIT Preferred Securities, would generally be entitled to the first recoveries or distributions from the Trust because the Trust had no creditors.

The Debtor has been informed that the terms of the REIT Preferred Securities provided that the occurrence of an exchange event (an “Exchange Event”) would result in (i) each share of the Investors’ REIT Preferred Securities being automatically exchanged for one share of new preferred stock (the “New Preferred Stock”) of the Debtor and (ii) the Debtor receiving all 300,000 shares of the REIT Preferred Securities (the “Conditional Exchange”).

Case 09-32303 Doc 971 Filed 11/03/10 Entered 11/03/10 14:13:07 Desc Main Document Page 5 of 21

The Debtor believes that, on or about May 21, 2007, an Exchange Agreement was entered into among the Debtor, the Trust and Colonial Bank (the “Exchange Agreement”), which provided, among other things, that if an Exchange Event occurred and the Debtor became the owner of the REIT Preferred Securities, the Debtor “shall contribute all of the [REIT Preferred Securities] to [Colonial Bank] as a capital contribution and the [Trust] shall record, or cause to be recorded, in its share registry [Colonial Bank] as owner of all of the REIT Preferred Securities.” A copy of the Exchange Agreement is attached hereto as Exhibit B.

The Debtor believes that, on or about August 10, 2009, four days before Colonial Bank entered into receivership and 15 days before the Debtor filed for bankruptcy protection, the FDIC sent a letter to the Debtor, Colonial Bank, the Trust and CBG Nevada Holding Corp. directing the Trust to exchange all outstanding shares of the REIT Preferred Securities for an equal amount of New Preferred Stock issued by the Debtor based on the occurrence of an Exchange Event. According to the Form 8-K filed by the Debtor on August 12, 2009 (the “REIT Preferred 8-K”), the exchange (the “Exchange”) was consummated effective as of 8:00 a.m. New York time on August 11, 2009. In the REIT Preferred 8-K, the statement is made that until certificates representing the New Preferred Stock are issued, the certificates representing the REIT Preferred Securities “will be deemed for all purposes to represent BancGroup [New Preferred Stock].”

The Debtor’s records, many of which are not in the Debtor’s possession, supposedly contain the document attached hereto as Exhibit C (the “Certificate”), which is signed in the name of the Secretary for the Debtor and states that is certifies that the “exchange took effect at 8:00 a.m. New York time on August 11, 2009” and was provided to the Debtor by the FDIC-Receiver. The Certificate also states that the Attachment A thereto reflects the “impact” of the Exchange in the books and records on August 11, 2009.

Pursuant to an order dated August 14, 2009, the Alabama State Banking Department closed Colonial Bank and appointed the FDIC-Receiver as its receiver. Effective as of its appointment as receiver, the FDIC-Receiver, the FDIC, and Branch Banking & Trust Company (“BB&T”) entered into a Purchase and Assumption Agreement, Whole Bank, All Deposits, dated as of August 14, 2009. The Debtor understands that the FDIC-Receiver contends that the REIT Preferred Securities were transferred to Colonial Bank prior to commencement of the receivership and then transferred by the FDIC-Receiver to BB&T.

The Debtor filed a proof of claim in the Colonial Bank receivership on November 19, 2009, which, among other claims, alleged that the Debtor is either the owner of REIT Preferred Securities because such securities were never properly transferred by the Debtor to Colonial Bank prior to the commencement of the Debtor’s Chapter 11 bankruptcy case on August 25, 2010, or, if such securities were properly transferred by the Debtor to Colonial Bank, the transfer is avoidable under applicable provisions of the Bankruptcy Code as to Colonial Bank and any subsequent transferee. In a letter dated January 6, 2010, the FDIC-Receiver notified the Debtor that its receivership claim had been disallowed in its entirety. Thereafter, the Debtor filed a complaint against the FDIC-Receiver in federal district court seeking a judicial determination of its disallowed receivership claims. The Colonial BancGroup, Inc. v. F.D.I.C., No. 2:10-cv-00198 (MHT) (M.D. Ala.).

The FDIC-Receiver filed a proof of claim in the Debtor’s Chapter 11 bankruptcy case on November 30, 2009 [Claim. No. 139] and amended its proof of claim on February 19, 2010 [Claim No.139 - Amended]. In this proof of claim, the FDIC-Receiver asserted that the REIT Preferred Securities were transferred to Colonial Bank prior to the commencement of the receivership and, in the alternative, asserted certain claims against the Debtor to the extent the transfer did not take place. On March 4, 2010, the Debtor filed an objection to the FDIC-Receiver’s proof of claim [Doc. No. 598]. In an order entered on May 10, 2010, the district court withdrew the reference of proceedings with respect to that contested matter, which is pending under the caption In re The Colonial BancGroup, Inc., No. 2:10-cv-00409 (MHT) (M.D. Ala.). The FDIC-Receiver filed a response to Debtor’s objection on June 25, 2010 [Doc. No. 15], and a scheduling order has been entered that provides for proceedings leading up to a scheduled trial date in July 2011 [Doc. No. 36].

Case 09-32303 Doc 971 Filed 11/03/10 Entered 11/03/10 14:13:07 Desc Main Document Page 6 of 21

The Debtor is unable, without further discovery and other due diligence in the various legal proceedings and further analysis, to state with any degree of assurance the range of possible recovery, if any, for the Debtor’s estate in connection with the REIT Preferred Securities or the transactions described hereinabove.

8. The Debtor may hold various claims for the benefit of the Debtor’s estate against entities that include, but are not limited to, the following: (a) individuals identified in the pending derivative lawsuits referenced in the Debtor’s Statement of Financial Affairs; (b) professionals, consultants and investment bankers engaged by the Debtor prior to the petition date; (c) the FDIC-Receiver; and (d) any of the Debtor’s former or existing affiliates or insiders. The Debtor may also hold various claims that can be offset against or asserted as a defense to the proof of claim of TITAN Technology Partners, Limited. The foregoing list is only a preliminary list of persons against whom the Debtor may have claims of various types. This list is neither exhaustive nor exclusive and is subject to additions, deletions or changes as the Debtor investigates the relevant facts and issues. Neither the inclusion of any claim on this list nor the omission of any claim from this list is intended or shall be deemed to constitute a stipulation or admission by the Debtor that any claim does or does not exist. This list is as of the petition date and does not include post-petition claims, avoidance actions or causes of action arising under the Bankruptcy Code.

Case 09-32303 Doc 971 Filed 11/03/10 Entered 11/03/10 14:13:07 Desc Main Document Page 7 of 21

Exhibit A

Tax Sharing Agreement

Case 09-32303 Doc 971 Filed 11/03/10 Entered 11/03/10 14:13:07 Desc Main Document Page 8 of 21

Colonial Bancgroup

Intercorporate Tax Allocation Policy

The following intercorporate tax allocation policy has been elected by the Colonial Bancgroup and its subsidiaries under IRS regulation 1.552 & 1.1502, Bank Holding Company Rules and Regulations, OTS Holding Company Regulatory Handbook (Section 500), and FDIC 1978 Statement of Policy as a method of allocating the consolidated federal tax liability to each respective subsidiary in the consolidated group.

The tax liability/refund of each member of the consolidated group is computed on separate return basis and is then remitted to/from the parent for payment of the consolidated tax liability. The excess of the tax liability computed on separate return basis over the consolidated tax liability is then allocated as a benefit to the other members of the group having no positive taxable income based on their respective share of tax losses and tax credits as calculated on separate return basis. Alternative minimum tax is determined on a consolidated basis, and any AMT in excess of the consolidated tax liability is allocated to the members of the group based on their respective share of the tax liability. The surtax exemption will be allocated to the bank.

A member of the consolidated group may incur a tax loss that it cannot carry back on a separate entity basis, but could be utilized as a carry forward for the group member. If this tax loss is used currently to reduce the consolidated tax liability, the group member will receive payment from the parent for its use of the tax loss. Also, if a member’s prior year tax loss is used as a carry forward to offset the current year consolidated tax liability, the group member will receive payment from the parent for its use of the carry forward tax loss.

The tax liability/refund of each member of the consolidated group will be estimated on a quarterly basis and funds remitted to/from the parent, also on a quarterly basis, within 30 days of the time that the estimated tax payments/refunds are due to/from the federal and state taxing authority; April 15, June 15, September 15, and December 15. Each year after such time as the consolidated tax return is prepared, each group members’ tax over/under estimated payments will be “trued-up” to the actual tax liability. Also, any surtax exemption will be allocated to the subsidiary bank.

Also, in accordance with Bank Holding Company Rules and Regulations and OTS Holding Companies Regulatory Handbook, deferred taxes; that result from a difference in taxable income for financial reporting purposes and taxable income as reported to the taxing authority, will be maintained on each separate subsidiaries books, and that no deferred tax assets will be inappropriately transferred from subsidiaries to the parent company.

If a member of the group departs from the consolidated entity through acquisition or otherwise, the group member will receive the full unpaid benefits of any its tax losses that were used or will remain with the consolidated entity.

Note: The end result of the above allocation is that each member of the group having a positive tax liability is allocated their respective tax liability on a separate return basis, as though each subsidiary were dealing directly with State or Federal taxing authorities. The members of the group having losses on unused credits on a separate return basis receive a tax benefit for the use of such losses and credits by the other members of the group.

Case 09-32303 Doc 971 Filed 11/03/10 Entered 11/03/10 14:13:07 Desc Main Document Page 9 of 21

Exhibit B

Exchange Agreement

Case 09-32303 Doc 971 Filed 11/03/10 Entered 11/03/10 14:13:07 Desc Main Document Page 10 of 21

CBG FLORIDA REIT CORP.

FIXED-TO-FLOATING RATE PERPETUAL NON-CUMULATIVE PREFERRED

STOCK, CLASS A, SERIES A

AND

THE COLONIAL BANCGROUP, INC.

FIXED-TO-FLOATING RATE PERPETUAL NON-CUMULATIVE PREFERRED

STOCK, SERIES A

EXCHANGE AGREEMENT

This EXCHANGE AGREEMENT (this “Agreement”) is entered into as of May 21, 2007, among CBG FLORIDA REIT CORP., a Florida corporation (the “Company”), Colonial Bank, N.A., a national banking association, or successors and assigns (the “Bank”) and The Colonial BancGroup, Inc., a Delaware corporation (“Colonial”).

RECITALS

WHEREAS, the Company will issue 300,000 shares of its Fixed-to-Floating Rate Perpetual Non-Cumulative Preferred Stock, Class A, Series A, with a liquidation preference of $1,000.00 per share (the “Series A Company Preferred Stock”);

WHEREAS, each share of Series A Company Preferred Stock will be conditionally exchangeable into one newly issued share of Colonial’s Fixed-to-Floating Rate Perpetual Non-Cumulative Preferred Stock, Series A, with a liquidation preference of $1,000.00 per share (the “Series A Colonial Preferred Stock”); and

WHEREAS, the parties hereto desire to ensure that in the event of the occurrence of circumstances requiring the exchange of the Series A Company Preferred Stock into the Series A Colonial Preferred Stock, Colonial will be contractually bound unconditionally to make available shares of Series A Colonial Preferred Stock sufficient for exchange of the Series A Company Preferred Stock, and to effect the exchange of all outstanding Series A Company Preferred Stock into Series A Colonial Preferred Stock.

AGREEMENT

NOW THEREFORE, for good and valuable consideration, the receipt and sufficiency of which are hereby expressly acknowledged, the parties hereto, intending to be legally bound, hereby agree as follows:

SECTION 1. Definitions. Whenever used in this Agreement, the following words and phrases, unless the context otherwise requires, shall have the following meanings:

“Agreement” has the meaning specified in the Preamble to this Agreement.

Case 09-32303 Doc 971 Filed 11/03/10 Entered 11/03/10 14:13:07 Desc Main Document Page 11 of 21

“Articles of Incorporation” means the Amended and Restated Articles of Incorporation of the Company, dated May 21, 2007, as amended, modified or supplemented from time to time.

“Business Combination” has the meaning as specified in Section 3 of this Agreement.

“Colonial” has the meaning specified in the Preamble to this Agreement.

“Company” has the meaning specified in the Preamble to this Agreement.

“Conditional Exchange” means if the OCC so directs upon the occurrence of an Exchange Event, each Series A Company Preferred Stock then outstanding shall be automatically exchanged for one share of Series A Company Preferred Stock.

“Dividend Period” has the meaning specified in the Articles of Incorporation.

“Dividend Stopper Period” has the meaning specified in Section 5(a)(i).

An “Exchange Event” will occur when:

(a) the Bank becomes “undercapitalized” under the OCC’s “prompt corrective action” regulations (and including any successor regulations);

(b) the Bank is placed into conservatorship or receivership; or

(c) the OCC, in its sole discretion, anticipates the Bank becoming “undercapitalized” in the near term or takes a supervisory action that limits the payment of dividends by the Bank and in connection therewith, directs an exchange.

“OCC” means the United States Office of the Comptroller of the Currency or any successor United States Federal bank regulatory authority agency that is the primary supervisory agency for the Bank.

“Person” means any individual, corporation, association, partnership (general or limited), joint venture, trust, estate, limited liability company, or any legal entity or organization.

“Preamble” means the preamble to this Agreement

“Series A Colonial Preferred Stock” has the meaning specified in the Recitals.

“Series A Company Preferred Stock” has the meaning specified in the Recitals.

“Substitute Preferred Stock” means a class or series of equity securities of a Successor Entity having the preferences, limitations and relative rights in its articles or certificate of incorporation or other constituent documents that are substantially similar to those set forth in Colonial’s certificate of designation to Colonial’s amended and restated certificate of incorporation, as amended, establishing the Series A Colonial Preferred Stock.

“Successor Entity” means a corporation designated by the Board of Directors of Colonial (i) that is the surviving, resulting or receiving corporation, as applicable, in any Business

Case 09-32303 Doc 971 Filed 11/03/10 Entered 11/03/10 14:13:07 Desc Main Document Page 12 of 21

2

Combination, (ii) the securities of which are received in a Business Combination by some or all holders of Colonial voting shares or (iii) that the Board of Directors of Colonial determines to be an acquiror of Colonial in a Business Combination.

SECTION 2. Exchange of the Series A Company Preferred Stock. If at any time after the issuance and sale of the Series A Company Preferred Stock, the OCC directs in writing, upon or after the occurrence of a Conditional Exchange, that the Series A Company Preferred Stock be exchanged for an equal number of Series A Colonial Preferred Stock, then, the Conditional Exchange will occur as of 8:00 A.M., New York time, on the date for such exchange set forth in the applicable OCC directive or, if such date is not set forth in the applicable OCC directive, as of 8:00 A.M., New York time, on the earliest possible date such exchange could occur consistent with the OCC directive, as evidenced by the issuance by Colonial of a press release prior to such time. Effective on the date and time of the Conditional Exchange:

(a) each holder of Series A Company Preferred Stock shall be unconditionally obligated to surrender to Colonial any certificate representing the Series A Company Preferred Stock as set forth in the Articles of Incorporation;

(b) the Company shall record, or cause to be recorded, in its share registry Colonial as owner of all of the Series A Company Preferred Stock, as transferee from the Persons who are holders of Series A Company Preferred Stock immediately prior to such date and time;

(c) Colonial shall issue a number of shares of Series A Colonial Preferred Stock equal to the number of shares of Series a Company Preferred Stock to the holders of record of the Series A Company Preferred Stock upon surrender of the certificates representing Series A Company Preferred Stock;

(d) all of the Series A Company Preferred Stock then outstanding will be deemed to be owned by Colonial, without any action by the Company or any other action being necessary or required by any other Person, and Persons who are holders of Series A Company Preferred Stock shall have no rights under such securities, other than the right to receive Series A Colonial Preferred Stock in exchange therefor, as provided herein; and

(e) Colonial shall contribute all of the Series A Company Preferred Stock to the Bank as a capital contribution and the Company shall record, or cause to be recorded, in its share registry the Bank as owner of all of the Series A Company Preferred Stock.

Until such Series A Colonial Preferred Stock is issued, any certificates previously representing the Series A Company Preferred Stock shall be deemed for all purposes to represent Series A Colonial Preferred Stock.

Colonial will mail notice of the issuance of an OCC directive after the occurrence of an Exchange Event to each holder of Series A Company Preferred Stock within 30 days of the issuance of an OCC directive.

SECTION 3. Permitted Assignment. (a) In the event that, prior to the Conditional Exchange, Colonial effects, or is, the subject of a merger, consolidation, statutory share exchange, sale of all or substantially all of its assets or other form of business combination, (i) in

Case 09-32303 Doc 971 Filed 11/03/10 Entered 11/03/10 14:13:07 Desc Main Document Page 13 of 21

3

which Colonial is not the surviving, resulting or receiving corporation thereof or (ii) if Colonial is the surviving or resulting corporation, shares representing a majority of Colonial’s total voting power are either converted or exchanged into securities of another person or into cash or other property (any such transaction in either (i) or (ii) being a “Business Combination”), then Colonial (i) shall not enter into such Business Combination unless the Successor Entity agrees, effective upon the consummation of such Business Combination, to abide by all of Colonial’s obligations under the provisions of this Exchange Agreement restricting the payment of dividends by Colonial in the event dividends are not paid with respect to the Series A Company Preferred Stock and (ii) will, prior to the effectiveness of such Business Combination, assign, effective upon the consummation of such Business Combination, all of its obligations and rights under this Exchange Agreement to a Successor Entity that has Substitute Preferred Stock and, as a result of such assignment, all references to Colonial and Series A Colonial Preferred Stock shall become and be deemed to be references to such Successor Entity and to such Substitute Preferred Stock, respectively .

(b) This Section 3 shall apply to any subsequent Business Combination mutatis mutandis.

SECTION 4. Representations and Warranties of Colonial. Colonial hereby represents and warrants that the Series A Colonial Preferred Stock will, in each case, upon issuance, rank senior, in respect of the right to receive dividends and the right to receive payment out of the assets of Colonial, upon voluntary or involuntary dissolution, winding-up or termination of Colonial, to Colonial’s common stock and at least pari passu with the most senior preferred stock of Colonial, if any, then outstanding, and to any other preferred stock that Colonial may issue in the future.

SECTION 5. Additional Covenants of Colonial.

Colonial hereby covenants and agrees for the benefit of the holders of the Series A Company Preferred Stock that:

(a) Colonial Dividend Stopper. (i) If full dividends on the Series A Company Preferred Stock have not been declared and paid for any Dividend Period, then Colonial shall not declare or pay dividends or other distributions with respect to, or redeem, repurchase or otherwise acquire any of its equity capital securities, except dividends in connection with a shareholders’ rights plan, if any, or dividends in connection with benefits plans, during the next succeeding Dividend Period (a “Dividend Stopper Period”).

(ii) Colonial will not permit any of its subsidiaries, on its behalf, to pay dividends or other distributions with respect to, or redeem, repurchase or otherwise acquire any of Colonial’s equity capital securities, except dividends in connection with a shareholders’ rights plan, if any, or dividends in connection with benefits plans, during any Dividend Stopper Period.

(b) Limitation on Issuance of Senior Preferred Stock. Prior to the issuance of the Series A Colonial Preferred Stock, Colonial will not issue any class or series of preferred stock

Case 09-32303 Doc 971 Filed 11/03/10 Entered 11/03/10 14:13:07 Desc Main Document Page 14 of 21

4

ranking senior to the Series A Colonial Preferred Stock in respect of the right to receive dividends and the right to receive payments out of the assets of Colonial, upon voluntary or involuntary dissolution, winding-up or termination of Colonial.

(c) Reservation of Shares. Colonial hereby covenants and agrees to reserve the Series A Colonial Preferred Stock for issuance in accordance with the terms hereof.

(d) Third-Party Beneficiaries. The holders of the Series A Company Preferred Stock shall be express third-party beneficiaries of Colonial’s representations and warranties set forth in Section 4 and Colonial’s covenants set forth in this Section 5.

SECTION 6. Notices. (a) All notices provided for in this Agreement shall be in writing, duly signed by the party giving such notice, and shall be delivered, telecopied or mailed by registered or certified mail, as follows:

If given to Colonial or Colonial Bank, at the address set forth below:

100 Colonial Bank Blvd.

Montgomery, Alabama 36117

Attention: General Counsel

Telephone: (334) 676-5000

Facsimile: (334) 676-5069

email: david byrne@colonialbank.com

If given to the Company, at the address set forth below:

c/o Colonial Bank, N.A.

100 Colonial Bank Blvd.

Montgomery, Alabama 36117

Attention: General Counsel

Telephone: (334) 676-5000

Facsimile: (334) 676-5069

email: david byrne@coionialbank.com

(b) Each such notice, request or other communication shall be effective (i) if given by telecopier, when transmitted to the number specified in such registration books and the appropriate confirmation is received, (ii) if given by mail, 72 hours after such communication is deposited in the mails with first class postage prepaid, addressed as aforesaid, or (iii) if given by any other means, when delivered at the address specified above.

SECTION 7. Governing Law. THIS EXCHANGE AGREEMENT AND ALL RIGHTS HEREUNDER AND PROVISIONS HEREOF SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF NEW YORK.

Case 09-32303 Doc 971 Filed 11/03/10 Entered 11/03/10 14:13:07 Desc Main Document Page 15 of 21

5

SECTION 8. Counterparts. This Agreement may be executed in any number of counterparts, each of which shall be an original as against any party whose signature appears thereon and all of which together shall constitute one and the same instrument. This Agreement shall become binding when one or more counterparts hereof, individually or taken together, shall bear the signatures of all of the parties reflected hereon as signatories.

Case 09-32303 Doc 971 Filed 11/03/10 Entered 11/03/10 14:13:07 Desc Main Document Page 16 of 21

6

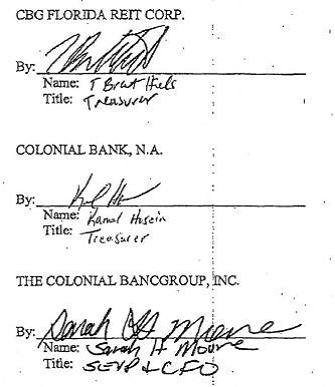

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the day and year first above written.

[Exchange Agreement Signature Page]

Case 09-32303 Doc 971 Filed 11/03/10 Entered 11/03/10 14:13:07 Desc Main Document Page 17 of 21

Exhibit C

Certificate

Case 09-32303 Doc 971 Filed 11/03/10 Entered 11/03/10 14:13:07 Desc Main Document Page 18 of 21

THE COLONIAL BANCGROUP, INC.

CERTIFICATION OF ISSUANCE OF

FIXED-TO-FLOATING PERPETUAL NON-CUMULATIVE PREFERRED STOCK, SERIES A

The Colonial BancGroup, Inc., a Delaware corporation, hereby certifies as follows:

Colonial Bank (the “Bank”), a wholly owned subsidiary of The Colonial BancGroup, Inc., (“BancGroup”), received notice on August 10, 2009 from the Federal Deposit Insurance Corporation (“FDIC”), the Bank’s primary federal regulator, directing CBG Florida REIT Corp., an indirect subsidiary of the Bank, to exchange all outstanding shares of its Fixed-to-Floating Rate Perpetual Non-cumulative Preferred Stock, Class A, Series A (the “REIT Preferred Stock”) for an equal amount of Fixed-to-Floating Rate Perpetual Non-cumulative Preferred Stock, Series A of BancGroup (the “BancGroup Preferred Stock”) due to the occurrence of an “Exchange Event” (as described in BancGroup’s Current Report on Form 8-K filed with the Securities and Exchange Commission on May 29, 2007). As of the date of this report, there was $300 million in liquidation amount of REIT Preferred Stock outstanding.

The exchange was effective at 8:00 a.m. New York time on August 11, 2009. BancGroup will shortly send notice to registered holders of the REIT Preferred Stock of the procedures for exchanging their REIT Preferred Stock for BancGroup Preferred Stock. Until certificates representing the BancGroup Preferred Stock are issued, the certificates representing the REIT Preferred Stock will be deemed for all purposes to represent BancGroup Preferred Stock.

The exchange took effect under the terms of the Exchange Agreement. As exhibited on Attachment A, Colonial reflected the impact of the exchange in its books and records on August 11, 2009. Colonial is also working to get the notice to provide to the holders of the preferred shares.

Case 09-32303 Doc 971 Filed 11/03/10 Entered 11/03/10 14:13:07 Desc Main Document Page 19 of 21

ATTACHMENT A

| The Colonial BancGroup, Inc. (Parent Only) |

Consolidated Colonial Bank | Consolidated Colonial BancGroup |

||||||||||||||||||||||||

| DR | CR | DR | CR | DR | CR | |||||||||||||||||||||

| 148156000 | EQUITY INVESTMENT IN COLONIAL BANK | 293,057,776 | — | |||||||||||||||||||||||

| TOTAL IMPACT TO ASSETS | 293,057,776 | — | — | |||||||||||||||||||||||

| 3003000000 | BANCGROUP PREFERRED STOCK | 300,000,000 | 300,000,000 | |||||||||||||||||||||||

| 3203010000 | ADDITIONAL PAID IN CAPITAL | — | 293,057,776 | — | ||||||||||||||||||||||

| 3203014900 | PREFERRED STOCK ISSUANCE COSTS | 6,942,224 | 6,942,224 | |||||||||||||||||||||||

| 3503010010 | REIT PREFERRED, CLASS A | 300,000,000 | 300,000,000 | |||||||||||||||||||||||

| 3503010020 | REIT PREFERRED ISSUE COSTS | 6,942,224 | 6,942,224 | |||||||||||||||||||||||

| TOTAL IMPACT TO EQUITY | 293,057,776 | — | — | |||||||||||||||||||||||

Case 09-32303 Doc 971 Filed 11/03/10 Entered 11/03/10 14:13:07 Desc Main Document Page 20 of 21

DECLARATION CONCERNING DEBTOR’S

THIRD AMENDMENT TO SCHEDULE B - PERSONAL PROPERTY

I, the Chief Restructuring Officer of the corporation named as debtor in this case, declare under penalty of perjury that I have read the Third Amendment to Schedule B - Personal Property, consisting of 18 pages, and that it is true and correct to the best of my knowledge, information and belief.

| Date: |

November 3, 2010 |

Signature: | /s/ Kevin O’Halloran | |||||||

| Kevin O’Halloran | ||||||||||

| Chief Restructuring Officer |

Case 09-32303 Doc 971 Filed 11/03/10 Entered 11/03/10 14:13:07 Desc Main Document Page 21 of 21