Attached files

Table of Contents

As filed with the Securities and Exchange Commission on November 2, 2010

Registration No. 333-168316

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Cooper-Standard Holdings Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 3714 | 20-1945088 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

| 39550 Orchard Hill Place Drive Novi, MI 48375 (248) 596-5900 |

Timothy W. Hefferon, Esq. Vice President, General Counsel and Secretary Cooper-Standard Holdings Inc. 39550 Orchard Hill Place Drive Novi, MI 48375 (248) 596-5900 | |

| (Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices) |

(Name, address, including zip code, and telephone number, including area code, of agent for service) |

Copy to:

Daniel J. Bursky, Esq.

Fried, Frank, Harris, Shriver & Jacobson LLP

One New York Plaza

New York, New York 10004

(212) 859-8000

Approximate date of commencement of proposed sale to public: From time to time after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer x | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) |

CALCULATION OF REGISTRATION FEE

| Title of each class of securities to be registered |

Amount to be registered(1) |

Proposed maximum offering price per security |

Proposed maximum aggregate offering price |

Amount of registration fee | ||||

| Common stock, par value $0.001 per share |

11,181,673 | $29.80(2) | $333,213,855 | $23,758 | ||||

| 7% cumulative participating convertible preferred stock, par value $0.001 per share |

1,160,772(3) | $100.00(4) | $116,077,200 | $8,276 | ||||

| Common stock, par value $0.001 per share |

4,980,627 |

—(5) | — | — | ||||

| Warrants to purchase common stock, par value $0.001 per share |

1,693,827 | —(6) | — | — | ||||

| Common stock, par value $0.001 per share |

1,693,827 | $27.33(7) | $46,292,292 | $3,301 | ||||

| Total |

$35,335(8) | |||||||

Table of Contents

| (1) | Represents shares of common stock, shares of 7% cumulative participating convertible preferred stock, including shares of common stock issuable upon conversion, and warrants to purchase common stock, including shares of common stock underlying the warrants, being registered for resale that were privately placed to investors in connection with the registrant’s emergence from bankruptcy on May 27, 2010. In accordance with Rule 416 under the Securities Act, the shares of common stock offered hereby also include such indeterminate number of shares of common stock that may be issued with respect to stock splits, stock dividends or similar transactions. |

| (2) | Includes a bona fide estimate of shares of 7% cumulative participating convertible preferred stock to be issued as dividends paid in kind during the next two years. |

| (3) | Estimated solely for the purpose of determining the registration fee pursuant to Rule 457(c) under the Securities Act, based on the average of the high and low sales price of our common stock as of July 21, 2010 as reported on the Over-the-Counter Bulletin Board. |

| (4) | Estimated solely for purposes of calculating the registration fee pursuant to Rule 457 under the Securities Act. |

| (5) | Pursuant to Rule 457(i) under the Securities Act, no additional registration fee is required with respect to the shares of common stock issuable upon conversion of the preferred stock. |

| (6) | Pursuant to Rule 457(i), no additional registration fee is required with respect to the warrants as a fee is being paid for the registration of the shares of common stock underlying the warrants. |

| (7) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(g) under the Securities Act, based on an exercise price of $27.33 per share. |

| (8) | $34,263 already paid. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. The selling security holders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED NOVEMBER 2, 2010

Prospectus

Cooper-Standard Holdings Inc.

17,210,676 Shares of Common Stock

1,010,345 Shares of 7% Cumulative Participating Convertible Preferred Stock

Warrants to Purchase 1,693,827 Shares of Common Stock

We emerged from Chapter 11 reorganization on May 27, 2010. As part of our plan of reorganization, we issued the securities listed below in a private placement to certain creditors in order to raise a portion of the funds necessary for our emergence from bankruptcy. Pursuant to our plan of reorganization, certain creditors that received these securities and their transferees, who are identified as selling security holders throughout this prospectus, are entitled to have these securities registered for resale.

This prospectus relates to the following securities that may be sold from time to time by the selling security holders identified in this prospectus:

| • | 11,181,673 shares of our common stock, par value $0.001 per share, which consists of 8,623,491 shares issued to certain creditors pursuant to a rights offering and 2,558,182 shares issued to certain creditors pursuant to a commitment agreement that provided for the backstop of the rights offering; |

| • | 1,010,345 shares of our 7% cumulative participating convertible preferred stock, par value $0.001 per share, issued to certain creditors pursuant to the commitment agreement that provided for the backstop of the rights offering (including 10,345 shares of 7% preferred stock issued as a dividend payment on our outstanding shares of 7% preferred stock); |

| • | 4,335,176 shares of our common stock issuable to holders of our 7% preferred stock upon conversion of their 7% preferred stock; |

| • | warrants to purchase 1,693,827 shares of our common stock issued to certain creditors pursuant to the commitment agreement that provided for the backstop of the rights offering; and |

| • | 1,693,827 shares of our common stock issuable to holders of our warrants upon exercise of their warrants. |

All of the securities covered by this prospectus are being sold by the selling security holders. We will not receive any proceeds from the sales of any of these securities other than proceeds from the exercise of warrants to purchase shares of our common stock, which will be used for general corporate purposes. It is anticipated that the selling security holders will sell these securities from time to time in one or more transactions, in negotiated transactions or otherwise, at prevailing market prices or at prices otherwise negotiated.

Our common stock and warrants are currently traded on the Over-the-Counter Bulletin Board, commonly known as the OTC Bulletin Board, under the symbols “COSH” and “COSHW,” respectively. On October 29, 2010, the last sale price of our common stock was $42.50 per share and the last sale price of our warrants was $21.00 per warrant. There is currently no established market for our preferred stock.

Investing in our securities involves substantial risks. You should carefully consider the matters discussed under the section entitled “Risk Factors” beginning on page 15 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2010

Table of Contents

| Page | ||||

| 1 | ||||

| 15 | ||||

| 29 | ||||

| RATIO OF EARNINGS TO COMBINED FIXED CHARGES AND PREFERRED STOCK |

31 | |||

| 32 | ||||

| 33 | ||||

| 33 | ||||

| MARKET FOR OUR COMMON STOCK AND WARRANTS AND RELATED STOCKHOLDER MATTERS |

33 | |||

| UNAUDITED PRO FORMA CONDENSED CONSOLIDATED FINANCIAL INFORMATION |

34 | |||

| 41 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

43 | |||

| 75 | ||||

| 76 | ||||

| 77 | ||||

| 80 | ||||

| 96 | ||||

| 129 | ||||

| 132 | ||||

| 139 | ||||

| 142 | ||||

| 149 | ||||

| 152 | ||||

| 159 | ||||

| 161 | ||||

| 161 | ||||

| 161 | ||||

| F-1 | ||||

You should rely only on the information contained in this prospectus and any applicable prospectus supplement or amendment. We have not authorized any person to provide you with different information. This prospectus is not an offer to sell, nor is it an offer to buy, these securities in any state where the offer or sale is not permitted. The information in this prospectus is complete and accurate as of the date on the front cover of this prospectus, but our business, financial condition or results of operations may have changed since that date.

i

Table of Contents

This summary highlights information about us that is contained elsewhere in this prospectus. This summary may not contain all of the information that may be important to you. You should read the entire prospectus carefully before making an investment decision, including the section entitled “Risk Factors” and our consolidated financial statements and related notes. Unless the context requires otherwise, references in this prospectus to “Cooper-Standard,” the “Company,” “we,” “us,” “our” or similar terms refer to Cooper-Standard Holdings Inc. and all of its consolidated subsidiaries.

Our Business

We are a leading manufacturer of body sealing, anti-vibration, or AVS, and fluid handling components, systems, subsystems and modules. Our products are primarily for use in passenger vehicles and light trucks that are manufactured by global automotive original equipment manufacturers, or OEMs, and replacement markets. We believe that we are the largest global producer of body sealing systems, the second largest global producer of the types of fluid handling products that we manufacture and one of the largest North American producers in the AVS business.

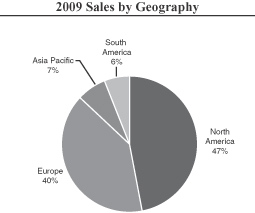

We design and manufacture our products in each major automotive region of the world in close proximity to our customers through a disciplined and consistent approach to engineering and production. We operate in 66 manufacturing locations and nine design, engineering and administrative locations around the world, including Australia, Belgium, Brazil, Canada, China, Czech Republic, France, Germany, India, Italy, Japan, Korea, Mexico, the Netherlands, Poland, Spain, the United Kingdom and the United States. For the year ended December 31, 2009, we generated approximately 47% of our sales in North America, 40% in Europe, 6% in South America and 7% in Asia/Pacific.

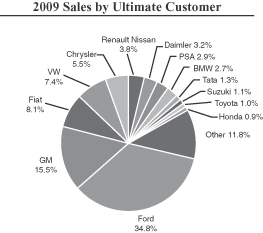

For the year ended December 31, 2009, approximately 80% of our sales were direct to OEMs, including Ford Motor Company, or Ford, “GM,” defined herein as General Motors Corporation combined with General Motors Company, and “Chrysler,” defined herein as Chrysler LLC combined with Chrysler Group LLC, or, collectively, the Detroit 3, Fiat, Volkswagen/Audi Group, Renault/Nissan, PSA Peugeot Citroën, Daimler, BMW, Toyota, Volvo, Jaguar/Land Rover and Honda. The remaining 20% of our sales for the year ended December 31, 2009 were primarily to Tier I and Tier II automotive suppliers and non-automotive customers. In 2009, our products were found in 17 of the 20 top-selling vehicle models in North America and in 19 of the 20 top-selling vehicle models in Europe.

The following chart illustrates our balance and diversity by providing a breakdown of our $1.9 billion in sales for the year ended December 31, 2009 by geography and customer.

|

|

1

Table of Contents

We conduct substantially all of our activities through our subsidiaries and sell our product lines through two reportable segments—North America and International. The International segment covers Europe, South America and Asia. For the year ended December 31, 2009 and the six months ended June 30, 2010, we had sales of $1.9 billion and $1.2 billion and a net loss of $(356.1) million and net income of $641.2 million, respectively. See “Business” for a more detailed description of our business. On a pro forma basis, for the year ended December 31, 2009 and on a combined pro forma basis for the six months ended June 30, 2010, we had sales of $1.9 billion and $1.2 billion and a net loss of $(332.4) million and net income of $23.9 million, respectively. See “Business” for a more detailed description of our business.

Products

We supply a diverse range of products on a global basis to a broad group of customers across a wide range of vehicles. Our principal product lines are body and chassis products and fluid handling products. For the years ended December 31, 2008 and 2009, and the six months ended June 30, 2010, body and chassis products accounted for 66%, 65% and 66%, respectively, of our sales, and fluid handling products accounted for 34%, 35% and 34%, respectively, of our sales. The top ten vehicle platforms we supply accounted for approximately 28% of our sales in 2008, 32% of our sales in 2009 and 34% of our sales in the six months ended June 30, 2010. Our principal product lines are described below.

| Product Lines |

Solutions |

Products & Modules |

Market Position* | |||

| Body & Chassis: |

||||||

| Body Sealing |

Protect vehicle interiors from weather, dust and noise intrusion | Extruded rubber and thermoplastic sealing, weather strip assemblies and encapsulated glass products | #1 globally | |||

| Anti-Vibration |

Control and isolate noise and vibration in the vehicle to improve ride and handling | Engine and body mounts, dampers, isolators, springs, stamped or cast metal products and rubber products | #3 North America | |||

| Fluid Handling |

Control, sense, measure and deliver fluids and vapors throughout the vehicle | Pumps, tubes and hoses, connectors and valves (individually and in systems and subsystems) | #2 globally |

| * | Market positions are management’s estimates, which are based on reports prepared by industry consultants commissioned by us in 2008. See “Market and Industry Data.” |

Our Industry

The automotive industry is one of the world’s largest and most competitive. Consumer demand for new vehicles largely determines sales and production volumes of global OEMs, and component suppliers rely on high levels of vehicle sales and production to be successful.

The automotive supplier industry is generally characterized by high barriers to entry, significant start-up costs and long-standing customer relationships. The key criteria by which OEMs judge automotive suppliers include price, quality, service, performance, design and engineering capabilities, innovation, timely delivery and, more recently, financial stability. Over the last decade, those suppliers that have been able to achieve manufacturing

2

Table of Contents

scale, reduce structural costs, diversify their customer bases and establish a global manufacturing footprint have been successful.

The table below outlines vehicle production forecasts for years 2010 through 2014:

| 2010 | 2011 | 2012 | 2013 | 2014 | ||||||

| (vehicle units in millions) | ||||||||||

| Europe |

17.0 | 17.2 | 18.3 | 19.9 | 21.2 | |||||

| North America |

11.6 | 12.6 | 13.5 | 14.6 | 15.2 | |||||

| Asia |

32.8 | 34.6 | 37.4 | 39.9 | 41.4 | |||||

| Source: | IHS Automotive (formerly CSM Worldwide) June 2010 Forecast |

Among the leading drivers of new vehicle demand is the availability of consumer credit to finance purchases. Beginning in late 2008, turmoil in the global credit markets and the recession in the United States and global economies led to a severe contraction in the availability of consumer credit. As a result, global vehicle sales volumes plummeted, led by severe declines in the mature North American and European markets. During 2009, North American light vehicle industry production declined by approximately 32% from 2008 levels to 8.6 million units, while European light vehicle industry production declined by approximately 20% from 2008 levels to 16.3 million units. The decline was less pronounced in Asia, where volumes were down only 1% from 2008 levels to 26.6 million units. This resilience was largely attributable to the continued expansion of the Chinese and Indian markets, both of which are expected to continue to increase as a share of the global automotive market in the coming years.

The severe decline in vehicle sales and production in 2009 led to major restructuring activity in the industry, particularly in North America. GM and Chrysler reorganized through chapter 11 bankruptcy proceedings and the Detroit 3 undertook other strategic actions, including the divestiture or discontinuance of non-core businesses and brands and the acceleration or broadening of operational and financial restructuring activities. A number of significant automotive suppliers, including us, restructured through chapter 11 bankruptcy proceedings or through other means.

Several significant trends and developments are now contributing to improvement in the automotive supplier industry. These include improved retail vehicle sales and production in North America in the fourth quarter of 2009 and first quarter of 2010, a more positive credit environment, the continued growth of new markets in Asia, particularly China, and increased emphasis on “green” and other innovative technologies.

Our Competitive Strengths

Innovative and high quality products

We believe we have distinguished ourselves in the automotive industry through our engineering and technological capabilities, as evidenced by our development of innovative solutions, including our ESP Thermoplastic Glassruns (body sealing), ride stabilizing hydromounts (AVS) and proprietary plastics-to-aluminum overmolding process (fluid handling). In addition, we believe we have a reputation for outstanding quality within the automotive industry, a factor that has been important to maintaining and expanding our successful relationships with our customers. We have earned numerous awards, including, among others, the DaimlerChrysler Global Supplier Award, GM Supplier of the Year, Ford’s Silver World Excellence Award and Toyota’s Cost Excellence Performance Award.

Operational excellence

We have a proven track record and disciplined approach to operational excellence, which has generated significant cost savings of approximately 4% of sales annually since 2004. We believe we have the ability to

3

Table of Contents

generate similar savings in the future due to the flexible nature of our manufacturing capabilities, our highly efficient operations and our ability to leverage economies of scale from the high volumes of products we produce for the world’s top-selling vehicle platforms. We have created a culture of continuous improvement and lean manufacturing in all aspects of our operations. Over the life cycle of each platform, we focus on streamlining manufacturing, increasing automation and reducing material and other costs in an effort to generate additional operational savings. We budget and track operational savings at the facility level, which management regularly reports and reviews.

Strong customer relations and program management

We believe that our customer relationships, program management capabilities, global presence, comprehensive product line, excellence in manufacturing, product innovation and quality assurance combine to provide us with significant competitive advantages. We have proven our ability to expand globally with customers, increase scale in a consolidating industry and be first-to-market with design and engineering innovations.

We have a high level of dedication to customer service, and for each major product launch we dedicate a team of sales representatives, engineers, quality specialists and senior management, who work together to ensure that the product launch is completed on time and consistent with rigorous quality standards. These characteristics have allowed us to remain a leading supplier to Ford and GM while steadily growing our business with European and Asian OEMs. Our capabilities are evidenced by our success in being awarded significant content on our customers’ top-selling platforms, including the Ford F-Series and GM’s GMT900 platform, which includes the Yukon, Tahoe, Sierra and Silverado vehicle models.

Global manufacturing footprint

We have established a global manufacturing footprint that allows us to serve our customers worldwide. Our global manufacturing operations are supported by 66 manufacturing locations and nine design, engineering and administrative locations around the world, including Australia, Belgium, Brazil, Canada, China, Czech Republic, France, Germany, India, Italy, Japan, Korea, Mexico, the Netherlands, Poland, Spain, the United Kingdom and the United States. Since 2004, we have increased our sales outside North America from 30% to 53%, largely reflecting our strategic focus on gaining exposure to high growth Asian markets and from key acquisitions in Europe. As part of our strategy, we operate several successful international joint ventures, which has allowed us to enter into new geographic markets, to acquire new customers and to develop new technologies. Our joint venture partners provide knowledge and insight into local markets and access to local suppliers of raw materials and components. We believe our global manufacturing footprint and proximity to customers provides us with a competitive advantage by allowing us to efficiently transport parts to local customers at a significantly lower cost as many of the parts are difficult to transport across long distances.

Incumbent position across diverse customer base

In 2009, our products were found in 17 of the 20 top-selling vehicle models in North America and in 19 of the 20 top-selling vehicle models in Europe. As the incumbent supplier to platforms, we have typically participated in the design of their successor platforms, and therefore, we believe we have been afforded a competitive advantage to win the upgrade and the ultimate replacement business. In addition, we believe that our presence on our largest customers’ highest-volume and most important platforms is a competitive advantage that allows us to further increase our market share, cross-sell our other product lines, fully leverage our lean initiatives, spread our fixed costs over higher volumes and increase our return on capital.

Experienced management team

Our senior management team has extensive experience in the automotive industry and collectively has over 130 years of experience in the industry. Our management team is focused on guiding us through the challenges facing the

4

Table of Contents

automotive industry and the changing economic environment through ongoing and continued cost reduction and restructuring initiatives and is intent on continuing to implement our business strategies. For more information on our executive officers, see “Management—Directors and Executive Officers.”

Conservative capital structure

Upon the date of our emergence from bankruptcy, May 27, 2010, or the emergence date, we significantly improved our leverage as compared to historical levels. As part of our plan of reorganization, we extinguished $1,126.7 million of prepetition debt, issued $450 million of 8 1/2% senior notes due 2018, or our senior notes, and entered into a $125 million senior secured asset-based revolving credit facility, or our senior ABL facility. At the emergence date, we had $479.3 million of outstanding indebtedness, consisting of our senior notes and $29.3 million in other debt of certain of our foreign subsidiaries. Our senior ABL facility is subject to borrowing base limitations, and we had approximately $34.3 million of letters of credit outstanding but not drawn under our senior ABL facility on the emergence date. For the year ended December 31, 2009 and the six months ended June 30, 2010, we had a net loss of $(356.1) million and net income of $641.2 million, respectively. On a pro forma basis, for the year ended December 31, 2009 and on a combined pro forma basis for the six months ended June 30, 2010, we had a net loss of $(332.4) million and net income of $23.9 million, respectively. We believe our emergence date capital structure is a conservative and stable structure.

Our Business Strategy

Continue optimization of our business and cost structure

We seek to optimize our business and cost structure so that we are appropriately configured in the rapidly changing environment in the automotive industry, with an emphasis on reducing our overall cost structure and making our manufacturing operations more efficient. Our primary areas of focus are:

| • | Identifying and implementing lean manufacturing initiatives. Our lean manufacturing initiatives focus on optimizing manufacturing by eliminating waste, controlling cost and enhancing productivity. Lean manufacturing initiatives have been implemented at each of our manufacturing and design facilities and continue to be an important element in our disciplined approach to operational excellence. |

| • | Relocating operations to lower-cost countries. We are supplementing our Western European operations with Central and Eastern European facilities where there are lower operating costs and to more closely match our customers’ footprints for more efficient transport of parts. In addition, we have expanded our operations in China, India and Mexico. |

| • | Consolidating facilities to reduce our cost structure. Our optimization efforts are designed to streamline our global operations and include taking advantage of opportunities to reduce our overall cost structure by consolidating and closing facilities. For example, in the second half of 2009, we closed two manufacturing facilities, one located in Ohio and another located in Germany, and in March 2010, we announced the closure of our manufacturing facility in Spain. We will continue to take a disciplined approach to evaluating opportunities that would improve our efficiency, profitability and cost structure. |

| • | Maintaining flexibility in all areas of our operations. Our operational capital needs are generally lower than many in our industry and a major portion of our manufacturing machinery is movable from job-to-job, providing us flexibility in adapting to market changes and serving customers worldwide. |

Further developing technologies

We will draw on our technical expertise to provide customers with innovative solutions. Our engineers combine product design with a broad understanding of material options for enhanced vehicle performance. We believe our

5

Table of Contents

reputation for successful innovation in product design and material usage is the reason our customers consult us early in the development and design process of their next generation vehicles.

Recent innovations that highlight our ability to combine materials and product design expertise can be found in the following products:

| • | Safe Seal™. Safe Seal™ is a body sealing product featuring sensors built into the seal capable of reversing power windows, doors and partitions to prevent injury. |

| • | Our new generation Hydro Body Mount. Our new generation Hydro Body Mount features patented Inertia-track design, combining plastic, metal and rubber to provide superior damping in the driver compartment for improved ride. |

| • | Direct Injection Fuel Rail. Direct Injection Fuel Rails draw upon our innovative welding processes and understanding of metal dynamics to create high pressure capability for highly advanced direct injection engines, improving fuel economy and performance. |

| • | Stratlink. Utilizing our internal material engineering capabilities, we have developed a rubber compound that performs equally with externally sourced compounds, which will significantly reduce cost. |

| • | PlastiCool. PlastiCool is a low cost, low weight, high temperature alternative to metal and rubber hose currently used in transmission cooling that offers a more robust joint design, improving quality and potentially reducing warranty costs. Additionally, because the material is smaller than current alternatives, it allows for greater design flexibility. |

Continued emphasis on fuel efficient, global and high volume vehicles

We believe that by focusing on fuel efficient, global and high volume vehicles, we will be able to solidify and expand our global leadership position.

| • | Fuel efficient. With the recent shift in customer preferences toward light weight, fuel efficient vehicles, we intend to target small car, hybrid and alternative powertrains and increase the content we provide to these platforms. We believe that furthering our position in the small car and hybrid market and alternative powertrains will allow us to increase market share, create greater economies of scale and provide more opportunities to partner with customers. |

| • | Global. Our global presence makes us one of the select few manufacturers of products in our product line areas who can take advantage of the many business opportunities that are becoming available worldwide as a result of the OEMs’ expanding emphasis on global platforms. Examples of successful global platforms we supply are the redesigned Ford Fiesta and GM’s Buick LaCrosse. |

China, India and South America will continue to be regions of emphasis as their light vehicle market is projected to grow substantially as their economies continue to develop. In China, we are developing a substantial manufacturing and marketing presence to serve local OEMs, and we intend to follow our customers as they target other high growth developing markets.

| • | High volume. While smaller cars and crossover vehicles have grown in popularity, certain large car and truck platforms continue to be in demand and remain important to our business. For example, the Ford F-150 and GM’s GMT 900 platform (the Silverado, Sierra, Tahoe and Yukon nameplates) continue to be popular models for which we supply a broad range of our product offerings, including body sealing systems, anti-vibration systems and fuel, brake, emissions and thermal management components. |

Through our extensive product portfolio, innovative solutions and broad global capabilities, we expect to continue winning new business across all major regions and automakers.

6

Table of Contents

Developing systems solutions and other value-added products

We believe that significant opportunities exist to grow by providing complete subsystems, modules and assemblies. As a leader in design, engineering and technical capabilities, we are able to focus on improving products, developing new technologies and implementing more efficient processes in each of our product lines. Our body sealing products are visible to vehicle passengers and can enhance the vehicle’s aesthetic appeal, in addition to creating a barrier to wind, precipitation, dust and noise. Our AVS products are an important contributor to vehicle quality, significantly improving ride and handling. Our fluid handling modules and subsystems are designed to increase functionality and decrease costs to the OEM, which can be the deciding factor in winning new business.

Selectively pursuing complementary acquisitions and alliances

We intend to continue to selectively pursue complementary acquisitions and joint ventures to enhance our customer base, geographic penetration, scale and technology. Consolidation is an industry trend and is encouraged by the OEMs’ desire for fewer supplier relationships. We believe we have a strong platform for growth through acquisitions based on our past integration successes, experienced management team, global presence and operational excellence. In addition, we believe joint ventures allow us to penetrate new markets with less relative risk and capital investment. We currently operate through several successful joint ventures, including those with Nishikawa Rubber Company, Zhejiang Saiyang Seal Products Co., Ltd., Guyoung Technology Co. Ltd., Hubei Jingda Precision Steel Tube Industry Co., Ltd., Shanghai Automotive Industry Corporation and Toyoda Gosei Co., Ltd.

Developing business in non-automotive markets

While the automotive industry will continue to be our core business, we supply other industries with products using our expertise and material compounding capabilities. For example, we supply parts to customers in the technical rubber business and develop and produce synthetic rubber products for a variety of industry applications, including aircraft flooring, commercial flooring, insulating sheets for power stations, non-slip step coverings, rubber for appliances and construction applications. In our technical rubber business we fabricate products from a wide variety of elastomer compounds and can custom fit many applications.

Risk Factors

Investing in our equity securities involves substantial risk, and our ability to successfully operate our business is subject to numerous risks. Any of the factors set forth under “Risk Factors” may limit our ability to successfully execute our business strategy. You should carefully consider all of the information set forth in this prospectus and, in particular, the specific factors set forth under “Risk Factors” in deciding whether to invest in our equity securities. Among these important risks are the following:

| • | Because of our new post-bankruptcy capital structure and implementation of “fresh-start” accounting, our financial condition or results of operations will not be comparable to the financial condition or results of operations reflected in our historical financial statements. |

| • | We may not be able to generate sufficient cash to service all of our indebtedness and meet the dividend obligations of our preferred stock, and we may be forced to take other actions to satisfy our obligations under our indebtedness and preferred stock, which may not be successful. Because our ability to make scheduled payments on our debt and meet the dividend obligations of our preferred stock depends on our financial condition and operating performance, we are subject to prevailing economic and competitive conditions and to certain financial, business and other factors beyond our control. |

7

Table of Contents

| • | The financial condition of our customers, particularly the Detroit 3, may adversely affect our results of operations and financial condition. Chrysler, Ford and GM have engaged in unprecedented restructuring, which included Chrysler and GM reorganizing under bankruptcy laws, and while portions of Chrysler and GM have successfully emerged from bankruptcy proceedings, it is still uncertain what portion of their respective sales will return and whether they can be viable at a lower level of sales. |

| • | A prolonged or further material contraction in automotive sales and production volumes could materially adversely affect our liquidity, the viability of our supply base and the financial conditions of our customers. Our customers have been severely affected by the turmoil in the global credit markets and the economic recession. Our supply base has also been adversely affected by the current industry environment. Our financial condition, operating results and cash flows could be further affected by a material contraction in the automotive industry, which would impact our ability to meet our obligations. |

| • | Disruptions in the financial markets are adversely impacting the availability and cost of credit to us, which could continue to negatively affect our business. In addition, if our customers and suppliers are not able to obtain required capital, their businesses would be negatively impacted, which could negatively impact our business, whether through loss of sales or an inability to meet our commitments. |

| • | We could be materially adversely affected if we are unable to continue to compete successfully in the highly competitive automotive parts industry. We face numerous competitors in each of the product lines we produce and increased competition from suppliers producing in lower-cost countries. |

| • | We are subject to other risks associated with our non-U.S. operations, including: exchange controls and currency restrictions; currency fluctuations and devaluations; changes in local economic conditions; changes in laws and regulations, including the imposition of embargos; exposure to possible expropriation or other government actions; and unsettled political conditions and possible terrorist attacks. These and other factors may have a material adverse effect on out international operations or on our business, results of operations and financial condition. |

Our Reorganization

On August 3, 2009, we along with our U.S. subsidiaries, or the debtors, filed voluntary petitions for chapter 11 bankruptcy protection in the United States Bankruptcy Court for the District of Delaware. On August 4, 2009, our Canadian subsidiary, Cooper-Standard Automotive Canada Limited, or CSA Canada, sought relief under the Companies’ Creditors Arrangement Act in the Ontario Superior Court of Justice in Toronto, Ontario, Canada. The debtors and CSA Canada emerged from their respective insolvency proceedings on May 27, 2010, with approximately $480 million of funded debt, representing a reduction of over $650 million from prepetition levels.

As part of our emergence from chapter 11, we raised $450 million through the issuance of our senior notes and entered into our $125 million senior ABL facility with certain agent and lending banks. In addition, we raised $355 million through the issuance of (i) $100 million of our 7% cumulative participating convertible preferred stock, or our 7% preferred stock, to certain creditors pursuant to a commitment agreement that provided for the backstop of our rights offering, or the Backstop Parties, and (ii) $255 million of our common stock to the Backstop Parties and holders of our prepetition 8 3/8% senior subordinated notes due 2014, or our prepetition senior subordinated notes, pursuant to our rights offering. The Backstop Parties also received warrants to purchase 7% of our common stock (assuming the conversion of our 7% preferred stock) for their commitment to backstop the rights offering.

In connection with our emergence from chapter 11, amounts outstanding under our $175 million debtor-in- possession financing facility and $639.6 million of claims under our prepetition credit facility were paid in full in cash. Holders of our prepetition 7% senior notes due 2012, or our prepetition senior notes, were also paid in full

8

Table of Contents

in cash, except that the Backstop Parties received a distribution of our common stock in lieu of the cash payment for certain of their prepetition senior note claims. Holders of our prepetition senior subordinated notes were issued 8% of our outstanding common stock and warrants to purchase, in the aggregate, 3% of our outstanding common stock (in each case, assuming the conversion of our 7% preferred stock). In addition, our obligations under both our prepetition senior notes and our prepetition senior subordinated notes were cancelled. See “Description of Certain Indebtedness” for a more detailed description of our senior notes and senior ABL facility, “Description of Capital Stock” for a more detailed description of our equity securities and “Our Reorganization” for a more detailed description of our reorganization.

Accounting Impact of Emergence from Chapter 11

In accordance with the provisions of Financial Accounting Standards Board, or FASB, Accounting Standards Codification, or ASC, 852, “Reorganizations,” we adopted “fresh-start” accounting upon our emergence from bankruptcy and became a new entity for financial reporting purposes as of June 1, 2010. Accordingly, the consolidated financial statements for the reporting entity subsequent to emergence from bankruptcy, or the Successor, are not comparable to the consolidated financial statements for the reporting entity prior to emergence from bankruptcy, or the Predecessor. For a discussion of “fresh-start” accounting, see note 3 to our unaudited interim financial statements as of June 30, 2010.

Corporate History

Cooper-Standard Holdings Inc. was formed and capitalized in 2004 as a Delaware corporation and began operating on December 23, 2004, when it acquired the automotive segment of Cooper Tire & Rubber Company, or the 2004 acquisition. Cooper-Standard Holdings Inc. operates the business primarily through its principal operating subsidiary, Cooper-Standard Automotive Inc. Our principal executive office is located at 39550 Orchard Hill Place Drive, Novi, MI 48375. Our telephone number is (248) 596-5900. Our website address is www.cooperstandard.com. The information available on or through our website is not part of this prospectus.

Market and Industry Data

Market data and other statistical information, including market share, ranking and similar information, used throughout this prospectus is based on data available from third party market research firms, other third party sources and our good faith estimates based on internal surveys and market intelligence. For a more detailed description of the market and industry data used in this prospectus, including a discussion of the risks and uncertainties inherent in such data, see “Risk Factors,” “Forward-Looking Statements” and “Market and Industry Data.”

Trademarks and Tradenames

We own or have rights to trademarks or trade names that we use in conjunction with the operation of our business. In addition, Stratlink™, Safe Seal™, PosiBond™, and PosiLock™, our name, logo and website name and address are our service marks or trademarks. Each trademark, trade name or service mark of any other company appearing in this prospectus belongs to its holder.

9

Table of Contents

The Offering

Common Stock:

| Offered by the selling security holders |

Up to 17,210,676 shares of our common stock consisting of: |

| • | 11,181,673 shares of our outstanding common stock; |

| • | 4,335,176 shares of our common stock issuable to holders of our 7% preferred stock upon conversion of their preferred stock; and |

| • | 1,693,827 shares of our common stock issuable to holders of our warrants upon exercise of their warrants. |

| Outstanding prior to and after to the offering(1) |

18,376,112. |

| Outstanding prior to and after the offering, diluted(2) |

26,101,583. |

7% Preferred Stock:

| Offered by the selling security holders |

Up to 1,010,345 shares of our 7% preferred stock. |

| Outstanding prior to and after the offering(3) |

1,052,446. |

Warrants:

| Offered by the selling security holders |

Warrants to purchase up to 1,693,827 shares of our common stock. We use the term warrant to refer to the right to purchase one share of our common stock. |

| Outstanding prior to and after the offering(4) |

2,419,753. |

| Use of Proceeds |

We will not receive any of the proceeds from the sale of the securities by the selling security holders. We may receive proceeds upon the exercise of warrants if any warrant holder pays the exercise price in cash rather than exercising on a cashless basis. If we receive any proceeds from the issuance of shares of our common stock upon the exercise of warrants, such proceeds will be used for working capital and general corporate purposes. See “Use of Proceeds.” |

OTC Bulletin Board Symbol:

| Common stock |

COSH. |

| Warrants |

COSHW. |

| 7% Preferred Stock |

There is currently no established market for our 7% preferred stock. |

| Risk Factors |

Investing in our securities involves a high degree of risk. You should carefully read and consider the information set forth under the heading “Risk Factors” beginning on page 15 of this prospectus and all other information in this prospectus before investing in our securities. |

| (1) | Reflects the total number of outstanding shares of our common stock as of October 29, 2010 without giving effect to shares of our common stock that may be issued upon the conversion of outstanding shares of our 7% preferred stock or upon the exercise of outstanding warrants or options to purchase shares of our common stock. |

| (2) | Reflects the total number of outstanding shares of our common stock as of October 29, 2010, plus 4,515,823 shares issuable upon the conversion of our 7% preferred stock, 2,419,753 shares issuable upon the exercise of our warrants and 787,895 shares of our common stock that may be issued to certain of our officers and key employees and directors upon the exercise of options. |

| (3) | Based upon the total number of outstanding shares of our 7% preferred stock as of October 29, 2010, including 42,101 shares of restricted 7% preferred stock issued to certain of our officers and key employees. |

| (4) | Based upon the total number of outstanding warrants as of October 29, 2010. |

10

Table of Contents

Summary Historical and Pro Forma Financial Data

The following tables set forth our summary consolidated historical financial data and unaudited pro forma condensed consolidated financial information for the periods ended and as of the dates set forth below. The summary consolidated historical financial data as of December 31, 2008 and 2009 and for the years ended December 31, 2007, 2008 and 2009 have been derived from our audited consolidated financial statements and the notes thereto, which are included elsewhere in this prospectus. Ernst & Young LLP’s report on the consolidated financial statements for the year ended December 31, 2009, which appears elsewhere herein, includes an explanatory paragraph which describes an uncertainty about Cooper-Standard Holding, Inc.’s ability to continue as a going concern. The data should be read in conjunction with the consolidated financial statements, related notes, and other financial information included herein. The financial information as of December 31, 2007 was derived from our 2007 audited consolidated financial statements, which are not included in this prospectus. The summary historical financial data as of June 30, 2010 and for the six months ended June 30, 2009, the five months ended May 31, 2010 and the one month ended June 30, 2010 have been derived from our unaudited consolidated financial statements and the notes thereto, which are included elsewhere in this prospectus.

We have prepared the unaudited summary consolidated financial data as of and for the six months ended June 30, 2009, the five months ended May 31, 2010 and the one month ended June 30, 2010 on a basis consistent with our audited consolidated financial statements for the year ended December 31, 2009, and this information includes all adjustments (consisting of only normal recurring adjustments unless otherwise disclosed therein) that management considers necessary for a fair presentation of our financial position and results of operations for the periods indicated. Historical results are not necessarily indicative of future performance. Operating results for the five months ended May 31, 2010 and the one month ended June 30, 2010 are not necessarily indicative of results that may be expected for the full fiscal year.

The summary unaudited pro forma condensed consolidated financial data set forth below has been derived by applying the pro forma adjustments described under “Unaudited Pro Forma Condensed Consolidated Financial Information” to our historical consolidated statement of operations for the year ended December 31, 2009 and the combined historical five months ended May 31, 2010 and one month ended June 30, 2010, respectively. The summary unaudited pro forma condensed consolidated statement of operations data has been prepared to give effect to the Pro Forma Adjustments, as further described under “Unaudited Pro Forma Condensed Consolidated Financial Information,” as if they had occurred on January 1, 2009.

The summary unaudited pro forma condensed consolidated financial data presented for the year ended December 31, 2009 are based on the historical consolidated financial statements and the summary unaudited pro forma condensed consolidated financial data presented for the six months ended June 30, 2010 was derived from the unaudited consolidated financial statements and each has been prepared to give effect to the following:

| • | the effectiveness of the debtors’ Second Amended Joint Chapter 11 Plan, or our plan of reorganization, including the issuance of our senior notes and the rights offering, collectively referred to as Reorganization Adjustments in “Unaudited Pro Forma Condensed Consolidated Financial Information”; and |

| • | the adjustments required under “fresh-start” accounting for the entities that emerged from the bankruptcy cases, classified as Fresh-Start Adjustments in “Unaudited Pro Forma Condensed Consolidated Financial Information.” |

We adopted “fresh-start” accounting upon our emergence from Chapter 11 bankruptcy proceedings and became a new entity for financial reporting purposes as of June 1, 2010. Accordingly, the consolidated financial statements for the reporting entity subsequent to emergence from Chapter 11 bankruptcy proceedings, or the Successor, are not comparable to the consolidated financial statements for the reporting entity prior to emergence from Chapter 11 bankruptcy proceedings, or the Predecessor. For a discussion of “fresh-start” accounting, see note 3 to our unaudited interim financial statements as of June 30, 2010.

11

Table of Contents

The following summary historical and unaudited pro forma condensed consolidated financial data is qualified by reference to, and should be read in conjunction with, our historical consolidated financial statements and the notes to those statements included elsewhere in this prospectus and the information under “Unaudited Pro Forma Condensed Consolidated Financial Information,” “Capitalization” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

The summary unaudited pro forma condensed consolidated financial information set forth below is presented for illustrative purposes only and is not necessarily indicative of the results of operations or financial position that would have actually been reported had the transactions and other matters reflected in the Pro Forma Adjustments occurred on January 1, 2009, nor is it indicative of our future results of operations or financial position. In addition, our historical financial statements will not be comparable to our financial statements following our emergence from bankruptcy due to the effects of the consummation of our plan of reorganization as well as adjustments for “fresh-start” accounting. In addition, the amount of new stockholders’ equity in the unaudited pro forma condensed consolidated balance sheet is not an estimate of the market value of our common stock or 7% preferred stock as of the emergence date or at any other time. We make no representations as to the market value, if any, of our common stock and 7% preferred stock.

| Historical | Pro Forma | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Predecessor | Successor | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year Ended December 31, | Six Months Ended June 30, 2009 |

Five Months Ended May 31, 2010 |

One Month Ended June 30, 2010 |

Year Ended December 31, 2009 |

Six Months Ended June 30, 2010 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2007 | 2008 | 2009 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Statement of operations: |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sales |

$ | 2,511.2 | $ | 2,594.6 | $ | 1,945.3 | $ | 849.8 | $ | 1,009.1 | $ | 215.6 | $ | 1,945.3 | $ | 1,224.7 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cost of products sold |

2,114.1 | 2,260.1 | 1,679.0 | 756.7 | 832.2 | 181.9 | 1,691.9 | 1,008.8 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gross profit |

397.1 | 334.5 | 266.3 | 93.1 | 176.9 | 33.7 | 253.4 | 215.9 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Selling, administration & engineering expenses |

222.1 | 231.7 | 199.5 | 93.5 | 92.1 | 23.0 | 199.7 | 118.7 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Amortization of intangibles |

31.9 | 31.0 | 15.0 | 14.6 | 0.3 | 1.3 | 15.1 | 7.6 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Impairment charges |

146.4 | 33.4 | 363.5 | 362.7 | — | — | 363.5 | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Restructuring |

26.4 | 38.3 | 32.4 | 28.5 | 5.9 | 0.4 | 32.4 | 6.3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Operating profit (loss) |

(29.7 | ) | 0.1 | (344.1 | ) | (406.2 | ) |

As a result of the adoption of fresh-start accounting, all remaining amounts recorded in accumulated other comprehensive income (loss) related to forward foreign exchange contracts and interest rate swaps were eliminated. See Note 3, “Fresh-Start Accounting”. Fair Value Measurements ASC 820 clarifies that fair value is an exit price, representing the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants. As such, fair value is a market-based measurement that should be determined based upon assumptions that market participants would use in pricing an asset or liability. As a basis for considering such assumptions, ASC 820 establishes a three-tier fair value hierarchy, which prioritizes the inputs used in measuring fair value as follows: Level 1: Observable inputs, such as quoted prices in active markets; Level 2: Inputs, other than quoted prices in active markets, that are observable either directly or indirectly; and Level 3: Unobservable inputs in which there is little or no market data, which require the reporting entity to develop its own assumptions. Estimates of the fair value of foreign currency and commodity derivative instruments are determined using exchange traded prices and rates. The Company also considers the risk of non-performance in the estimation of fair value and includes an adjustment for non-performance risk in the measure of fair value of derivative instruments. In certain instances where market data is not available, the Company uses management judgment to develop assumptions that are used to determine fair value. Fair value measurements and the fair value hierarchy level for the Company’s liabilities measured or disclosed at fair value on a recurring basis as of June 30, 2010, are shown below:

F-97

Table of ContentsNOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS—(Continued) (Unaudited) (Dollar amounts in thousands except per share amounts)

A reconciliation of changes in assets and liabilities related to derivative instruments measured at fair value using the market and income approach adjusted for our and our counterparty’s credit risks for the six months ended June 30, 2010, is shown below:

(Gains) and losses (realized and unrealized) included in earnings (or changes in net liabilities) for the period (above) are reported in cost of products sold and other income (expense):

Items measured at fair value on a non-recurring basis In addition to items that are measured at fair value on a recurring basis, the Company measures certain assets and liabilities at fair value on a non-recurring basis, which are not included in the table above. As these non-recurring fair value measurements are generally determined using unobservable inputs, these fair value measurements are classified within Level 3 of the fair value hierarchy. For further information on assets and liabilities measured at fair value on a non-recurring basis, see Note 3, “Fresh-Start Accounting,” and Note 5, “Restructuring.” 18. Accounts Receivable Factoring As a part of its working capital management, the Company sells certain receivables through third party financial institutions without recourse. The amount sold varies each month based on the amount of underlying receivables and cash flow needs of the Company. At June 30, 2009 and 2010, the Company had $41,540 and $37,619, respectively, of receivables outstanding under receivable transfer agreements entered into by various locations. For the one month ended June 30, 2010 and five months ended May 31, 2010, total accounts receivables factored was $7,043 and $40,592, respectively.

F-98

Table of ContentsNOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS—(Continued) (Unaudited) (Dollar amounts in thousands except per share amounts)

The Company incurred a loss on the sale of receivables of $81 for the one month period ended June 30, 2010, $174 for the two month period ended May 31, 2010 and $293 for the three months ended June 30, 2009. Losses incurred on the sale of receivables were $377 and $550 for the five months ended May 31, 2010 and six months ended June 30, 2009, respectively; this amount is recorded in other income (expense) in the consolidated statements of operations. The Company continues to service the receivables for one of the locations. These are permitted transactions under the Company’s credit agreement. The Company is also pursuing similar arrangements in various locations. 19. Subsequent Events In preparing these financial statements, the Company has evaluated events and transactions for potential recognition or disclosure through the date the financial statements were issued.

F-99

Table of Contents

Cooper-Standard Holdings Inc. 17,210,676 Shares of Common Stock 1,010,345 Shares of 7% Cumulative Participating Convertible Preferred Stock Warrants to Purchase 1,693,827 Shares of Common Stock Prospectus

Table of Contents

PART II INFORMATION NOT REQUIRED IN PROSPECTUS

The following table sets forth the costs and expenses, if any, payable by us relating to the sale of securities being registered. The selling security holders are responsible for any expenses incurred by them for brokerage, accounting, tax, or legal or other services incurred by the selling security holders in disposing of the securities. All amounts are estimates except the SEC registration fee.

Section 145 of the Delaware General Corporation Law, or the DGCL, permits a Delaware corporation to indemnify its officers, directors and other corporate agents to the extent and under the circumstances set forth therein. Our certificate of incorporation and bylaws provide that we will indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding whether civil, criminal, administrative or investigative, by reason of the fact that he is or was our director or officer, or is or was serving at our request as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, in accordance with provisions corresponding to Section 145 of the Delaware General Corporation Law. These indemnification provisions may be sufficiently broad to permit indemnification of the registrant’s executive officers and directors for liabilities, including reimbursement of expenses incurred, arising under the Securities Act. Pursuant to Section 102(b)(7) of the Delaware General Corporation Law, our certificate of incorporation eliminates the personal liability of a director to us or our stockholders for monetary damages for a breach of fiduciary duty as a director, except for liabilities arising:

The above discussion of Section 145 of the Delaware General Corporation Law and of our certificate of incorporation and bylaws is not intended to be exhaustive and is respectively qualified in its entirety by Section 145 of the Delaware General Corporation Law, our certificate of incorporation and our bylaws. As permitted by Section 145 of the Delaware General Corporation Law, we carry primary and excess insurance policies insuring our directors and officers against certain liabilities they may incur in their capacity as directors and officers. Under the policies, the insurer, on our behalf, may also pay amounts for which we granted indemnification to our directors and officers. Our certificate of incorporation provides that our directors shall not be personally liable to us or our stockholders for monetary damages for breach of fiduciary duty as a director, except to the extent such exemption from

II-1

Table of Contentsliability or limitation thereof is not permitted by the Delaware General Corporation Law. If the DGCL is amended to authorize corporate action further eliminating or limiting the liability of directors, then the liability of our directors will be eliminated or limited to the fullest extent permitted by the DGCL, as so amended. Our bylaws provide for the same indemnification for our directors and officers. Our bylaws provide that expenses (including attorneys’ fees) incurred by a Covered Person in defending, testifying or otherwise participating in any proceeding for which such officer or director may be entitled to indemnification hereunder shall be paid by us in advance of the final disposition of such proceeding upon receipt of an undertaking by or on behalf of such Covered Person to repay such amount if it shall ultimately be determined that he or she is not entitled to be indemnified by us as authorized by the bylaws. The indemnification provided by our bylaws is not deemed to be exclusive of any other right to which a person seeking indemnification or advancement of expenses may be entitled under applicable law, our certificate of incorporation, our bylaws, an agreement, a vote of stockholders or disinterested directors or otherwise, as to action taken in another capacity while holding his or her office or position, and will continue as to a person who has ceased to be a Covered Person and will inure to the benefit of his or her heirs, executors and administrators. Our bylaws provide that we may maintain insurance, at our expense, to protect ourselves and/or any director, officer, employee or agent of ours or another corporation, partnership, joint venture, trust or other enterprise against any expense, liability or loss, whether or not we would have the power to indemnify such person against such expense, liability or loss under the DGCL.

Equity Securities In connection with our emergence from bankruptcy, on May 27, 2010, the effective date of our plan of reorganization, all then existing shares of our common stock were cancelled and we issued new equity securities comprised of 18,351,664 shares of new common stock, 1,041,666 shares of 7% preferred stock, 2,419,753 warrants to purchase common stock and 780,566 options to purchase common stock. On May 28, 2010, we issued 26,448 shares of common stock and 58,386 options to purchase common stock. These issuances are described below. Of the 18,351,664 shares of common stock issued on May 27, 2010,

II-2

Table of Contents

Of the 1,041,666 shares of 7% preferred stock issued on May 27, 2010,

Of the 2,419,753 warrants issued on May 27, 2010,

On May 27, 2010, we granted 702,509 options to purchase shares of common stock, plus an additional 78,057 options to purchase shares of common stock that may be reduced subject to realized dilution on the warrants, to officers and key employees in reliance on the exemptions from registration under the Securities Act afforded by Section 4(2) of the Securities Act and Rule 701 promulgated thereunder. On May 28, 2010, we granted 26,448 shares of common stock and 58,386 options to purchase shares of common stock to non-employee directors and an affiliate of a non-employee director in reliance on the exemptions from registration under the Securities Act afforded by Section 4(2) of the Securities Act and Rule 701 promulgated thereunder. On July 19, 2010, we paid a dividend to holders of our outstanding 7% preferred stock in the form of 10,780 additional shares of 7% preferred stock in reliance on the exemptions from registration under the Securities Act afforded by Section 4(2) of the Securities Act and Rule 701 promulgated thereunder. Debt Securities In connection with our emergence from bankruptcy on May 27, 2010, on May 11, 2010, CSA Escrow Corporation, an indirect wholly-owned subsidiary of ours, issued $450 million aggregate principal amount of 8½% senior notes due 2018 at a price of 100% of their face value resulting in $450 million of gross proceeds, the net proceeds of which were used to repay outstanding indebtedness under our debtor-in-possession credit facility and our prepetition credit facility, a portion of our prepetition senior notes and certain other bankruptcy claims and to make other payments in connection with our emergence. CSA Escrow Corporation merged with and into Cooper-Standard Holdings Inc. on May 27, 2010 in connection with our emergence from bankruptcy. The initial purchasers for the senior notes issued on May 11, 1010 were Deutsche Bank Securities Inc., Banc of America Securities LLC, Barclays Capital Inc. and UBS Securities LLC. The senior notes were offered and sold to qualified institutional buyers pursuant to Rule 144A under the Securities Act and to non-U.S. investors outside the United States in compliance with Regulation S of the Securities Act.

The exhibits to this registration statement are listed on the Exhibit Index beginning on page II-8 hereof, which is incorporated by reference in this Item 16.

II-3

Table of Contents