Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SIMON PROPERTY GROUP INC /DE/ | a2200620z8-k.htm |

| EX-99.2 - EX-99.2 - SIMON PROPERTY GROUP INC /DE/ | a2200620zex-99_2.htm |

QuickLinks -- Click here to rapidly navigate through this document

The Company

Simon Property Group, Inc., ("Simon," "we," "us," "our," or the "Company") (NYSE:SPG) is a self-administered and self-managed real estate investment trust ("REIT"). Simon Property Group, L.P., or the Operating Partnership, is a majority-owned subsidiary partnership of the Company. Together, the Company and the Operating Partnership, or Simon Group, are engaged primarily in the ownership, development and management of retail real estate properties including regional malls, Premium Outlets®, The Mills®, community/lifestyle centers and international properties. At September 30, 2010, we owned or had an interest in 393 properties comprising 264 million square feet of gross leasable area in North America, Europe and Asia.

This package was prepared to provide (1) ownership information, (2) certain operational information, and (3) balance sheet information as of September 30, 2010, for the Company and the Operating Partnership.

Certain statements made in this Supplemental Package may be deemed "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Although we believe the expectations reflected in any forward-looking statements are based on reasonable assumptions, we can give no assurance that our expectations will be attained, and it is possible that actual results may differ materially from those indicated by these forward-looking statements due to a variety of risks, uncertainties and other factors. Such factors include, but are not limited to: our ability to meet debt service requirements, the availability and terms of financing, changes in our credit rating, changes in market rates of interest and foreign exchange rates for foreign currencies, changes in value of investments in foreign entities, the ability to hedge interest rate risk, risks associated with the acquisition, development, expansion, leasing and management of properties, general risks related to retail real estate, the liquidity of real estate investments, environmental liabilities, international, national, regional and local economic climates, changes in market rental rates, trends in the retail industry, relationships with anchor tenants, the inability to collect rent due to the bankruptcy or insolvency of tenants or otherwise, risks relating to joint venture properties, costs of common area maintenance, competitive market forces, risks related to international activities, insurance costs and coverage, terrorist activities, changes in economic and market conditions and maintenance of our status as a real estate investment trust. We discuss these and other risks and uncertainties under the heading "Risk Factors" in our annual and quarterly periodic reports filed with the SEC. We may update that discussion in our periodic reports, but otherwise we undertake no duty or obligation to update or revise these forward-looking statements, whether as a result of new information, future developments, or otherwise.

We hope you find this Supplemental Package beneficial. Any questions, comments or suggestions should be directed to: Shelly J. Doran, Vice President of Investor Relations-Simon Property Group, P.O. Box 7033, Indianapolis, IN 46207. Telephone: (317) 685-7330; e-mail: sdoran@simon.com

5

SIMON PROPERTY GROUP

Overview

Reporting Calendar

Results for the next two quarters will be announced according to the following approximate schedule:

| Fourth Quarter 2010 | February 4, 2011 | |

| First Quarter 2011 | April 29, 2011 |

Stock Information

The Company's common stock and one issue of preferred stock are traded on the New York Stock Exchange under the following symbols:

| Common Stock | SPG | |

| 8.375% Series J Cumulative Redeemable Preferred | SPGPrJ |

Credit Ratings

| Standard & Poor's | |||||

| Corporate | A- | (Stable Outlook) | |||

| Senior Unsecured | A- | (Stable Outlook) | |||

| Preferred Stock | BBB | (Stable Outlook) | |||

Moody's |

|||||

| Senior Unsecured | A3 | (Stable Outlook) | |||

| Preferred Stock | Baa1 | (Stable Outlook) | |||

Fitch |

|||||

| Senior Unsecured | A- | (Stable Outlook) | |||

| Preferred Stock | BBB | (Stable Outlook) | |||

6

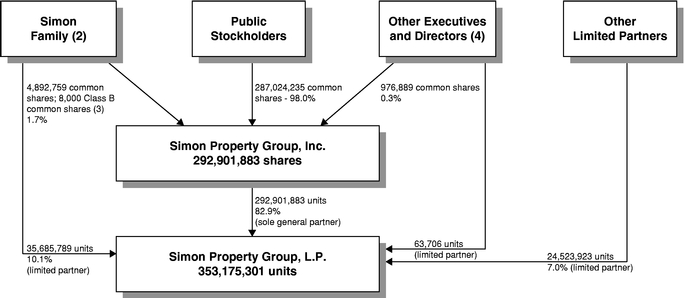

Simon Property Group Ownership Structure(1)

September 30, 2010

- (1)

- Schedule

excludes Company preferred stock and Operating Partnership units not convertible into common stock.

- (2)

- This

group consists of Melvin Simon & Associates, Inc. ("MSA"), wholly owned subsidiaries of MSA, the estate of Melvin Simon, Herbert Simon,

David Simon, MH Holdings, Inc. and related trusts for the benefit of the preceding. MSA is owned 69.06% by the estate of Melvin Simon and 30.94% by a trust for the benefit of Herbert Simon. MH

Holdings, Inc. is owned by a trust for the benefit of Herbert Simon. A total of 3,192,000 common shares and 8,000 shares of Class B common stock owned by one or more members of the group

are subject to voting trusts as to which Herbert Simon and David Simon are the voting trustees.

- (3)

- The

holder of Class B common stock is entitled to elect 4 of the members of the Board of Directors and also has voting rights with common stock.

- (4)

- Includes directors and executive officers of the Company, excluding David Simon and Herbert Simon.

7

SIMON PROPERTY GROUP

Changes in Company Common Share and Operating Partnership Unit Ownership

For the Period from December 31, 2009 through September 30, 2010

| |

Operating Partnership Units(1) |

Company Common Shares(2) |

|||||

|---|---|---|---|---|---|---|---|

Number Outstanding at December 31, 2009 |

57,804,779 | 285,748,271 | |||||

Activity During the First Six Months of 2010: |

|||||||

Issuance of Common Stock for Stock Option Exercises |

— | 116,083 | |||||

Conversion of Operating Partnership Units into Common Stock |

(166,608 | ) | 166,608 | ||||

Restricted Stock Awards (Stock Incentive Program)(3) |

— | 118,420 | |||||

Conversion of Operating Partnership Preferred Units into Units |

862,292 | — | |||||

Conversion of Series I Preferred Stock into Common Stock |

— | 6,670,589 | |||||

Issuance of Operating Partnership Units for Acquisition |

77,798 | — | |||||

Number Outstanding at June 30, 2010 |

58,578,261 |

292,819,971 |

|||||

Activity During the Third Quarter of 2010: |

|||||||

Issuance of Common Stock for Stock Option Exercises |

— | 57,100 | |||||

Conversion of Operating Partnership Units into Common Stock |

(25,514 | ) | 25,514 | ||||

Restricted Stock Awards (Stock Incentive Program)(3) |

— | (702 | ) | ||||

Issuance of Operating Partnership Units for Acquisition |

1,720,671 | — | |||||

Number Outstanding at September 30, 2010 |

60,273,418 |

292,901,883 |

|||||

Details for Diluted Common Shares Outstanding(4): |

|||||||

Company Common Shares Outstanding at September 30, 2010 |

292,901,883 |

||||||

Net Number of Common Shares Issuable Assuming Exercise of Stock Options(5) |

258,710 |

||||||

Diluted Common Shares Outstanding at September 30, 2010(4) |

293,160,593 |

||||||

- (1)

- Excludes

units owned by the Company (shown here as Company Common Shares) and Operating Partnership units not convertible into common shares.

- (2)

- Excludes

Operating Partnership preferred units relating to Company preferred stock outstanding (see Schedule of Preferred Stock/Units Outstanding on

page 57).

- (3)

- Net

of forfeitures.

- (4)

- For

Funds From Operations (FFO) purposes.

- (5)

- Based upon the weighted average stock price for the quarter ended September 30, 2010.

8

SIMON PROPERTY GROUP

Selected Financial and Equity Information

As of September 30, 2010

Unaudited

(In thousands, except as noted)

| |

As of or for the Three Months Ended September 30, |

As of or for the Nine Months Ended September 30, |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2009 | 2010 | 2009 | |||||||||

Financial Highlights of the Company |

|||||||||||||

Total Revenue—Consolidated Properties |

$ | 979,275 | $ | 924,932 | $ | 2,837,912 | $ | 2,747,036 | |||||

Net Income Attributable to Common |

$ |

230,624 |

$ |

105,547 |

$ |

392,501 |

$ |

191,555 |

|||||

Basic Earnings per Common Share (EPS) |

$ | 0.79 | $ | 0.38 | $ | 1.35 | $ | 0.73 | |||||

Diluted Earnings per Common Share (EPS) |

$ | 0.79 | $ | 0.38 | $ | 1.35 | $ | 0.73 | |||||

FFO of the Operating Partnership |

$ |

318,522 |

$ |

473,073 |

$ |

1,131,742 |

$ |

1,263,054 |

|||||

Diluted FFO of the Operating Partnership |

$ | 318,522 | $ | 479,930 | $ | 1,135,418 | $ | 1,283,666 | |||||

Basic FFO per Share (FFOPS) |

$ | 0.90 | $ | 1.40 | $ | 3.24 | $ | 3.97 | |||||

Diluted FFO per Share (FFOPS) |

$ | 0.90 | $ | 1.38 | $ | 3.23 | $ | 3.92 | |||||

Diluted FFOPS as adjusted(1) |

$ | 1.43 | $ | 1.38 | $ | 4.23 | $ | 4.35 | |||||

Distributions per Share |

$ |

0.60 |

$ |

0.60 |

(2) |

$ |

1.80 |

$ |

2.10 |

(2) |

|||

- (1)

- During

the first and third quarters of 2010, the Company recorded a loss on extinguishment of debt of $165.6 million and $185.1 million, respectively.

During the second quarter of 2009, the Company recorded a non-cash impairment charge of $140.5 million.

- (2)

- In the first quarter of 2009, the Company paid a common stock dividend of $0.90 per share, comprised of 10% cash and 90% shares of the Company's common stock. In the second and third quarters of 2009, the Company paid a common stock dividend of $0.60 per share, comprised of 20% cash and 80% shares of the Company's common stock.

9

SIMON PROPERTY GROUP

Selected Financial and Equity Information

As of September 30, 2010

Unaudited

(In thousands, except as noted)

| |

September 30, 2010 |

December 31, 2009 |

||||||

|---|---|---|---|---|---|---|---|---|

Stockholders' Equity Information |

||||||||

Limited Partner Units Outstanding at End of Period |

60,273 | 57,805 | ||||||

Common Shares Outstanding at End of Period |

292,902 | 285,748 | ||||||

Total Common Shares and Units Outstanding at End of Period |

353,175 | 343,553 | ||||||

Weighted Average Limited Partnership Units Outstanding |

58,446 | 57,292 | ||||||

Weighted Average Common Shares Outstanding: |

||||||||

Basic—for purposes of EPS and FFOPS |

290,451 | 267,055 | ||||||

Diluted—for purposes of EPS |

290,739 | 268,472 | ||||||

Diluted—for purposes of FFOPS |

293,396 | 276,100 | ||||||

Simon Group's Debt Information |

||||||||

Share of Consolidated Debt |

$ | 17,217,571 | $ | 18,354,130 | ||||

Share of Joint Venture Debt |

6,524,491 | 6,552,370 | ||||||

Share of Total Debt |

$ | 23,742,062 | $ | 24,906,500 | ||||

Simon Group's Market Capitalization |

||||||||

Common Stock Price at End of Period |

$ | 92.74 | $ | 79.80 | ||||

Common Equity Capitalization, including operating |

$ | 32,753,477 | $ | 27,415,533 | ||||

Preferred Equity Capitalization, including operating |

81,539 | 676,021 | ||||||

Total Equity Market Capitalization |

$ | 32,835,016 | $ | 28,091,554 | ||||

Total Capitalization—Including Simon Group's Share of Total Debt |

$ | 56,577,078 | $ | 52,998,054 | ||||

| |

As of or for the Nine Months Ended September 30, |

|||||||

|---|---|---|---|---|---|---|---|---|

| |

2010 | 2009 | ||||||

Miscellaneous Balance Sheet Data |

||||||||

Interest Capitalized during the Period: |

||||||||

Consolidated Properties |

$ | 3,061 | $ | 11,349 | ||||

Joint Venture Properties |

$ | 288 | $ | 972 | ||||

Simon Group's Share of Joint Venture Properties |

$ | 101 | $ | 531 | ||||

10

On the following pages, we present balance sheet and income statement data on a pro-rata basis reflecting our proportionate economic ownership of each asset in the Simon Group portfolio.

Basis of Presentation: The consolidated amounts shown are prepared on a consistent basis with our consolidated financial statements. The Company's Share of Joint Ventures column was derived on a property-by-property basis by applying the same percentage interests used to arrive at our share of net income during the period and applying them to all financial statement line items of each property. A similar calculation was performed for noncontrolling interests.

11

SIMON PROPERTY GROUP

Unaudited Pro-Rata Statement of Operations

| |

For the Three Months Ended September 30, 2010 | |

|||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

For the Three Months Ended September 30, 2009 Our Total Share |

||||||||||||||||||||

| |

Consolidated | Non- Controlling Interests |

Our Consolidated Share |

Our Share of Joint Ventures |

Our Total Share |

||||||||||||||||

REVENUE: |

|||||||||||||||||||||

Minimum rent |

$ | 605,146 | $ | (8,637 | ) | $ | 596,509 | $ | 192,880 | $ | 789,389 | $ | 754,313 | ||||||||

Overage rent |

26,265 | (80 | ) | 26,185 | 15,835 | 42,020 | 33,491 | ||||||||||||||

Tenant reimbursements |

274,013 | (5,319 | ) | 268,694 | 93,217 | 361,911 | 356,344 | ||||||||||||||

Management fees and other revenues |

29,980 | — | 29,980 | — | 29,980 | 29,988 | |||||||||||||||

Other income |

43,871 | (354 | ) | 43,517 | 33,936 | 77,453 | 56,770 | ||||||||||||||

Total revenue |

979,275 | (14,390 | ) | 964,885 | 335,868 | 1,300,753 | 1,230,906 | ||||||||||||||

EXPENSES: |

|||||||||||||||||||||

Property operating |

115,647 | (3,263 | ) | 112,384 | 67,012 | 179,396 | 179,831 | ||||||||||||||

Depreciation and amortization |

243,303 | (2,024 | ) | 241,279 | 97,856 | 339,135 | 349,281 | ||||||||||||||

Real estate taxes |

86,680 | (1,483 | ) | 85,197 | 23,976 | 109,173 | 99,451 | ||||||||||||||

Repairs and maintenance |

20,200 | (467 | ) | 19,733 | 8,985 | 28,718 | 29,423 | ||||||||||||||

Advertising and promotion |

21,435 | (284 | ) | 21,151 | 5,358 | 26,509 | 29,050 | ||||||||||||||

(Recovery of) provision for credit losses |

(3,096 | ) | (16 | ) | (3,112 | ) | (85 | ) | (3,197 | ) | 293 | ||||||||||

Home and regional office costs |

28,640 | — | 28,640 | — | 28,640 | 26,899 | |||||||||||||||

General and administrative |

5,170 | — | 5,170 | — | 5,170 | 4,509 | |||||||||||||||

Transaction expenses |

47,585 | — | 47,585 | — | 47,585 | — | |||||||||||||||

Other |

15,917 | (917 | ) | 15,000 | 22,881 | 37,881 | 36,116 | ||||||||||||||

Total operating expenses |

581,481 | (8,454 | ) | 573,027 | 225,983 | 799,010 | 754,853 | ||||||||||||||

OPERATING INCOME |

397,794 | (5,936 | ) | 391,858 | 109,885 | 501,743 | 476,053 | ||||||||||||||

Interest expense |

(249,264 | ) | 3,816 | (245,448 | ) | (87,352 | ) | (332,800 | ) | (339,802 | ) | ||||||||||

Loss on extinguishment of debt |

(185,063 | ) | — | (185,063 | ) | — | (185,063 | ) | — | ||||||||||||

Income tax benefit of taxable REIT subsidiaries |

249 | — | 249 | — | 249 | 238 | |||||||||||||||

Income from unconsolidated entities |

22,533 | — | 22,533 | (22,533 | ) | — | — | ||||||||||||||

Gain due to acquisition of controlling interest, sale or disposal of assets and interests in unconsolidated entities, net |

294,283 | — | 294,283 | — | 294,283 | — | |||||||||||||||

CONSOLIDATED NET INCOME |

280,532 | (2,120 | ) | 278,412 | — | 278,412 | 136,489 | ||||||||||||||

Net income attributable to noncontrolling interests |

49,074 | (2,120 | ) | 46,954 | — | 46,954 | 24,403 | ||||||||||||||

Preferred dividends |

834 | — | 834 | — | 834 | 6,539 | |||||||||||||||

NET INCOME ATTRIBUTABLE TO |

$ | 230,624 | $ | — | $ | 230,624 | $ | — | $ | 230,624 | $ | 105,547 | |||||||||

RECONCILIATION OF CONSOLIDATED NET |

|||||||||||||||||||||

Consolidated Net Income |

$ | 280,532 | $ | — | $ | 280,532 | $ | 139,189 | |||||||||||||

Adjustments to Consolidated Net Income to Arrive at FFO: |

|||||||||||||||||||||

Depreciation and amortization from consolidated properties and discontinued operations |

239,828 | — | 239,828 | 247,236 | |||||||||||||||||

Simon's share of depreciation and amortization from unconsolidated entities |

— | 97,788 | 97,788 | 100,027 | |||||||||||||||||

Income from unconsolidated entities |

(22,533 | ) | 22,533 | — | — | ||||||||||||||||

Gain due to acquisition of controlling interest, sale or disposal of assets and interests in unconsolidated entities, net |

(294,283 | ) | — | (294,283 | ) | — | |||||||||||||||

Net income attributable to noncontrolling interest holders in properties |

(2,119 | ) | — | (2,119 | ) | (2,700 | ) | ||||||||||||||

Noncontrolling interests portion of depreciation and amortization |

(1,911 | ) | — | (1,911 | ) | (2,017 | ) | ||||||||||||||

Preferred distributions and dividends |

(1,313 | ) | — | (1,313 | ) | (8,662 | ) | ||||||||||||||

FFO of the Operating Partnership |

$ | 198,201 | $ | 120,321 | $ | 318,522 | $ | 473,073 | |||||||||||||

Percentage of FFO of the Operating Partnership |

62.23 | % | 37.77 | % | 100.00 | % | 100.00 | % | |||||||||||||

- (1)

- See pages 17-19 for additional reconciliations of non-GAAP financial measures.

12

SIMON PROPERTY GROUP

Unaudited Pro-Rata Statement of Operations

| |

For the Nine Months Ended September 30, 2010 | |

|||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

For the Nine Months Ended September 30, 2009 Our Total Share |

||||||||||||||||||||

| |

Consolidated | Non- Controlling Interests |

Our Consolidated Share |

Our Share of Joint Ventures |

Our Total Share |

||||||||||||||||

REVENUE: |

|||||||||||||||||||||

Minimum rent |

$ | 1,756,913 | $ | (25,994 | ) | $ | 1,730,919 | $ | 582,260 | $ | 2,313,179 | $ | 2,254,232 | ||||||||

Overage rent |

53,953 | (151 | ) | 53,802 | 38,438 | 92,240 | 79,732 | ||||||||||||||

Tenant reimbursements |

785,634 | (16,022 | ) | 769,612 | 276,186 | 1,045,798 | 1,046,184 | ||||||||||||||

Management fees and other revenues |

86,897 | — | 86,897 | — | 86,897 | 90,694 | |||||||||||||||

Other income |

154,515 | (972 | ) | 153,543 | 84,937 | 238,480 | 180,778 | ||||||||||||||

Total revenue |

2,837,912 | (43,139 | ) | 2,794,773 | 981,821 | 3,776,594 | 3,651,620 | ||||||||||||||

EXPENSES: |

|||||||||||||||||||||

Property operating |

315,649 | (9,004 | ) | 306,645 | 190,674 | 497,319 | 509,005 | ||||||||||||||

Depreciation and amortization |

706,402 | (6,254 | ) | 700,148 | 291,000 | 991,148 | 1,052,440 | ||||||||||||||

Real estate taxes |

255,067 | (4,332 | ) | 250,735 | 73,691 | 324,426 | 317,498 | ||||||||||||||

Repairs and maintenance |

64,550 | (1,659 | ) | 62,891 | 31,242 | 94,133 | 91,917 | ||||||||||||||

Advertising and promotion |

62,553 | (824 | ) | 61,729 | 17,077 | 78,806 | 77,968 | ||||||||||||||

(Recovery of) provision for credit losses |

(2,060 | ) | (46 | ) | (2,106 | ) | 1,013 | (1,093 | ) | 25,959 | |||||||||||

Home and regional office costs |

72,699 | — | 72,699 | — | 72,699 | 79,732 | |||||||||||||||

General and administrative |

15,909 | — | 15,909 | — | 15,909 | 13,867 | |||||||||||||||

Impairment charge |

— | — | — | — | — | 140,478 | |||||||||||||||

Transaction expenses |

62,554 | — | 62,554 | — | 62,554 | — | |||||||||||||||

Other |

44,412 | (2,544 | ) | 41,868 | 70,460 | 112,328 | 111,198 | ||||||||||||||

Total operating expenses |

1,597,735 | (24,663 | ) | 1,573,072 | 675,157 | 2,248,229 | 2,420,062 | ||||||||||||||

OPERATING INCOME |

1,240,177 | (18,476 | ) | 1,221,701 | 306,664 | 1,528,365 | 1,231,558 | ||||||||||||||

Interest expense |

(774,686 | ) | 11,135 | (763,551 | ) | (255,935 | ) | (1,019,486 | ) | (971,195 | ) | ||||||||||

Loss on extinguishment of debt |

(350,688 | ) | — | (350,688 | ) | — | (350,688 | ) | — | ||||||||||||

Income tax benefit of taxable REIT subsidiaries |

557 | — | 557 | — | 557 | 2,904 | |||||||||||||||

Income from unconsolidated entities |

50,729 | — | 50,729 | (50,729 | ) | — | — | ||||||||||||||

Gain due to acquisition of controlling interest, sale or disposal of assets and interests in unconsolidated entities, net |

320,349 | — | 320,349 | — | 320,349 | — | |||||||||||||||

CONSOLIDATED NET INCOME |

486,438 | (7,341 | ) | 479,097 | — | 479,097 | 263,267 | ||||||||||||||

Net income attributable to noncontrolling interests |

88,158 | (7,341 | ) | 80,817 | — | 80,817 | 52,115 | ||||||||||||||

Preferred dividends |

5,779 | — | 5,779 | — | 5,779 | 19,597 | |||||||||||||||

NET INCOME ATTRIBUTABLE TO COMMON STOCKHOLDERS |

$ | 392,501 | $ | — | 392,501 | $ | — | $ | 392,501 | $ | 191,555 | ||||||||||

RECONCILIATION OF CONSOLIDATED NET INCOME TO FFO(1) |

|||||||||||||||||||||

Consolidated Net Income |

$ | 486,438 | $ | — | $ | 486,438 | $ | 271,329 | |||||||||||||

Adjustments to Consolidated Net Income to Arrive at FFO: |

|||||||||||||||||||||

Depreciation and amortization from consolidated properties and discontinued operations |

695,982 | — | 695,982 | 748,191 | |||||||||||||||||

Simon's share of depreciation and amortization from unconsolidated entities |

— | 290,517 | 290,517 | 287,901 | |||||||||||||||||

Income from unconsolidated entities |

(50,729 | ) | 50,729 | — | — | ||||||||||||||||

Gain due to acquisition of controlling interest, sale or disposal of assets and interests in unconsolidated entities, net |

(320,349 | ) | — | (320,349 | ) | — | |||||||||||||||

Net income attributable to noncontrolling interest holders in properties |

(7,342 | ) | — | (7,342 | ) | (8,064 | ) | ||||||||||||||

Noncontrolling interests portion of depreciation and amortization |

(5,888 | ) | — | (5,888 | ) | (6,253 | ) | ||||||||||||||

Preferred distributions and dividends |

(7,616 | ) | — | (7,616 | ) | (30,050 | ) | ||||||||||||||

FFO of the Operating Partnership |

$ | 790,496 | $ | 341,246 | $ | 1,131,742 | $ | 1,263,054 | |||||||||||||

Percentage of FFO of the Operating Partnership |

69.85 | % | 30.15 | % | 100.00 | % | 100.00 | % | |||||||||||||

- (1)

- See pages 17-19 for additional reconciliations of non-GAAP financial measures.

13

SIMON PROPERTY GROUP

Unaudited Pro-Rata Balance Sheet

| |

As of September 30, 2010 | |

||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Consolidated | Non- Controlling Interests |

Our Consolidated Share |

Our Share of Joint Ventures |

Our Total Share |

As of December 31, 2009 Our Total Share |

||||||||||||||||

ASSETS: |

||||||||||||||||||||||

Investment properties, at cost |

$ | 27,432,323 | $ | (172,450 | ) | $ | 27,259,873 | $ | 9,353,154 | $ | 36,613,027 | $ | 34,426,322 | |||||||||

Less—accumulated depreciation |

7,468,070 | (92,117 | ) | 7,375,953 | 1,791,978 | 9,167,931 | 8,531,014 | |||||||||||||||

|

19,964,253 | (80,333 | ) | 19,883,920 | 7,561,176 | 27,445,096 | 25,895,308 | |||||||||||||||

Cash and cash equivalents |

1,011,574 | (5,733 | ) | 1,005,841 | 328,413 | 1,334,254 | 4,261,201 | |||||||||||||||

Tenant receivables and accrued revenue, net |

383,168 | (4,270 | ) | 378,898 | 140,297 | 519,195 | 541,813 | |||||||||||||||

Investment in unconsolidated entities, at equity |

1,412,207 | — | 1,412,207 | (1,412,207 | ) | — | — | |||||||||||||||

Deferred costs and other assets |

1,366,085 | (4,911 | ) | 1,361,174 | 216,527 | 1,577,701 | 1,341,821 | |||||||||||||||

Notes receivable from related party |

651,000 | — | 651,000 | — | 651,000 | 632,000 | ||||||||||||||||

Total assets |

$ | 24,788,287 | $ | (95,247 | ) | $ | 24,693,040 | $ | 6,834,206 | $ | 31,527,246 | $ | 32,672,143 | |||||||||

LIABILITIES: |

||||||||||||||||||||||

Mortgages and other indebtedness |

$ | 17,485,466 | $ | (267,895 | ) | $ | 17,217,571 | $ | 6,524,491 | $ | 23,742,062 | $ | 24,906,500 | |||||||||

Accounts payable, accrued expenses, intangibles, and deferred revenues |

984,240 | (8,204 | ) | 976,036 | 322,987 | 1,299,023 | 1,323,741 | |||||||||||||||

Cash distributions and losses in partnerships and joint ventures, at equity |

411,023 | — | 411,023 | (411,023 | ) | — | — | |||||||||||||||

Other liabilities and accrued dividends |

214,009 | (993 | ) | 213,016 | 397,751 | 610,767 | 558,383 | |||||||||||||||

Total liabilities |

19,094,738 | (277,092 | ) | 18,817,646 | 6,834,206 | 25,651,852 | 26,788,624 | |||||||||||||||

Limited partners' preferred interest in the Operating Partnership and noncontrolling redeemable interests in properties |

85,687 | 5,220 | 90,907 | — | 90,907 | 128,221 | ||||||||||||||||

Series I 6% convertible perpetual preferred stock, 19,000,000 shares authorized, 0 and 8,091,155 issued and outstanding, respectively, at liquidation value |

— | — | — | — | — | 404,558 | ||||||||||||||||

EQUITY: |

||||||||||||||||||||||

Stockholders' equity |

||||||||||||||||||||||

Capital Stock (850,000,000 total shares authorized, $.0001 par value, 238,000,000 shares of excess common stock, 100,000,000 authorized shares of preferred stock): |

||||||||||||||||||||||

Series J 83/8% cumulative redeemable preferred stock, 1,000,000 shares authorized, 796,948 issued and outstanding, with a liquidation value of $39,847 |

45,458 | — | 45,458 | — | 45,458 | 45,704 | ||||||||||||||||

Common stock, $.0001 par value, 511,990,000 shares authorized, 296,897,334 and 289,866,711 issued, respectively |

30 | — | 30 | — | 30 | 29 | ||||||||||||||||

Class B common stock, $.0001 par value, 10,000 shares authorized, 8,000 issued and outstanding |

— | — | — | — | — | — | ||||||||||||||||

Capital in excess of par value |

8,051,544 | — | 8,051,544 | — | 8,051,544 | 7,547,959 | ||||||||||||||||

Accumulated deficit |

(3,099,689 | ) | — | (3,099,689 | ) | — | (3,099,689 | ) | (2,955,671 | ) | ||||||||||||

Accumulated other comprehensive loss |

(25,851 | ) | — | (25,851 | ) | — | (25,851 | ) | (3,088 | ) | ||||||||||||

Common stock held in treasury at cost, 4,003,451 and 4,126,440 shares, respectively |

(166,436 | ) | — | (166,436 | ) | — | (166,436 | ) | (176,796 | ) | ||||||||||||

Total stockholders' equity |

4,805,056 | — | 4,805,056 | — | 4,805,056 | 4,458,137 | ||||||||||||||||

Noncontrolling interests |

802,806 | 176,625 | 979,431 | — | 979,431 | 892,603 | ||||||||||||||||

Total equity |

5,607,862 | 176,625 | 5,784,487 | — | 5,784,487 | 5,350,740 | ||||||||||||||||

Total liabilities and equity |

$ | 24,788,287 | $ | (95,247 | ) | $ | 24,693,040 | $ | 6,834,206 | $ | 31,527,246 | $ | 32,672,143 | |||||||||

14

SIMON PROPERTY GROUP

NOI Composition(1)(2)

For the Nine Months Ended September 30, 2010

| |

Percent of Simon Group's Share of NOI |

|||

|---|---|---|---|---|

U.S. Portfolio NOI by State |

||||

Florida |

13.1 | % | ||

Texas |

11.6 | % | ||

California |

11.1 | % | ||

New York |

7.3 | % | ||

Massachusetts |

7.0 | % | ||

Georgia |

5.1 | % | ||

Nevada |

4.9 | % | ||

Indiana |

4.6 | % | ||

New Jersey |

4.3 | % | ||

Pennsylvania |

4.2 | % | ||

Top 10 Contributors by State |

73.2 | % | ||

NOI by Asset Type |

||||

Regional Malls and Premium Outlets |

87.6 | % | ||

The Mills |

4.5 | % | ||

International(3) |

3.5 | % | ||

Community/Lifestyle Centers |

4.2 | % | ||

Other |

0.2 | % | ||

Total |

100.0 | % | ||

- (1)

- Based

on Simon Group's share of total NOI and does not reflect any property, entity or corporate-level debt.

- (2)

- Includes

properties added to the Company's portfolio in connection with the Prime Outlets Acquisition Company transaction.

- (3)

- International includes Premium Outlets in Asia and shopping centers in Europe.

15

SIMON PROPERTY GROUP

Analysis of Other Income and Other Expense

As of September 30, 2010

(In thousands)

| |

For the Three Months Ended September 30, |

For the Nine Months Ended September 30, |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2009 | 2010 | 2009 | |||||||||

Consolidated Properties |

|||||||||||||

Other Income |

|||||||||||||

Interest and Dividend Income |

$ |

4,248 |

$ |

7,420 |

$ |

28,172 |

$ |

20,538 |

|||||

Lease Settlement Income |

11,226 | 2,112 | 45,651 | 16,613 | |||||||||

Gains on Land Sales |

697 | 76 | 3,903 | 2,343 | |||||||||

Other |

27,700 | 26,819 | 76,789 | 76,997 | |||||||||

Totals |

$ | 43,871 | $ | 36,427 | $ | 154,515 | $ | 116,491 | |||||

Other Expense |

|||||||||||||

Ground Rent |

$ |

9,645 |

$ |

7,940 |

$ |

26,191 |

$ |

23,591 |

|||||

Professional Fees |

5,202 | 4,404 | 11,983 | 12,311 | |||||||||

Other |

1,070 | 3,551 | 6,238 | 17,006 | |||||||||

Totals |

$ | 15,917 | $ | 15,895 | $ | 44,412 | $ | 52,908 | |||||

Transaction Expenses |

$ |

47,585 |

$ |

— |

$ |

62,554 |

$ |

— |

|||||

16

SIMON PROPERTY GROUP

Reconciliation of Non-GAAP Financial Measures

As of September 30, 2010

(in thousands, except as noted)

This report contains measures of financial or operating performance that are not specifically defined by accounting principles generally accepted in the United States ("GAAP"), including funds from operations ("FFO"), FFO as adjusted, diluted FFO per share, diluted FFO per share as adjusted, net operating income ("NOI"), and comparable property NOI. FFO and NOI are performance measures that are standard in the REIT business. We believe FFO and NOI provide investors with additional information concerning our operating performance and a basis to compare our performance with those of other REITs. We also use these measures internally to monitor the operating performance of our portfolio. FFO as adjusted and diluted FFO per share as adjusted measures exclude the effect of certain non-cash impairment and debt-related charges. We believe these measures provide investors with a basis to compare our current operating performance with previous periods in which we did not have those charges. Our computation of these non-GAAP measures may not be the same as similar measures reported by other REITs.

The non-GAAP financial measures used in this report should not be considered as alternatives to net income as a measure of our operating performance or to cash flows computed in accordance with GAAP as a measure of liquidity nor are they indicative of cash flows from operating and financial activities.

Reconciliations of each of the non-GAAP measures used in this report to the most-directly comparable GAAP measure are included in the following tables.

Reconciliation of Consolidated Net Income to FFO and FFO as Adjusted(1)

| |

For the Three Months Ended September 30, |

For the Nine Months Ended September 30, |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2009 | 2010 | 2009 | ||||||||||

Consolidated Net Income (2) |

$ | 280,532 | $ | 139,189 | $ | 486,438 | $ | 271,329 | ||||||

Adjustments to Consolidated Net Income to Arrive at FFO: |

||||||||||||||

Depreciation and amortization from consolidated properties |

239,828 | 247,236 | 695,982 | 748,191 | ||||||||||

Simon's share of depreciation and amortization from unconsolidated entities |

97,788 | 100,027 | 290,517 | 287,901 | ||||||||||

Gain upon acquisition of controlling interest, and on sale or disposal of assets and interests in unconsolidated entities, net |

(294,283 | ) | — | (320,349 | ) | — | ||||||||

Net income attributable to noncontrolling interest holders in properties |

(2,119 | ) | (2,700 | ) | (7,342 | ) | (8,064 | ) | ||||||

Noncontrolling interests portion of depreciation and amortization |

(1,911 | ) | (2,017 | ) | (5,888 | ) | (6,253 | ) | ||||||

Preferred distributions and dividends |

(1,313 | ) | (8,662 | ) | (7,616 | ) | (30,050 | ) | ||||||

FFO of the Operating Partnership |

318,522 | 473,073 | 1,131,742 | 1,263,054 | ||||||||||

Impairment charge |

— | — | — | 140,478 | ||||||||||

Loss on debt extinguishment |

185,063 | — | 350,688 | — | ||||||||||

FFO as adjusted of the Operating Partnership |

$ | 503,585 | $ | 473,073 | $ | 1,482,430 | $ | 1,403,532 | ||||||

Per Share Reconciliation: |

||||||||||||||

Diluted net income attributable to common stockholders per share |

$ |

0.79 |

$ |

0.38 |

$ |

1.35 |

$ |

0.73 |

||||||

Adjustments to arrive at FFO: |

||||||||||||||

Depreciation and amortization from consolidated properties and Simon's share of depreciation and amortization from unconsolidated entities, net of noncontrolling interests portion of depreciation and amortization |

0.95 | 1.02 | 2.81 | 3.24 | ||||||||||

Gain upon acquisition of controlling interest, and on sale or disposal of assets and interests in unconsolidated entities, net |

(0.84 | ) | — | (0.92 | ) | — | ||||||||

Impact of additional dilutive securities for FFO per share |

— | (0.02 | ) | (0.01 | ) | (0.05 | ) | |||||||

Diluted FFO per share |

$ | 0.90 | $ | 1.38 | $ | 3.23 | $ | 3.92 | ||||||

Impairment charge |

— | — | — | 0.43 | ||||||||||

Loss on debt extinguishment |

0.53 | — | 1.00 | — | ||||||||||

Diluted FFO as adjusted per share |

$ | 1.43 | $ | 1.38 | $ | 4.23 | $ | 4.35 | ||||||

17

SIMON PROPERTY GROUP

Reconciliation of Non-GAAP Financial Measures

As of September 30, 2010

(in thousands, except as noted)

Reconciliation of Net Income to NOI

The Reconciliation of Net Income to NOI provides net income, which we believe is the most directly comparable GAAP financial measure, and reconciles the amounts to "Total NOI of the Simon Group Portfolio." This schedule also provides the change in NOI of comparable properties for the quarter and nine months ended September 30, 2010.

| |

For the Three Months Ended September 30, | For the Nine Months Ended September 30, | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2009 | 2010 | 2009 | |||||||||

Reconciliation of NOI of consolidated Properties: |

|||||||||||||

Consolidated Net Income |

$ | 280,532 | $ | 139,189 | $ | 486,438 | $ | 271,329 | |||||

Income tax benefit of taxable REIT subsidiaries |

(249 | ) | (238 | ) | (557 | ) | (2,904 | ) | |||||

Interest expense |

249,264 | 257,881 | 774,686 | 728,360 | |||||||||

Income from unconsolidated entities |

(22,533 | ) | (4,655 | ) | (50,729 | ) | (15,694 | ) | |||||

Loss on extinguishment of debt |

185,063 | — | 350,688 | — | |||||||||

Gain upon acquisition of controlling interest, and on sale or disposal of assets and interests in unconsolidated entities, net |

(294,283 | ) | — | (320,349 | ) | — | |||||||

Operating Income |

397,794 | 392,177 | 1,240,177 | 981,091 | |||||||||

Impairment charge |

— | — | — | 140,478 | |||||||||

Depreciation and amortization |

243,303 | 250,151 | 706,402 | 758,173 | |||||||||

NOI of consolidated Properties |

$ | 641,097 | $ | 642,328 | $ | 1,946,579 | $ | 1,879,742 | |||||

Reconciliation of NOI of unconsolidated entities: |

|||||||||||||

Net Income |

$ | 101,780 | $ | 58,452 | $ | 276,983 | $ | 170,140 | |||||

Interest expense |

218,238 | 221,166 | 653,419 | 661,586 | |||||||||

Loss from unconsolidated entities |

327 | 3,170 | 1,368 | 2,383 | |||||||||

Gain on sale or disposal of assets and interests in unconsolidated entities, net |

— | — | (39,761 | ) | — | ||||||||

Operating Income |

320,345 | 282,788 | 892,009 | 834,109 | |||||||||

Depreciation and amortization |

195,679 | 194,727 | 591,763 | 580,215 | |||||||||

NOI of unconsolidated entities |

$ | 516,024 | $ | 477,515 | $ | 1,483,772 | $ | 1,414,324 | |||||

Total NOI of the Simon Group Portfolio |

$ | 1,157,121 | $ | 1,119,843 | $ | 3,430,351 | $ | 3,294,066 | |||||

Change in NOI from prior period |

3.3 | % | (0.2 | )% | 4.1 | % | 1.8 | % | |||||

Less: Joint venture partner's share of NOI |

316,243 | 294,508 | 910,838 | 869,590 | |||||||||

Simon Group's Share of NOI |

$ | 840,878 | $ | 825,335 | $ | 2,519,513 | $ | 2,424,476 | |||||

Increase in Simon Group's Share of NOI from prior period |

1.9 | % | 0.9 | % | 3.9 | % | 2.2 | % | |||||

Total NOI of Comparable Properties(3) |

$ | 840,129 | $ | 810,952 | $ | 2,456,100 | $ | 2,390,286 | |||||

Increase in Total NOI of Comparable Properties(3) |

3.6 | % | 2.8 | % | |||||||||

Reconciliation of Diluted FFO per Share to Diluted FFO Per Share as adjusted(1)

| |

As of or for the Three Months Ended September 30, |

As of or for the Nine Months Ended September 30, |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2009 | 2010 | 2009 | |||||||||

Diluted FFO per Share (FFOPS) |

$ | 0.90 | $ | 1.38 | $ | 3.23 | $ | 3.92 | |||||

Loss on debt extinguishment |

0.53 | — | 1.00 | — | |||||||||

Impairment charge |

— | — | — | 0.43 | |||||||||

Diluted FFOPS as adjusted |

$ | 1.43 | $ | 1.38 | $ | 4.23 | $ | 4.35 | |||||

18

SIMON PROPERTY GROUP

Footnotes to Reconciliation of Non-GAAP Financial Measures

- (1)

- The

Company determines FFO based upon the definition set forth by the National Association of Real Estate Investment Trusts ("NAREIT"). The Company

determines FFO to be our share of consolidated net income computed in accordance with GAAP, excluding real estate related depreciation and amortization, excluding gains and losses from extraordinary

items, excluding gains and losses from the sales of previously depreciated operating properties, plus the allocable portion of FFO of unconsolidated joint ventures based upon economic ownership

interest, and all determined on a consistent basis in accordance with GAAP.

The Company has adopted NAREIT's clarification of the definition of FFO that requires it to include the effects of nonrecurring items not classified as extraordinary, cumulative effect of accounting changes, or a gain or loss resulting from the sale of previously depreciated operating properties. We include in FFO gains and losses realized from the sale of land, outlot buildings, marketable and non-marketable securities, and investment holdings of non-retail real estate. However, you should understand that FFO does not represent cash flow from operations as defined by GAAP, should not be considered as an alternative to net income determined in accordance with GAAP as a measure of operating performance, and is not an alternative to cash flows as a measure of liquidity.

- (2)

- Consolidated

Net Income includes:

- •

- the Company's share of gains on land sales of $1.0 million for the three months ended September 30, 2010, and

$4.1 million and $2.2 million for the nine months ended September 30, 2010 and 2009, respectively.

- •

- the Company's share of straight-line adjustments to minimum rent of $9.7 million and $7.8 million

for the three months ended September 30, 2010 and 2009, respectively and $23.8 million and $25.3 million for the nine months ended September 30, 2010 and 2009,

respectively.

- •

- the Company's share of the amortization of fair market value of leases from acquisitions of $5.0 million and

$5.7 million for the three months ended September 30, 2010 and 2009, respectively and $14.8 million and $19.0 million for the nine months ended September 30, 2010

and 2009, respectively.

- •

- the Company's share of debt premium amortization of $3.0 million and $3.5 million for the three months ended

September 30, 2010 and 2009, respectively and $9.4 million and $10.8 million for the nine months ended September 30, 2010 and 2009, respectively.

- (3)

- Properties that were owned in both of the periods under comparison are referred to as comparable properties. Does not include community/lifestyle centers, properties owned by SPG-FCM (the Mills portfolio), international properties, or properties included in the Prime Outlets Acquisition Company transaction.

19

SIMON PROPERTY GROUP

U.S. Portfolio GLA

As of September 30, 2010

Type of Property

|

GLA-Sq. Ft. | Total Owned GLA |

% of Owned GLA |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Regional Malls and Premium Outlets |

|||||||||||

Mall Stores |

76,027,797 | 75,697,486 | 47.5 | % | |||||||

Freestanding |

4,558,144 | 1,914,036 | 1.2 | % | |||||||

Anchors |

94,901,722 | 25,598,227 | 16.1 | % | |||||||

Office |

1,998,443 | 1,998,443 | 1.2 | % | |||||||

Regional Malls and Premium Outlets Total |

177,486,106 | 105,208,192 | 66.0 | % | |||||||

Properties Acquired from Prime Outlets Acquisition Company |

7,954,003 |

7,880,230 |

5.0 |

% |

|||||||

Community/Lifestyle Centers |

20,194,844 |

13,815,009 |

8.7 |

% |

|||||||

The Mills® |

22,746,268 |

20,226,236 |

12.7 |

% |

|||||||

Mills Regional Malls |

17,369,777 | 8,630,651 | 5.4 | % | |||||||

Mills Community Centers |

1,014,074 | 962,520 | 0.6 | % | |||||||

Mills Portfolio Total |

41,130,119 | 29,819,407 | 18.7 | % | |||||||

Other(1) |

3,714,457 | 2,621,499 | 1.6 | % | |||||||

Total U.S. Properties |

250,479,529 | 159,344,337 | 100.0 | % | |||||||

- (1)

- Consists of ten other shopping centers and two centers that are being de-malled through a major redevelopment. These properties contribute 0.2% of Simon Group's share of total NOI.

20

SIMON PROPERTY GROUP

U.S. Operational Information(1)

As of September 30, 2010

| |

As of or for the Nine Months Ended September 30, |

|||||||

|---|---|---|---|---|---|---|---|---|

| |

2010 | 2009 | ||||||

Total Number of Properties |

203 | 204 | ||||||

Total GLA (in millions of square feet) |

177.5 |

178.1 |

||||||

Occupancy(2) |

||||||||

Consolidated Assets |

94.2 | % | 93.4 | % | ||||

Unconsolidated Assets |

91.6 | % | 90.9 | % | ||||

Total Portfolio |

93.6 | % | 92.8 | % | ||||

Comparable sales per square foot(3) |

||||||||

Consolidated Assets |

$ | 474 | $ | 443 | ||||

Unconsolidated Assets |

$ | 516 | $ | 470 | ||||

Total Portfolio |

$ | 483 | $ | 449 | ||||

Average rent per square foot(2) |

||||||||

Consolidated Assets |

$ | 37.11 | $ | 36.73 | ||||

Unconsolidated Assets |

$ | 43.50 | $ | 43.18 | ||||

Total Portfolio |

$ | 38.69 | $ | 38.35 | ||||

Historical Data:

|

Occupancy(2) | Comparable Sales Per Square Foot(3) |

Average Rent Per Square Foot(2) |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

12/31/09 |

93.4 | % | $ | 452 | $ | 38.47 | ||||

12/31/08 |

93.8 | % | $ | 480 | 36.69 | |||||

12/31/07 |

94.7 | % | $ | 495 | 34.67 | |||||

12/31/06 |

94.3 | % | $ | 475 | 33.14 | |||||

12/31/05 |

94.2 | % | $ | 448 | 32.36 | |||||

Small Shop Leasing Activity for the Twelve Months Ended:

| |

|

Average Base Rent(4) | |

|

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Square Footage of Lease Openings |

Lease Openings |

Store Closings/ Lease Expirations |

Amount of Change (Referred to as "Leasing Spread') |

||||||||||||

9/30/10 |

9,725,768 | $ | 41.16 | $ | 40.03 | $ | 1.13 | 2.8 | % | |||||||

6/30/10 |

9,098,080 | 40.73 | 40.23 | 0.50 | 1.2 | % | ||||||||||

3/31/10 |

8,140,121 | 42.82 | 40.71 | 2.11 | 5.2 | % | ||||||||||

12/31/09 |

7,648,857 | 43.24 | 38.32 | 4.92 | 12.8 | % | ||||||||||

9/30/09 |

7,630,394 | 41.78 | 36.35 | 5.43 | 14.9 | % | ||||||||||

6/30/09 |

7,723,034 | 43.73 | 35.68 | 8.05 | 22.6 | % | ||||||||||

3/31/09 |

7,736,965 | 45.18 | 34.83 | 10.35 | 29.7 | % | ||||||||||

12/31/08 |

8,425,720 | 43.93 | 34.96 | 8.97 | 20.4 | % | ||||||||||

12/31/07 |

7,497,322 | 41.41 | 34.84 | 6.57 | 15.9 | % | ||||||||||

12/31/06 |

6,595,918 | 39.78 | 33.26 | 6.52 | 16.4 | % | ||||||||||

12/31/05 |

6,484,682 | 38.53 | 31.95 | 6.58 | 17.1 | % | ||||||||||

|

||||||||||||||||

- (1)

- Combined

information for U.S. regional malls and U.S. Premium Outlets. Does not include information for properties owned by SPG-FCM (the Mills

portfolio) or properties included in the Prime Outlets Acquisition Company transaction.

- (2)

- Represents

mall stores in regional malls and all owned gross leasable area in Premium Outlets.

- (3)

- Based

upon the standard definition of sales for regional malls adopted by the International Council of Shopping Centers which includes mall stores less than

10,000 square feet in regional malls and all owned gross leasable area in Premium Outlets.

- (4)

- Represents the average base rent in effect during the period for those tenants who opened as compared to the average base rent in effect during the period for those tenants whose leases terminated or expired.

21

SIMON PROPERTY GROUP

U.S. Lease Expirations (1)(2)

As of September 30, 2010

Year

|

Number of Leases Expiring |

Square Feet |

Avg. Base Rent per Square Foot at 9/30/10 |

Percentage of Gross Annual Rental Revenues(3) |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Small Shops |

|||||||||||||

Month to Month Leases |

550 |

1,408,521 |

$ |

40.45 |

1.1 |

% |

|||||||

2010 (10/1/10—12/31/10) |

339 | 824,902 | $ | 37.71 | 0.7 | % | |||||||

2011 |

3,057 | 8,712,364 | $ | 33.14 | 6.7 | % | |||||||

2012 |

2,616 | 9,026,500 | $ | 33.81 | 7.1 | % | |||||||

2013 |

2,449 | 7,525,521 | $ | 38.44 | 6.7 | % | |||||||

2014 |

1,877 | 6,243,437 | $ | 37.83 | 5.5 | % | |||||||

2015 |

1,857 | 6,766,560 | $ | 39.02 | 6.1 | % | |||||||

2016 |

1,599 | 5,005,468 | $ | 42.05 | 4.9 | % | |||||||

2017 |

1,529 | 5,140,018 | $ | 44.45 | 5.3 | % | |||||||

2018 |

1,533 | 5,853,533 | $ | 47.38 | 6.5 | % | |||||||

2019 |

1,334 | 5,185,783 | $ | 45.50 | 5.5 | % | |||||||

2020 |

876 | 3,378,549 | $ | 44.93 | 3.5 | % | |||||||

2021 and Thereafter |

581 | 3,062,112 | $ | 35.84 | 2.6 | % | |||||||

Specialty Leasing Agreements w/ terms in excess of 12 months |

1,618 | 4,047,268 | $ | 13.93 | 1.2 | % | |||||||

Anchor Tenants |

|||||||||||||

Month to Month Leases |

1 |

144,000 |

$ |

7.00 |

— |

||||||||

2011 |

9 | 1,019,373 | $ | 5.04 | 0.1 | % | |||||||

2012 |

23 | 2,647,131 | $ | 3.90 | 0.2 | % | |||||||

2013 |

31 | 3,911,542 | $ | 4.42 | 0.4 | % | |||||||

2014 |

32 | 3,306,934 | $ | 4.79 | 0.4 | % | |||||||

2015 |

28 | 3,337,128 | $ | 3.02 | 0.2 | % | |||||||

2016 |

17 | 2,095,160 | $ | 3.50 | 0.2 | % | |||||||

2017 |

5 | 871,969 | $ | 1.28 | — | ||||||||

2018 |

8 | 820,648 | $ | 6.62 | 0.1 | % | |||||||

2019 |

10 | 1,230,799 | $ | 4.33 | 0.1 | % | |||||||

2020 |

11 | 1,149,573 | $ | 5.50 | 0.1 | % | |||||||

2021 and Thereafter |

32 | 3,196,797 | $ | 5.53 | 0.4 | % | |||||||

- (1)

- Combined

information for U.S. regional malls and U.S. Premium Outlets. Does not include information for properties owned by SPG-FCM (the Mills

portfolio) or properties included in the Prime Outlets Acquisition Company transaction.

- (2)

- Does

not consider the impact of renewal options that may be contained in leases.

- (3)

- Annual rental revenues represent 2009 consolidated and joint venture combined base rental revenue.

22

SIMON PROPERTY GROUP

U.S. Top Tenants(1)

As of September 30, 2010

Top Small Shop Tenants (sorted by percentage of total Simon Group base minimum rent)

Tenant

|

Number of Stores |

Square Feet (000's) |

Percent of Total Simon Group Sq. Ft. |

Percent of Total Simon Group Base Min. Rent |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

The Gap, Inc. |

361 | 3,943 | 1.6 | % | 2.9 | % | |||||||

Limited Brands, Inc. |

335 | 1,890 | 0.8 | % | 2.0 | % | |||||||

Abercrombie & Fitch Co. |

227 | 1,614 | 0.6 | % | 1.6 | % | |||||||

Foot Locker, Inc. |

388 | 1,516 | 0.6 | % | 1.3 | % | |||||||

Luxottica Group S.P.A |

421 | 801 | 0.3 | % | 1.1 | % | |||||||

Zale Corporation |

349 | 376 | 0.2 | % | 1.1 | % | |||||||

Phillips-Van Heusen |

223 | 1,212 | 0.5 | % | 1.0 | % | |||||||

American Eagle Outfitters, Inc. |

173 | 990 | 0.4 | % | 0.9 | % | |||||||

Express, Inc. |

115 | 1,014 | 0.4 | % | 0.9 | % | |||||||

Genesco, Inc. |

418 | 616 | 0.2 | % | 0.9 | % | |||||||

Top Anchors (sorted by percentage of total Simon Group square footage) (2)

Tenant

|

Number of Stores |

Square Feet (000's) |

Percent of Total Simon Group Sq. Ft. |

Percent of Total Simon Group Base Min. Rent |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Macy's, Inc. |

148 | 26,494 | 10.6 | % | 0.4 | % | |||||||

Sears Roebuck & Co. |

120 | 18,210 | 7.3 | % | 0.2 | % | |||||||

J.C. Penney Co., Inc. |

113 | 16,098 | 6.4 | % | 0.6 | % | |||||||

Dillard's Dept. Stores |

74 | 11,506 | 4.6 | % | 0.1 | % | |||||||

Nordstrom, Inc. |

27 | 4,590 | 1.8 | % | 0.1 | % | |||||||

Belk, Inc. |

22 | 2,792 | 1.1 | % | 0.3 | % | |||||||

The Bon-Ton Stores, Inc. |

22 | 2,180 | 0.9 | % | 0.2 | % | |||||||

Target Corporation |

13 | 1,686 | 0.7 | % | 0.0 | % | |||||||

The Neiman Marcus Group, Inc. |

10 | 1,265 | 0.5 | % | 0.0 | % | |||||||

Dick's Sporting Goods, Inc. |

18 | 1,188 | 0.5 | % | 0.3 | % | |||||||

Saks Incorporated |

8 | 973 | 0.4 | % | 0.2 | % | |||||||

Lord and Taylor |

7 | 954 | 0.4 | % | 0.0 | % | |||||||

- (1)

- Combined

information for U.S. regional malls and U.S. Premium Outlets. Does not include information for properties owned by SPG-FCM (the Mills

portfolio) or properties included in the Prime Outlets Acquisition Company transaction.

- (2)

- Includes space leased and owned by the anchor.

23

SIMON PROPERTY GROUP

Other U.S. Operational Information

As of September 30, 2010

| |

As of or for the Nine Months Ended September 30, |

||||||

|---|---|---|---|---|---|---|---|

| |

2010 | 2009 | |||||

Properties Acquired from Prime Outlets Acquisition Company |

|||||||

Total Number of Properties |

21 | n/a | |||||

Total GLA (in millions of square feet) |

8.0 | n/a | |||||

Occupancy(1) |

94.7 | % | n/a | ||||

Sales per square foot(7) |

$ | 406 | n/a | ||||

Average rent per square foot(1) |

$ | 24.52 | n/a | ||||

Community/Lifestyle Centers |

|||||||

Total Number of Properties |

66 | 70 | |||||

Total GLA (in millions of square feet) |

20.2 | 20.7 | |||||

Occupancy(1) |

91.7 | % | 88.9 | % | |||

Average rent per square foot(1) |

$ | 13.39 | $ | 13.34 | |||

The Mills Portfolio(3) |

|||||||

The Mills® |

|||||||

Total Number of Properties |

16 | 16 | |||||

Total GLA (in millions of square feet) |

22.7 | 22.7 | |||||

Occupancy(1)(4) |

92.9 | % | 92.4 | % | |||

Comparable sales per square foot(2)(4) |

$ | 382 | $ | 369 | |||

Average rent per square foot(1)(4) |

$ | 19.82 | $ | 19.66 | |||

Mills Regional Malls(5) |

|||||||

Total Number of Properties |

16 | 16 | |||||

Total GLA (in millions of square feet) |

17.4 | 17.6 | |||||

Occupancy(6) |

90.1 | % | 88.9 | % | |||

Comparable sales per square foot(2) |

$ | 400 | $ | 388 | |||

Average rent per square foot(6) |

$ | 35.03 | $ | 35.64 | |||

- (1)

- For

all owned gross leasable area.

- (2)

- Based

upon the standard definition of sales for regional malls adopted by the International Council of Shopping Centers which includes mall stores less than

10,000 square feet.

- (3)

- Excludes

four community/lifestyle centers in the Mills portfolio.

- (4)

- Opry

Mills has closed and is undergoing a renovation as a result of flooding. Therefore, this property has been excluded from occupancy, comparable sales

per square foot and average base rent per square foot until it reopens.

- (5)

- Does

not include two regional malls in Atlanta (Gwinnett Place and Town Center at Cobb) in which the Company held a 50% interest prior to the Mills

acquisition.

- (6)

- For

mall stores.

- (7)

- Sales for the twelve months ended September 30, 2010, for all owned GLA.

24

SIMON PROPERTY GROUP

International Operational Information

As of September 30, 2010

| |

As of or for the Nine Months Ended September 30, |

||||||

|---|---|---|---|---|---|---|---|

| |

2010 | 2009 | |||||

International Properties |

|||||||

European Shopping Centers |

|||||||

Total Number of Properties |

45 | 51 | |||||

Total GLA (in millions of square feet) |

10.1 | 13.4 | |||||

Occupancy |

97.3 | % | 95.8 | % | |||

Comparable sales per square foot |

€ | 386 | € | 406 | |||

Average rent per square foot |

€ | 26.60 | € | 31.66 | |||

International Premium Outlets—Japan (1) |

|||||||

Total Number of Properties |

8 | 8 | |||||

Total GLA (in millions of square feet) |

2.5 | 2.2 | |||||

Occupancy |

99.2 | % | 99.7 | % | |||

Comparable sales per square foot |

¥ | 89,351 | ¥ | 93,930 | |||

Average rent per square foot |

¥ | 4,792 | ¥ | 4,711 | |||

- (1)

- Does not include Premium Outlets Punta Norte in Mexico or Yeoju Premium Outlets in South Korea.

25

SIMON PROPERTY GROUP

Property Listing

Regional Malls(1)

| |

Property Name | State | City (CBSA) | Legal Ownership |

Total Gross Leasable Area |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

1. |

McCain Mall |

AR | N. Little Rock |

100.0 | % | 775,852 | |||||||

2. |

Brea Mall |

CA |

Brea (Los Angeles) |

100.0 |

% |

1,320,165 |

|||||||

3. |

Coddingtown Mall |

CA | Santa Rosa |

50.0 | % | 841,718 | |||||||

4. |

Fashion Valley |

CA | San Diego |

50.0 | % | 1,726,118 | |||||||

5. |

Laguna Hills Mall |

CA | Laguna Hills (Los Angeles) |

100.0 | % | 866,380 | |||||||

6. |

Santa Rosa Plaza |

CA | Santa Rosa |

100.0 | % | 692,417 | |||||||

7. |

Shops at Mission Viejo, The |

CA | Mission Viejo (Los Angeles) |

100.0 | % | 1,149,634 | |||||||

8. |

Stanford Shopping Center |

CA | Palo Alto (San Francisco) |

100.0 | % | 1,359,538 | (7) | ||||||

9. |

Westminster Mall |

CA | Westminster (Los Angeles) |

100.0 | % | 1,189,885 | |||||||

10. |

Mesa Mall(2) |

CO |

Grand Junction |

50.0 |

% |

882,172 |

|||||||

11. |

Town Center at Aurora |

CO | Aurora (Denver) |

100.0 | % | 1,081,530 | |||||||

12. |

Crystal Mall |

CT |

Waterford |

74.6 |

% |

783,348 |

|||||||

13. |

Aventura Mall(2) |

FL |

Miami Beach (Miami) |

33.3 |

% |

2,098,966 |

|||||||

14. |

Avenues, The |

FL | Jacksonville |

25.0 | %(3) | 1,116,833 | |||||||

15. |

Boynton Beach Mall |

FL | Boynton Beach (Miami) |

100.0 | % | 1,101,829 | |||||||

16. |

Coconut Point |

FL | Estero |

50.0 | % | 1,199,849 | (7) | ||||||

17. |

Coral Square |

FL | Coral Springs (Miami) |

97.2 | % | 941,339 | |||||||

18. |

Cordova Mall |

FL | Pensacola |

100.0 | % | 856,982 | |||||||

19. |

Crystal River Mall |

FL | Crystal River |

100.0 | % | 420,109 | |||||||

20. |

Dadeland Mall |

FL | Miami |

50.0 | % | 1,487,741 | |||||||

21. |

DeSoto Square |

FL | Bradenton |

100.0 | % | 678,219 | |||||||

22. |

Edison Mall |

FL | Fort Myers |

100.0 | % | 1,051,139 | |||||||

23. |

Florida Mall, The |

FL | Orlando |

50.0 | % | 1,776,875 | |||||||

24. |

Gulf View Square |

FL | Port Richey (Tampa) |

100.0 | % | 753,564 | |||||||

25. |

Indian River Mall |

FL | Vero Beach |

50.0 | % | 736,658 | |||||||

26. |

Lake Square Mall |

FL | Leesburg (Orlando) |

50.0 | % | 559,168 | |||||||

27. |

Melbourne Square |

FL | Melbourne |

100.0 | % | 665,627 | |||||||

28. |

Miami International Mall |

FL | Miami |

47.8 | % | 1,071,484 | |||||||

29. |

Orange Park Mall |

FL | Orange Park (Jacksonville) |

100.0 | % | 957,844 | |||||||

30. |

Paddock Mall |

FL | Ocala |

100.0 | % | 554,083 | |||||||

31. |

Port Charlotte Town Center |

FL | Port Charlotte |

80.0 | %(4) | 766,230 | |||||||

32. |

Seminole Towne Center |

FL | Sanford (Orlando) |

45.0 | %(3) | 1,125,909 | |||||||

33. |

Shops at Sunset Place, The |

FL | S. Miami |

37.5 | %(3) | 514,624 | |||||||

34. |

St. Johns Town Center |

FL | Jacksonville |

50.0 | % | 1,235,705 | |||||||

35. |

Town Center at Boca Raton |

FL | Boca Raton (Miami) |

100.0 | % | 1,753,839 | |||||||

36. |

Treasure Coast Square |

FL | Jensen Beach |

100.0 | % | 878,213 | |||||||

37. |

Tyrone Square |

FL | St. Petersburg (Tampa) |

100.0 | % | 1,095,794 | |||||||

38. |

Gwinnett Place |

GA |

Duluth (Atlanta) |

75.0 |

% |

1,279,751 |

(7) |

||||||

39. |

Lenox Square |

GA | Atlanta |

100.0 | % | 1,544,002 | |||||||

40. |

Mall of Georgia |

GA | Buford (Atlanta) |

100.0 | % | 1,833,763 | |||||||

41. |

Northlake Mall |

GA | Atlanta |

100.0 | % | 962,133 | |||||||

42. |

Phipps Plaza |

GA | Atlanta |

100.0 | % | 817,342 | |||||||

43. |

Town Center at Cobb |

GA | Kennesaw (Atlanta) |

75.0 | % | 1,275,939 | |||||||

44. |

Lindale Mall(2) |

IA |

Cedar Rapids |

50.0 |

% |

693,977 |

|||||||

45. |

NorthPark Mall |

IA | Davenport |

50.0 | % | 1,073,101 | |||||||

46. |

Southern Hills Mall(2) |

IA |

Sioux City |

50.0 |

% |

796,758 |

|||||||

47. |

SouthRidge Mall(2) |

IA | Des Moines |

50.0 | % | 888,839 | |||||||

48. |

Lincolnwood Town Center |

IL |

Lincolnwood (Chicago) |

100.0 |

% |

421,370 |

|||||||

49. |

Northfield Square Mall |

IL | Bourbonnais |

31.6 | %(4) | 530,011 | |||||||

50. |

Northwoods Mall |

IL | Peoria |

100.0 | % | 694,380 | |||||||

26

SIMON PROPERTY GROUP

Property Listing

Regional Malls(1)

| |

Property Name | State | City (CBSA) | Legal Ownership |

Total Gross Leasable Area |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

51. |

Orland Square |

IL | Orland Park (Chicago) |

100.0 | % | 1,210,321 | |||||||

52. |

River Oaks Center |

IL | Calumet City (Chicago) |

100.0 | % | 1,353,042 | (7) | ||||||

53. |

SouthPark Mall |

IL | Moline |

50.0 | % | 1,017,107 | |||||||

54. |

White Oaks Mall |

IL | Springfield |

80.7 | % | 930,151 | (7) | ||||||

55. |

Castleton Square |

IN |

Indianapolis |

100.0 |

% |

1,381,698 |

|||||||

56. |

Circle Centre |

IN | Indianapolis |

14.7 | %(3) | 739,081 | |||||||

57. |

College Mall |

IN | Bloomington |

100.0 | % | 636,096 | |||||||

58. |

Eastland Mall |

IN | Evansville |

50.0 | % | 865,160 | |||||||

59. |

Fashion Mall at Keystone, The |

IN | Indianapolis |

100.0 | % | 684,009 | |||||||

60. |

Greenwood Park Mall |

IN | Greenwood (Indianapolis) |

100.0 | % | 1,279,870 | |||||||

61. |

Markland Mall |

IN | Kokomo |

100.0 | % | 415,892 | |||||||

62. |

Muncie Mall |

IN | Muncie |

100.0 | % | 635,645 | |||||||

63. |

Tippecanoe Mall |

IN | Lafayette |

100.0 | % | 862,773 | |||||||

64. |

University Park Mall |

IN | Mishawaka |

100.0 | % | 922,681 | |||||||

65. |

Washington Square |

IN | Indianapolis |

100.0 | % | 971,921 | |||||||

66. |

Towne East Square |

KS |

Wichita |

100.0 |

% |

1,127,420 |

|||||||

67. |

Towne West Square |

KS | Wichita |

100.0 | % | 941,485 | |||||||

68. |

West Ridge Mall |

KS | Topeka |

100.0 | % | 992,313 | |||||||

69. |

Prien Lake Mall |

LA |

Lake Charles |

100.0 |

% |

791,043 |

|||||||

70. |

Arsenal Mall |

MA |

Watertown (Boston) |

100.0 |

% |

440,124 |

(7) |

||||||

71. |

Atrium Mall |

MA | Chestnut Hill (Boston) |

49.1 | % | 205,369 | |||||||

72. |

Auburn Mall |

MA | Auburn |

49.1 | % | 588,270 | |||||||

73. |

Burlington Mall |

MA | Burlington (Boston) |

100.0 | % | 1,318,162 | |||||||

74. |

Cape Cod Mall |

MA | Hyannis |

49.1 | % | 721,313 | |||||||

75. |

Copley Place |

MA | Boston |

98.1 | % | 1,243,230 | (7) | ||||||

76. |

Emerald Square |

MA | North Attleboro (Providence, RI) |

49.1 | % | 1,022,647 | |||||||

77. |

Greendale Mall |

MA | Worcester (Boston) |

49.1 | % | 429,827 | (7) | ||||||

78. |

Liberty Tree Mall |

MA | Danvers (Boston) |

49.1 | % | 858,742 | |||||||

79. |

Mall at Chestnut Hill, The |

MA | Chestnut Hill (Boston) |

94.4 | % | 474,909 | |||||||

80. |

Northshore Mall |

MA | Peabody (Boston) |

49.1 | % | 1,579,849 | (7) | ||||||

81. |

Solomon Pond Mall |

MA | Marlborough (Boston) |

49.1 | % | 885,993 | |||||||

82. |

South Shore Plaza |

MA | Braintree (Boston) |

100.0 | % | 1,400,288 | |||||||

83. |

Square One Mall |

MA | Saugus (Boston) |

49.1 | % | 928,569 | |||||||

84. |

Bowie Town Center |

MD |

Bowie (Washington, D.C.) |

100.0 |

% |

684,341 |

|||||||

85. |

St. Charles Towne Center |

MD | Waldorf (Washington, D.C.) |

100.0 | % | 980,643 | |||||||

86. |

Bangor Mall |

ME |

Bangor |

67.4 |

%(6) |

652,740 |

|||||||

87. |

Maplewood Mall |

MN |

St. Paul (Minneapolis) |

100.0 |

% |

927,457 |

|||||||

88. |

Miller Hill Mall |

MN | Duluth |

100.0 | % | 805,321 | |||||||

89. |

Battlefield Mall |

MO |

Springfield |

100.0 |

% |

1,199,901 |

|||||||

90. |

Independence Center |

MO | Independence (Kansas City) |

100.0 | % | 931,240 | |||||||

91. |

SouthPark |

NC |

Charlotte |

100.0 |

% |

1,625,546 |

|||||||

92. |

Mall at Rockingham Park, The |

NH |

Salem (Boston) |

24.6 |

% |

1,020,003 |

|||||||

93. |

Mall of New Hampshire, The |

NH | Manchester |

49.1 | % | 811,321 | |||||||

94. |

Pheasant Lane Mall |

NH | Nashua |

(5 | ) | 870,060 | |||||||

95. |

Brunswick Square |

NJ |

East Brunswick (New York) |

100.0 |

% |

765,293 |

|||||||

96. |

Livingston Mall |

NJ | Livingston (New York) |

100.0 | % | 984,701 | |||||||

97. |

Menlo Park Mall |

NJ | Edison (New York) |

100.0 | % | 1,322,919 | (7) | ||||||

27

SIMON PROPERTY GROUP

Property Listing

Regional Malls(1)

| |

Property Name | State | City (CBSA) | Legal Ownership |

Total Gross Leasable Area |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

98. |

Ocean County Mall |

NJ | Toms River (New York) |

100.0 | % | 890,283 | |||||||

99. |

Quaker Bridge Mall |

NJ | Lawrenceville |

38.0 | %(6) | 1,098,690 | |||||||

100. |

Rockaway Townsquare |

NJ | Rockaway (New York) |

100.0 | % | 1,246,536 | |||||||

101. |

Cottonwood Mall |

NM |

Albuquerque |

100.0 |

% |

1,040,593 |

|||||||

102. |

Forum Shops at Caesars, The |

NV |

Las Vegas |

100.0 |

% |

649,551 |

|||||||

103. |

Chautauqua Mall |

NY |

Lakewood |

100.0 |

% |

423,337 |

|||||||

104. |

Jefferson Valley Mall |

NY | Yorktown Heights (New York) |

100.0 | % | 580,109 | |||||||

105. |

Roosevelt Field |

NY | Garden City (New York) |

100.0 | % | 2,227,012 | (7) | ||||||

106. |

Smith Haven Mall |

NY | Lake Grove (New York) |

25.0 | % | 1,287,543 | |||||||

107. |

Walt Whitman Mall |

NY | Huntington Station (New York) |

100.0 | % | 1,027,680 | |||||||

108. |

Westchester, The |

NY | White Plains (New York) |

40.0 | % | 827,389 | (7) | ||||||

109. |

Great Lakes Mall |

OH |

Mentor (Cleveland) |

100.0 |

% |

1,237,581 |

(7) |

||||||

110. |

Lima Mall |

OH | Lima |

100.0 | % | 739,354 | |||||||

111. |

Richmond Town Square |

OH | Richmond Heights (Cleveland) |

100.0 | % | 1,015,451 | |||||||

112. |

Southern Park Mall |

OH | Youngstown |

100.0 | % | 1,189,725 | |||||||

113. |

Summit Mall |

OH | Akron |

100.0 | % | 767,914 | |||||||

114. |

Upper Valley Mall |

OH | Springfield |

100.0 | % | 739,569 | |||||||

115. |

Penn Square Mall |

OK |

Oklahoma City |

94.5 |

% |

1,050,736 |

|||||||

116. |

Woodland Hills Mall |

OK | Tulsa |

94.5 | % | 1,092,050 | |||||||

117. |

Century III Mall |

PA |

West Mifflin (Pittsburgh) |

100.0 |

% |

1,210,487 |

(7) |

||||||

118. |

Granite Run Mall |

PA | Media (Philadelphia) |

50.0 | % | 1,032,545 | |||||||

119. |

King of Prussia Mall |

PA | King of Prussia (Philadelphia) |

12.4 | %(6) | 2,615,797 | (7) | ||||||

120. |

Lehigh Valley Mall |

PA | Whitehall |

37.6 | %(6) | 1,169,508 | (7) | ||||||

121. |

Montgomery Mall |

PA | North Wales (Philadelphia) |

60.0 | %(6) | 1,154,062 | |||||||

122. |

Oxford Valley Mall |

PA | Langhorne (Philadelphia) |

65.0 | %(6) | 1,332,240 | (7) | ||||||

123. |

Ross Park Mall |

PA | Pittsburgh |

100.0 | % | 1,210,464 | |||||||

124. |

South Hills Village |

PA | Pittsburgh |

100.0 | % | 1,142,139 | (7) | ||||||

125. |

Springfield Mall(2) |

PA | Springfield (Philadelphia) |

38.0 | %(6) | 589,251 | |||||||

126. |

Plaza Carolina |

PR |

Carolina (San Juan) |

100.0 |

% |

1,077,680 |

(7) |

||||||

127. |

Anderson Mall |

SC |

Anderson |

100.0 |

% |

671,791 |

|||||||

128. |

Haywood Mall |

SC | Greenville |

100.0 | % | 1,231,097 | |||||||

129. |

Empire Mall(2) |

SD |

Sioux Falls |

50.0 |

% |

1,073,838 |

|||||||

130. |

Rushmore Mall(2) |

SD | Rapid City |

50.0 | % | 833,459 | |||||||

131. |

Knoxville Center |

TN |

Knoxville |

100.0 |

% |

978,110 |

(7) |

||||||

132. |

Oak Court Mall |

TN | Memphis |

100.0 | % | 849,148 | (7) | ||||||

133. |

West Town Mall |

TN | Knoxville |

50.0 | % | 1,335,972 | |||||||

134. |

Wolfchase Galleria |

TN | Memphis |

94.5 | % | 1,152,536 | |||||||

135. |

Barton Creek Square |

TX |

Austin |

100.0 |

% |

1,429,273 |

|||||||

136. |

Broadway Square |

TX | Tyler |

100.0 | % | 627,793 | |||||||

137. |

Cielo Vista Mall |

TX | El Paso |

100.0 | % | 1,242,812 | |||||||

138. |

Domain, The |

TX | Austin |

100.0 | % | 1,176,638 | (7) | ||||||

139. |

Firewheel Town Center |

TX | Garland (Dallas) |

100.0 | % | 1,004,259 | (7) | ||||||

140. |

Galleria, The |

TX | Houston |

50.4 | % | 2,222,131 | |||||||

141. |

Ingram Park Mall |

TX | San Antonio |

100.0 | % | 1,125,713 | |||||||

142. |

Irving Mall |

TX | Irving (Dallas) |

100.0 | % | 1,053,116 | |||||||

143. |

La Plaza Mall |

TX | McAllen |

100.0 | % | 1,200,344 | |||||||

144. |

Lakeline Mall |

TX | Cedar Park (Austin) |

100.0 | % | 1,097,543 | |||||||

145. |

Longview Mall |

TX | Longview |

100.0 | % | 638,438 | |||||||

146. |

Midland Park Mall |

TX | Midland |

100.0 | % | 617,068 | |||||||

28

SIMON PROPERTY GROUP

Property Listing

Regional Malls(1)

| |

Property Name | State | City (CBSA) | Legal Ownership |

Total Gross Leasable Area |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

147. |

North East Mall |

TX | Hurst (Dallas) |

100.0 | % | 1,670,766 | |||||||

148. |

Rolling Oaks Mall |

TX | San Antonio |

100.0 | % | 883,521 | (7) | ||||||

149. |

Sunland Park Mall |

TX | El Paso |

100.0 | % | 917,534 | |||||||

150. |

Valle Vista Mall |

TX | Harlingen |

100.0 | % | 651,134 | |||||||

151. |

Apple Blossom Mall |

VA |

Winchester |

49.1 |

% |

439,922 |

|||||||

152. |

Charlottesville Fashion Square |

VA | Charlottesville |

100.0 | % | 570,202 | |||||||

153. |

Chesapeake Square |

VA | Chesapeake (Virginia Beach) |

75.0 | %(4) | 797,282 | |||||||

154. |

Fashion Centre at Pentagon City, The |

VA | Arlington (Washington, DC) |

42.5 | % | 990,331 | (7) | ||||||

155. |

Valley Mall |

VA | Harrisonburg |

50.0 | % | 506,269 | |||||||

156. |

Virginia Center Commons |

VA | Glen Allen |

100.0 | % | 785,393 | |||||||

157. |

Columbia Center |

WA |

Kennewick |

100.0 |

% |

768,431 |

|||||||

158. |

Northgate Mall |

WA | Seattle |

100.0 | % | 1,058,682 | |||||||

159. |

Tacoma Mall |

WA | Tacoma (Seattle) |

100.0 | % | 1,265,429 | |||||||

160. |

Bay Park Square |

WI |

Green Bay |

100.0 |

% |

710,952 |

|||||||

161. |

Forest Mall |

WI | Fond Du Lac |

100.0 | % | 500,174 | |||||||

|

Total Regional Mall GLA |

160,057,609 | |||||||||||

Premium Outlets

| |

Property Name | State | City (Metro Area Served) | Legal Ownership |

Total Gross Leasable Area |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

1. |

Camarillo Premium Outlets |

CA | Camarillo (Los Angeles) |

100.0 | % | 673,936 | |||||||

2. |

Carlsbad Premium Outlets |

CA | Carlsbad (San Diego) |

100.0 | % | 288,219 | |||||||

3. |

Desert Hills Premium Outlets |

CA | Cabazon (Palm Springs) |

100.0 | % | 501,723 | |||||||

4. |

Folsom Premium Outlets |

CA | Folsom (Sacramento) |

100.0 | % | 295,994 | |||||||

5. |

Gilroy Premium Outlets |

CA | Gilroy (San Jose) |

100.0 | % | 577,859 | |||||||

6. |

Las Americas Premium Outlets |

CA | San Diego |

100.0 | % | 560,904 | |||||||

7. |

Napa Premium Outlets |

CA | Napa |

100.0 | % | 179,407 | |||||||

8. |

Petaluma Village Premium Outlets |

CA | Petaluma |

100.0 | % | 195,772 | |||||||

9. |

Vacaville Premium Outlets |

CA | Vacaville |

100.0 | % | 437,528 | |||||||

10. |

Clinton Crossing Premium Outlets |

CT |

Clinton |

100.0 |

% |

276,173 |

|||||||

11. |

Orlando Premium Outlets- Vineland Ave. |

FL |

Orlando |

100.0 |

% |

549,580 |

|||||||

12. |

St. Augustine Premium Outlets |

FL | St. Augustine (Jacksonsville) |

100.0 | % | 328,549 | |||||||

13. |