Attached files

| file | filename |

|---|---|

| EX-99 - UIL EXHIBIT 99 - PRESS RELEASE - UIL HOLDINGS CORP | uil_exh99.htm |

| 8-K - UIL FORM 8-K DATED SEPTEMBER 29, 2010 - UIL HOLDINGS CORP | uil_form8kdated09292010.htm |

1

EEI Nov. 2010

45th Annual EEI Financial Conference

November 2010

EXHIBIT 99.1

2

EEI Nov. 2010

2

Important Note to Investors

James P. Torgerson

President and Chief Executive Officer, UIL Holdings Corporation

Richard J. Nicholas

Executive Vice President and Chief Financial Officer, UIL Holdings Corporation

Safe Harbor Provision

Certain statements contained herein, regarding matters that are not historical facts, are forward-looking statements (as defined in the Private Securities

Litigation Reform Act of 1995). These include statements regarding management’s intentions, plans, beliefs, expectations or forecasts for the future

including, without limitation, UIL’s expectations with respect to the benefits, costs and other anticipated financial impacts of the proposed gas

company acquisition transaction; future financial and operating results of UIL; UIL’s plans, objectives, expectations and intentions with respect to

future operations and services; approval of the proposed transaction by governmental regulatory authorities; the satisfaction of the closing conditions to

the proposed transaction; and the timing of the completion of the proposed transaction. Such forward-looking statements are based on UIL’s

expectations and involve risks and uncertainties; consequently, actual results may differ materially from those expressed or implied in the statements.

Such risks and uncertainties include, but are not limited to, general economic conditions, legislative and regulatory changes, changes in demand for

electricity and other products and services, changes in financial markets, unanticipated weather conditions, changes in accounting principles, policies

or guidelines, and other economic, competitive, governmental, and technological factors affecting the operations, timing, markets, products, services

and prices of UIL’s subsidiaries. Examples of such risks and uncertainties specific to the transaction include, but are not limited to: the possibility that

the proposed transaction is delayed or does not close, including due to the failure to receive required regulatory approvals, the taking of governmental

action (including the passage of legislation) to block the transaction, or the failure of other closing conditions; and the possibility that the expected

benefits will not be realized, or will not be realized within the expected time period. The foregoing and other factors are discussed and should be

reviewed in UIL’s most recent Annual Report on Form 10-K and other subsequent filings with the Securities and Exchange Commission. Forward-

looking statements included herein speak only as of the date hereof and the UIL undertakes no obligation to revise or update such statements to reflect

events or circumstances after the date hereof or to reflect the occurrence of unanticipated events or circumstances.

Litigation Reform Act of 1995). These include statements regarding management’s intentions, plans, beliefs, expectations or forecasts for the future

including, without limitation, UIL’s expectations with respect to the benefits, costs and other anticipated financial impacts of the proposed gas

company acquisition transaction; future financial and operating results of UIL; UIL’s plans, objectives, expectations and intentions with respect to

future operations and services; approval of the proposed transaction by governmental regulatory authorities; the satisfaction of the closing conditions to

the proposed transaction; and the timing of the completion of the proposed transaction. Such forward-looking statements are based on UIL’s

expectations and involve risks and uncertainties; consequently, actual results may differ materially from those expressed or implied in the statements.

Such risks and uncertainties include, but are not limited to, general economic conditions, legislative and regulatory changes, changes in demand for

electricity and other products and services, changes in financial markets, unanticipated weather conditions, changes in accounting principles, policies

or guidelines, and other economic, competitive, governmental, and technological factors affecting the operations, timing, markets, products, services

and prices of UIL’s subsidiaries. Examples of such risks and uncertainties specific to the transaction include, but are not limited to: the possibility that

the proposed transaction is delayed or does not close, including due to the failure to receive required regulatory approvals, the taking of governmental

action (including the passage of legislation) to block the transaction, or the failure of other closing conditions; and the possibility that the expected

benefits will not be realized, or will not be realized within the expected time period. The foregoing and other factors are discussed and should be

reviewed in UIL’s most recent Annual Report on Form 10-K and other subsequent filings with the Securities and Exchange Commission. Forward-

looking statements included herein speak only as of the date hereof and the UIL undertakes no obligation to revise or update such statements to reflect

events or circumstances after the date hereof or to reflect the occurrence of unanticipated events or circumstances.

Reconciliation of Non-GAAP Financial Measures

Financial measures highlighted in this presentation may be considered non-GAAP financial measures such as Earnings Before Interest Expense,

Income Tax, Depreciation and Amortization (“EBITDA”), Adjusted EBITDA and Adjusted Net Income. Comparable GAAP financial measures and a

reconciliation of GAAP financial measures to non-GAAP financial measures are available in the Appendix to this presentation.

Income Tax, Depreciation and Amortization (“EBITDA”), Adjusted EBITDA and Adjusted Net Income. Comparable GAAP financial measures and a

reconciliation of GAAP financial measures to non-GAAP financial measures are available in the Appendix to this presentation.

3

EEI Nov. 2010

Today’s Topics

Ø Gas Companies Acquisition Update

Ø UI Transmission Growth

Ø YTD Accomplishments

Ø UI Base 10-year Capital Expenditure Forecast

Ø Near-term Capital Expenditures including Gas Companies

Ø GenConn

Ø NEEWS

Ø Near-term Average Rate Base Forecast

Ø Energy Conservation & Smart System

Ø 3Q & YTD 2010 Financial Results

Ø 2010 Guidance

Ø Looking Forward to 2011

4

EEI Nov. 2010

4

Investment Highlights

Attractive Dividend

(6% Yield) (2)

› Current annual dividend of $1.728 per share

› Core regulated earnings combined with the enhanced cash flow and expected earnings per

share accretion from the acquisition provide continued support for UIL’s dividend

share accretion from the acquisition provide continued support for UIL’s dividend

Visible Regulated

Growth

Opportunities

Growth

Opportunities

› Approximately $2.1B of regulated capital investment in The United Illuminating Company

(UI) 10-year plan

(UI) 10-year plan

» UI 5-year Rate Base CAGR of 8.2% (9.4% including equivalent GenConn rate base) (1)

» Includes $0.6B of highly attractive transmission projects

› Pending acquisition provides additional avenue for growth through investment in gas

distribution system

distribution system

Conservative

Financial Strategy

Financial Strategy

› Maintenance of investment grade credit ratings is an important objective

FERC-Regulated

Electric

Transmission

Electric

Transmission

› 2009 earned composite return on equity of 12.52%

› Proven ability to partner reaching beyond service territory

› New England renewable portfolio standards driving need for major transmission build

Note: (1) CAGRs calculated based on annual average rate base from 2010-2015

(2) Based on share price of $28.41 as of October 25, 2010

Attractive Regulated

Utility

Utility

› Proven ability to earn allowed electric return

› Highly experienced with Connecticut regulatory proceedings

› Constructive long-term rate plan in Massachusetts comes with acquisition

5

EEI Nov. 2010

5

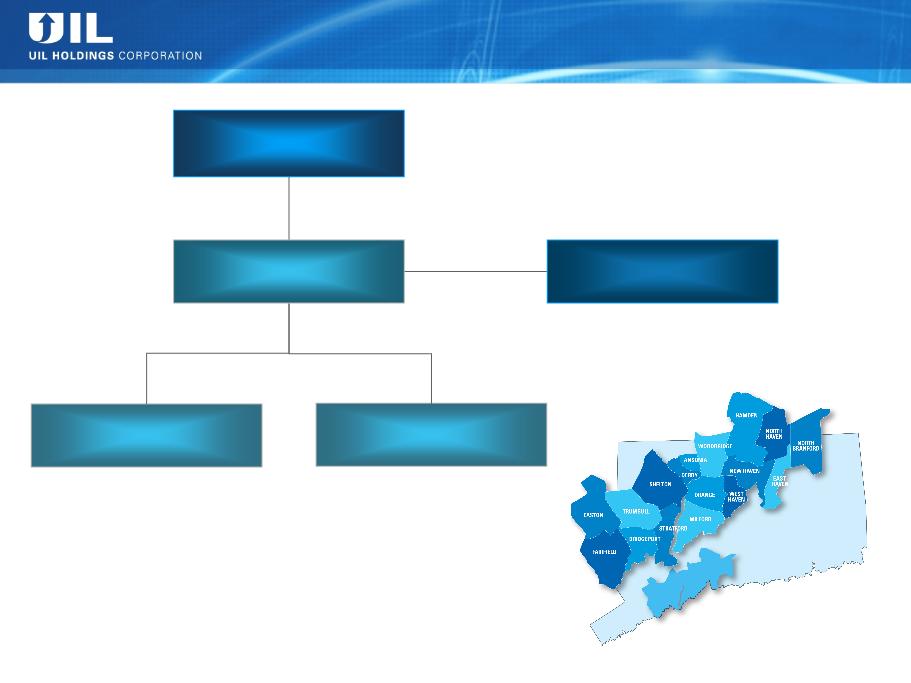

UIL - Current Corporate Structure

Retail Distribution

~60% of rate base

~60% of rate base

~53% of ’09 Net Income (4)

Transmission

~40% of rate base

~40% of rate base

~47% of ’09 Net Income

› 2009 Distribution Avg. Rate Base

$492M

$492M

› 2009 CTA (5) Avg. Rate Base $162M

› Allowed ROE of 8.75% in 2010 with

full revenue decoupling

full revenue decoupling

› Attractive FERC authorized ROE

› Expected 2010 composite ROE of

12.4%-12.5%

12.4%-12.5%

› Collaborating on CT portion of New

England East West Solution

(“NEEWS”) projects

England East West Solution

(“NEEWS”) projects

› Joint venture between UI and NRG

› ~400MW of new peaking generation in CT

› Regulated cost of service with 9.75% ROE

lifetime floor

lifetime floor

› Regulated T&D utility

› ~324,000 customers (3)

› Market cap of ~$1.4B (1)

› 1,066 employees (2)

› 335 square miles (2)

› Population of ~736,000

(2)

(2)

Note: (1) Based on share price of $28.41 as of October 25, 2010

(2) As of 12/31/09

(3) As of 9/30/10

(4) Includes UIL Corporate. Retail Distribution ~ 58% of ’09 Net Income

(5) CTA = Competitive Transition Assessment

UIL Holdings Corporation

GenConn Energy LLC

The United Illuminating

Company

Company

UI Service Territory

6

EEI Nov. 2010

Pending Acquisition of SCG, CNG & Berkshire

› Connecticut Department of Public Utility Control (DPUC)

» Draft decision received

» Final decision expected 11/10

› Massachusetts Department of Public Utilities (DPU)

» Order issued 8/31 stating no approval required under MA Law

» MA AG filed petition for reconsideration on 9/20

4 UIL/Iberdrola joint response filed 10/4

4 DPU ruling still pending

› Completed Financing Plan

» $501.5M net proceeds equity financing completed on 9/22

» $443.5M net proceeds 4.625% UIL senior unsecured debt issued on 10/7

› Working diligently through transition plan

› If the DPUC draft decision is adopted as a final decision, UIL expects to close

on the acquisition of the gas companies in mid-November

on the acquisition of the gas companies in mid-November

7

EEI Nov. 2010

7

UIL - Post-acquisition Corporate Structure

› Service territory: 512 sq

miles from Westport, CT to

Old Saybrook, CT

miles from Westport, CT to

Old Saybrook, CT

› ~173,000 customers

› 324 employees

› 2,269 miles of mains with

~131,000 services

~131,000 services

› 2009 rate case allowed ROE

of 9.26% (1)

of 9.26% (1)

Southern Connecticut Gas

(SCG)

(SCG)

› Service territory: 716 sq

miles in Greater Hartford-

New Britain area and

Greenwich

miles in Greater Hartford-

New Britain area and

Greenwich

› ~158,000 customers

› 341 employees

› 2,011 miles of mains with

~124,000 services

~124,000 services

› 2009 rate case allowed ROE

of 9.31% (1)

of 9.31% (1)

Connecticut Natural Gas

(CNG)

(CNG)

› Service territory: 738 sq

miles in Western MA

including Pittsfield and

North Adams

miles in Western MA

including Pittsfield and

North Adams

› ~35,000 customers

› 127 employees

› 738 miles of mains

› Allowed ROE of 10.50%

Berkshire Gas Company

(Berkshire)

(Berkshire)

› Service territory: 335 sq

miles

miles

› ~324,000 customers

› 1,066 employees

› Allowed Distribution ROE

of 8.75%

of 8.75%

› Allowed ’09 Transmission

ROE (composite) of 12.52%

ROE (composite) of 12.52%

› 50% interest in GenConn

Energy LLC

Energy LLC

The United Illuminating

Company (UI)

Company (UI)

Note: (1) Includes 10 basis point penalty reduction

UIL Holdings

Corporation

Corporation

Connecticut Energy

Corporation

Corporation

(Holding Company for SCG)

BER

(Holding Company for

Berkshire)

Berkshire)

Service Area Key

SCG

CNG

UI

Berkshire

Overlapping Territory

CTG Resources, Inc.

(Holding Company for CNG)

8

EEI Nov. 2010

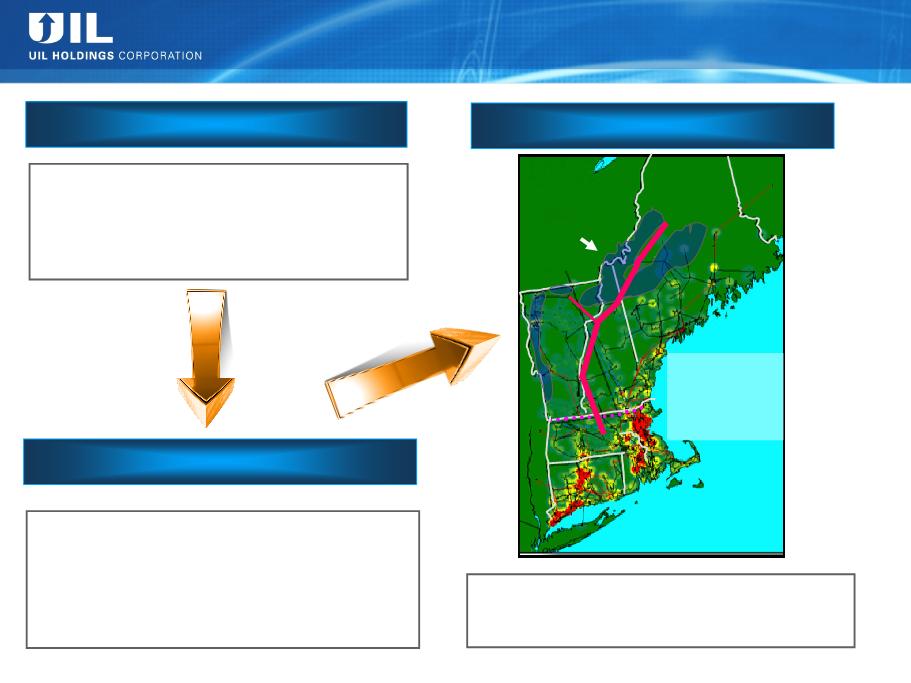

UI Transmission Growth

Renewable Requirement, Potential Solution

Renewable Requirement, Potential Solution

Need Statement

Potential Solution

› Renewable Portfolio Standard (RPS)

Requirement is ~3x current renewables level

Requirement is ~3x current renewables level

› CT requirement is > than UI’s entire load

› Gap will likely be filled by renewables remote

from load

from load

8

Assessment

Governors’ Blueprint, ISO-NE Study

› Significant Transmission build-out indicated

› Potential $7B - $10B range, could be higher or

lower to satisfy a 4,000 - 12,000 MW need

lower to satisfy a 4,000 - 12,000 MW need

› Cost to New England likely to be significantly

less than importation of midwestern wind

less than importation of midwestern wind

North-South

Interface:

Interface:

80% of NE

electric load is

below this line

electric load is

below this line

Vast majority of

potential onshore

renewables (wind)

potential onshore

renewables (wind)

are in northern NE

Collaborative effort between UI, NU, NSTAR and

NGrid to research and develop potential

solutions to the region’s RPS requirements

NGrid to research and develop potential

solutions to the region’s RPS requirements

9

EEI Nov. 2010

(1) The revenue decoupling mechanism was allowed to continue until the Department issues its

final ruling in 2011 on the evaluation of this adjustment mechanism.

final ruling in 2011 on the evaluation of this adjustment mechanism.

YTD Accomplishments/Milestones

ü Transformative Gas Companies Acquisition Underway

ü Successful Execution of Financing Plan

ü Executing on 10-year Capital Expenditure Plan

ü GenConn Devon is Operational

ü Collaborating on CT Portion of New England East West

Solution projects

Solution projects

ü Continued Enhancement of UI’s Smart System

ü Continuation of Revenue Decoupling (1)

10

EEI Nov. 2010

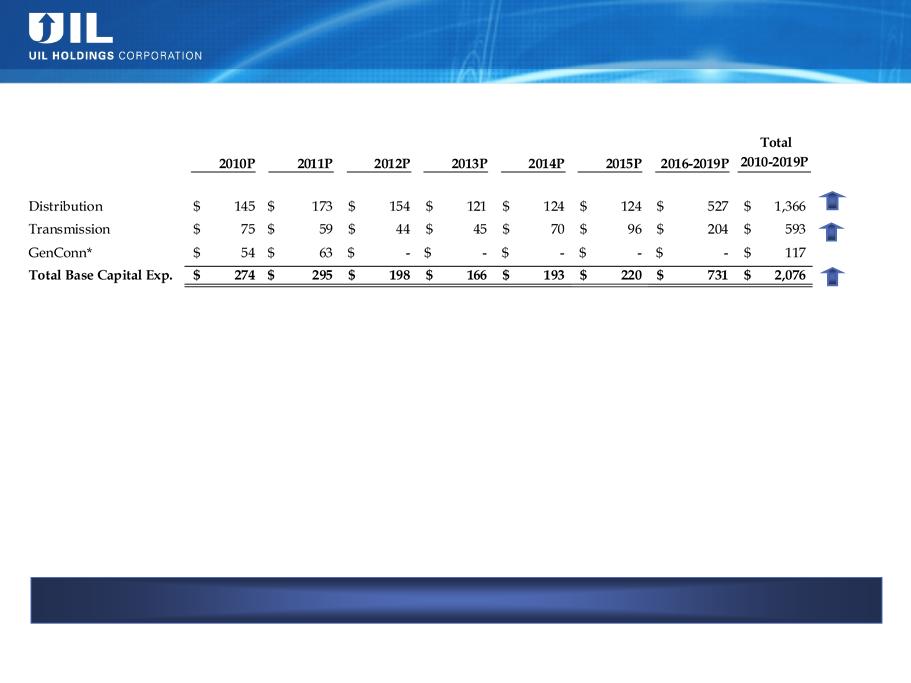

* Equity investment - Devon plant now operating, Middletown expected operation June 2011.

Amounts may not add due to rounding.

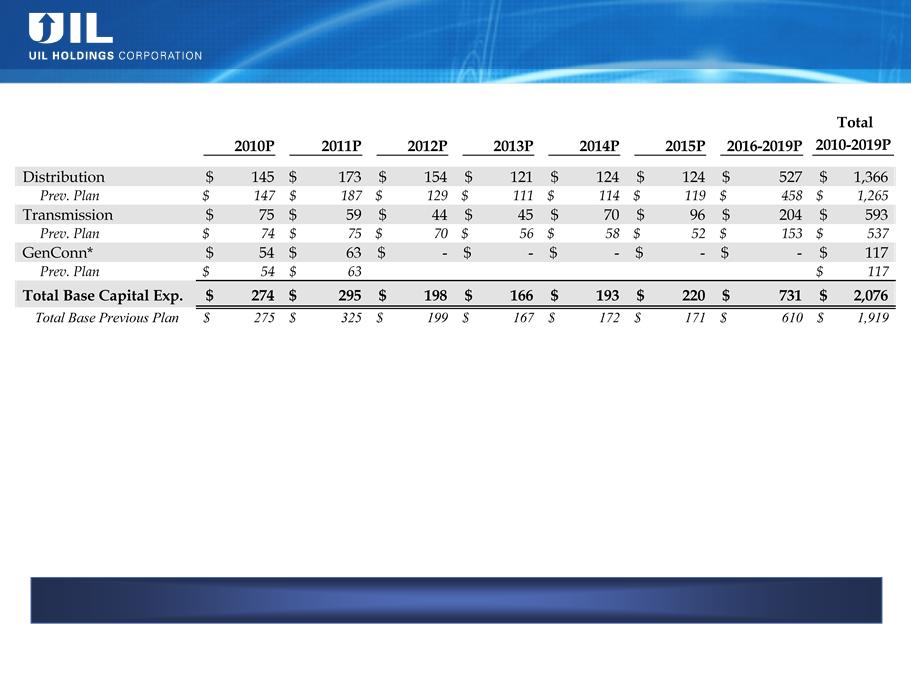

Explanations to Previous Plan

› Distribution

» 2 additional substation rebuilds

» Increases in IT related/Core Support

7%

10%

8%

Indentified projects with clear need and regulatory support

› Transmission

» Timing and amount of NEEWS investments

» 2 additional substation rebuilds

($ in millions)

Updated UI Base 10-yr CapEx Forecast

11

EEI Nov. 2010

11

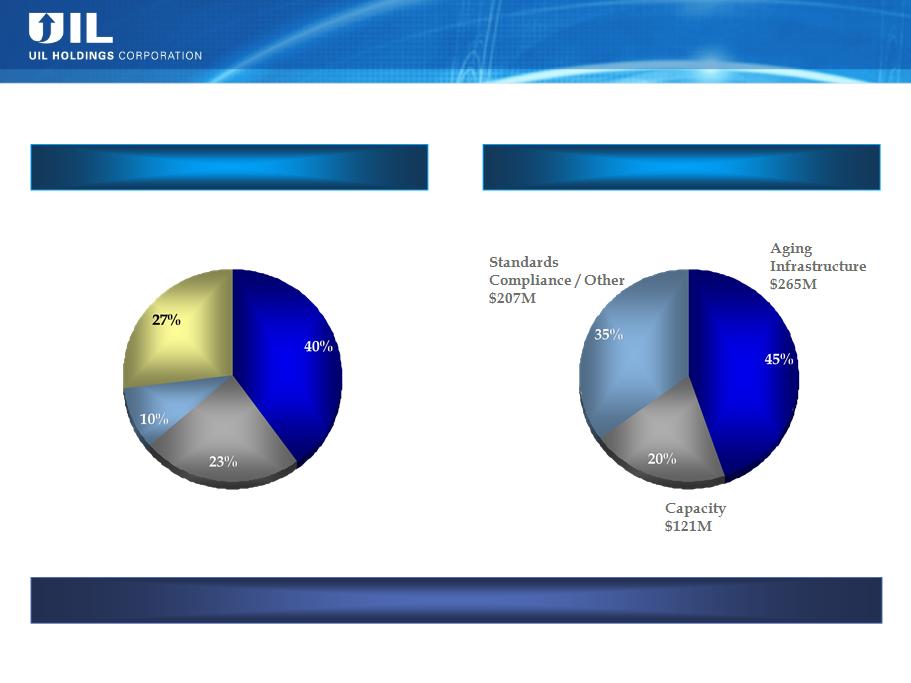

Transmission Investments

Distribution Investments

UI Base 10-Year T&D Capital

Investment Program

Investment Program

2010P - 2019P: $1,366M

2010P - 2019P: $593M

Capacity

$320M

$320M

Aging

Infrastructure

$547M

Infrastructure

$547M

System

Operations

$130M

Operations

$130M

Core Support

$369M

$369M

Note: (1) Includes $117M of GenConn capital expenditures

Amounts may not add due to rounding.

Approximately $2.1B (1) of Regulated Investment in Base Program for 2010P - 2019P

12

EEI Nov. 2010

12

|

Total Capex ($M)

|

2011P - 2015P

|

|

Distribution

|

$695

|

|

Transmission

|

314

|

|

GenConn

|

63

|

UIL Near-Term Regulated Capital Investment

Pipeline

Pipeline

($M)

Identified Projects With Clear Need

Distribution

GenConn

Transmission

To be Acquired Utilities

(1)

Note: (1) 2011 projections include to be Acquired Utilities’ full-year projected capex. To be Acquired Utilities’ projected capex provided by Iberdrola, USA.

Amounts may not add due to rounding.

20%

27%

53%

18%

17%

48%

24%

17%

59%

27%

20%

53%

25%

27%

48%

17%

23%

34%

43%

13

EEI Nov. 2010

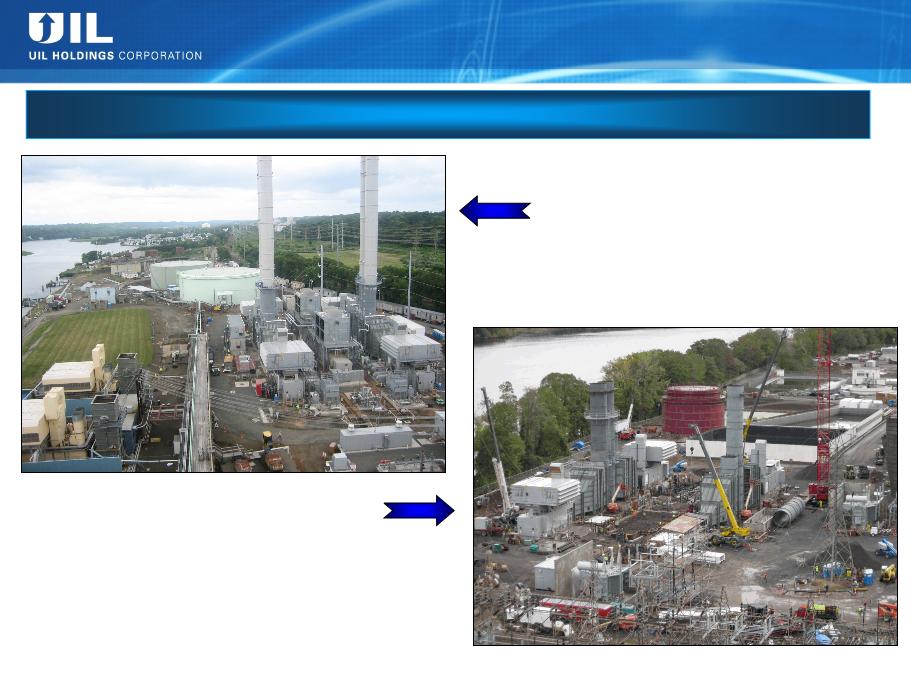

Devon Facility

› Operating

› Contractual requirements met

on 9/10/10

on 9/10/10

Middletown Facility

› 55% complete as of week ending 10/22

› Expected to be operational in June 2011

50/50 Joint Venture between UI and NRG

GenConn Energy

14

EEI Nov. 2010

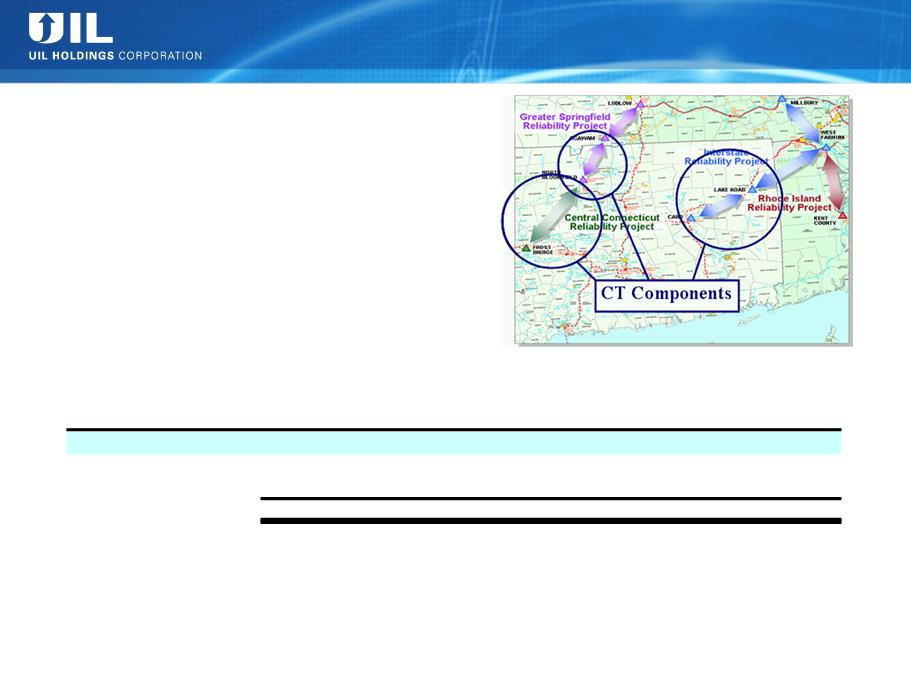

UI Transmission - Participation in NEEWS

» UI’s portion - increased to the greater

of $69M or 8.4% of CL&P’s costs for

the CT portions

of $69M or 8.4% of CL&P’s costs for

the CT portions

UI’s Investment increased from

$60M to $69M

$60M to $69M

($ in millions)

Potential UI Investment*

2010P

2011P

2012P

2013P

2014P

2015P

2016P

Total

Current Projection

7

$

3

$

9

$

8

$

12

$

23

$

7

$

69

$

Previous Projection

7

$

3

$

26

$

17

$

7

$

-

$

-

$

60

$

Difference

-

$

-

$

(17)

$

(9)

$

5

$

23

$

7

$

9

$

* Based on NU's latest projection of UI's Investment in CL&P's portion of the NEEWS Projects.

15

EEI Nov. 2010

UI’s 50% Share ($M): 2010P 2011P 2012P 2013P 2014P 2015P

15

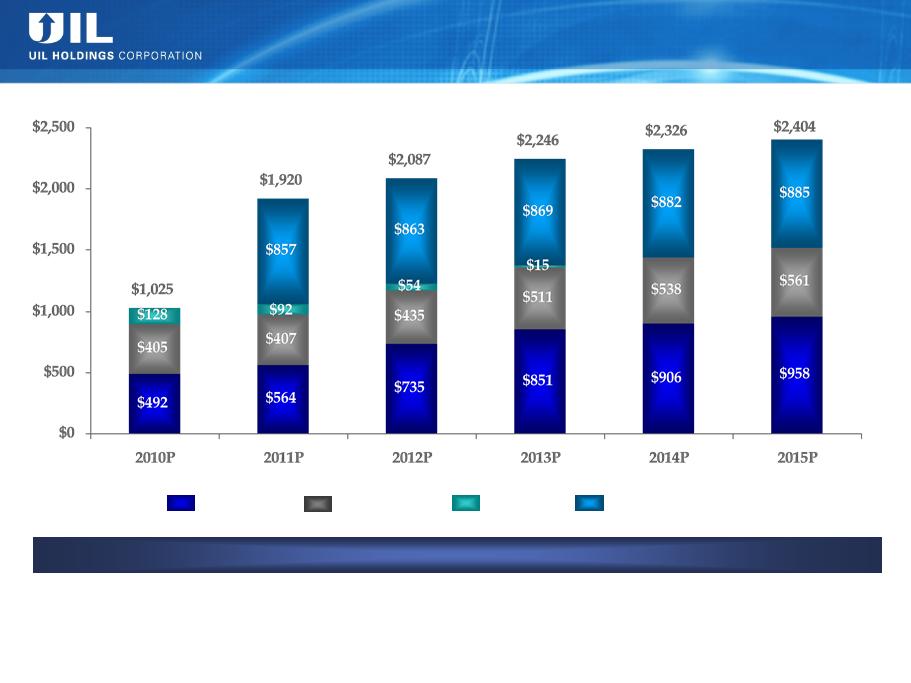

Near-Term Average Rate Base Profile

(Excluding GenConn Equity Investments)

(Excluding GenConn Equity Investments)

($M)

48%

40%

12%

29%

21%

5%

35%

3%

41%

Attractive Rate Base Growth Even With a Declining CTA Balance

1%

23%

38%

38%

39%

45%

21%

38%

23%

Avg. GenConn RB Equivalent

$153

Avg. GenConn Equity “Rate Base”

$77

$188

$94

$177

$89

$199

$99

$52

$26

40%

37%

23%

$167

$84

To be Acquired Utilities’ rate base projections provided by Iberdrola, USA.

Amounts may not add due to rounding.

Distribution

GenConn

Acquired Utilities

Transmission

16

EEI Nov. 2010

Energy Conservation

17

EEI Nov. 2010

CT Energy Efficiency Fund Activities in 2009

UI approximately 20%

UI has been a leader in energy efficiency programs for more than 2 decades

Leader in Conservation & Demand Response Programs

› Nationally and internationally

recognized for its programs

recognized for its programs

› Small Business Energy Advantage

Program incorporates innovative

“on-bill financing”

Program incorporates innovative

“on-bill financing”

› 863 million annual lifetime

kilowatt hour savings

kilowatt hour savings

(5-year average)

› 433 thousand annual lifetime tons

of carbon dioxide emissions

of carbon dioxide emissions

(5-year average)

› Annual pre-tax income

approximately $1 million

approximately $1 million

18

EEI Nov. 2010

UI is a leading demand response provider throughout New England

Leader in Conservation & Demand Response Programs

› Home Depot, Walmart and Kohl’s

stores throughout New England

participate in UI’s Load Response

Program

stores throughout New England

participate in UI’s Load Response

Program

› In total, UI enrolls over 600

individual customer assets and

over 80 MW of load in the

Forward Capacity Market (FCM)

individual customer assets and

over 80 MW of load in the

Forward Capacity Market (FCM)

› Active in ISO-NE Markets

Committee and FCM Working

Group to help shape demand

response programs that customers

value

Committee and FCM Working

Group to help shape demand

response programs that customers

value

› Annual pre-tax income of more

than $0.5 million

than $0.5 million

19

EEI Nov. 2010

Source: U.S. Department of Energy

End-Use Customers

› Home Area Networks

› Electric Vehicles

› Distributed Resources

Modernization of UI’s Electric System

UI’s Smart System

Monitors

› SCADA

Optimizes the Operation

› Voltage Control

› Automatic switching & restoration

Distribution System

› Outage Detection

› Advanced Meter Infrastructure

› Meter Data Management

› Smart Meter Deployment

» 17,000+ meters installed

» 40,000 two-way meters installed by

year-end 2010

» 80,000 two-way meters installed by

year-end 2011

20

EEI Nov. 2010

› UI is currently conducting a one-year HAN pilot

with 950 households

with 950 households

› Enables two-way communication with the new meter

into customer’s home

into customer’s home

› Customers can access near real-time energy usage

information from their homes and on-line

information from their homes and on-line

› Creates opportunities for customers to save energy

» Dynamic Pricing

» Residential Demand Response

» Integration of distributed resources

» Next generation energy efficiency appliances

such as electric vehicles and smart appliances

such as electric vehicles and smart appliances

Home Area Network (HAN) Pilot

21

EEI Nov. 2010

Financial Results

22

EEI Nov. 2010

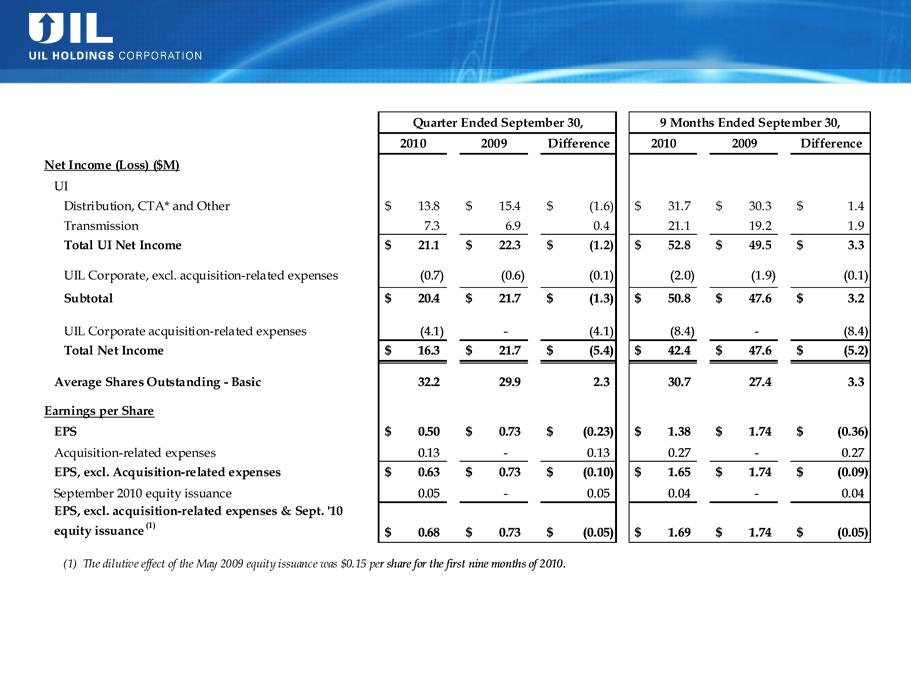

|

(1) The dilutive effect of the May 2009 equity issuance was $0.15 per share for the first nine months of 2010.

|

Net Income 3Q ’10 vs. 3Q ’09

› Unfavorable variance of $1.3 million, excluding $4.1

million acquisition-related expenses in 3Q ‘10

million acquisition-related expenses in 3Q ‘10

» Higher Distribution O&M expense due to timing

» Lower CTA rate base

» Timing of below the line income

Net Income YTD 2010 vs. 2009

› Favorable variance of $3.2 million, excluding $8.4

million acquisition-related expenses in 2010

million acquisition-related expenses in 2010

» Increased Distribution revenues partially offset

by increased O&M and interest expenses

by increased O&M and interest expenses

» Increased Allowance for Funds Used During

Construction

Construction

3Q & YTD 2010 Financial Results - Summary

23

EEI Nov. 2010

* Competitive Transition Assessment

3Q & YTD 2010 Financial Results - Details

24

EEI Nov. 2010

24

Pro Forma Near-Term Debt Maturities

Standalone Liquidity Overview (9/30/10)*

Strong Liquidity Position and Manageable

Near-Term Debt Maturities

Near-Term Debt Maturities

*UIL Plans to Increase Size of Credit Facilities to Provide Adequate Liquidity for Larger Business

Amounts may not add due to rounding.

($M)

UI Equity Bridge Loan

To be Acquired

Utilities

**

Notes: All 2010 debt maturities have either been remarketed or repaid

** To be remarketed

25

EEI Nov. 2010

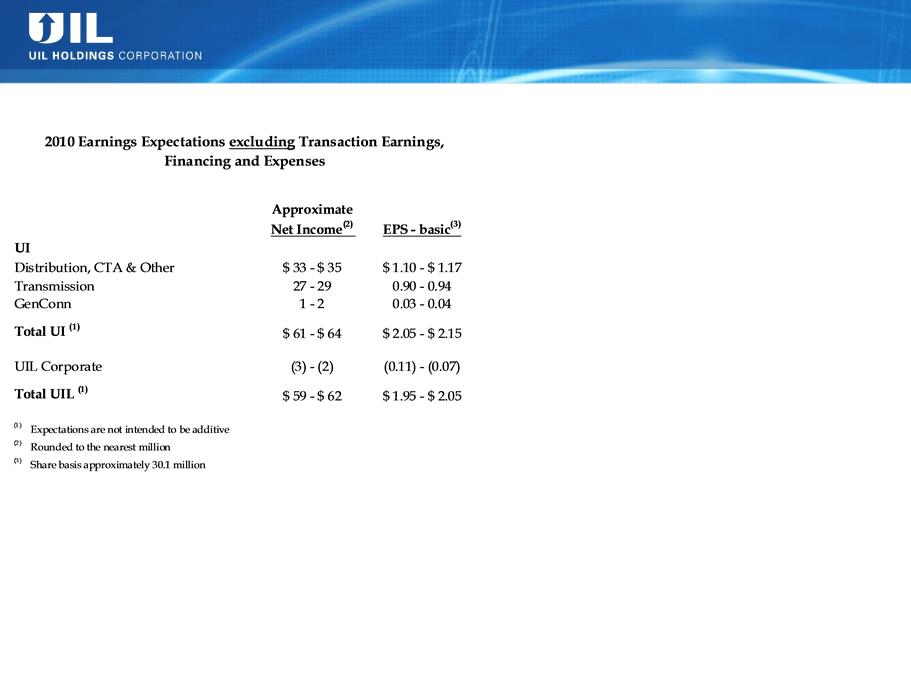

Guidance Assumptions

2010 Earnings Guidance as of November 1, 2010

Narrowing Range

Narrowing Range

› Better than anticipated Distribution, CTA &

Other earnings performance for first nine

months of 2010 with updated projections for 4Q

’10 O&M expenses

Other earnings performance for first nine

months of 2010 with updated projections for 4Q

’10 O&M expenses

› Increase in Transmission Allowance for Funds

Used During Construction

Used During Construction

› Earnings impact from a delay in GenConn

Devon achieving commercial operation

Devon achieving commercial operation

› UIL Corporate updated to reflect tax rate true-

ups

ups

26

EEI Nov. 2010

Looking Forward to 2011

› Gas companies acquisition

» Transition year - work through Transitional Services Agreement

› Driving to earn allowed returns on all regulated businesses

› Continual management of O&M expenses

› Executing on capital expenditure plan à realizing rate base growth

› GenConn Middletown scheduled to be operational June 2011

27

EEI Nov. 2010

27

Attractive Dividend

› UIL has paid a consecutive quarterly dividend for over 100 years (1)

› Dividend has been set at current annual level of $1.728 per share for

more than 14 years

more than 14 years

› Management is focused on maintaining the dividend and reducing

the payout ratio over time through earnings growth

the payout ratio over time through earnings growth

› Pending acquisition will provide additional earnings and cash flow to

help achieve this objective

help achieve this objective

Note: (1) Refers to UIL and UI

28

EEI Nov. 2010

28

Investment Highlights

Attractive Dividend

(6% Yield) (2)

› Current annual dividend of $1.728 per share

› Core regulated earnings combined with the enhanced cash flow and expected earnings per

share accretion from the acquisition provide continued support for UIL’s dividend

share accretion from the acquisition provide continued support for UIL’s dividend

Visible Regulated

Growth

Opportunities

Growth

Opportunities

› Approximately $2.1B of regulated capital investment in The United Illuminating Company

(UI) 10-year plan

(UI) 10-year plan

» UI 5-year Rate Base CAGR of 8.2% (9.4% including equivalent GenConn rate base) (1)

» Includes $0.6B of highly attractive transmission projects

› Pending acquisition provides additional avenue for growth through investment in gas

distribution system

distribution system

Conservative

Financial Strategy

Financial Strategy

› Maintenance of investment grade credit ratings is an important objective

FERC-Regulated

Electric

Transmission

Electric

Transmission

› 2009 earned composite return on equity of 12.52%

› Proven ability to partner reaching beyond service territory

› New England renewable portfolio standards driving need for major transmission build

Note: (1) CAGRs calculated based on annual average rate base from 2010-2015

(2) Based on share price of $28.41 as of October 25, 2010

Attractive Regulated

Utility

Utility

› Proven ability to earn allowed electric return

› Highly experienced with Connecticut regulatory proceedings

› Constructive long-term rate plan in Massachusetts comes with acquisition

29

EEI Nov. 2010

Q&A

30

EEI Nov. 2010

Appendix

31

EEI Nov. 2010

Pending Acquisition of SCG, CNG and Berkshire

Description

› Acquisition of three regulated gas LDCs owned by Iberdrola USA with

approximately 366,000 customers(1) announced on May 25, 2010

approximately 366,000 customers(1) announced on May 25, 2010

» Southern Connecticut Gas - 173,000 customers(1)

» Connecticut Natural Gas - 158,000 customers(1)

» Berkshire Gas Company - 35,000 customers(1)

Purchase Price

› $1,296M less net debt of approximately $411M for an expected cash payment at

closing of approximately $885M, subject to post closing adjustments

closing of approximately $885M, subject to post closing adjustments

Tax Treatment

Financing Plan

ü Completed $524M equity issuance, 20.355 million shares @ $25.75

ü Issued $450M of 4.625%UIL Holdings senior unsecured debt

Note: (1) As of 6/30/10.

› UIL expects to realize transaction related tax benefits of approximately

$135M on a net present value basis (19 year schedule)

$135M on a net present value basis (19 year schedule)

» Front-end loaded with over half of the expected benefits realized in the first

six years following closing due to accelerated tax depreciation on the

majority of the tax write-up

six years following closing due to accelerated tax depreciation on the

majority of the tax write-up

» $20M of cash tax benefit expected in the first year following closing (2011)

Status Update

› Connecticut Department of Public Utility Control (DPUC) à filed 7/16; hearings concluded; draft

decision received 10/27, final decision expected 11/10

decision received 10/27, final decision expected 11/10

ü Massachusetts Department of Public Utilities (DPU) à 8/31 ruling stating DPU approval not required

under Massachusetts law à 9/20 Massachusetts AG filed motion for reconsideration àUIL/Iberdrola joint

response filed 10/4

under Massachusetts law à 9/20 Massachusetts AG filed motion for reconsideration àUIL/Iberdrola joint

response filed 10/4

ü HSR (Hart-Scott-Rodino) à expired without comment

ü No shareowner vote required

› If the DPUC draft decision is adopted as a final decision, UIL expects to close on the

acquisition of the gas companies in mid-November

acquisition of the gas companies in mid-November

32

EEI Nov. 2010

› Connecticut Department of Public Utility Control (DPUC)

› Distribution currently operating under 2 year rate plan with full revenue decoupling pilot*

› Allowed ROE of 8.75%, based on a capital structure of 50.0% equity

› Federal Energy Regulatory Commission (FERC)

› Transmission trued up on an annual basis to allowed composite ROE based on FERC approved formula rate

› 2010 composite ROE of approximately 12.4%-12.5%, based on a capital structure of 50.0% equity

› DPUC Contracts for Differences with CL&P (subsidiary of Northeast Utilities) and cost sharing agreement (80% CL&P /

20% UI)

20% UI)

› Allowed ROE has a lifetime floor of 9.75% based on a capital structure of 50.0% equity

› Connecticut Department of Public Utility Control (DPUC)

› 2009 Rate Case decision is under appeal and has been stayed pending determination of the appeal

› Currently operating under old rates with embedded overearnings credit - new rates per rate case virtually the same as old

rates currently in place

rates currently in place

› Allowed ROE of 9.26%, based on a capital structure of 52.0% equity

› Massachusetts Department of Public Utilities (DPU)

› 10 year constructive rate plan expiring 1/31/12

› Rates adjusted annually based on inflation and other factors

32

Regulatory Overview

Distribution

Transmission

(1) The revenue decoupling mechanism was allowed to continue until the Department issues its

final ruling in 2011 on the evaluation of this adjustment mechanism.

final ruling in 2011 on the evaluation of this adjustment mechanism.

› Connecticut Department of Public Utility Control (DPUC)

› 2009 Rate Case decision is under appeal and has been stayed pending determination of the appeal

› Currently operating under old rates with embedded overearnings credit - new rates per rate case virtually the same as old

rates currently in place

rates currently in place

› Allowed ROE of 9.31%, based on a capital structure of 52.5% equity

33

EEI Nov. 2010

33

|

|

2009

|

|

6 Months Ended June 30, 2010

|

||||

|

($M)

|

UIL

|

Target

|

Pro Forma (1)

|

|

UIL

|

Target

|

Pro Forma (1)

|

|

Gross Margin

|

$563

|

$323

|

$887

|

|

$298

|

$187

|

$486

|

|

Adjusted EBITDA (2)

|

$220

|

$128

|

$348

|

|

$113

|

$92

|

$212

|

|

Adjusted Net Income (2)

|

$54

|

||||||

|

Average Basic Shares

Outstanding (000s) |

28,027

|

|

45,548

|

|

30,037

|

|

47,558

|

|

Adjusted Net Income per

Basic Share |

$1.94

|

NA

|

$1.74

|

|

$0.87

|

NA

|

$1.23

|

|

Long-Term Debt

|

|

|

|

|

$676

|

$378

|

$1,490

|

Summary Pro Forma Financials

Note: (1) Assumes $436M of debt acquisition financing with 4.50% coupon, and $475M of equity acquisition financing issued at August 17, 2010 price of $27.11; does not include any expected savings

(2) Non-GAAP financial measure. For a reconciliation to net income on next 2 slides.

Amounts may not add due to rounding.

34

EEI Nov. 2010

34

Net Income to Adjusted EBITDA Reconciliation

|

|

UIL Holdings

|

Target

|

Pro Forma

|

|||

|

($M)

|

FY 2009

|

Six Months

Ended June 30, 2010 |

FY 2009

|

Six Months

Ended June 30, 2010 |

FY 2009

|

Six Months

Ended June 30, 2010

|

|

Net Income (GAAP)

|

$54

|

$26

|

$25

|

($235)

|

$67

|

($211)

|

|

Adjustments

|

|

|

|

|

|

|

|

Interest Expense, Net

|

$40

|

$21

|

$35

|

$16

|

$95

|

$47

|

|

Income Tax Expense

|

33

|

19

|

4

|

25

|

29

|

42

|

|

Depreciation and Amortization

|

98

|

54

|

46

|

24

|

144

|

78

|

|

Other Deductions / (Income)

|

(6)

|

(8)

|

(3)

|

(5)

|

(8)

|

(13)

|

|

One-Time Adjustments

|

|

|

|

|

|

|

|

Goodwill Impairment

|

$-

|

$-

|

$-

|

$271

|

$-

|

$271

|

|

Workforce Separation Costs

|

-

|

-

|

2

|

(2)

|

2

|

(2)

|

|

Expenses Related to Retirement and Insurance

Plans |

-

|

-

|

13

|

(2)

|

13

|

(2)

|

|

Expense Allocations from Parent and

Miscellaneous Items |

-

|

-

|

6

|

-

|

6

|

-

|

|

Total Pre-tax Adjustments

|

$166

|

$87

|

$103

|

$327

|

$281

|

$422

|

|

Adjusted EBITDA

|

$220

|

$113

|

$128

|

$92

|

$348

|

$212

|

Amounts may not add due to rounding.

Source: Adjustments based on notes in audited financial statements and financials provided by Iberdrola USA management.

34

35

EEI Nov. 2010

35

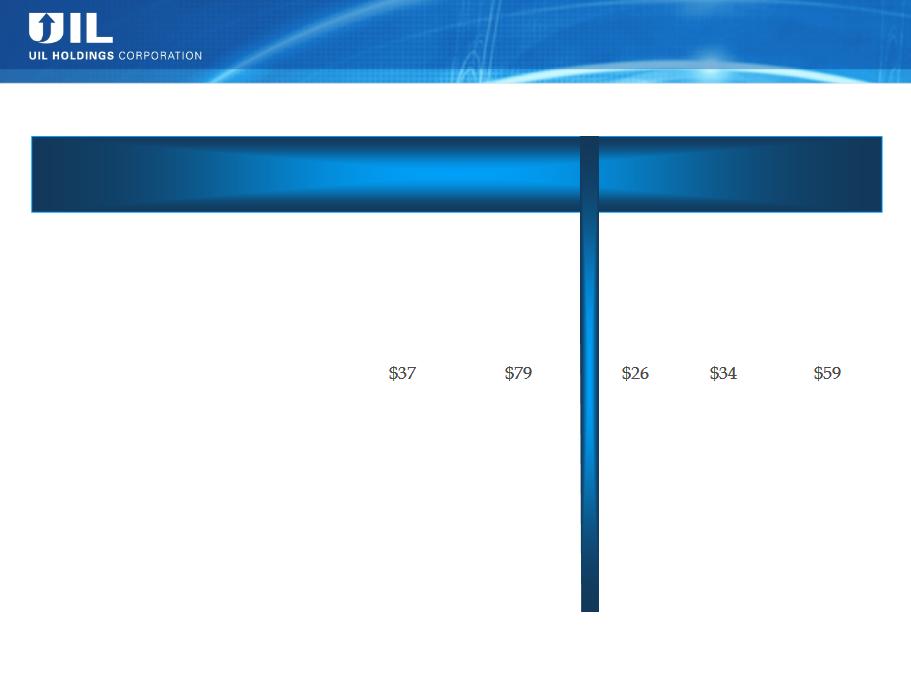

Adjusted Net Income Reconciliation

|

|

UIL Holdings

|

Target

|

Pro Forma

|

|||

|

($M)

|

FY 2009

|

Six Months

Ended June 30, 2010 |

FY 2009

|

Six Months

Ended June 30, 2010 |

FY 2009

|

Six Months

Ended June 30, 2010

|

|

Net Income (GAAP)

|

$54

|

$26

|

$25

|

($235)

|

$67

|

($211)

|

|

One-Time Adjustments

|

|

|

|

|

|

|

|

Goodwill Impairment

|

$-

|

$-

|

$-

|

$271

|

$-

|

$271

|

|

Workforce Separation Costs

|

-

|

-

|

1

|

(1)

|

1

|

(1)

|

|

Expenses Related to Retirement and Insurance

Plans |

-

|

-

|

7

|

(1)

|

7

|

(1)

|

|

Expense Allocations from Parent and

Miscellaneous Items |

-

|

-

|

4

|

-

|

4

|

-

|

|

Total After-tax Adjustments

|

$-

|

$-

|

$12

|

$269

|

$12

|

$269

|

|

Adjusted Net Income

|

$54

|

$26

|

$37

|

$34

|

$79

|

$59

|

Amounts may not add due to rounding.

Source: Adjustments based on notes in audited financial statements and financials provided by Iberdrola USA management.

36

EEI Nov. 2010

* Equity investment - Devon plant now operating, Middletown expected operation June 2011.

Amounts may not add due to rounding.

Indentified projects with clear need and regulatory support

Explanations to Previous Plan

› Distribution

» 2 additional substation rebuilds

» Increases in IT related/Core Support

› Transmission

» Timing and amount of NEEWS investments

» 2 additional substation rebuilds

($ in millions)

UI Base 10-yr CapEx

Current Plan vs. Previous Plan

Current Plan vs. Previous Plan

37

EEI Nov. 2010

Connecticut RPS Requirements

(Percentage of Retail Load)

Class 1 resources include energy derived from solar, wind, fuel cell, methane gas from landfills, ocean thermal, wave,

tidal, run-of-river hydropower (<5MW, began operation after July 1, 2003), sustainable biomass (NOx emission <0.075

lbs/MMBtu of heat input)

tidal, run-of-river hydropower (<5MW, began operation after July 1, 2003), sustainable biomass (NOx emission <0.075

lbs/MMBtu of heat input)

Class 2 resources include other biomass (NOx emission <0.2 lbs/MMBtu of heat input, began operation before July 1,

1998), small run-of-river hydroelectric (<5MW, began operation before July 1, 2003) and municipal solid waste trash-to-

energy facilities.

1998), small run-of-river hydroelectric (<5MW, began operation before July 1, 2003) and municipal solid waste trash-to-

energy facilities.

Class 3 include customer-sited combined heat and power (with operating efficiency >50% of facilities installed after

January 1, 2006), waste heat recovery systems (installed on or after April 1, 2007), electricity savings from conservation

and load management programs (began on or after January 1, 2006)

January 1, 2006), waste heat recovery systems (installed on or after April 1, 2007), electricity savings from conservation

and load management programs (began on or after January 1, 2006)

CT RPS Requirements

38

EEI Nov. 2010

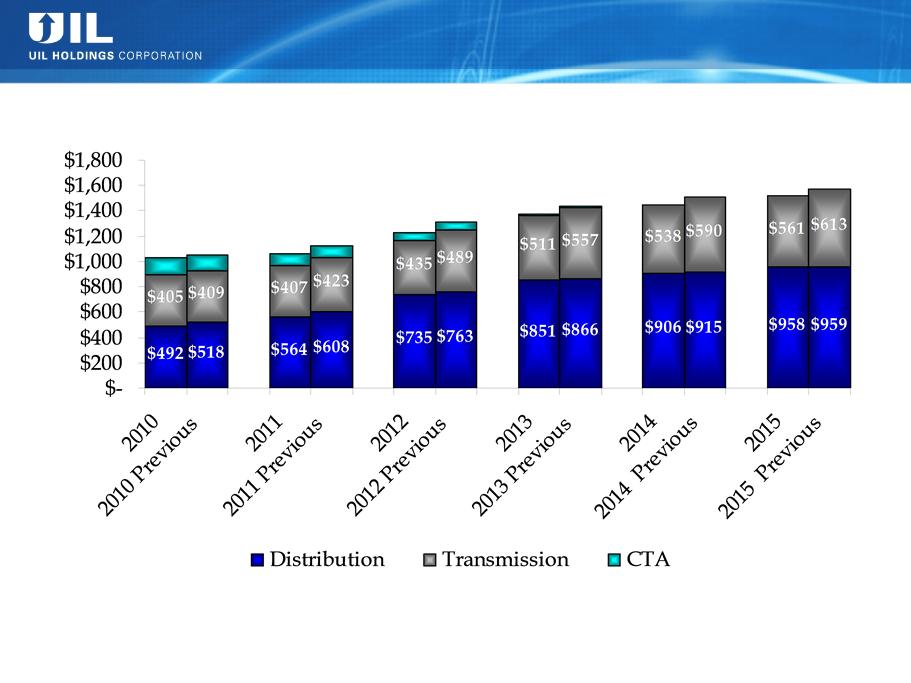

($M)

* CTA Avg Rate Base figures unchanged from previous forecast -- $128M ’10, $92 ’11, $54M ’12 and $15M ‘13

*

$1,025

$1,055

$1,063

$1,123

$1,224

$1,307

$1,377

$1,438

$1,444

$1,505

$1,519

$1,572

UI Avg Rate Base 2010 - 2015

Current Forecast vs. Previous Forecast

Current Forecast vs. Previous Forecast

39

EEI Nov. 2010

UI Distribution Avg Rate Base 2010 - 2015

Current Forecast vs. Previous Forecast Bridge

Current Forecast vs. Previous Forecast Bridge

Explanations

› Shift in IT-related Core Support CapEx timing coupled with increased Aging

Infrastructure expenditures

Infrastructure expenditures

› Tax Repairs and Maintenance election - approx. $36M of cash tax benefit in 2010,

increased Accumulated Deferred Income Tax rate base offset

increased Accumulated Deferred Income Tax rate base offset

› Expected 2011 Pension contribution of $45-$50M up from previous estimate of $21M

40

EEI Nov. 2010

($ in millions)

Transmission Average Rate Base

Current vs. Previous Forecast

2010

Current

vs.

Previous

2011

Current

vs.

Previous

2012

Current

vs.

Previous

2013

Current

vs.

Previous

2014

Current

vs.

Previous

2015

Current

vs.

Previous

Plant In Service

(3)

$

(9)

$

(43)

$

(37)

$

(42)

$

(43)

$

Accum Depreciation

(1)

$

(1)

$

(6)

$

(4)

$

(6)

$

(6)

$

Accum Def Income Taxes

(1)

$

(5)

$

(5)

$

(5)

$

(4)

$

(3)

$

Other

1

$

(1)

$

(1)

$

(1)

$

(1)

$

(1)

$

Total Transmission Avg Rate Base

UI Transmission Avg Rate Base 2010 - 2015

Current Forecast vs. Previous Forecast Bridge

Current Forecast vs. Previous Forecast Bridge

Explanations

› Shift in timing and overall amount of NEEWS investment

» New in-service dates for Interstate (2015) and CCRP (2016) reflect regional and state review processes

› Shift in timing and overall amount of Pequonnock 115kV Fault Duty Mitigation project

› Tax Repairs and Maintenance election - approx. $4M of cash tax benefit in 2010,

increased Accumulated Deferred Income Tax rate base offset

increased Accumulated Deferred Income Tax rate base offset

41

EEI Nov. 2010

41

GenConn Energy LLC

› 50/50 debt/equity

Status

› On 7/30/10, the 2011 revenue requirement

application for both the Devon and

Middletown facilities was filed with the DPUC

application for both the Devon and

Middletown facilities was filed with the DPUC

› Final regulatory review of construction costs

will be part of 2013 revenue requirement

proceeding

will be part of 2013 revenue requirement

proceeding

Financing