Attached files

| file | filename |

|---|---|

| 8-K - SUNOCO LOGISTICS PARTNERS LP--FORM 8-K - Energy Transfer Operating, L.P. | d8k.htm |

| EX-99.1 - PRESS RELEASE - Energy Transfer Operating, L.P. | dex991.htm |

Third Quarter 2010

Earnings Conference Call

October 28, 2010

Sunoco Logistics Partners L.P.

Exhibit 99.2 |

Forward-Looking Statement

You should review this slide presentation in conjunction with the third

quarter 2010 earnings conference call for Sunoco Logistics

Partners L.P., held on October 28 at 8:30 a.m. EDT. You may listen to

the

audio

portion

of

the

conference

call

on

our

website

at

www.sunocologistics.com

or

by

dialing

(USA

toll-

free) 1-888-889-4955. International callers should dial

1-312-470-0130. Please enter Conference ID

“Sunoco Logistics”.

Audio replays of the conference call will be available for two weeks

after the conference call beginning approximately two hours

following the completion of the call. To access the replay, dial 1-800-294-7481.

International callers should dial 1-203-369-3233.

During the call, those statements we make that are not historical facts

are forward-looking statements. Although we believe the

assumptions underlying these statements are reasonable, investors are

cautioned that such forward-looking statements involve risks that may

affect our business prospects and performance, causing actual

results to differ from those discussed during the conference call. Such risks

and uncertainties include, among other things: our ability to

successfully consummate announced acquisitions

and

organic

growth

projects

and

integrate

them

into

existing

business

operations;

the

ability

of

announced acquisitions to be cash-flow accretive; increased

competition; changes in the demand both for crude oil that we buy

and sell, as well as for crude oil and refined products that we store and distribute; the

loss of a major customer; changes in our tariff rates; changes in

throughput of third-party pipelines that connect to our

pipelines and terminals; changes in operating conditions and costs; changes in the level of

environmental remediation spending; potential equipment malfunction;

potential labor relations problems; the legislative or regulatory

environment; plant construction/repair delays; and political and economic

conditions,

including

the

impact

of

potential

terrorist

acts

and

international

hostilities.

These and other applicable risks and uncertainties are described

more fully in our Form 10-Q, filed

with the Securities and Exchange Commission in August 2010. We

undertake no obligation to update publicly any forward-looking

statements whether as a result of new information or future events.

2 |

Q3 2010 Assessment

Increased total distribution to $1.17 ($4.68 annualized)

per unit, a 10 percent increase over the prior year’s

distribution

•

Represents the twenty-second consecutive

distribution increase

Distributable cash flow for the third quarter of 2010 was

$70 million compared to $54 million in the prior year

Completed acquisitions totaling $243 million

3 |

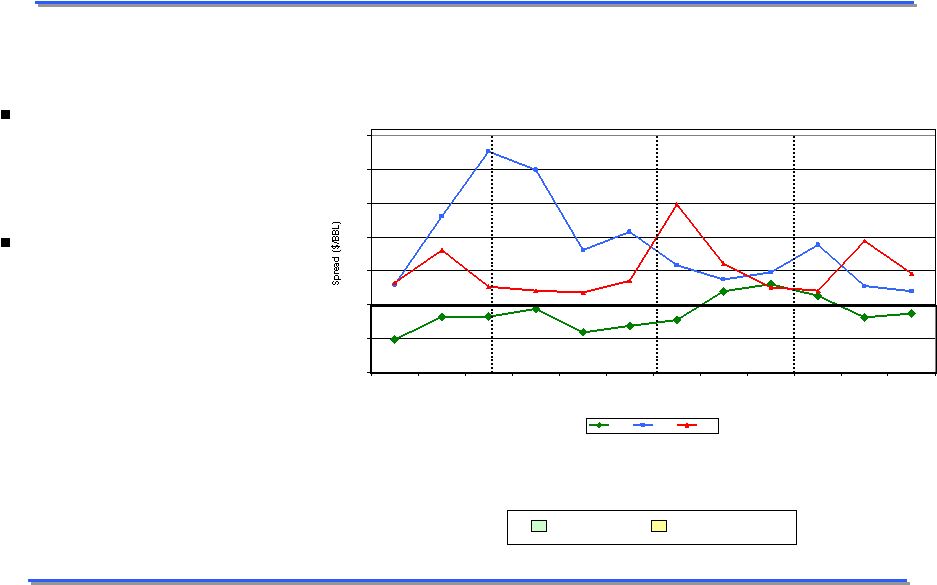

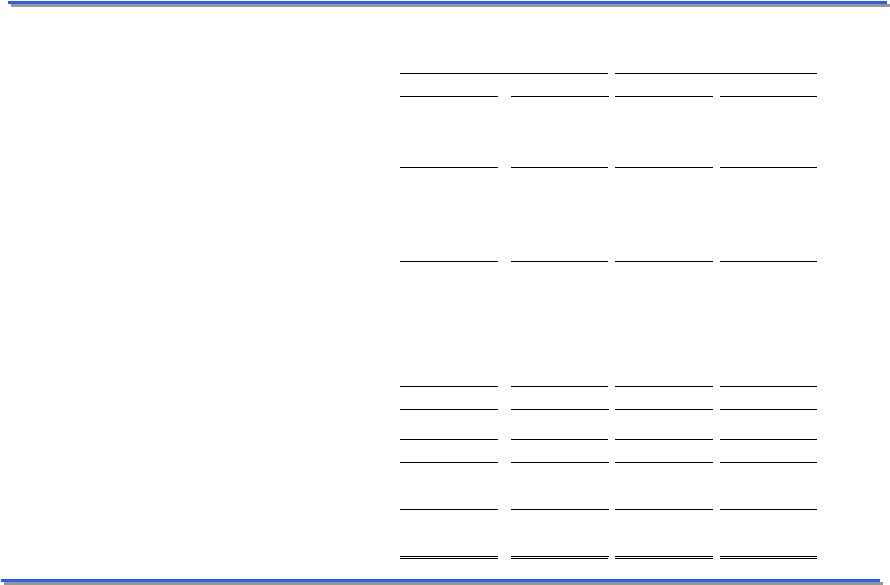

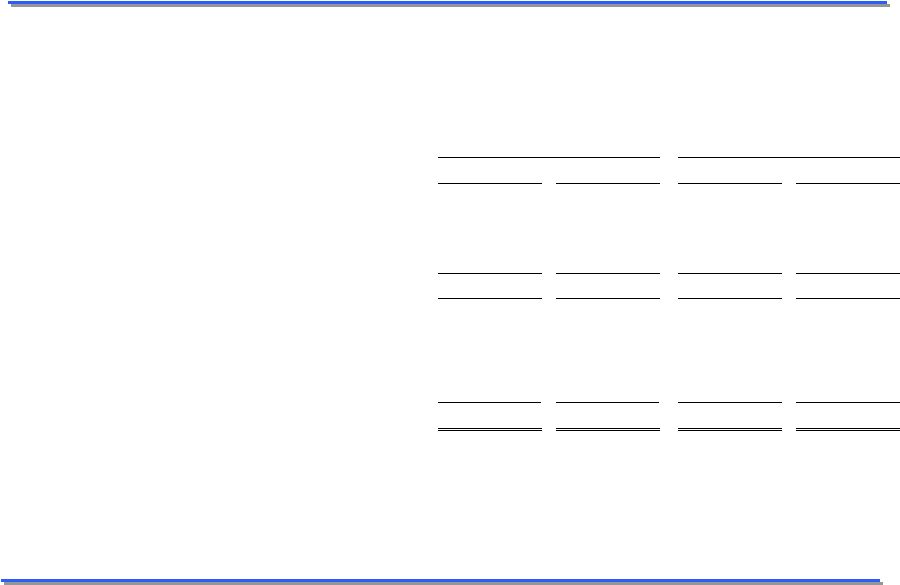

Crude Oil Contango

Widened contango market

structure provided strong

earnings in the third quarter

While the contango market

has come off from the very

strong early 3Q levels, we

do have a contango

investment at September 30

of approximately $215MM

to take advantage of fourth

quarter opportunities

4

Backwardation

Contango

WTI NYMEX Month 2 vs. Month 1

-2

-1

0

1

2

3

4

5

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Month

2008

2009

2010 |

YTD 2010 Operating Performance

Continued solid performance by our asset base supplemented by:

•

Crude contango market opportunities

•

Contribution from 2010 and 2009 organic growth projects

including: Expanded services at refined products terminals

Expansion program at Nederland facility

•

Contributions from recent acquisitions

Through the first three quarters of 2010, operating performance as

expected •

Distribution decisions exclude market related activities

•

Will continue to take advantage of market related opportunities when

available

5 |

2010 Growth -

Acquisitions

Acquired

Butane

Blending

Business

–

Third

Quarter

•

Enhances terminal service offerings

•

Tremendous growth potential: actively working to increase installations

at key terminals and third-party locations

Acquired

Three

Additional

Joint

Venture

Interests

–

Third

Quarter

•

Joint venture assets are an excellent fit with Sunoco Logistics asset

base Acquired

Terminal

in

Bay

City,

Texas

–

Fourth

Quarter

•

110 thousand barrel terminal expands the lease crude gathering business

and provides an opportunity to continue our growth in southwest

refined products

6 |

2010 Growth -

Organic

Agreement with TransCanada

•

Provide access to Nederland for their Keystone XL project

Project Mariner with MarkWest

•

Economical solution of transporting ethane from Marcellus Shale to

market •

Excellent growth potential for fee based income

Nederland Tank Expansion

•

Two additional tanks to bring capacity to 22 MMB

Investment in Biodiesel at 11 terminals

7 |

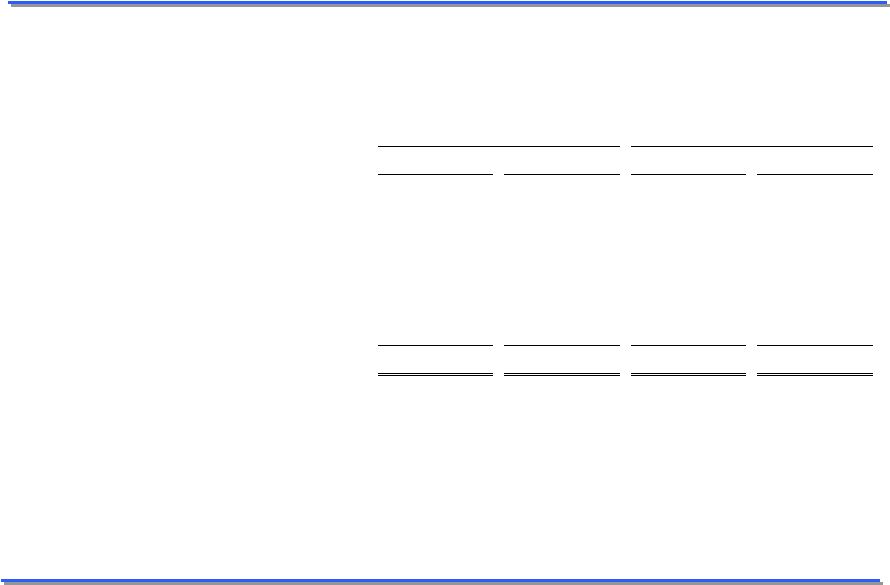

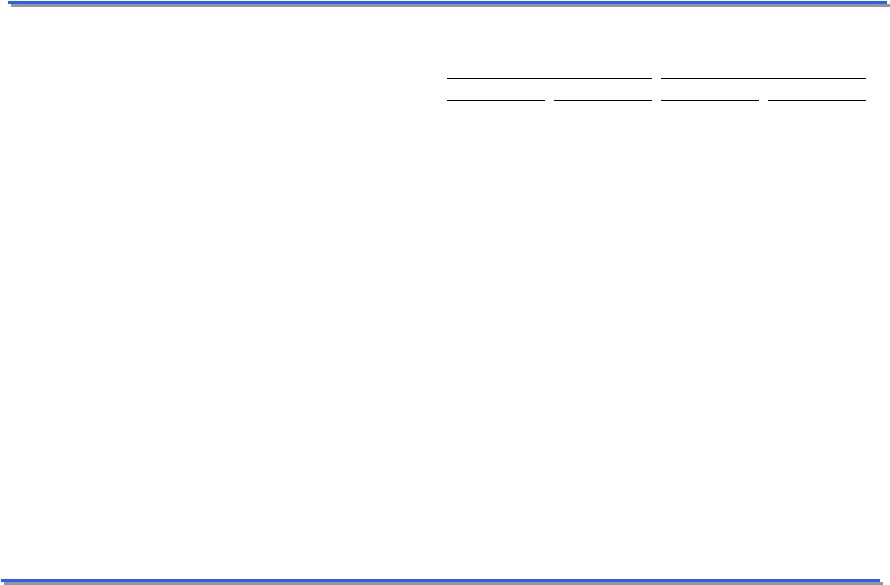

Q3 2010 Financial Highlights

($ in millions, unaudited)

8

Three Months Ended

Nine Months Ended

September 30,

September 30,

2010

2009

2010

2009

Sales and other operating revenue

1,876.2

$

1,420.0

$

5,585.5

$

3,740.8

$

Other income

7.2

8.8

24.4

21.3

Total revenues

1,883.4

1,428.8

5,609.9

3,762.1

Cost of products sold and operating expenses

1,762.4

1,342.0

5,296.2

3,450.5

Depreciation and amortization

16.4

12.2

44.9

35.3

Selling, general and administrative expenses

15.6

14.7

51.8

47.6

Total costs and expenses

1,794.4

1,368.9

5,392.9

3,533.4

Operating income

89.0

59.9

217.0

228.7

Interest cost and debt expense

20.9

12.6

57.0

36.3

Capitalized interest

(1.2)

(1.2)

(3.2)

(3.6)

Gain on investments in affiliates

128.5

-

128.5

-

Income before provision for income taxes

197.8

$

48.5

$

291.7

$

196.0

$

Provision for income taxes

3.8

-

3.8

-

Net Income

194.0

$

48.5

$

287.9

$

196.0

$

Net income attributable to noncontrolling

interests

1.1

-

1.1

-

Net Income attributable to Sunoco Logistics

Partners L.P.

192.9

$

48.5

$

286.8

$

196.0

$ |

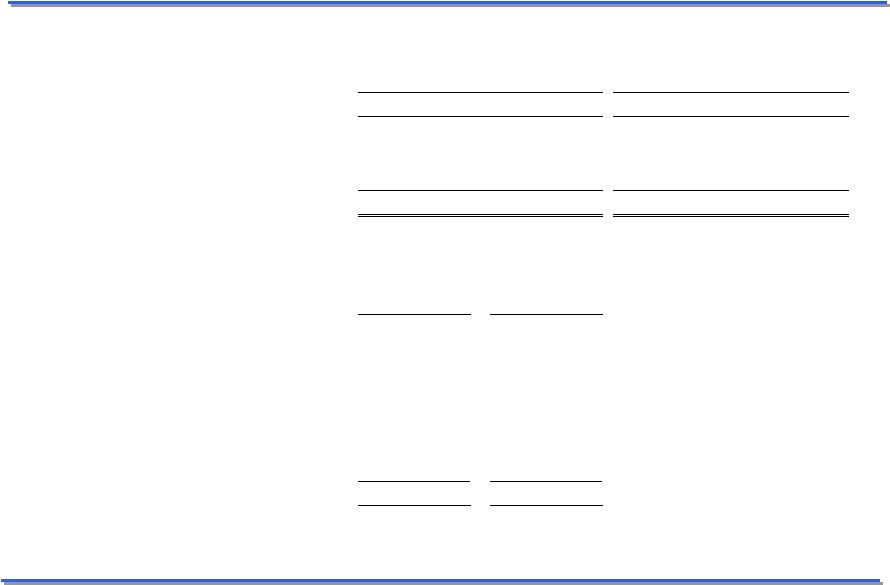

Q3 2010 Financial Highlights

9

(amounts in millions, except unit and per unit amounts, unaudited)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2010

2009

2010

2009

Calculation of Limited Partners' interest:

Net Income attributable to Sunoco Logistics

Partners L.P.

192.9

$

48.5

$

286.8

$

196.0

$

Less: General Partner's interest

(14.7)

(13.4)

(35.5)

(38.9)

Limited Partners' interest in Net Income

178.2

$

35.1

$

251.3

$

157.1

$

Net Income per Limited Partner unit:

Basic

5.60

$

1.13

$

8.03

$

5.22

$

Diluted

5.57

$

1.13

$

7.99

$

5.19

$

Weighted Average Limited Partners' units

outstanding (in thousands):

Basic

31,797

30,981

31,291

30,085

Diluted

31,955

31,190

31,463

30,288

|

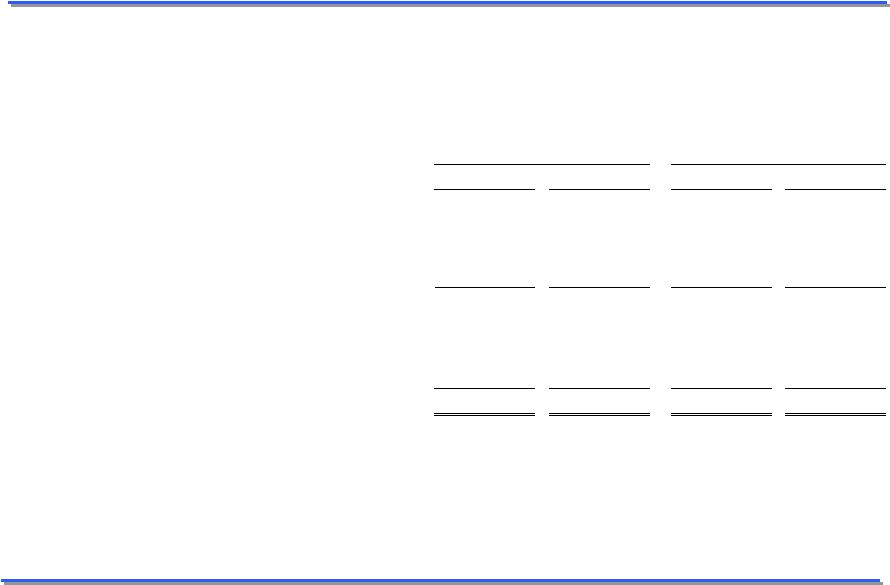

Q3 2010 Financial Highlights

10

Three Months Ended

Nine Months Ended

September 30,

September 30,

2010

2009

2010

2009

Refined Products Pipeline System

13.2

$

13.3

$

33.4

$

34.5

$

Terminal Facilities

23.6

20.7

74.0

63.1

Crude Oil Pipeline System

52.2

25.9

109.6

131.1

Total

89.0

$

59.9

$

217.0

$

228.7

$

Operating income ($ in millions,

unaudited) |

Refined Products Pipeline System

($ in millions, unaudited)

11

Three Months Ended

Nine Months Ended

September 30,

September 30,

2010

2009

2010

2009

Financial Highlights

Sales and other operating revenue

29.7

$

32.0

$

90.2

$

94.6

$

Other income

5.5

3.9

11.4

9.2

Total revenues

35.2

35.9

101.6

103.8

Operating expenses

13.5

14.4

40.2

43.7

Depreciation and amortization

3.6

3.2

11.1

9.6

Selling, general and administrative expenses

4.9

5.0

16.9

16.0

Operating income

13.2

$

13.3

$

33.4

$

34.5

$

|

Terminal Facilities

($ in millions, unaudited)

12

Three Months Ended

Nine Months Ended

September 30,

September 30,

2010

2009

2010

2009

Financial Highlights

Total Revenues

58.9

$

46.2

$

173.2

$

140.8

$

Cost of products sold and operating expenses

22.7

15.7

63.9

48.4

Depreciation and amortization

7.3

5.2

18.6

14.5

Selling, general and administrative expenses

5.4

4.6

16.8

14.8

Operating income

23.6

$

20.7

$

74.0

$

63.1

$

|

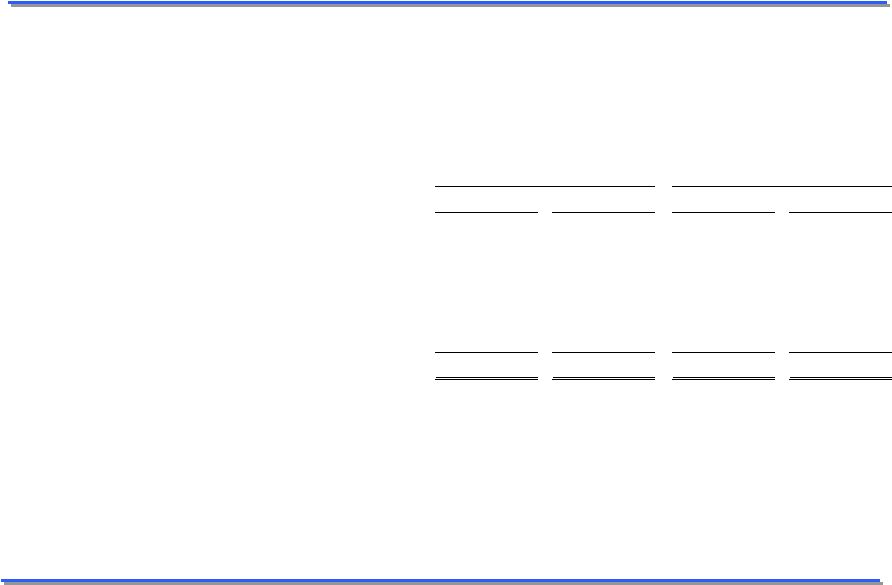

Crude Oil Pipeline System

13

($ in millions, unaudited)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2010

2009

2010

2009

Financial Highlights

Sales and other operating revenue

1,787.5

$

1,341.9

$

5,322.8

$

3,506.8

$

Other income

1.7

4.9

12.3

10.7

Total revenues

1,789.2

1,346.8

5,335.1

3,517.5

Cost of products sold and operating expenses

1,726.1

1,311.9

5,192.2

3,358.4

Depreciation and amortization

5.5

3.9

15.2

11.2

Selling, general and administrative expenses

5.4

5.1

18.1

16.8

Operating income

52.2

$

25.9

$

109.6

$

131.1

$ |

Q3 2010 Operating Highlights

14

Three Months Ended

Nine Months Ended

September 30,

September 30,

2010

2009

2010

2009

Operating

highlights

(unaudited)

Refined Products Pipeline System:

Total

shipments

(barrel

miles

per

day)

(1)(2)

50,411,601

56,848,807

51,253,071

58,145,900

Revenue per barrel mile (cents)

0.641

0.612

0.645

0.596

Terminal Facilities:

Refined products terminals throughput (bpd)

505,465

465,206

483,966

462,969

Nederland terminal throughput (bpd)

780,313

559,874

730,551

619,297

Refinery terminals throughput (bpd)

459,174

609,020

475,897

597,191

Crude Oil Pipeline System:

Crude

oil

pipeline

throughput

(bpd)

(2)(3)

1,556,365

610,856

1,501,307

648,183

Crude oil purchases at wellhead (bpd)

187,953

176,643

187,779

183,047

Gross

margin

per

barrel

of

pipeline

throughput

(cents)

(3)(4)

46.4

46.4

41.5

77.6

Average crude oil price (per barrel)

76.21

$

68.29

$

77.65

$

57.13

$

(1)

(2)

(3)

(4)

Represents total average daily pipeline throughput multiplied by the

number of miles of pipeline through which each barrel has been shipped.

Excludes amounts attributable to equity ownership interests which are

not consolidated. Includes 602 thousand bpd from the

Partnership's consolidation of Mid-Valley Pipeline Company and West Texas Gulf Pipe Line Company from the acquisition date.

Represents total segment sales and other operating revenue minus cost

of products sold and operating expenses and depreciation and amortization divided by crude oil pipeline throughput. Gross

margin and throughput volumes for Mid-Valley Pipeline Company and

West Texas Gulf Pipe Line Company have been included from the acquisition date. |

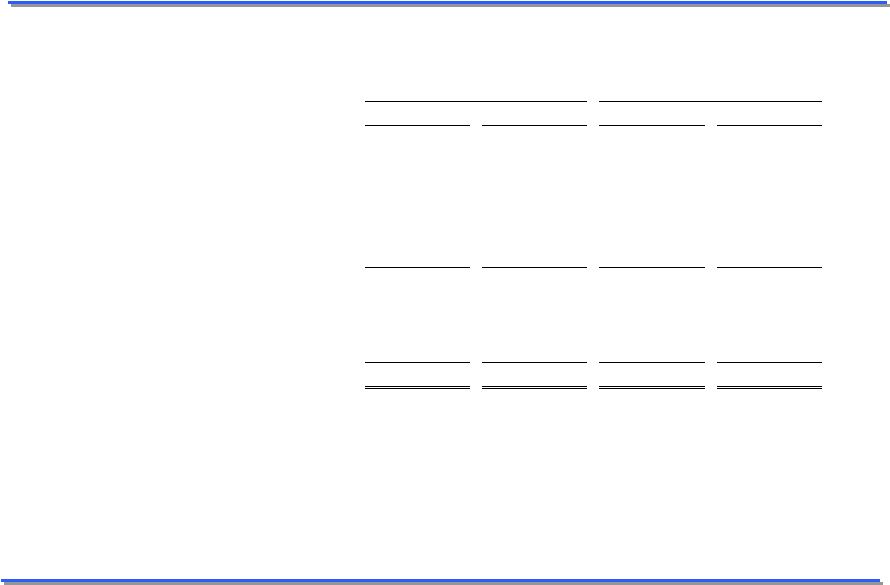

Q3 2010 Financial Highlights

15

($ in millions, unaudited)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2010

2009

2010

2009

Capital Expenditure Data:

Maintenance capital expenditures

10.7

$

6.3

$

25.0

$

15.3

$

Expansion capital expenditures

269.2

82.1

331.1

143.5

Total

279.9

$

88.4

$

356.1

$

158.8

$

September 30,

December 31,

2010

2009

Balance Sheet Data (at period end):

Cash and cash equivalents

2.0

$

2.0

$

Total debt

(1)

1,347.8

868.4

Equity

Sunoco Logistics Partners L.P. Equity

957.5

861.6

Noncontrolling interests

78.1

-

1,035.6

$

861.6

$

(1)

Total debt includes the $100 million promissory note to Sunoco,

Inc. |

Non-GAAP Financial Measures

($ in millions, unaudited)

16

Non-GAAP Financial Measures

(1) Management

of

the

Partnership

believes

EBITDA

and

distributable

cash

flow

information

enhances

an

investor's

understanding

of

a

business’

ability

to

generate cash for payment of distributions and other purposes.

EBITDA and distributable cash flow do not represent and should not be considered an

alternative to net income or cash flows from operating activities as

determined under United States generally accepted accounting principles (GAAP) and may

not be comparable to other similarly titled measures of other

businesses. Reconciliations of these measures to the comparable GAAP measure are provided in

the tables accompanying this release.

2010

2009

2010

2009

Add: Interest expense, net

19.7

11.4

53.8

32.7

Add: Depreciation and amortization

16.4

12.2

44.9

35.3

Add: Provision for income taxes

3.8

-

3.8

-

Less: Gain on investments in affiliates

(128.5)

-

(128.5)

-

EBITDA

104.3

72.1

260.8

264.0

Less: Interest expense, net

(19.7)

(11.4)

(53.8)

(32.7)

Less: Maintenance capital expenditures

(10.7)

(6.3)

(25.0)

(15.3)

Less: Provision for income taxes

(3.8)

-

(3.8)

-

Distributable cash flow

70.1

$

54.4

$

178.2

$

216.0

$

196.0

$

286.8

$

48.5

$

192.9

$

Net Income attributable to Sunoco

Logistics Partners L.P.

Three Months Ended

Nine Months Ended

September 30,

September 30, |

Non-GAAP Financial Measures

($ in millions, unaudited)

17

Less: Gain on investments in affiliates

(128,451)

(128,451)

Adjusted Net Income attributable to Sunoco Logistics

Partners L.P.

64,403

$

158,384

$

Less: General Partner's interest

(12,148)

(32,903)

Limited Partners' interest in Net Income

52,255

$

125,481

$

Net Income per Limited Partner unit:

Basic

1.64

$

4.01

$

Diluted

1.64

$

3.99

$

Weighted Average Limited Partners' units outstanding:

Basic

31,797,082

31,291,262

Diluted

31,955,360

31,462,963

Nine Months Ended

Net Income attributable to Sunoco Logistics Partners L.P.

Adjusted Net Income Attributable to Sunoco Logistics Partners L.P.

2010

2010

September 30,

192,854

$

286,835

$

Three Months Ended

September 30, |