Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CONCEPTUS INC | d8k.htm |

| EX-99.1 - PRESS RELEASE - CONCEPTUS INC | dex991.htm |

Conceptus

Inc.

Quarterly Results

Third Quarter 2010

©

2010 Conceptus, Inc. All rights reserved.

October 28, 2010

Exhibit 99.2 |

Safe

Harbor Except for the historical information contained herein, the matters

discussed in this presentation include forward-looking statements, the

accuracy of which is subject to risks and uncertainties. These

forward-looking statements include discussions regarding: projected net

sales, net income and earnings per share for the fourth quarter and full year 2010,

the expected impact of reduced physician office visits due to economic conditions,

currency exchange rates, growth in physician metrics and the French

government’s ruling on changes in insurance coverage on 2010 net

sales and GAAP diluted EPS, the effects of competitor product trialing, and

the use of non-GAAP financial measures.

These discussions and other forward-looking statements included herein may

differ significantly

from

actual

results.

Such

differences

may

be

based

upon

factors

such

as

changes in strategic planning decisions by management, re-allocation of

internal resources, changes in the impact of recessionary pressures,

decisions by insurance companies, scientific advances by third parties,

litigation risks, effect of regulations promulgated pursuant to the Health

Care Reform Act, and the introduction of competitive products, as well as

those factors set forth in the Company's most recent Annual Report on Form 10-K

and most recent Quarterly Report on Form 10-Q, and other filings with the

Securities and Exchange Commission. These forward-looking

statements speak only as to the date on which the statements were

made. We undertake no obligation to update or revise publicly any

forward-looking statements, whether as a result of new information, future events, or

otherwise.

-

2

- |

Key Factors

Mark Sieczkarek

President and Chief Executive Officer

©

2010 Conceptus, Inc. All rights reserved. |

-

4

-

Summary of Q3’10

Steps we have taken to

“control the controllable”

in the current

environment gained

some initial traction

Macro economic

headwinds continue to

cause considerable

unpredictability in our

business |

-

5

-

Key Factors Remain

Macro Factor:

1.

Reduced physician office

visits due to economy

Macro Factor:

2. Currency fluctuations

Controllable Factor:

3. Physician metrics growth affected

by competitor trialing |

-

6

-

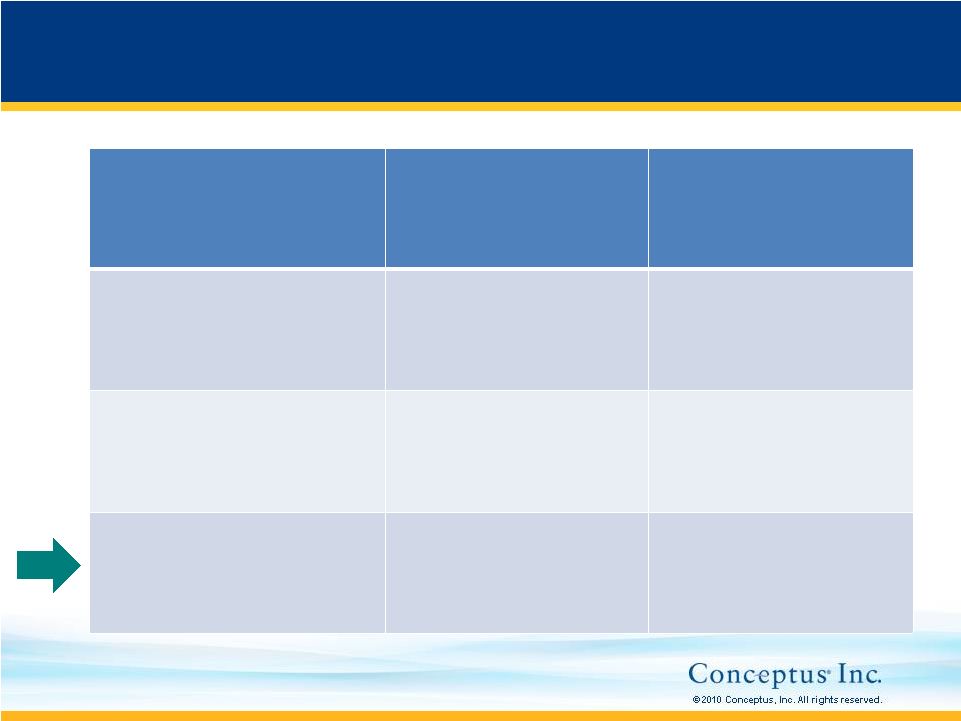

Status of Key Factors: Office Visits

Q2’10 Factors

Q3’10 Impact

Future

Expectation

1. Reduced physician

office visits

Significantly

unfavorable

Remains unfavorable |

-

7

-

Macro economic drivers continued to negatively impact

domestic general physician office visits in Q3’10

Economic Drivers

•

Continued unemployment at 9.6%

•

Involuntary part-time workers up

to 9.5 million, with few or no

benefits

•

Patients losing insurance

coverage (COBRA subsidies

ended) or switching to Medicaid

•

Patients opting for high-

deductible health insurance plans

and health savings accounts

Patients postponing

non-urgent procedures

= |

-

8

-

Reduced Physician Office Visits

(1) IMS Data provided by Credit Suisse Healthcare Team

Domestic general physician office visits remained depressed

in Q3’10

(1)

. We expect this trend to continue. |

-

9

-

Reduced OB/GYN Office Visits

(1) IMS Data provided by Credit Suisse Healthcare Team

Domestic OB/GYN office visits have declined significantly

during 2010

(1)

. We expect this trend to continue. |

-

10

-

Status of Key Factors: Currency

Q2’10 Factors

Q3’10 Impact

Future

Expectation

1. Reduced physician

office visits

Significantly

unfavorable

Remains unfavorable

2. Currency

fluctuations

Slightly

favorable

Dollar remains

strong against euro |

-

11

-

Currency: Dollar vs. Euro

Dollar was weaker to euro than expected in Q3’10

–

Modeled exchange rate for H2’10 of

$1.20

–

Actual exchange rate for Q3’10 was

$1.29

–

Variance resulted in slight benefit in Q3’10

80% to 90% of international sales are euro

denominated |

-

12

-

Changes in French Reimbursement

The French government has reduced physician

reimbursement for hysteroscopic

occlusion

procedures for women under the age of 40,

effective October 1, 2010

Further cost-cutting measures by the Ministry of

Health are expected to affect reimbursements for

medical devices

We are working to reverse this decision, but

expect sales growth in France to be lower in the

near term |

-

13

-

Status of Key Factors: Physician Metrics

Q2’10 Factors

Q3’10 Impact

Future

Expectations

1. Reduced physician

office visits

Significantly

unfavorable

Remains unfavorable

2. Currency

fluctuations

Slightly

favorable

Dollar remains

strong against euro

3. Physician metrics:

shortfall due to

competitor trialing

Moderately

unfavorable

Physician metric

growth improves |

-

14

-

Physician Metrics –

Stabilizing in Q3

In Q2’10, significant resources were allocated to defend our

customer base as competitive trialing ramped, which resulted

in a temporary distraction from growing the market through

additional physician preceptorships, certifications and

transitions to office

Since physician metric growth is a key “controllable”

factor,

we aggressively increased the number of direct field sales

reps to re-energize growth

In Q3’10, physician metrics have initially stabilized

Focus remains on growing physician metrics |

-

15

-

Our Priorities

Solution

Control the Controllable

Solution

Solution

Re-deploy assets

to energize

market growth:

“back-to-basics”

strategy

Accelerate growth

of physician

metrics including

new physician

adoption of

Essure

procedure

Implement leaner

cost structure

through

discretionary cuts |

-

16

-

Back-to-Basics Solution

Increased direct sales territories to better align resources

Re-deployed existing sales personnel: ~160

sales personnel

in the field, with ~120

in direct sales

Improved ability to focus on both competitive defense and

physician metric growth

Direct sales reps’

transition is still in early stages

Expanded field sales coverage

We are one of the industry’s largest medical device

sales teams dedicated to OB/GYN physicians |

Third Quarter 2010 Financials

Greg Lichtwardt

Executive Vice President, Operations and

Chief Financial Officer

©

2010 Conceptus, Inc. All rights reserved. |

-

18

-

Q3’10 Snapshot

Net Sales

($mm)

Gross Margin

(%)

Diluted Non-

GAAP

(2)

EPS

Operating

Margin (%)

Q3’09

Q3’10

Q3’09

Q3’10

Q3’09

Q3’10

Q3’09

Q3’10

Q3’09

Q3’10

$0.29

(1)

$34.2

85.3%

(1)

80.6%

$33.9

23.4%

(1)

8.1%

$0.20

(1)

$0.03

$0.16

Diluted

GAAP EPS

Company guidance for Q3’10:

Net sales: $33mm to $34mm

GAAP EPS: $0.03 to $0.06

Non-GAAP EPS: $0.15 to $0.18

(1)

Includes

one-time

Ovion

acquisition

benefit

(2)

See GAAP to non-GAAP reconciliation in appendix |

-

19

-

Worldwide Sales

Increasing Diversification through International Sales

The difference between dollar growth and international unit growth is primarily

due to average selling price reductions due to customer mix

Q3’10 Net Sales (in million $)

Q3’10 Units (in thousands):

$34.2

Q3’09

Q3’10

$28.0

(82%)

$33.9

$27.3

(81%)

28.1

Q3’09

Q3’10

20.3

(72%)

7.8

(28%)

30.1

19.9

(66%)

10.2

(34%)

Domestic

International

International units up 31% in Q3’10

$6.6

(19%)

$6.2

(18%) |

-

20

-

U.S. Physician Metrics

Q3’10

Q2’10

Q1’09

Q4’09

Q3’09

Current Period Activity:

Physicians entering preceptorship

375

387

423

401

512

Physicians becoming certified

324

335

406

409

462

Physicians transitioning to office

185

163

243

464

342

Physician Base:

In preceptorship

3,537

3,486

3,434

3,417

3,425

Certified and in hospital

3,267

3,128

2,956

2,793

2,848

Certified and in office

5,313

5,128

4,965

4,722

4,258

TOTAL:

12,117

11,742

11,355

10,932

10,531 |

-

21

-

Q3’10

Q3’09

Y/Y

Change

Q2’10

Q/Q

Change

Net Sales

$33.9

$34.2

(1.1 %)

$36.8

(8.0%)

Gross Profit Margin

80.6%

85.3%

(1)

nm

80.2%

nm

Operating Expenses

$24.6

$21.2

15.9%

$28.1

(12.7%)

Other Income / (Expense)

($1.6)

($1.6)

nm

($1.6)

nm

Tax Provision

$0.2

$0.2

nm

$0.1

100%

NEAT

$1.0

$6.2

(1)

(84.3%)

($0.3)

nm

GAAP EPS (basic

and diluted)

$0.03

$0.20

(1)

(85.0%)

($0.01)

nm

Non-GAAP EPS

(2)

(basic

and diluted)

$0.16

$0.29

(1)

(44.8%)

$0.11

45.5%

Q3’10 Results

In million $ except for EPS

(1)

Includes one-time Ovion

acquisition benefit

(2)

See GAAP to non-GAAP reconciliation in appendix |

-

22

-

Q3’10 GAAP vs. Non-GAAP EPS

Non-GAAP

EPS

$0.16

Amortization

of intangibles

Stock-based

compensation

$0.03

$0.06

$0.04

Amortization of

non-cash items

for convertible

notes

$0.03

GAAP

EPS

See GAAP to non-GAAP reconciliation in appendix

$976

$810

$1,881

$1,231

$4,898

Actual amount

in $ thousands: |

-

23

-

Balance Sheet

Cash & cash equivalents

Investments

and

put

option

(1)

A/R, inventories & other

current assets

PP&E

Intangible and other assets

Goodwill

Total assets

ASSETS

19.3

64.0

28.2

10.4

26.2

16.4

164.5

61.7

43.5

25.7

9.8

29.1

17.3

187.1

9/30/10

A/P & other accrued ST

liabilities

Line

of

credit

(2)

Other accrued LT liabilities

Notes payable

Total Equity

Total liabilities & equity

LIABILITIES &

EQUITY

12/31/09

18.1

29.2

2.4

76.5

60.9

187.1

9/30/10

12/31/09

16.1

0.0

2.3

79.8

66.3

164.5

$ millions

(1)

Put option for 12/31/09 only

(2)

Used proceeds from redemption of all outstanding

auction rate securities to pay down line of credit in full

|

-

24

-

Guidance

Q4’10E

FY’10E

Q4’09A

FY’09A

Net Sales

$39 mm to

$41 mm

$143 mm to

$145 mm

$37.0

$131.4mm

Gross Profit

Margin

82.2%

81.1%

82.2%

81.7%

Operating

Expenses

$22.0mm

$102.5mm

$22.2mm

$92.7mm

Net Income

$8.3 mm to

$9.9 mm

$6.6 mm to

$8.3 mm

$6.6mm

$7.9mm

GAAP EPS

(diluted)

$0.26 to $0.31

$0.21 to $0.26

$0.21

$0.25

Non-GAAP

EPS

(1)

(diluted)

$0.39 to $0.44

$0.70 to $0.75

$0.33

$0.65

(1)

See GAAP to non-GAAP reconciliation in appendix |

Competitive Environment &

Road to Standard of Care

Mark Sieczkarek

President and Chief Executive Officer

©

2010 Conceptus, Inc. All rights reserved. |

-

26

-

Permanent birth control failures per 1,000 women at 3 years:

Essure: 1.6

(1)

Tubal ligation: 9.9

(2)

Vasectomy: 11.3

(3)

Competitor’s procedure: 16

(4)

………………...

.………

..........

...

(1)

Essure

Effectiveness Report (data 12/16/04) page 14

(2)

Peterson, H.B., et al. The risk of pregnancy after tubal sterilization: findings from the U.S.

Collaborative Review

of

Sterilization.

Am

J

Obstet

Gynecol.

1996

Apr;

174(4):

1161-8.

(3)

Jamieson DJ et al. For the U.S. Collaborative Review of Sterilization Working Group. The Risk of

Pregnancy After

Vasectomy.

Obstet

Gynecol.

2004;103:848-50.

848-50.

(4)

Competitor’s Instructions for Use, Rev 3.

Essure: Beats PBC Competition |

-

27

-

Essure

Competitor’s product

Clinical

0 pregnancies reported

12 pregnancies reported

99.84% effective at 3 years

label claim or 1 in 625

98.4% effective at 3 years

label claim or 1 in 62

Commercial

667

pregnancies reported

against

465,000

procedures or 1 in 700

?

Essure: Long Term Efficacy Will Win

Data confirms Essure

as the superior product

Commercial observations of competitor’s product is resulting

in failures to occlude and pregnancies

(1)

(1) On October 1, 2010, Dr. M.Y. Bongers

et al. presented a research study on the competitor's product at the European

Society for Gynaecological Endoscopy (ESGE). The study resulted in an 89%

successful bilateral placement on 130 patients and a 7.4% failure to occlude, excluding the 3

patients that became pregnant. This study to date represents a 3-year

effectiveness rate of 2-in-75. |

-

28

-

Essure: Latest Research

“Permanent birth control with Essure

device has demonstrated to be a safe method, with low

rate of complications, which its security persist(s) after 8 years follow up.

That means that Essure

method should be the reference method in what is to do with definitive

contraception. The devices have been placed in 25 known nickel

allergies (patients) without side effects.” Arjona

Berral,

JE

et

al.

Complications

associated

with

Essure

device:

analysis

after

4000

procedures.

October 2010. Gynecol

Surg.

7(S 1) S89

“Transabdominal

3D ultrasound is an interesting new alternative technique to confirm proper

placement of the Essure

microinserts. It’s an easy and reproductible

technique and could

replace the 3D transvaginal

ultrasound in many cases, especially if the conditions are

favorable.”

Bader,

G

et

al.

Localization

of

Essure

microinserts

using

3D

transabdominal

ultrasound

after

hysteroscopic

sterilization.

October

2010.

Gynecol

Surg.

7(S

1)

S74

“Essure

hysteroscopic

sterilization remains an excellent option in IUD carriers, as it shows no

significant differences in this small group when compared to standard non-IUD

women.” Nogueira

Martins,

N.

et

al.

Hysteroscopic

sterilization

in

IUD

carrier

-

department’s

experience.

October

2010. Gynecol

Surg.

7(S 1) S45

Sample highlights from abstracts presented at European Society

for Gynaecological

Endoscopy (ESGE) in October 2010

©

2010 Conceptus, Inc. All rights reserved. |

-

29

-

Status of Competitive Trialing

7,000 total Essure

accounts

–

1,500 to

2,000 anticipated to trial

–

800 to

900 have trialed to date

Expect trialing to last

9 to

15 months if physician

utilization stays steady at 1 to 2 hysteroscopic

sterilization

procedures per month

Many mature trialing accounts have returned to Essure;

some

have

signed

agreements

indicating

Essure

exclusivity |

-

30

-

Multi-Billion Dollar Market

Our current

addressable market

“Sweet Spot”

Our future market:

Essure: 30,000

Tubal ligations

(2)

:

643,000

Permanent birth control

procedures each year

673,000

In millions

Base of 38 million women

(1) 2006-08 CDC report, Data from the National Survey of Family Growth,

published May 2010

(2) Tubal sterilization trends in the United States, Chan and Westoff, published

June 2010; sourced 2006-08 CDC report

Market

based

on

intent

to

have

children

(1) |

-

31

-

Road to Standard of Care

1992

Conceptus

founded

2001

2002

EU

approves

Essure

FDA approves

Essure

6,000

hysteroscopically

trained physicians

Minimal patient

awareness

2010

465,000 women

rely on Essure

15,000

hysteroscopically

trained physicians

30% patient

awareness

Hysteroscopic

tubal occlusion

14% of PBC

market (U.S.)

Goal: Essure

becomes

Standard of

Care for PBC

market

Increase utilization and tap into

addressable market of 9.3 million women

Increase number of hysteroscopically

trained physicians

Gain additional Medicaid support in 30+

states that lag reimbursement

Physicians routinely choose Essure

over competition

Expand into more international markets

Drive greater patient awareness

Develop next generations of Essure

Future

milestones: |

Appendix

©

2010 Conceptus, Inc. All rights reserved. |

-

33

-

Use of Non-GAAP Financial Measures

The Company has supplemented its GAAP results of operations with

a non-GAAP

measure of net income (loss) and has supplemented its GAAP guidance with a

non- GAAP measure of non-GAAP earnings per share. In each case,

the non-GAAP measure excludes stock-based compensation expense,

non-cash interest expense, amortization of intangible assets and

amortization of debt issuance costs. Management believes that these

non-GAAP financial measures provide useful supplemental information to

management and investors regarding the performance of the Company’s business

operations, facilitate a better comparison of results for current periods with

the Company’s previous operating results, and assist management in

analyzing future

trends, making strategic and business decisions and establishing

internal budgets and

forecasts. A reconciliation of non-GAAP net income (loss) to GAAP net income

(loss), and a reconciliation of the guidance of non-GAAP earnings per

share to GAAP earnings per share, in each case the most directly comparable

GAAP measure, are provided on slides 34 and 35 of this presentation.

There are limitations in using these non-GAAP financial measures because they are

not prepared in accordance with GAAP and may be different from non-GAAP

financial measures used by other companies. These non-GAAP financial

measures should not be considered in isolation or as a substitute for GAAP

financial measures. Investors and

potential investors should consider non-GAAP financial measures only in

conjunction with the Company’s consolidated financial statements prepared

in accordance with GAAP and the reconciliations of the non-GAAP financial

measures provided on slides 34 and 35 of this presentation.

|

-

34

-

GAAP to Non-GAAP Reconciliation

2010

2009

2010

2009

Net income (loss), as reported

976

$

6,232

$

(1,665)

$

1,341

$

Adjustments to net income (loss):

Amortization of intangibles (a)

810

191

2,437

557

Stock-based compensation (b)

1,881

1,626

5,412

4,556

Amortization of non-cash interest expense (c)

1,115

1,054

3,298

3,118

Amortization of debt issuance costs (d)

116

116

348

349

Adjustments to net income (loss)

3,922

2,987

11,495

8,580

Non-GAAP net income

4,898

$

9,219

$

9,830

$

9,921

$

Income (loss) per share, as reported

Basic

0.03

$

0.20

$

(0.05)

$

0.04

$

Diluted

0.03

$

0.20

$

(0.05)

$

0.04

$

Non-GAAP earnings per share

Basic

0.16

$

0.30

$

0.32

$

0.33

$

Diluted

0.16

$

0.29

$

0.31

$

0.32

$

Weighted average common shares used in calculation

Basic

31,072

30,599

31,012

30,519

Diluted

31,413

31,503

31,759

31,116

(a) Consists of amortization of intangible assets, primarily licenses and customer

relationships (b) Consists of stock-based compensation in accordance with

ASC 718 (c) Consists of amortization of non-cash interest expense in

accordance with ASC 470-20 (d) Consists of amortization of debt issuance

costs Conceptus, Inc.

(Unaudited)

(In thousands, except per share amounts)

September 30,

Three Months Ended

Nine Months Ended

September 30,

Reconciliation of Reported Net Income (Loss) and Income (Loss) Per Share to

Non-GAAP Net Income (Loss) and Earnings Per Share |

-

35

-

From

To

From

To

GAAP Guidance

0.26

$

0.31

$

0.21

$

0.26

$

Estimated Non-GAAP Guidance

Amortization of intangibles (a)

0.03

$

0.03

$

0.10

$

0.10

$

Stock-based compensation (b)

0.06

$

0.06

$

0.24

$

0.24

$

Amortization of non-cash items for convertible note (c)

0.04

$

0.04

$

0.15

$

0.15

$

Total Non-GAAP Adjustments

0.13

$

0.13

$

0.49

$

0.49

$

Non-GAAP Guidance

0.39

$

0.44

$

0.70

$

0.75

$

(a) Consists of amortization of intangible assets, primarily licenses and customer relationships

(b) Consists of stock-based compensation in accordance with ASC 718

(c) Consists of amortization of non-cash interest expense in accordance with ASC 470-20 and debt

issuance costs (Unaudited)

Three Months Ending

Twelve Months Ending

December 31, 2010

December 31, 2010

Conceptus, Inc.

To Projected GAAP EPS

Reconciliation of Forward-Looking Guidance For Non-GAAP Financial Measures

GAAP to Non-GAAP Reconciliation |

Thank You

©

2010 Conceptus, Inc. All rights reserved.

CC-2551 27OCT10F |